JANUARY 2018 McDermott International + CB&I Creating a premier global fully vertically integrated onshore-offshore company with a broad EPCI offering, driven by technology and innovation with the scale and diversification to capitalize on global growth opportunities Exhibit 99.1

FORWARD LOOKING STATEMENTS McDermott and CB&I caution that statements in this presentation which are forward-looking, and provide other than historical information, involve risks, contingencies and uncertainties that may impact actual results of operations of McDermott, CB&I and the combined businesses. These forward-looking statements include, among other things, statements about anticipated cost and revenue synergies, accretion, risks related to CB&I projects, best-in-class operations, opportunities to capture additional value from market trends, maintenance of a consistent customer approach to pricing, safety and transition issues, free cash flow, plans to de-lever, targeted credit ratings, expected completion date and permanent debt financing. Although we believe that the expectations reflected in those forward-looking statements are reasonable, we can give no assurance that those expectations will prove to have been correct. Those statements are made by using various underlying assumptions and are subject to numerous risks, contingencies and uncertainties, including, among others: the ability of McDermott and CB&I to obtain the regulatory and shareholder approvals necessary to complete the proposed combination; the risk that a condition to the closing of the proposed combination may not be satisfied, or that the proposed combination may fail to close, including as the result of any inability to obtain the financing for the combination; the outcome of any legal proceedings, regulatory proceedings or enforcement matters that may be instituted relating to the proposed combination; the costs incurred to consummate the proposed combination; the possibility that the expected synergies from the proposed combination will not be realized, or will not be realized within the expected time period; difficulties related to the integration of the two companies; the credit ratings of the combined businesses following the proposed combination; disruption from the proposed combination making it more difficult to maintain relationships with customers, employees, regulators or suppliers; the diversion of management time and attention on the proposed combination; adverse changes in the markets in which McDermott and CB&I operate or credit markets; the inability of McDermott or CB&I to execute on contracts in backlog successfully; changes in project design or schedules; the availability of qualified personnel; changes in the terms, scope or timing of contracts; contract cancellations; change orders and other modifications and actions by customers and other business counterparties of McDermott and CB&I; changes in industry norms; and adverse outcomes in legal or other dispute resolution proceedings. If one or more of these risks materialize, or if underlying assumptions prove incorrect, actual results may vary materially from those expected. You should not place undue reliance on forward-looking statements. For a more complete discussion of these and other risk factors, please see each of McDermott’s and CB&I’s annual and quarterly filings with the Securities and Exchange Commission, including their annual reports on Form 10-K for the year ended December 31, 2016 and subsequent quarterly reports on Form 10-Q. This presentation reflects the views of McDermott’s management and CB&I’s management as of the date hereof. Except to the extent required by applicable law, McDermott and CB&I undertake no obligation to update or revise any forward-looking statement.

ADDITIONAL INFORMATION AND WHERE TO FIND IT This communication is for information purposes only and does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any proxy, vote or approval with respect to the proposed transaction or otherwise, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. In connection with the proposed transactions, McDermott International, Inc. (“McDermott”) intends to file a Registration Statement on Form S-4 with the U.S. Securities and Exchange Commission (the “SEC”), that will include (1) a joint proxy statement of McDermott and Chicago Bridge & Iron Company N.V. (“CB&I”), which also will constitute a prospectus of McDermott and (2) an offering prospectus of McDermott Technology, B.V. to be used in connection with McDermott Technology, B.V.’s offer to acquire CB&I shares. After the registration statement is declared effective by the SEC, McDermott and CB&I intend to mail a definitive joint proxy statement/prospectus to shareholders of McDermott and shareholders of CB&I, McDermott or McDermott Technology, B.V. intends to file a Tender Offer Statement on Schedule TO (the “Schedule TO”) with the SEC and soon thereafter CB&I intends to file a Solicitation/Recommendation Statement on Schedule 14D-9 (the “Schedule 14D-9”) with respect to the exchange offer. The exchange offer for the outstanding common stock of CB&I referred to in this document has not yet commenced. The solicitation and offer to purchase shares of CB&I’s common stock will only be made pursuant to the Schedule TO and related offer to purchase. This material is not a substitute for the joint proxy statement/prospectus, the Schedule TO, the Schedule 14D-9 or the Registration Statement or for any other document that McDermott or CB&I may file with the SEC and send to McDermott’s and/or CB&I’s shareholders in connection with the proposed transactions. BEFORE MAKING ANY VOTING OR INVESTMENT DECISION OR DECISION WITH RESPECT TO THE EXCHANGE OFFER, WE URGE INVESTORS OF CB&I AND MCDERMOTT TO READ THE REGISTRATION STATEMENT, JOINT PROXY STATEMENT/PROSPECTUS, SCHEDULE TO (INCLUDING AN OFFER TO PURCHASE, RELATED LETTER OF TRANSMITTAL AND OTHER OFFER DOCUMENTS) AND SCHEDULE 14D-9, AS EACH MAY BE AMENDED OR SUPPLEMENTED FROM TIME TO TIME, AND OTHER RELEVANT DOCUMENTS FILED BY MCDERMOTT AND CB&I WITH THE SEC CAREFULLY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT MCDERMOTT, CB&I AND THE PROPOSED TRANSACTIONS. Investors will be able to obtain free copies of the Registration Statement, joint proxy statement/prospectus, Schedule TO and Schedule 14D-9, as each may be amended from time to time, and other relevant documents filed by McDermott and CB&I with the SEC (when they become available) at http://www.sec.gov, the SEC’s website, or free of charge from McDermott’s website (http://www.mcdermott.com) under the tab, “Investors” and under the heading “Financial Information” or by contacting McDermott’s Investor Relations Department at (281) 870-5147. These documents are also available free of charge from CB&I’s website (http://www.cbi.com) under the tab “Investors” and under the heading “SEC Filings” or by contacting CB&I’s Investor Relations Department at (832) 513-1068. Participants in Proxy Solicitation McDermott, CB&I and their respective directors and certain of their executive officers and employees may be deemed, under SEC rules, to be participants in the solicitation of proxies from McDermott’s and CB&I’s shareholders in connection with the proposed transactions. Information regarding the officers and directors of McDermott is included in its definitive proxy statement for its 2017 annual meeting filed with SEC on March 24, 2017. Information regarding the officers and directors of CB&I is included in its definitive proxy statement for its 2017 annual meeting filed with the SEC on March 24, 2017. Additional information regarding the persons who may be deemed participants and their interests will be set forth in the Registration Statement and joint proxy statement/prospectus and other materials when they are filed with SEC in connection with the proposed transactions. Free copies of these documents may be obtained as described in the paragraphs above.

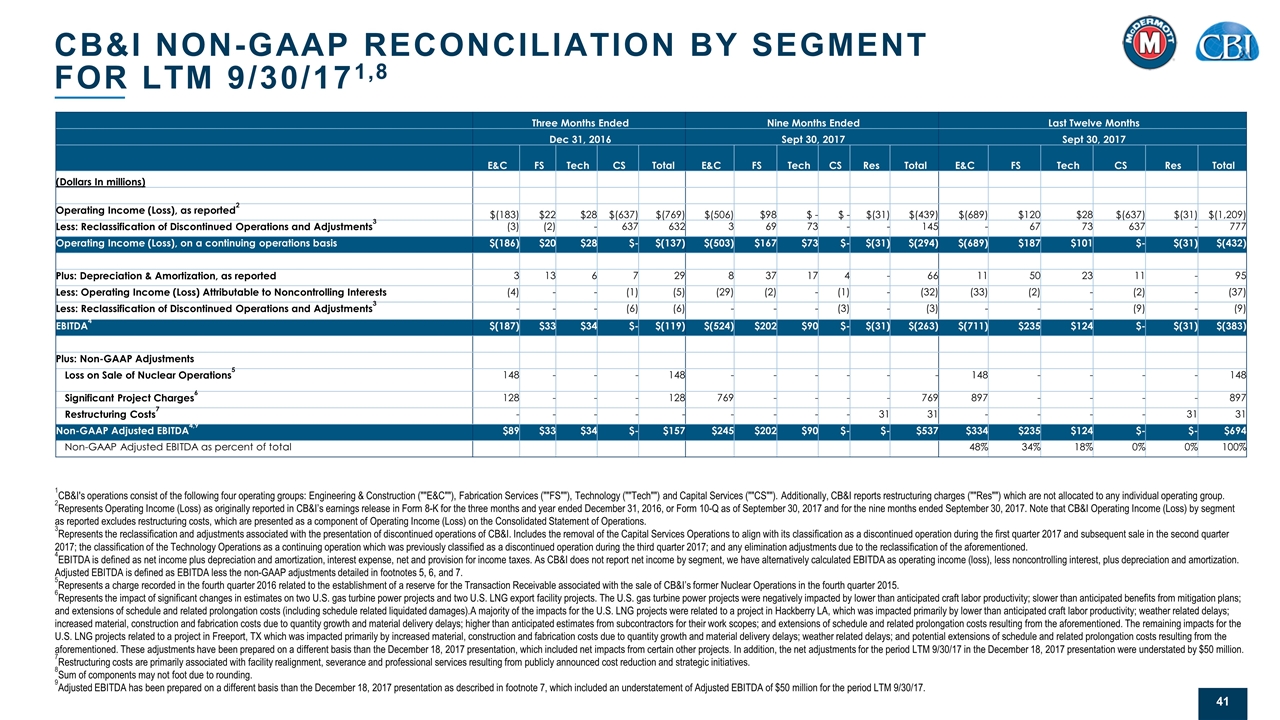

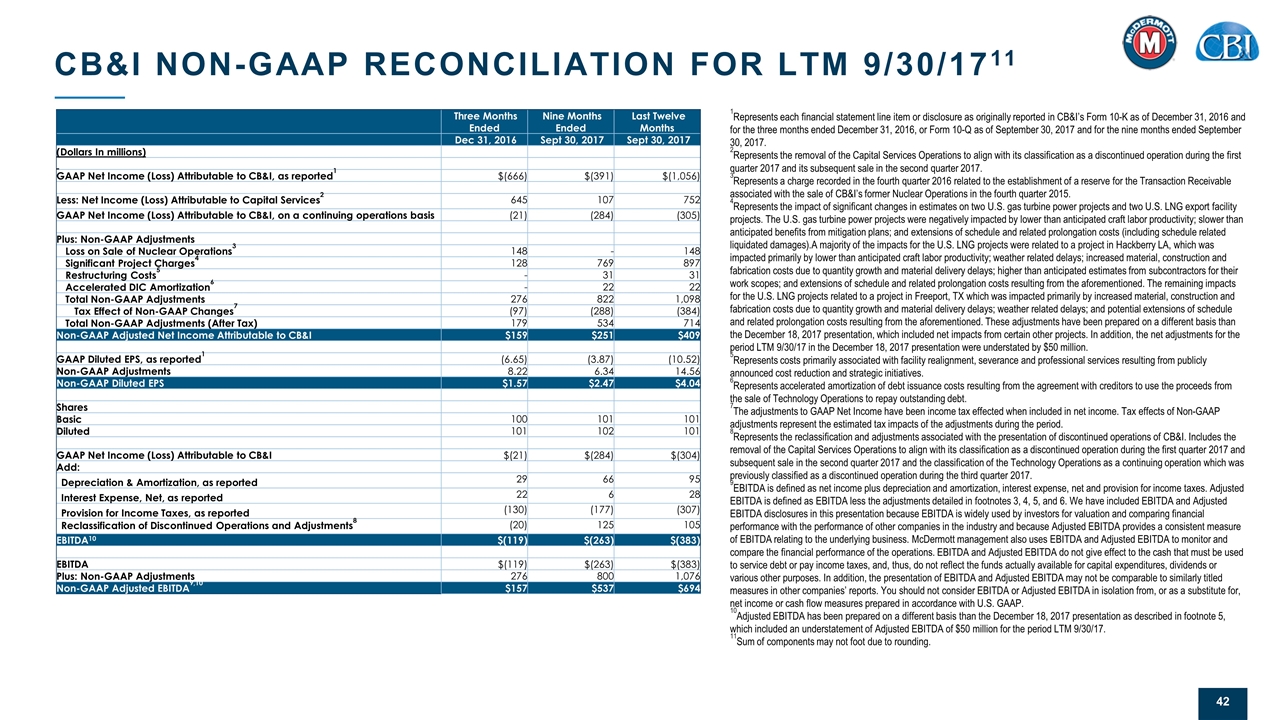

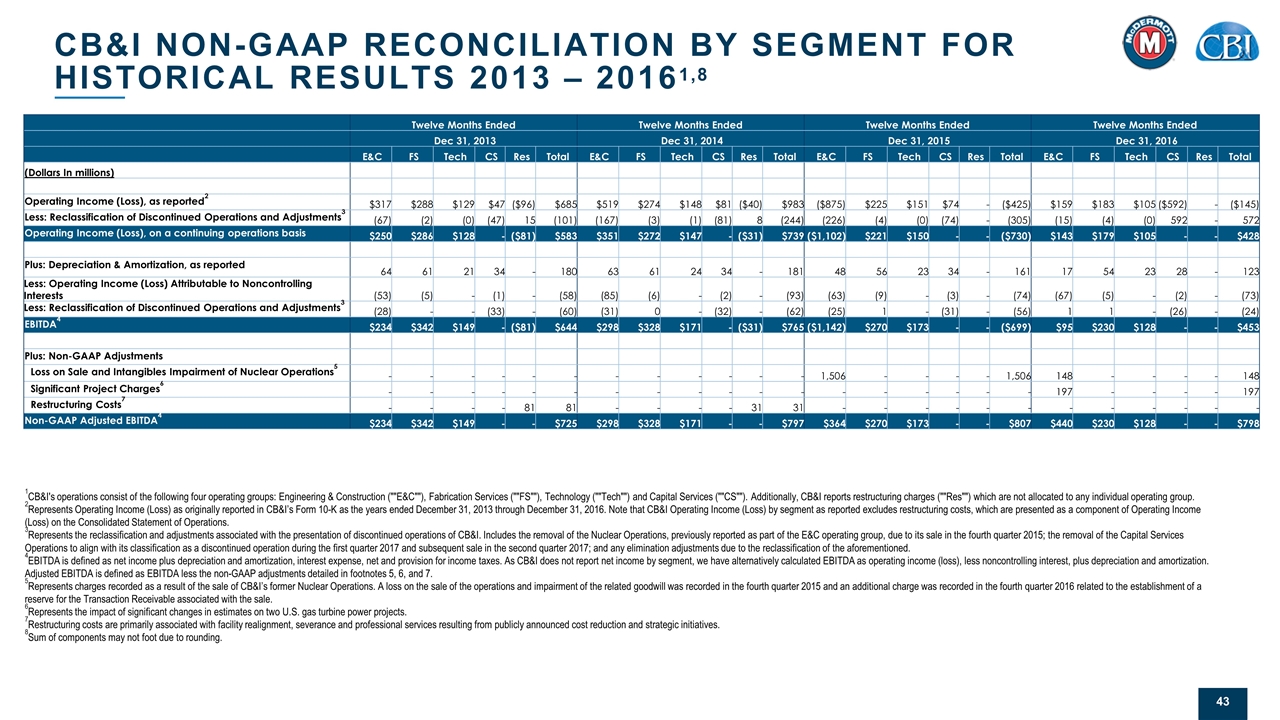

NON-GAAP DISCLOSURES This presentation includes several “non-GAAP” financial measures as defined under Regulation G of the U.S. Securities Exchange Act of 1934, as amended. Each of McDermott and CB&I reports its financial results in accordance with U.S. generally accepted accounting principles, but McDermott and CB&I believe that certain non-GAAP financial measures provide useful supplemental information to investors regarding the underlying business trends and performance of their respective ongoing operations and are useful for period-over-period comparisons of those operations. The non-GAAP measures in this presentation include EBITDA, Adjusted EBITDA Adjusted Net Income, Adjusted EPS and Free Cash Flow. These non-GAAP financial measures should be considered as a supplement to, and not as a substitute for, or superior to, the financial measures prepared in accordance with GAAP. Reconciliations of these non-GAAP financial measures to the most comparable GAAP measures are provided on pages 41 to 48 of this presentation.

MANAGEMENT PROFILES McDermott President & Chief Executive Officer DAVID DICKSON McDermott Executive Vice President & Chief Financial Officer STUART SPENCE McDermott Executive Vice President and Chief Financial Officer since August 2014 More than 25 years of financial and operational management experience with companies in oilfield products and services, and engineering and construction businesses Prior to McDermott, served as Vice President of Halliburton’s Artificial Lift business, and previously as Senior Director, Strategy and Marketing for Halliburton’s Completion and Production Division Prior to joining Halliburton, served as Executive Vice President and Chief Financial Officer of Global Oilfield Services Inc. from 2008 to 2011 and as Executive Vice President, Strategy, in May 2011 in connection with the sale to Halliburton McDermott President and Chief Executive Officer and member of the Board of Directors since December 2013 More than 25 years industry experience, including 11 years with Technip S.A. and its subsidiaries Served as President of Technip U.S.A. Inc. from 2008 to 2013, with overall responsibility for Onshore (refining, petrochemicals, LNG) and Offshore (shallow and deepwater) businesses in North America and Latin America Prior to Technip, headed Operations at CNS Subsea Ltd., was Operations Manager at ETPM DeepSea Ltd., and worked for McDermott in the U.K.

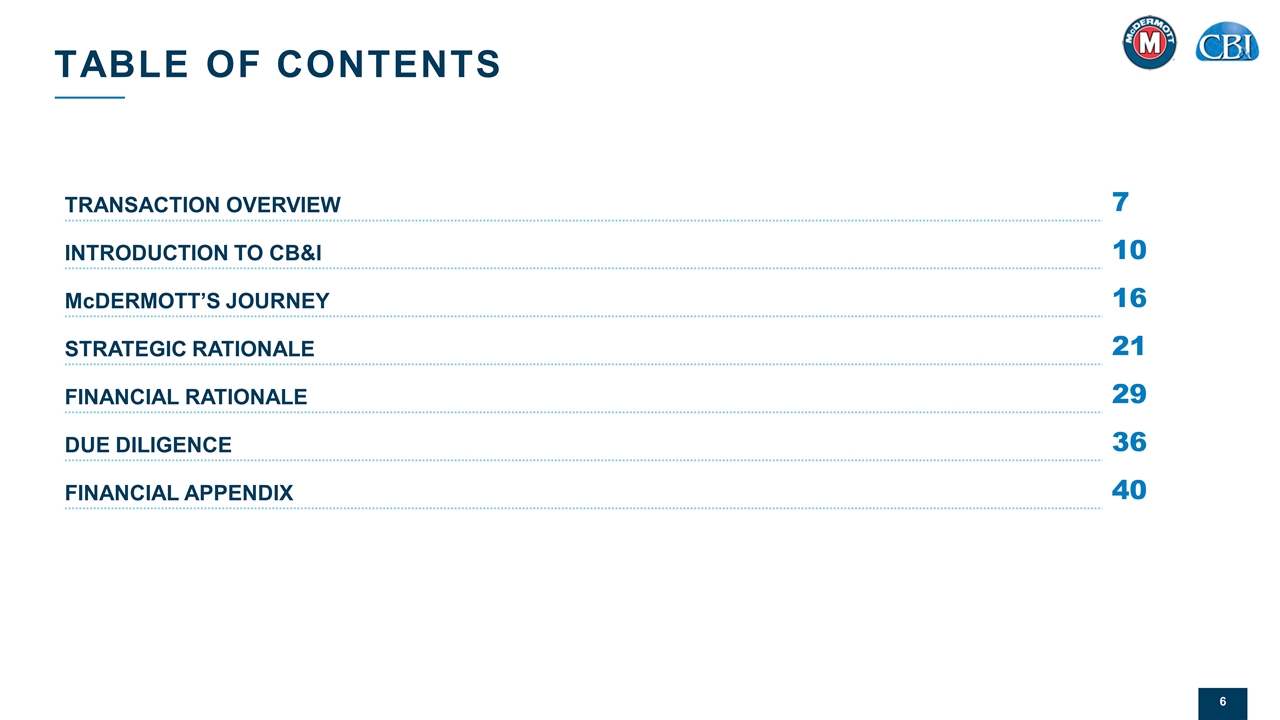

TABLE OF CONTENTS TRANSACTION OVERVIEW INTRODUCTION TO CB&I McDERMOTT’S JOURNEY STRATEGIC RATIONALE FINANCIAL RATIONALE DUE DILIGENCE FINANCIAL APPENDIX 7 10 16 21 29 36 40

