U.S. SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark one)

☒ | Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

| for the fiscal year ended December 31, 2023. |

| |

☐ | Transition Report Pursuant to Section 13 or 15 (d) of the Securities Exchange Act of 1934 |

| for the transition period from ____ to____. |

Commission file number 0-11104

NOBLE ROMAN’S, INC. |

(Exact name of registrant as specified in its charter) |

Indiana | | 35-1281154 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

6612 E. 75th Street, Suite 450

Indianapolis, Indiana 46250

(Address of principal executive offices)

Registrant’s telephone number, including area code: (317) 634-3377

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

N/A | | |

Securities registered pursuant to Section 12(g) of the Act: Common Stock

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer | ☐ | Accelerated Filer | ☐ |

Non-Accelerated Filer | ☒ | Smaller Reporting Company | ☒ |

Emerging Growth Company | ☐ | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the Registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the common stock held by non-affiliates of the registrant as of June 30, 2023, the last business day of the registrant’s most recently completed second fiscal quarter, based on the closing price of the registrant’s common shares on such date was approximately $3.14 million.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date: 22,215,512 shares of common stock as of March 1, 2024.

Documents Incorporated by Reference: None

NOBLE ROMAN’S, INC.

FORM 10-K

Year Ended December 31, 2023

Table of Contents

Explanatory Note

Noble Roman’s, Inc. (the “Company”) was recently advised by Assurance Dimensions (“Assurance”), the independent accounting firm, that the Company’s previously issued financial statements in its Annual Report on Form 10-K for the year ended December 31, 2022 (the “Prior Statements”) should be restated to correct errors from prior periods that were reflected in the opening balance sheet for that year. The errors affected accounts payable and accumulated deficit. Accordingly, the prior statements should no longer be relied upon. As a result, we determined to restate such financial statements to correct the error, as included in this report.

The error related to years prior to 2020 and were carried forward to 2022. This error affected the Company’s accounts payable and accumulated deficit in the consolidated balance sheets. Specifically, the Company’s accounts payable and accumulated deficit were understated. The correction also restates interest expense incurred in 2022 which the Company had recorded in 2023.

Below is a comparison of the previously reported amounts, as compared to the restated amounts:

Balance Sheet as of December 31, 2022

| | As Filed | | | As Restated | |

Total current assets | | $ | 3,032,303 | | | $ | 3,032,303 | |

Net property and equipment | | | 4,713,208 | | | | 4,713,208 | |

All other assets | | | 10,597,687 | | | | 10,597,687 | |

Total assets | | | 18,343,198 | | | | 18,343,198 | |

| | | | | | | | |

Accounts payable and accrued expenses | | | 650,582 | | | | 1,807,035 | |

All other current liabilities | | | 1,665,831 | | | | 1,665,831 | |

Total current liabilities | | | 2,316,413 | | | | 3,472,866 | |

Long-term liabilities | | | 14,160,123 | | | | 14,160,123 | |

| | | | | | | | |

Common stock | | | 24,819,736 | | | | 24,819,736 | |

Accumulated deficit | | | (22,953,074 | ) | | | (24,109,527 | ) |

Total liability and stockholders equity | | $ | 18,343,198 | | | $ | 18,343,198 | |

This restatement of the balance sheet as of December 31, 2022 would indicate the three quarter 10-Q’s for 2023 needed to be restated as the change above would carry over to the balance sheet of those quarterly reports. However, because of the immaterial nature of the restatement on the quarterly reports, management has made the decision not to restate those quarterly reports.

Management evaluated its prior conclusions regarding the effectiveness of the Company disclosure control and procedures and internal control over financial reporting. Based on that evaluation, management has concluded that this matter resulted from material weaknesses in the Company’s internal control over financial reporting. See Part II, Item 9A, Controls and Procedures, for additional information regarding this material weakness.

PART 1

ITEM 1. BUSINESS

General Information

Noble Roman’s, Inc., an Indiana corporation incorporated in 1972, sells and services franchises and licenses and operates Company-owned stand-alone restaurants and non-traditional foodservice operations under the trade names “Noble Roman’s Craft Pizza & Pub,” “Noble Roman’s Pizza,” “Noble Roman’s Take-N-Bake,” and “Tuscano’s Italian Style Subs.” References in this report to the “Company” are to Noble Roman’s, Inc. and its two wholly-owned subsidiaries, RH Roanoke, Inc. and Pizzaco, Inc., unless the context requires otherwise. RH Roanoke, Inc. operates a Company-owned non-traditional location. Pizzaco, Inc. currently is dormant.

The Company has been operating, franchising and licensing Noble Roman’s Pizza operations in a variety of stand-alone and non-traditional locations across the country since 1972. The Company is currently experiencing significant growth in the number of non-traditional franchised locations. See “Noble Roman’s Pizza for Non-Traditional Locations” below for additional information.

The Company’s first Craft Pizza & Pub location opened in January 2017 as a Company-operated restaurant in a northern suburb of Indianapolis, Indiana. Since then, the Company opened a total of eight more Company-operated locations in 2017, 2018, 2020 and 2021. The Company may open additional locations in the future. The Company-operated locations serve as the base for what it sees as a significant potential future growth driver, including additional Company operated locations and franchising its full-service restaurant format to experienced, multi-unit restaurant operators with a track record of success.

As discussed below under “Impact of COVID-19 Pandemic” the COVID-19 pandemic materially affected the Company’s business and its franchising operations, beginning when the pandemic emerged during the first quarter of 2020.

Noble Roman’s Craft Pizza & Pub

The Noble Roman’s Craft Pizza & Pub format incorporates many of the basic elements first introduced in 1972 but in a modern atmosphere with up-to-date baking technology and equipment to maximize speed, enhance quality and continue the taste customers love and expect from a Noble Roman’s.

The Noble Roman’s Craft Pizza & Pub provides for a selection of over 40 different toppings, cheeses and sauces from which to choose. Beer and wine also are featured, with 16 different beers on tap including both national and local craft selections. Wines include 16 affordably priced options by the bottle or glass in a range of varietals. Beer and wine service is provided at the bar and throughout the dining room.

The Company designed the system to enable fast cook times, with oven speeds running approximately 2.5 minutes for traditional pizzas and 5.75 minutes for Sicilian pizzas. Popular pizza favorites such as pepperoni are options on the menu and these locations also offer a selection of Craft Pizza & Pub original pizza creations. The menu also features a selection of contemporary and fresh, made-to-order salads and fresh-cooked pasta. The menu also incorporates baked sub sandwiches, hand-sauced wings and a selection of desserts, as well as Noble Roman’s famous Breadsticks with Spicy Cheese Sauce, most of which has been offered in its locations since 1972. In 2022, new salad bars were rolled out over time across all Company-operated restaurants.

Additional enhancements include a glass enclosed “Dough Room” where Noble Roman’s Dough Masters hand make all pizza and breadstick dough from scratch in customer view. Kids and adults enjoy Noble Roman’s self-serve root beer tap, which is also part of a special menu for customers 12 and younger. Throughout the dining room and the bar area there are many giant screen television monitors for sports and the nostalgic black and white shorts featured in Noble Roman’s since 1972.

The Company designed its curbside service for carry-out customers, called “Pizza Valet Service,” to create added value and convenience. With Pizza Valet Service, customers place orders ahead, drive into the restaurant’s reserved valet parking spaces and have their pizza run to their vehicle by specially uniformed pizza valets. Customers who pay when they place their orders are able to drive up and leave with their order very quickly without stepping out of their vehicle. For those who choose to pay after they arrive, pizza valets can take credit card payments on their mobile payment devices right at the customer's vehicle. With the fast baking times, the entire experience, from order to pick-up can take as little as 12 minutes.

