First Financial Bancorp Investor Presentation First Quarter 2013 Exhibit 99.1

2 Certain statements contained in this presentation which are not statements of historical fact constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act (the ‘‘Act’’). In addition, certain statements in future filings by First Financial with the SEC, in press releases, and in oral and written statements made by or with the approval of First Financial which are not statements of historical fact constitute forward-looking statements within the meaning of the Act. Examples of forward-looking statements include, but are not limited to, projections of revenues, income or loss, earnings or loss per share, the payment or non-payment of dividends, capital structure and other financial items, statements of plans and objectives of First Financial or its management or board of directors, and statements of future economic performances and statements of assumptions underlying such statements. Words such as ‘‘believes,’’ ‘‘anticipates,’’ “likely,” “expected,” ‘‘intends,’’ and other similar expressions are intended to identify forward-looking statements but are not the exclusive means of identifying such statements. Management’s analysis contains forward-looking statements that are provided to assist in the understanding of anticipated future financial performance. However, such performance involves risks and uncertainties that may cause actual results to differ materially. Factors that could cause actual results to differ from those discussed in the forward-looking statements include, but are not limited to: • management’s ability to effectively execute its business plan; • the risk that the strength of the United States economy in general and the strength of the local economies in which we conduct operations may continue to deteriorate resulting in, among other things, a further deterioration in credit quality or a reduced demand for credit, including the resultant effect on our loan portfolio, allowance for loan and lease losses and overall financial performance; • U.S. fiscal debt and budget matters; • the ability of financial institutions to access sources of liquidity at a reasonable cost; • the impact of recent upheaval in the financial markets and the effectiveness of domestic and international governmental actions taken in response, and the effect of such governmental actions on us, our competitors and counterparties, financial markets generally and availability of credit specifically, and the U.S. and international economies, including potentially higher FDIC premiums arising from increased payments from FDIC insurance funds as a result of depository institution failures; • the effect of and changes in policies and laws or regulatory agencies (notably the recently enacted Dodd-Frank Wall Street Reform and Consumer Protection Act); • the effect of the current low interest rate environment or changes in interest rates on our net interest margin and our loan originations and securities holdings; • our ability to keep up with technological changes; • failure or breach of our operational or security systems or infrastructure, or those of our third party vendors and other service providers; • our ability to comply with the terms of loss sharing agreements with the FDIC; • mergers and acquisitions, including costs or difficulties related to the integration of acquired companies and the wind-down of non-strategic operations that may be greater than expected, such as the risks and uncertainties associated with the Irwin Mortgage Corporation bankruptcy proceedings and other acquired subsidiaries; • the risk that exploring merger and acquisition opportunities may detract from management’s time and ability to successfully manage our Company; • expected cost savings in connection with the consolidation of recent acquisitions may not be fully realized or realized within the expected time frames, and deposit attrition, customer loss and revenue loss following completed acquisitions may be greater than expected; • our ability to increase market share and control expenses; • the effect of changes in accounting policies and practices, as may be adopted by the regulatory agencies as well as the Financial Accounting Standards Board and the SEC; • adverse changes in the creditworthiness of our borrowers and lessees, collateral values, the value of investment securities and asset recovery values, including the value of the FDIC indemnification asset and related assets covered by FDIC loss sharing agreements; • adverse changes in the securities, debt and/or derivatives markets; • our success in recruiting and retaining the necessary personnel to support business growth and expansion and maintain sufficient expertise to support increasingly complex products and services; • monetary and fiscal policies of the Board of Governors of the Federal Reserve System (Federal Reserve) and the U.S. government and other governmental initiatives affecting the financial services industry; • unpredictable natural or other disasters could have an adverse effect on us in that such events could materially disrupt our operations or our vendors’ operations or willingness of our customers to access the financial services we offer; • our ability to manage loan delinquency and charge-off rates and changes in estimation of the adequacy of the allowance for loan losses; and • the costs and effects of litigation and of unexpected or adverse outcomes in such litigation. In addition, please refer to our Annual Report on Form 10-K for the year ended December 31, 2012, as well as our other filings with the SEC, for a more detailed discussion of these risks and uncertainties and other factors. Such forward-looking statements are meaningful only on the date when such statements are made, and First Financial undertakes no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such a statement is made to reflect the occurrence of unanticipated events. Forward Looking Statement Disclosure

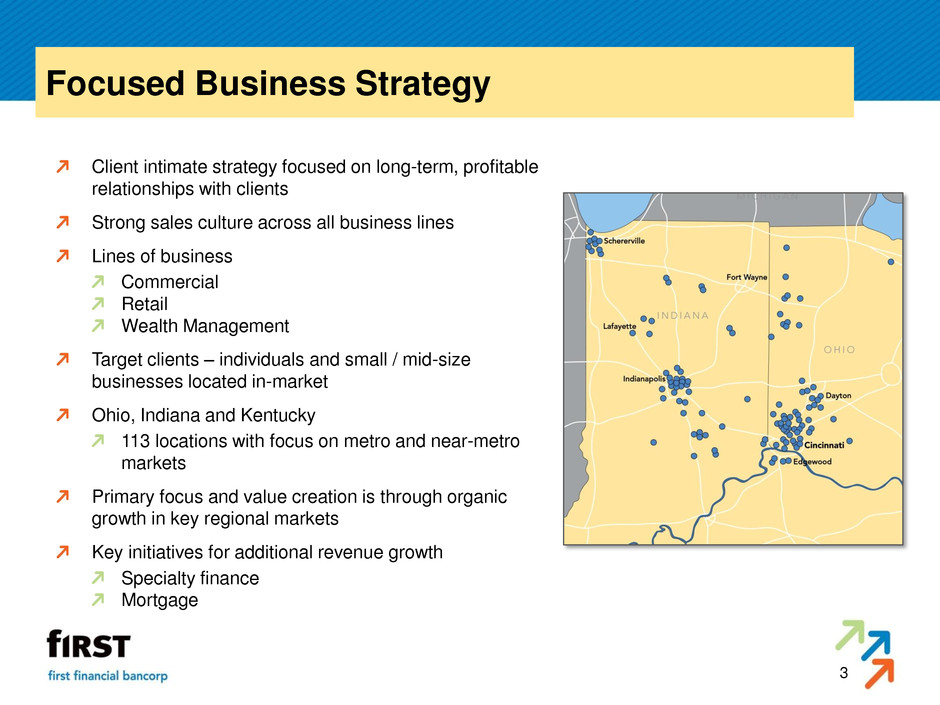

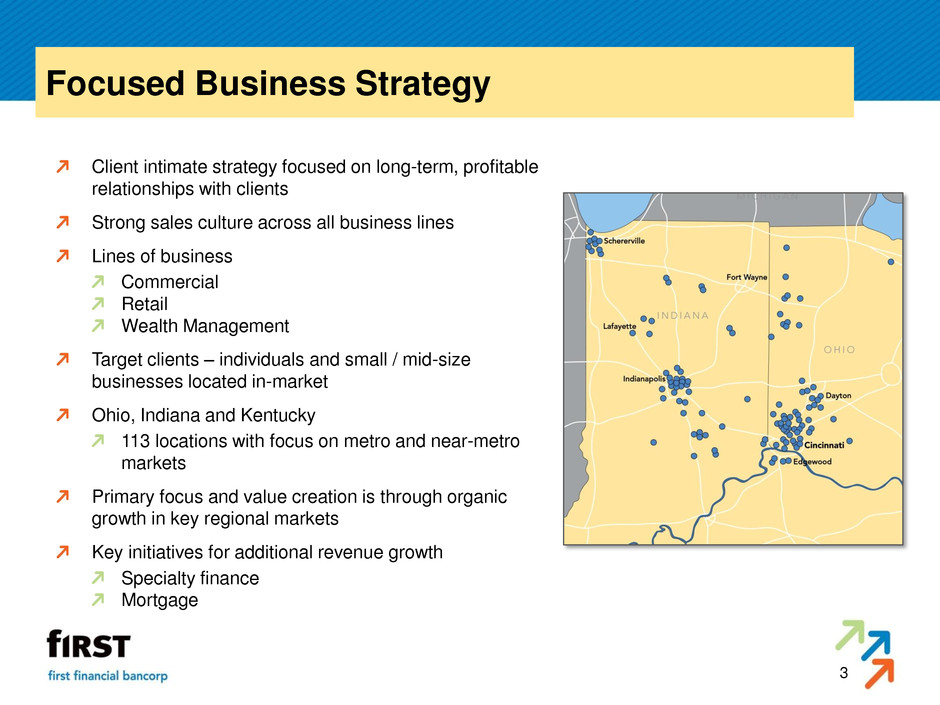

3 Focused Business Strategy Client intimate strategy focused on long-term, profitable relationships with clients Strong sales culture across all business lines Lines of business Commercial Retail Wealth Management Target clients – individuals and small / mid-size businesses located in-market Ohio, Indiana and Kentucky 113 locations with focus on metro and near-metro markets Primary focus and value creation is through organic growth in key regional markets Key initiatives for additional revenue growth Specialty finance Mortgage

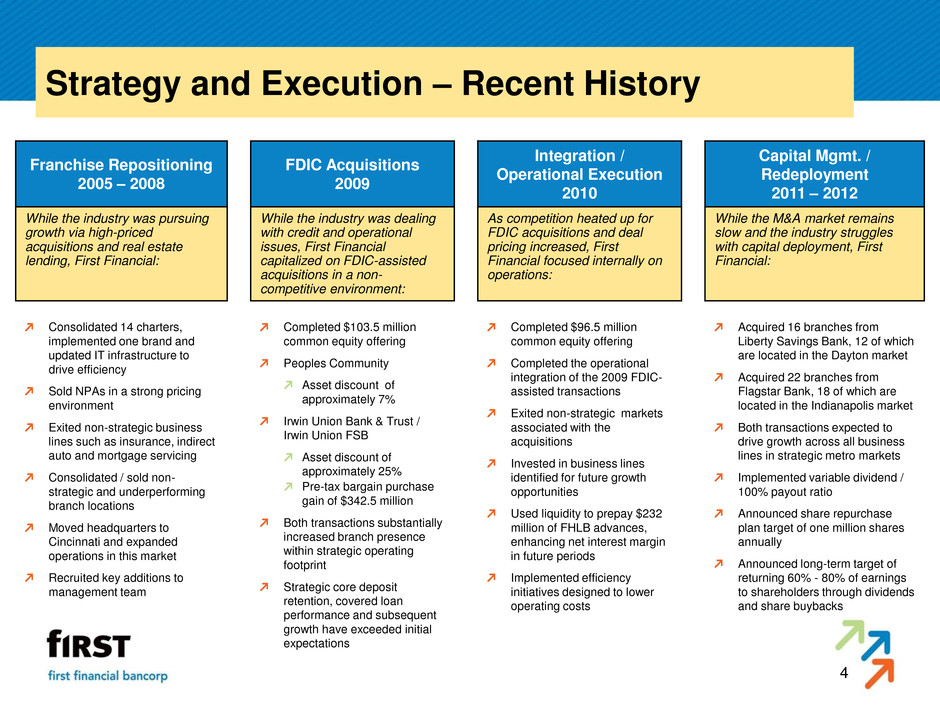

4 Strategy and Execution – Recent History Franchise Repositioning 2005 – 2008 FDIC Acquisitions 2009 Integration / Operational Execution 2010 Capital Mgmt. / Redeployment 2011 – 2012 While the industry was pursuing growth via high-priced acquisitions and real estate lending, First Financial: While the industry was dealing with credit and operational issues, First Financial capitalized on FDIC-assisted acquisitions in a non- competitive environment: As competition heated up for FDIC acquisitions and deal pricing increased, First Financial focused internally on operations: While the M&A market remains slow and the industry struggles with capital deployment, First Financial: Consolidated 14 charters, implemented one brand and updated IT infrastructure to drive efficiency Sold NPAs in a strong pricing environment Exited non-strategic business lines such as insurance, indirect auto and mortgage servicing Consolidated / sold non- strategic and underperforming branch locations Moved headquarters to Cincinnati and expanded operations in this market Recruited key additions to management team Completed $103.5 million common equity offering Peoples Community Asset discount of approximately 7% Irwin Union Bank & Trust / Irwin Union FSB Asset discount of approximately 25% Pre-tax bargain purchase gain of $342.5 million Both transactions substantially increased branch presence within strategic operating footprint Strategic core deposit retention, covered loan performance and subsequent growth have exceeded initial expectations Completed $96.5 million common equity offering Completed the operational integration of the 2009 FDIC- assisted transactions Exited non-strategic markets associated with the acquisitions Invested in business lines identified for future growth opportunities Used liquidity to prepay $232 million of FHLB advances, enhancing net interest margin in future periods Implemented efficiency initiatives designed to lower operating costs Acquired 16 branches from Liberty Savings Bank, 12 of which are located in the Dayton market Acquired 22 branches from Flagstar Bank, 18 of which are located in the Indianapolis market Both transactions expected to drive growth across all business lines in strategic metro markets Implemented variable dividend / 100% payout ratio Announced share repurchase plan target of one million shares annually Announced long-term target of returning 60% - 80% of earnings to shareholders through dividends and share buybacks

