Exhibit 99.1

McDERMOTT INTERNATIONAL, INC.

Lehman Brothers 2005 CEO

Energy / Power Conference

September 6, 2005 New York

Cautionary Statements / Safe Harbor

Statements in this presentation which express a forecast, expectation or estimate, as well as those which are not historical fact, are forward looking and include statements regarding the proposed settlement of B&W’s Chapter 11 proceeding, B&W’s favorable business environment, management’s expectations regarding outstanding bids, J. Ray’s position to capture industry growth and prospects for growing its backlog, and management’s areas of focus. They involve a number of risks and uncertainties which may cause actual results to differ materially from such forward-looking statements. These risks and uncertainties include the risk that the proposed Chapter 11 settlement may not be finalized on the terms we have described, adverse changes in the company’s liquidity or in the industry, and such other factors detailed in McDermott International’s filings with the U.S. Securities & Exchange Commission, including its Form 10-K for the year ended December 31, 2004 and its Form 10-Q’s which are filed quarterly.

Lehman Brothers 2005 CEO Energy / Power Conference September 6, 2005 2

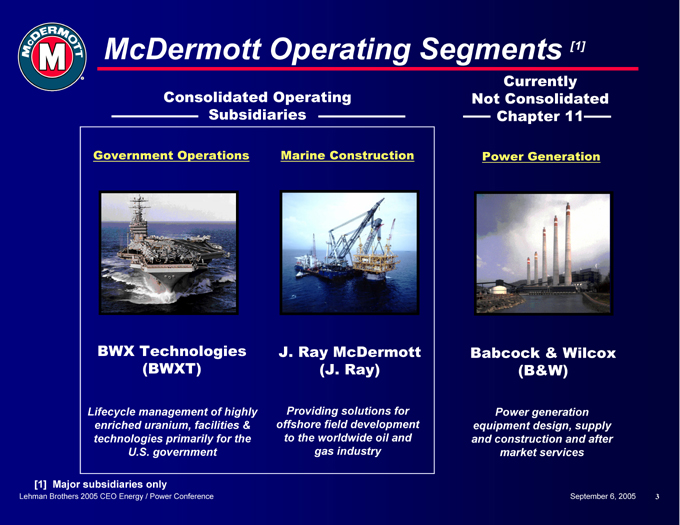

McDermott Operating Segments [1]

Consolidated Operating Subsidiaries

Government Operations

BWX Technologies (BWXT)

Lifecycle management of highly enriched uranium, facilities & technologies primarily for the U.S. government

Marine Construction

J. Ray McDermott (J. Ray)

Providing solutions for offshore field development to the worldwide oil and gas industry

Currently Not Consolidated Chapter 11

Power Generation

Babcock & Wilcox (B&W)

Power generation equipment design, supply and construction and after market services

[1] Major subsidiaries only

Lehman Brothers 2005 CEO Energy / Power Conference September 6, 2005 3

Investment Highlights

Three industry-leading, franchise-name businesses Solid, predictable backlog and performance at BWXT Improved disciplines and results at J. Ray B&W Chapter 11 bankruptcy resolution in sight

Revised settlement provides for retention of B&W Economic benefit of FAIR Act if signed into law Industry fundamentals for B&W are promising

Experienced, shareholder-focused management team

Lehman Brothers 2005 CEO Energy / Power Conference September 6, 2005 4

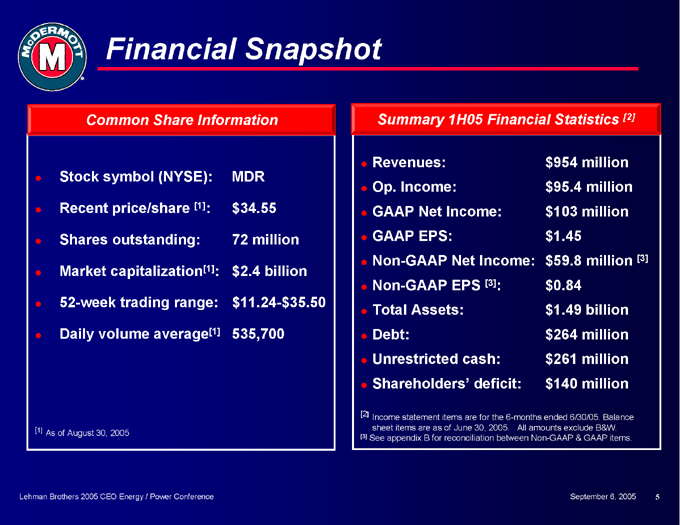

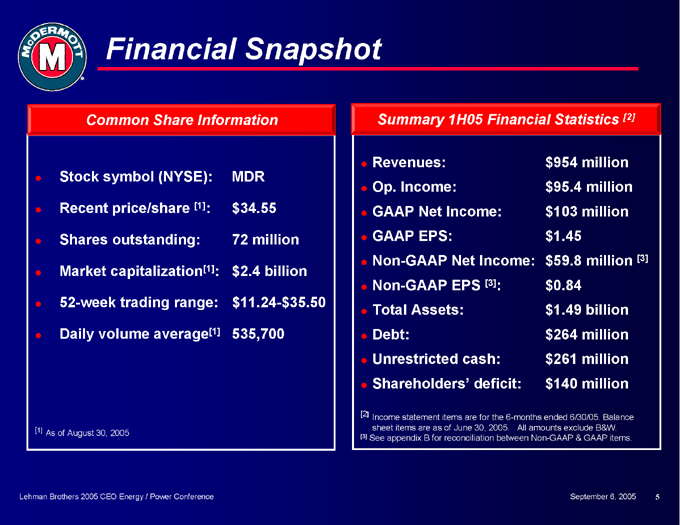

Financial Snapshot

Common Share Information

Stock symbol (NYSE): MDR Recent price/share [1]: $34.55 Shares outstanding: 72 million Market capitalization[1]: $2.4 billion 52-week trading range: $11.24-$35.50 Daily volume average[1] 535,700

[1] As of August 30, 2005

Summary 1H05 Financial Statistics [2]

Revenues: $954 million Op. Income: $95.4 million GAAP Net Income: $103 million GAAP EPS: $1.45 Non-GAAP Net Income: $59.8 million [3] Non-GAAP EPS [3]: $0.84 Total Assets: $1.49 billion Debt: $264 million Unrestricted cash: $261 million Shareholders’ deficit: $140 million

[2] Income statement items are for the 6-months ended 6/30/05. Balance sheet items are as of June 30, 2005. All amounts exclude B&W.

[3] See appendix B for reconciliation between Non-GAAP & GAAP items.

Lehman Brothers 2005 CEO Energy / Power Conference September 6, 2005 5

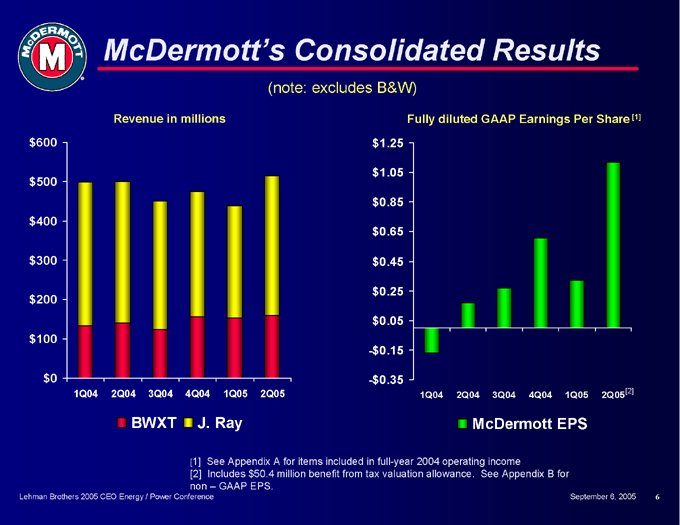

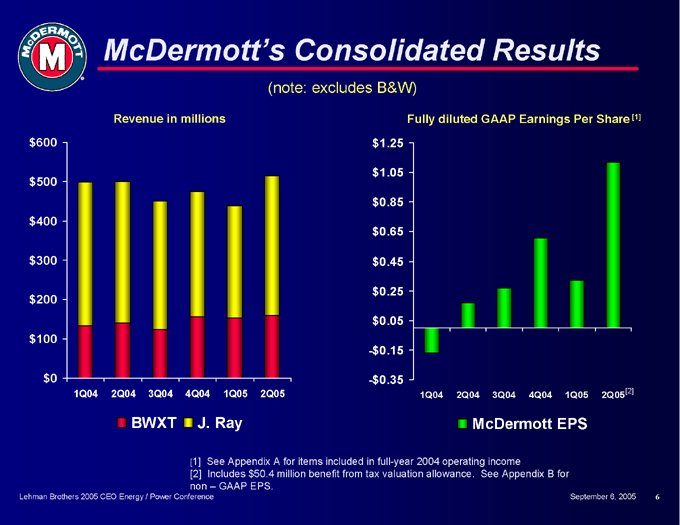

McDermott’s Consolidated Results

(note: excludes B&W)

Revenue in millions $600

$500 $400 $300 $200 $100

$0

1Q04 2Q04 3Q04 4Q04 1Q05 2Q05

BWXT J. Ray

Fully diluted GAAP Earnings Per Share [1] $1.25

$1.05 $0.85 $0.65 $0.45 $0.25 $0.05

-$0.15

-$0.35

1Q04 2Q04 3Q04 4Q04 1Q05 2Q05[2]

McDermott EPS

[1] See Appendix A for items included in full-year 2004 operating income

[2] Includes $50.4 million benefit from tax valuation allowance. See Appendix B for non – GAAP EPS.

