Exhibit 99.1 Investor Presentation Third Quarter 2018

Forward Looking Statement Disclosure Certain statements contained in this report which are not statements of historical fact constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as ‘‘believes,’’ ‘‘anticipates,’’ “likely,” “expected,” “estimated,” ‘‘intends’’ and other similar expressions are intended to identify forward-looking statements but are not the exclusive means of identifying such statements. Examples of forward-looking statements include, but are not limited to, statements we make about (i) our future operating or financial performance, including revenues, income or loss and earnings or loss per share, (ii) future common stock dividends, (iii) our capital structure, including future capital levels, (iv) our plans, objectives and strategies, and (v) the assumptions that underlie our forward-looking statements. As with any forecast or projection, forward-looking statements are subject to inherent uncertainties, risks and changes in circumstances that may cause actual results to differ materially from those set forth in the forward-looking statements. Forward-looking statements are not historical facts but instead express only management’s beliefs regarding future results or events, many of which, by their nature, are inherently uncertain and outside of management’s control. It is possible that actual results and outcomes may differ, possibly materially, from the anticipated results or outcomes indicated in these forward-looking statements. Important factors that could cause actual results to differ materially from those in our forward-looking statements include the following, without limitation: (i) economic, market, liquidity, credit, interest rate, operational and technological risks associated with the Company’s business; (ii) the effect of and changes in policies and laws or regulatory agencies, including the Dodd-Frank Wall Street Reform and Consumer Protection Act and other legislation and regulation relating to the banking industry; (iii) management’s ability to effectively execute its business plans; (iv) mergers and acquisitions, including costs or difficulties related to the integration of acquired companies; (v) the possibility that any of the anticipated benefits of the Company’s recent merger with MainSource Financial Group, Inc. will not be realized or will not be realized within the expected time period; (vi) the effect of changes in accounting policies and practices; (vii) changes in consumer spending, borrowing and saving and changes in unemployment; (viii) changes in customers’ performance and creditworthiness; and (ix) the costs and effects of litigation and of unexpected or adverse outcomes in such litigation. Additional factors that may cause our actual results to differ materially from those described in our forward- looking statements can be found in the Form 10-K for the year ended December 31, 2017, as well as its other filings with the SEC, which are available on the SEC website at www.sec.gov. All forward-looking statements included in this filing are made as of the date hereof and are based on information available at the time of the filing. Except as required by law, the Company does not assume any obligation to update any forward-looking statement. . 2

Presentation Contents About First Financial Bancorp Financial Performance Appendix 3

Company Overview Overview Lines of Business Founded: 1863 Commercial Headquarters: Cincinnati, Ohio C&I, O-CRE, ABL, Equipment Finance, Treasury Retail Banking Banking Centers: 159 Consumer, Business Banking, Small Business Assets: $13.8 billion Mortgage Banking Loans: $8.8 billion Wealth Management / Private Banking Deposits: $9.8 billion Investment Commercial Real Estate Wealth Mgmt: $4.5 billion Commercial Finance $2.8 billion AUM $1.7 billion brokerage NASDAQ: FFBC 3.23% 2.60% 2.58% 2.59% 2.48% 2.69% $29.35 $30.65 $29.70 $26.15 $26.35 $24.74 www.bankatfirst.com 3Q17 4Q17 1Q18 2Q18 3Q18 10.22.18 Share Price Dividend Yield 4

Franchise Growth Plans 5

Market Centric Strategies METRO MARKETS COMMUNITY MARKETS HEADQUARTERS NATIONAL Louisville, KY Southeastern IN Columbus, OH South Central IN Greater Cincinnati Industry Specific Indianapolis, IN Northwest IN Northern KY Dayton, OH Northern OH th Low brand awareness High brand awareness 4 in market share Niche offering Low market share High market share All business lines represented Hometown Community Deepen relationships Build relationships through becoming Significant branch network the Premier Business Bank Oak Street Funding Expand product offering Alternative to larger banks Bank the business, the business owners and the employees Mass player, based on brand, First Franchise Capital Word-of-mouth referrals reputation and legacy Leads to targeted growth across all business lines Leads to organic growth Visible presence Large associate population 6

Revenue Growth Strategies 7

Current Priorities . Successful integration of the two companies . Build out sales teams in key market areas . Successfully complete trailing integration projects . Achieve expense savings and deliver the financial returns we communicated to our shareholders by 1Q 2019 . Achieve targeted income and balance sheet growth . Develop and effectively communicate new plans . Strategic plan for the corporation . Business plans for the revenue lines . Functional plans for key staff areas . Implement risk framework for the new company, achieve satisfactory regulatory exam ratings 8

Invest with First Financial . Experienced and proven management team . Increased scale to invest in franchise . Proven & sustainable business model . Well managed through the cycle . Conservative operating philosophy . Consistent profitability – 112 consecutive quarters . Top quartile performer – ROAA, ROATCE, Efficiency . Robust capital management . Prudent steward of shareholders’ capital . Strong asset quality . Well defined M&A strategy . Selective markets, products & asset diversification 9

Invest with First Financial Total Shareholder Return1,2,3,4 89.2% 84.3% 54.6% 47.4% 41.7% 33.2% 0.5% -3.0% -4.3% -2.2% -10.7% -10.6% 5 Year 3 Year 1 Year YTD 2018 FFBC KBW Peer Median KBW Peer Top Quartile 1 Includes dividend reinvestment 2 Peer group includes KBW regional bank index peers 3 Based on stock price as of 10/22/2018 4 Beginning date is 10/01/2017 for the 1-year return, 10/01/2015 for the 3-year return, and 10/01/2013 for the 5-year return 10

Presentation Contents About First Financial Bancorp Financial Performance Appendix 11