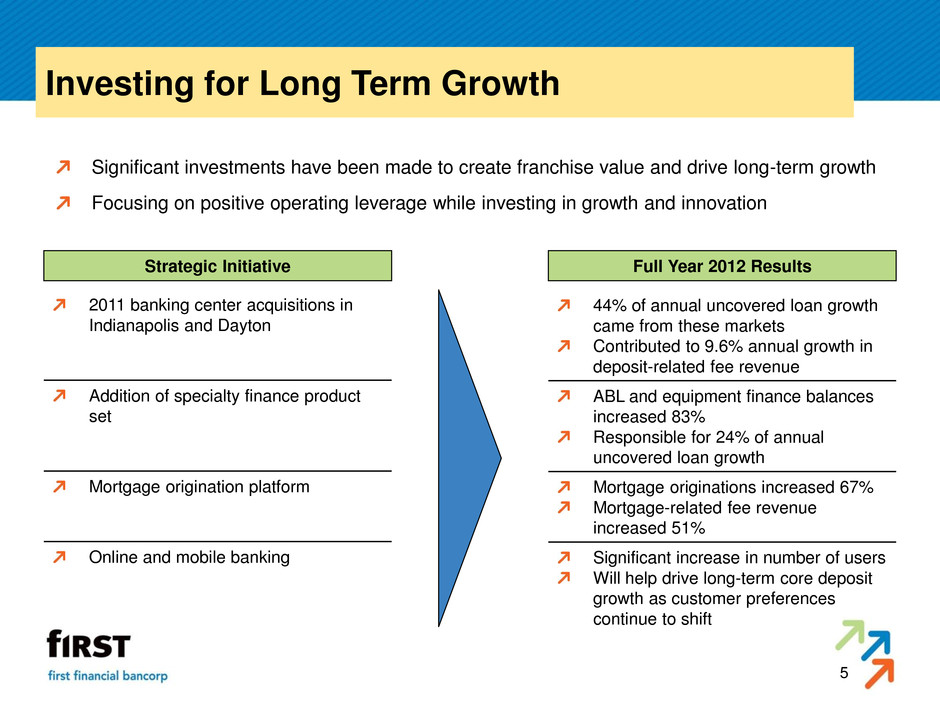

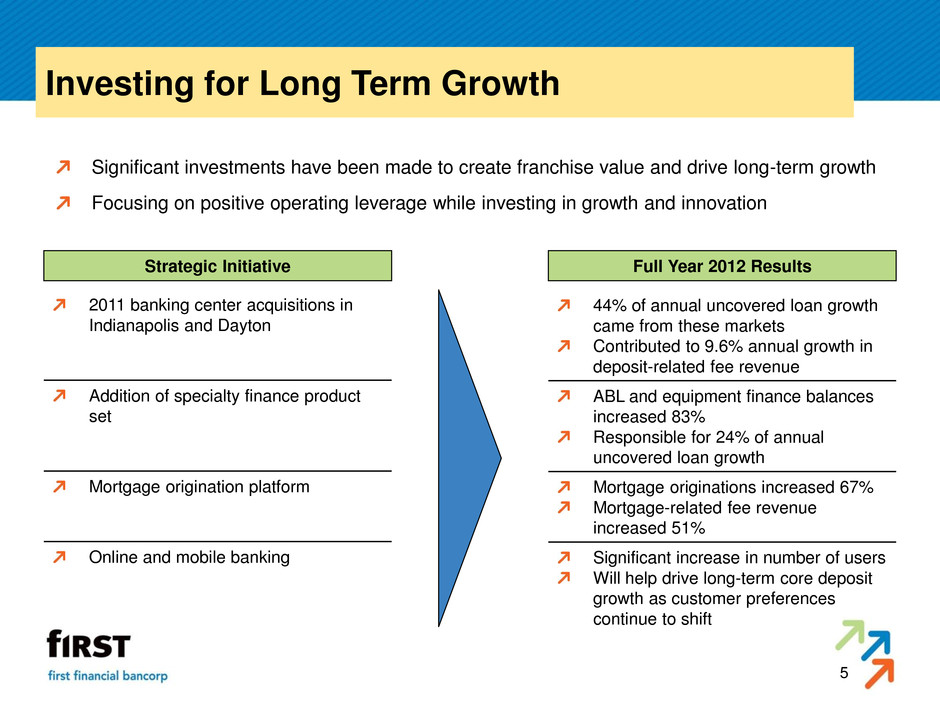

5 Investing for Long Term Growth Significant investments have been made to create franchise value and drive long-term growth Focusing on positive operating leverage while investing in growth and innovation Strategic Initiative Full Year 2012 Results 44% of annual uncovered loan growth came from these markets Contributed to 9.6% annual growth in deposit-related fee revenue ABL and equipment finance balances increased 83% Responsible for 24% of annual uncovered loan growth Mortgage originations increased 67% Mortgage-related fee revenue increased 51% Significant increase in number of users Will help drive long-term core deposit growth as customer preferences continue to shift 2011 banking center acquisitions in Indianapolis and Dayton Addition of specialty finance product set Mortgage origination platform Online and mobile banking

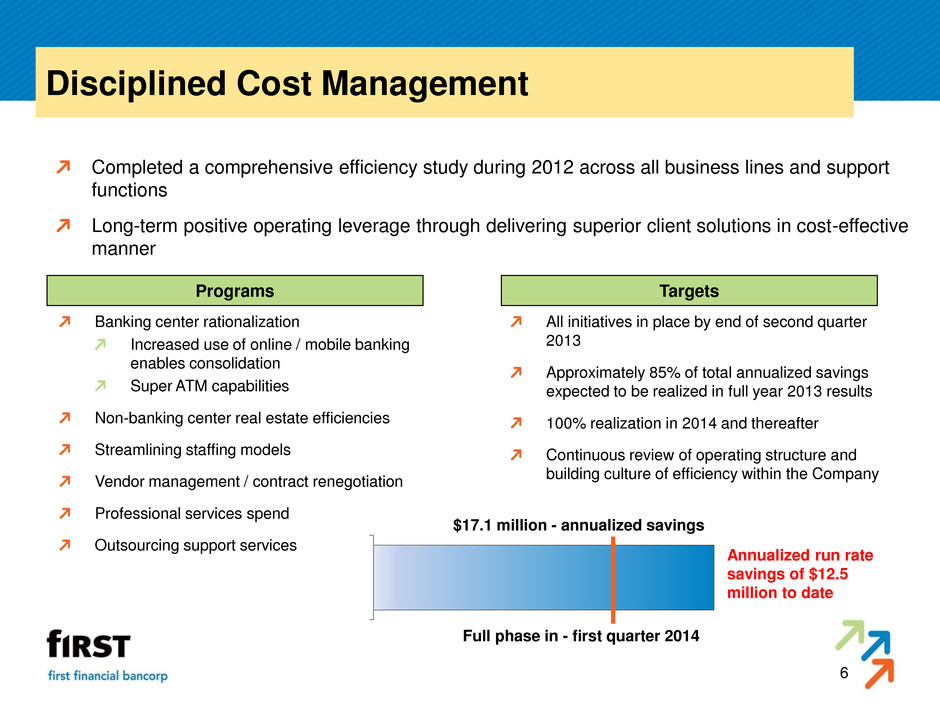

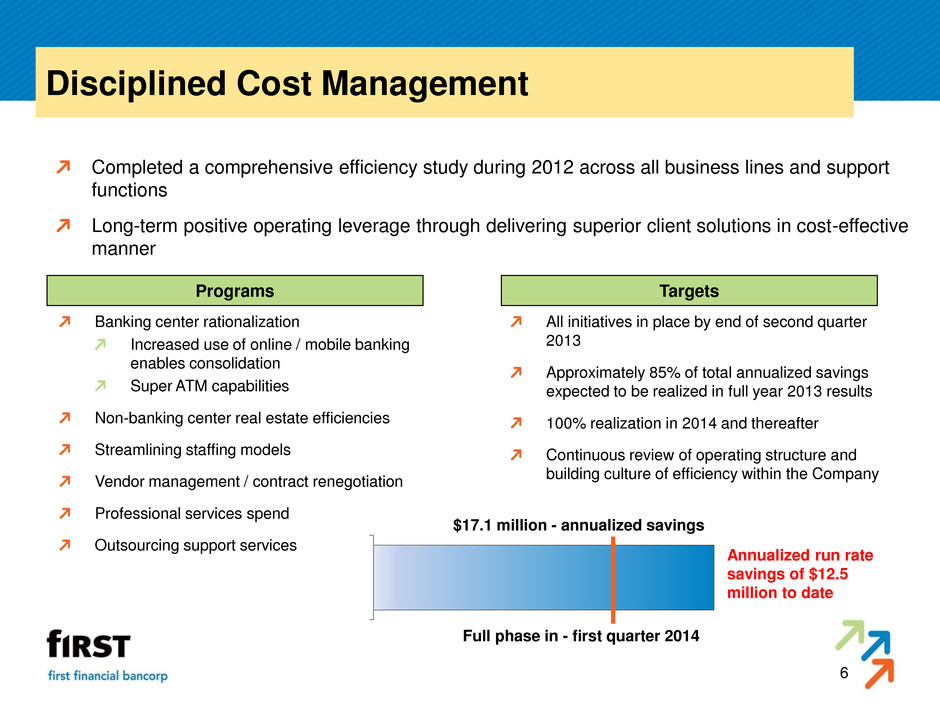

6 Disciplined Cost Management Completed a comprehensive efficiency study during 2012 across all business lines and support functions Long-term positive operating leverage through delivering superior client solutions in cost-effective manner Programs Targets Banking center rationalization Increased use of online / mobile banking enables consolidation Super ATM capabilities Non-banking center real estate efficiencies Streamlining staffing models Vendor management / contract renegotiation Professional services spend Outsourcing support services All initiatives in place by end of second quarter 2013 Approximately 85% of total annualized savings expected to be realized in full year 2013 results 100% realization in 2014 and thereafter Continuous review of operating structure and building culture of efficiency within the Company Full phase in - first quarter 2014 $17.1 million - annualized savings Annualized run rate savings of $12.5 million to date

7 First Quarter 2013 Financial Highlights Quarterly net income of $13.8 million, or $0.24 per diluted common share Incurred pre-tax expenses of $2.9 million related to the efficiency initiative and $0.4 million related to an isolated fraud loss; offset by pre-tax gains of $1.5 million resulting from sales of investment securities Adjusted pre-tax, pre-provision income of $25.3 million, or 1.60% of average assets Continued solid performance Return on average assets of 0.88%; 0.95% adjusted for the items noted above Return on average tangible common equity of 9.24%; 9.96% adjusted for the items noted above Quarterly net interest margin of 4.04% Excluding a $2.2 million prepayment fee recognized in the linked quarter, net interest margin declined 7 bps Cost of interest-bearing deposit funding declined 8 bps to 0.41% Uncovered loan balances increased $69.8 million, or 8.9% on an annualized basis Strong growth in C&I, owner-occupied CRE, construction and residential mortgage Uncovered loan growth exceeded covered loan decline for the second consecutive quarter Net charge-offs declined $2.8 million, or 52.6%, compared to the linked quarter and totaled 32 bps of average uncovered loans for the quarter on an annualized basis

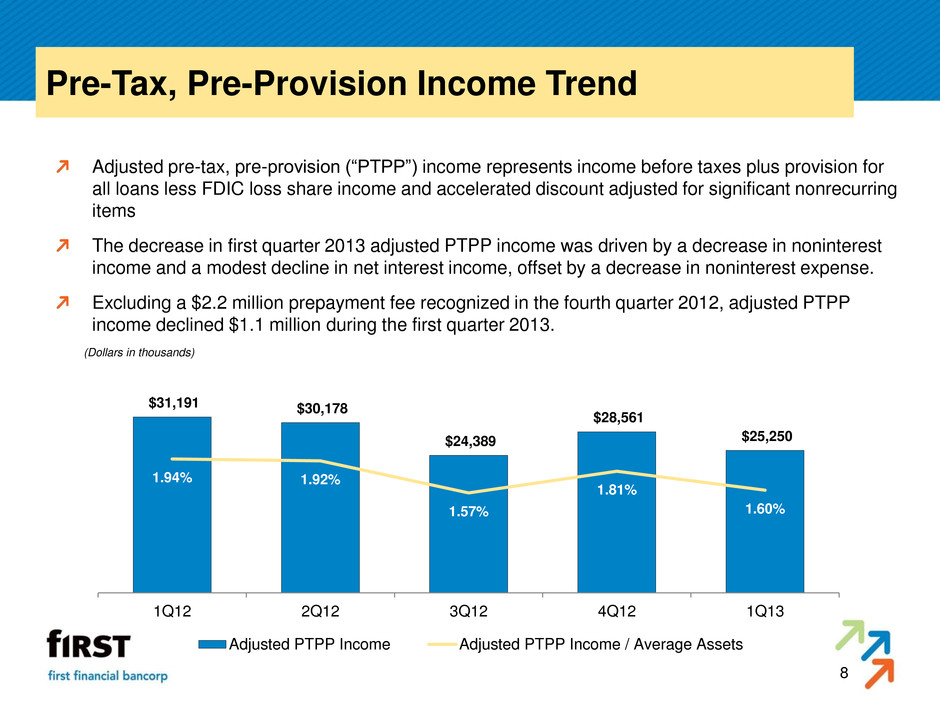

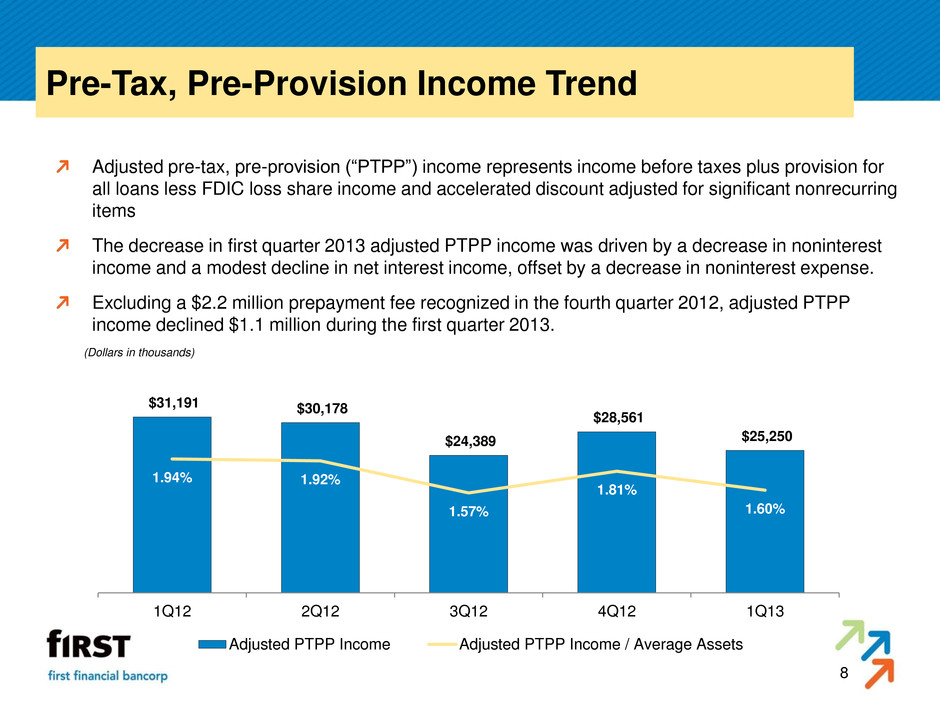

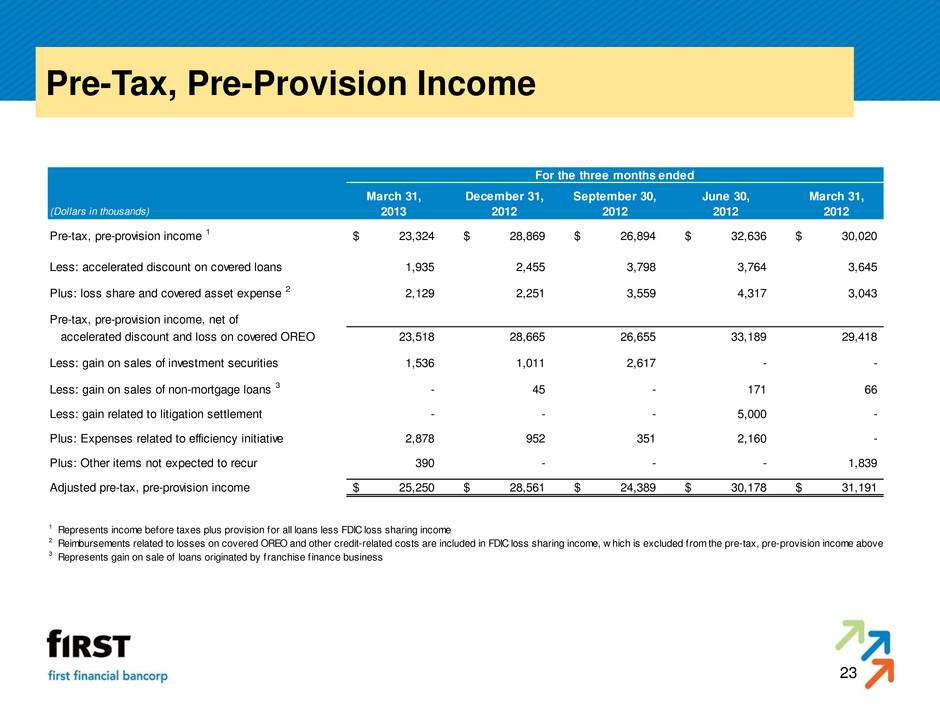

8 Pre-Tax, Pre-Provision Income Trend Adjusted pre-tax, pre-provision (“PTPP”) income represents income before taxes plus provision for all loans less FDIC loss share income and accelerated discount adjusted for significant nonrecurring items The decrease in first quarter 2013 adjusted PTPP income was driven by a decrease in noninterest income and a modest decline in net interest income, offset by a decrease in noninterest expense. Excluding a $2.2 million prepayment fee recognized in the fourth quarter 2012, adjusted PTPP income declined $1.1 million during the first quarter 2013. $31,191 $30,178 $24,389 $28,561 $25,250 1.94% 1.92% 1.57% 1.81% 1.60% 1Q12 2Q12 3Q12 4Q12 1Q13 (Dollars in thousands) Adjusted PTPP Income Adjusted PTPP Income / Average Assets

