1

EXHIBIT 99.2

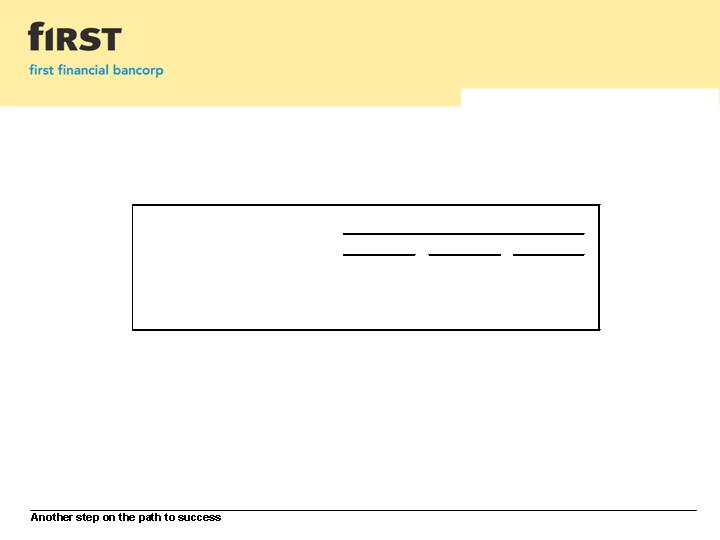

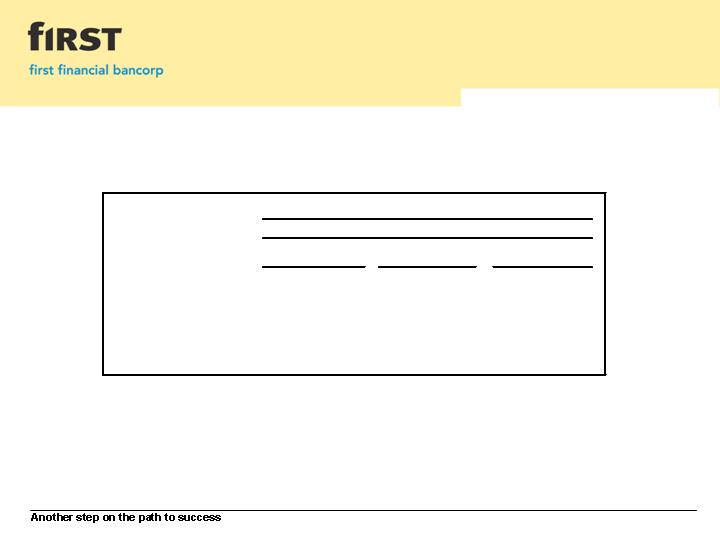

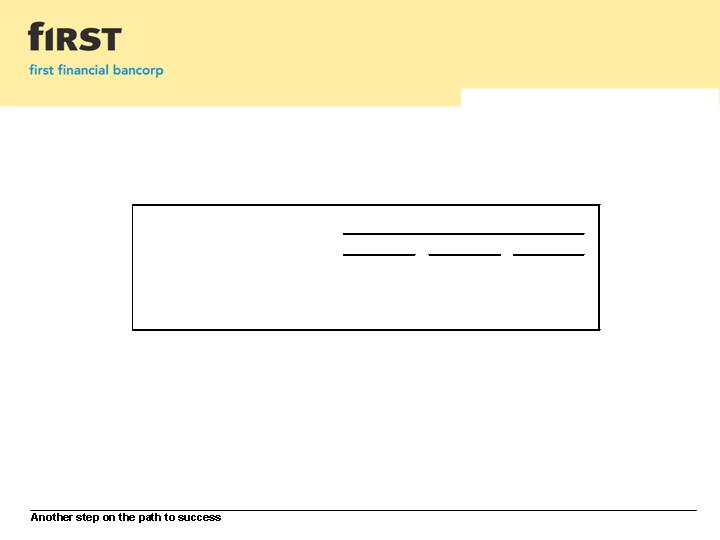

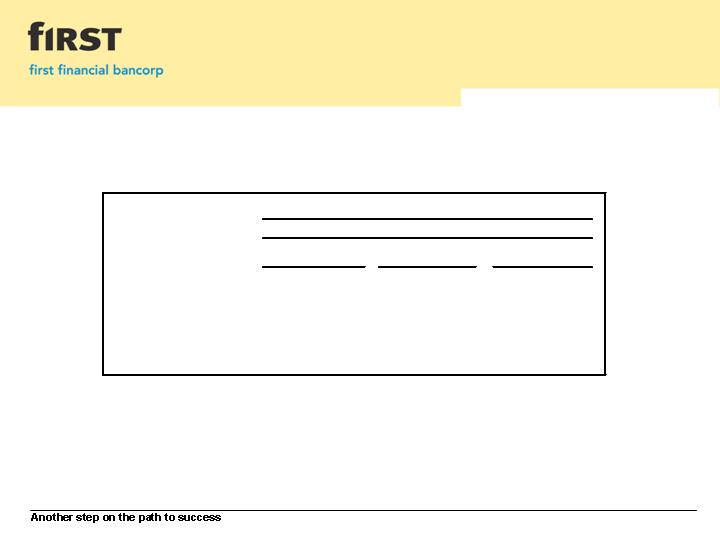

Return on Average Assets &

Return on Average Common Shareholders’ Equity

Table I

1Q-09

4Q-08

1Q-08

Return on Average Assets

0.62%

0.23%

0.89%

Return on Average Common

Shareholders' Equity

7.67%

2.97%

10.66%

Quarter

2

