In addition to the grants described above, the Compensation Committee approved a discretionary retention grant of 10,000 shares of restricted stock to Mr. Cicchinelli; 2,500 shares vested on the date of grant, 2,500 shares vested on January 1, 2020, and 5,000 shares will vest on January 1, 2021, subject to Mr. Cicchinelli’s continuing employment through the applicable vesting date.

In 2019, we granted 20,000 shares of time vesting restricted stock and 80,000 shares of performance vesting restricted stock to Mr. Singh under the 2015 Equity Incentive Plan as contemplated by his March 2019 employment agreement (described below). The 20,000 time vesting shares vest and are distributable to Mr. Singh on March 31, 2020, provided Mr. Singh is employed as Chief Executive Officer or is otherwise providing services to the Company on such date. The 80,000 performance vesting shares vest on such date or dates as the Compensation Committee certifies the achievement of performance goals, including the percentage of achievement; and, to the extent vested, are distributable to Mr. Singh in equal installments on March 31, 2020, March 31, 2021 and March 31, 2022, provided Mr. Singh remains employed as our Chief Executive Officer or is otherwise providing services to the Company continuously through and including the applicable distribution dates. Based on performance, the Compensation Committee determined that Mr. Singh earned 78,000 of the performance vesting shares.

Benefits. Our named executive officers are eligible for the same benefits available to our other full-time employees. Our benefits include our 401(k)/retirement plan (“retirement plan”), employee stock purchase plan, health and life insurance plans, and other welfare benefit programs. Our retirement plan has a deferred profit-sharing component. Contributions to the profit-sharing component of the retirement plan are made at the discretion of the Board. No contributions were made to the profit-sharing program in 2019.

Deferred Compensation. We sponsor a non-qualified deferred compensation plan for a select group of highly compensated employees that includes certain of our named executive officers. Participants may make voluntary deferrals of their salary and/or cash bonus to the plan. The Board also has the sole discretion to make employer contributions to the plan, although it did not make any such employer contributions in 2019.

Employment Arrangements in effect for 2019

Savneet Singh. In connection with his appointment as Interim Chief Executive Officer and President of the Company effective December 4, 2018, we entered into an employment letter with Mr. Singh, which provided for an annual base salary of $473,500 (which was pro-rated for 2018). Pursuant to the employment letter Mr. Singh was granted 5,000 shares of performance based restricted stock under the 2015 Equity Incentive Plan.

In connection with his appointment as Chief Executive Officer and President of the Company effective March 22, 2019, we entered into a new employment agreement with Mr. Singh. The March 2019 employment agreement superseded and preempted the terms of the December 2018 employment letter (including cancelling the 5,000 performance shares described above). The March 2019 employment agreement provided for an annual base salary of $490,000, an STI bonus target equal to 90% of his base salary earned in 2019, 20,000 shares of restricted stock that vest on March 31, 2020, subject to his continued service, and 80,000 shares of performance vesting restricted stock as described above under “Long-Term Incentive (“LTI”) Compensation”. The March 2019 employment agreement further provided that for each of 2020 and 2021, Mr. Singh would be eligible to receive an award of 90,000 shares of performance vesting restricted stock that would become earned to the extent performance goals established by the Compensation Committee are satisfied, and then, so long as he remained continuously employed as Chief Executive Officer, fully vested on the third anniversary date thereafter. In accordance with the Company’s reimbursement policy, Mr. Singh was eligible for reimbursement of travel and other expenses, including up to $35,000 in reimbursement for housing and living expenses.

On February 27, 2020, we entered into a new employment agreement with Mr. Singh. The February 2020 employment agreement supersedes and preempts the March 2019 employment letter and is further described in our Current Report on Form 8-K filed with the SEC on March 2, 2020 and is filed as Exhibit 10.20 to our Annual Report on Form 10-K for our fiscal year ended December 31, 2019. The terms of the February 2020 employment offer letter will be further described in our proxy statement for the 2021 annual meeting of stockholders.

Bryan A. Menar. In connection with his appointment as Chief Financial Officer and Vice President of the Company, we entered into an employment agreement with Mr. Menar. Pursuant to that employment agreement Mr. Menar was paid an annual base salary of 250,000, which was increased to $271,000 in 2018; he participates in our STI program at an individual bonus target of up to 40% of his annual base salary for performance against targets established by the Board; and he participates in our retirement plan and receives insurance and other customary benefits offered by us to our executives. If Mr. Menar’s employment had been terminated without cause prior to November 14, 2019, then, pursuant to the terms of his employment agreement, he would have been paid severance equal to six months of his then annual base salary in exchange for a duly executed standard release.

Matthew R. Cicchinelli. Effective December 12, 2015, Mr. Cicchinelli was appointed to the position of President of PAR Government Systems Corporation and Rome Research Corporation. In connection with this appointment, we entered into an employment agreement with Mr. Cicchinelli. Pursuant to that employment agreement, Mr. Cicchinelli was paid an annual base salary of $240,000, which was increased to $247,000 in 2018; participates in our STI program at an individual bonus target of up to 50% (increased to 55% by the Compensation Committee in 2019) of his annual base salary for performance against targets established by the Board; and participates in our retirement plan and receives insurance and other customary benefits offered by us to our executives. Mr. Cicchinelli’s employment is not governed by any severance agreement.

Summary Compensation Table

The following table sets forth information regarding compensation earned by our named executive officers during 2019 and 2018.

Name and Principal Position | Year | | Salary ($) | | | Bonus ($) | | | Stock Awards ($) | | | Option Awards ($) | | | Non- Equity Incentive Plan Compensation ($) | | | Non- Qualified Deferred Compensation Earnings ($) | | | All Other Compensation ($) | | | Total ($) | |

| (a) | (b) | | (c) | | | (d) | | | (e) | | | (f) | | | (g) | | | (h) | | | (i) | | | (j) | |

| Savneet Singh, CEO and | 2019 | | | 485,939 | | | | ------ | | | | 2,450,400 | | | | ------ | | | | 448,878 | | | | ------ | | | | 29,388 | | | | 3,414,605 | |

| President | 2018 | | | 30,595 | | | | ------ | | | | 96,850 | | | | ------ | | | | ------ | | | | ------ | | | | ------ | | | | 127,445 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Bryan A. Menar, Chief Financial and Accounting Officer, | 2019 | | | 271,000 | | | | ------ | | | | 65,000 | | | | 35,000 | | | | 113,159 | | | | ------ | | | | 4,891 | | | | 489,050 | |

| Vice President | 2018 | | | 260,169 | | | | 32,500 | | | | 48,750 | | | | 26,250 | | | | ------ | | | | ------ | | | | 2,438 | | | | 370,107 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Matthew R. Cicchinelli, President, PAR Government | 2019 | | | 247,000 | | | | 37,304 | | | | 299,850 | | | | 26,250 | | | | ------ | | | | ------ | | | | 3,081 | | | | 613,485 | |

| Systems Corporation and Rome Research Corporation | 2018 | | | 244,827 | | | | 16,768 | | | | 48,750 | | | | 26,250 | | | | 121,750 | | | | ------ | | | | 3,031 | | | | 461,376 | |

Column (c) - Salary. Mr. Singh’s base salary during the period he served as Interim Chief Executive Officer and President from December 4, 2018 through March 22, 2019 was $473,500. In connection with his appointment to Chief Executive Officer and President, effective March 22, 2019, Mr. Singh’s base salary was increased to $490,000.

Column (d) - Bonus. Mr. Cicchinelli’s PGSC retention bonus ($17,304) and discretionary bonus ($20,000) earned in 2019.

Column (e) - Stock Awards. The dollar amounts reflect the aggregate grant date fair value computed in accordance with FASB ASC Topic 718 with respect to stock awards made to our named executive officers. Assumptions made, including the probable outcome of performance conditions of the performance-based stock awards, in the valuations are discussed in Note 10 to our 2019 Consolidated Financial Statements included in our Annual Report on Form 10-K filed with the SEC on March 16, 2020.

For Mr. Singh, column (e) reflects the grant date fair value of the 100,000 shares of restricted stock granted to him 2019 in connection with his appointment to the position of Chief Executive Officer and President on March 22, 2019. Of these shares, 20,000 shares, granted in March 27, 2019, are time vesting shares, that vest and are distributable on March 31, 2020, subject to Mr. Singh’s continued service, and 80,000 shares, granted on May 13, 2019, are performance vesting shares, that vest on such date or dates as our Compensation Committee certifies the achievement of performance goals, including the percentage of achievement; and, to the extent vested, are distributable to Mr. Singh in equal installments on March 31, 2020, March 31, 2021 and March 31, 2022, provided he remains employed as our Chief Executive Officer or is otherwise providing services continuously through and including the applicable distribution dates. The 5,000 shares of restricted stock, with a grant date fair value of $96,850, granted to Mr. Singh in December 2018 in connection with his appointment as Interim Chief Executive Officer and President in December 2018, were cancelled.

