EXHIBIT 13

First Financial Bancorp 2012 Annual Report Success Begins Here

First Financial Bancorp 2012 Annual Report Success Begins Here

1$6.5 Billion in Assets $5.0 Billion in deposits 2012 performance First Financial KBW Regional Bank index Components - Median Value 10% 8% 6% 4% 2% 0% 9. 43 % For Full Year 2012 Return on Average Shareholders' Equity 8. 34 % For Full Year 2012 Net Interest Margin 5% 4% 3% 2% 1% 0% 4. 37 % 3. 69 % For Full Year 2012 Return on Average Assets 1.25% 1.0% .75% .5% .25% 0% 1. 07 % 0. 96 % Key financial results and trends: 89 consecutive quarters of profitability Total uncovered loans of $3.2 billion, an increase of $210.6 million, or 7.1%, compared to December 31, 2011 Total classified, or problem, assets declined 20.5% compared to balances on December 31, 2011

$5.0 Billion in deposits Maintained high capital levels that are among industry leaders. First Financial tangible Common equity Ratio First Financial tier 1 Capital Ratio First Financial total Risk-Based Capital Ratio KBW Regional Bank index Components - Median Value 20% 15% 10% 5% 0% As of December 31, 2012 9. 50 % 8. 66 % 16 .3 2% 13 .1 2% 17 .6 0 % 14 .8 0% the variable dividend under which 100% of quarterly earnings are paid out placed First Financial's common stock among the highest yielding dividend investments in the banking industry. 8% 6% 4% 2% 0% At December 31, 2012 7. 66 % 2. 67 % Dividend Yield Capital Ratios ■ Financial operating results remained solid during 2012 as continued execution of our strategic plan resulted in key profitability metrics exceeding standard performance for similar financial institutions across the country. ■ Almost 45 percent of our total growth in uncovered loans came from the Indianapolis and Dayton markets. Furthermore, added deposit relationships contributed to earnings as fee revenue from deposit products increased 9.6 percent compared to 2011. ■ our business credit and equipment finance products enjoyed tremendous growth as balances increased over 80 percent during the year and represented approximately 24 percent of the annual growth in uncovered loans. ■ Mortgage originations increased more than 67 percent during 2012 and fee revenue from our mortgage business increased 51 percent year-over-year. First Financial continues to be recognized as an industry leader in capital management. throughout 2012, we continued the 100 percent of quarterly earnings dividend payout to shareholders that began in 2011. We also announced a share repurchase plan with the ability to repurchase up to 5,000,000 shares of common stock. in the fourth quarter, First Financial bought back 460,500 shares under this plan. When combined with the dividends paid, we returned 110.8 percent of 2012 full-year net income to shareholders during the year. Success begins with responsible growth and the day-to-day execution of a focused plan. the banking industry continues to face challenging headwinds due to the persistent low interest rate environment and slow-recovering economy. over the last several years, though, we have made significant investments intended to create long-term franchise value for all company stakeholders. investments include the acquisition of banking centers in Dayton and Indianapolis, the expansion of our specialty finance product offerings, and our renewed focus on mortgage banking. during 2012, these investments began to show promising returns. Our company has been recognized for three consecutive years by The Bank Director as being one of the top performing banks in the country.

First Financial Bancorp 2012 Annual Report 1

40 million tablets are projected to be purchased in the U.S. in 2013. Smartphone shipments are projected to rise in 2013 by 35.5% since launching our new online banking platform in August of 2012, registered users have increased by 30%. Since August of 2012, First Financial mobile users have increased by 150%.

2 First Financial Bancorp 2012 Annual Report

40 million tablets are projected to be purchased in the U.S. in 2013. Since launching our new online banking platform in August of 2012, registered users have increased by 30% . Success begins by connecting with clients. in today's fast-paced world, we continue to see a shift in banking habits and preferences. At First Financial, we are investing in new technology and redefining our delivery channels to meet our clients' changing needs. Whether clients visit our banking centers or prefer to manage their finances from their computers, tablets or mobile phones, we must provide them with access to their accounts and ways to communicate with us that fit their lifestyles. in 2012, First Financial introduced: ■ An improved online banking and bill payment solution for consumers, featuring a fresh look for clients to manage their finances online. ■ our new mobile banking app to provide easy on-the-go account access. ■ Brand-new money management tools that integrate with the new online banking system. Panorama puts real-time tracking, budgeting and planning tools at clients' fingertips, while Ping Pay lets clients send funds to anyone, anywhere from their mobile devices. ■ Upgraded ATMs - more than 135 - throughout our footprint that offer envelope-free deposits, check images on receipts and extended deposit time for same-day business processing. in addition to new products and services, we increased our social media presence to build stronger connections and communicate more often with our clients. during the year, we focused on building our brand awareness through Facebook. A 2012 Facebook contest with Habitat for Humanity helped us increase our fan base and give back to our local communities at the same time. throughout 2013, we will continue our commitment to and investment in new technology with the launch of a new online business banking platform, online account opening capabilities, additional mobile banking features, and an expanded social media strategy. our expanding presence and visibility in all channels will help expand the First brand of banking to a growing client base. even with technology, our banking centers continue to be the most visible part of the client experience. in 2012, we opened six new prototype banking centers, including: ■ Anderson, Kenwood, Montgomery and a downtown location in Greater Cincinnati ■ Hessville in northwest Indiana ■ Columbus in southern Indiana

First Financial Bancorp 2012 Annual Report 3

our community bank business model executed through local leadership and decision making combined with the product set and resources of larger financial institutions sets us apart from our competitors. We continue to build a strong sales culture and our commercial, retail and wealth management lines of business are working hard to capitalize on our competitive advantages. Success begins with a focus on deeper client relationships. We strive to be more than a bank to our clients-we want to be a true partner on their path to financial success. throughout 2012, our sales teams shifted to a more consultative approach to client relationships- learning all that we can so we can become the go-to resource for our clients' financial questions, ideas and plans. this allows sales teams to make smart recommendations and provide customized solutions to help clients fulfill all of their financial needs within one bank-ours.