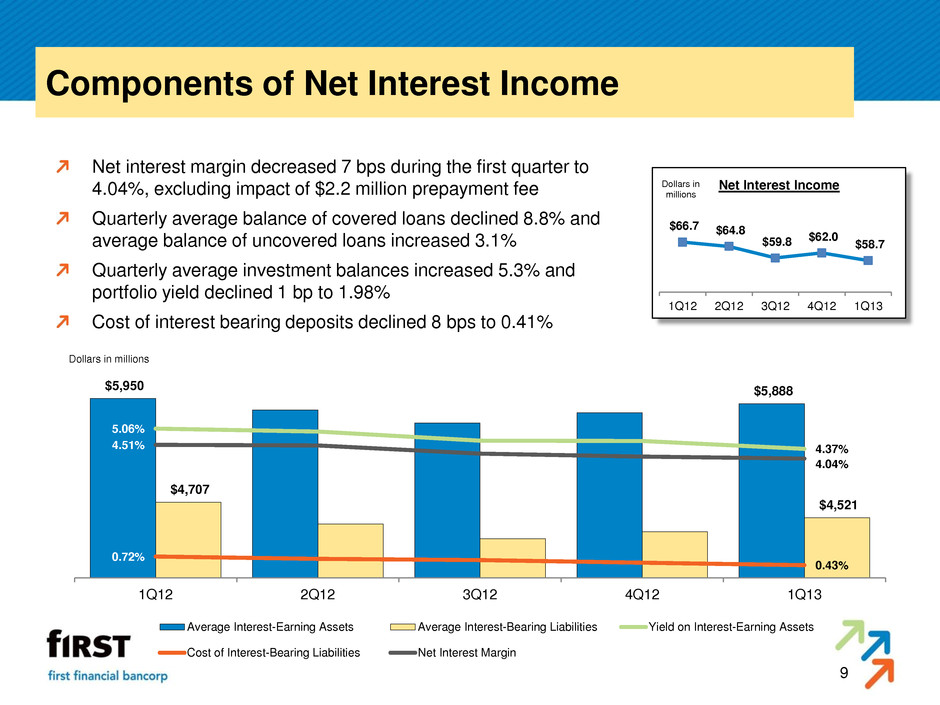

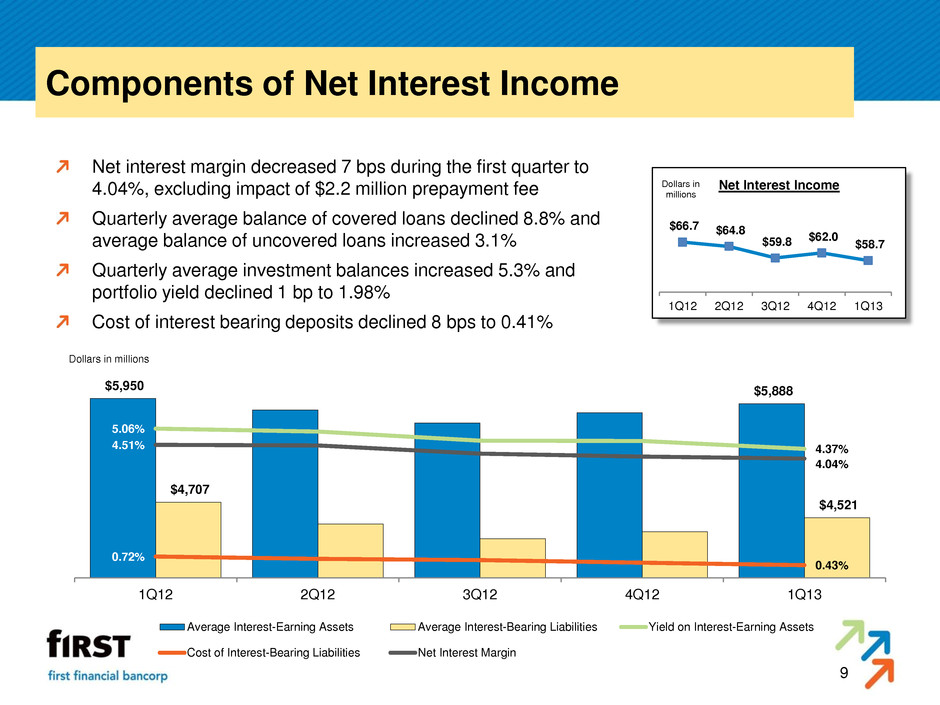

9 Components of Net Interest Income Net interest margin decreased 7 bps during the first quarter to 4.04%, excluding impact of $2.2 million prepayment fee Quarterly average balance of covered loans declined 8.8% and average balance of uncovered loans increased 3.1% Quarterly average investment balances increased 5.3% and portfolio yield declined 1 bp to 1.98% Cost of interest bearing deposits declined 8 bps to 0.41% $5,950 $5,888 $4,707 $4,521 5.06% 4.37% 0.72% 0.43% 4.51% 4.04% 1Q12 2Q12 3Q12 4Q12 1Q13 Dollars in millions Average Interest-Earning Assets Average Interest-Bearing Liabilities Yield on Interest-Earning Assets Cost of Interest-Bearing Liabilities Net Interest Margin $66.7 $64.8 $59.8 $62.0 $58.7 1Q12 2Q12 3Q12 4Q12 1Q13 Dollars in millions Net Interest Income

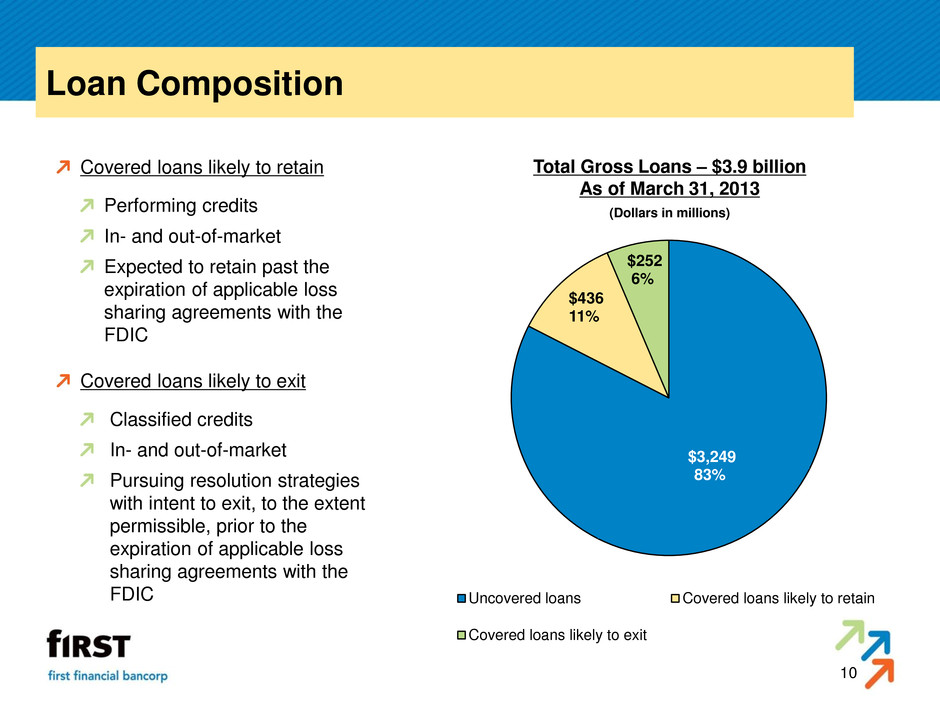

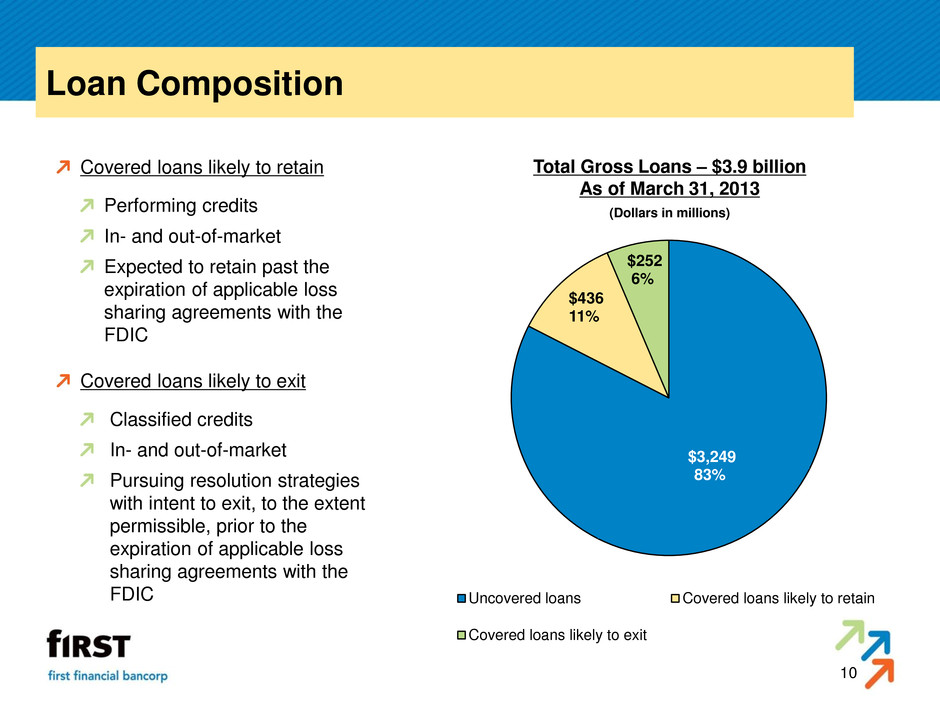

10 Loan Composition Total Gross Loans – $3.9 billion As of March 31, 2013 (Dollars in millions) Covered loans likely to retain Performing credits In- and out-of-market Expected to retain past the expiration of applicable loss sharing agreements with the FDIC Covered loans likely to exit Classified credits In- and out-of-market Pursuing resolution strategies with intent to exit, to the extent permissible, prior to the expiration of applicable loss sharing agreements with the FDIC $3,249 83% $436 11% $252 6% Uncovered loans Covered loans likely to retain Covered loans likely to exit

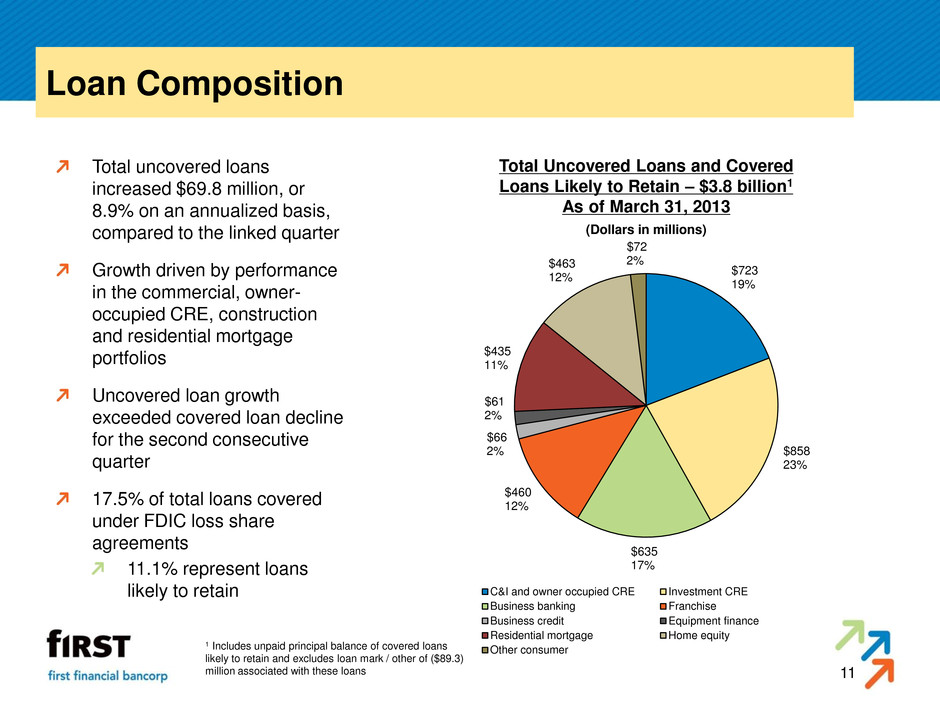

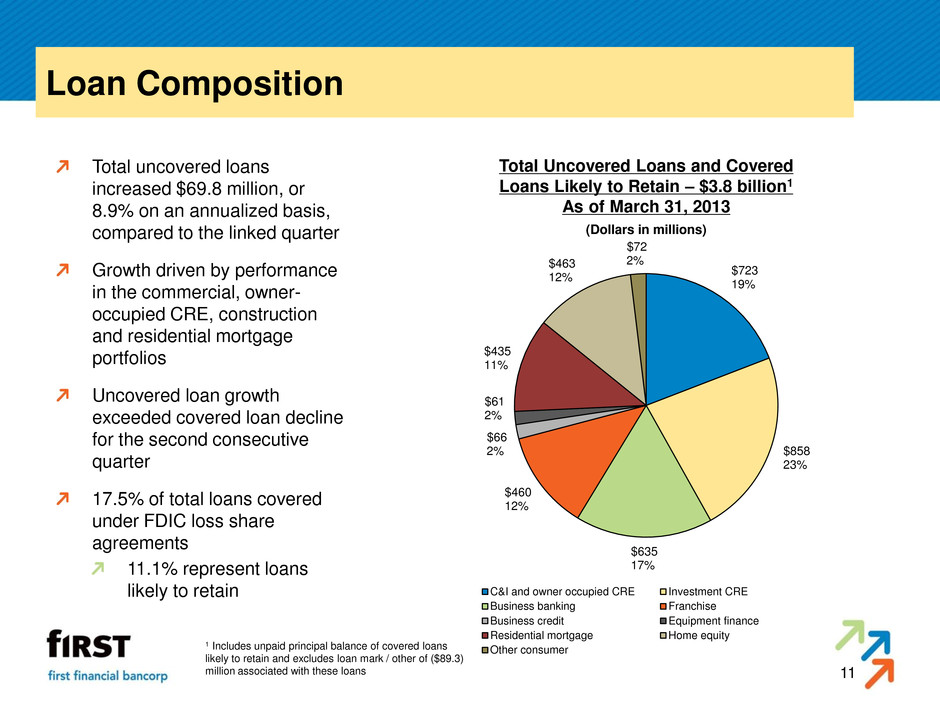

11 Loan Composition Total uncovered loans increased $69.8 million, or 8.9% on an annualized basis, compared to the linked quarter Growth driven by performance in the commercial, owner- occupied CRE, construction and residential mortgage portfolios Uncovered loan growth exceeded covered loan decline for the second consecutive quarter 17.5% of total loans covered under FDIC loss share agreements 11.1% represent loans likely to retain 1 Includes unpaid principal balance of covered loans likely to retain and excludes loan mark / other of ($89.3) million associated with these loans Total Uncovered Loans and Covered Loans Likely to Retain – $3.8 billion1 As of March 31, 2013 (Dollars in millions) $723 19% $858 23% $635 17% $460 12% $66 2% $61 2% $435 11% $463 12% $72 2% C&I and owner occupied CRE Investment CRE Business banking Franchise Business credit Equipment finance Residential mortgage Home equity Other consumer

