First Financial Bancorp Fourth Quarter 2012 Earnings Release Supplemental Information EXHIBIT 99.2

2 Certain statements contained in this presentation which are not statements of historical fact constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act (the ‘‘Act’’). In addition, certain statements in future filings by First Financial with the SEC, in press releases, and in oral and written statements made by or with the approval of First Financial which are not statements of historical fact constitute forward-looking statements within the meaning of the Act. Examples of forward-looking statements include, but are not limited to, projections of revenues, income or loss, earnings or loss per share, the payment or non-payment of dividends, capital structure and other financial items, statements of plans and objectives of First Financial or its management or board of directors, and statements of future economic performances and statements of assumptions underlying such statements. Words such as ‘‘believes,’’ ‘‘anticipates,’’ “likely,” “expected,” ‘‘intends,’’ and other similar expressions are intended to identify forward-looking statements but are not the exclusive means of identifying such statements. Management’s analysis contains forward-looking statements that are provided to assist in the understanding of anticipated future financial performance. However, such performance involves risks and uncertainties that may cause actual results to differ materially. Factors that could cause actual results to differ from those discussed in the forward-looking statements include, but are not limited to: • management’s ability to effectively execute its business plan; • the risk that the strength of the United States economy in general and the strength of the local economies in which we conduct operations may continue to deteriorate resulting in, among other things, a further deterioration in credit quality or a reduced demand for credit, including the resultant effect on our loan portfolio, allowance for loan and lease losses and overall financial performance; • U.S. fiscal debt and budget matters; • the ability of financial institutions to access sources of liquidity at a reasonable cost; • the impact of recent upheaval in the financial markets and the effectiveness of domestic and international governmental actions taken in response, and the effect of such governmental actions on us, our competitors and counterparties, financial markets generally and availability of credit specifically, and the U.S. and international economies, including potentially higher FDIC premiums arising from increased payments from FDIC insurance funds as a result of depository institution failures; • the effect of and changes in policies and laws or regulatory agencies (notably the recently enacted Dodd-Frank Wall Street Reform and Consumer Protection Act); • the effect of the current low interest rate environment or changes in interest rates on our net interest margin and our loan originations and securities holdings; • our ability to keep up with technological changes; • failure or breach of our operational or security systems or infrastructure, or those of our third party vendors and other service providers; • our ability to comply with the terms of loss sharing agreements with the FDIC; • mergers and acquisitions, including costs or difficulties related to the integration of acquired companies and the wind-down of non-strategic operations that may be greater than expected, such as the risks and uncertainties associated with the Irwin Mortgage Corporation bankruptcy proceedings and other acquired subsidiaries; • the risk that exploring merger and acquisition opportunities may detract from management’s time and ability to successfully manage our company; • expected cost savings in connection with the consolidation of recent acquisitions may not be fully realized or realized within the expected time frames, and deposit attrition, customer loss and revenue loss following completed acquisitions may be greater than expected; • our ability to increase market share and control expenses; • the effect of changes in accounting policies and practices, as may be adopted by the regulatory agencies as well as the Financial Accounting Standards Board and the SEC; • adverse changes in the securities, debt and/or derivatives markets; • our success in recruiting and retaining the necessary personnel to support business growth and expansion and maintain sufficient expertise to support increasingly complex products and services; • monetary and fiscal policies of the Board of Governors of the Federal Reserve System (Federal Reserve) and the U.S. government and other governmental initiatives affecting the financial services industry; • our ability to manage loan delinquency and charge-off rates and changes in estimation of the adequacy of the allowance for loan losses; and • the costs and effects of litigation and of unexpected or adverse outcomes in such litigation. In addition, please refer to our Annual Report on Form 10-K for the year ended December 31, 2011, as well as our other filings with the SEC, for a more detailed discussion of these risks and uncertainties and other factors. Such forward-looking statements are meaningful only on the date when such statements are made, and First Financial undertakes no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such a statement is made to reflect the occurrence of unanticipated events. Forward Looking Statement Disclosure

3 Pre-Tax, Pre-Provision Income Trend Adjusted pre-tax, pre-provision income represents income before taxes plus provision for all loans less FDIC loss share income and accelerated discount adjusted for significant nonrecurring items The increase in fourth quarter 2012 adjusted PTPP income was driven primarily by an increase in net interest income, including a $2.2 million prepayment fee, and improvements in noninterest income and expense $31,468 $31,191 $30,178 $24,389 $28,561 1.92% 1.94% 1.92% 1.57% 1.81% 4Q11 1Q12 2Q12 3Q12 4Q12 (Dollars in thousands) Adjusted PTPP Income Adjusted PTPP / Average Assets

