First Financial Bancorp

Investor Presentation

First Quarter 2009

Exhibit 99.1

2

Forward-Looking Statement Disclosure

Certain statements that are not statements of historical fact constitute forward-looking statements within the meaning of the Private

Securities Litigation Reform Act (the Act). In addition, certain statements in future filings by First Financial with the Securities and

Exchange Commission, in press releases, investor presentations, and in oral and written statements made by or with the approval of

First Financial which are not statements of historical fact constitute forward-looking statements within the meaning of the Act.

Examples of forward-looking statements include, but are not limited to, projections of revenues, income or loss, earnings or loss per

share, the payment or non-payment of dividends, capital structure and other financial items, statements of plans and objectives of

First Financial or its management or board of directors, and statements of future economic performances and statements of

assumptions underlying such statements. Words such as “believes,” “anticipates,” “intends,” and other similar expressions are

intended to identify forward-looking statements but are not the exclusive means of identifying such statements.

Forward-looking statements involve risks and uncertainties that may cause actual results to differ materially from those in such

statements. Factors that could cause actual results to differ from those discussed in the forward-looking statements include, but are

not limited to, management’s ability to effectively execute its business plan; the risk that the strength of the United States economy in

general and the strength of the local economies in which First Financial conducts operations may be different than expected resulting

in, among other things, a deterioration in credit quality or a reduced demand for credit, including the resultant effect on First

Financial’s loan portfolio and allowance for loan and lease losses; the ability of financial institutions to access sources of liquidity at a

reasonable cost; the effects of and changes in policies and laws of regulatory agencies; inflation, interest rates, market and monetary

fluctuations; technological changes; mergers and acquisitions; the ability to increase market share and control expenses; the effect

of changes in accounting policies and practices, as may be adopted by the regulatory agencies as well as the Financial Accounting

Standards Board and the Securities and Exchange Commission; the costs and effects of litigation and of unexpected or adverse

outcomes in such litigation; and the success of First Financial at managing the risks involved in the foregoing.

Such forward-looking statements speak only as of the date on which such statements are made, and First Financial undertakes no

obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made

to reflect the occurrence of unanticipated events.

3

Investment Highlights

Profitably managing the company throughout the economic downturn

First Quarter 2009

Strong loan and deposit growth

Stable net interest margin

Continued strong capital and liquidity levels

Maintaining a strong emphasis on credit and risk management while

cautiously pursuing select growth opportunities

Corporate Overview (March 31, 2009)

Total Assets: $3.8 billion

Total Loans: $2.7 billion

Total Deposits: $2.9 billion

82 retail branch locations serving 9 regional

markets in 53 communities in 3 states

1,063 FTEs

Trading Statistics (March 31, 2009)

Nasdaq: FFBC

Shares Outstanding: 37.5 million

Market Capitalization: $357 million

YTD-2009 Average Daily Trading Volume :

154,000 shares

Credit quality, although stressed, remains strong

relative to industry and peers

Investing in and growing the business

Expanding presence in key metropolitan markets

Branch acquisition

Prudent acquisition of 17 branches in key Cincinnati MSA – expected to close in third quarter 2009

Well-positioned to endure the economic challenges

Adequate capital cushion in the event of an even more severe economic downturn

Managing the company with a long-term view

First Financial stands ready to benefit as economic conditions improve

4

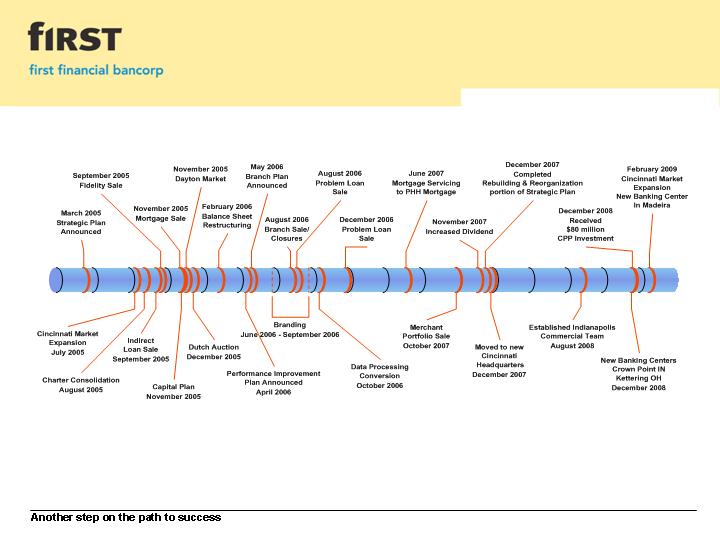

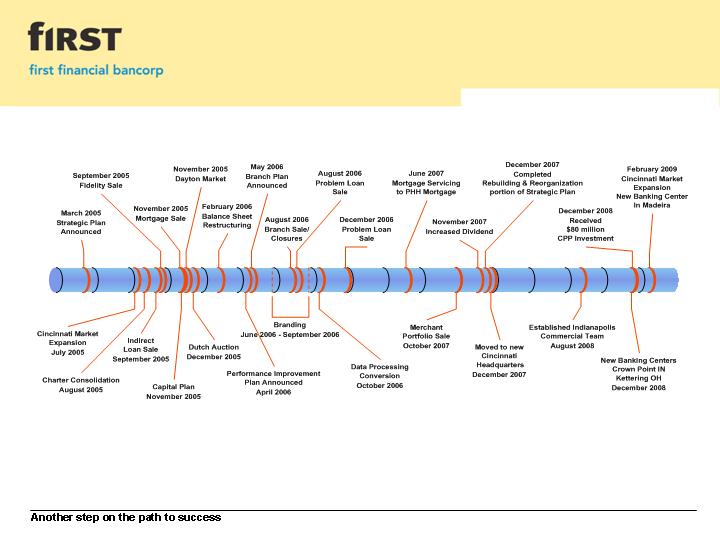

First Financial Bank was founded in 1863

16 bank/thrift acquisitions from 1989 through 1999 resulted in multiple bank

charters and brand identities

Established Strategic (Rebuilding & Reorganization) Plan in March 2005

History

Consolidated and streamlined company to establish one charter and one brand

identity

Restructured credit process

Restructured balance sheet

Exited non-strategic, high risk and unprofitable businesses and product lines

Renewed focus on expenses and efficiency

Upgraded infrastructure (physical, processes, technology)

Expanded market presence and recruited sales teams in regional metropolitan areas

Renewed focus on clients and sales growth

5

Reorganization Plan - Timeline

January

2005

March

2009

6

Business Units

Retail Banking

Commercial Banking

Wealth Management

7

Corporate Goals

Top-quartile performance for all stakeholders

Sustained and consistent excellence

Commitment to growth

Effective management of all risks

8

Growth Plan

Primary focus and value creation is through organic growth in key regional markets

2008 expansion included the addition of a commercial lending team in Indianapolis

(IN), a new business office and banking center in Kettering (OH), and a new

banking center in Crown Point (IN)

2009 plans include opening additional banking centers, including further expansion

within the Cincinnati metropolitan market, Northern Kentucky, Northern Ohio,

Southern Indiana

Acquisitions can advance market position and accelerate the timing of market

share compared with an organic growth only strategy

Pricing must be disciplined and favorable compared with the longer-term organic

growth only strategy

Ohio, Indiana and Kentucky where there is a strategic and geographic fit

Size and growth potential to help achieve corporate financial targets

9

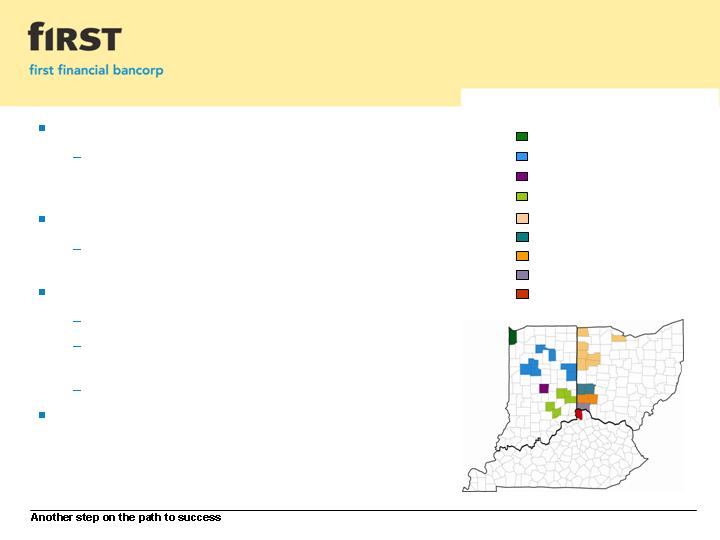

Business Strategy

Client “Intimate” Strategy

Strategic Focus: build long-term relationships with

clients by identifying and meeting their financial

needs

Target clients

Individuals and small / mid-size private businesses

located within the regional markets we serve

Ohio, Indiana, Kentucky

Serving 9 regional markets / 53 communities

Each market is managed by experienced, local

bankers

Markets are supported by centralized experts

Organic growth focus supplemented by strategic

acquisitions

Northwest Indiana

North Central Indiana

South Central Indiana

Indianapolis - Indiana

Butler / Warren County - Ohio

Northern Ohio

Dayton / Middletown - Ohio

Cincinnati - Ohio

Northern Kentucky

Markets

10

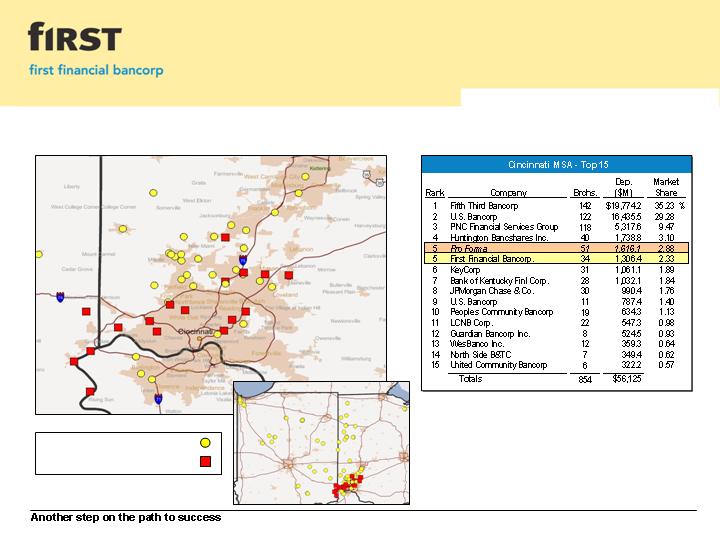

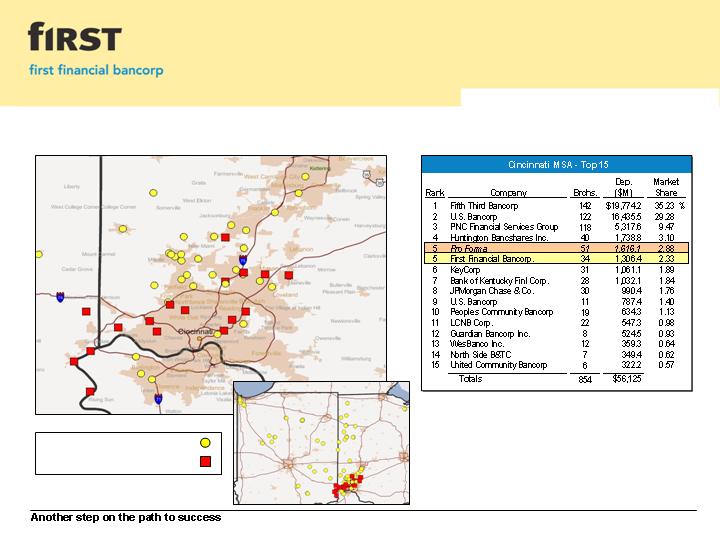

Growth-Market Expansion

Source: SNL Financial

Considerably enhances First Financial’s presence in the attractive Cincinnati MSA

