UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | | Preliminary Proxy Statement |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | | Definitive Proxy Statement |

| ¨ | | Definitive Additional Materials |

| ¨ | | Soliciting Material Pursuant to §240.14a-12 |

First Citizens Bancorporation, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

First Citizens Bancorporation, Inc.

1225 Lady Street

Columbia, South Carolina 29201

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

The Annual Meeting of Shareholders of First Citizens Bancorporation, Inc. will be held at 2:00 p.m. on Thursday, April 21, 2005, in the third floor Board Room of the First Citizens Service Center located at 1314 Park Street, Columbia, South Carolina.

The purposes of the meeting are:

| | (1) | | Election of Directors: To elect 19 directors for one-year terms; and |

| | (2) | | Other Business: To transact any other business properly presented for action at the Annual Meeting. |

You are invited to attend the Annual Meeting in person. However, even if you plan to attend, we ask that you complete, sign and date the enclosed appointment of proxy and return it to us as soon as you can in the accompanying envelope. Doing that will help us ensure that your shares are represented and that a quorum is present at the Annual Meeting. Even if you sign an appointment of proxy, you may still revoke it later or attend the Annual Meeting and vote in person.

This notice and the enclosed Proxy Statement and form of appointment of proxy are being mailed to our shareholders on or about March 24, 2005.

By Order of the Board of Directors

Charles D. Cook

Corporate Secretary

First Citizens Bancorporation, Inc.

1225 Lady Street

Columbia, South Carolina 29201

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

General

This Proxy Statement is dated March 24, 2005, and is being furnished to our shareholders in connection with our solicitation of appointments of proxy in the enclosed form for use at the 2005 Annual Meeting of our shareholders and at any adjournments of the meeting. The Annual Meeting will be held in the third floor Board Room of the First Citizens Service Center located at 1314 Park Street, Columbia, South Carolina, at 2:00 p.m. on Thursday, April 21, 2005.

In this Proxy Statement, the terms “you,” “your” and similar terms refer to the shareholder receiving it. The terms “we,” “us,” “our” and similar terms refer to First Citizens Bancorporation, Inc. “FCBank,” and “Exchange Bank” refer to our bank subsidiaries, First Citizens Bank and Trust Company, Inc. and The Exchange Bank of South Carolina, Inc., and the “Banks” refers to those subsidiaries collectively.

Solicitation and Voting of Proxies

A form of “appointment of proxy” is included with this Proxy Statement that provides for you to name Jim B. Apple, Peter M. Bristow, and Charles D. Cook to act as your “Proxies” and vote your shares at the Annual Meeting. We ask that you sign and date an appointment of proxy and return it to us in the enclosed envelope so that your shares will be represented at the meeting.

If you sign an appointment of proxy and return it to us before the Annual Meeting, the shares of our voting securities that you hold of record will be voted by the Proxies according to your instructions. If you sign and return an appointment of proxy but do not give any voting instructions, then your shares will be voted by the Proxies“FOR” the election of each of the 19 nominees for director named in Proposal 1 below. If, before the Annual Meeting, any nominee named in Proposal 1 becomes unable or unwilling to serve as a director for any reason, the Proxies will have the discretion to vote for a substitute nominee named by our Board of Directors. We are not aware of any other business that will be brought before the Annual Meeting but, if any other matter is properly presented for action by our shareholders, the Proxies will be authorized to vote your shares according to their best judgment. The Proxies also will be authorized to vote your shares according to their best judgment on matters incident to the conduct of the meeting, including adjournments.

Revocation of Appointment of Proxy

If you sign and return an appointment of proxy, you can revoke it at any time before the voting takes place at the Annual Meeting either by filing with our Secretary a written instrument revoking it or an executed appointment of proxy dated as of a later date, or by attending the Annual Meeting and announcing your intention to vote in person.

Expenses and Methods of Solicitation

We will pay all costs of our solicitation of appointments of proxy for the Annual Meeting, including the costs of preparing and mailing this Proxy Statement. In addition to solicitation by mail, the Banks’ and our directors, officers and employees may solicit appointments of proxy, personally or by telephone, without additional compensation.

Record Date

The close of business on March 4, 2005, is the “Record Date” for determining which shareholders are entitled to receive notice of and to vote at the Annual Meeting. You must have been a record holder of our voting securities on that date in order to be eligible to vote at the meeting.

Voting Securities

On the Record Date, our voting securities consisted of (1) 862,505 outstanding shares of common stock (“Common Stock”), (2) 49,771 outstanding shares of $50 par value preferred stock (“$50 Par Preferred,” which includes 6,596 shares of Series A, 11,810 shares of Series B, and 31,365 shares of Series F, preferred stock), (3) 5,838 outstanding shares of $20 par value Series C preferred stock (“$20 Par Preferred”), and (4) 8,113 outstanding shares of no par value Series G preferred stock (“No Par Preferred”). Under South Carolina law, our Common Stock, $50 Par Preferred, $20 Par Preferred and No Par Preferred are considered to be separate classes of stock. However, unless class voting is required by law, each outstanding share of our voting securities is entitled to one vote, without distinction as to class or series, on each director to be elected and on each other matter voted on by shareholders at the Annual Meeting. Class voting rights will not apply in the election of directors at the Annual Meeting.

Voting Procedures; Votes Required for Approval

Our directors are elected by a plurality of the votes cast in elections. In the election of directors at the Annual Meeting, the 19 nominees receiving the highest numbers of votes will be elected. Abstentions and broker non-votes will have no effect in the voting for directors.

In the election of directors, shareholders may cumulate their votes by multiplying the number of shares they are entitled to vote by the number of directors to be elected and then casting that total number of votes for any one nominee or distributing the total number among two or more nominees. A shareholder who intends to cumulate his votes must either (1) give written notice of that intention, not less than 48 hours before the time fixed for the Annual Meeting, to one of our officers (who must announce that intention in the Annual Meeting), or (2) announce that intention in the Annual Meeting before the voting for directors begins. Upon the announcement that any shareholder intends to vote cumulatively, all shareholders will be entitled to cumulate their votes. The form of appointment of proxy that accompanies this Proxy Statement authorizes the Proxies, at their discretion, to distribute the votes they may cast equally or unequally among the nominees named in Proposal 1 (or their substitutes) and in a manner which would tend to elect the greatest number of those nominees as the number of votes entitled to be cast by the Proxies would permit.

Beneficial Ownership of Securities

Principal Shareholders. The following table describes the beneficial ownership of our voting securities on the Record Date by persons known by us to own, beneficially or of record, 5% or more of a class of our voting securities.

| | | | | | | | | | | |

Title of class

| | Name and address beneficial owner

| | Amount and nature of beneficial ownership (1)

| | | Percentage of class (2)

| | | Percentage of total votes (2)

| |

Common Stock | | Hope Holding Connell

3128 Smoketree Ct.

Raleigh, NC 27604 | | 56,044 | (3) | | 6.50 | % | | 6.05 | % |

| | | Frank B. Holding

409 East Market St.

Smithfield, NC 27577 | | 367,475 | (4) | | 42.61 | % | | 39.67 | % |

| | | Lewis R. Holding

Columbia Rd.

Lyford Cay, Bahamas | | 191,269 | (5) | | 22.18 | % | | 20.65 | % |

| | | North State Trustees

128 South Tryon St.

Charlotte, NC 28202 | | 53,886 | (6) | | 6.25 | % | | 5.82 | % |

$50 Par Preferred | | Pearl S. Arant

P.O. Box 97

Pageland, SC 29729 | | 3,504 | | | 7.04 | % | | .38 | % |

| | | Frank B. Holding

409 East Market St.

Smithfield, NC 27577 | | 3,556 | (4) | | 7.14 | % | | .38 | % |

| | | Scott W. Wells

2920 Oceola St.

Columbia, SC 29205 | | 3,540 | | | 7.11 | % | | .38 | % |

2

| | | | | | | | | | | |

Title of class

| | Name and address beneficial owner

| | Amount and nature of beneficial ownership (1)

| | | Percentage of class (2)

| | | Percentage of total votes (2)

| |

$20 Par Preferred | | Carson Holding Brice

2416 Oxford Rd.

Raleigh, NC 27608 | | 447 | (7) | | 7.66 | % | | .05 | % |

| | | Olivia B. Holding

2700 Cambridge Rd.

Raleigh, NC 27608 | | 427 | (7) | | 7.31 | % | | .05 | % |

| | | Hope Holding Connell

3128 Smoketree Ct.

Raleigh, NC 27604 | | 427 | (3) | | 7.31 | % | | .05 | % |

| | | Frank B. Holding, Jr.