4 Pre-Tax, Pre-Provision Income For the three months ended December 31, September 30, June 30, March 31, December 31, (Dollars in thousands) 2012 2012 2012 2012 2011 Pre-tax, pre-provision income 1 28,869$ 26,894$ 32,636$ 30,020$ 33,015$ Less: accelerated discount on covered loans 2,455 3,798 3,764 3,645 4,775 Plus: loss share and covered asset expense 2 2,251 3,559 4,317 3,043 2,521 Pre-tax, pre-provision income, net of accelerated discount and loss on covered OREO 28,665 26,655 33,189 29,418 30,761 Less: gain on sales of investment securities 1,011 2,617 - - 2,541 Less: gain on sales of non-mortgage loans 3 45 - 171 66 290 Less: gain related to litigation settlement - - 5,000 - - Plus: One-time expenses related to branch acquisitions - - - - 1,037 Plus: One-time other employee benefit, exit and and retention costs 952 351 2,160 - 2,501 Plus: On -time pension, trust and other costs - - - 1,839 - Adjusted pre-tax, pre-provision income 28,561$ 24,389$ 30,178$ 31,191$ 31,468$ 1 Represents income before taxes plus provision for all loans less FDIC loss sharing income 2 Reimbursements related to losses on covered OREO and other credit-related costs are included in FDIC loss sharing income, w hich is excluded from the pre-tax, pre-provision income above 3 Represents gain on sale of loans originated by franchise f inance business