First Financial Banking Centers

Banking Centers to be Acquired

Addition of 17 banking centers in Cincinnati MSA announced May 18, 2009

Consistent with First Financial's stated and conservative strategy

First Financial will have the 4th largest branch network in the Cincinnati MSA

Pro forma 2.88% Cincinnati MSA deposit market share compared with 2.33% currently –

still room to grow

Further solidifying First Financial's position in this very attractive market

Accelerates growth-market expansion strategy by several years

Acquisition is compelling relative to cost and time to build 17 profitable de novo banking

centers

Portfolio of approximately $261 million loans acquired

Comprised of approximately 68% owner-occupied 1-4 family residential real estate

First Financial is not acquiring any construction loans, land loans, unsecured commercial

loans, nor subprime loans nor past due nor non-performing loans

5.0% deposit premium

Based on $310.0 million of deposits, premium of $15.5 million

Anticipated cash EPS accretion in 2010

11

Branch Acquisition Highlights

1

1 Source: SNL Financial

1

12

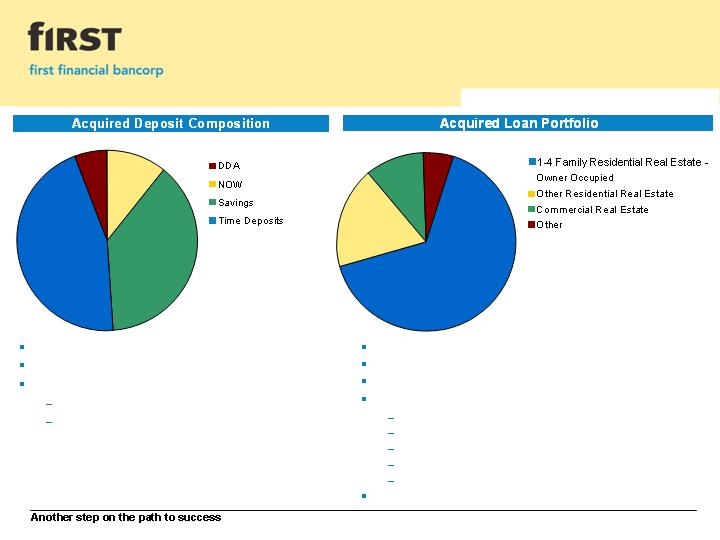

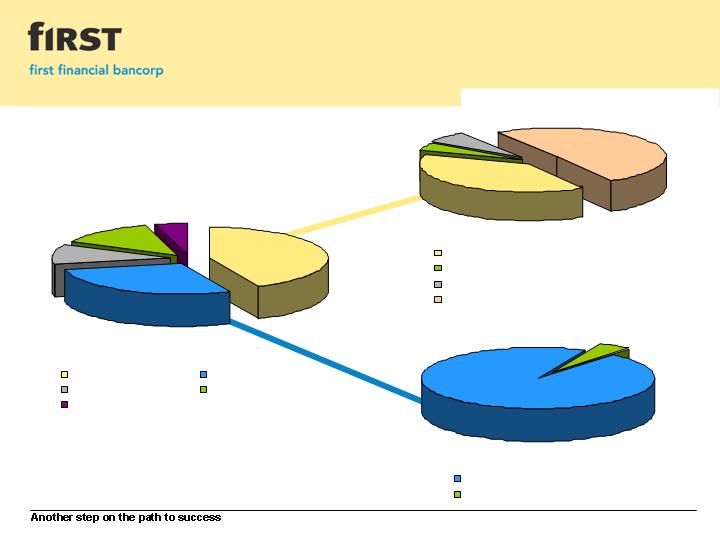

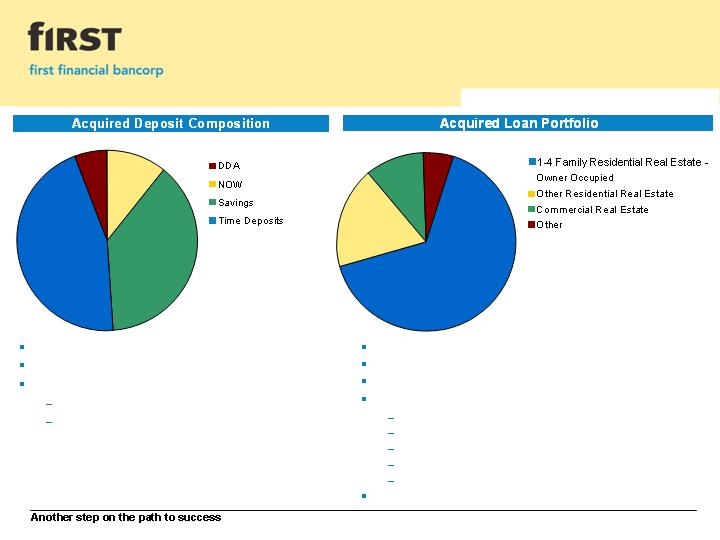

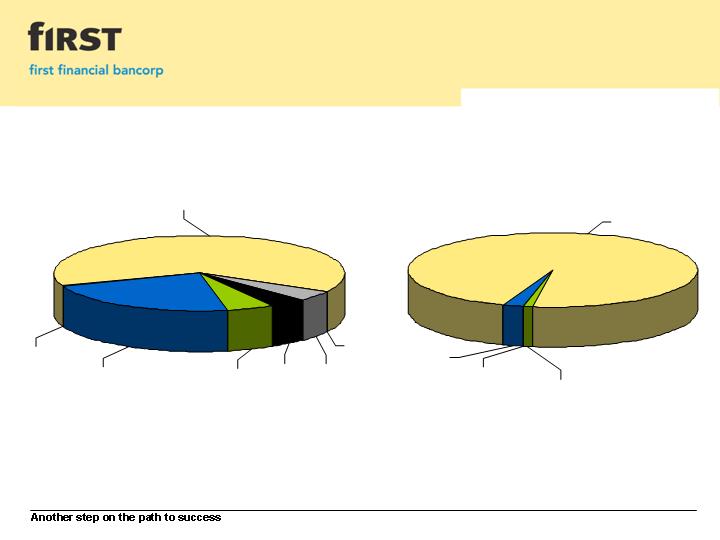

Attractive Deposit Composition &

Low-Risk Loan Portfolio

Strong core deposit funding

Weighted average interest rate 2.52%

First Financial is not assuming any

Brokered CDs

Out-of-market deposits

Balances and rates as of March 31, 2009

No loans 30+ days past due

Weighted average interest rate 5.98%

Entirely in-market portfolio

First Financial is not acquiring any

Builder lots or land loans

Unsecured commercial loans

Construction loans

Unsecured consumer loans

Subprime loans

The average retail borrower FICO score is 721

1 “Other” includes church, farm, commercial and

personal vehicle loans, and loans secured by

deposit accounts

1

$12.8M,

4.1%

$34.4M,

11.1%

$119.4M,

38.6%

$43.1M,

46.2%

$5.8M,

2.2%

$28.9M,

11.0%

$177.3M,

67.8%

$49.4M,

18.9%

13

Investment Highlights

Very attractive transaction

First Financial expands its banking center network in the Cincinnati MSA by 50%1

Transaction adds stable funding and banking centers in key areas that will leverage the First Financial

brand to increase market share

Minimal deposit runoff is expected

In-market transaction with low integration risk

Extensive due diligence performed

Highly negotiated transaction with lower risk 1-4 family owner occupied loans and deposits being

acquired

Attractive demographic profile1 2

5-year population growth rate of 6.4%

Median household income of $66,900

5-year household income growth rate of 27%

Based on current assumptions, the acquisition is projected to be accretive to 2010 EPS, and will

leave First Financial with a strong pro forma capital position

1 Source: SNL Financial

2 Weighted average demographics for each banking center based on its ZIP code, weighted by deposits as of June 30, 2008

Summary: This transaction leverages current market conditions and First Financial’s capital and

competitive strength to accelerate the company’s key-market growth strategy

14

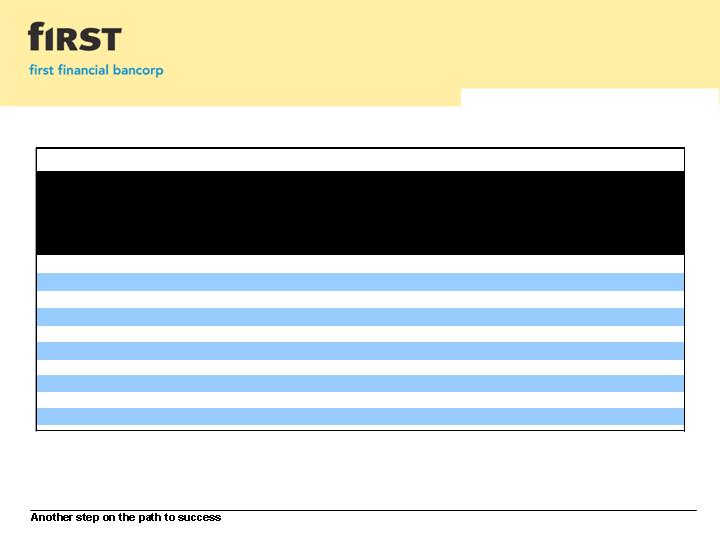

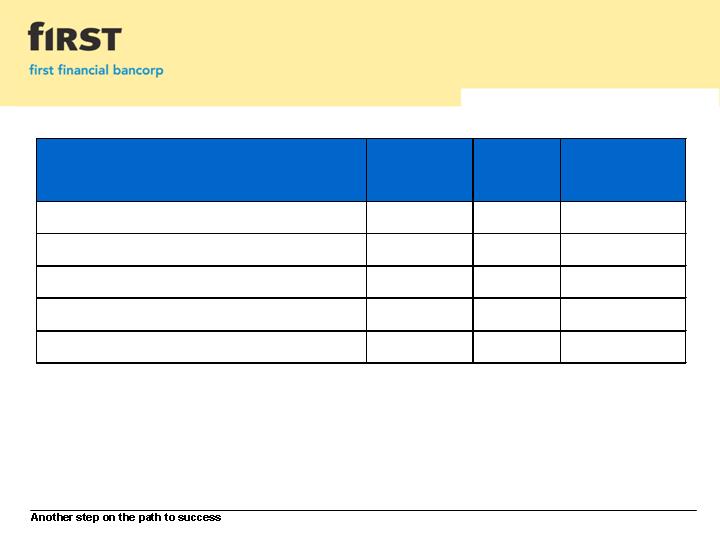

* First Financial entered the Indianapolis market in August 2008

Source: SNL Financial

Demographic Profile

Demographic Profile (First Financial Bancorp)

Deposit, Market Share and Popluation Data as of June 30, 2008

State

Market

Number

of FFBC

Banking

Centers

Total Deposits

in Market

($000)

FFBC Deposits

in Market

($000)

FFBC Deposit

Market Share

(%)

Projected

Population

Change

2008 - 2013

(%)