4 First Financial Bancorp 2012 Annual Report

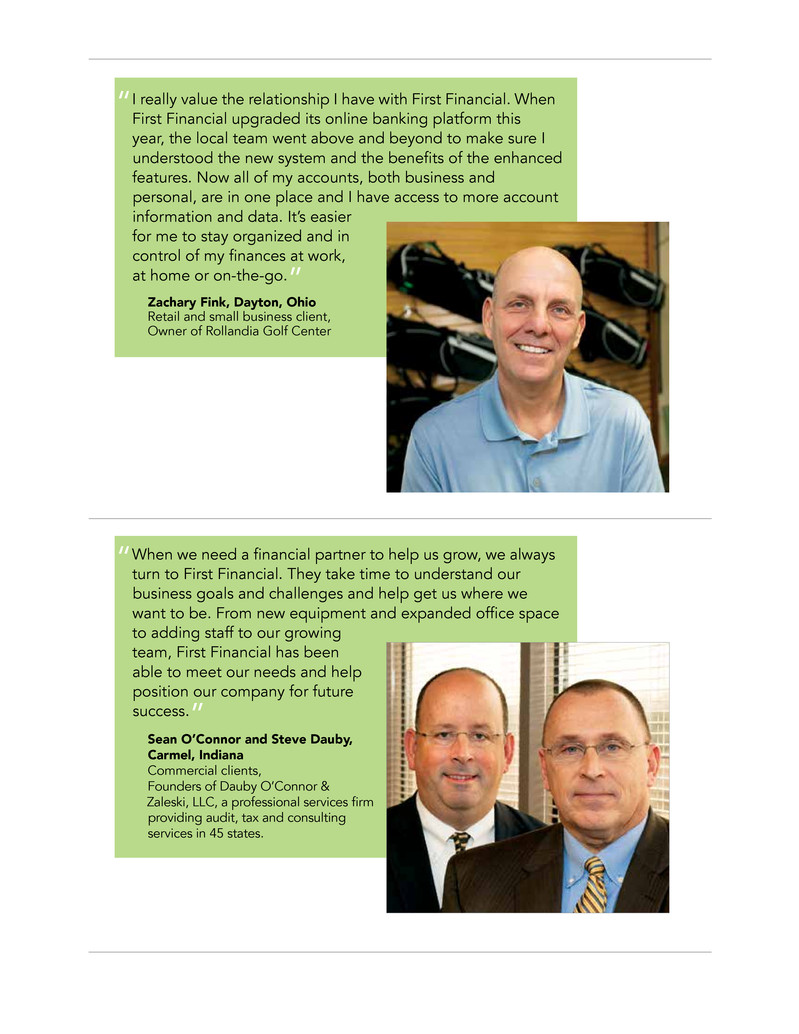

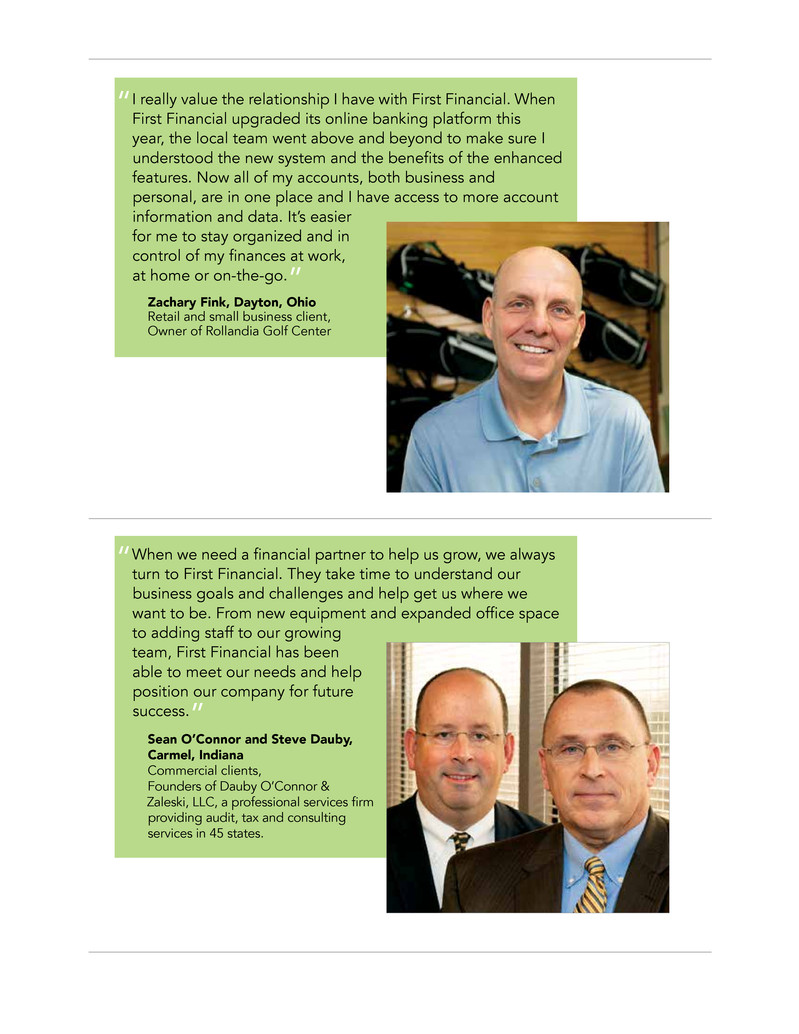

“ i really value the relationship i have with First Financial. When First Financial upgraded its online banking platform this year, the local team went above and beyond to make sure i understood the new system and the benefits of the enhanced features. now all of my accounts, both business and personal, are in one place and i have access to more account information and data. it's easier for me to stay organized and in control of my finances at work, at home or on-the-go.” Zachary Fink, Dayton, Ohio Retail and small business client, owner of Rollandia Golf Center “ When we need a financial partner to help us grow, we always turn to First Financial. they take time to understand our business goals and challenges and help get us where we want to be. From new equipment and expanded office space to adding staff to our growing team, First Financial has been able to meet our needs and help position our company for future success.” Sean O'Connor and Steve Dauby, Carmel, Indiana Commercial clients, Founders of dauby o'Connor & Zaleski, llC, a professional services firm providing audit, tax and consulting services in 45 states.

First Financial Bancorp 2012 Annual Report 5

Research links stronger business results to higher associate engagement

6 First Financial Bancorp 2012 Annual Report

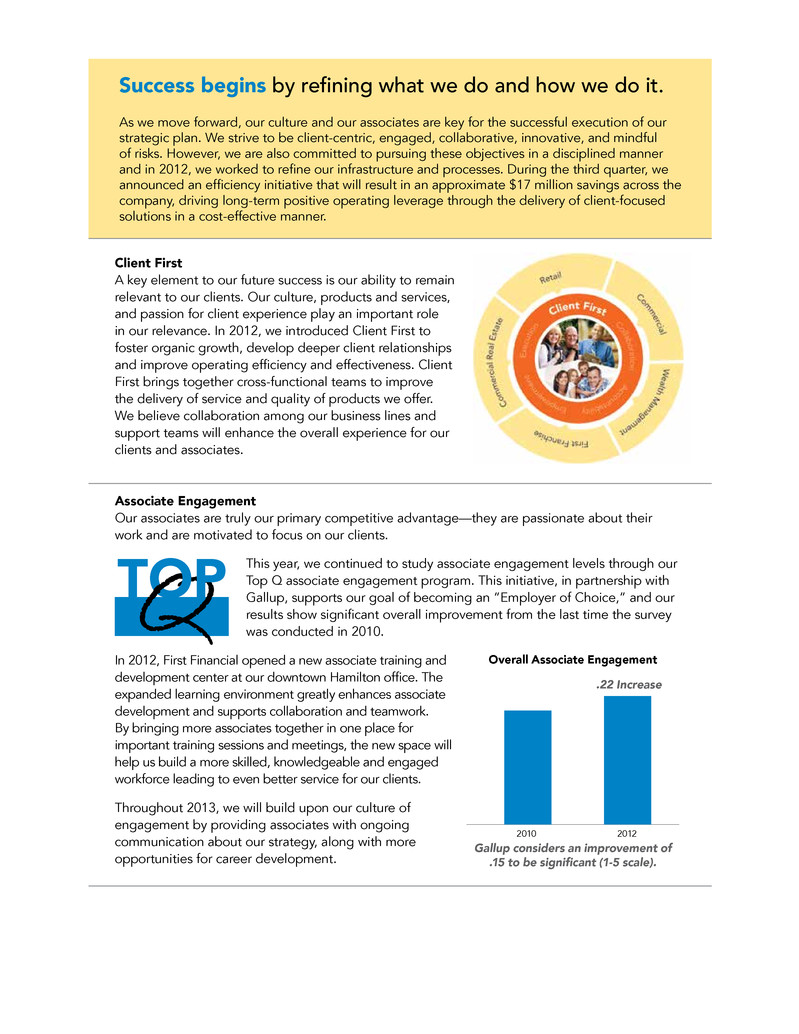

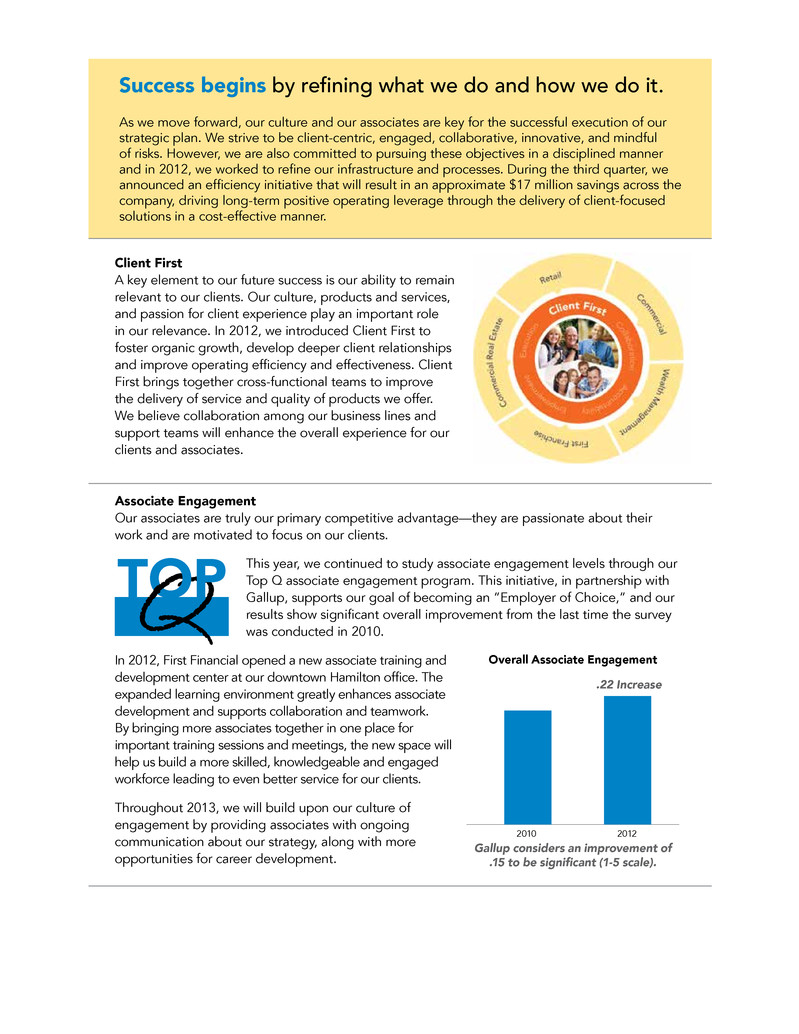

Associate Engagement our associates are truly our primary competitive advantage-they are passionate about their work and are motivated to focus on our clients. this year, we continued to study associate engagement levels through our top Q associate engagement program. this initiative, in partnership with Gallup, supports our goal of becoming an “employer of Choice,” and our results show significant overall improvement from the last time the survey was conducted in 2010. in 2012, First Financial opened a new associate training and development center at our downtown Hamilton office. the expanded learning environment greatly enhances associate development and supports collaboration and teamwork. By bringing more associates together in one place for important training sessions and meetings, the new space will help us build a more skilled, knowledgeable and engaged workforce leading to even better service for our clients. throughout 2013, we will build upon our culture of engagement by providing associates with ongoing communication about our strategy, along with more opportunities for career development. Success begins by refining what we do and how we do it. As we move forward, our culture and our associates are key for the successful execution of our strategic plan. We strive to be client-centric, engaged, collaborative, innovative, and mindful of risks. However, we are also committed to pursuing these objectives in a disciplined manner and in 2012, we worked to refine our infrastructure and processes. during the third quarter, we announced an efficiency initiative that will result in an approximate $17 million savings across the company, driving long-term positive operating leverage through the delivery of client-focused solutions in a cost-effective manner. Client First A key element to our future success is our ability to remain relevant to our clients. our culture, products and services, and passion for client experience play an important role in our relevance. in 2012, we introduced Client First to foster organic growth, develop deeper client relationships and improve operating efficiency and effectiveness. Client First brings together cross-functional teams to improve the delivery of service and quality of products we offer. We believe collaboration among our business lines and support teams will enhance the overall experience for our clients and associates. Research links stronger business results to higher associate engagement n 2010 2012 Overall Associate Engagement Gallup considers an improvement of .15 to be significant (1-5 scale). .22 Increase TOPQ

