® Deferral Portfolio Reporting November 30, 2020 Exhibit 99.1

Loans Under Deferral as of 11/30/20 $429 million, or 4.6%, of total loans, excluding PPP, remain under deferral $358 million, or 84%, is currently projected for Round 3 (booked and pipeline) $56 million, or 13%, is in Round 2 (booked and pipeline) $15 million, or 3%, remains in Round 1 $76 million, or 18%, are full payment deferrals while the remaining $353 million, or 82%, are interest only payments $1.7 billion, or 79%, of the original $2.2 billion has exited the deferral portfolio and returned to normal payment 2 All dollars shown in millions Hotel $255 59% Franchise $38 9% Other ICRE $91 21% Other $45 11% Total $429 Million

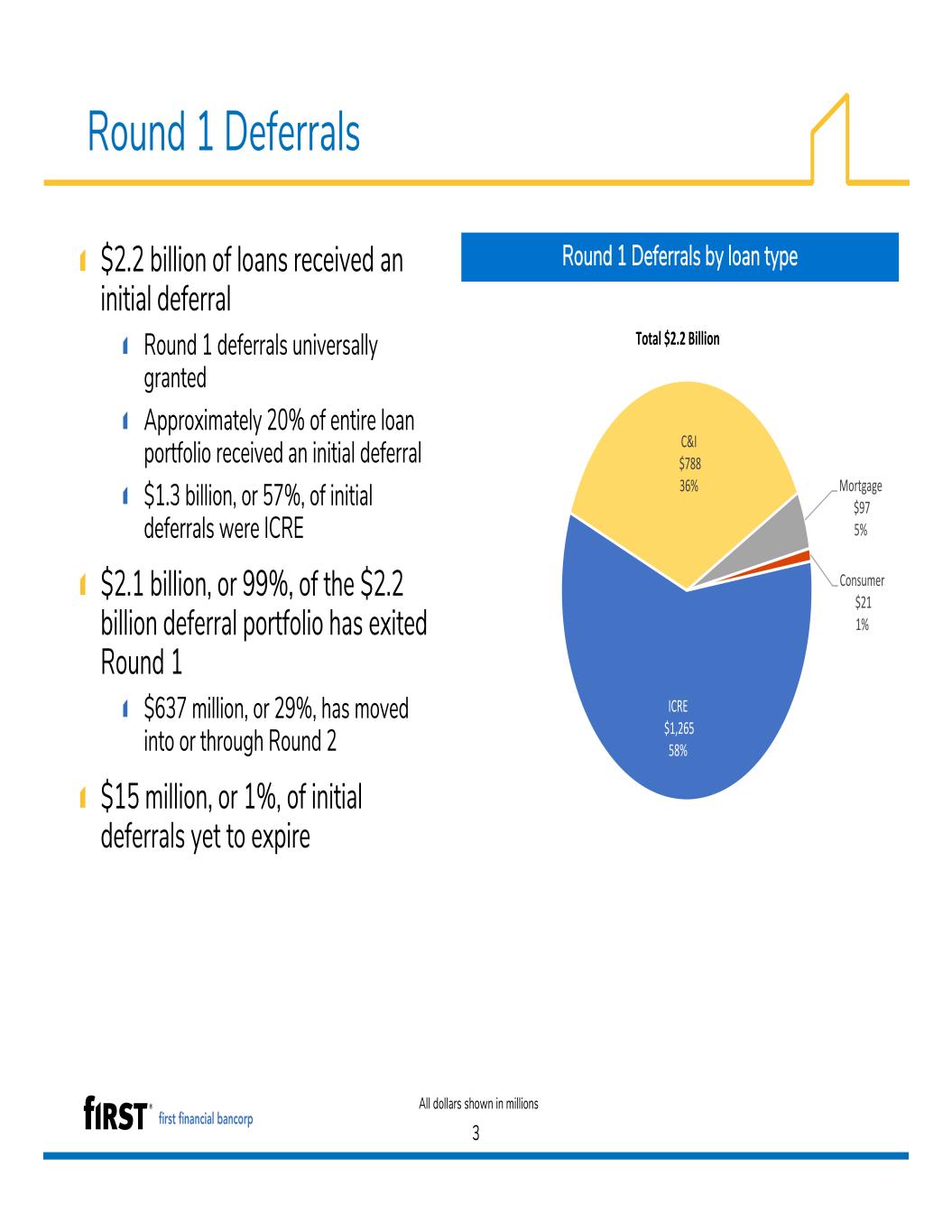

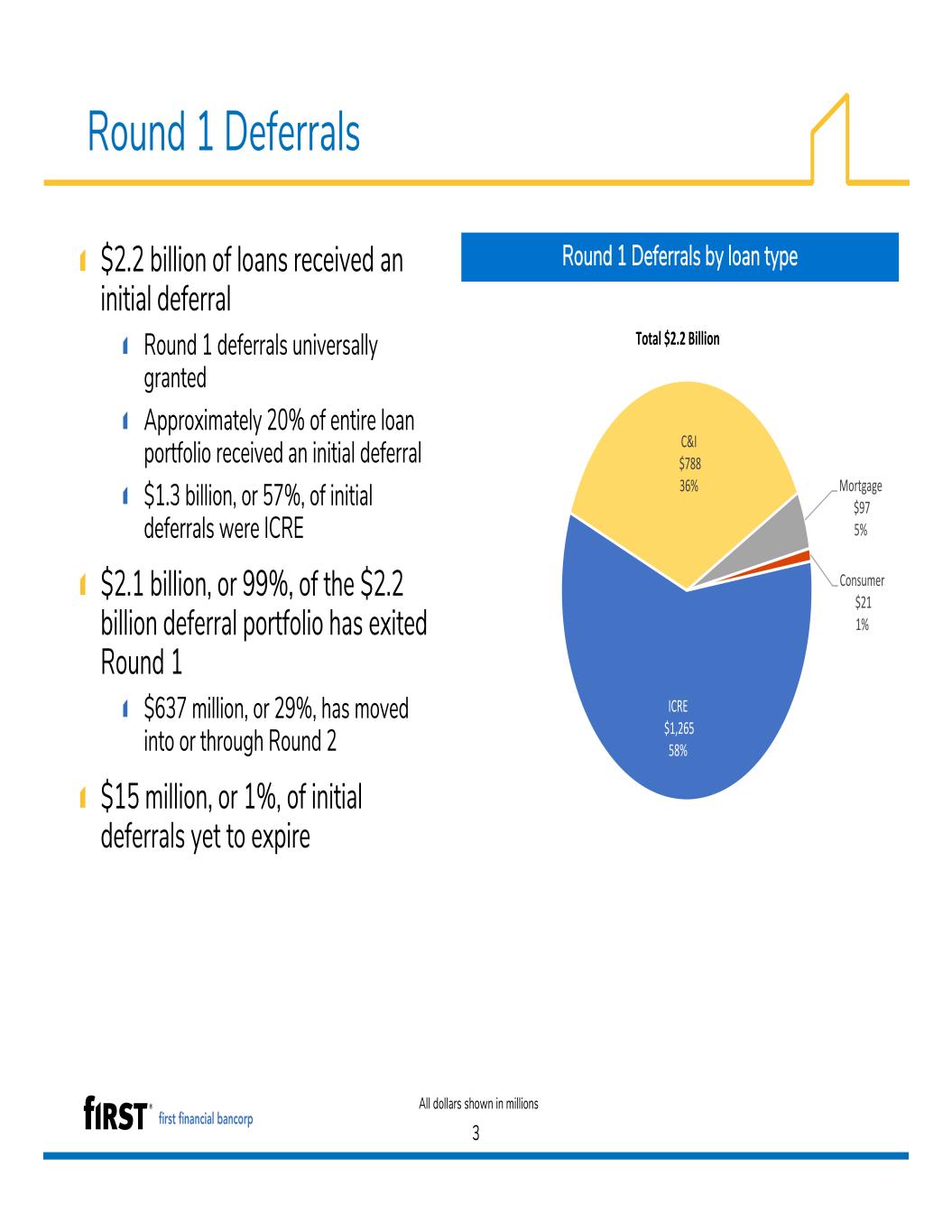

Round 1 Deferrals $2.2 billion of loans received an initial deferral Round 1 deferrals universally granted Approximately 20% of entire loan portfolio received an initial deferral $1.3 billion, or 57%, of initial deferrals were ICRE $2.1 billion, or 99%, of the $2.2 billion deferral portfolio has exited Round 1 $637 million, or 29%, has moved into or through Round 2 $15 million, or 1%, of initial deferrals yet to expire 3 Round 1 Deferrals by loan type All dollars shown in millions ICRE $1,265 58% C&I $788 36% Mortgage $97 5% Consumer $21 1% Total $2.2 Billion