Lehman Brothers 2005 CEO Energy / Power Conference September 6, 2005 6

BWX Technologies, Inc.SM

BWXT is the premier manager of complex, high-consequence nuclear and national security operations. We are disciplined operators and managers of nuclear production facilities, who deliver value and customer confidence.

Powering Transformation

McDERMOTT INTERNATIONAL, INC.

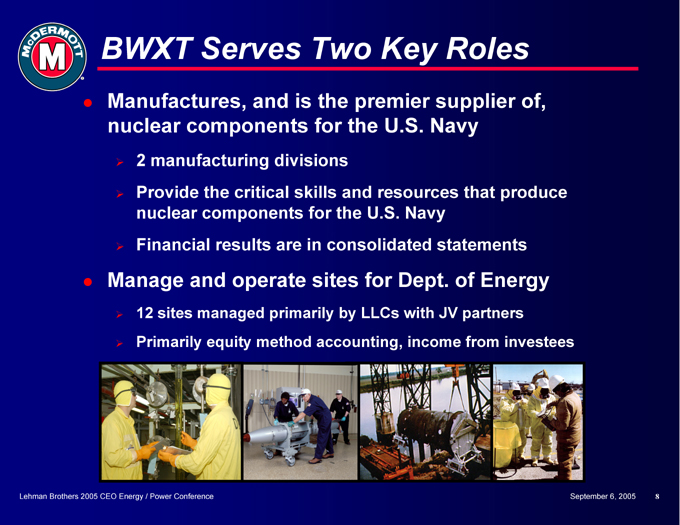

BWXT Serves Two Key Roles

Manufactures, and is the premier supplier of, nuclear components for the U.S. Navy

2 manufacturing divisions

Provide the critical skills and resources that produce nuclear components for the U.S. Navy Financial results are in consolidated statements

Manage and operate sites for Dept. of Energy

12 sites managed primarily by LLCs with JV partners Primarily equity method accounting, income from investees

Lehman Brothers 2005 CEO Energy / Power Conference September 6, 2005 8

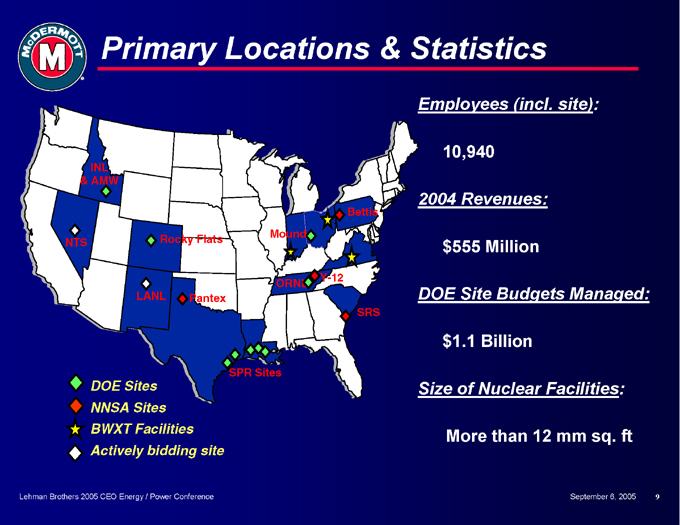

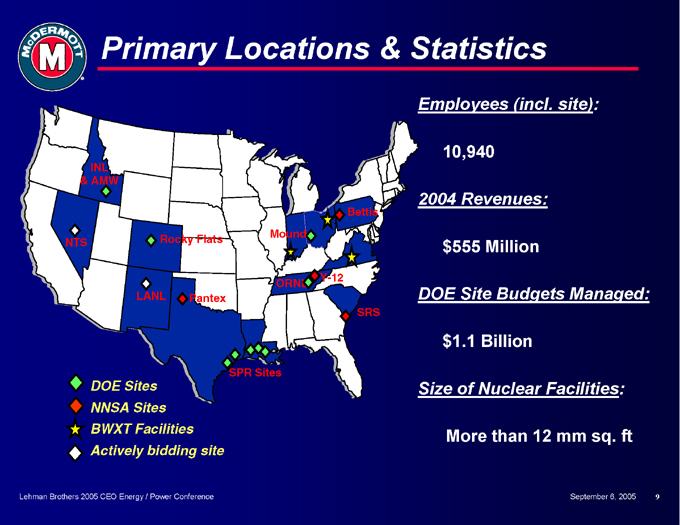

Primary Locations & Statistics

INL & AMW

Bettis Rocky Flats Mound NTS

Y-12 ORNL

LANL Pantex

SRS

SPR Sites

DOE Sites NNSA Sites BWXT Facilities Actively bidding site

Employees (incl. site):

10,940

2004 Revenues:

$555 Million

DOE Site Budgets Managed:

$1.1 Billion

Size of Nuclear Facilities:

More than 12 mm sq. ft

Lehman Brothers 2005 CEO Energy / Power Conference September 6, 2005 9

BWXT Growth Drivers

Ship & submarine building rates Refuel New DOE M&O opportunities Space reactor programs Down-blending services

Funding of strategic & environmental programs

Regulatory and policy changes

Lehman Brothers 2005 CEO Energy / Power Conference September 6, 2005 10

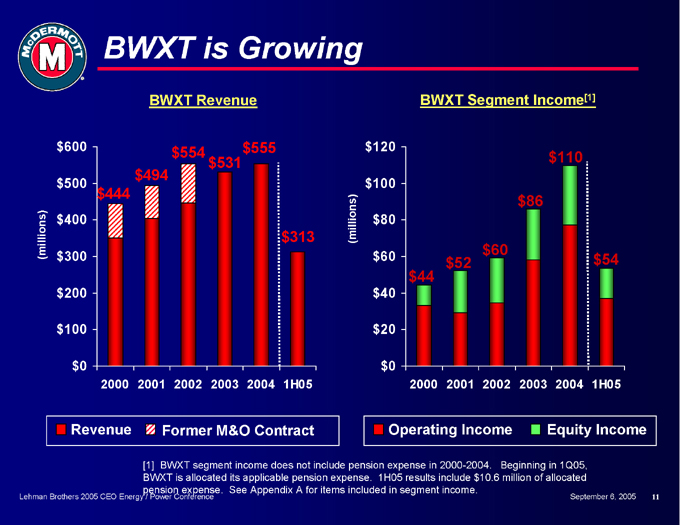

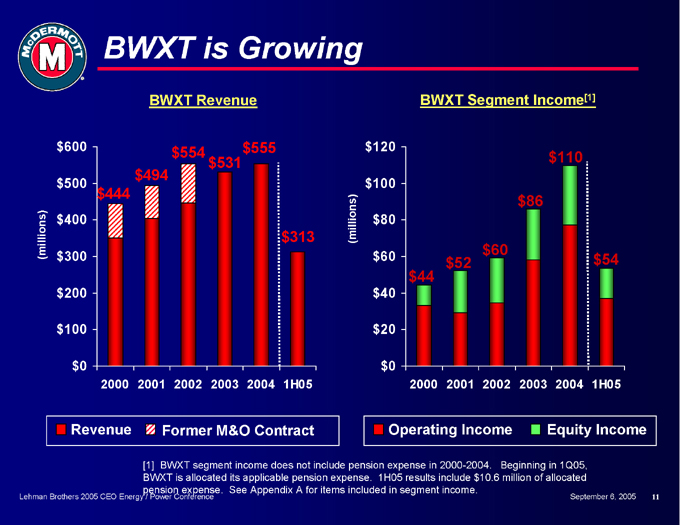

BWXT is Growing

BWXT Revenue $600 $554 $555 $531 $494

$500

$444

(millions) $400

$313

$300 $200 $100

$0

2000 2001 2002 2003 2004 1H05

Revenue

Former M&O Contract

BWXT Segment Income[1] $120

$110

$100

(millions) $86

$80

$60 $60

$52 $54 $44

$40

$20

$0

2000 2001 2002 2003 2004 1H05

Operating Income

Equity Income

[1] BWXT segment income does not include pension expense in 2000-2004. Beginning in 1Q05, BWXT is allocated its applicable pension expense. 1H05 results include $10.6 million of allocated pension expense. See Appendix A for items included in segment income.

