EXHIBIT 99.1

Mc DERMOTT INTERNATIONAL, INC.

Fourth Quarter 2003 Supplemental Presentation

March 19, 2004

Cautionary Statements/Explanation of Non–GAAP Measurements

Statements in this presentation which express a belief, expectation or intention, as well as those which are not historical fact, are forward looking. They involve a number of risks and uncertainties which may cause actual results to differ materially from such forward-looking statements. These risks and uncertainties include factors detailed in McDermott International’s filings with the Securities Exchange Commission, including its Form 10-K for the year ended December 31, 2003 and its Form 10-Q’s which are filed quarterly.

McDermott management believes that certain non-GAAP measurements used in this presentation provide the investor with useful information to evaluate the financial results of the Company’s ongoing operations and allows for easier comparison to historical basis. The term non-GAAP is used in this presentation to distinguish certain measurements from those prepared on a generally accepted accounting principle basis (“GAAP”).

Reconciliations of non-GAAP measurements are included as part of the presentation. The presentation can be found for a period of time on Company’s website at www.mcdermott.com in the investor relations section.

2

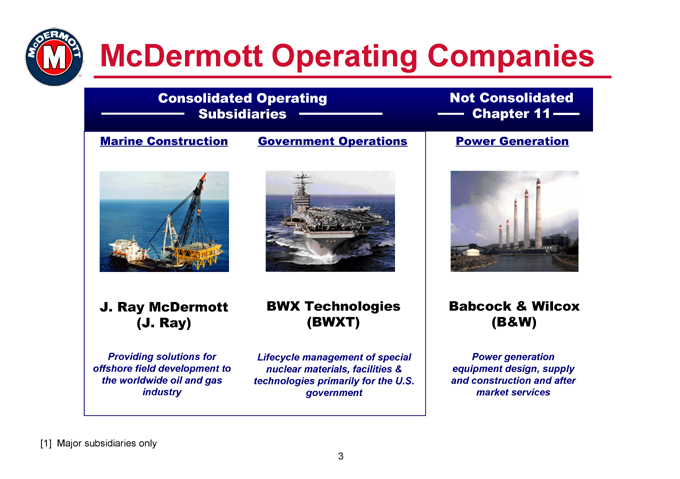

McDermott Operating Companies

Consolidated Operating Subsidiaries

Marine Construction

J. Ray McDermott (J. Ray)

Providing solutions for offshore field development to the worldwide oil and gas industry

Government Operations

BWX Technologies (BWXT)

Lifecycle management of special nuclear materials, facilities & technologies primarily for the U.S. government

Not Consolidated Chapter 11

Power Generation

Babcock & Wilcox (B&W)

Power generation equipment design, supply and construction and after market services