OH

Butler Warren

19

4,180,986

$

828,641

$

19.8%

10.3%

OH

Cincinnati

4

42,824,615

55,672

0.1%

-2.4%

OH

Dayton / Middletown

10

9,134,296

351,086

3.8%

1.0%

KY

Northern Kentucky

3

1,887,691

106,277

5.6%

19.9%

IN

North Central Indiana

14

3,997,721

294,351

7.4%

2.6%

OH

Northern Ohio

16

5,219,065

517,777

9.9%

0.0%

IN

Northwest Indiana

8

7,329,142

486,655

6.6%

2.6%

IN

South Central Indiana

8

3,691,281

144,975

3.9%

2.2%

IN

Indianapolis*

0

24,769,456

-

-

8.6%

Totals

82

103,034,252

$

2,785,434

$

2.7%

15

Retail Banking

Strategic Focus

Retail consumer clients

Deposits

Select consumer lending activities

82 retail banking center locations

Serving 9 regional markets in 53

communities in 3 states

Managed locally by experienced

local bankers

Supported centrally

16

Commercial Banking

Strategic Focus

Small / mid-size private businesses located within our regional

markets

Commercial & Industrial

Commercial Real Estate

Deposits / Cash Management

Sales Force

9 Market Presidents

48 Commercial Lenders

10 Treasury Management Representatives

17

Wealth Management

First Financial Wealth Resource Group

Trust

Brokerage

Investment Advisor

Strategic Focus

Maintain existing client base

Increase share of wallet of existing client base

Integration with retail and commercial banking clients

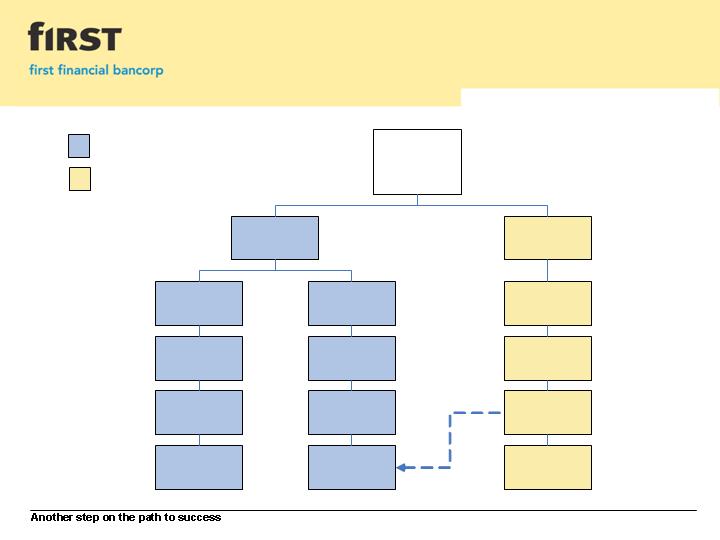

Credit Management System

Market-Based

18

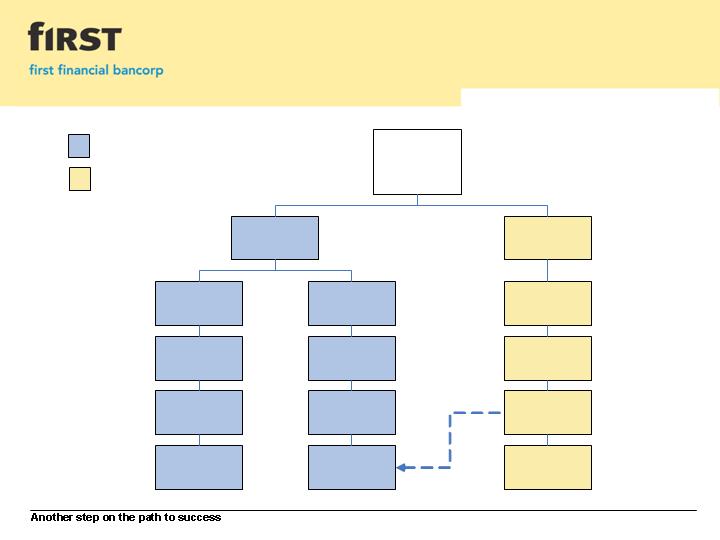

First Financial

Bancorp

/

Bank

CEO

Executive Vice

President Markets

Chief Credit

Officer

Market

Presidents

Commercial

Lenders

Credit

Analysts

Administrative

Assistants

Regional Credit

Officers

Central

Documentation

/

Filing

Commercial Real

Estate Specialist

Special Assets

Collections

Sr

.

Portfolio

Credit Analyst

Government

Lending Specialist

Small Business

Banking

Loan Participation

&

Credit Analysis

Centralized

Market Level

19

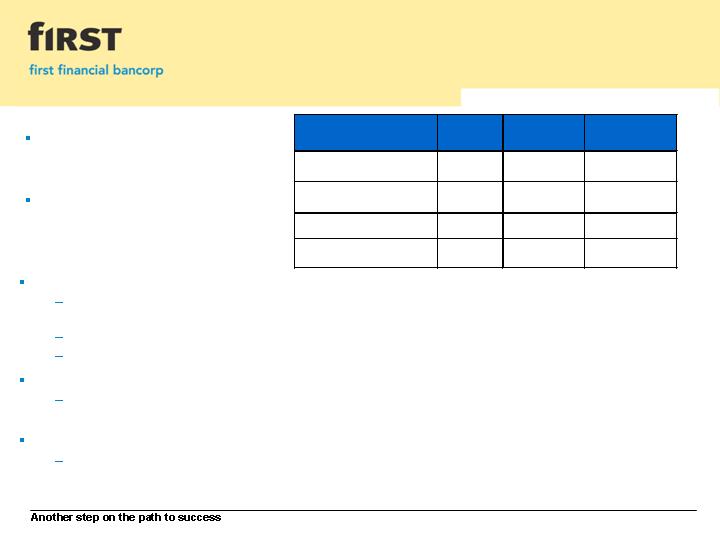

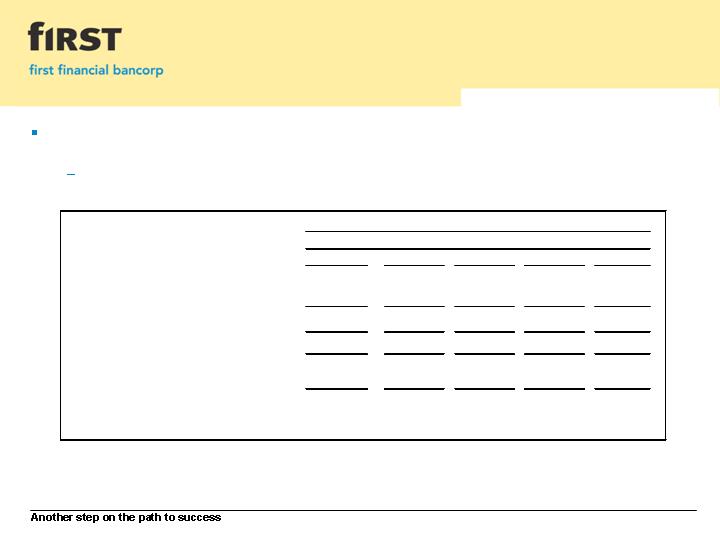

Credit Quality

March 31, 2009

Credit quality trends remained relatively stable and within expected range throughout most of 2008

Reflects discipline of originating loans within existing footprint, strong underwriting policies, and proactive management of

resolution strategies for problem credits

Ongoing economic stress impacting credit quality metrics late in fourth quarter 2008 and into first quarter 2009

Significantly increased loan loss reserve in fourth quarter 2008 in response to a higher level of net charge-offs and continued

deterioration in economic conditions

Net charge-offs declined $1.3 million / Nonperforming loans increased $6.7 million

Provision expense represented 115% of total net charge-offs at March 31, 2009

Allowance for loan and lease losses as a percent of period-end loans remained stable at 1.33% at March 31, 2009

Expecting credit quality to remain challenging throughout 2009 for the entire industry

1

1 First quarter 2009 compared with fourth quarter 2008

2 Net of loan sale

2

1Q-09

4Q-08

3Q-08

2Q-08

1Q-08

2008

2007

2006

2005

2004

2003

Net Charge-Off Ratio

0.55%

0.73%

0.36%

0.40%

0.40%

0.47%

0.24%

0.48%

0.30%

0.26%

0.69%

Nonperforming Loans /

Loans

0.91%

0.68%

0.53%

0.57%

0.58%

0.68%

0.56%

0.44%

1.08%

0.70%

0.96%

Reserve Ratio

1.33%

1.34%

1.14%

1.11%

1.14%

1.34%

1.12%

1.10%

1.62%

1.61%

1.71%

Reserves / Nonperforming

Loans

146.4%

197.3%

216.2%

192.5%

194.8%

197.3%

197.9%

252.8%

149.8%

230.2%

177.9%

Year

Quarter

Credit Quality Trends

20

Peer Group I is comprised of approximately 95 bank holding companies located throughout the United States with total asset size ranging from $3 - $10 billion

Peer Group II is comprised of 30 bank holding companies conducting business primarily in Ohio, Kentucky and Indiana