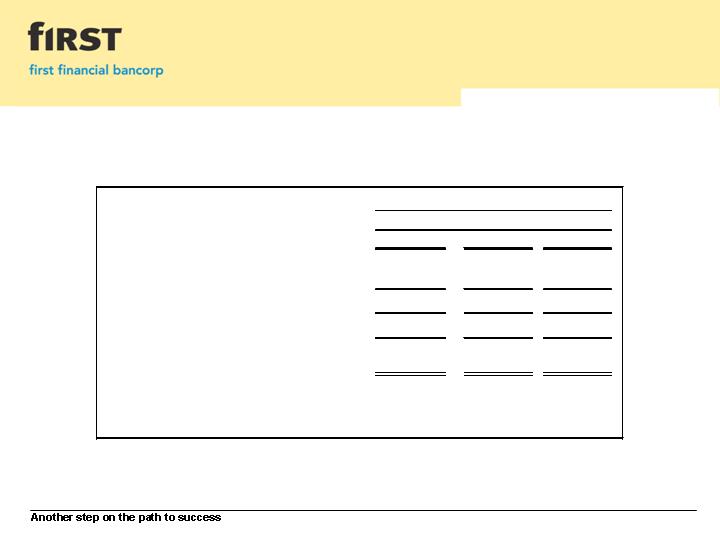

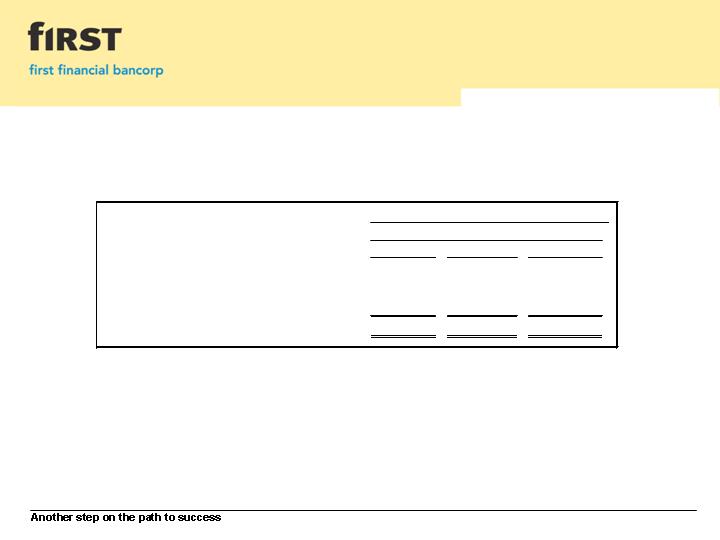

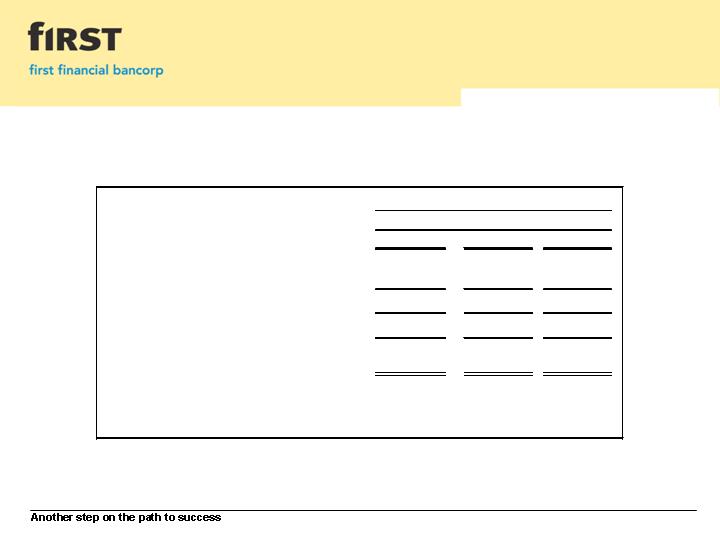

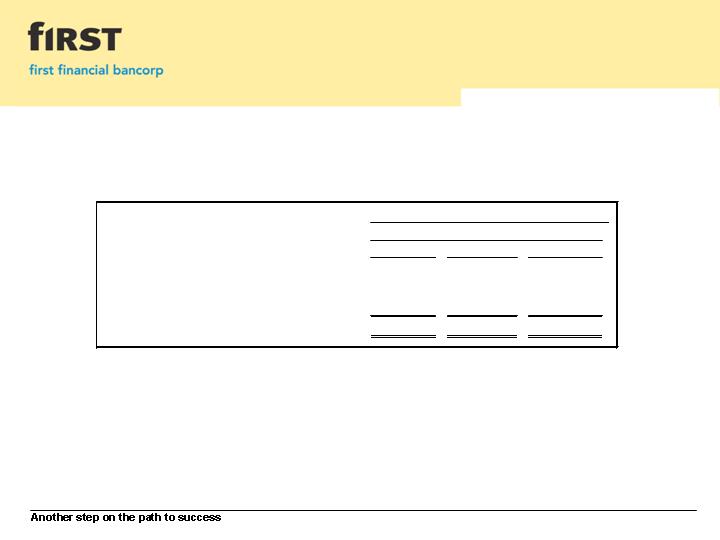

Pre-Tax, Pre-Provision Income

(including and excluding applicable securities gains and losses)

Table II

1Q-09

4Q-08

1Q-08

Pre-Tax Income

8,768

$

2,455

$

10,881

$

Excluding Provision Expense

4,259

10,475

3,223

Pre-Tax, Pre-Provision Income

13,027

$

12,930

$

14,104

$

Securities Gains (Losses)

11

1

(137)

1

1,605

2

Pre-Tax, Pre-Provision Income, excluding

Securities Gains (Losses)

13,016

$

13,067

$

12,499

$

1

2

($ in thousands)

Quarter

Gains (losses) related to the company's investment in 200,000 Federal Home Loan Mortgage Corporation (FHLMC) perpetual

preferred series V shares.

Includes a $1,585 gain associated with the partial redemption of Visa, Inc. common shares.