3128 Smoketree Ct.

Raleigh, NC 27604 | | 494 | (8) | | 8.46 | % | | .05 | % |

| | | Claire Holding Bristow

1524 Adger Rd.

Columbia, SC 29205 | | 448 | (7) | | 7.67 | % | | .05 | % |

| | | Carolina Bonded Storage Co.

P.O. Box 1089

Columbia, SC 29202 | | 462 | | | 7.91 | % | | .05 | % |

| | | William B. Jennings

900 Bruce Rd.

Cayce, SC 29033 | | 311 | | | 5.33 | % | | .03 | % |

| | | Frank B. Holding

409 East Market St.

Smithfield, NC 27577 | | 2,274 | (4) | | 38.95 | % | | .25 | % |

| | | Scott W. Wells

2920 Oceola St.

Columbia, SC 29202 | | 583 | | | 9.99 | % | | .06 | % |

No Par Preferred | | Peter M. Bristow

1225 Lady St.

Columbia, SC 29201 | | 1,257 | (9) | | 15.49 | % | | .14 | % |

| | | Frank B. Holding

409 East Market St.

Smithfield, NC 27577 | | 6,107 | (4) | | 75.27 | % | | .66 | % |

| | | John H. Connell

1723 Canterbury Rd.

Raleigh, NC 27608 | | 850 | (7) | | 10.48 | % | | .09 | % |

| | | Olivia B. Holding

2700 Cambridge Rd.

Raleigh, NC 27608 | | 3,400 | (10) | | 41.91 | % | | .37 | % |

| (1) | | Except as otherwise noted, and to the best of our knowledge, each named individual exercises sole voting and investment power with respect to all listed shares. |

| (2) | | “Percentage of class” reflects the listed shares as a percentage of the total number of outstanding shares of that class of stock.“Percentage of total votes” reflects the votes represented by the listed shares as a percentage of the aggregate votes represented by all outstanding shares of our voting securities. |

| (3) | | Includes an aggregate of 4,614 shares of Common Stock held by Ms. Connell’s spouse or by them as custodian for their children and with respect to which shares she disclaims beneficial ownership, and 35,000 shares held by a corporation which she may be deemed to control and with respect to which shares she may be deemed to exercise shared voting and investment power. Of the listed shares, 21,044 shares of Common Stock and 427 shares of $20 Par Preferred are included in the shares shown as beneficially owned by Mr. F. Holding, and 35,000 shares of Common Stock also are included in the shares shown as beneficially owned by Mr. L. Holding. |

| (4) | | Includes an aggregate of 56,626 shares of Common Stock held by certain corporations and other entities which Mr. F. Holding may be deemed to control and with respect to which shares he may be deemed to exercise shared |

3

| | voting and investment power, and an aggregate of 156,926 shares of Common Stock, 3,556 shares of $50 Par Preferred, 2,274 shares of $20 Par Preferred and 6,107 shares of No Par Preferred held by or in trust for Mr. Holding’s spouse, adult children and their spouses, and with respect to which shares he disclaims beneficial ownership. The listed shares, include shares that also are shown as beneficially owned by other individuals in the table as follows: 21,044 shares of Common Stock and 427 shares of $20 Par Preferred also shown as beneficially owned by Ms. Connell, 47,393 shares of Common Stock also shown as beneficially owned by Mr. L. Holding; 1,257 shares of No Par Preferred also shown as beneficially owned by Mr. Bristow; 447 share of $20 Par Preferred also shown as beneficially owned by Ms. Brice; 494 shares of $20 Par Preferred also shown as beneficially owned by Mr. F. Holding, Jr.; 3,400 shares of No Par Preferred also shown as beneficially owned by Ms. O. Holding; 448 shares of Par Preferred also shown as beneficially owned by Ms. Bristow; and 850 shares of No Par Preferred also shown as beneficially owned by Mr. Connell. |

| (5) | | Includes 81,980 shares of Common Stock held by certain corporations and other entities which Mr. L. Holding may be deemed to control and with respect to which shares he may be deemed to exercise shared voting and investment power, and an aggregate of 11,286 shares of Common Stock held by or in trust for Mr. Holding’s spouse and adult daughter and with respect to which shares he disclaims beneficial ownership. Of the listed shares, 35,000 shares of Common Stock also are included in the shares shown as beneficially owned by Ms. Connell, 47,393 shares also are included in the shares shown as beneficially owned by Mr. F. Holding, and 2,341 shares also are included in the shares shown as beneficially owned by North State Trustees. |

| (6) | | Consists of shares held by two irrevocable grantor trusts (the “1976 Trust” and the “1990 Trust”) with respect to which Carmen Holding Ames currently is the sole beneficiary. Ms. Ames has sole power to direct the voting, and shared power (with the six trustees) to direct the disposition, of the 2,341 shares held by the 1976 Trust. The written agreement pertaining to the 1990 Trust provides that, in connection with their voting of the 51,545 shares held by that trust, the trustees will consult with the then current beneficiaries who are at least 40 years of age, but that the trustees will not be bound by the voting preference of any such beneficiary. |

| (7) | | All listed shares are also shown as beneficially owned by Mr. F. Holding. |

| (8) | | Includes 50 shares of $20 Par Preferred held by Mr. F. Holding, Jr. as custodian for his children and with respect to which shares he disclaims beneficial ownership. All listed shares also are included in the shares shown as beneficially owned by Mr. F. Holding. |

| (9) | | Includes 200 shares of No Par Preferred held by Mr. Bristow’s spouse and with respect to which shares he disclaims beneficial ownership. All listed shares also are shown as beneficially owned by Mr. F. Holding. |

| (10) | | Includes 3,200 shares of No Par Preferred Stock held by Ms. Holding as trustee and with respect to which shares she disclaims beneficial ownership. All listed shares also are included in the shares shown as beneficially owned by Mr. F. Holding. |

Management. The following table reflects the beneficial ownership of all classes of our equity securities on the Record Date by our current directors, nominees for election as directors, and certain of our executive officers, individually, and by all of our current directors and executive officers as a group.

| | | | | | | | | | | |

Title of class

| | Name of beneficial owner

| | Amount and nature of beneficial ownership (1)

| | | Percentage of class (2)

| | | Percentage of total votes (2)

| |

Common Stock | | Carmen Holding Ames | | 2,441 | (3) | | .28 | % | | .26 | % |

| | | Jim B. Apple | | 8,613 | (4) | | 1.00 | % | | .93 | % |

| | | Richard W. Blackmon | | 110 | | | .01 | % | | .01 | % |

| | | Peter M. Bristow | | 23,514 | (5) | | 2.73 | % | | 2.54 | % |

| | | George H. Broadrick | | 118 | | | .01 | % | | .01 | % |

| | | Walter C. Cottingham DVM | | 1,435 | (6) | | .17 | % | | .15 | % |

| | | David E. Dukes | | 200 | | | .02 | % | | .02 | % |

| | | M. Craig Garner, Jr. | | 5 | | | * | | | * | |

| | | William E. Hancock III | | 4,644 | (7) | | .54 | % | | .50 | % |

| | | Robert B. Haynes | | 26,487 | (8) | | 3.07 | % | | 2.86 | % |

| | | Wycliffe E. Haynes | | 26,592 | (9) | | 3.08 | % | | 2.87 | % |

| | | Lewis M. Henderson | | 5 | | | * | | | * | |

| | | Frank B. Holding | | 367,475 | (10) | | 42.61 | % | | 39.67 | % |

| | | William A. Loadholdt | | -0- | | | — | | | — | |

| | | Kevin B. Marsh | | 2 | | | * | | | * | |

4

| | | | | | | | | | | |

Title of class

| | Name of beneficial owner

| | Amount and nature of beneficial ownership (1)

| | | Percentage of class (2)

| | | Percentage of total votes (2)