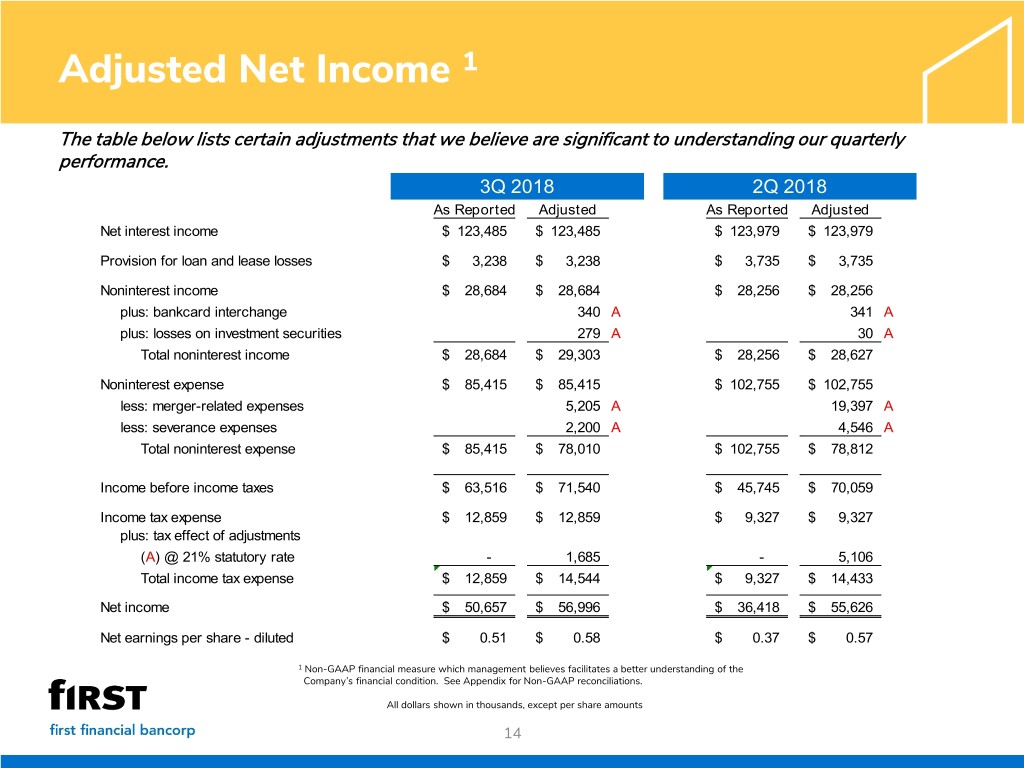

3Q 2018 Results 112th Consecutive Quarter of Profitability . Net income = $50.7 million or $0.51 per diluted share. Adjusted net income = $57.0 million or $0.58 per diluted share1,2 . Return on average assets = 1.45%. Adjusted return on average assets = 1.64%1 . Profitability Return on average shareholders’ equity = 9.94%. Adjusted return on average shareholders’ equity = 11.19%1 . Return on average tangible common equity = 18.52%1. Adjusted return on average tangible common equity = 20.83%1 . Net interest income = $123.5 million. . Net interest margin of 4.06% on a GAAP basis; 4.12% on a fully tax equivalent basis1. . Noninterest income = $28.7 million ; $29.3 million1 as adjusted for merger related items . Income Statement Noninterest expense = $85.4 million; $78.0 million1 as adjusted for merger related items. . Efficiency ratio = 56.13%. Adjusted efficiency ratio = 51.06%1 . Effective tax rate of 20.2%. Adjusted effective tax rate of 20.3%1 . Total assets decreased $77.5 million compared to the linked quarter to $13.8 billion. . EOP loans decreased $37.2 million compared to the linked quarter to $8.8 billion. . Balance Sheet EOP deposits decreased $351.1 million compared to the linked quarter to $9.8 billion. . EOP investment securities decreased $17.0 million compared to the linked quarter. . Provision expense = $3.2 million. Net charge offs = ($0.4) million. NCOs / Avg. Loans = (0.02)% annualized. . Nonperforming Loans / Total Loans = 0.71%. Nonperforming Assets / Total Assets = 0.47%. . Asset Quality ALLL / Nonaccrual Loans = 136.22%. ALLL / Total Loans = 0.65%. Classified Assets / Total Assets = 1.00%. . Credit mark of $30.8 million on acquired MainSource loans. . Total capital ratio = 13.77%. . Tier 1 common equity ratio = 11.52%. . Capital Tangible common equity ratio = 8.53%. . Tangible book value per share = $11.25. 1 Non-GAAP financial measure which management believes facilitates a better understanding of the Company’s financial condition. See Appendix for Non-GAAP reconciliation. 2 See Slide 14 for Adjusted Earnings detail. 12

3Q 2018 Highlights Strong quarterly earnings Adjusted1 earnings per share - $0.58 Adjusted1 return on assets – 1.64% Adjusted1 return on average tangible common equity – 20.83% Expansion in capital ratios Stable net interest margin Slight decline driven by lower loan fees and day count Higher asset yields offset by shifts in funding mix Adjusted1 noninterest income increased $0.7 million to $29.3 million compared to the linked quarter Adjusted1 noninterest expense decreased $0.8 million to $78.0 million compared to the linked quarter Slight decline in loan balances Increased fundings and commitments offset by lower than expected line utilization and elevated payoffs compared to the linked quarter Deposit outflows primarily related to decline in public funds and brokered CD’s Core deposit attrition rates began to normalize late in the third quarter Credit quality remains excellent 1 Non-GAAP financial measure which management believes facilitates a better understanding of the Company’s financial condition. See Appendix for Non-GAAP reconciliations. 13