Lehman Brothers 2005 CEO Energy / Power Conference September 6, 2005 11

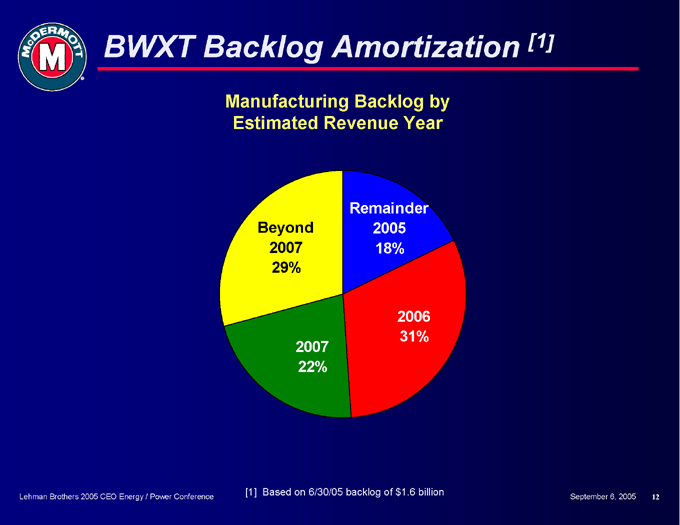

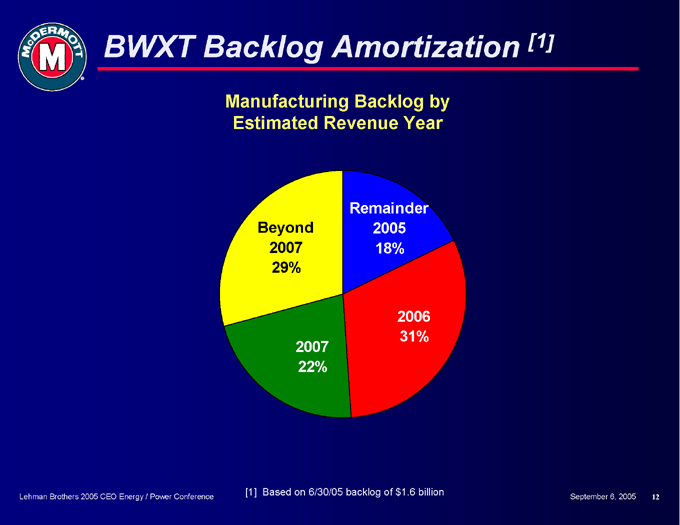

BWXT Backlog Amortization [1]

Manufacturing Backlog by Estimated Revenue Year

Beyond 2007 29%

2007 22%

2006 31%

Remainder 2005 18%

[1] Based on 6/30/05 backlog of $1.6 billion

Lehman Brothers 2005 CEO Energy / Power Conference

September 6, 2005 12

BWXT’s Strategy

Maintain leadership position Maintain customer confidence Generate cost reductions

Explore opportunities selectively outside the U.S.

Continue strong operational and financial performance

Lehman Brothers 2005 CEO Energy / Power Conference September 6, 2005 13

McDERMOTT INTERNATIONAL, INC.

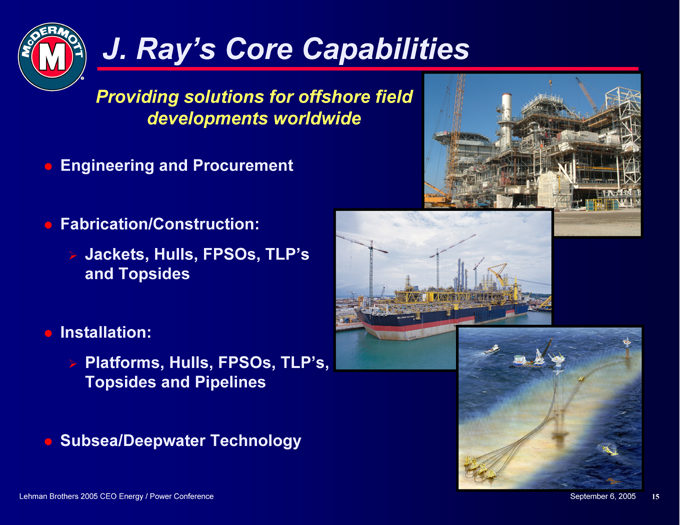

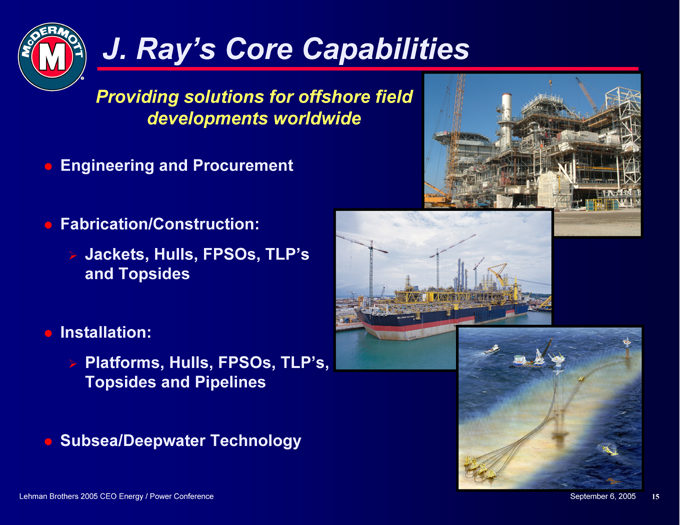

J. Ray’s Core Capabilities

Providing solutions for offshore field developments worldwide

Engineering and Procurement

Fabrication/Construction:

Jackets, Hulls, FPSOs, TLP’s and Topsides

Installation:

Platforms, Hulls, FPSOs, TLP’s, Topsides and Pipelines

Subsea/Deepwater Technology

Lehman Brothers 2005 CEO Energy / Power Conference September 6, 2005 15

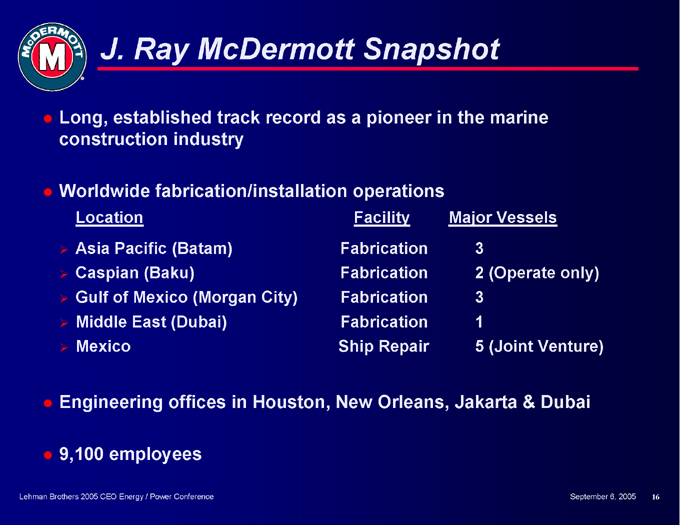

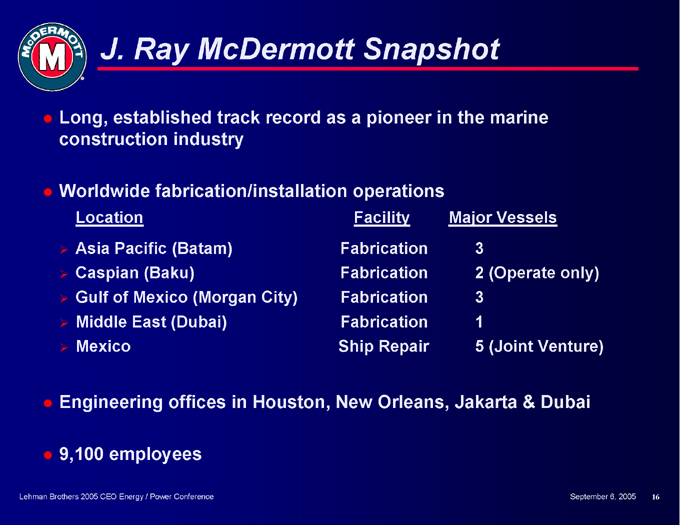

J. Ray McDermott Snapshot

Long, established track record as a pioneer in the marine construction industry

Worldwide fabrication/installation operations

Location Facility Major Vessels

Asia Pacific (Batam) Fabrication 3

Caspian (Baku) Fabrication 2 (Operate only)

Gulf of Mexico (Morgan City) Fabrication 3

Middle East (Dubai) Fabrication 1

Mexico Ship Repair 5 (Joint Venture)

Engineering offices in Houston, New Orleans, Jakarta & Dubai

9,100 employees

Lehman Brothers 2005 CEO Energy / Power Conference

September 6, 2005 16

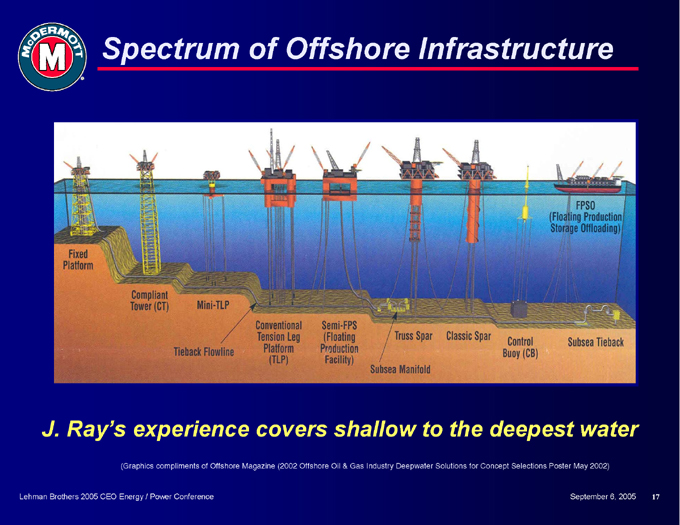

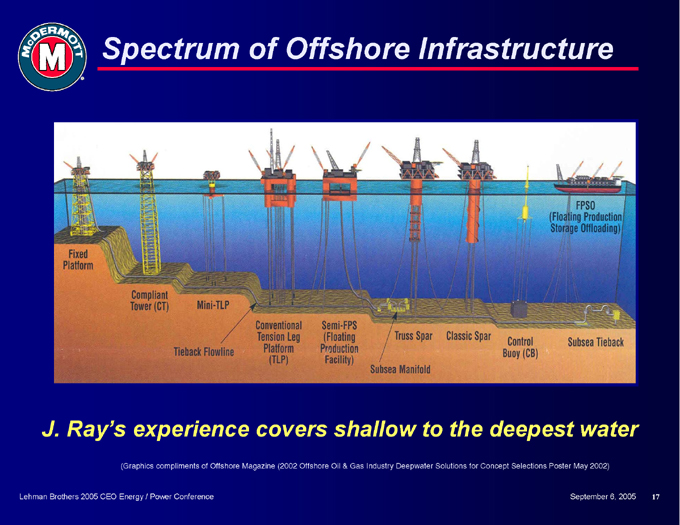

Spectrum of Offshore Infrastructure

FPSO (Floating Production Storage Offloading)

