partech.com Q4 ‘24 Earnings Presentation February 28, 2025 NYSE: PAR 1

partech.com Forward-Looking Statements. This presentation contains forward-looking statements made pursuant to the safe harbor provisions of Section 21E of the Securities Exchange Act of 1934, as amended, Section 27A of the Securities Act of 1933, as amended, and the Private Securities Litigation Reform Act of 1995, the accuracy of such statements is necessarily subject to risks, uncertainties and assumptions as to future events that may not prove to be accurate. These statements include, but are not limited to, express or implied forward-looking statements relating to the plans, strategies and objectives of management relating to PAR's growth, results of operations, and financial performance, including service and product offerings, the development, demand, market share, and competitive performance of our products and services, continued growth of our business, our ability to achieve and sustain profitability, acceleration or improvement of financial results, annual recurring revenue (ARR) growth, active sites, future efficiencies and scale economics, customer retention, capital investment and re-investment, expanding our addressable markets, cross-selling efforts, and anticipated benefits of acquisitions, divestitures, and capital markets transactions. These statements are neither promises nor guarantees but are subject to a variety of risks and uncertainties, many of which are beyond our control, which could cause actual results to differ materially from those contemplated in these forward-looking statements. Factors, risks, trends and uncertainties that could cause actual results to differ materially from those expressed or implied by forward-looking statements include our ability to successfully develop or acquire and transition new products and services and enhance existing products and services to meet evolving customer needs and respond to emerging technological trends, including artificial intelligence (AI); our ability to successfully integrate acquisitions into our operations, and realize the anticipated benefits; macroeconomic trends, such as a recession or slowed economic growth, fluctuating interest rates, inflation, and changes in consumer confidence and discretionary spending; our ability to successfully expand our business or products into new markets or industries; geopolitical events, such the Russia-Ukraine war, tensions with China and between China and Taiwan, hostilities in the Middle East, including the Israel conflict(s), and uncertainty relating to new or increased tariffs or other trade restrictions implemented by the U.S. or retaliatory trade measures or tariffs implemented by other countries; and the other factors discussed in our most recent Annual Report on Form 10-K and our other filings with the Securities and Exchange Commission. Undue reliance should not be placed on the forward-looking statements in this presentation, which are based on information available to us on the date hereof. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise, except as may be required under applicable securities law. Industry and Market Data. Market, industry, and other data included in this presentation are from or based on our own internal good faith estimates and research, and on publicly available publications, research, surveys and studies conducted by third parties, which we believe are reliable, but have not independently verified. Similarly, while we believe our internal estimates and research are reliable, we have not independently verified our internal estimates or research. While we are not aware of any misstatements regarding any market, industry, or other data used by us or expressed in this presentation, such information, because it has not been verified or, by its nature - market surveys, estimates, projections or similar data, are inherently subject to uncertainties, and actual results may differ materially from the assumptions and circumstances reflected in this information. Key Performance Indicators and Non-GAAP Financial Measures.(1) We monitor certain key performance indicators and non-GAAP financial measures in the evaluation and management of our business; certain key performance indicators and non-GAAP financial measures are provided in this presentation as we believe they are useful in facilitating period-to-period comparisons of our business performance. Key performance indicators and non-GAAP financial measures do not reflect and should be viewed independently of our financial performance determined in accordance with GAAP. Key performance indicators and non-GAAP financial measures are not forecasts or indicators of future or expected results and should not have undue reliance placed upon them by investors. Where non-GAAP financial measures are included in this presentation, the most directly comparable GAAP financial measures and a detailed reconciliation between GAAP and non- GAAP financial measures is included in the Appendix to this presentation. Unless otherwise indicated, financial and operating data included in this presentation is as of December 31, 2024. Trademarks. “PAR®,” “PAR POS®” (formerly “Brink POS®”), “Punchh®,” “PAR OrderingTM” (formerly “MENUTM”), "PAR OPSTM," “Data Central®," “DelagetTM,” "PAR RetailTM", "PAR® Pay”, “PAR® Payment Services”, and other trademarks identifying our products and services appearing in this presentation belong to us. This presentation may also contain trade names and trademarks of other companies. Our use of such other companies’ trade names or trademarks is not intended to imply any endorsement or sponsorship by these companies of us or our products or services. (1) See Appendix for Non-GAAP reconciliations and Key Performance Indicators 2

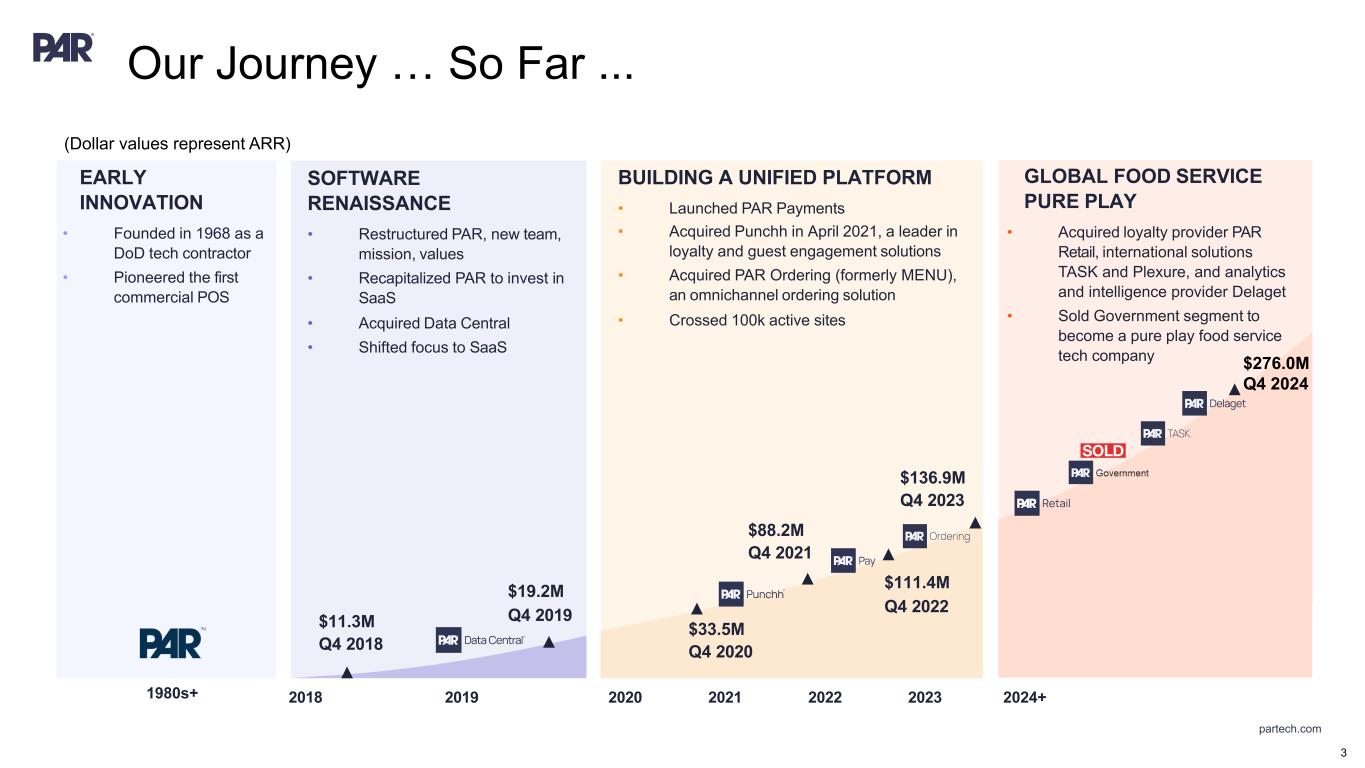

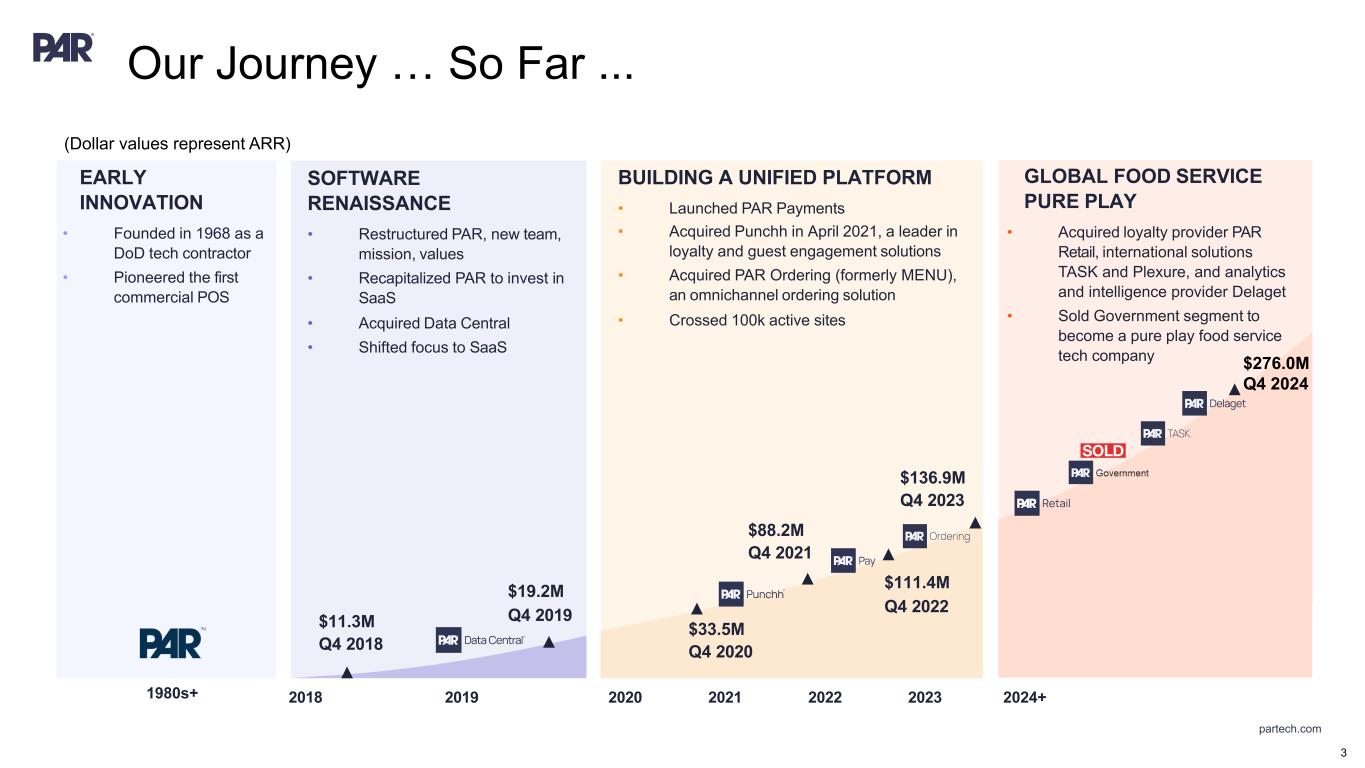

partech.com Our Journey … So Far ... 3 GLOBAL FOOD SERVICE PURE PLAY • Acquired loyalty provider PAR Retail, international solutions TASK and Plexure, and analytics and intelligence provider Delaget • Sold Government segment to become a pure play food service tech company 1980s+ EARLY INNOVATION • Founded in 1968 as a DoD tech contractor • Pioneered the first commercial POS 2018 2019 SOFTWARE RENAISSANCE • Restructured PAR, new team, mission, values • Recapitalized PAR to invest in SaaS • Acquired Data Central • Shifted focus to SaaS $11.3M Q4 2018 ▲ 2020 2021 2022 BUILDING A UNIFIED PLATFORM • Launched PAR Payments • Acquired Punchh in April 2021, a leader in loyalty and guest engagement solutions • Acquired PAR Ordering (formerly MENU), an omnichannel ordering solution • Crossed 100k active sites ▲ $33.5M Q4 2020 2023 2024+ $19.2M Q4 2019 ▲ $136.9M Q4 2023 ▲$88.2M Q4 2021 ▲ ▲ $111.4M Q4 2022 ▲ $276.0M Q4 2024 (Dollar values represent ARR)