Source: Peer Group median data obtained from SNL Financial

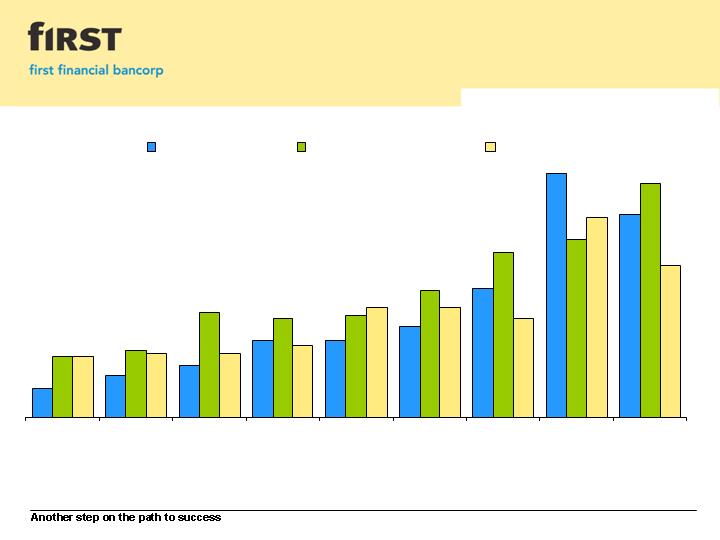

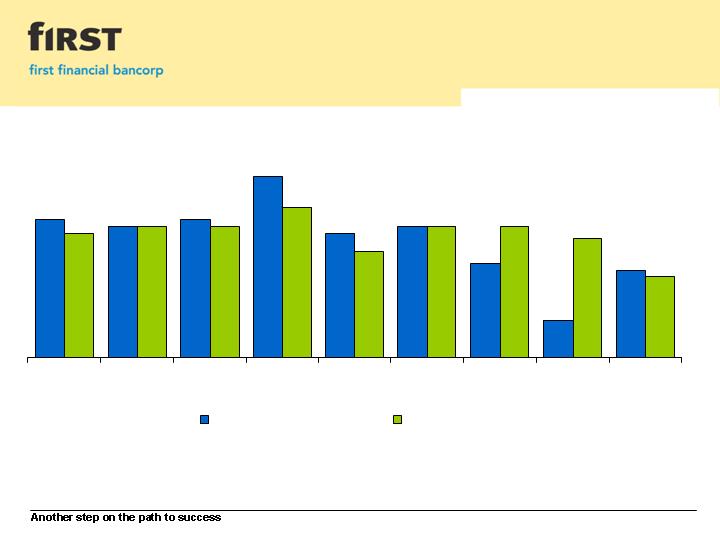

Credit Quality

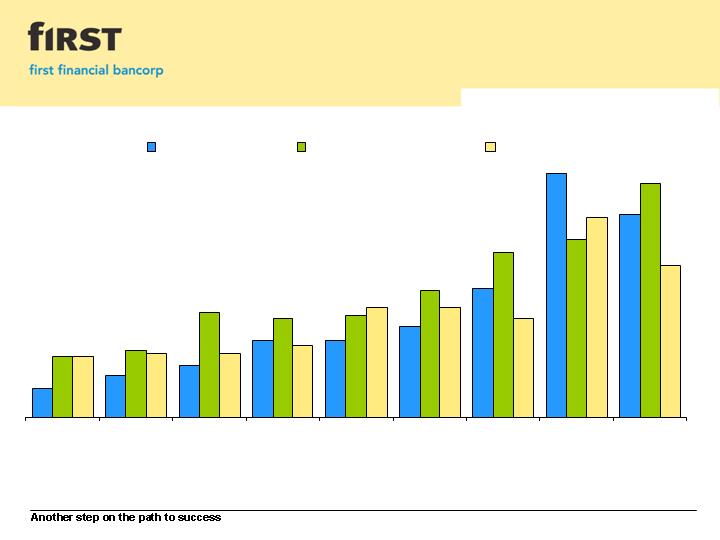

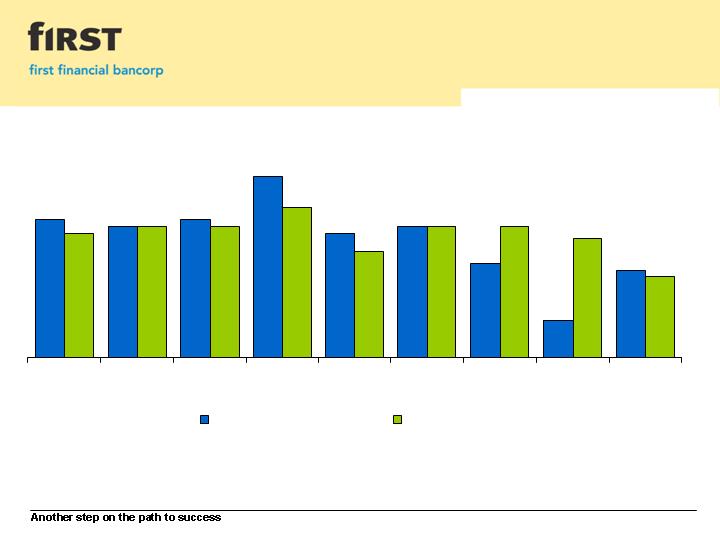

Net Charge-offs to Average Loans & Leases

0.89%

0.74%

0.38%

0.36%

0.46%

0.60%

0.85%

0.15%

0.47%

0.33%

0.28%

0.28%

0.19%

0.10%

0.37%

0.24%

0.22%

0.65%

0.55%

0.73%

0.36%

0.40%

0.40%

0.26%

0.23%

0.23%

0.22%

1Q-07

2Q-07

3Q-07

4Q-07

1Q-08

2Q-08

3Q-08

4Q-08

1Q-09

Peer Group I (size)

Peer Group II (geography)

FFBC

21

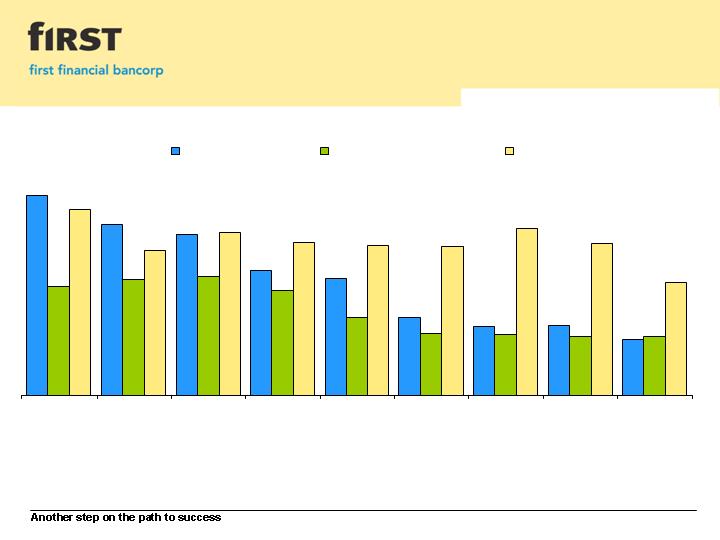

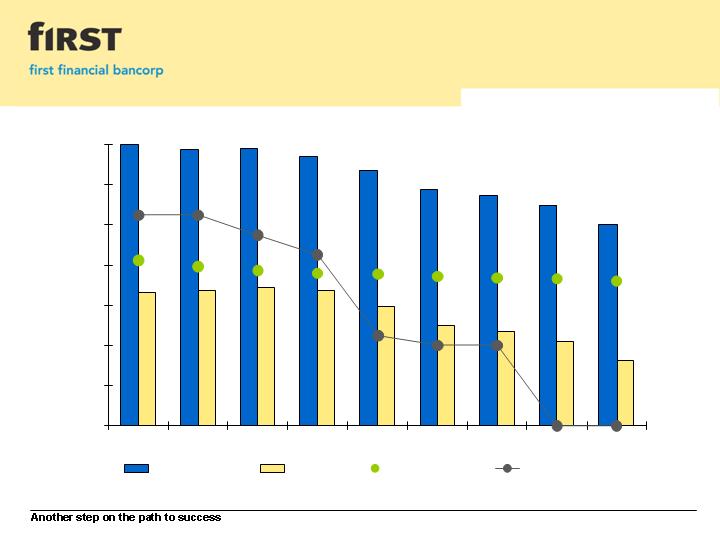

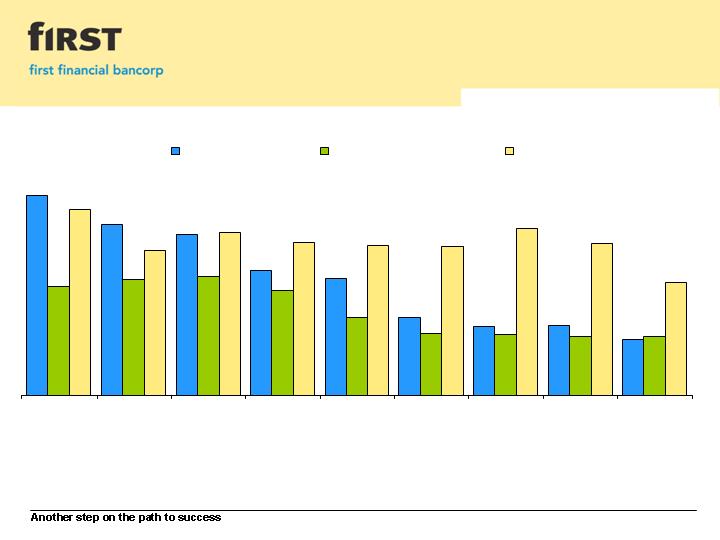

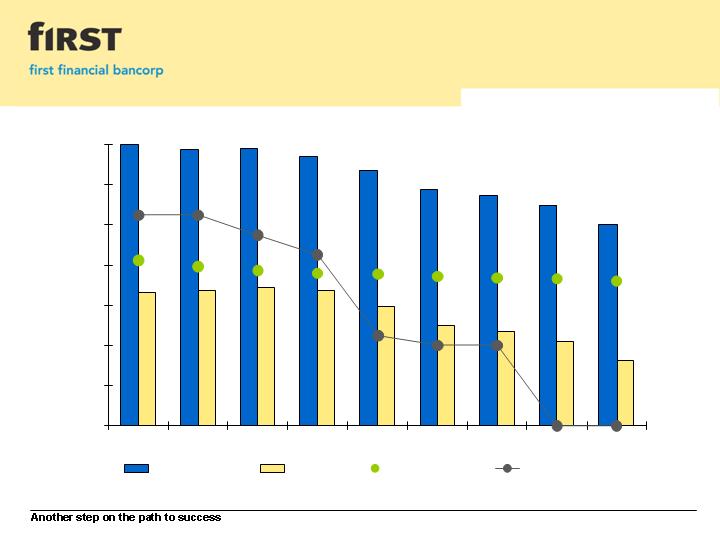

Credit Quality

Allowance for Loan & Lease Losses to Nonperforming Loans

Peer Group I is comprised of approximately 95 bank holding companies located throughout the United States with total asset size ranging from $3 - - $10 billion

Peer Group II is comprised of 30 bank holding companies conducting business primarily in Ohio, Kentucky and Indiana; 1Q-09 data is comprised of 26 bank holding companies

Source: Peer Group median data obtained from SNL Financial

260%

222%

209%

162%

152%

101%

90%

90%

72%

141%

151%

155%

136%

100%

80%

79%

76%

77%

187%

212%

198%

195%

193%

216%

197%

146%

241%

1Q-07

2Q-07

3Q-07

4Q-07

1Q-08

2Q-08

3Q-08

4Q-08

1Q-09

Peer Group I (size)

Peer Group II (geography)

FFBC

22

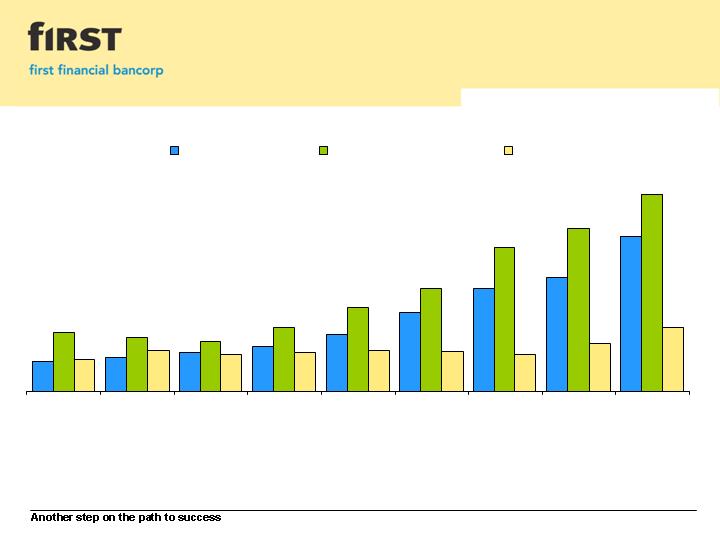

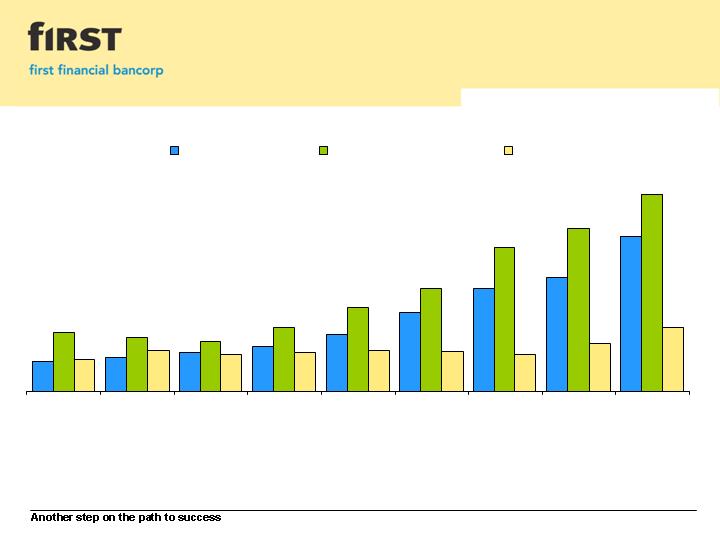

Credit Quality

Nonperforming Loans to Total Loans

Peer Group I is comprised of approximately 95 bank holding companies located throughout the United States with total asset size ranging from $3 - - $10 billion