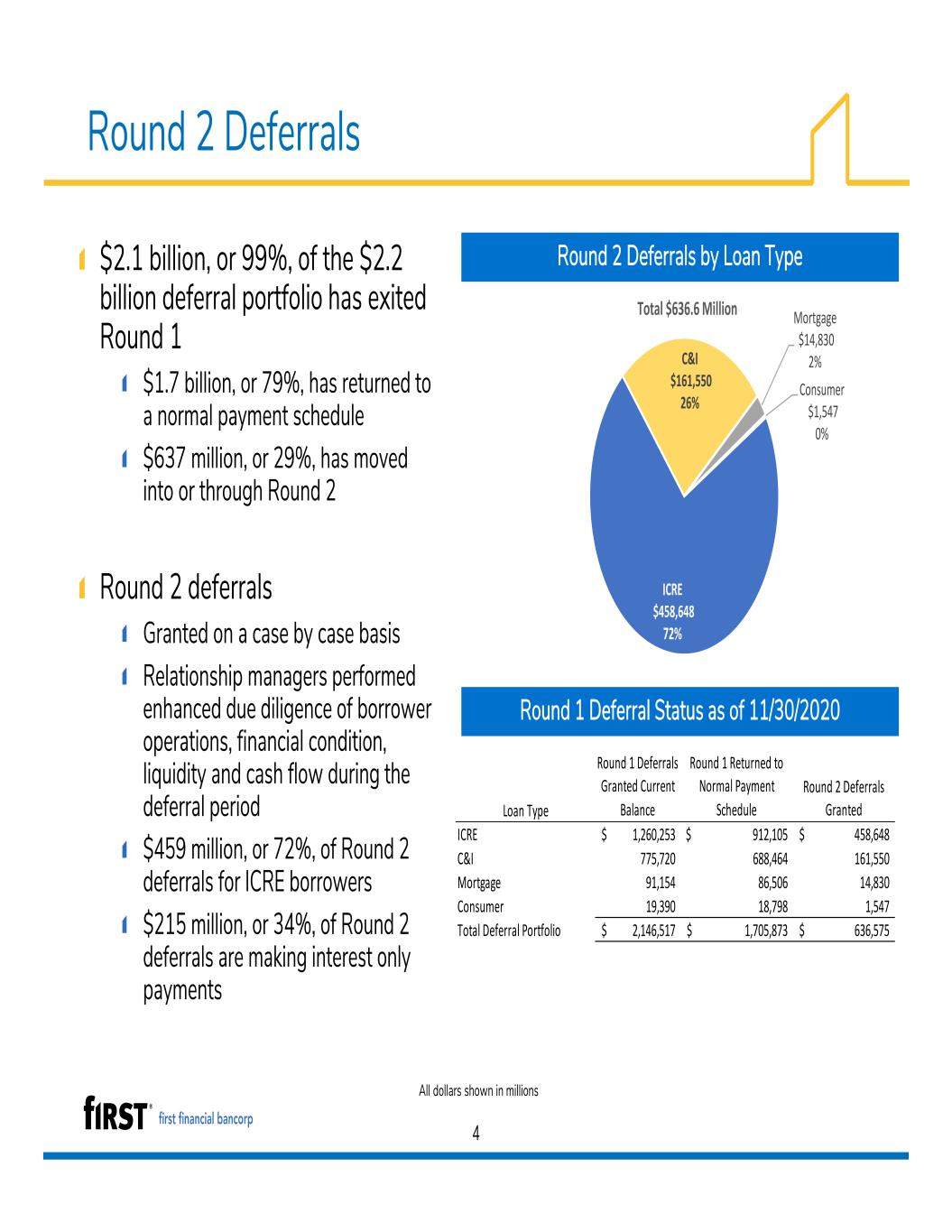

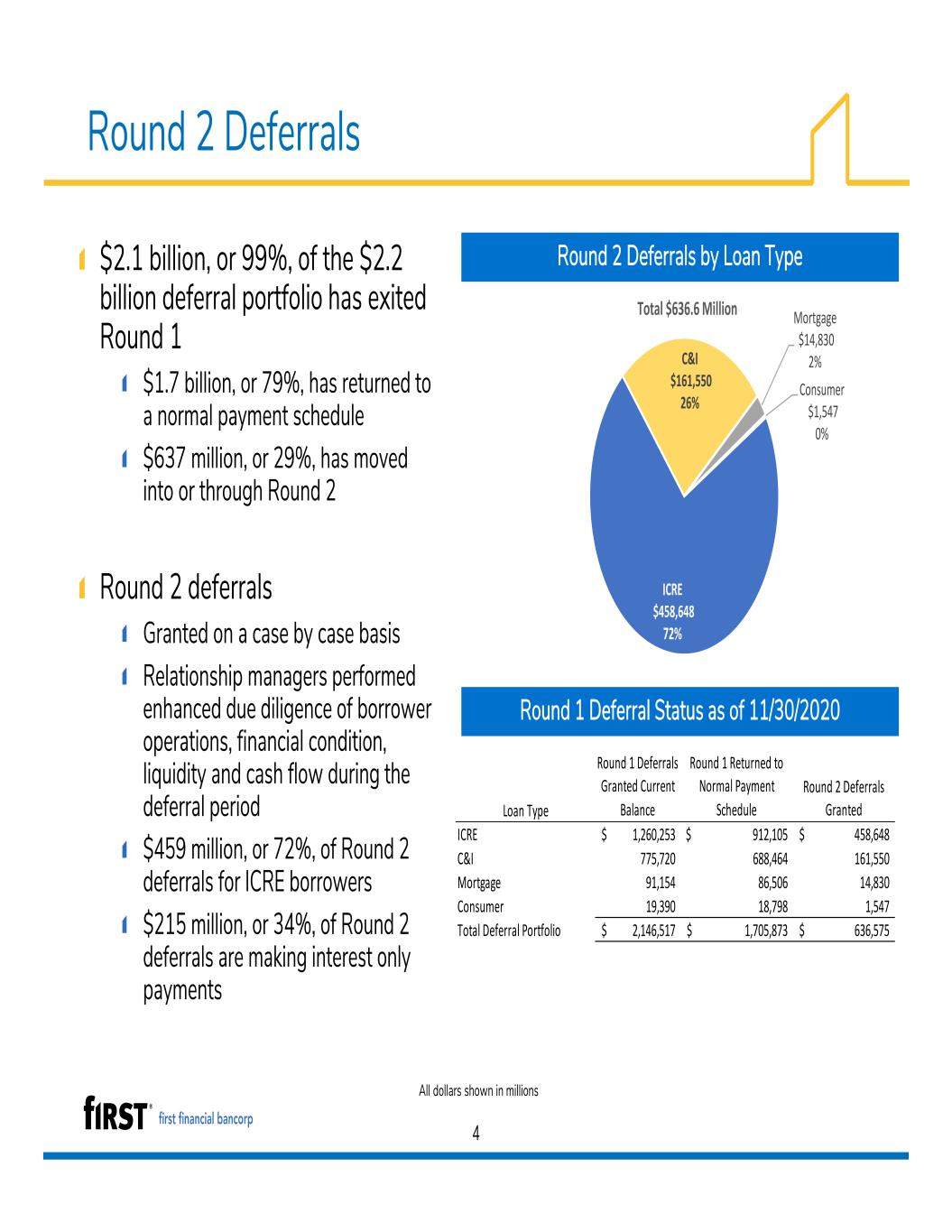

Round 2 Deferrals $2.1 billion, or 99%, of the $2.2 billion deferral portfolio has exited Round 1 $1.7 billion, or 79%, has returned to a normal payment schedule $637 million, or 29%, has moved into or through Round 2 Round 2 deferrals Granted on a case by case basis Relationship managers performed enhanced due diligence of borrower operations, financial condition, liquidity and cash flow during the deferral period $459 million, or 72%, of Round 2 deferrals for ICRE borrowers $215 million, or 34%, of Round 2 deferrals are making interest only payments 4 Round 2 Deferrals by Loan Type Round 1 Deferral Status as of 11/30/2020 All dollars shown in millions ICRE $458,648 72% C&I $161,550 26% Mortgage $14,830 2% Consumer $1,547 0% Total $636.6 Million Loan Type Round 1 Deferrals Granted Current Balance Round 1 Returned to Normal Payment Schedule Round 2 Deferrals Granted ICRE 1,260,253$ 912,105$ 458,648$ C&I 775,720 688,464 161,550 Mortgage 91,154 86,506 14,830 Consumer 19,390 18,798 1,547 Total Deferral Portfolio 2,146,517$ 1,705,873$ 636,575$