| |

| | | Charles S. McLaurin III | | 114 | | | .01 | % | | .01 | % |

| | | N. Welch Morrisette, Jr. | | 118 | | | .01 | % | | .01 | % |

| | | Craig L. Nix | | -0- | | | — | | | — | |

| | | E. Perry Palmer | | 800 | | | .09 | % | | .09 | % |

| | | William E. Sellars | | 26,547 | (11) | | 3.08 | % | | 2.87 | % |

| | | Henry F. Sherrill | | 2,096 | | | .24 | % | | .23 | % |

| | | All directors and executive officers

as a group (33 persons) | | 407,311 | | | 47.22 | % | | 43.98 | % |

$50 Par Preferred | | Peter M. Bristow | | 637 | (5) | | 1.28 | % | | .07 | % |

| | | Frank B. Holding | | 3,556 | (10) | | 7.14 | % | | .38 | % |

| | | All directors and executive officers

as a group (33 persons) | | 3,781 | | | 7.60 | % | | .41 | % |

$20 Par Preferred | | Peter M. Bristow | | 454 | (5) | | 7.78 | % | | .05 | % |

| | | Frank B. Holding | | 2,274 | (10) | | 38.95 | % | | .25 | % |

| | | All directors and executive officers

as a group (33 persons) | | 2,274 | | | 38.95 | % | | .25 | % |

No Par Preferred | | Peter M. Bristow | | 1,257 | (5) | | 15.49 | % | | .14 | % |

| | | Frank B. Holding | | 6,107 | (10) | | 75.27 | % | | .65 | % |

| | | All directors and executive officers

as a group (33 persons) | | 6,107 | | | 75.27 | % | | .66 | % |

Non-Voting Common (12) | | Frank B. Holding | | 18,806 | (10) | | 51.65 | % | | — | |

| | | All directors and executive officers

as a group (33 persons) | | 18,806 | | | 51.65 | % | | — | |

Non-Voting Preferred (12) | | Peter M. Bristow | | 254 | (5) | | 51.00 | % | | — | |

| | | Frank B. Holding | | 378 | (10) | | 75.90 | % | | — | |

| | | All directors and executive officers

as a group (33 persons) | | 378 | | | 75.90 | % | | — | |

| (1) | | Except as otherwise noted, and to the best of our knowledge, each individual named and included in the group exercise sole voting and investment power with respect to all listed shares. |

| (2) | | “Percentage of class” reflects the listed shares as a percentage of the total number of outstanding shares of that class of stock. “Percentage of total votes” reflects the votes represented by the listed shares as a percentage of the aggregate votes represented by all outstanding shares of our voting securities. An asterisk indicates less than .01%. |

| (3) | | Consists of shares held by an irrevocable grantor trust (the “1976 Trust”) with respect to which Carmen Holding Ames currently is the sole beneficiary. Ms. Ames has sole power to direct the voting, and shared power (with six trustees) to direct the disposition, of the 2,341 shares held by the 1976 Trust. |

| (4) | | Includes 8,076 shares held by our Pension Plan and with respect to which shares Mr. Apple may be deemed to exercise shared voting and investment power. These shares also are shown as beneficially owned by Mr. F. Holding. |

| (5) | | Includes an aggregate of 4,251 shares of Common Stock, 383 shares of $50 Par Preferred, 448 shares of $20 Par Preferred, 200 shares of No Par Preferred and 104 shares of Non-Voting Preferred held by, or in trust for the benefit of, Mr. Bristow’s spouse, and with respect to which shares he disclaims beneficial ownership. All listed shares also are shown as beneficially owned by Mr. F. Holding. |

| (6) | | Includes 12 shares held by Dr. Cottingham jointly with his spouse and with respect to which shares he may be deemed to exercise shared voting and investment power. |

| (7) | | Includes an aggregate of 2,836 shares held by two entities which Mr. Hancock may be deemed to control and with respect to which shares he may be deemed to exercise shared voting and investment power. |

| (8) | | Includes 26,347 shares held by an entity that Mr. R. Haynes may be deemed to control and with respect to which shares he may be deemed to exercise shared voting and investment power. These shares also are shown as beneficially owned by Mr. W. Haynes and Mr. Sellars. |

| (9) | | Includes 26,347 shares held by an entity that Mr. W. Haynes may be deemed to control and with respect to which shares he may be deemed to exercise shared voting and investment power. These shares also are shown as beneficially owned by Mr. R. Haynes and Mr. Sellars. Also includes 109 shares held by Mr. W. Haynes’ spouse and with respect to which shares he disclaims beneficial ownership. |

5

| (10) | | Includes an aggregate of 56,626 shares of Common Stock and 18,806 shares of Non-Voting Common held by certain corporations and other entities which Mr. F. Holding may be deemed to control, and 8,076 shares of Common Stock held by our Pension Plan, and with respect to which shares he may be deemed to exercise shared voting and investment power, and an aggregate of 156,926 shares of Common Stock, 3,556 shares of $50 Par Preferred, 2,274 shares of $20 Par Preferred, 6,107 shares of No Par Preferred, and 378 shares of Non-Voting Preferred held by or in trust for Mr. Holding’s spouse, adult children and their spouses, and with respect to which shares he disclaims beneficial ownership. Of the listed shares, 23,541 shares of Common Stock, 637 shares of $50 Par Preferred, 454 shares of $20 Par Preferred, 1,257 shares of No Par Preferred, and 254 shares of Non-Voting Preferred also are included in the shares shown as beneficially owned by Mr. Bristow, and 8,076 shares of Common Stock also are shown as beneficially owned by Mr. Apple. |

| (11) | | Includes 26,347 shares held by an entity that Mr. Sellars may be deemed to control and with respect to which shares he may be deemed to exercise shared voting and investment power. These shares also are shown as beneficially owned by Mr. R. Haynes and Mr. W. Haynes. |

| (12) | | Except as required by law, holders of our Non-Voting Common and Non-Voting Preferred have no right to vote unless dividends are in arrears on that stock, in which case the holders may cast one vote per share in the election of directors. |

Section 16(a) Beneficial Ownership Reporting Compliance

Our directors and executive officers are required by federal law to file reports with the Securities and Exchange Commission regarding the amounts of and changes in their beneficial ownership of our equity securities. Based on our review of copies of those reports, our Proxy Statements are required to disclose failures to report shares beneficially owned or changes in beneficial ownership, and failures to timely file required reports, during previous years. It has come to our attention that, during 2004, two reports inadvertently were filed after their due dates, including one report each by Frank B. Holding, our director, and Lewis R. Holding, one of our principal shareholders, covering a purchase of shares by one of their related parties, and one report by Marc H. Johnson, one of our executive officers, covering one purchase of shares. Also, during 2004 William E. Hancock III, our director, neglected to file reports covering 13 purchases of shares, but has now reported each of those transactions.

PROPOSAL 1: ELECTION OF DIRECTORS

Our Bylaws provide that our Board of Directors will consist of not less than seven nor more than 28 members and authorize our Board or shareholders to set and change the actual number of our directors from time to time within those limits. Our directors are elected each year at the Annual Meeting for terms of one year or until their respective successors have been duly elected and qualified. The number of directors currently is set at 19, and our current directors named below have been nominated by our Board of Directors for reelection at the Annual Meeting.

| | | | | | |

Name and age (1)

| | Positions with FCBank and us (2)

| | Year first

elected (3)

| | Principal occupation and business experience

|

Carmen Holding Ames (4)(5) 36 | | Director | | 1992 | | Homemaker |

| | | |

Jim B. Apple 52 | | Our Chairman, President, and Chief Executive Officer; FCBank’s Chairman and Chief Executive Officer | | 1993 | | FCBank’s and our executive officer |

| | | |

Richard W. Blackmon * 90 | | Director | | 1970 | | Owner, Richard Blackmon Construction Co. (construction and land development) |

| | | |

Peter M. Bristow (4) 39 | | Our Executive Vice President and Chief Operating Officer; FCBank’s President and Chief Operating Officer | | 1999 | | FCBank’s and our executive officer |

| | | |

George H. Broadrick (5) 82 | | Director | | 1972 | | Retired President, First Citizens BancShares, Inc. and First-Citizens Bank & Trust Company, Raleigh, NC (7) |