Peer Group II is comprised of 30 bank holding companies conducting business primarily in Ohio, Kentucky and Indiana; 1Q-09 data is comprised of 26 bank holding companies

Source: Peer Group median data obtained from SNL Financial

0.83%

0.76%

0.70%

0.91%

1.19%

1.46%

2.04%

2.31%

2.81%

2.21%

0.55%

0.49%

0.43%

0.65%

0.81%

1.12%

1.46%

1.62%

0.59%

0.53%

0.56%

0.58%

0.57%

0.53%

0.68%

0.91%

0.45%

1Q-07

2Q-07

3Q-07

4Q-07

1Q-08

2Q-08

3Q-08

4Q-08

1Q-09

Peer Group I (size)

Peer Group II (geography)

FFBC

23

Capital

Excess consolidated capital of

$159.1 million over regulatory

minimum required level

Based on “well-capitalized”

requirements, can support

bank-level asset growth up to

$606 million

Announced dividend reduction to common shareholders in January 2009

Will further boost already strong capital levels and position the company to weather the economic

challenges while still taking advantage of select growth opportunities

Preserved approximately $2.6 million in common equity in first quarter 2009

Consistent with other capital management strategies

Committed to maintaining a strong capital base

Will continue to take steps to ensure capital position remains sound throughout this period of economic

uncertainty

Participating in U.S. Treasury’s Troubled Asset Relief (TARP) Capital Purchase Program (CPP)

Treasury made an investment in $80 million First Financial perpetual preferred securities in December

2008

Ratio

1Q-09

Target

Regulatory

"well-capitalized"

minimum

EOP Tangible Equity /

EOP Tangible Assets

8.60%

6.75% - 7.25%

n/a

EOP Tangible Common Equity /

EOP Tangible Common Assets

6.54%

n/a

n/a

Leverage Ratio

9.51%

8.00% - 8.50%

5.00%

Total Risk-Based Capital Ratio

13.39%

11.50% - 12.00%

10.00%

Capital Raise

24

Common Share Offering

Completed a public offering of 13.8 million shares at $7.50 per share

Net proceeds of approximately $98.0 million after deducting underwriting

discounts, commissions and estimated offering expenses

Proceeds will be used for general corporate purposes, which may include

Providing capital to support the bank’s asset and deposit growth

Acquisitions, or other business combinations

Planned purchase of 17 banking centers and the approximate $310 million in

balance sheet growth

Organic growth in key markets

Other strategic opportunities if appropriate for our franchise

Strong Capital Ratios

25

* Adjusted to reflect the $98 million in new capital from the offering

Ratio

Actual

(March 31, 2009)

Adjusted *

Regulatory

"well-capitalized"

minimum

Tier 1 Leverage

9.51%

11.77%

5.00%

Tier 1 Risk-Based Capital

12.16%

14.96%

6.00%

Total Risk-Based Capital

13.39%

16.19%

10.00%

Tangible Equity to Tangible Assets (period-end)

8.60%

10.62%

n/a

Tangible Common Equity to Tangible Assets (period-end)

6.54%

8.60%

n/a

Participation in the U.S. Treasury

Capital Purchase Program

26

Issued and sold to Treasury 80,000 shares of Series A Senior Preferred Stock* for an

aggregate purchase price of $80 million

Liquidation preference of $1,000 per share

Warrant to purchase up to 930,233 common shares, without par value at an initial exercise price

of $12.90 per share, subject to certain anti-dilution and other adjustments

Asked to participate by banking regulators

Additional capital further strengthened already strong capital levels

Due to political implications, the real benefits of participating in the program may have

been altered

Changes that have been enacted to-date have not significantly impaired either our business

model or our ability to execute our core business strategy

Board of Directors will continue to evaluate capital plan and structure, including the merits of

continued participation in the program

Quarterly dividend payments

$1.0 million in May 2009

$0.6 million (pro-rated) in February 2009

* December 23, 2008

27

CPP Investment Portfolio

March 31, 2009

Established CPP Investment Portfolio with proceeds received from Treasury

Totaled approximately $225.4 million compared with $122.5 million at December 31, 2008

Short and long-term plans for the utilization of CPP proceeds

Selectively added to the CPP Investment Portfolio during the first quarter of 2009

Funded with short-term borrowings to maximize return on net interest income

Ratio of investments to capital, or leverage, was 2.8 times the proceeds received, compared with

1.5 times at December 31, 2008, with internal maximum not to exceed 5 times

Earnings from the CPP Investment Portfolio have had, and are expected to continue to have a

positive effect on net interest income and should also exceed quarterly dividends payable to U.S.

Treasury on its investment in the preferred shares

Increased lending activities during first quarter 2009 consistent with the intent of the

Program

Commercial lending balances increased $73.1 million from December 31, 2008

Originated $47.9 residential mortgage loans compared with $21.8 million in fourth quarter 2008

Cash flows from the CPP Investment portfolio are expected to provide sufficient liquidity

and capital for redeployment into additional lending opportunities

Financial Information

29

Earnings Per Share

* Reflects the impact of certain non-recurring items. A reconciliation presenting a summary of items impacting earnings per share is on page 43

$0.22

$0.21

$0.22

$0.29

$0.20

$0.21

$0.15

$0.06

$0.14

$0.20

$0.21

$0.21

$0.24

$0.17

$0.21

$0.21

$0.19

$0.13

1Q-07

2Q-07

3Q-07

4Q-07

1Q-08

2Q-08

3Q-08

4Q-08

1Q-09

GAAP Earnings Per Share

Earnings Per Share*

30

Pre-Tax Pre-Provision Income

Demonstrates a more representative comparison of operational performance without the

volatility of credit quality that is typically present in times of economic stress

Excludes provision expense and applicable securities gains and losses

1Q-09

4Q-08

3Q-08

2Q-08

1Q-08

Pre-Tax Income

8,768

$

2,455

$

8,329

$

11,700

$

10,881

$

Excluding Provision Expense

4,259

10,475

3,219

2,493

3,223

Pre-Tax, Pre-Provision Income

13,027

$

12,930

$

11,548

$

14,193

$

14,104

$

Securities Gains (Losses)

11

1

(137)

1

(3,400)

1

(221)

1

1,605

2

Pre-Tax, Pre-Provision Income, excluding

Securities Gains (Losses)

13,016

$

13,067

$

14,948

$

14,414

$

12,499

$

1

2

Gains (losses) related to the company's investment in 200,000 Federal Home Loan Mortgage Corporation (FHLMC) perpetual preferred series V shares.

Includes a $1,585 gain associated with the partial redemption of Visa, Inc. common shares.

($ in thousands)

