1

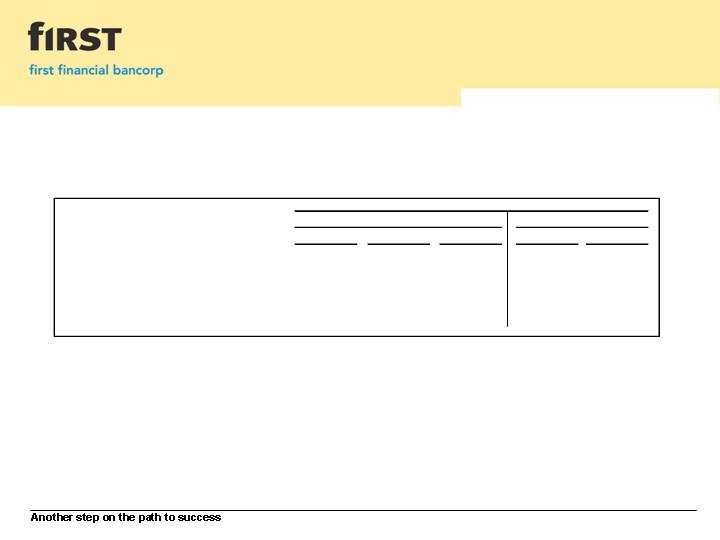

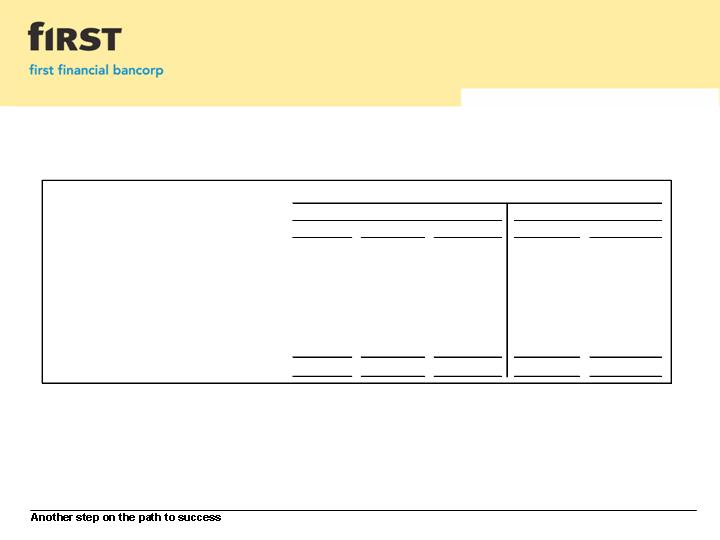

Return on Average Assets &

Return on Average Shareholders’ Equity

Table I

EXHIBIT 99.2

4Q-08

3Q-08

4Q-07

2008

2007

Return on Average Assets

0.23%

0.66%

1.27%

0.67%

1.08%

Return on Average Shareholders' Equity

2.89%

8.24%

15.37%

8.21%

12.73%

Quarter

Year

2

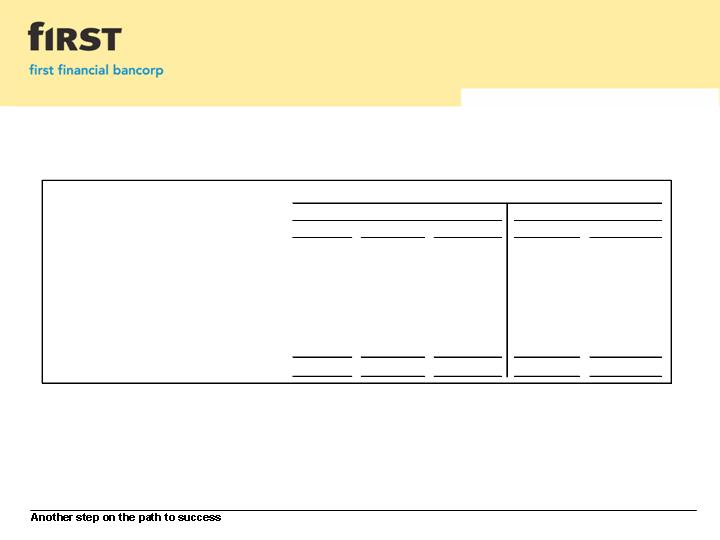

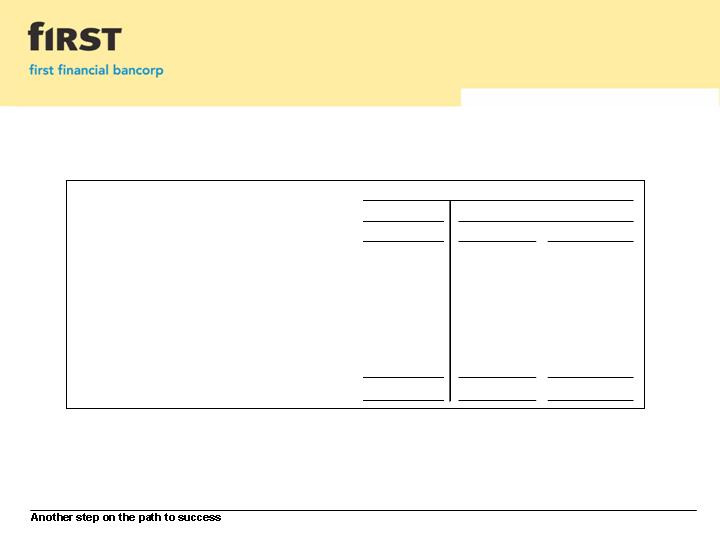

Summary of Significant Items

Table II

Table II

Full-Year

4Q

3Q

Full-Year

4Q

3Q

Loss on FHLMC shares*

(3,738)

$

(137)

$

(3,400)

$

-

$

-

$

-

$

Increase in Loan Loss Reserve & Higher

Charge-offs

(7,539)

(7,539)

-

-

-

-

Gain on Sale of Merchant Payment Processing

Portfolio

-

-

-

5,501

5,501

-

Pension Settlement Charges

-

-

-

(2,222)

(2,222)

-

Gains on Sales of Investment Securities

(VISA 2008; MasterCard 2007)

1,585

-

-

367

-

367

Gain on Sale of Mortgage Servicing Rights

-

-

-

1,061

-

-

Visa Member Litigation Charges

-

-

-

(461)

(461)

-

Impact to Pre-Tax Net Income

(9,692)

$

(7,676)

$

(3,400)

$

4,246

$

2,818

$

367

$

After-Tax Impact to Earnings Per Diluted Share

(0.17)

$

(0.13)

$

(0.06)

$

0.07

$

0.05

$

0.01

$

*

2008

Loss related to the company's investment in 200,000 Federal Home Loan Mortgage Corporation (FHLMC) perpetual preferred series V shares.