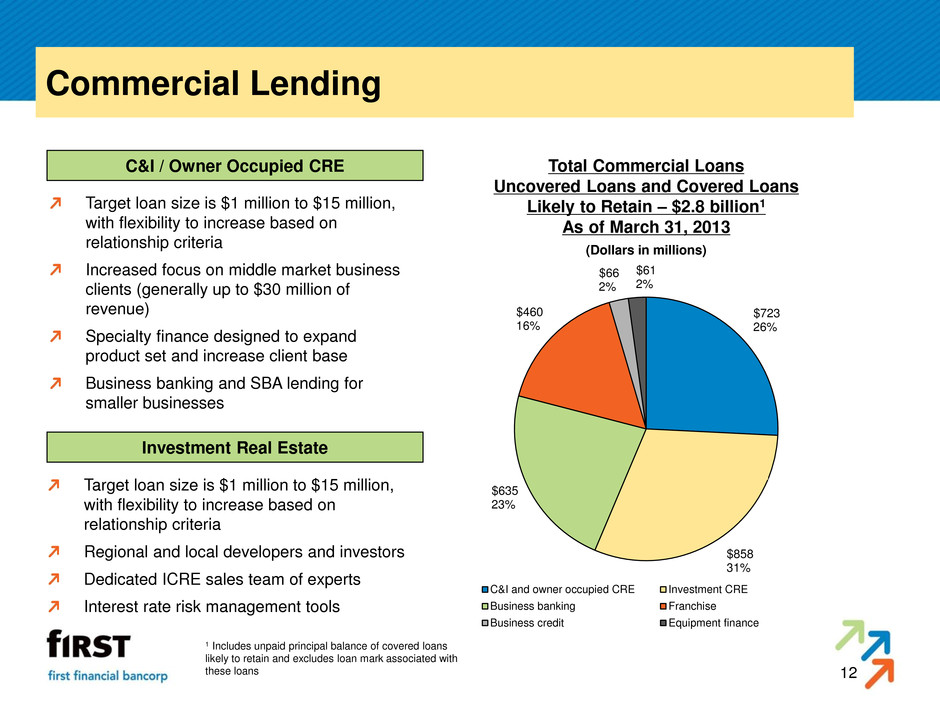

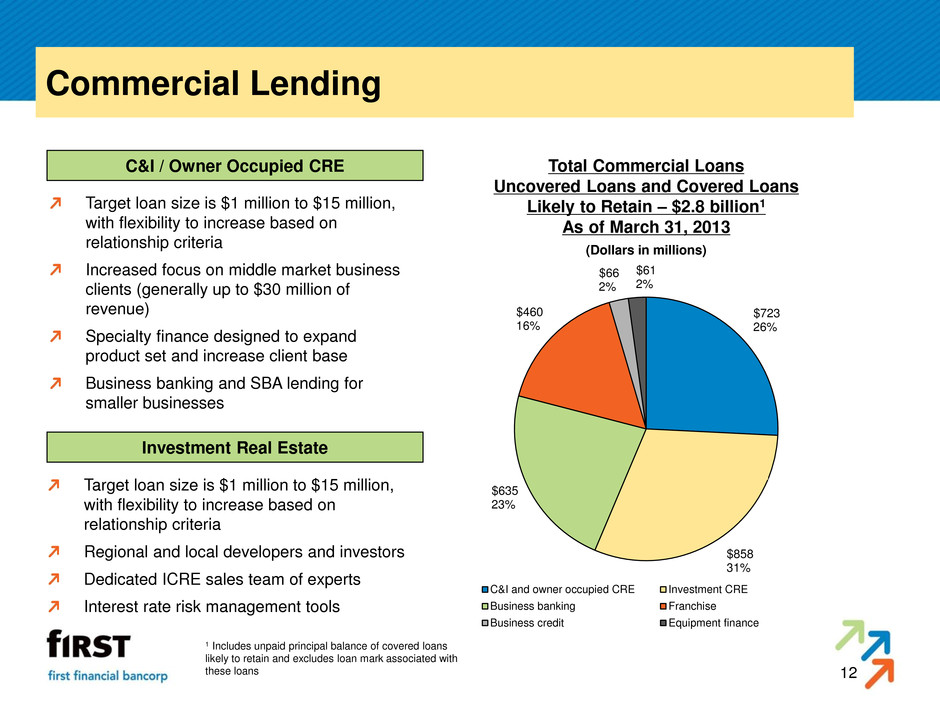

12 Commercial Lending C&I / Owner Occupied CRE Investment Real Estate Target loan size is $1 million to $15 million, with flexibility to increase based on relationship criteria Increased focus on middle market business clients (generally up to $30 million of revenue) Specialty finance designed to expand product set and increase client base Business banking and SBA lending for smaller businesses Target loan size is $1 million to $15 million, with flexibility to increase based on relationship criteria Regional and local developers and investors Dedicated ICRE sales team of experts Interest rate risk management tools Total Commercial Loans Uncovered Loans and Covered Loans Likely to Retain – $2.8 billion1 As of March 31, 2013 (Dollars in millions) 1 Includes unpaid principal balance of covered loans likely to retain and excludes loan mark associated with these loans $723 26% $858 31% $635 23% $460 16% $66 2% $61 2% C&I and owner occupied CRE Investment CRE Business banking Franchise Business credit Equipment finance

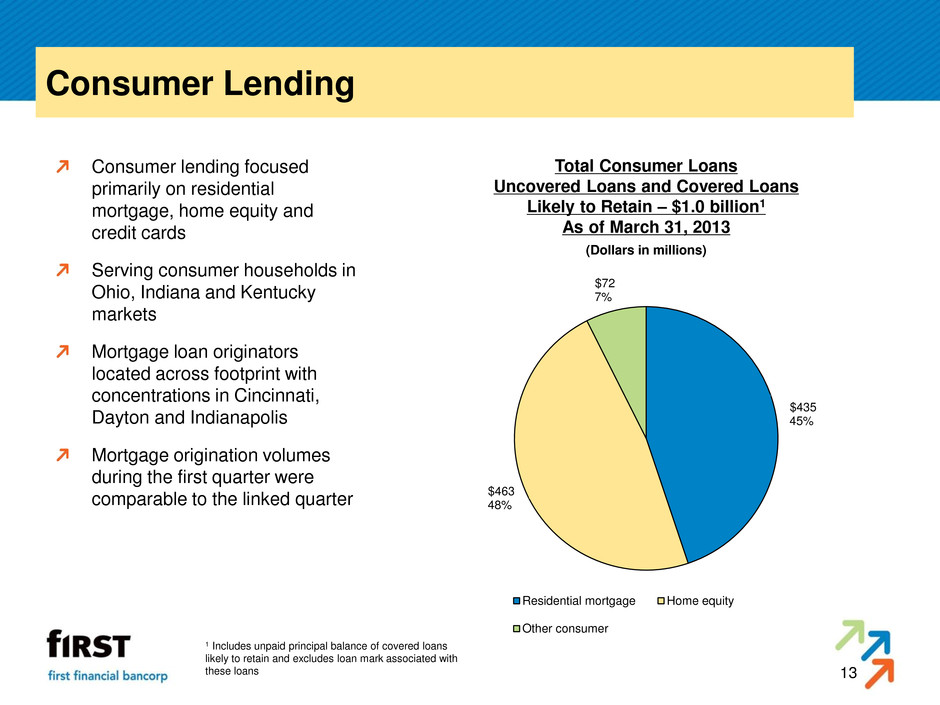

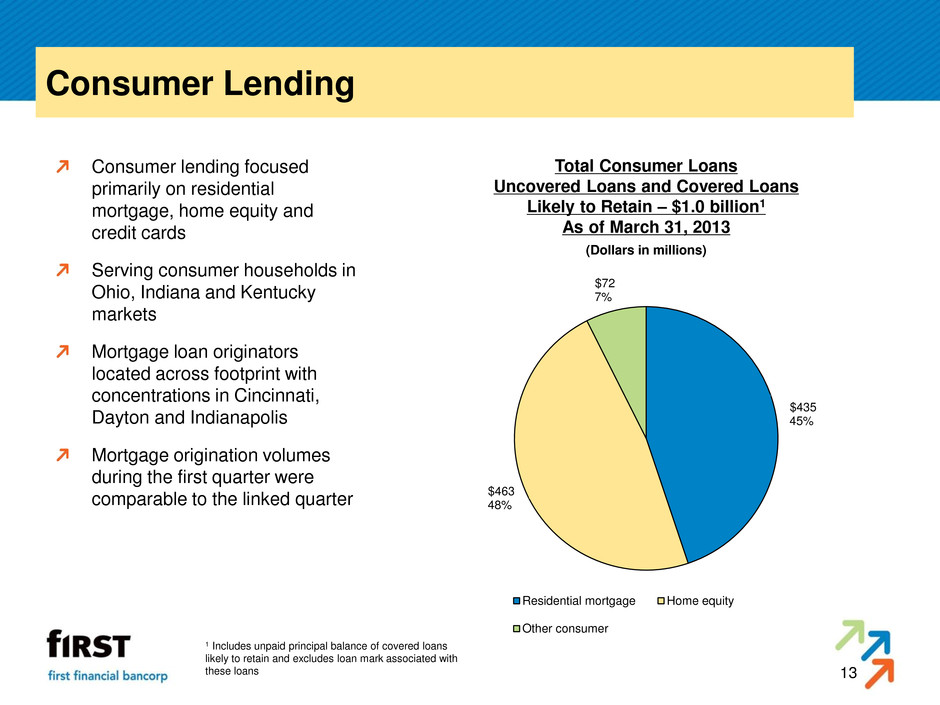

13 Consumer Lending Consumer lending focused primarily on residential mortgage, home equity and credit cards Serving consumer households in Ohio, Indiana and Kentucky markets Mortgage loan originators located across footprint with concentrations in Cincinnati, Dayton and Indianapolis Mortgage origination volumes during the first quarter were comparable to the linked quarter Total Consumer Loans Uncovered Loans and Covered Loans Likely to Retain – $1.0 billion1 As of March 31, 2013 (Dollars in millions) 1 Includes unpaid principal balance of covered loans likely to retain and excludes loan mark associated with these loans $435 45% $463 48% $72 7% Residential mortgage Home equity Other consumer

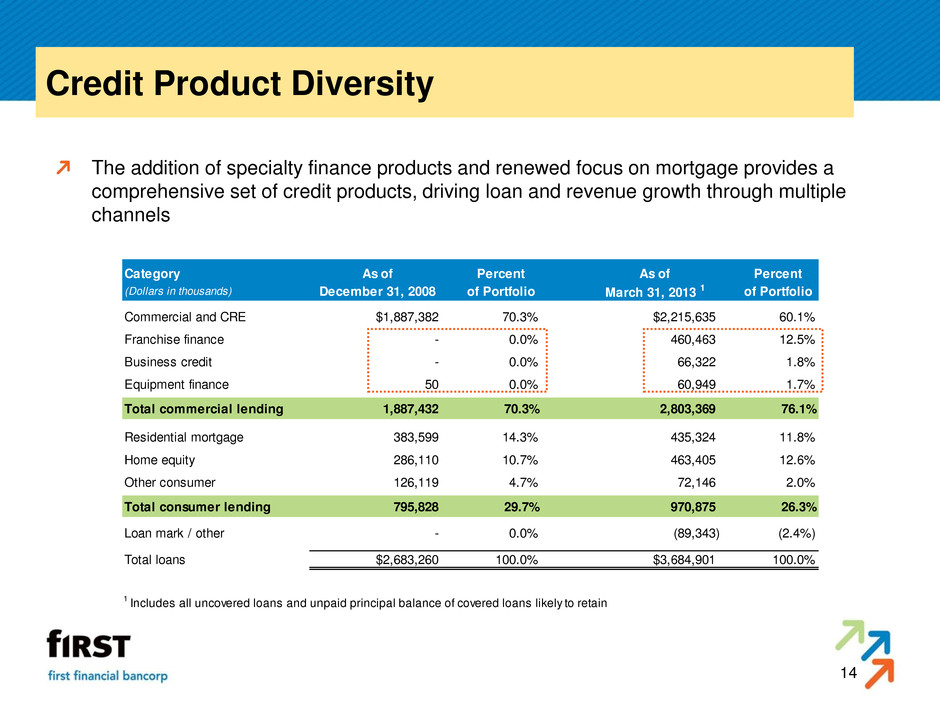

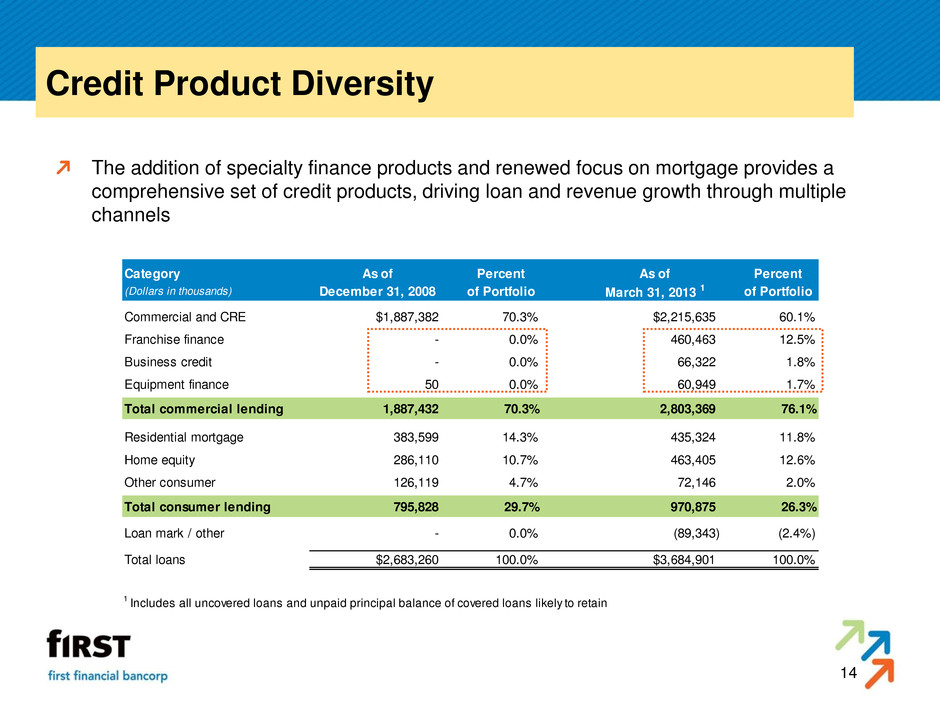

14 Credit Product Diversity The addition of specialty finance products and renewed focus on mortgage provides a comprehensive set of credit products, driving loan and revenue growth through multiple channels Category As of Percent As of Percent (Dollars in thousands) December 31, 2008 of Portfolio March 31, 2013 1 of Portfolio Commercial and CRE $1,887,382 70.3% $2,215,635 60.1% Franchise finance - 0.0% 460,463 12.5% Business credit - 0.0% 66,322 1.8% Equipment finance 50 0.0% 60,949 1.7% Total commercial lending 1,887,432 70.3% 2,803,369 76.1% Residential mortgage 383,599 14.3% 435,324 11.8% Home equity 286,110 10.7% 463,405 12.6% Other consumer 126,119 4.7% 72,146 2.0% Total consumer lending 795,828 29.7% 970,875 26.3% Loan mark / other - 0.0% (89,343) (2.4%) Total loans $2,683,260 100.0% $3,684,901 100.0% 1 Includes all uncovered loans and unpaid principal balance of covered loans likely to retain

15 Building the “fIRST” Brand Significant growth in brand awareness Award-winning sales center prototype Proactive marketing and media relations Expands presence and market share Deeper relationships and differentiated client experience 2012 Metropolitan Brand Awareness Cincinnati 64% Dayton 47% Indianapolis 40%

16 Delivery Channels and Product Innovation Launched new online banking platform Mobile apps to accommodate client preferences with further enhancements expected later in 2013 Sales centers focused on relationship vs. transactions Deployed image-capture ATMs Launched Snap Deposit and online account opening in near-term pipeline Deliver a consistent brand experience in a cost-effective manner

17 Capital Management Current dividend policy consists of a 100% payout ratio comprised of two components: Regular dividend based on payout of between 40% - 60% of earnings; currently $0.15 per share Variable dividend based on the remainder of quarterly EPS; $0.09 per share based on first quarter results Variable dividend will continue through 2013 unless the Company’s capital position changes materially or capital deployment opportunities arise Dividend payout ratio of 100% results in a current dividend yield of 6.1% compared to peer median LTM payout ratio of 39.6% and current peer median dividend yield of 2.6% Announced a share repurchase plan targeting one million shares annually beginning fourth quarter 2012 Repurchased 249,000 shares during the first quarter and an additional 87,400 shares during the second quarter 2013; repurchased 796,900 total shares since fourth quarter 2012 When combined with the dividend policy, returned 144.5% of quarterly net income to shareholders during the first quarter As both the variable dividend and the share repurchase plan are expected to remain in place during 2013, the return of capital to shareholders is expected to exceed 100% of earnings throughout the year On a long term basis, expectation is to return to shareholders a target range of 60% - 80% of earnings through combination of the regular dividend and share repurchases Peer Group comprised of the component banks within the KBW Regional Bank Index (49 total companies excluding First Financial); peer median data as of March 31, 2013. Dividend valuation data as of May 15, 2013.