Quarter

31

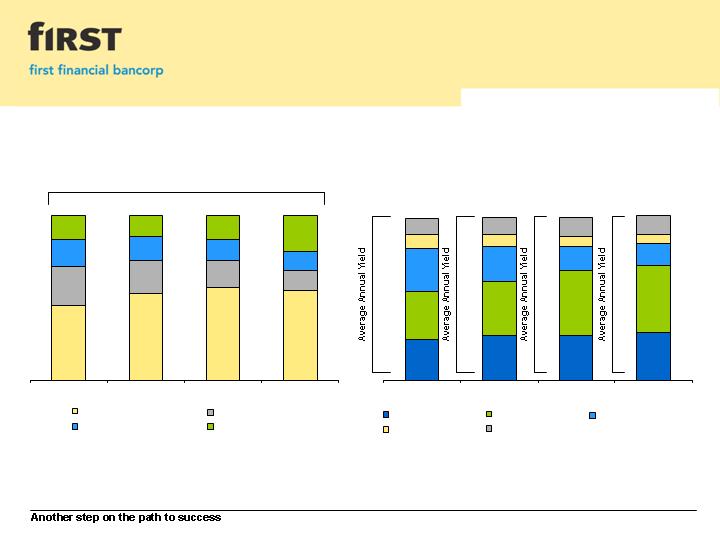

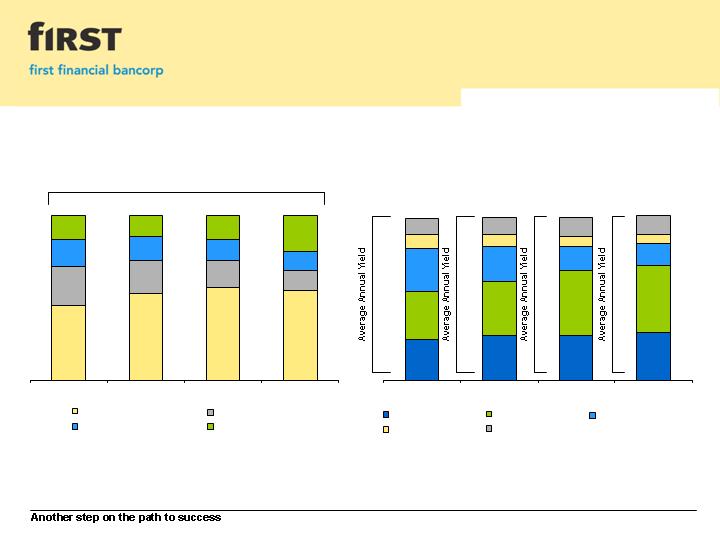

Net Interest Margin

* Represents the Fed Funds Target Rate at the end of the quarter

4.12%

3.97%

3.88%

3.79%

3.78%

3.72%

3.68%

3.67%

3.61%

0.00%

1.00%

2.00%

3.00%

4.00%

5.00%

6.00%

7.00%

1Q-07

2Q-07

3Q-07

4Q-07

1Q-08

2Q-08

3Q-08

4Q-08

1Q-09

Earning Asset Yield

Liability Cost

Net Interest Margin

Fed Funds Target Rate*

Non-Owner Occupied - $601.8 million

Acquisition & Land Development - $72.9 million

Single Issuer Loan Participation - $50.5 million

Owner Occupied - $458.1 million

39%

4%

6%

51%

44%

28%

11%

13%

4%

Commercial Real Estate

Commercial & Industrial

HELOC

Residential Real Estate

Installment & Other

Loan Composition

March 31, 2009

32

4%

96%

All Other - $742.4 million

Shared National Credits - $34.8 million

33

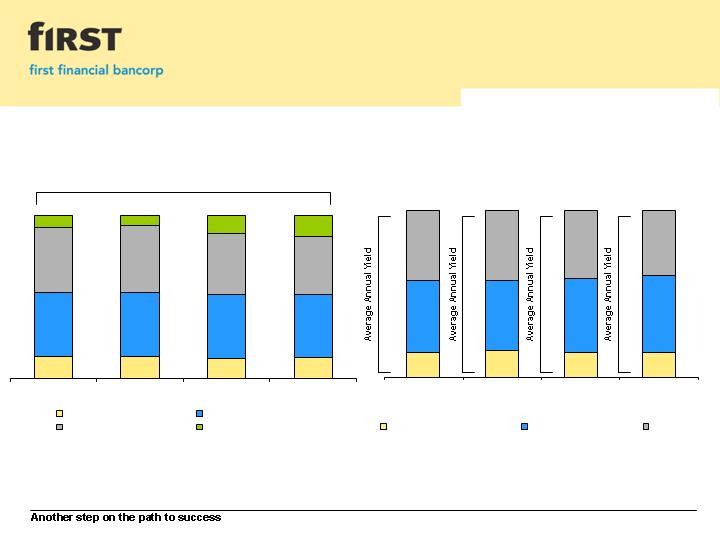

Yield presented is not tax-equivalent

8.0%

End of Period

Loan Portfolio Composition

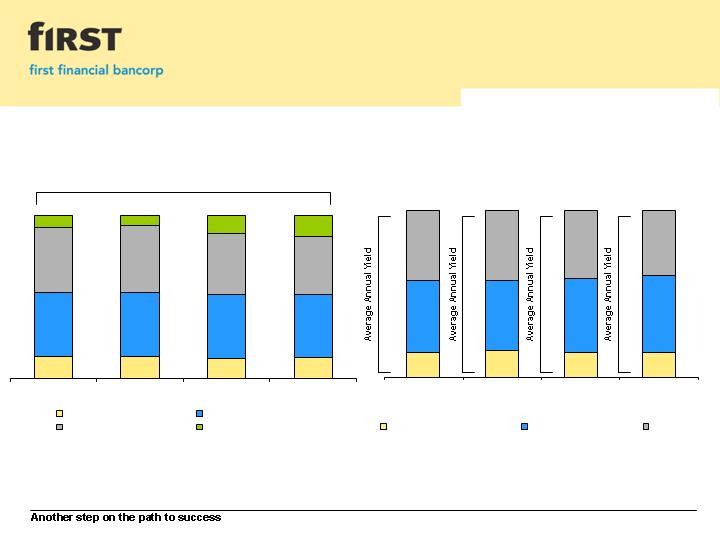

Earning Assets &

Loan Composition

6.7%

5.5%

6.5%

8.0%

7.9%

7.1%

5.6%

7.9%

8.2%

5.7%

6.1%

5.6%

7.8%

5.7%

4.0%

7.6%

5.6%

4.3%

5.1%

9%

31%

27%

30%

30%

41%

29%

33%

40%

13%

14%

21%

26%

6%

5%

4%

9%

10%

11%

11%

2006

2007

2008

1Q-2009

Commercial

Commercial RE

Residential Mortgages

Installment

Home Equity

5.0%

6.6%

5.9%

Average

Earning Assets

Yield

6.9%

12%

11%

55%

45%

53%

57%

16%

20%

24%

13%

15%

17%

22%

14%

14%

12%

Average FY-2006

Average FY-2007

Average FY-2008

Average 1Q-2009

Commercial Loans & Leases

Residential Mortgages

Consumer Loans

Investments

34

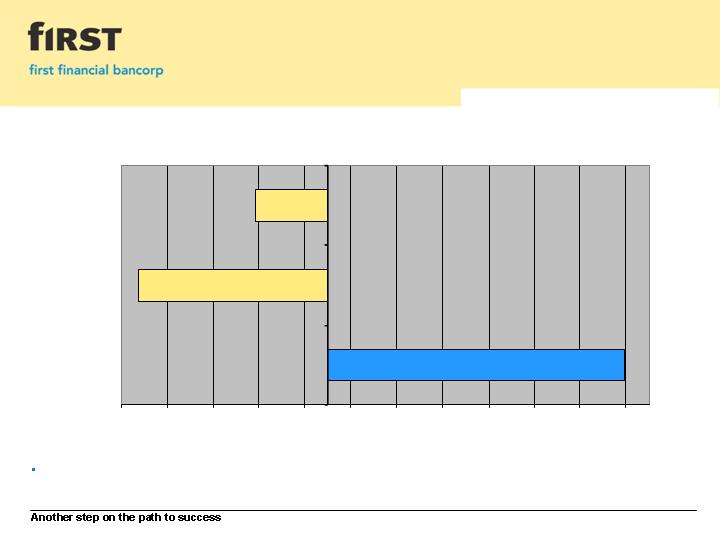

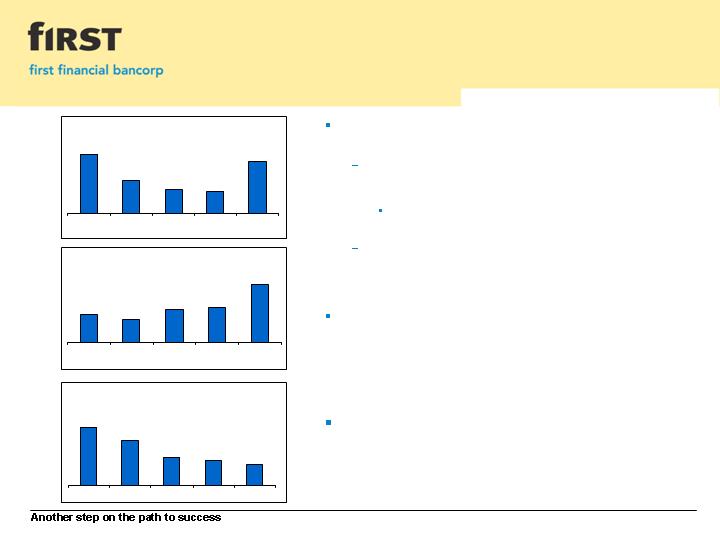

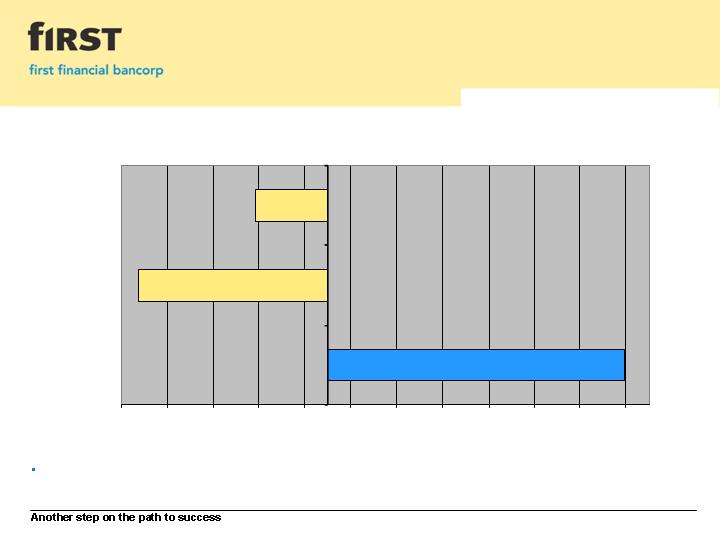

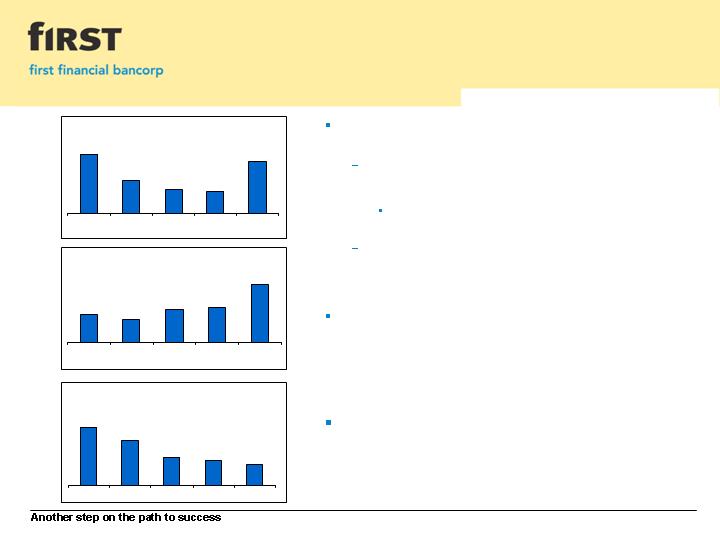

Loan Strategy

Linked-quarter percentage growth is annualized

First quarter 2009 average total loans increased

$23.0 million or 3.4% from fourth quarter 2008

Driven primarily by 14.1% growth in commercial

lending portfolios

Overall declines in the average consumer lending

portfolios are a result of the company’s strategy

to de-emphasize certain consumer-based lending

activities

Originated $47.9 million in residential mortgage

loans in first quarter 2009 compared with $21.8

million in fourth quarter 2008

Residential mortgage loan balances are not

reflected on the balance sheet due to the

company’s originate-and-sell strategy

Renewed emphasis to expand

residential mortgage lending, including maintaining

the originate-and-sell strategy

1Q-09

4Q-08

3Q-08

2Q-08

1Q-08

$1,927

$1,861

$1,809

$1,731

$1,652

($ in millions)

Average Commercial Loans

Average Total Loans

($ in millions)

$2,593

$2,645

$2,708

$2,689

$2,712

1Q-08

2Q-08

3Q-08

4Q-08

1Q-09

Average Consumer Loans

($ in millions)

$941

$914

$898

$828

$785

1Q-08

2Q-08

3Q-08

4Q-08

1Q-09

35

49%

(53%)

(88%)

* December 31, 2005 through March 31, 2009

Gross loan CAGR* = 0.65% due to planned runoff in indirect loans and residential mortgages.

Loan Portfolio Strategy

(450,000)

(350,000)

(250,000)

(150,000)

(50,000)

50,000

150,000

250,000

350,000

450,000

550,000

650,000

Commercial Lending

Residential Mortgages

Indirect Installments

($000s)

Growth Since 2005*

36

Investment Portfolio

March 31, 2009

On-going review of various strategies to increase the size of the investment portfolio and its absolute

level of earnings, while balancing capital and liquidity targets

Since the end of the first quarter of 2008, the portfolio has grown approximately $380.7 million on a net

basis

Approximately $112.9 million of securities were added during the first quarter of 2009

Portfolio selection criteria avoids securities backed by sub-prime assets and those with geographic

considerations

($ in thousands, excluding book price and market value)

Base

% of

Book

Book

Book

03/31/2009

Gain/

Total

Value

Yield

Price

Market Value

(Loss)

Agencys

5.4%

$ 41,534

5.31%

$ 99.78

103.66

$

$ 1,554

CMO's (Agency)

22.3%

170,397

4.62%

100.87

103.00

3,526

CMO's (Private)

0.0%

85

2.04%

100.00

98.04

(2)

MBS's (Agency)

63.8%

488,448

4.87%

101.01

103.50

11,790

Agency Preferred

0.0%

72

-

0.36

0.36

-

Subtotal

91.5%

$ 700,536

4.83%

100.89

$

103.38

$

$ 16,868

Municipal

4.4%

$ 33,699

7.15%

$ 99.17

100.28

$ 376

Other *

4.1%

31,382

4.41%

100.91

99.45

(461)

Subtotal

8.5%

$ 65,081

5.83%

100.01

$

99.88

$

(85)

$

Total Investment Portfolio

100.0%

765,617

$

4.92%

100.82

$

102.40

$

16,783

$

Net Unrealized Gain/(Loss)

16,783

$

Aggregate Gains

17,836

$

Aggregate Losses

(1,053)