[1] Major subsidiaries only

3

Financial Results

Fourth Quarter and Full Year 2003

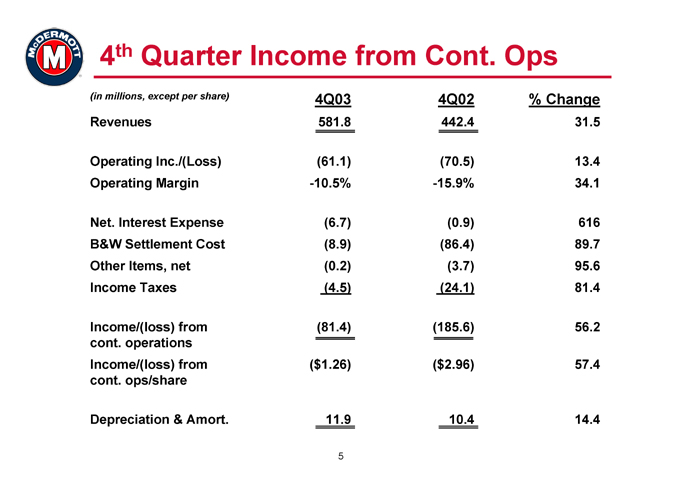

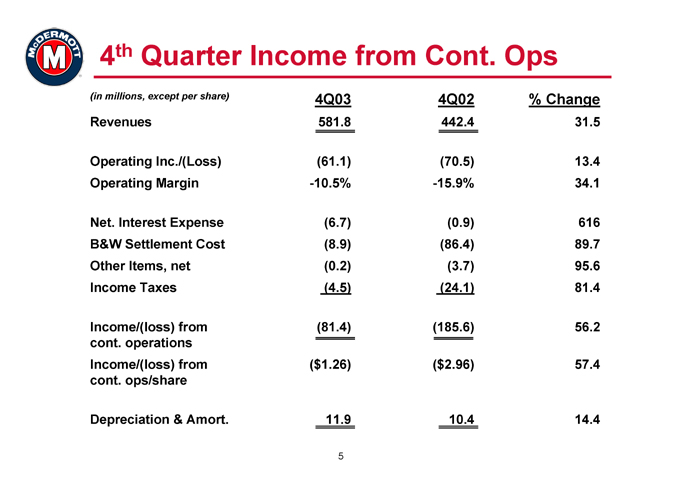

4th Quarter Income from Cont. Ops

(in millions, except per share) 4Q03 4Q02 % Change

Revenues 581.8 442.4 31.5

Operating Inc./(Loss) (61.1) (70.5) 13.4

Operating Margin -10.5% -15.9% 34.1

Net. Interest Expense (6.7) (0.9) 616

B&W Settlement Cost (8.9) (86.4) 89.7

Other Items, net (0.2) (3.7) 95.6

Income Taxes (4.5) (24.1) 81.4

Income/(loss) from (81.4) (185.6) 56.2

cont. operations

Income/(loss) from ($1.26) ($2.96) 57.4

cont. ops/share

Depreciation & Amort. 11.9 10.4 14.4

5

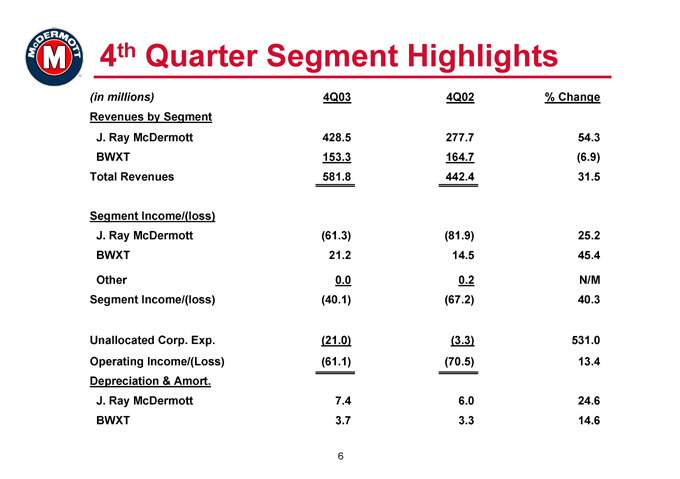

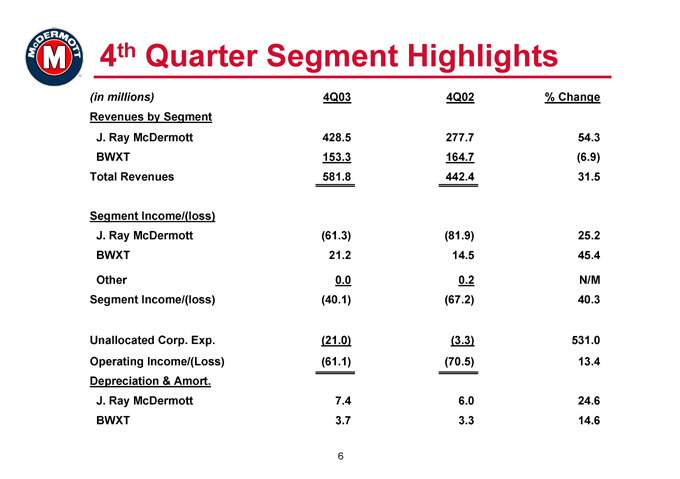

4th Quarter Segment Highlights

(in millions) 4Q03 4Q02 % Change

Revenues by Segment

J. Ray McDermott 428.5 277.7 54.3

BWXT 153.3 164.7 (6.9)

Total Revenues 581.8 442.4 31.5

Segment Income/(loss)

J. Ray McDermott (61.3) (81.9) 25.2

BWXT 21.2 14.5 45.4

Other 0.0 0.2 N/M

Segment Income/(loss) (40.1) (67.2) 40.3

Unallocated Corp. Exp. (21.0) (3.3) 531.0

Operating Income/(Loss) (61.1) (70.5) 13.4

Depreciation & Amort.

J. Ray McDermott 7.4 6.0 24.6

BWXT 3.7 3.3 14.6

6

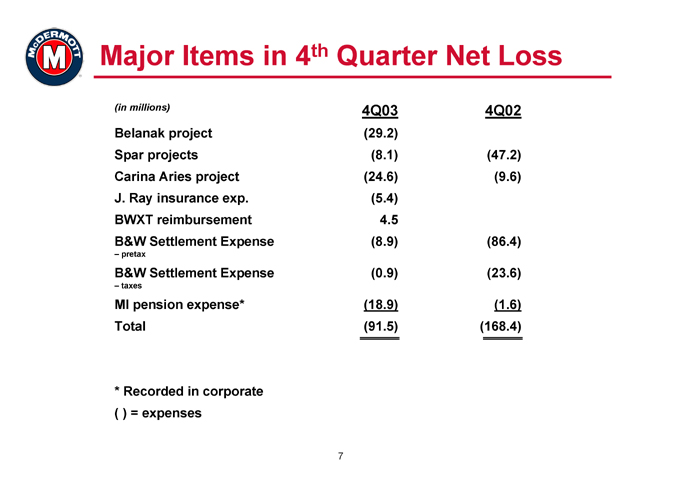

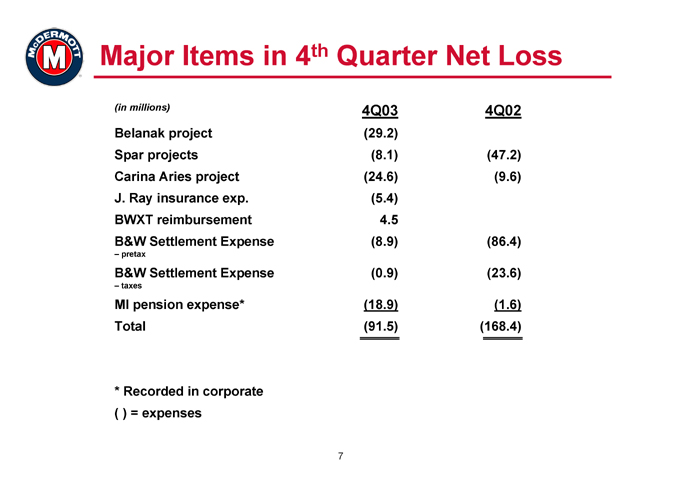

Major Items in 4th Quarter Net Loss

(in millions) 4Q03 4Q02

Belanak project (29.2)

Spar projects (8.1) (47.2)

Carina Aries project (24.6) (9.6)

J. Ray insurance exp. (5.4)

BWXT reimbursement 4.5

B&W Settlement Expense (8.9) (86.4)

– pretax

B&W Settlement Expense (0.9) (23.6)

– taxes

MI pension expense* (18.9) (1.6)

Total (91.5) (168.4)