18 Capitalization Primary component of capital is common equity Capitalization levels still remain high despite the strong return of capital to shareholders Can support estimated asset growth capacity of approximately $1.3 billion under current regulatory guidelines 10.38% 10.33% 10.40% 11.11% 10.38%7.96% 8.06% 8.28% 8.12% 8.39% 3Q10 4Q1 1Q11 2Q1 3Q11 First Financial Peer Group Median Peer Group comprised of the component banks within the KBW Regional Bank Index (49 total companies excluding First Financial); based on most recent financial information as of May 15, 2013. Source: Peer Group median data obtained from SNL Financial 8.62% 8.73% 8.78% 8.67% 8.66% 9.66% 9.91% 9.99% 9.50% 9.60% 1Q12 2Q12 3Q12 4Q12 1Q13 TCE / Tangible Assets 9.85% 9.67% 9.63% 9.50% 9.37% 9.94% 10.21% 10.54% 10.25% 10.00% 1Q12 2Q12 3Q12 4Q12 1Q13 Tier 1 Leverage Ratio 13.52% 13.35% 13.23% 13.12% 13.30% 17.18% 17.14% 16.93% 16.32% 15.87% 1Q12 2Q12 3Q12 4Q12 1Q13 Tier 1 Capital Ratio 15.45% 15.33% 14.93% 14.69% 15.14% 18.45% 18.42% 18.21% 17.60% 17.15% 1Q12 2Q12 3Q12 4Q12 1Q13 T tal Capital Ratio

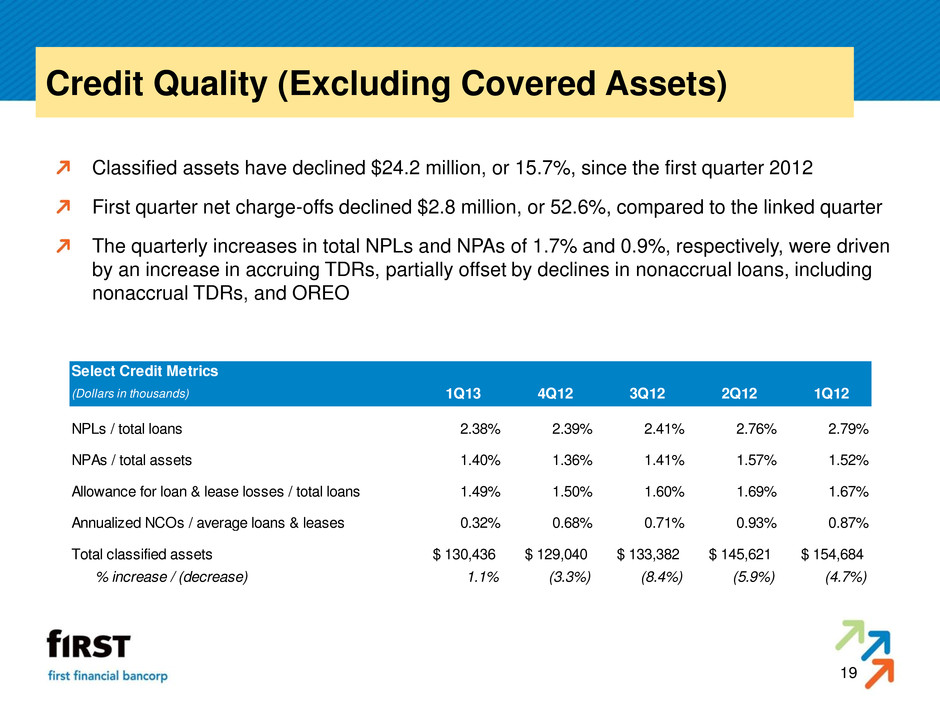

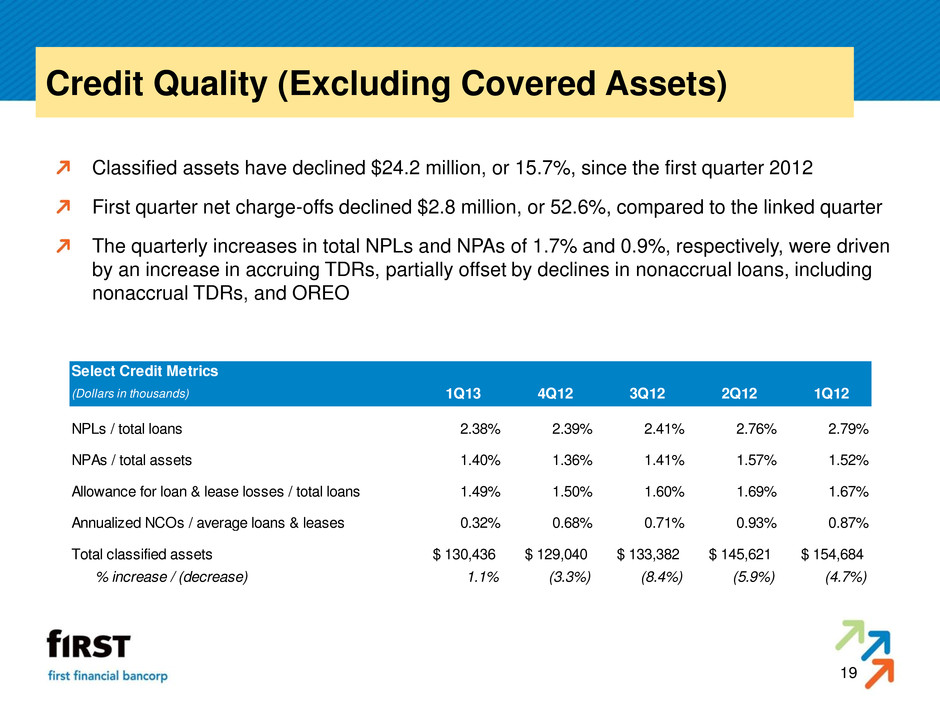

19 Credit Quality (Excluding Covered Assets) Classified assets have declined $24.2 million, or 15.7%, since the first quarter 2012 First quarter net charge-offs declined $2.8 million, or 52.6%, compared to the linked quarter The quarterly increases in total NPLs and NPAs of 1.7% and 0.9%, respectively, were driven by an increase in accruing TDRs, partially offset by declines in nonaccrual loans, including nonaccrual TDRs, and OREO Select Credit Metrics (Dollars in thousands) 1Q13 4Q12 3Q12 2Q12 1Q12 NPL / t tal lo ns 2.38% 2.39% 2.41% 2.76% 2.79% NPAs / total ssets 1.40% 1.36% 1.41% 1.57% 1.52% Allowance for loan & lease losses / total loans 1.49% 1.50% 1.60% 1.69% 1.67% Annualized NCOs / average loans & leases 0.32% 0.68% 0.71% 0.93% 0.87% Total classified assets 130,436$ 129,040$ 133,382$ 145,621$ 154,684$ % increase / (decrease) 1.1% (3.3%) (8.4%) (5.9%) (4.7%)

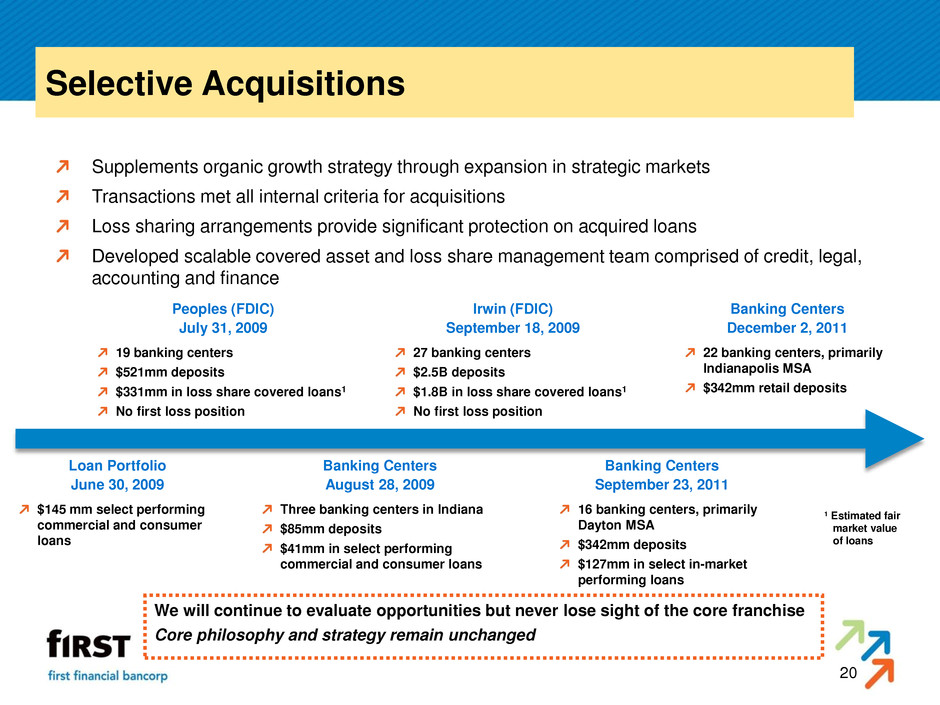

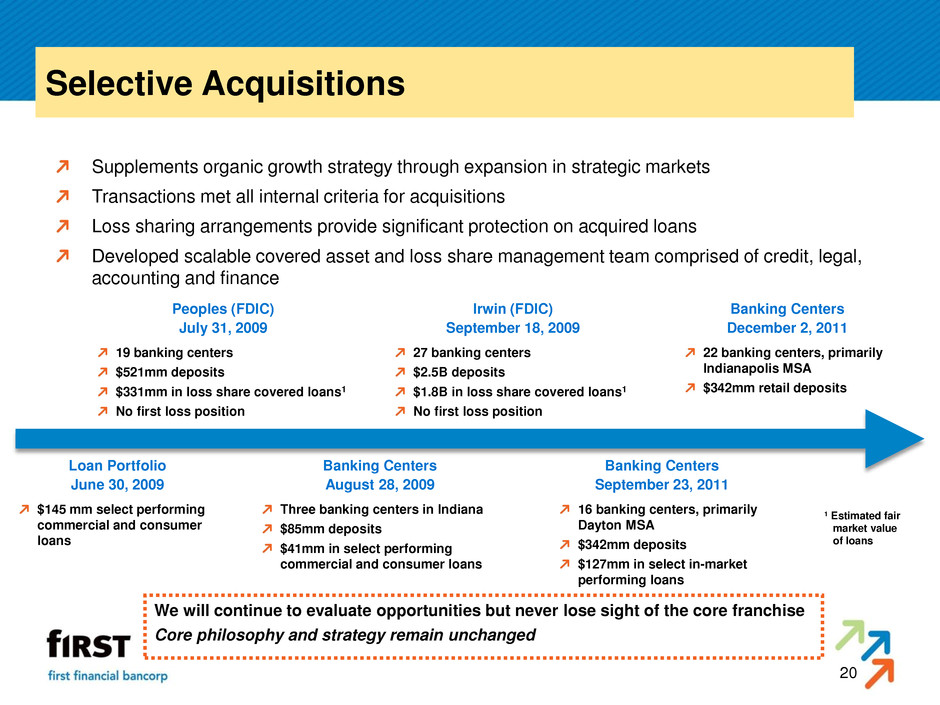

20 Selective Acquisitions Supplements organic growth strategy through expansion in strategic markets Transactions met all internal criteria for acquisitions Loss sharing arrangements provide significant protection on acquired loans Developed scalable covered asset and loss share management team comprised of credit, legal, accounting and finance Peoples (FDIC) July 31, 2009 19 banking centers $521mm deposits $331mm in loss share covered loans1 No first loss position Irwin (FDIC) September 18, 2009 27 banking centers $2.5B deposits $1.8B in loss share covered loans1 No first loss position Banking Centers December 2, 2011 22 banking centers, primarily Indianapolis MSA $342mm retail deposits Loan Portfolio June 30, 2009 $145 mm select performing commercial and consumer loans Banking Centers August 28, 2009 Three banking centers in Indiana $85mm deposits $41mm in select performing commercial and consumer loans Banking Centers September 23, 2011 16 banking centers, primarily Dayton MSA $342mm deposits $127mm in select in-market performing loans 1 Estimated fair market value of loans We will continue to evaluate opportunities but never lose sight of the core franchise Core philosophy and strategy remain unchanged

21 Franchise Highlights 1. Strong operating fundamentals – 90 consecutive quarters of profitability 2. Investments to create long-term growth are producing results 3. Comprehensive portfolio of credit products to drive loan and revenue growth 4. Strong capital levels with ability to support significant asset growth 5. Dividend yield in excess of 6%; capital return exceeding 100% of earnings when combined with share repurchase plan 6. Solid market share in strategic operating markets 7. Continual focus on improving efficiency, operating processes and service delivery