First Financial Bancorp 2012 Annual Report 7

Claude E. Davis, President and CEO We appreciate the support of our shareholders, our dedicated associates and our valuable client relationships. We look forward to continuing our story of success in 2013. Success begins with a focus on the future. the banking industry continues to face many challenges, including historically low interest rates, increased regulatory and compliance requirements, and a slow economic recovery. However, First Financial remains strong and we continue to make strategic decisions that are in the best long-term interest of the company. now is the time for us to be engaged, proactive and focused on taking First Financial to the next level. to continue to move forward, we must continue to meet the changing needs of our clients, respond and adapt to industry challenges, make smart investments to enhance the products and services we provide, and build a culture of innovation. 2013 marks the bank's 150th anniversary and we've been fortunate to have experienced a long tradition of success. We have survived and excelled as a company because of the strategic decisions our predecessors made and we continue to strive to make smart, thoughtful business decisions today. As we celebrate this milestone, we are well positioned to take advantage of new opportunities and build a stronger First Financial. strategic priorities for 2013 ■ Continue to capitalize on investments we've made to drive future growth through diverse revenue streams ■ Focus on disciplined cost management and positive operating leverage while continuing to invest in technology and delivery channels ■ Create a culture of innovation and empowerment ■ Remain disciplined with our capital and continue to manage and deploy it in ways that enhance shareholder value ■ leverage our growing brand to continue building market share in all markets

8 First Financial Bancorp 2012 Annual Report

Directors and Officers

|

| | | | |

| Board of Directors | | | | Senior Management |

| | | | | |

| Murph Knapke | | Corinne R. Finnerty | | Claude E. Davis |

| Chairman of the Board, | | Partner, | | President and |

| First Financial Bancorp; | | McConnell Finnerty Waggoner PC | | Chief Executive Officer |

| Owner, | | | | |

| Knapke Law Office, | | Susan L. Knust | | Richard Barbercheck |

| Attorney-at-Law | | Managing Partner, | | Executive Vice President and |

| | | K.P. Properties and | | Chief Credit Officer |

| J. Wickliffe Ach | | Omega Warehouse Services | | |

| President and | | | | Gregory A. Gehlmann |

| Chief Executive Officer, | | William J. Kramer | | Executive Vice President, |

| Hixson, Inc. | | Vice President of Operations, | | Chief General Counsel |

| | | Valco Companies, Inc. | | |

| David S. Barker | | | | Kevin T. Langford |

| President and | | Richard E. Olszewski | | Executive Vice President and |

| Chief Executive Officer, | | Owner, | | Chief Administrative Officer |

| SIHO Insurance Services | | 7 Eleven Food Stores | | |

| | | | | C. Douglas Lefferson |

| Cynthia O. Booth | | Maribeth S. Rahe | | Executive Vice President and |

| President and | | President and | | Chief Banking Officer |

| Chief Executive Officer, | | Chief Executive Officer, | | |

| COBCO Enterprises | | Fort Washington Investment | | Alisa E. Poe |

| | | Advisors, Inc. | | Executive Vice President and |

| Donald M. Cisle, Sr. | | | | Chief Talent Officer |

| President, | | | | |

| Seward-Murphy, Inc. | | | | Jill A. Stanton |

| | | | | Executive Vice President and |

| Mark A. Collar | | | | Co-Chief Retail Banking Officer |

| Partner, | | | | |

| Triathlon Medical Ventures; | | | | Anthony M. Stollings |

| Retired President, | | | | Executive Vice President and |

| Global Pharmaceuticals & | | | | Chief Financial Officer |

| Personal Health, | | | | |

| Procter & Gamble Company | | | | Jill L. Wyman |

| | | | | Executive Vice President and |

| Claude E. Davis | | | | Co-Chief Retail Banking Officer |

| President and | | | | |

| Chief Executive Officer, | | | | Thomas J. Schuldt |

| First Financial Bancorp; | | | | Senior Vice President, |

| Chairman of the Board, President, | | | | Franchise and Specialty Finance |

| and Chief Executive Officer, | | | | |

| First Financial Bank, N.A. | | | | John M. Gavigan |

| | | | | First Vice President and |

| | | | | Corporate Controller |

| | | | | |

First Financial Bancorp 2012 Annual Report 9

|

| | | | | | | | | | | |

| FINANCIAL HIGHLIGHTS |

| | | | | | | |

| (Dollars in thousands, except per share data) | | 2012 | | 2011 | | % Change |

| Earnings | | | | | | |

| Net interest income | | $ | 253,341 |

| | $ | 263,896 |

| | (4.0 | )% |

| Net income | | 67,303 |

| | 66,739 |

| | 0.8 | % |

| | | | | | | |

| Per Share | | | | | | |

| Net income per common share-basic | | $ | 1.16 |

| | $ | 1.16 |

| | 0.0 | % |

| Net income per common share-diluted | | 1.14 |

| | 1.14 |

| | 0.0 | % |

| Cash dividends declared per common share | | 1.18 |

| | 0.78 |

| | 51.3 | % |

| Tangible book value per common share (end of year) | | 10.47 |

| | 10.41 |

| | 0.6 | % |

| Market price (end of year) | | 14.62 |

| | 16.64 |

| | (12.1 | )% |

| | | | | | | |

| Balance Sheet - End of Year | | | | | | |

| Total assets | | $ | 6,497,048 |

| | $ | 6,671,511 |

| | (2.6 | )% |

| Deposits | | 4,955,840 |

| | 5,642,840 |

| | (12.2 | )% |

| Loans, including covered loans | | 3,927,180 |

| | 4,021,691 |

| | (2.4 | )% |

| Investment securities | | 1,874,343 |

| | 1,516,002 |

| | 23.6 | % |

| Shareholders' equity | | 710,425 |

| | 712,221 |

| | (0.3 | )% |

| | | | | | | |

| Ratios | | | | | | |

| Return on average assets | | 1.07 | % | | 1.06 | % | | |

| Return on average shareholders' equity | | 9.43 | % | | 9.37 | % | | |

| Return on average tangible shareholders' equity | | 11.01 | % | | 11.01 | % | | |

| Net interest margin | | 4.37 | % | | 4.55 | % | | |

| Net interest margin (fully tax equivalent) | | 4.39 | % | | 4.57 | % | | |

10 First Financial Bancorp 2012 Annual Report

|

| |

| | 2012 Financial Information |

First Financial Bancorp 2012 Annual Report 11

Management’s Discussion And Analysis Of Financial Condition And Results Of Operations

This annual report contains forward-looking statements. See the Forward Looking Statements section that follows for further information on the risks and uncertainties associated with forward-looking statements. The following discussion and analysis is presented to facilitate the understanding of the financial position and results of operations of First Financial Bancorp. (First Financial or the Company). It identifies trends and material changes that occurred during the reporting periods and should be read in conjunction with the Statistical Data, Consolidated Financial Statements and accompanying Notes.

EXECUTIVE SUMMARY

First Financial is a $6.5 billion bank holding company headquartered in Cincinnati, Ohio. As of December 31, 2012, First Financial, through its subsidiaries, operated primarily in Ohio, Indiana and Kentucky. These subsidiaries include a commercial bank, First Financial Bank, N.A. (First Financial Bank or the Bank) with 124 banking centers and 143 ATMs. First Financial conducts three primary activities through its bank subsidiary and the Bank's operating subsidiaries: commercial banking, retail banking and wealth management. First Financial Bank provides credit-based products, deposit accounts, corporate cash management support and other services to commercial and retail clients. First Financial Wealth Management provides wealth planning, portfolio management, trust and estate, brokerage and retirement plan services.

First Financial acquired the banking operations of Peoples Community Bank (Peoples), and Irwin Union Bank and Trust Company and Irwin Union Bank, F.S.B. (collectively, Irwin), through Federal Deposit Insurance Corporation (FDIC)-assisted transactions in 2009. The acquisitions of the Peoples and Irwin franchises significantly expanded the First Financial footprint, opened new markets and strengthened the Company through the generation of additional capital.

In connection with the Peoples and Irwin FDIC-assisted transactions, First Financial entered into loss sharing agreements with the FDIC. Under the terms of these agreements the FDIC reimburses First Financial for a percentage of losses with respect to certain loans (covered loans) and other real estate owned (covered OREO) (collectively, covered assets). These agreements provide for loss protection on single-family, residential loans for a period of ten years and First Financial is required to share any recoveries of previously charged-off amounts for the same time period, on the same pro-rata basis with the FDIC. All other loans are provided loss protection for a period of five years and recoveries of previously charged-off loans must be shared with the FDIC for a period of eight years, again on the same pro-rata basis. The FDIC's obligation to reimburse First Financial for losses with respect to covered assets for all three assisted transactions began with the first dollar of loss incurred.

First Financial must follow specific servicing and resolution procedures, as outlined in the loss sharing agreements, in order to receive reimbursement from the FDIC for losses on covered assets. The Company has established separate and dedicated teams of legal, finance, credit and technology staff to execute and monitor all activity related to each agreement, including the required periodic reporting to the FDIC. First Financial services all covered assets with the same resolution practices and diligence as it does for assets that are not subject to a loss sharing agreement.

The major components of First Financial’s operating results for the past five years are summarized in Table 1 – Financial Summary and discussed in greater detail on subsequent pages.

MARKET STRATEGY

First Financial serves a combination of metropolitan and non-metropolitan markets in Ohio, Indiana and Kentucky through its full-service banking centers, while providing franchise lending services to borrowers throughout the United States. First Financial’s market selection process includes a number of factors, but markets are primarily chosen for their potential for growth and long-term profitability. First Financial’s goal is to develop a competitive advantage utilizing a local market focus, building long-term relationships with clients to help them reach greater levels of success in their financial life and providing a superior level of service. First Financial intends to continue to concentrate future growth plans and capital investments in its metropolitan markets. Smaller markets have historically provided stable, low-cost funding sources to First Financial and remain an important part of its funding base. First Financial believes its historical strength in these markets should enable it to retain or improve its market share.

During the third quarter 2012, First Financial completed a comprehensive efficiency study across all business lines and support

functions in an effort to mitigate earnings growth challenges related to the current interest rate and economic environment as well as declining balances in the Company's high-yielding covered loan portfolio. As a result, the Company identified approximately $17.1 million of annualized cost savings impacting several expense categories. Realization of the identified cost savings began during the fourth quarter 2012, however the Company did not recognize net savings during 2012 as costs associated with implementing the efficiency plan offset initial savings. Ultimately, the achievement of these cost savings will

12 First Financial Bancorp 2012 Annual Report

be contingent upon management's ability to successfully implement the efficiency plan while managing external factors, such as regulatory changes and a dynamic business environment, without impacting service levels throughout the Company and to customers.