Fixed Platform

Compliant Tower (CT)

Mini-TLP

Tieback Flowline

Conventional Tension Leg Platform (TLP)

Semi-FPS (Floating Production Facility)

Subsea Manifold

Truss Spar

Classic Spar

Control Buoy (CB)

Subsea Tieback

J. Ray’s experience covers shallow to the deepest water

(Graphics compliments of Offshore Magazine (2002 Offshore Oil & Gas Industry Deepwater Solutions for Concept Selections Poster May 2002)

Lehman Brothers 2005 CEO Energy / Power Conference September 6, 2005 17

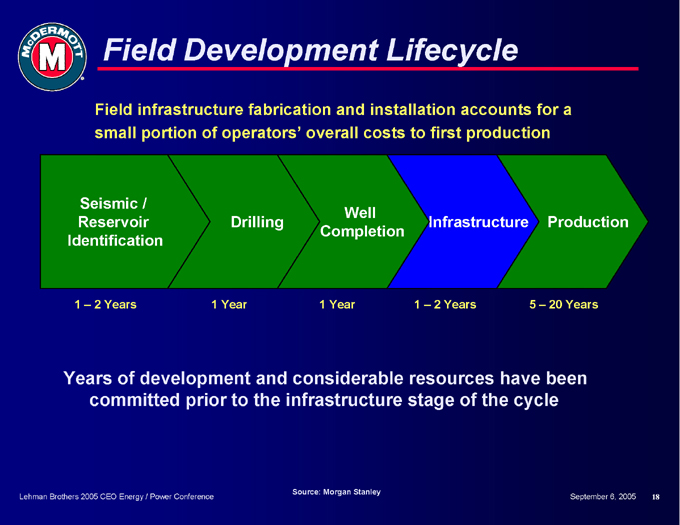

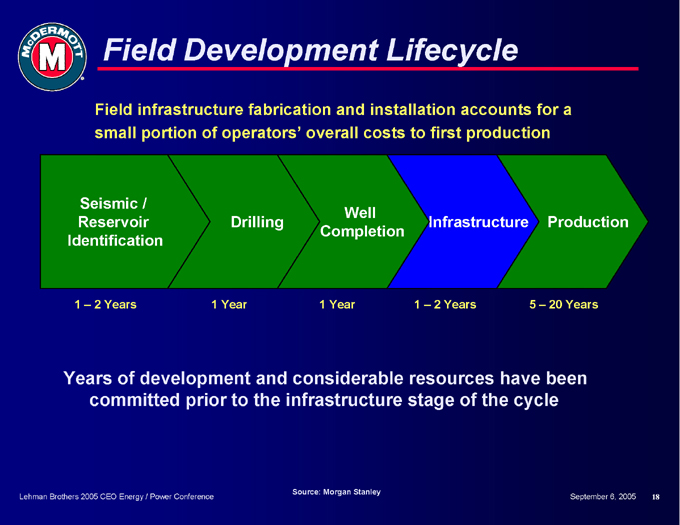

Field Development Lifecycle

Field infrastructure fabrication and installation accounts for a small portion of operators’ overall costs to first production

Seismic /

Well

Reservoir Drilling Infrastructure Production Completion Identification

1 – 2 Years 1 Year 1 Year 1 – 2 Years 5 – 20 Years

Years of development and considerable resources have been committed prior to the infrastructure stage of the cycle

Source: Morgan Stanley

Lehman Brothers 2005 CEO Energy / Power Conference

September 6, 2005 18

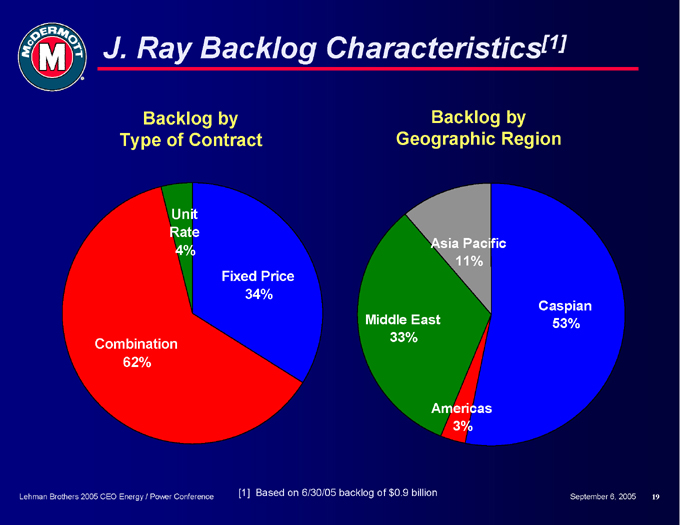

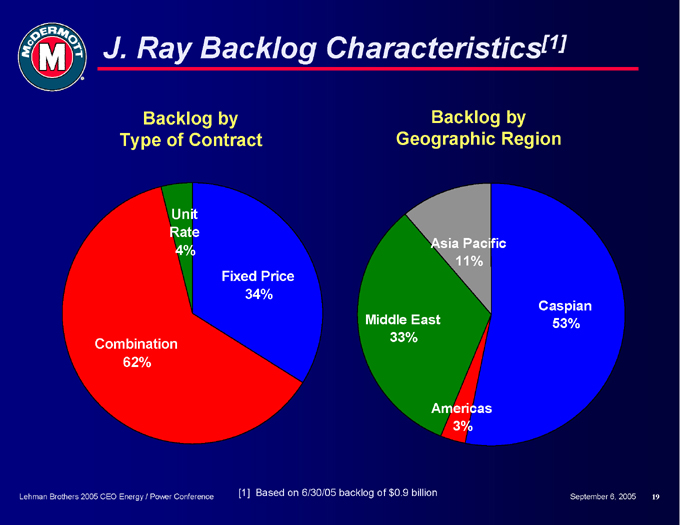

J. Ray Backlog Characteristics[1]

Backlog by Type of Contract

Unit Rate 4%

Fixed Price 34%

Combination 62%

Backlog by Geographic Region

Asia Pacific 11%

Caspian Middle East 53% 33%

Americas 3%

[1] Based on 6/30/05 backlog of $0.9 billion

Lehman Brothers 2005 CEO Energy / Power Conference

September 6, 2005 19

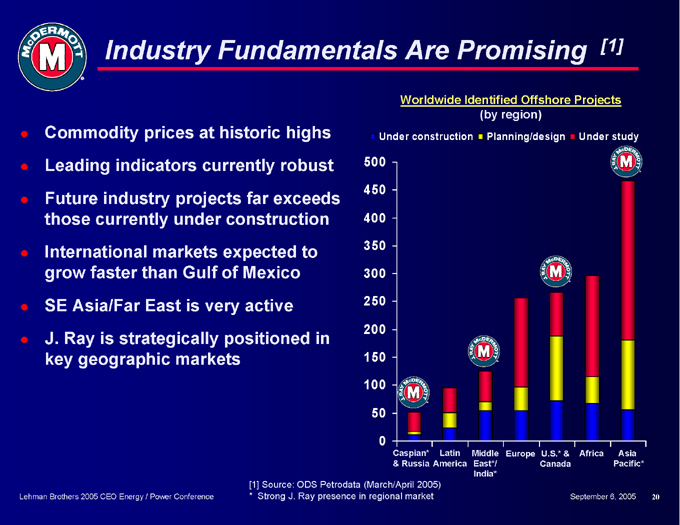

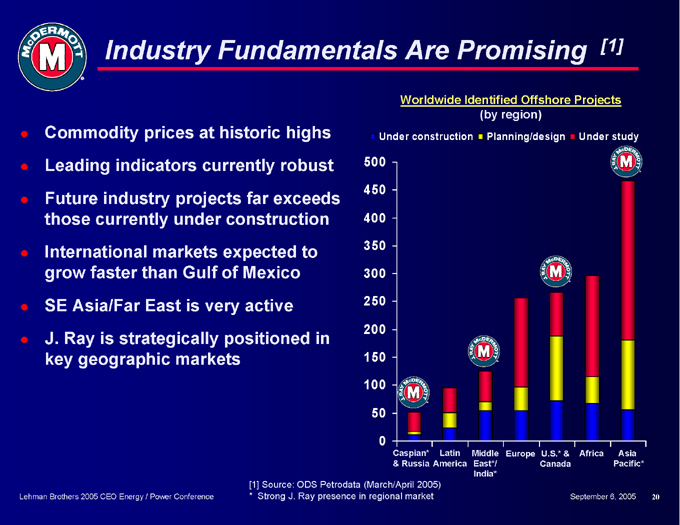

Industry Fundamentals Are Promising [1]

