Another step on the path to success 1 Investor Presentation Fourth Quarter 2011 EXHIBIT 99.1

Another step on the path to success 2 Certain statements contained in this presentation which are not statements of historical fact constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act (the ‘‘Act’’). In addition, certain statements in future filings by First Financial with the SEC, in press releases, and in oral and written statements made by or with the approval of First Financial which are not statements of historical fact constitute forward-looking statements within the meaning of the Act. Examples of forward-looking statements include, but are not limited to, projections of revenues, income or loss, earnings or loss per share, the payment or non-payment of dividends, capital structure and other financial items, statements of plans and objectives of First Financial or its management or board of directors, and statements of future economic performances and statements of assumptions underlying such statements. Words such as ‘‘believes’’, ‘‘anticipates’’, “likely”, “expected”, ‘‘intends’’, and other similar expressions are intended to identify forward-looking statements but are not the exclusive means of identifying such statements. Management’s analysis contains forward-looking statements that are provided to assist in the understanding of anticipated future financial performance. However, such performance involves risks and uncertainties that may cause actual results to differ materially. Factors that could cause actual results to differ from those discussed in the forward-looking statements include, but are not limited to: • management’s ability to effectively execute its business plan; • the risk that the strength of the United States economy in general and the strength of the local economies in which we conduct operations may continue to deteriorate resulting in, among other things, a further deterioration in credit quality or a reduced demand for credit, including the resultant effect on our loan portfolio, allowance for loan and lease losses and overall financial performance; • the effects of the potential delay or failure of the U.S. federal government to pay its debts as they become due or make payments in the ordinary course; • the ability of financial institutions to access sources of liquidity at a reasonable cost; • the impact of recent upheaval in the financial markets and the effectiveness of domestic and international governmental actions taken in response, such as the U.S. Treasury’s TARP and the FDIC’s Temporary Liquidity Guarantee Program, and the effect of such governmental actions on us, our competitors and counterparties, financial markets generally and availability of credit specifically, and the U.S. and international economies, including potentially higher FDIC premiums arising from increased payments from FDIC insurance funds as a result of depository institution failures; • the effect of and changes in policies and laws or regulatory agencies (notably the recently enacted Dodd-Frank Wall Street Reform and Consumer Protection Act); • inflation and possible changes in interest rates; • our ability to keep up with technological changes; • our ability to comply with the terms of loss sharing agreements with the FDIC; • mergers and acquisitions, including costs or difficulties related to the integration of acquired companies and the wind-down of non-strategic operations that may be greater than expected, such as the previous activities of Irwin Union Bank & Trust Company and its former affiliates, including the risks and uncertainties associated with the Irwin Mortgage Corporation bankruptcy proceedings and other acquired subsidiaries; • the risk that exploring merger and acquisition opportunities may detract from management’s time and ability to successfully manage our company; • expected cost savings in connection with the consolidation of recent acquisitions may not be fully realized or realized within the expected time frames, and deposit attrition, customer loss and revenue loss following completed acquisitions may be greater than expected; • our ability to increase market share and control expenses; • the effect of changes in accounting policies and practices, as may be adopted by the regulatory agencies as well as the Financial Accounting Standards Board and the SEC; • adverse changes in the securities and debt markets; • our success in recruiting and retaining the necessary personnel to support business growth and expansion and maintain sufficient expertise to support increasingly complex products and services; • monetary and fiscal policies of the Board of Governors of the Federal Reserve System (Federal Reserve) and the U.S. government and other governmental initiatives affecting the financial services industry; • our ability to manage loan delinquency and charge-off rates and changes in estimation of the adequacy of the allowance for loan losses; and • the costs and effects of litigation and of unexpected or adverse outcomes in such litigation. In addition, please refer to our Annual Report on Form 10-K for the year ended December 31, 2010, as well as our other filings with the SEC, for a more detailed discussion of these risks and uncertainties and other factors. Such forward-looking statements are meaningful only on the date when such statements are made, and First Financial undertakes no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such a statement is made to reflect the occurrence of unanticipated events. Forward Looking Statement Disclosure

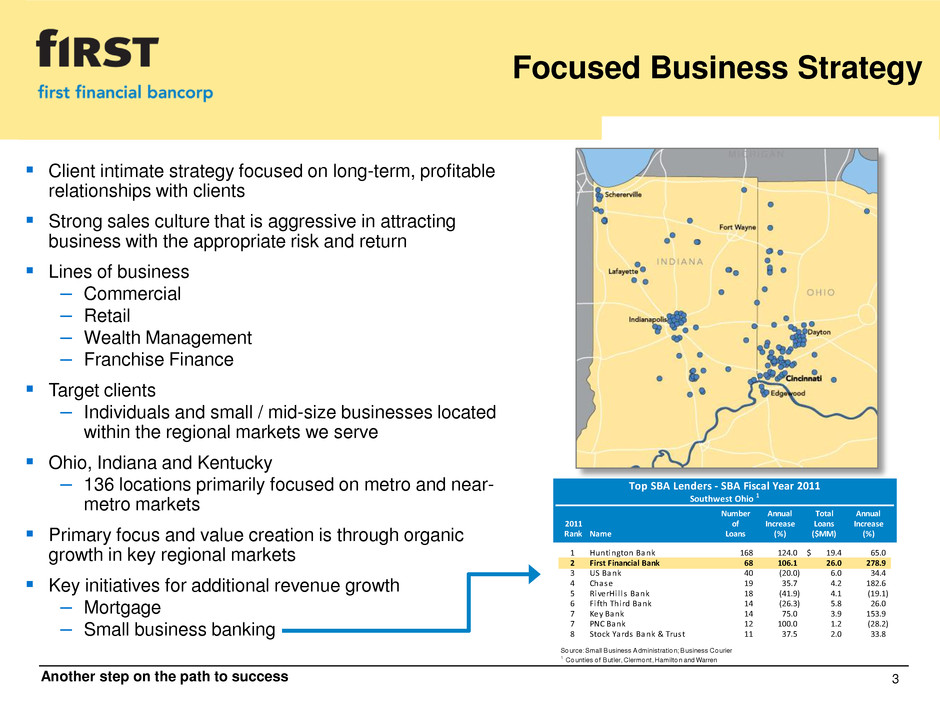

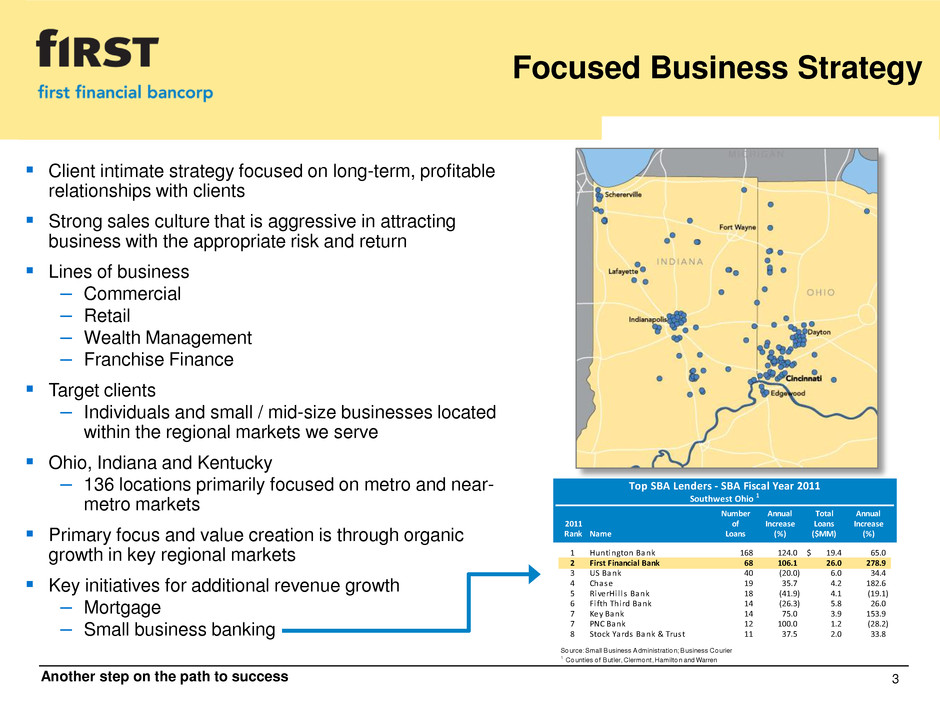

Another step on the path to success 3 Focused Business Strategy Client intimate strategy focused on long-term, profitable relationships with clients Strong sales culture that is aggressive in attracting business with the appropriate risk and return Lines of business – Commercial – Retail – Wealth Management – Franchise Finance Target clients – Individuals and small / mid-size businesses located within the regional markets we serve Ohio, Indiana and Kentucky – 136 locations primarily focused on metro and near- metro markets Primary focus and value creation is through organic growth in key regional markets Key initiatives for additional revenue growth – Mortgage – Small business banking Top SBA Lenders - SBA Fiscal Year 2011 Southwest Ohio 1 Number Annual Total Annual 2011 of Increase Loans Increase Rank Name Loans (%) ($MM) (%) 1 Huntington Bank 168 124.0 19.4$ 65.0 2 First Financial Bank 68 106.1 26.0 278.9 3 US Bank 40 (20.0) 6.0 34.4 4 Chase 19 35.7 4.2 182.6 5 RiverHi l l s Bank 18 (41.9) 4.1 (19.1) 6 Fi fth Third Bank 14 (26.3) 5.8 26.0 7 Key Bank 14 75.0 3.9 153.9 7 PNC Bank 12 100.0 1.2 (28.2) 8 Stock Yards Bank & Trust 11 37.5 2.0 33.8 Source: Small Business Administration; Business Courier 1 Counties of Butler, Clermont, Hamilton and Warren

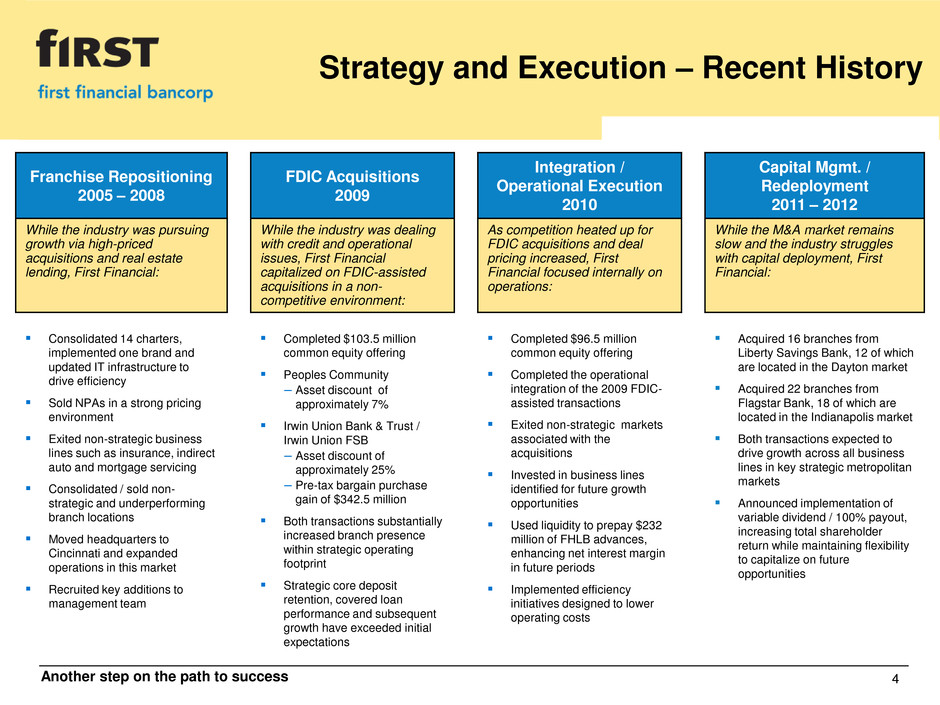

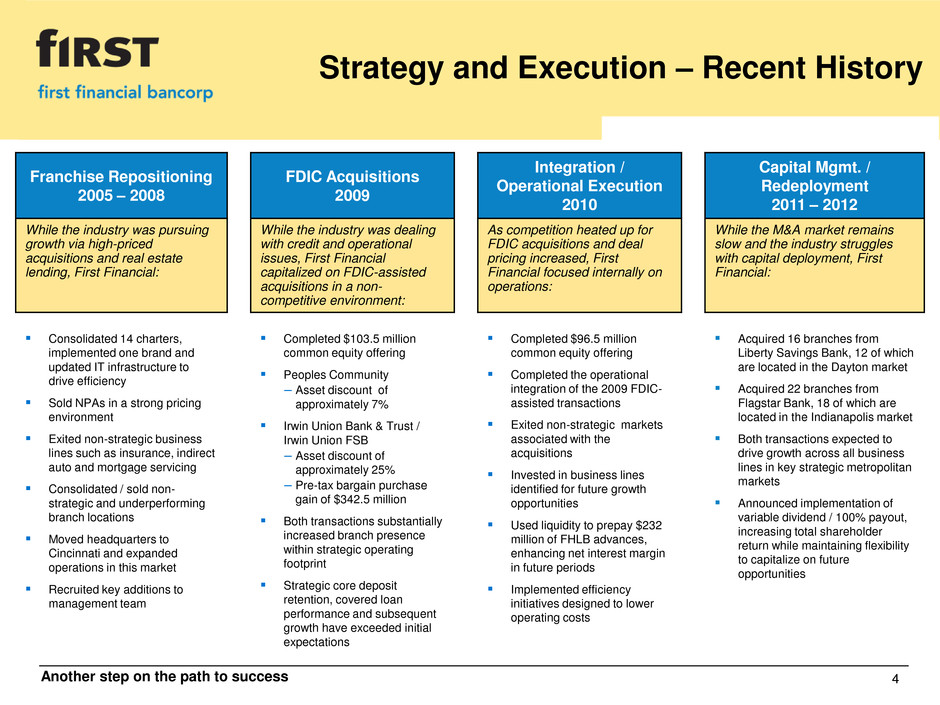

Another step on the path to success 4 Strategy and Execution – Recent History Franchise Repositioning 2005 – 2008 FDIC Acquisitions 2009 Integration / Operational Execution 2010 Capital Mgmt. / Redeployment 2011 – 2012 While the industry was pursuing growth via high-priced acquisitions and real estate lending, First Financial: While the industry was dealing with credit and operational issues, First Financial capitalized on FDIC-assisted acquisitions in a non- competitive environment: As competition heated up for FDIC acquisitions and deal pricing increased, First Financial focused internally on operations: While the M&A market remains slow and the industry struggles with capital deployment, First Financial: Consolidated 14 charters, implemented one brand and updated IT infrastructure to drive efficiency Sold NPAs in a strong pricing environment Exited non-strategic business lines such as insurance, indirect auto and mortgage servicing Consolidated / sold non- strategic and underperforming branch locations Moved headquarters to Cincinnati and expanded operations in this market Recruited key additions to management team Completed $103.5 million common equity offering Peoples Community – Asset discount of approximately 7% Irwin Union Bank & Trust / Irwin Union FSB – Asset discount of approximately 25% – Pre-tax bargain purchase gain of $342.5 million Both transactions substantially increased branch presence within strategic operating footprint Strategic core deposit retention, covered loan performance and subsequent growth have exceeded initial expectations Completed $96.5 million common equity offering Completed the operational integration of the 2009 FDIC- assisted transactions Exited non-strategic markets associated with the acquisitions Invested in business lines identified for future growth opportunities Used liquidity to prepay $232 million of FHLB advances, enhancing net interest margin in future periods Implemented efficiency initiatives designed to lower operating costs Acquired 16 branches from Liberty Savings Bank, 12 of which are located in the Dayton market Acquired 22 branches from Flagstar Bank, 18 of which are located in the Indianapolis market Both transactions expected to drive growth across all business lines in key strategic metropolitan markets Announced implementation of variable dividend / 100% payout, increasing total shareholder return while maintaining flexibility to capitalize on future opportunities

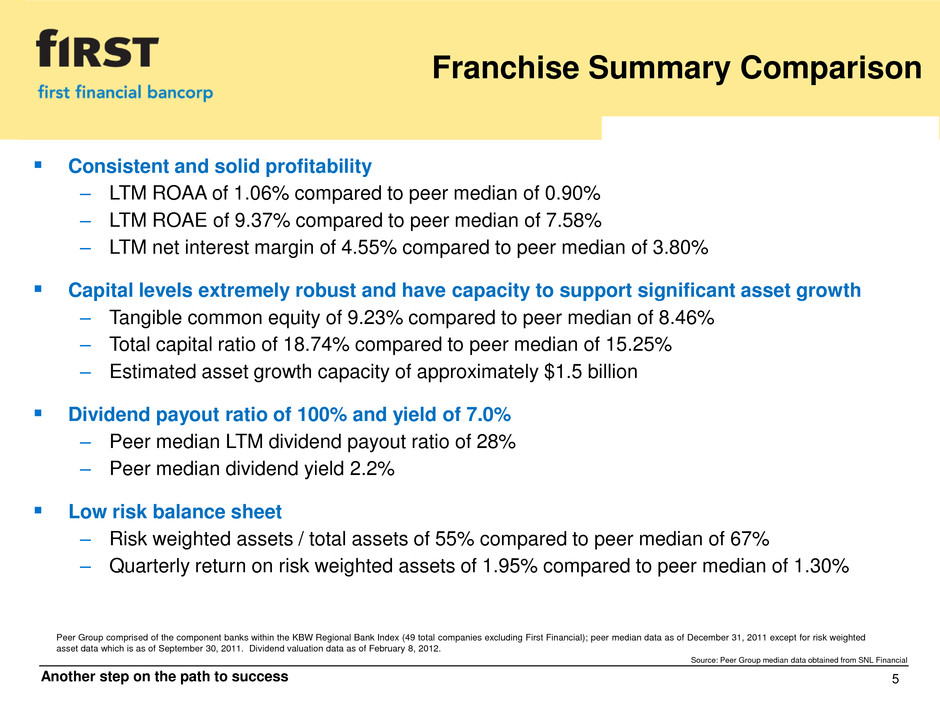

Another step on the path to success Franchise Summary Comparison Consistent and solid profitability – LTM ROAA of 1.06% compared to peer median of 0.90% – LTM ROAE of 9.37% compared to peer median of 7.58% – LTM net interest margin of 4.55% compared to peer median of 3.80% Capital levels extremely robust and have capacity to support significant asset growth – Tangible common equity of 9.23% compared to peer median of 8.46% – Total capital ratio of 18.74% compared to peer median of 15.25% – Estimated asset growth capacity of approximately $1.5 billion Dividend payout ratio of 100% and yield of 7.0% – Peer median LTM dividend payout ratio of 28% – Peer median dividend yield 2.2% Low risk balance sheet – Risk weighted assets / total assets of 55% compared to peer median of 67% – Quarterly return on risk weighted assets of 1.95% compared to peer median of 1.30% Peer Group comprised of the component banks within the KBW Regional Bank Index (49 total companies excluding First Financial); peer median data as of December 31, 2011 except for risk weighted asset data which is as of September 30, 2011. Dividend valuation data as of February 8, 2012. Source: Peer Group median data obtained from SNL Financial 5

Another step on the path to success 6 Fourth Quarter 2011 Financial Highlights Quarterly net income of $17.9 million, or $0.31 per diluted common share Strong quarterly and annual growth in diluted earnings per common share – Fourth quarter 2011 increased 14.8% compared to linked quarter – Full year 2011 increased 15.2% compared to full year 2010 Continued strong profitability – Return on average assets of 1.09% – Return on risk-weighted assets of 1.95% – Return on average shareholders’ equity of 9.89% Adjusted pre-tax, pre-provision income remained solid, totaling $31.5 million, or 1.92% of average assets Strong growth in key uncovered loan portfolios compared to linked quarter – Commercial loan balances increased 16.6% on an annualized basis – Commercial real estate balances increased 10.2% on an annualized basis Quarterly net interest margin remains strong at 4.32% – Driven by yield on covered loans and continued decline in cost of deposits Decrease in nonperforming assets and credit costs – Nonperforming assets / total assets declined to 1.31% from 1.40% as of September 30, 2011 – Total provision for loan and lease losses declined 19% compared to linked quarter