As part of the on-going evaluation of its banking center network and the efficiency plan discussed above, First Financial consolidated 11 banking centers located in Ohio and Indiana and closed 5 other banking centers in areas of Indiana where the Company had a limited presence during 2012. Additionally, the Company announced that it will consolidate 10 additional banking centers located in Ohio and Indiana effective in February of 2013. Customer relationships related to the consolidated banking centers were transferred to the nearest First Financial location where those customers will continue to receive the same high level of service.

During 2011, First Financial exited the 4 banking center locations comprising its Michigan geographic market as well as its single banking center in Louisville, Kentucky. The five banking centers in Michigan and Louisville were acquired during 2009 as part of First Financial’s FDIC-assisted transactions.

These banking center actions allow First Financial to focus additional resources in core markets, such as Cincinnati and Dayton, Ohio and Indianapolis, Southern and Northwest Indiana, that the Company believes provide a higher level of potential overall growth and improve the efficiency of its operations.

BUSINESS COMBINATIONS

On September 23, 2011, First Financial Bank completed the purchase of 16 retail banking centers located in and around Dayton, Ohio from Liberty Savings Bank, FSB (Liberty) including $126.5 million of performing loans and $341.9 million of deposits at their estimated fair values. First Financial also acquired $3.8 million of fixed assets at estimated fair value and paid Liberty a $22.4 million net deposit premium. First Financial recorded $17.1 million of goodwill related to the Liberty banking center acquisition.

On December 2, 2011, First Financial Bank completed the purchase of 22 retail banking centers located in and around Indianapolis, Indiana from Flagstar Bank, FSB (Flagstar) and assumed approximately $464.7 million of deposits at their estimated fair value. First Financial also acquired $6.6 million of fixed assets at estimated fair value and paid Flagstar a $22.5 million net deposit premium. First Financial recorded $26.1 million of goodwill related to the Flagstar banking center acquisition.

The Liberty and Flagstar banking center acquisitions were accounted for in accordance with FASB Accounting Standards Codification (ASC) Topic 805, Business Combinations. Assets acquired in these transactions are not subject to loss sharing agreements.

First Financial's investments in the Liberty and Flagstar banking center acquisitions positively impacted 2012 results as approximately 44% of the Company's year-over-year growth in uncovered loans came from the Indianapolis and Dayton markets due to significant growth in both the commercial and retail lines of business. While the earnings impact of this growth was muted due to the current low interest rate environment, the Company's sales efforts in these markets have laid the groundwork for continued success. Additionally, the deposit relationships acquired as part of the Liberty and Flagstar banking center acquisitions contributed to growth in noninterest income as overall fee revenue from deposit products increased 9.6% during the year.

First Financial Bancorp 2012 Annual Report 13

Management’s Discussion And Analysis Of Financial Condition And Results Of Operations

|

| | | | | | | | | | | | | | | | | | | |

| Table 1 • Financial Summary | | | | | | | | | |

| | December 31, |

| (Dollars in thousands, except per share data) | 2012 | | 2011 | | 2010 | | 2009 | | 2008 |

| Summary of operations | | | | | | | | | |

| Interest income | $ | 280,930 |

| | $ | 308,817 |

| | $ | 343,502 |

| | $ | 233,228 |

| | $ | 183,305 |

|

Tax equivalent adjustment (1) | 1,055 |

| | 979 |

| | 866 |

| | 1,265 |

| | 1,808 |

|

Interest income tax – equivalent (1) | 281,985 |

| | 309,796 |

| | 344,368 |

| | 234,493 |

| | 185,113 |

|

| Interest expense | 27,589 |

| | 44,921 |

| | 67,992 |

| | 57,245 |

| | 67,103 |

|

Net interest income tax – equivalent (1) | $ | 254,396 |

| | $ | 264,875 |

| | $ | 276,376 |

| | $ | 177,248 |

| | $ | 118,010 |

|

| Interest income | $ | 280,930 |

| | $ | 308,817 |

| | $ | 343,502 |

| | $ | 233,228 |

| | $ | 183,305 |

|

| Interest expense | 27,589 |

| | 44,921 |

| | 67,992 |

| | 57,245 |

| | 67,103 |

|

| Net interest income | 253,341 |

| | 263,896 |

| | 275,510 |

| | 175,983 |

| | 116,202 |

|

| Provision for loan and lease losses – uncovered | 19,117 |

| | 19,210 |

| | 33,564 |

| | 56,084 |

| | 19,410 |

|

| Provision for loan and lease losses – covered | 30,903 |

| | 64,081 |

| | 63,144 |

| | 0 |

| | 0 |

|

| Noninterest income | 122,421 |

| | 142,531 |

| | 146,831 |

| | 404,715 |

| | 51,749 |

|

| Noninterest expenses | 221,997 |

| | 218,097 |

| | 233,680 |

| | 170,638 |

| | 115,176 |

|

| Income before income taxes | 103,745 |

| | 105,039 |

| | 91,953 |

| | 353,976 |

| | 33,365 |

|

| Income tax expense | 36,442 |

| | 38,300 |

| | 32,702 |

| | 132,639 |

| | 10,403 |

|

| Net income | 67,303 |

| | 66,739 |

| | 59,251 |

| | 221,337 |

| | 22,962 |

|

| Dividends on preferred stock | 0 |

| | 0 |

| | 1,865 |

| | 3,578 |

| | 0 |

|

| Income available to common shareholders | $ | 67,303 |

| | $ | 66,739 |

| | $ | 57,386 |

| | $ | 217,759 |

| | $ | 22,962 |

|

| | | | | | | | | | |

| Per share data | | | | | | | | | |

| Earnings per common share | | | | | | | | | |

| Basic | $ | 1.16 |

| | $ | 1.16 |

| | $ | 1.01 |

| | $ | 4.84 |

| | $ | 0.62 |

|

| Diluted | $ | 1.14 |

| | $ | 1.14 |

| | $ | 0.99 |

| | $ | 4.78 |

| | $ | 0.61 |

|

| Cash dividends declared per common share | $ | 1.18 |

| | $ | 0.78 |

| | $ | 0.40 |

| | $ | 0.40 |

| | $ | 0.68 |

|

| Average common shares outstanding–basic (in thousands) | 57,877 |

| | 57,692 |

| | 56,969 |

| | 45,029 |

| | 37,112 |

|

| Average common shares outstanding–diluted (in thousands) | 58,869 |

| | 58,693 |

| | 57,993 |

| | 45,557 |

| | 37,484 |

|

| | | | | | | | | | |

| Selected year-end balances | | | | | | | | | |

| Total assets | $ | 6,497,048 |

| | $ | 6,671,511 |

| | $ | 6,250,225 |

| | $ | 6,657,593 |

| | $ | 3,699,142 |

|

| Earning assets | 5,961,727 |

| | 6,110,934 |

| | 5,741,683 |

| | 5,964,853 |

| | 3,379,873 |

|

Investment securities (2) | 1,874,343 |

| | 1,516,002 |

| | 1,015,205 |

| | 579,147 |

| | 692,759 |

|

| Loans, excluding covered loans | 3,179,064 |

| | 2,968,447 |

| | 2,816,093 |

| | 2,895,129 |

| | 2,683,260 |

|

| Covered loans | 748,116 |

| | 1,053,244 |

| | 1,481,493 |

| | 1,934,740 |

| | 0 |

|

| Total loans | 3,927,180 |

| | 4,021,691 |

| | 4,297,586 |

| | 4,829,869 |

| | 2,683,260 |

|

| FDIC indemnification asset | 119,607 |

| | 173,009 |

| | 222,648 |

| | 287,407 |

| | 0 |

|

| Interest-bearing demand deposits | 1,160,815 |

| | 1,317,339 |

| | 1,111,877 |

| | 1,060,383 |

| | 636,945 |

|

| Savings deposits | 1,623,614 |

| | 1,724,659 |

| | 1,534,045 |

| | 1,231,081 |

| | 583,081 |

|

| Time deposits | 1,068,637 |

| | 1,654,662 |

| | 1,794,843 |

| | 2,229,500 |

| | 1,150,208 |

|

| Noninterest-bearing demand deposits | 1,102,774 |

| | 946,180 |

| | 705,484 |

| | 829,676 |

| | 413,283 |

|

| Total deposits | 4,955,840 |

| | 5,642,840 |

| | 5,146,249 |

| | 5,350,640 |

| | 2,783,517 |

|

| Short-term borrowings | 624,570 |

| | 99,431 |

| | 59,842 |

| | 37,430 |

| | 354,533 |

|

| Long-term debt | 75,202 |

| | 76,544 |

| | 128,880 |

| | 404,716 |

| | 148,164 |

|

| Other long-term debt | 0 |

| | 0 |

| | 20,620 |

| | 20,620 |

| | 20,620 |

|

| Shareholders’ equity | 710,425 |

| | 712,221 |

| | 697,394 |

| | 649,958 |

| | 348,327 |

|

| | | | | | | | | | |

| Select Financial Ratios | | | | | | | | | |

Average loans to average deposits (3) | 75.66 | % | | 78.53 | % | | 86.43 | % | | 92.56 | % | | 95.14 | % |

| Net charge-offs to average loans, excluding covered loans | 0.79 | % | | 0.84 | % | | 1.27 | % | | 1.16 | % | | 0.47 | % |

| Average shareholders’ equity to average total assets | 11.30 | % | | 11.33 | % | | 10.53 | % | | 9.85 | % | | 8.16 | % |

| Average common shareholders’ equity to average total assets | 11.30 | % | | 11.33 | % | | 10.35 | % | | 8.20 | % | | 8.11 | % |

| Return on average assets | 1.07 | % | | 1.06 | % | | 0.91 | % | | 4.67 | % | | 0.67 | % |

| Return on average common equity | 9.43 | % | | 9.37 | % | | 8.55 | % | | 56.07 | % | | 8.27 | % |

| Return on average equity | 9.43 | % | | 9.37 | % | | 8.68 | % | | 47.44 | % | �� | 8.21 | % |

| Net interest margin | 4.37 | % | | 4.55 | % | | 4.66 | % | | 4.05 | % | | 3.71 | % |

Net interest margin (tax equivalent basis) (1) | 4.39 | % | | 4.57 | % | | 4.68 | % | | 4.08 | % | | 3.77 | % |

| Dividend payout | 101.72 | % | | 67.24 | % | | 39.60 | % | | 8.26 | % | | 109.68 | % |

(1) Tax equivalent basis was calculated using a 35.00% tax rate in all years presented.