For Mr. Menar, column (e) reflects the grant date fair value of 2,613 shares of restricted stock granted to him on August 9, 2019. Of these shares, 1,005 are time vesting shares, that vest ratably in one-third increments on December 31, 2019, December 31, 2020 and December 31, 2021, subject to Mr. Menar’s continued service, and 1,608 are performance vesting shares, that vest ratably in one-third increments on December 31, 2019, December 31, 2020 and December 31, 2021, based on the percentage annual performance goals are achieved for the applicable performance year, and subject to Mr. Menar’s continued service. The grant date fair value of the performance vesting restricted stock, assuming the highest level of performance will be achieved, is $59,986.

For Mr. Cicchinelli, column (e) reflects the grant date fair value of 10,000 shares of timing vesting restricted stock granted to him on May 10, 2019, of which 2,500 vested on the date of grant, 2,500 vested on January 1, 2020 and 5,000 shares vest on January 1, 2021, subject to Mr. Cicchinelli’s continuous employment; and the grant date fair value of 1,959 shares of restricted stock granted to him in August 2019. Of these shares, 753 are time vesting shares, that vest ratably in one-third increments on December 31, 2019, December 31, 2020 and December 31, 2021, subject to Mr. Cicchinelli’s continued service, and 1,206 are performance vesting shares, that vest ratably in one-third increments on December 31, 2019, December 31, 2020 and December 31, 2021, based on the percentage annual performance goals are achieved for the applicable performance year, and subject to Mr. Cicchinelli’s continued service. The grant date fair value of the performance vesting restricted stock, assuming the highest level of performance will be achieved, is $44,989.

Column (f) – Option Awards. The dollar amounts reflect the aggregate grant date fair value computed in accordance with FASB ASC Topic 718. Assumptions made in the valuations are discussed in Note 10 to our 2019 Consolidated Financial Statements included in our Annual Report on Form 10-K filed with the SEC on March 16, 2020.

For each of Messrs. Menar and Cicchinelli column (f) reflects non-qualified stock options to purchase shares of our common stock granted on August 9, 2019. The options vest ratably in one-third increments on August 9, 2020, August 9, 2021, and August 9, 2022, subject to continuing employment on the applicable vesting dates.

Column (g) – Non-Equity Incentive Plan Compensation. Reflects the STI bonuses earned by Messrs. Singh and Menar in 2019.

Column (i) - All Other Compensation. The amounts represent 401(k) employer matching contributions ($4,192 -Mr. Singh, $4,303 – Mr. Menar and $2,500 – Mr. Cicchinelli), the Company’s payment of premiums on term life insurance ($588 – Messrs. Singh and Menar and $581 – Mr. Cicchinelli), as to Mr. Singh, payments related to relocation expenses of $14,544 and a company car lease of $10,064.

Outstanding Equity Awards at Fiscal Year-End

The following table shows information regarding outstanding equity awards held by our named executive officers at December 31, 2019.

| | | Option Awards | | | Stock Awards | |

Name | | Number of Securities Underlying Unexercised Options Exercisable (#) | | | Number of Securities Underlying Unexercised Options Unexercisable (#) | | | Option Exercise Price ($) | | | Option Expiration Date | | | Number of Shares or Units of Stock That Have Not Vested (#) | | | Market Value of Shares or Units of Stock that Have Not Vested ($)(1) | | | Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights that Have Not Vested (#) | | | Equity Incentive Awards: Market Value of Unearned Shares, Units or Other Rights that Have Not Vested ($) (1) | |

(a) | | (b) | | | (c) | | | (e) | | | (f) | | | (g) | | | (h) | | | (i) | | | (j) | |

Savneet Singh | | | -- | | | | -- | | | | -- | | | | -- | | | | 20,000 | (2) | | | 614,800 | | | | -- | | | | -- | |

| | | | | | | | | | | | | | | | | | | | 16,000 | (3) | | | 491,840 | | | | 64,000 | (3) | | | 1,967,360 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | -- | | | | -- | | | | -- | | | | -- | | | | | | | | | | | | -- | | | | -- | |

Bryan A. Menar | | | -- | | | | 5,382 | (4) | | | 24.87 | | | 8/09/29 | | | | -- | | | | -- | | | | -- | | | | -- | |

| | | | 1,062 | | | | 2,126 | (5) | | | 22.18 | | | 8/13/28 | | | | -- | | | | -- | | | | -- | | | | -- | |

| | | | 20,000 | | | | 20,000 | (6) | | | 8.90 | | | 12/08/27 | | | | -- | | | | -- | | | | -- | | | | -- | |

| | | | -- | | | | -- | | | | -- | | | | -- | | | | 670 | (8) | | | 20,596 | | | | -- | | | | -- | |

| | | | -- | | | | -- | | | | -- | | | | -- | | | | | | | | | | | | 1,608 | (9) | | | 49,430 | |

| | | | -- | | | | -- | | | | -- | | | | -- | | | | 282 | (11) | | | 8,669 | | | | -- | | | | -- | |

| | | | -- | | | | -- | | | | -- | | | | -- | | | | 418 | | | | 12,849 | | | | 902 | (12) | | | 27,727 | |

| | | | -- | | | | -- | | | | -- | | | | -- | | | | -- | | | | -- | | | | 1,500 | (13) | | | 46,110 | |

Matthew R. Cicchinelli | | | -- | | | | 4,036 | (4) | | | 24.87 | | | 8/09/29 | | | | -- | | | | -- | | | | -- | | | | -- | |

| | | | 1,062 | | | | 2,126 | (5) | | | 22.18 | | | 8/13/28 | | | | -- | | | | -- | | | | -- | | | | -- | |

| | | | 2,000 | (7) | | | -- | | | | 4.80 | | | 1/9/24 | | | | -- | | | | -- | | | | -- | | | | -- | |

| | | | -- | | | | -- | | | | -- | | | | -- | | | | 502 | (8) | | | 15,431 | | | | -- | | | | -- | |

| | | | -- | | | | -- | | | | -- | | | | -- | | | | -- | | | | -- | | | | 1,206 | (9) | | | 37,072 | |

| | | | | | | | | | | | | | | | | | | | 7,500 | (10) | | | 230,550 | | | | -- | | | | -- | |

| | | | -- | | | | -- | | | | -- | | | | -- | | | | 282 | (11) | | | 8,669 | | | | -- | | | | -- | |

| | | | -- | | | | -- | | | | -- | | | | -- | | | | 418 | | | | 12,849 | | | | 902 | (12) | | | 27,727 | |

| | | | -- | | | | -- | | | | -- | | | | -- | | | | -- | | | | -- | | | | 1,667 | (13) | | | 51,244 | |

| | 1. | The dollar amounts reflect the market value of the shares based on the closing price of our common stock on December 31, 2019 ($30.74). |

| 2. | These shares of restricted stock were granted on March 27, 2019 and vest and are distributable on March 31, 2020. |

| 3. | These shares of performance vesting restricted stock were granted on May 13, 2019, and vest on such date or dates as our Compensation Committee certifies the achievement of performance goals, including the percentage of achievement; and, to the extent vested, are distributable in equal installments on March 31, 2020, March 31, 2021 and March 31, 2022. |

| 4. | This option was granted on August 9, 2019 and vests ratably over three years on the anniversary of the date of grant. |

| 5. | This option was granted on August 13, 2018 and vests ratably over three years on the anniversary of the date of grant. |

| 6. | This option was granted on December 8, 2017 and vests ratably over four years on the anniversary of the date of grant. |

| 7. | This option was granted on January 9, 2014 and vested ratably over three years on the anniversary of the date of grant. |

| 8. | These shares of time vesting restricted stock were granted on August 9, 2019 and vest ratably December 31, 2019, 2020 and 2021. |

| 9. | These shares of performance vesting restricted stock were granted on August 9, 2019 and vest ratably December 31, 2019, 2020 and 2021 subject to attaining annual performance targets. |

| 10. | These shares of time vesting restricted stock were granted on May 10, 2019 and vest as follows: 2,500 shares on the date of grant, 2,500 shares on January 1, 2020 and 5,000 shares on January 1, 2021. |

| 11. | These shares of time vesting restricted stock were granted on August 13, 2018 and vest ratably on December 31, 2018, 2019 and 2020. |

| 12. | These shares of performance vesting restricted stock were granted on August 13, 2018 and vest on December 31, 2020 subject to attaining annual performance targets for the years ending December 31, 2018, 2019 and 2020. The number of shares assumes that performance goals for the remaining vesting dates will be achieved. |

| 13. | These shares of performance vesting restricted stock were granted on December 8, 2017 and vest ratably on December 31, 2017, 2018 and 2019 if annual performance targets are achieved. However, if a performance target for a performance year is not met, the shares of restricted stock for such missed performance year are eligible for recapture. The shares of restricted stock for a missed performance year are eligible for recapture at the end of the immediately subsequent performance year, if the cumulative actual performance exceeds the cumulative performance targets for such performance years. The recapture right is only available in the immediately subsequent performance year; provided, in the case of the last performance year, if the performance target for the last performance year is not met, the shares of restricted stock for that last performance year may be recaptured if the cumulative actual performance for the three (3) performance years exceeds the cumulative performance targets for the three (3) performance years. None of the shares were eligible to vest based on performance. |