Noble Roman’s Pizza For Non-Traditional Locations

In 1997, the Company started franchising non-traditional locations (a Noble Roman’s pizza operation within some other host business or activity with existing traffic) such as entertainment facilities, hospitals, convenience stores and other types of facilities. These locations utilize the two pizza styles the Company started with in 1972, along with its great tasting, high quality ingredients and menu extensions.

The Company refocused its development plans toward selling more non-traditional franchises as a result of the pandemic coming to an end and the owners of non-traditional locations becoming more willing to look at expansion options and to invest in their growth. The focus on selling more non-traditional franchise locations, including several locations with higher-than-average potential volumes, is proceeding, and the Company has a significant backlog of prospects to expand the franchise locations.

As an example of its development plans, in October 2023, the Company entered into a development agreement with Majors Management, LLC (“Majors Management”) for 100 franchise locations to be developed prior to September 30, 2026. Majors Management owns many more locations than the initial locations covered by this development agreement and has indicated that it is likely to expand the Company’s development of new locations with many other locations. In addition, the Company believes that its development with Majors Management has spurred interest in the Company’s concept by many other owners of potential host facilities.

The hallmark of Noble Roman’s Pizza for non-traditional locations is “Superior quality that our customers can taste.” Every ingredient and process has been designed with a view to produce superior results.

| · | A fully-prepared pizza crust that captures the made-from-scratch pizzeria flavor which gets delivered to non-traditional locations in a shelf-stable condition so that dough handling is no longer an impediment to a consistent product, which otherwise is a challenge in non-traditional locations. |

| · | Fresh packed, uncondensed and never cooked sauce made with secret spices, parmesan cheese and vine-ripened tomatoes in all venues. |

| · | 100% real cheese blended from mozzarella and Muenster, with no additives or extenders. |

| · | 100% real meat toppings, with no soy additives or extenders, a distinction compared to many pizza concepts. |

| · | Vegetables (like onions and green peppers) and mushrooms for pizzas are sliced and delivered fresh, never canned. |

| · | An extended product line that includes breadsticks and cheesy stix with dip, pasta, baked sandwiches, salads, wings and a line of breakfast products. |

| · | The fully-prepared crust also forms the basis for the Company’s Take-N-Bake pizza for use as an add-on component for its non-traditional franchise and licensing base. |

Business Strategy

The Company refocused its development plans toward selling more non-traditional franchises as a result of the pandemic coming to an end and the owners of non-traditional locations becoming more willing to look at expansion options and to invest in their growth. In doing so the Company is maintaining its focus on expansion of revenue while carefully managing corporate-level overhead expenses. The Company will also continue to develop, own and operate select Craft Pizza & Pub locations as opportunities present themselves. The Company believes franchising the Craft Pizza & Pub concept has considerable future growth potential as well.

The initial fees for a Noble Roman’s Pizza non-traditional location or a Craft Pizza & Pub location are as follows:

| | Non-Traditional Except Hospitals | | | Non-Traditional Hospitals | | | Traditional Stand-Alone | |

Either a Noble Roman’s Pizza or Craft Pizza & Pub | | $ | 7,500 | | | $ | 10,000 | | | $ | 30,000 | (1) |

(1) With the sale of multiple traditional stand-alone franchises to a single franchisee, the franchise fee for the first unit is $30,000, the franchise fee for the second unit is $25,000 and the franchise fee for the third unit and any additional unit is $20,000.

The fees are paid upon signing the franchise agreement and, when paid, are non-refundable in consideration of the administration and other expenses incurred by the Company in granting the franchises.

The Company’s proprietary ingredients used by both Craft Pizza & Pub locations and non-traditional locations are manufactured pursuant to the Company’s recipes and formulas by third-party manufacturers under contracts between the Company and its various manufacturers. These contracts require the manufacturers to produce ingredients meeting the Company’s specifications and to sell them to Company-approved distributors at prices negotiated between the Company and the manufacturer.

The Company utilizes distributors it has strategically identified in areas across the United States where Company-owned and franchise operations are located. The distributor agreements require the distributors to maintain adequate inventories of all ingredients necessary to meet the needs of the Company’s franchisees and licensees in their distribution areas for weekly deliveries.

Competition

The restaurant industry and the retail food industry in general are very competitive with respect to convenience, price, product quality and service. In addition, the Company competes for franchise and license sales on the basis of product engineering and quality, investment cost, cost of sales, distribution, simplicity of operation and labor requirements. Actions by one or more of the Company’s competitors could have an adverse effect on the Company’s ability to sell additional franchises or licenses, maintain and renew existing franchises or licenses, or sell its products. Many of the Company’s competitors are very large, internationally established companies.

Within the environment in which the Company competes, management has identified what it believes to be certain competitive advantages for the Company. Many of the Company’s competitors in the non-traditional venue were established with little or no organizational history operating traditional foodservice locations. This lack of operating experience may limit their ability to attract and maintain non-traditional franchisees or licensees who, by the nature of the venue, often have little exposure to foodservice operations themselves. The Company’s background in traditional restaurant operations has provided it experience in structuring, planning, marketing, and controlling costs of franchise or license unit operations which may be of material benefit to franchisees or licensees.

The Company’s Noble Roman’s Craft Pizza & Pub format competes with similar restaurants in its service area. Some of the competitors are company-owned, some are franchised locations of large chains and others are independently owned. Some of the competitors are larger and have greater financial resources than the Company.

Seasonality of Sales

Inclement or unusually cold winter weather conditions tend to adversely affect sales, especially those of the Craft Pizza & Pubs which are primarily designed for in-store dining and carry-out, which in turn affects Company revenue. Spring weather may also adversely affect sales in Craft Pizza & Pub locations as people first start to spend time outside. Sales of non-traditional franchises or licenses may be affected by weather and holiday periods. Non-traditional venue sales may be slower around major holidays such as Thanksgiving and Christmas, and during the first quarter of the year. Product sales by the non-traditional franchises/licenses may be slower during the first quarter of the year.

Human Capital

As of March 1, 2024, the Company employed approximately 36 persons full-time and 118 persons on a part-time, hourly basis, of which 11 of the full-time employees are employed in sales and service of the franchise/license units and 25 in restaurant locations. No employees are covered under a collective bargaining agreement. The Company believes that relations with its employees are good.

Trademarks and Service Marks

The Company owns and protects several trademarks and service marks. Many of these, including NOBLE ROMAN’S®, Noble Roman’s Pizza®, THE BETTER PIZZA PEOPLE®, “Noble Roman’s Take-N-Bake Pizza,” “Noble Roman’s Craft Pizza & Pub®,” “Pizza Valet” and “Tuscano’s Italian Style Subs®,” are registered with the U.S. Patent and Trademark Office as well as with the corresponding agencies of certain other foreign governments. The Company believes that its trademarks and service marks have significant value and are important to its sales and marketing efforts.