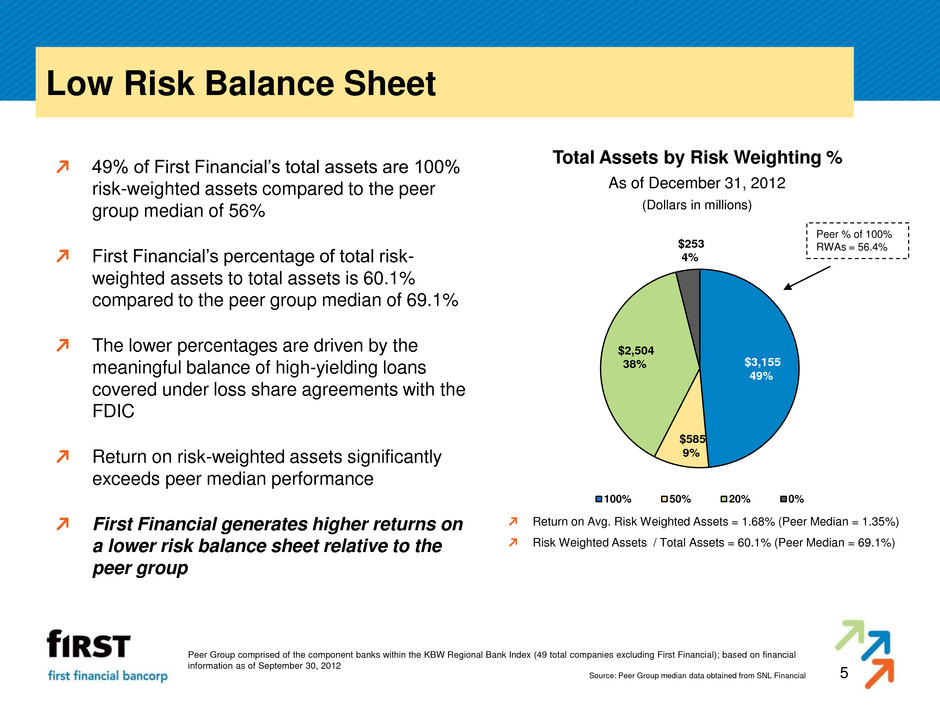

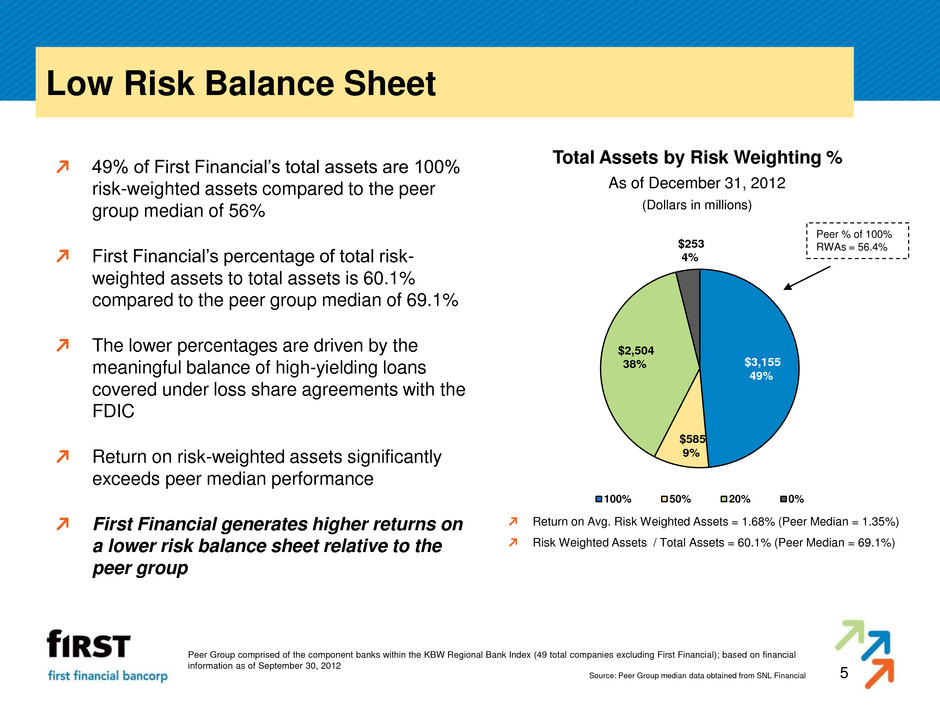

5 Low Risk Balance Sheet 49% of First Financial’s total assets are 100% risk-weighted assets compared to the peer group median of 56% First Financial’s percentage of total risk- weighted assets to total assets is 60.1% compared to the peer group median of 69.1% The lower percentages are driven by the meaningful balance of high-yielding loans covered under loss share agreements with the FDIC Return on risk-weighted assets significantly exceeds peer median performance First Financial generates higher returns on a lower risk balance sheet relative to the peer group Total Assets by Risk Weighting % As of December 31, 2012 (Dollars in millions) Peer % of 100% RWAs = 56.4% Return on Avg. Risk Weighted Assets = 1.68% (Peer Median = 1.35%) Risk Weighted Assets / Total Assets = 60.1% (Peer Median = 69.1%) Peer Group comprised of the component banks within the KBW Regional Bank Index (49 total companies excluding First Financial); based on financial information as of September 30, 2012 Source: Peer Group median data obtained from SNL Financial $3,155 49% $585 9% $2,504 38% $253 4% 100% 50% 20% 0%