* Recorded in corporate ( ) = expenses

7

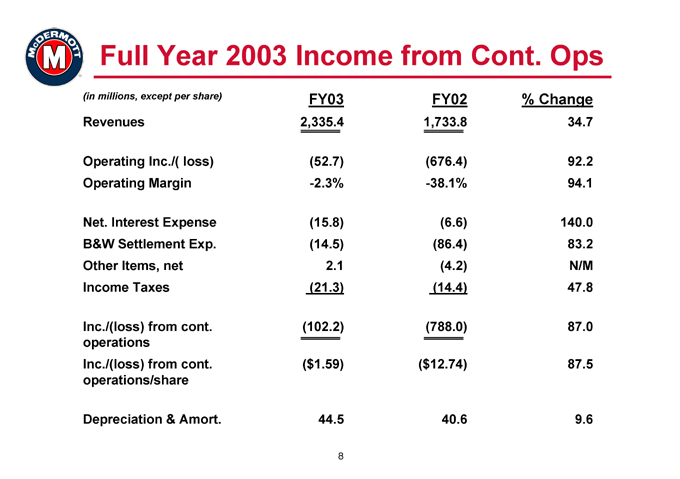

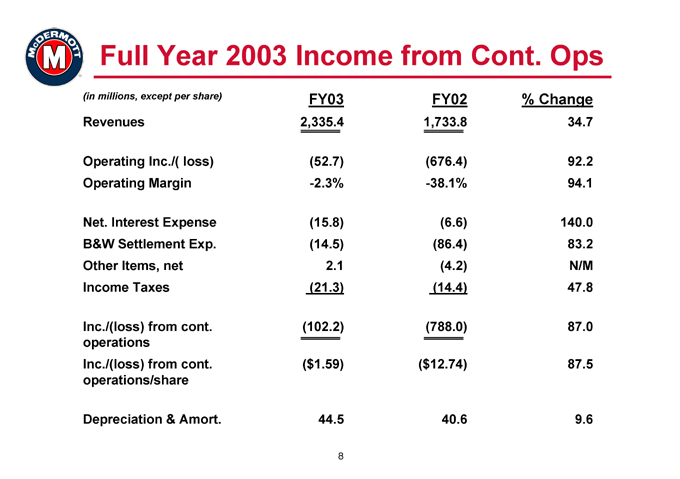

Full Year 2003 Income from Cont. Ops

(in millions, except per share) FY03 FY02 % Change

Revenues 2,335.4 1,733.8 34.7

Operating Inc./( loss) (52.7) (676.4) 92.2

Operating Margin -2.3% -38.1% 94.1

Net. Interest Expense (15.8) (6.6) 140.0

B&W Settlement Exp. (14.5) (86.4) 83.2

Other Items, net 2.1 (4.2) N/M

Income Taxes (21.3) (14.4) 47.8

Inc./(loss) from cont. (102.2) (788.0) 87.0

operations

Inc./(loss) from cont. ($1.59) ($12.74) 87.5

operations/share

Depreciation & Amort. 44.5 40.6 9.6

8

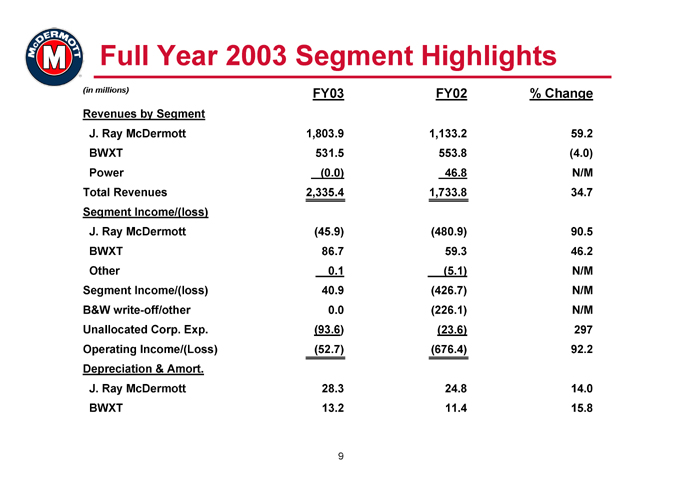

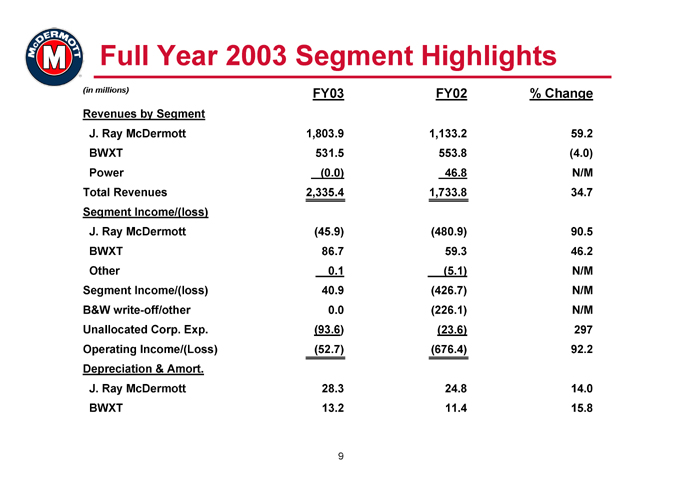

Full Year 2003 Segment Highlights

(in millions) FY03 FY02 % Change

Revenues by Segment

J. Ray McDermott 1,803.9 1,133.2 59.2

BWXT 531.5 553.8 (4.0)

Power (0.0) 46.8 N/M

Total Revenues 2,335.4 1,733.8 34.7

Segment Income/(loss)

J. Ray McDermott (45.9) (480.9) 90.5

BWXT 86.7 59.3 46.2

Other 0.1 (5.1) N/M

Segment Income/(loss) 40.9 (426.7) N/M

B&W write-off/other 0.0 (226.1) N/M

Unallocated Corp. Exp. (93.6) (23.6) 297

Operating Income/(Loss) (52.7) (676.4) 92.2

Depreciation & Amort.

J. Ray McDermott 28.3 24.8 14.0

BWXT 13.2 11.4 15.8

9

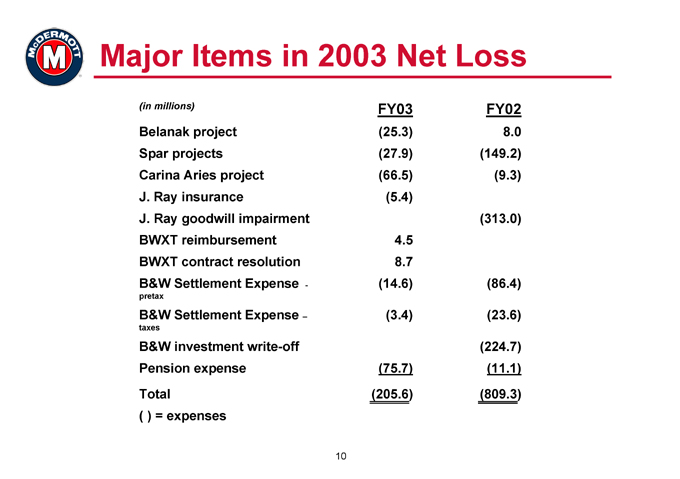

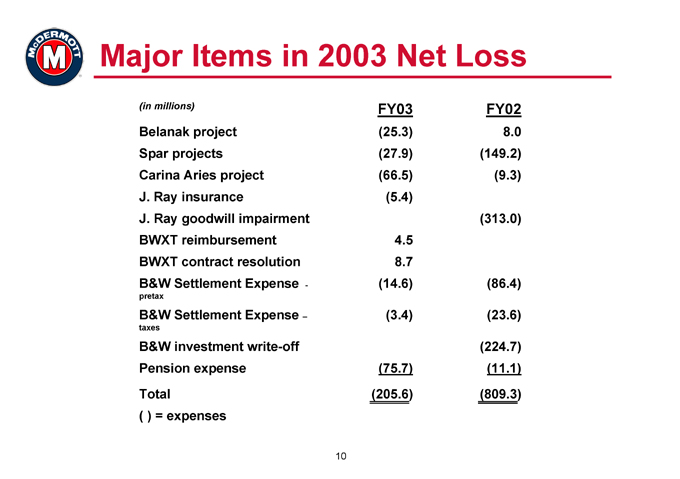

Major Items in 2003 Net Loss

(in millions) FY03 FY02

Belanak project (25.3) 8.0

Spar projects (27.9) (149.2)