Government Regulation

The Company and its franchisees and licensees are subject to various federal, state and local laws affecting the operation of the respective businesses. Each location, including the Company’s Craft Pizza & Pub locations, are subject to licensing and regulation by a number of governmental authorities, which include health, safety, sanitation, building, employment, alcohol and other agencies and ordinances in the state or municipality in which the facility is located. The process of obtaining and maintaining required licenses or approvals can delay or prevent the opening of a location. Vendors, such as third parties that produce and distribute products the Company and its franchisees and licensees sell are also licensed and subject to regulation by state and local health and fire codes, and the U. S. Department of Transportation. The Company, its franchisees, licensees and vendors are also subject to federal and state environmental regulations, as well as laws and regulations relating to minimum wage and other employment-related matters. The Company is subject to various local, state and/or federal laws requiring disclosure of nutritional and/or ingredient information concerning the Company’s products, its packaging, menu boards and/or other literature. Changes in the laws and rules applicable to the Company or its franchisees or licensees, or their interpretation, could have a material adverse effect on the Company’s business.

The Company is subject to regulation by the Federal Trade Commission (“FTC”) and various state agencies pursuant to federal and state laws regulating the offer and sale of franchises. Several states also regulate aspects of the franchisor-franchisee relationship. The FTC requires the Company to furnish to prospective franchisees a disclosure document containing specified information. Several states also regulate the sale of franchises and require registration of a franchise disclosure document with state authorities. Substantive state laws that regulate the franchisor-franchisee relationship presently exist in a substantial number of states and bills have been introduced in Congress from time to time that would provide for additional federal regulation of the franchisor-franchisee relationship in certain respects. State laws often limit, among other things, the duration and scope of non-competition provisions and the ability of a franchisor to terminate or refuse to renew a franchise. Some foreign countries also have disclosure requirements and other laws regulating franchising and the franchisor-franchisee relationship, and the Company is subject to applicable laws in each jurisdiction where it seeks to market additional franchised units.

Impact of COVID-19 Pandemic and the Government Response

In the first quarter of 2020, a novel strain of coronavirus (COVID-19) emerged and spread throughout the United States. The World Health Organization recognized COVID-19 as a pandemic in March 2020. In response to the pandemic, the U.S. federal government and various state and local governments have, among other things, imposed travel and business restrictions, including stay-at-home orders and other guidelines that required restaurants and bars to close or restrict inside dining. The pandemic resulted in significant economic volatility, uncertainty and disruption, reduced commercial activity and weakened economic conditions in the regions in which the Company and its franchisees operate.

The pandemic and the governmental response had a significant adverse impact on the Company due to, among other things, governmental restrictions, reduced customer traffic, staffing challenges and supply difficulties, especially as a result of the emergence of the Omicron and other variants of COVID-19 in late 2021 and early in 2022. Many states and municipalities in the United States, including Indiana where all of the Company-owned Craft Pizza & Pub restaurants are located, temporarily restricted travel and suspended the operations of dine-in restaurants and other businesses in light of COVID-19 which negatively affected the Company’s operations. Future outbreaks of COVID-19 or other pandemics could adversely affect the Company. Further, the Company can provide no assurance the phase out of restrictions will result in the full restoration of the Company’s historical sales patterns and levels.

Host facilities for the Company’s non-traditional franchises were also affected by labor shortages which adversely impacted those developments and in turn slowed the sales of franchises. The largest impact on the Company’s non-traditional franchising segment was that essentially all facilities located inside entertainment centers, including bowling centers, were ordered to close as they were deemed to be high risk of spread of the disease. Though varied by state, generally speaking those locations were closed for up to two years by government order. Often being small businesses and not highly capitalized, most could not withstand that period of being closed and were not able to reopen. However, with the current strategy of focusing the Company’s efforts on well capitalized non-traditional locations it has successfully replaced those locations with other non-traditional franchise locations.

In February 2021, the Company received a loan of $940,734 under the Paycheck Protection Program (“PPP”), which was in addition to prior PPP loan. In accordance with the adoption of the applicable accounting policy, the Company accounted for the loan as a government grant and presented it in the Condensed Consolidated Statement of Operations as a reduction of certain qualifying expenses incurred during the three-month period ended March 31, 2021. The expenses included payroll costs and benefits, interest on mortgage obligations, rent under lease agreements, utilities and other qualifying expenses pursuant to the Coronavirus Aid, Relief and Economic Security Act (the “CARES Act”). Because the $940,734 loan was applied against relevant expenses in the first quarter 2021, the result of operations for the 12-month periods in 2021 and 2022 are of limited comparability.

The employee retention credit (“ERC”) is a refundable tax credit that businesses may claim on qualified wages paid to employees. The program was introduced in March 2020 in the CARES Act to incentivize employees to keep their employees on their payroll during the pandemic and economic shutdown. The credit applies to all qualified wages, including certain health plan expenses, paid during the period in which the operations were fully or partially suspended due to a government shutdown order or where there was significant cost increases or decline in gross receipts.

When first established under the CARES Act, the tax credit was equal to 50% of the qualified wages an eligible employer paid to employees after March 12, 2020 and before January 1, 2021. The credit was also limited to a maximum annual per employee credit of $5,000. The credit was then extended through June 30, 2021 by the Tax Payer Certainty and Disaster Relief Act (“Relief Act”) (Division EE of the Consolidated Appropriations Act). The Relief Act modified the credit to be 70% of up to $10,000 of qualified wages per quarter in 2021 through June 30, 2021. The program was further extended through December 31, 2021 by the American Rescue Plan Act of 2021 (“ARPA”) but was retroactively cut short by the Infrastructure Investment and Jobs Act, ending effective September 30, 2021.

During the first quarter of 2023 the Company determined that it was entitled to an ERC of $1.718 million and submitted amended federal Form 941 returns claiming that refund. The ERC refund is treated as a government grant and reduced appropriate expenses for the $1.718 million less expenses for applying for the refund of $258,000 or a net of $1.460 million. This refund applied both to Noble Roman’s, Inc. and its subsidiary, RH Roanoke, Inc. To date, the Company has received all five quarterly refunds for RH Roanoke, Inc. and three refunds for 2020 and one of the two quarterly refunds for 2021 for Noble Roman’s, Inc. In recent communications with the Internal Revenue Service (“IRS”), that was initiated by the Company, the IRS indicated the final refund claim had been received and was still in process but that all ERC refund payments had been delayed while IRS addresses administrative issues in processing refunds generally.

Available Information

The Company makes available, free of charge through its Investor Relations website (http://www.nrom.info), the latest Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K and amendments to these reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, as soon as reasonably practicable after electronically filing these reports with, or furnishing them to, the Securities and Exchange Commission. The information on the Company’s investor website is not incorporated into this Annual Report on Form 10-K.

ITEM 1A. RISK FACTORS

All phases of the Company’s operations are subject to a number of uncertainties, risks and other influences, many of which are outside of its control, and any one or a combination of which could materially affect its results of operations. Important factors that could cause actual results to differ materially from the Company’s expectations are discussed below. Prospective investors should carefully consider these factors before investing in the Company’s securities as well as the information set forth under “Forward-Looking Statements” in Item 7 of this report. These risks and uncertainties include:

Risks Related to Economic Conditions and Events

Continuing effects of COVID-19 pandemic and continuing economic uncertainties.

The COVID-19 pandemic and the governmental response had a significant adverse impact on the Company due to, among other things, governmental restrictions and forced business closures, reduced customer traffic, staffing challenges, decreased franchising interest, supply chain disruptions, inflation and product shortages. To date, consumer spending behavior has not yet returned to pre-pandemic patterns and the economic pressures resulting from the pandemic and government actions have had an adverse impact on consumer spending at the Company-operated restaurants. Additionally, several venues within the Company’s non-traditional franchising segment, particularly within the broad entertainment venue, remain unviable but the number of locations impacted have been replaced with different non-traditional locations. There is no assurance that these specific conditions will return to pre-pandemic norms. Furthermore, a resurgence of COVID, or the start of a new pandemic or other national emergencies, could result in renewed issues of the type listed above. These risks and any additional risks associated with COVID-19 or a similar outbreak may materially adversely affect the Company’s business or results of operations, and may impact the Company’s liquidity or financial condition.