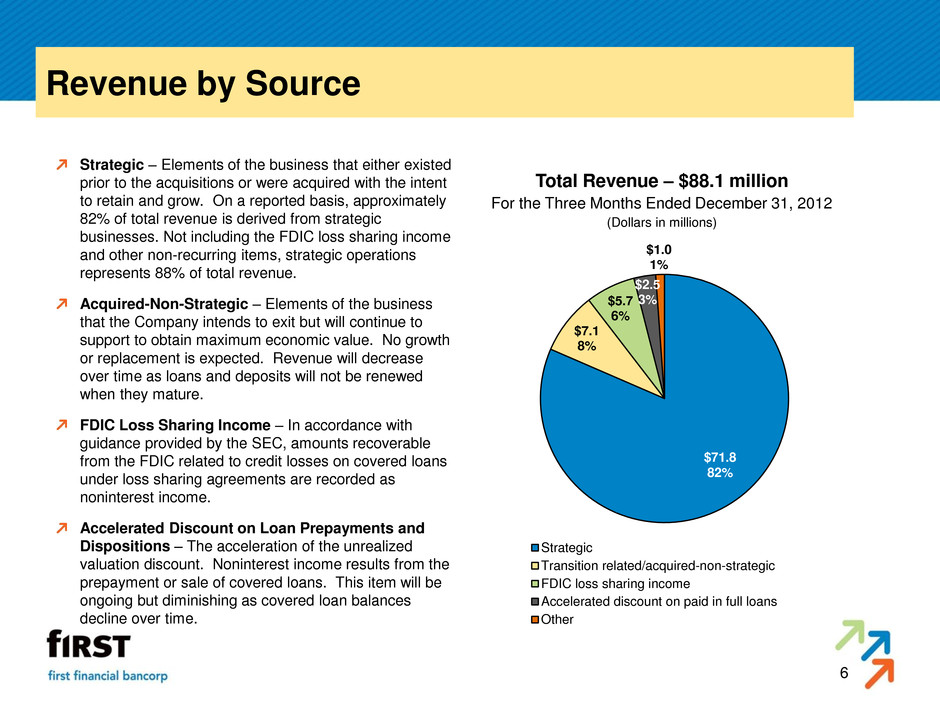

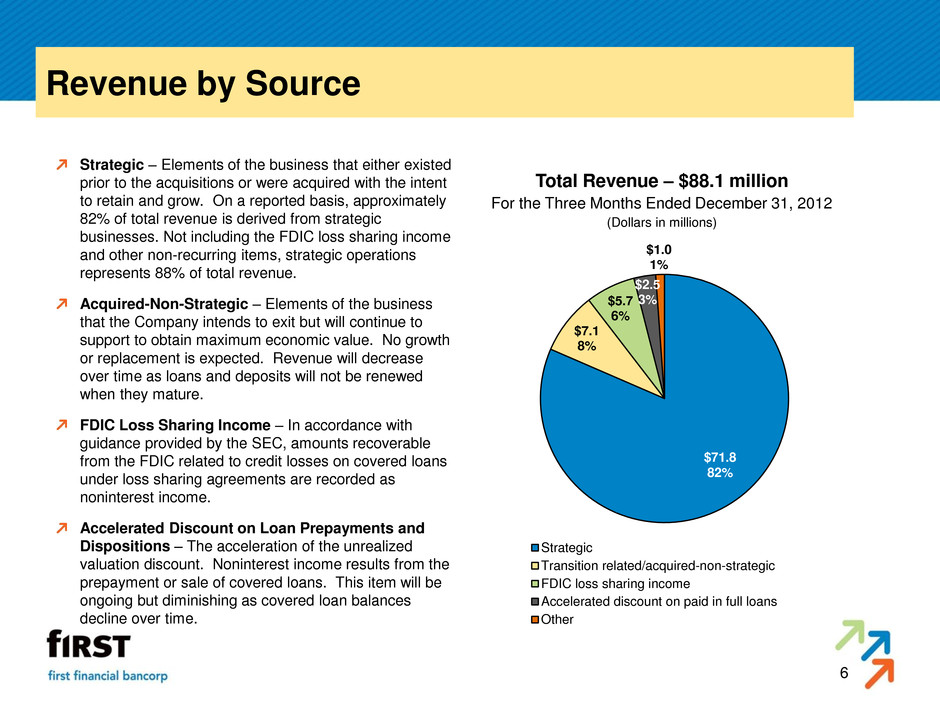

6 Revenue by Source Strategic – Elements of the business that either existed prior to the acquisitions or were acquired with the intent to retain and grow. On a reported basis, approximately 82% of total revenue is derived from strategic businesses. Not including the FDIC loss sharing income and other non-recurring items, strategic operations represents 88% of total revenue. Acquired-Non-Strategic – Elements of the business that the Company intends to exit but will continue to support to obtain maximum economic value. No growth or replacement is expected. Revenue will decrease over time as loans and deposits will not be renewed when they mature. FDIC Loss Sharing Income – In accordance with guidance provided by the SEC, amounts recoverable from the FDIC related to credit losses on covered loans under loss sharing agreements are recorded as noninterest income. Accelerated Discount on Loan Prepayments and Dispositions – The acceleration of the unrealized valuation discount. Noninterest income results from the prepayment or sale of covered loans. This item will be ongoing but diminishing as covered loan balances decline over time. Total Revenue – $88.1 million For the Three Months Ended December 31, 2012 (Dollars in millions) $71.8 82% $7.1 8% $5.7 6% $2.5 3% $1.0 1% Strategic Transition related/acquired-non-strategic FDIC loss sharing income Accelerated discount on paid in full loans Other