Commodity prices at historic highs Leading indicators currently robust Future industry projects far exceeds those currently under construction International markets expected to grow faster than Gulf of Mexico SE Asia/Far East is very active J. Ray is strategically positioned in key geographic markets

Worldwide Identified Offshore Projects (by region)

Under construction Planning/design Under study

500 450 400 350 300 250 200 150 100 50

0

Caspian* Latin Middle Europe U.S.* & Africa Asia & Russia America East*/ Canada Pacific* India*

[1] Source: ODS Petrodata (March/April 2005)

* Strong J. Ray presence in regional market

Lehman Brothers 2005 CEO Energy / Power Conference

September 6, 2005 20

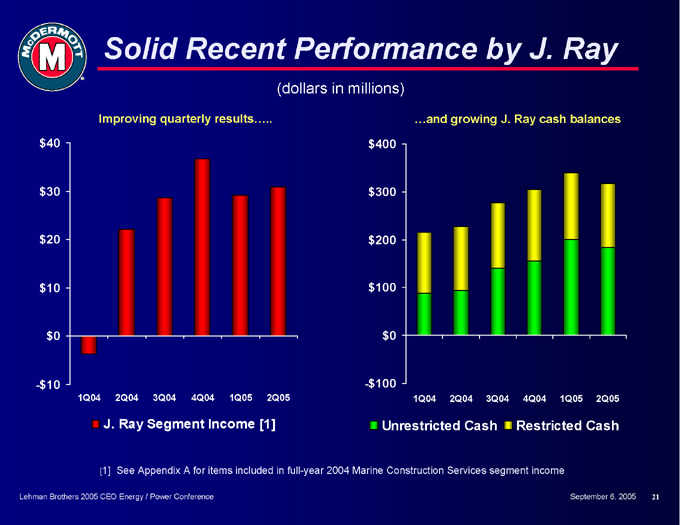

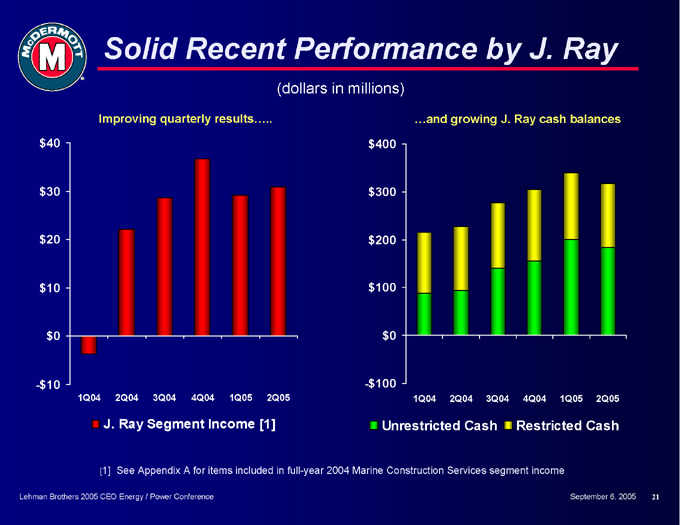

Solid Recent Performance by J. Ray

(dollars in millions)

Improving quarterly results

$40 $30 $20 $10 $0

-$10

1Q04 2Q04 3Q04 4Q04 1Q05 2Q05

J. Ray Segment Income [1]

…and growing J. Ray cash balances $400 $300 $200 $100 $0

-$ 100

1Q04 2Q04 3Q04 4Q04 1Q05 2Q05

Unrestricted Cash Restricted Cash

[1] See Appendix A for items included in full-year 2004 Marine Construction Services segment income

Lehman Brothers 2005 CEO Energy / Power Conference

September 6, 2005 21

Bidding Activity leads to 3rd Qtr. Awards

Bids outstanding exceeded $2 billion in June 2005 Awarded Saudi Aramco project in August Chevron Gulf of Mexico marine contract signed Expect near-term awards in the Asia Pacific market Plan to win our share of remaining bids

Maintain financial discipline in bids; manage risk and reward Selectively pursue projects, a rifle approach Manage the business from a global perspective

Lehman Brothers 2005 CEO Energy / Power Conference September 6, 2005 22

J. Ray Summary

Late-cycle service company in offshore field development

Well positioned to capture industry growth

Strong franchise in strategic geographical locations Management team leading change in all areas $930 million backlog with good growth prospects

Lehman Brothers 2005 CEO Energy / Power Conference September 6, 2005 23

McDERMOTT INTERNATIONAL, INC.

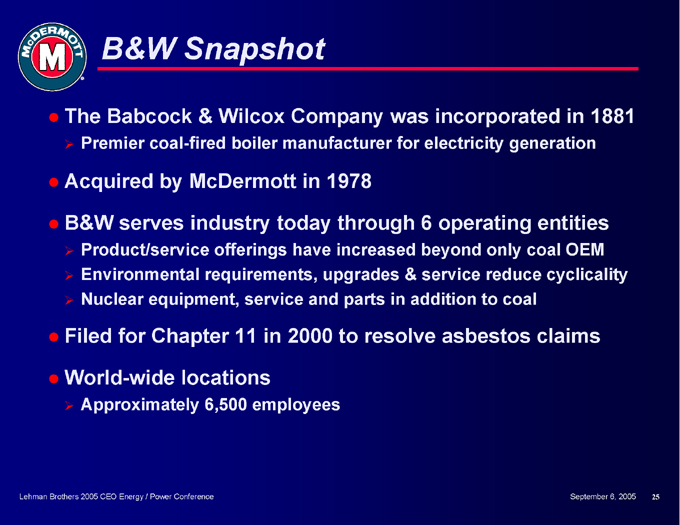

B&W Snapshot

The Babcock & Wilcox Company was incorporated in 1881

Premier coal-fired boiler manufacturer for electricity generation

Acquired by McDermott in 1978

B&W serves industry today through 6 operating entities

Product/service offerings have increased beyond only coal OEM Environmental requirements, upgrades & service reduce cyclicality Nuclear equipment, service and parts in addition to coal

Filed for Chapter 11 in 2000 to resolve asbestos claims World-wide locations

Approximately 6,500 employees

Lehman Brothers 2005 CEO Energy / Power Conference September 6, 2005 25

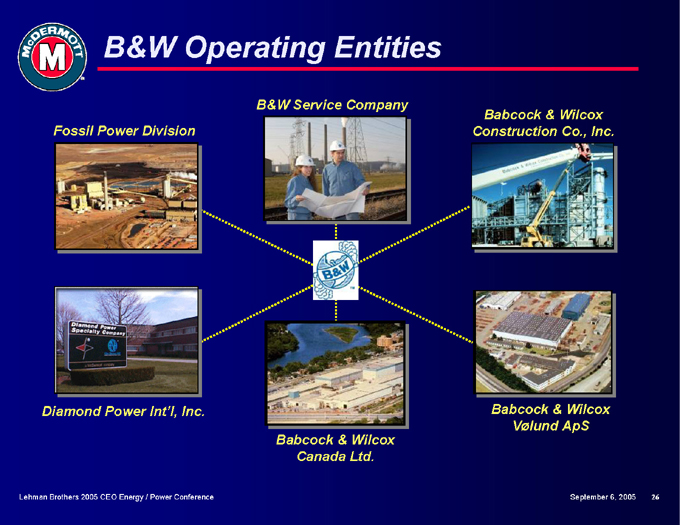

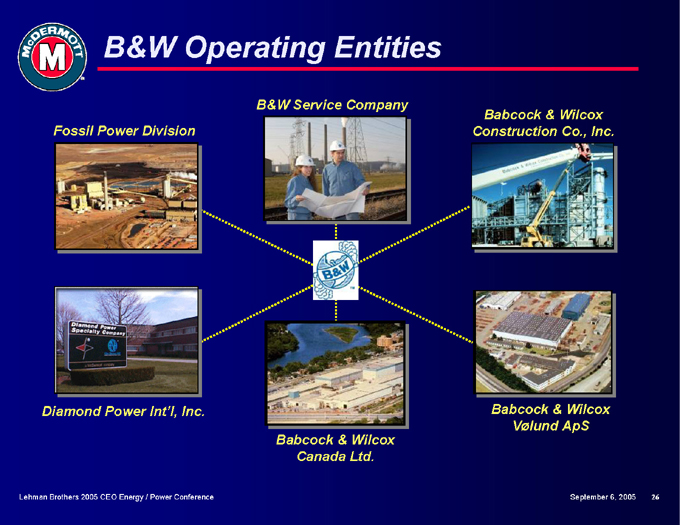

B&W Operating Entities

B&W Service Company

Babcock & Wilcox Fossil Power Division Construction Co., Inc.

Diamond Power Int’l, Inc. Babcock & Wilcox

Vølund ApS Babcock & Wilcox Canada Ltd.