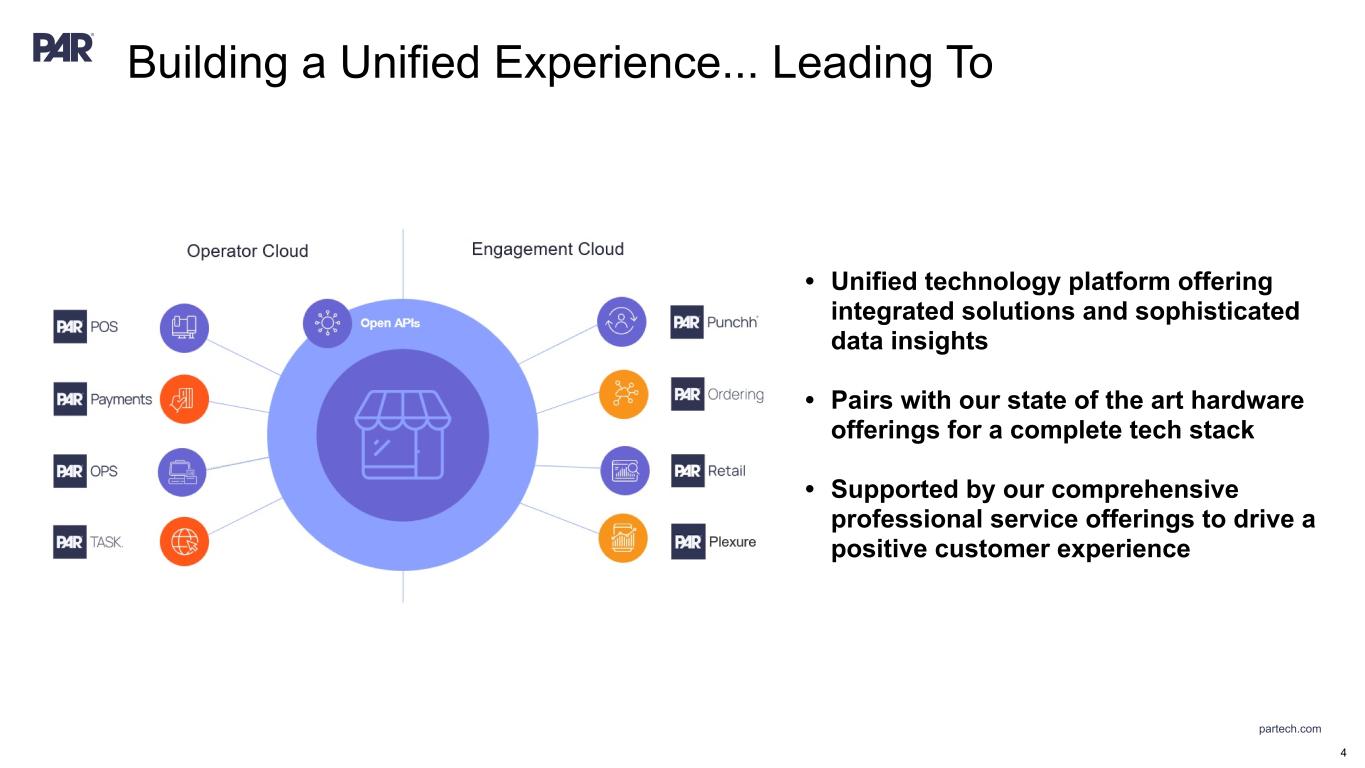

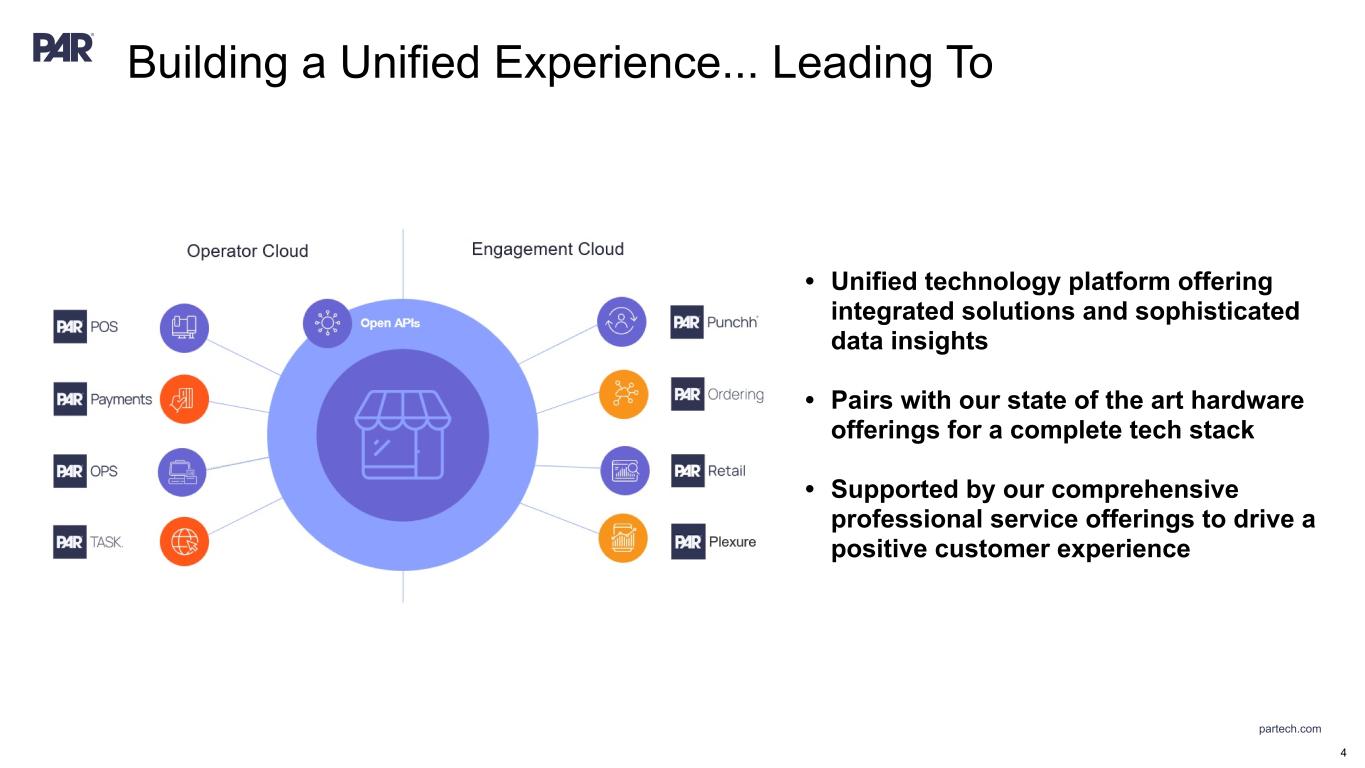

partech.com • Unified technology platform offering integrated solutions and sophisticated data insights • Pairs with our state of the art hardware offerings for a complete tech stack • Supported by our comprehensive professional service offerings to drive a positive customer experience Building a Unified Experience... Leading To 4