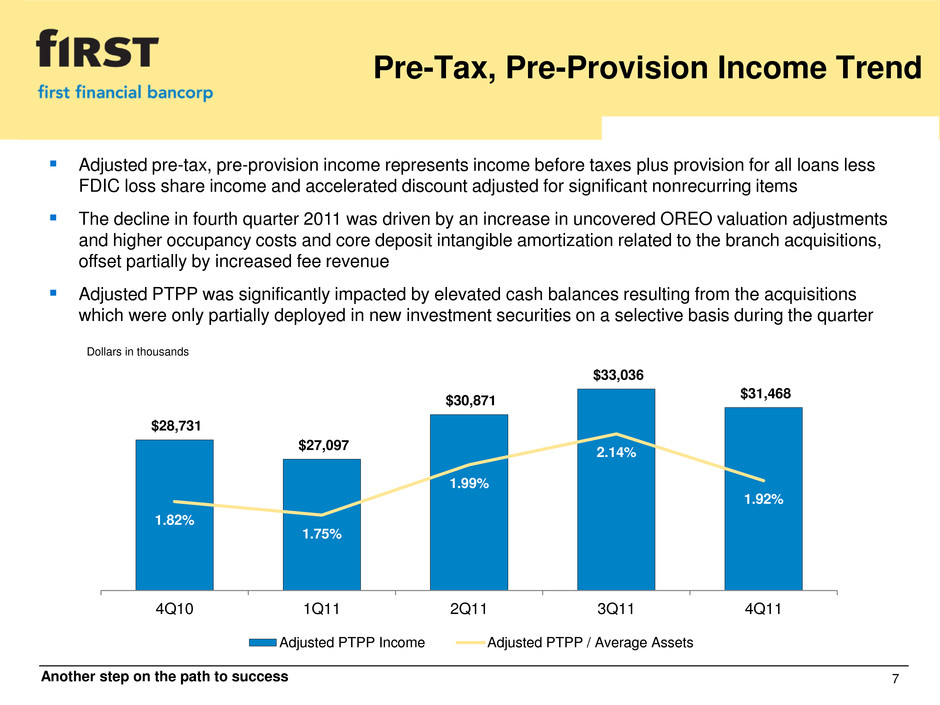

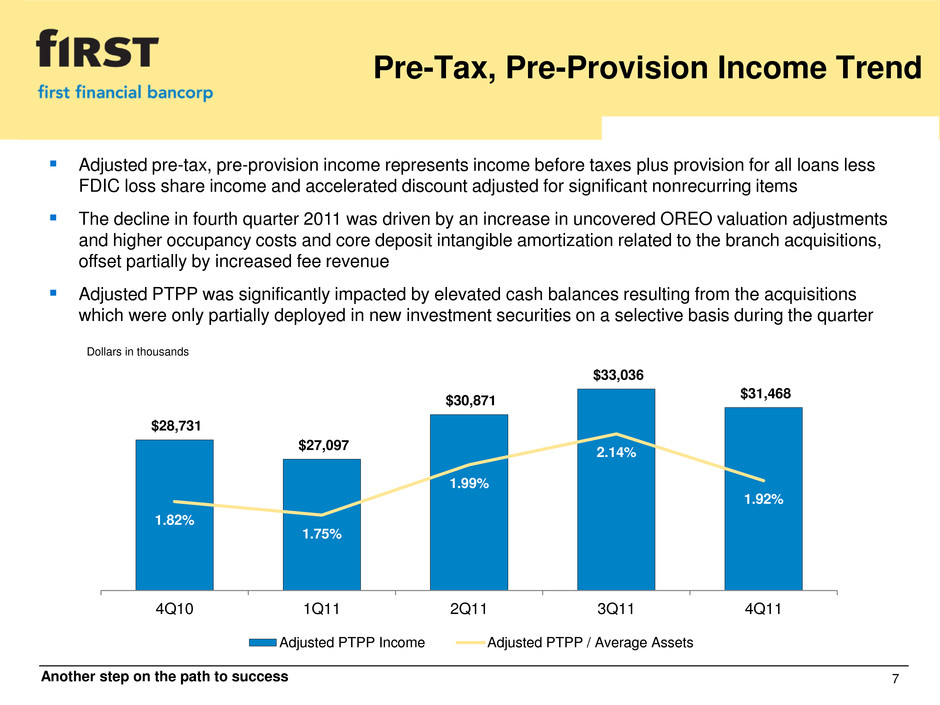

Another step on the path to success 7 Pre-Tax, Pre-Provision Income Trend Adjusted pre-tax, pre-provision income represents income before taxes plus provision for all loans less FDIC loss share income and accelerated discount adjusted for significant nonrecurring items The decline in fourth quarter 2011 was driven by an increase in uncovered OREO valuation adjustments and higher occupancy costs and core deposit intangible amortization related to the branch acquisitions, offset partially by increased fee revenue Adjusted PTPP was significantly impacted by elevated cash balances resulting from the acquisitions which were only partially deployed in new investment securities on a selective basis during the quarter $28,731 $27,097 $30,871 $33,036 $31,468 1.82% 1.75% 1.99% 2.14% 1.92% 4Q10 1Q11 2Q11 3Q11 4Q11 Dollars in thousands Adjusted PTPP Income Adjusted PTPP / Average Assets

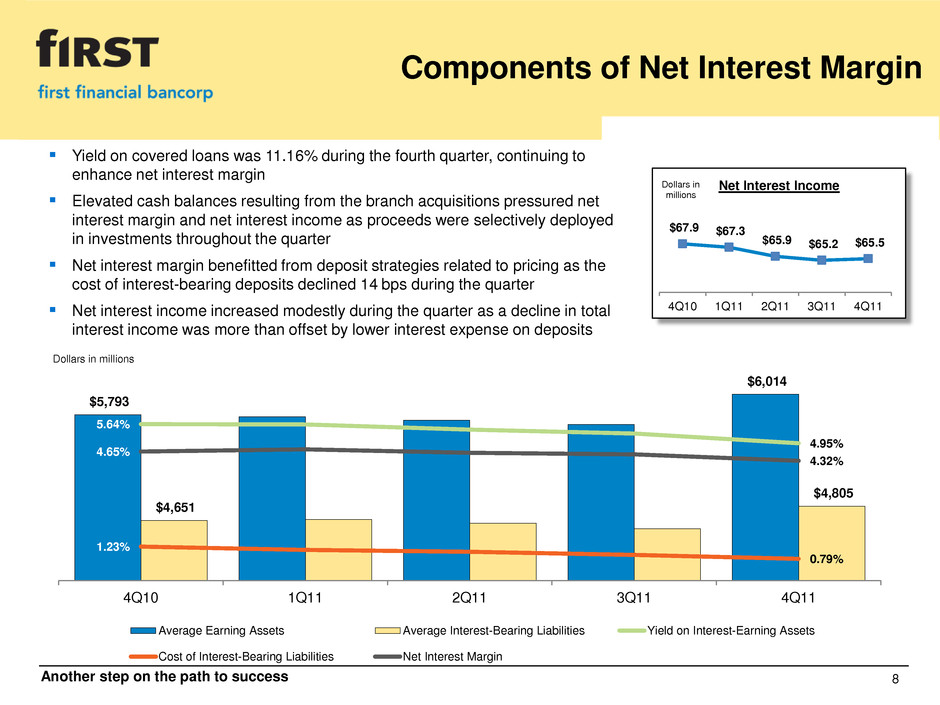

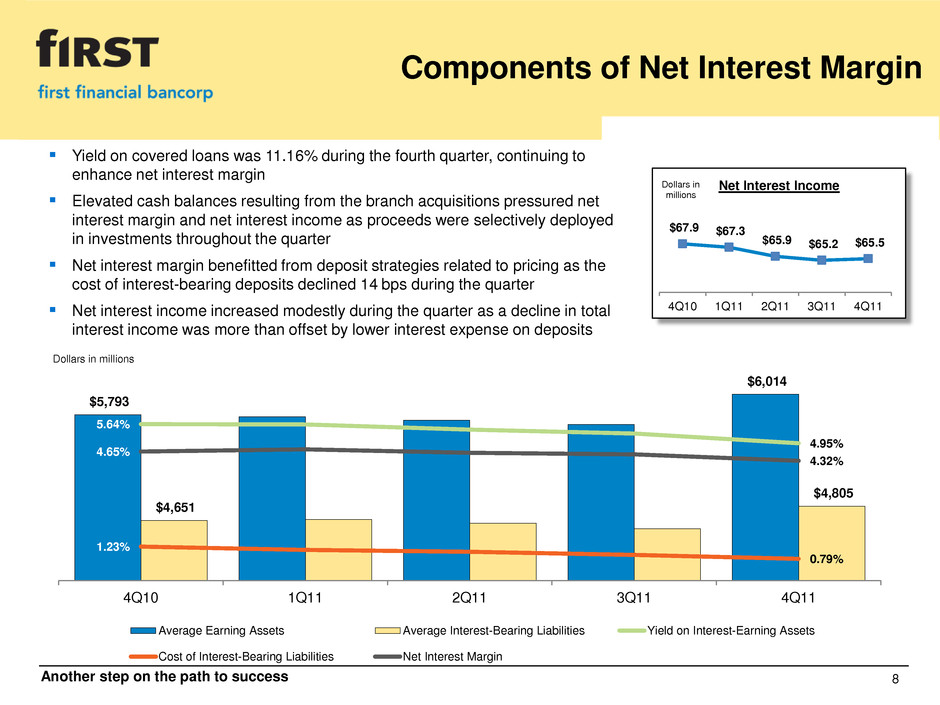

Another step on the path to success 8 Components of Net Interest Margin Yield on covered loans was 11.16% during the fourth quarter, continuing to enhance net interest margin Elevated cash balances resulting from the branch acquisitions pressured net interest margin and net interest income as proceeds were selectively deployed in investments throughout the quarter Net interest margin benefitted from deposit strategies related to pricing as the cost of interest-bearing deposits declined 14 bps during the quarter Net interest income increased modestly during the quarter as a decline in total interest income was more than offset by lower interest expense on deposits $67.9 $67.3 $65.9 $65.2 $65.5 4Q10 1Q11 2Q11 3Q11 4Q11 Dollars in millions Net Interest Income $5,793 $6,014 $4,651 $4,805 5.64% 4.95% 1.23% 0.79% 4.65% 4.32% 4Q10 1Q11 2Q11 3Q11 4Q11 Dollars in millions Average Earning Assets Average Interest-Bearing Liabilities Yield on Interest-Earning Assets Cost of Interest-Bearing Liabilities Net Interest Margin

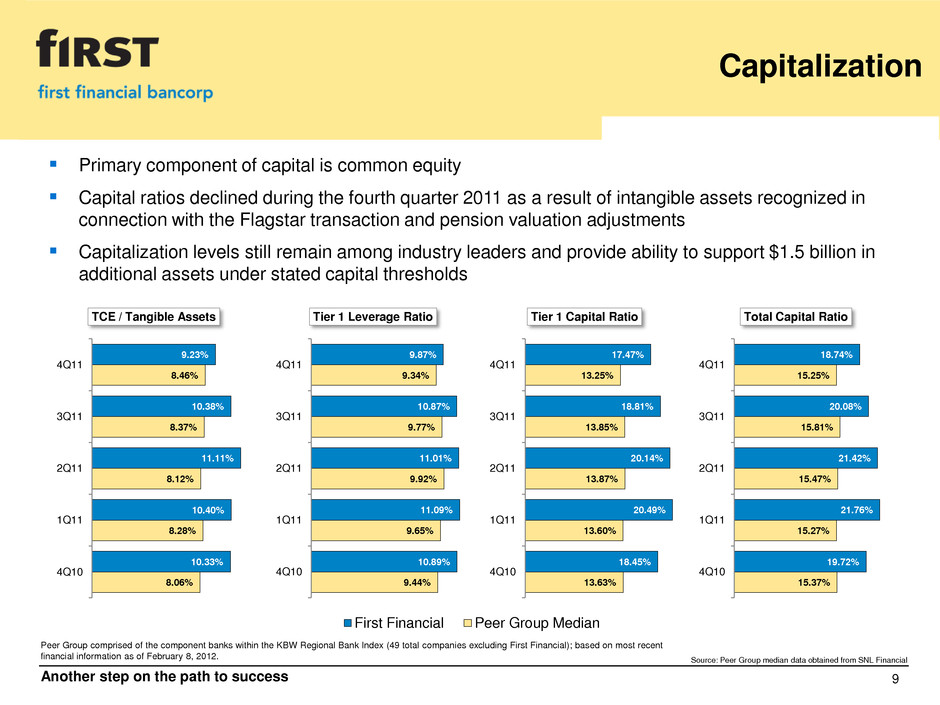

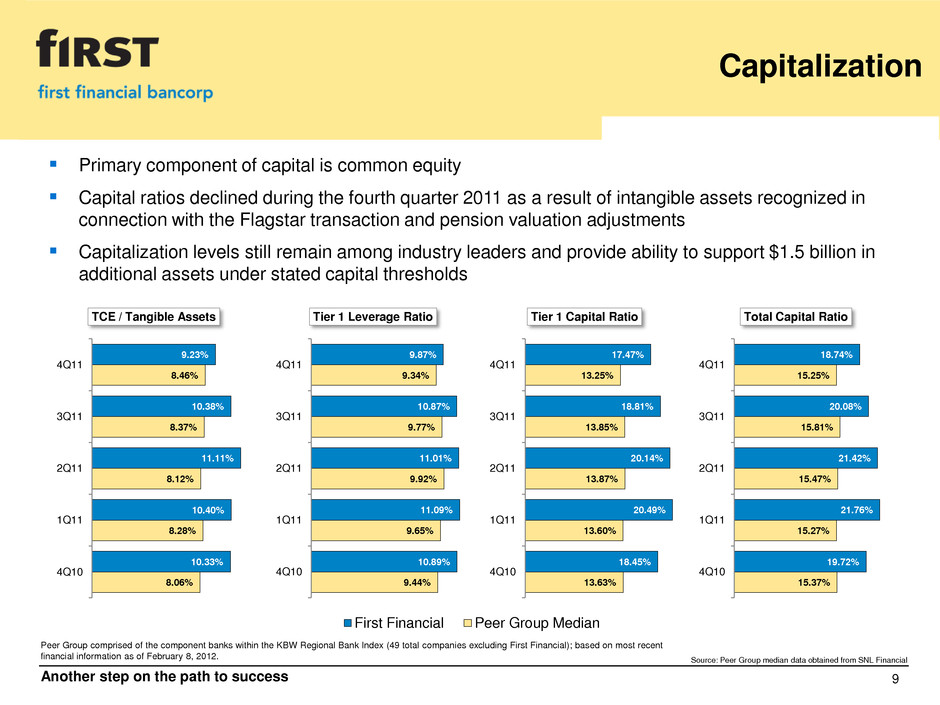

Another step on the path to success 9 Capitalization Primary component of capital is common equity Capital ratios declined during the fourth quarter 2011 as a result of intangible assets recognized in connection with the Flagstar transaction and pension valuation adjustments Capitalization levels still remain among industry leaders and provide ability to support $1.5 billion in additional assets under stated capital thresholds Source: Peer Group median data obtained from SNL Financial Peer Group comprised of the component banks within the KBW Regional Bank Index (49 total companies excluding First Financial); based on most recent financial information as of February 8, 2012. 10.38% 10.33% 10.40% 11.11% 10.38%7.96% 8.06% 8.28% 8.12% 8.39% 3Q10 4Q1 1Q11 2Q1 3Q11 First Financial Peer Group Median 8.06% 8.28% 8.12% 8.37% 8.46% 10.33% 10.40% 11.11% 10.38% 9.23% 4Q10 1Q11 2Q11 3Q11 4Q11 TCE / Tangible Assets 9.44% 9.65% 9.92% 9.77% 9.34% 10.89% 11.09% 11.01% 10.87% 9.87% 4Q10 1Q11 2Q11 3Q11 4Q11 Tier 1 Leverage Ratio 13.63% 13.60% 13.87% 13.85% 13.25% 18.45% 20.49% 20.14% 18.81% 17.47% 4Q10 1Q11 2Q11 3Q11 4Q11 Tier 1 Capital Ratio 15.37% 15.27% 15.47% 15.81% 15.25% 19.72% 21.76% 21.42% 20.08% 18.74% 4Q10 1Q11 2Q11 3Q11 4Q11 T tal Capital Ratio

Another step on the path to success 10 Variable Dividend / 100% Payout Ratio 100% dividend payout ratio comprised of two components: – Regular dividend based on stated payout of between 40% - 60% of quarterly earnings; currently $0.12 per share – Variable dividend based on the remainder of quarterly earnings; $0.19 per share based on fourth quarter 2011 earnings Stated capital thresholds include a tangible equity ratio of 7%, tier 1 leverage ratio of 8% and total capital ratio of 13%; current capital levels are well in excess of these thresholds and can support significant growth – Strong earnings continue to generate capital to support further growth – we are returning this incremental growth capacity to shareholders with the variable dividend Variable dividend is intended to provide an enhanced return to our shareholders and avoid adding to our capital position until capital deployment opportunities arise, such as acquisitions or organic growth, that move the Company towards its capital thresholds. Board of directors will evaluate the variable dividend on a quarterly basis but expects to approve a 100% payout ratio for the foreseeable future Source: Bloomberg; reflects period since First Financial’s second quarter 2011 earnings release when initiation of variable dividend was announced; July 28, 2011 through February 8, 2012. 15.2% 9.0% 3.9% 1.5% First Financial KBW Regional Bank Index Total Return Comparison Since Announcement of Variable Dividend Price Appreciation Dividend Return 19.1% 10.5%

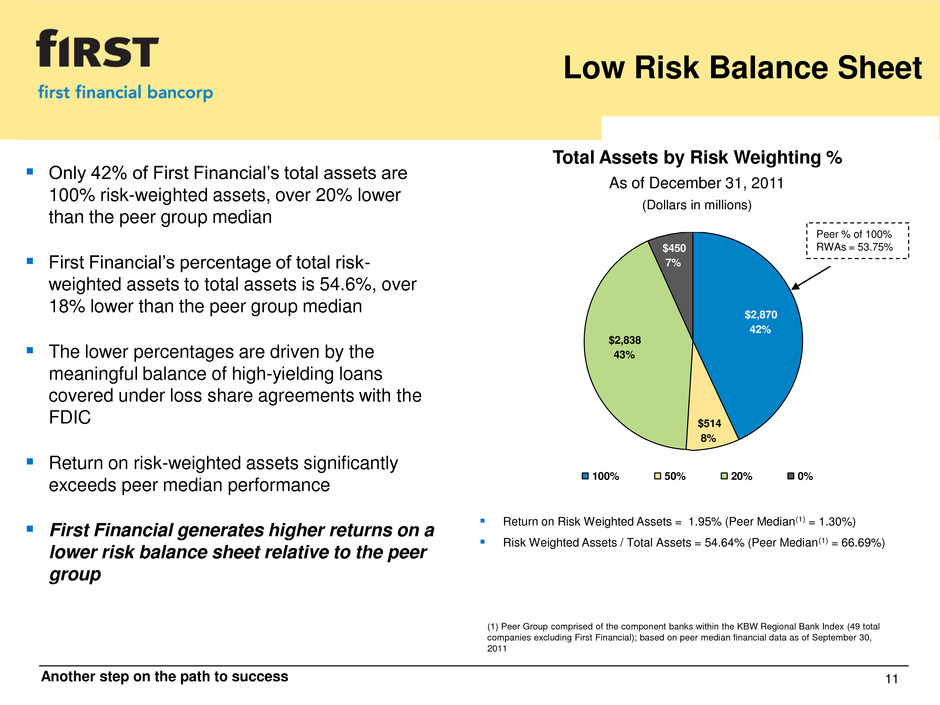

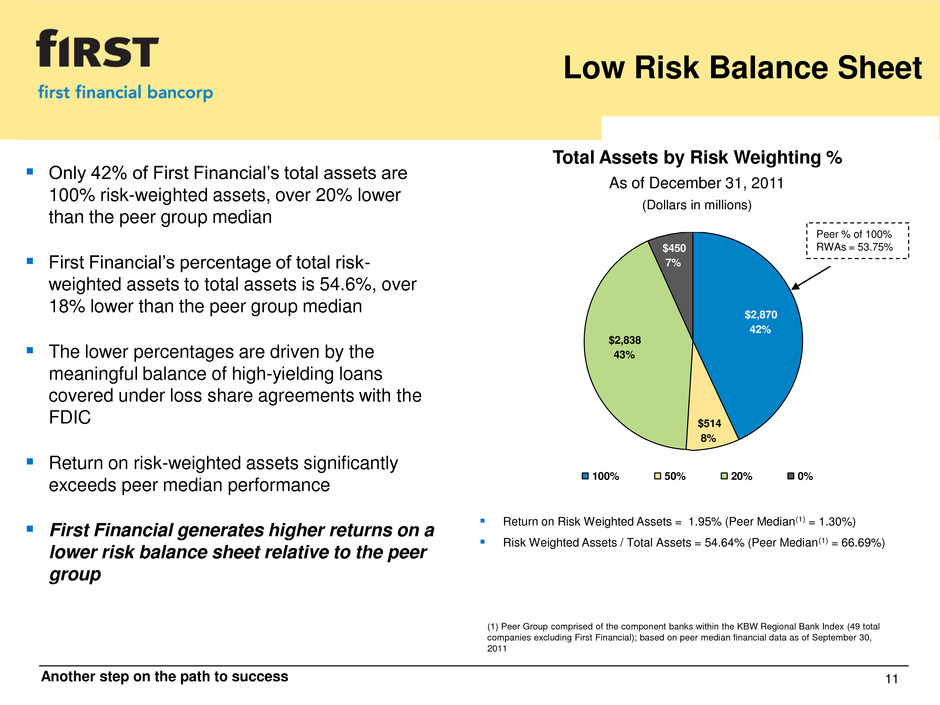

Another step on the path to success 11 Low Risk Balance Sheet Total Assets by Risk Weighting % As of December 31, 2011 (Dollars in millions) Return on Risk Weighted Assets = 1.95% (Peer Median(1) = 1.30%) Risk Weighted Assets / Total Assets = 54.64% (Peer Median(1) = 66.69%) (1) Peer Group comprised of the component banks within the KBW Regional Bank Index (49 total companies excluding First Financial); based on peer median financial data as of September 30, 2011 Peer % of 100% RWAs = 53.75% $2,870 42% $514 8% $2,838 43% $450 7% 100% 50% 20% 0% Only 42% of First Financial’s total assets are 100% risk-weighted assets, over 20% lower than the peer group median First Financial’s percentage of total risk- weighted assets to total assets is 54.6%, over 18% lower than the peer group median The lower percentages are driven by the meaningful balance of high-yielding loans covered under loss share agreements with the FDIC Return on risk-weighted assets significantly exceeds peer median performance First Financial generates higher returns on a lower risk balance sheet relative to the peer group