Competition from larger companies.

The Company competes with large national companies and numerous regional and local companies for franchise and license sales and with respect to its Company-owned locations. Many of its competitors have greater financial and other resources than the Company. The restaurant industry in general is intensely competitive with respect to convenience, price, product quality and service. The Company believes it has some compelling advantages to compete for franchise and license sales on the basis of several factors, including product engineering and quality, investment cost, cost of sales, distribution, simplicity of operation and labor requirements. Activities of the Company’s competitors though could have an adverse effect on the Company’s ability to sell additional franchises or licenses or maintain and renew existing franchises and licenses or the operating results of the Company’s system.

Dependence on growth strategy.

The Company’s growth strategy includes continuing to sell new franchises or licenses and continuing to open the backlog of sold but unopened non-traditional locations. The Company’s growth strategy also contemplates expanding Craft Pizza & Pub locations opportunistically in the future by franchising to qualified franchisees and gradually increasing the number of Company-owned Craft Pizza & Pub locations. The opening and success of new locations will depend upon various factors, which include: (1) the traffic generated by and viability of the underlying activity or business in non-traditional locations; (2) the continued viability of the Craft Pizza & Pub locations; (3) the ability of the franchisees and licensees of either venue to operate their locations effectively; (4) the franchisee's ability to comply with applicable regulatory requirements; and (5) the effect of competition and general economic and business conditions including food and labor costs. Many of the foregoing factors are not within the Company’s control. There can be no assurance that the Company will be able to achieve its plans with respect to the opening and/or operation of new franchises/licenses of non-traditional locations and/or Craft Pizza & Pub locations.

Risks Related to the Company’s Operations

Dependence on success of franchisees and licensees.

While a portion of its revenues are being generated by Company-owned operations, a growing portion of the Company’s revenues comes from royalties and other fees generated by its franchisees and licensees which are independent operators. Their employees are not the Company’s employees. The Company is dependent on the franchisees to accurately report their weekly sales and, consequently, the calculation of royalties. The Company provides training and support to franchisees and licensees but the quality of the store operations and collectability of the receivables may be diminished by a number of factors beyond the Company’s control. Consequently, franchisees and licensees may not operate locations in a manner consistent with the Company’s standards and requirements, or may not hire and train qualified managers and other store personnel. If they do not, the Company’s image and reputation may suffer and its revenues could decline. While the Company attempts to ensure that its franchisees and licensees maintain the quality of its brand and branded products, franchisees and licensees may take actions that adversely affect the value of the Company’s intellectual property or reputation. Overall inflation, general economic conditions, initiatives to increase the Federal minimum wage and a shortage of available labor could have an adverse financial effect on the franchisees/licensees or the Company by increasing labor and other costs.

Dependence on distributors.

The success of the Company’s license and franchise offerings depends upon the Company’s ability to engage and retain unrelated, third-party distributors. The Company’s distributors collect and remit certain of the Company’s royalties and must reliably stock and deliver products to the Company’s licensees and franchisees as well as the Company-owned operations. The Company’s inability to engage and retain quality distributors, or a failure by distributors to perform in accordance with the Company’s standards, could have a material adverse effect on the Company. The COVID-19 pandemic had a materially adverse impact on many of the Company’s current distributors as well as other potential distributors, especially those located in or servicing states that had or have significant and/or prolonged restrictions. Potential disruptions in distribution could result in distribution service under less favorable terms to the Company and its franchisees and licensees. This risk is somewhat mitigated by the number of distributors in the market from which to choose.

Dependence on consumer preferences and perceptions.

The restaurant industry and the retail food industry are often affected by changes in consumer tastes, national, regional and local economic conditions, demographic trends, traffic patterns and the type, number and location of competing restaurants. The Company could be substantially adversely affected by publicity resulting from food quality, illness, an infection pandemic, injury, other health concerns or operating issues stemming from one restaurant or retail outlet or a limited number of restaurants and retail outlets.

Interruptions in supply or delivery of food products.

Dependence on frequent deliveries of product from unrelated third-party manufacturers through unrelated third-party distributors also subjects the Company to the risk that shortages or interruptions in supply caused by contractual interruptions, market conditions, inclement weather or other conditions could adversely affect the availability, quality and cost of ingredients. The COVID-19 pandemic created supply chain shortages that adversely impacted the Company’s operations. In addition, factors such as inflation, which has intensified significantly since the beginning of 2021, market conditions for cheese, wheat, meats, paper, labor and other items may also adversely affect the franchisees and licensees and, as a result, can adversely affect the Company’s ability to add new franchised or licensed locations.

Federal, state and local laws with regard to the operation of the businesses.

The Company is subject to regulation by the FTC and various state agencies pursuant to federal and state laws regulating the offer and sale of franchises. Several states also regulate aspects of the franchisor-franchisee relationship. The FTC requires the Company to furnish to prospective franchisees a disclosure document containing specified information. Several states also regulate the sale of franchises and require registration of a franchise disclosure document with state authorities. Substantive state laws that regulate the franchisor-franchisee relationship presently exist in a substantial number of states, and bills have been introduced in Congress from time to time that would provide for federal regulation of the franchisor-franchisee relationship in certain respects. The state laws often limit, among other things, the duration and scope of non-competition provisions and the ability of a franchisor to terminate or refuse to renew a franchise. Some foreign countries also have disclosure requirements and other laws regulating franchising and the franchisor-franchisee relationship, and the Company would be subject to applicable laws in each jurisdiction where it seeks to market additional franchise units.

Each franchise and Company-owned location is subject to licensing and regulation by a number of governmental authorities, which include health, safety, sanitation, building, alcohol, employment and other agencies and ordinances in the state or municipality in which the facility is located. The process of obtaining and maintaining required licenses or approvals can delay or prevent the opening of a franchise location. Vendors, such as the Company’s third-party production and distribution services, are also licensed and subject to regulation by state and local health and fire codes, and U. S. Department of Transportation regulations. The Company, its franchisees and its vendors are also subject to federal and state environmental regulations. Failure of the Company or its franchisees to comply with these laws and regulations could have an adverse impact on the Company, its operations, financial results or reputation. Additionally, expenses related to compliance with these laws and regulations could have an adverse impact on the Company’s financial results.

Material Weaknesses in Our Internal Control Over Financial Reporting That Resulted in Restatement of Our Financial Statements For the Year Ended December 31, 2022

As a public company, we are required to maintain internal control over financial reporting and to report any material weaknesses in such internal control. Effective internal control over financial reporting is necessary for us to provide reliable financial reports and is designed to prevent fraud. Any failure to maintain or implement required new or improved controls, or difficulties encountered in implementation could cause us to fail to meet our reporting obligations.

As disclosed in the explanatory note at the beginning of this report and Note 2 of our Consolidated Financial Statements, we have identified material weaknesses in our internal control over our financial reporting, which pre-dated our balance sheet as of January 1, 2022. The material weakness was caused by an ineffective control environment resulting from a former employee, who lacked a sufficient level of accounting knowledge and training to appropriately analyze the records and disclose this particular matter accurately. Management of the Company thought they were provided sufficient oversight but on this particular matter they obviously were not. The material weakness is described in more detail under the heading Part II, Item 9kA, Controls and Procedures, in this report. This material weakness resulted in the error discussed in the Explanation Note and elsewhere in this report and the Company concluded that our prior statements should be restated.