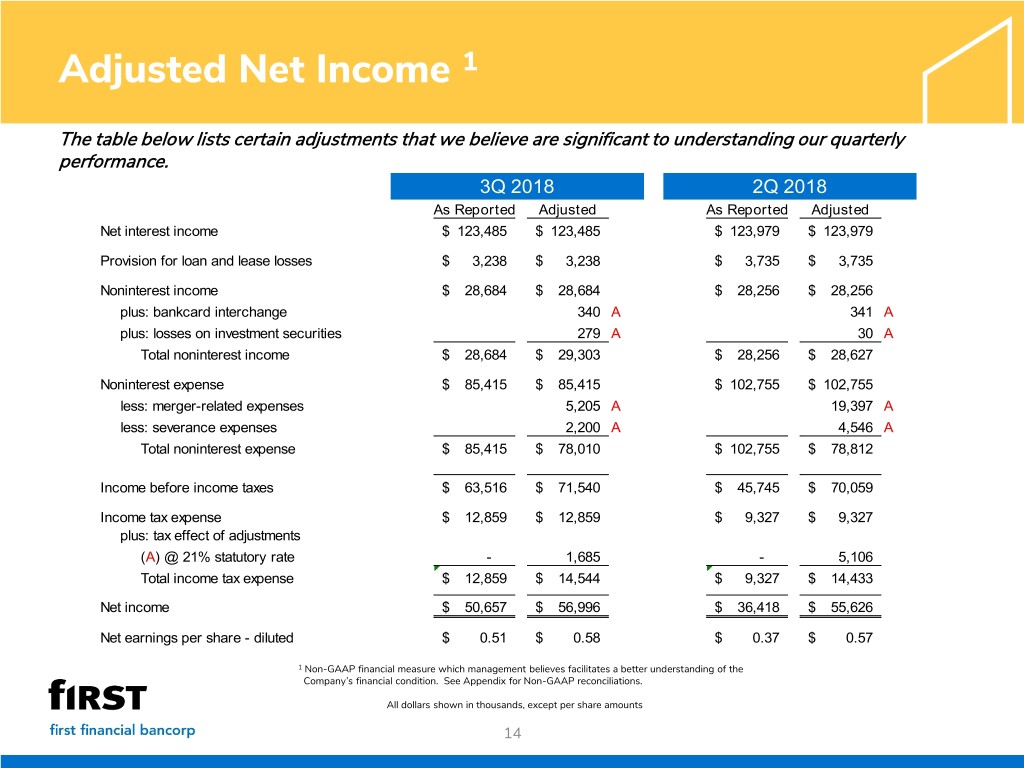

Adjusted Net Income 1 The table below lists certain adjustments that we believe are significant to understanding our quarterly performance. 3Q 2018 2Q 2018 As Reported Adjusted As Reported Adjusted Net interest income $ 123,485 $ 123,485 $ 123,979 $ 123,979 Provision for loan and lease losses $ 3,238 $ 3,238 $ 3,735 $ 3,735 Noninterest income $ 28,684 $ 28,684 $ 28,256 $ 28,256 plus: bankcard interchange 340 A 341 A plus: losses on investment securities 279 A 30 A Total noninterest income $ 28,684 $ 29,303 $ 28,256 $ 28,627 Noninterest expense $ 85,415 $ 85,415 $ 102,755 $ 102,755 less: merger-related expenses 5,205 A 19,397 A less: severance expenses 2,200 A 4,546 A Total noninterest expense $ 85,415 $ 78,010 $ 102,755 $ 78,812 Income before income taxes $ 63,516 $ 71,540 $ 45,745 $ 70,059 Income tax expense $ 12,859 $ 12,859 $ 9,327 $ 9,327 plus: tax effect of adjustments (A) @ 21% statutory rate - 1,685 - 5,106 Total income tax expense $ 12,859 $ 14,544 $ 9,327 $ 14,433 Net income $ 50,657 $ 56,996 $ 36,418 $ 55,626 Net earnings per share - diluted $ 0.51 $ 0.58 $ 0.37 $ 0.57 1 Non-GAAP financial measure which management believes facilitates a better understanding of the Company’s financial condition. See Appendix for Non-GAAP reconciliations. All dollars shown in thousands, except per share amounts 14

Profitability Diluted EPS Return on Average Assets $0.57 $0.58 1.60% 1.64% $0.52 1.49% $0.45 1.26% $0.39 1.11% 1.45% $0.49 $0.51 1.40% $0.40 $0.40 1.13% 1.13% $0.37 1.05% 3Q17 4Q17 1Q18 2Q18 3Q18 3Q17 4Q17 1Q18 2Q18 3Q18 1 DilutedEPS Adjusted EPS 1 ROA Adjusted ROA Return on Avg Tangible Common Equity Efficiency Ratio 88.19% 67.50% 21.00% 20.83% 58.28% 56.38% 56.13% 18.24% 15.47% 13.86% 18.5% 57.02% 57.99% 53.79% 17.2% 51.64% 51.06% 14.1% 13.9% 13.7% 3Q17 4Q17 1Q18 2Q18 3Q18 3Q17 4Q17 1Q18 2Q18 3Q18 1 ROATCE Adjusted ROATCE 1 Adjusted Efficiency Ratio Efficiency Ratio 1 Non-GAAP financial measure which management believes facilitates a better understanding of the Company’s financial condition. See Appendix for Non-GAAP reconciliation. 15

Net Interest Margin Net Interest Margin (FTE) 3Q18 NIM (FTE) Progression 4.15% 4.12% 2Q18 4.15% Asset yields 0.09% 0.29% 0.29% 3.82% 3.84% Asset mix -0.01% 0.15% 0.15% 0.13% Loan fees -0.02% 0.24% 3.57% Funding costs -0.02% 0.14% Funding mix -0.05% 3.69% 3.71% 3.70% 3.58% Purchase accounting 0.00% 3.43% Day count -0.02% 3Q17 4Q17 1Q18 2Q18 3Q18 3Q18 4.12% Basic Margin (FTE) Loan Fees Purchase accounting 16

Interest Rate Sensitivity Loan Portfolio – Floating Loan Mix (1) . Asset sensitive position 63% 65% 67% . 55% 55% Majority of loans are variable rate: . $4,916 $4,910 $4,099 55% reprice <=3 months $3,783 $3,908 . Securities portfolio duration – 3.5 years . +100 scenario 3.8 years 3Q17 4Q17 1Q18 2Q18 3Q18 . +200 scenario 3.9 years Floating % of Gross Loans . Non-maturity, interest bearing accounts Sensitivity Trend (Up100, Up200) (2) modeled to increase 59 bps in an “Up 100” 5.41% 4.73% 5.71% scenario 1.81% 1.43% 2.88% . 2.65% 2.40% 1.12% 50% of deposits in Community Markets with $0.219 0.76% $0.176 $0.166 high market share. $0.111 $0.086 $0.084 $0.070 $0.054 $0.043 $0.029 3Q17 4Q17 1Q18 2Q18 3Q18 Up100 Up200 Up100 Up200 EPS Impact Sensitivity (1) As defined by EOP loans repricing in three months or less. (2) Immediate parallel shifts across a 12 month horizon 17

Average Balance Sheet Average Loans Average Deposits 5.49% 5.53% 0.61% 0.60% 0.59% 5.05% 0.54% 0.57% 4.90% 4.71% $8,933 $8,849 $5,911 $5,960 $6,018 $10,383 $9,888 $6,680 $6,840 $6,903 3Q17 4Q17 1Q18 2Q18 3Q18 3Q17 4Q17 1Q18 2Q18 3Q18 Gross Loans Loan Yield (Gross) Total Deposits Cost of Deposits Average Securities 3.16% 3.21% 3.04% 2.85% 2.90% $3,157 $3,168 $2,042 $2,020 $2,043 3Q17 4Q17 1Q18 2Q18 3Q18 Average Investment Securities Investment Securities Yield All dollars shown in millions 18

Loan Portfolio Loan LOB Mix (EOP) Net Loan Change-LOB (Linked Quarter) Total $8.8 billion ICRE $36.6 $1,074 Commercial -$13.1 12% $2,747 Small Business Banking -$75.2 $971 31% 11% Consumer -$19.8 $921 11% Mortgage $13.5 Commercial Finance $40.7 $1,360 $1,774 15% 20% 1 Other -$19.9 ICRE Commercial Small Business Banking Consumer Total growth/(decline): ($37.2) Mortgage Commercial Finance 1 Includes planned attrition related to syndications and loan marks All dollars shown in millions 19