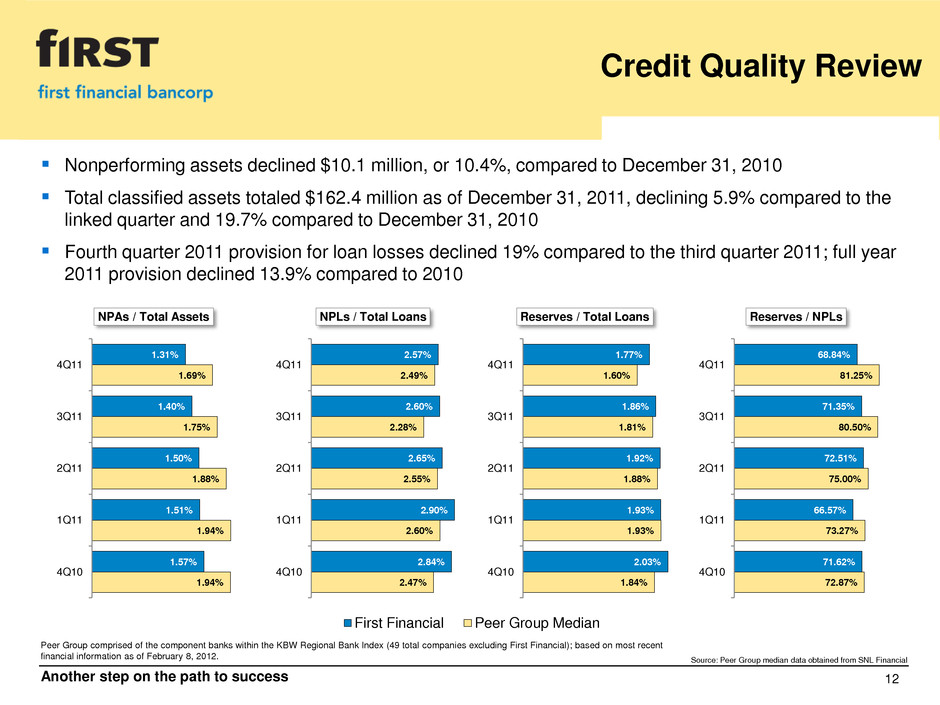

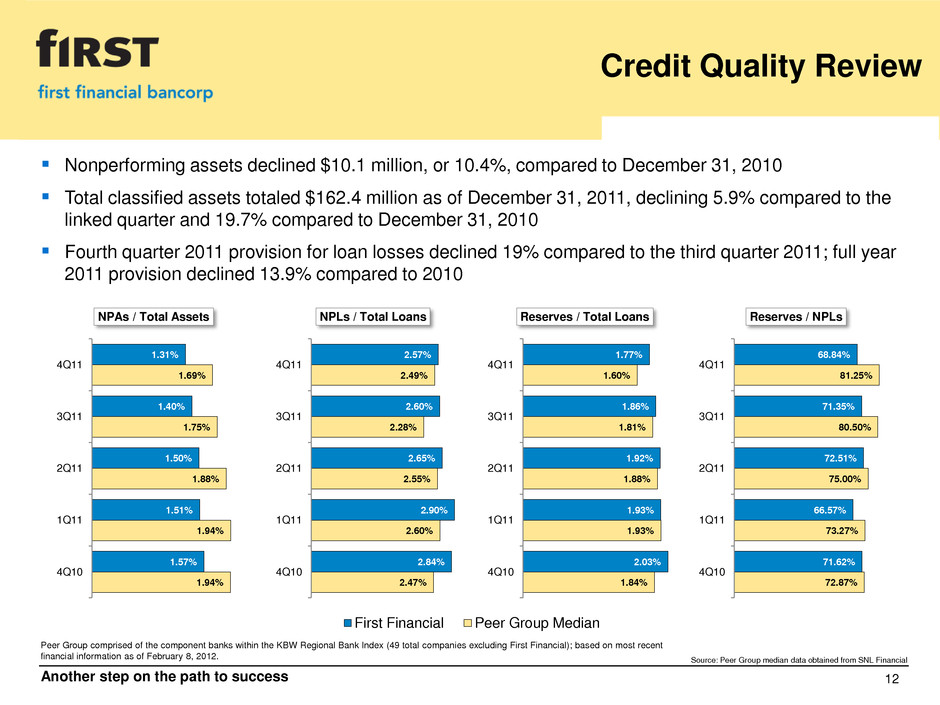

Another step on the path to success 12 Credit Quality Review Nonperforming assets declined $10.1 million, or 10.4%, compared to December 31, 2010 Total classified assets totaled $162.4 million as of December 31, 2011, declining 5.9% compared to the linked quarter and 19.7% compared to December 31, 2010 Fourth quarter 2011 provision for loan losses declined 19% compared to the third quarter 2011; full year 2011 provision declined 13.9% compared to 2010 Peer Group comprised of the component banks within the KBW Regional Bank Index (49 total companies excluding First Financial); based on most recent financial information as of February 8, 2012. Source: Peer Group median data obtained from SNL Financial 10.38% 10.33% 10.40% 11.11% 10.38%7.96% 8.06% 8.28% 8.12% 8.39% 3Q10 4Q1 1Q11 2Q1 3Q11 First Financial Peer Group Median 1.84% 1.93% 1.88% 1.81% 1.60% 2.03% .93% 1.92% 1.86% 1.77% 4Q10 1Q11 2Q11 3Q11 4Q11 Reserves / Total Loans 1.94% 1.94% 1.88% 1.75% 1.69% 1.57% 1.51% 1.50% 1.40% 1.31% 4Q10 1Q11 2Q11 3Q11 4Q11 NPAs / Total Assets 2.47% 2.60% 2.55% 2.28% 2.49% 2.84% 2.90% 2.65% 2.60% 2.57% 4Q10 1Q11 2Q11 3Q11 4Q11 NPLs / Total Loans 72.87% 73.27% 75.00% 80.50% 81.25% 71.62% 66.57% 72.51% 71.35% 68.84% 4Q10 1Q11 2Q11 3Q11 4Q11 Reserves / NPLs

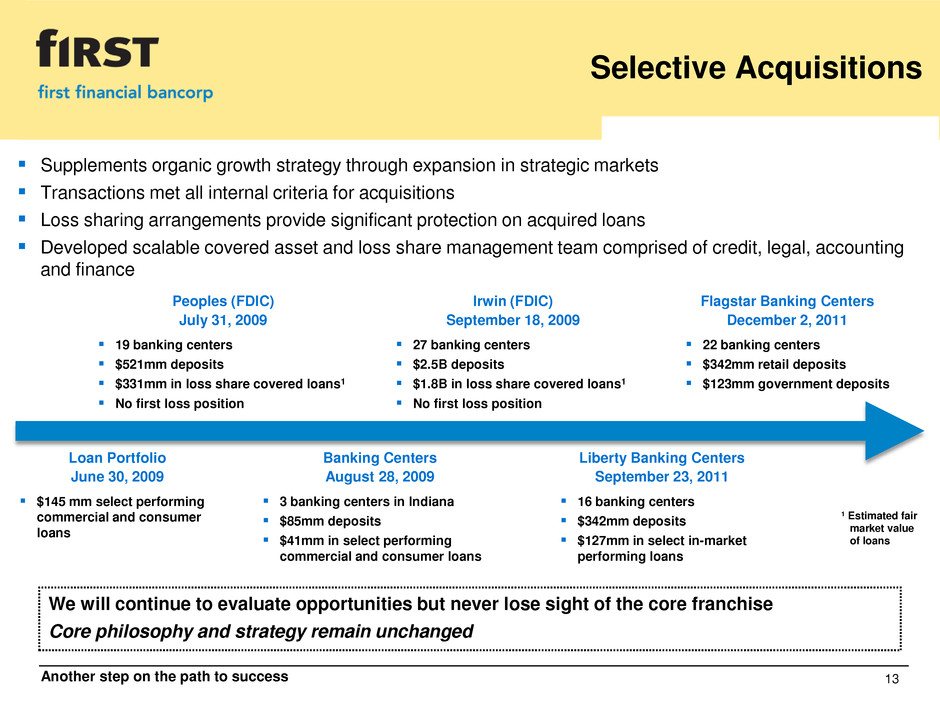

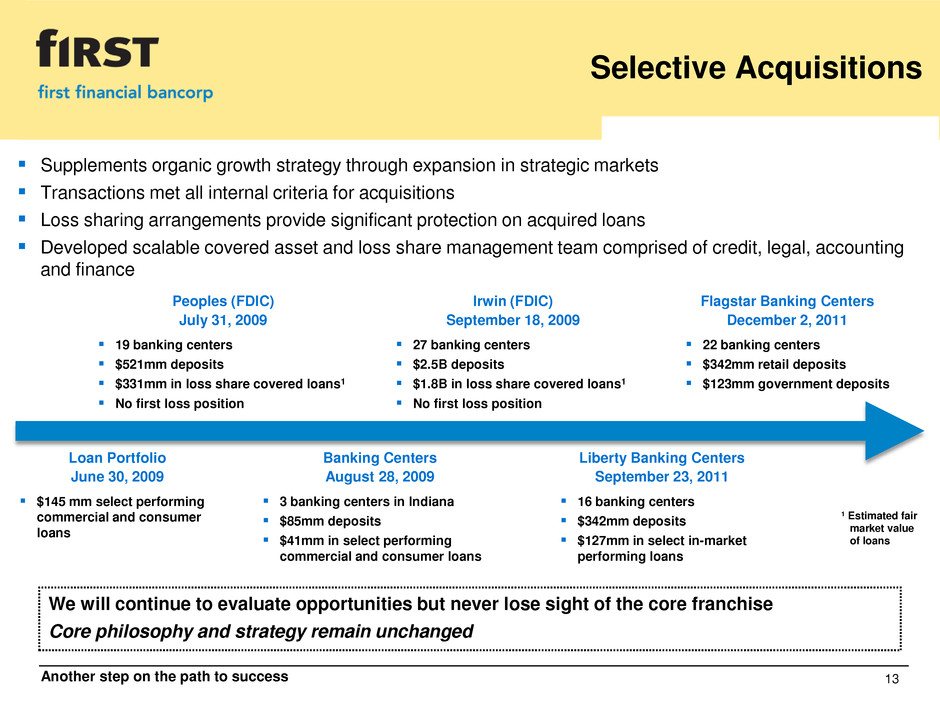

Another step on the path to success 13 Selective Acquisitions Supplements organic growth strategy through expansion in strategic markets Transactions met all internal criteria for acquisitions Loss sharing arrangements provide significant protection on acquired loans Developed scalable covered asset and loss share management team comprised of credit, legal, accounting and finance Loan Portfolio June 30, 2009 $145 mm select performing commercial and consumer loans Peoples (FDIC) July 31, 2009 19 banking centers $521mm deposits $331mm in loss share covered loans1 No first loss position Banking Centers August 28, 2009 3 banking centers in Indiana $85mm deposits $41mm in select performing commercial and consumer loans Irwin (FDIC) September 18, 2009 27 banking centers $2.5B deposits $1.8B in loss share covered loans1 No first loss position Liberty Banking Centers September 23, 2011 16 banking centers $342mm deposits $127mm in select in-market performing loans Flagstar Banking Centers December 2, 2011 22 banking centers $342mm retail deposits $123mm government deposits 1 Estimated fair market value of loans We will continue to evaluate opportunities but never lose sight of the core franchise Core philosophy and strategy remain unchanged

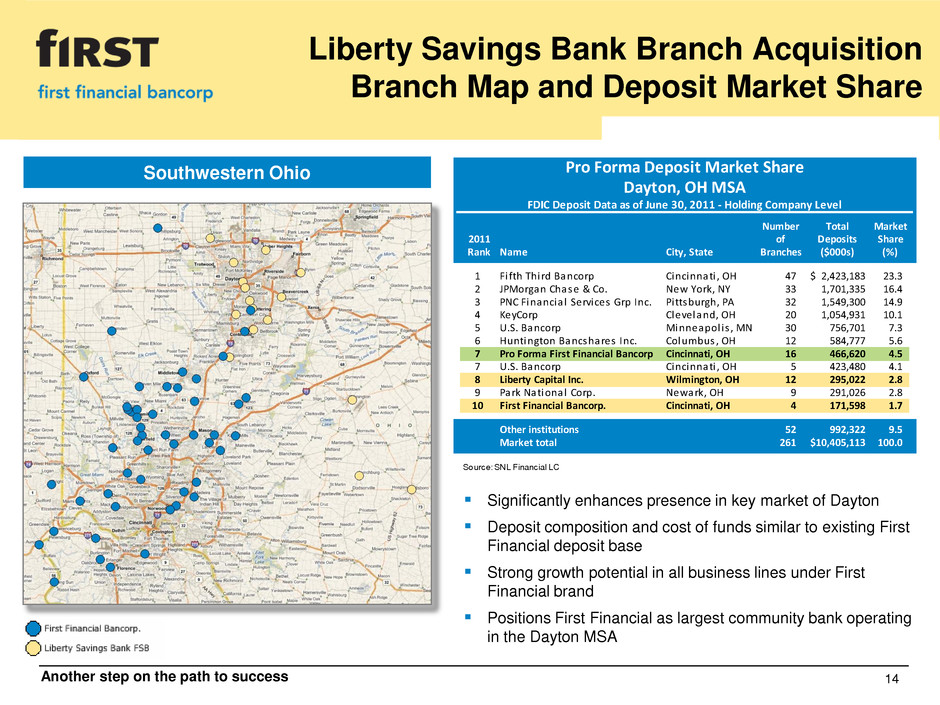

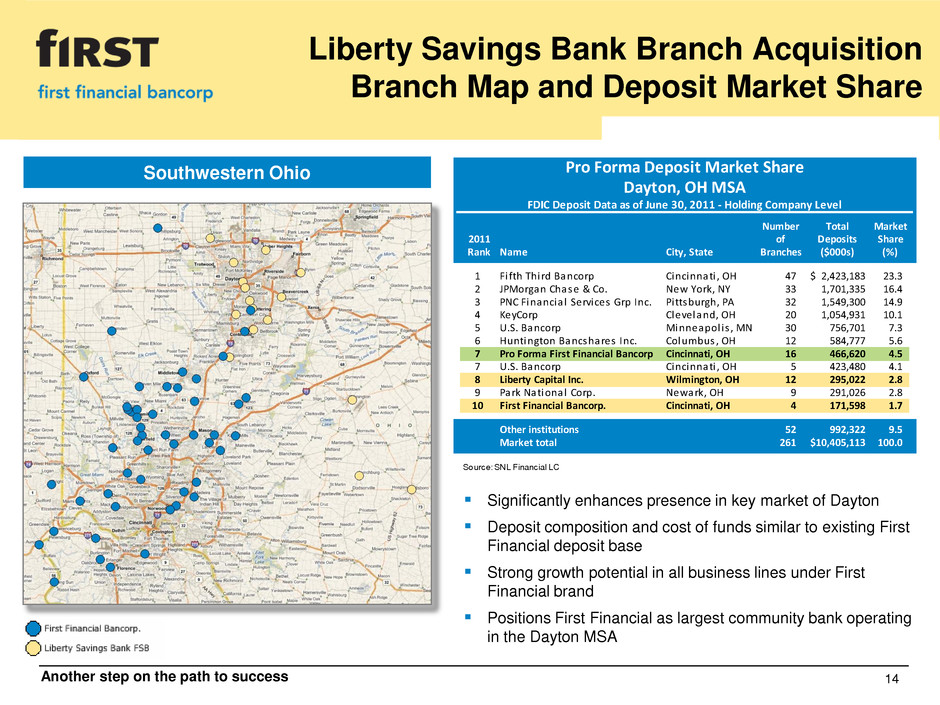

Another step on the path to success 14 Liberty Savings Bank Branch Acquisition Branch Map and Deposit Market Share Significantly enhances presence in key market of Dayton Deposit composition and cost of funds similar to existing First Financial deposit base Strong growth potential in all business lines under First Financial brand Positions First Financial as largest community bank operating in the Dayton MSA Southwestern Ohio Pro Forma Deposit Market Share Dayton, OH MSA FDIC Deposit Data as of June 30, 2011 - Holding Company Level Number Total Market 2011 of Deposits Share Rank Name City, State Branches ($000s) (%) 1 Fi fth Third Bancorp Cincinnati , OH 47 2,423,183$ 23.3 2 JPMorgan Chase & Co. New York, NY 33 1,701,335 16.4 3 PNC Financia l Services Grp Inc. Pi ttsburgh, PA 32 1,549,300 14.9 4 KeyCorp Cleveland, OH 20 1,054,931 10.1 5 U.S. Bancorp Minneapol is , MN 30 756,701 7.3 6 Huntington Bancshares Inc. Columbus, OH 12 584,777 5.6 7 Pro Forma First Financial Bancorp Cincinnati, OH 16 466,620 4.5 7 U.S. Bancorp Cincinnati , OH 5 423,480 4.1 8 Liberty Capital Inc. Wilmington, OH 12 295,022 2.8 9 Park National Corp. Newark, OH 9 291,026 2.8 10 First Financial Bancorp. Cincinnati, OH 4 171,598 1.7 Other institutions 52 992,322 9.5 Market total 261 10,405,113$ 100.0 Source: SNL Financial LC