TRANSACTION OVERVIEW 7

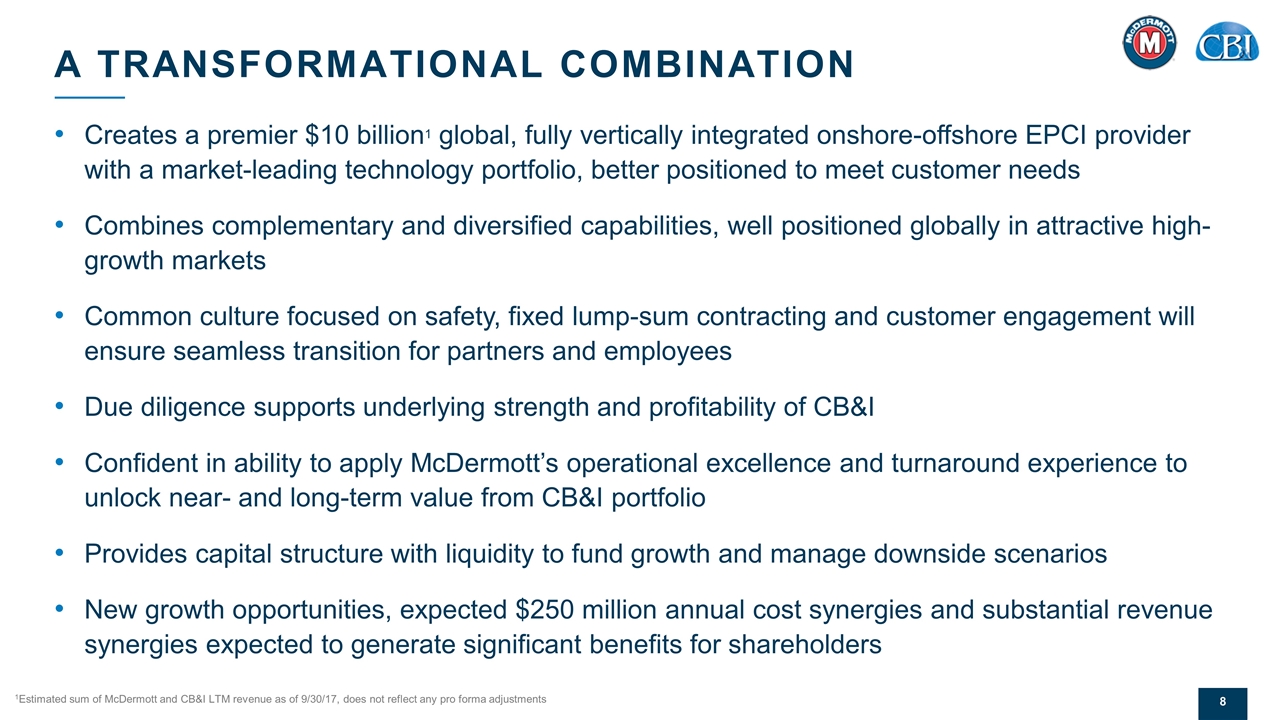

A TRANSFORMATIONAL COMBINATION Creates a premier $10 billion1 global, fully vertically integrated onshore-offshore EPCI provider with a market-leading technology portfolio, better positioned to meet customer needs Combines complementary and diversified capabilities, well positioned globally in attractive high-growth markets Common culture focused on safety, fixed lump-sum contracting and customer engagement will ensure seamless transition for partners and employees Due diligence supports underlying strength and profitability of CB&I Confident in ability to apply McDermott’s operational excellence and turnaround experience to unlock near- and long-term value from CB&I portfolio Provides capital structure with liquidity to fund growth and manage downside scenarios New growth opportunities, expected $250 million annual cost synergies and substantial revenue synergies expected to generate significant benefits for shareholders 1Estimated sum of McDermott and CB&I LTM revenue as of 9/30/17, does not reflect any pro forma adjustments

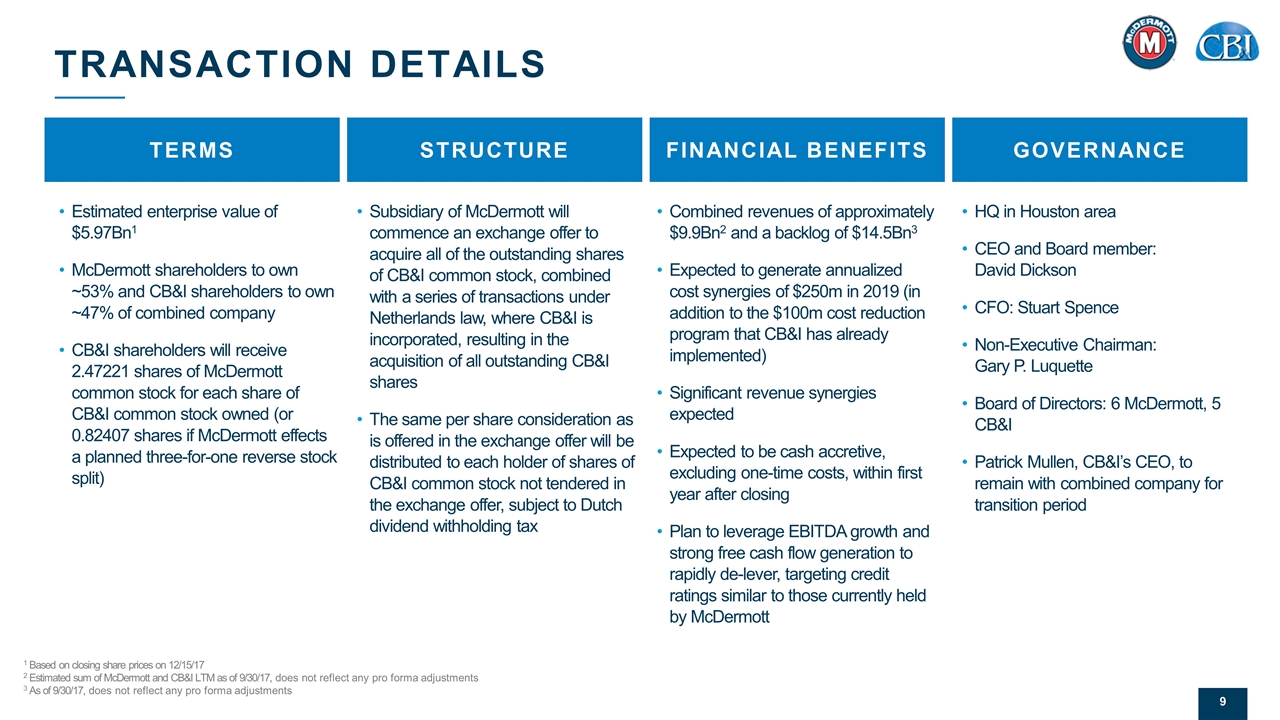

TRANSACTION DETAILS Combined revenues of approximately $9.9Bn2 and a backlog of $14.5Bn3 Expected to generate annualized cost synergies of $250m in 2019 (in addition to the $100m cost reduction program that CB&I has already implemented) Significant revenue synergies expected Expected to be cash accretive, excluding one-time costs, within first year after closing Plan to leverage EBITDA growth and strong free cash flow generation to rapidly de-lever, targeting credit ratings similar to those currently held by McDermott 1 Based on closing share prices on 12/15/17 2 Estimated sum of McDermott and CB&I LTM as of 9/30/17, does not reflect any pro forma adjustments 3 As of 9/30/17, does not reflect any pro forma adjustments TERMS STRUCTURE FINANCIAL BENEFITS GOVERNANCE Subsidiary of McDermott will commence an exchange offer to acquire all of the outstanding shares of CB&I common stock, combined with a series of transactions under Netherlands law, where CB&I is incorporated, resulting in the acquisition of all outstanding CB&I shares The same per share consideration as is offered in the exchange offer will be distributed to each holder of shares of CB&I common stock not tendered in the exchange offer, subject to Dutch dividend withholding tax Estimated enterprise value of $5.97Bn1 McDermott shareholders to own ~53% and CB&I shareholders to own ~47% of combined company CB&I shareholders will receive 2.47221 shares of McDermott common stock for each share of CB&I common stock owned (or 0.82407 shares if McDermott effects a planned three-for-one reverse stock split) HQ in Houston area CEO and Board member: David Dickson CFO: Stuart Spence Non-Executive Chairman: Gary P. Luquette Board of Directors: 6 McDermott, 5 CB&I Patrick Mullen, CB&I’s CEO, to remain with combined company for transition period

INTRODUCTION TO CB&I 10

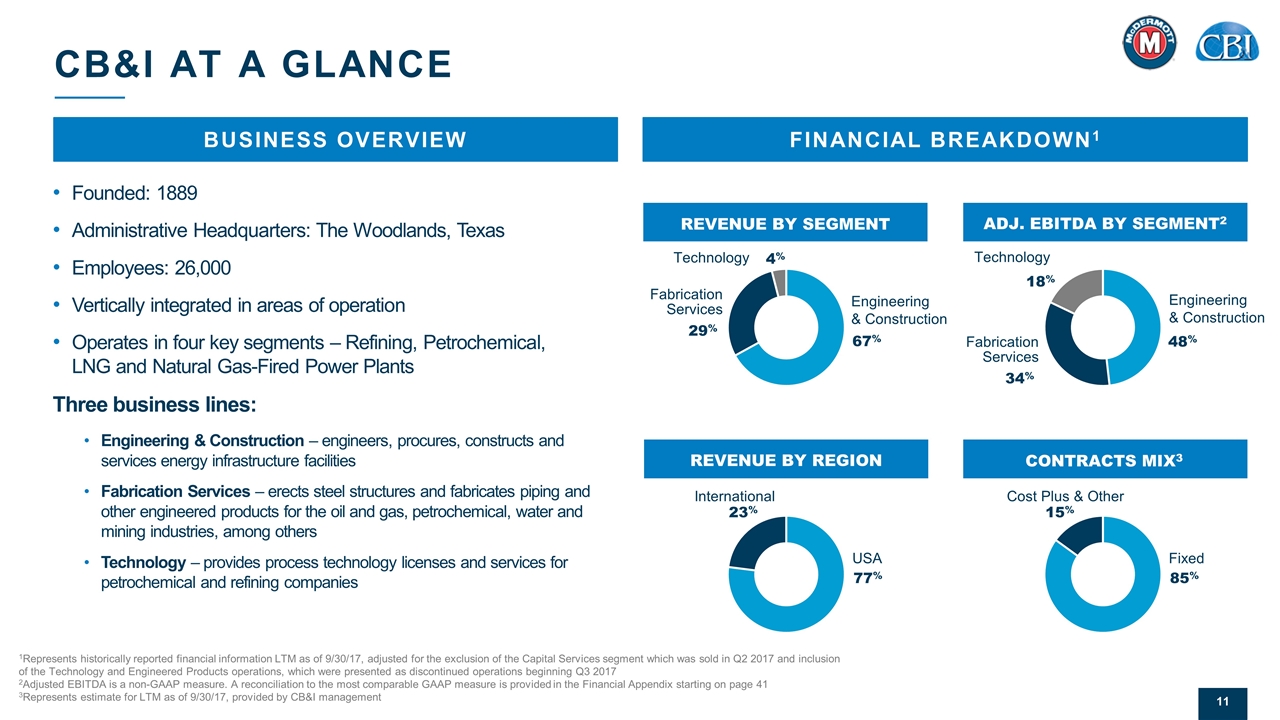

FINANCIAL BREAKDOWN1 BUSINESS OVERVIEW CB&I AT A GLANCE Founded: 1889 Administrative Headquarters: The Woodlands, Texas Employees: 26,000 Vertically integrated in areas of operation Operates in four key segments – Refining, Petrochemical, LNG and Natural Gas-Fired Power Plants Three business lines: Engineering & Construction – engineers, procures, constructs and services energy infrastructure facilities Fabrication Services – erects steel structures and fabricates piping and other engineered products for the oil and gas, petrochemical, water and mining industries, among others Technology – provides process technology licenses and services for petrochemical and refining companies Optimize REVENUE BY REGION USA 77% International 23% 29% REVENUE BY SEGMENT Fabrication Services Technology 4% ADJ. EBITDA BY SEGMENT2 34% 48% Fabrication Services Technology 18% 15% CONTRACTS MIX3 Fixed 85% Cost Plus & Other Engineering & Construction 67% Engineering & Construction 1Represents historically reported financial information LTM as of 9/30/17, adjusted for the exclusion of the Capital Services segment which was sold in Q2 2017 and inclusion of the Technology and Engineered Products operations, which were presented as discontinued operations beginning Q3 2017 2Adjusted EBITDA is a non-GAAP measure. A reconciliation to the most comparable GAAP measure is provided in the Financial Appendix starting on page 41 3Represents estimate for LTM as of 9/30/17, provided by CB&I management

Primary Business Focus: Process licensing, Related catalysts Employees: ~650 Major Operating Facilities: New Jersey, Germany, India Extensive refinery technologies portfolio Leaders in: Dehydration (#1; Chevron-Lummus JV) Ethylene (#2) Polypropylene (#2) Clean fuels and residuum upgrading (#2) Leverage McDermott’s reputation and strong commercial presence in key markets such as Saudi Arabia, Qatar, India, Mexico, Indonesia Crude to chemicals technology Increase R&D spend More extensive use of high value centers OVERVIEW STRENGTHS OPPORTUNITIES COMPETITIVE LANDSCAPE TIER 11 TECHNOLOGY COMPANIES TIER 2 TECHNOLOGY COMPANIES 1Based on volume and number of licenses offered TECHNOLOGY BUSINESS LINES Petrochemicals: Olefins & Aromatics Refining & Gasification: Refining Process; Coal / Petcoke Gasification Novolen Technology: Polypropylene & Polyethylene Chevron Lummus Global (JV with Chevron): Hydroprocessing, including Base Oils & Heavy Oil Upgrading Consulting: Advisory services in Energy, Petrochemicals and Refining Markets Creates SIGNIFICANT PULL-THROUGH for e&c and fabrication portfolio

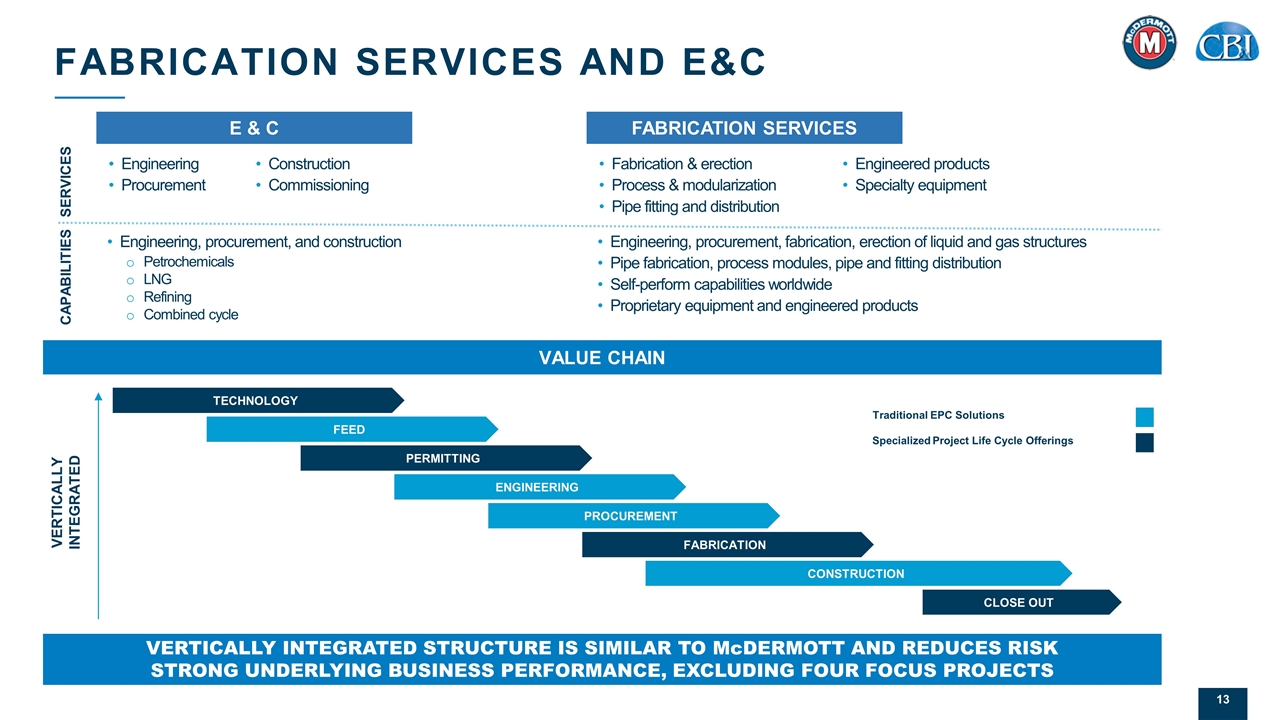

FABRICATION SERVICES AND E&C E & C Fabrication Services Engineering Procurement Construction Commissioning Engineering, procurement, and construction Petrochemicals LNG Refining Combined cycle Fabrication & erection Process & modularization Pipe fitting and distribution Engineered products Specialty equipment Engineering, procurement, fabrication, erection of liquid and gas structures Pipe fabrication, process modules, pipe and fitting distribution Self-perform capabilities worldwide Proprietary equipment and engineered products Services Capabilities VALUE CHAIN Specialized Project Life Cycle Offerings Traditional EPC Solutions TECHNOLOGY PERMITTING FEED PROCUREMENT ENGINEERING FABRICATION CONSTRUCTION CLOSE OUT VERTICALLY INTEGRATED Vertically integrated structure is similar to McDERMOTT and reduces risk Strong underlying business performance, excluding four focus projects

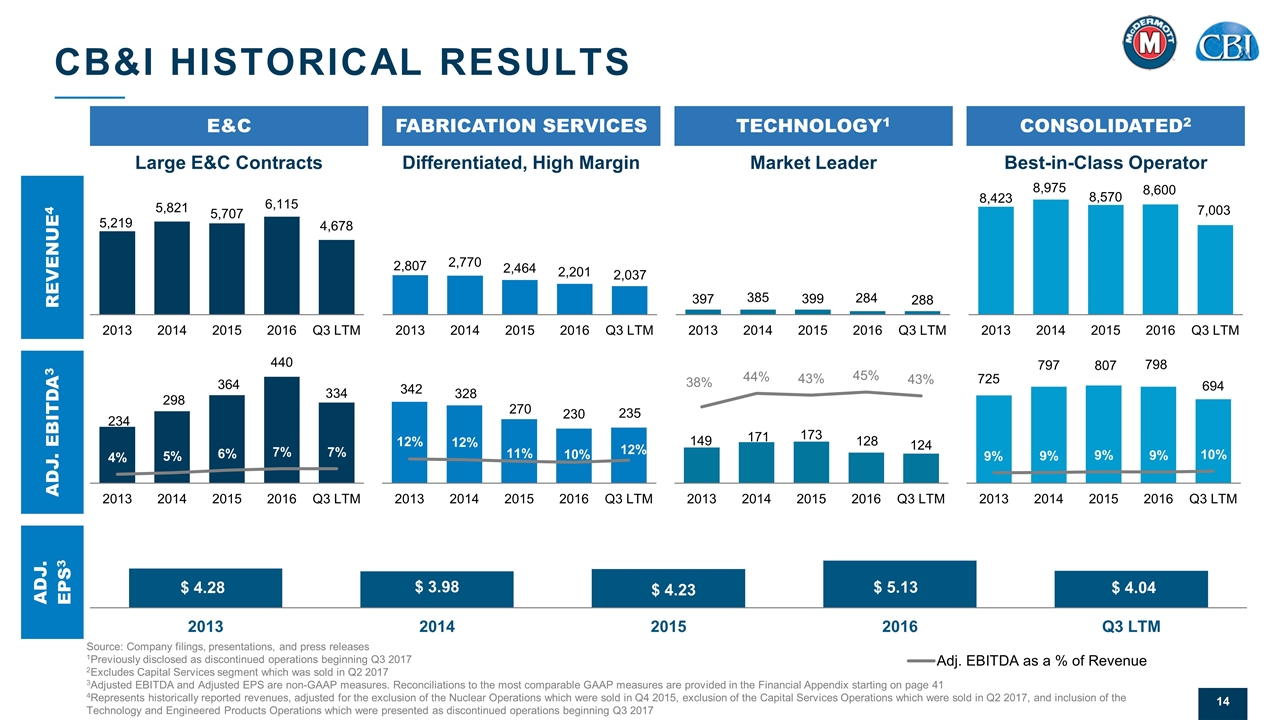

E&C CB&I HISTORICAL RESULTS Source: Company filings, presentations, and press releases 1Previously disclosed as discontinued operations beginning Q3 2017 2Excludes Capital Services segment which was sold in Q2 2017 3Adjusted EBITDA and Adjusted EPS are non-GAAP measures. Reconciliations to the most comparable GAAP measures are provided in the Financial Appendix starting on page 41 4Represents historically reported revenues, adjusted for the exclusion of the Nuclear Operations which were sold in Q4 2015, exclusion of the Capital Services Operations which were sold in Q2 2017, and inclusion of the Technology and Engineered Products Operations which were presented as discontinued operations beginning Q3 2017 FABRICATION SERVICES TECHNOLOGY1 REVENUE4 ADJ. EBITDA3 CONSOLIDATED2 ADJ. EPS3 Large E&C Contracts Differentiated, High Margin Market Leader Best-in-Class Operator