Lehman Brothers 2005 CEO Energy / Power Conference September 6, 2005 26

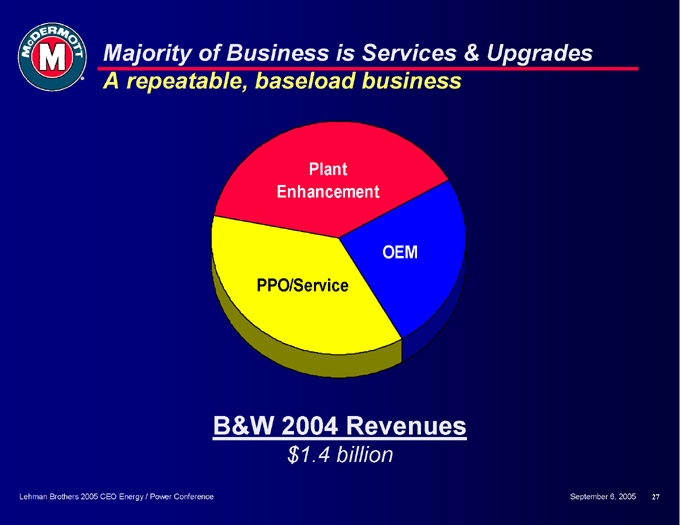

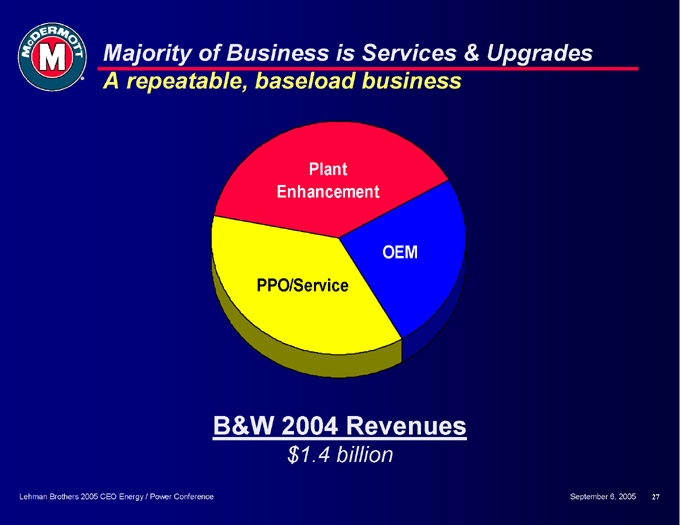

Majority of Business is Services & Upgrades A repeatable, baseload business

Plant Enhancement

OEM PPO/Service

B&W 2004 Revenues

$1.4 billion

Lehman Brothers 2005 CEO Energy / Power Conference September 6, 2005 27

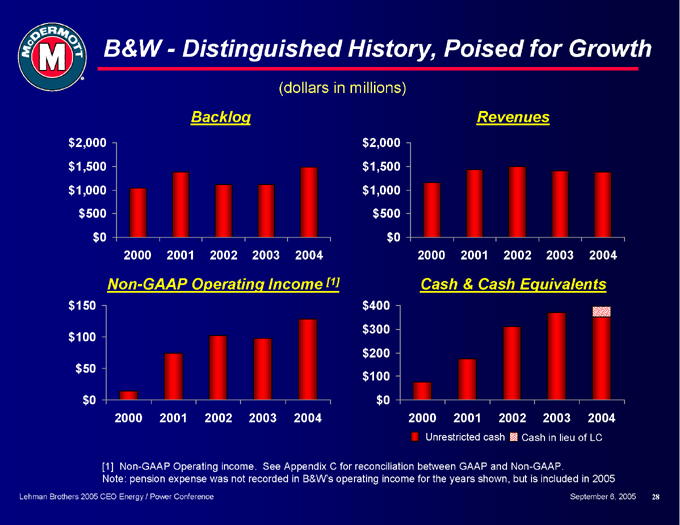

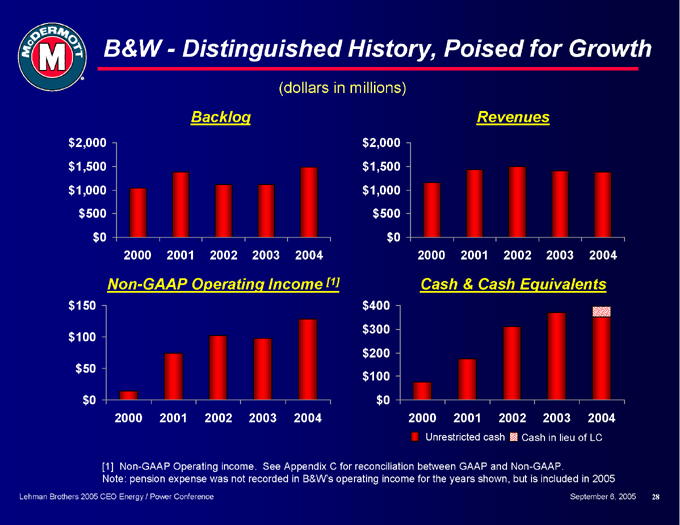

B&W - Distinguished History, Poised for Growth

(dollars in millions)

Backlog $2,000 $1,500 $1,000 $500 $0

2000 2001 2002 2003 2004

Revenues $2,000 $1,500 $1,000 $500 $0

2000 2001 2002 2003 2004

Non-GAAP Operating Income [1] $150 $100 $50

$0

2000 2001 2002 2003 2004

Cash & Cash Equivalents $400 $300 $200 $100 $0

2000 2001 2002 2003 2004

Unrestricted cash Cash in lieu of LC

[1] Non-GAAP Operating income. See Appendix C for reconciliation between GAAP and Non-GAAP.

Note: pension expense was not recorded in B&W’s operating income for the years shown, but is included in 2005

Lehman Brothers 2005 CEO Energy / Power Conference September 6, 2005 28

Revised Settlement Agreement – 8/29/05

Key points of revised agreement

MDR retains B&W – with or without FAIR Act passage Economic opportunity of FAIR Act preserved Fast track resolution to Chapter 11 versus existing settlement Greater certainty of effective settlement, not later than 2/22/06

Consideration of settlement $350 million payment on effective date (no later than 2/22/06) $250 million contingent note (5-years, 7% interest) $355 million contingent payment right (180 days after 11/30/06) Contingent payments dependent on FAIR Act status If FAIR Act becomes law by 11/30/06, only $25 million additional payment required, remaining contingent consideration cancelled

B&W $352 million of cash available on August 24, 2005

Lehman Brothers 2005 CEO Energy / Power Conference September 6, 2005 29

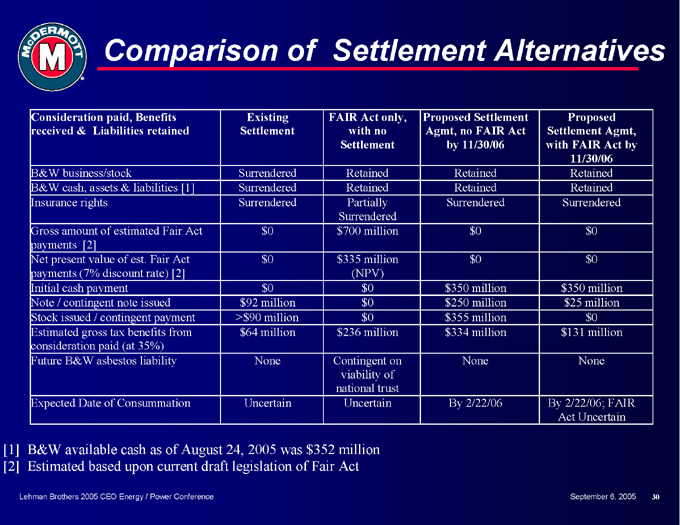

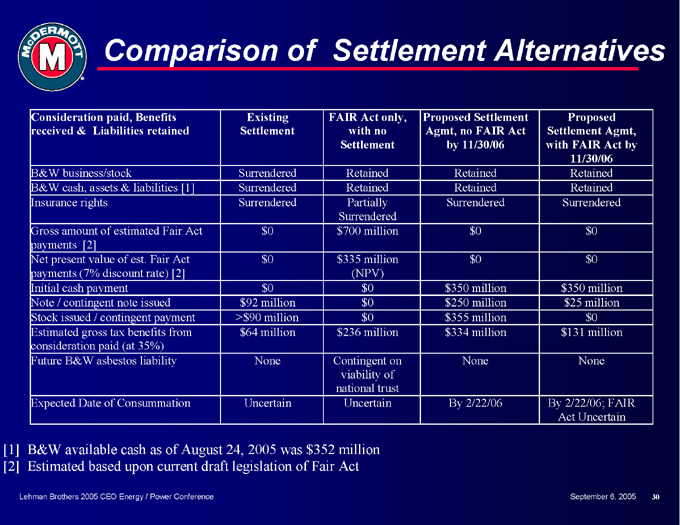

Comparison of Settlement Alternatives

Consideration paid, Benefits received & Liabilities retained Existing Settlement FAIR Act only, with no Settlement Proposed Settlement Agmt, no FAIR Act by 11/30/06 Proposed Settlement Agmt, with FAIR Act by 11/30/06