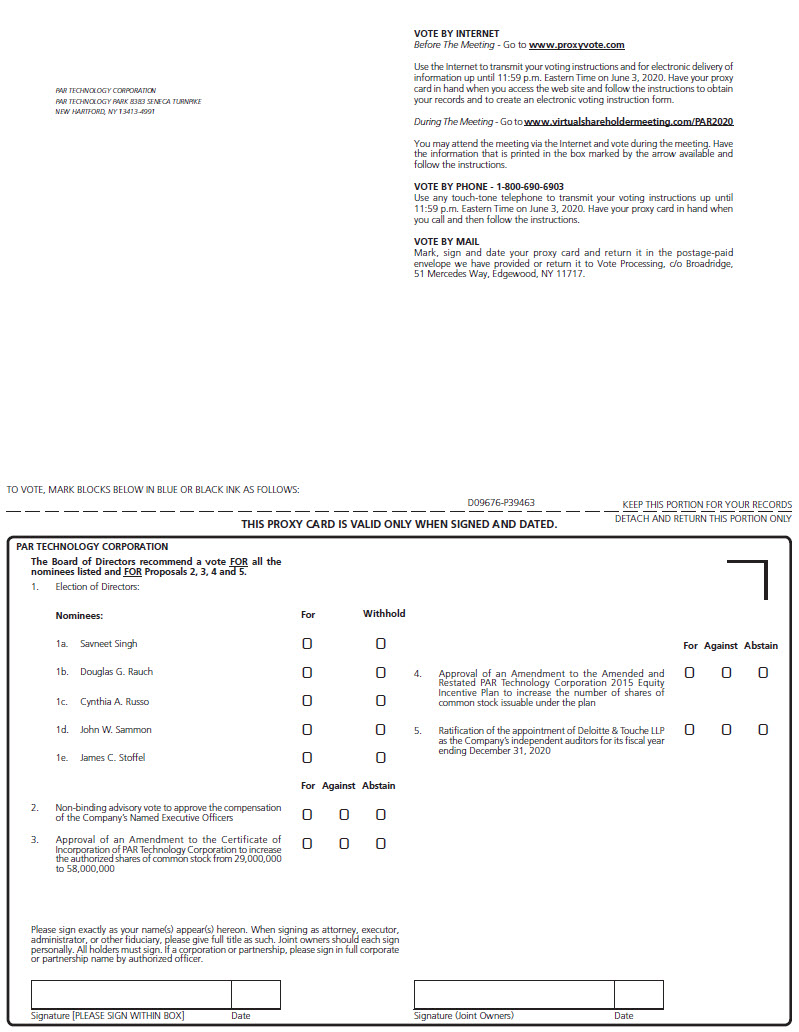

PROPOSAL 2 — NON-BINDING, ADVISORY VOTE TO APPROVE

THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS

Our disclosure regarding the compensation of our named executive officers is pursuant to the scaled requirements for smaller reporting companies under Item 402(m) through (q) of Regulation S-K of the Exchange Act. The compensation paid to our named executive officers in 2019 is disclosed in the narrative discussion and compensation tables on pages 17 through 26 of this Proxy Statement. As discussed, we believe our compensation program is focused on pay-for-performance principles and are strongly aligned with the long-term interests of building stockholder value.

Our stockholders, through their non-binding, advisory vote at the 2019 annual meeting of stockholders, indicated a desire for an annual non-binding, advisory vote regarding the compensation of our named executive officers. Our Board believes an annual vote will enhance stockholder communication by providing a clear, simple means for us to obtain information on stockholder sentiment about our executive compensation philosophies and practices. Therefore, in accordance with Section 14A of the Exchange Act and the associated regulations, stockholders are being asked to provide a non-binding, advisory vote on the following resolution:

RESOLVED, that the stockholders of PAR Technology Corporation approve, on an advisory basis, the compensation paid to the Company’s named executive officers, as disclosed in this Proxy Statement, including the compensation tables and narrative discussion contained herein.

The next non-binding, advisory vote regarding the compensation of our named executive officers will be held at the 2021 annual meeting of stockholders.

The vote solicited by Proposal 2 is advisory in nature, and therefore is not binding on the Company, the Board, or the Compensation Committee. While the opinions of our stockholders are valued, the result of the vote will not require the Company, the Board, or the Compensation Committee to take any actions, and will not be construed as overruling any decision of the Company, the Board or the Compensation Committee. To the extent there is any significant vote against the compensation of our named executive officers as disclosed in this Proxy Statement, we will consider stockholder concerns and an evaluation will be made as to whether any actions are necessary to address those concerns.

The Board of Directors unanimously recommends a vote “For” the proposal to approve the compensation of our named executive officers as disclosed in this Proxy Statement, including the compensation tables and narrative discussion.

PROPOSAL 3 - APPROVAL OF AN AMENDMENT TO OUR CERTIFICATE OF INCORPORATION TO INCREASE

THE AUTHORIZED SHARES OF COMMON STOCKFROM 29,000,000 TO 58,000,000

We currently have thirty million (30,000,000) shares of authorized capital stock, par value $0.02 per share, consisting of twenty-nine million (29,000,000) shares of common stock and one million (1,000,000) shares of preferred stock.

As of March 27, 2020 we had outstanding 18,275,044 shares of common stock. No shares of preferred stock are outstanding.

Of the 9,711,385 shares of common stock authorized, but unissued, as of March 27, 2020 we had approximately 952,192 shares of common stock reserved for issuance upon the exercise of outstanding stock options under the 2015 Equity Incentive Plan; approximately 160,243 shares of common stock available for future awards under the 2015 Equity Incentive Plan, which will increase to approximately 860,243 if Proposal 4 is approved; 43,350 shares reserved for issuance upon the exercise of outstanding stock options under the Company’s 2005 Equity Incentive Plan; 67,273 shares issuable upon vesting of restricted stock units issued by us in connection with our assumption of awards granted by AccSys, Inc. (“Restaurant Magic”) to its employees and contractors prior to the closing of our acquisition of Restaurant Magic in December 2019; 148,072 shares for issuance to the sellers of Restaurant Magic in the event certain post-closing earn-out targets are achieved; and approximately 1,013,571 unreserved shares of common stock held in treasury. In addition, there are approximately 4,338,322 shares of common stock reserved for issuance in the event some or all of our 4.500% convertible senior notes due 2024 and/or our 2.875% convertible senior notes due 2026 convert into shares of common stock.

Due to the limited number of shares of common stock remaining available for future issuance, our Board unanimously approved and voted to recommend that you approve an amendment to our Certificate of Incorporation to increase the number of authorized shares of common stock from 29,000,000 to 58,000,000. In addition, to effect this change, the total number of shares of capital stock authorized in the Certificate of Incorporation, as amended, would increase from 30,000,000 to 59,000,000, consisting of 58,000,000 shares of common stock and 1,000,000 shares of preferred stock. The proposed Amendment to our Certificate of Incorporation is included as Appendix A to this Proxy Statement.

The additional shares of common stock would provide us with greater flexibility and additional potential opportunities in the future by allowing us to take any one or a combination of general corporate initiatives to optimize stockholder value and support our growth plans, including: raise additional capital through common stock offerings; provide stock-based awards to attract, motivate, and retain employees, executive officers and non-employee Directors; acquire businesses, technologies, product franchises or other assets through business combinations and acquisitions using common stock as consideration; and issue common stock for other corporate purposes. The Board believes that these additional shares of common stock will provide us with needed flexibility to issue shares in the future without potential expense and delay incident to obtaining stockholder approval for a particular issuance, except as otherwise required by law or the rules and regulations of the New York Stock Exchange. We currently have no specific plans, arrangements, or understandings to issue any of the newly authorized shares that have otherwise not been disclosed.

