Exhibit 99.2

Acquisition of Summit Funding Group

2 Certain statements contained in this report that are not statements of historical fact constitute forward - looking statements wit hin the meaning of the Private Securities Litigation Reform Act of 1995. Words such as ''believes,'' ''anticipates,'' "likely," "expected," "estimated," ''intends'' and other similar expressio ns are intended to identify forward - looking statements but are not the exclusive means of identifying such statements. Examples of forward - looking statements include, but are not limited to, statemen ts we make about (i) our future operating or financial performance, including revenues, income or loss and earnings or loss per share, (ii) future common stock dividends, (iii) our ca pital structure, including future capital levels, (iv) our plans, objectives and strategies, and (v) the assumptions that underlie our forward - looking statements. As with any forecast or projection, forward - looking statements are subject to inherent uncertainties, risks and changes in circu mstances that may cause actual results to differ materially from those set forth in the forward - looking statements. Forward - looking statements are not historical facts but instead express only management's beliefs regarding future results or events, many of which, by their nature, are inherently uncertain and outside of management's control. It is possible that actual results and out comes will differ, possibly materially, from the anticipated results or outcomes indicated in these forward - looking statements. Important factors that could cause actual results to differ materially f rom those in our forward - looking statements include the following, without limitation: • economic, market, liquidity, credit, interest rate, operational and technological risks associated with First Financial’s bus i ness; • future credit quality and performance, including our expectations regarding future loan losses and our allowance for credit l o sses; • the effect of and changes in policies and laws or regulatory agencies, including the Dodd - Frank Wall Street Reform and Consume r Protection Act and other legislation and regulation relating to the banking industry; • Management's ability to effectively execute its business plans; • mergers and acquisitions, including costs or difficulties related to the integration of acquired companies; • the possibility that any of the anticipated benefits of First Financial’s acquisitions will not be realized or will not be re a lized within the expected time period; • the effect of changes in accounting policies and practices; • changes in consumer spending, borrowing and saving and changes in unemployment; • changes in customers' performance and creditworthiness; • the costs and effects of litigation and of unexpected or adverse outcomes in such litigation; • current and future economic and market conditions, including the effects of declines in housing prices, high unemployment rat e s, U.S. fiscal debt, budget and tax matters, geopolitical matters, and any slowdown in global economic growth; • the adverse impact on the U.S. economy, including the markets in which we operate, of the novel coronavirus, which causes the Coronavirus disease 2019 global pandemic, and the impact of a slowing U.S. economy and increased unemployment on the performance of our loan and lease portfolio, the market va lue of our investment securities, the availability of sources of funding and the demand for our products; • our capital and liquidity requirements (including under regulatory capital standards, such as the Basel III capital standards ) and our ability to generate capital internally or raise capital on favorable terms; • financial services reform and other current, pending or future legislation or regulation that could have a negative effect on our revenue and businesses, including the Dodd - Frank Act and other legislation and regulation relating to bank products and services; • the effect of the current interest rate environment or changes in interest rates or in the level or composition of our assets or liabilities on our net interest income, net interest margin and our mortgage originations, mortgage servicing rights and mortgage loans held for sale; • the effect of a fall in stock market prices on our brokerage, asset and wealth management businesses; • a failure in or breach of our operational or security systems or infrastructure, or those of our third - party vendors or other service providers, including as a result of cyber attacks; • the effect of changes in the level of checking or savings account deposits on our funding costs and net interest margin; and • our ability to develop and execute effective business plans and strategies. Additional factors that may cause our actual results to differ materially from those described in our forward - looking statements can be found in our Form 10 - K for the year ended December 31, 2020, as well as our other filings with the SEC, which are available on the SEC website at www.sec.gov. All forward - looking statements included in this filing are made as of the date hereof and are based on information available at the time of the filing. Except as required by law, First Financial does not assume any obligation to update any forward - looking statement. Forward Looking Statement Disclosure