(2) Includes investment securities held-to-maturity, investment securities available-for-sale, investment securities trading, and other investments.

(3) Includes covered loans and loans held for sale.

14 First Financial Bancorp 2012 Annual Report

OVERVIEW OF OPERATIONS

The primary source of First Financial’s revenue is net interest income, or the excess of interest received from earning assets over interest paid on interest-bearing liabilities, plus the fees for financial services provided to clients. First Financial’s business results tend to be influenced by overall economic factors and conditions, including market interest rates, competition within the marketplace, business spending, consumer confidence and regulatory changes.

Net interest income in 2012 declined 4.0% from 2011, compared to a 4.2% decrease from 2010 to 2011. The decline in 2012 was attributable to a 27.7% decrease in average covered loan balances and a lower yield on the FDIC indemnification asset. Average earning assets declined $2.2 million during 2012. The net interest margin was 4.37% for 2012 compared with 4.55% in 2011 and 4.66% in 2010.

Noninterest income declined $20.1 million during the year, from $142.5 million in 2011 to $122.4 million in 2012. The decline in noninterest income was primarily due to decreases in FDIC loss sharing income and accelerated discount on covered loans that prepay, partially offset by increases in fee income, gains on sales of investment securities and other noninterest income during the year. FDIC loss sharing income represents reimbursements due from the FDIC under loss sharing agreements for losses and resolution expenses on covered assets.

Noninterest expense increased $3.9 million during the year, from $218.1 million in 2011 to $222.0 million in 2012. The increase was primarily due to higher salaries and benefits, data processing and loss sharing expenses, partially offset by lower professional services expense, FDIC assessments and losses on covered OREO during the year.

Net income for the year ended December 31, 2012 was $67.3 million, resulting in basic earnings per share of $1.16, and $1.14 of earnings per diluted common share. This represented a 0.8% increase in net income from $66.7 million in 2011. Basic and diluted earnings per share for the year ended December 31, 2011 were $1.16 and $1.14, respectively. First Financial’s return on average shareholders’ equity for 2012 was 9.43%, which compares to 9.37% for 2011. First Financial’s return on average assets for 2012 was 1.07%, which compares to a return on average assets of 1.06% for 2011.

Total loan growth during 2012 continued to be negatively impacted by runoff in the Company's covered loan portfolio. Total loans decreased $94.5 million from $4.0 billion at December 31, 2011 to $3.9 billion at December 31, 2012. Total uncovered loans increased $210.6 million, from $3.0 billion at December 31, 2011 to $3.2 billion at December 31, 2012 while total covered loans decreased $305.1 million, from $1.1 billion at December 31, 2011 to $0.7 billion at December 31, 2012.

First Financial experienced a $687.0 million or 12.2% decline in total deposits during 2012, from $5.6 billion at December 31, 2011 to $5.0 billion as of December 31, 2012. Noninterest bearing deposits increased by $156.6 million, while interest-bearing checking deposits decreased by $156.5 million, savings deposits decreased by $101.0 million and time deposits declined by $586.0 million during the period. The decrease in total deposits during 2012 was primarily related to the Company's deposit pricing and rationalization strategies during the year.

The allowance for loan and lease losses at December 31, 2012, was $47.8 million, or 1.50%, of loans, a 0.27% decline from 1.77% of loans at December 31, 2011. The Company's credit quality performance improved moderately in 2011 and 2012, reflecting the gradual recovery in the U.S. economy from a period of sustained weakness and falling real estate values experienced from 2007 to 2010. First Financial's lower levels of nonaccrual loans and classified assets in 2012 reflect these improving economic conditions, including lower unemployment rates and higher levels of business and consumer spending.

For a more detailed discussion of the above topics, please refer to the sections that follow.

NET INCOME

2012 vs. 2011. First Financial’s net income increased $0.6 million or 0.8% to $67.3 million in 2012, compared to net income of $66.7 million in 2011. The increase was primarily related to a $33.2 million or 51.8% reduction in provision for loan and lease losses on covered loans, offset by a related $20.1 million or 14.1% decline in noninterest income as well as a $10.6 million or 4.0% decline in net interest income in 2012. The decline in net interest income during 2012 was primarily driven by a 27.7% decrease in average covered loan balances. Noninterest expenses increased $3.9 million or 1.8% in 2012. For more detail, refer to the Net Interest Income, Noninterest income and Noninterest expense sections that follow. For more detail, refer to Table 2 – Volume/Rate Analysis and the Net Interest Income section.

2011 vs. 2010. First Financial’s net income increased $7.5 million or 12.6% to $66.7 million in 2011, compared to net income of $59.3 million in 2010. Net interest income decreased $11.6 million or 4.2% in 2011 from 2010 due to lower interest income

First Financial Bancorp 2012 Annual Report 15

Management’s Discussion And Analysis Of Financial Condition And Results Of Operations

earned on loans and other earning assets, primarily driven by a 26.8% decrease in average covered loan balances. Net interest income in 2011 was positively impacted by the Liberty banking center acquisition as well as organic growth in both the commercial and commercial real estate loan portfolios. A contributing factor to the decline in net interest income was the decline in average earning assets of $105.3 million or 1.8% during 2011. The decline in net interest income was offset by a $14.4 million or 42.8% decline in the provision for loan and lease losses on the uncovered loan portfolio during 2011.

NET INTEREST INCOME

First Financial’s net interest income for the years 2008 through 2012 is shown in Table 1 – Financial Summary. Net interest income, First Financial’s principal source of income, is the excess of interest received from earning assets over interest paid on interest-bearing liabilities. The amount of net interest income is determined by the volume and mix of earning assets, the rates earned on such earning assets and the volume, mix and rates paid for the deposits and borrowed money that support the earning assets. Table 2 – Volume/Rate Analysis describes the extent to which changes in interest rates and changes in volume of earning assets and interest-bearing liabilities have affected First Financial’s net interest income on a tax equivalent basis during the years indicated. Nonaccruing loans and loans held for sale, excluding covered loans, were included in the daily average loan balances used in determining the yields in Table 2 – Volume/Rate Analysis. Table 2 – Volume/Rate Analysis should be read in conjunction with the Statistical Information table.

Interest income on a tax equivalent basis is presented in Table 1 – Financial Summary. The tax equivalent adjustment recognizes the income tax savings when comparing taxable and tax-exempt assets and assumes a 35.0% tax rate for all years presented. The tax equivalent net interest margin was 4.39%, 4.57% and 4.68% for the years 2012, 2011 and 2010, respectively.

The amount of loan fees included in the interest income computation for 2012, 2011 and 2010 was $9.4 million, $5.6 million and $4.4 million, respectively. The increase in loan fees in 2012 was primarily due to higher prepayment fee income related to elevated levels of loan refinancings, including a $2.2 million prepayment fee related to the early payoff of a commercial loan relationship.

2012 vs. 2011. Net interest income decreased $10.6 million or 4.0%, from $263.9 million in 2011 to $253.3 million in 2012, primarily due to lower yields on earning assets during 2012. While average earning assets were relatively unchanged, the yield on earning assets declined 0.48% from 5.32% in 2011 to 4.84% in 2012.

Interest income was $280.9 million in 2012, a $27.9 million or 9.0% decrease from 2011. The decline in interest income and the lower yield on earning assets in 2012 are primarily the result of a $305.1 million or 29.0% decrease in covered loans, which generally accrete a yield above market interest rates. The decline in interest income on covered loans was partially offset by higher interest income on investment securities in 2012 related to a $358.3 million or 23.6% increase in investment securities during the period.

Interest expense was $27.6 million in 2012, a $17.3 million or 38.6% decrease from 2011. The total cost of funds declined 0.34% to 0.62% in 2012 from 0.96% in 2011, primarily due to a 0.32% decrease in the cost of interest-bearing deposits to 0.59% in 2012 from 0.91% in 2011. The lower cost of funds in 2012 was primarily a result of the lower interest rate environment as well as deposit pricing and rationalization strategies the Company implemented in 2011 and continued throughout 2012.

2011 vs. 2010. Net interest income decreased $11.6 million, or 4.2%, primarily due to the decreased level of earning assets. Average earning assets declined $105.3 million, or 1.8%, during 2011.

Interest income was $308.8 million in 2011, a $34.7 million or 10.1% increase from 2010. The yield on earning assets decreased 0.49% from 5.81% in 2010 to 5.32% in 2011, reflecting a decline in the covered loan portfolio which generally accretes a yield above market interest rates. Interest expense was $44.9 million in 2011, a decrease of $23.1 million, or 33.9%, from 2010. The total cost of funds decreased 0.44% to 0.96% in 2011 from 1.40% in 2010, primarily due to a 0.39% decrease in the cost of interest-bearing deposits to 0.91% in 2011 from 1.30% in 2010 as a result of deposit rationalization strategies implemented in 2011.