All newly authorized shares of common stock when issued would have the same rights as the presently authorized shares of common stock, including the right to cast one vote per share and to receive dividends if and to the extent we declare and pay them. There would be no change in the par value of $0.02 per share. Stockholders would have no preemptive rights with respect to the issuance of additional common stock.

Any issuance of additional shares of common stock would increase the outstanding number of shares of common stock and dilute the percentage ownership of existing stockholders. The dilutive effect of an issuance could discourage a change of control by making it more difficult or costly. We are not aware of any specific effort to obtain control of us, and we have no present intention of using the proposed increase in authorized common stock to deter a change of control.

Approval of the amendment to the Certificate of Incorporation requires the affirmative vote of a majority of all outstanding common stock. The Board of Directors recommends a vote “For” approval of the Amendment to our Certificate of Incorporation to increase the authorized shares of common stock from 29,000,000 to 58,000,000.

PROPOSAL 4 — APPROVAL OF AN AMENDMENT TO THE AMENDED AND RESTATED

PAR TECHNOLOGY CORPORATION 2015 EQUITY INCENTIVE PLAN

The Board has unanimously approved and voted to recommend that you approve, an amendment to the Amended and Restated PAR Technology Corporation 2015 Equity Incentive Plan. The amendment (the “Amendment”) increases the number of shares of common stock authorized for issuance by 700,000. The Board believes that the Company’s ability to grant stock-based awards is important to its continuing ability to attract, motivate and retain talented people.

The PAR Technology Corporation 2015 Equity Incentive Plan was originally adopted by our Board and approved by our stockholders at the 2015 annual meeting of stockholders. In 2019, the Board adopted, and the stockholders approved, the Amended and Restated PAR Technology Corporation 2015 Equity Incentive Plan (the “Plan”), which included an increase of 1,000,000 shares available for issuance under the Plan.

In 2019, we increased the equity portion of total compensation for our employees, executive officers, and non-employee Directors in order to drive performance, align incentives with stockholder value, and improve retention. As a result, the total number of shares of common stock available for future awards under the Plan is 160,243 as of March 27, 2020. Based on estimated usage, the Compensation Committee anticipates depleting these shares by the end of calendar 2020. In order to continue to have an appropriate supply of shares for stock-based awards to attract, motivate, and retain the talent required to successfully execute our business strategy, the Board believes that the additional 700,000 shares requested in the Amendment will provide the Compensation Committee with sufficient shares for our equity compensation program for approximately three years, depending on the size of our workforce, the estimated range of our stock price, historical forfeiture rates, and other factors.

Our executive officers and non-employee Directors have an interest in this proposal by virtue of their being eligible to receive equity awards under the Plan as amended.

While adding 700,000 shares to the Plan will increase the potential dilution to our current stockholders, our Board believes that our equity compensation program is appropriately managed. As shown in the table below, as of December 31, 2017, 2018 and 2019, stockholder dilution, measured by the quotient of the sum of (1) shares of common stock reserved for future awards, (2) outstanding, but unexercised stock options, and (3) unvested restricted stock outstanding, over the total number of shares of common stock outstanding, attributable to the Plan was 9.24%, 7.73% and 9.38%, respectively. Potential dilution as of March 27, 2020, inclusive of the additional 700,000 shares, would be 12.19%.

| | | December 31, 2017 | | December 31, 2018 | | December 31, 2019 | | March 27, 2020 (with 700,000 additional shares) | |

| | Shares reserved for future awards under Current Plan | 555,437 | | 378,194 | | 1,127,717 | | 860,243 | |

| | Outstanding, but unexercised stock options | 761,141 | | 677,840 | | 365,693 | | 952,192 | |

| | Unvested restricted stock outstanding | 158,574 | | 193,342 | | 65,494 | | 415,931 | |

| | Total shares of common stock outstanding | 15,969,085 | | 16,171,879 | | 16,629,177 | | 18,275,044 | |

| | Total dilution | 9.24% | | 7.73% | | 9.38% | | 12.19% | |

The Company’s three-year adjusted average annual burn rate as of December 31, 2019 is 2.1%, well below the Institutional Shareholder Services (“ISS”) “burn rate benchmark” for our industry of 3.93%.

| | (Shares are stated in thousands) | | | | | | | |

| | Weighted Average Number of Shares of Common Stock Outstanding | | | | | | | |

| | | | | | | | 123 | |

| | | | | | | | | |

| | | | | | 262 | | 421 | |

| | Granted Stock Options and Restricted Stock Burn Rate | | |

| |

| | |

| | 3-year average (adjusted) Burn Rate 2.1% |

(1) Adjusted total reflects that ISS considers full-value awards to be more valuable than stock options. The adjustment is made based on the Company’s annual stock price volatility, such that 1 full value award will count as 2 option shares.

Plan Summary

Set forth below is a summary of the principal provisions of the Plan. We are proposing to amend the Plan solely to increase the shares available for issuance. The Company is not proposing to amend any of the provisions described below. The summary is qualified in its entirety by reference to the text of the Plan, which is attached as Appendix B to this Proxy Statement. We urge our stockholders to carefully review the Plan.

Plan Term. The present term of the Plan began on June 10, 2019, the date of stockholder approval of the Plan. No awards may be granted under the Plan after June 10, 2029, but awards previously granted may extend beyond that date unless terminated by the Board or Compensation Committee in accordance with the terms of those awards.

Eligible Participants. All employees, officers, directors, consultants and advisors of the Company are eligible to participate in the Plan. As of March 27, 2020, there were approximately 1,000 employees (including officers) and five directors eligible to participate in the Plan. Although consultants and advisors are eligible to participate, we have not historically granted stock-based awards to consultants and advisors.

Total Shares Authorized. If stockholders approve the Amendment, the Plan will include an aggregate of 860,243 shares available for issuance.

Administration and Authority. The Board has broad authority to administer the Plan, which it may delegate to the Compensation Committee, which is comprised solely of independent Directors. References hereafter in this Proposal 4 to the Board apply equally to the Compensation Committee when the Board delegates its authority under the Plan. The Board has the authority to grant and amend awards and, subject to the express limitations of the Plan, the Board has the authority to (i) to construe and determine award agreements, awards and the Plan, (ii) to prescribe, amend and rescind rules and regulations relating to the Plan and any awards thereunder, (iii) to determine the terms and conditions of the awards, and (iv) to make all other determinations or certifications and take such other actions in the judgment of the Board are necessary or desirable for the administration and interpretation of the Plan.

Award Types. Stock options, restricted stock, and such other stock-based awards as the Board or Compensation Committee may determine, including securities convertible into our common stock, stock appreciation rights, phantom stock awards and restricted stock units. The Board may grant stock options that are incentive stock options (ISOs) or non-qualified stock options. Only employees may receive ISOs. No stock option can be exercised more than ten (10) years from the date of grant.

Award Limits. Awards intended to qualify as incentive stock options may not become exercisable in any one calendar year for shares of common stock with an aggregate fair market value of more than $100,000. The Plan places an annual limit of $200,000 on the fair value of shares awarded to non-employee Directors.

No Repricing. The Board may not reprice stock options or stock appreciation rights without stockholder approval.

Clawback, Recovery, and Recoupment. All awards are subject to clawback, recovery or recoupment in accordance with any compensation clawback, recovery, or recoupment policy adopted by the Board or otherwise required by applicable law, government regulation or stock exchange listing requirement and, in addition to any other remedies available under such policy and applicable law, government regulation or stock exchange listing requirement, may require the forfeiture and cancelation of outstanding awards and the recoupment of any gains realized with respect to any awards. The Board may impose any such clawback, recovery, or recoupment provisions in an award agreement as the Board determines necessary or appropriate.

Change in Control. In connection with a Change in Control as defined under the Plan, the Board may (1) make provision for continuation of the award, assumption of the award by the acquiring entity or by substitution of the award on an equitable basis for the shares subject to the award, (2) accelerate vesting of an award, or (3) exchange of the award for the right to participate in an equity or benefit plan of any successor corporation.

Acceleration. The Board may at any time provide that any stock options shall become immediately exercisable in full or in part, that any restricted stock awards shall be free of some or all restrictions, or that any other stock-based awards may become exercisable in full or in part or free of some or all restrictions or conditions, or otherwise realizable in full or in part, as the case may be, despite the fact that such action may cause application of Section 280G and Section 4999 of the Internal Revenue Code of 1983, as amended (the “Code”) or disqualify all or part of an incentive stock option award.