B&W business/stock Surrendered Retained Retained Retained

B&W cash, assets & liabilities [1] Surrendered Retained Retained Retained

Insurance rights Surrendered Partially Surrendered Surrendered Surrendered

Gross amount of estimated Fair Act payments [2] $0 $700 million $0 $0

Net present value of est. Fair Act payments (7% discount rate) [2] $0 $335 million (NPV) $0 $0

Initial cash payment $0 $0 $350 million $350 million

Note / contingent note issued $92 million $0 $250 million $25 million

Stock issued / contingent payment >$90 million $0 $355 million $0

Estimated gross tax benefits from consideration paid (at 35%) $64 million $236 million $334 million $131 million

Future B&W asbestos liability None Contingent on viability of national trust None None

Expected Date of Consummation Uncertain Uncertain By 2/22/06 By 2/22/06; FAIR Act Uncertain

[1] B&W available cash as of August 24, 2005 was $352 million [2] Estimated based upon current draft legislation of Fair Act

Lehman Brothers 2005 CEO Energy / Power Conference September 6, 2005 30

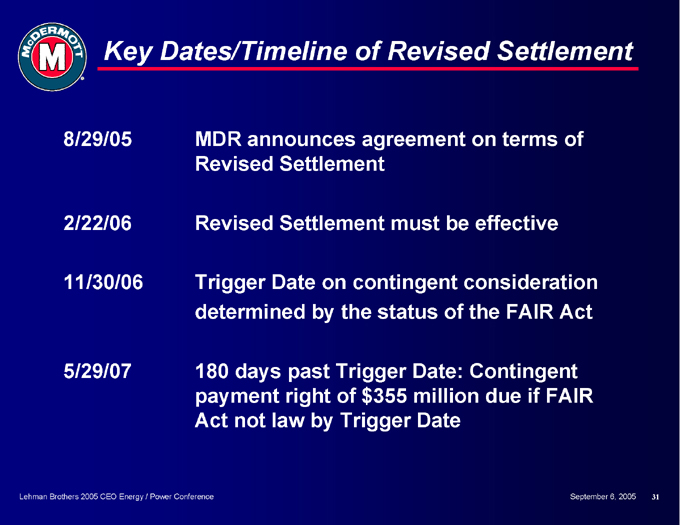

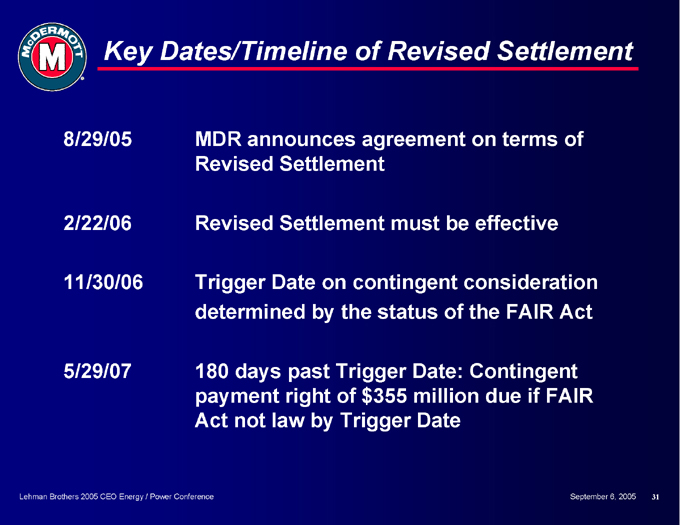

Key Dates/Timeline of Revised Settlement

8/29/05 MDR announces agreement on terms of Revised Settlement

2/22/06 Revised Settlement must be effective

11/30/06 Trigger Date on contingent consideration determined by the status of the FAIR Act

5/29/07 180 days past Trigger Date: Contingent payment right of $355 million due if FAIR Act not law by Trigger Date

Lehman Brothers 2005 CEO Energy / Power Conference September 6, 2005 31

Remaining Issues / Events for Settlement

Key remaining issues to reach effective date

Negotiate and sign acceptable definitive agreements Obtain necessary approvals: MDR Board, shareholder, asbestos claimants and Court confirmation Resolve any objections to plan of reorganization Install exit financing and book reconsolidation

Achieve effective date by February 22, 2006

Lehman Brothers 2005 CEO Energy / Power Conference September 6, 2005 32

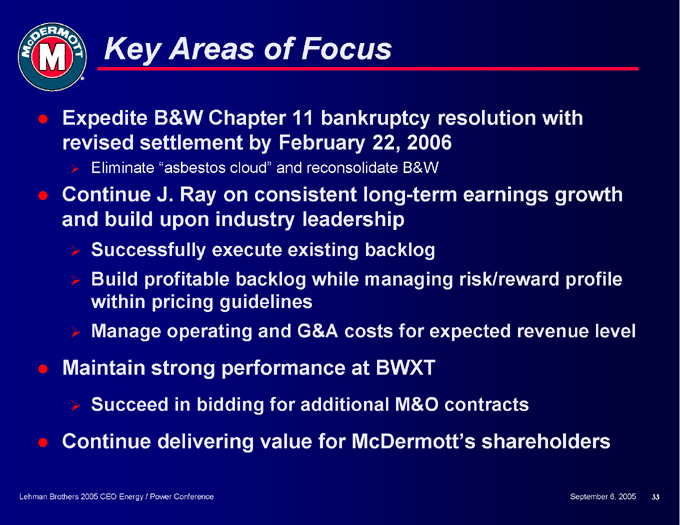

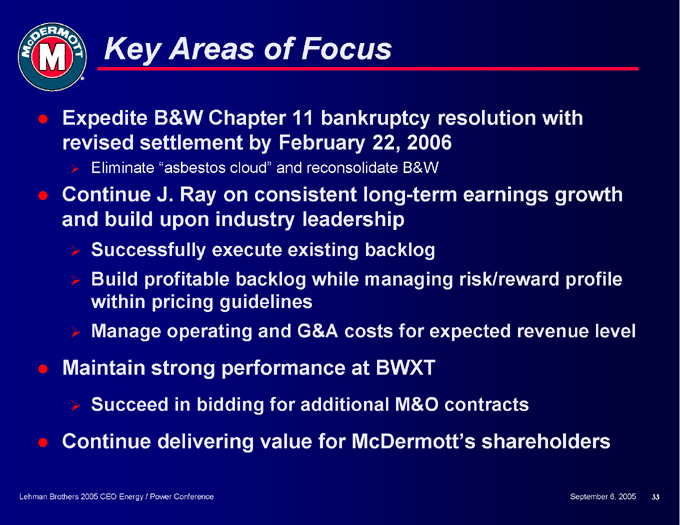

Key Areas of Focus

Expedite B&W Chapter 11 bankruptcy resolution with revised settlement by February 22, 2006

Eliminate “asbestos cloud” and reconsolidate B&W

Continue J. Ray on consistent long-term earnings growth and build upon industry leadership

Successfully execute existing backlog

Build profitable backlog while managing risk/reward profile within pricing guidelines Manage operating and G&A costs for expected revenue level

Maintain strong performance at BWXT

Succeed in bidding for additional M&O contracts

Continue delivering value for McDermott’s shareholders

Lehman Brothers 2005 CEO Energy / Power Conference September 6, 2005 33

McDERMOTT INTERNATIONAL, INC.

(NYSE: MDR)

For more information contact:

Jay Roueche Director of Investor Relations 281-870-5462

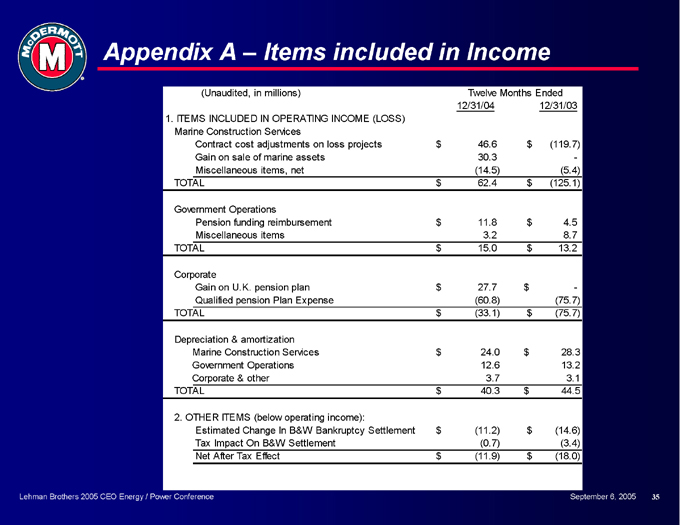

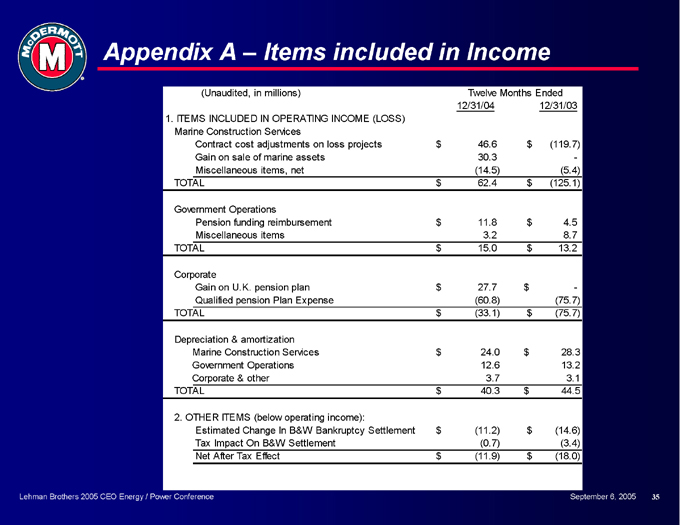

Appendix A – Items included in Income

(Unaudited, in millions) Twelve Months Ended

12/31/04 12/31/03

1. ITEMS INCLUDED IN OPERATING INCOME (LOSS)

Marine Construction Services

Contract cost adjustments on loss projects $46.6 $(119.7)