3

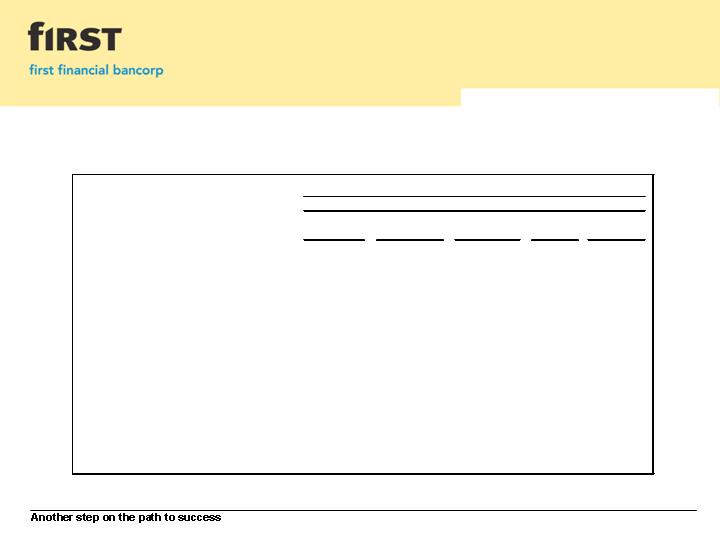

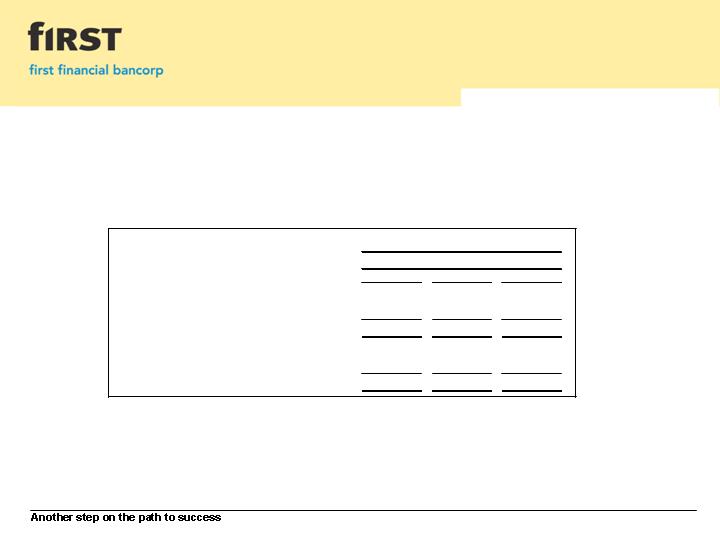

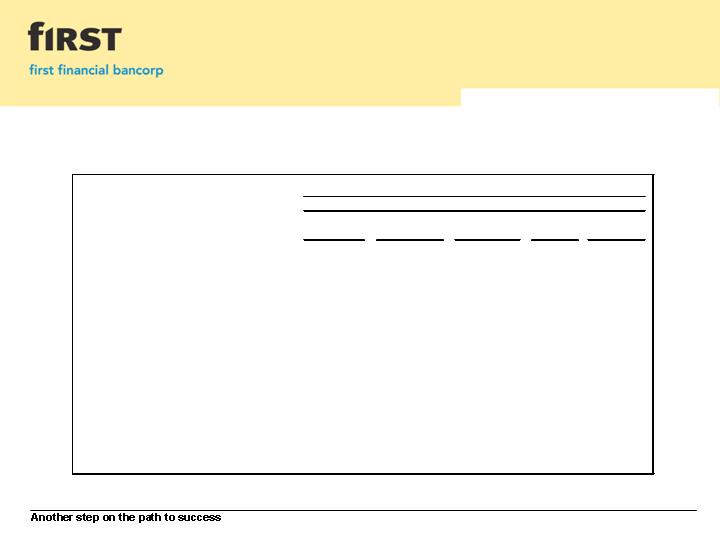

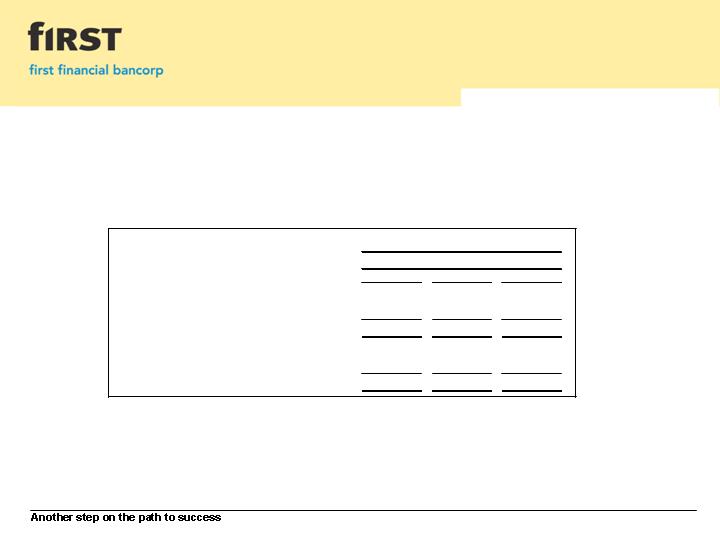

Credit Quality Trends

Table III

March 31,

2009

December 31,

2008

September 30,

2008

June 30,

2008

March 31,

2008

Total Nonperforming Loans

24,892

$

18,185

$

14,038

$

15,366

$

15,253

$

Total Nonperforming Assets

28,405

$

22,213

$

18,648

$

19,129

$

17,621

$

Nonperforming Assets as a % of:

Period-End Loans, Plus Other Real Estate Owned

1.04%

0.83%

0.70%

0.71%

0.67%

Total Assets

0.75%

0.60%

0.53%

0.55%

0.53%

Nonperforming Loans as a % of Total Loans

0.91%

0.68%

0.53%

0.57%

0.58%

Allowance for Loan & Lease Losses

36,437

$

35,873

$

30,353

$

29,580

$

29,718

$

Allowance for Loan & Lease Losses as a % of:

Period-End Loans

1.33%

1.34%

1.14%

1.11%

1.14%

Nonaccrual Loans

147.6%

199.5%

219.5%

199.7%

202.3%

Nonperforming Loans

146.4%

197.3%

216.2%

192.5%

194.8%

Total Net Charge-Offs

3,695

$

4,955

$

2,446

$

2,631

$

2,562

$

Annualized Net Charge-Offs as a % of Average

Loans & Leases

0.55%

0.73%

0.36%

0.40%

0.40%

($ in thousands)

Three Months Ended

4

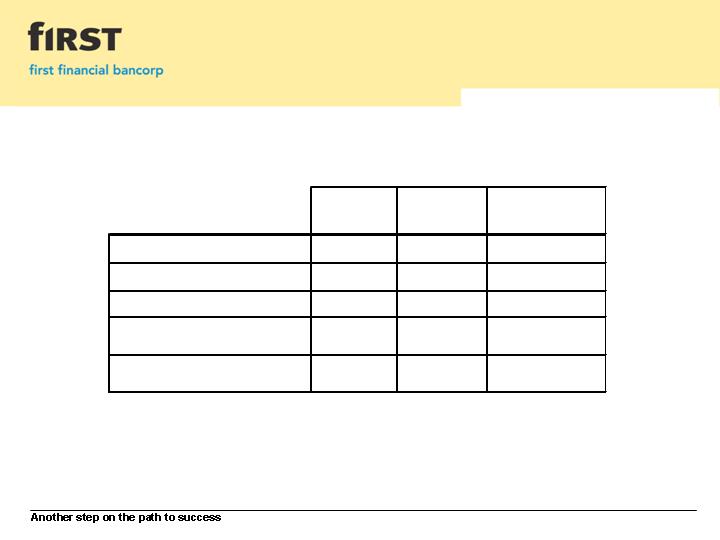

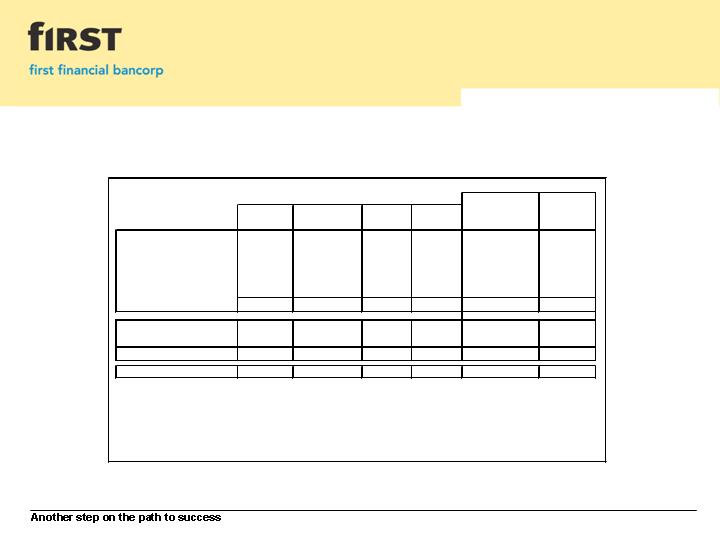

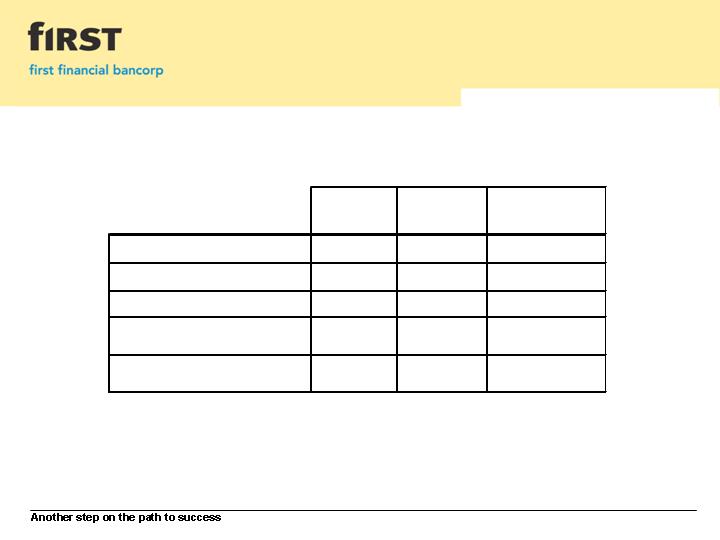

Capital Management

Table IV

FFBC

First

Financial Bank

Regulatory

"well-capitalized"

minimum

Leverage Ratio

9.51%

8.26%

5%

Tier 1 Capital Ratio

12.16%

10.58%

6%

Total Risk-Based Capital Ratio

13.39%

12.07%

10%

EOP Tangible Equity /

EOP Tangible Assets

8.60%

N/A

N/A

EOP Tangible Common Equity /

EOP Tangible Assets

6.54%

N/A

N/A

N/A = not applicable

5

Net Interest Income &

Net Interest Margin

Table V

1Q-09

4Q-08

1Q-08

Net Interest Income

30,928

$

30,129

$

28,249

$

Net Interest Margin

3.61%

3.67%

3.78%

Net Interest Margin

(fully tax equivalent)