Recapitalization. In the event of certain corporate transactions or changes in corporate capitalization, the Board or the Compensation Committee will make appropriate and proportionate adjustments to the terms of the Plan (e.g., the maximum number of shares available and individual limits) and outstanding awards.

Tax Withholding. The issuance of common stock in satisfaction of an award under the Plan is conditioned on the participant having made arrangements for the satisfaction of tax withholding obligations, which a participant may satisfy, by making a cash payment or authorizing withholding from the participant’s compensation, and subject to prior approval of the Company by (i) causing the Company to withhold shares of common stock from the payment of an award or (ii) by delivering to the Company shares of common stock already held by the participant.

Transferability. Awards granted under the Plan generally may not be sold, assigned, transferred, pledged or otherwise encumbered by the person to whom they are granted, either voluntarily or by operation of law, except by will or the laws of descent and distribution, and, during the life of the participant, shall be exercisable only by the participant, except as the Board may otherwise provide.

Amendment/Termination. The Board has broad authority to amend, suspend or terminate the Plan, except where stockholder approval is required (i) by the rules of any securities exchange or inter-dealer quotation system on which the Company’s common stock is listed or traded or (ii) in order to continue to comply with applicable provisions of the Code and any regulations promulgated thereunder. Amendments may not materially adversely affect participants without the consent of the affected participants.

Certain Federal Income Tax Consequences

The following discussion of the U.S. federal income tax consequences of awards under the Plan is based on present federal tax laws and regulations and does not purport to be complete. Foreign, other federal, state and local taxes not described below may also apply.

Incentive Stock Options. If a stock option is an ISO, the employee does not realize income upon grant or exercise of the ISO, and no deduction is available to the company at such times, but the difference between the value of the shares of stock purchased on the exercise date and the exercise price paid is an item of tax preference for purposes of determining the employee’s alternative minimum tax. If the shares of stock purchased upon the exercise of an ISO are held by the employee for at least two years from the date of the grant and for at least one year after exercise, any resulting gain is taxed at long-term capital gains rates.

If the shares are disposed of before the expiration of that period, any gain on the disposition, up to the difference between the fair market value of the shares at the time of exercise and the exercise price of the ISO, is taxed at ordinary rates as compensation paid to the employee, and the company is entitled to a deduction for an equivalent amount. Any additional gain recognized from the disposition in excess of the fair market value of the shares at the time of exercise is treated as short- or long-term capital gain depending on how long the shares have been held.

Non-Qualified Stock Options. If a stock option is a NQSO, the participant does not realize income at the time of grant of the NQSO, and no deduction is available to the company at such time. At the time of exercise, ordinary income is realized by the participant in an amount equal to the difference between the exercise price and the fair market value of the shares of stock on the exercise date, and the company is entitled to a deduction for such amount. Upon disposition, any appreciation or depreciation of the shares after the date of exercise will be treated as short- or long-term capital gain or loss depending on how long the shares have been held.

Stock Awards. Upon the grant of an award of restricted shares of stock, no income is realized by the participant (unless the participant makes an election under Section 83(b) of the Code), and the company is not allowed a deduction at that time. When the restricted shares vest, the participant realizes ordinary income in an amount equal to the fair market value of the restricted shares at the time of vesting, and, subject to the limitations of Section 162(m) of the Code, the company is entitled to a corresponding deduction at such time. Upon disposition, any appreciation or depreciation of the shares after the time of vesting will be treated as short- or long-term capital gain or loss depending on how long the shares have been held.

If a participant makes a timely election under Section 83(b) of the Code, then the participant recognizes ordinary income in an amount equal to the fair market value of the restricted shares at the time of grant (instead of the time of vesting), and, subject to the limitations of Section 162(m) of the Code, the company is entitled to a corresponding deduction at such time. Upon disposition, any appreciation or depreciation of the shares after the time of grant will be treated as short- or long-term capital gain or loss depending on how long the shares have been held.

Restricted Stock Units. The grant of a restricted stock unit (RSU) will not result in taxable income to the participant. Provided that the grant sets forth the time and form of payment (as required under Section 409A of the Internal Revenue Code), at the time the RSU award is paid to the participant in the form of shares of Company stock, the participant will recognize ordinary income equal to the then-current fair market value of the Company stock) and the Company will be entitled to a corresponding tax deduction. Gains and losses realized by the participant upon disposition of any shares received upon payment of a stock-settled RSU will be treated as capital gains and losses, with the basis in such shares equal to the fair market value of the shares at the time of payment.

New Plan Benefits

We cannot determine the benefits or amounts that participants will receive and/or the number of shares of common stock that will be granted under the Plan because the Compensation Committee, in its discretion, will determine the amount and form of grants to eligible participants in any year. As of April [●], 2020, the closing price of a share of our common stock was $[●].

Board Recommendation

Approval of the amendment to the Amended and Restated PAR Technology Corporation 2015 Equity Incentive Plan requires the affirmative vote of a majority of votes cast and entitled to vote on this Proposal. The Board of Directors recommends a vote “For” approval of the Amended and Restated PAR Technology Corporation 2015 Equity Incentive Plan.

EQUITY COMPENSATION PLAN INFORMATION

The following table shows the number of shares of common stock authorized for issuance under our equity incentive plans as of December 31, 2019.

| Plan Category | | Number of Securities to be issued upon exercise of outstanding options, warrants and rights | | | Weighted-Average exercise price of outstanding options, warrants and rights | | | Number of Securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) | |

| | | (a) | | | (b) | | | (c) | |

| Equity compensation plans approved by security holders | | | 410,043 | | | $ | 14.50 | | | $ | 1,127,717 | (1)

|

| Equity compensation plans not approved by security holders | | | 67,273 | (2)

| | | --- | | | | --- | |

| Total | | | 477,316 | | | $ | 12.45 | | | $ | 1,127,717 | |

| (1) | This total reflects those shares available for issuance under the Amended and Restated PAR Technology Corporation 2015 Equity Incentive Plan. The ability to issue grants under our 2005 Equity Incentive Plan expired by its terms on December 28, 2015; however, awards previously granted under that plan remain valid and may extend beyond that date. |

| (2) | Reflects restricted stock units issued by us in connection with our assumption of awards granted by Restaurant Magic to its employees and contractors prior to the closing of our acquisition of Restaurant Magic in December 2019. The restricted stock units vest in equal annual installments over three (3) years, subject to continued service requirements. |

TRANSACTIONS WITH RELATED PERSONS

The Board of Directors has adopted a written “Related Party Transactions Policy & Procedure” (“Policy”), which provides that the Company will only enter into, ratify, or continue a related party transaction, when the Board, acting through the Nominating & Corporate Governance Committee, determines that the transaction is in the best interests of the Company and its stockholders. Pursuant to the Policy, the Nominating and Corporate Governance Committee reviews and either approves or disapproves all transactions or relationships in which the Company or any of its subsidiaries: (i) is a party, (ii) the amount of the transaction exceeds or is expected to exceed $120,000, and (iii) in which a director (director nominee), executive officer, a person who beneficially owns more than 5% of our common stock, or any immediate family member or affiliated entity of any of the foregoing persons (a “related party”), has a direct or indirect interest.

Except as set forth below, no transactions occurred during 2018 or 2019 in which the Company was a participant, the amount involved exceeded the lesser of $120,000 or 1% of the Company’s total assets at December 31, 2019 or December 31, 2018, and a related party had a direct or indirect material interest as defined in Item 404 of Regulation S-K of the Exchange Act, and no such related party transaction is currently proposed.