6

| | | | | | |

Name and age (1)

| | Positions with FCBank and us (2)

| | Year first

elected (3)

| | Principal occupation and business experience

|

| | | |

Walter C. Cottingham * 72 | | Director | | 1999 | | Veterinarian; owner, Cottingham Veterinary Hospital |

| | | |

David E. Dukes * 46 | | Director | | 2001 | | Attorney; managing partner, Nelson Mullins Riley & Scarborough, LLP. (law firm) |

| | | |

M. Craig Garner, Jr. * 56 | | Director | | 2004 | | Attorney; shareholder, McNair Law Firm P.A. (law firm) |

| | | |

William E. Hancock III * 58 | | Director | | 1976 | | President, Hancock Buick/BMW Company (auto dealer) |

| | | |

Robert B. Haynes * (6) 59 | | Director | | 1972 | | Chairman, Vice President and Secretary, C. W. Haynes and Company, Inc. (mortgage banking and real estate) |

| | | |

Wycliffe E. Haynes * (6) 61 | | Director | | 1972 | | Vice President and Treasurer, C. W. Haynes and Company, Inc. (mortgage banking and real estate) |

| | | |

Lewis M. Henderson * 51 | | Director | | 1996 | | Senior member, Henderson & Associates (certified public accountants) since 1999; previously, partner with Tourville, Simpson & Henderson (certified public accountants) |

| | | |

Frank B. Holding (4)(5) 76 | | Vice Chairman | | 1970 | | Executive Vice Chairman, First Citizens BancShares, Inc. and First-Citizens Bank & Trust Company, Raleigh, NC (7) |

| | | |

Kevin B. Marsh * 49 | | Director | | 2004 | | Senior Vice President of Finance and Chief Financial Officer; SCANA Corporation (energy based holding company) since 1998; President and Chief Operating Officer, PSNC Energy from (2001 to 2003) and, previously, Vice President of Finance and Chief Financial Officer (1996 to 1998) and Vice President of Finance (1992 to 1996) |

| | | |

Charles S. McLaurin III 66 | | Director; | | 2001 | | Retired; formerly employed by FCBank from 1964 to 2004; served as Executive Vice President of FCBank from 1995 to 2004; currently serves as consultant to and Vice Chairman of Exchange Bank |

| | | |

N. Welch Morrisette, Jr. * 83 | | Director | | 1970 | | Retired attorney |

| | | |

E. Perry Palmer * 69 | | Director | | 1993 | | Owner, E. P. Palmer Corporation (funeral service) |

| | | |

William E. Sellars 80 | | Director | | 1970 | | President, C. W. Haynes and Company, Inc. (mortgage banking and real estate) |

| | | |

Henry F. Sherrill 82 | | Director | | 1970 | | Attorney; senior partner, Sherrill and Roof, LLP (law firm) |

| (1) | | Asterisks denote individuals who we believe are “independent directors” as that term is defined by the listing standards of The Nasdaq Stock Market. |

| (2) | | Each of our directors also serves as a director of FCBank, and Dr. Cottingham and Mr. McLaurin also serve as directors of Exchange Bank. |

| (3) | | “First elected” refers to the year in which each individual first became one of our directors or, if prior to our organization in 1982, a director of FCBank. |

| (4) | | Mr. Holding is Ms. Ames’ uncle and Mr. Bristow’s father-in-law. |

| (5) | | Certain of our directors also serve as directors of other publicly held companies. Ms. Ames, Mr. Broadrick and Mr. Holding serve as directors of First Citizens BancShares, Inc., Raleigh, NC, and Mr. Holding also serves as a director of Southern BancShares (N.C.), Inc., Mount Olive, NC. |

| (6) | | Mr. R Haynes and Mr. W. Haynes are brothers. |

| (7) | | We are affiliated with First Citizens BancShares, Inc. and First-Citizens Bank & Trust Company through common control relationships that are described under the caption “Transactions with Related Parties.” |

Our Board of Directors recommends that you vote “FOR” each of the 19 nominees named above. The 19 nominees receiving the highest numbers of votes will be elected.

7

Director Compensation

During 2004, each of our directors (with the exception of Mr. Holding, Mr. Sellars, and directors who also serve as executive officers) received $1,000 for attendance at each meeting of our Board of Directors and $600 for attendance at each meeting of a committee of our Board that is not held in conjunction with a Board meeting. In addition, the Chairman of our Audit Committee received an annual retainer of $15,000, and each other member of that Committee received an annual retainer of $5,000. For 2005, the annual retainer for the Audit Committee Chairman will be increased to $16,000 and the annual retainer for each other member or the Audit Committee will be increased to $6,000.

Our directors (other than those referenced above) who serve as directors of the Banks receive additional fees. FCBank’s directors receive $500 for attendance of each regular meeting, and $600 for attendance at each special meeting, of its Board, and $600 for attendance at each meeting of the Audit, Executive, Compensation or Trust Committees and certain other committees not held in conjunction with a Board meeting. Directors of Exchange Bank who are not employees of the Banks receive $650 per quarter for their service as directors, and members of that Board’s Executive Committee receive $650 per quarter for attendance at meetings of that Committee.

Upon his retirement from active employment on December 31, 2004,Charles S. McLaurin III began receiving payments of $4,313 per month under an agreement with FCBank under which he agreed to provide consultation services to, and that he will not “compete” (as defined in the agreement) with, FCBank. The agreement expires during 2015. In addition, during 2005, Mr. McLaurin will provide consulting services to Exchange Bank for which he will be paid $8,333 per month, and he will not receive any fees or other compensation for his services as a director of either FCBank or Exchange Bank.

Attendance by Directors at Meetings

Board of Directors Meetings. Our Board of Directors met six times during 2004. Each person who served as a director during 2004 attended at least 75% of the aggregate number of those meetings and meetings of committees on which he or she served.

Annual Meetings. Attendance by our directors at Annual Meetings gives directors an opportunity to meet, talk with and hear the concerns of shareholders who attend those meetings, and it gives those shareholders access to our directors that they may not have at any other time during the year. Our Board of Directors recognizes that directors have their own business interests and are not our full-time employees, and that it is not always possible for them to attend Annual Meetings. However, our Board’s policy is that attendance by directors at our Annual Meetings is beneficial to us and to our shareholders and that our directors are strongly encouraged to attend each Annual Meeting whenever possible. Eighteen of our 19 directors then in office attended our last Annual Meeting which was held during April 2004.

Committees

Our Board of Directors has several standing committees, including an Audit Committee, a Nominating Committee, and a Compensation Committee which are described below.

Audit Committee

Function. The Audit Committee acts under a written charter that was reapproved by our Board of Directors during January 2005. Under its charter, the Committee, among other things, appoints our independent accountants each year and approves the compensation and terms of engagement of our accountants, approves services proposed to be provided by the independent accountants, and monitors and oversees the quality and integrity of our accounting process and systems of internal controls. The Committee reviews reports of our independent accountants (including its reports on our annual consolidated financial statements), reports we file under the Securities Exchange Act of 1934, and reports of examinations by our regulatory agencies, and it generally oversees our internal audit program. A copy of the Committee’s charter was attached as an Appendix to the Proxy Statement we distributed last year in connection with our 2004 Annual Meeting. The Committee met sixteen times during 2004.

8

Members. The current members of the Audit Committee are Lewis M. Henderson — Chairman, M. Craig Garner, Jr., and Kevin B. Marsh. We believe that each member of the Committee is an “independent director” as that term is defined by the listing standards of The Nasdaq Stock Market, and our Board of Directors believes that Mr. Henderson, the Committee Chairman, is an “audit committee financial expert” as that term is defined by rules of the Securities and Exchange Commission.

Audit Committee Report. Our management is responsible for our financial reporting process, including our system of internal controls and disclosure controls and procedures, and for the preparation of consolidated financial statements in accordance with accounting principles generally accepted in the United States of America. Our independent accountants are responsible for auditing those consolidated financial statements. The Audit Committee oversees and reviews those processes. In connection with the preparation and audit of our consolidated financial statements for 2004, the Audit Committee has:

| | • | | reviewed our audited consolidated financial statements for 2004 and discussed them with management; |

| | • | | discussed with our independent accountants the matters required to be discussed by Statement on Auditing Standards No. 61, as amended; |

| | • | | received written disclosures and a letter from our independent accountants required by Independence Standards Board Standard No. 1; and |

| | • | | discussed the independence of our independent accountants with the accountants. |

Based on the above reviews and discussions, the Committee recommended to our Board of Directors that the audited consolidated financial statements be included in our 2004 Annual Report on Form 10-K as filed with the Securities and Exchange Commission.