Loan Portfolio C&I Loans by Industry 1 CRE Loans by Collateral 2 C&I Loans: $3.7B CRE Loans: $3.2B Real Estate 7% Wholesale Trade Office Manufacturing 6% Hotel/Motel 13% 12% 10% Agriculture 6% Retail Strip Center Finance and 15% 8% Nursing/Assisted Insurance Living 15% Health Care 6% 6% Professional, Residential, 1-4 Residential, Multi Accommodation Scientific, & Tech Family Family 5+ & Food Services 5% 6% 19% 20% Other Services Other Warehouse Other (except Public 14% 3% 15% Administration) Industrial Facility 5% 3% Retail Trade Student Housing 4% 2% 1 Industry types included in Other representing greater than 1% of total C&I loans include Construction, Public Administration, Transportation & Warehousing, Arts, Entertainment, & Recreation, Waste Management, and Educational Services. Includes owner-occupied CRE. 2 Collateral types included in Other representing greater than 1% of total CRE loans include Medical Office, Commercial Lot, Mini Storage, Manufacturing Facility, and Real Estate IUB Other. 20

Deposits Deposit Product Mix (Avg) 3Q18 Average Deposit Progression Total $9.9 billion Balance as of June 30 $ 10,382,635 $ 1,408 14% $ 2,389 Impact from: 24% $ 1,245 Branch divestiture (86,335) 13% $ 576 Brokered CD's (155,326) 6% $ 906 $ 1,058 9% Public funds (163,126) 11% $ 381 $ 1,925 Total (404,787) 4% 19% Organic growth/(decline) (89,760) Interest-bearing demand Public Funds Savings Money Markets Balance as of September 30 $ 9,888,088 Other Time Retail CDs Brokered CDs Noninterest-bearing Dollars shown in millions Dollars shown in thousands 21

Investment Portfolio . Total EOP investments of approximately $3.2 billion . Investment portfolio / total assets = approximately 23% . Portfolio duration = estimated 3.5 years Portfolio Composition Portfolio Quality Corporate Debt obligations of U.S. securities Government Agency AA+ Regulatory stock 3% 1% 4% AA Non-Agency 3% 4% CMOs AA- 4% 4% AAA FRB/FHLB Stock Non-Agency pass- 15% 4% through securities Agency CMOs A+ 4% 24% 3% Agency pass- BBB through securities 2% 15% Other Commercial MBSs 11% 16% Asset-backed Agency securities 53% 15% Municipal bond securities 15% 22

Noninterest Income and Noninterest Expense Noninterest Income Noninterest Expense 1 Total $28.7 million Total $85.4 million $4,611 $19,224 16% 22% $1,739 6% $10,316 36% $4,502 $3,029 5% $50,852 11% $10,837 60% 13% $5,261 $3,728 18% 13% Salaries and benefits Occupancy and equipment Service Charges Wealth Mgmt Data processing Other Bankcard Client derivatives Gains from sales of loans Other 1 Includes $7.4 million of merger-related expenses Combined FTE 2,293 2,205 2,152 2,118 2,028 930 901 863 1,363 1,304 1,289 3Q17 4Q17 1Q18 2Q18 3Q18 FTE-FFBC FTE-MSFG All dollars shown in thousands 23

Asset Quality Classified Assets / Total Assets Nonperforming Assets / Total Assets 1.08% 0.98% 0.98% 1.00% 1.00% 0.60% 0.50% 0.52% 0.46% 0.47% $139.3 $138.9 $64.2 $64.6 $52.9 $44.4 $46.3 $94.3 $87.3 $87.6 3Q17 4Q17 1Q18 2Q18 3Q18 3Q17 4Q17 1Q18 2Q18 3Q18 Classified Assets Classified Assets / Total Assets NPAs NPAs / Total Assets Allowance / Total Loans Net Charge Offs & Provision Expense 0.22% 0.18% 0.91% 0.90% 0.89% 0.13% 0.65% 0.02% -0.02% 0.61% $4.0 $3.7 $3.3 $54.5 $54.0 $54.4 $54.1 $57.7 $3.0 $3.2 $2.3 $1.9 3Q17 4Q17 1Q18 2Q18 3Q18 $0.3 -$0.2 -$0.4 3Q17 4Q17 1Q18 2Q18 3Q18 Allowance for Loan Losses ALLL / Total Loans NCOs Provision Expense NCOs / Average Loans All dollars shown in millions 24

Capital Tangible Book Value Per Share Total Capital Ratio $11.75 $11.62 $11.36 $11.25 13.77% $11.01 13.36% 13.17% 12.50% 12.98% 13.07% 3Q17 4Q17 1Q18 2Q18 3Q18 3Q17 4Q17 1Q18 2Q18 3Q18 Tangible Book Value per Share Total Capital Ratio Target Tier 1 Common Equity Ratio Tangible Common Equity Ratio 11.52% 8.53% 10.50% 11.15% 8.30% 8.41% 8.30% 10.77% 8.25% 10.53% 10.63% 7.50% 3Q17 4Q17 1Q18 2Q18 3Q18 3Q17 4Q17 1Q18 2Q18 3Q18 Tier 1 Common Equity Ratio Target Tangible Common Equity Ratio Target All capital numbers are considered preliminary 25

Presentation Contents About First Financial Bancorp Financial Performance Appendix 26

Appendix: Executive Chairman & CEO Roles . Claude Davis has assumed the role of Executive Chairman of the board . Three-year term, then transitions to Non-executive Chairman . Chairman & Archie Brown, Jr. serving as President & CEO, member of the board CEO Roles . Jointly leading the company, partnering on strategy, management & performance . Also jointly leading the transition team to ensure successful cultural integration . Newly created role to provide capacity for CEO to focus on business execution & results . Role will focus on: . Board Integration . Strategy . Executive Investor Relations . Chairman Role Corporate Development . Community, Regulatory & Government Relations . Regulatory Management Model . Oversee development of ERM model to meet the increased regulatory & compliance requirements of a $10B+ bank 27

Appendix: Company Overview Executive Team Line of Business Leaders . . Commercial Finance – Rick Dennen Chief Banking Officer – Anthony Stollings . . Commercial – Brad Ringwald Chief Financial Officer – Jamie Anderson . . Investment Commercial Real Estate – Paul Silva Chief Administrative Officer – John Gavigan . . Wealth Management & Private Banking – Greg Chief Credit Officer – Bill Harrod Harris . Chief Risk Officer – Shannon Kuhl . Consumer – Chris Harrison . General Counsel – Karen Woods . Mortgage – Ann Davis . Chief Internal Auditor – Matt Burgess 28