● Karen E. Sammon, a member of the immediate family of John W. Sammon, a Director and a beneficial owner of more than 10% of our common stock, served in the role of Chief of Staff of the Company from April 2017 until March 2019. Ms. Sammon’s total compensation for 2018 was $405,750, comprised of a base salary of $300,000, 3,098 shares of restricted stock, and a non-qualified stock option to purchase 4,495 shares of our common stock. Of the shares of restricted stock granted to Ms. Sammon in 2018, 1,191 shares vested ratably on December 31, 2018, December 31, 2019, and December 31, 2020 subject to Ms. Sammon’s continued employment with the Company on the applicable vesting dates, and 1,907 shares vest on December 31, 2020 to the extent annual performance targets are achieved; the non-qualified stock option vests ratably over three years beginning on the one-year anniversary of the date of grant, for an exercise price of $22.18 per share. The aggregate grant date fair value of equity awards granted to Ms. Sammon in 2018 was $105,750. In connection with Ms. Sammon’s departure from the Company in March 2019, the Company entered into an agreement with Ms. Sammon; in consideration of a general release of claims in favor of the Company, we agreed to pay Ms. Sammon $138,461, payable in equal amounts in accordance with the Company’s normal payroll cycle, permit Ms. Sammon to vest in the remaining 33.33% of her May 5, 2016 stock option (16,667 shares), permit Ms. Sammon to vest on December 31, 2020 in 33.33% of the performance vesting shares of restricted stock granted to Ms. Sammon in August 2018 linked to the performance year ended December 31, 2018, pay the current employer portion of COBRA coverage through the earlier of December 31, 2019 and Ms. Sammon’s securing substitute medical coverage; provide Ms. Sammon with career coaching services up to $1,500 per month until the earlier of December 31, 2019 and Ms. Sammon’s subsequent employment, and pay Ms. Sammon 120 hours of earned, but unused vacation. Except as to the remaining 33.33% of her May 5, 2016 stock option and 33.33% of the August 2018 performance vesting shares linked to the performance year ended December 31, 2018, all unvested equity awards granted to Ms. Sammon were forfeited.

● John W. Sammon, III, a member of the immediate family of John W. Sammon, became an employee of ParTech, Inc. on October 13, 2014, serving as General Manager & Senior Vice President, SureCheck, until his departure from the Company in September 2018. Mr. Sammon’s total compensation for 2018 was $183,164, comprised of a base salary of $138,164, 1,318 shares of restricted stock, and a non-qualified stock option to purchase 1,913 shares of our common stock. Of the shares of restricted stock granted to Mr. Sammon in 2018, 507 shares vested ratably on December 31, 2018, December 31, 2019, and December 31, 2020 subject to Mr. Sammon’s continued employment with the Company on the applicable vesting dates, and 811 shares vest on December 31, 2020 to the extent annual performance targets are achieved; the non-qualified stock option vests ratably over three years beginning on the one-year anniversary of the date of grant, for an exercise price of $22.18 per share. The aggregate grant date fair value of equity awards granted to Mr. Sammon in 2018 was $45,000. In connection with Mr. Sammon’s departure, all unvested equity awards were forfeited and, in consideration of a general release of claims in favor of the Company, the Company paid Mr. Sammon $47,307.

● During 2018, Karen E. Sammon and John W. Sammon, III were the principals of Sammon and Sammon, LLC, doing business as Paragon Racquet Club. For a portion of 2018, Paragon Racquet Club leased a building from us on a month-to-month basis at the base rate of $9,775 per month (or an aggregate annual amount of $39,100) and provided complimentary memberships to the Company’s local employees, which were valued at $6,350. Expenses related to the facility were $74,000 during 2018. The Nominating and Corporate Governance Committee reviewed this arrangement and, after consulting with Ms. Sammon and Mr. Sammon, terminated this arrangement as of April 30, 2018.

PROPOSAL 5 – RATIFICATION OF THE APPOINTMENT OF DELOITTE & TOUCHE LLP

AS OUR INDEPENDENT AUDITORS

Independent Public Accountants. The Audit Committee has appointed Deloitte & Touche LLP (“Deloitte & Touche”) as the Company’s independent auditor for its fiscal year ending December 31, 2020. BDO USA, LLP (“BDO”) served as the Company’s independent auditor for its fiscal years ended December 31, 2019 and December 31, 2018.

As previously reported on a Current Report on Form 8-K filed with the SEC on March 24, 2020 (“Current Report”), on March 19, 2020, the Audit Committee approved the dismissal of BDO and approved the appointment of Deloitte & Touche as our independent auditor for the fiscal year ending December 31, 2020.

BDO’s audit report on the Company’s consolidated financial statements as of and for the fiscal years ended December 31, 2019 and December 31, 2018 did not contain any adverse opinion or a disclaimer of opinion, and were not qualified or modified as to uncertainty, audit scope or accounting principles, except that BDO’s audit report on the Company’s consolidated financial statements as of and for the fiscal year ended December 31, 2018 contained an explanatory paragraph stating that “As discussed in Note 1 to the consolidated financial statements, the Company has suffered recurring losses from operations, has defaulted on covenants related to its credit agreement, and has not generated sufficient cash flows from operations that raise substantial doubt about its ability to continue as a going concern. Management’s plans in regard to these matters are also described in Note 1. The consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty.”

During the fiscal years ended December 31, 2019 and December 31, 2018, and in the subsequent interim period through March 19, 2020, there were no disagreements with BDO (within the meaning of Item 304(a)(1)(iv) of Regulation S-K of the rules and regulations (“Regulation S-K”) of the SEC) on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure that if not resolved to BDO’s satisfaction, would have caused BDO to make reference thereto in its reports.

The Company provided BDO with a copy of the foregoing disclosures and a copy of the Current Report and requested that BDO furnish the Company with a copy of its letter addressed to the SEC stating whether BDO agreed with such disclosures. A copy of BDO’s letter dated March 24, 2020 is filed as Exhibit 16.1 to the Current Report. BDO declined to comment or provide further clarity on the disclosures contained in this Proxy Statement.

On March 19, 2020, the Audit Committee approved the appointment of Deloitte & Touche as the Company’s new independent registered public accounting firm for its fiscal year ending December 31, 2020 and related interim periods. The Company entered into an engagement letter with Deloitte & Touche dated March 23, 2020.

During the Company’s two most recent fiscal years ended December 31, 2019 and December 31, 2018, and for the subsequent interim period through March 23, 2020, neither the Company nor anyone on its behalf consulted Deloitte & Touche regarding any of the matters set forth in Item 304(a)(2)(i) or (ii) of Regulation S-K.

Ratification of the Appointment of Deloitte & Touche LLP. Although your vote to ratify the appointment of Deloitte & Touche is not binding on the Company, the Audit Committee will consider your vote in determining the appointment of our independent auditors for next year. The Audit Committee reserves the right, in its sole discretion, to change an appointment at any time during the year if it determines that such a change would be in our best interests.

Ratification of the appointment of Deloitte & Touche as our independent auditors for 2020 requires the affirmative vote of a majority of votes cast and entitled to vote on this Proposal.

The Board of Directors recommends a vote “For” ratification of the appointment of Deloitte & Touche LLP as the Company’s independent auditors for 2020.

PRINCIPAL ACCOUNTING FEES AND SERVICES

The following table presents fees billed to the Company for the years ended December 31, 2019 and December 31, 2018 by BDO USA, LLP.

| | | Fiscal Year Ended | |

| Type of Fees | | 2019 | | | 2018 | |

Audit Fees(1) | | $ | 717,530 | | | $ | 716,965 | |

| | | | | | | | | |

| Audit-Related Fees | | | | | | | | |

| | | | | | | | | |

| Tax Fees | | | | | | | | |

| All Other Fees | | | | | | | | |

| Total: | | $ | 717,530 | | | $ | 716,965 | |

| | (1) | Audit Fees are fees for professional services rendered for the audit of the Company’s annual financial statements and review of the interim financial statements included in quarterly reports and services that are normally provided by the auditor in connection with statutory and regulatory filings or engagements. For the year ended December 31, 2019, this included fees related to a comfort letter and consents issued for certain registration statements. |

The Audit Committee has established a policy to pre-approve all auditing services and permitted non-audit services, including the fees and terms thereof, performed by the Company’s independent auditors. As such, all auditing services and permitted non-audit services, including the fees and terms thereof, performed by BDO were pre-approved by the Audit Committee.

One or more representatives of Deloitte & Touche are expected to attend the Annual Meeting, where they will have the opportunity to make a statement, if they so desire, and be available to answer appropriate questions. We do not anticipate that representatives of BDO will attend the Annual Meeting.

Stockholder Proposals

We will include in our proxy materials for our 2021 annual meeting of stockholders any stockholder proposal that complies with Rule 14a-8 under the Exchange Act. Rule 14a-8 requires that we receive such proposals not less than 120 days prior to the one-year anniversary of the date of this Proxy Statement, or by December [●], 2020. If the proposal is in compliance with all of the requirements set forth in Rule 14a-8, we will include the stockholder proposal in our proxy statement and place it on the form of proxy issued for the 2021 annual meeting. Stockholder proposals submitted for inclusion in our proxy materials should be mailed to the following address: Corporate Secretary, PAR Technology Corporation, 8383 Seneca Turnpike, New Hartford, New York 13413-4991.