Carina Aries project (66.5) (9.3)

J. Ray insurance (5.4)

J. Ray goodwill impairment (313.0)

BWXT reimbursement 4.5

BWXT contract resolution 8.7

B&W Settlement Expense - (14.6) (86.4)

pretax

B&W Settlement Expense – (3.4) (23.6)

taxes

B&W investment write-off (224.7)

Pension expense (75.7) (11.1)

Total (205.6) (809.3)

( ) = expenses

10

Summary Balance Sheet at 12/31/03

(in millions) 12/31/03 12/31/02

Assets

Cash & equivalents, unrestricted 174.8 129.5

Cash & equivalents, restricted 180.5 44.8

Investments 0.0 108.3

Other current assets 343.2 466.7

Total Current Assets 698.5 749.3

Property, Plant & Eq. 363.8 353.4

LT Investments 42.8 65.0

All Other Assets 143.8 110.5

Total Assets $ 1,248.9 $ 1,278.2

Liabilities & equity

Current liabilities 722.8 917.0

Long-term debt 279.7 86.1

Pension liability 311.4 392.1

B&W Settlement 100.9 86.4

Self Insurance 60.7 71.9

All other liabilities 136.6 141.5

Shareholder’s equity (363.2) (416.8)

Total Liabilities &SE $ 1,248.9 $ 1,278.2

11

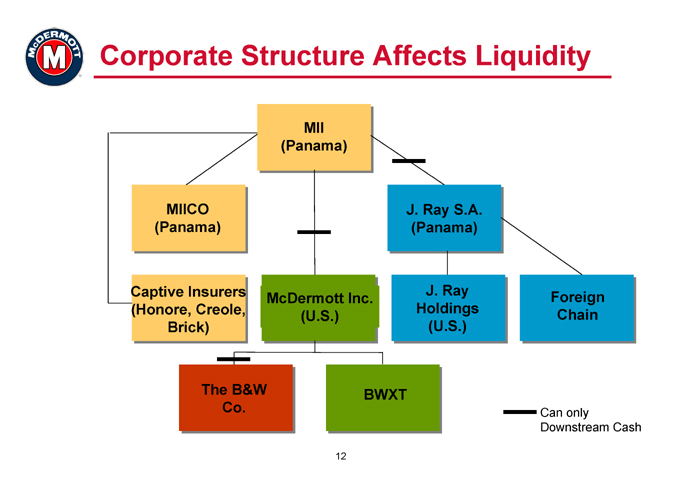

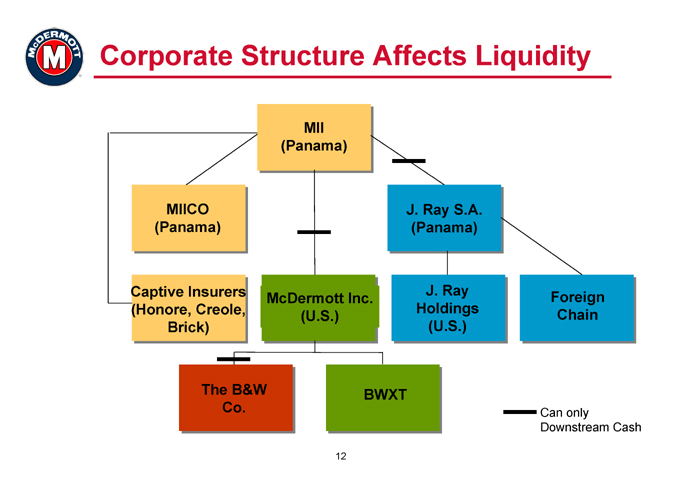

Corporate Structure Affects Liquidity

MII (Panama)

MIICO (Panama)

J. Ray S.A. (Panama)

Captive Insurers (Honore, Creole, Brick)

McDermott Inc.

(U.S.)

J. Ray Holdings (U.S.)

Foreign Chain

The B&W Co.

BWXT

Can only

Downstream Cash

12

Liquidity at 3/9/04

($ in millions) J. Ray MI MII Total

Cash, equivalents & $ 188 $ 1 $ 116 $ 305

investments

Less restricted amounts:

Letter of credit collateral (84) 0 (4) (88)

Captive insurer (16) 0 (33) (49)

Pledged securities 0 0 (41) (41)

Temporary interest reserve (22) 0 0 (22)

Foreign accounts (3) 0 (1) (4)

FX trading (5) 0 0 (5)

Total free cash available 58 1 37 96

BWXT credit capacity 0 74 0 74

Total available liquidity $58 $ 75 $37 $ 170

13

Finance Activities

• In December 2003, finance activities included:

– Issuance of J. Ray’s $200 million note offering

– Signing BWXT’s $135 million credit facility

• Cancelled prior omnibus credit facility

• Negotiating letter-of-credit facility for J. Ray

– Expected to be securitized by accounts receivable

– Borrowing base expected to be about $75 million

• J. Ray reviewing sales of non-strategic assets

14

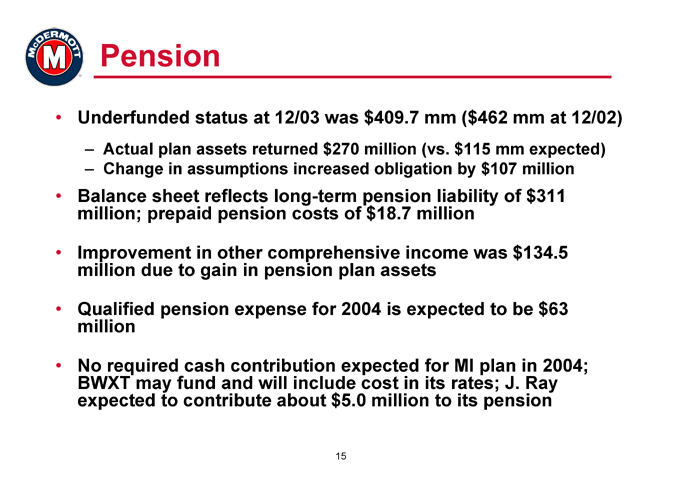

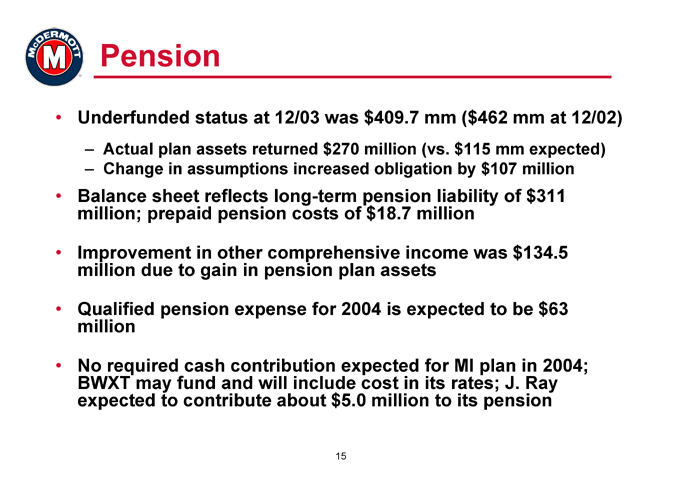

Pension

• Underfunded status at 12/03 was $409.7 mm ($462 mm at 12/02)