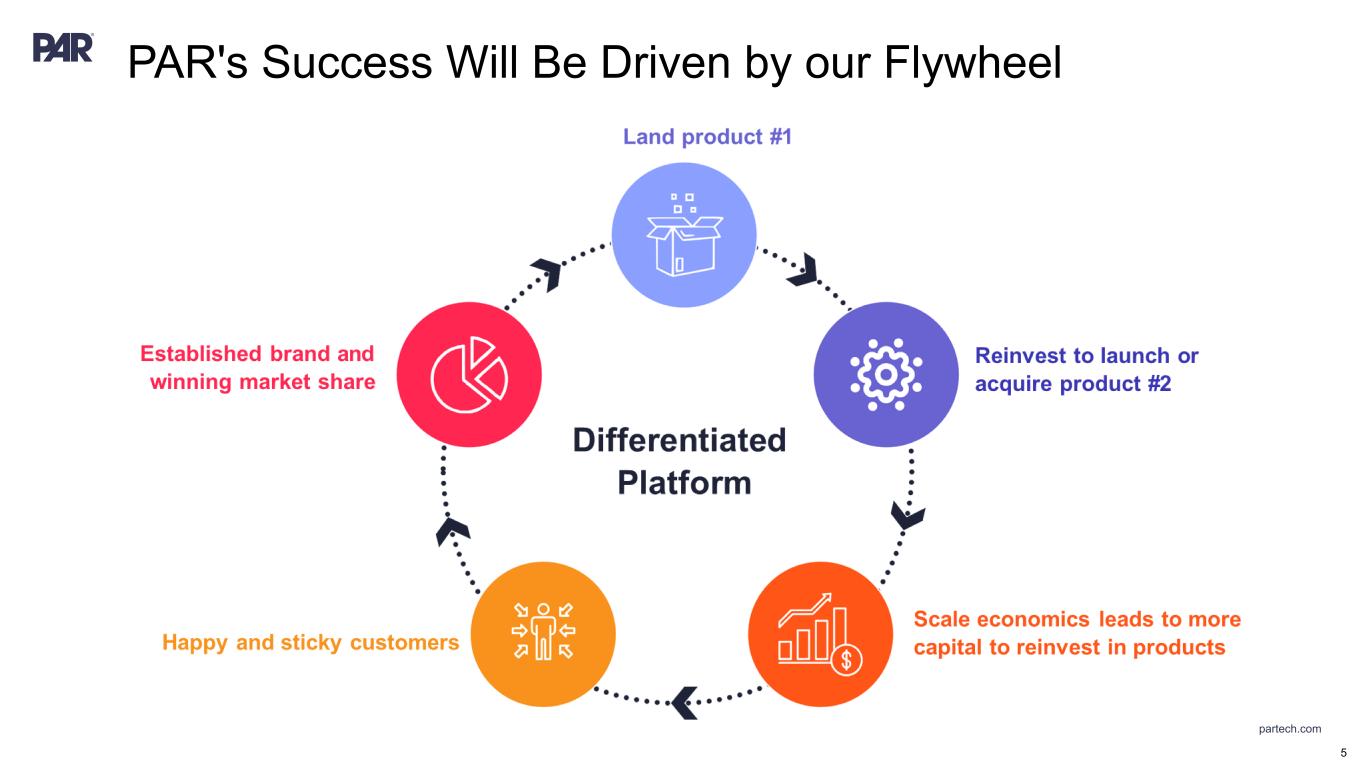

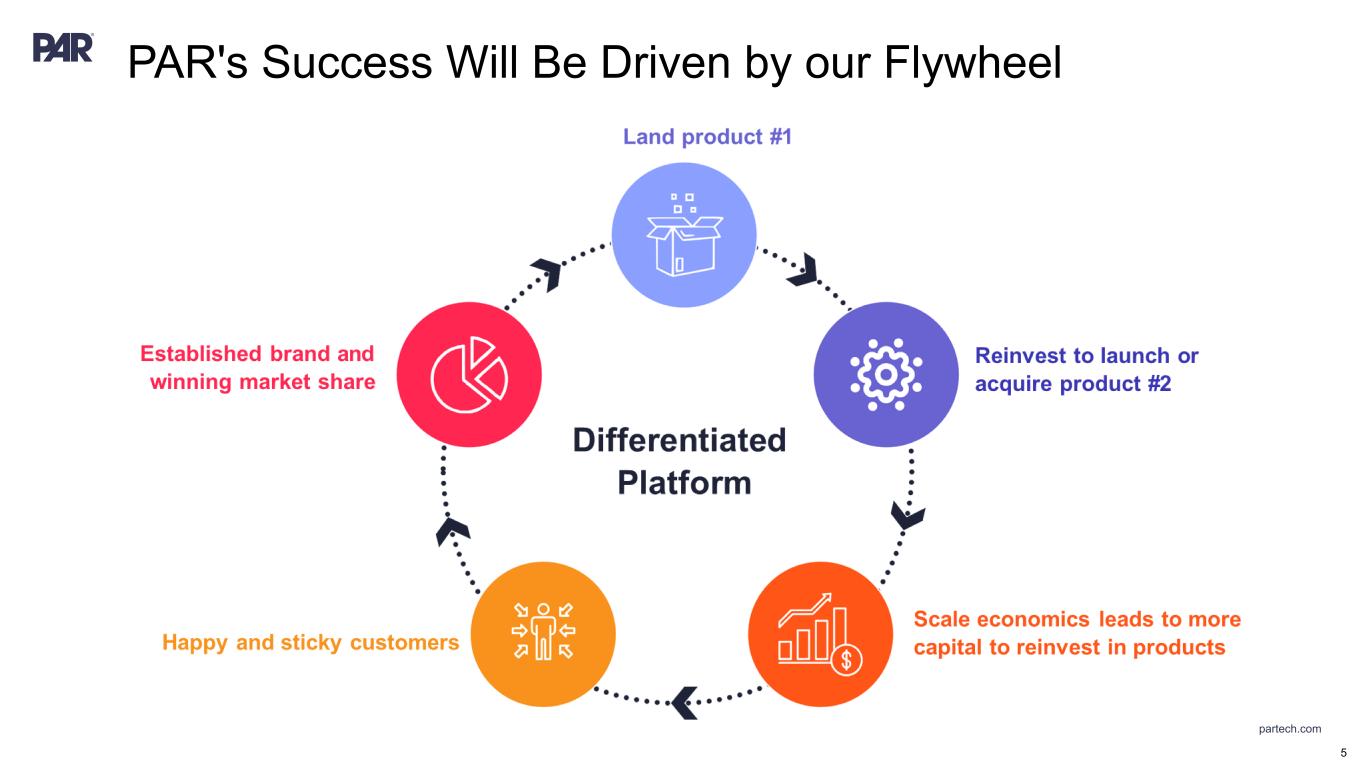

partech.com PAR's Success Will Be Driven by our Flywheel 5

partech.com Financial Review Fourth Quarter 2024 Highlights 6

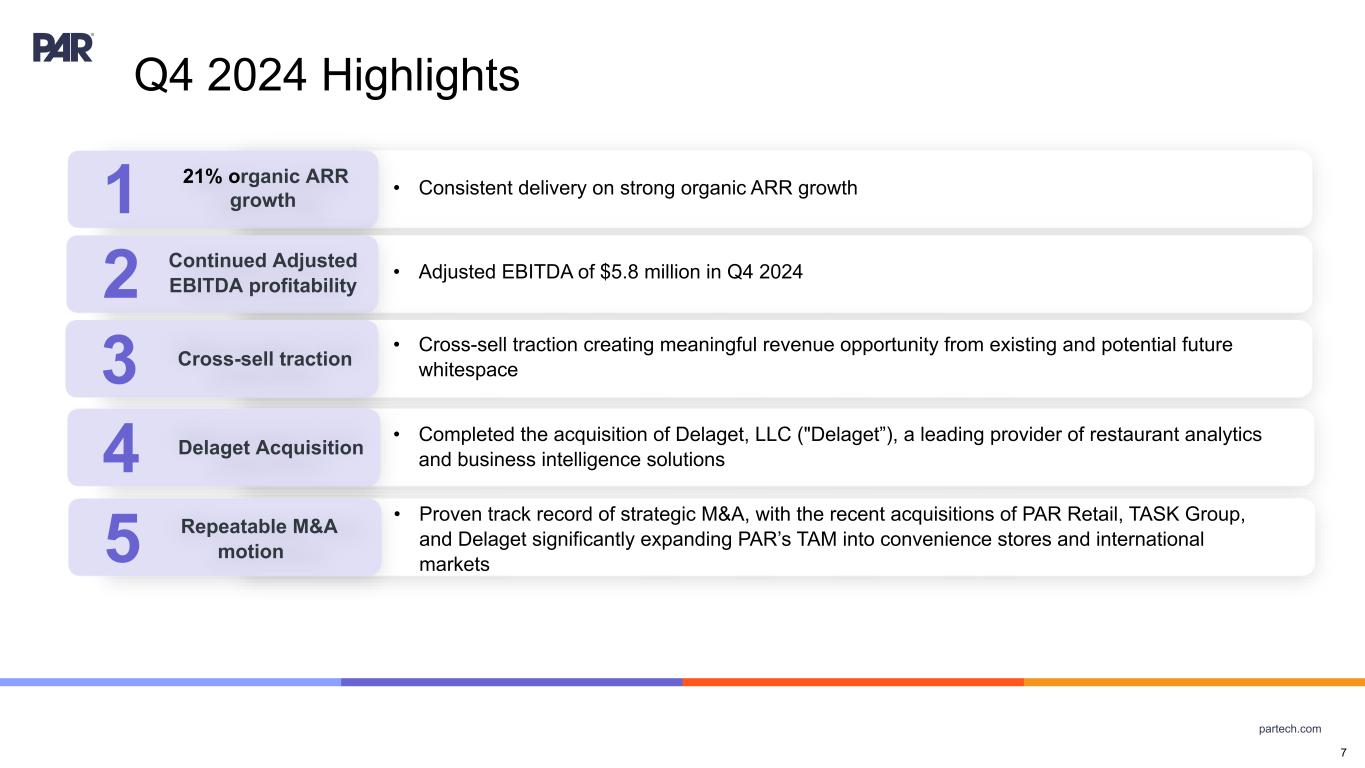

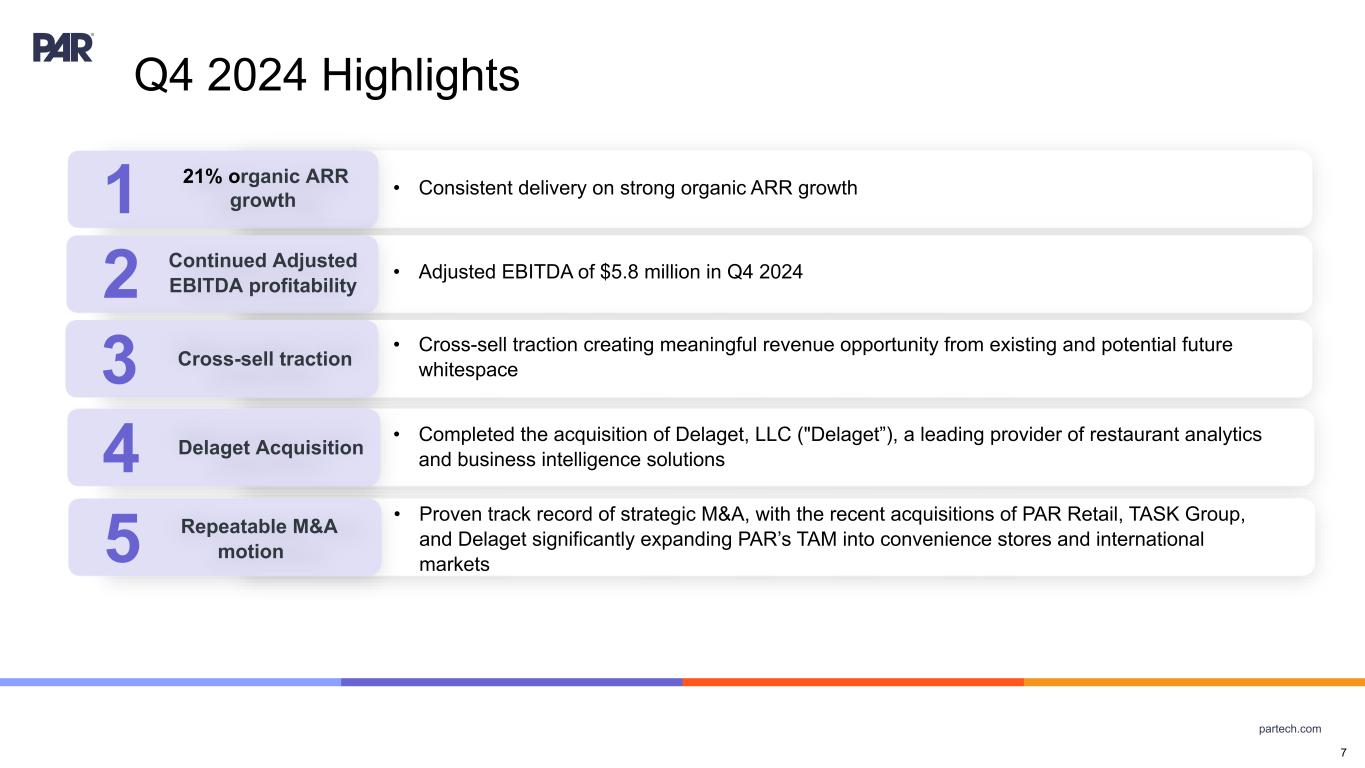

partech.com Q4 2024 Highlights 7 • Consistent delivery on strong organic ARR growth 21% organic ARR growth1 2 • Cross-sell traction creating meaningful revenue opportunity from existing and potential future whitespace Continued Adjusted EBITDA profitability 3 Cross-sell traction 4 Delaget Acquisition • Adjusted EBITDA of $5.8 million in Q4 2024 • Completed the acquisition of Delaget, LLC ("Delaget”), a leading provider of restaurant analytics and business intelligence solutions • Proven track record of strategic M&A, with the recent acquisitions of PAR Retail, TASK Group, and Delaget significantly expanding PAR’s TAM into convenience stores and international markets5 Repeatable M&A motion