($ in thousands, excluding per share data)

2007

3

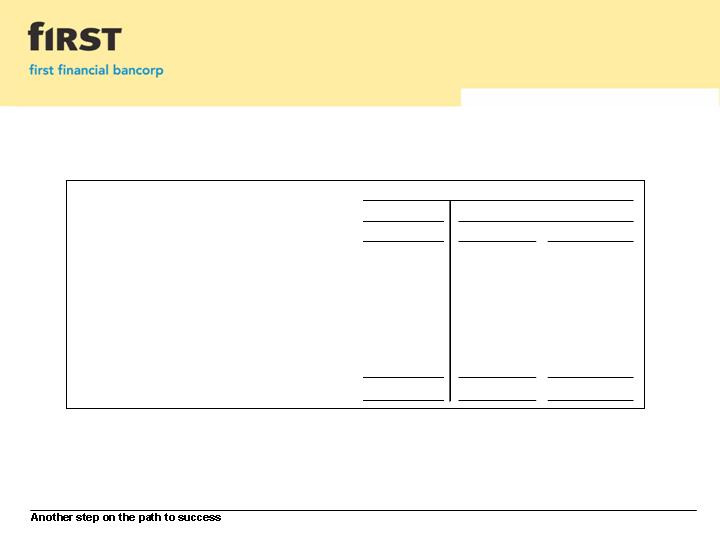

Credit Quality Trends

Table III

December 31,

2008

September 30,

2008

June 30,

2008

March 31,

2008

December 31,

2007

December 31,

2008

December 31,

2007

Total Nonperforming Loans

18,185

$

14,038

$

15,366

$

15,253

$

14,680

$

18,185

$

14,680

$

Total Nonperforming Assets

22,213

$

18,648

$

19,129

$

17,621

$

17,316

$

22,213

$

17,316

$

Nonperforming Assets as a % of:

Period-End Loans, Plus Other Real Estate Owned

0.83%

0.70%

0.71%

0.67%

0.67%

0.83%

0.67%

Total Assets

0.60%

0.53%

0.55%

0.53%

0.51%

0.60%

0.51%

Nonperforming Loans as a % of Total Loans

0.68%

0.53%

0.57%

0.58%

0.56%

0.68%

0.56%

Allowance for Loan & Lease Losses

35,873

$

30,353

$

29,580

$

29,718

$

29,057

$

35,873

$

29,057

$

Allowance for Loan & Lease Losses as a % of:

Period-End Loans

1.34%

1.14%

1.11%

1.14%

1.12%

1.34%

1.12%

Nonaccrual Loans

199.5%

219.5%

199.7%

202.3%

205.9%

199.5%

205.9%

Nonperforming Loans

197.3%

216.2%

192.5%

194.8%

197.9%

197.3%

197.9%

Total Net Charge-Offs

4,955

$

2,446

$

2,631

$

2,652

$

1,719

$

12,594

$

5,981

$

Annualized Net-Charge-Offs as a % of Average

Loans & Leases

0.73%

0.36%

0.40%

0.40%

0.26%

0.47%

0.24%

($ in thousands)