Risks Related to the Company’s Indebtedness

Ability to service outstanding indebtedness and the dilutive effect of the Company’s outstanding warrants.

As of February 19, 2024, the Company had approximately $8.0 million in principal amount debt obligations. Of that debt, $7.4 million is in the form of a senior secured promissory note (as amended, the “Senior Note”) and $575,000 is in the form of convertible, subordinated, unsecured promissory notes (the “Notes”), each as described below.

In February 2020, the Company entered into a Senior Secured Promissory Note and Warrant Purchase Agreement (as amended, the “Agreement”) with Corbel Capital Partners SBIC, L.P. (the “Purchaser”). Pursuant to the Agreement, the Company issued to the Purchaser the Senior Note in the initial principal amount of $8.0 million. The Company has used the net proceeds of the Agreement as follows: (i) $4.2 million to repay the Company’s then-existing bank debt which was in the original amount of $6.1 million; (ii) $1.275 million to repay the portion of the Company’s outstanding subordinated convertible debt the maturity date of which most had not previously been extended; (iii) payment of debt issuance costs; and (iv) for working capital or other general corporate purposes, including development of new Company-owned Craft Pizza & Pub locations.

The Senior Note bears cash interest of SOFR, as defined in the Agreement, plus 7.75%. Interest is payable in arrears on the last calendar day of each month. In addition, the Note requires non-cash payment-in-kind interest (“PIK Interest”) of 3% per annum, which is added to the principal amount of the Senior Note. The Senior Note matures on February 7, 2025. Beginning February 28, 2023, the Senior Note requires fixed principal payments in the amount of $33,333 per month during February 2023 and $83,333 per month continuing until maturity.

In conjunction with the Senior Note, the Company issued to the Purchaser a warrant (as amended, the “Corbel Warrant”) to purchase up to 2,250,000 shares of Common Stock. The Corbel Warrant, as amended in September 2023, entitles the Purchaser to purchase from the Company, at any time or from time to time: (i) 1,200,000 shares of Common Stock at an exercise price of $0.30 per share (“Tranche 1”), (ii) 900,000 shares of Common Stock at an exercise price of $0.30 per share (“Tranche 2”), and (iii) 150,000 shares of Common Stock at an exercise price of $0.30 per share (“Tranche 3”). The Purchaser is required to exercise the Corbel Warrant with respect to Tranche 1 if the Common Stock is trading at $1.40 per share or higher for a specified period, and is further required to exercise the Corbel Warrant with respect to Tranche 2 if the Common Stock is trading at $1.50 per share or higher for a specified period. Cashless exercise of the Corbel Warrant is only permitted with respect to Tranche 3. The Purchaser has the right, within six months after the issuance of any shares under the Corbel Warrant, to require the Company to repurchase such shares for cash or for put notes, at the Company's discretion. The Corbel Warrant expires on the seventh anniversary of the date of its issuance.

Additionally, the Company previously issued certain units (the “Units”) consisting of a Note in an aggregate principal amount of $50,000 and warrants (the “Warrants”) to purchase up to 50,000 shares of the Company’s Common Stock at a price of $1.00 per share. Following the refinancing described above, $575,000 in principal amount of Notes and the associated Warrants remain outstanding, however, per the terms of the agreement, the Warrants were re-priced to $0.30 per share. Notes with an outstanding principal balance of $150,000 matured and accompanying Warrants expired January 31, 2023, however a $50,000 note was repaid to Margaret Huffman with the approval of Corbel. The principal amount of $100,000 such Notes cannot be repaid until Corbel’s loan is paid because the Notes are subordinate to such loan. The maturity of the Notes with an outstanding principal balance of $475,000, and accompanying Warrants, have been extended to February 28, 2025 or the repayment of the Senior Secured Loan, whichever comes first.

Risks Related to Human Capital

Dependence on key executives.

The Company’s business has been and will continue to be dependent upon the efforts and abilities of its executive staff generally, and particularly Paul W. Mobley, its Executive Chairman and Chief Financial Officer, and A. Scott Mobley, its President and Chief Executive Officer. The loss of either of their services could have a material adverse effect on the Company.

Risks Related to the Company’s Common Stock

Indiana law with regard to purchases of the Company’s stock.

Certain provisions of Indiana law applicable to the Company could have the effect of making it more difficult for a third party to acquire, or of discouraging a third party from attempting to acquire, control of the Company. Such provisions could also limit the price that certain investors might be willing to pay in the future for shares of its Common Stock. These provisions include prohibitions against certain business combinations with persons or groups of persons that become “interested shareholders” (persons or groups of persons who are beneficial owners of shares with voting power equal to 10% or more) unless the board of directors approves either the business combination or the acquisition of stock before the person becomes an “interested shareholder.”

Inapplicability of corporate governance standards that apply to companies listed on a national exchange.

The Company’s stock is quoted on the OTCQB, a Nasdaq-sponsored and operated inter-dealer automated quotation system for equity securities not included on the Nasdaq Stock Market. The Company is not subject to the same corporate governance requirements that apply to exchange-listed companies. These requirements include: (1) a majority of independent directors, although the company does have a majority of independent directors; (2) an audit committee of independent directors, instead the Board as a whole acts as the audit committee; and (3) shareholder approval of certain equity compensation plans or equity issuances. As a result, stockholders do not have the same governance protection as they would for a stock traded on a national exchange.

Thinly traded stock.

The market for the Common Stock is limited, meaning that an investment in the Company’s stock is less liquid than in a stock listed on a national exchange with a higher average trading volume. Because of this, attempts by one or more stockholders of the Company to sell significant amounts of stock may result in an imbalance in the market that materially decreases the trading price of the stock which could continue for an indefinite period of time. Accordingly, the traded price of the stock may not reflect the Company’s equity value. Additionally, there is no assurance that the Company’s stock will continue to be authorized for quotation by the OTCQB or any other market in the future.

Activities of activist group of investors.

BTB Brands, Inc. (“BT Brands”) and its CEO and principal shareholder, Gary Copperud (“Copperud”), launched a proxy contest to elect Copperud to the Company’s board of directors at its 2023 annual meeting. BT Brands, Copperud and Kennth Brimmer, BT Brands CFO, reported beneficial ownership as a group of 1.9 million Company shares.

BT Brands, (NASDAQ; BTBD), purports to operate 18 restaurants of various formats. For the fiscal year ended December 31, 2023, BT Brands reported a net loss of $887,368 ($0.14 per share) on sales of $14 million after tax benefit of $145,000. BTBD stock price has declined by over 42% over the past 52 weeks and its market capitalization currently is approximately $10.7 million.