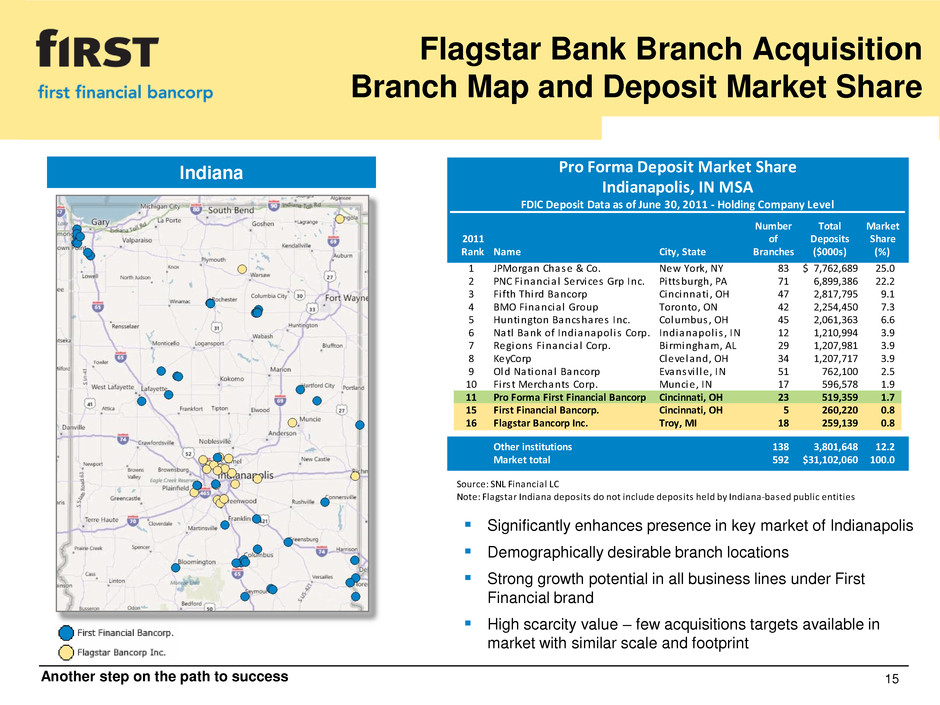

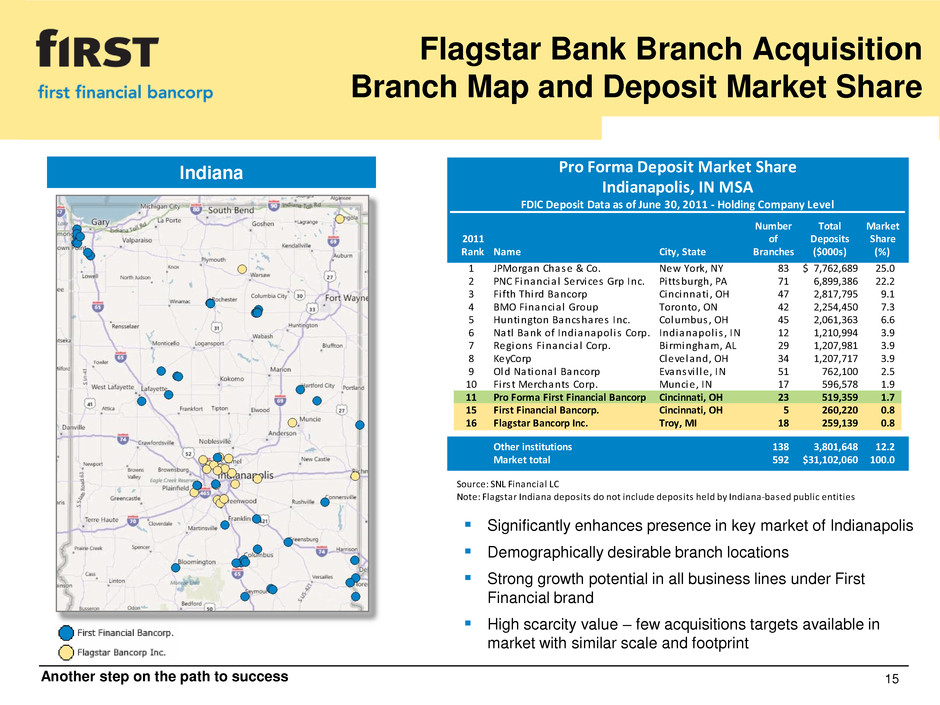

Another step on the path to success 15 Flagstar Bank Branch Acquisition Branch Map and Deposit Market Share Indiana Pro Forma Deposit Market Share Indianapolis, IN MSA FDIC Deposit Data as of June 30, 2011 - Holding Company Level Number Total Market 2011 of Deposits Share Rank Name City, State Branches ($000s) (%) 1 JPMorgan Chase & Co. New York, NY 83 7,762,689$ 25.0 2 PNC Financia l Services Grp Inc. Pi ttsburgh, PA 71 6,899,386 22.2 3 Fi fth Third Bancorp Cincinnati , OH 47 2,817,795 9.1 4 BMO Financia l Group Toronto, ON 42 2,254,450 7.3 5 Huntington Bancshares Inc. Columbus, OH 45 2,061,363 6.6 6 Natl Bank of Indianapol is Corp. Indianapol is , IN 12 1,210,994 3.9 7 Regions Financia l Corp. Birmingham, AL 29 1,207,981 3.9 8 KeyCorp Cleveland, OH 34 1,207,717 3.9 9 Old National Bancorp Evansvi l le, IN 51 762,100 2.5 10 Firs t Merchants Corp. Muncie, IN 17 596,578 1.9 11 Pro Forma First Financial Bancorp Cincinnati, OH 23 519,359 1.7 15 First Financial Bancorp. Cincinnati, OH 5 260,220 0.8 16 Flagstar Bancorp Inc. Troy, MI 18 259,139 0.8 Other institutions 138 3,801,648 12.2 Market total 592 31,102,060$ 100.0 Source: SNL Financial LC Note: Flagstar Indiana deposits do not include deposits held by Indiana-based public entities Significantly enhances presence in key market of Indianapolis Demographically desirable branch locations Strong growth potential in all business lines under First Financial brand High scarcity value – few acquisitions targets available in market with similar scale and footprint

Another step on the path to success 16 Franchise Highlights 1. Strong operating fundamentals – 85 consecutive quarters of profitability 2. Strong capital levels 3. Dividend yield of 7.0% 4. Solid growth in commercial and commercial real estate business lines 5. Low risk balance sheet 6. Credit metrics have remained strong throughout the economic downturn 7. Solid market share in strategic operating markets Dividend yield data as of February 8, 2012.

Another step on the path to success 17 Appendix

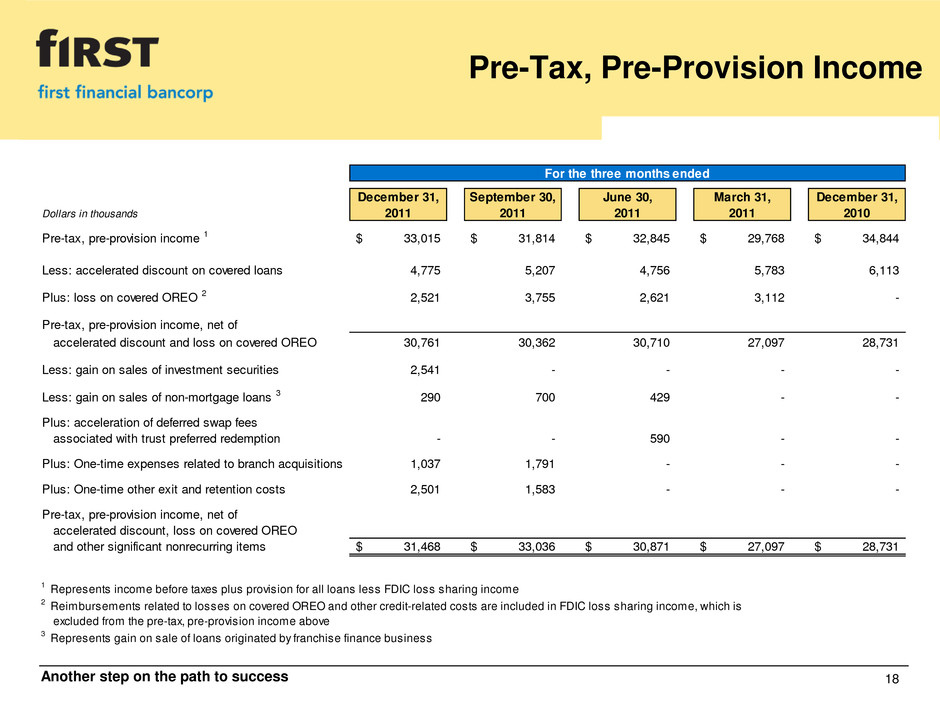

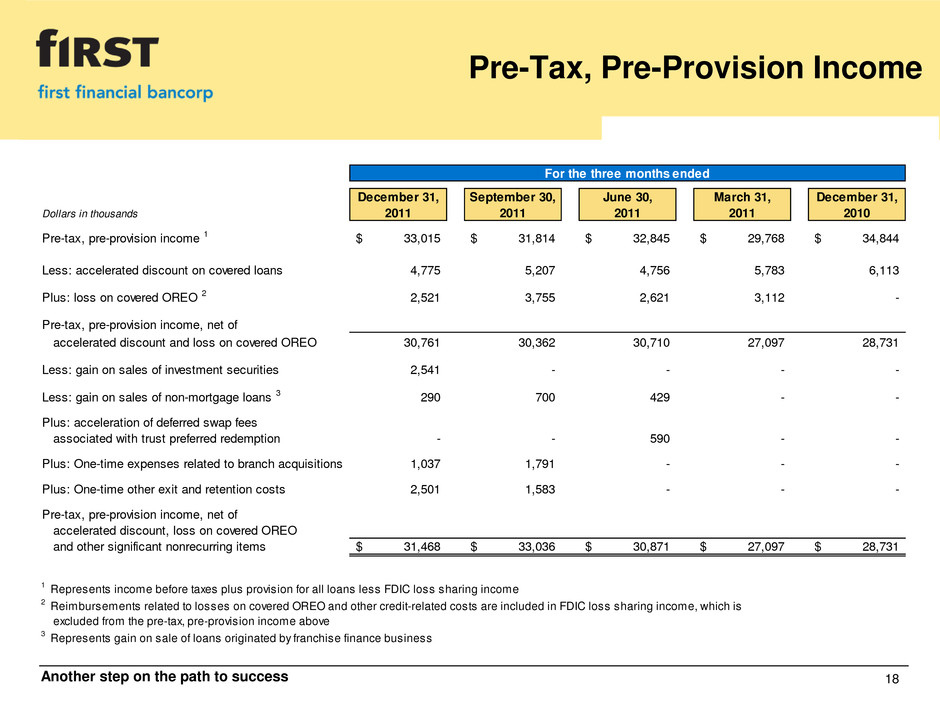

Another step on the path to success 18 Pre-Tax, Pre-Provision Income For the three months ended December 31, September 30, June 30, March 31, December 31, Dollars in thousands 2011 2011 2011 2011 2010 Pre-tax, pre-provision income 1 33,015$ 31,814$ 32,845$ 29,768$ 34,844$ Less: accelerated discount on covered loans 4,775 5,207 4,756 5,783 6,113 Plus: loss on covered OREO 2 2,521 3,755 2,621 3,112 - Pre-tax, pre-provision income, net of accelerated discount and loss on covered OREO 30,761 30,362 30,710 27,097 28,731 Less: gain on sales of investment securities 2,541 - - - - Less: gain on sales of non-mortgage loans 3 290 700 429 - - Plus: acceleration of deferred swap fees associated with trust preferred redemption - - 590 - - Plus: One-time expenses related to branch acquisitions 1,037 1,791 - - - Plus: One-time other exit and retention costs 2,501 1,583 - - - Pre-tax, pre-provision income, net of accelerated discount, loss on covered OREO and other significant nonrecurring items 31,468$ 33,036$ 30,871$ 27,097$ 28,731$ 1 Represents income before taxes plus provision for all loans less FDIC loss sharing income 2 Reimbursements related to losses on covered OREO and other credit-related costs are included in FDIC loss sharing income, which is excluded from the pre-tax, pre-provision income above 3 Represents gain on sale of loans originated by franchise finance business

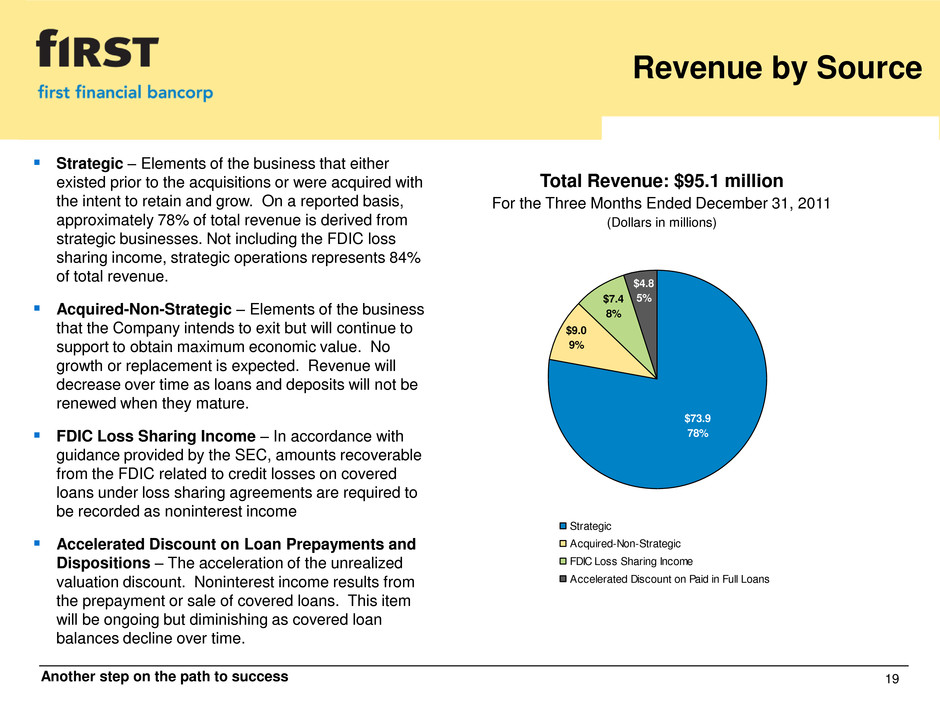

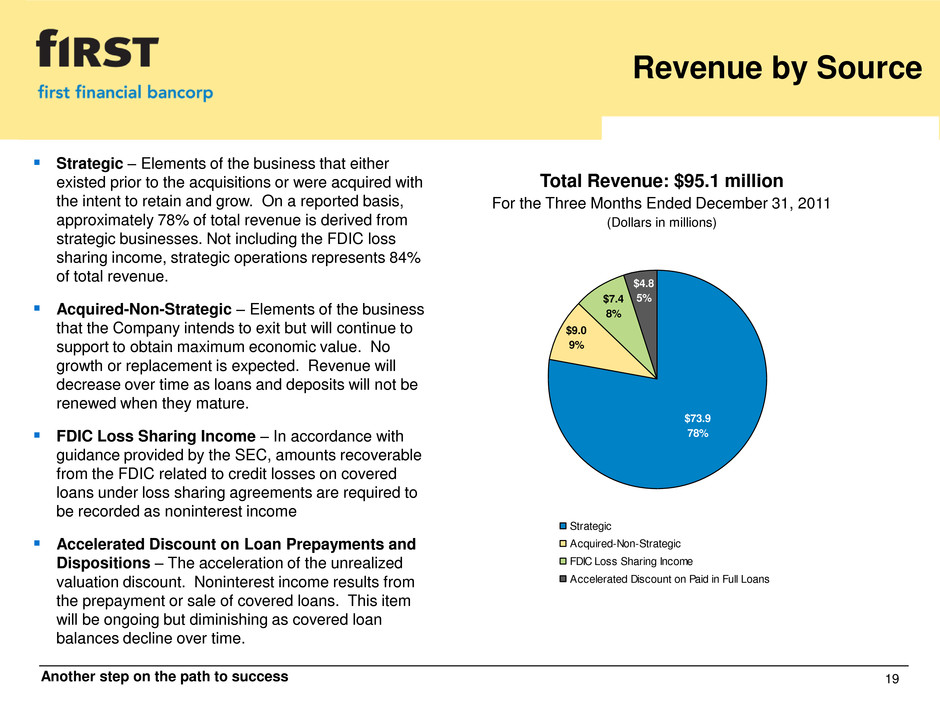

Another step on the path to success 19 Revenue by Source Strategic – Elements of the business that either existed prior to the acquisitions or were acquired with the intent to retain and grow. On a reported basis, approximately 78% of total revenue is derived from strategic businesses. Not including the FDIC loss sharing income, strategic operations represents 84% of total revenue. Acquired-Non-Strategic – Elements of the business that the Company intends to exit but will continue to support to obtain maximum economic value. No growth or replacement is expected. Revenue will decrease over time as loans and deposits will not be renewed when they mature. FDIC Loss Sharing Income – In accordance with guidance provided by the SEC, amounts recoverable from the FDIC related to credit losses on covered loans under loss sharing agreements are required to be recorded as noninterest income Accelerated Discount on Loan Prepayments and Dispositions – The acceleration of the unrealized valuation discount. Noninterest income results from the prepayment or sale of covered loans. This item will be ongoing but diminishing as covered loan balances decline over time. Total Revenue: $95.1 million For the Three Months Ended December 31, 2011 (Dollars in millions) $4.8 5%$7.4 8% $9.0 9% $73.9 78% Strategic Acquired-Non-Strategic FDIC Loss Sharing Income Accelerated Discount on Paid in Full Loans

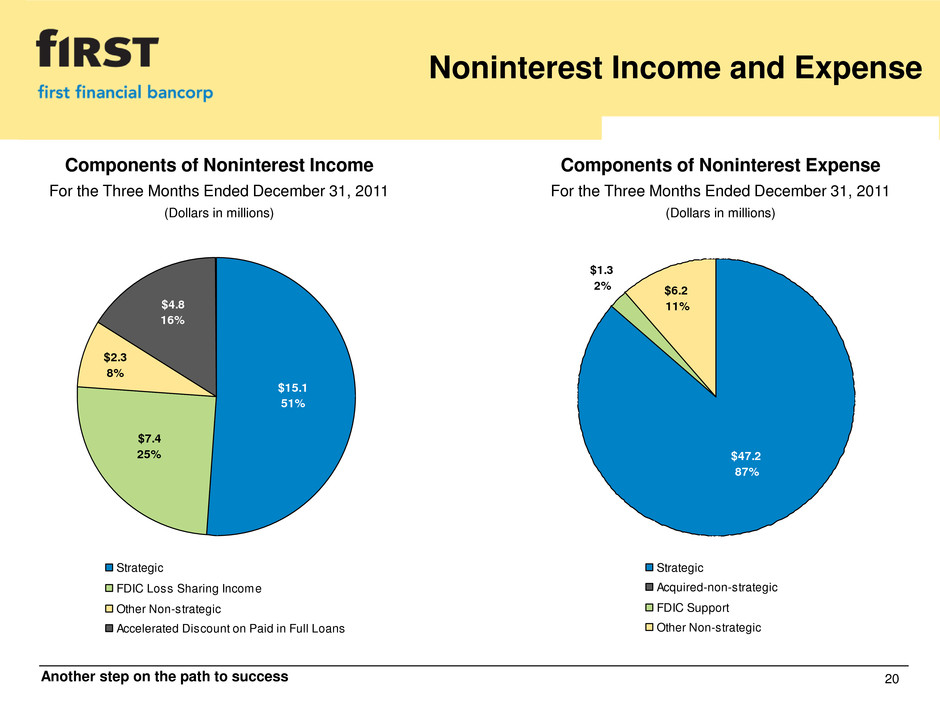

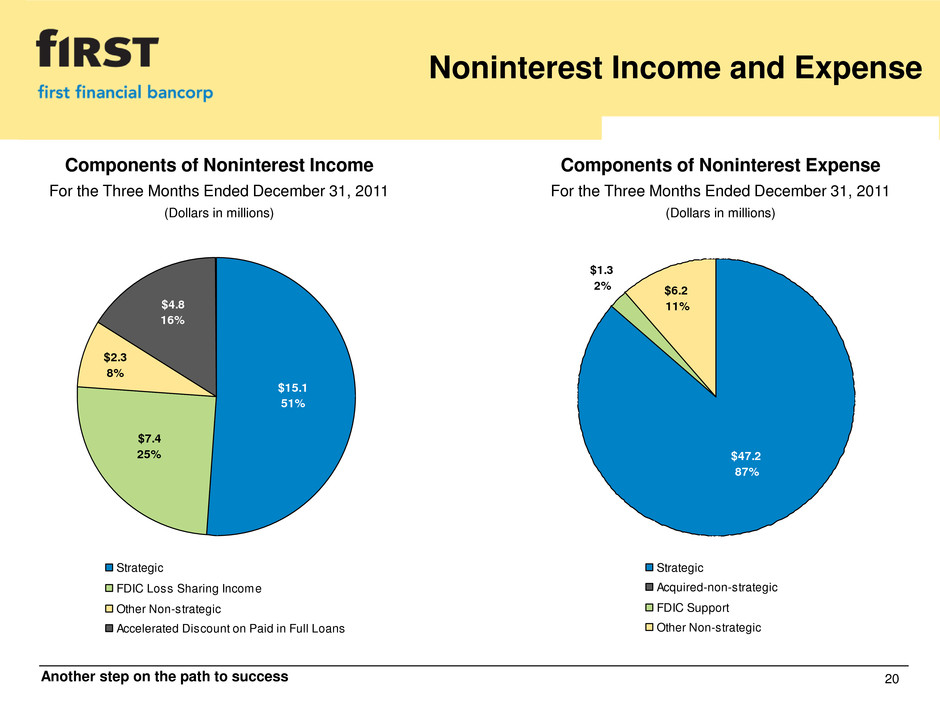

Another step on the path to success 20 Noninterest Income and Expense Components of Noninterest Expense For the Three Months Ended December 31, 2011 (Dollars in millions) Components of Noninterest Income For the Three Months Ended December 31, 2011 (Dollars in millions) $2.3 8% $15.1 51% $7.4 25% $4.8 16% Strategic FDIC Loss Sharing Income Other Non-strategic Accelerated Discount on Paid in Full Loans $1.3 2% $6.2 11% $47.2 87% Strategic Acquired-non-strategic FDIC Support Other Non-strategic