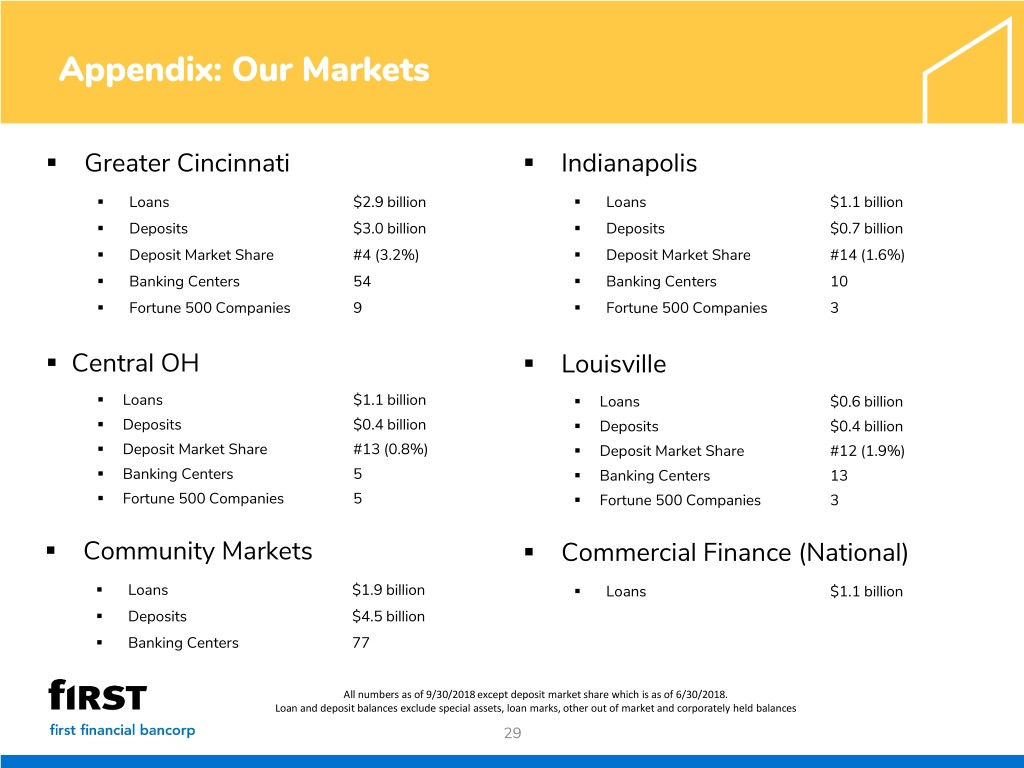

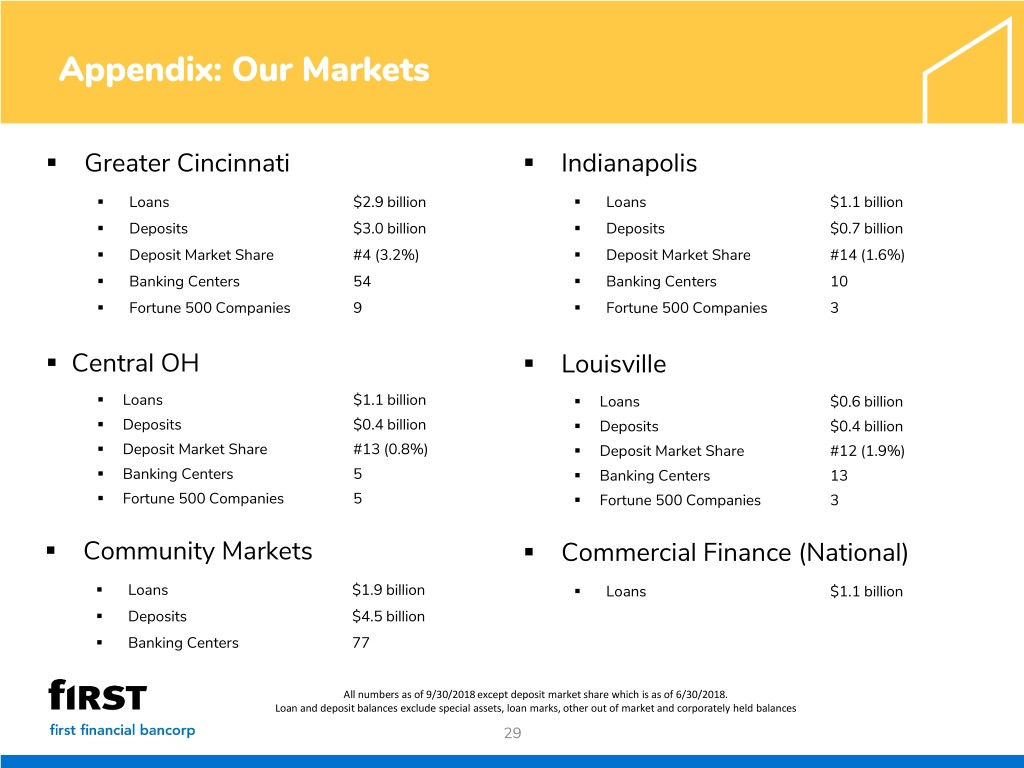

Appendix: Our Markets . . Greater Cincinnati Indianapolis . . Loans $2.9 billion Loans $1.1 billion . . Deposits $3.0 billion Deposits $0.7 billion . . Deposit Market Share #4 (3.2%) Deposit Market Share #14 (1.6%) . . Banking Centers 54 Banking Centers 10 . . Fortune 500 Companies 9 Fortune 500 Companies 3 . . Central OH Louisville . . Loans $1.1 billion Loans $0.6 billion . . Deposits $0.4 billion Deposits $0.4 billion . . Deposit Market Share #13 (0.8%) Deposit Market Share #12 (1.9%) . . Banking Centers 5 Banking Centers 13 . . Fortune 500 Companies 5 Fortune 500 Companies 3 . . Community Markets Commercial Finance (National) . . Loans $1.9 billion Loans $1.1 billion . Deposits $4.5 billion . Banking Centers 77 All numbers as of 9/30/2018 except deposit market share which is as of 6/30/2018. Loan and deposit balances exclude special assets, loan marks, other out of market and corporately held balances 29