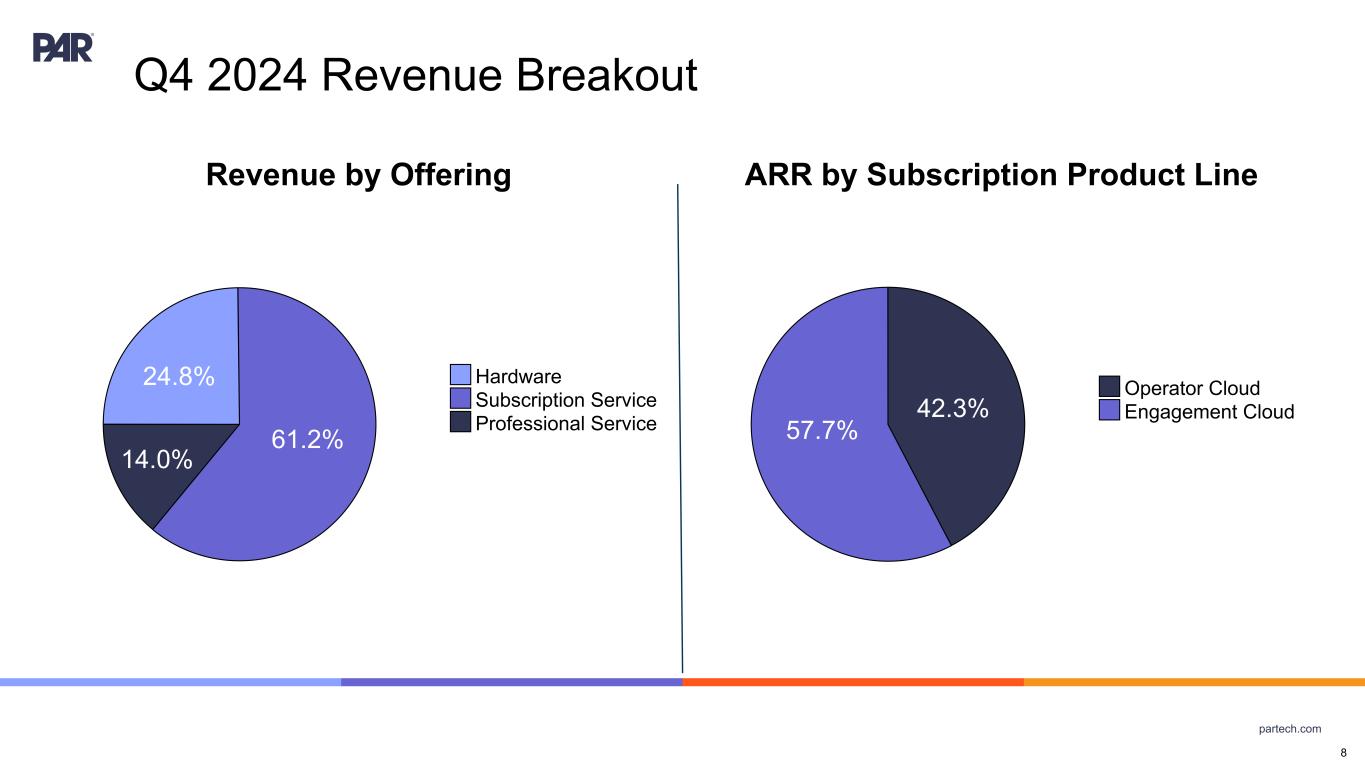

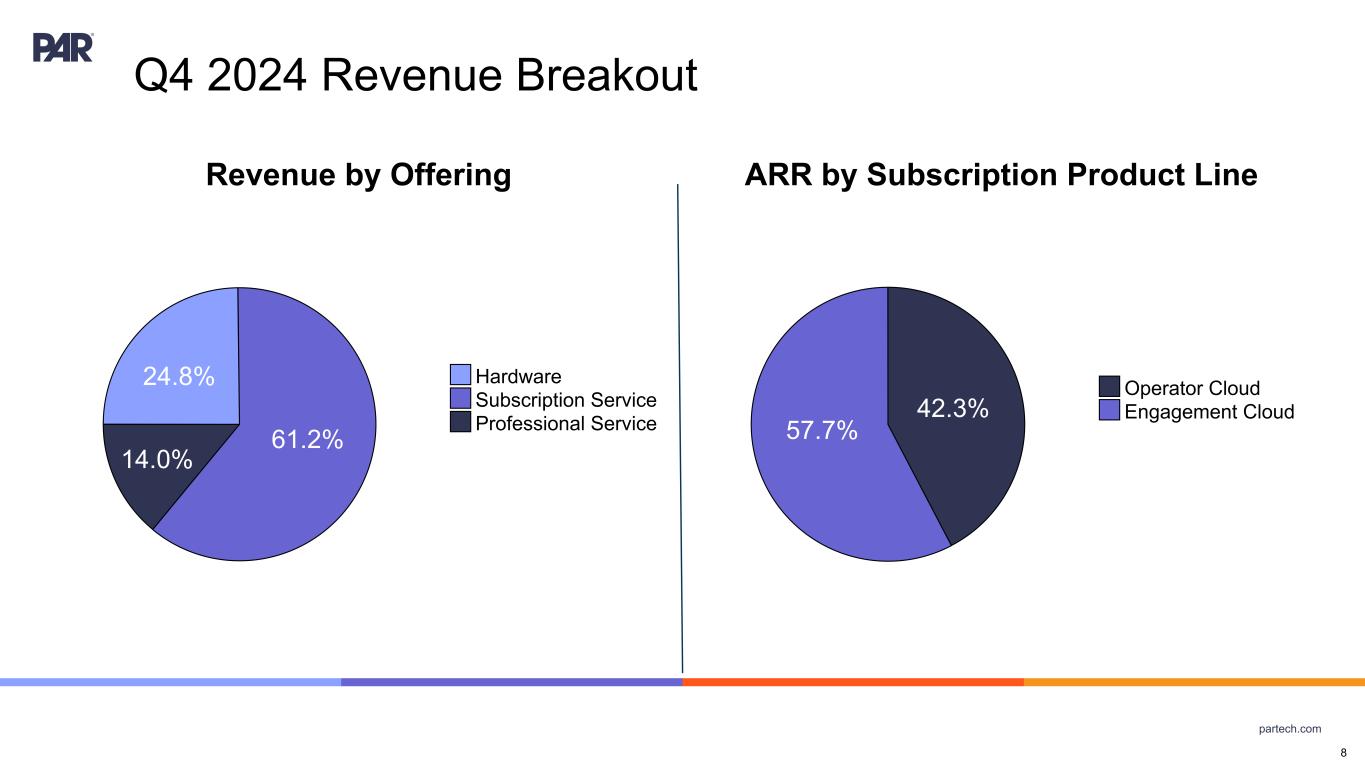

partech.com Q4 2024 Revenue Breakout Revenue by Offering 24.8% 61.2% 14.0% Hardware Subscription Service Professional Service ARR by Subscription Product Line 42.3% 57.7% Operator Cloud Engagement Cloud 8

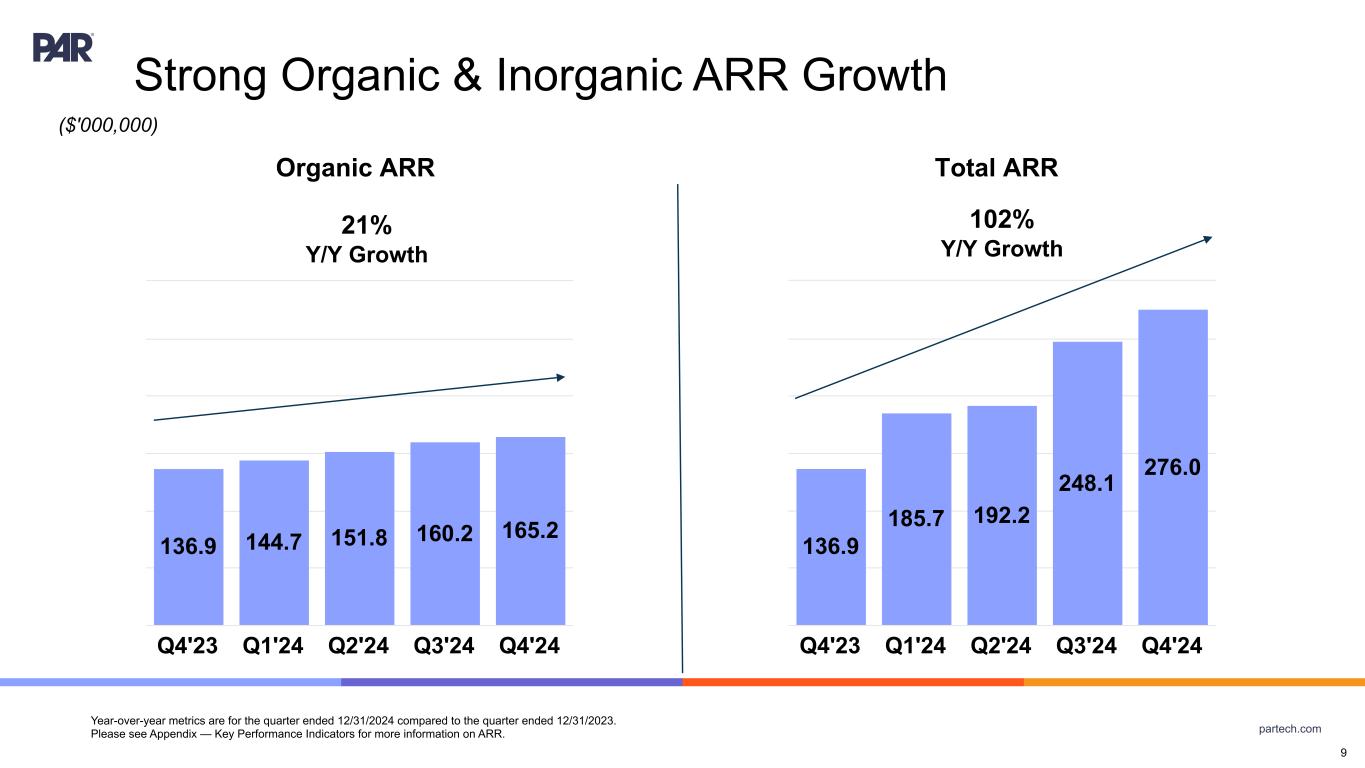

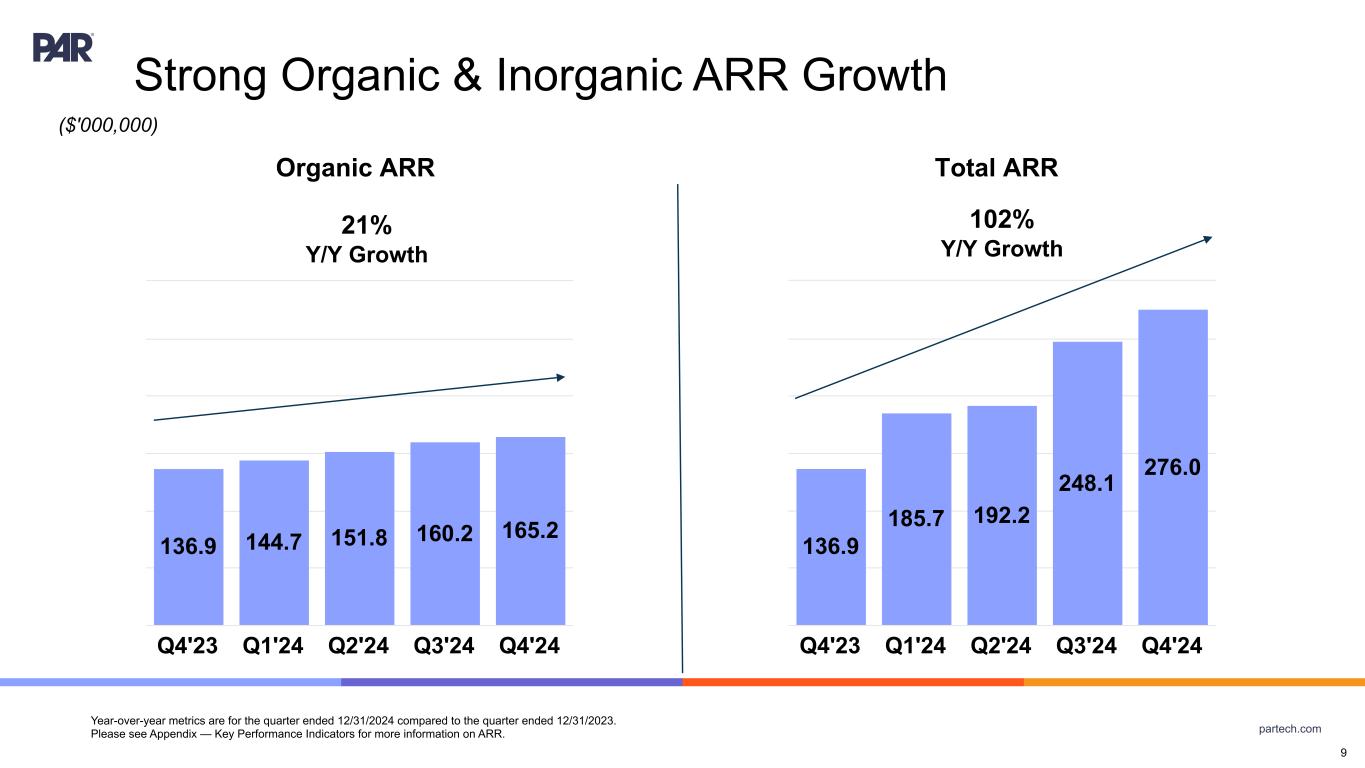

partech.com Strong Organic & Inorganic ARR Growth Year-over-year metrics are for the quarter ended 12/31/2024 compared to the quarter ended 12/31/2023. Please see Appendix — Key Performance Indicators for more information on ARR. 136.9 144.7 151.8 160.2 165.2 Q4'23 Q1'24 Q2'24 Q3'24 Q4'24 136.9 185.7 192.2 248.1 276.0 Q4'23 Q1'24 Q2'24 Q3'24 Q4'24 9 Organic ARR 21% Y/Y Growth Total ARR 102% Y/Y Growth ($'000,000)