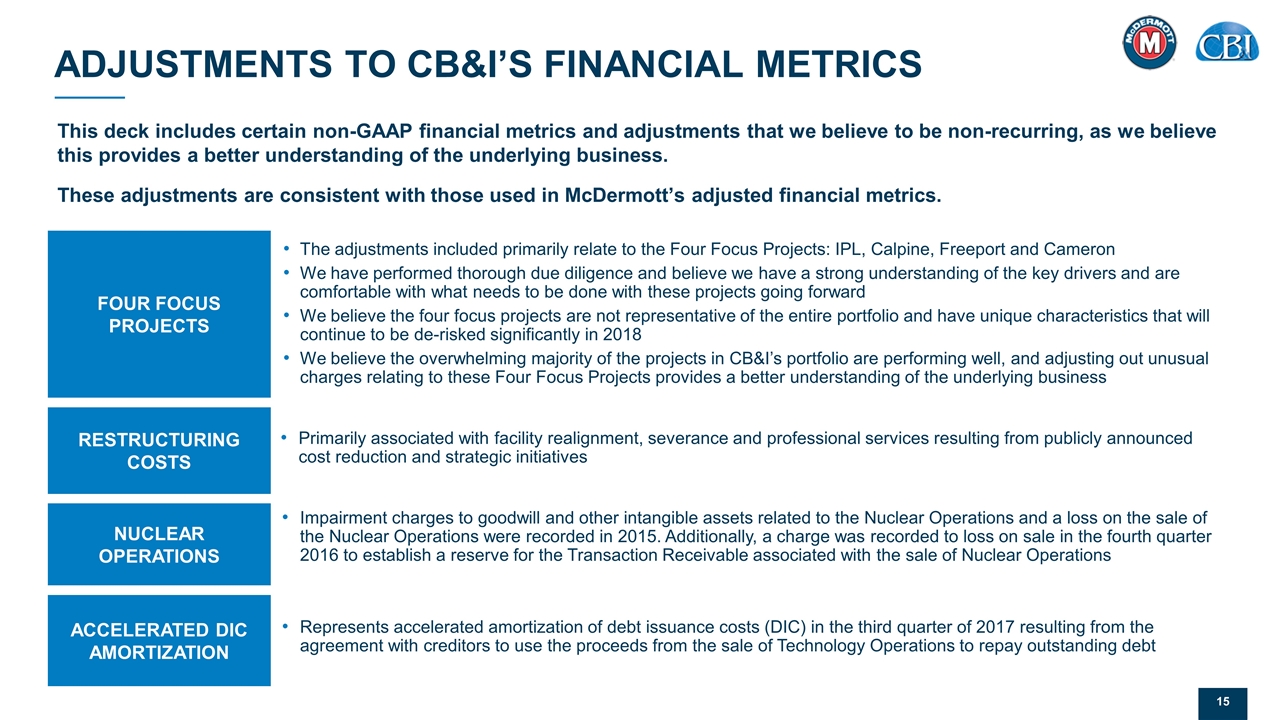

ADJUSTMENTS TO CB&I’S FINANCIAL METRICS This deck includes certain non-GAAP financial metrics and adjustments that we believe to be non-recurring, as we believe this provides a better understanding of the underlying business. These adjustments are consistent with those used in McDermott’s adjusted financial metrics. The adjustments included primarily relate to the Four Focus Projects: IPL, Calpine, Freeport and Cameron We have performed thorough due diligence and believe we have a strong understanding of the key drivers and are comfortable with what needs to be done with these projects going forward We believe the four focus projects are not representative of the entire portfolio and have unique characteristics that will continue to be de-risked significantly in 2018 We believe the overwhelming majority of the projects in CB&I’s portfolio are performing well, and adjusting out unusual charges relating to these Four Focus Projects provides a better understanding of the underlying business RESTRUCTURING COSTS NUCLEAR OPERATIONS FOUR FOCUS PROJECTS ACCELERATED DIC AMORTIZATION Primarily associated with facility realignment, severance and professional services resulting from publicly announced cost reduction and strategic initiatives Impairment charges to goodwill and other intangible assets related to the Nuclear Operations and a loss on the sale of the Nuclear Operations were recorded in 2015. Additionally, a charge was recorded to loss on sale in the fourth quarter 2016 to establish a reserve for the Transaction Receivable associated with the sale of Nuclear Operations Represents accelerated amortization of debt issuance costs (DIC) in the third quarter of 2017 resulting from the agreement with creditors to use the proceeds from the sale of Technology Operations to repay outstanding debt

McDERMOTT’S JOURNEY 6

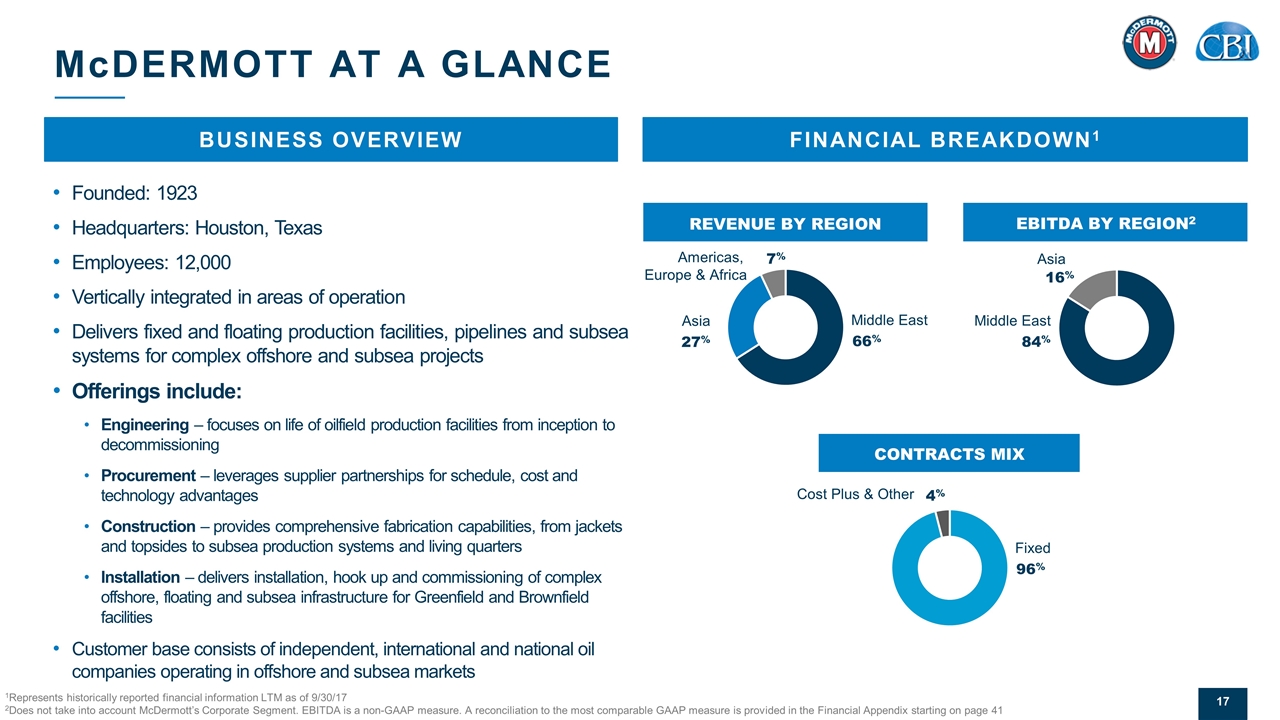

REVENUE BY REGION EBITDA BY REGION2 CONTRACTS MIX 27% Asia Americas, Europe & Africa 7% 16% Middle East 66% 84% Middle East Asia 4% Fixed 96% Cost Plus & Other 1Represents historically reported financial information LTM as of 9/30/17 2Does not take into account McDermott’s Corporate Segment. EBITDA is a non-GAAP measure. A reconciliation to the most comparable GAAP measure is provided in the Financial Appendix starting on page 41 FINANCIAL BREAKDOWN1 BUSINESS OVERVIEW McDERMOTT AT A GLANCE Founded: 1923 Headquarters: Houston, Texas Employees: 12,000 Vertically integrated in areas of operation Delivers fixed and floating production facilities, pipelines and subsea systems for complex offshore and subsea projects Offerings include: Engineering – focuses on life of oilfield production facilities from inception to decommissioning Procurement – leverages supplier partnerships for schedule, cost and technology advantages Construction – provides comprehensive fabrication capabilities, from jackets and topsides to subsea production systems and living quarters Installation – delivers installation, hook up and commissioning of complex offshore, floating and subsea infrastructure for Greenfield and Brownfield facilities Customer base consists of independent, international and national oil companies operating in offshore and subsea markets

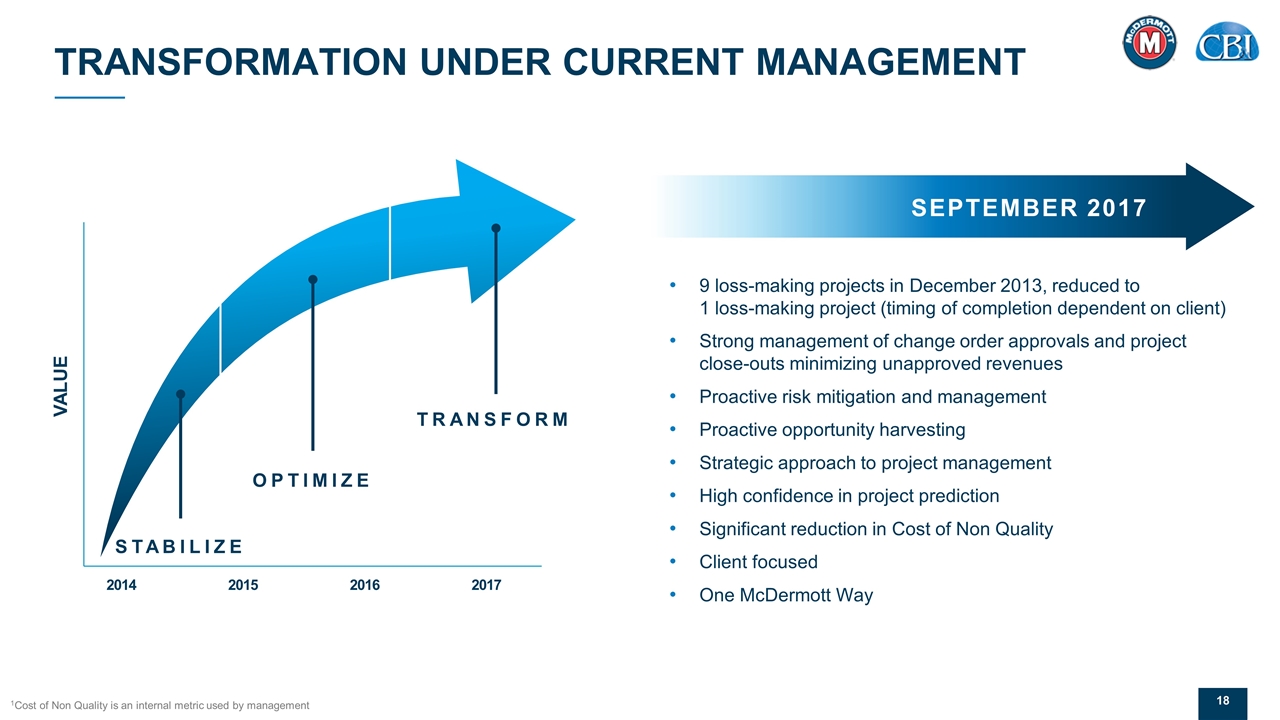

TRANSFORMATION UNDER CURRENT MANAGEMENT 2014 OPTIMIZE TRANSFORM 2015 2016 VALUE 2017 STABILIZE 1Cost of Non Quality is an internal metric used by management 9 loss-making projects in December 2013, reduced to 1 loss-making project (timing of completion dependent on client) Strong management of change order approvals and project close-outs minimizing unapproved revenues Proactive risk mitigation and management Proactive opportunity harvesting Strategic approach to project management High confidence in project prediction Significant reduction in Cost of Non Quality Client focused One McDermott Way SEPTEMBER 2017

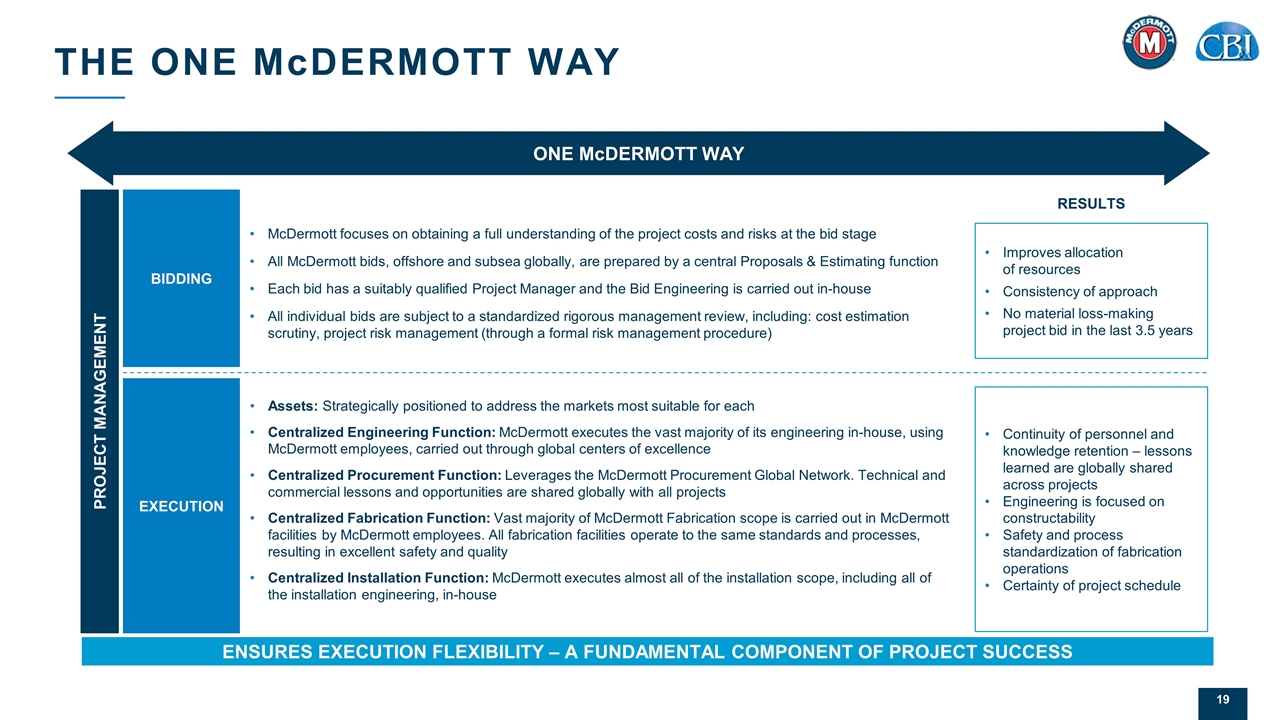

THE ONE McDERMOTT WAY One McDermott Way Results Bidding McDermott focuses on obtaining a full understanding of the project costs and risks at the bid stage All McDermott bids, offshore and subsea globally, are prepared by a central Proposals & Estimating function Each bid has a suitably qualified Project Manager and the Bid Engineering is carried out in-house All individual bids are subject to a standardized rigorous management review, including: cost estimation scrutiny, project risk management (through a formal risk management procedure) Improves allocation of resources Consistency of approach No material loss-making project bid in the last 3.5 years Execution Assets: Strategically positioned to address the markets most suitable for each Centralized Engineering Function: McDermott executes the vast majority of its engineering in-house, using McDermott employees, carried out through global centers of excellence Centralized Procurement Function: Leverages the McDermott Procurement Global Network. Technical and commercial lessons and opportunities are shared globally with all projects Centralized Fabrication Function: Vast majority of McDermott Fabrication scope is carried out in McDermott facilities by McDermott employees. All fabrication facilities operate to the same standards and processes, resulting in excellent safety and quality Centralized Installation Function: McDermott executes almost all of the installation scope, including all of the installation engineering, in-house Continuity of personnel and knowledge retention – lessons learned are globally shared across projects Engineering is focused on constructability Safety and process standardization of fabrication operations Certainty of project schedule Ensures execution Flexibility – a fundamental component of project success Project Management

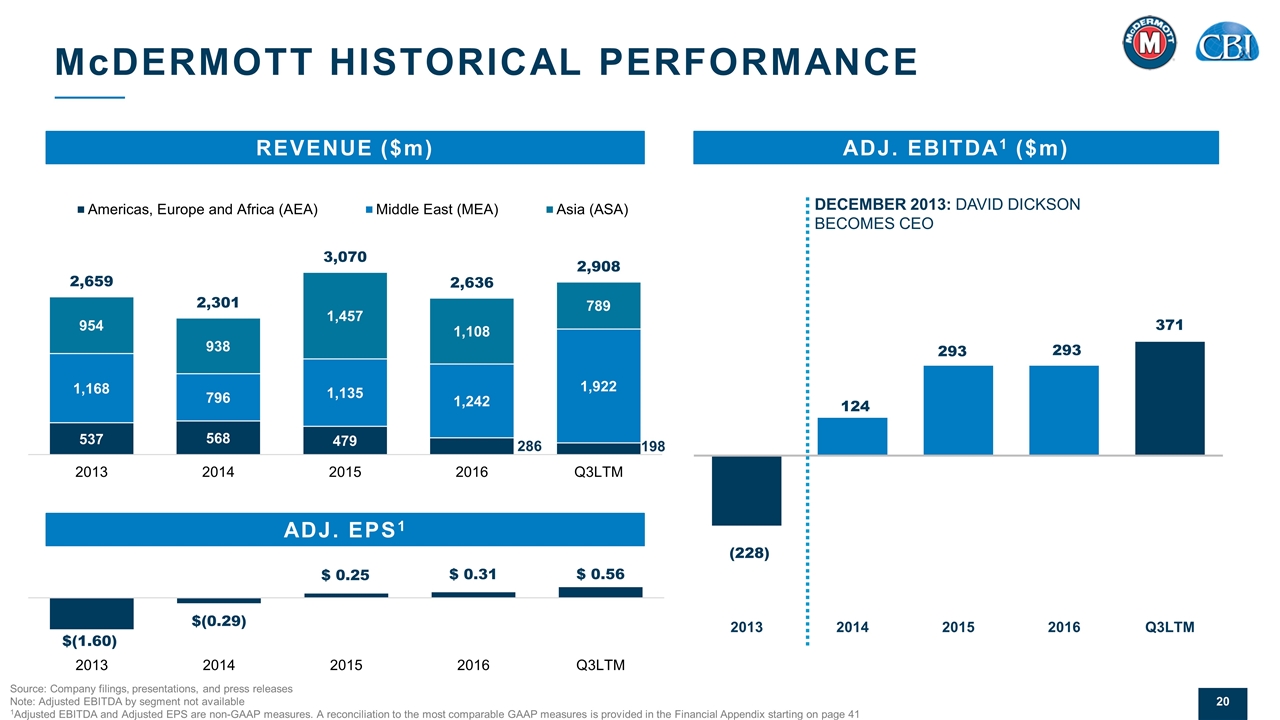

REVENUE ($m) McDERMOTT HISTORICAL PERFORMANCE Source: Company filings, presentations, and press releases Note: Adjusted EBITDA by segment not available 1Adjusted EBITDA and Adjusted EPS are non-GAAP measures. A reconciliation to the most comparable GAAP measures is provided in the Financial Appendix starting on page 41 december 2013: davID dickson becomes ceo ADJ. EBITDA1 ($m) ADJ. EPS1