Appendix Investor Presentation First Quarter 2013

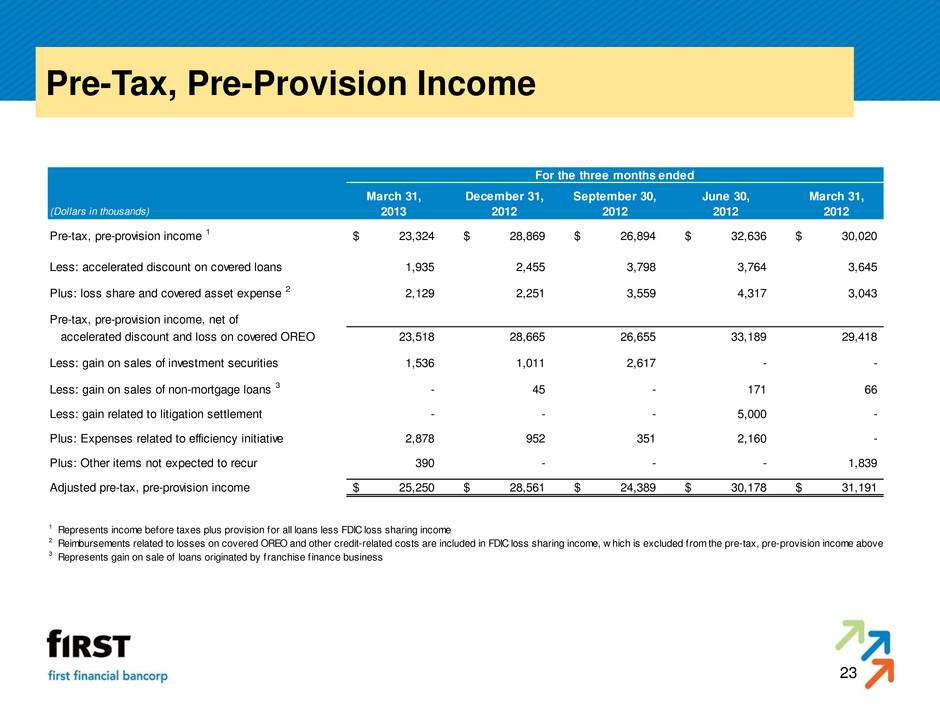

23 Pre-Tax, Pre-Provision Income For the three months ended March 31, December 31, September 30, June 30, March 31, (Dollars in thousands) 2013 2012 2012 2012 2012 Pre-tax, pre-provision income 1 23,324$ 28,869$ 26,894$ 32,636$ 30,020$ Less: accelerated discount on covered loans 1,935 2,455 3,798 3,764 3,645 Plus: loss share and covered asset expense 2 2,129 2,251 3,559 4,317 3,043 Pre-tax, pre-provision income, net of accelerated discount and loss on covered OREO 23,518 28,665 26,655 33,189 29,418 Less: gain on sales of investment securities 1,536 1,011 2,617 - - Less: gain on sales of non-mortgage loans 3 - 45 - 171 66 Less: gain related to litigation settlement - - - 5,000 - Plus: Expenses related to efficiency initiative 2,878 952 351 2,160 - Plus: Other items not expected to recur 390 - - - 1,839 Adjusted pre-tax, pre-provision income 25,250$ 28,561$ 24,389$ 30,178$ 31,191$ 1 Represents income before taxes plus provision for all loans less FDIC loss sharing income 2 Reimbursements related to losses on covered OREO and other credit-related costs are included in FDIC loss sharing income, w hich is excluded from the pre-tax, pre-provision income above 3 Represents gain on sale of loans originated by franchise f inance business

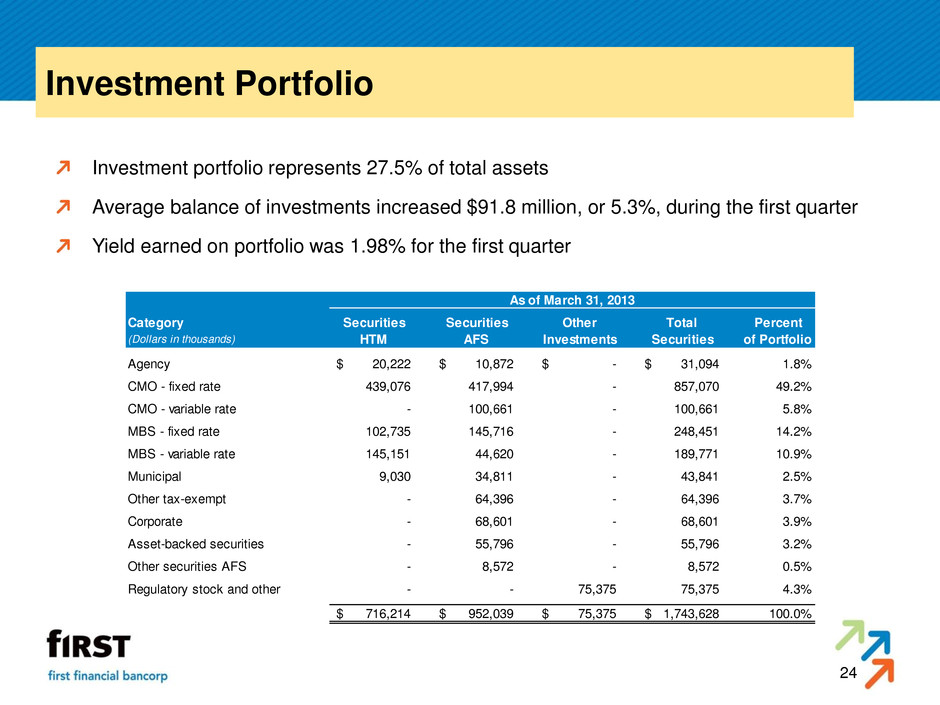

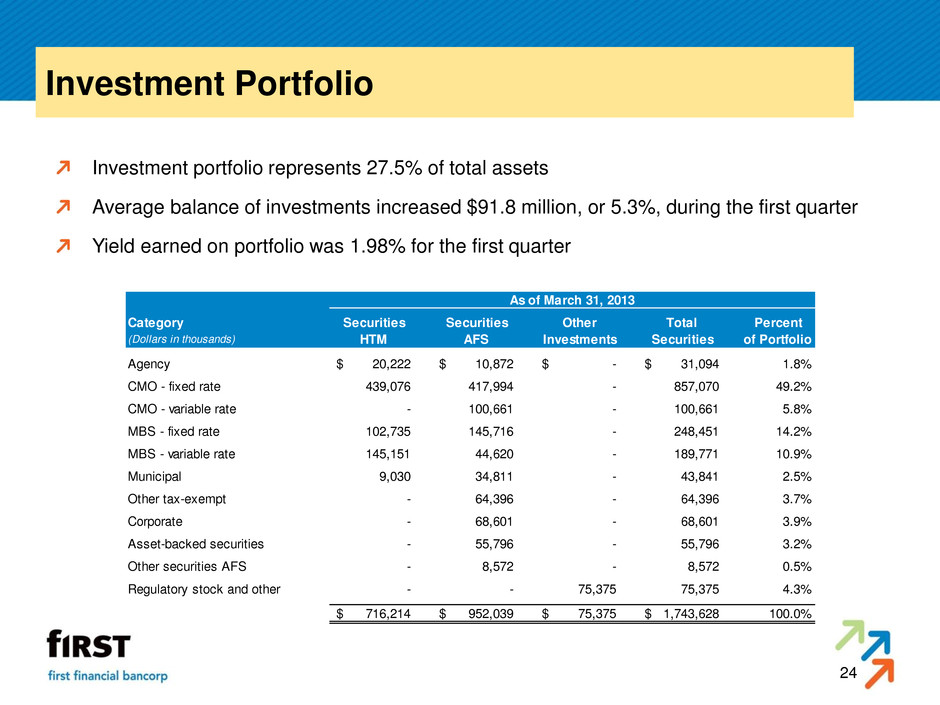

24 Investment Portfolio Investment portfolio represents 27.5% of total assets Average balance of investments increased $91.8 million, or 5.3%, during the first quarter Yield earned on portfolio was 1.98% for the first quarter As of March 31, 2013 Category Securities Securities Other Total Percent (Dollars in thousands) HTM AFS Investments Securities of Portfolio Agency 20,222$ 10,872$ -$ 31,094$ 1.8% CMO - fixed rate 439,076 417,994 - 857,070 49.2% CMO - variable rate - 100,661 - 100,661 5.8% MBS - fixed rate 102,735 145,716 - 248,451 14.2% MBS - variable rate 145,151 44,620 - 189,771 10.9% Municipal 9,030 34,811 - 43,841 2.5% Oth r tax-exempt - 64,396 - 64,396 3.7% C rporate - 68,601 - 68,601 3.9% Asset-backed securities - 55,796 - 55,796 3.2% Other securities AFS - 8,572 - 8,572 0.5% Regulatory stock and other - - 75,375 75,375 4.3% 716,214$ 952,039$ 75,375$ 1,743,628$ 100.0%

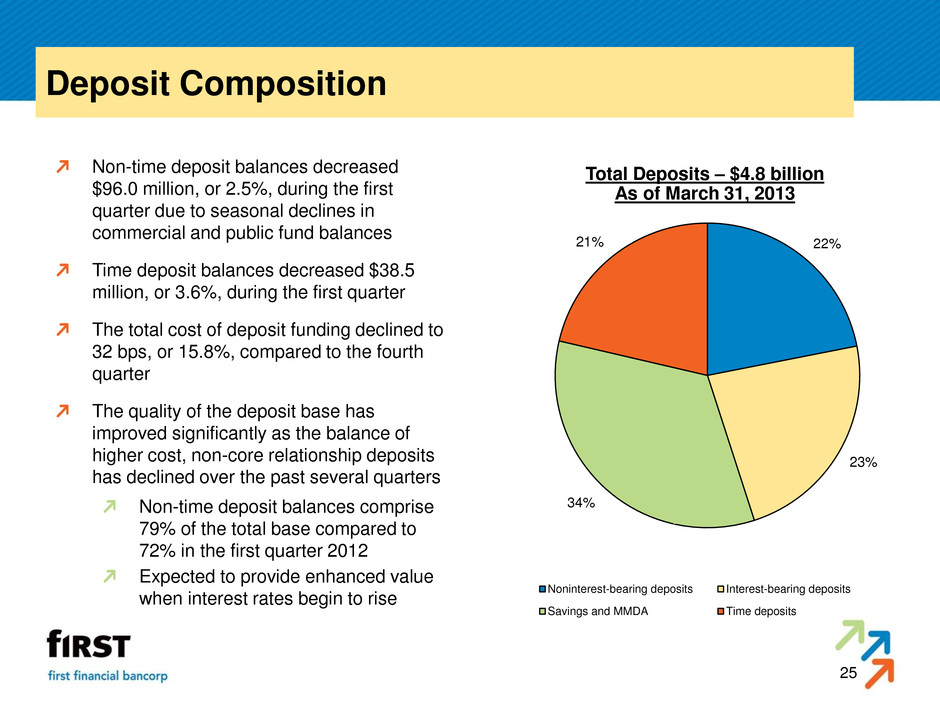

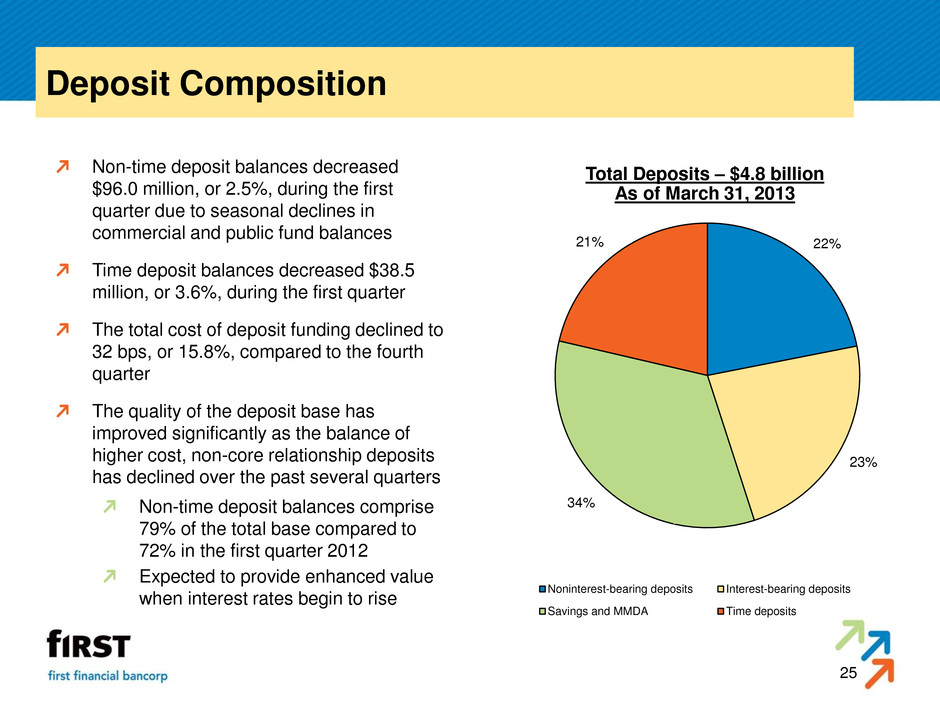

25 Deposit Composition Non-time deposit balances decreased $96.0 million, or 2.5%, during the first quarter due to seasonal declines in commercial and public fund balances Time deposit balances decreased $38.5 million, or 3.6%, during the first quarter The total cost of deposit funding declined to 32 bps, or 15.8%, compared to the fourth quarter The quality of the deposit base has improved significantly as the balance of higher cost, non-core relationship deposits has declined over the past several quarters Non-time deposit balances comprise 79% of the total base compared to 72% in the first quarter 2012 Expected to provide enhanced value when interest rates begin to rise Total Deposits – $4.8 billion As of March 31, 2013 22% 23% 34% 21% Noninterest-bearing deposits Interest-bearing deposits Savings and MMDA Time deposits