Upon review, the Company determined that BT Brands had not complied with the express requirements for a shareholder nomination and had misrepresented its record ownership of the Company’s shares in their submission to the Company for the nomination required under the Company’s By-laws. Accordingly, Copperud was disqualified as a nominee. The Company’s Board determined that Mr. Copperud was not a suitable Board candidate given his background of unsuccessful business ventures and misconduct in pursuing the election contest. BT Brands and Mr. Copperud filed a lawsuit in Federal Court and also filed for a temporary restraining order and preliminary injunction requiring the Company to permit Copperud to stand for election despite admitting that he had not met the requirements to do so. The Company has to date incurred $181,570 of direct expenses in successfully defending against BT Brands and Copperud. The Company may incur additional expenses if BT Brands or Copperud again takes action the Board determines is not in the best interest of all shareholders.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM IC. CYBERSECURITY

In many areas, the Company is dependent upon computer systems, devices and communications networks to efficiently collect, process and store data necessary to conduct many aspects of its business. For example, the Company:

| · | collects and processes transactions in its Craft Pizza & Pub locations using point-of-purchase equipment |

| · | transmits credit card information from customers through credit/debit card processing terminals in its Craft Pizza & Pub locations |

| · | collects, transmits and stores personnel data relating to employment and payroll |

| · | collects and transmits data related to employee health insurance enrollments |

| · | collects, stores and uses customer data in a voluntary email program for marketing purposes – this data is limited to names, email addresses and other very limited information such as restaurant location preference |

| · | the collection and processing of sales and royalty information from franchisees, and the frequent execution of ACH transactions to collect those royalties |

This list is not exhaustive and is only meant to provide a sampling of the types of information the Company collects, stores and processes directly. Additionally, the Company uses third parties to assist in some services, such as health insurance, third-party home delivery services and third-party web ordering services. These third parties are also subject to cybersecurity risks, and the Company can have no assurance that their cybersecurity measures would prevent security threats from being successful.

The Company recognizes the importance of protecting both its information and operations from threats that could disrupt its business or compromise the Company’s customer, franchisee and employee data. the Company’s cybersecurity is implemented and maintained using security procedures, hardware, software and services that are reviewed and updated as needed on a periodic basis.

As of the date of this Annual Report, the Company is not aware of any previous cybersecurity breaches that have materially affected the Company. However, the Company acknowledges that cybersecurity threats are continually proliferating and evolving, and the possibility of future cybersecurity incidents remains. Security measures cannot guarantee that a significant cybersecurity attack will not occur. While the Company intends to devote increasing resources to its cybersecurity measures beyond those currently in place and designed to protect systems and information, no security measure is infallible. As discussed, the Company relies on many third parties for various aspects of its data collection, processing and storage, and thus also relies on those third parties to provide continuing cybersecurity but does not control their ability to do so.

The Company’s management, as a result of efforts by Company employees as well as external experts, who may be consulted from time to time, will report on the Company’s cybersecurity efforts to the entire Board of Directors on a periodic basis.

ITEM 2. PROPERTIES

The Company owns no real property. Its headquarters are located in 8,088 square feet of leased office space in Indianapolis, Indiana. The lease for this property expires in April 2029.

The Company also leases space for its Company-owned restaurants in Westfield, Indiana which expires in January 2027, in Whitestown, Indiana which expires in November 2027, in Fishers, Indiana which expires in January 2028, in Carmel, Indiana which expires in June 2028, in Brownsburg, Indiana which expires October 2030, in Greenwood, Indiana which expires in October 2030, in McCordsville, Indiana which expires in February 2031, in Indianapolis, Indiana which expires in October 2031, and in Franklin, Indiana which expires in February 2032. The Company’s lender holds a security interest in the leasehold interest.

ITEM 3. LEGAL PROCEEDINGS

The Company, from time to time, is or may become involved in litigation or regulatory proceedings arising out of its normal business operations.

Currently, there are no such pending proceedings which the Company considers to be material.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market Information

The Company’s Common Stock is included on the Nasdaq OTCQB and trades under the symbol “NROM”. The over-the-counter market quotations on the Nasdaq OTCQB reflect inter-dealer prices without retail markup, markdown or commission and may not necessarily represent actual transactions.

Holders of Record

As of March 1, 2024, there were approximately 208 holders of record of the Company’s Common Stock. This excludes persons whose shares are held of record by a bank, brokerage house or clearing agency.

Dividends

The Company has never declared or paid dividends on its Common Stock. The Company’s current loan agreement, as described in Note 6 of the notes to the Company’s consolidated financial statements included in Item 8 of this report, prohibits the payment of dividends on Common Stock.

Sale of Unregistered Securities

None.

Repurchases of Equity Securities

None.

Equity Compensation Plan Information

The following table provides information as of December 31, 2023 with respect to the shares of the Company’s Common Stock that may be issued under its existing equity compensation plan.

Plan Category | | Number of Securities to be issued upon exercise of outstanding options, warrants and rights (a) | | | Weighted-average exercise price of outstanding options, warrants and rights (b) | | | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) (c) | |

Equity compensation plans approved by stockholders | | | - | | | $ | - | | | | - | |

Equity compensation plans not approved by stockholders | | | 3,240,000 | | | $ | .58 | | | | (1 | ) |

Total | | | 3,240,000 | | | $ | .58 | | | | (1 | ) |

(1) The Company may grant additional options under the employee stock option plan. There is no maximum number of shares available for issuance under the employee stock option plan.

The Company maintains an employee stock option plan for its employees, officers and directors. Any employee, officer and director of the Company is eligible to be awarded options under the plan. The employee stock option plan provides that any options issued pursuant to the plan will generally have a three-year vesting period and will expire ten years after the date of grant. Awards under the plan are periodically made at the recommendation of the Executive Chairman and the Chief Executive Officer and authorized by the Board of Directors. The employee stock option plan does not limit the number of shares that may be issued under the plan.

ITEM 6. RESERVED

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Restatement of Previously Issued Consolidated Financial Statements

The Company has restated certain of its previously issued consolidated financial statements contained in this Annual Report on Form 10-K. Refer to the section entitled “Explanatory Note” preceding Item 1 hereof for background on the restatement, the fiscal periods impacted, control considerations, and other information.

Introduction

The Company currently owns and operates nine Craft Pizza & Pub locations and one non-traditional location in a hospital. Craft Pizza & Pub is designed to have a fun, pleasant atmosphere serving pizza and other related menu items, all made fresh using fresh ingredients in the view of the customers for inside dining and offers Pizza Valet service for a quick, easy and fun way to provide carry-out for those customers who want to dine elsewhere. These units operate under the trade name “Noble Roman’s Craft Pizza & Pub”.

The Company also sells and services franchises and licenses for non-traditional foodservice operations under the trade names “Noble Roman’s Pizza” and “Noble Roman’s Take-N-Bake.” The non-traditional concepts’ hallmarks include high quality pizza along with other related menu items, simple operating systems, fast service times, labor-minimizing operations, attractive food costs and overall affordability.

During the 12-month period ended December 31, 2023 there were no company-operated or franchised Craft Pizza & Pub restaurants opened or closed. During the same 12-month period there were 61 new non-traditional outlets opened and six non-traditional outlets closed.

The Company, at December 31, 2022 and December 31, 2023, had deferred tax assets on its balance sheet totaling $3.4 million. Based on the Company’s review of its available tax credits the Company believes it is more likely than not that the deferred tax assets will be utilized prior to their expiration.

Financial Summary

The preparation of the consolidated financial statements in conformity with United States generally accepted accounting principles requires management to make estimates and assumptions that affect the amounts reported in the consolidated financial statements and accompanying notes. Actual results may differ from those estimates. The Company evaluates the carrying values of its assets, including property, equipment and related costs, accounts receivable and deferred tax assets, periodically to assess whether any impairment indications are present due to (among other factors) recurring operating losses, significant adverse legal developments, competition, changes in demand for the Company’s products or changes in the business climate that affect the recovery of recorded values. If any impairment of an individual asset is evident, a charge will be recorded to reduce the carrying value to its estimated fair value.