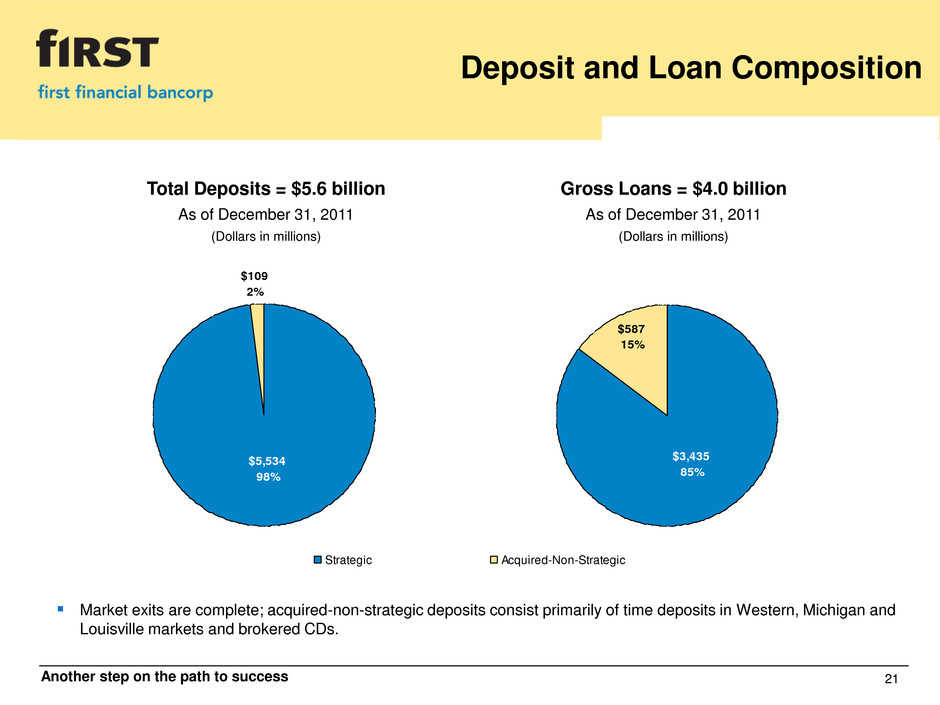

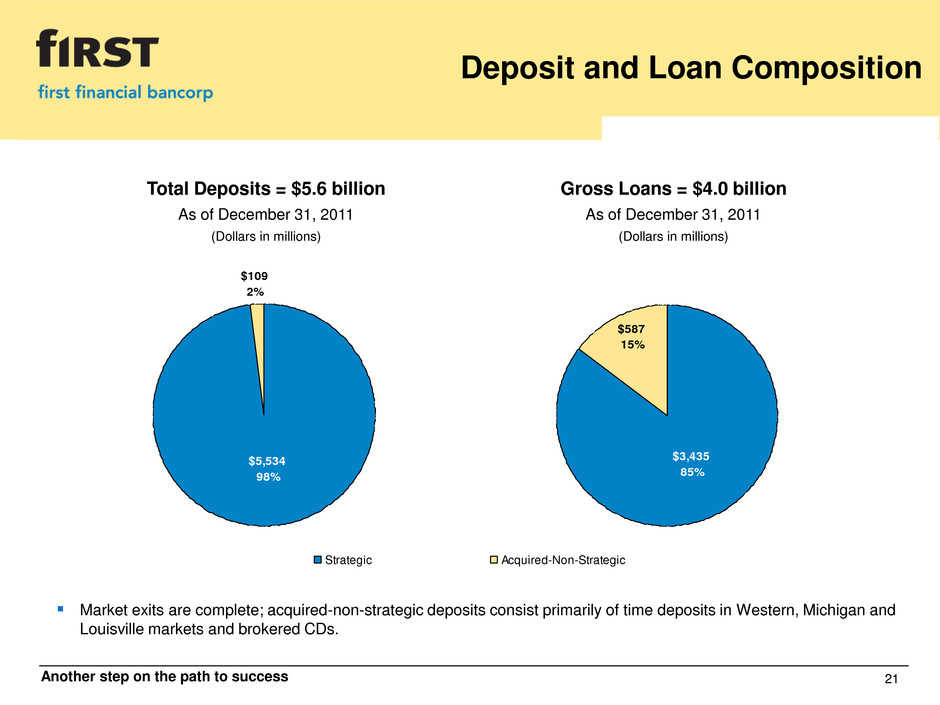

Another step on the path to success 21 Deposit and Loan Composition Total Deposits = $5.6 billion As of December 31, 2011 (Dollars in millions) Gross Loans = $4.0 billion As of December 31, 2011 (Dollars in millions) Market exits are complete; acquired-non-strategic deposits consist primarily of time deposits in Western, Michigan and Louisville markets and brokered CDs. $5,534 98% $109 2% Strategic Acquired-Non-Strategic $3,435 85% $587 15%

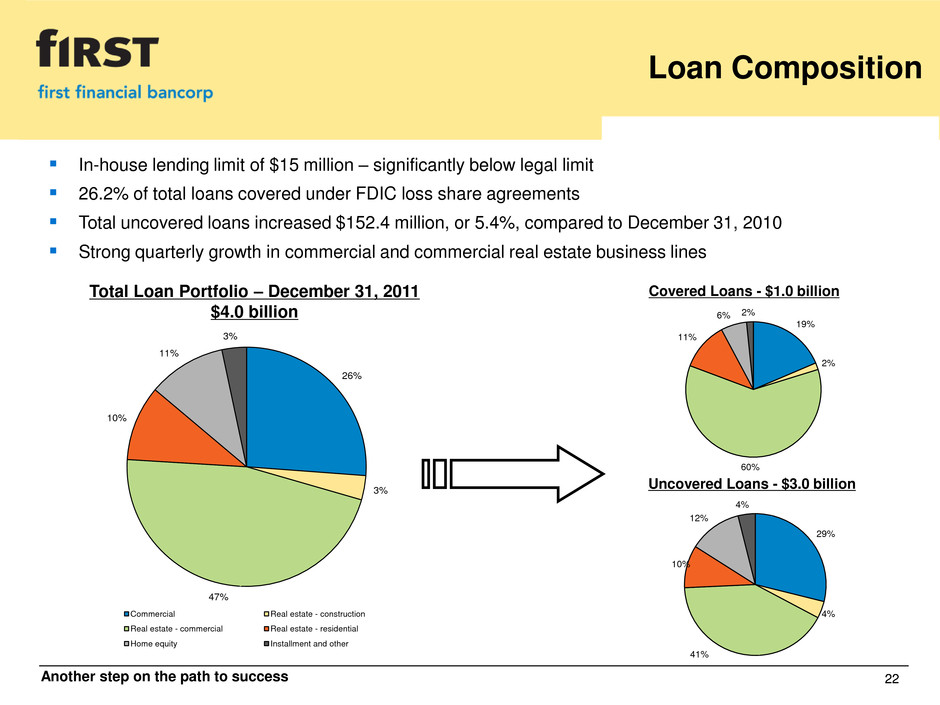

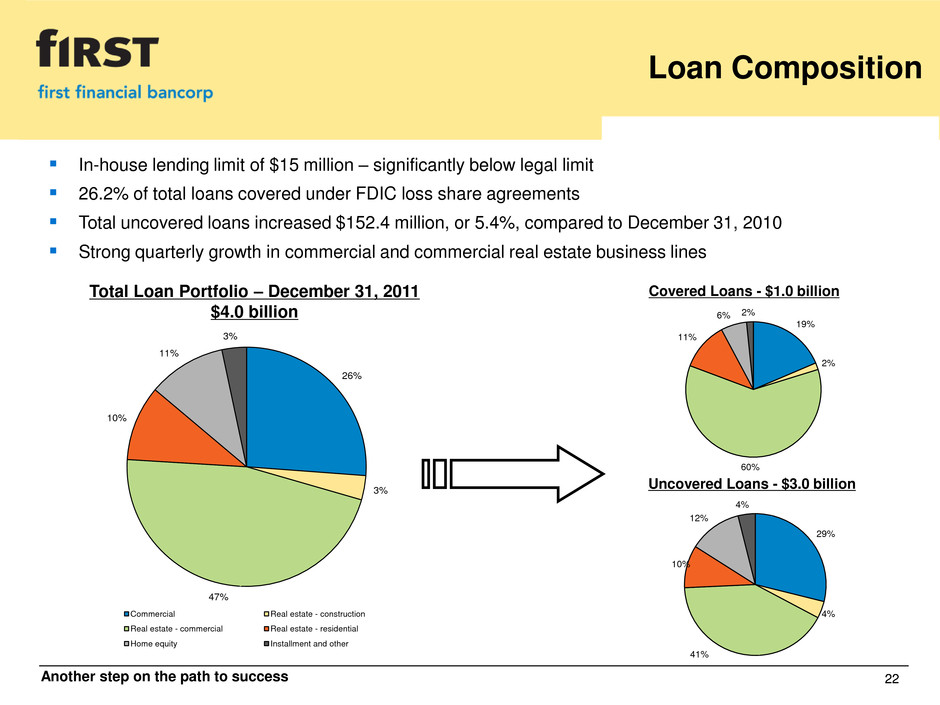

Another step on the path to success 22 Loan Composition Covered Loans - $1.0 billion Uncovered Loans - $3.0 billion Total Loan Portfolio – December 31, 2011 $4.0 billion In-house lending limit of $15 million – significantly below legal limit 26.2% of total loans covered under FDIC loss share agreements Total uncovered loans increased $152.4 million, or 5.4%, compared to December 31, 2010 Strong quarterly growth in commercial and commercial real estate business lines 26% 3% 47% 10% 11% 3% Commercial Real estate - construction Real estate - commercial Real estate - residential Home equity Installment and other 19% 2% 60% 11% 6% 2% 29% 4% 41% 10% 12% 4%

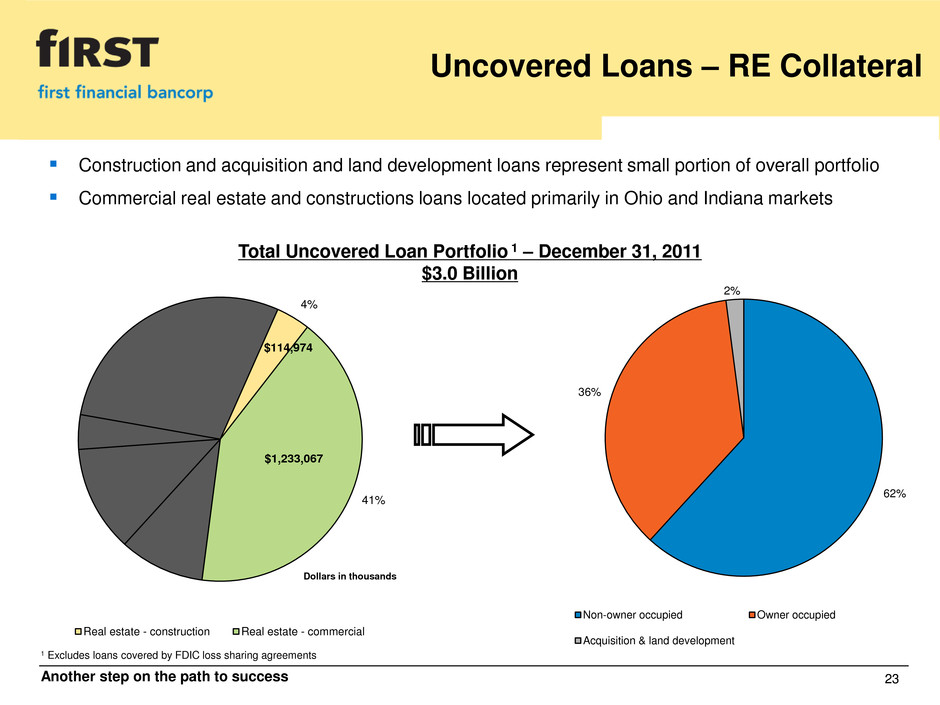

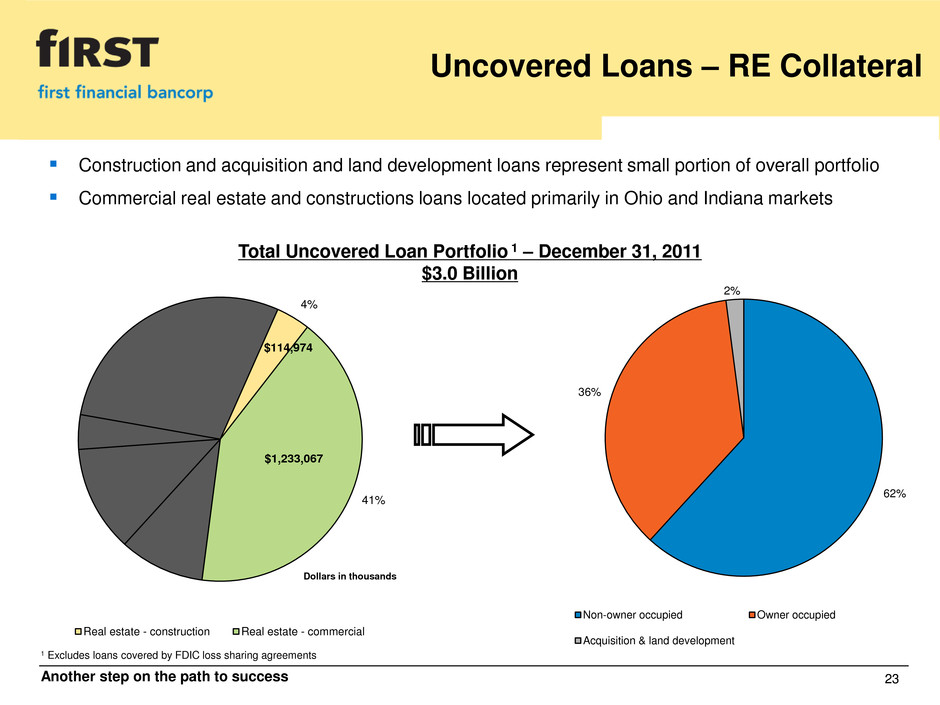

Another step on the path to success 23 Uncovered Loans – RE Collateral Total Uncovered Loan Portfolio 1 – December 31, 2011 $3.0 Billion 1 Excludes loans covered by FDIC loss sharing agreements Construction and acquisition and land development loans represent small portion of overall portfolio Commercial real estate and constructions loans located primarily in Ohio and Indiana markets 4% 41% Real estate - construction Real estate - commercial $1,233,067 $114,974 Dollars in thousands 62% 36% 2% Non-owner occupied Owner occupied Acquisition & land development

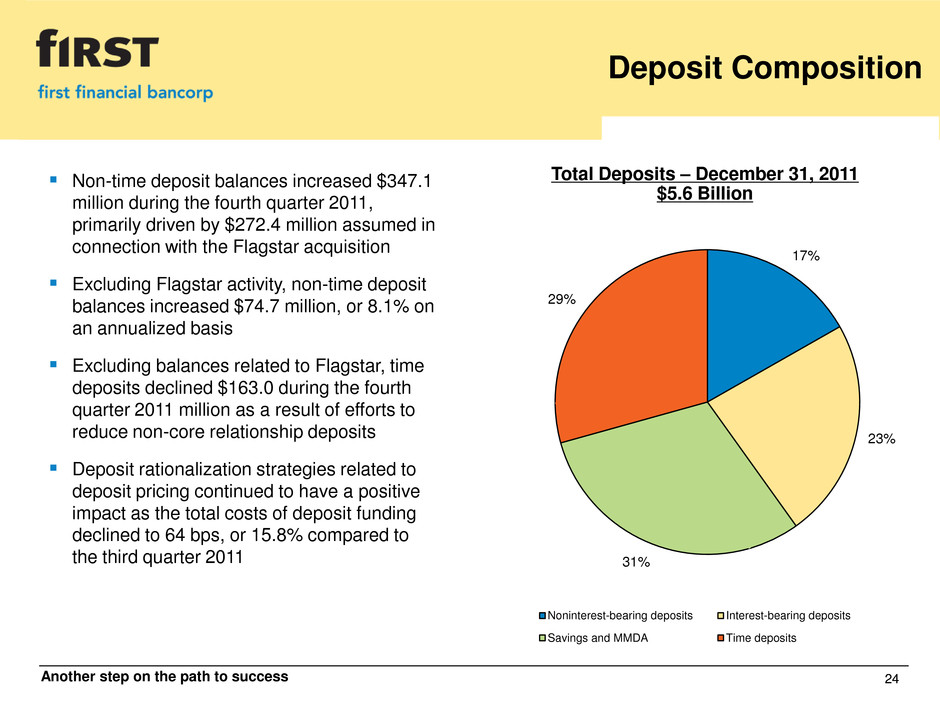

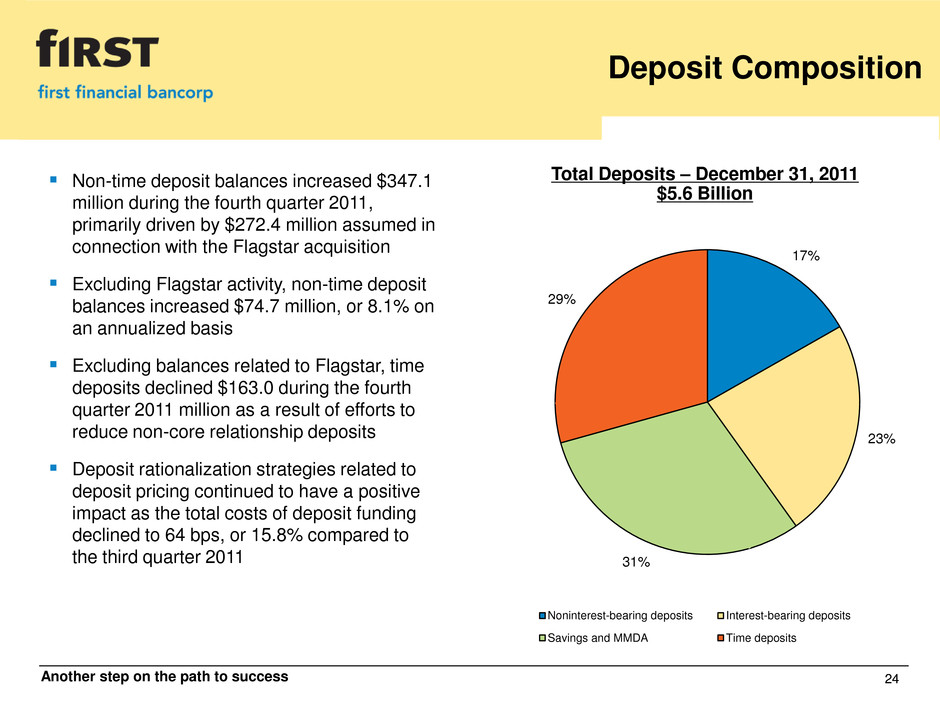

Another step on the path to success 24 Deposit Composition Non-time deposit balances increased $347.1 million during the fourth quarter 2011, primarily driven by $272.4 million assumed in connection with the Flagstar acquisition Excluding Flagstar activity, non-time deposit balances increased $74.7 million, or 8.1% on an annualized basis Excluding balances related to Flagstar, time deposits declined $163.0 during the fourth quarter 2011 million as a result of efforts to reduce non-core relationship deposits Deposit rationalization strategies related to deposit pricing continued to have a positive impact as the total costs of deposit funding declined to 64 bps, or 15.8% compared to the third quarter 2011 17% 23% 31% 29% Noninterest-bearing deposits Interest-bearing deposits Savings and MMDA Time deposits Total Deposits – December 31, 2011 $5.6 Billion