– Actual plan assets returned $270 million (vs. $115 mm expected)

– Change in assumptions increased obligation by $107 million

• Balance sheet reflects long-term pension liability of $311 million; prepaid pension costs of $18.7 million

• Improvement in other comprehensive income was $134.5 million due to gain in pension plan assets

• Qualified pension expense for 2004 is expected to be $63 million

• No required cash contribution expected for MI plan in 2004; BWXT may fund and will include cost in its rates; J. Ray expected to contribute about $5.0 million to its pension

15

J. Ray Operational Information

Fourth Quarter and Full Year 2003

J. Ray 2003 Overview

• Substantially completed 2 troubled spars projects

– Medusa (3/03) & Devil’s Tower (1/04)

• Incurred $120mm additional charges on contracts in loss position

• Problem contracts have common traits

– First-of-a-kind; fixed price & EPIC

• End is in sight; contracts in loss position expected to be completed in 2004

• Improving people, processes and procedures

17

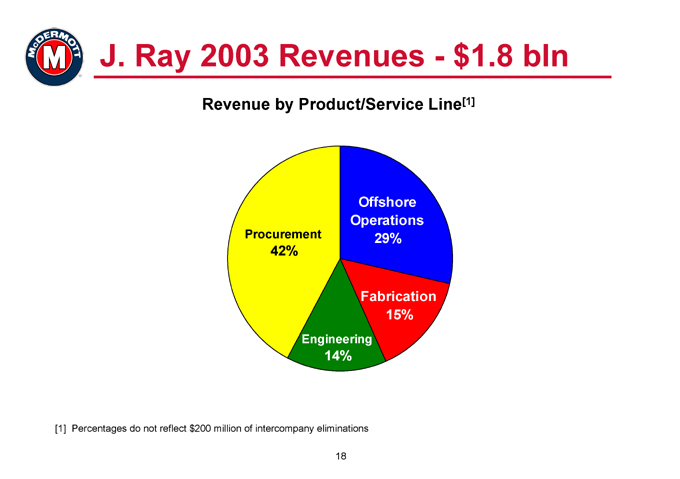

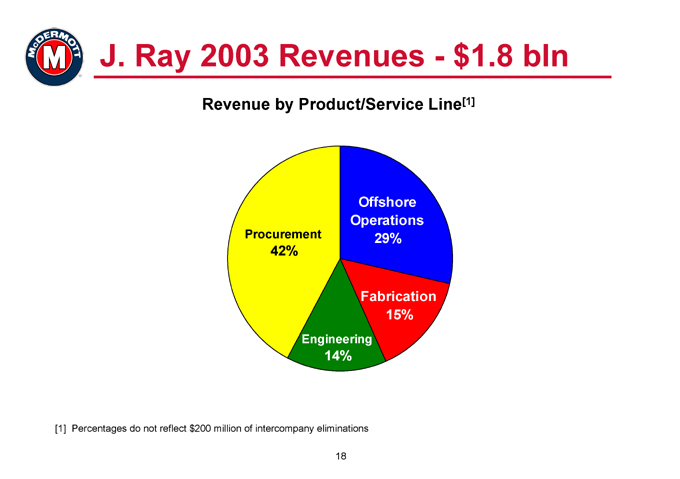

J. Ray 2003 Revenues—$1.8 bln

Revenue by Product/Service Line[1]

Procurement 42%

Offshore Operations 29%

Engineering 14%

Fabrication 15%

[1] Percentages do not reflect $200 million of intercompany eliminations

18

Belanak Project

PROJECT OVERVIEW

• Floating Production Storage Offloading Project

• Client: KBR

• Awarded in 3Q01

• First of a kind, fixed cost, EPIC

• JRM facility: Batam Island

4Q2003 UPDATE

• Increased cost related to overruns of material and subcontractor cost estimates and increased labor costs

• Loss of $29.2 mm in 4Q03

– Offset $11.9 mm in previously recorded income ($3.9 in 2003)

– Increased est. manhours to complete

– Increased contingency

• Expected completion in fall ‘04

19

Front Runner Spar Project

PROJECT OVERVIEW

• Spar engineering, procurement, construction, and installation

• Client: Murphy Oil

• Awarded in 1Q02

• First of a kind, fixed cost, EPIC

• Spar hull constructed at JRM Jebel Ali facility; subcontracted topsides

4Q2003 UPDATE

• Hull complete and moored in Gulf of Mexico; subcontractor completing topsides; marine installation during June

• Loss of $39.7 mm in 2003

–$ 10.7 mm in 4Q03

– Increased reimbursable expenses at subcontractor

– Improvements on other spar projects was $12 mm

• Expected completion in summer 2004

20

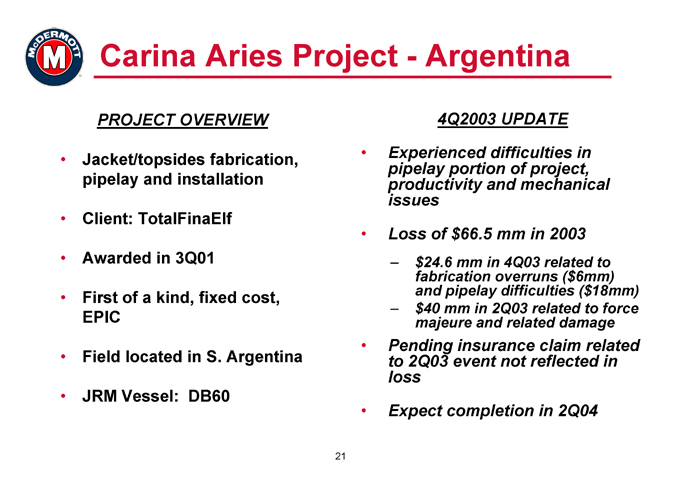

Carina Aries Project—Argentina

PROJECT OVERVIEW

• Jacket/topsides fabrication, pipelay and installation

• Client: TotalFinaElf

• Awarded in 3Q01

• First of a kind, fixed cost, EPIC

• Field located in S. Argentina

• JRM Vessel: DB60

4Q2003 UPDATE

• Experienced difficulties in pipelay portion of project, productivity and mechanical issues