Condensed Consolidated Statement of Operations Data

Noble Roman’s, Inc. and Subsidiaries

| | Years Ended December 31, | |

| | 2022 (as restated) | | | 2023 | |

Revenue: | | | | | | |

Restaurant revenue – company-owned restaurants | | $ | 9,704,169 | | | $ | 8,744,158 | |

Restaurant revenue –company-owned non-traditional | | | 712,517 | | | | 934,662 | |

Franchising revenue | | | 4,002,824 | | | | 4,665,187 | |

Administrative fees and other | | | 33,255 | | | | 29,567 | |

Total revenue | | | 14,452,765 | | | | 14,373,574 | |

| | | | | | | | |

Operating expenses: | | | | | | | | |

Restaurant expenses – company-owned restaurants | | | 8,516,405 | | | | 7,813,176 | |

Restaurant expenses – company-owned non-traditional | | | 704,665 | | | | 792,532 | |

Franchising expenses | | | 2,185,751 | | | | 231,695 | |

Total operating expenses | | | 11,406,821 | | | | 8,837,403 | |

| | | | | | | | |

Depreciation and amortization | | | 450,550 | | | | 379,516 | |

General and administrative expenses | | | 2,167,678 | | | | 1,548,878 | |

Defense against activist shareholder | | | - | | | | 168,092 | |

Total expenses | | | 14,025,049 | | | | 10,933,889 | |

Operating income | | | 427,716 | | | | 3,439,685 | |

| | | | | | | | |

Interest expense | | | 1,884,147 | | | | 1,744,488 | |

Change in fair value of warrants | | | - | | | | 234,913 | |

Income (loss) before income taxes | | | (1,456,431 | ) | | | 1,460,284 | |

Income tax expense (benefit) | | | (142,435 | ) | | | - | |

Net income (loss) | | $ | (1,313,996 | ) | | $ | 1,460,284 | |

The following table sets forth the revenue, expense and margin contribution of the Company's Craft Pizza & Pub locations and the percent relationship to its revenue:

| | Year Ended December 31, | |

Description | | 2022 | | | 2023 | |

Revenue | | $ | 9,704,169 | | | | 100 | % | | $ | 8,744,158 | | | | 100 | % |

Cost of sales | | | 2,076,514 | | | | 21.4 | | | | 1,795,473 | | | | 20.5 | |

Salaries and wages | | | 2,850,333 | | | | 29.4 | | | | 2,542,083 | | | | 29.1 | |

Facility cost including rent, common area and utilities | | | 1,635,951 | | | | 16.8 | | | | 1,585,492 | | | | 18.1 | |

Packaging | | | 344,823 | | | | 3.6 | | | | 289,139 | | | | 3.3 | |

All other operating expenses | | | 1,608,784 | | | | 16.5 | | | | 1,600,989 | | | | 18.3 | |

Total expenses | | | 8,516,405 | | | | 87.7 | | | | 7,813,176 | | | | 89.4 | |

Margin contribution | | $ | 1,187,764 | | | | 12.3 | % | | $ | 930,982 | | | | 10.6 | % |

The following table sets forth the revenue, expense and margin contribution of the Company's franchising venue and the percent relationship to its revenue:

| | Year Ended December 31, | |

Description | | 2022 | | | 2023 | |

Royalties and fees franchising | | $ | 4,002,824 | | | | 100 | % | | $ | 4,665,187 | | | | 100 | % |

Salaries and wages | | | 861,190 | | | | 21.5 | | | | 886,680 | | | | 19.0 | |

Trade show expense | | | 315,000 | | | | 7.9 | | | | 111,629 | | | | 2.4 | |

Travel and auto | | | 113,186 | | | | 2.8 | | | | 148,846 | | | | 3.2 | |

All other operating expenses (benefit) | | | 896,375 | | | | 22.4 | | | | (915,460 | )(1) | | | (19.6 | ) |

Total expenses | | | 2,185,751 | | | | 54.6 | | | | 231,695 | | | | 5.0 | |

Margin contribution | | $ | 1,817,073 | | | | 45.4 | % | | $ | 4,433,492 | | | | 95.0 | % |

(1) All other expenses in franchising are shown as a large negative as the credits from the ERTC refund for various expenses were not separated between other categories. In addition, select salaries and other expenses were treated as deferred expenses under our revenue recognition policy.

The following table sets forth the revenue, expense and margin contribution of the Company-owned non-traditional venue and the percent relationship to its revenue:

| | Year Ended December 31, | |

Description | | 2022 | | | 2023 | |

Revenue | | $ | 712,517 | | | | 100 | % | | $ | 934,662 | | | | 100 | % |

Total expenses | | | 704,665 | | | | 98.9 | | | | 792,532 | | | | 84.8 | |

Margin contribution | | $ | 7,852 | | | | 1.1 | % | | $ | 142,130 | | | | 15.2 | % |

Results of Operations

Company-Owned Craft Pizza & Pub

The revenue from the company-owned Craft Pizza & Pub generates from the retail sales to the restaurants’ customers primarily from inside dining and carry-out but some through third-party delivery. The revenue is recognized when the product is delivered to the customer or to the third-party delivery companies.

The revenue from this venue decreased from $9.7 million to $8.7 million for the 12 months ended December 31, 2023 compared to the corresponding period in 2022. The primary reason for the decrease in the 12-month period was same store sales reduction as a result of the general economy, high gas prices, extraordinarily high consumer credit card balances and a decrease in disposable income on the part of local consumers.

Despite inflationary pressures, cost of sales as a percentage of revenue decreased from 21.4% to 20.5% for the 12-month periods ended December 31, 2023 compared to 2022. The decrease was the result of a small increase in menu prices in mid-2022 in addition to more stability in staffing, new efficiencies in production methodologies and declining commodity cheese prices late in 2023.

Salaries and wages as a percentage of revenue decreased from 29.4% to 29.1% for the 12-month period ended December 31, 2023 compared to the corresponding periods in 2022. The decrease in the 12-month period was the result of scheduling efficiencies and stabilized restaurant management, despite the significant increase in individual labor cost.

Facility costs, including rent, common area maintenance and utilities, as a percentage of revenue increased from 16.8% to 18.1% of revenue for the respective 12-month period ended December 31, 2023 compared to the corresponding period in 2022. The primary reasons for the increase was a slight decline in sales volumes and increases in other operating rent costs as well as utility costs.

All other operating costs and expenses as a percentage of revenue increased from 16.5% to 18.3% for the 12-month period ended December 31, 2023 compared to the corresponding period in 2022. The increase was the result of general inflationary pressure on substantially all costs of operations.

Gross margin contribution decreased from 12.3% to 10.6% for the 12-month period ended December 31, 2023 compared to the corresponding period in 2022. The decrease in margin was primarily the result of increase in wages and other costs due to inflationary pressures and slightly lower sales volumes only partially offset by tighter controls in both cost of sales and personnel cost. The Company had no menu price increases in 2023.