16 First Financial Bancorp 2012 Annual Report

|

| | | | | | | | | | | | | | | | | | | | | | | | |

Table 2 • Volume/Rate Analysis - Tax Equivalent Basis (1) | | | | |

| | | 2012 change from 2011 due to | | 2011 change from 2010 due to |

| (Dollars in thousands) | | Volume | Rate | | Total | | Volume | Rate | | Total |

| Interest income | | | | | | | | | | | | |

Loans (2) | | $ | 8,652 |

| | $ | (9,715 | ) | | $ | (1,063 | ) | | $ | 1,563 |

| | $ | (3,059 | ) | | $ | (1,496 | ) |

| Covered loans and indemnification asset | | (37,357 | ) | | 2,251 |

| | (35,106 | ) | | (49,103 | ) | | 10,231 |

| | (38,872 | ) |

Investment securities (3) | | | | | | | | | | | | |

| Taxable | | 11,873 |

| | (2,448 | ) | | 9,425 |

| | 12,242 |

| | (5,751 | ) | | 6,491 |

|

| Tax-exempt | | 470 |

| | (518 | ) | | (48 | ) | | (356 | ) | | 99 |

| | (257 | ) |

Total investment securities interest (3) | | 12,343 |

| | (2,966 | ) | | 9,377 |

| | 11,886 |

| | (5,652 | ) | | 6,234 |

|

| Interest-bearing deposits with other banks | | (983 | ) | | (36 | ) | | (1,019 | ) | | (306 | ) | | (132 | ) | | (438 | ) |

| Total | | (17,345 | ) | | (10,466 | ) | | (27,811 | ) | | (35,960 | ) | | 1,388 |

| | (34,572 | ) |

| | | | | | | | | | | | | |

| Interest expense | | | | | | | | | | | | |

| Interest-bearing demand deposits | | 7 |

| | (1,455 | ) | | (1,448 | ) | | 284 |

| | (1,637 | ) | | (1,353 | ) |

| Savings deposits | | 7 |

| | (3,807 | ) | | (3,800 | ) | | 835 |

| | (3,358 | ) | | (2,523 | ) |

| Time deposits | | (4,722 | ) | | (6,186 | ) | | (10,908 | ) | | (7,617 | ) | | (6,062 | ) | | (13,679 | ) |

| Short-term borrowings | | 135 |

| | (36 | ) | | 99 |

| | 82 |

| | (13 | ) | | 69 |

|

| Long-term debt | | (811 | ) | | (73 | ) | | (884 | ) | | (7,342 | ) | | 2,587 |

| | (4,755 | ) |

| Other long-term debt | | (391 | ) | | 0 |

| | (391 | ) | | (402 | ) | | (428 | ) | | (830 | ) |

| Total | | (5,775 | ) | | (11,557 | ) | | (17,332 | ) | | (14,160 | ) | | (8,911 | ) | | (23,071 | ) |

| Net interest income | | $ | (11,570 | ) | | $ | 1,091 |

| | $ | (10,479 | ) | | $ | (21,800 | ) | | $ | 10,299 |

| | $ | (11,501 | ) |

(1) Tax equivalent basis was calculated using a 35.00% tax rate.

(2) Includes nonaccrual loans and loans held-for-sale.

(3) Includes investment securities held-to-maturity, investment securities available-for-sale and other investments.

NONINTEREST INCOME AND NONINTEREST EXPENSES

Noninterest income and noninterest expenses for 2012, 2011 and 2010 are shown in Table 3 – Noninterest Income and Noninterest Expenses.

NONINTEREST INCOME

2012 vs. 2011. Noninterest income decreased $20.1 million or 14.1% from $142.5 million in 2011 to $122.4 million in 2012 primarily related to lower FDIC loss sharing income and income from the accelerated discount on covered loans that prepay. FDIC loss sharing income declined $25.5 million or 41.9% from 2011 to 2012. FDIC loss sharing income represents the proportionate share of credit losses on covered loans that First Financial expects to receive from the FDIC. Net of the FDIC loss sharing income described above, noninterest income increased $5.4 million, or 6.7%, in 2012 as compared with 2011, primarily due to higher service charges on deposits, bankcard income and other noninterest income partially offset by lower income from the accelerated discount on covered loans that prepay.

The increases in service charges on deposits and bankcard income during 2012 were primarily a result of the Company's banking center acquisitions late in 2011. Accelerated discounts on covered loans that prepay result from the immediate or accelerated recognition of a component of the covered loan discount that would have been recognized over the expected life of the loan had it not prepaid. The increase in other noninterest income was primarily related to a $5.0 million legal settlement received in the second quarter as well as increased rental income on OREO properties, both covered and uncovered, as well as the credit valuation adjustment applied to the derivative portfolio.

2011 vs. 2010. Noninterest income decreased $4.3 million, or 2.9%, from 2010. Noninterest income in 2011 included $60.9 million of FDIC loss sharing income, which was a $9.0 million increase from $51.8 million in 2010. First Financial recognized a pre-tax gain on the sale of investment securities in the fourth quarter of 2011 of $2.5 million, contributing to the increase in non-interest income. These increases were offset by an $8.5 million, or 29.4%, decrease in income related to accelerated discounts on covered loans as well as a $3.0 million, or 13.4%, decrease in service charges on deposits. Other noninterest income decreased $5.3 million in 2011 primarily related to a gain on sale of an insurance business and final resolution of FDIC

First Financial Bancorp 2012 Annual Report 17

Management’s Discussion And Analysis Of Financial Condition And Results Of Operations

settlement items related to the Irwin acquisition in 2010, as well as a decline in insurance fee income partially offset by an increase in client derivative fees in 2011.

|

| | | | | | | | | | | | | | | | | |

| Table 3 • Noninterest Income and Noninterest Expense |

| | 2012 | | 2011 | | 2010 |

| | | % Change | | | % Change | | | % Change |

| | | Increase | | | Increase | | | Increase |

| (Dollars in thousands) | Total | (Decrease) | | Total | (Decrease) | | Total | (Decrease) |

| Noninterest income | | | | | | | | |

| Service charges on deposit accounts | $ | 21,215 |

| 10.5 | % | | $ | 19,206 |

| (13.4 | )% | | $ | 22,188 |

| 12.8 | % |

| Trust and wealth management fees | 13,951 |

| (2.7 | )% | | 14,340 |

| 3.4 | % | | 13,862 |

| 2.9 | % |

| Bankcard income | 10,028 |

| 7.9 | % | | 9,291 |

| 9.1 | % | | 8,518 |

| 42.9 | % |

| Net gains from sales of loans | 4,570 |

| 7.3 | % | | 4,258 |

| (8.1 | )% | | 4,632 |

| 287.3 | % |

| Gain on acquisition | 0 |

| N/M |

| | 0 |

| N/M |

| | 0 |

| (100.0 | )% |

| FDIC loss sharing income | 35,346 |

| (41.9 | )% | | 60,888 |

| 17.4 | % | | 51,844 |

| N/M |

|

| Accelerated discount on covered loans | 13,662 |

| (33.4 | )% | | 20,521 |

| (29.4 | )% | | 29,067 |

| 237.9 | % |

| Loss on preferred securities | 0 |

| N/M |

| | 0 |

| (100.0 | )% | | (30 | ) | (121.6 | )% |

| Other | 20,021 |

| 74.3 | % | | 11,486 |

| (31.4 | )% | | 16,750 |

| 70.1 | % |

| Subtotal | 118,793 |

| (15.1 | )% | | 139,990 |

| (4.7 | )% | | 146,831 |

| (63.4 | )% |

| Gains on sales of investment securities | 3,628 |

| 42.8 | % | | 2,541 |

| N/M |

| | 0 |

| (100.0 | )% |

| Total | $ | 122,421 |

| (14.1 | )% | | $ | 142,531 |

| (2.9 | )% | | $ | 146,831 |

| (63.7 | )% |

| | | | | | | | | |

| Noninterest expenses | | | | | | | | |

| Salaries and employee benefits | $ | 113,154 |

| 5.8 | % | | $ | 106,914 |

| (8.9 | )% | | $ | 117,363 |

| 36.4 | % |

| Net occupancy | 20,682 |

| (3.4 | )% | | 21,410 |

| (5.1 | )% | | 22,555 |

| 39.2 | % |

| Furniture and equipment | 9,190 |

| (7.6 | )% | | 9,945 |

| (3.4 | )% | | 10,299 |

| 27.9 | % |

| Data processing | 8,837 |

| 54.6 | % | | 5,716 |

| 10.9 | % | | 5,152 |

| 48.3 | % |

| Marketing | 5,550 |

| (4.2 | )% | | 5,794 |

| 8.2 | % | | 5,357 |

| 53.3 | % |

| Communication | 3,409 |

| 6.4 | % | | 3,203 |

| (18.0 | )% | | 3,908 |

| 20.4 | % |

| Professional services | 7,269 |

| (24.6 | )% | | 9,636 |

| 5.1 | % | | 9,169 |

| 52.0 | % |

| Debt extinguishment | 0 |

| N/M |

| | 0 |

| (100.0 | )% | | 8,029 |

| N/M |

|

| State intangible tax | 3,899 |

| 8.8 | % | | 3,583 |

| (26.0 | )% | | 4,843 |

| 93.1 | % |

| FDIC assessments | 4,682 |

| (17.5 | )% | | 5,676 |

| (31.7 | )% | | 8,312 |

| 21.4 | % |

| Loss-other real estate owned | 3,250 |

| (18.2 | )% | | 3,971 |

| 241.4 | % | | 1,163 |

| 334.0 | % |

| Loss-covered other real estate owned | 2,446 |

| (73.5 | )% | | 9,224 |

| 907.0 | % | | 916 |

| N/M |

|

| Loss sharing expense | 10,725 |

| 197.9 | % | | 3,600 |

| 485.4 | % | | 615 |

| N/M |

|

| Other | 28,904 |

| (1.8 | )% | | 29,425 |

| (18.3 | )% | | 35,999 |

| 4.5 | % |

| Total | $ | 221,997 |

| 1.8 | % | | $ | 218,097 |

| (6.7 | )% | | $ | 233,680 |

| 36.9 | % |

N/M = Not meaningful

NONINTEREST EXPENSES

2012 vs. 2011. Noninterest expenses increased $3.9 million or 1.8% in 2012 compared to 2011, due primarily to a $6.2 million or 5.8% increase in salaries and employee benefits, a $3.1 million or 54.6% increase in data processing expense and a $7.1 million or 197.9% increase in loss sharing expense. These increases were partially offset by a $2.4 million or 24.6% decrease in professional services expense, a $1.0 million or 17.5% decrease in FDIC assessments and a $6.8 million or 73.5% decrease in losses incurred on the sale of covered OREO properties during 2012.