Transaction Overview First Financial will acquire Summit Funding Group (“Summit”), a full - service equipment finance company, headquartered locally in Cincinnati and operating across all 50 states and Canada Transaction is highly accretive to earnings, additive to First Financial’s growth profile and represents a strategic use of excess capital and liquidity 3 • Complements First Financial’s existing business lines, enhancing exposure to the highly attractive and growing equipment finance market for SME customers • Adds a national platform at scale: 4 th largest independent U.S. equipment finance platform 1 , with ~$400M of originations expected in 2022 • Additive to First Financial’s growth prospects, with double - digit origination growth forecasted • Accretive to earnings, net interest margin, ROA and ROATCE with a transaction IRR of ~30% • Existing banking relationship between First Financial and Summit – high cultural alignment • Strong risk management and historical credit performance • Highly effective use of First Financial’s excess capital and liquidity • Accelerating transaction benefits over time, with meaningful potential upside • Adds an enviable roster of SME clients; material revenue synergies identified, but not modeled, represent further potential for upside Strategically and Financially Accretive Acquisition Low Risk Transaction with High Embedded Upside 1 Source: 2020 Monitor 100 Report

Summit Funding Group Overview Summit is a full - service equipment finance company operating throughout the U.S. and Canada Offers both full payout and residual - based leases, across its two operating divisions: Middle market : ~$500k average ticket; middle market companies to large corporates Vendor finance : ~$80k average ticket; small - and - medium sized businesses Long history of originating high - quality “bank - ready” leases – currently partners with banks (including First Financial) in funding its originated portfolio Attractive opportunity for First Financial to leverage low cost of funds, hold production on balance sheet and benefit from highly attractive unit economics Loss - adjusted total lease yields of ~8% All - in, steady - state ROA of ~3.0% 1 Has developed exceptional asset management expertise Founded, grown and managed by exceptional leadership Led by founder Rick Ross; all members of management will join First Financial 4 Company Overview Key Statistics Headquarters Founded Geography Scaled Platform Mason (Cincinnati), Ohio 1993 (nearly 30 - year track record) All 50 U.S. states and Canada ~$400M of annual originations (2022E), growing at double - digits Currently manages ~$500M outstanding balances across 4,000 leases Deep and Diverse Relationships Highly Attractive Risk Adjusted Returns Employees 70 Total lease yields of ~9.3% (implicit lease rate of ~6.3% and residual realization of ~3.0%) Exceptional loss history; <1% average annual charge - offs All - in, after - tax ROA of ~3.0% 1 200+ SME businesses and corporates 100+ OEMs; 50+ Vendors Significant cross - sell opportunity 1 Estimated projected performance of steady - state business under First Financial ownership.

Transaction Details 5 Strategic Use of Excess Capital and Liquidity Consideration Highly Attractive Financial Returns Consideration at closing consists of $111.5 million in cash and approximately 400k FFBC shares; total transaction value of ~$121 million 1 Expected to originate ~$400 million in volume in 2022; forecasted to achieve double - digit origination growth in the near and medium term Significant ramp - up in earnings as business transitions towards a bank - funded model Mid - single digit EPS accretion in 2023, double digit EPS accretion in 2024 and growing Transaction IRR of ~30%; accretive to net interest margin, ROA and ROATCE Significant Potential Upside Significant commercial cross - sell opportunities identified, but not modeled Upfront transaction value based on conservative growth assumptions relative to platform potential under First Financial’s ownership Earn - out arrangement structured to align incentives above base case performance as modeled Results in significant enhancement to First Financial’s financial returns if achieved First Financial is currently highly liquid and operating with excess capital: Loans / Deposits of ~74%; Cash and Securities / Total Assets of ~29% ; Total Capital Ratio of ~15.0% Remain well - capitalized pro forma; ~85 basis points dilutive to risk - based capital ratios at closing TBVPS dilution at close of ~$0.93; recovery of initial TBVPS dilution in approximately 1 year; cross - over earnback of under 5 years 1 Based on FFBC’s 20 - day trailing VWAP of $24.71.