Stockholder Nominations of Directors and Other Annual Meeting Business

As described in our bylaws, stockholders may bring nominations for directors and other items of business before the 2021 annual meeting of stockholders only with timely and proper notice to the Company. To be considered timely, our Corporate Secretary must receive notice of stockholder nominations for directors and/or other items of business not more than 90 days nor less than 60 days before the 2021 annual meeting of stockholders. However, in the event the Company provides less than 70 days’ notice or prior public disclosure of the date of the 2021 annual meeting of stockholders, a stockholder’s notice must be received not later than the close of business on the tenth (10th) day following the date on which the Company gives such notice or makes prior public disclosure.

Based on an assumed annual meeting date of June 4, 2021, the deadline for stockholders to provide timely notice of director nominations and/or other items of business will be no earlier than March 6, 2021, and no later than April 5, 2021. Stockholders must mail written notice that complies with all requirements set forth in our bylaws to the following address: Corporate Secretary, PAR Technology Corporation, 8383 Seneca Turnpike, New Hartford, New York 13413-4991. We recommend all submissions be sent by Certified Mail — Return Receipt Requested.

| | By Order of the Board of Directors, |

| | |

| | Cathy A. King |

| | Corporate Secretary |

| April [●], 2020 | |

A copy of our Annual Report on Form 10-K for the year ended December 31, 2019, including financial statements thereto but not including exhibits, as filed with the SEC on March 16, 2020, is available without charge upon written request to: PAR Technology Corporation, Attn: Investor Relations, 8383 Seneca Turnpike, New Hartford, New York 13413.

CERTIFICATE OF AMENDMENT

TO THE

CERTIFICATE OF INCORPORATION

OF

PAR TECHNOLOGY CORPORATION

PAR Technology Corporation, a corporation organized and existing under the laws of the State of Delaware, does hereby certify that:

1. The name of the corporation is PAR Technology Corporation (the “Corporation”).

2. The Certificate of Incorporation of the Corporation is hereby amended as follows:

The section designated “Fourth”, paragraph “1.” in the Certificate of Incorporation is hereby amended to read in its entirety as follows:

FOURTH

1. The total number of shares of capital stock which the Corporation shall have the authority to issue is fifty-nine million (59,000,000) shares of stock, par value $0.02 per share, consisting of fifty-eight million (58,000,000) shares of Common Stock, and one million (1,000,000) shares of Preferred Stock.

3. The amendment of the Certificate of Incorporation herein certified has been duly adopted by the Corporation’s Board of Directors and stockholders in accordance with the provisions of Section 242 of the General Corporation Law of the State of Delaware.

IN WITNESS WHEREOF, the Corporation has caused this Certificate of Amendment to be signed this _____ day of __________, 2020.

| | |

| | Savneet Singh, Chief Executive Officer and President |

APPENDIX B

AMENDED AND RESTATED

PAR TECHNOLOGY CORPORATION

2015 EQUITY INCENTIVE PLAN

(Effective Date: June 10, 2019, as amended June [●], 2020)

1 Purpose and Eligibility. The purpose of this Amended and Restated 2015 Equity Incentive Plan (the “Plan”) of PAR Technology Corporation, a Delaware corporation (the “Company”) is to provide stock options, stock issuances and other equity interests in the Company (each, an “Award”) to employees, officers, directors, consultants and advisors of the Company and its Subsidiaries. Any person to whom an Award has been granted under the Plan is called a “Participant”. Except where the context otherwise requires, the term “Company” shall include any of the Company’s present or future Subsidiary. Additional definitions are contained in Section 10 .

2. Administration.

a. Administration by Board of Directors. The Plan will be administered by the Board of Directors of the Company (the “Board”). The Board, in its sole discretion, shall have the authority to grant and amend Awards. The Board shall have authority, subject to the express limitations of the Plan, (i) to construe and determine the respective Award Agreements (defined below), Awards and the Plan, (ii) to prescribe, amend and rescind rules and regulations relating to the Plan and any Awards, (iii) to determine the terms and conditions of the Awards, and (iv) to make all other determinations or certifications and take such other actions that, in the judgment of the Board, are necessary or desirable for the administration and interpretation of the Plan. The Board may correct any defect or supply any omission or reconcile any inconsistency in the Plan or in any Award Agreement in the manner and to the extent it shall deem expedient to carry-out the Plan or to effectuate any Award and it shall be the sole and final judge of such expediency. All decisions by the Board shall be final and binding on all interested persons. A Participant or other holder of an Award may contest a decision or action by the Board or other person exercising authority under the Plan only on the grounds that such decision or action was arbitrary or capricious or was unlawful, and any review of such decision or action shall be limited to determining whether the Board’s or such other person’s decision or action was arbitrary or capricious or was unlawful.

b. Appointment of Committee. To the extent permitted by applicable law, the Board may delegate any or all of its powers under the Plan to the Compensation Committee of the Board (the “Committee”). All references in the Plan to the “Board” shall include the Committee to the extent that some or all of such powers have been delegated to the Committee.

c. Delegation to Executive Officers. To the extent permitted by applicable law, the Board or Committee may delegate to one or more executive officers of the Company the power to grant Awards and exercise such other powers under the Plan as the Board or Committee may determine, provided that the Board or Committee shall fix the maximum number of Awards to be granted and the maximum number of shares of Common Stock issuable to any one Participant pursuant to Awards granted by such executive officers, and shall provide that no authorized executive officer may designate himself or herself or any Reporting Person (as defined below) as a recipient of any Award. Any actions taken by any executive officer of the Company pursuant to such delegation of authority shall be deemed to have been taken by the Board or the Committee, as applicable.

d. Applicability of Section Rule 16b-3. The Plan shall be administered in a manner consistent with Rule 16b-3 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or any successor rules (“Rule 16b-3”), such that all Awards to Reporting Persons shall be exempt under such rule. Those provisions of the Plan that make express reference to Rule 16b-3 or are required in order for certain transactions to qualify for exemption under Rule 16b-3 shall apply only to such persons as are required to file reports under Section 16(a) of the Exchange Act (a “Reporting Person”).

e. Applicability of Section 162 (m). Any provisions in the Plan to the contrary notwithstanding, whenever the Board is authorized to exercise its discretion in the administration or amendment of the Plan or any Award hereunder or otherwise, the Board may not exercise such discretion in a manner that would cause any outstanding Award that would otherwise qualify as performance-based compensation under Section 162(m) of the Code to fail to so qualify under Section 162(m).

3. Stock Available for Awards .

a. Number of Shares. Subject to adjustment under Section 3(d) , the aggregate number of shares of Common Stock that may be issued under the Plan is 2,700,000, of which 860,243 shares remain available as of April [●], 2020; 100% of such shares of Common Stock may be issued as Incentive Stock Options. If any Award expires, or is terminated, surrendered or forfeited, in whole or in part, the unissued Common Stock covered by such Award shall again be available for the grant of Awards under the Plan. Shares to be delivered under the Plan may consist, in whole or in part, of authorized but unissued Common Stock or treasury stock.

b. Per-Participant Limit. Subject to adjustment under Section 3(d) , no Participant may be granted Awards during any one fiscal year to purchase more than the number of shares of Common Stock that are authorized for issuance under the Plan.

c. Outside Director Awards. The aggregate dollar value of Awards (based on the grant date Fair Market Value of any such Awards) granted under the Plan during any calendar year to any non-employee director of the Board (each an “Outside Director”) shall not exceed $200,000; provided, however, that in the calendar year in which an Outside Director first joins the Board or is first designated as an Outside Director, the aggregate dollar value of Awards granted to the Outside Director may be up to 200% of the foregoing limit.

d. Adjustment to Stock. Subject to Section 7 , in the event of a Capitalization Adjustment, the Board or Committee will appropriately and proportionately adjust (i) the number and class(es) of Stock available for Awards under the Plan and the per-Participant share limit; (ii) the class(es) and maximum number of shares of Stock that may be issued pursuant to the exercise of Incentive Stock Options; and (iii) the class(es) and number of shares of Stock or other property and value (including the price per share of Stock) subject to outstanding Awards. The Board or Committee will make such adjustments, and its determination will be final, binding and conclusive.

e. Substitute Awards. To the maximum extent permitted by applicable law and any securities exchange or NYSE rule, Awards granted or Stock issued by the Company in assumption of, or in substitution or exchange for, awards previously granted, or the right or obligation to make future awards, by a company acquired by the Company or any Subsidiary, or with which the Company or any Subsidiary combines (“Substitute Awards”) shall not be charged against the limitation provided for in Section 3(a) . The terms and conditions of the Substitute Awards may vary from the terms and conditions set forth in the Plan to the extent the Board or Committee may deem appropriate to conform, in whole or in part, to the provisions of the awards being assumed, substituted or exchanged. Additionally, in the event that a company acquired by the Company or any Subsidiary, or with which the Company or any Subsidiary combines, has shares available under a pre-existing plan approved by the acquired company’s stockholders and not adopted in contemplation of such acquisition or combination, such shares (as adjusted, to the extent appropriate, using the exchange ratio or other adjustment or valuation ratio or formula used in such acquisition or combination to determine the consideration payable to the holders of the same class of shares of the company party to such acquisition or combination) may be used for Awards under the Plan and shall not reduce the shares of Stock authorized for issuance under the Plan; provided that Awards using such available shares shall not be made after the date awards or grants could have been made under the terms of the pre-existing plan, absent the acquisition or combination, and shall only be made to individuals who were employees of such acquired or combined company before such acquisition or combination or to any employee who first commences employment with the Company or any Subsidiary after such acquisition or combination.