• Loss of $66.5 mm in 2003

–$ 24.6 mm in 4Q03 related to fabrication overruns ($6mm) and pipelay difficulties ($18mm)

–$ 40 mm in 2Q03 related to force majeure and related damage

• Pending insurance claim related to 2Q03 event not reflected in loss

• Expect completion in 2Q04

21

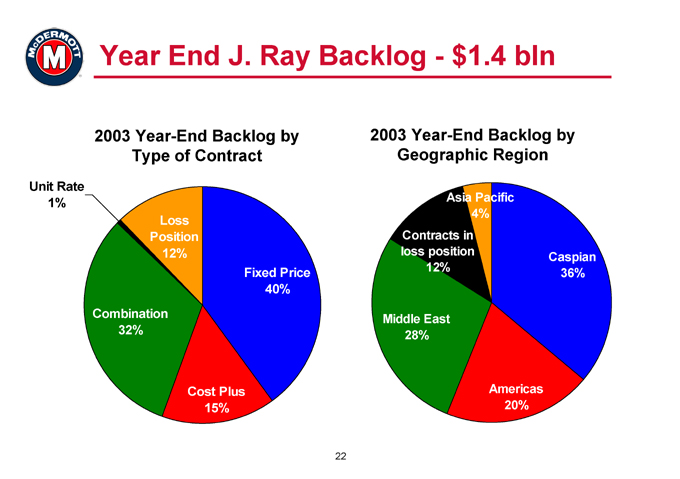

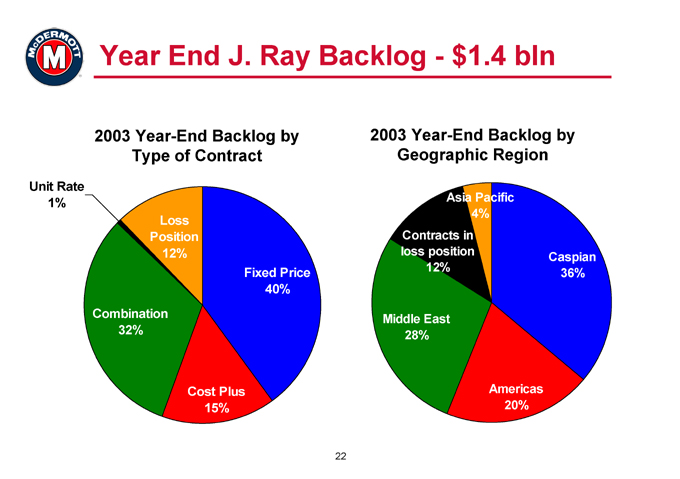

Year End J. Ray Backlog—$1.4 bln

2003 Year-End Backlog by Type of Contract

Unit Rate 1%

Combination 32%

Loss Position 12%

Fixed Price 40%

Cost Plus 15%

2003 Year-End Backlog by Geographic Region

Asia Pacific 4%

Contracts in loss position 12%

Middle East 28%

Caspian 36%

Americas 20%

22

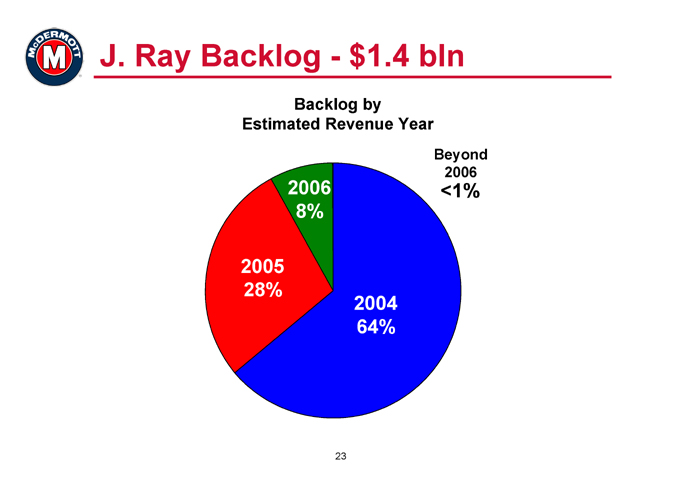

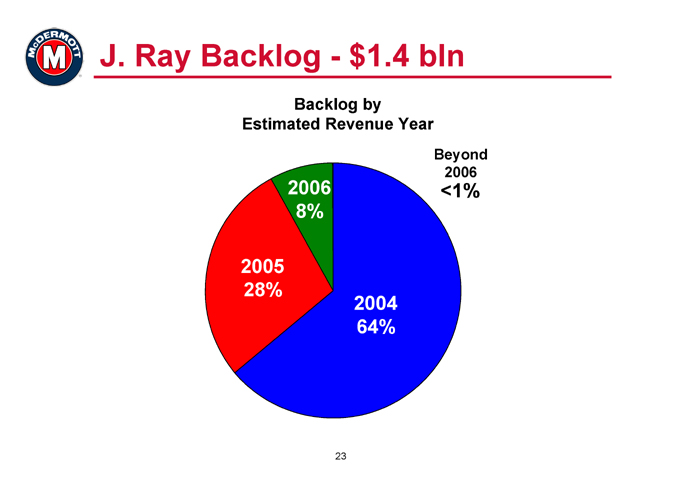

J. Ray Backlog—$1.4 bln

Backlog by Estimated Revenue Year

Beyond 2006 <1%

2005 28%

2006 8%

2004 64%

23

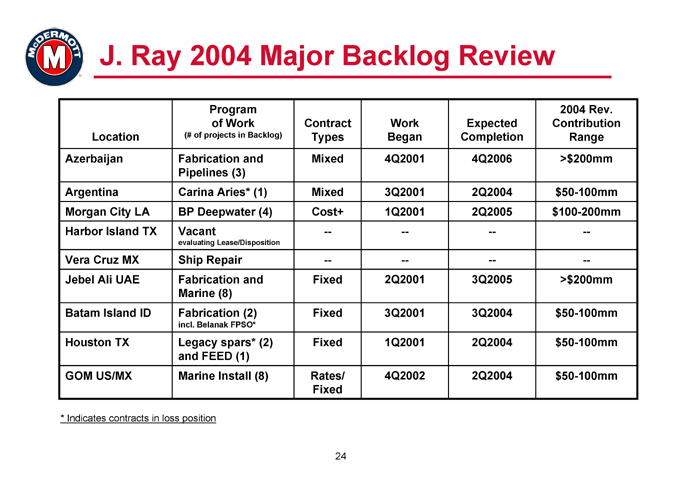

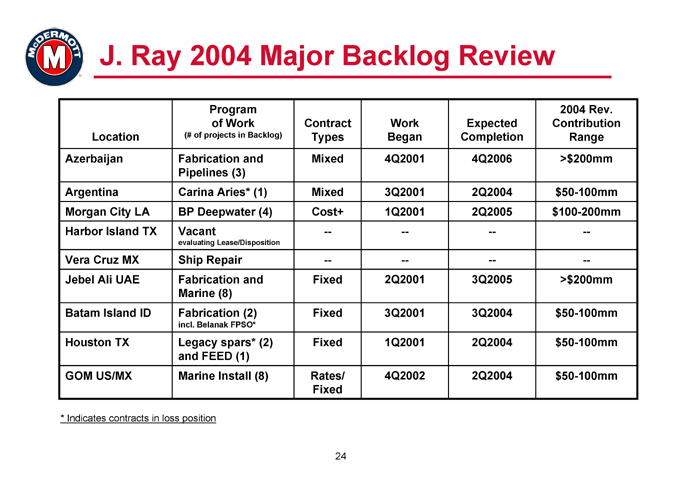

J. Ray 2004 Major Backlog Review

Program 2004 Rev.

of Work Contract Work Expected Contribution

Location (# of projects in Backlog) Types Began Completion Range

Azerbaijan Fabrication and Mixed 4Q2001 4Q2006 >$200mm

Pipelines (3)

Argentina Carina Aries* (1) Mixed 3Q2001 2Q2004 $50-100mm