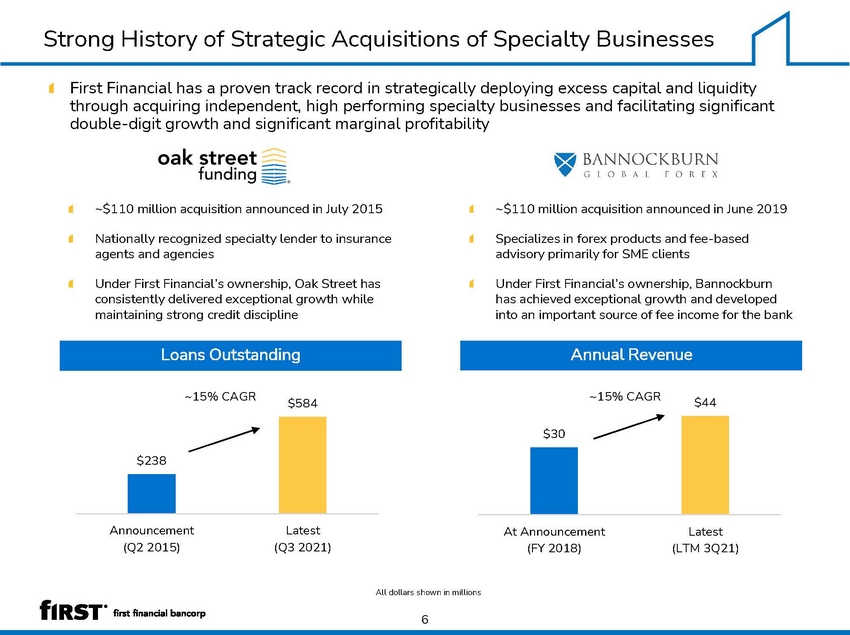

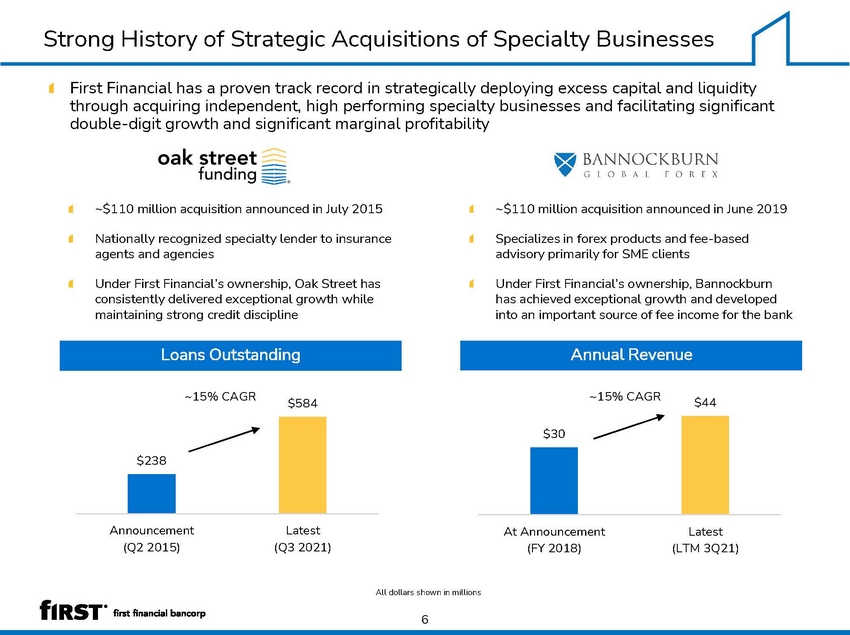

Strong History of Strategic Acquisitions of Specialty Businesses First Financial has a proven track record in strategically deploying excess capital and liquidity through acquiring independent, high performing specialty businesses and facilitating significant double - digit growth and significant marginal profitability 6 All dollars shown in millions ~$110 million acquisition announced in June 2019 Specializes in forex products and fee - based advisory primarily for SME clients Under First Financial’s ownership, Bannockburn has achieved exceptional growth and developed into an important source of fee income for the bank Loans Outstanding Annual Revenue ~$110 million acquisition announced in July 2015 Nationally recognized specialty lender to insurance agents and agencies Under First Financial’s ownership, Oak Street has consistently delivered exceptional growth while maintaining strong credit discipline $238 $584 Announcement (Q2 2015) Latest (Q3 2021) $30 $44 At Announcement (FY 2018) Latest (LTM 3Q21) ~15% CAGR ~15% CAGR

7 First Financial Bancorp First Financial Center 255 East Fifth Street Suite 800 Cincinnati, OH 45202