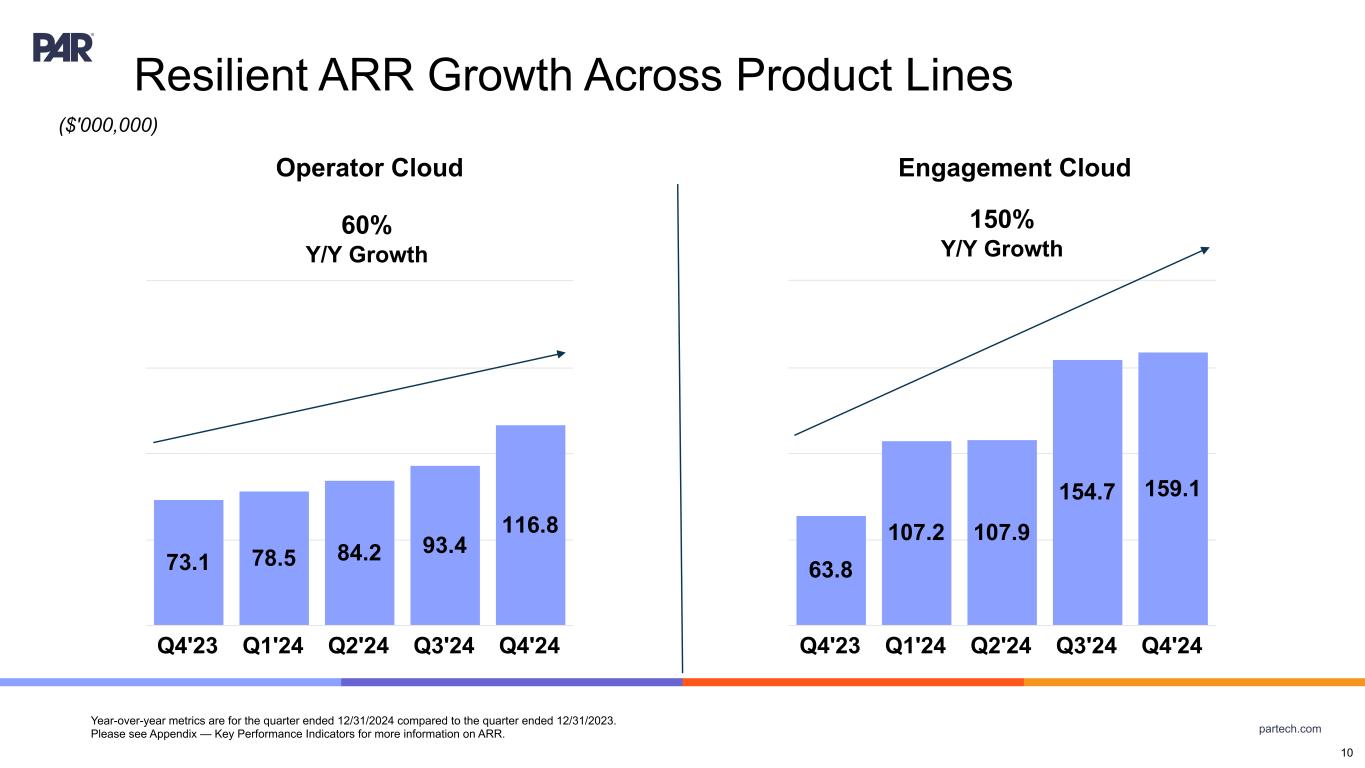

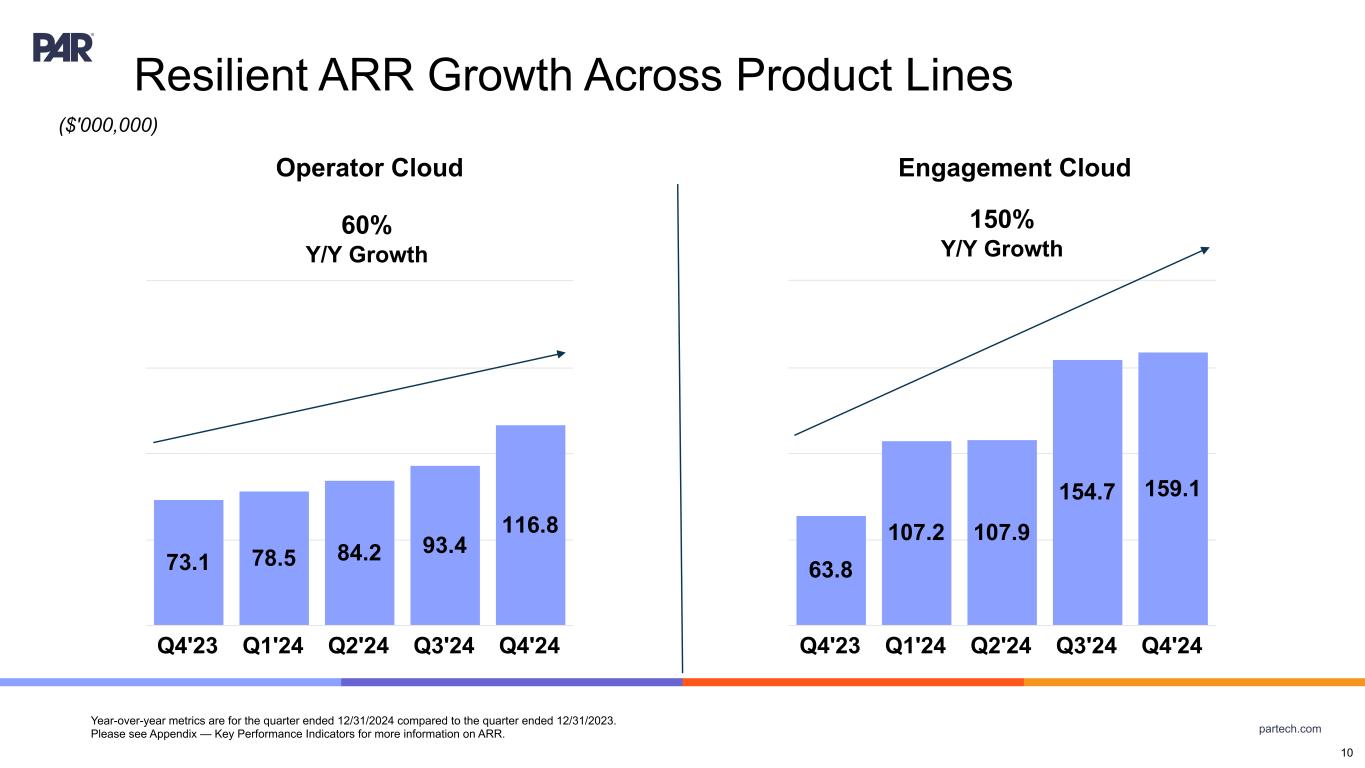

partech.com Resilient ARR Growth Across Product Lines Year-over-year metrics are for the quarter ended 12/31/2024 compared to the quarter ended 12/31/2023. Please see Appendix — Key Performance Indicators for more information on ARR. 73.1 78.5 84.2 93.4 116.8 Q4'23 Q1'24 Q2'24 Q3'24 Q4'24 63.8 107.2 107.9 154.7 159.1 Q4'23 Q1'24 Q2'24 Q3'24 Q4'24 10 Operator Cloud 60% Y/Y Growth Engagement Cloud 150% Y/Y Growth ($'000,000)