Franchising Revenue and Expense

Franchise revenue consists of initial franchise fee amortization over the term of the agreements, royalties generated by the 7% of sales by franchisees mostly collected on a weekly basis from sales reports from the franchisees, commissions on equipment sales that the company helps franchisees arrange the purchase of, and manufacturing allowances based on the volume of product used. Total revenue from this venue increased from $4.0 million to $4.7 million for the 12-month period ended December 31, 2023 compared to the corresponding period in 2022. The increase in revenue from this venue was a result of opening more non-traditional locations as a result of the Company refocusing its efforts on that goal as COVID was receding and convenience stores and travel plazas became willing to invest to increase their margins and profitability. In addition, in October 2023 the Company entered into a development agreement with Majors Management for 100 franchise locations to be developed over the next three years. In addition, the Company believes that the development with Majors Management has spurred interest in the concept by many other owners of host facilities.

Gross margin in this venue increased from 45.4% to 95.0% for the 12-month period ended December 31, 2023 compared to the corresponding period in 2022. A primary factor in this substantial growth in margin was the result of all of the additional sales and openings in this venue and from the refund of various expenses and reimbursement of lost revenue by the Employee Retention Tax Credit (“ERC”) program which was created as a part of the CARES Act. The negative cost of other operating expenses in this category was a result of the ERC program. All other expenses in franchising are shown as a large negative as the credits from the ERTC refund for various expenses were not separated between other categories. In addition, due to the significant growth in opened non-traditional franchise units this year, select salaries and other expenses were treated as deferred expenses under our revenue recognition policy.

Company-Owned Non-Traditional Locations

Gross revenue from this venue increased from $713,000 to $935,000 for the 12-month period ended December 31, 2023 compared to the corresponding period in 2022. This venue consists of one location in a hospital. Access to the hospital had been very limited and movement within the hospital was prohibited because of the potential spread of COVID-19, and revenue increased as those restrictions within the hospital were relaxed. The Company does not intend to operate any more Company-owned non-traditional locations except for the one location that is currently being operated.

Total expenses increased from $705,000 to $793,000 for the 12-month period ended December 31, 2023 compared to the corresponding period in 2022. The primary reason for the increase was increased revenue as the hospital relieved many of their restrictions on access to the hospital and on movement within the hospital, as discussed in the previous paragraph, resulting from the COVID-19 pandemic.

Corporate Expenses

Depreciation and amortization decreased from $451,000 to $380,000 for the 12-month period ended December 31, 2023 compared to the corresponding period in 2022. The decrease was the result of the Company not opening any Company locations during 2023.

General and administrative expenses decreased from $2.17 million to $1.55 million for the 12-month period ended December 31, 2023 compared to the corresponding period in 2022. The decrease was the result of maintaining tight controls on expenditures despite the inflationary pressures on substantially all costs. In addition, $280,000 of the cost was deferred relating directly to costs attributable to new franchise locations to be amortized over the term of the contracts.

Interest expense decreased from $1.9 million to $1.7 million for the 12-month period ended December 31, 2023 compared to the corresponding period in 2022. The primary reason for the decrease was the result of principal payments on the Senior Note partially offset by compounding of the PIK interest on the Senior Note and an increase in interest rate due to the variable loan terms. This is also the correcting entry moving $257,926 into interest expense in 2022 from 2023. In 2024, the interest cost should decline gradually as a result of the required principal payment on the note assuming steady or falling interest rates.

Direct expenses to defend against an activist shareholder increased from $0 to $168,000 for the twelve-month period ended December 31, 2023 compared to the corresponding period in 2022. Shortly before the 2023 annual meeting, BT Brands filed a lawsuit against Noble Roman’s, Inc. and its Directors. Additionally, they filed motions for a temporary restraining and for a preliminary injunction. The Federal court held a hearing on both motions and heard arguments from both parties. The court denied both of BT Brands’ motions, in part because the Judge did not believe the underlying lawsuit would be successful. As a result, BT Brands voluntarily dismissed their lawsuit against Noble Roman’s and its Directors on September 7, 2023. See activities of activist group of investors on page 14 for more details.

Liquidity and Capital Resources

The Company’s current ratio was 1.1-to-1 as of December 31, 2023 compared to .9-to-1 as of December 31, 2022.

In January 2017, the Company completed the offering of $2.4 million principal amount of convertible common stock at $0.50 per share and warrants to purchase up to 2.4 million shares of the Company’s Common Stock at an exercise price of $1.00 per share, subject to adjustment. In 2018, $400,000 principal amount of Notes was converted into 800,000 shares of the Company’s Common Stock, in January 2019 another Note in the principal amount of $50,000 was converted into 100,000 shares of the Company’s Common Stock, and in August 2019 another Note in the principal amount of $50,000 was converted into 100,000 shares of the Company’s Common Stock, leaving principal amounts of Notes of $1.9 million outstanding as of December 31, 2019. Holders of Notes in the principal amount of $775,000 extended their maturity date to January 31, 2023. In February 2020, $1,275,000 principal amount of the Notes were repaid in conjunction with a new financing leaving a principal balance of $625,000 of subordinated convertible notes outstanding due January 31, 2023. In April 2023, the holder of $50,000 principal amount of the subordinated convertible notes were repaid by the Company leaving $575,000 outstanding. These Notes bear interest at 10% per annum, including the Notes which have not been extended, paid quarterly and are convertible to Common Stock any time prior to maturity at the option of the holder at $0.30 per share.

In February 2020, the Company entered into the Agreement with Corbel, pursuant to which the Company issued to Corbel the Senior Note in the initial principal amount of $8.0 million. The Company used the net proceeds of the Agreement as follows: (i) $4.2 million to repay the Company’s then-existing bank debt which were in the original amount of $6.1 million; (ii) $1,275,000 to repay the portion of the Company’s existing subordinated convertible debt the maturity date of which most had not previously been extended; (iii) debt issuance costs; and (iv) for working capital and other general corporate purposes, including development of new Company-owned Craft Pizza & Pub locations.

The Senior Note bears cash interest of SOFR, as defined in the Agreement, plus 7.75%. In addition, the Senior Note requires PIK Interest of 3% per annum, which is added to the principal amount of the Senior Note. Interest is payable in arrears on the last calendar day of each month. The Senior Note matures on February 7, 2025. The Senior Note, as amended, requires principal payments of $33,333 in February 2023 and beginning in March 2023 principal payments of $83,333 per month continuing until maturity. In July 2023, the Company made non-required principal payments of approximately $579,000.

See Note 1 to the Company’s consolidated financial statements for discussion of funds received from the ERC.

As a result of the financial arrangements described above and the Company’s cash flow projections, the Company believes it will have sufficient cash flow to meet its obligations and to carry out its current business plan. The Company’s cash flow projections for the next two years are primarily based on the Company’s strategy of growing the non-traditional franchising/licensing venues, operating Craft Pizza & Pub locations and pursuing a franchising program for Craft Pizza & Pub restaurants as market conditions allow. The Company intends to refinance its outstanding debt payable to Corbel before maturity in February 2025.

The Company does not anticipate that any of the recently issued pronouncements relating to the Statement of Financial Accounting Standards will have a material impact on its Consolidated Statement of Operations or its Consolidated Balance Sheet.

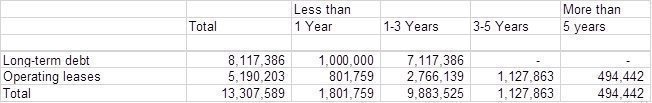

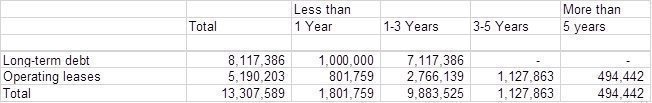

Contractual Obligations

The following table sets forth the future contractual obligations of the Company as of December 31, 2023:

(1) The amounts do not include interest.

Forward-Looking Statements