3.65%

3.71%

3.85%

Quarter

($ in thousands)

6

Noninterest Income

Table VI

1Q-09

4Q-08

1Q-08

Gain on Sale of Propery & Casualty Liability

Portion of Insurance Business

574

$

-

$

-

$

Gain on Sales of Investment Securities (VISA)

-

-

1,585

Impact to Noninterest Income

574

$

-

$

1,585

$

($ in thousands)

Quarter

7

Components of noninterest income negatively impacted by the current economic conditions and their effect

on consumer spending activity, as well as volatility in the investment and equity markets

Service Charges on Deposit Accounts &

Trust & Wealth Management Fees

Table VII

1Q-09

4Q-08

1Q-08

Overdraft/Non-Sufficient Fund Fees

2,785

$

3,445

$

3,329

$

Other Deposit Fees

1,294

1,307

1,278

Total Service Charges on Deposit Accounts

4,079

$

4,752

$

4,607

$

Trust Fees

2,946

3,284

3,913

Investment Advisory Fees

343

461

709

Total Trust & Wealth Management Fees

3,289

$

3,745

$

4,622

$

($ in thousands)

Quarter

8

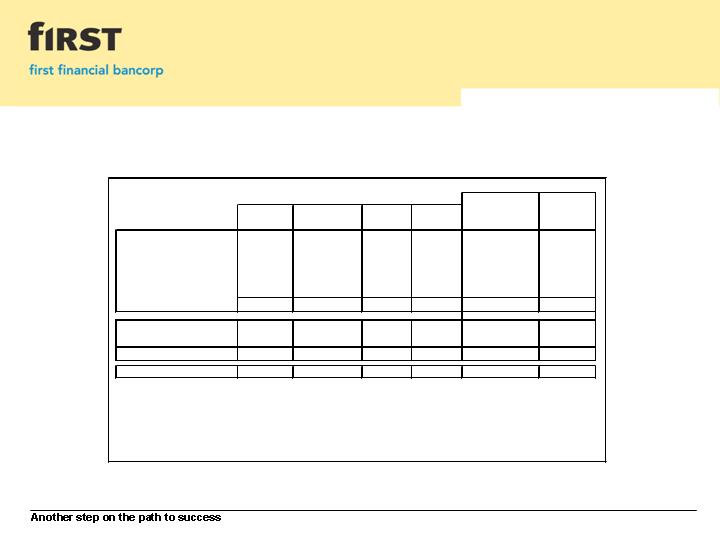

Investment Portfolio

March 31, 2009

Table VIII

($ in thousands, excluding book price)

Base

% of

Book

Book

Book

03/31/2009

Gain/

Total

Value

Yield

Price

Market Value

(Loss)

Agency's

5.4%

$ 41,534

5.31%

$ 99.78

103.66

$

$ 1,554

CMO's (Agency)

22.3%

170,397

4.62%

100.87

103.00

3,526

CMO's (Private)

0.0%

85

2.04%

100.00

98.04

(2)

MBS's (Agency)

63.8%

488,448

4.87%

101.01

103.50

11,790

Agency Preferred

0.0%

72

-

0.36

0.36

-

91.5%

$ 700,536

4.83%

100.89

$

103.38

$

$ 16,868

Municipal

4.4%

$ 33,699

7.15%

$ 99.17

100.28

$ 376

Other *

4.1%

31,382

4.41%

100.91

99.45

(461)

8.5%

$ 65,081

5.83%

100.01

$

99.88

$

(85)

$

Total Investment Portfolio

100.0%

765,617

$

4.92%

100.82

$

102.40

$

16,783

$

Net Unrealized Gain/(Loss)

16,783

$

Aggregate Gains

17,836

$

Aggregate Losses

(1,053)

$

Net Unrealized Gain/(Loss) % of Book Value

2.19%

* Other includes $28.0 million of regulatory stock

Subtotal

Subtotal