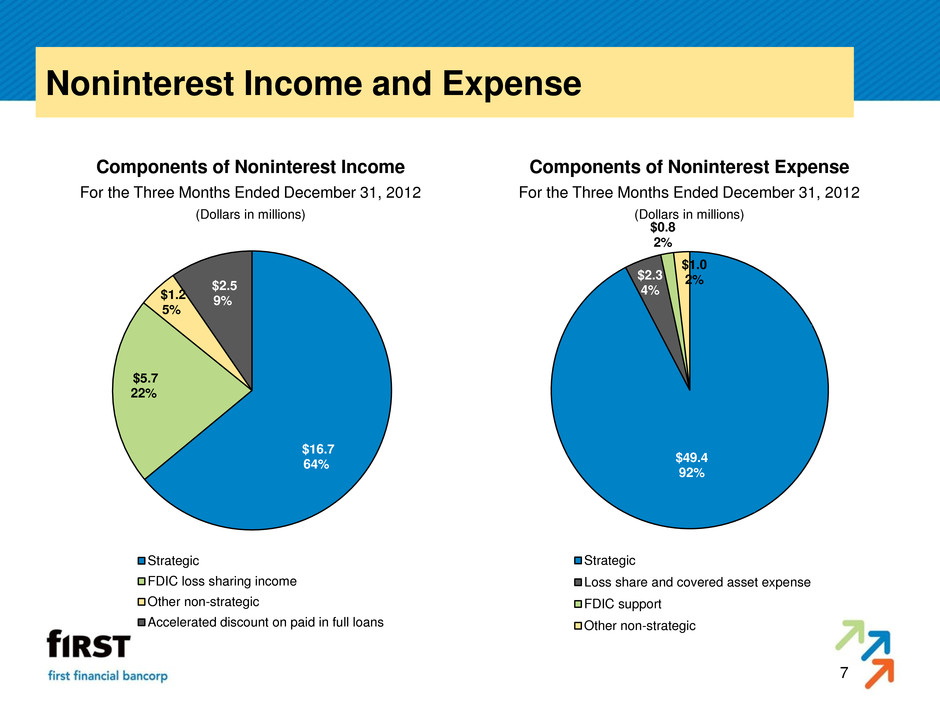

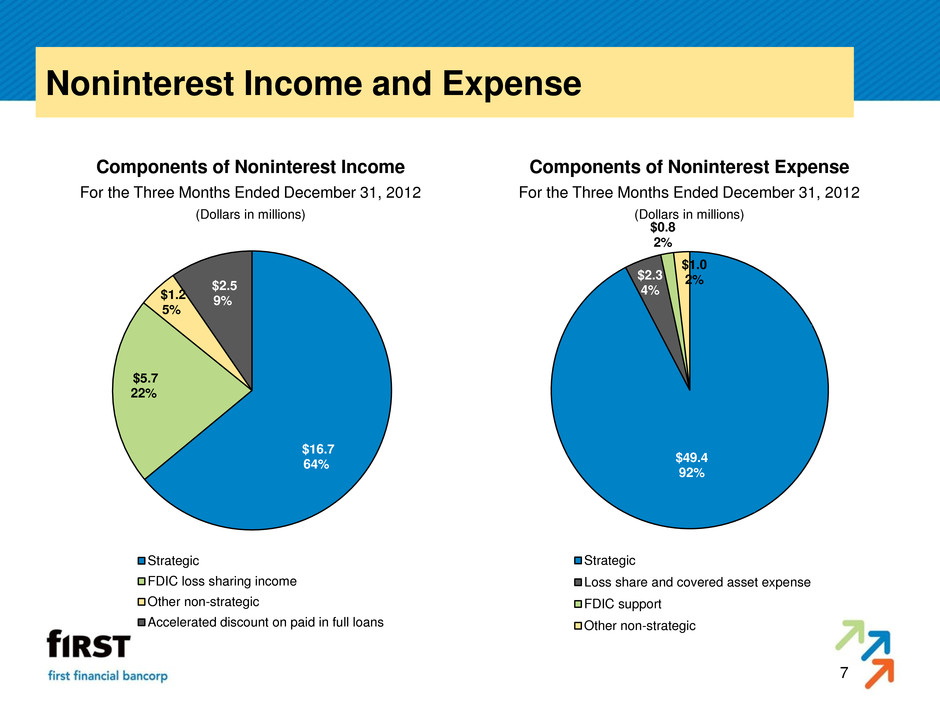

7 Noninterest Income and Expense Components of Noninterest Income For the Three Months Ended December 31, 2012 (Dollars in millions) Components of Noninterest Expense For the Three Months Ended December 31, 2012 (Dollars in millions) $16.7 64% $5.7 22% $1.2 5% $2.5 9% Strategic FDIC loss sharing income Other non-strategic Accelerated discount on paid in full loans $49.4 92% $2.3 4% $0.8 2% $1.0 2% Strategic Loss share and covered asset expense FDIC support Other non-strategic

8 Deposit and Loan Composition Total Deposits – $5.0 billion As of December 31, 2012 (Dollars in millions) Gross Loans – $3.9 billion As of December 31, 2012 (Dollars in millions) Market exits are complete; acquired-non-strategic deposits consist primarily of time deposits in Western, Michigan and Louisville markets and brokered CDs. $4,908 99% $48 1% Strategic Acquired-Non-Strategic $3,576 91% $351 9%