The increase in salaries and benefits during 2012 was primarily attributable to the banking center acquisitions late in 2011 as well as higher incentive payments related to elevated loan originations in 2012. The increase in data processing expense in 2012 was due to various software and system implementations finalized during the year, including new internet and mobile

18 First Financial Bancorp 2012 Annual Report

banking platforms introduced late in 2012. The increase in loss sharing expense relates primarily to collection costs incurred on covered loans that have been resolved. First Financial views the combination of provision expense on covered loans, losses on covered OREO and loss sharing expense, net of the related reimbursements due under loss sharing agreements recorded as FDIC loss sharing income, as the net credit costs associated with covered assets during the period. For additional discussion of the credit costs associated with covered assets, see "Allowance for loan and lease losses, covered loans."

The decline in professional services expense in 2012 was primarily attributable to lower legal costs during the year while the decline in FDIC assessments was related to reduced assessment rates that took effect mid-2011.

2011 vs. 2010. Noninterest expenses decreased $15.6 million or 6.7% for 2011 compared to 2010 due to an $8.0 million prepayment penalty on Federal Home Loan Bank (FHLB) advances prepaid in 2010, lower FDIC assessment costs and lower salaries and benefits. Salaries and benefits expenses decreased $10.4 million or 8.9% from 2010 primarily as a result of pension income recognized in 2011 due to the funded status of the pension plan compared to expense in 2010, as well as the Company exiting 5 banking center locations in Michigan and Kentucky during the first quarter of 2011 and other cost management efforts.

Noninterest expenses included $4.0 million and $9.2 million of losses and valuation adjustments on uncovered and covered OREO properties, respectively, resulting in a combined increase of $11.1 million in noninterest expense compared to 2010 which was partially offset by a $3.6 million decline in acquisition and covered loan related expenses during 2011.

INCOME TAXES

First Financial’s tax expense in 2012 totaled $36.4 million compared to $38.3 million in 2011 and $32.7 million in 2010, resulting in effective tax rates of 35.1%, 36.5% and 35.6% in 2012, 2011 and 2010, respectively. The decrease in the effective tax rate in 2012 compared to 2011 was primarily due to a one-time provision to return adjustment related to state income taxes at the subsidiary level as well as the marginal impact of 2011's higher pre-tax earnings. The increase in the effective tax rate in 2011 compared to 2010 was primarily due to a decline in certain tax credits during the year as well as the marginal impact of 2011's higher pre-tax earnings.

Further information on income taxes is presented in Note 15 of the Notes to Consolidated Financial Statements.

LOANS

First Financial, primarily through its banking subsidiary, remains dedicated to meeting the financial needs of individuals and businesses through its client-focused business model. The loan portfolio is comprised of a broad range of borrowers primarily in the Ohio, Indiana and Kentucky markets; however, the franchise finance lending activity represents a national client base. All loans acquired in the Peoples and Irwin acquisitions during 2009 were acquired under loss sharing agreements whereby the FDIC reimburses First Financial for losses incurred in accordance with those loss sharing agreements.

Lending Practices. First Financial’s loan portfolio is composed of commercial loan types, including commercial and industrial (commercial), real estate construction, commercial real estate and equipment leasing (lease financing), as well as consumer loan types, including residential real estate, home equity, installment and credit card loans.

Commercial – Commercial loans include revolving lines of credit and term loans to commercial customers for use in normal business operations to finance working capital needs, equipment purchases, leasehold improvements or other projects. Commercial loans also include equipment and leasehold improvement financing for select franchisees and concepts in the quick service and casual dining restaurant sector throughout the United States. First Financial focuses on a limited number of concepts that have sound economics, low closure rates and brand awareness within specified local, regional or national markets. Additionally, First Financial continues to invest in its asset-based lending (ABL) platform. ABL transactions typically involve larger commercial clients and are secured by specific assets, such as inventory, accounts receivable, machinery and equipment. Commercial loans are generally underwritten individually and secured with the assets of the Company and/or the personal guarantee of the business owners. First Financial's franchise lending portfolio is managed to a risk-appropriate level so as not to create an industry, geographic or franchisee concept concentration.

Real Estate Construction – Real estate construction loans are term loans to individuals, companies or developers used for the construction of a commercial or residential property for which repayment will be generated by the sale or permanent financing of the property. Generally, these loans are for construction projects that have been either pre-sold, pre-leased or have secured permanent financing, as well as loans to real estate companies with significant equity invested in the project. Real estate construction loans are underwritten and managed by experienced lending officers that actively monitor the construction phase

First Financial Bancorp 2012 Annual Report 19

Management’s Discussion And Analysis Of Financial Condition And Results Of Operations

and manage the loan disbursements. First Financial continues to restrict real estate construction lending due to excess supply and declining property values in recent years.

Commercial Real Estate – Commercial real estate loans consist of term loans secured by a mortgage lien on the real estate properties, such as apartment buildings, office and industrial buildings, and retail shopping centers. Additionally, the Company's franchise lending activities discussed in the "Commercial" section above often include the financing of real estate as well as equipment. The credit underwriting for both owner-occupied and investor income producing real estate loans includes detailed market analysis, historical and projected cash flow analysis, appropriate equity margins, assessment of lessees and lessors, type of real estate and other analysis.

Lease Financing – Lease financing consists of lease transactions for the purchase of both new and used business equipment for commercial clients. Lease products may include tax leases, finance leases, lease lines of credit and interim funding. The credit underwriting for lease transactions includes detailed analysis of the lessee's industry and business model, historical and projected cash flow analysis, secondary sources of repayment and guarantor analysis as well as other considerations.

Residential Real Estate – Residential real estate loans represent loans to consumers for the purchase or refinance of a residence.

These loans are generally financed over a 15 to 30 year term, and in most cases, are extended to borrowers to finance their primary residence. First Financial sells the majority of residential real estate loan originations into the secondary market on a servicing released basis. Residential real estate loans are generally underwritten to secondary market lending standards, utilizing underwriting systems that rely on empirical data to assess credit risk as well as analysis of the borrowers’ ability to repay their obligations, credit history, the amount of any down payment and the market value or other characteristics of the property. Late in 2012, First Financial introduced a new residential mortgage product that features similar borrower credit characteristics but a more streamlined underwriting process than typically required to sell to the government-sponsored enterprises and thus is retained on the Consolidated Balance Sheet.

Home Equity – Home equity lending includes both home equity loans and revolving lines of credit secured by a first or second lien on the borrower’s residence. Home equity loans and lines of credit are underwritten to adhere to debt-to-income and loan-to-value policy limits.

Installment – Installment lending consists of consumer loans not secured by real estate, including loans secured by automobiles and personal unsecured loans.

Credit Card – Credit card lending consists of secured and unsecured revolving lines of credit to consumer and business customers. Credit card lines are generally available for an indefinite period of time as long as the borrower's credit characteristics do not materially or adversely change, but may be canceled by the Company under certain circumstances.

Underwriting for installment and credit card lending focuses on the borrowers’ ability to repay their obligations, including debt-to-income analysis, prior credit history and other information.

Credit Management. Subject to First Financial’s credit policy and guidelines, credit underwriting and approval occur within the market originating the loan. First Financial has delegated to each regional president a lending limit sufficient to handle the majority of client requests in a timely manner. Loan requests for amounts greater than the market limit require the approval of a senior credit committee and can include additional approval(s) from the chief credit officer, the chief executive officer and the board of directors as necessary. This allows First Financial to manage the initial credit risk exposure through a standardized, disciplined and strategically focused loan approval process, but with an increasingly higher level of authority. Plans to purchase or sell a participation in a loan or a group of loans require the approval of certain senior lending and administrative officers, and in some cases could include the board of directors.

Credit management practices are dependent on the type and nature of the loan. First Financial monitors all significant

exposures on an on-going basis. Commercial loans are assigned internal risk ratings reflecting the risk of loss inherent in the loan. These internal risk ratings are assigned upon initial approval of credit to borrowers and updated periodically thereafter. First Financial reviews and adjusts its risk rating criteria based on actual experience, which provides the Company with an assessment of the current risk level in the portfolio and is the basis for determining an appropriate allowance for loan and lease losses.

20 First Financial Bancorp 2012 Annual Report

First Financial utilizes the following categories of risk ratings, derived from standard regulatory rating definitions, to facilitate the monitoring of credit quality for commercial loans:

Pass - Higher quality loans that do not fit any of the other categories described below.

Special Mention - First Financial assigns a Special Mention rating to loans and leases with potential weaknesses that deserve management's close attention. If left uncorrected, these potential weaknesses may result in deterioration of the repayment prospects for the loan or lease or in First Financial's credit position at some future date.

Substandard - First Financial assigns a substandard rating to loans or leases that are inadequately protected by the current sound worth and paying capacity of the borrower or of the collateral pledged, if any. Substandard loans and leases have well-defined weaknesses that jeopardize repayment of the debt. Substandard loans and leases are characterized by the distinct possibility that the Company will sustain some loss if the deficiencies are not addressed.

Doubtful - First Financial assigns a doubtful rating to loans and leases with all the attributes of a substandard rating with the added characteristic that the weaknesses make collection or liquidation in full, on the basis of currently existing facts, conditions and values, highly questionable and improbable. The possibility of loss is extremely high, but because of certain important and reasonably specific pending factors that may work to the advantage and strengthening of the credit quality of the loan or lease, its classification as an estimated loss is deferred until its more exact status may be determined. Pending factors include proposed merger, acquisition or liquidation procedures, capital injection, perfecting liens on additional collateral and refinancing plans.

Commercial loans rated as Special Mention, Substandard or Doubtful are considered Criticized. Commercial loans rated as Substandard or Doubtful are considered Classified. Commercial loans may be designated as Criticized based on individual borrower performance or industry and environmental factors. Criticized loans are subject to additional reviews to adequately assess the borrower’s credit status and develop appropriate action plans.

Classified loans are managed by the Special Assets Division (Special Assets) of the Company. Special Assets is a credit group whose primary focus is to handle the day-to-day management of workouts, commercial recoveries and problem loan resolutions. Special Assets ensures that First Financial has appropriate oversight, improved communication and timely resolution of issues throughout the loan portfolio, including those loans covered by FDIC loss sharing agreements. Additionally, the Credit Risk Management group within First Financial's Risk Management function provides objective oversight and assessment of commercial credit quality and processes using an independent, market-based credit risk review approach.

