First Financial Bancorp

Investor Presentation

Assumption of Deposits and

Acquisition of Assets of

Peoples Community Bank from the FDIC

August 2009

Exhibit 99.3

2

Forward-Looking Statement Disclosure

This presentation should be read in conjunction with the consolidated financial statements, notes and tables in First Financial Bancorp’s most recent Annual Report on Form 10-K for

the year ended December 31, 2008.

Management’s analysis contains forward-looking statements that are provided to assist in the understanding of anticipated future financial performance. However, such performance

involves risk and uncertainties that may cause actual results to differ materially. Factors that could cause actual results to differ from those discussed in the forward-looking statements

include, but are not limited to, management’s ability to effectively execute its business plan; the risk that the strength of the United States economy in general and the strength of the

local economies in which First Financial conducts operations continue to deteriorate, resulting in, among other things, a deterioration in credit quality or a reduced demand for credit,

including the resultant effect on First Financial’s loan portfolio, allowance for loan and lease losses and overall financial purpose; the ability of financial institutions to access sources of

liquidity at a reasonable cost; the impact of recent upheaval in the financial markets and the effectiveness of domestic and international governmental actions taken in response, such

as the U.S. Treasury’s TARP and the FDIC’s Temporary Liquidity Guarantee Program, and the effect of such governmental actions on First Financial, its competitors and

counterparties, financial markets generally and availability of credit specifically, and the U.S. and international economies, including potentially higher FDIC premiums arising from

participation in the Temporary Liquidity Guarantee Program or from increased payments from FDIC insurance funds as a result of depository institution failures; the effects of and

changes in policies and laws of regulatory agencies, inflation, and interest rates; technology changes; mergers and acquisitions; including our ability to successfully integrate the

Peoples Community Bank banking centers, and the banking centers which are expected to be acquired from Irwin Union Bank and Trust Company; the effect of changes in

accounting policies and practices; adverse changes in the securities and debt markets; First Financial’s success in recruiting and retaining the necessary personnel to support

business growth and expansion and maintain sufficient expertise to support increasingly complex products and services; the cost and effects of litigation and of unexpected or adverse

outcomes in such litigation; uncertainties arising from First Financial’s participation in the TARP, including impacts on employee recruitment and retention and other business

practices, and uncertainties concerning the potential redemption of the U.S. Treasury’s preferred stock investment under the program, including the timing of, regulatory approvals for,

and conditions placed upon, any such redemption; and First Financial’s success at managing the risks involved in the foregoing.

For further discussion these and other factors that may cause such forward-looking statements to differ materially from actual results, refer to the 2008 Form 10-K and other public

documents filed with the Securities and Exchange Commission (SEC), as well as the most recent Form 10-Q filing for the quarter ended March 31, 2009. These documents are

available at no cost within the investor relations section of First Financial’s website at www.bankatfirst.com/investor and on the SEC's website at www.sec.gov. Additional information

will also be set forth in our quarterly report on Form 10-Q for the quarter ended June 30, 2009, which will be filed with the SEC no later than August 10, 2009.