Three Months Ended

Twelve Months Ended

4

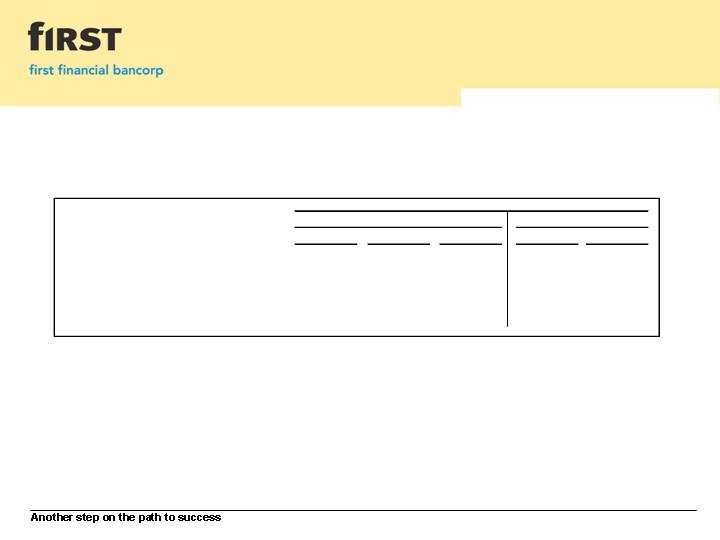

Capital Management

Table IV

FFBC

Bank

Regulatory

"well-capitalized"

minimum

Leverage Ratio

10.00%

8.77%

5%

Tier 1 Capital Ratio

12.38%

10.86%

6%

Total Risk-based Capital Ratio

13.62%

12.37%

10%

EOP Tangible Equity /

EOP Tangible Assets

8.70%

N/A

N/A

EOP Tangible Common Equity /

EOP Tangible Assets

6.52%

N/A

N/A

N/A = not applicable

5

Net Interest Income &

Net Interest Margin

Table V

4Q-08

3Q-08

4Q-07

2008

2007

Net Interest Income

30,129

$

29,410

$

29,079

$

116,202

$

118,500

$

Net Interest Margin

3.67%

3.68%

3.79%

3.71%

3.94%

Net Interest Margin

(fully tax equivalent)

3.71%

3.73%

3.86%

3.77%

4.01%

Quarter

($ in thousands)

Year

6

Noninterest Income

Table VI

4Q-08

3Q-08

4Q-07

2008

2007

Loss on FHLMC shares

(137)

$

(3,400)

$

-

$

(3,738)

$

-

$

Gain on Sale of Merchant Payment Processing

Portfolio

-

-

5,501

-

5,501

Gain on Sale of Mortgage Servicing Rights

-

-

-

-

1,061

Gains on Sales of Investment Securities

(VISA 2008; MasterCard 2007)

-

-

-

1,585

367

Impact to Noninterest Income

(137)

$

(3,400)

$

5,501

$

(2,153)

$

6,929

$

Quarter

Year

($ in thousands)

7

Noninterest Expense

Table VII

Quarter

4Q-07

2008

2007

Pension Settlement Charges

2,222

$

-

$

2,222

$

Visa Member Litigation Charges

461

-

461

Liability for Retiree Medical Benefits

-

(1,285)

-

Severance Costs

-

-

1,620

(Gain) Loss on Properties & Fixed Assets

(227)

-

(575)

Impact to Noninterest Expense

2,456

$

(1,285)

$

3,728

$

Year

($ in thousands)

8

Investment Portfolio

Table VIII

($ in thousands, excluding book price and market value)

Base

% of

Book

Book

Book

12/31/2008

Gain/

Total

Value

Yield

Price

Market Value

(Loss)

Agency's

6.7%

$ 46,681

5.33

99.74

103.58

$ 1,731

CMO's (Agency)

19.4%

134,353

4.96

100.42

101.85

1,882

CMO's (Private)

0.0%

104

3.36

100.00

99.83

-

MBS's (Agency)

63.3%

438,249

5.10

100.66

102.37

7,292

Subtotal

89.4%

619,387

5.09

100.54

102.34

$ 10,905

Municipal

6.0%

$ 41,638

7.19

99.32

100.14

344

$

Other *

4.6%

31,673

5.01

100.86

100.32

(169)

Subtotal

10.6%

$ 73,311

6.25

99.98

100.22

175

$

Total Investment Portfolio

100.0%

692,698

$

5.21

100.48

102.12

11,080

$

Net Unrealized Gain/(Loss)

11,080

$

Aggregate Gains

11,250

$

Aggregate Losses

(170)

$

Net Unrealized Gain/(Loss) % of Book Value

1.60%

* Other includes $28.0 million of regulatory stock