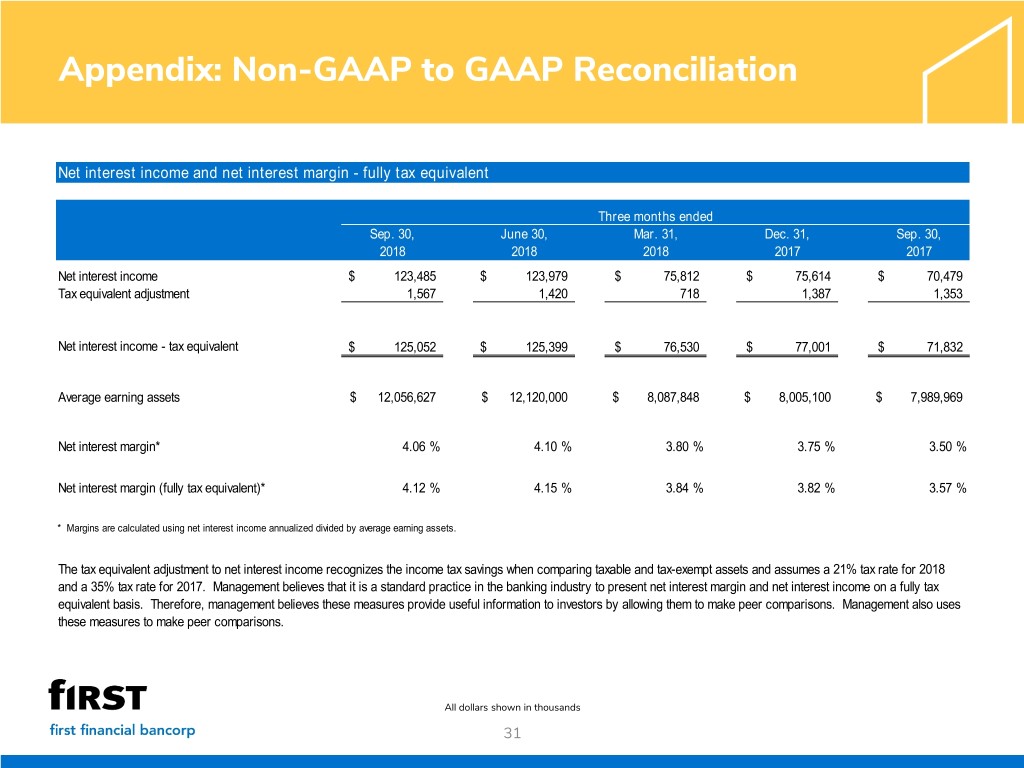

Appendix: Non-GAAP Measures The Company’s earnings release and accompanying presentation contain certain financial information determined by methods other than in accordance with accounting principles generally accepted in the United States (GAAP). Such non-GAAP financial information should be considered supplemental to, and not as a substitute for, or superior to, financial measures calculated in accordance with GAAP. However, we believe that non-GAAP reporting provides meaningful information and therefore we use it to supplement our GAAP information. We have chosen to provide this supplemental information to investors, analysts and other interested parties to enable them to perform additional analyses of operating results, to illustrate the results of operations giving effect to the non-GAAP adjustments and to provide an additional measure of performance. We believe this information is helpful in understanding the results of operations separate and apart from items that may, or could, have a disproportional positive or negative impact in any given period. For a reconciliation of the differences between the non-GAAP financial measures and the most comparable GAAP measures, please refer to the following reconciliation tables. to GAAP Reconciliation 30

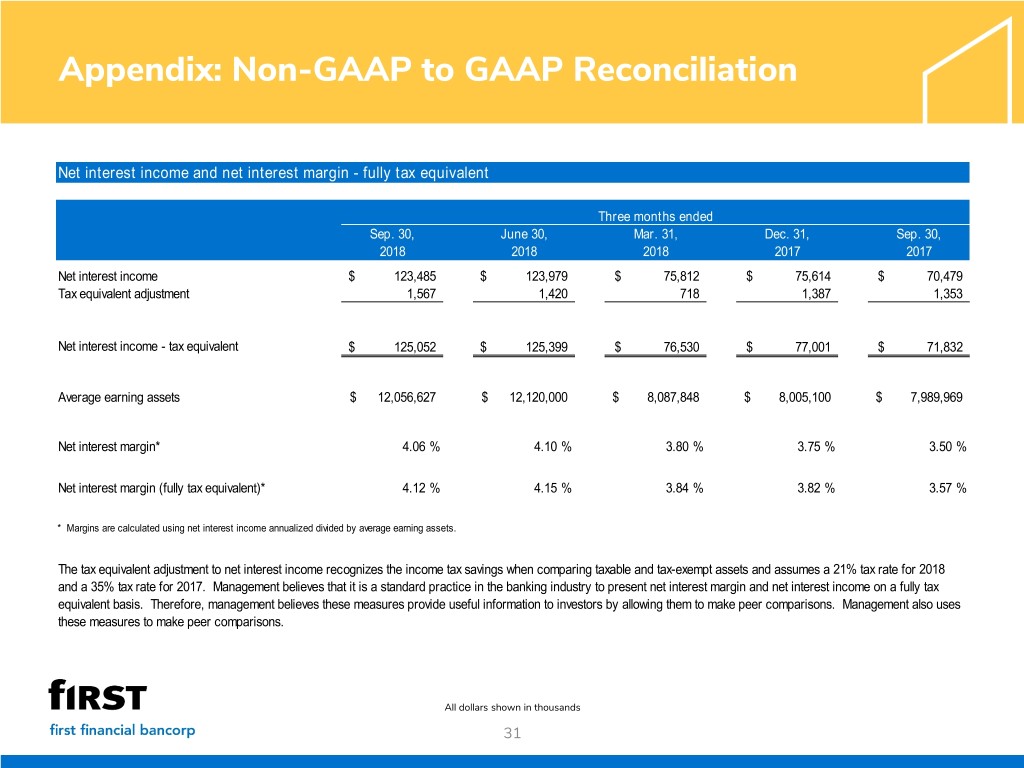

Appendix: Non-GAAP to GAAP Reconciliation Net interest income and net interest margin - fully tax equivalent Three months ended Sep. 30, June 30, Mar. 31, Dec. 31, Sep. 30, 2018 2018 2018 2017 2017 Net interest income $ 123,485 $ 123,979 $ 75,812 $ 75,614 $ 70,479 Tax equivalent adjustment 1,567 1,420 718 1,387 1,353 Net interest income - tax equivalent $ 125,052 $ 125,399 $ 76,530 $ 77,001 $ 71,832 Average earning assets $ 12,056,627 $ 12,120,000 $ 8,087,848 $ 8,005,100 $ 7,989,969 Net interest margin* 4.06 % 4.10 % 3.80 % 3.75 % 3.50 % Net interest margin (fully tax equivalent)* 4.12 % 4.15 % 3.84 % 3.82 % 3.57 % * Margins are calculated using net interest income annualized divided by average earning assets. The tax equivalent adjustment to net interest income recognizes the income tax savings when comparing taxable and tax-exempt assets and assumes a 21% tax rate for 2018 and a 35% tax rate for 2017. Management believes that it is a standard practice in the banking industry to present net interest margin and net interest income on a fully tax equivalent basis. Therefore, management believes these measures provide useful information to investors by allowing them to make peer comparisons. Management also uses these measures to make peer comparisons. All dollars shown in thousands 31