Consumer lending credit approvals are based on, among other factors, the financial strength and payment history of the borrower, type of exposure and the transaction structure. Consumer loans are generally smaller dollar amounts than other types of lending and are made to a large number of customers which provides diversification within the portfolio. Credit risk in the consumer loan portfolio is managed by loan type. Consumer loan types are continuously monitored for changes in delinquency trends and other asset quality indicators. The Credit Risk Management group performs product-level reviews of portfolio performance and assesses credit quality and compliance with underwriting and loan administration guidelines.

LOANS, EXCLUDING COVERED LOANS

2012 vs. 2011. First Financial experienced strong loan demand in 2012 as a result of focused sales efforts and the Company's recent investments, including banking center acquisitions in the Dayton, Ohio and Indianapolis, Indiana metropolitan markets as well as investments in the lease financing and mortgage origination platforms. While overall loan growth and the earnings impact of this loan demand were muted due to the low interest rate environment, sales efforts in these markets have laid the groundwork for continued success as the Company pursues new client relationships. Uncovered loans increased $210.6 million, or 7.1%, during 2012, primarily due to the growth in the commercial real estate, lease financing and residential real estate portfolios. Average loan balances increased $175.9 million, or 6.2%, during 2012.

Period-end commercial, commercial real estate, real estate construction and lease financing balances increased $180.0 million or 8.1% from December 31, 2011 to December 31, 2012. The increase in the commercial portfolio was primarily due to a $183.9 million or 14.9% increase in commercial real estate loans and a $33.5 million or 193.4% increase in lease financing balances, partially offset by a $41.5 million or 36.1% decline in real estate construction loans. The decline in real estate construction loans was the result of First Financial's decision to restrict lending in this category primarily due to weak demand and declining property values in recent years. First Financial's consumer loan categories increased $30.6 million or 4.1%

First Financial Bancorp 2012 Annual Report 21

Management’s Discussion And Analysis Of Financial Condition And Results Of Operations

during 2012, primarily due to a $30.2 million or 10.5% increase in residential real estate loans during the year. This increase is related to the introduction of a new residential mortgage product in 2012 as described above.

At December 31, 2012, commercial loans represent 27.1% of uncovered loans while commercial real estate, real estate construction and lease financing balances represent 44.6%, 2.3% and 1.6%, respectively. Residential real estate loans represent 10.0% of uncovered loan balances while home equity, installment and credit card loans represent 11.6%, 1.8% and 1.1%, respectively.

Comparatively, at December 31, 2011, commercial loans represent 28.9% of uncovered loans while commercial real estate, real estate construction and lease financing balances represent 41.5%, 3.9% and 0.6%, respectively. Residential real estate loans represent 9.7% of uncovered loan balances while home equity, installment and credit card loans represent 12.1%, 2.3% and 1.1%, respectively.

|

| | | | | | | | | | | | | | | | | | | |

| Table 4 • Loan Portfolio | | | | | | | | | |

| | December 31, |

| (Dollars in thousands) | 2012 | | 2011 | | 2010 | | 2009 | | 2008 |

| Commercial | $ | 861,033 |

| | $ | 856,981 |

| | $ | 800,253 |

| | $ | 800,261 |

| | $ | 807,720 |

|

| Real estate – construction | 73,517 |

| | 114,974 |

| | 163,543 |

| | 253,223 |

| | 232,989 |

|

| Real estate – commercial | 1,417,008 |

| | 1,233,067 |

| | 1,139,931 |

| | 1,079,628 |

| | 846,673 |

|

| Real estate – residential | 318,210 |

| | 287,980 |

| | 269,173 |

| | 321,047 |

| | 383,599 |

|

| Installment | 56,810 |

| | 67,543 |

| | 69,711 |

| | 82,989 |

| | 98,581 |

|

| Home equity | 367,500 |

| | 358,960 |

| | 341,310 |

| | 328,940 |

| | 286,110 |

|

| Credit card | 34,198 |

| | 31,631 |

| | 29,563 |

| | 29,027 |

| | 27,538 |

|

| Lease financing | 50,788 |

| | 17,311 |

| | 2,609 |

| | 14 |

| | 50 |

|

| Total loans, excluding covered loans | 3,179,064 |

| | 2,968,447 |

| | 2,816,093 |

| | 2,895,129 |

| | 2,683,260 |

|

| Covered loans | 748,116 |

| | 1,053,244 |

| | 1,481,493 |

| | 1,934,740 |

| | 0 |

|

| Total | $ | 3,927,180 |

| | $ | 4,021,691 |

| | $ | 4,297,586 |

| | $ | 4,829,869 |

| | $ | 2,683,260 |

|

Table 5 – Loan Maturity/Rate Sensitivity indicates the contractual maturity of commercial loans and real estate construction loans outstanding at December 31, 2012. Loans due after one year are classified according to their sensitivity to changes in interest rates.

|

| | | | | | | | | | | | | | | | |

| Table 5 • Loan Maturity/Rate Sensitivity (Excluding Covered Loans) |

| | | December 31, 2012 |

| | | Maturity |

| | | | | After one | | | | |

| | | Within | | but within | | After | | |

| (Dollars in thousands) | | one year | | five years | | five years | | Total |

| Commercial | | $ | 391,463 |

| | $ | 361,953 |

| | $ | 107,617 |

| | $ | 861,033 |

|

| Real estate – construction | | 60,174 |

| | 11,720 |

| | 1,623 |

| | 73,517 |

|

| Total | | $ | 451,637 |

| | $ | 373,673 |

| | $ | 109,240 |

| | $ | 934,550 |

|

| | | | | | | | | |

| | | | | Sensitivity to changes in interest rates |

| | | | | Predetermined |

| | Variable | | |

| (Dollars in thousands) | | | | rate | | rate | | Total |

| Due after one year but within five years | | | | $ | 242,720 |

| | $ | 130,953 |

| | $ | 373,673 |

|

| Due after five years | | | | 65,140 |

| | 44,100 |

| | 109,240 |

|

| Total | |

|

| | $ | 307,860 |

| | $ | 175,053 |

| | $ | 482,913 |

|

22 First Financial Bancorp 2012 Annual Report

COVERED LOANS

Acquired loans subject to loss share agreements whereby the FDIC reimburses First Financial for the majority of any losses incurred are referred to as covered loans.

First Financial evaluated the loans acquired in conjunction with the Peoples and Irwin acquisitions for impairment in accordance with the provisions of FASB ASC Topic 310-30, Loans and Debt Securities Acquired with Deteriorated Credit Quality (FASB ASC Topic 310-30). Acquired loans are considered impaired if there is evidence of credit deterioration since origination and if it is probable that not all contractually required payments will be collected. First Financial accounts for the majority of covered loans under FASB ASC Topic 310-30 with the exception of loans with revolving privileges, which are outside the scope of FASB ASC Topic 310-30, and other consumer loans for which expected cash flows could not be reasonably estimated. For further information regarding the accounting for covered loans, see the Critical Accounting Policies section included in Management’s Discussion and Analysis as well as the Notes to the Consolidated Financial Statements.

2012 vs. 2011. Total covered loans decreased $305.1 million, or 29.0%, during 2012. The decline in the covered loan portfolio is to be expected as there were no new acquisitions of loans subject to loss share agreements during 2012. The covered loan portfolio will continue to decline through payoffs, charge-offs, and termination or expiration of loss share coverage, unless First Financial acquires additional loans subject to loss share agreements in the future.

|

| | | | | | | | | | | | | | | |

| Table 6 • Covered Loan Portfolio | | | | | | | |

| | December 31, |

| (Dollars in thousands) | 2012 | | 2011 | | 2010 | | 2009 |

| Commercial | $ | 102,126 |

| | $ | 195,892 |

| | $ | 334,039 |

| | $ | 506,887 |

|

| Real estate – construction | 10,631 |

| | 17,120 |

| | 42,743 |

| | 97,560 |

|

| Real estate – commercial | 465,555 |

| | 637,044 |

| | 855,725 |

| | 1,008,104 |

|

| Real estate – residential | 100,694 |

| | 121,117 |

| | 147,052 |

| | 206,371 |

|

| Installment | 8,674 |

| | 13,176 |

| | 21,071 |

| | 8,235 |

|

| Home equity | 57,458 |

| | 64,978 |

| | 73,695 |

| | 87,933 |

|

| Other covered loans | 2,978 |

| | 3,917 |

| | 7,168 |

| | 19,650 |

|

| Total covered loans | $ | 748,116 |

| | $ | 1,053,244 |

| | $ | 1,481,493 |

| | $ | 1,934,740 |

|

|

| | | | | | | | | | | | | | | | |

| Table 7 • Covered Loan Maturity | | | | | | | | |

| | | December 31, 2012 |

| | | Maturity |

| | | | | After one | | | | |

| | | Within | | but within | | After | | |

| (Dollars in thousands) | | one year | | five years | | five years | | Total |

| Commercial | | $ | 38,840 |

| | $ | 59,987 |

| | $ | 3,299 |

| | $ | 102,126 |

|

| Real estate – construction | | 6,727 |

| | 3,312 |

| | 592 |

| | 10,631 |

|

| Total | | $ | 45,567 |

| | $ | 63,299 |

| | $ | 3,891 |

| | $ | 112,757 |

|

|

| | | | | | | | | | | | |

| | | Sensitivity to changes in interest rates |

| | | Predetermined | | Variable | | |

| (Dollars in thousands) | | rate | | rate | | Total |

| Due after one year but within five years | | $ | 49,647 |

| | $ | 13,652 |

| | $ | 63,299 |

|

| Due after five years | | 1,459 |

| | 2,432 |

| | 3,891 |

|

| Total | | $ | 51,106 |

| | $ | 16,084 |

| | $ | 67,190 |

|

INVESTMENTS

First Financial Bancorp 2012 Annual Report 23

Management’s Discussion And Analysis Of Financial Condition And Results Of Operations