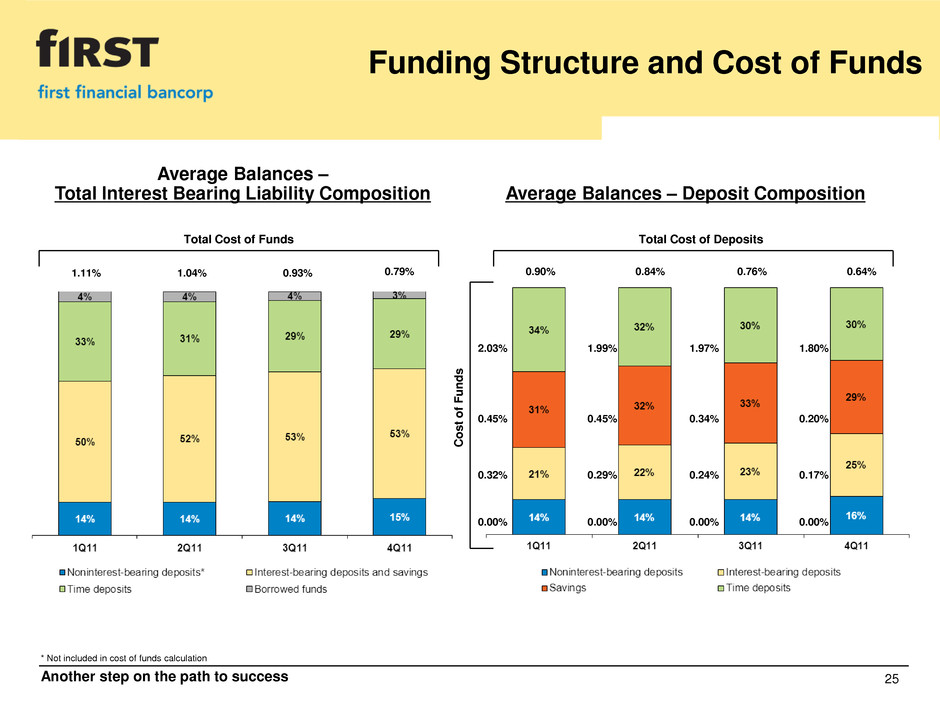

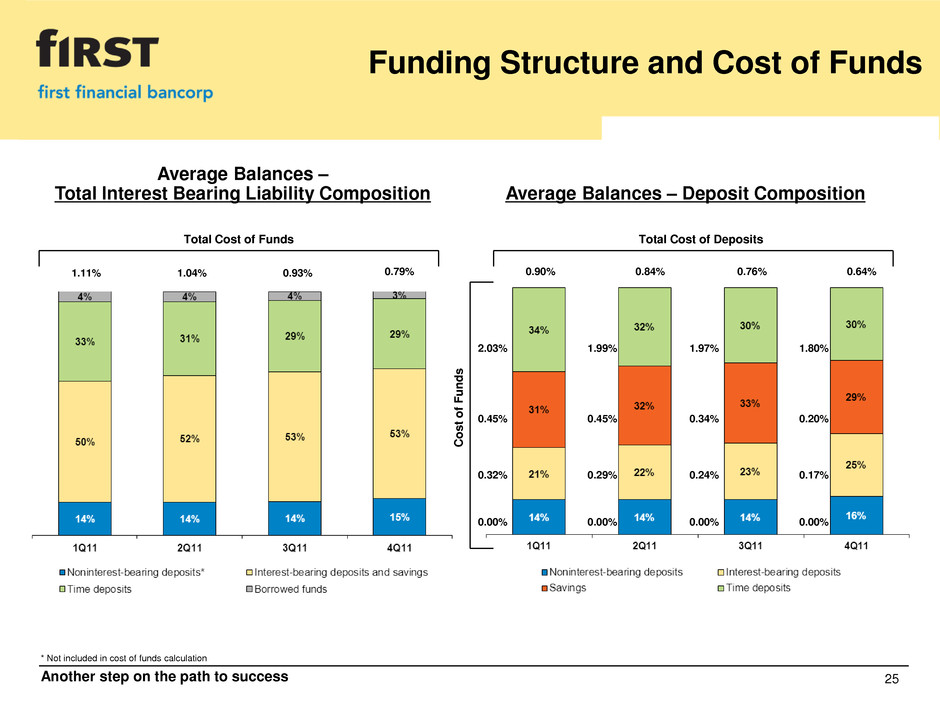

Another step on the path to success 25 1.11% 1.04% 0.93% * Not included in cost of funds calculation Average Balances – Total Interest Bearing Liability Composition Average Balances – Deposit Composition 0.32% 2.03% Co s t of F u n d s Total Cost of Funds Funding Structure and Cost of Funds 0.00% 0.79% 0.29% 1.99% 0.00% 0.24% 1.97% 0.00% 0.20% 1.80% 0.00% 0.45% 0.45% 0.34% 0.17% Total Cost of Deposits 0.64% 0.76% 0.84% 0.90%

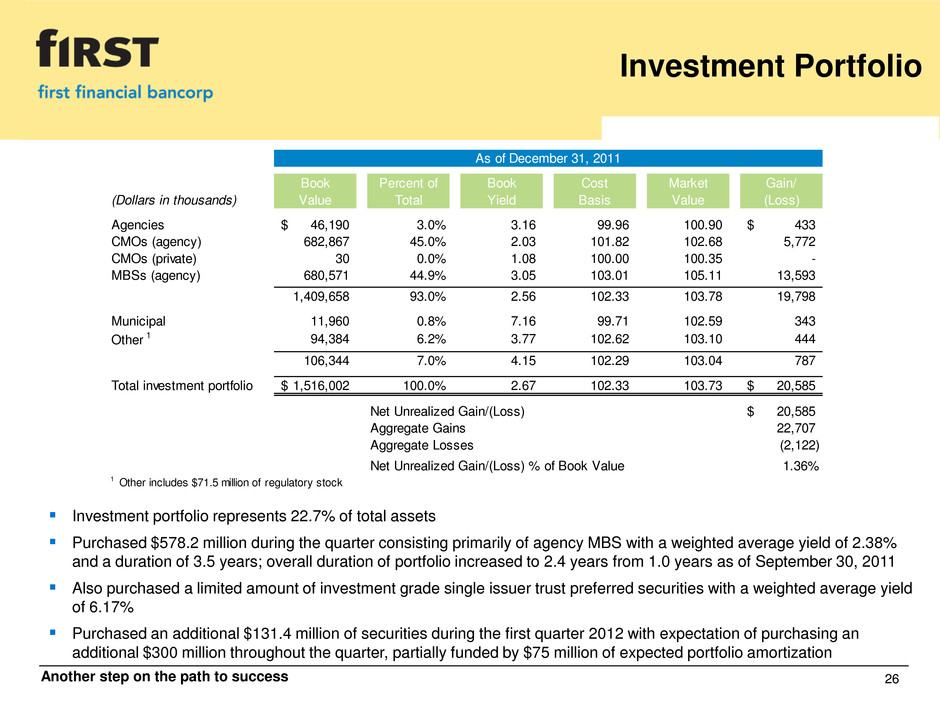

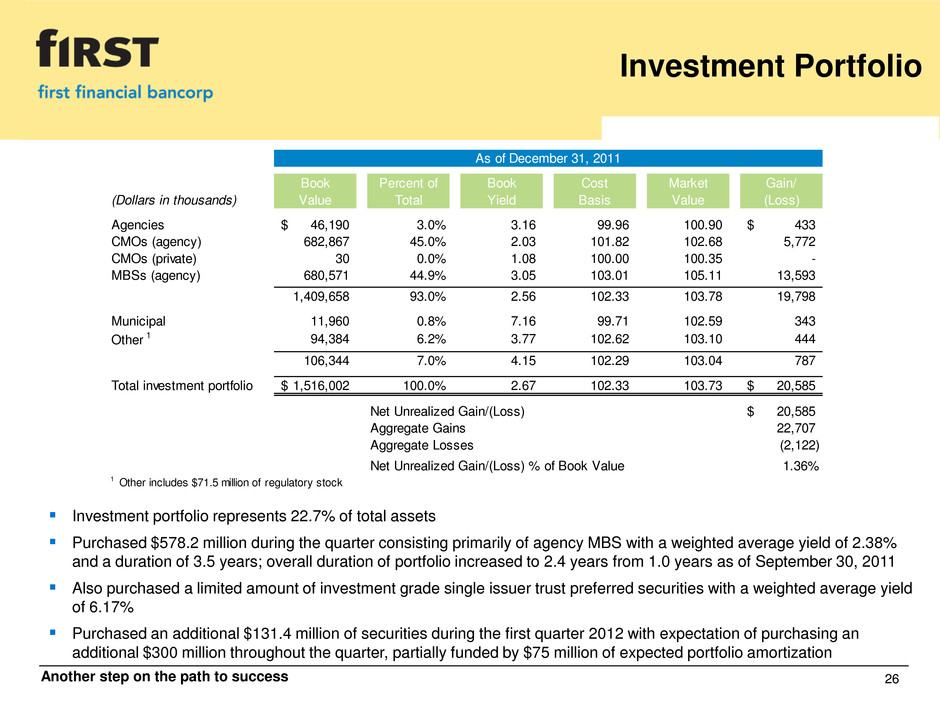

Another step on the path to success 26 Investment Portfolio Investment portfolio represents 22.7% of total assets Purchased $578.2 million during the quarter consisting primarily of agency MBS with a weighted average yield of 2.38% and a duration of 3.5 years; overall duration of portfolio increased to 2.4 years from 1.0 years as of September 30, 2011 Also purchased a limited amount of investment grade single issuer trust preferred securities with a weighted average yield of 6.17% Purchased an additional $131.4 million of securities during the first quarter 2012 with expectation of purchasing an additional $300 million throughout the quarter, partially funded by $75 million of expected portfolio amortization As of December 31, 2011 Book Percent of Book Cost Market Gain/ (Dollars in thousands) Value Total Yield Basis Value (Loss) Agencies 46,190$ 3.0% 3.16 99.96 100.90 433$ CMOs (agency) 682,867 45.0% 2.03 101.82 102.68 5,772 CMOs (private) 30 0.0% 1.08 100.00 100.35 - MBSs (agency) 680,571 44.9% 3.05 103.01 105.11 13,593 1,409,658 93.0% 2.56 102.33 103.78 19,798 Municipal 11,960 0.8% 7.16 99.71 102.59 343 Other 1 94,384 6.2% 3.77 102.62 103.10 444 106,344 7.0% 4.15 102.29 103.04 787 Total investment portfolio 1,516,002$ 100.0% 2.67 102.33 103.73 20,585$ Net Unrealized Gain/(Loss) 20,585$ Aggregate Gains 22,707 Aggregate Losses (2,122) Net Unrealized Gain/(Loss) % of Book Value 1.36% 1 Other includes $71.5 million of regulatory stock

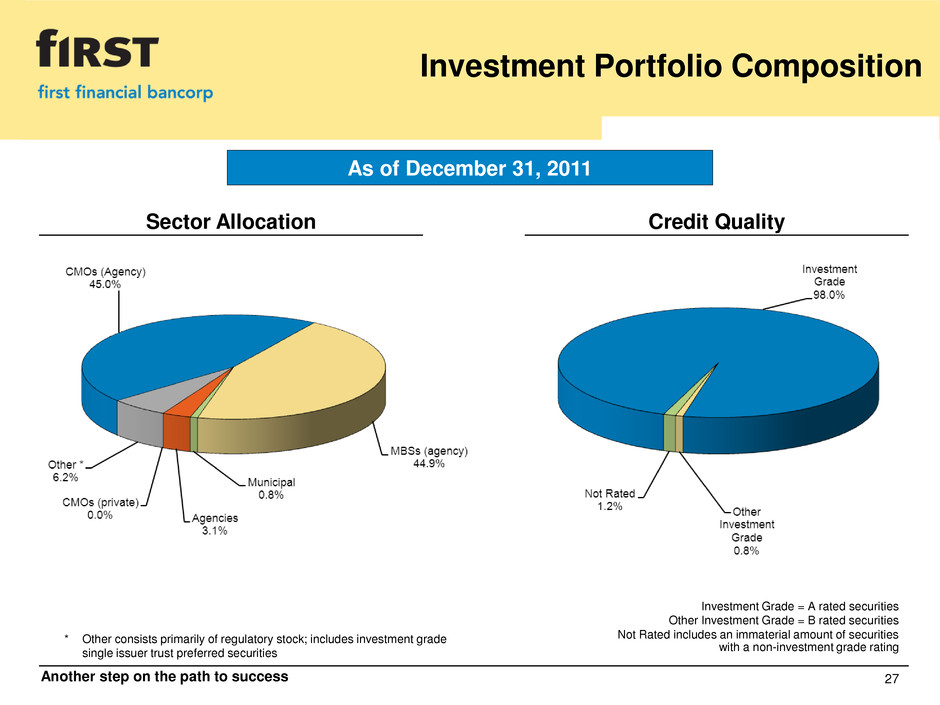

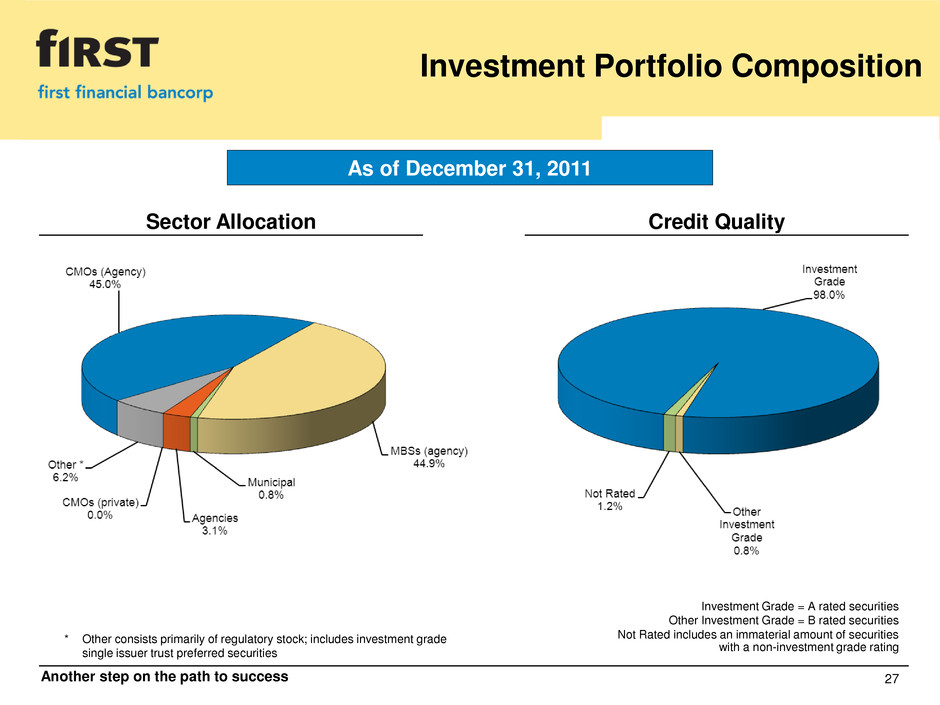

Another step on the path to success 27 Sector Allocation Credit Quality Investment Grade = A rated securities Other Investment Grade = B rated securities Not Rated includes an immaterial amount of securities with a non-investment grade rating * Other consists primarily of regulatory stock; includes investment grade single issuer trust preferred securities Investment Portfolio Composition As of December 31, 2011

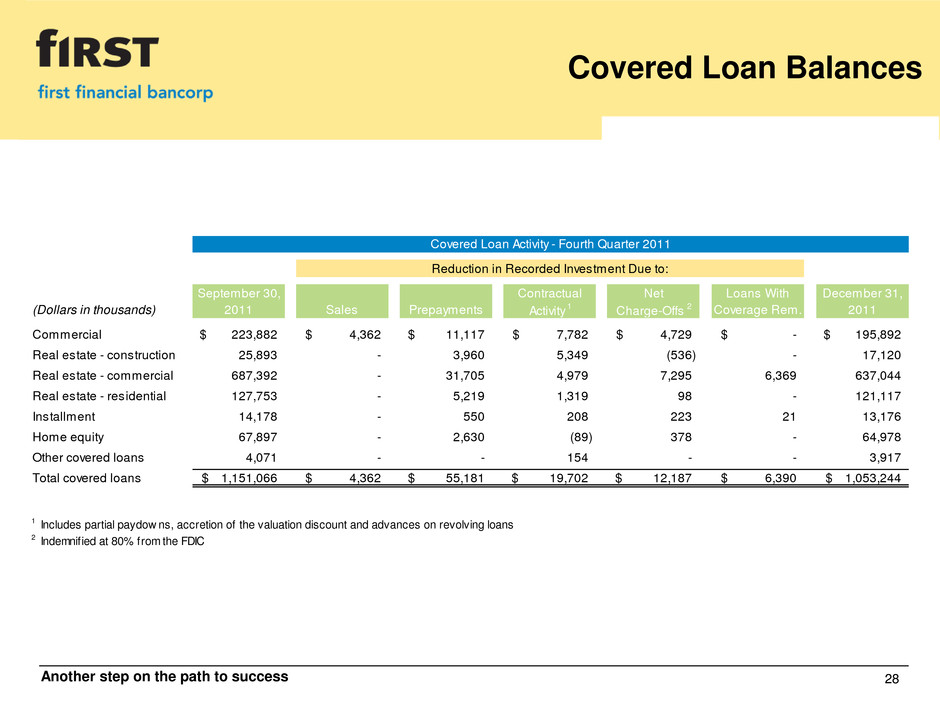

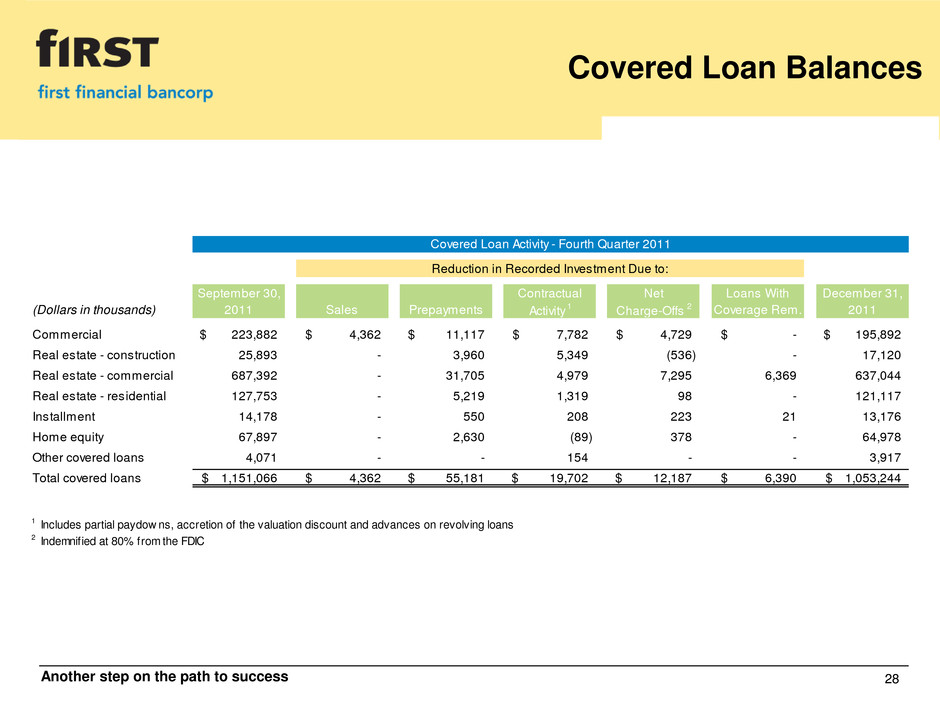

Another step on the path to success 28 Covered Loan Balances Covered Loan Activity - Fourth Quarter 2011 Reduction in Recorded Investment Due to: September 30, Contractual Net Loans With December 31, (Dollars in thousands) 2011 Sales Prepayments Activity 1 Charge-Offs 2 Coverage Rem. 2011 Commercial 223,882$ 4,362$ 11,117$ 7,782$ 4,729$ -$ 195,892$ Real estate - construction 25,893 - 3,960 5,349 (536) - 17,120 Real estate - commercial 687,392 - 31,705 4,979 7,295 6,369 637,044 Real estate - residential 127,753 - 5,219 1,319 98 - 121,117 Installment 14,178 - 550 208 223 21 13,176 Home equity 67,897 - 2,630 (89) 378 - 64,978 Other covered loans 4,071 - - 154 - - 3,917 Total covered loans 1,151,066$ 4,362$ 55,181$ 19,702$ 12,187$ 6,390$ 1,053,244$ 1 Includes partial paydow ns, accretion of the valuation discount and advances on revolving loans 2 Indemnified at 80% from the FDIC