Morgan City LA BP Deepwater (4) Cost+ 1Q2001 2Q2005 $ 100-200mm

Harbor Island TX Vacant — — — —

evaluating Lease/Disposition

Vera Cruz MX Ship Repair — — — —

Jebel Ali UAE Fabrication and Fixed 2Q2001 3Q2005 >$200mm

Marine (8)

Batam Island ID Fabrication (2) Fixed 3Q2001 3Q2004 $50-100mm

incl. Belanak FPSO*

Houston TX Legacy spars* (2) Fixed 1Q2001 2Q2004 $50-100mm

and FEED (1)

GOM US/MX Marine Install (8) Rates/ 4Q2002 2Q2004 $50-100mm

Fixed

* Indicates contracts in loss position

24

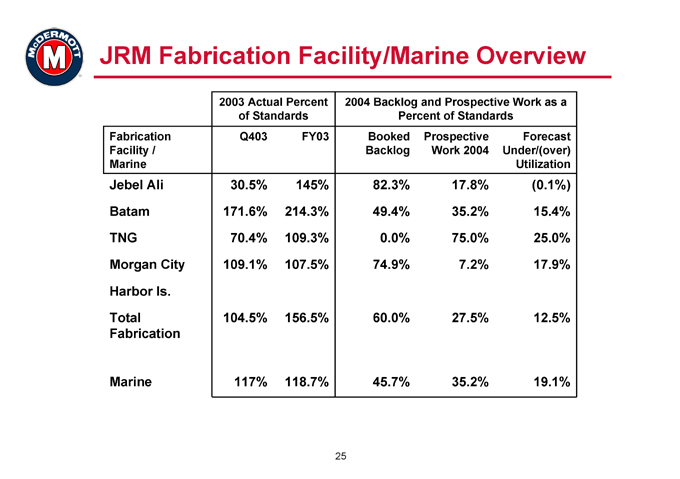

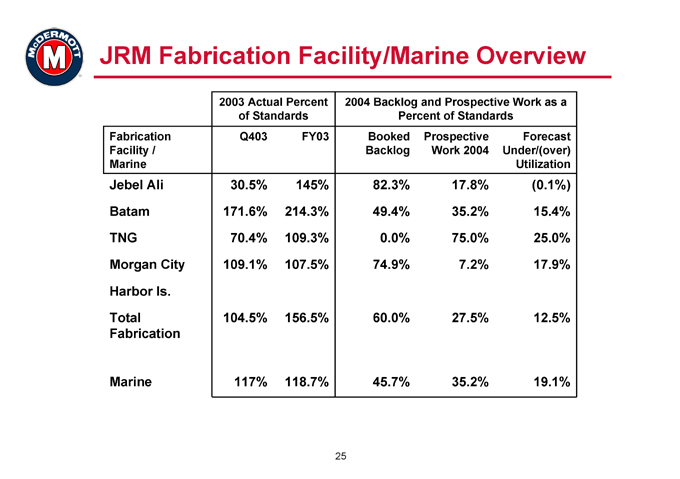

JRM Fabrication Facility/Marine Overview

2003 Actual Percent 2004 Backlog and Prospective Work as a

of Standards Percent of Standards

Fabrication Q403 FY03 Booked Prospective Forecast

Facility / Backlog Work 2004 Under/(over)

Marine Utilization

Jebel Ali 30.5% 145% 82.3% 17.8% (0.1%)

Batam 171.6% 214.3% 49.4% 35.2% 15.4%

TNG 70.4% 109.3% 0.0% 75.0% 25.0%

Morgan City 109.1% 107.5% 74.9% 7.2% 17.9%

Harbor Is.

Total 104.5% 156.5% 60.0% 27.5% 12.5%

Fabrication

Marine 117% 118.7% 45.7% 35.2% 19.1%

25

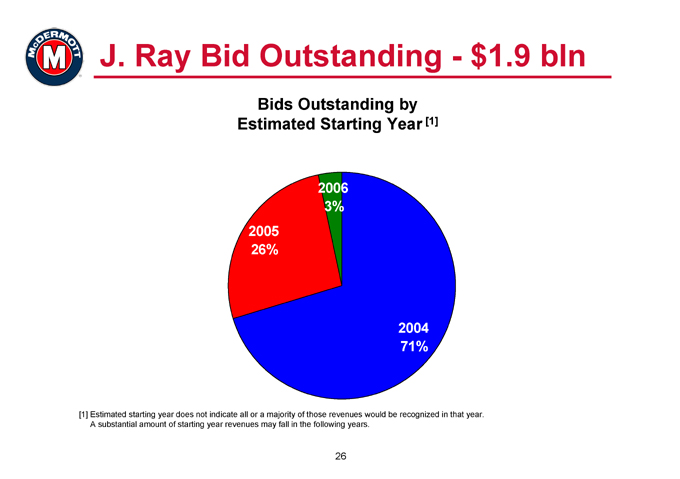

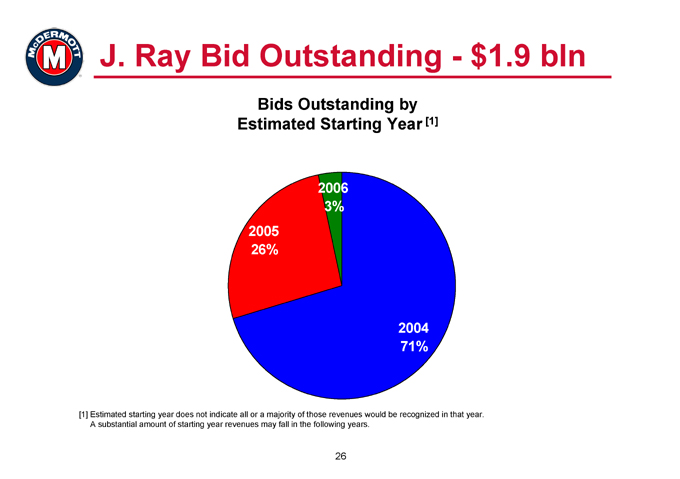

J. Ray Bid Outstanding—$1.9 bln

Bids Outstanding by Estimated Starting Year [1]