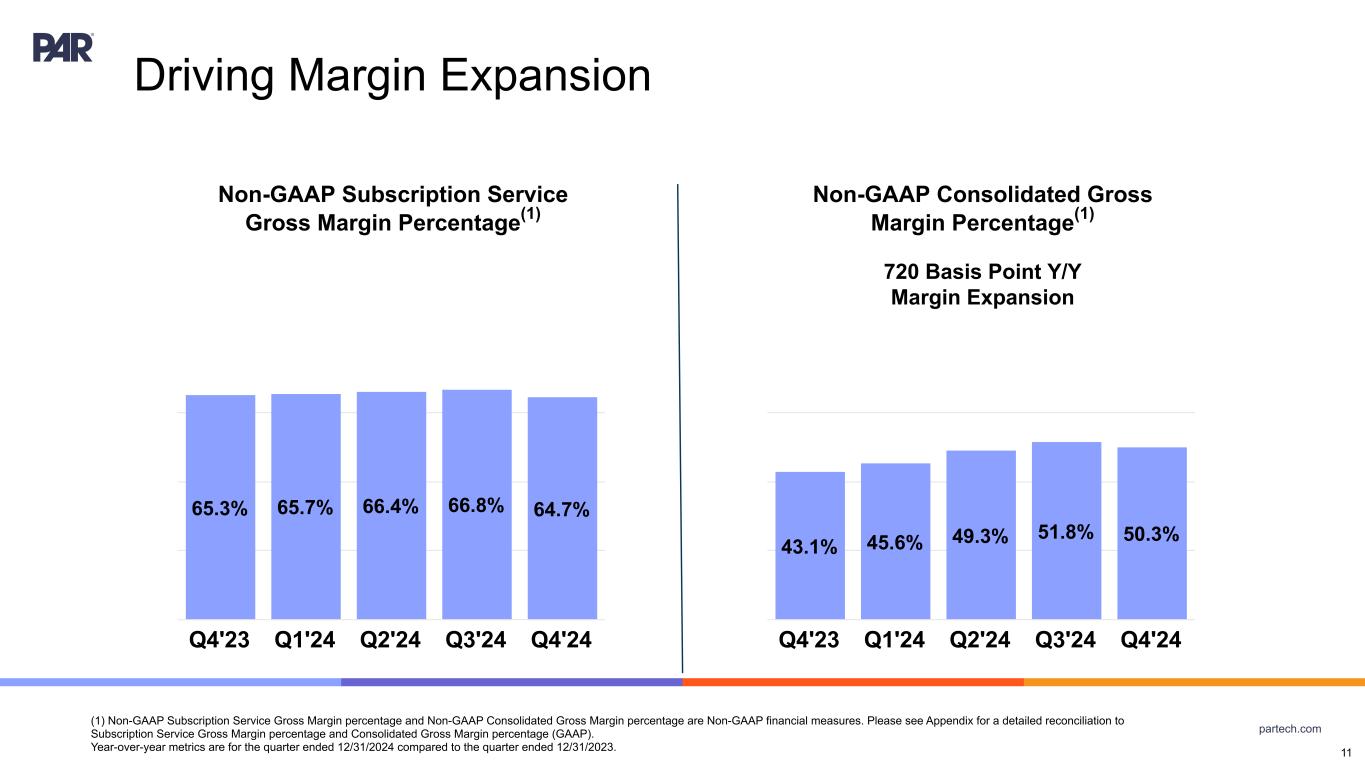

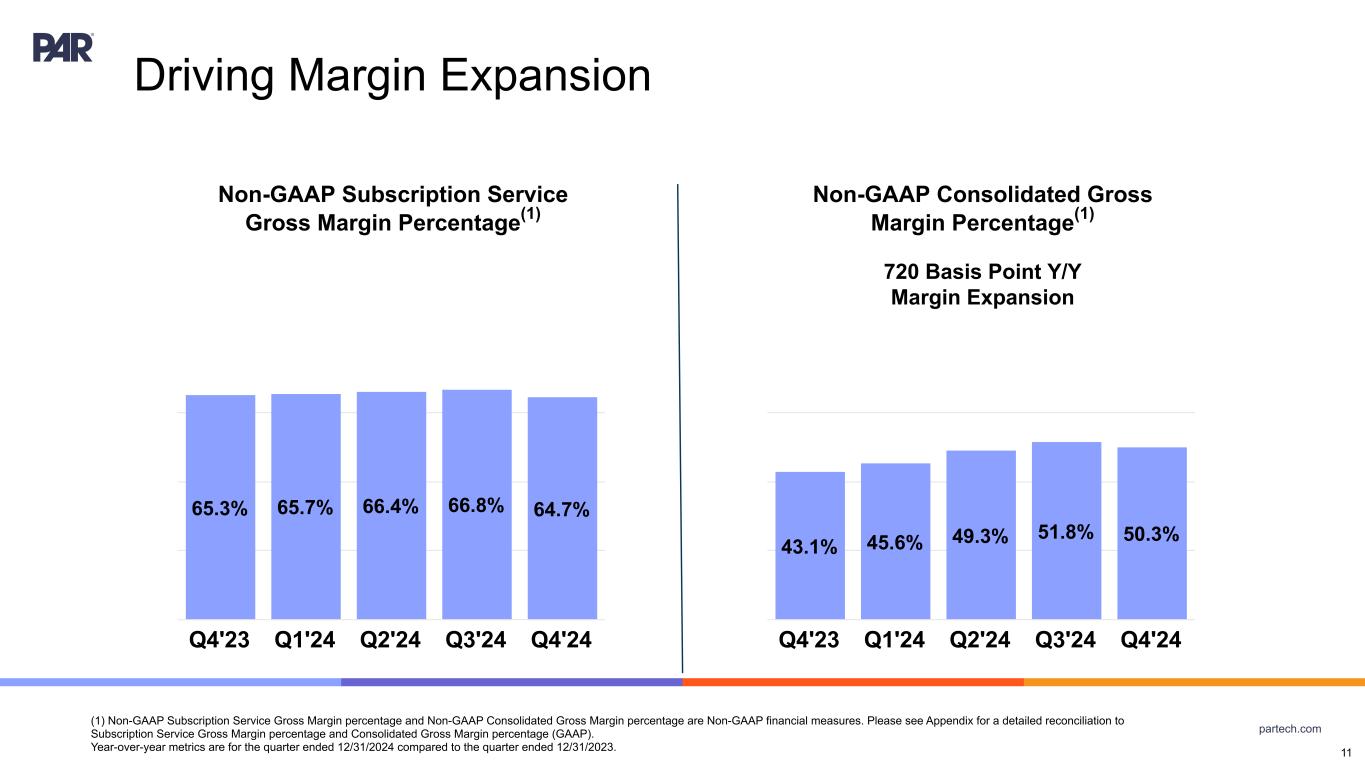

partech.com Driving Margin Expansion (1) Non-GAAP Subscription Service Gross Margin percentage and Non-GAAP Consolidated Gross Margin percentage are Non-GAAP financial measures. Please see Appendix for a detailed reconciliation to Subscription Service Gross Margin percentage and Consolidated Gross Margin percentage (GAAP). Year-over-year metrics are for the quarter ended 12/31/2024 compared to the quarter ended 12/31/2023. 65.3% 65.7% 66.4% 66.8% 64.7% Q4'23 Q1'24 Q2'24 Q3'24 Q4'24 11 Non-GAAP Subscription Service Gross Margin Percentage(1) 43.1% 45.6% 49.3% 51.8% 50.3% Q4'23 Q1'24 Q2'24 Q3'24 Q4'24 720 Basis Point Y/Y Margin Expansion Non-GAAP Consolidated Gross Margin Percentage(1)

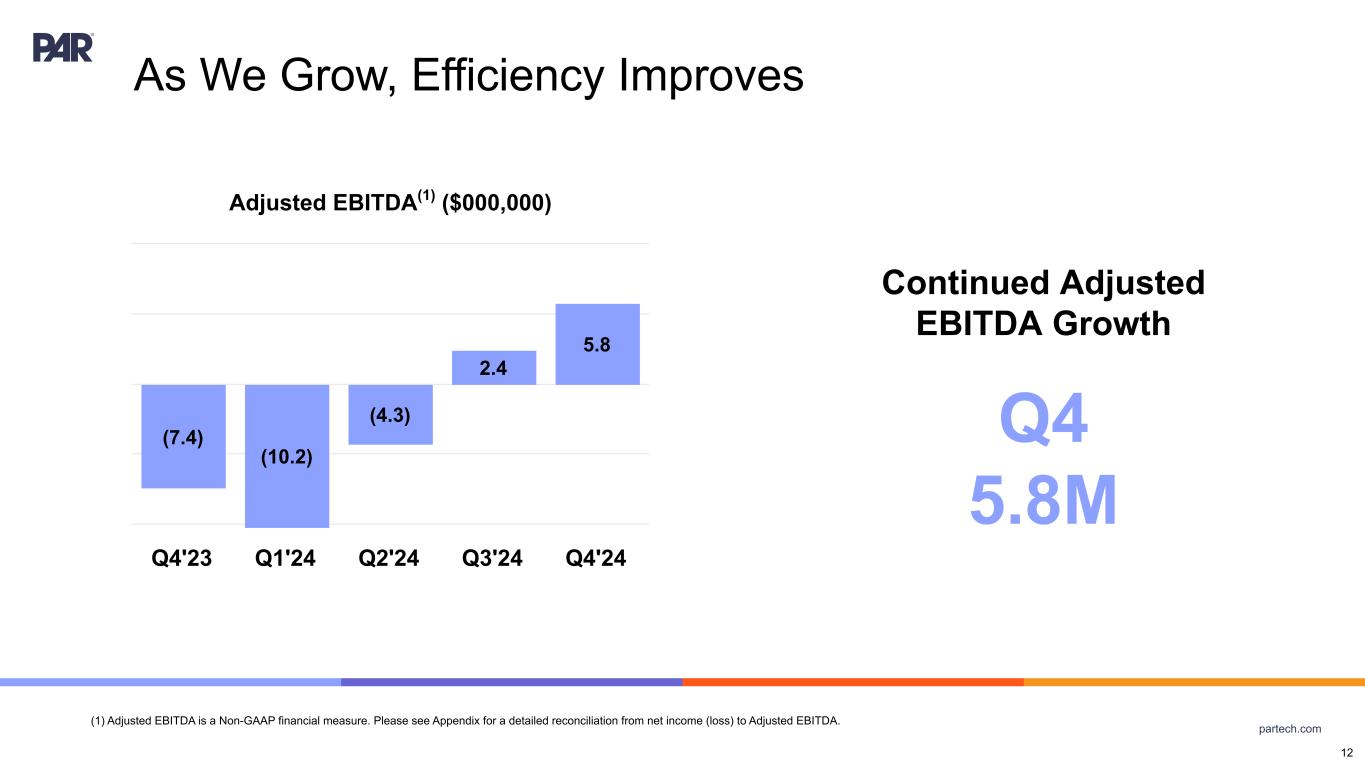

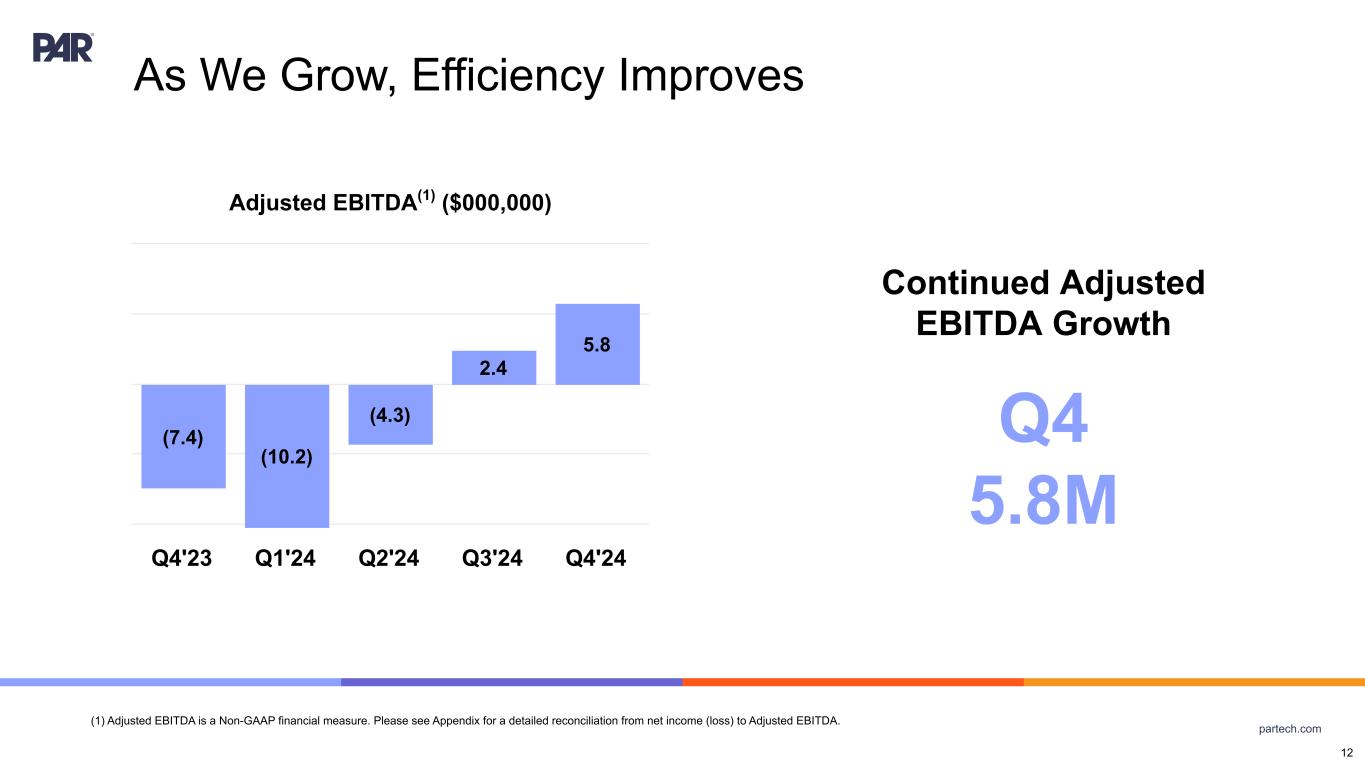

partech.com As We Grow, Efficiency Improves (1) Adjusted EBITDA is a Non-GAAP financial measure. Please see Appendix for a detailed reconciliation from net income (loss) to Adjusted EBITDA. (7.4) (10.2) (4.3) 2.4 5.8 Q4'23 Q1'24 Q2'24 Q3'24 Q4'24 12 Adjusted EBITDA(1) ($000,000) Continued Adjusted EBITDA Growth Q4 5.8M