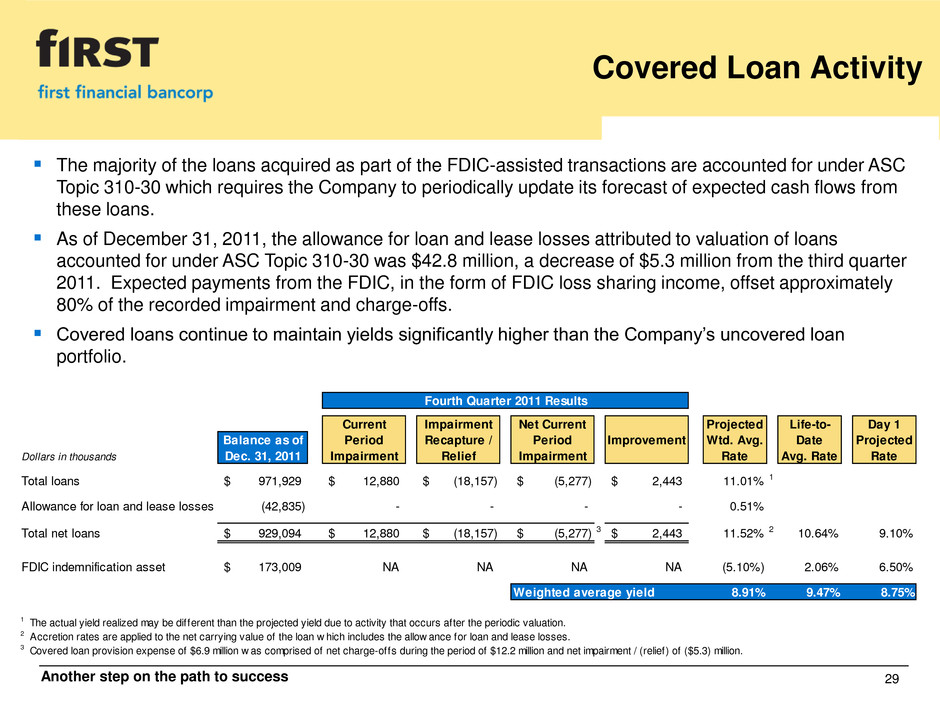

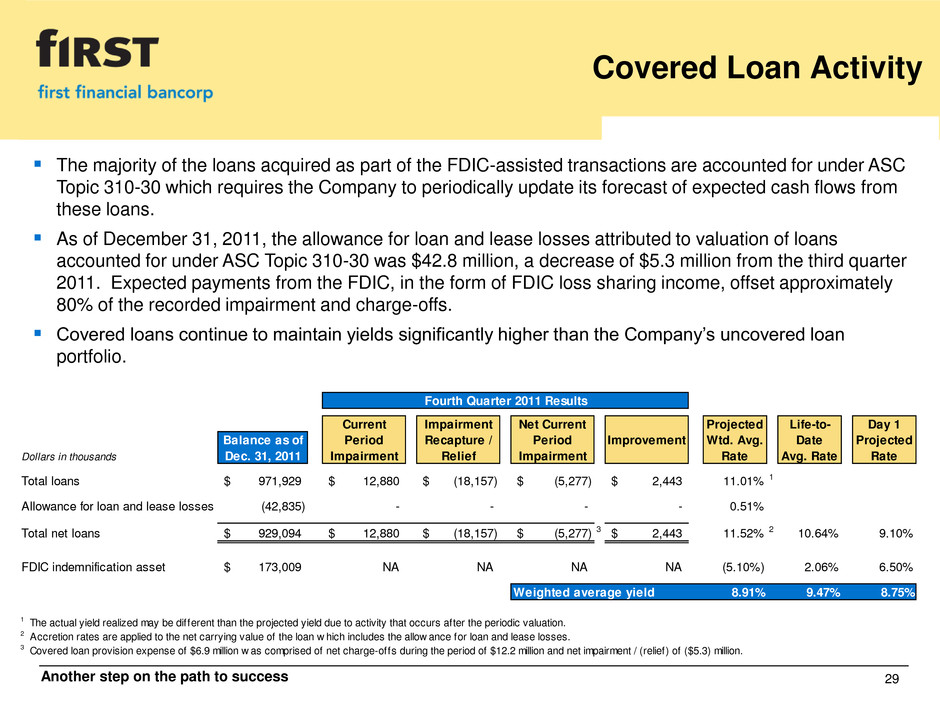

Another step on the path to success 29 Covered Loan Activity The majority of the loans acquired as part of the FDIC-assisted transactions are accounted for under ASC Topic 310-30 which requires the Company to periodically update its forecast of expected cash flows from these loans. As of December 31, 2011, the allowance for loan and lease losses attributed to valuation of loans accounted for under ASC Topic 310-30 was $42.8 million, a decrease of $5.3 million from the third quarter 2011. Expected payments from the FDIC, in the form of FDIC loss sharing income, offset approximately 80% of the recorded impairment and charge-offs. Covered loans continue to maintain yields significantly higher than the Company’s uncovered loan portfolio. Fourth Quarter 2011 Results Current Impairment Net Current Projected Life-to- Day 1 Balance as of Period Recapture / Period Improvement Wtd. Avg. Date Projected Dollars in th us nds Dec. 31, 2011 Impairment Relief Impairment Rate Avg. Rate Rate Total loans 971,929$ 12,880$ (18,157)$ (5,277)$ 2,443$ 11.01% 1 Allowance for loan and lease losses (42,835) - - - - 0.51% T tal n t loans 929,094$ 12,880$ (18,157)$ (5,277)$ 3 2,443$ 11.52% 2 10.64% 9.10% FDIC indemnification asset 173,009$ NA NA NA NA (5.10%) 2.06% 6.50% Weighted average yield 8.91% 9.47% 8.75% 1 The actual yield realized may be different than the projected yield due to activity that occurs after the periodic valuation. 2 Accretion rates are applied to the net carrying value of the loan w hich includes the allow ance for loan and lease losses. 3 Covered loan provision expense of $6.9 million w as comprised of net charge-offs during the period of $12.2 million and net impairment / (relief) of ($5.3) million.

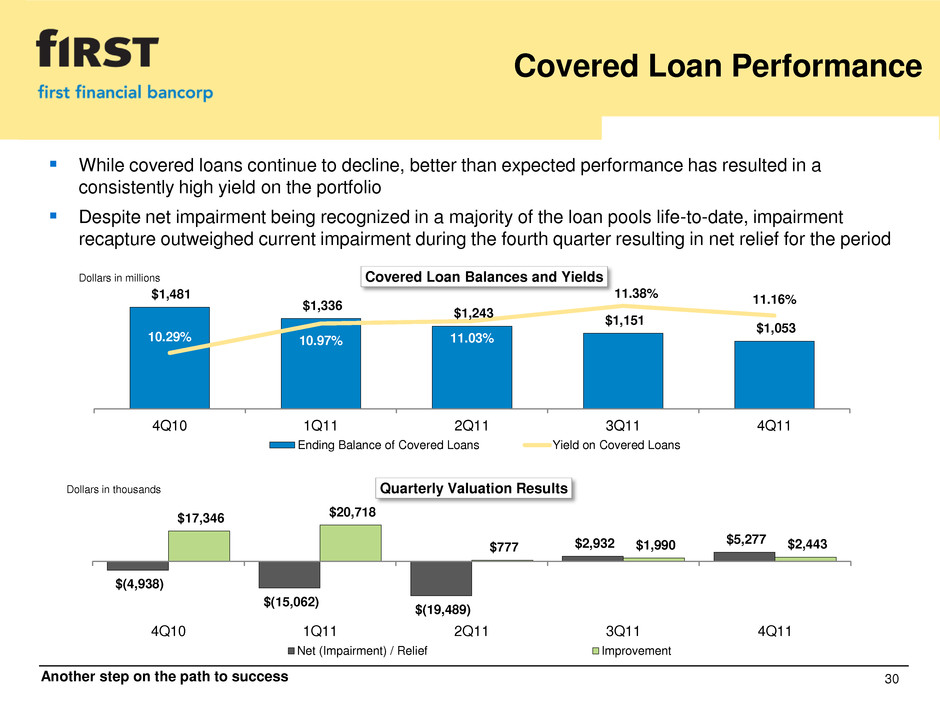

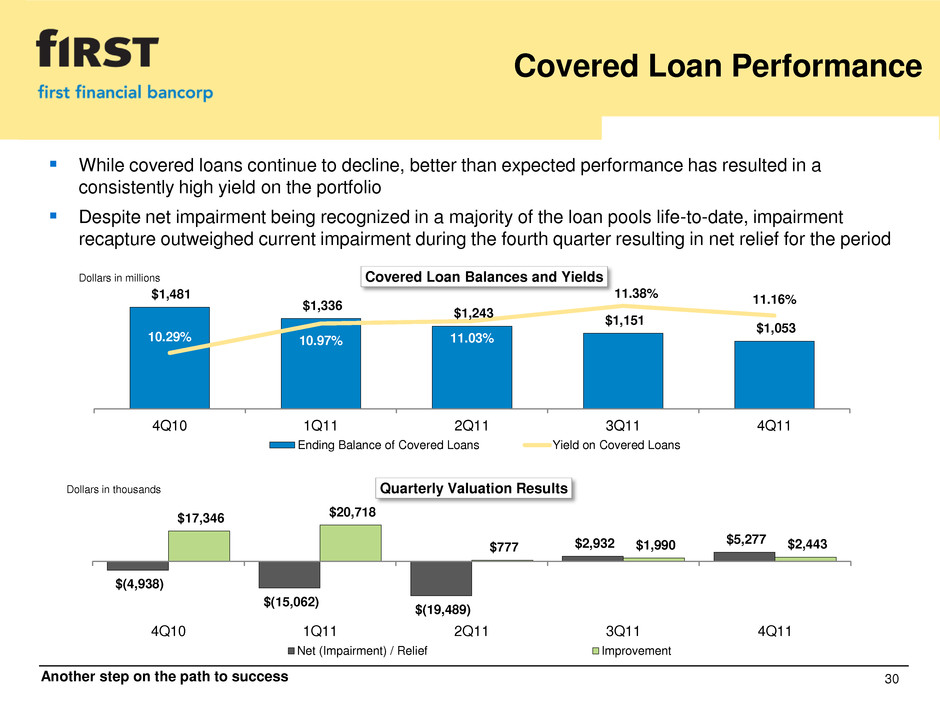

Another step on the path to success 30 Covered Loan Performance While covered loans continue to decline, better than expected performance has resulted in a consistently high yield on the portfolio Despite net impairment being recognized in a majority of the loan pools life-to-date, impairment recapture outweighed current impairment during the fourth quarter resulting in net relief for the period $(4,938) $(15,062) $(19,489) $2,932 $5,277 $17,346 $20,718 $777 $1,990 $2,443 4Q10 1Q11 2Q11 3Q11 4Q11 Dollars in thousands Quarterly Valuation Results Net (Impairment) / Relief Improvement $1,481 $1,336 $1,243 $1,151 $1,053 10.29% 10.97% 11.03% 11.38% 11.16% 4Q10 1Q11 2Q11 Q11 4Q11 Dollars in millions Covered Loan Balances and Yields Ending Balance of Covered Loans Yield on Covered Loans

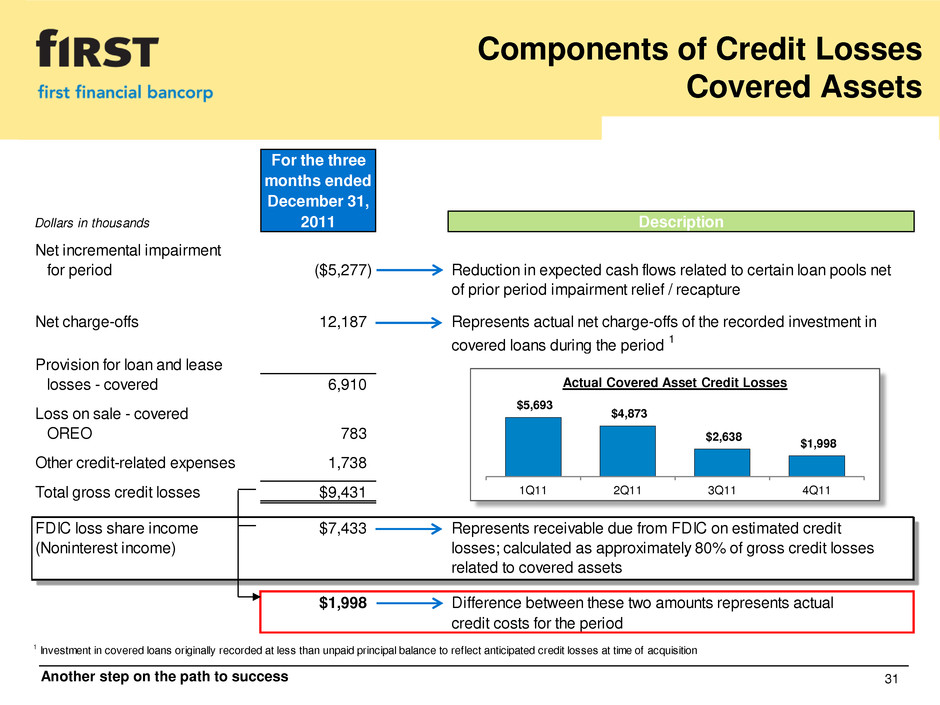

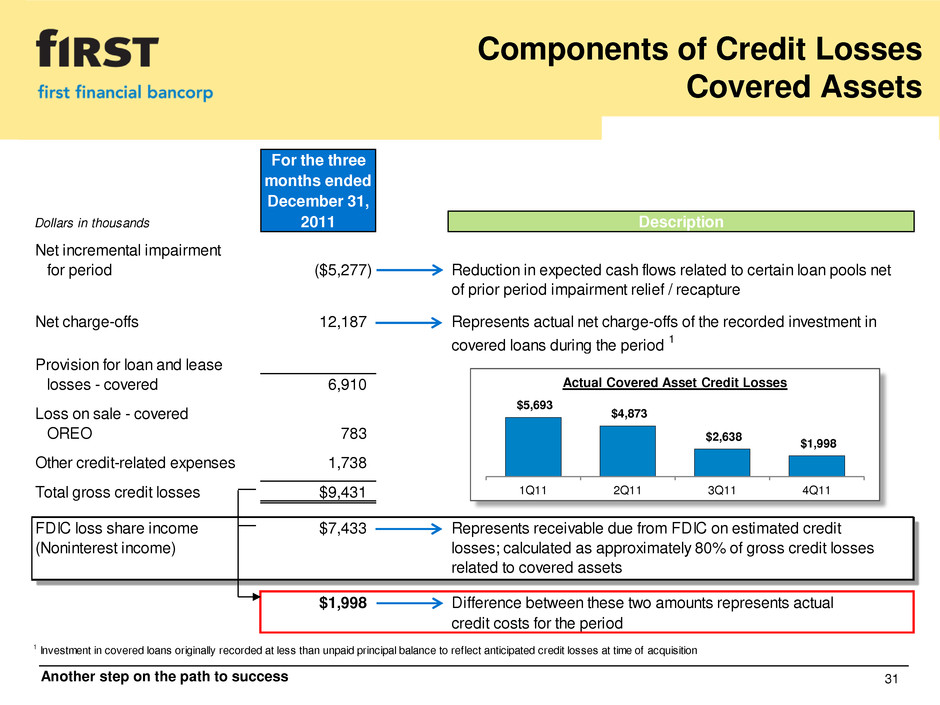

Another step on the path to success Components of Credit Losses Covered Assets 31 For the three months ended December 31, Dollars in thousands 2011 Description Net incremental impairment for period ($5,277) Reduction in expected cash flows related to certain loan pools net of prior period impairment relief / recapture Net charge-offs 12,187 Represents actual net charge-offs of the recorded investment in covered loans during the period 1 Provision for loan and lease losses - covered 6,910 Loss on sale - covered OREO 783 Other credit-related expenses 1,738 Total gross credit losses $9,431 FDIC loss share income $7,433 Represents receivable due from FDIC on estimated credit (Noninter t income) losses; calculated as approximately 80% of gross credit losses related to covered assets $1,998 Difference between these two amounts represents actual credit costs for the period 1 Investment in covered loans originally recorded at less than unpaid principal balance to reflect anticipated credit losses at time of acquisition $5,693 $4,873 $2,638 $1,998 1Q11 2Q11 3Q11 4Q11 Actual Covered Asset Credit Losses

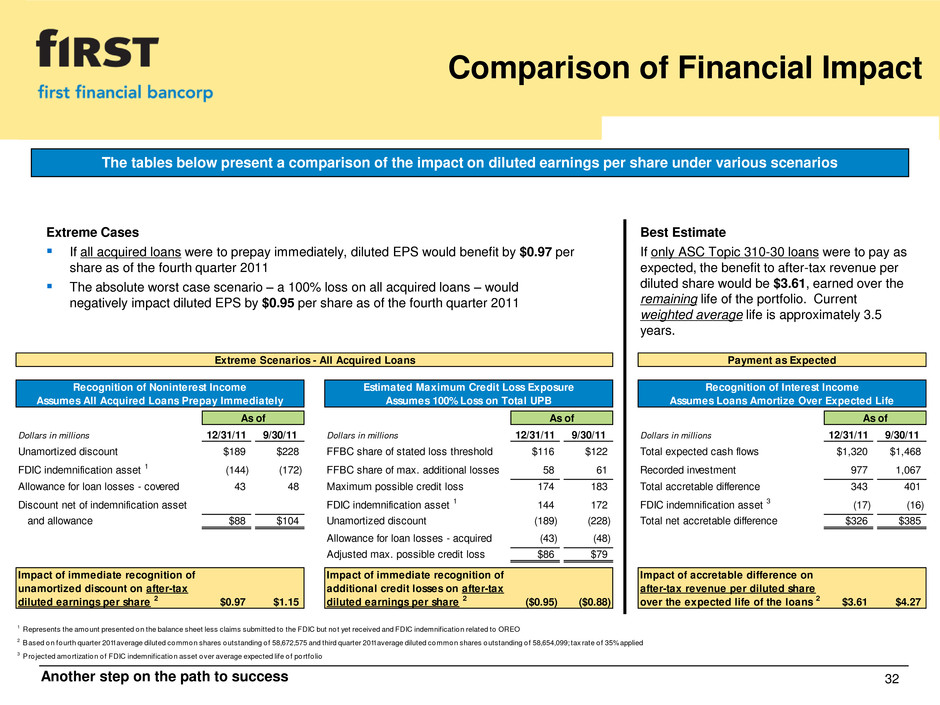

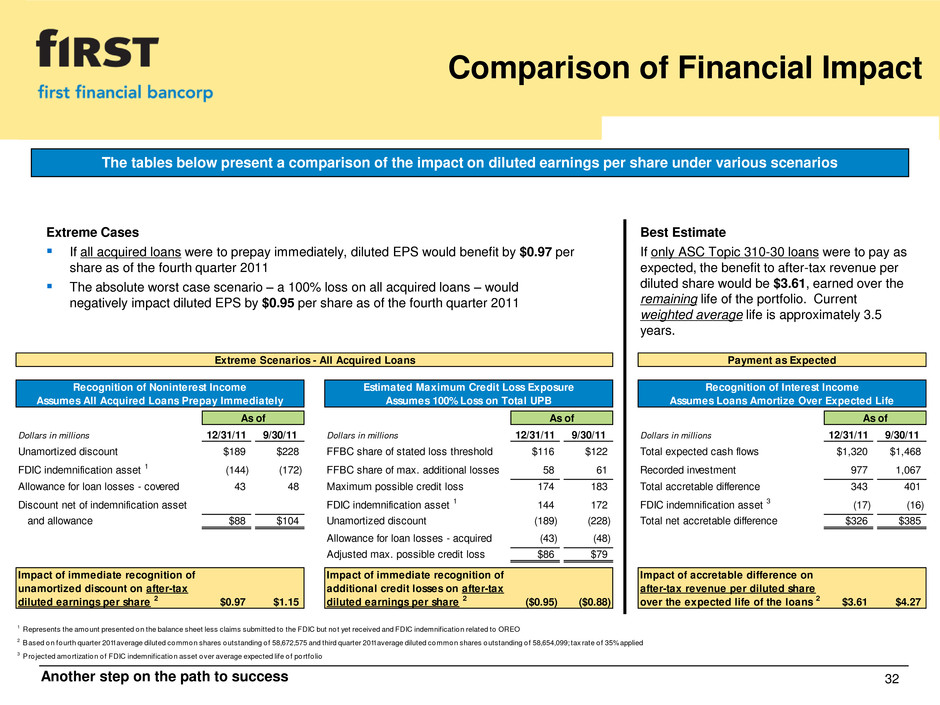

Another step on the path to success 32 Comparison of Financial Impact 1 Extreme Cases If all acquired loans were to prepay immediately, diluted EPS would benefit by $0.97 per share as of the fourth quarter 2011 The absolute worst case scenario – a 100% loss on all acquired loans – would negatively impact diluted EPS by $0.95 per share as of the fourth quarter 2011 The tables below present a comparison of the impact on diluted earnings per share under various scenarios Best Estimate If only ASC Topic 310-30 loans were to pay as expected, the benefit to after-tax revenue per diluted share would be $3.61, earned over the remaining life of the portfolio. Current weighted average life is approximately 3.5 years. Extreme Scenarios - All Acquired Loans Payment as Expected Recognition of Noninterest Income Estimated Maximum Credit Loss Exposure Recognition of Interest Income Assumes All Acquired Loans Prepay Immediately Assumes 100% Loss on Total UPB Assumes Loans Amortize Over Expected Life As of As of As of Dollars in millions 12/31/11 9/30/11 Dollars in millions 12/31/11 9/30/11 Dollars in millions 12/31/11 9/30/11 Unamortized discount $189 $228 FFBC share of stated loss threshold $116 $122 Total expected cash flows $1,320 $1,468 FDIC indemnification asset 1 (144) (172) FFBC share of max. additional losses 58 61 Recorded investment 977 1,067 Allowance for loan losses - covered 43 48 Maximum possible credit loss 174 183 Total accretable difference 343 401 Discount net of indemnification asset FDIC indemnification asset 1 144 172 FDIC indemnification asset 3 (17) (16) and allowa ce $88 $104 Unamortized discount (189) (228) Total net accretable difference $326 $385 Allowance for loan losses - acquired (43) (48) Adjusted max. possible credit loss $86 $79 Impact of i ediate recognition of Impact of immediate recognition of Impact of accretable difference on unamortized discount on after-tax additional credit losses on after-tax after-tax revenue per diluted share diluted earnings per share 2 $0.97 $1.15 diluted earnings per share 2 ($0.95) ($0.88) over the expected life of the loans 2 $3.61 $4.27 1 Represents the amount presented on the balance sheet less claims submitted to the FDIC but not yet received and FDIC indemnification related to OREO 2 Based on fourth quarter 2011 average diluted common shares outstanding of 58,672,575 and third quarter 2011 average diluted common shares outstanding of 58,654,099; tax rate of 35% applied 3 Pro jected amortization of FDIC indemnification asset over average expected life of portfo lio