2006 3%

2005 26%

2004 71%

[1] Estimated starting year does not indicate all or a majority of those revenues would be recognized in that year.

A substantial amount of starting year revenues may fall in the following years.

26

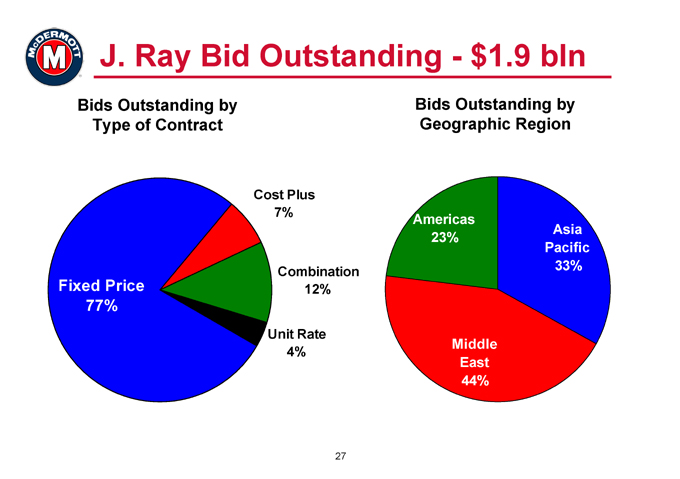

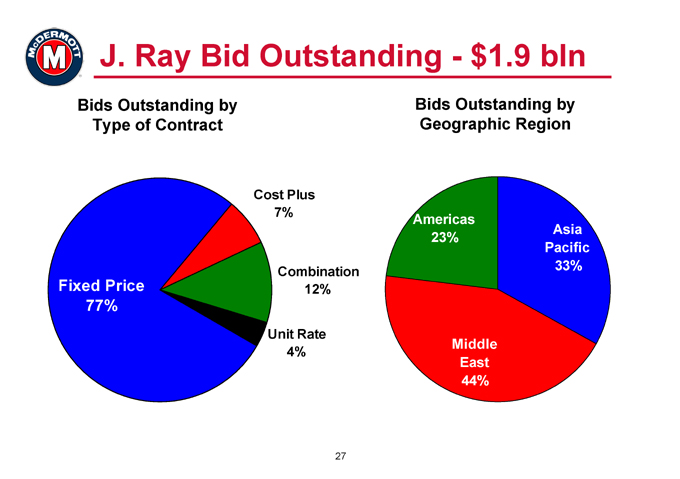

J. Ray Bid Outstanding—$1.9 bln

Bids Outstanding by Type of Contract

Fixed Price 77%

Cost Plus 7%

Combination 12%

Unit Rate 4%

Bids Outstanding by Geographic Region

Americas 23%

Asia Pacific 33%

Middle East 44%

27

BWXT Operational Information

Fourth Quarter and Full Year 2003

BWXT 2003 Overview

• Record segment income of $86.7 million

• Year end backlog of $1.8 billion is all time high

• Substantial M&O contract bids on the horizon

• Continue to be a leader in the defense industry

29

BWXT 2003 Revenues—$531 million

Revenue by Product/Service Line

4% Other

3% Environmental

5% Commercial

2% M&O contracts

86% Nuclear components

30

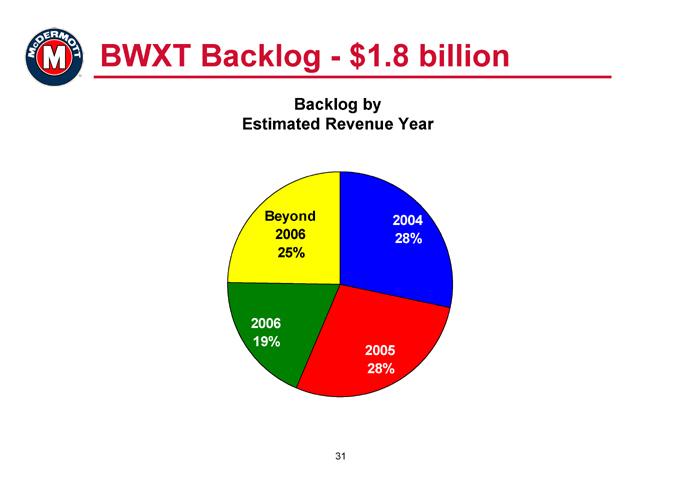

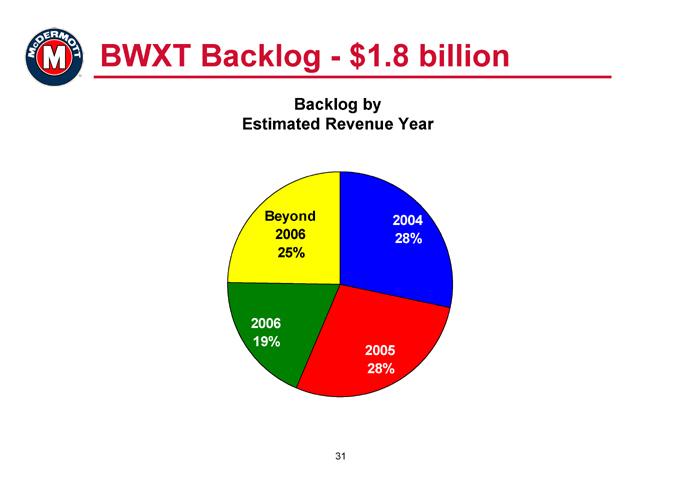

BWXT Backlog—$1.8 billion

Backlog by Estimated Revenue Year

Beyond 2006 25%

2004 28%

2005 28%

2006 19%

31

For additional information, please contact: Jay Roueche Director of Investor Relations 281-870-5462