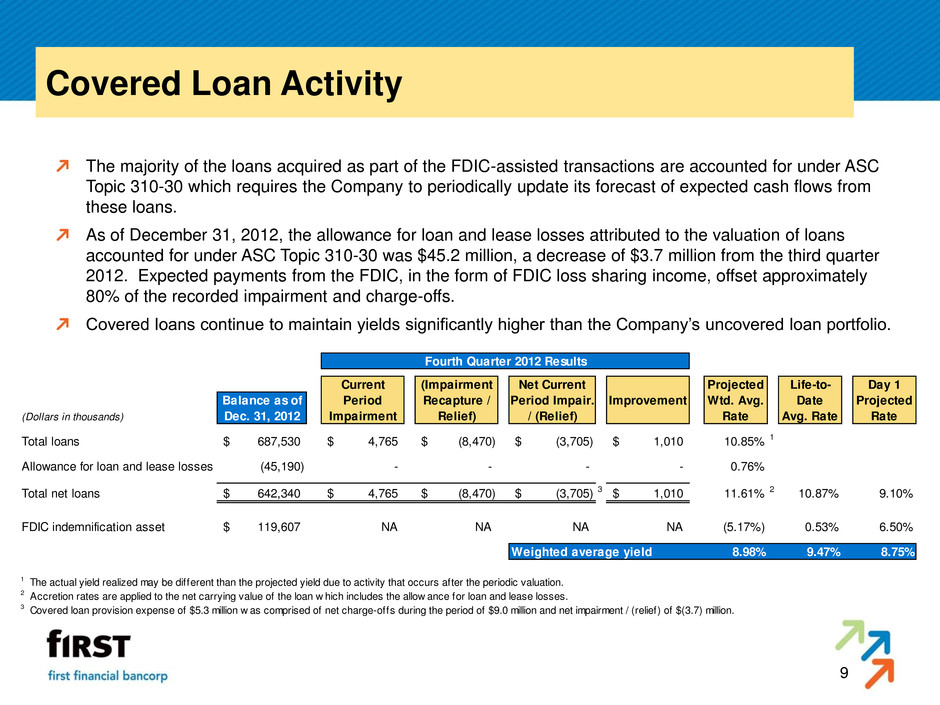

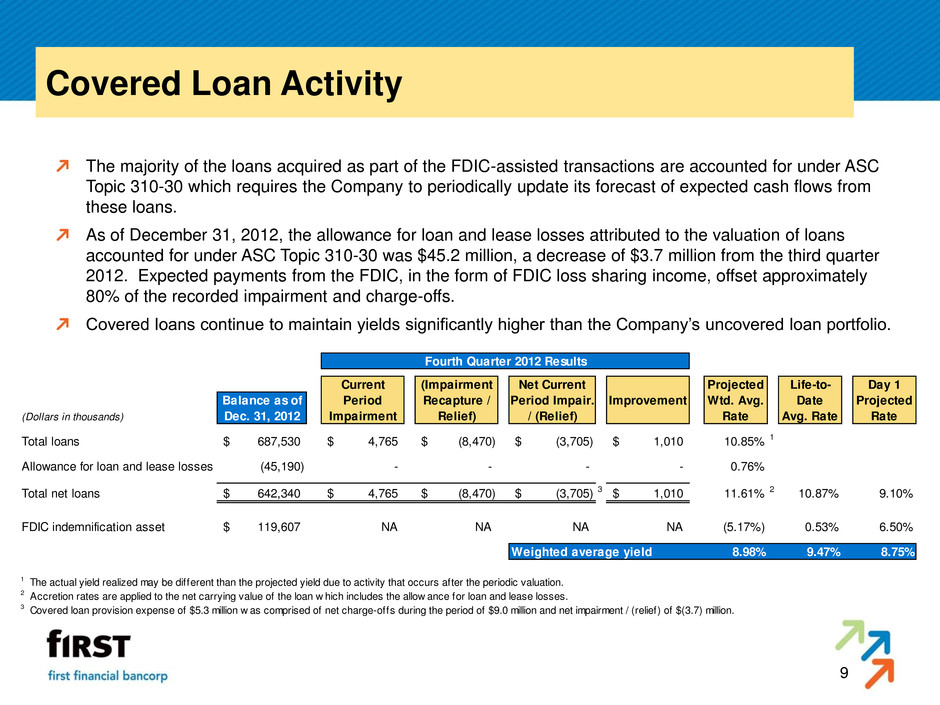

9 Covered Loan Activity The majority of the loans acquired as part of the FDIC-assisted transactions are accounted for under ASC Topic 310-30 which requires the Company to periodically update its forecast of expected cash flows from these loans. As of December 31, 2012, the allowance for loan and lease losses attributed to the valuation of loans accounted for under ASC Topic 310-30 was $45.2 million, a decrease of $3.7 million from the third quarter 2012. Expected payments from the FDIC, in the form of FDIC loss sharing income, offset approximately 80% of the recorded impairment and charge-offs. Covered loans continue to maintain yields significantly higher than the Company’s uncovered loan portfolio. Fourth Quarter 2012 Results Current (Impairment Net Current Projected Life-to- Day 1 Balance as of Period Recapture / Period Impair. Improvement Wtd. Avg. Date Projected (Dollars in thousands) Dec. 31, 2012 Impairment Relief) / (Relief) Rate Avg. Rate Rate Tot l loans 687,530$ 4,765$ (8,470)$ (3,705)$ 1,010$ 10.85% 1 Allowanc for loan and lease losses (45,190) - - - - 0.76% T tal net loans 642,340$ 4,765$ (8,470)$ (3,705)$ 3 1,010$ 11.61% 2 10.87% 9.10% FDIC indemnification asset 119,607$ NA NA NA NA (5.17%) 0.53% 6.50% Weighted average yield 8.98% 9.47% 8.75% 1 The actual yield realized may be different than the projected yield due to activity that occurs after the periodic valuation. 2 Accretion rates are applied to the net carrying value of the loan w hich includes the allow ance for loan and lease losses. 3 Covered loan provision expense of $5.3 million w as comprised of net charge-offs during the period of $9.0 million and net impairment / (relief) of $(3.7) million.