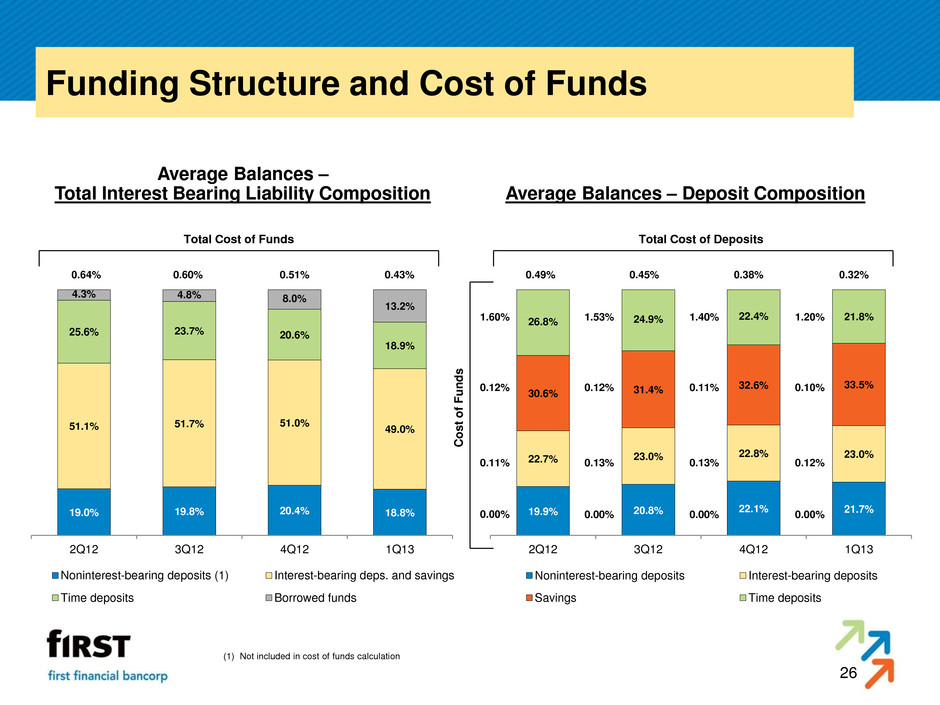

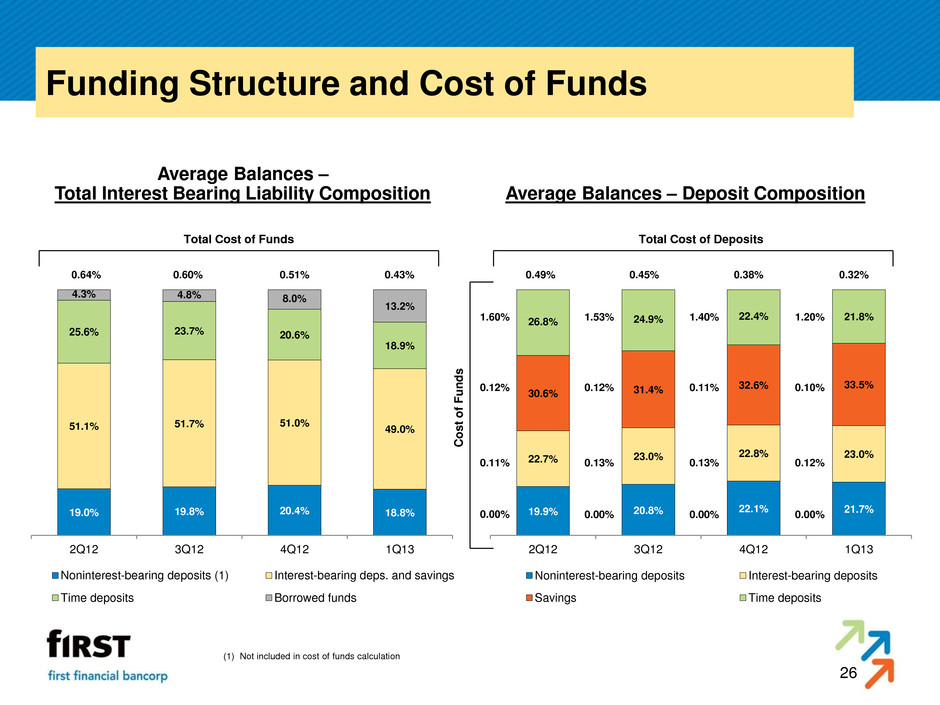

26 Funding Structure and Cost of Funds Average Balances – Total Interest Bearing Liability Composition Average Balances – Deposit Composition Total Cost of Funds (1) Not included in cost of funds calculation Total Cost of Deposits Co s t of F u n d s 0.64% 0.60% 0.51% 0.43% 0.49% 0.45% 0.38% 0.32% 0.00% 0.00% 0.00% 0.00% 0.11% 0.13% 0.13% 0.12% 0.12% 0.12% 0.11% 0.10% 1.60% 1.53% 1.40% 1.20% 18.8%20.4%19.8%19.0% 49.0% 51.0%51.7%51.1% 18.9% 20.6%23.7%25.6% 13.2% 8.0%4.8%4.3% 1Q134Q123Q122Q12 Noninterest-bearing deposits (1) Interest-bearing deps. and savings Time deposits Borrowed funds 21.7%22.1%20.8%19. % 23.0%22.8%23.0%22.7% 33.5%32.6%31.4%30.6% 21.8%22.4%24.9%26.8% 1Q134Q123Q122Q12 Nonin erest-bearing depo its Intere t-bearing deposits Savings Time deposits

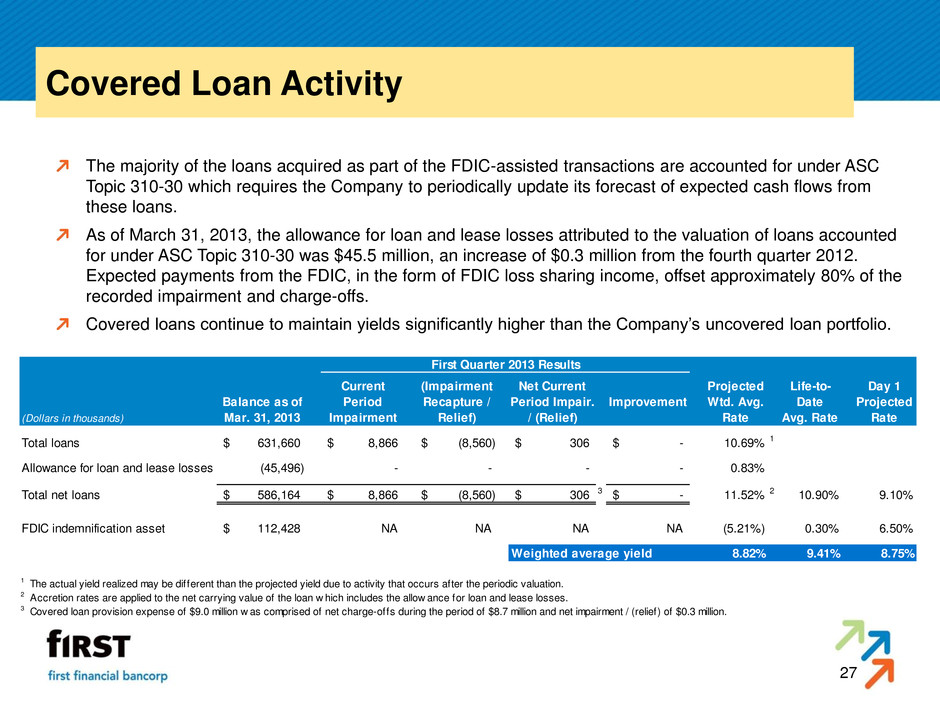

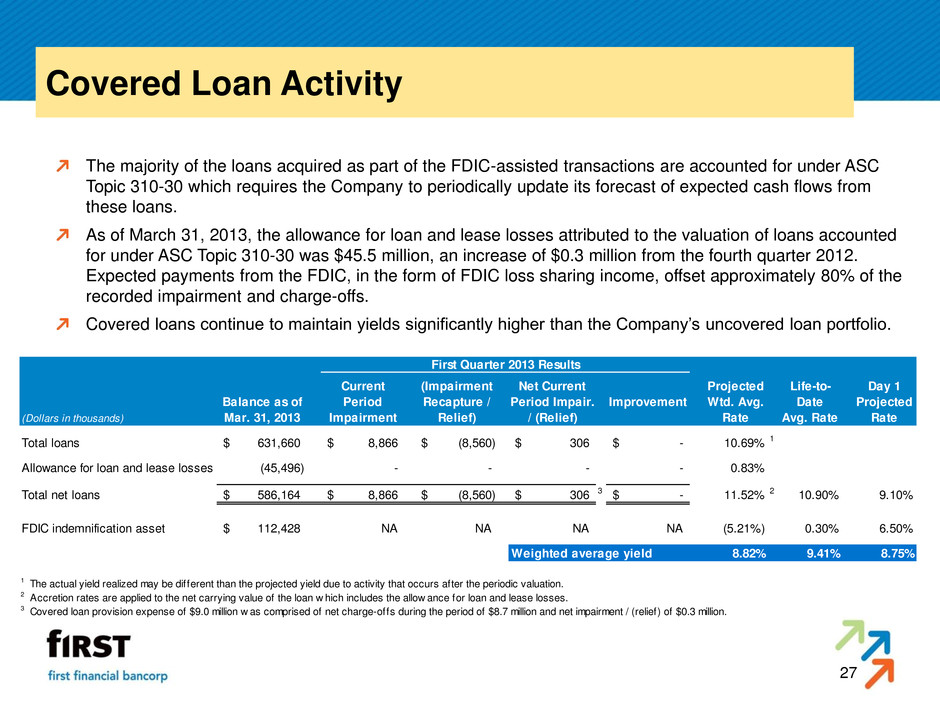

27 Covered Loan Activity The majority of the loans acquired as part of the FDIC-assisted transactions are accounted for under ASC Topic 310-30 which requires the Company to periodically update its forecast of expected cash flows from these loans. As of March 31, 2013, the allowance for loan and lease losses attributed to the valuation of loans accounted for under ASC Topic 310-30 was $45.5 million, an increase of $0.3 million from the fourth quarter 2012. Expected payments from the FDIC, in the form of FDIC loss sharing income, offset approximately 80% of the recorded impairment and charge-offs. Covered loans continue to maintain yields significantly higher than the Company’s uncovered loan portfolio. First Quarter 2013 Results Current (Impairment Net Current Projected Life-to- Day 1 Balance as of Period Recapture / Period Impair. Improvement Wtd. Avg. Date Projected (Dollars in thousands) Mar. 31, 2013 Impairment Relief) / (Relief) Rate Avg. Rate Rate Tot l loans 631,660$ 8,866$ (8,560)$ 306$ -$ 10.69% 1 Allowanc for loan and lease losses (45,496) - - - - 0.83% Total net loans 586,164$ 8,866$ (8,560)$ 306$ 3 -$ 11.52% 2 10.90% 9.10% FDIC indemnification asset 112,428$ NA NA NA NA (5.21%) 0.30% 6.50% Weighted average yield 8.82% 9.41% 8.75% 1 The actual yield realized may be different than the projected yield due to activity that occurs after the periodic valuation. 2 Accretion rates are applied to the net carrying value of the loan w hich includes the allow ance for loan and lease losses. 3 Covered loan provision expense of $9.0 million w as comprised of net charge-offs during the period of $8.7 million and net impairment / (relief) of $0.3 million.

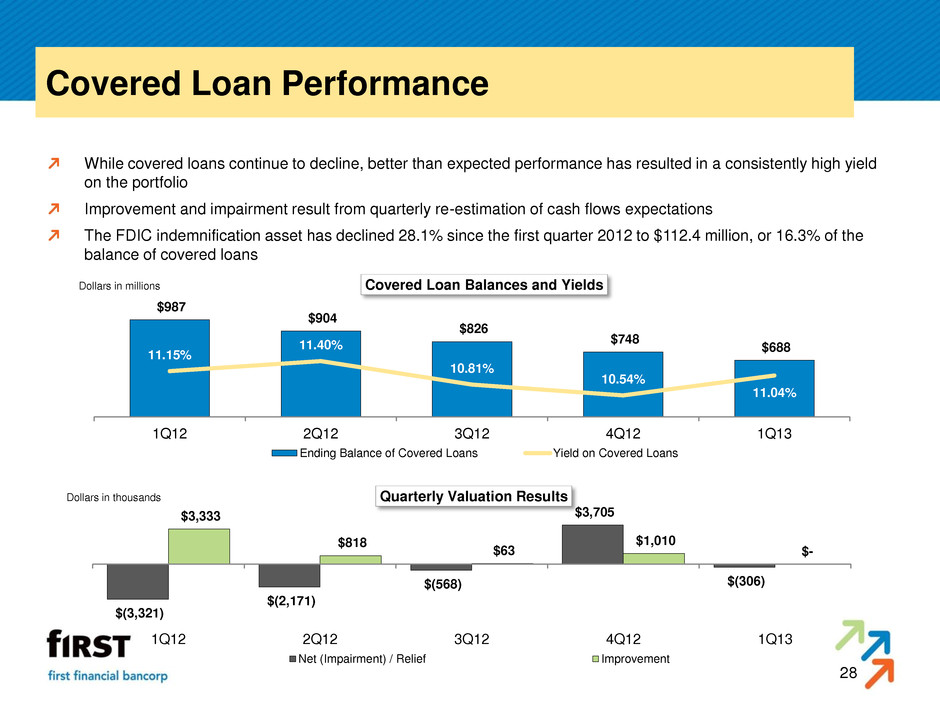

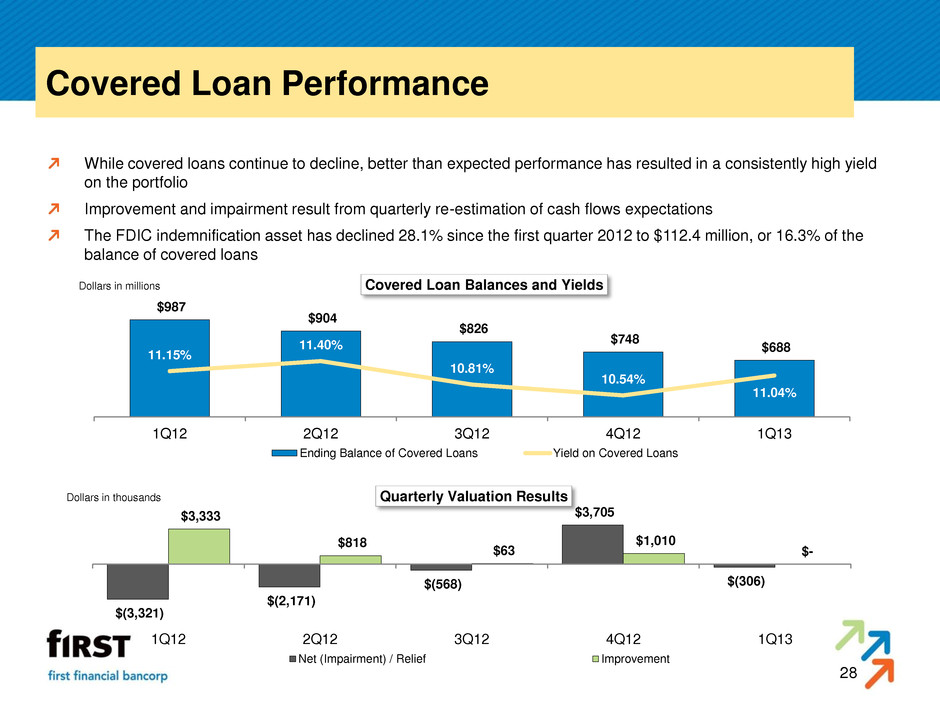

28 Covered Loan Performance While covered loans continue to decline, better than expected performance has resulted in a consistently high yield on the portfolio Improvement and impairment result from quarterly re-estimation of cash flows expectations The FDIC indemnification asset has declined 28.1% since the first quarter 2012 to $112.4 million, or 16.3% of the balance of covered loans $987 $904 $826 $748 $688 11.15% 11.40% 10.81% 10.54% 11.04% 1Q12 2Q12 3Q12 4Q12 1Q13 Dollars in millions Covered Loan Balances and Yields Ending Balance of Covered Loans Yield on Covered Loans $(3,321) $(2,171) $(568) $3,705 $(306) $3,333 $818 $63 $1,010 $- 1Q12 2Q12 3Q12 4Q12 1Q13 Dollars in thousands Quarterly Valuation Results Net (Impairment) / Relief Improvement