STRATEGIC RATIONALE

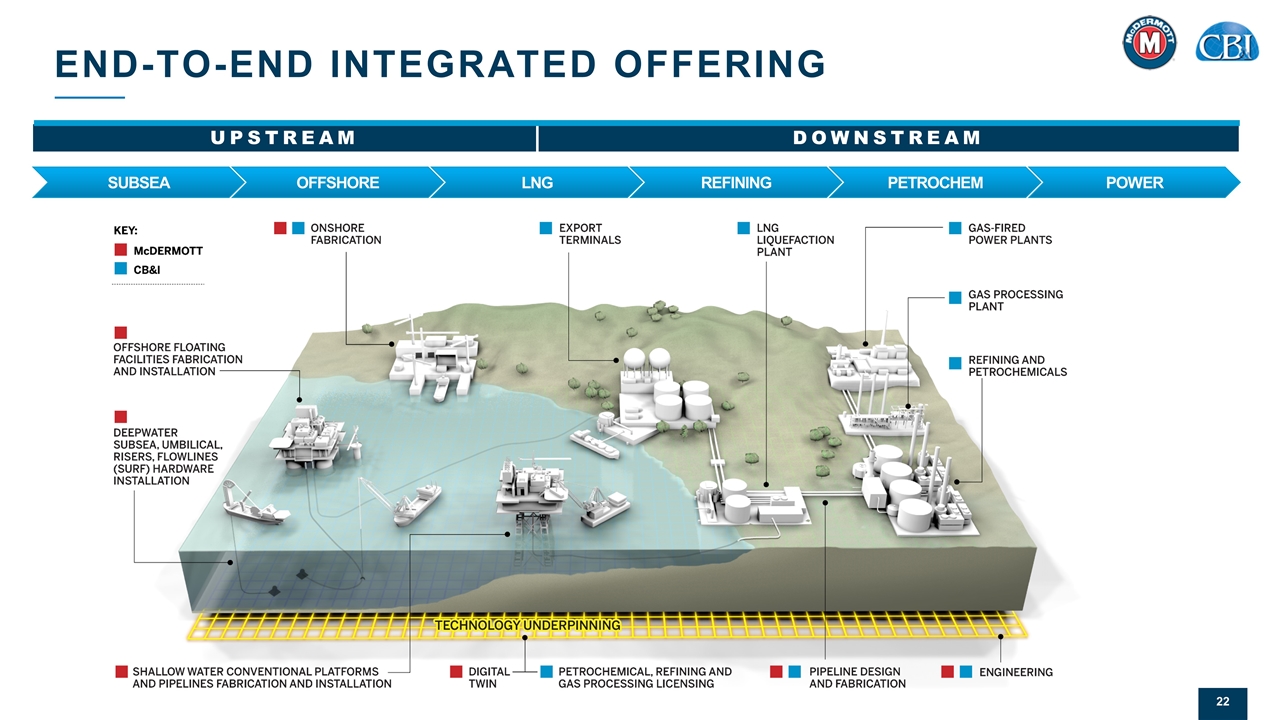

END-TO-END INTEGRATED OFFERING UPSTREAM DOWNSTREAM SUBSEA OFFSHORE LNG PETROCHEM POWER REFINING

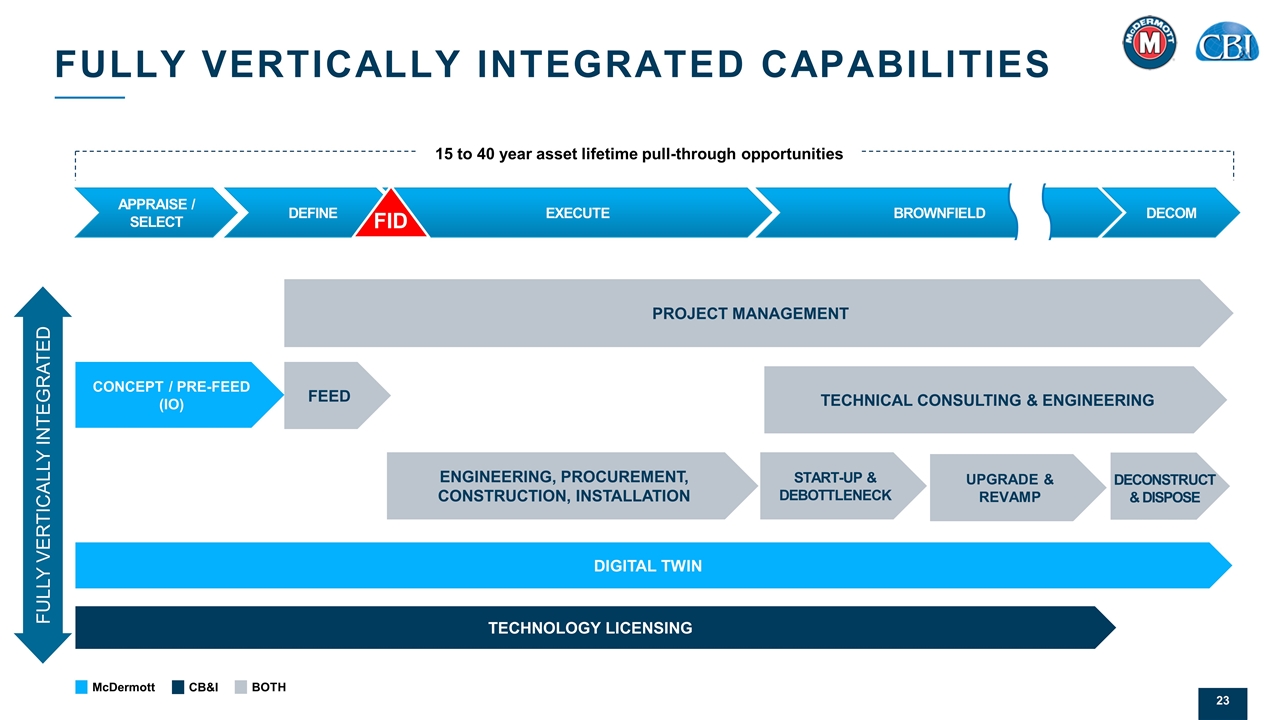

FULLY VERTICALLY INTEGRATED CAPABILITIES CONCEPT / PRE-FEED (IO) FEED TECHNOLOGY LICENSING PROJECT MANAGEMENT START-UP & DEBOTTLENECK UPGRADE & REVAMP TECHNICAL CONSULTING & ENGINEERING DIGITAL TWIN APPRAISE / SELECT EXECUTE BROWNFIELD DECOM DEFINE McDermott CB&I BOTH 15 to 40 year asset lifetime pull-through opportunities FID ENGINEERING, PROCUREMENT, CONSTRUCTION, INSTALLATION FULLY VERTICALLY INTEGRATED DECONSTRUCT & DISPOSE

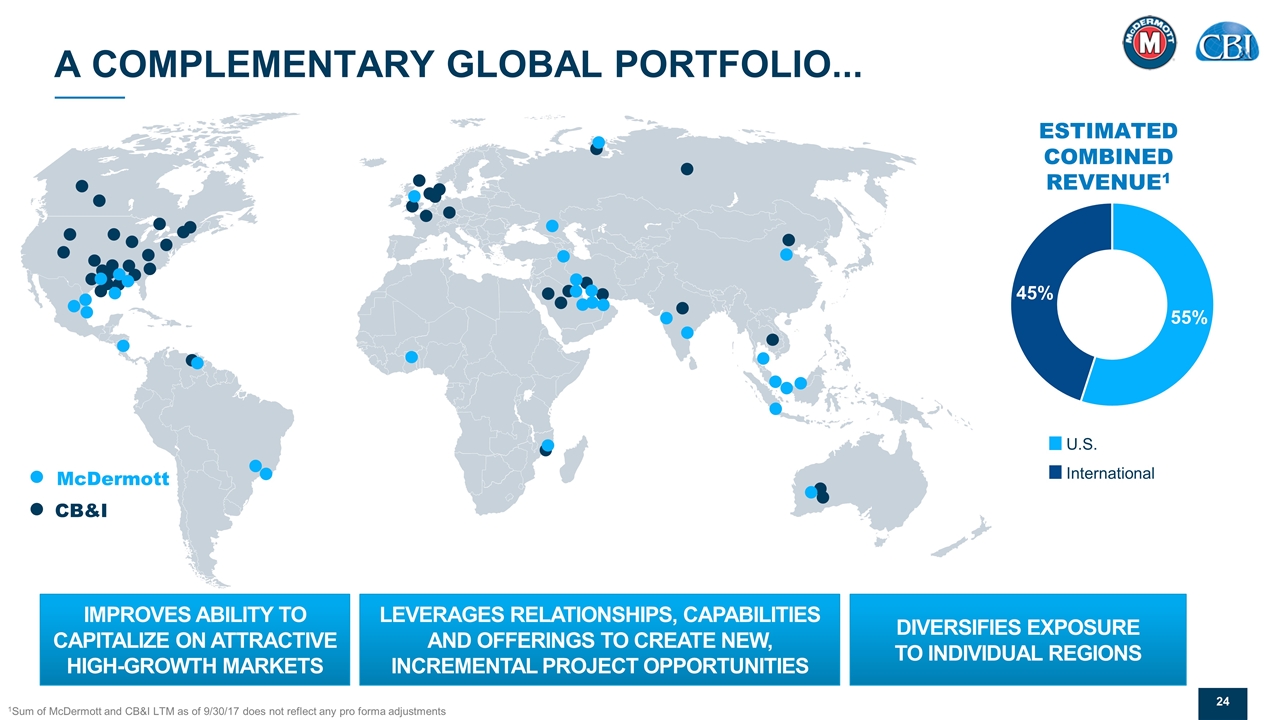

A COMPLEMENTARY GLOBAL PORTFOLIO... McDermott CB&I ESTIMATED COMBINED REVENUE1 International U.S. Improves ability to capitalize on attractive high-growth markets Leverages relationships, capabilities and offerings to create new, incremental project opportunities Diversifies exposure to individual regions 1Sum of McDermott and CB&I LTM as of 9/30/17 does not reflect any pro forma adjustments 24

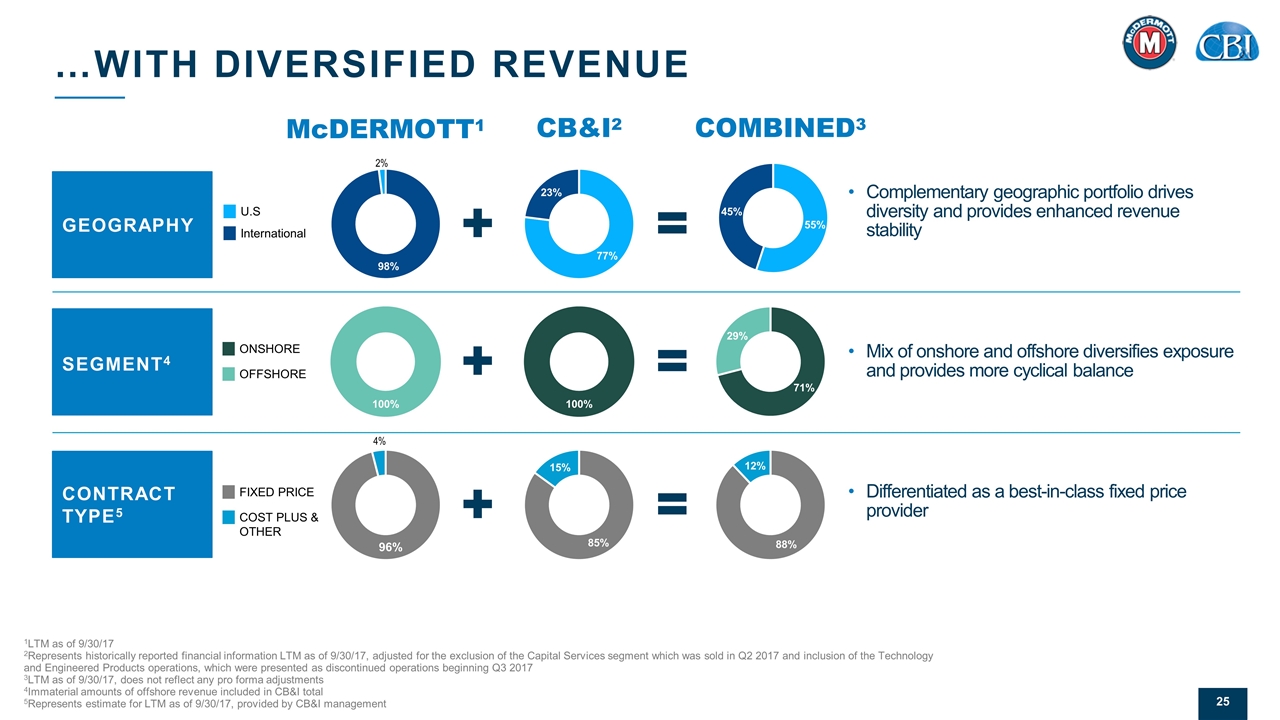

…WITH DIVERSIFIED REVENUE COMBINED3 McDermott1 CB&I2 GEOGRAPHY + = International U.S Complementary geographic portfolio drives diversity and provides enhanced revenue stability SEGMENT4 ONSHORE OFFSHORE + = Mix of onshore and offshore diversifies exposure and provides more cyclical balance CONTRACT TYPE5 FIXED PRICE COST PLUS & OTHER + = Differentiated as a best-in-class fixed price provider 1LTM as of 9/30/17 2Represents historically reported financial information LTM as of 9/30/17, adjusted for the exclusion of the Capital Services segment which was sold in Q2 2017 and inclusion of the Technology and Engineered Products operations, which were presented as discontinued operations beginning Q3 2017 3LTM as of 9/30/17, does not reflect any pro forma adjustments 4Immaterial amounts of offshore revenue included in CB&I total 5Represents estimate for LTM as of 9/30/17, provided by CB&I management 2% 4%

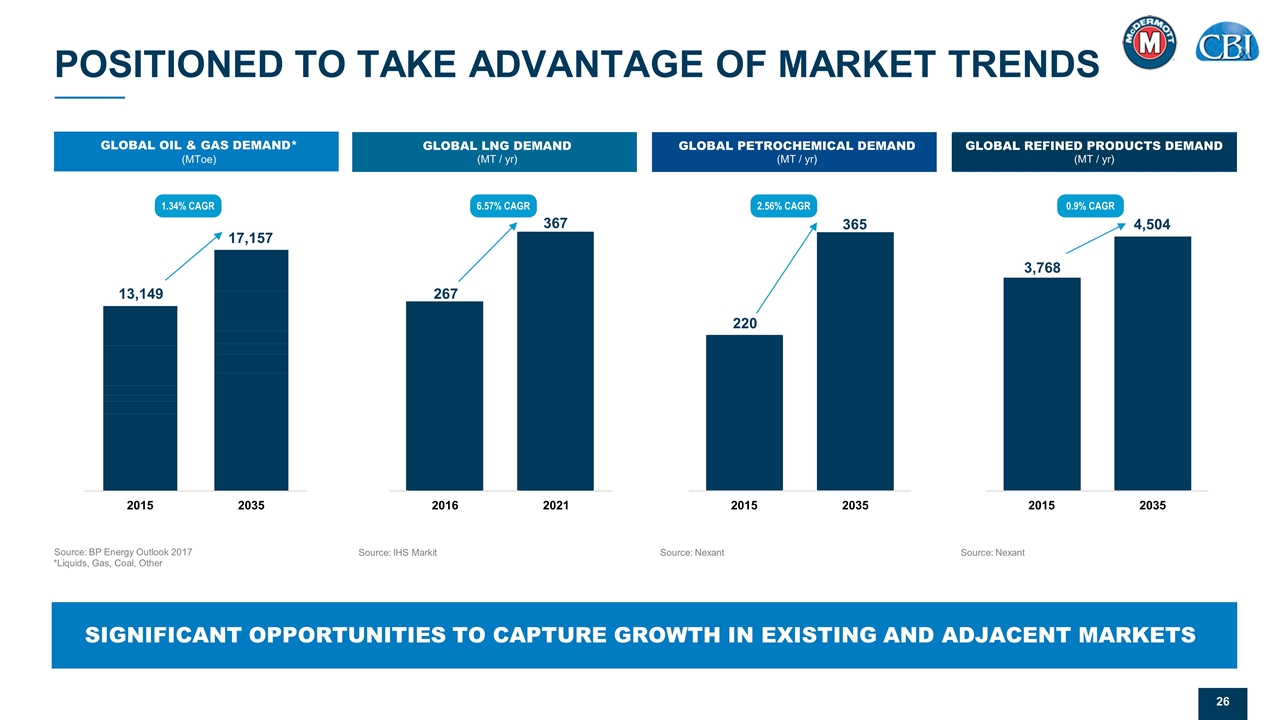

GLOBAL REFINED PRODUCTS DEMAND (MT / yr) GLOBAL PETROCHEMICAL DEMAND (MT / yr) GLOBAL LNG DEMAND (MT / yr) GLOBAL OIL & GAS DEMAND* (MToe) Source: IHS Markit Source: Nexant Source: Nexant Source: BP Energy Outlook 2017 *Liquids, Gas, Coal, Other POSITIONED TO TAKE ADVANTAGE OF MARKET TRENDS Significant opportunities to capture growth in existing and adjacent markets 1.34% CAGR 6.57% CAGR 2.56% CAGR 0.9% CAGR

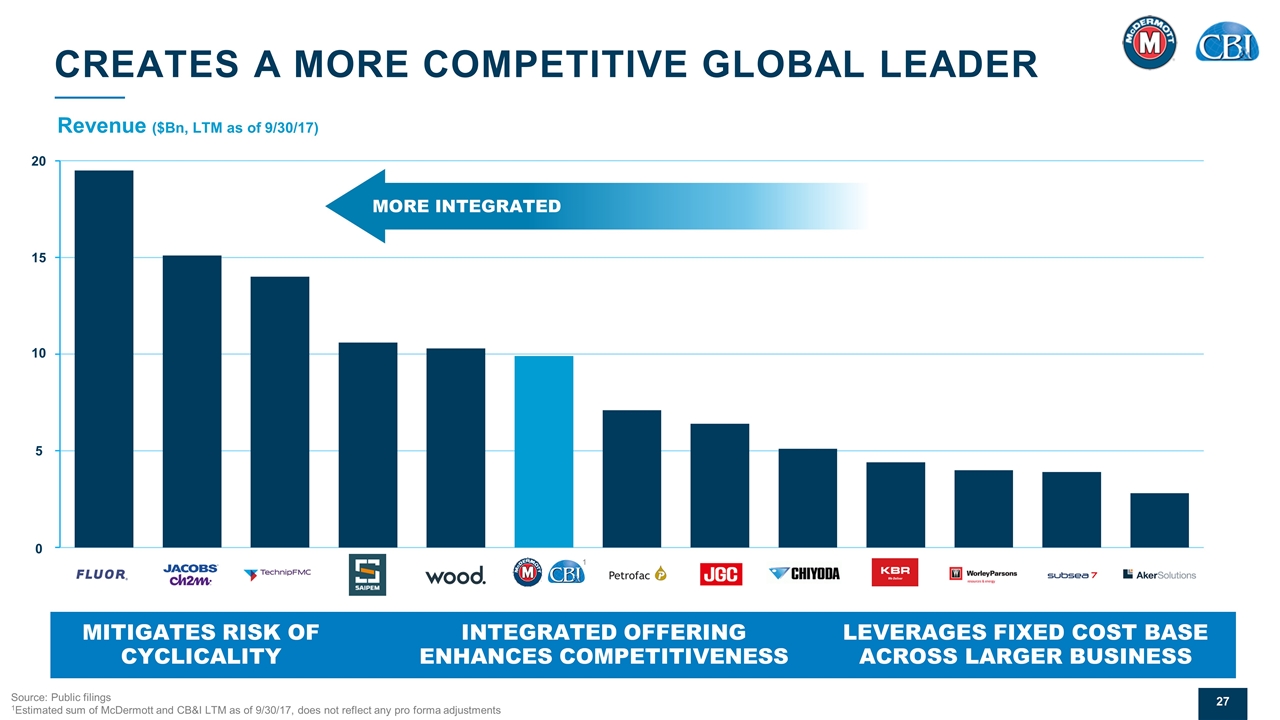

CREATES A MORE COMPETITIVE GLOBAL LEADER Revenue ($Bn, LTM as of 9/30/17) Source: Public filings 1Estimated sum of McDermott and CB&I LTM as of 9/30/17, does not reflect any pro forma adjustments 0 5 10 15 20 MORE INTEGRATED 1 MITIGATES RISK OF CYCLICALITY INTEGRATED OFFERING ENHANCES COMPETITIVENESS LEVERAGES FIXED COST BASE ACROSS LARGER BUSINESS