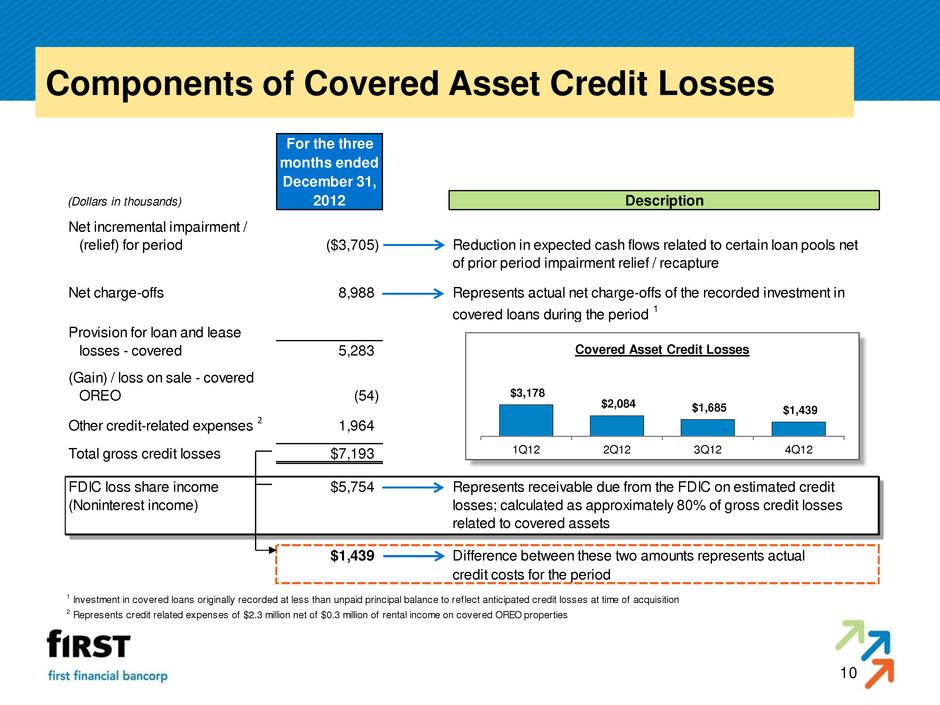

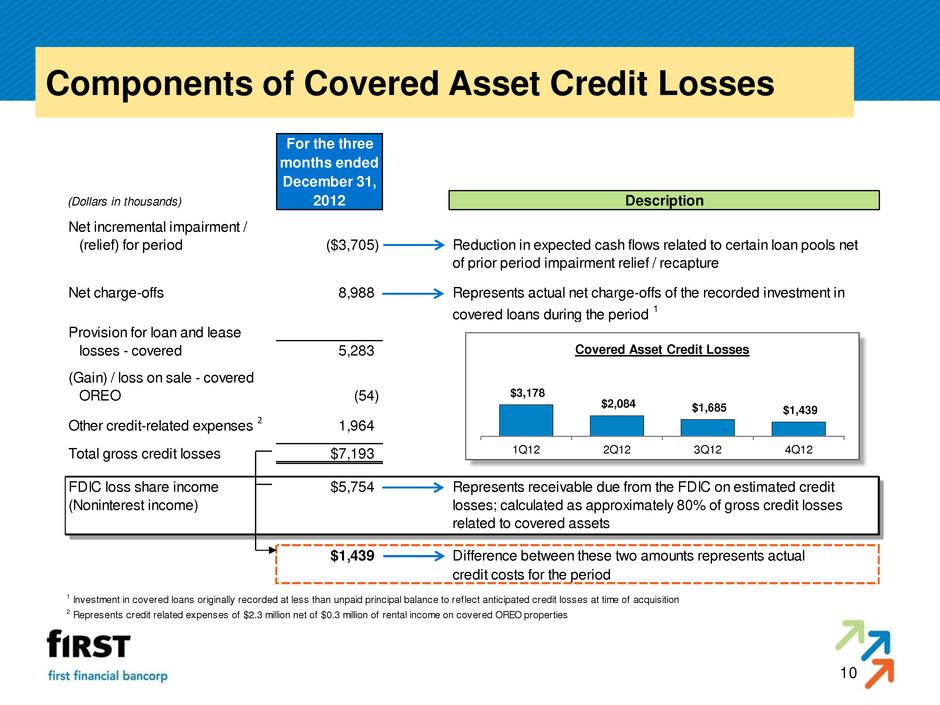

10 Components of Covered Asset Credit Losses $3,178 $2,084 $1,685 $1,439 1Q12 2Q12 3Q12 4Q12 Covered Asset Credit Losses For the three months ended December 31, (Dollars in thousands) 2012 Description Net incremental impairment / (relief) for period ($3,705) Reduction in expected cash flows related to certain loan pools net of prior period impairment relief / recapture Net charge-offs 8,988 Represents actual net charge-offs of the recorded investment in covered loans during the period 1 Provision for loan and lease losses - covered 5,283 (Gain) / loss on sale - covered OREO (54) Other credit-related expenses 2 1,964 Total gross credit losses $7,193 FDIC loss share income $5,754 Represents receivable due from the FDIC on estimated credit (Noninterest income) losses; calculated as approximately 80% of gross credit losses related to covered assets $1,439 Difference between these two amounts represents actual credit costs for the period 1 Investment in covered loans originally recorded at less than unpaid principal balance to reflect anticipated credit losses at time of acquisition 2 Represents credit related expenses of $2.3 million net of $0.3 million of rental income on covered OREO properties