Gain on sale of marine assets 30.3 -

Miscellaneous items, net (14.5) (5.4)

TOTAL $62.4 $(125.1)

Government Operations

Pension funding reimbursement $11.8 $4.5

Miscellaneous items 3.2 8.7

TOTAL $15.0 $13.2

Corporate

Gain on U.K. pension plan $27.7 $-

Qualified pension Plan Expense (60.8) (75.7)

TOTAL $(33.1) $(75.7)

Depreciation & amortization

Marine Construction Services $24.0 $28.3

Government Operations 12.6 13.2

Corporate & other 3.7 3.1

TOTAL $40.3 $44.5

2. OTHER ITEMS (below operating income):

Estimated Change In B&W Bankruptcy Settlement $(11.2) $(14.6)

Tax Impact On B&W Settlement (0.7) (3.4)

Net After Tax Effect $(11.9) $(18.0)

Lehman Brothers 2005 CEO Energy / Power Conference September 6, 2005 35

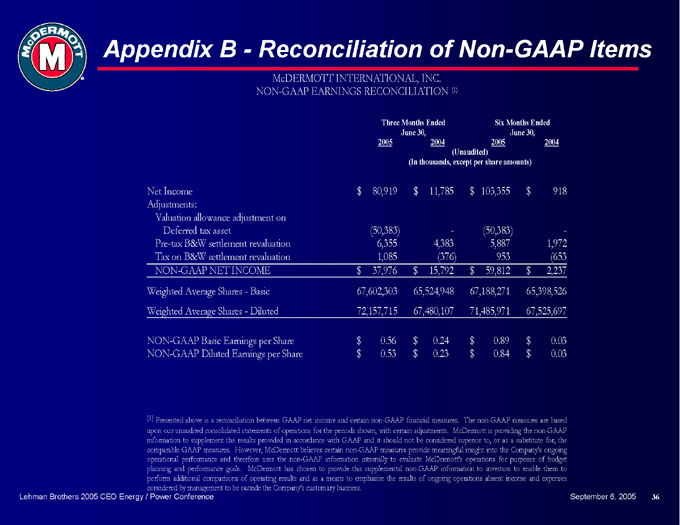

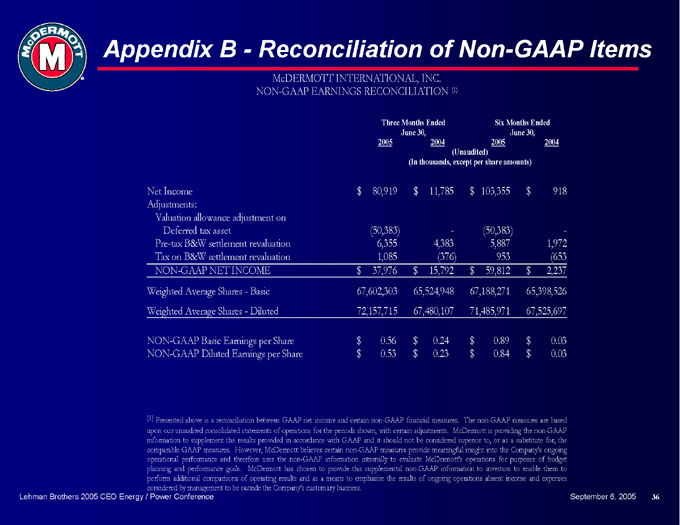

Appendix B - Reconciliation of Non-GAAP Items

McDERMOTT INTERNATIONAL, INC. NON-GAAP EARNINGS RECONCILIATION (1)

Three Months Ended June 30, Six Months Ended June 30,

2005 2004 2005 2004

(Unaudited)

(In thousands, except per share amounts)

Net Income $80,919 $11,785 $103,355 $918

Adjustments:

Valuation allowance adjustment on

Deferred tax asset (50,383) - (50,383) -

Pre-tax B&W settlement revaluation 6,355 4,383 5,887 1,972

Tax on B&W settlement revaluation 1,085 (376) 953 (653

NON-GAAP NET INCOME $37,976 $15,792 $59,812 $2,237

Weighted Average Shares—Basic 67,602,303 65,524,948 67,188,271 65,398,526

Weighted Average Shares—Diluted 72,157,715 67,480,107 71,485,971 67,525,697

NON-GAAP Basic Earnings per Share $0.56 $0.24 $0.89 $0.03

NON-GAAP Diluted Earnings per Share $0.53 $0.23 $0.84 $0.03

[1] Presented above is a reconciliation between GAAP net income and certain non-GAAP financial measures. The non-GAAP measures are based upon our unaudited consolidated statements of operations for the periods shown, with certain adjustments. McDermott is providing the non-GAAP information to supplement the results provided in accordance with GAAP and it should not be considered superior to, or as a substitute for, the comparable GAAP measures. However, McDermott believes certain non-GAAP measures provide meaningful insight into the Company’s ongoing operational performance and therefore uses the non-GAAP information internally to evaluate McDermott’s operations for purposes of budget planning and performance goals. McDermott has chosen to provide this supplemental non-GAAP information to investors to enable them to perform additional comparisons of operating results and as a means to emphasize the results of ongoing operations absent income and expenses considered by management to be outside the Company’s customary business.

Lehman Brothers 2005 CEO Energy / Power Conference September 6, 2005 36

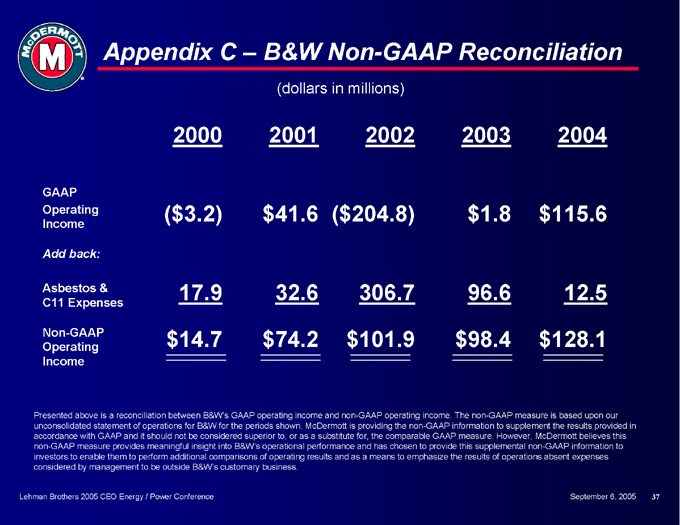

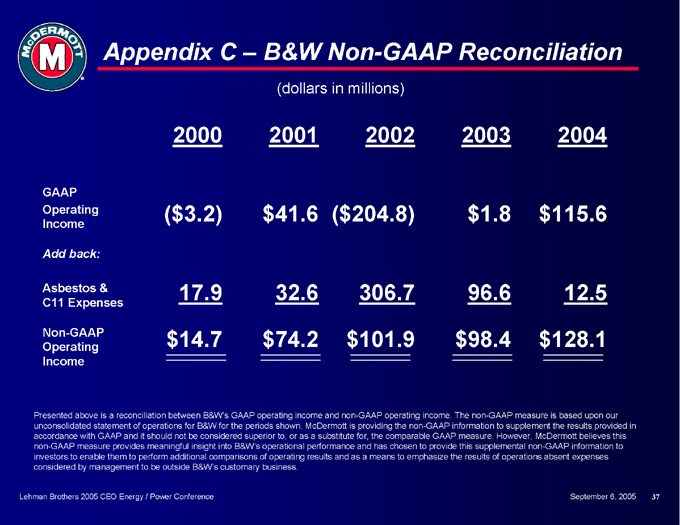

Appendix C – B&W Non-GAAP Reconciliation

(dollars in millions)

2000 2001 2002 2003 2004

GAAP

Operating ($3.2) $41.6 ($204.8) $1.8 $115.6

Income

Add back:

Asbestos & 17.9 32.6 306.7 96.6 12.5

C11 Expenses

Non-GAAP $14.7 $74.2 $101.9 $98.4 $128.1

Operating

Presented above is a reconciliation between B&W’s GAAP operating income and non-GAAP operating income. The non-GAAP measure is based upon our unconsolidated statement of operations for B&W for the periods shown. McDermott is providing the non-GAAP information to supplement the results provided in accordance with GAAP and it should not be considered superior to, or as a substitute for, the comparable GAAP measure. However, McDermott believes this non-GAAP measure provides meaningful insight into B&W’s operational performance and has chosen to provide this supplemental non-GAAP information to investors to enable them to perform additional comparisons of operating results and as a means to emphasize the results of operations absent expenses considered by management to be outside B&W’s customary business.

Lehman Brothers 2005 CEO Energy / Power Conference September 6, 2005 37