The Audit Committee:

| | | | |

| Lewis M. Henderson | | M. Craig Garner, Jr. | | Kevin B. Marsh |

Nominating Committee

Function. The Nominating Committee makes recommendations to our Board of Directors regarding its selection of nominees for election as directors and of candidates to fill vacancies that occur on the Board from time to time between meetings of shareholders. Our Board has not adopted a written charter for the Committee. The Committee met once during 2004.

Effective during 2004, The Nasdaq Stock Market amended its listing standards to require that nominees for election as directors of listed companies be selected, or recommended to those companies’ boards of directors for selection, by committees made up of “independent directors” (as that term is defined in Nasdaq’s rules) or by a majority of the companies’ independent directors. We are not a listed company and are not subject to Nasdaq’s requirements. However, our Board of Directors intends, to the extent practicable, to adopt corporate governance procedures consistent with Nasdaq’s requirements. In connection with the Boards’ selection of nominees for election at the Annual Meeting, the Nominating Committee made recommendations to our full Board of Directors, and the Board gave final approval of the nominees recommended by the Committee. In the future, the Committee’s recommendations will be reviewed by our independent directors before being acted upon by our full Board.

The Committee will seek to identify and recommend individuals who have high personal and professional integrity, who demonstrate ability and judgment, and who, with other members of the Board, will be effective in collectively serving the long-term interests of our shareholders. Candidates also must satisfy applicable requirements of state and federal banking regulators, and the Committee may develop other criteria or minimum qualifications for use in identifying and evaluating candidates. In identifying candidates to be recommended to the Board of Directors, the Committee will consider candidates recommended by shareholders. Shareholders who wish to recommend candidates to the Committee should send their recommendations in writing to:

Nominations Committee

First Citizens Bancorporation, Inc.

Attention: Corporate Secretary

Post Office Box 29

Columbia, South Carolina 29202

9

Each recommendation should be accompanied by the following:

| | • | | the full name, address and telephone number of the person making the recommendation, and a statement that the person making the recommendation is a shareholder of record (or, if the person is a beneficial owner of our shares but not a record holder, a statement from the record holder of the shares verifying the number of shares beneficially owned), and a statement as to whether the person making the recommendation has a good faith intention to continue to hold those shares through the date of our next Annual Meeting; |

| | • | | the full name, address and telephone number of the candidate being recommended, information regarding the candidate’s beneficial ownership of our equity securities and any business or personal relationship between the candidate and the person making the recommendation, and an explanation of the value or benefit that the person making the recommendation believes that the candidate would provide as a director; |

| | • | | a statement signed by the candidate that he or she is aware of and consents to being recommended to the Committee and will provide such information as the Committee may request in connection with its evaluation of candidates; |

| | • | | a description of the candidate’s current principal occupation, business or professional experience, previous employment history, educational background, and any areas of particular expertise; |

| | • | | information regarding any business or personal relationships between the candidate and any of our or the Banks’ customers, suppliers, vendors, competitors, directors or officers, affiliated companies, or other persons with any special interest regarding our company or our affiliated companies, and any transactions between the candidate and our company or any of our affiliated companies; and |

| | • | | any information in addition to the above regarding the candidate that would be required to be included in our proxy statement pursuant to the SEC’s Regulation 14A (including without limitation information regarding legal proceedings in which the candidate has been involved within the past five years). |

In order to be considered by the Committee in connection with its recommendations of candidates for selection as nominees for election at an Annual Meeting, a shareholder’s recommendation must be received by the Committee not later than the 120th day prior to the first anniversary of the date that our proxy statement was first mailed to our shareholders in conjunction with our preceding year’s Annual Meeting. Recommendations submitted by shareholders other than in accordance with these procedures will not be considered by the Committee.

The Committee will evaluate candidates recommended by shareholders in a manner similar to its evaluation of other candidates. The Committee will select candidates to be recommended to the Board of Directors each year based on its assessment of, among other things, (1) candidates’ business, life and educational background and experience, community leadership, independence, geographic location within the Company’s service area, and their other qualifications, attributes and potential contributions; (2) the past and future contributions of our current directors, and the value of continuity, diversity and prior Board experience; (3) the existence of one or more vacancies on the Board; (4) the need for a director possessing particular attributes or particular experience or expertise; (5) the role of directors in the Banks’ business development activities; and (6) other factors that it considers relevant, including any specific qualifications the Committee adopts from time to time.

Members. The current members of the Nominating Committee are Frank B. Holding — Chairman, Richard W. Blackmon, William E. Sellars and Henry F. Sherrill. We believe that Mr. Blackmon is an “independent director” as that term is defined by the listing standards of The Nasdaq Stock Market. However, we do not consider Messrs. Holding, Sellars or Sherrill to be independent directors.

Compensation Committee

Function. Our executive officers serve as officers and employees of and are compensated by FCBank, and they receive no salaries or other separate compensation from us. For that reason, in past years FCBank’s Board of Directors has had a Compensation Committee, but our Board of Directors has not had such a committee. Effective during 2004, The Nasdaq Stock Market amended its listing standards to require that compensation paid to listed companies’ executive officers be determined by committees made up of “independent directors” (as that term is defined in Nasdaq’s rules) or by a majority of the companies’ independent directors. We are not a listed company and are not subject to Nasdaq’s requirements. However, we intend, to the extent practicable, to adopt corporate governance procedures consistent with

10

Nasdaq’s requirements. For that reason, during 2004, we established a new joint Compensation Committee of our and FCBank’s Boards which operates under a written charter approved by the Boards during January 2005 and which makes recommendations to the Boards regarding compensation paid to our Chief Executive Officer and other executive officers. The current Committee is not made up of independent directors. However, under its current process, the Committee’s recommendations are reviewed in executive session by our independent directors, and they make their own recommendations to the full Boards of Directors for final determinations regarding executive compensation matters. During 2004, the Committee met four times.

Members. The current members of the joint Compensation Committee are George H. Broadrick — Chairman, William E. Sellars, and Henry F. Sherrill, who serve as members of both FCBank’s and our Board of Directors.

Compensation Committee Interlocks and Insider Participation. Mr. Broadrick also serves as a director of First Citizens BancShares, Inc., Raleigh, North Carolina (“BancShares”), and its bank subsidiary, First-Citizens Bank & Trust Company (“FCB/NC”). Prior to his retirement in 1987, he served as President of both BancShares and FCB/NC, and he currently serves as a consultant to FCB/NC. FCBank and Exchange Bank are parties to agreements with FCB/NC under which FCB/NC provides various services to them, including data and item processing, investment, accounting and management consulting services (including the services of Frank B. Holding as FCBank’s and our Vice Chairman). During 2004, the aggregate fees paid to FCB/NC for those services were approximately $13,900,000. Additional information regarding the services provided by FCB/NC is contained below under the caption “Transactions with Related Parties.”

Mr. Sellars is President of C. W. Haynes and Company, Inc. and serves as a consultant to FCBank with respect to matters relating to real estate and mortgage lending. FCBank pays $5,596 per month to that company as reimbursement for Mr. Sellars’ services. Mr. Sellars himself does not receive any compensation from FCBank or us for his services as a director or consultant.

Mr. Sherrill provided legal services to us and the Banks during 2004 as our general counsel, and he is expected to continue to provide those services during 2005. During 2004, we and the Banks paid an aggregate of $221,684 to Mr. Sherrill’s law firm, Sherrill and Roof, LLP, for those services.