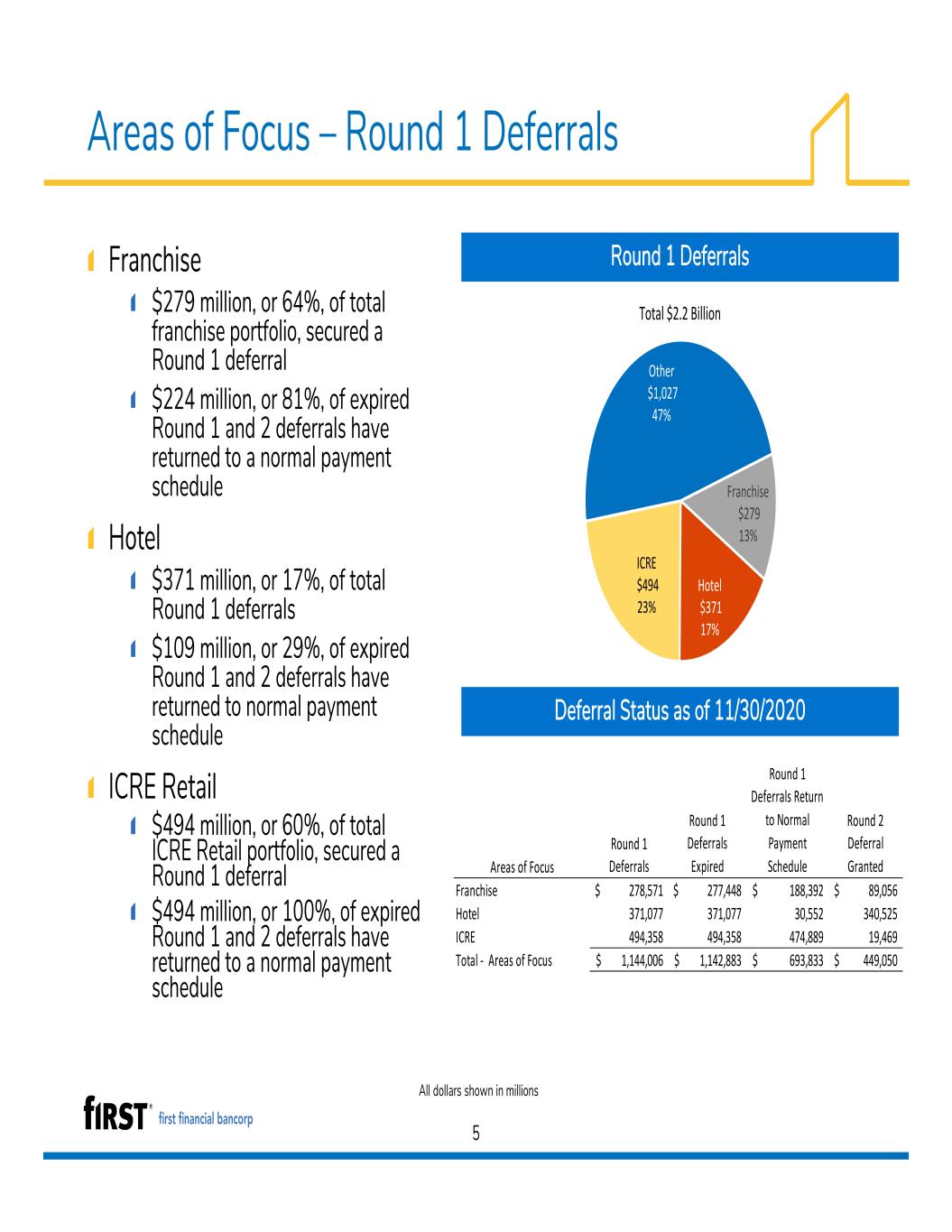

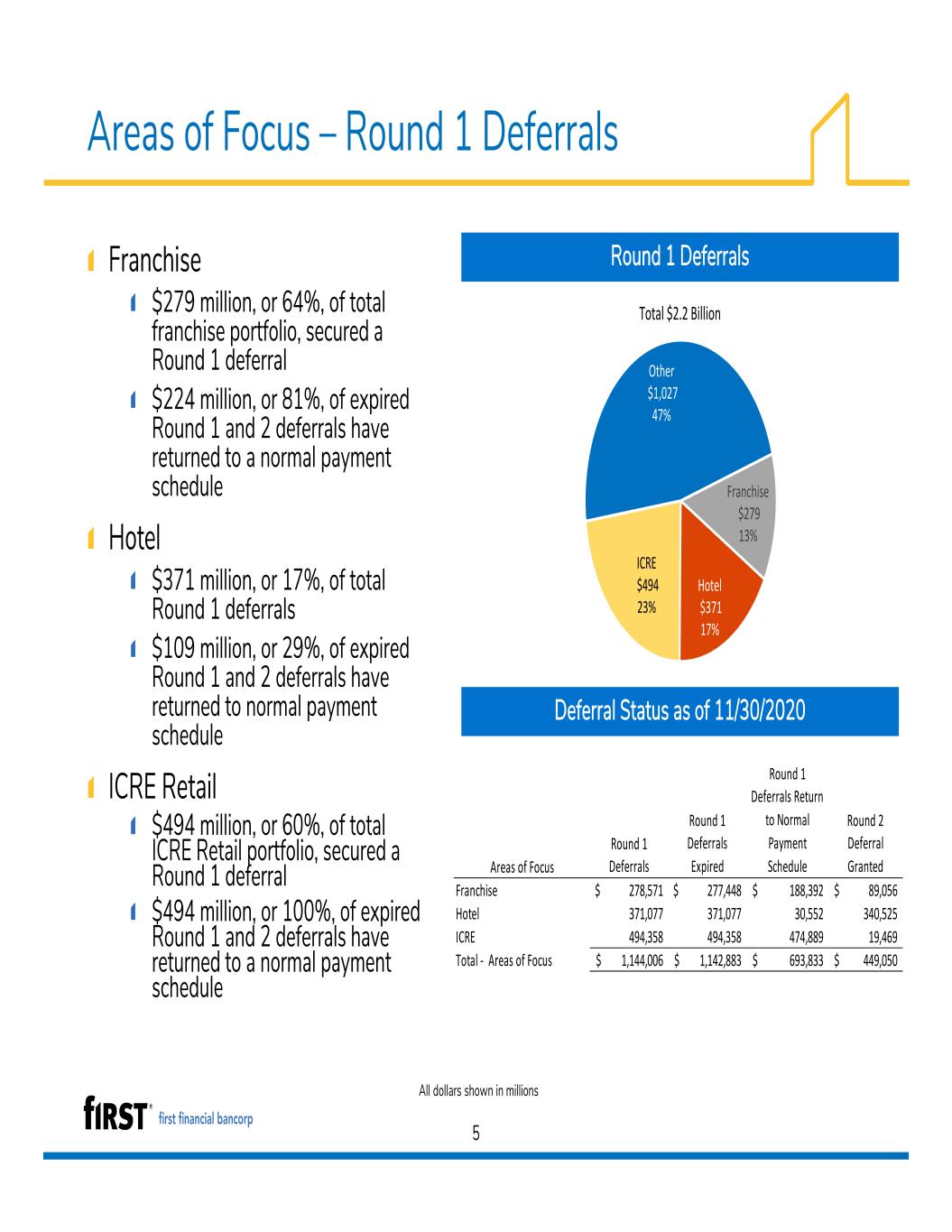

Areas of Focus – Round 1 Deferrals Franchise $279 million, or 64%, of total franchise portfolio, secured a Round 1 deferral $224 million, or 81%, of expired Round 1 and 2 deferrals have returned to a normal payment schedule Hotel $371 million, or 17%, of total Round 1 deferrals $109 million, or 29%, of expired Round 1 and 2 deferrals have returned to normal payment schedule ICRE Retail $494 million, or 60%, of total ICRE Retail portfolio, secured a Round 1 deferral $494 million, or 100%, of expired Round 1 and 2 deferrals have returned to a normal payment schedule 5 Round 1 Deferrals Deferral Status as of 11/30/2020 All dollars shown in millions Franchise $279 13% Hotel $371 17% ICRE $494 23% Other $1,027 47% Total $2.2 Billion Areas of Focus Round 1 Deferrals Round 1 Deferrals Expired Round 1 Deferrals Return to Normal Payment Schedule Round 2 Deferral Granted Franchise 278,571$ 277,448$ 188,392$ 89,056$ Hotel 371,077 371,077 30,552 340,525 ICRE 494,358 494,358 474,889 19,469 Total ‐ Areas of Focus 1,144,006$ 1,142,883$ 693,833$ 449,050$