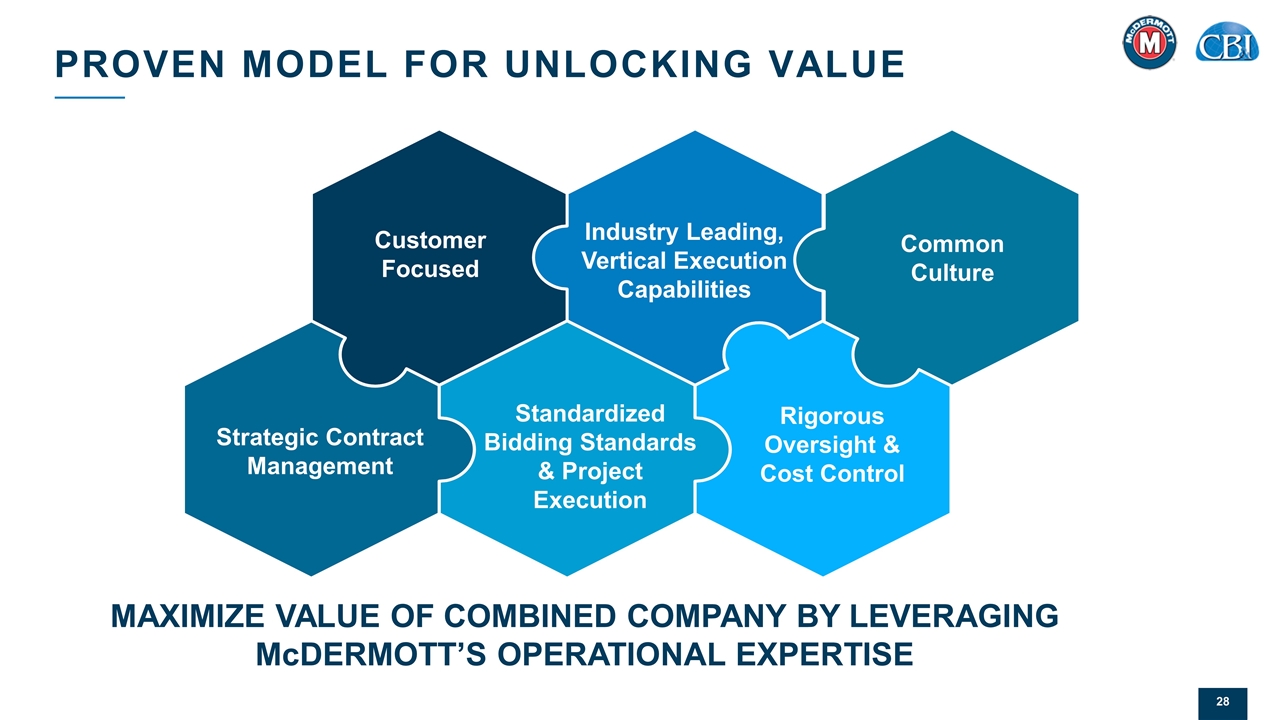

PROVEN MODEL FOR UNLOCKING VALUE maximize value of combined company BY Leveraging McDermott’s operational expertise Industry Leading, Vertical Execution Capabilities Rigorous Oversight & Cost Control Strategic Contract Management Customer Focused Standardized Bidding Standards & Project Execution Common Culture

FINANCIAL RATIONALE

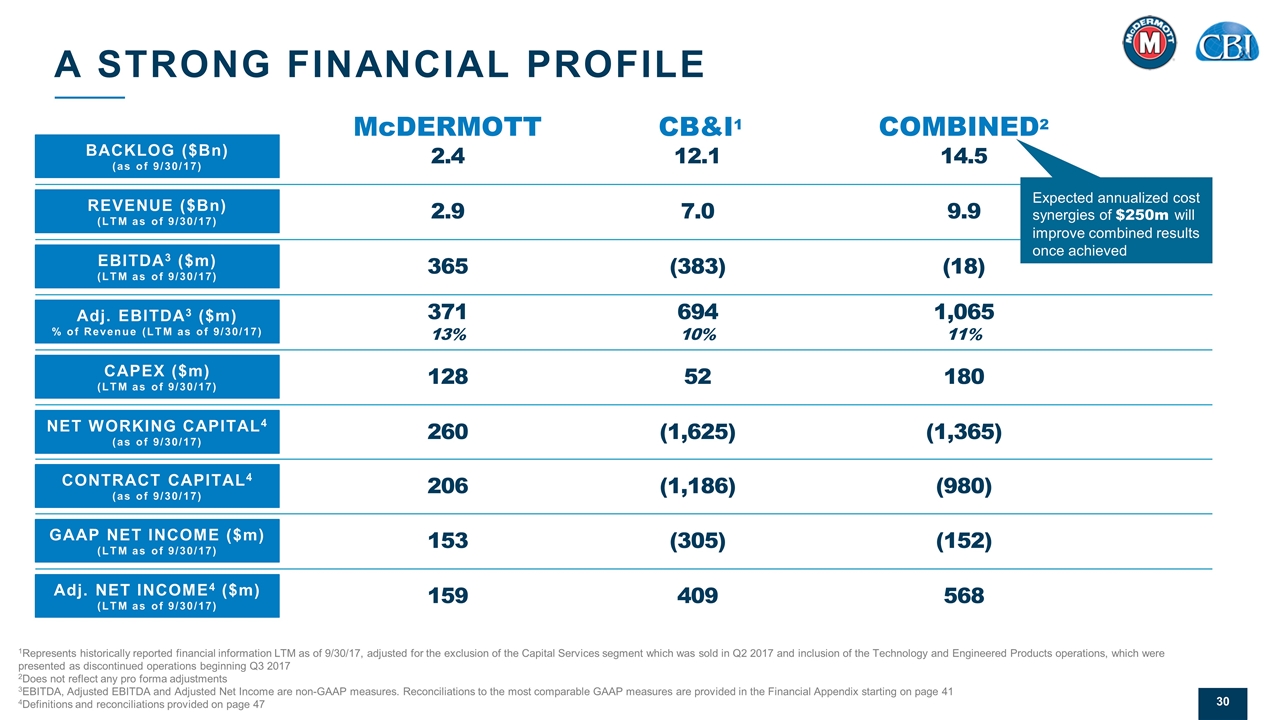

A STRONG FINANCIAL PROFILE 12.1 Net Working Capital4 (as of 9/30/17) BACKLOG ($Bn) (as of 9/30/17) 14.5 REVENUE ($Bn) (LTM as of 9/30/17) Combined2 CB&I1 McDermott Adj. EBITDA3 ($m) % of Revenue (LTM as of 9/30/17) CapEx ($m) (LTM as of 9/30/17) EBITDA3 ($m) (LTM as of 9/30/17) GAAP Net Income ($m) (LTM as of 9/30/17) 2.4 2.9 371 13% 128 365 260 7.0 694 10% 52 (383) (1,625) (305) 9.9 1,065 11% 180 (18) (1,365) (152) 153 Adj. Net Income4 ($m) (LTM as of 9/30/17) 409 568 159 1Represents historically reported financial information LTM as of 9/30/17, adjusted for the exclusion of the Capital Services segment which was sold in Q2 2017 and inclusion of the Technology and Engineered Products operations, which were presented as discontinued operations beginning Q3 2017 2Does not reflect any pro forma adjustments 3EBITDA, Adjusted EBITDA and Adjusted Net Income are non-GAAP measures. Reconciliations to the most comparable GAAP measures are provided in the Financial Appendix starting on page 41 4Definitions and reconciliations provided on page 47 Expected annualized cost synergies of $250m will improve combined results once achieved CONTRACT Capital4 (as of 9/30/17) 206 (1,186) (980)

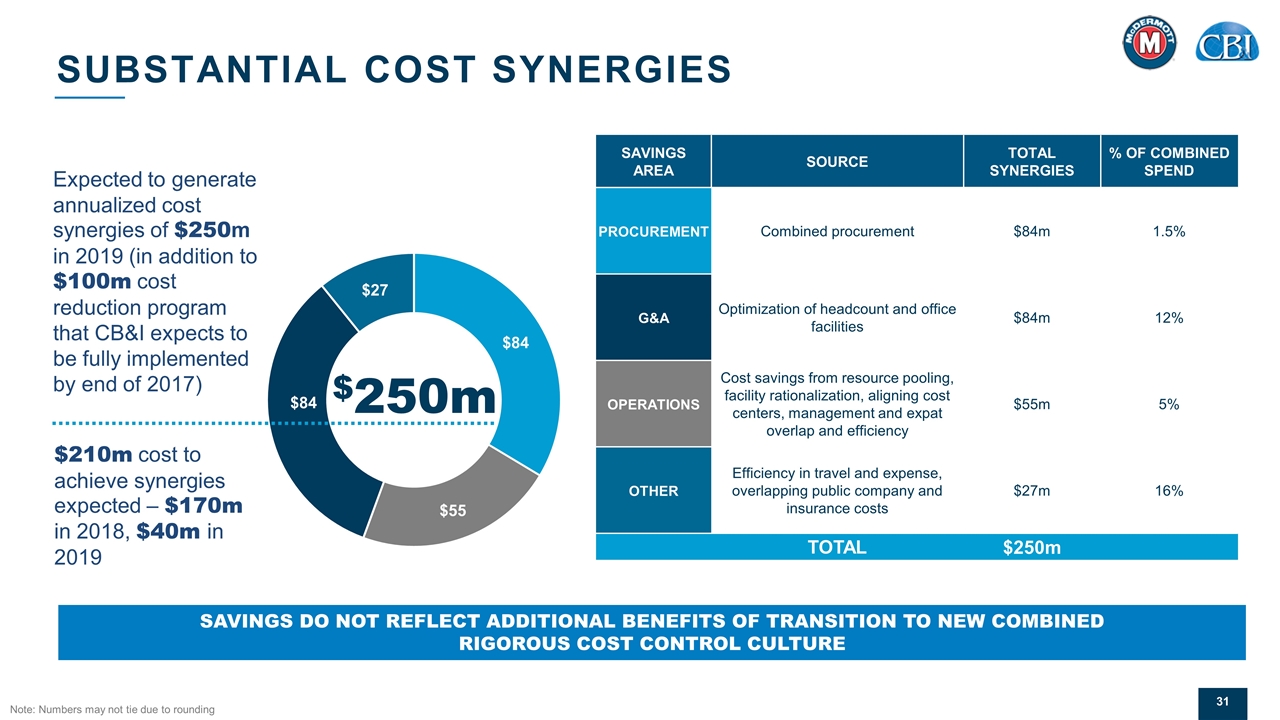

SUBSTANTIAL COST SYNERGIES Operations 22% G&A 34% Other 11% Savings Area Source Total Synergies % of Combined Spend Procurement Combined procurement $84m 1.5% G&A Optimization of headcount and office facilities $84m 12% Operations Cost savings from resource pooling, facility rationalization, aligning cost centers, management and expat overlap and efficiency $55m 5% Other Efficiency in travel and expense, overlapping public company and insurance costs $27m 16% Total $250m Note: Numbers may not tie due to rounding Expected to generate annualized cost synergies of $250m in 2019 (in addition to $100m cost reduction program that CB&I expects to be fully implemented by end of 2017) $210m cost to achieve synergies expected – $170m in 2018, $40m in 2019 Savings do not reflect additional benefits of transition to new combined rigorous cost control culture

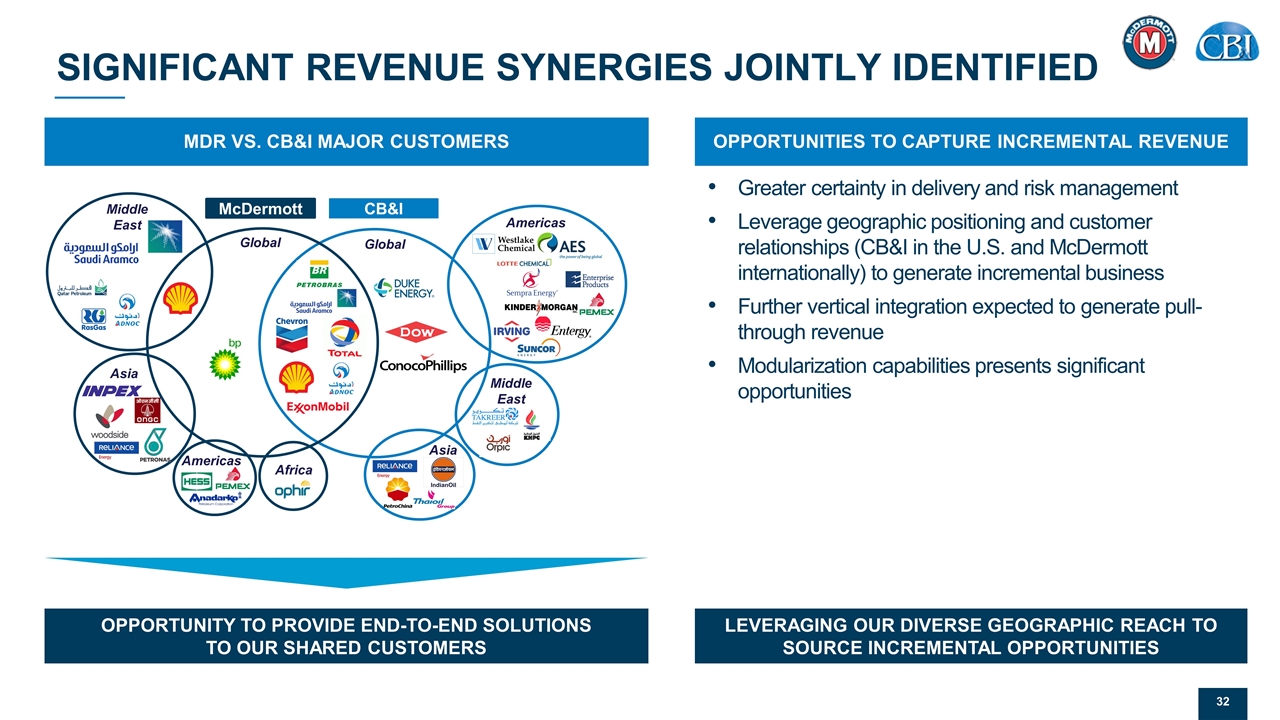

SIGNIFICANT REVENUE SYNERGIES JOINTLY IDENTIFIED MDR vs. CB&I Major Customers Americas Global Middle East Asia Middle East Global Americas Asia Africa McDermott CB&I Opportunity to Provide End-to-End Solutions to our shared customers Opportunities to capture incremental revenue Greater certainty in delivery and risk management Leverage geographic positioning and customer relationships (CB&I in the U.S. and McDermott internationally) to generate incremental business Further vertical integration expected to generate pull-through revenue Modularization capabilities presents significant opportunities Leveraging Our Diverse Geographic Reach to Source Incremental Opportunities

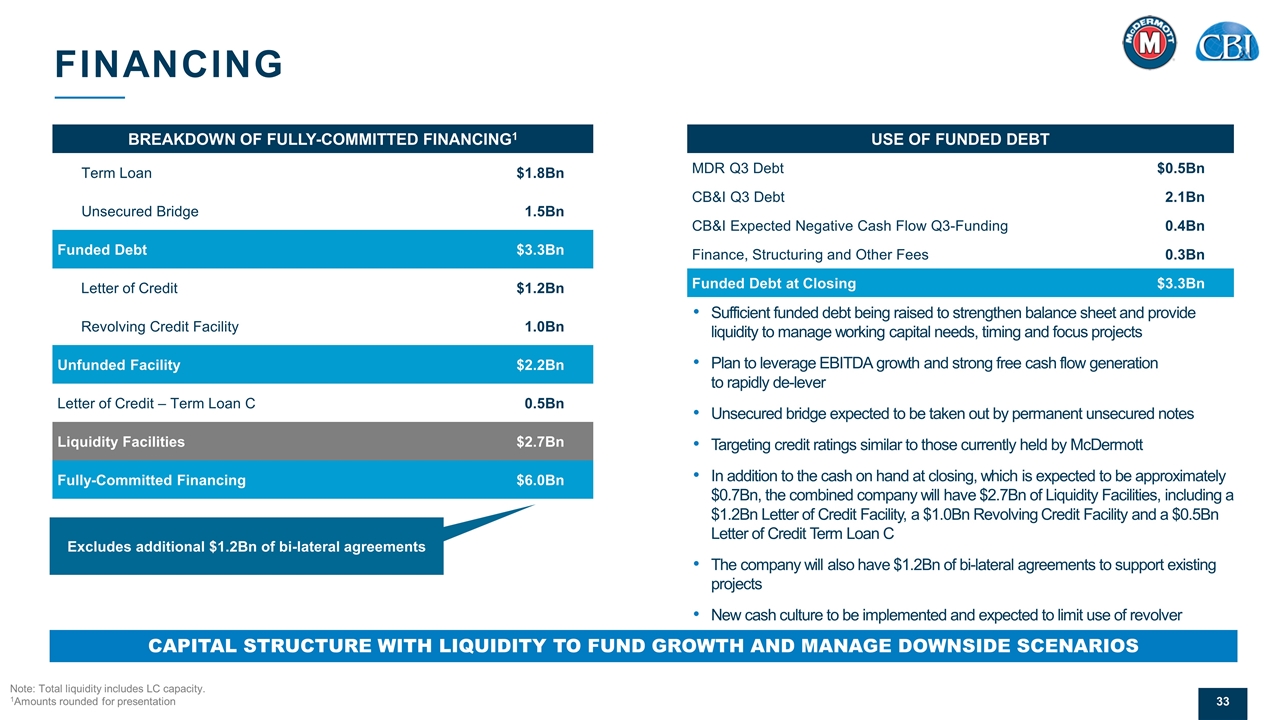

FINANCING Sufficient funded debt being raised to strengthen balance sheet and provide liquidity to manage working capital needs, timing and focus projects Plan to leverage EBITDA growth and strong free cash flow generation to rapidly de-lever Unsecured bridge expected to be taken out by permanent unsecured notes Targeting credit ratings similar to those currently held by McDermott In addition to the cash on hand at closing, which is expected to be approximately $0.7Bn, the combined company will have $2.7Bn of Liquidity Facilities, including a $1.2Bn Letter of Credit Facility, a $1.0Bn Revolving Credit Facility and a $0.5Bn Letter of Credit Term Loan C The company will also have $1.2Bn of bi-lateral agreements to support existing projects New cash culture to be implemented and expected to limit use of revolver Note: Total liquidity includes LC capacity. 1Amounts rounded for presentation USE OF FUNDED DEBT MDR Q3 Debt $0.5Bn CB&I Q3 Debt 2.1Bn CB&I Expected Negative Cash Flow Q3-Funding 0.4Bn Finance, Structuring and Other Fees 0.3Bn Funded Debt at Closing $3.3Bn Breakdown of Fully-Committed Financing1 Term Loan $1.8Bn Unsecured Bridge 1.5Bn Funded Debt $3.3Bn Letter of Credit $1.2Bn Revolving Credit Facility 1.0Bn Unfunded Facility $2.2Bn Letter of Credit – Term Loan C 0.5Bn Liquidity Facilities $2.7Bn Fully-Committed Financing $6.0Bn Excludes additional $1.2Bn of bi-lateral agreements Capital structure with liquidity to fund growth and manage downside scenarios

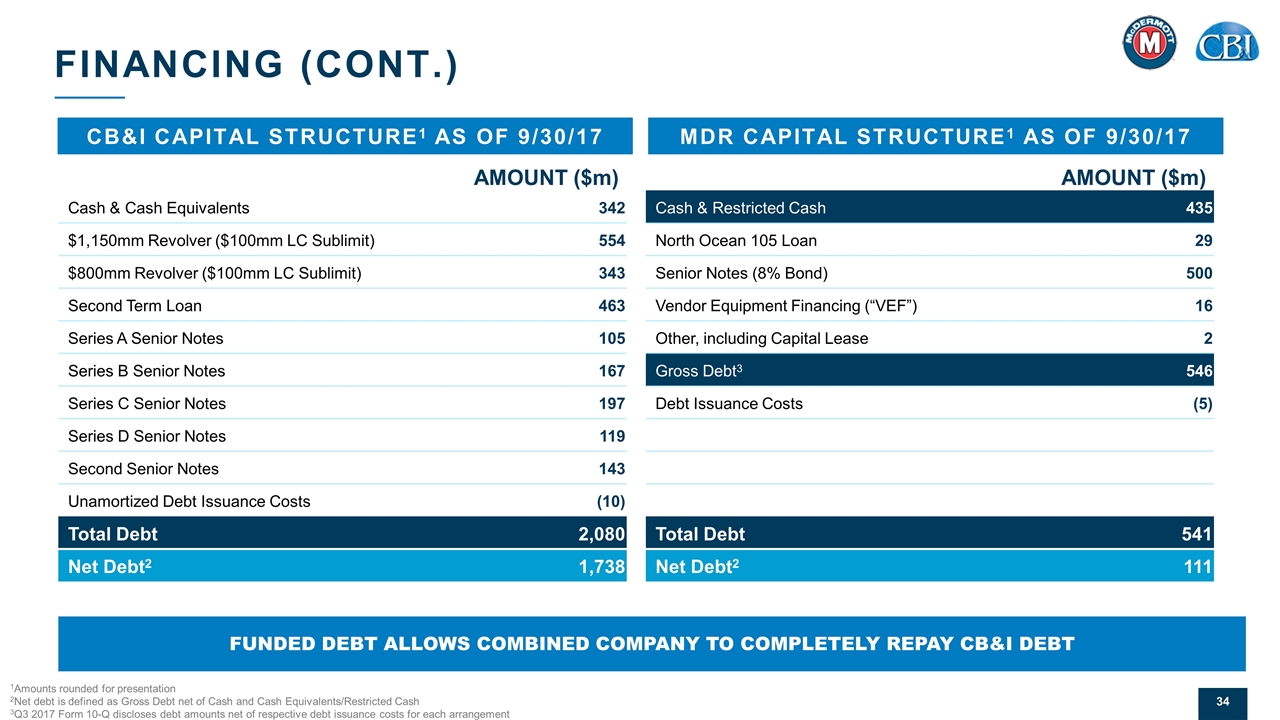

Amount ($m) Cash & Cash Equivalents 342 $1,150mm Revolver ($100mm LC Sublimit) 554 $800mm Revolver ($100mm LC Sublimit) 343 Second Term Loan 463 Series A Senior Notes 105 Series B Senior Notes 167 Series C Senior Notes 197 Series D Senior Notes 119 Second Senior Notes 143 Unamortized Debt Issuance Costs (10) Total Debt 2,080 Net Debt2 1,738 CB&I Capital Structure1 as of 9/30/17 Funded debt allows combined company to COMPLETELY repay CB&I debt FINANCING (CONT.) Amount ($m) Cash & Restricted Cash 435 North Ocean 105 Loan 29 Senior Notes (8% Bond) 500 Vendor Equipment Financing (“VEF”) 16 Other, including Capital Lease 2 Gross Debt3 546 Debt Issuance Costs (5) Total Debt 541 Net Debt2 111 MDR Capital Structure1 as of 9/30/17 1Amounts rounded for presentation 2Net debt is defined as Gross Debt net of Cash and Cash Equivalents/Restricted Cash 3Q3 2017 Form 10-Q discloses debt amounts net of respective debt issuance costs for each arrangement