Appendix: Non-GAAP to GAAP Reconciliation Additional non-GAAP ratios Three months ended YTD Sep. 30, June 30, Mar. 31, Dec. 31, Sep. 30, Sep. 30, Sep. 30, (Dollars in thousands, except per share data) 2018 2018 2018 2017 2017 2018 2017 Net income (a) $ 50,657 $ 36,418 $ 30,506 $ 24,811 $ 24,826 $ 117,581 $ 71,976 Average total shareholders' equity 2,021,400 2,000,093 929,474 920,194 908,057 1,654,322 889,760 Less: Goodwill and other intangibles (935,930) (937,457) (209,244) (209,571) (209,933) (696,872) (210,218) Average tangible equity (b) 1,085,470 1,062,636 720,230 710,623 698,124 957,450 679,542 Total shareholders' equity 2,035,520 2,012,937 939,985 930,664 914,954 2,035,520 914,954 Less: Goodwill and other intangibles (934,360) (934,656) (209,053) (209,379) (209,730) (934,360) (209,730) Ending tangible equity (c) 1,101,160 1,078,281 730,932 721,285 705,224 1,101,160 705,224 Total assets 13,842,667 13,920,167 8,898,429 8,896,923 8,761,689 13,842,667 8,761,689 Less: Goodwill and other intangibles (934,360) (934,656) (209,053) (209,379) (209,730) (934,360) (209,730) Ending tangible assets (d) 12,908,307 12,985,511 8,689,376 8,687,544 8,551,959 12,908,307 8,551,959 Risk-weighted assets (e) 10,222,466 10,251,147 7,240,731 7,108,629 7,090,714 10,222,466 7,090,714 Total average assets 13,822,675 13,956,360 8,830,176 8,731,956 8,716,917 12,221,358 8,570,777 Less: Goodwill and other intangibles (935,930) (937,457) (209,244) (209,571) (209,933) (696,872) (210,218) Average tangible assets (f) $ 12,886,745 $ 13,018,903 $ 8,620,932 $ 8,522,385 $ 8,506,984 $ 11,524,486 $ 8,360,559 Ending shares outstanding (g) 97,914,526 97,904,897 62,213,823 62,069,087 62,061,465 97,914,526 62,061,465 Ratios Return on average tangible shareholders' equity (a)/(b) 18.52% 13.75% 17.18% 13.85% 14.11% 16.42% 14.16% Ending tangible equity as a percent of: Ending tangible assets (c)/(d) 8.53% 8.30% 8.41% 8.30% 8.25% 8.53% 8.25% Risk-weighted assets (c)/(e) 10.77% 10.52% 10.09% 10.15% 9.95% 10.77% 9.95% Average tangible equity as a percent of average tangible assets (b)/(f) 8.42% 8.16% 8.35% 8.34% 8.21% 8.31% 8.13% Tangible book value per share (c)/(g) $ 11.25 $ 11.01 $ 11.75 $ 11.62 $ 11.36 $ 11.25 $ 11.36 All dollars shown in thousands 32