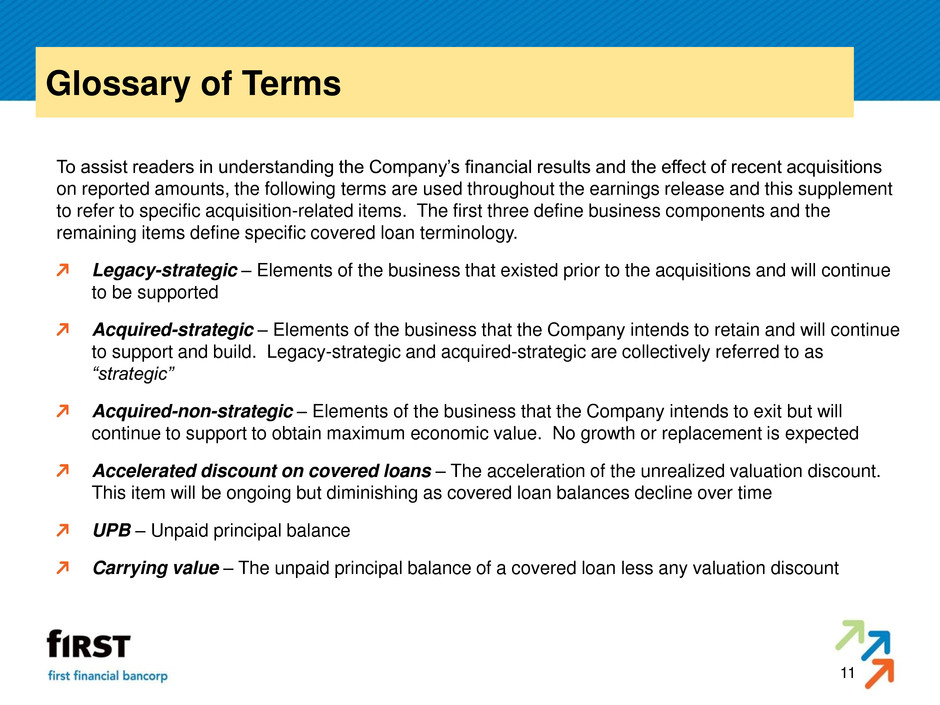

11 Glossary of Terms To assist readers in understanding the Company’s financial results and the effect of recent acquisitions on reported amounts, the following terms are used throughout the earnings release and this supplement to refer to specific acquisition-related items. The first three define business components and the remaining items define specific covered loan terminology. Legacy-strategic – Elements of the business that existed prior to the acquisitions and will continue to be supported Acquired-strategic – Elements of the business that the Company intends to retain and will continue to support and build. Legacy-strategic and acquired-strategic are collectively referred to as “strategic” Acquired-non-strategic – Elements of the business that the Company intends to exit but will continue to support to obtain maximum economic value. No growth or replacement is expected Accelerated discount on covered loans – The acceleration of the unrealized valuation discount. This item will be ongoing but diminishing as covered loan balances decline over time UPB – Unpaid principal balance Carrying value – The unpaid principal balance of a covered loan less any valuation discount

First Financial Bancorp Fourth Quarter 2012 Earnings Release Supplemental Information