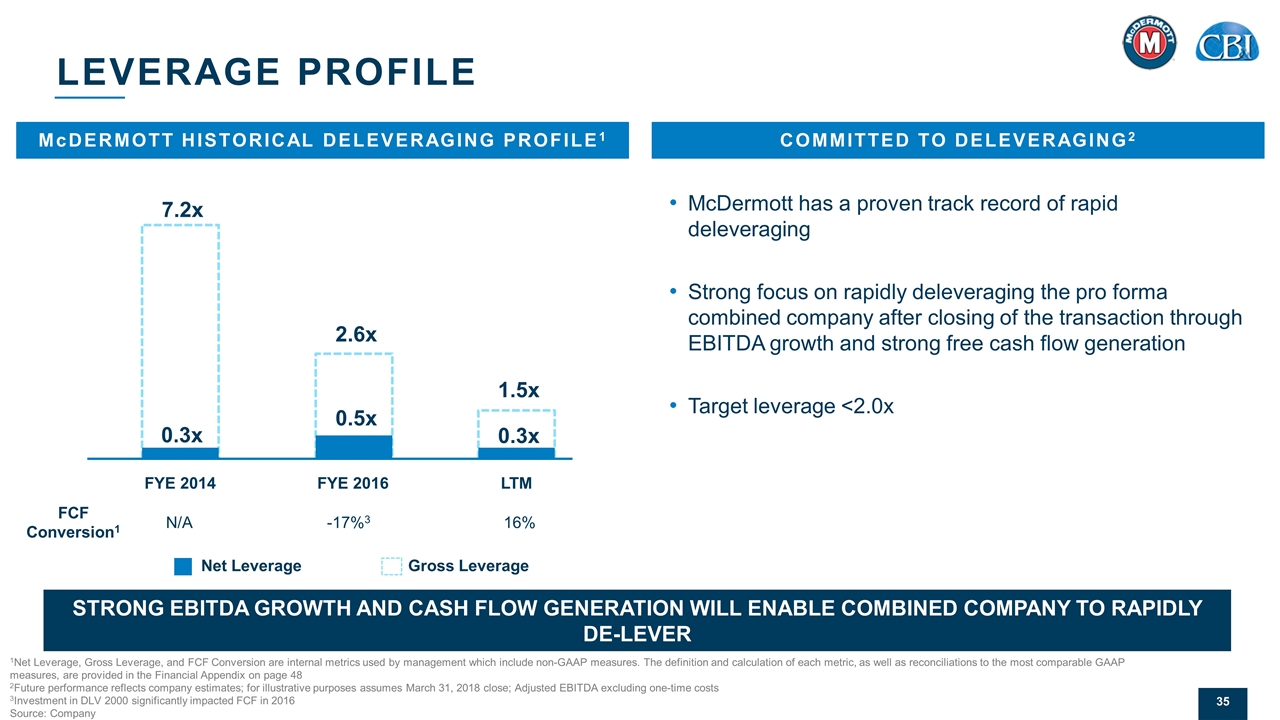

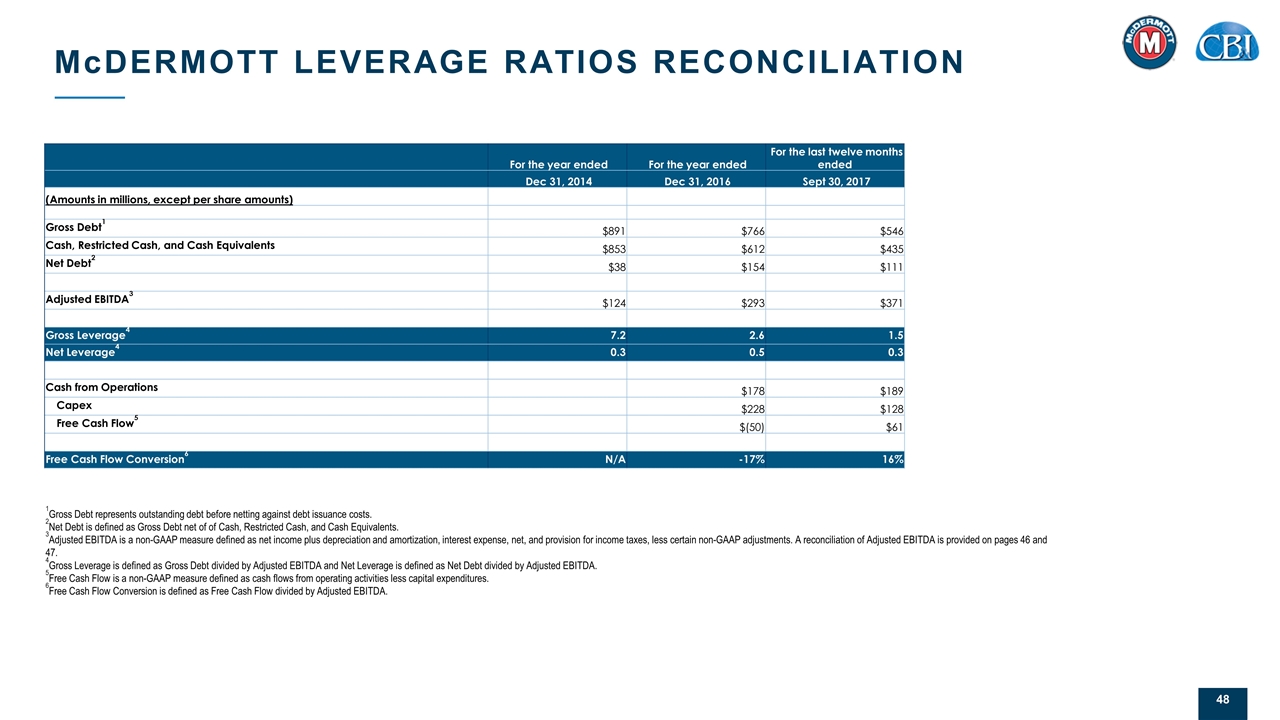

1Net Leverage, Gross Leverage, and FCF Conversion are internal metrics used by management which include non-GAAP measures. The definition and calculation of each metric, as well as reconciliations to the most comparable GAAP measures, are provided in the Financial Appendix on page 48 2Future performance reflects company estimates; for illustrative purposes assumes March 31, 2018 close; Adjusted EBITDA excluding one-time costs 3Investment in DLV 2000 significantly impacted FCF in 2016 Source: Company strong EBITDA growth and cash flow generation WILL ENABLE COMBINED COMPANY TO rapidly De-Lever McDermott Historical Deleveraging Profile1 Committed to Deleveraging2 LEVERAGE PROFILE 7.2x 0.3x 2.6x 1.5x FYE 2014 FYE 2016 LTM Net Leverage Gross Leverage 0.5x 0.3x FCF Conversion1 N/A -17%3 16% McDermott has a proven track record of rapid deleveraging Strong focus on rapidly deleveraging the pro forma combined company after closing of the transaction through EBITDA growth and strong free cash flow generation Target leverage <2.0x

DUE DILIGENCE

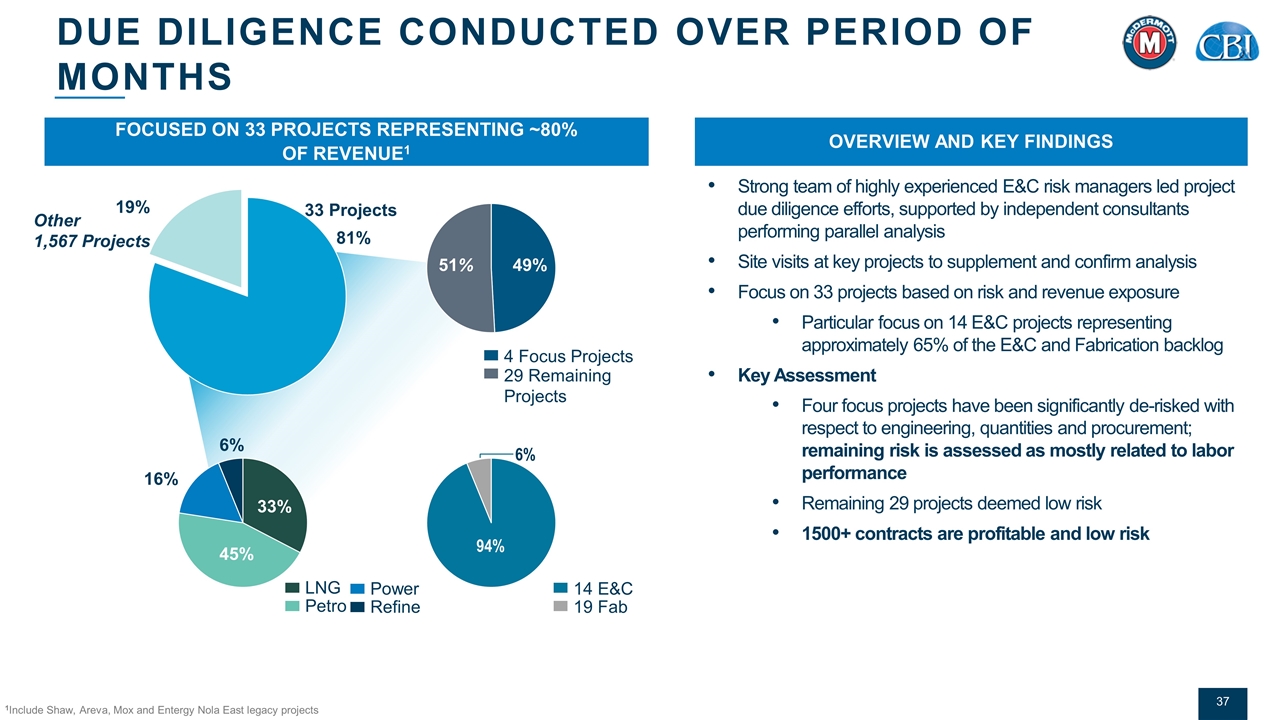

1Include Shaw, Areva, Mox and Entergy Nola East legacy projects DUE DILIGENCE CONDUCTED OVER PERIOD OF MONTHS Focused on 33 Projects Representing ~80% of Revenue1 33% 16% 45% 6% 33 Projects Overview and Key Findings Strong team of highly experienced E&C risk managers led project due diligence efforts, supported by independent consultants performing parallel analysis Site visits at key projects to supplement and confirm analysis Focus on 33 projects based on risk and revenue exposure Particular focus on 14 E&C projects representing approximately 65% of the E&C and Fabrication backlog Key Assessment Four focus projects have been significantly de-risked with respect to engineering, quantities and procurement; remaining risk is assessed as mostly related to labor performance Remaining 29 projects deemed low risk 1500+ contracts are profitable and low risk

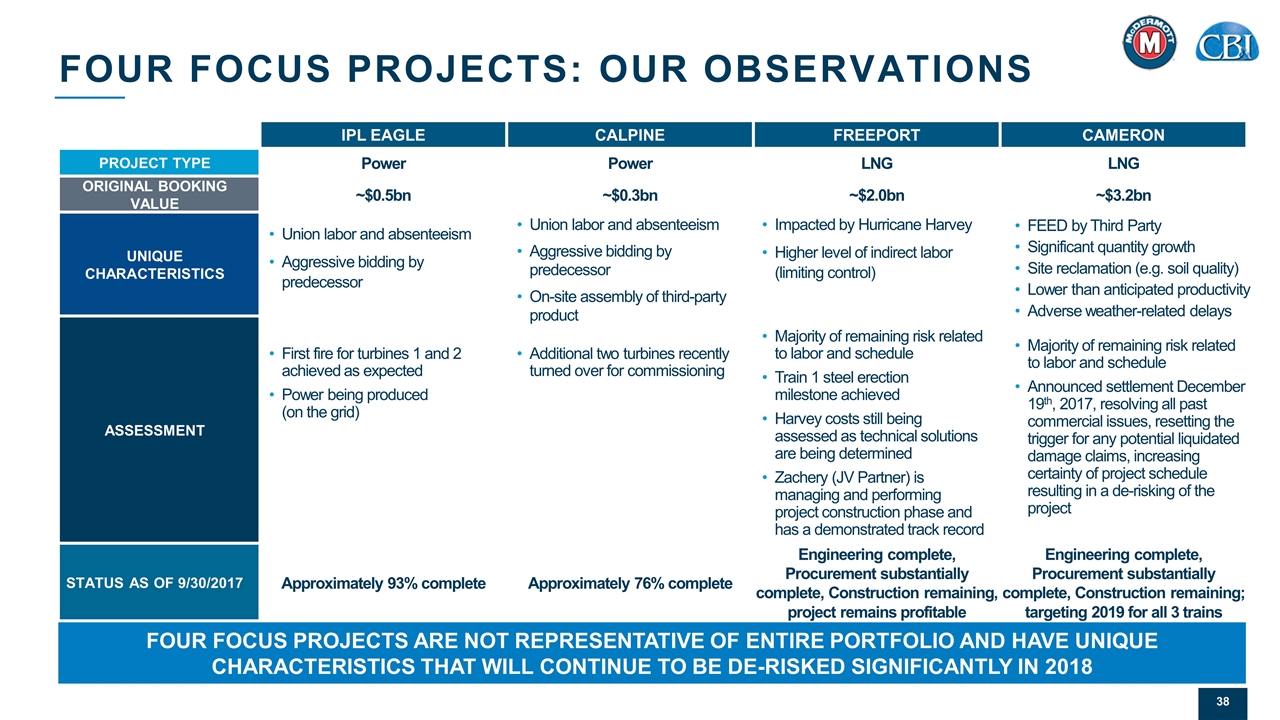

FOUR FOCUS PROJECTS: OUR OBSERVATIONS four focus projects are not representative of entire portfolio and have unique characteristics that will continue to be de-risked significantly in 2018 IPL Eagle Calpine Freeport Cameron Project Type Power Power LNG LNG Original booking value ~$0.5bn ~$0.3bn ~$2.0bn ~$3.2bn Unique Characteristics Assessment Status as of 9/30/2017 Approximately 93% complete Approximately 76% complete Engineering complete, Procurement substantially complete, Construction remaining, project remains profitable Engineering complete, Procurement substantially complete, Construction remaining; targeting 2019 for all 3 trains Union labor and absenteeism Aggressive bidding by predecessor Union labor and absenteeism Aggressive bidding by predecessor On-site assembly of third-party product Impacted by Hurricane Harvey Higher level of indirect labor (limiting control) FEED by Third Party Significant quantity growth Site reclamation (e.g. soil quality) Lower than anticipated productivity Adverse weather-related delays First fire for turbines 1 and 2 achieved as expected Power being produced (on the grid) Additional two turbines recently turned over for commissioning Majority of remaining risk related to labor and schedule Train 1 steel erection milestone achieved Harvey costs still being assessed as technical solutions are being determined Zachery (JV Partner) is managing and performing project construction phase and has a demonstrated track record Majority of remaining risk related to labor and schedule Announced settlement December 19th, 2017, resolving all past commercial issues, resetting the trigger for any potential liquidated damage claims, increasing certainty of project schedule resulting in a de-risking of the project

SUMMARY Creates a premier $10 billion1 global, fully vertically integrated onshore-offshore EPCI provider with a market-leading technology portfolio, better positioned to meet customer needs Combines complementary and diversified capabilities, well positioned globally in attractive high-growth markets Common culture focused on safety, fixed lump-sum contracting and customer engagement will ensure seamless transition for partners and employees Due diligence supports underlying strength and profitability of CB&I Confident in ability to apply McDermott’s operational excellence and turnaround experience to unlock near- and long-term value from CB&I portfolio Provides capital structure with liquidity to fund growth and manage downside scenarios New growth opportunities, expected $250 million annual cost synergies and substantial revenue synergies expected to generate significant benefits for shareholders 1Estimated sum of McDermott and CB&I LTM revenue as of 9/30/17, does not reflect any pro forma adjustments

FINANCIAL APPENDIX

Three Months Ended Nine Months Ended Last Twelve Months Dec 31, 2016 Sept 30, 2017 Sept 30, 2017 E&C FS Tech CS Total E&C FS Tech CS Res Total E&C FS Tech CS Res Total (Dollars In millions) Operating Income (Loss), as reported2 $(183) $22 $28 $(637) $(769) $(506) $98 $ - $ - $(31) $(439) $(689) $120 $28 $(637) $(31) $(1,209) Less: Reclassification of Discontinued Operations and Adjustments3 (3) (2) - 637 632 3 69 73 - - 145 - 67 73 637 - 777 Operating Income (Loss), on a continuing operations basis $(186) $20 $28 $- $(137) $(503) $167 $73 $- $(31) $(294) $(689) $187 $101 $- $(31) $(432) Plus: Depreciation & Amortization, as reported 3 13 6 7 29 8 37 17 4 - 66 11 50 23 11 - 95 Less: Operating Income (Loss) Attributable to Noncontrolling Interests (4) - - (1) (5) (29) (2) - (1) - (32) (33) (2) - (2) - (37) Less: Reclassification of Discontinued Operations and Adjustments3 - - - (6) (6) - - - (3) - (3) - - - (9) - (9) EBITDA4 $(187) $33 $34 $- $(119) $(524) $202 $90 $- $(31) $(263) $(711) $235 $124 $- $(31) $(383) Plus: Non-GAAP Adjustments Loss on Sale of Nuclear Operations5 148 - - - 148 - - - - - - 148 - - - - 148 Significant Project Charges6 128 - - - 128 769 - - - - 769 897 - - - - 897 Restructuring Costs7 - - - - - - - - - 31 31 - - - - 31 31 Non-GAAP Adjusted EBITDA4,9 $89 $33 $34 $- $157 $245 $202 $90 $- $- $537 $334 $235 $124 $- $- $694 Non-GAAP Adjusted EBITDA as percent of total 48% 34% 18% 0% 0% 100% CB&I NON-GAAP RECONCILIATION BY SEGMENT FOR LTM 9/30/171,8 1CB&I's operations consist of the following four operating groups: Engineering & Construction (""E&C""), Fabrication Services (""FS""), Technology (""Tech"") and Capital Services (""CS""). Additionally, CB&I reports restructuring charges (""Res"") which are not allocated to any individual operating group. 2Represents Operating Income (Loss) as originally reported in CB&I’s earnings release in Form 8-K for the three months and year ended December 31, 2016, or Form 10-Q as of September 30, 2017 and for the nine months ended September 30, 2017. Note that CB&I Operating Income (Loss) by segment as reported excludes restructuring costs, which are presented as a component of Operating Income (Loss) on the Consolidated Statement of Operations. 3Represents the reclassification and adjustments associated with the presentation of discontinued operations of CB&I. Includes the removal of the Capital Services Operations to align with its classification as a discontinued operation during the first quarter 2017 and subsequent sale in the second quarter 2017; the classification of the Technology Operations as a continuing operation which was previously classified as a discontinued operation during the third quarter 2017; and any elimination adjustments due to the reclassification of the aforementioned. 4EBITDA is defined as net income plus depreciation and amortization, interest expense, net and provision for income taxes. As CB&I does not report net income by segment, we have alternatively calculated EBITDA as operating income (loss), less noncontrolling interest, plus depreciation and amortization. Adjusted EBITDA is defined as EBITDA less the non-GAAP adjustments detailed in footnotes 5, 6, and 7. 5Represents a charge recorded in the fourth quarter 2016 related to the establishment of a reserve for the Transaction Receivable associated with the sale of CB&I’s former Nuclear Operations in the fourth quarter 2015. 6Represents the impact of significant changes in estimates on two U.S. gas turbine power projects and two U.S. LNG export facility projects. The U.S. gas turbine power projects were negatively impacted by lower than anticipated craft labor productivity; slower than anticipated benefits from mitigation plans; and extensions of schedule and related prolongation costs (including schedule related liquidated damages).A majority of the impacts for the U.S. LNG projects were related to a project in Hackberry LA, which was impacted primarily by lower than anticipated craft labor productivity; weather related delays; increased material, construction and fabrication costs due to quantity growth and material delivery delays; higher than anticipated estimates from subcontractors for their work scopes; and extensions of schedule and related prolongation costs resulting from the aforementioned. The remaining impacts for the U.S. LNG projects related to a project in Freeport, TX which was impacted primarily by increased material, construction and fabrication costs due to quantity growth and material delivery delays; weather related delays; and potential extensions of schedule and related prolongation costs resulting from the aforementioned. These adjustments have been prepared on a different basis than the December 18, 2017 presentation, which included net impacts from certain other projects. In addition, the net adjustments for the period LTM 9/30/17 in the December 18, 2017 presentation were understated by $50 million. 7Restructuring costs are primarily associated with facility realignment, severance and professional services resulting from publicly announced cost reduction and strategic initiatives. 8Sum of components may not foot due to rounding. 9Adjusted EBITDA has been prepared on a different basis than the December 18, 2017 presentation as described in footnote 7, which included an understatement of Adjusted EBITDA of $50 million for the period LTM 9/30/17.