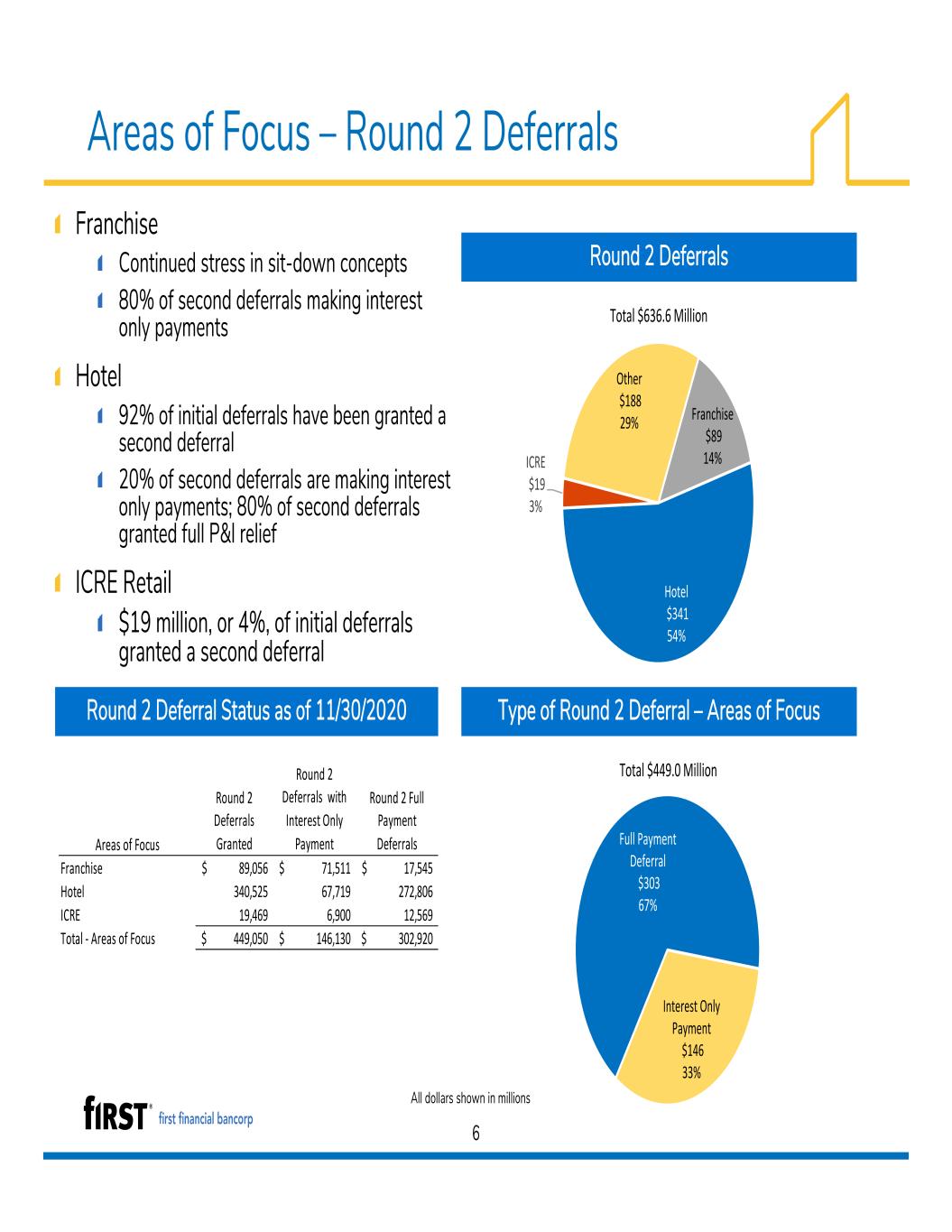

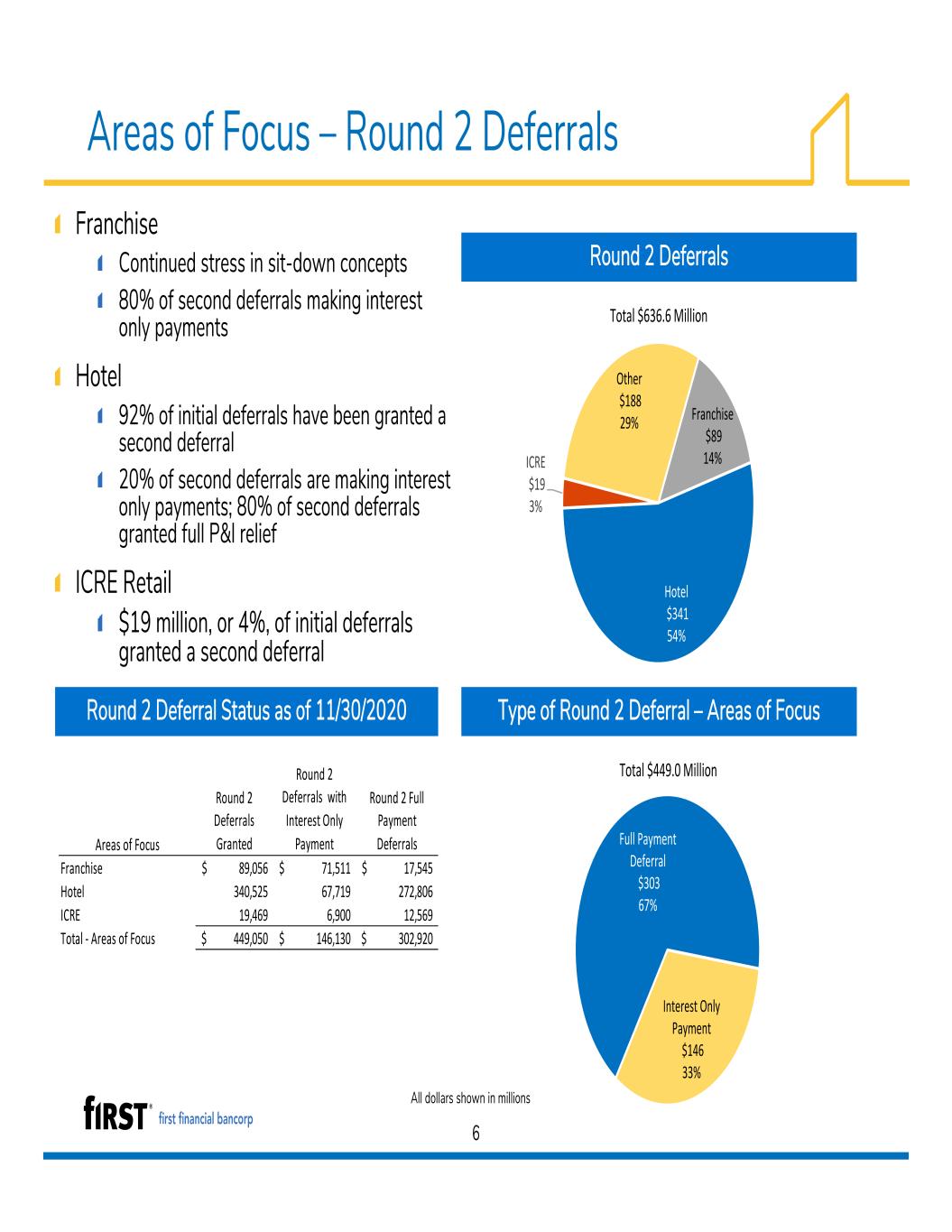

Areas of Focus – Round 2 Deferrals Franchise Continued stress in sit-down concepts 80% of second deferrals making interest only payments Hotel 92% of initial deferrals have been granted a second deferral 20% of second deferrals are making interest only payments; 80% of second deferrals granted full P&I relief ICRE Retail $19 million, or 4%, of initial deferrals granted a second deferral 6 Round 2 Deferrals Type of Round 2 Deferral – Areas of Focus All dollars shown in millions Round 2 Deferral Status as of 11/30/2020 Interest Only Payment $146 33% Full Payment Deferral $303 67% Total $449.0 Million Franchise $89 14% Hotel $341 54% ICRE $19 3% Other $188 29% Total $636.6 Million Areas of Focus Round 2 Deferrals Granted Round 2 Deferrals with Interest Only Payment Round 2 Full Payment Deferrals Franchise 89,056$ 71,511$ 17,545$ Hotel 340,525 67,719 272,806 ICRE 19,469 6,900 12,569 Total ‐ Areas of Focus 449,050$ 146,130$ 302,920$