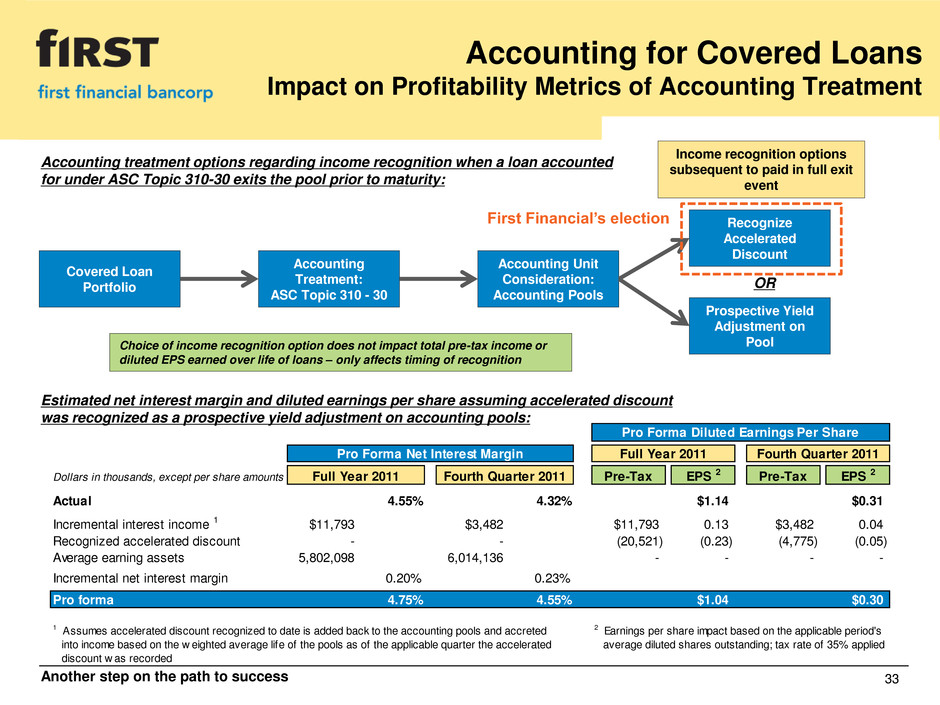

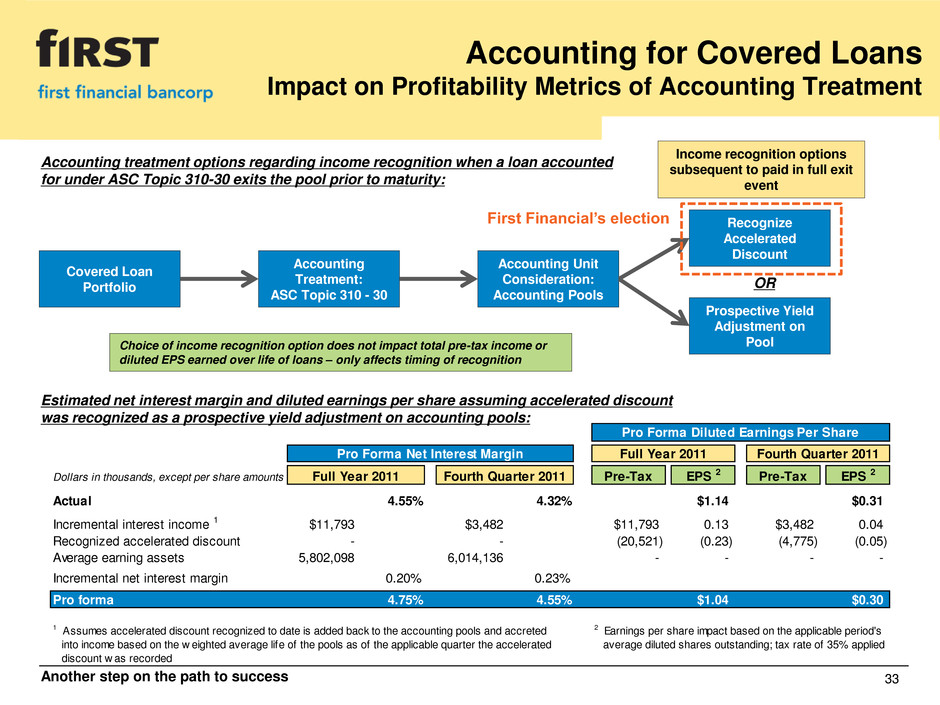

Another step on the path to success 33 Accounting for Covered Loans Impact on Profitability Metrics of Accounting Treatment Covered Loan Portfolio Accounting Treatment: ASC Topic 310 - 30 Accounting Unit Consideration: Accounting Pools Prospective Yield Adjustment on Pool Recognize Accelerated Discount Accounting treatment options regarding income recognition when a loan accounted for under ASC Topic 310-30 exits the pool prior to maturity: Income recognition options subsequent to paid in full exit event OR First Financial’s election Estimated net interest margin and diluted earnings per share assuming accelerated discount was recognized as a prospective yield adjustment on accounting pools: Pro Forma Diluted Earnings Per Share Pro Forma Net Interest Margin Full Year 2011 Fourth Quarter 2011 D llars in thou ands, except per share amounts Full Year 2011 Fourth Quarter 2011 Pre-Tax EPS 2 Pre-Tax EPS 2 Actual 4.55% 4.32% $1.14 $0.31 Incremental interest income 1 $11,793 $3,482 $11,793 0.13 $3,482 0.04 Recognized accelerated discount - - (20,521) (0.23) (4,775) (0.05) Avera ear ing assets 5,802,098 6,014,136 - - - - Incremental net interest margin 0.20% 0.23% Pro forma 4.75% 4.55% $1.04 $0.30 1 Assumes accelerated discount recognized to date is added back to the accounting pools and accreted 2 Earnings per share impact based on the applicable period's into income based on the w eighted average life of the pools as of the applicable quarter the accelerated average diluted shares outstanding; tax rate of 35% applied discount w as recorded Choice of income recognition option does not impact total pre-tax income or diluted EPS earned over life of loans – only affects timing of recognition

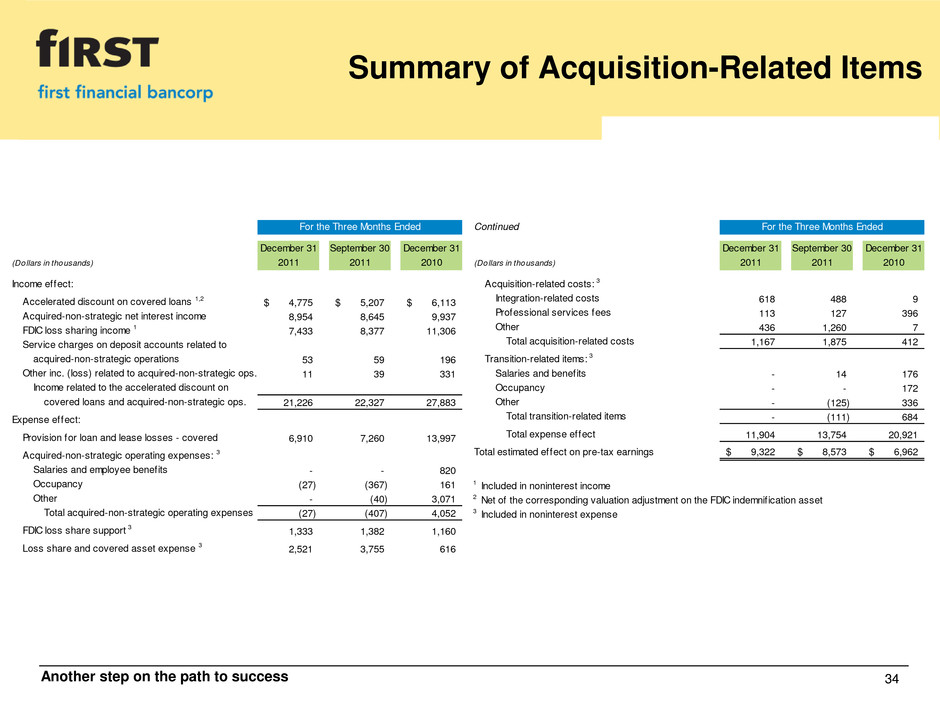

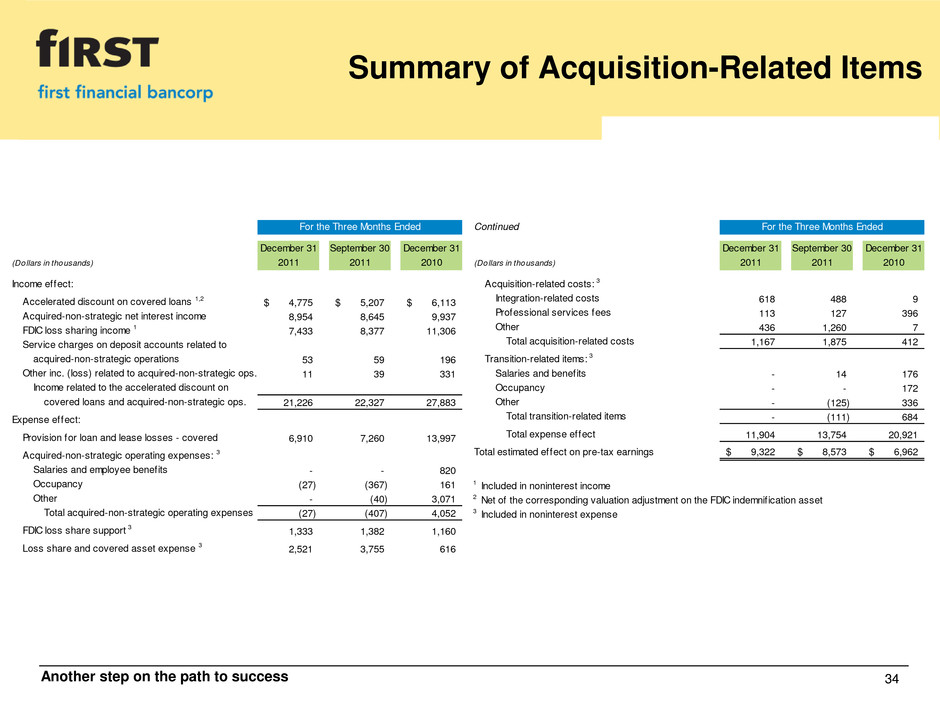

Another step on the path to success 34 Summary of Acquisition-Related Items For the Three Months Ended December 31 September 30 December 31 (Dollars in thousands) 2011 2011 2010 Income effect: Accelerated discount on covered loans 1,2 4,775$ 5,207$ 6,113$ Acquired-non-strategic net interest income 8,954 8,645 9,937 FDIC loss sharing income 1 7,433 8,377 11,306 Service charges on deposit accounts related to acquired-non-strategic operations 53 59 196 Other inc. (loss) related to acquired-non-strategic ops. 11 39 331 Income related to the accelerated discount on covered loans and acquired-non-strategic ops. 21,226 22,327 27,883 Expense effect: Provision for loan and lease losses - covered 6,910 7,260 13,997 Acquired-non-strategic operating expenses: 3 Salaries and employee benefits - - 820 Occupancy (27) (367) 161 Other - (40) 3,071 Total acquired-non-strategic operating expenses (27) (407) 4,052 FDIC loss share support 3 1,333 1,382 1,160 Loss share and covered asset expense 3 2,521 3,755 616 Continued For the Three Months Ended December 31 September 30 December 31 (Dollars in thousands) 2011 2011 2010 Acquisition-related costs: 3 Integr tion-related costs 618 488 9 Professional services fees 113 127 396 O her 436 1,260 7 Total acquisition-related costs 1,167 1,875 412 Transition-related items: 3 Salaries and benefits - 14 176 Occupancy - - 172 Oth r - (125) 336 Total transition-related items - (111) 684 Total expense effect 11,904 13,754 20,921 Total estimated effect on pre-tax earnings 9,322$ 8,573$ 6,962$ 1 Included in noninterest income 2 Net of the corresponding valuation adjustment on the FDIC indemnification asset 3 Included in noninterest expense

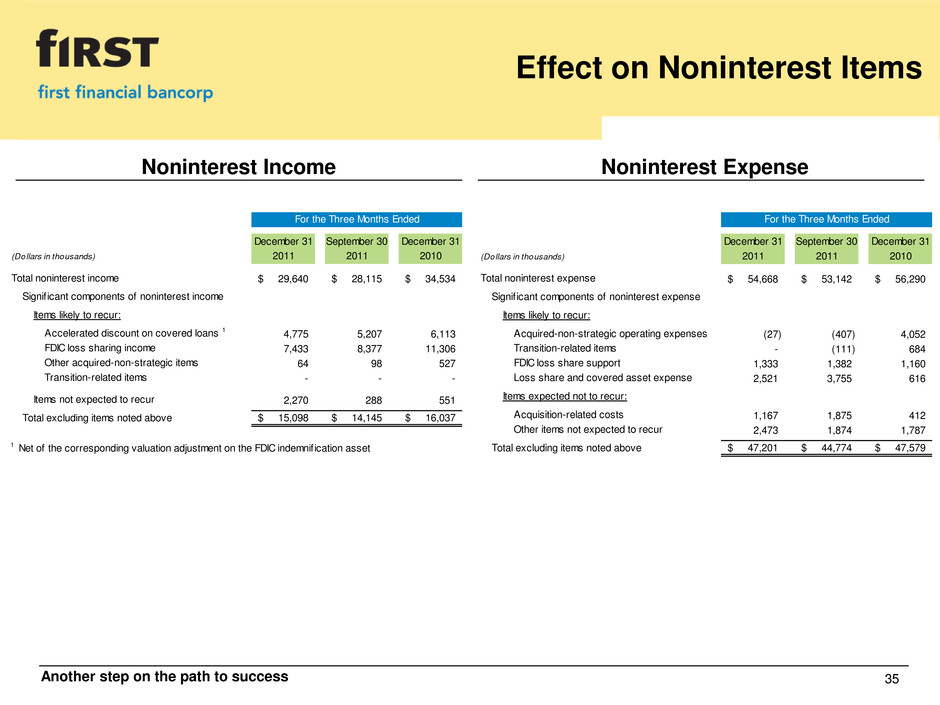

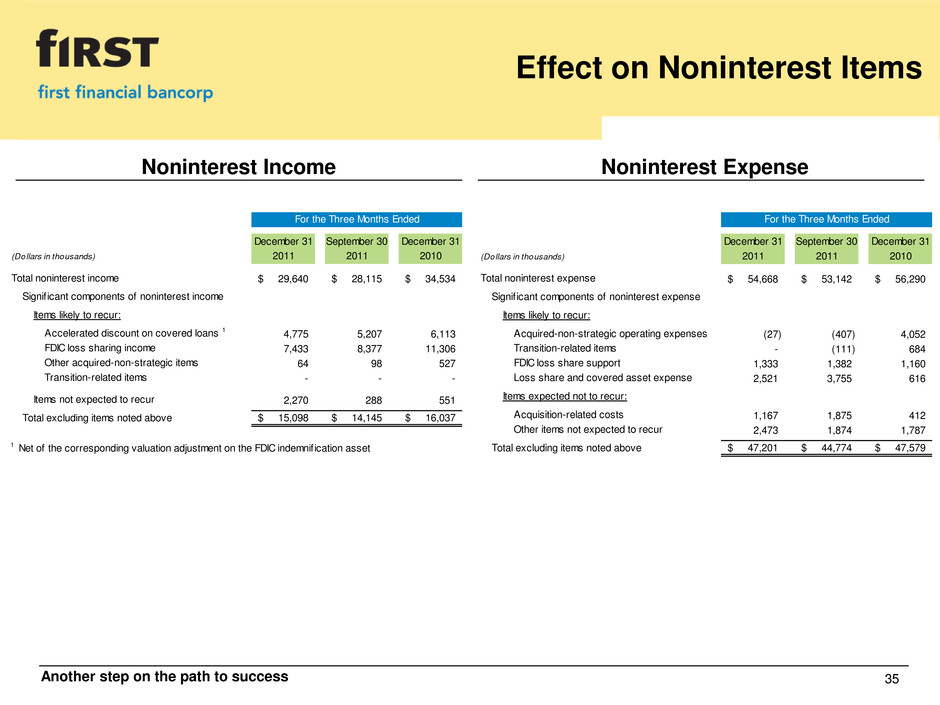

Another step on the path to success 35 Effect on Noninterest Items Noninterest Income Noninterest Expense For the Three Months Ended December 31 September 30 December 31 (Dollars in thousands) 2011 2011 2010 Total noninterest income 29,640$ 28,115$ 34,534$ Signif icant components of noninterest income Items likely to recur: Accelerated discount on covered loans 1 4,775 5,207 6,113 FDIC loss sharing income 7,433 8,377 11,306 Other acquired-non-strategic items 64 98 527 Transition-related items - - - Items not expected to recur 2,270 288 551 Total excluding items noted above 15,098$ 14,145$ 16,037$ 1 Net of the corresponding valuation adjustment on the FDIC indemnification asset For the Three Months Ended Dec mber 31 Sept mber 30 December 31 (Dollars in thousands) 2011 2011 2010 Total noninterest expense 54,668$ 53,142$ 56,290$ Signif ica t components of noninterest expense Items likely to recur: Acquired-non-strategic operating expenses (27) (407) 4,052 Transition-related items - (111) 684 FDIC loss share support 1,333 1,382 1,160 Loss share and covered asset expense 2,521 3,755 616 Items expected not to recur: Acquisition-related costs 1,167 1,875 412 Other items not expected to recur 2,473 1,874 1,787 Total excluding items noted above 47,201$ 44,774$ 47,579$

Another step on the path to success 36 Another step on the path to success