4. Stock Options.

a. General. The Board or Committee may grant options to purchase shares of Common Stock (each, an “Option”) and determine the number of shares of Common Stock to be covered by each Option, the exercise price of each Option and the conditions and limitations applicable to the exercise of each Option and the shares of Common Stock issued upon the exercise of each Option, including, but not limited to, vesting provisions, and restrictions relating to applicable federal or state securities laws. Each Option will be evidenced by a Stock Option Agreement (a “Stock Option Agreement”).

b. Incentive Stock Options. An Option that the Board or Committee intends to be an incentive stock option (an “Incentive Stock Option”) as defined in Section 422 of the Code (“Section 422”) shall be granted only to an employee of the Company or a Subsidiary and shall be subject to and shall be construed consistently with the requirements of Section 422 and regulations thereunder. Neither the Board, Committee nor the Company shall have any liability if an Option or any part thereof that is intended to be an Incentive Stock Option does not qualify as such. An Option or any part thereof that does not qualify as an Incentive Stock Option is referred to herein as a “Nonstatutory Stock Option” or “Non-Qualified Stock Option”.

c. Dollar Limitation. For so long as the Code shall so provide, Options granted to any employee under the Plan (and any other incentive stock option plans of the Company) which are intended to qualify as Incentive Stock Options shall not qualify as Incentive Stock Options to the extent that such Options, in the aggregate, become exercisable for the first time in any one calendar year for shares of Common Stock with an aggregate Fair Market Value (determined as of the respective date or dates of grant) of more than $100,000. The amount of Incentive Stock Options which exceed such $100,000 limitation shall be deemed to be Non-Qualified Stock Options. For the purpose of this limitation, unless otherwise required by the Code or determined by the Board or Committee, Options shall be taken into account in the order granted, and the Board or Committee may designate that portion of any Incentive Stock Option that shall be treated as a Non-Qualified Stock Option in the event that the provisions of this paragraph apply to a portion of any Option. The designation described in the preceding sentence may be made at such time as the Board or Committee considers appropriate, including after the issuance of the Option or at the time of its exercise.

d. Exercise Price. The Board or Committee shall establish the exercise price (or determine the method by which the exercise price shall be determined) at the time each Option is granted and specify the exercise price in the applicable Stock Option Agreement, provided, however, in no event may the per share exercise price be less than the Fair Market Value (as defined below) of the Common Stock on the date of grant. In the case of an Incentive Stock Option granted to a Participant who, on the date of grant, owns Common Stock representing more than ten percent (10%) of the voting power of all classes of stock of the Company, the exercise price shall be not less than 110% of the Fair Market Value of the Common Stock on the date of grant.

e. Duration of Options. Each Option shall be exercisable at such times and subject to such terms and conditions as the Board or Committee may specify in the applicable Stock Option Agreement, but no Option will be exercisable more than ten (10) years from the date of grant; provided, in the case of an Incentive Stock Option granted to a Participant who, on the date of grant, owns Common Stock representing more than ten percent (10%) of the voting power of all classes of stock of the Company, the term of the Option shall be no longer than five (5) years from the date of grant.

f. Exercise of Option. Options may be exercised only by delivery to the Company of a written notice of exercise signed by the proper person together with payment in full as specified in Section 4(g) and the Stock Option Agreement for the number of shares of Common Stock for which the Option is exercised.

g. Payment Upon Exercise. Common Stock purchased upon the exercise of an Option shall be paid for by one or any combination of the following forms of payment as permitted by the Board or Committee in its sole and absolute discretion:

i. by cash or check payable to the order of the Company;

ii. only if the Common Stock is then publicly traded, by delivery of an irrevocable and unconditional undertaking by a creditworthy broker to deliver promptly to the Company sufficient funds to pay the exercise price, or delivery by the Participant to the Company of a copy of irrevocable and unconditional instructions to a creditworthy broker to deliver promptly to the Company cash or a check sufficient to pay the exercise price;

iii. by the delivery of shares of Common Stock owned by the Participant having a Fair Market Value on the date of exercise equal to the exercise price;

iv. by the surrender of shares of Common Stock issuable upon the exercise of the Option having a Fair Market Value on the date of exercise equal to the exercise price; or

v. payment of such other lawful consideration as the Board may determine.

The Board or Committee shall determine in its sole and absolute discretion and subject to the securities laws and the Company’s insider trading policy whether to accept consideration other than cash.

h. Determination of Fair Market Value. For purposes of the Plan, “Fair Market Value” will be determined as follows: (i) if the Common Stock trades on a national securities exchange, the closing sale price (for the primary trading session) for a share of Common Stock on the date of grant; or (ii) if the Company Stock does not trade on any such exchange, the average of the closing bid and asked prices for a share of Common Stock on the date of grant as reported by an over-the-counter marketplace designated by the Board; or (iii) if the Common Stock is not publicly traded, the Board will determine the Fair Market Value of a share of Common Stock for purposes of the Plan using any measure of value it determines to be appropriate (including, as it considers appropriate, relying on appraisals). For any date that is not a trading day, the Fair Market Value of a share of Common Stock for such date will be determined by using the closing sale price or average of the bid and asked prices, as applicable, for the immediately preceding trading day and with the timing formulas specified in clauses (i) and (ii) above adjusted accordingly. The Board has sole discretion to determine the Fair Market Value of a share of Common Stock for purposes of the Plan, and all Awards are conditioned on the Participants’ agreement that the Board’s determination is conclusive and binding even though others might make a different determination.

i. No Repricing of Options or Stock Appreciation Rights (“SAR”). Unless otherwise approved by the Company’s stockholders, the Board or the Committee may not “reprice” any Option or SAR. For purposes of this Section 4(i) , “reprice” means any of the following or any other action that has the same effect: (i) amending an Option or SAR to reduce its exercise price or base price, (ii) canceling an Option or SAR at a time when its exercise price or base price exceeds the Fair Market Value of a share of Common Stock in exchange for cash or an Option, SAR, or other equity award or (iii) taking any other action that is treated as a repricing under GAAP, provided that nothing in this Section 4(i) shall prevent the Board or the Committee from making adjustments pursuant to Section 3(d) .

5. Restricted Stock .

a. Grants. The Board or Committee may grant Awards entitling recipients to acquire shares of Common Stock subject to such terms and conditions as shall be established by the Board or Committee consistent with the Plan (each, a “Restricted Stock Award”). Each Restricted Stock Award will be evidenced by a Restricted Stock Award Agreement (a “Restricted Stock Award Agreement”).

b. Terms and Conditions; Stock Certificates. The Board or Committee shall determine the terms and conditions of any Restricted Stock Award. Any stock certificates issued in respect of shares of a Restricted Stock Award shall be registered in the name of the Participant and, unless otherwise determined by the Board or Committee, deposited by the Participant, together with a stock power endorsed in blank, with the Company (or its designee). After the expiration of the applicable restrictions, the Company (or such designee) shall deliver the certificates no longer subject to such restrictions to the Participant or, if the Participant has died, to his or her Designated Beneficiary. “Designated Beneficiary” means (i) the beneficiary designated, in a manner determined by the Board or Committee, by a Participant to receive amounts due or exercise rights of the Participant in the event of the Participant’s death or (ii) in the absence of an effective designation by a Participant, the Participant’s estate.

6. Other Stock-Based Awards. The Board or Committee shall have the right to grant other Awards based upon the Common Stock having such terms and conditions as the Board or Committee may determine, including, without limitation, the grant of shares based upon certain conditions, the grant of securities convertible into Common Stock and the grant of SARs, phantom stock awards or stock units; provided, however, that any such grant that would be subject to Section 409A of the Code, shall in all respects be compliant with Section 409A.

7. General Provisions Applicable to Awards .