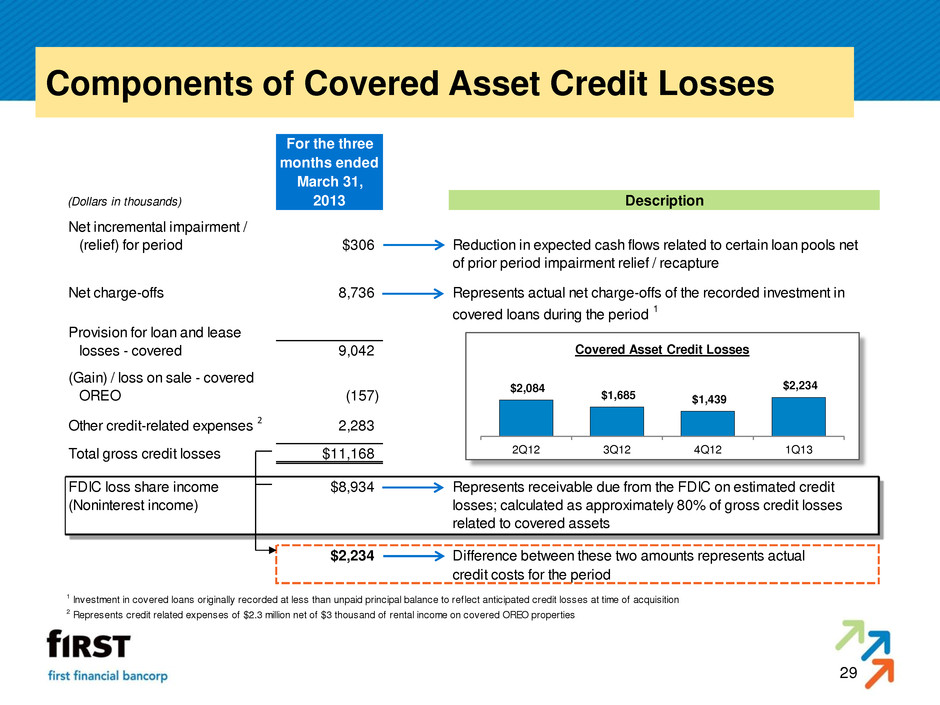

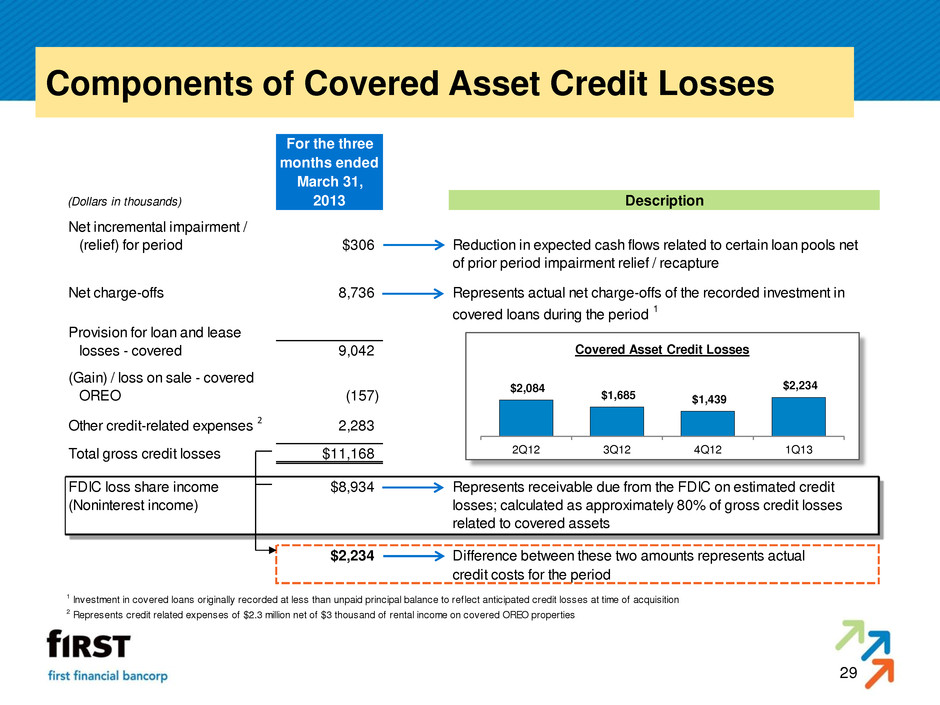

29 Components of Covered Asset Credit Losses $2,084 $1,685 $1,439 $2,234 2Q12 3Q12 4Q12 1Q13 Covered Asset Credit Losses For the three months ended March 31, (Dollars in thousands) 2013 Description Net incremental impairment / (relief) for period $306 Reduction in expected cash flows related to certain loan pools net of prior period impairment relief / recapture Net charge-offs 8,736 Represents actual net charge-offs of the recorded investment in covered loans during the period 1 Provision for loan and lease losses - covered 9,042 (Gain) / loss on sale - covered OREO (157) Other credit-related expenses 2 2,283 Total gross credit losses $11,168 FDIC loss share income $8,934 Represents receivable due from the FDIC on estimated credit (Noninterest income) losses; calculated as approximately 80% of gross credit losses related to covered assets $2,234 Difference between these two amounts represents actual credit costs for the period 1 Investment in covered loans originally recorded at less than unpaid principal balance to reflect anticipated credit losses at time of acquisition 2 Represents credit related expenses of $2.3 million net of $3 thousand of rental income on covered OREO properties

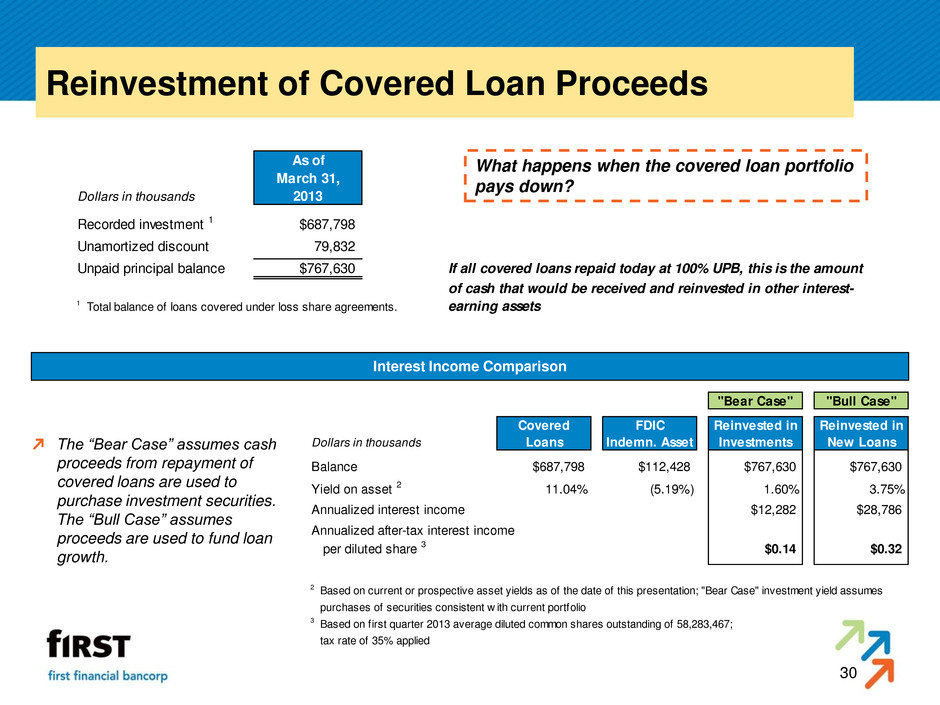

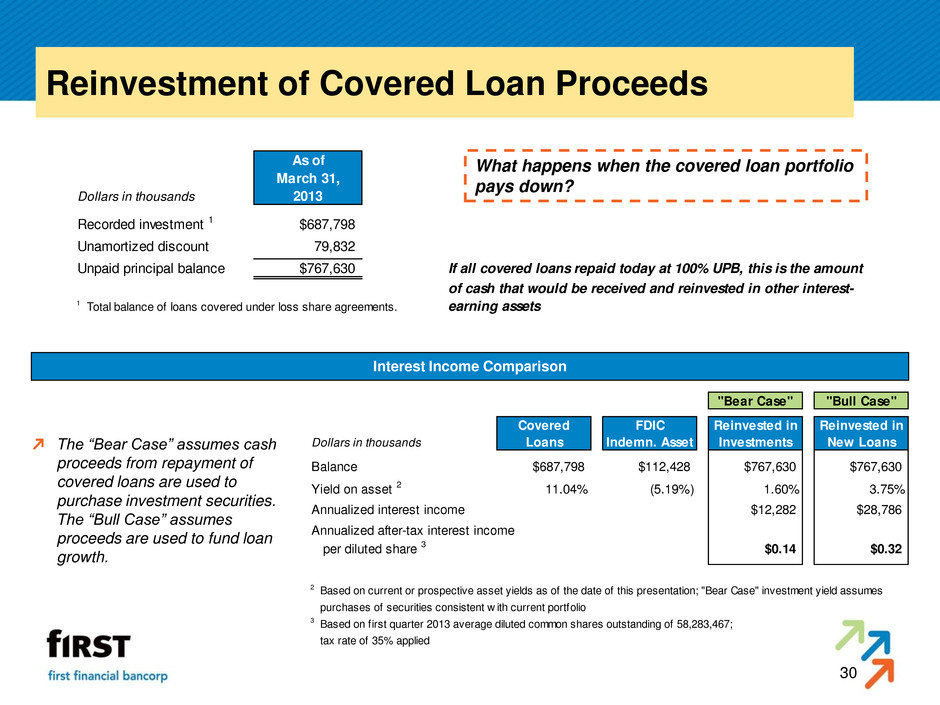

30 Reinvestment of Covered Loan Proceeds What happens when the covered loan portfolio pays down? Interest Income Comparison The “Bear Case” assumes cash proceeds from repayment of covered loans are used to purchase investment securities. The “Bull Case” assumes proceeds are used to fund loan growth. As of March 31, Dollars in thousands 2013 Recorded investment 1 $687,798 Unamortized discount 79,832 Unpaid principal balance $767,630 If all covered loans repaid today at 100% UPB, this is the amount of cash that would be received and reinvested in other interest- 1 Total balance of loans covered under loss share agreements. earning assets "Bear Case" "Bull Case" Covered FDIC Reinvested in Reinvested in Dollars in thousands Loans Indemn. Asset Investments New Loans Balance $687,798 $112,428 $767,630 $767,630 Yield on asset 2 11.04% (5.19%) 1.60% 3.75% Annualized interest income $12,282 $28,786 Annualized after-tax interest income per diluted share 3 $0.14 $0.32 2 Based on current or prospective asset yields as of the date of this presentation; "Bear Case" investment yield assumes purchases of securities consistent w ith current portfolio 3 Based on first quarter 2013 average diluted common shares outstanding of 58,283,467; tax rate of 35% applied

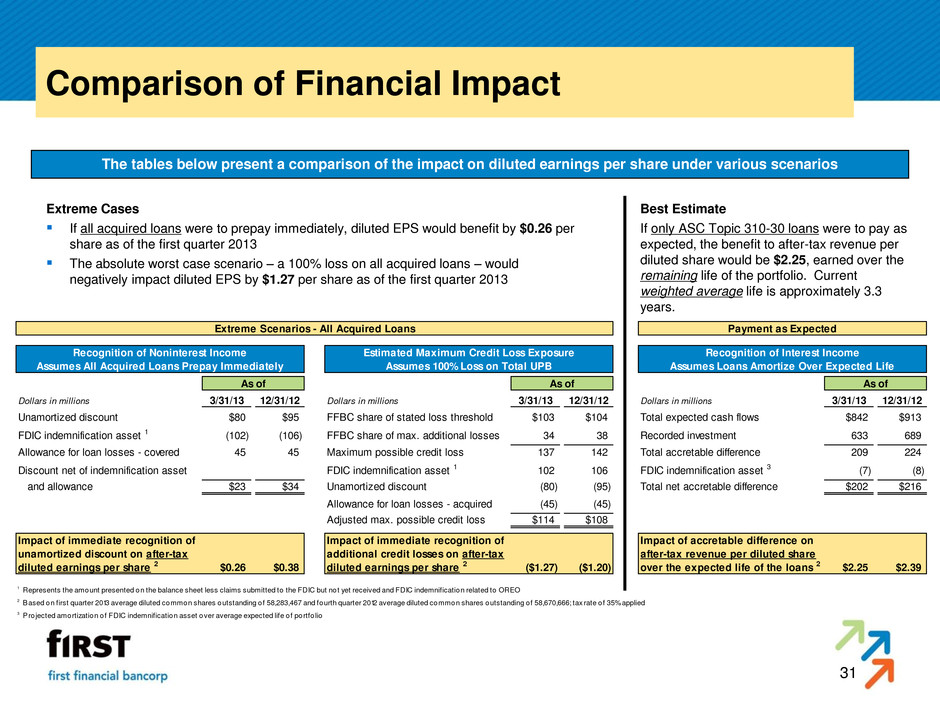

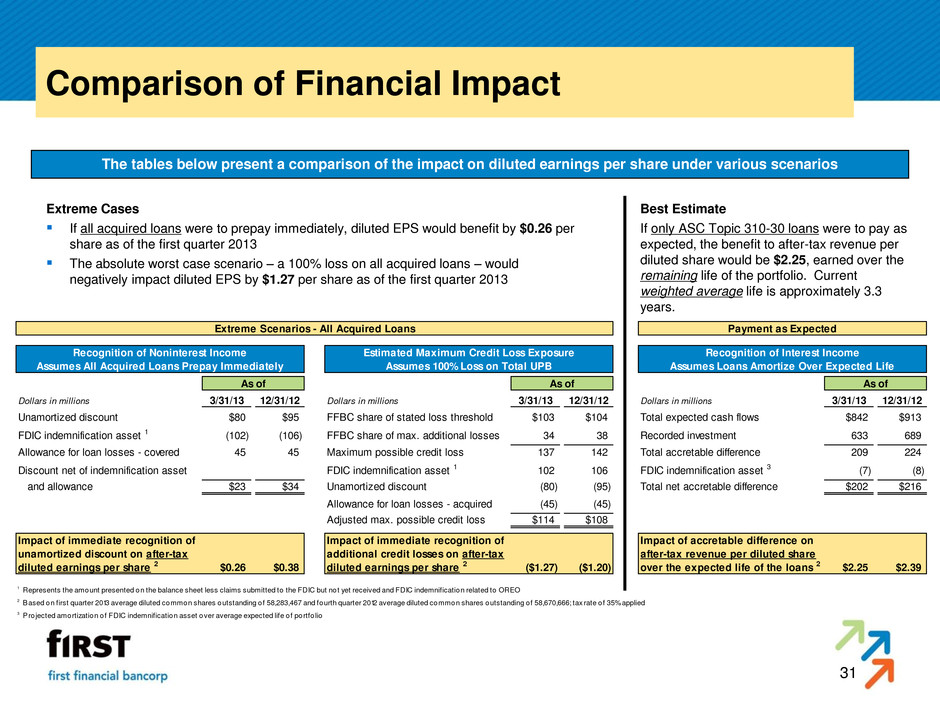

31 Comparison of Financial Impact The tables below present a comparison of the impact on diluted earnings per share under various scenarios Extreme Cases If all acquired loans were to prepay immediately, diluted EPS would benefit by $0.26 per share as of the first quarter 2013 The absolute worst case scenario – a 100% loss on all acquired loans – would negatively impact diluted EPS by $1.27 per share as of the first quarter 2013 Best Estimate If only ASC Topic 310-30 loans were to pay as expected, the benefit to after-tax revenue per diluted share would be $2.25, earned over the remaining life of the portfolio. Current weighted average life is approximately 3.3 years. Extreme Scenarios - All Acquired Loans Payment as Expected Recognition of Noninterest Income Estimated Maximum Credit Loss Exposure Recognition of Interest Income Assumes All Acquired Loans Prepay Immediately Assumes 100% Loss on Total UPB Assumes Loans Amortize Over Expected Life As of As of As of Dollars in millions 3/31/13 12/31/12 Dollars in millions 3/31/13 12/31/12 Dollars in millions 3/31/13 12/31/12 Unamortized discount $80 $95 FFBC share of stated loss threshold $103 $104 Total expected cash flows $842 $913 FDIC indemnification asset 1 (102) (106) FFBC share of max. additional losses 34 38 Recorded investment 633 689 Allowance for loan losses - covered 45 45 Maximum possible credit loss 137 142 Total accretable difference 209 224 Discount net of indemnification asset FDIC indemnification asset 1 102 106 FDIC indemnification asset 3 (7) (8) and allowance $23 $34 Unamortized discount (80) (95) Total net accretable difference $202 $216 Allowance for loan losses - acquired (45) (45) Adjusted max. possible credit loss $114 $108 Impact of i ediate recognition of Impact of immediate recognition of Impact of accretable difference on unamortized discount on after-tax additional credit losses on after-tax after-tax revenue per diluted share diluted earnings per share 2 $0.26 $0.38 diluted earnings per share 2 ($1.27) ($1.20) over the expected life of the loans 2 $2.25 $2.39 1 Represents the amount presented on the balance sheet less claims submitted to the FDIC but not yet received and FDIC indemnification related to OREO 2 Based on first quarter 2013 average diluted common shares outstanding of 58,283,467 and fourth quarter 2012 average diluted common shares outstanding of 58,670,666; tax rate of 35% applied 3 Pro jected amortization of FDIC indemnification asset over average expected life of portfo lio

First Financial Bancorp Investor Presentation First Quarter 2013