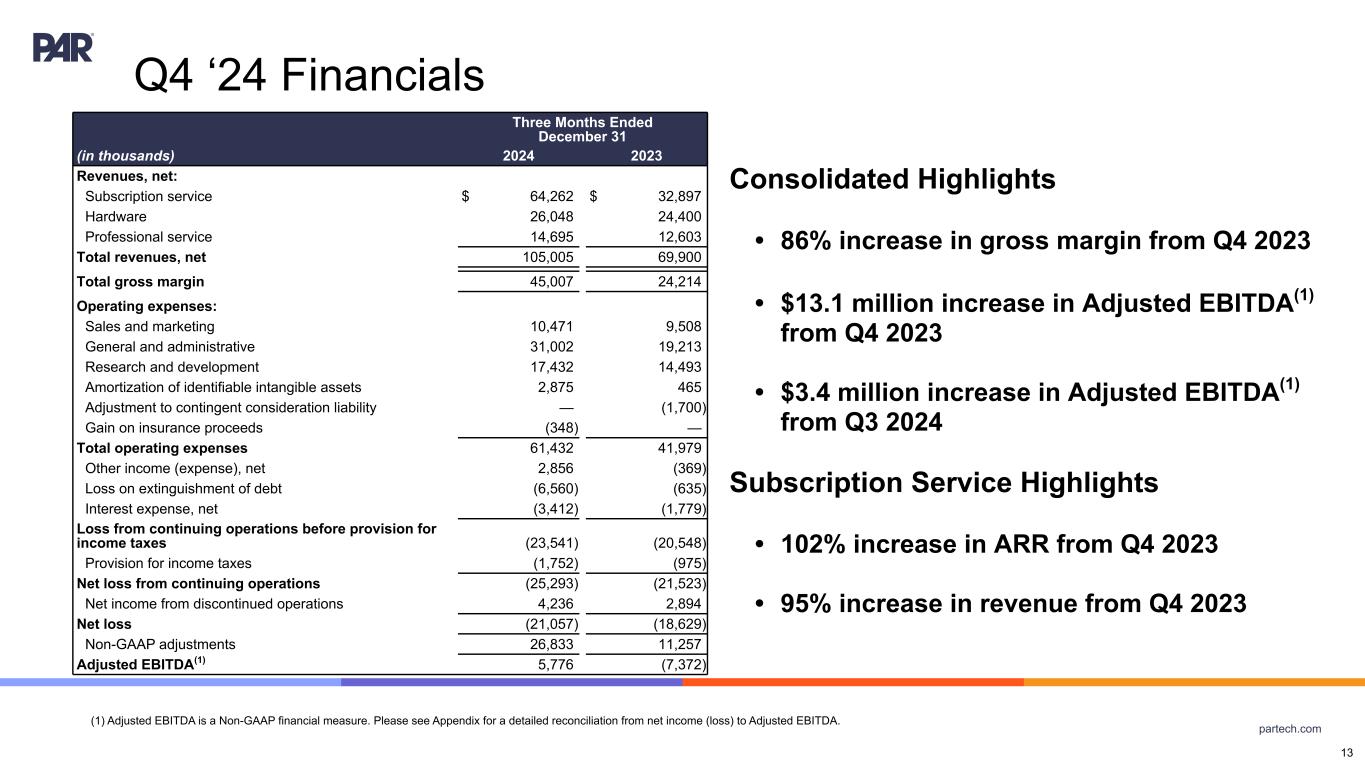

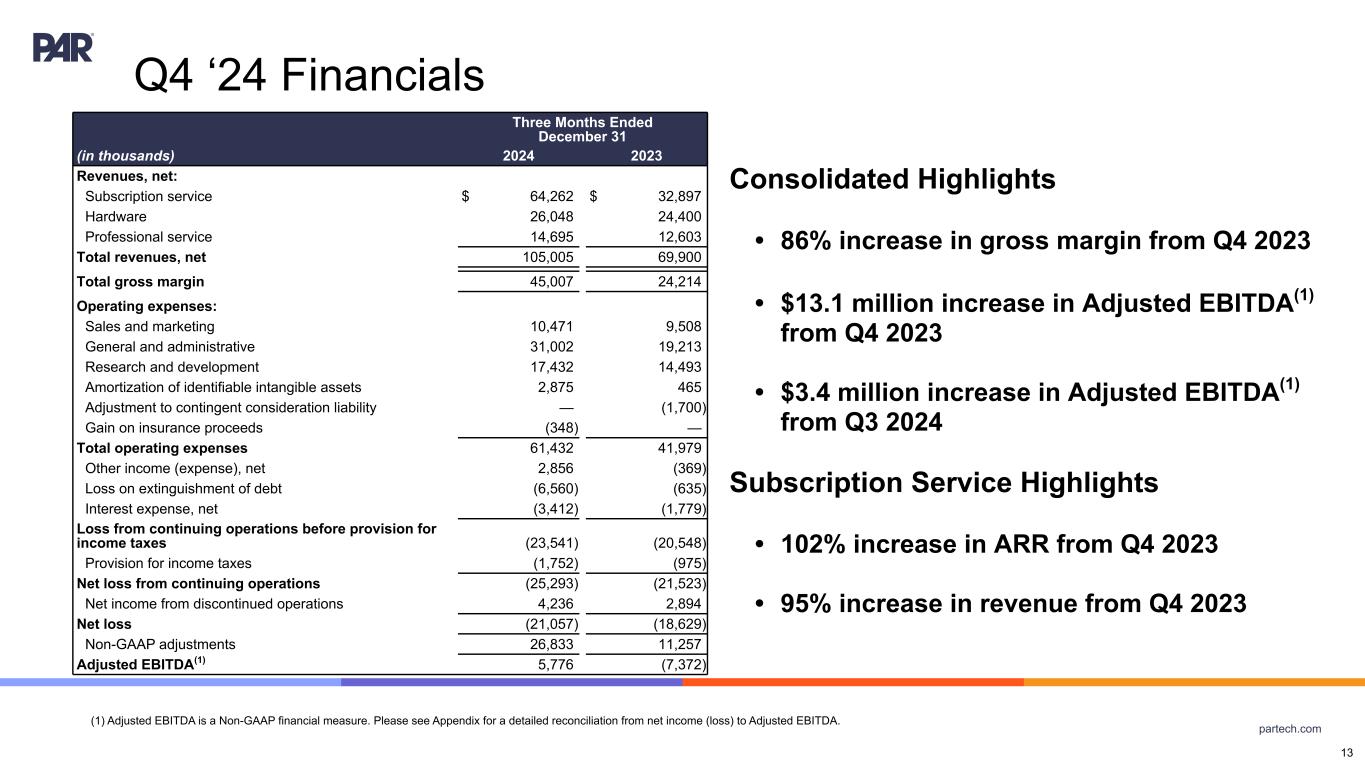

partech.com Q4 ‘24 Financials Consolidated Highlights • 86% increase in gross margin from Q4 2023 • $13.1 million increase in Adjusted EBITDA(1) from Q4 2023 • $3.4 million increase in Adjusted EBITDA(1) from Q3 2024 Subscription Service Highlights • 102% increase in ARR from Q4 2023 • 95% increase in revenue from Q4 2023 Three Months Ended December 31 (in thousands) 2024 2023 Revenues, net: Subscription service $ 64,262 $ 32,897 Hardware 26,048 24,400 Professional service 14,695 12,603 Total revenues, net 105,005 69,900 Total gross margin 45,007 24,214 Operating expenses: Sales and marketing 10,471 9,508 General and administrative 31,002 19,213 Research and development 17,432 14,493 Amortization of identifiable intangible assets 2,875 465 Adjustment to contingent consideration liability — (1,700) Gain on insurance proceeds (348) — Total operating expenses 61,432 41,979 Other income (expense), net 2,856 (369) Loss on extinguishment of debt (6,560) (635) Interest expense, net (3,412) (1,779) Loss from continuing operations before provision for income taxes (23,541) (20,548) Provision for income taxes (1,752) (975) Net loss from continuing operations (25,293) (21,523) Net income from discontinued operations 4,236 2,894 Net loss (21,057) (18,629) Non-GAAP adjustments 26,833 11,257 Adjusted EBITDA(1) 5,776 (7,372) 13 (1) Adjusted EBITDA is a Non-GAAP financial measure. Please see Appendix for a detailed reconciliation from net income (loss) to Adjusted EBITDA.

partech.com Appendix 14

partech.com 3 Months Ended Q4'23 Q1'24 Q2'24 Q3'24 Q4'24 Subscription Service Gross Margin Percentage 48.1% 51.6% 53.1% 55.3% 53.2% Add: Depreciation and amortization 16.9% 13.9% 13.1% 11.4% 11.3% Add: Stock-based compensation 0.3% 0.1% 0.2% 0.1% 0.1% Add: Severance —% 0.1% —% —% 0.1% Non-GAAP Subscription Service Gross Margin Percentage 65.3% 65.7% 66.4% 66.8% 64.7% May not sum/recalculate due to rounding. Non-GAAP Subscription Service Gross Margin Percentage Reconciliation 15