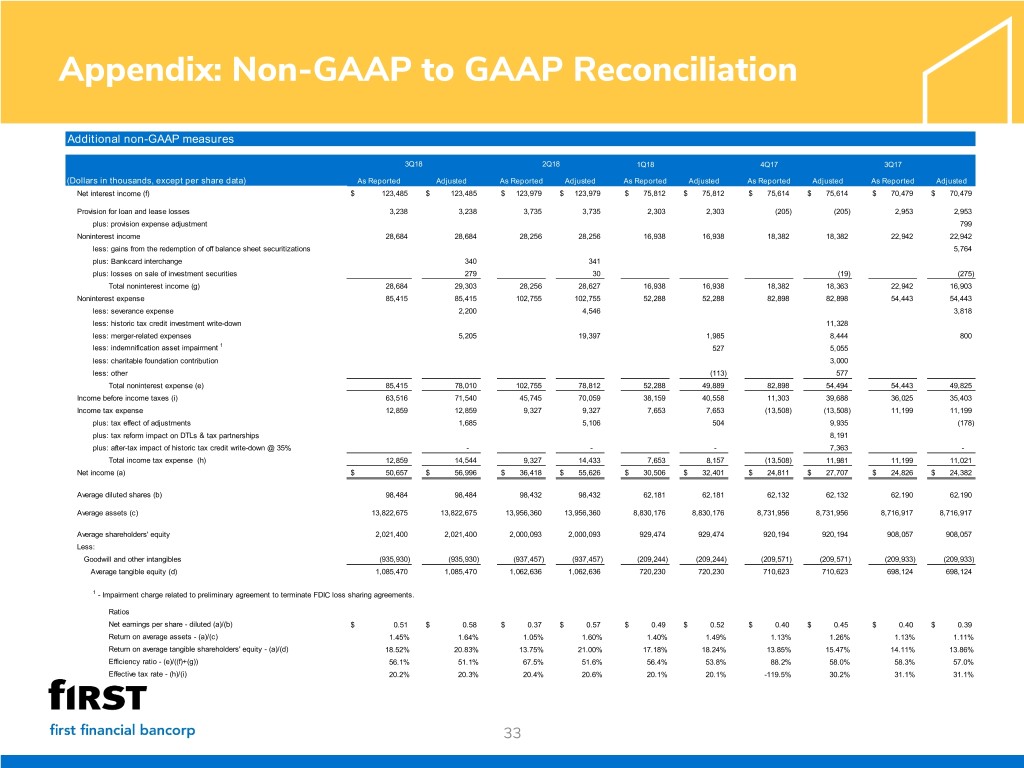

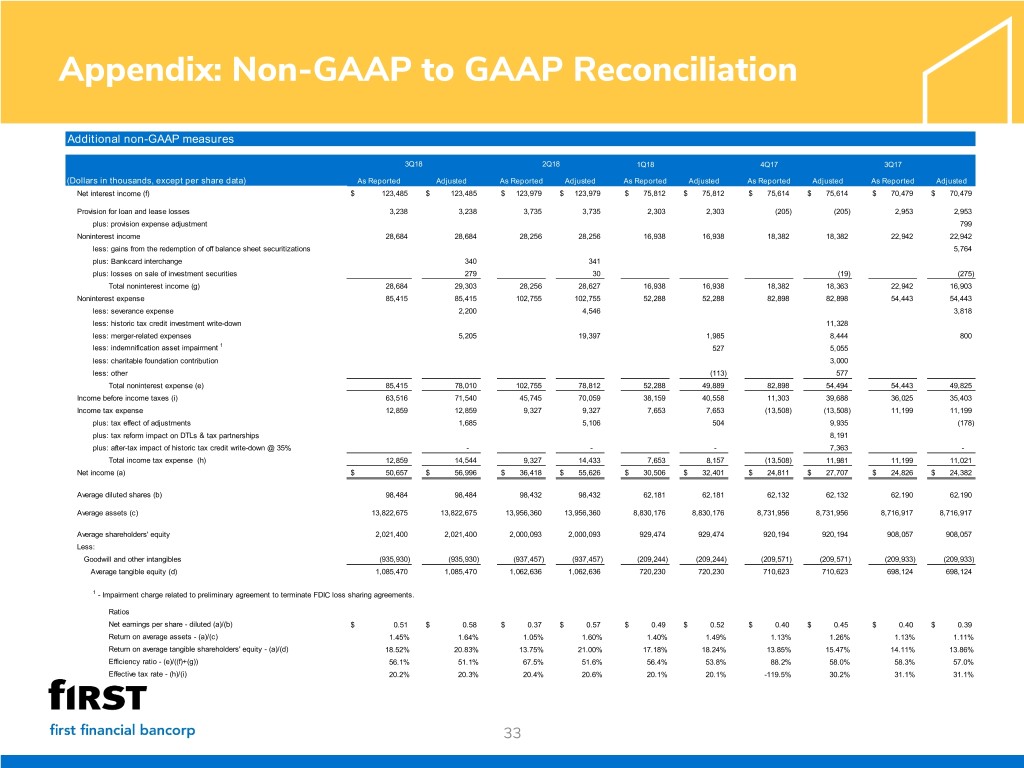

Appendix: Non-GAAP to GAAP Reconciliation Additional non-GAAP measures 3Q18 2Q18 1Q18 4Q17 3Q17 (Dollars in thousands, except per share data) As Reported Adjusted As Reported Adjusted As Reported Adjusted As Reported Adjusted As Reported Adjusted Net interest income (f) $ 123,485 $ 123,485 $ 123,979 $ 123,979 $ 75,812 $ 75,812 $ 75,614 $ 75,614 $ 70,479 $ 70,479 Provision for loan and lease losses 3,238 3,238 3,735 3,735 2,303 2,303 (205) (205) 2,953 2,953 plus: provision expense adjustment 799 Noninterest income 28,684 28,684 28,256 28,256 16,938 16,938 18,382 18,382 22,942 22,942 less: gains from the redemption of off balance sheet securitizations 5,764 plus: Bankcard interchange 340 341 plus: losses on sale of investment securities 279 30 (19) (275) Total noninterest income (g) 28,684 29,303 28,256 28,627 16,938 16,938 18,382 18,363 22,942 16,903 Noninterest expense 85,415 85,415 102,755 102,755 52,288 52,288 82,898 82,898 54,443 54,443 less: severance expense 2,200 4,546 3,818 less: historic tax credit investment write-down 11,328 less: merger-related expenses 5,205 19,397 1,985 8,444 800 less: indemnification asset impairment 1 527 5,055 less: charitable foundation contribution 3,000 less: other (113) 577 Total noninterest expense (e) 85,415 78,010 102,755 78,812 52,288 49,889 82,898 54,494 54,443 49,825 Income before income taxes (i) 63,516 71,540 45,745 70,059 38,159 40,558 11,303 39,688 36,025 35,403 Income tax expense 12,859 12,859 9,327 9,327 7,653 7,653 (13,508) (13,508) 11,199 11,199 plus: tax effect of adjustments 1,685 5,106 504 9,935 (178) plus: tax reform impact on DTLs & tax partnerships 8,191 plus: after-tax impact of historic tax credit write-down @ 35% - - - 7,363 - Total income tax expense (h) 12,859 14,544 9,327 14,433 7,653 8,157 (13,508) 11,981 11,199 11,021 Net income (a) $ 50,657 $ 56,996 $ 36,418 $ 55,626 $ 30,506 $ 32,401 $ 24,811 $ 27,707 $ 24,826 $ 24,382 Average diluted shares (b) 98,484 98,484 98,432 98,432 62,181 62,181 62,132 62,132 62,190 62,190 Average assets (c) 13,822,675 13,822,675 13,956,360 13,956,360 8,830,176 8,830,176 8,731,956 8,731,956 8,716,917 8,716,917 Average shareholders' equity 2,021,400 2,021,400 2,000,093 2,000,093 929,474 929,474 920,194 920,194 908,057 908,057 Less: Goodwill and other intangibles (935,930) (935,930) (937,457) (937,457) (209,244) (209,244) (209,571) (209,571) (209,933) (209,933) Average tangible equity (d) 1,085,470 1,085,470 1,062,636 1,062,636 720,230 720,230 710,623 710,623 698,124 698,124 1 - Impairment charge related to preliminary agreement to terminate FDIC loss sharing agreements. Ratios Net earnings per share - diluted (a)/(b) $ 0.51 $ 0.58 $ 0.37 $ 0.57 $ 0.49 $ 0.52 $ 0.40 $ 0.45 $ 0.40 $ 0.39 Return on average assets - (a)/(c) 1.45% 1.64% 1.05% 1.60% 1.40% 1.49% 1.13% 1.26% 1.13% 1.11% Return on average tangible shareholders' equity - (a)/(d) 18.52% 20.83% 13.75% 21.00% 17.18% 18.24% 13.85% 15.47% 14.11% 13.86% Efficiency ratio - (e)/((f)+(g)) 56.1% 51.1% 67.5% 51.6% 56.4% 53.8% 88.2% 58.0% 58.3% 57.0% Effective tax rate - (h)/(i) 20.2% 20.3% 20.4% 20.6% 20.1% 20.1% -119.5% 30.2% 31.1% 31.1% 33

Update -New colors 34