Three Months Ended Nine Months Ended Last Twelve Months Dec 31, 2016 Sept 30, 2017 Sept 30, 2017 (Dollars In millions) GAAP Net Income (Loss) Attributable to CB&I, as reported1 $(666) $(391) $(1,056) Less: Net Income (Loss) Attributable to Capital Services2 645 107 752 GAAP Net Income (Loss) Attributable to CB&I, on a continuing operations basis (21) (284) (305) Plus: Non-GAAP Adjustments Loss on Sale of Nuclear Operations3 148 - 148 Significant Project Charges4 128 769 897 Restructuring Costs5 - 31 31 Accelerated DIC Amortization6 - 22 22 Total Non-GAAP Adjustments 276 822 1,098 Tax Effect of Non-GAAP Changes7 (97) (288) (384) Total Non-GAAP Adjustments (After Tax) 179 534 714 Non-GAAP Adjusted Net Income Attributable to CB&I $159 $251 $409 GAAP Diluted EPS, as reported1 (6.65) (3.87) (10.52) Non-GAAP Adjustments 8.22 6.34 14.56 Non-GAAP Diluted EPS $1.57 $2.47 $4.04 Shares Basic 100 101 101 Diluted 101 102 101 GAAP Net Income (Loss) Attributable to CB&I $(21) $(284) $(304) Add: Depreciation & Amortization, as reported 29 66 95 Interest Expense, Net, as reported 22 6 28 Provision for Income Taxes, as reported (130) (177) (307) Reclassification of Discontinued Operations and Adjustments8 (20) 125 105 EBITDA10 $(119) $(263) $(383) EBITDA $(119) $(263) $(383) Plus: Non-GAAP Adjustments 276 800 1,076 Non-GAAP Adjusted EBITDA9,10 $157 $537 $694 CB&I NON-GAAP RECONCILIATION FOR LTM 9/30/1711 1Represents each financial statement line item or disclosure as originally reported in CB&I’s Form 10-K as of December 31, 2016 and for the three months ended December 31, 2016, or Form 10-Q as of September 30, 2017 and for the nine months ended September 30, 2017. 2Represents the removal of the Capital Services Operations to align with its classification as a discontinued operation during the first quarter 2017 and its subsequent sale in the second quarter 2017. 3Represents a charge recorded in the fourth quarter 2016 related to the establishment of a reserve for the Transaction Receivable associated with the sale of CB&I’s former Nuclear Operations in the fourth quarter 2015. 4Represents the impact of significant changes in estimates on two U.S. gas turbine power projects and two U.S. LNG export facility projects. The U.S. gas turbine power projects were negatively impacted by lower than anticipated craft labor productivity; slower than anticipated benefits from mitigation plans; and extensions of schedule and related prolongation costs (including schedule related liquidated damages).A majority of the impacts for the U.S. LNG projects were related to a project in Hackberry LA, which was impacted primarily by lower than anticipated craft labor productivity; weather related delays; increased material, construction and fabrication costs due to quantity growth and material delivery delays; higher than anticipated estimates from subcontractors for their work scopes; and extensions of schedule and related prolongation costs resulting from the aforementioned. The remaining impacts for the U.S. LNG projects related to a project in Freeport, TX which was impacted primarily by increased material, construction and fabrication costs due to quantity growth and material delivery delays; weather related delays; and potential extensions of schedule and related prolongation costs resulting from the aforementioned. These adjustments have been prepared on a different basis than the December 18, 2017 presentation, which included net impacts from certain other projects. In addition, the net adjustments for the period LTM 9/30/17 in the December 18, 2017 presentation were understated by $50 million. 5Represents costs primarily associated with facility realignment, severance and professional services resulting from publicly announced cost reduction and strategic initiatives. 6Represents accelerated amortization of debt issuance costs resulting from the agreement with creditors to use the proceeds from the sale of Technology Operations to repay outstanding debt. 7The adjustments to GAAP Net Income have been income tax effected when included in net income. Tax effects of Non-GAAP adjustments represent the estimated tax impacts of the adjustments during the period. 8Represents the reclassification and adjustments associated with the presentation of discontinued operations of CB&I. Includes the removal of the Capital Services Operations to align with its classification as a discontinued operation during the first quarter 2017 and subsequent sale in the second quarter 2017 and the classification of the Technology Operations as a continuing operation which was previously classified as a discontinued operation during the third quarter 2017. 9EBITDA is defined as net income plus depreciation and amortization, interest expense, net and provision for income taxes. Adjusted EBITDA is defined as EBITDA less the adjustments detailed in footnotes 3, 4, 5, and 6. We have included EBITDA and Adjusted EBITDA disclosures in this presentation because EBITDA is widely used by investors for valuation and comparing financial performance with the performance of other companies in the industry and because Adjusted EBITDA provides a consistent measure of EBITDA relating to the underlying business. McDermott management also uses EBITDA and Adjusted EBITDA to monitor and compare the financial performance of the operations. EBITDA and Adjusted EBITDA do not give effect to the cash that must be used to service debt or pay income taxes, and, thus, do not reflect the funds actually available for capital expenditures, dividends or various other purposes. In addition, the presentation of EBITDA and Adjusted EBITDA may not be comparable to similarly titled measures in other companies’ reports. You should not consider EBITDA or Adjusted EBITDA in isolation from, or as a substitute for, net income or cash flow measures prepared in accordance with U.S. GAAP. 10Adjusted EBITDA has been prepared on a different basis than the December 18, 2017 presentation as described in footnote 5, which included an understatement of Adjusted EBITDA of $50 million for the period LTM 9/30/17. 11Sum of components may not foot due to rounding.

Twelve Months Ended Twelve Months Ended Twelve Months Ended Twelve Months Ended Dec 31, 2013 Dec 31, 2014 Dec 31, 2015 Dec 31, 2016 E&C FS Tech CS Res Total E&C FS Tech CS Res Total E&C FS Tech CS Res Total E&C FS Tech CS Res Total (Dollars In millions) Operating Income (Loss), as reported2 $317 $288 $129 $47 ($96) $685 $519 $274 $148 $81 ($40) $983 ($875) $225 $151 $74 - ($425) $159 $183 $105 ($592) - ($145) Less: Reclassification of Discontinued Operations and Adjustments3 (67) (2) (0) (47) 15 (101) (167) (3) (1) (81) 8 (244) (226) (4) (0) (74) - (305) (15) (4) (0) 592 - 572 Operating Income (Loss), on a continuing operations basis $250 $286 $128 - ($81) $583 $351 $272 $147 - ($31) $739 ($1,102) $221 $150 - - ($730) $143 $179 $105 - - $428 Plus: Depreciation & Amortization, as reported 64 61 21 34 - 180 63 61 24 34 - 181 48 56 23 34 - 161 17 54 23 28 - 123 Less: Operating Income (Loss) Attributable to Noncontrolling Interests (53) (5) - (1) - (58) (85) (6) - (2) - (93) (63) (9) - (3) - (74) (67) (5) - (2) - (73) Less: Reclassification of Discontinued Operations and Adjustments3 (28) - - (33) - (60) (31) 0 - (32) - (62) (25) 1 - (31) - (56) 1 1 - (26) - (24) EBITDA4 $234 $342 $149 - ($81) $644 $298 $328 $171 - ($31) $765 ($1,142) $270 $173 - - ($699) $95 $230 $128 - - $453 Plus: Non-GAAP Adjustments Loss on Sale and Intangibles Impairment of Nuclear Operations5 - - - - - - - - - - - - 1,506 - - - - 1,506 148 - - - - 148 Significant Project Charges6 - - - - - - - - - - - - - - - - - - 197 - - - - 197 Restructuring Costs7 - - - - 81 81 - - - - 31 31 - - - - - - - - - - - - Non-GAAP Adjusted EBITDA4 $234 $342 $149 - - $725 $298 $328 $171 - - $797 $364 $270 $173 - - $807 $440 $230 $128 - - $798 CB&I NON-GAAP RECONCILIATION BY SEGMENT FOR HISTORICAL RESULTS 2013 – 20161,8 1CB&I's operations consist of the following four operating groups: Engineering & Construction (""E&C""), Fabrication Services (""FS""), Technology (""Tech"") and Capital Services (""CS""). Additionally, CB&I reports restructuring charges (""Res"") which are not allocated to any individual operating group. 2Represents Operating Income (Loss) as originally reported in CB&I’s Form 10-K as the years ended December 31, 2013 through December 31, 2016. Note that CB&I Operating Income (Loss) by segment as reported excludes restructuring costs, which are presented as a component of Operating Income (Loss) on the Consolidated Statement of Operations. 3Represents the reclassification and adjustments associated with the presentation of discontinued operations of CB&I. Includes the removal of the Nuclear Operations, previously reported as part of the E&C operating group, due to its sale in the fourth quarter 2015; the removal of the Capital Services Operations to align with its classification as a discontinued operation during the first quarter 2017 and subsequent sale in the second quarter 2017; and any elimination adjustments due to the reclassification of the aforementioned. 4EBITDA is defined as net income plus depreciation and amortization, interest expense, net and provision for income taxes. As CB&I does not report net income by segment, we have alternatively calculated EBITDA as operating income (loss), less noncontrolling interest, plus depreciation and amortization. Adjusted EBITDA is defined as EBITDA less the non-GAAP adjustments detailed in footnotes 5, 6, and 7. 5Represents charges recorded as a result of the sale of CB&I’s former Nuclear Operations. A loss on the sale of the operations and impairment of the related goodwill was recorded in the fourth quarter 2015 and an additional charge was recorded in the fourth quarter 2016 related to the establishment of a reserve for the Transaction Receivable associated with the sale. 6Represents the impact of significant changes in estimates on two U.S. gas turbine power projects. 7Restructuring costs are primarily associated with facility realignment, severance and professional services resulting from publicly announced cost reduction and strategic initiatives. 8Sum of components may not foot due to rounding.

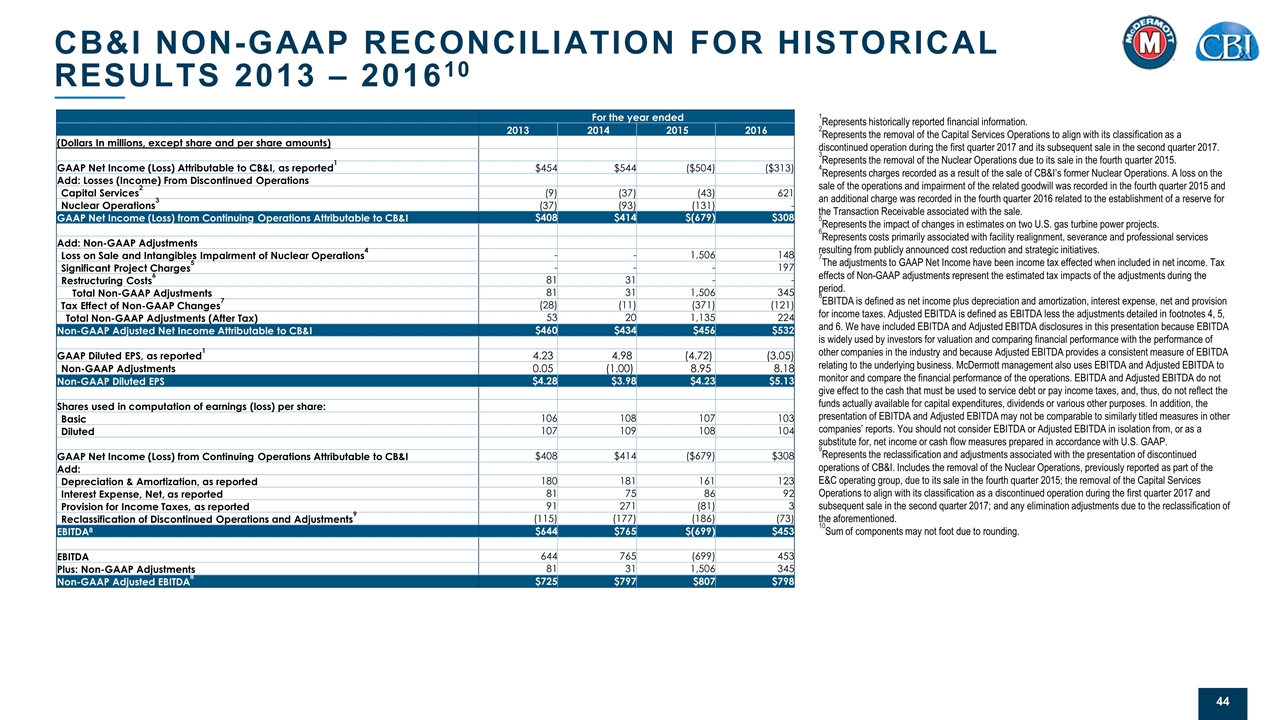

For the year ended 2013 2014 2015 2016 (Dollars In millions, except share and per share amounts) GAAP Net Income (Loss) Attributable to CB&I, as reported1 $454 $544 ($504) ($313) Add: Losses (Income) From Discontinued Operations Capital Services2 (9) (37) (43) 621 Nuclear Operations3 (37) (93) (131) - GAAP Net Income (Loss) from Continuing Operations Attributable to CB&I $408 $414 $(679) $308 Add: Non-GAAP Adjustments Loss on Sale and Intangibles Impairment of Nuclear Operations4 - - 1,506 148 Significant Project Charges5 - - - 197 Restructuring Costs6 81 31 - - Total Non-GAAP Adjustments 81 31 1,506 345 Tax Effect of Non-GAAP Changes7 (28) (11) (371) (121) Total Non-GAAP Adjustments (After Tax) 53 20 1,135 224 Non-GAAP Adjusted Net Income Attributable to CB&I $460 $434 $456 $532 GAAP Diluted EPS, as reported1 4.23 4.98 (4.72) (3.05) Non-GAAP Adjustments 0.05 (1.00) 8.95 8.18 Non-GAAP Diluted EPS $4.28 $3.98 $4.23 $5.13 Shares used in computation of earnings (loss) per share: Basic 106 108 107 103 Diluted 107 109 108 104 GAAP Net Income (Loss) from Continuing Operations Attributable to CB&I $408 $414 ($679) $308 Add: Depreciation & Amortization, as reported 180 181 161 123 Interest Expense, Net, as reported 81 75 86 92 Provision for Income Taxes, as reported 91 271 (81) 3 Reclassification of Discontinued Operations and Adjustments9 (115) (177) (186) (73) EBITDA8 $644 $765 $(699) $453 EBITDA 644 765 (699) 453 Plus: Non-GAAP Adjustments 81 31 1,506 345 Non-GAAP Adjusted EBITDA8 $725 $797 $807 $798 CB&I NON-GAAP RECONCILIATION FOR HISTORICAL RESULTS 2013 – 201610 1Represents historically reported financial information. 2Represents the removal of the Capital Services Operations to align with its classification as a discontinued operation during the first quarter 2017 and its subsequent sale in the second quarter 2017. 3Represents the removal of the Nuclear Operations due to its sale in the fourth quarter 2015. 4Represents charges recorded as a result of the sale of CB&I’s former Nuclear Operations. A loss on the sale of the operations and impairment of the related goodwill was recorded in the fourth quarter 2015 and an additional charge was recorded in the fourth quarter 2016 related to the establishment of a reserve for the Transaction Receivable associated with the sale. 5Represents the impact of changes in estimates on two U.S. gas turbine power projects. 6Represents costs primarily associated with facility realignment, severance and professional services resulting from publicly announced cost reduction and strategic initiatives. 7The adjustments to GAAP Net Income have been income tax effected when included in net income. Tax effects of Non-GAAP adjustments represent the estimated tax impacts of the adjustments during the period. 8EBITDA is defined as net income plus depreciation and amortization, interest expense, net and provision for income taxes. Adjusted EBITDA is defined as EBITDA less the adjustments detailed in footnotes 4, 5, and 6. We have included EBITDA and Adjusted EBITDA disclosures in this presentation because EBITDA is widely used by investors for valuation and comparing financial performance with the performance of other companies in the industry and because Adjusted EBITDA provides a consistent measure of EBITDA relating to the underlying business. McDermott management also uses EBITDA and Adjusted EBITDA to monitor and compare the financial performance of the operations. EBITDA and Adjusted EBITDA do not give effect to the cash that must be used to service debt or pay income taxes, and, thus, do not reflect the funds actually available for capital expenditures, dividends or various other purposes. In addition, the presentation of EBITDA and Adjusted EBITDA may not be comparable to similarly titled measures in other companies’ reports. You should not consider EBITDA or Adjusted EBITDA in isolation from, or as a substitute for, net income or cash flow measures prepared in accordance with U.S. GAAP. 9Represents the reclassification and adjustments associated with the presentation of discontinued operations of CB&I. Includes the removal of the Nuclear Operations, previously reported as part of the E&C operating group, due to its sale in the fourth quarter 2015; the removal of the Capital Services Operations to align with its classification as a discontinued operation during the first quarter 2017 and subsequent sale in the second quarter 2017; and any elimination adjustments due to the reclassification of the aforementioned. 10Sum of components may not foot due to rounding.