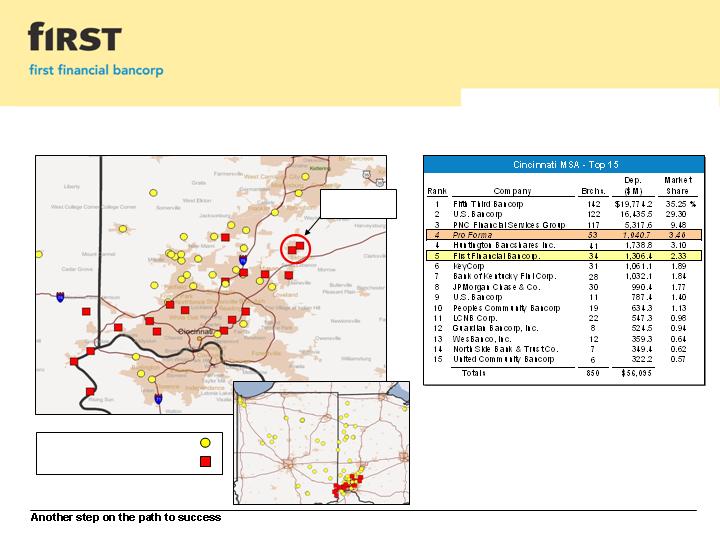

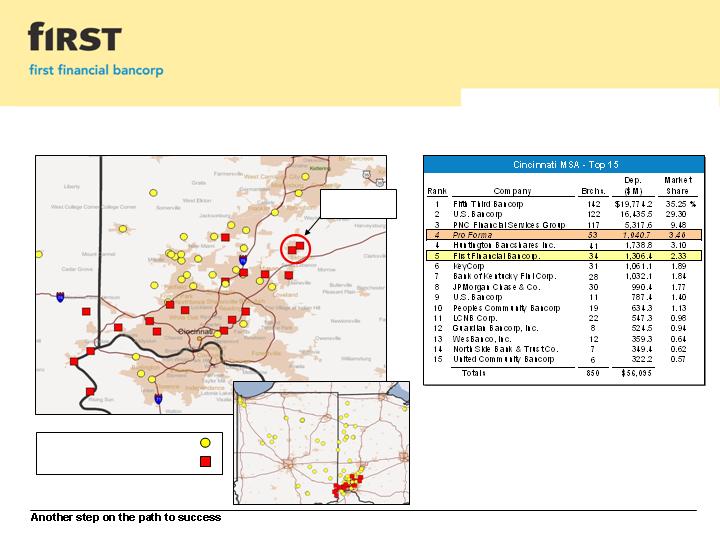

Addition of up to 19 banking centers in Cincinnati MSA announced July 31, 2009 via assumption of deposits

and purchase of assets from the FDIC

Consistent with First Financial's stated and conservative strategy

First Financial will have the 4th largest branch network in the Cincinnati MSA1

Pro forma 3.46% Cincinnati MSA deposit market share compared with 2.33% currently – still room to grow1

Further solidifying First Financial's position in this very attractive market

Accelerates growth-market expansion strategy by several years

Acquisition is compelling relative to cost and time to build 19 profitable de novo banking centers

Earlier agreement terminated and replaced with FDIC-assisted transaction

Assets

approximately $594 million in total assets (book value of seller)

$436 million of loans under loss sharing agreement with total loss protection of 88.5%

$138 million of securities and cash

$20 million of other assets includes foreclosed real estate

Liabilities

approximately $601 million in liabilities (book value of seller)

$538 million in deposits

$59 million in secured borrowings

$4 million in other liabilities

3

Transaction Overview

1 Source: SNL Financial

1.5% deposit premium

Deposit premium of approximately $8.0 million

Some core deposit premium intangible may be recorded after fair market value accounting applied

$42 million discount on assets

Loss-sharing agreement with FDIC

$0 First Loss Position for FFBC

Loss-sharing with the FDIC will be immediate

80% FDIC / 20% FFBC up to $190 million in loan and foreclosed real estate losses

95% FDIC / 5% FFBC above $190 million in loan and foreclosed real estate losses

90 Day option to purchase 19 branches, other property & equipment or assume leases

4

Transaction Overview

5

Acquisition Highlights

Low risk transaction

Loss sharing arrangement provides significant protection on the acquired loan and foreclosed real estate

portfolio. The transaction structure results in immediate loss sharing with the FDIC.

Due diligence over lengthy period of time (and during stressful economic period)

In-market transaction improves operating leverage

Manageable size reduces integration risk

Improves liquidity

First Financial's capital levels will remain well in excess of regulatory minimums for well capitalized

institutions

Risk weighting of covered assets is 20% for regulatory capital calculations

Nominal impact to capital

Preliminary transaction pro forma indicates potential for recognition of negative goodwill

6

Growth-Market Expansion

Source: SNL Financial and FDIC

Note: Data as of June 30, 2008

Considerably enhances First Financial’s presence in the attractive Cincinnati MSA