Compensation Committee Report on Executive Compensation. Our executive officers serve as officers and employees of and are compensated by FCBank, and they receive no separate compensation from us. FCBank attempts to provide compensation at levels that will enable it to attract and retain qualified and motivated individuals as officers and employees. Currently, FCBank’s executive compensation program includes primarily base salary and annual bonuses under incentive compensation plans. We do not maintain any equity-based or long-term incentive compensation plans. However, the Banks provide retirement and other employee benefit and welfare plans (including a defined benefit pension plan and a Section 401(k) plan) customary for companies of our size, and FCBank is party to post-retirement consulting agreements with certain of its executive officers that provide for payments to the officers following their retirement.

For 2004, the Compensation Committee reviewed the compensation of our Chief Executive Officer, Jim B. Apple, and four other most highly paid executive officers, and the Committee made recommendations to FCBank’s independent directors regarding increases in the base salaries of those officers. The Committee’s recommendations were based on its evaluation of their individual levels of responsibility and performance. The amounts of contributions to the separate accounts of executive officers under FCB’s 401(k) plan were determined solely by the terms of that plan. Based on the recommendation of the independent directors, FCBank’s Board of Directors made all final decisions regarding the salaries of those executive officers consistent with the Committee’s recommendations. Senior management was authorized to approve the amounts of salaries paid to other executive officers based on guidelines for salary increases recommended by the Committee and approved by the Board.

For 2004, Mr. Apple’s base salary rate was increased by approximately 7.6% over his 2003 rate. The performance of the Chief Executive Officer and other individual executive officers, and our financial performance generally, were considered by the Committee and the Board of Directors in connection with the setting the salaries for 2004. However, that process largely was subjective, and there were no specific formulae, objective criteria, or other such mechanisms by which salary adjustments recommended by the Committee for any executive officer’s salary was tied empirically or related to that individual’s performance or our financial performance.

11

For 2004, most executive officers were eligible to receive an incentive bonus award determined by formulae recommended by the Compensation Committee and approved by the Board of Directors during January 2004. Under the formula that applied to the executive management incentive plan in which the Chief Executive Officer and other executive officers (other than Mr. McLaurin) named in the Summary Compensation Table below were participants, officers could receive bonuses in amounts up to 20% of their year-end base salary rates based on the extent to which specific corporate performance goals were met (relating to FCBank’s deposit growth and our consolidated net income and ratio of net charge-offs to average gross loans), as well as the extent to which they met separate, individual performance goals established for them relating to their particular areas of responsibility. All corporate goals had to be fully met before any bonuses could be paid. If all corporate goals were met, then 50% of the maximum bonus amounts could be paid, and the extent to which the remainder of the maximum bonus amounts would be paid was dependent on the extent to which each officer met his or her individual goals. For 2004, one of our corporate goals was not met and no awards were made under the plan. Mr. McLaurin received an incentive award under a separate plan that applies to FCBank’s Division Executives but not to the Chief Executive Officer or other executive officers named in the Summary Compensation Table.

Section 162(m) of the Internal Revenue Code of 1986, as amended, limits the deductibility of annual compensation in excess of $1,000,000 paid to certain executive officers of public corporations. As none of FCBank’s or our executive officers receive annual compensation approaching that amount, FCBank’s Board of Directors has not adopted a policy with respect to Section 162(m).

The Compensation Committee:

| | | | |

| George H. Broadrick | | William E. Sellars | | Henry F. Sherrill |

Executive Compensation

Cash Compensation. The following table shows cash and certain other compensation paid or provided to or deferred by our named executive officers for the years indicated. Our executive officers are compensated by FCBank for their services as its officers, and they receive no separate salaries or other cash compensation from us for their services as our officers.

SUMMARY COMPENSATION TABLE

| | | | | | | | | | | | | | |

| | | | | Annual Compensation

| | | |

Name and principal position

| | Year

| | Salary (1)

| | Bonus

| | Other annual compensation

| | | All other compensation (3)

|

Jim B. Apple Chairman and Chief Executive Officer | | 2004

2003

2002 | | $

| 417,500

386,253

354,383 | | $

| -0-

72,088

61,202 | | (2

(2

(2 | )

)

) | | $

| 16,195

14,153

10,662 |

| | | | | |

Peter M. Bristow President and Chief Operating Officer of FCBank | | 2004

2003

2002 | |

| 277,500

248,750

222,073 | |

| -0-

47,940

44,851 | | (2

(2

(2 | )

)

) | |

| 12,196

10,679

8,633 |

| | | | | |

William A. Loadholdt Executive Vice President and Chief Information Officer of FCBank | | 2004

2003

2002 | |

| 245,125

229,002

218,757 | |

| -0-

41,327

69,002 | | (2

(2

(2 | )

)

) | |

| 11,627

10,325

8,427 |

| | | | | |

Charles S. McLaurin III Executive Vice President of FCBank (4) | | 2004

2003

2002 | |

| 224,025

214,880

204,089 | |

| 21,100

38,063

33,123 | | (2

(2

(2 | )

)

) | |

| 10,451

9,647

9,094 |

| | | | | |

Craig L. Nix Executive Vice President and Chief Financial Officer | | 2004

2003

2002 | |

| 222,500

190,785

159,855 | |

| -0-

38,660

32,138 | | (2

(2

(2 | )

)

) | |

| 10,317

8,223

7,264 |

| (1) | | Includes amounts of salary deferred at each officer’s election under our Section 401(k) and deferred compensation plans. |

| (2) | | In addition to compensation paid in cash, the Banks’ and our executive officers receive various personal benefits. The value of those non-cash benefits received each year by each named officer did not exceed 10% of his cash compensation for that year, and the amounts of those benefits are not shown in the Summary Compensation Table. |

12

| (3) | | The 2004 amounts consist of matching contributions on behalf of each named officer to our Section 401(k) plan, and portions of the interest accrued on other deferred compensation, respectively, as follows: Mr. Apple—$9,788 and $6,407; Mr. Bristow—$9,847 and $2,349; Mr. Loadholdt—$9,916 and $1,711; Mr. McLaurin—$10,097 and $354; and Mr. Nix—$9,834 and $483. The Banks also provide the named executive officers with certain group life, health, medical and other insurance coverages that are generally available to all salaried employees and that are not included in the Summary Compensation Table. |

| (4) | | Mr. McLaurin retired from FCBank effective December 31, 2004, and has begun receiving payments from FCBank under his agreement described under the caption “Post-retirement Consulting Agreements” below. |

Post-retirement Consulting Agreements. FCBank is party to separate agreements with certain of its senior officers under which FCBank has agreed to make monthly payments to the officers for a period of ten years following their retirement at age 65, or at another age agreed upon between FCBank and the officer. In return for those payments, each officer has agreed to provide limited consulting services to, and not to “compete” (as defined in the agreements) against, FCBank during the payment period. If an officer dies prior to retirement, or during the payment period following retirement, the payments due under his or her agreement will be paid to the officer’s designated beneficiary or estate. The amounts of monthly payments provided for in the agreements currently in effect between FCBank and executive officers named in the Summary Compensation Table above are as follows: Mr. Apple—$7,500; Mr. Bristow—$4,792; Mr. McLaurin—$4,313 and Mr. Nix—$3,399.

Pension Plan. The following table shows, for various numbers of years of service and levels of compensation, the estimated benefits currently payable to a participant at normal retirement age under our qualified defined benefit pension plan (the “Pension Plan”) based on federal tax laws currently in effect.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Years of Service

|

Final Average Compensation

| |

| | For

participants

hired after 01/01/2005

| | For

participants

hired before 01/01/2005

|

| | 10 Years

| | 15 Years

| | 20 Years

| | 25 Years

| | 30 Years

| | 35 Years

| | 40 Years

| | 40 Years

|

$100,000 | | $ | 15,335 | | $ | 23,002 | | $ | 30,670 | | $ | 38,337 | | $ | 46,004 | | $ | 53,672 | | $ | 53,672 | | $ | 59,672 |

125,000 | | | 19,960 | | | 29,940 | | | 39,920 | | | 49,889 | | | 59,879 | | | 69,859 | | | 69,859 | | | 77,359 |

150,000 | | | 24,585 | | | 36,877 | | | 49,170 | | | 61,462 | | | 73,754 | | | 86,047 | | | 86,047 | | | 95,047 |

175,000 | | | 29,210 | | | 43,815 | | | 58,420 | | | 73,024 | | | 87,629 | | | 102,234 | | | 102,234 | | | 112,734 |