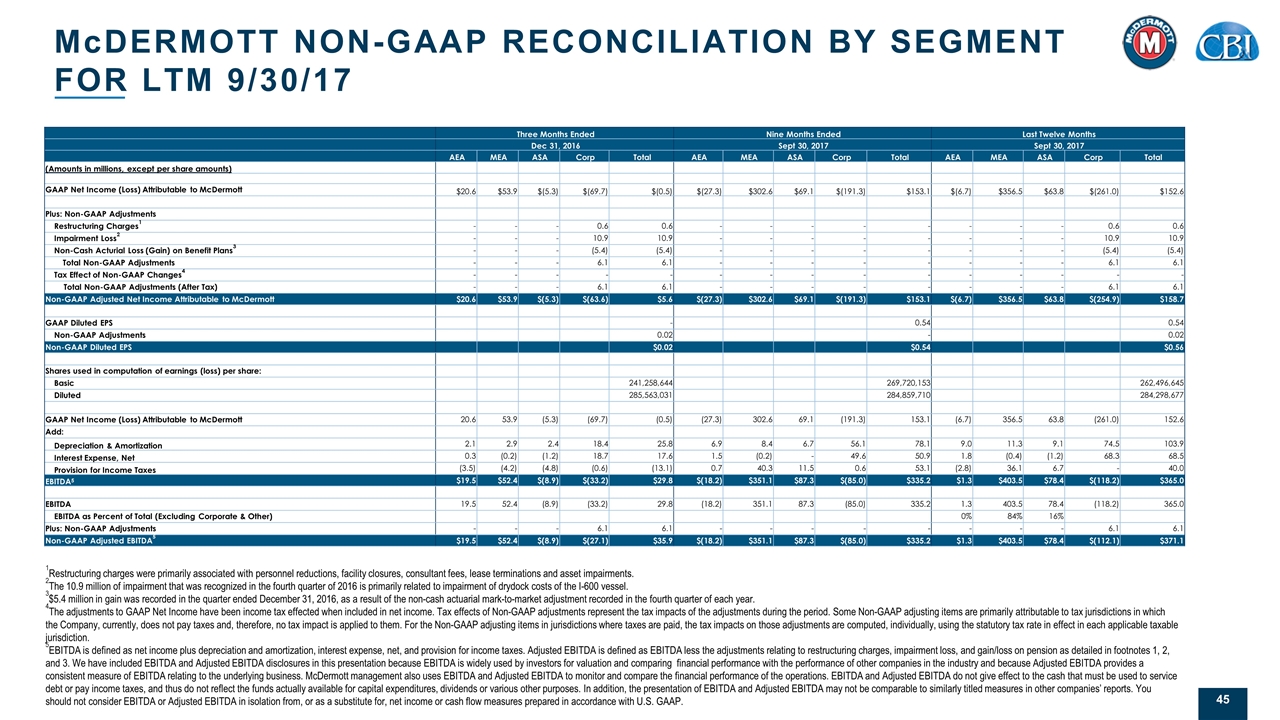

McDERMOTT NON-GAAP RECONCILIATION BY SEGMENT FOR LTM 9/30/17 Three Months Ended Nine Months Ended Last Twelve Months Dec 31, 2016 Sept 30, 2017 Sept 30, 2017 AEA MEA ASA Corp Total AEA MEA ASA Corp Total AEA MEA ASA Corp Total (Amounts in millions, except per share amounts) GAAP Net Income (Loss) Attributable to McDermott $20.6 $53.9 $(5.3) $(69.7) $(0.5) $(27.3) $302.6 $69.1 $(191.3) $153.1 $(6.7) $356.5 $63.8 $(261.0) $152.6 Plus: Non-GAAP Adjustments Restructuring Charges1 - - - 0.6 0.6 - - - - - - - - 0.6 0.6 Impairment Loss2 - - - 10.9 10.9 - - - - - - - - 10.9 10.9 Non-Cash Acturial Loss (Gain) on Benefit Plans3 - - - (5.4) (5.4) - - - - - - - - (5.4) (5.4) Total Non-GAAP Adjustments - - - 6.1 6.1 - - - - - - - - 6.1 6.1 Tax Effect of Non-GAAP Changes4 - - - - - - - - - - - - - - - Total Non-GAAP Adjustments (After Tax) - - - 6.1 6.1 - - - - - - - - 6.1 6.1 Non-GAAP Adjusted Net Income Attributable to McDermott $20.6 $53.9 $(5.3) $(63.6) $5.6 $(27.3) $302.6 $69.1 $(191.3) $153.1 $(6.7) $356.5 $63.8 $(254.9) $158.7 GAAP Diluted EPS - 0.54 0.54 Non-GAAP Adjustments 0.02 - 0.02 Non-GAAP Diluted EPS $0.02 $0.54 $0.56 Shares used in computation of earnings (loss) per share: Basic 241,258,644 269,720,153 262,496,645 Diluted 285,563,031 284,859,710 284,298,677 GAAP Net Income (Loss) Attributable to McDermott 20.6 53.9 (5.3) (69.7) (0.5) (27.3) 302.6 69.1 (191.3) 153.1 (6.7) 356.5 63.8 (261.0) 152.6 Add: Depreciation & Amortization 2.1 2.9 2.4 18.4 25.8 6.9 8.4 6.7 56.1 78.1 9.0 11.3 9.1 74.5 103.9 Interest Expense, Net 0.3 (0.2) (1.2) 18.7 17.6 1.5 (0.2) - 49.6 50.9 1.8 (0.4) (1.2) 68.3 68.5 Provision for Income Taxes (3.5) (4.2) (4.8) (0.6) (13.1) 0.7 40.3 11.5 0.6 53.1 (2.8) 36.1 6.7 - 40.0 EBITDA5 $19.5 $52.4 $(8.9) $(33.2) $29.8 $(18.2) $351.1 $87.3 $(85.0) $335.2 $1.3 $403.5 $78.4 $(118.2) $365.0 EBITDA 19.5 52.4 (8.9) (33.2) 29.8 (18.2) 351.1 87.3 (85.0) 335.2 1.3 403.5 78.4 (118.2) 365.0 EBITDA as Percent of Total (Excluding Corporate & Other) 0% 84% 16% Plus: Non-GAAP Adjustments - - - 6.1 6.1 - - - - - - - - 6.1 6.1 Non-GAAP Adjusted EBITDA5 $19.5 $52.4 $(8.9) $(27.1) $35.9 $(18.2) $351.1 $87.3 $(85.0) $335.2 $1.3 $403.5 $78.4 $(112.1) $371.1 1Restructuring charges were primarily associated with personnel reductions, facility closures, consultant fees, lease terminations and asset impairments. 2The 10.9 million of impairment that was recognized in the fourth quarter of 2016 is primarily related to impairment of drydock costs of the I-600 vessel. 3$5.4 million in gain was recorded in the quarter ended December 31, 2016, as a result of the non-cash actuarial mark-to-market adjustment recorded in the fourth quarter of each year. 4The adjustments to GAAP Net Income have been income tax effected when included in net income. Tax effects of Non-GAAP adjustments represent the tax impacts of the adjustments during the period. Some Non-GAAP adjusting items are primarily attributable to tax jurisdictions in which the Company, currently, does not pay taxes and, therefore, no tax impact is applied to them. For the Non-GAAP adjusting items in jurisdictions where taxes are paid, the tax impacts on those adjustments are computed, individually, using the statutory tax rate in effect in each applicable taxable jurisdiction. 5EBITDA is defined as net income plus depreciation and amortization, interest expense, net, and provision for income taxes. Adjusted EBITDA is defined as EBITDA less the adjustments relating to restructuring charges, impairment loss, and gain/loss on pension as detailed in footnotes 1, 2, and 3. We have included EBITDA and Adjusted EBITDA disclosures in this presentation because EBITDA is widely used by investors for valuation and comparing financial performance with the performance of other companies in the industry and because Adjusted EBITDA provides a consistent measure of EBITDA relating to the underlying business. McDermott management also uses EBITDA and Adjusted EBITDA to monitor and compare the financial performance of the operations. EBITDA and Adjusted EBITDA do not give effect to the cash that must be used to service debt or pay income taxes, and thus do not reflect the funds actually available for capital expenditures, dividends or various other purposes. In addition, the presentation of EBITDA and Adjusted EBITDA may not be comparable to similarly titled measures in other companies’ reports. You should not consider EBITDA or Adjusted EBITDA in isolation from, or as a substitute for, net income or cash flow measures prepared in accordance with U.S. GAAP.

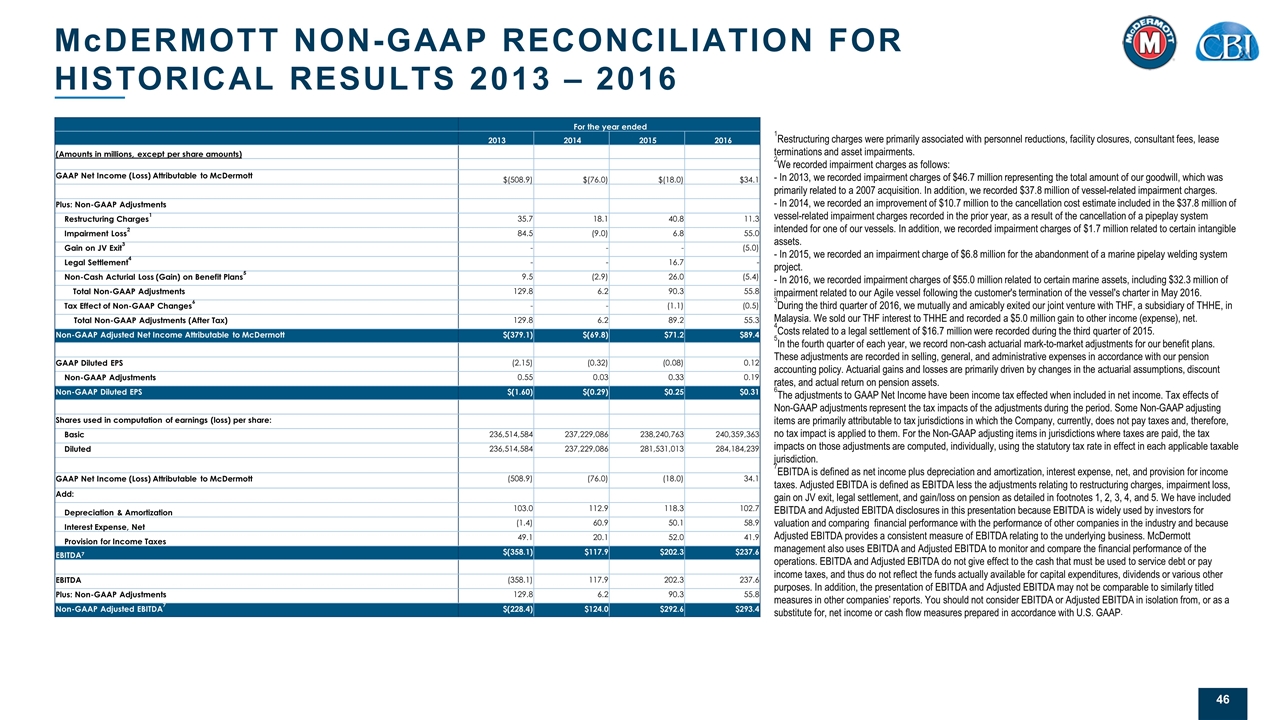

McDERMOTT NON-GAAP RECONCILIATION FOR HISTORICAL RESULTS 2013 – 2016 For the year ended 2013 2014 2015 2016 (Amounts in millions, except per share amounts) GAAP Net Income (Loss) Attributable to McDermott $(508.9) $(76.0) $(18.0) $34.1 Plus: Non-GAAP Adjustments Restructuring Charges1 35.7 18.1 40.8 11.3 Impairment Loss2 84.5 (9.0) 6.8 55.0 Gain on JV Exit3 - - - (5.0) Legal Settlement4 - - 16.7 - Non-Cash Acturial Loss (Gain) on Benefit Plans5 9.5 (2.9) 26.0 (5.4) Total Non-GAAP Adjustments 129.8 6.2 90.3 55.8 Tax Effect of Non-GAAP Changes6 - - (1.1) (0.5) Total Non-GAAP Adjustments (After Tax) 129.8 6.2 89.2 55.3 Non-GAAP Adjusted Net Income Attributable to McDermott $(379.1) $(69.8) $71.2 $89.4 GAAP Diluted EPS (2.15) (0.32) (0.08) 0.12 Non-GAAP Adjustments 0.55 0.03 0.33 0.19 Non-GAAP Diluted EPS $(1.60) $(0.29) $0.25 $0.31 Shares used in computation of earnings (loss) per share: Basic 236,514,584 237,229,086 238,240,763 240,359,363 Diluted 236,514,584 237,229,086 281,531,013 284,184,239 GAAP Net Income (Loss) Attributable to McDermott (508.9) (76.0) (18.0) 34.1 Add: Depreciation & Amortization 103.0 112.9 118.3 102.7 Interest Expense, Net (1.4) 60.9 50.1 58.9 Provision for Income Taxes 49.1 20.1 52.0 41.9 EBITDA7 $(358.1) $117.9 $202.3 $237.6 EBITDA (358.1) 117.9 202.3 237.6 Plus: Non-GAAP Adjustments 129.8 6.2 90.3 55.8 Non-GAAP Adjusted EBITDA7 $(228.4) $124.0 $292.6 $293.4 1Restructuring charges were primarily associated with personnel reductions, facility closures, consultant fees, lease terminations and asset impairments. 2We recorded impairment charges as follows: - In 2013, we recorded impairment charges of $46.7 million representing the total amount of our goodwill, which was primarily related to a 2007 acquisition. In addition, we recorded $37.8 million of vessel-related impairment charges. - In 2014, we recorded an improvement of $10.7 million to the cancellation cost estimate included in the $37.8 million of vessel-related impairment charges recorded in the prior year, as a result of the cancellation of a pipeplay system intended for one of our vessels. In addition, we recorded impairment charges of $1.7 million related to certain intangible assets. - In 2015, we recorded an impairment charge of $6.8 million for the abandonment of a marine pipelay welding system project. - In 2016, we recorded impairment charges of $55.0 million related to certain marine assets, including $32.3 million of impairment related to our Agile vessel following the customer's termination of the vessel's charter in May 2016. 3During the third quarter of 2016, we mutually and amicably exited our joint venture with THF, a subsidiary of THHE, in Malaysia. We sold our THF interest to THHE and recorded a $5.0 million gain to other income (expense), net. 4Costs related to a legal settlement of $16.7 million were recorded during the third quarter of 2015. 5In the fourth quarter of each year, we record non-cash actuarial mark-to-market adjustments for our benefit plans. These adjustments are recorded in selling, general, and administrative expenses in accordance with our pension accounting policy. Actuarial gains and losses are primarily driven by changes in the actuarial assumptions, discount rates, and actual return on pension assets. 6The adjustments to GAAP Net Income have been income tax effected when included in net income. Tax effects of Non-GAAP adjustments represent the tax impacts of the adjustments during the period. Some Non-GAAP adjusting items are primarily attributable to tax jurisdictions in which the Company, currently, does not pay taxes and, therefore, no tax impact is applied to them. For the Non-GAAP adjusting items in jurisdictions where taxes are paid, the tax impacts on those adjustments are computed, individually, using the statutory tax rate in effect in each applicable taxable jurisdiction. 7EBITDA is defined as net income plus depreciation and amortization, interest expense, net, and provision for income taxes. Adjusted EBITDA is defined as EBITDA less the adjustments relating to restructuring charges, impairment loss, gain on JV exit, legal settlement, and gain/loss on pension as detailed in footnotes 1, 2, 3, 4, and 5. We have included EBITDA and Adjusted EBITDA disclosures in this presentation because EBITDA is widely used by investors for valuation and comparing financial performance with the performance of other companies in the industry and because Adjusted EBITDA provides a consistent measure of EBITDA relating to the underlying business. McDermott management also uses EBITDA and Adjusted EBITDA to monitor and compare the financial performance of the operations. EBITDA and Adjusted EBITDA do not give effect to the cash that must be used to service debt or pay income taxes, and thus do not reflect the funds actually available for capital expenditures, dividends or various other purposes. In addition, the presentation of EBITDA and Adjusted EBITDA may not be comparable to similarly titled measures in other companies’ reports. You should not consider EBITDA or Adjusted EBITDA in isolation from, or as a substitute for, net income or cash flow measures prepared in accordance with U.S. GAAP.

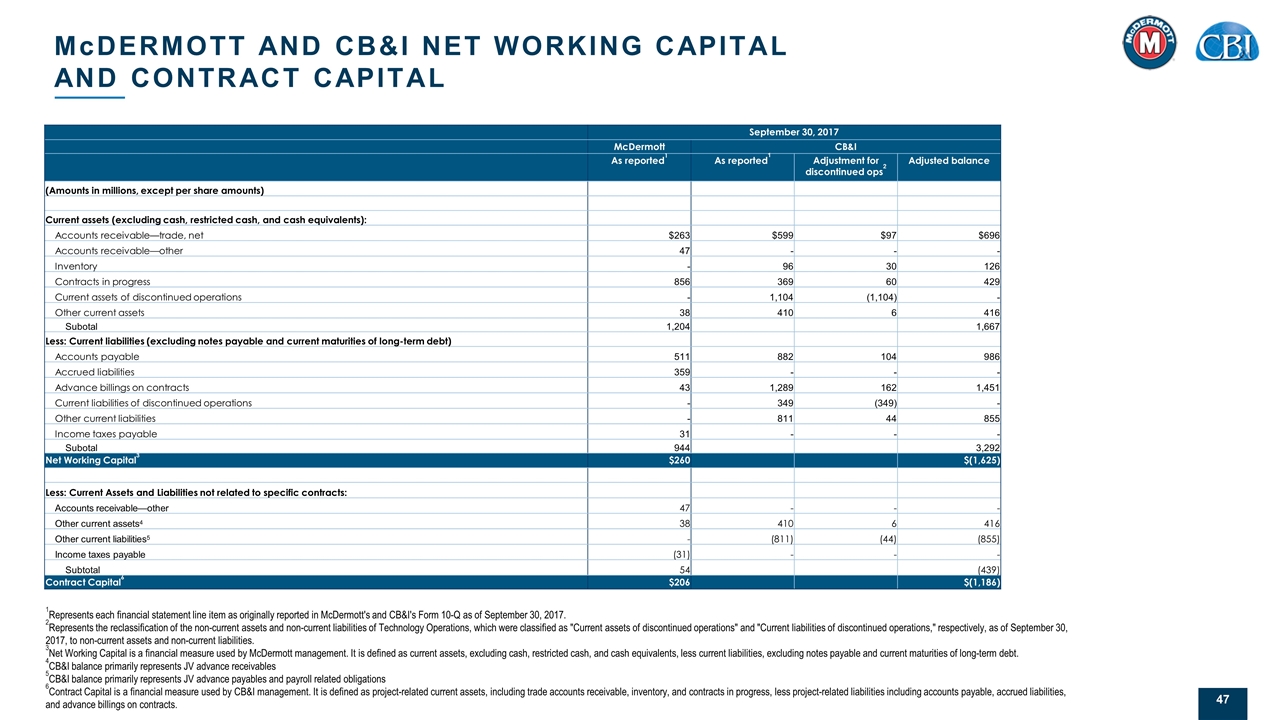

McDERMOTT AND CB&I NET WORKING CAPITAL AND CONTRACT CAPITAL September 30, 2017 McDermott CB&I As reported1 As reported1 Adjustment for discontinued ops2 Adjusted balance (Amounts in millions, except per share amounts) Current assets (excluding cash, restricted cash, and cash equivalents): Accounts receivable—trade, net $263 $599 $97 $696 Accounts receivable—other 47 - - - Inventory - 96 30 126 Contracts in progress 856 369 60 429 Current assets of discontinued operations - 1,104 (1,104) - Other current assets 38 410 6 416 Subotal 1,204 1,667 Less: Current liabilities (excluding notes payable and current maturities of long-term debt) Accounts payable 511 882 104 986 Accrued liabilities 359 - - - Advance billings on contracts 43 1,289 162 1,451 Current liabilities of discontinued operations - 349 (349) - Other current liabilities - 811 44 855 Income taxes payable 31 - - - Subotal 944 3,292 Net Working Capital3 $260 $(1,625) Less: Current Assets and Liabilities not related to specific contracts: Accounts receivable—other 47 - - - Other current assets4 38 410 6 416 Other current liabilities5 - (811) (44) (855) Income taxes payable (31) - - - Subtotal 54 (439) Contract Capital6 $206 $(1,186) 1Represents each financial statement line item as originally reported in McDermott's and CB&I's Form 10-Q as of September 30, 2017. 2Represents the reclassification of the non-current assets and non-current liabilities of Technology Operations, which were classified as "Current assets of discontinued operations" and "Current liabilities of discontinued operations," respectively, as of September 30, 2017, to non-current assets and non-current liabilities. 3Net Working Capital is a financial measure used by McDermott management. It is defined as current assets, excluding cash, restricted cash, and cash equivalents, less current liabilities, excluding notes payable and current maturities of long-term debt. 4CB&I balance primarily represents JV advance receivables 5CB&I balance primarily represents JV advance payables and payroll related obligations 6Contract Capital is a financial measure used by CB&I management. It is defined as project-related current assets, including trade accounts receivable, inventory, and contracts in progress, less project-related liabilities including accounts payable, accrued liabilities, and advance billings on contracts.

McDERMOTT LEVERAGE RATIOS RECONCILIATION 1Gross Debt represents outstanding debt before netting against debt issuance costs. 2Net Debt is defined as Gross Debt net of of Cash, Restricted Cash, and Cash Equivalents. 3Adjusted EBITDA is a non-GAAP measure defined as net income plus depreciation and amortization, interest expense, net, and provision for income taxes, less certain non-GAAP adjustments. A reconciliation of Adjusted EBITDA is provided on pages 46 and 47. 4Gross Leverage is defined as Gross Debt divided by Adjusted EBITDA and Net Leverage is defined as Net Debt divided by Adjusted EBITDA. 5Free Cash Flow is a non-GAAP measure defined as cash flows from operating activities less capital expenditures. 6Free Cash Flow Conversion is defined as Free Cash Flow divided by Adjusted EBITDA. For the year ended For the year ended For the last twelve months ended Dec 31, 2014 Dec 31, 2016 Sept 30, 2017 (Amounts in millions, except per share amounts) Gross Debt1 $891 $766 $546 Cash, Restricted Cash, and Cash Equivalents $853 $612 $435 Net Debt2 $38 $154 $111 Adjusted EBITDA3 $124 $293 $371 Gross Leverage4 7.2 2.6 1.5 Net Leverage4 0.3 0.5 0.3 Cash from Operations $178 $189 Capex $228 $128 Free Cash Flow5 $(50) $61 Free Cash Flow Conversion6 N/A -17% 16%