First Financial

PCB Branches

New with this

transaction

7

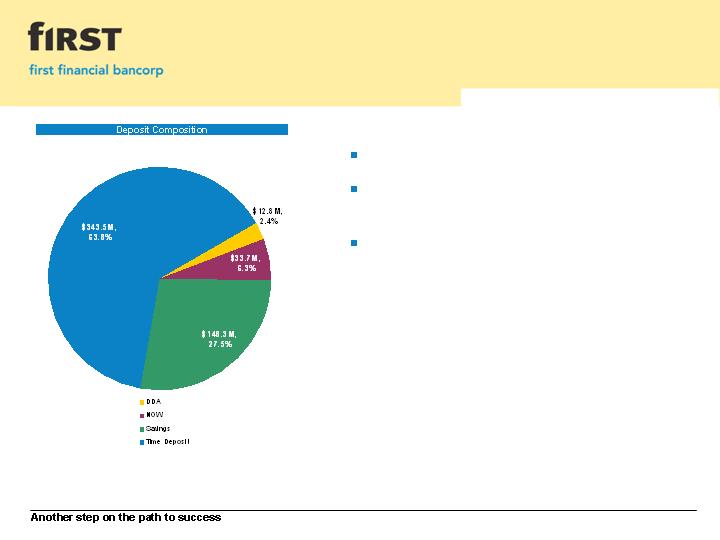

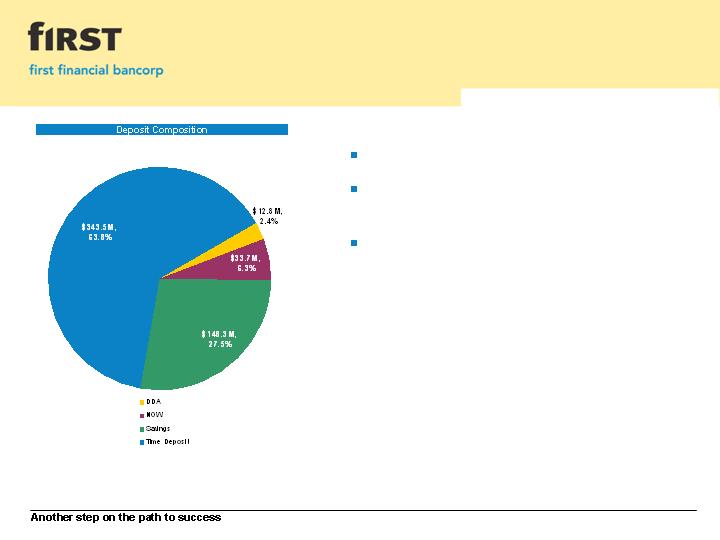

Deposit Composition

Total deposits of $538 million

Weighted average interest rate 3.06%

(based on seller’s book value)

Ability to modify rates on CD portfolio at

time of assumption

Balances and rates as of June 30, 2009

8

Loan Portfolio

Total loans of $436 million

Weighted average interest rate 5.73%

Yield on portfolio may change based on

fair value assessment

Primarily in-market portfolio

1 “Other” includes church, farm, stock, commercial and personal vehicle loans, unsecured commercial, and loans secured by deposit accounts