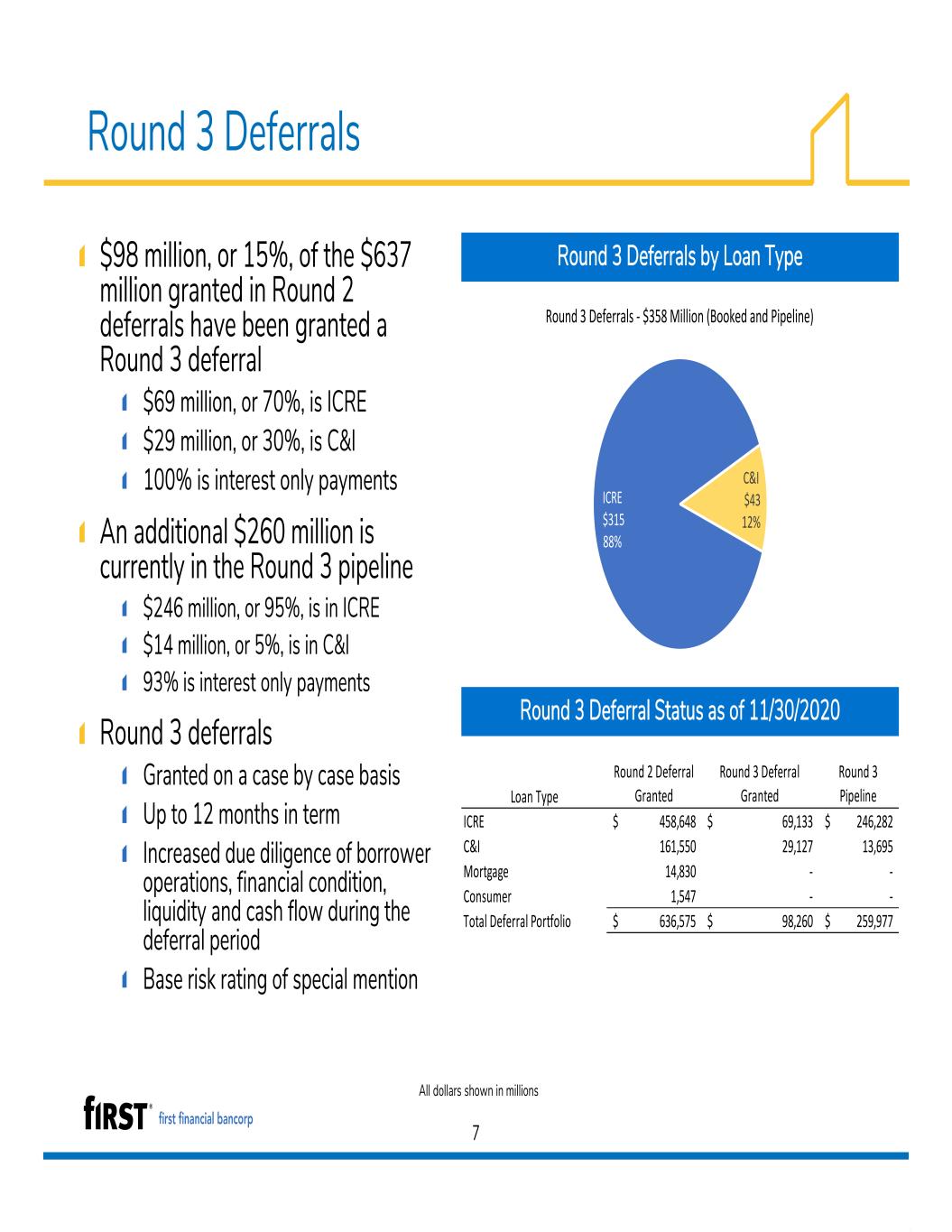

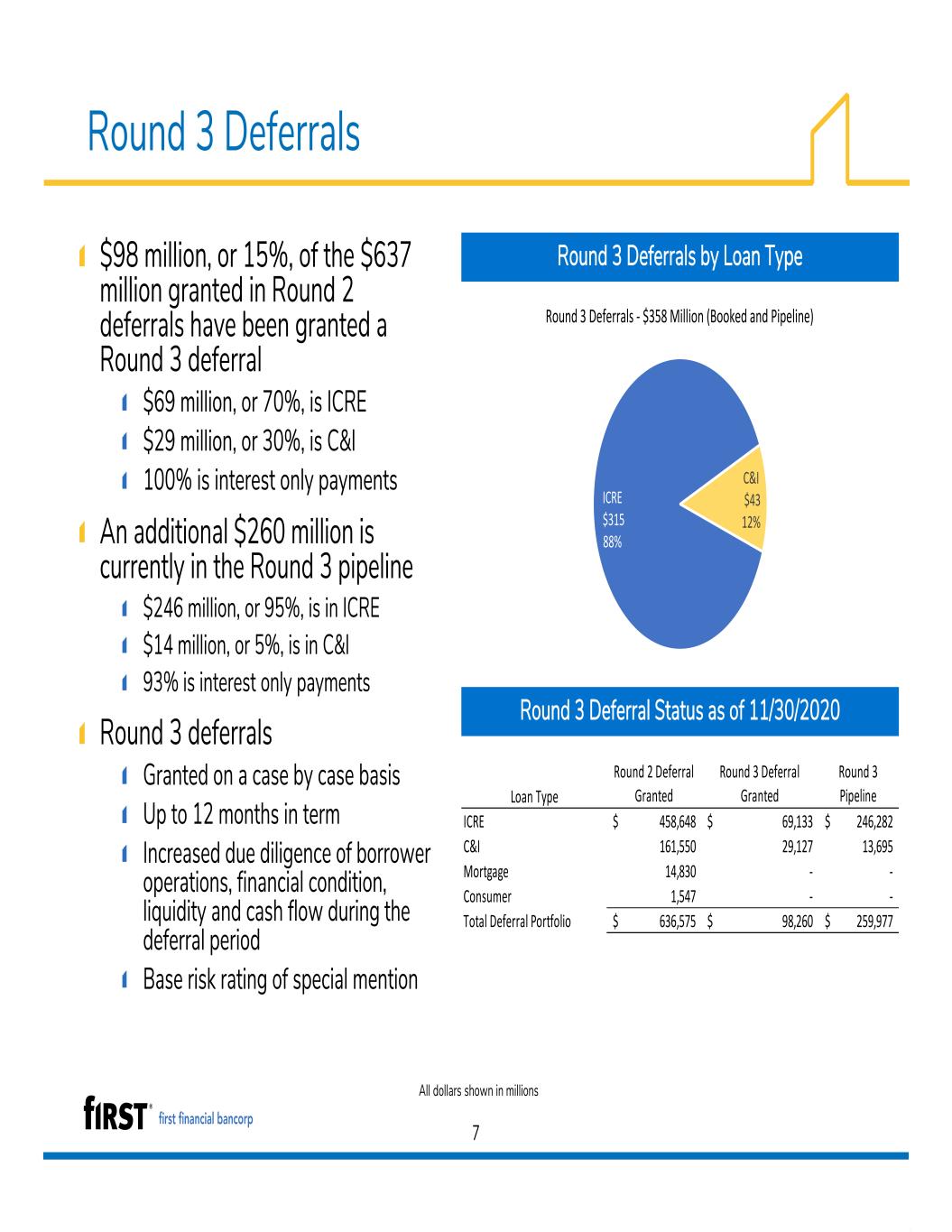

Round 3 Deferrals $98 million, or 15%, of the $637 million granted in Round 2 deferrals have been granted a Round 3 deferral $69 million, or 70%, is ICRE $29 million, or 30%, is C&I 100% is interest only payments An additional $260 million is currently in the Round 3 pipeline $246 million, or 95%, is in ICRE $14 million, or 5%, is in C&I 93% is interest only payments Round 3 deferrals Granted on a case by case basis Up to 12 months in term Increased due diligence of borrower operations, financial condition, liquidity and cash flow during the deferral period Base risk rating of special mention 7 Round 3 Deferrals by Loan Type Round 3 Deferral Status as of 11/30/2020 All dollars shown in millions ICRE $315 88% C&I $43 12% Round 3 Deferrals ‐ $358 Million (Booked and Pipeline) Loan Type Round 2 Deferral Granted Round 3 Deferral Granted Round 3 Pipeline ICRE 458,648$ 69,133$ 246,282$ C&I 161,550 29,127 13,695 Mortgage 14,830 ‐ ‐ Consumer 1,547 ‐ ‐ Total Deferral Portfolio 636,575$ 98,260$ 259,977$

® First Financial Bancorp First Financial Center 225 East Fifth Street Cincinnati, OH 45202