$

Net Unrealized Gain/(Loss) % of Book Value

2.19%

* Other includes $28.0 million of regulatory stock

37

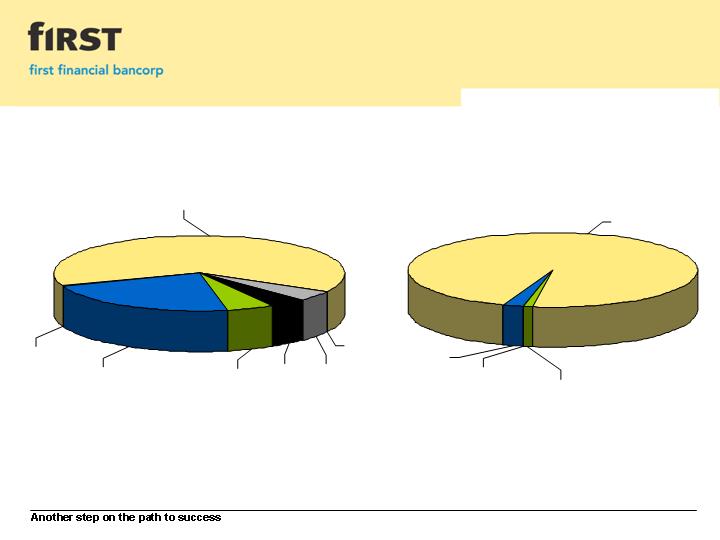

Investment Portfolio

March 31, 2009

* Other includes regulatory stock

Credit Quality

Investment Grade = A-rated securities

Other Investment Grade = B-rated securities

Non-Investment

Grade

0.2%

Investment Grade

96.7%

Other Investment

Grade

1.0%

Not Rated

2.1%

Sector Allocation

MBSs (Agency)

63.8%

Agency

Preferred

0.0%

Municipal

4.4%

Other *

4.1%

Agencys

5.4%

CMOs (Private)

0.0%

CMOs (Agency)

22.3%

38

0.0%

* Not included in yield calculation

End of Period

Deposit Portfolio Composition

Liability Mix &

Deposit Composition

1.8%

2.0%

0.8%

3.9%

4.5%

4.0%

0.0%

0.0%

0.0%

0.2%

3.2%

15%

15%

15%

16%

46%

43%

42%

44%

39%

41%

42%

42%

2006

2007

2008

1Q-2009

Noninterest-Bearing Deposits*

Interest-Bearing Deposits

Time Deposits

2.5%

Average

Liability Mix

Yield

1.6%

3.4%

3.0%

13%

7%

6%

10%

13%

13%

13%

13%

39%

39%

40%

40%

35%

38%

41%

40%

Average FY-2006

Average FY-2007

Average FY-2008

Average 1Q-2009

Noninterest-Bearing Deposits*

Interest-Bearing Deposits

Time Deposits

Borrowed Funds

39

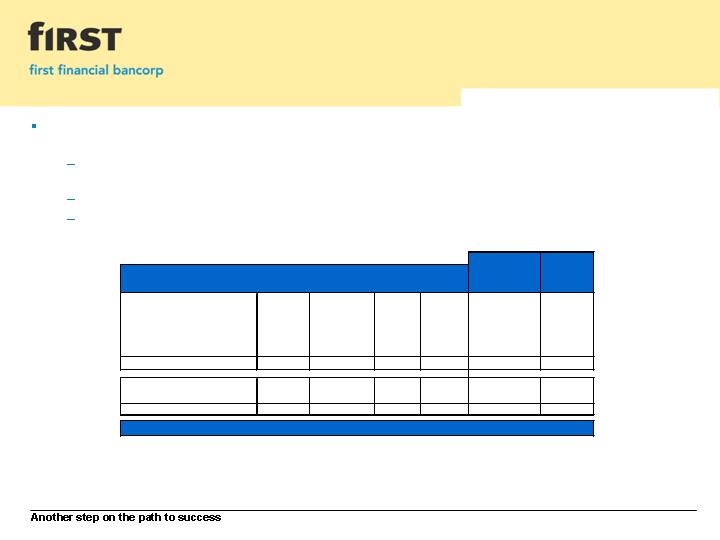

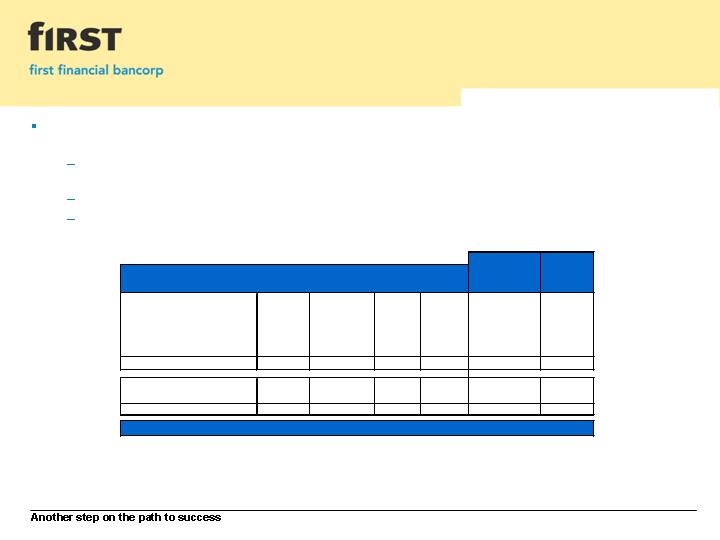

Deposit Strategy

Linked-quarter percentage growth is annualized

First quarter 2009 average total deposits increased

$42.1 million or 6.1% from fourth quarter 2008

Driven primarily by 13% growth in transaction and

savings deposits, including solid increases in

commercial transaction account balances

Includes the seasonal effect of a large public

fund deposit

Linked-quarter growth assisted by deposit-pricing

strategies and other initiatives designed to grow

and retain more transaction-based retail and

commercial deposits

Year-over-year declines in average total and

average time deposits is attributable to the runoff of

time deposits resulting from disciplined pricing and

the company’s strategy to generate lower-cost

transaction-based retail and commercial deposit

accounts

Disciplined pricing strategies are employed for all

deposit types

1Q-09

4Q-08

3Q-08

2Q-08

1Q-08

$1,680

$1,628

$1,624

$1,602

$1,613

($ in millions)

Average Transaction & Savings Deposits

Average Total Deposits

($ in millions)

$2,832

$2,795

$2,783

$2,780

$2,822

1Q-08

2Q-08

3Q-08

4Q-08

1Q-09

Average Time Deposits

($ in millions)

$1,219

$1,193

$1,158

$1,152

$1,142

1Q-08

2Q-08

3Q-08

4Q-08

1Q-09

40

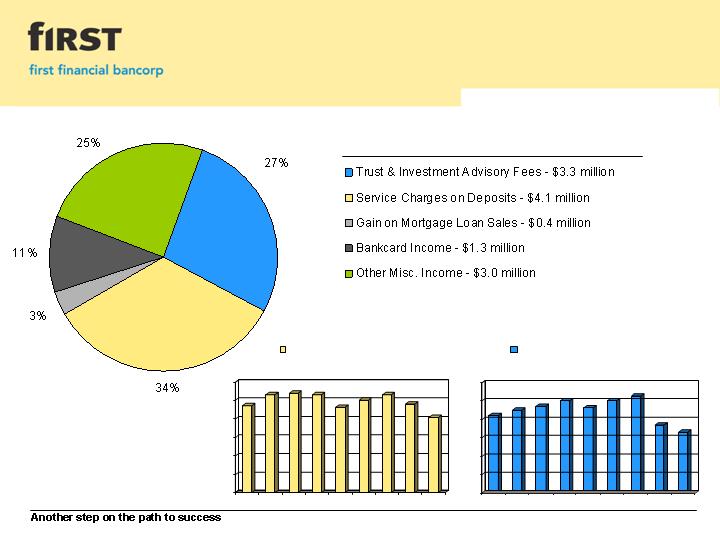

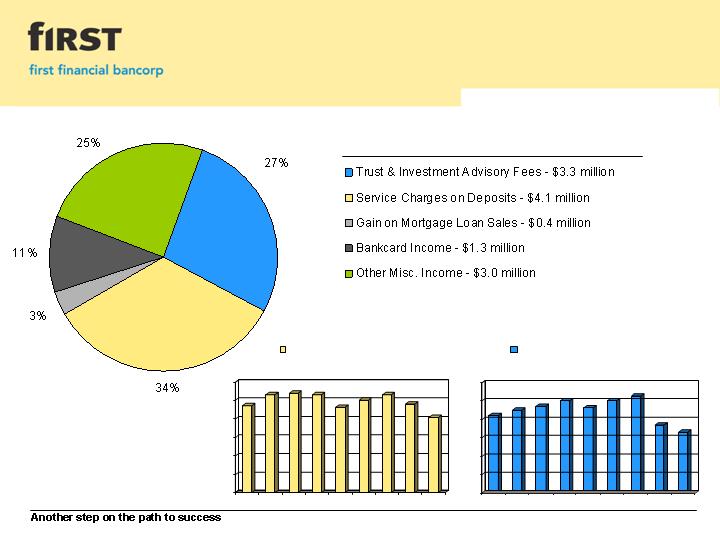

Noninterest Income

Trust & Investment Advisory Fees

1Q-09

4Q-08

3Q-08

2Q-08

1Q-08

4Q-07

3Q-07

2Q-07

1Q-07

$6.0

$5.0

$4.0

$3.0

$2.0

$1.0

$0.0

($ in millions)

($ in millions)