Balances and rates as of June 30, 2009

1

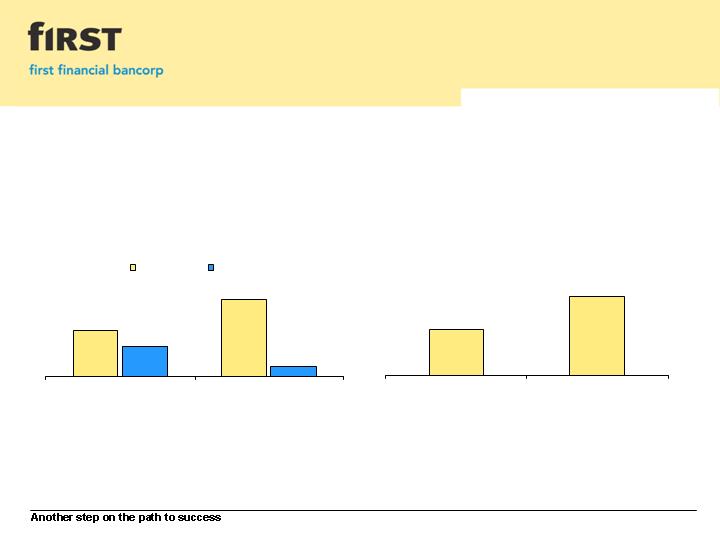

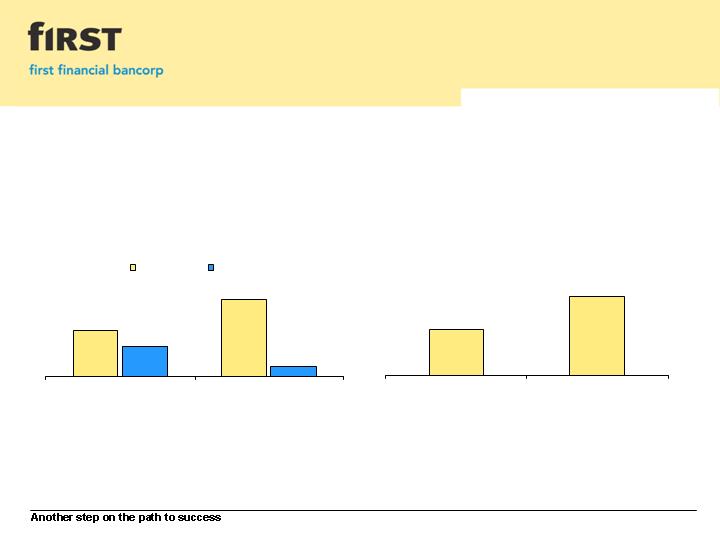

Transaction Comparison

9

Deposit yield is expected to decrease due to

the expected change in CD pricing allowed for

by the FDIC guidelines

Note

All balance sheet items are based on the book balances of the seller. Fair value adjustments will be finalized

during the third quarter.

5.73% WAR

5.98% WAR

Risk weighted loans

Total loans

FDIC

Previous

$55

$170

$261

$436

Loans

Deposits

$310

$538

Previous

FDIC

2.52% WAR

3.06% WAR

46% Time

deposits

64% Time

deposits

10

Investment Highlights

Very attractive transaction

First Financial expands its banking center network in the Cincinnati MSA by 50%1

Transaction adds stable funding and banking centers in key areas that will leverage the First Financial brand to

increase market share

Minimal deposit runoff is expected

In-market transaction with low integration risk

Attractive demographic profile1 2

5-year population growth rate of 9.8%

Median household income of $66,500

5-year household income growth rate of 26%

Based on current assumptions, the acquisition is projected to be accretive to 2010 cash EPS, and will leave

First Financial with a strong pro forma capital position

1 Source: SNL Financial

2 Weighted average demographics for each banking center based on its ZIP code, weighted by deposits as of June 30, 2008

Summary: This transaction leverages current market conditions and First Financial’s capital and

competitive strength to accelerate the company’s key-market growth strategy

11

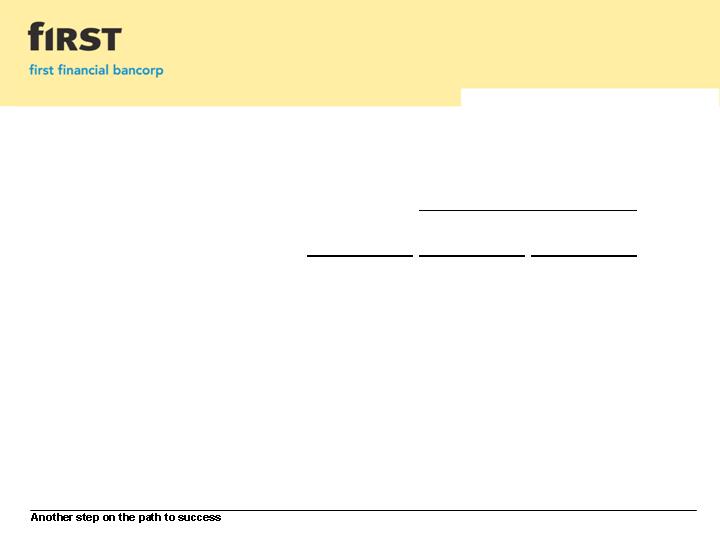

Pro Forma Performance Metrics

1

2

1 Based on June 30, 2009 Balances and preliminary fair value estimates which may change materially

2 Assumes pay down of PCB borrowings and release of escrow balances for IUB branch sale

Stand Alone

June 30, 2009

PCB Only

Irwin & Other

Adjustments

Capital Ratios

Tang. Common Equity / Tang. Assets

9.06%

7.98%

8.00%

Tang. Equity / Tang. Assets

11.14%

9.77%

9.79%

Tier I Capital Ratio

14.77%

14.44%

14.26%

Total Capital Ratio

16.02%

15.64%

15.45%

Estimated Pro Forma

Another step on the path to success