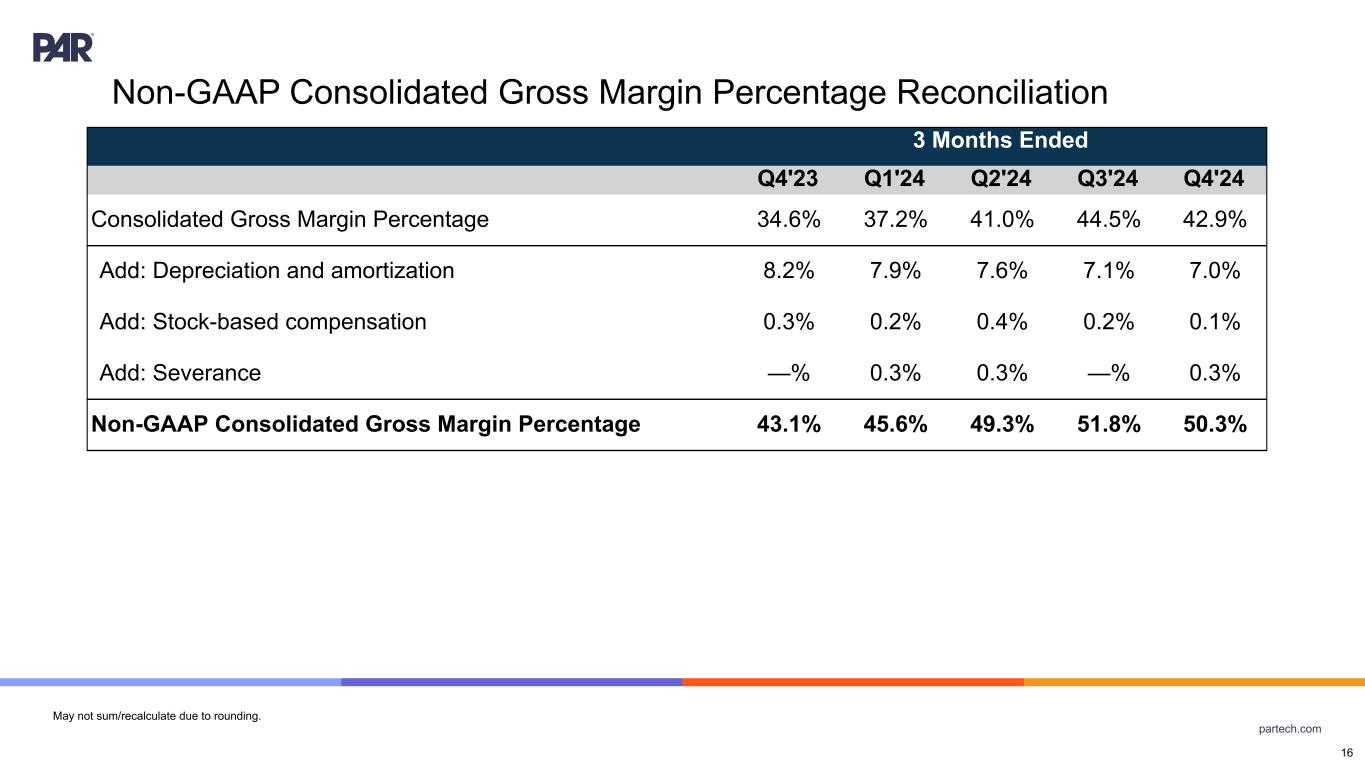

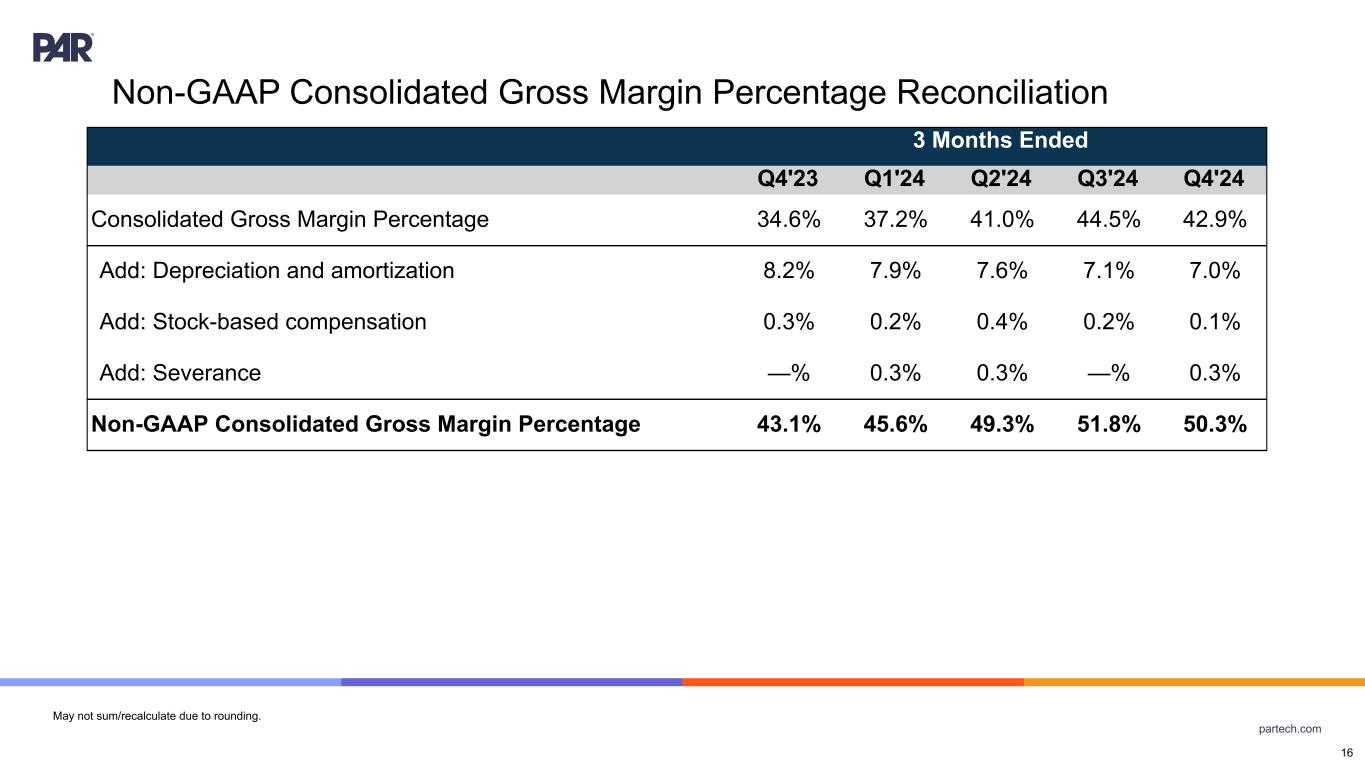

partech.com 3 Months Ended Q4'23 Q1'24 Q2'24 Q3'24 Q4'24 Consolidated Gross Margin Percentage 34.6% 37.2% 41.0% 44.5% 42.9% Add: Depreciation and amortization 8.2% 7.9% 7.6% 7.1% 7.0% Add: Stock-based compensation 0.3% 0.2% 0.4% 0.2% 0.1% Add: Severance —% 0.3% 0.3% —% 0.3% Non-GAAP Consolidated Gross Margin Percentage 43.1% 45.6% 49.3% 51.8% 50.3% May not sum/recalculate due to rounding. Non-GAAP Consolidated Gross Margin Percentage Reconciliation 16

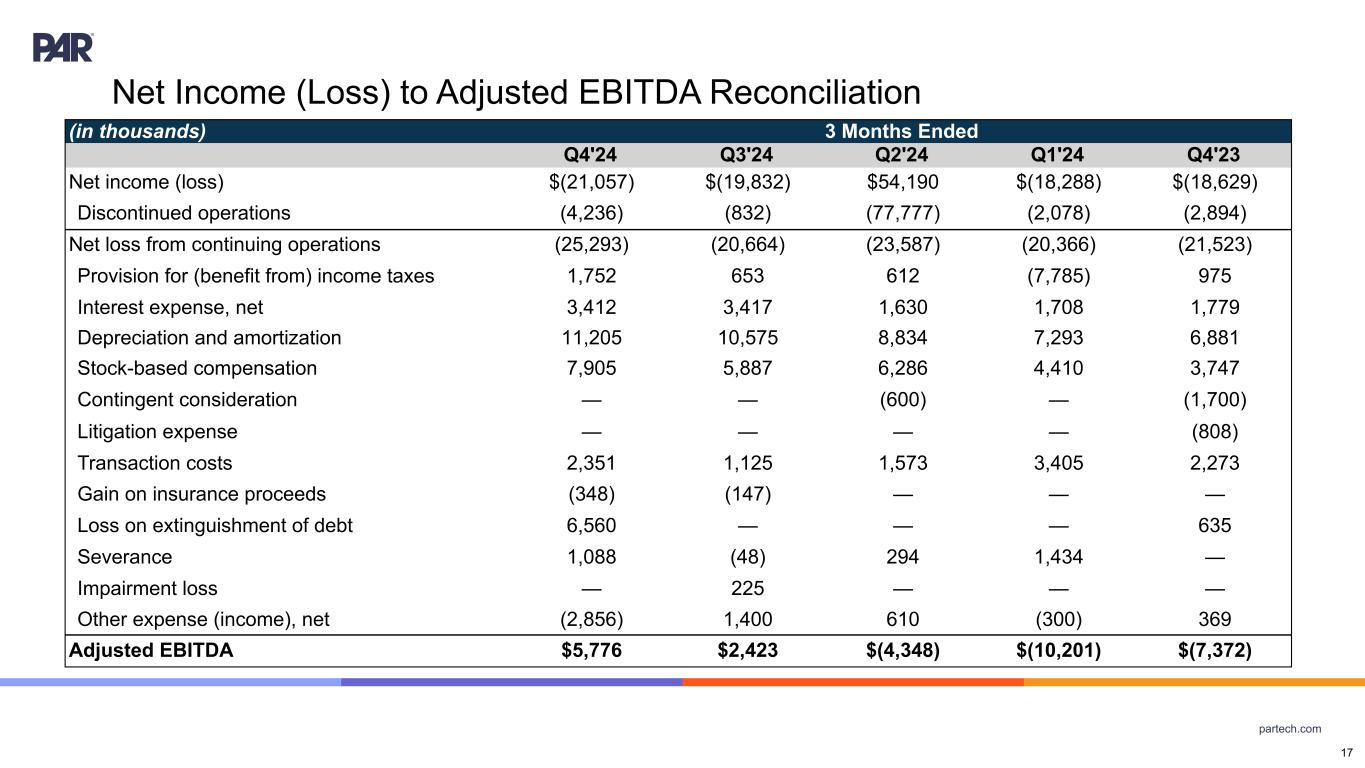

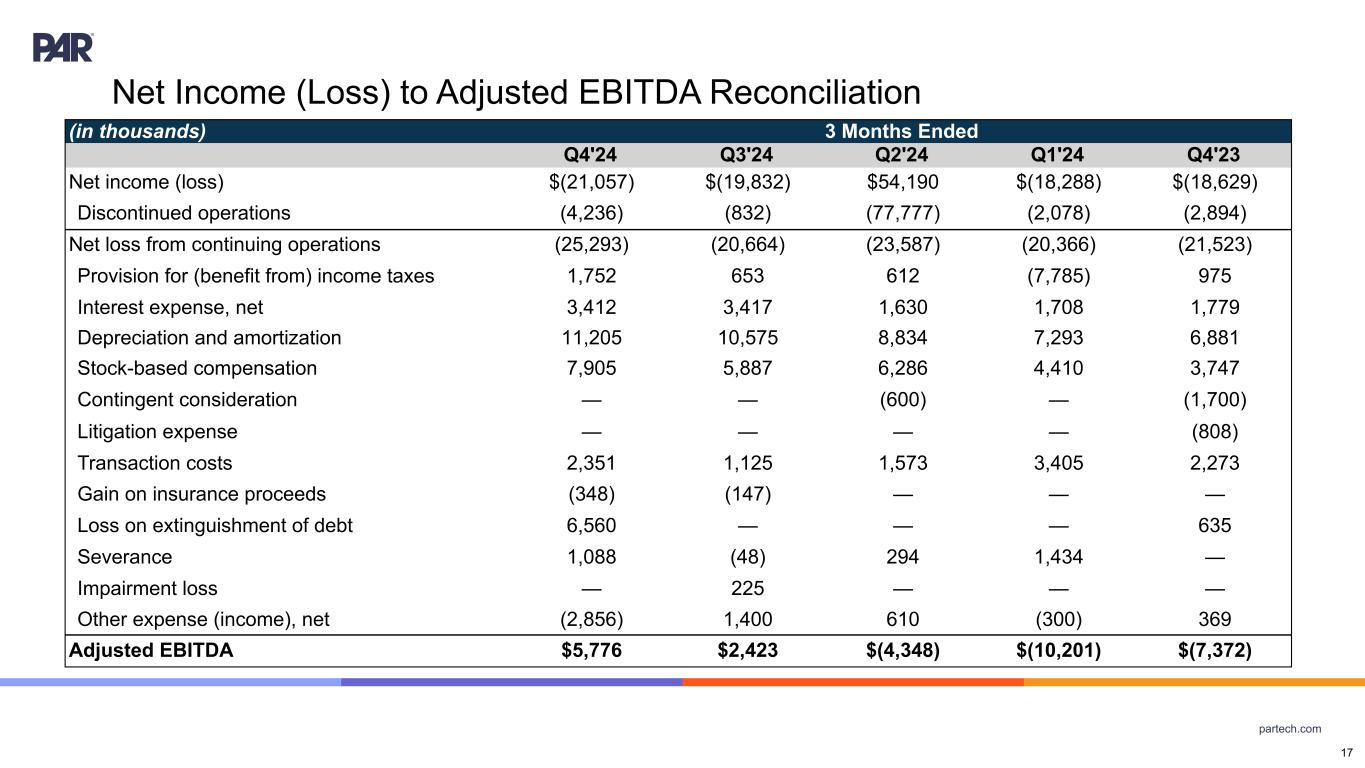

partech.com (in thousands) 3 Months Ended Q4'24 Q3'24 Q2'24 Q1'24 Q4'23 Net income (loss) $(21,057) $(19,832) $54,190 $(18,288) $(18,629) Discontinued operations (4,236) (832) (77,777) (2,078) (2,894) Net loss from continuing operations (25,293) (20,664) (23,587) (20,366) (21,523) Provision for (benefit from) income taxes 1,752 653 612 (7,785) 975 Interest expense, net 3,412 3,417 1,630 1,708 1,779 Depreciation and amortization 11,205 10,575 8,834 7,293 6,881 Stock-based compensation 7,905 5,887 6,286 4,410 3,747 Contingent consideration — — (600) — (1,700) Litigation expense — — — — (808) Transaction costs 2,351 1,125 1,573 3,405 2,273 Gain on insurance proceeds (348) (147) — — — Loss on extinguishment of debt 6,560 — — — 635 Severance 1,088 (48) 294 1,434 — Impairment loss — 225 — — — Other expense (income), net (2,856) 1,400 610 (300) 369 Adjusted EBITDA $5,776 $2,423 $(4,348) $(10,201) $(7,372) 17 Net Income (Loss) to Adjusted EBITDA Reconciliation

partech.com 1. Foodservice market ready for disruption • Large TAM in restaurants with ~1m locations in the US spending 2-3% of total revenue on technology1 • Enterprise foodservice playing “catch-up” in adopting new technology and anticipate this technology spend to ramp • The industry shift to cloud technology has led to an explosion in new technology from Voice AI to marketing technology 2. Meeting market need with a Unified Experience • Today technology is driving a wedge between restaurants and their guests • Brands are shifting to well integrated vendors and more targeted guest interactions • There is an opportunity to create an integrated solution with unified data that enables restaurants to have 1:1 relationship with their guests • Industry seeking vendor consolidation and platform experience and reduce single-product providers 3. ARR at scale with strong SaaS metrics • Through both organic and inorganic strategies, ARR has reached $276.0M with significant opportunity to expand within existing customers and win new business • Hyper-focus on stringent OpEx spend management with real ROI mindset (1) Source: Technomic Investment Thesis 18

partech.com • Annual Recurring Revenue or "ARR” is the annualized revenue from subscription services, including subscription fees for our SaaS solutions and related software support, managed platform development services, and transaction-based payment processing services. We generally calculate ARR by annualizing the monthly subscription service revenue for all Active Sites as of the last day of each month for the respective reporting period. Our reported ARR is based on a constant currency, using the exchange rates established at the beginning of the year and consistently applied throughout the period and to comparative periods presented. For acquisitions made during each period, the constant currency rate applied is the exchange rate at the date of each acquisition's closure. There was no impact on our prior period ARR as a result of applying a constant currency as the exchange rate effects only began with the TASK Group Acquisition in 2024. • “Active Sites” represent locations active on PAR’s subscription services as of the last day of the respective reporting period. • “Non-GAAP Subscription Service Gross Margin Percentage” represents subscription service gross margin percentage adjusted to exclude amortization from acquired and internally developed software, stock-based compensation, and severance. • “Non-GAAP Consolidated Gross Margin Percentage” represents consolidated gross margin percentage adjusted to exclude amortization from acquired and internally developed software, stock-based compensation, and severance. • “Adjusted EBITDA” represents net income (loss) before income taxes, interest expense and depreciation and amortization adjusted to exclude certain non-cash and non-recurring charges that may not be indicative of our financial performance Key Performance Indicators 19

partech.com Thank You! 20