First Quarter 2009

Total Noninterest Income = $12.0 million

$0.0

$1.0

$2.0

$3.0

$4.0

$5.0

$6.0

1Q-07

2Q-07

3Q-07

4Q-07

1Q-08

2Q-08

3Q-08

4Q-08

1Q-09

Service Charges on Deposits

41

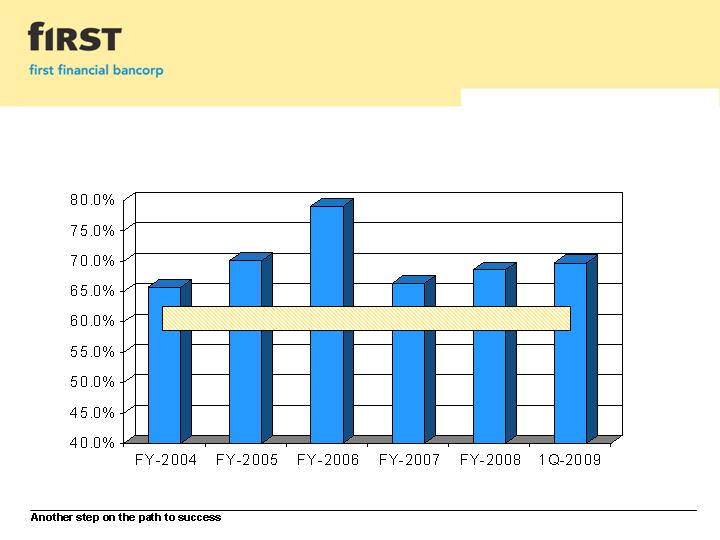

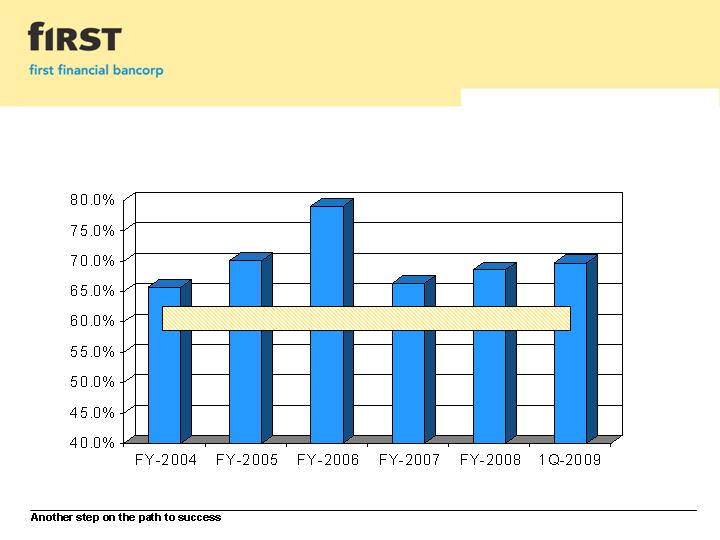

Efficiency

Long-Term Target = 55% to 60%

Efficiency Ratio

42

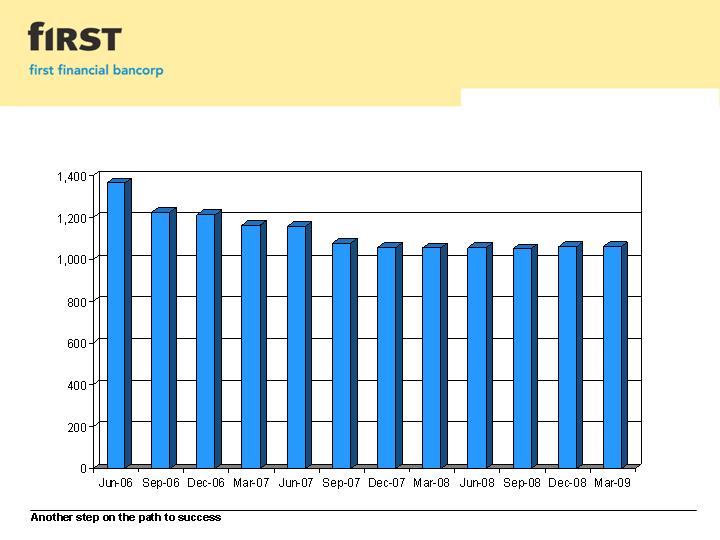

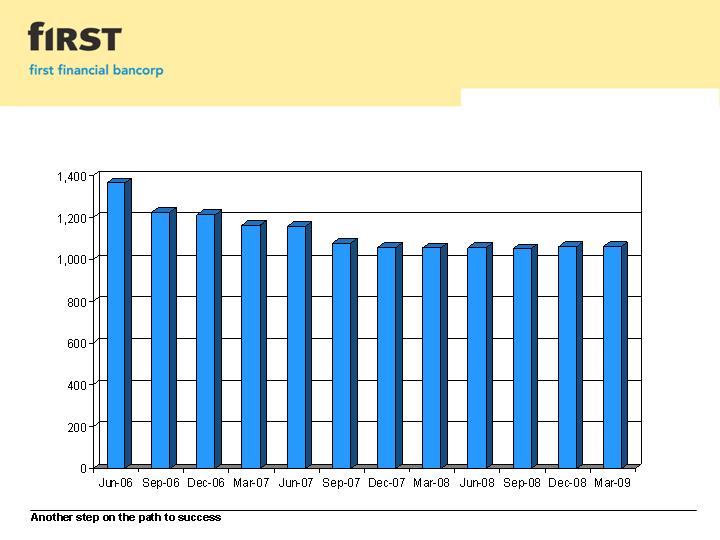

Staffing Level

Full-Time Equivalent Personnel

43

Summary of Items Impacting

Earnings Per Share

2009

1Q

Full-Year

4Q

3Q

2Q

1Q

Full-Year

4Q

3Q

2Q

1Q

Gain (Loss) on FHLMC shares*

11

$

(3,738)

$

(137)

$

(3,400)

$

(221)

$

20

$

-

$

-

$

-

$

-

$

-

$

Increase in Loan Loss Reserve & Higher

Charge-offs

-

(7,539)

(7,539)

-

-

-

-

-

-

-

-

Gain on Sale of Propery & Casualty Portion of

Insurance Business

574

-

-

-

-

-

Gain on Sale of Merchant Payment Processing

Portfolio

-

-

-

-

-

-

5,501

5,501

-

-

-

Severance Costs Related to Sale of Property &

Casualty Insurance Business

(232)

Pension Settlement Charges

-

-

-

-

-

-

(2,222)

(2,222)

-

-

-

Gains on Sales of Investment Securities

(VISA 2008; MasterCard 2007)

-

1,585

-

-

-

1,585

367

-

367

-

-

Gain on Sale of Mortgage Servicing Rights

-

-

-

-

-

-

1,061

-

-

-

1,061

Visa Member Litigation Charges

-

-

-

-

-

-

(461)

(461)

-

-

-

Impact to Pre-Tax Net Income

353

$

(9,692)

$

(7,676)

$

(3,400)

$

(221)

$

1,605

$

4,246

$

2,818

$

367

$

-

$

1,061

$

After-Tax Impact to Earnings Per Diluted

Share

0.01

$

(0.17)

$

(0.13)

$

(0.06)

$

(0.00)

$

0.03

$

0.07

$

0.05

$

0.01

$

-

$

0.02

$

*

($ in thousands, excluding per share data)

2007

2008

Gain (Loss) related to the company's investment in 200,000 Federal Home Loan Mortgage Corporation (FHLMC) perpetual preferred series V shares.

Leadership

45

Leadership

Claude E. Davis

President & Chief Executive Officer

Claude E. Davis joined First Financial in 2004 as President, Chief Executive Officer, and a member of the Board of Directors. Mr. Davis

also serves as Chairman of the Board of Directors of First Financial Bank. Prior to joining the company, he served as Senior Vice

President at Irwin Financial Corporation, and Chairman of Irwin Union Bank and Trust, the company’s lead bank, positions he held since

2003. Earlier in his career, he served as President of Irwin Union Bank and Trust for seven years. Mr. Davis began his career as a

Certified Public Accountant with the public accounting firm Coopers & Lybrand.

C. Douglas Lefferson

Executive Vice President & Chief Operating Officer

C. Douglas Lefferson has spent his entire career in various positions within First Financial Bancorp and First Financial Bank, and was

appointed to his current position in 2005. Prior to his current appointment, Mr. Lefferson served as Chief Financial Officer from 2002

through 2005.

J. Franklin Hall

Executive Vice President & Chief Financial Officer

J. Franklin Hall joined First Financial in 1999 as First Vice President, Controller, and Director of Finance, and was appointed to his

current position in 2005. Prior to joining the company, he was with Firstar Bank (currently US Bancorp). He is a Certified Public

Accountant (inactive), and began his career with the public accounting firm Ernst & Young, LLP. Mr. Hall also serves as President of the

First Financial Bancorp subsidiary First Financial Capital Advisors, LLC, and is President of the company’s proprietary mutual fund

family, First Funds.

Samuel J. Munafo

Executive Vice President, Banking Markets

Samuel J. Munafo has spent his entire career in various positions within First Financial Bancorp and First Financial Bank and currently

serves as Executive Vice President overseeing all of the company’s banking markets. Prior to his current appointment, Mr. Munafo

served as President of First Financial Bank (2005 – 2006), and President and Chief Executive Officer for several First Financial affiliates,

including Community First Bank & Trust (2001 - 2005), Indiana Lawrence Bank (1998 – 2001), and Clyde Savings Bank (1994 – 1998).

He began his career with the company as a management trainee and served the company in a number of areas, including operations,

retail, commercial lending, credit cards and security.

46

Leadership

Richard Barbercheck

Senior Vice President & Chief Credit Officer

Richard Barbercheck joined First Financial in 2005 as Senior Vice President and Chief Risk Officer, and was appointed to his current

position in 2006. Mr. Barbercheck is responsible for the administration of the bank’s lending portfolios as well as oversight of the

company’s credit policies and loan underwriting processes. Prior to joining the company, he oversaw the Credit Risk Evaluation Group

at Irwin Financial Corporation (Columbus, Indiana). Earlier in his career he served at several banks in executive-level positions

located in Southeastern Indiana, including Veedersburg State Bank (1989 – 1993), National City Bank (1993 - 1996), and Irwin Union

Bank (1999 - 2000). Mr. Barbercheck has a total of 27 years of banking experience, with a predominance of experience in the

commercial lending and credit administration areas.

Michael Cassani

Senior Vice President, Wealth Resource Group

Michael Cassani joined First Financial in 2007 as Senior Vice President and Chief Administrative Officer to oversee the company’s

Wealth Resource Group. Prior to joining the company, Mr. Cassani served as President of Fund Project Services, Inc., a financial

project management and consulting firm he co-founded in 1998. Earlier in his career, he served as Mutual Funds Product Manager at

Fifth Third Bank, and as Institutional Investment Officer at Roulston and Company. Prior to those appointments, Mr. Cassani served

as an Investment Representative for two separate companies located within the Chicago area.

Gregory A. Gehlmann

Senior Vice President, General Counsel

Gregory A. Gehlmann joined First Financial in 2005 as Senior Vice President and General Counsel. Mr. Gehlmann also served as

Chief Risk Officer for the company (2006 – 2008). Prior to joining the company, he practiced law for 16 years in Washington, D.C. Mr.

Gehlmann served as partner/counsel at Manatt, Phelps & Phillips, LLP (Washington, D.C.), where he was counsel to public and

private companies, as well as investors, underwriters, directors, officers, and principals regarding corporate securities, banking, and

general business and transactional matters.

47

Leadership

John Sabath

Senior Vice President & Chief Risk Officer

John Sabath joined First Financial in 2005 as Regulatory Risk Manager. Mr. Sabbath was then promoted to Senior Risk Officer and

First Vice President, and assumed his current position in 2008. He is responsible for management of the company’s risk management

function which includes commercial and retail credit, compliance, operational, market, strategic and reputation risk. Prior to joining the

company, he was in the Enterprise Risk Group at Fifth Third Bank. Earlier in his career, Mr. Sabbath held positions at the Federal

Reserve Bank of Cleveland, National City Bank and Star Bank (currently US Bancorp).

Jill A. Stanton

Senior Vice President, Retail & Small Business Lending Manager

Jill Stanton joined First Financial in 2008. Ms. Stanton has responsibility for product line management for first mortgage loans,

consumer lending and small business lending. Prior to joining the company, she served as Senior Vice President for Irwin Union Bank

where she was responsible for mortgage, consumer lending, business banking, commercial credit analysis, credit administration and

loan operations in their commercial banking business. Ms. Stanton has over 20 years of experience within the banking industry.

Jill L. Wyman

Senior Vice President, Retail Banking Sales & Deposit Manager

Jill Wyman joined First Financial in 2003 as Vice President and Sales Director. In her current position, Ms. Wyman has responsibility

for leading the retail sales process, growing retail deposits, and enhancing the sales culture throughout the company’s three-state

banking center network. She is also responsible for market services and corporate marketing. Prior to joining the company, she spent

19 years in retail where she served as general manager at Lazarus, a division of Federated Department Stores (currently Macy’s). Ms.

Wyman began her career as a management trainee at Federated/Macy’s and progressed to sales manager, group sales manager,

assistant general manager and regional merchandise manager.

March 31, 2009

About First Financial Bancorp

First Financial Bancorp is a Cincinnati, Ohio based bank holding company with

$3.8 billion in assets. Its banking subsidiary, First Financial Bank, N.A., founded

in 1863, provides retail and commercial banking products and services, and

investment and insurance products through its 82 retail banking locations in

Ohio, Kentucky and Indiana. The bank’s wealth management division, First

Financial Wealth Resource Group, provides investment management, traditional

trust, brokerage, private banking, and insurance services, and has approximately

$1.6 billion in assets under management. Additional information about the

company, including its products, services, and banking locations, is available at

www.bankatfirst.com.

Another step on the path to success