200,000 | | | 33,835 | | | 50,752 | | | 67,670 | | | 84,587 | | | 101,504 | | | 118,442 | | | 118,442 | | | 130,422 |

225,000 | | | 34,020 | | | 51,030 | | | 68,040 | | | 85,049 | | | 102,059 | | | 119,069 | | | 119,069 | | | 131,129 |

250,000 | | | 34,020 | | | 51,030 | | | 68,040 | | | 85,049 | | | 102,059 | | | 119,069 | | | 119,069 | | | 131,129 |

275,000 | | | 34,020 | | | 51,030 | | | 68,040 | | | 85,049 | | | 102,059 | | | 119,069 | | | 119,069 | | | 131,129 |

300,000 | | | 34,020 | | | 51,030 | | | 68,040 | | | 85,049 | | | 102,059 | | | 119,069 | | | 119,069 | | | 131,129 |

350,000 | | | 34,020 | | | 51,030 | | | 68,040 | | | 85,049 | | | 102,059 | | | 119,069 | | | 119,069 | | | 131,129 |

Benefits shown in the table are computed as straight life annuities beginning at age 65 and are not subject to a deduction for Social Security benefits or any other offset amount. Those benefits will be actuarially increased or decreased if benefit payments begin after or before age 65. A participant’s annual compensation covered by the Pension Plan includes base salary. A participant’s benefits under the Pension Plan are based on his or her years of service and “final average compensation,” which is the participant’s highest average covered compensation for any five consecutive years during his or her last ten complete calendar years as a Pension Plan participant. However, under current tax laws, $210,000 is the maximum amount of annual compensation for 2005 that can be included for purposes of calculating a participant’s final average compensation, and the maximum annual benefit that may be paid to a retiring participant is $170,000. In the case of participants who begin receiving benefits before or after age 65, the maximum permitted benefit is actuarially adjusted. The maximum years of credited service that may be counted in calculating benefits under the Pension Plan is 40 years or, in the case of participants hired after January 1, 2005, 35 years.

The credited years of service and final average compensation, respectively, as of January 1, 2005, for each of the executive officers named in the Summary Compensation Table above are as follows: Mr. Apple—12 years and $201,000; Mr. Bristow—13 years and $194,721; Mr. Loadholdt—3 years and $201,667; Mr. McLaurin—40 years and $197,674; and Mr. Nix—5 years and $168,474.

13

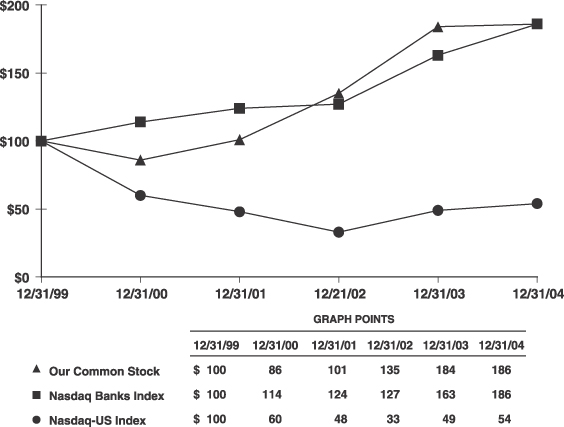

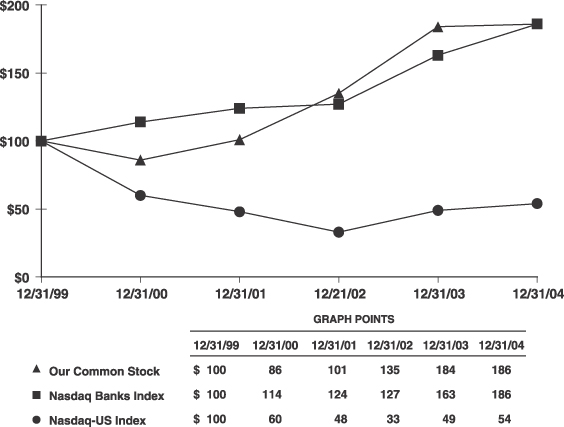

Performance Graph

The following line graphs compare the cumulative total shareholder return (“CTSR”) on our Common Stock during the previous five years with the CTSR over the same measurement period for the Nasdaq-U.S. index and the Nasdaq Banks index. Each line graph assumes that $100 was invested on December 31, 1999, and that dividends are reinvested in additional shares.

Comparison of Five-Year Cumulative Total Shareholder Return

among our Common Stock, the Nasdaq-US Index, and the

Nasdaq Banks Index

Transactions and Relationships with Related Parties

The Banks have had, and expect to have in the future, banking transactions in the ordinary course of their business with certain of their and our current directors, nominees for director, executive officers, principal shareholders, and their associates. All loans included in those transactions during 2004 were made on substantially the same terms, including interest rates, repayment terms and collateral, as those prevailing at the time the loans were made for comparable transactions with other persons, and those loans did not involve more than the normal risk of collectibility or present other unfavorable features.

The Bank’s are parties to contracts with First-Citizens Bank & Trust Company, Raleigh, North Carolina (“FCB/NC”), under which FCB/NC provides them with data and item processing, investment, accounting and management consulting services (including the services of Frank B. Holding as FCBank’s and our Vice Chairman). Aggregate fees paid to FCB/NC for all those services during 2004 totaled approximately $13,900,000, including amounts paid to reimburse FCB/NC for Mr. Holding’s services. Mr. Holding receives no salary, director’s fees or other compensation from us or FCBank for his services. FCB/NC is the wholly-owned subsidiary of First Citizens BancShares, Inc. (“BancShares”). Mr. Holding, one of FCBank’s and our directors, and one of our principal shareholders, and Lewis R. Holding, one of our principal shareholders, are directors and executive officers of BancShares and FCB/NC and also are principal shareholders of BancShares. George H. Broadrick and Carmen Holding Ames, who are our directors and directors of FCBank, also are directors of BancShares and FCB/NC. Based on comparisons of the terms of the contract in previous

14

years with terms available from other providers of the services we obtain from FCB/NC, we believe the terms of the contracts with FCB/NC, including prices, are no less favorable to FCBank and Exchange Bank than they could obtain from an unrelated provider.

David E. Dukes, one of our directors, is an attorney and serves as managing partner of Nelson Mullins Riley & Scarborough, LLP, which provided legal service to the Banks during 2004 and is expected to continue providing services in 2005. During 2004, the Banks paid an aggregate of $110,166 to that firm for those services.

In connection with the construction or renovation of office facilities, we and FCBank regularly use the services of an interior design firm in which Claire H. Bristow is a principal. Ms. Bristow is the spouse of Peter M. Bristow, one of our executive officers, and the daughter of Frank B. Holding, our Vice Chairman and one of our principal shareholders. During 2004, we and FCBank paid that firm an aggregate of $11,603 for its services, and $139,897 for furniture and fixtures acquired by it for FCBank and us.

Mr. Bristow, one of our executive officers, is the son-in-law of our director and principal shareholder, Frank B. Holding. Compensation paid to Mr. Bristow by FCBank is described in the Summary Compensation Table above.

Other relationships or transactions between us or FCBank and our directors or their related parties are described above under the caption “Compensation Committee Interlocks and Insider Participation.”

INDEPENDENT ACCOUNTANTS

Appointment of Independent Accountants

Our Audit Committee’s charter gives it the responsibility and authority to select and appoint our independent accountants each year and to approve the compensation and terms of the engagement of our accountants. PricewaterhouseCoopers LLP served as our independent accountants and audited our consolidated financial statements for 2004. The Committee has begun the process of making its selection of our independent accountants for 2005 and currently plans to request proposals from PricewaterhouseCoopers LLP and other firms. However, that process is ongoing and the Committee’s final decision is not expected to be made until the second quarter of this year. Representatives of PricewaterhouseCoopers LLP are expected to attend the Annual Meeting and be available to respond to appropriate questions, and they will have the opportunity to make a statement if they desire to do so.

Services and Fees During 2003 and 2004

Except as described below, under its current procedures the Audit Committee specifically pre-approves all audit and other services provided by our accountants. In the case of tax services and other permissible non-audit services, the Committee pre-approves the provision of those services up to specified amounts of fees, and it delegates authority to its Chairman to approve services in addition to those amounts. Any approval of additional services by the Chairman is communicated to the full Committee at its next regularly scheduled meeting.

As our independent accountants for 2003 and 2004, PricewaterhouseCoopers LLP provided various audit and other services for which we and the Banks were billed for fees as further described below. Our Audit Committee has considered whether PricewaterhouseCoopers LLP’s provision of non-audit services is compatible with maintaining its independence. The Committee believes that those services do not affect PricewaterhouseCoopers LLP’s independence.

Audit Fees. For 2003 and 2004, PricewaterhouseCoopers LLP audited our consolidated financial statements included in our Annual Reports on Form 10-K, reviewed our condensed interim consolidated financial statements included in our Quarterly Reports on Form 10-Q, and provided various other audit services. The aggregate amounts of fees billed to us for those services was $248,110 for 2003, and we expect that fees for 2004 audit services will amount to an aggregate of $955,913.

Audit-Related Fees. We paid PricewaterhouseCoopers LLP $43,756 for audit-related services it provided to us during 2003, and we expect that fees for 2004 audit-related services will amount to an aggregate of $121,100. For each year, those services consisted of employee benefit plan audits and, for 2004, they included advisory services relating to our process for evaluating, documenting and testing our internal controls.

15

Tax Fees. We paid PricewaterhouseCoopers LLP $47,855 and $64,892, respectively, for services it provided to us during 2003 and 2004 consisting each year of tax return preparation and consultations regarding general tax matters.

All Other Fees. For 2003, PricewaterhouseCoopers LLP did not provide us with or bill us for any other services. For 2004, we paid PricewaterhouseCoopers LLP a $1,575 subscription fee for access to an on-line library of financial reporting literature.

PROPOSALS FOR 2006 ANNUAL MEETING

Any proposal of a shareholder which is intended to be presented for action at our 2006 Annual Meeting must be received by us in writing at our main office in Columbia, South Carolina, no later than November 24, 2005, to be considered timely received for inclusion in the Proxy Statement and form of appointment of proxy that we will distribute in connection with that meeting. In order for a proposal to be included in our proxy materials for a particular meeting, the person submitting the proposal must own, beneficially or of record, at least 1% or $2,000 in market value of the shares of our stock entitled to be voted on that proposal at the meeting and must have held those shares for a period of at least one year and continue to hold them through the date of the meeting. Also, the proposal and the shareholder submitting it must comply with certain other eligibility and procedural requirements contained in rules of the Securities and Exchange Commission.

Written notice of a shareholder proposal intended to be presented at our 2006 Annual Meeting, but which is not intended to be included in our proxy statement and form of appointment of proxy, must be received by us at our main office in Columbia, South Carolina, no later than February 7, 2006, in order for that proposal to be considered timely received for purposes of the Proxies’ discretionary authority to vote on other matters presented for action by shareholders at that meeting.

ADDITIONAL INFORMATION

Communications with Our Board

Our Board of Directors encourages our shareholders to communicate with it regarding their concerns and other matters related to our business, and the Board has established a process by which you may send written communications to the Board or to one or more individual directors. You may address and mail your communication to:

First Citizens Bancorporation, Inc.

Attention: Corporate Secretary

Post Office Box 29

Columbia, South Carolina 29202

You also may send them by email tocharles.cook@firstcitizensonline.com. You should indicate whether your communication is directed to the entire Board of Directors, to a particular committee of the Board or its Chairman, or to one or more individual directors. All communications will be reviewed by our Corporate Secretary and forwarded on to the intended recipients. Communications that involve specific complaints from a customer of one of the Banks relating to a deposit, loan or other financial relationship or transaction also will be forwarded to the head of the department or division that is most closely associated with the subject of the complaint.

Annual Report on Form 10-K

We are subject to the reporting requirements of the Securities Exchange Act of 1934 and we file reports and other information, including proxy statements, annual reports and quarterly reports, with the Securities and Exchange Commission. FCBank’s Internet website(www.firstcitizensonline.com) contains a link to the Securities and Exchange Commission’s website(www.sec.gov) where you may obtain copies of our reports free of charge after they have been filed.

A copy of our 2004 Annual Report on Form 10-K, as filed with the Securities and Exchange Commission, will be provided without charge upon the written request of any shareholder entitled to vote at the Annual Meeting. Requests for copies should be directed to Charles D. Cook, Corporate Secretary, First Citizens Bancorporation, Inc., Post Office Box 29, Columbia, South Carolina 29202, telephone 803-733-2036.

16

FIRST CITIZENS BANCORPORATION, INC.

1230 Main Street

Post Office Box 29

Columbia, South Carolina 29202

APPOINTMENT OF PROXY SOLICITED BY THE BOARD OF DIRECTORS

The undersigned hereby appoints Jim B. Apple, Peter M. Bristow and Charles D. Cook (the “Proxies”), and any substitute appointed by them, as the undersigned’s attorneys and proxies, and authorizes any one or more of them to represent and vote as directed below all shares of the voting securities of First Citizens Bancorporation, Inc. (“Bancorp”) held of record by the undersigned on March 4, 2005, at the Annual Meeting of Shareholders of Bancorp to be held in the third floor board room of the First Citizens Service Center located at 1314 Park Street, Columbia, South Carolina at 2:00 p.m. on April 21, 2005, or at any adjournments of the meeting. The undersigned directs that shares represented by this appointment of proxy be voted as follows:

| 1. | ELECTION OF DIRECTORS: Proposal to elect 19 directors of Bancorp for one-year terms. |

| | | | | | |

| ¨ | | FOR all nominees listed below (except as indicated otherwise on the line below) | | ¨ | | WITHHOLD AUTHORITY to vote for all nominees listed below |

| | |

| Nominees: | | C.H. Ames; J.B. Apple; R.W. Blackmon; P.M. Bristow; G.H. Broadrick; W. C. Cottingham; D. E. Dukes; M. C. Garner, Jr.; W. E. Hancock III; R. B. Haynes; W. E. Haynes; L. M. Henderson; F. B. Holding; K. B. Marsh; C. S. McLaurin III; N. W. Morrisette, Jr.; E. P. Palmer; W. E. Sellars; and H. F. Sherrill |

| |

| Instruction: | | To withhold authority to vote for any individual nominee(s), write the nominee’s name(s) on the line below. |

| 2. | OTHER BUSINESS: On any other matter properly presented for action by shareholders at the Annual Meeting, and on matters incident to the conduct of the meeting, including adjournments, the Proxies are authorized to vote the shares represented by this appointment of proxy according to their best judgment. |

Please date and sign this appointment of proxy on the reverse side

and return it to Bancorp in the enclosed envelope.

I (We) direct that the shares represented by this appointment of proxy be voted as instructed above. In the absence of any instruction, the Proxies may vote shares represented by this appointment of proxy “FOR” the election of each nominee listed in Proposal 1 above by casting an equal number of votes for each such nominee. If, before the Annual Meeting, any nominee listed in Proposal 1 becomes unable or unwilling to serve as a director for any reason, the Proxies are authorized to vote for a substitute nominee named by the Board of Directors. If cumulative voting is in effect in the election of directors, the Proxies may, at their discretion, cumulate the votes represented by the shares to which this appointment of proxy relates and cast them on a basis other than equally for the nominees named in Proposal 1 (or their substitutes) and for less than all such nominees, but in a manner which would tend to elect the greatest number of those nominees (or their substitutes) as the number of votes cast by them would permit. This appointment of proxy may be revoked by the undersigned at any time before the voting takes place at the Annual Meeting by filing with Bancorp’s Corporate Secretary a written instrument revoking it or a duly executed appointment of proxy bearing a later date, or by attending the Annual Meeting and announcing an intention to vote in person.

Please sign belowexactly as your name appears on this appointment of proxy. Joint owners of shares shouldboth sign. Fiduciaries or other persons signing in a representative capacity should indicate the capacity in which they are signing.

| | | | |

| Dated | |

| | , 2005 |

|

|

| (Signature) |

|

|

| (Signature if held jointly) |

IMPORTANT: To ensure that your shares are represented and that a quorum is present at the

Annual Meeting, please send in your appointment of proxy whether or not you plan to attend.