June 25, 2015 Conference Call Presentation to Discuss Acquisition of Tri-State 1st Banc, Inc. Exhibit 99.1 |

2 Disclosure Statement Forward-Looking Statements This investor presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are not historical facts, but rather statements based on the Company's current expectations regarding our business strategies and their intended results and future performance. Forward-looking statements are preceded by terms such as "expects," "believes," "anticipates," "intends" and similar expressions, as well as any statements related to future expectations of performance or conditional verbs, such as "will," "would," "should," "could," or "may." Forward-looking statements are not guarantees of future performance. Numerous risks and uncertainties could cause or contribute to the Company's actual results, performance, and achievements to be materially different from those expressed or implied by the forward-looking statements. Factors that may cause or contribute to these differences include, without limitation, the Company's failure to integrate Tri-State 1 st Banc, Inc. and 1 st National Community Bank in accordance with expectations; deviations from performance expectations related to Tri-State 1 st Banc, Inc. and 1 st National Community Bank; general economic conditions, including changes in market interest rates and changes in monetary and fiscal policies of the federal government; legislative and regulatory changes; competitive conditions in the banking markets served by the Company's subsidiaries; the adequacy of the allowance for losses on loans and the level of future provisions for losses on loans; and other factors disclosed periodically in the Company's filings with the Securities and Exchange Commission. Because of the risks and uncertainties inherent in forward-looking statements, readers are cautioned not to place undue reliance on them, whether included in this report or made elsewhere from time to time by the Company or on the Company's behalf. The Company assumes no obligation to update any forward-looking statements. |

3 Additional Information for Stockholders In connection with the proposed merger, Farmers will file with the Securities and Exchange Commission ("SEC") a Registration Statement on Form S-4 that will include a joint proxy statement and a Farmers prospectus, as well as other relevant documents concerning the proposed transaction. SHAREHOLDERS OF FARMERS AND TRI-STATE 1ST BANC, INC. AND OTHER INVESTORS ARE URGED TO CAREFULLY READ THE PROXY STATEMENT/PROSPECTUS TO BE INCLUDED IN THE REGISTRATION STATEMENT ON FORM S-4, WHICH FARMERS WILL FILE WITH THE SEC IN CONNECTION WITH THE PROPOSED MERGER, BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION ABOUT FARMERS, TRI- STATE 1ST BANC, INC., THE MERGER, THE PERSONS SOLICITING PROXIES WITH RESPECT TO THE PROPOSED MERGER AND THEIR INTERESTS IN THE PROPOSED MERGER AND RELATED MATTERS. The respective directors and executive officers of Farmers and Tri-State 1 st Banc, Inc. and other persons may be deemed to be participants in the solicitation of proxies from Tri-State 1 st Banc, Inc. and Farmers shareholders with respect to the proposed merger. Information regarding the directors and executive officers of Farmers is available in its proxy statement filed with the SEC on March 13, 2015. Information regarding directors and executive officers of Tri- State 1 st Banc, Inc. is available on its website at http://www.1stncb.com. Other information regarding the participants in the solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials to be filed with the SEC when they become available. Investors and security holders will be able to obtain free copies of the registration statement (when available) and other documents filed with the SEC by Farmers through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with the SEC by Farmers will be available free of charge on Farmers' website at https://www.farmersbankgroup.com. |

• Acquisition of National Bancshares Corp. completed on June 19 th – Closing occurred in the 2 nd Quarter of 2015 as expected – Creates the third largest community bank by asset size headquartered in Northeastern Ohio (1) – Enhances scale, profitability, growth potential, and brand recognition – Integration progressing as expected • Farmers intends to remain a strategic acquirer within its core and contiguous markets. Yesterday’s announcement of the TSOH transaction further illustrates our commitment to identifying opportunities to help Farmers continue to enhance its franchise value. • Near-term focus will be on seamless integration of both transactions. 4 NBOH Transaction Update (1) Community Banks defined as those with assets less than $20.0 billion. Northeast Ohio includes area codes 216, 330 and 440 History of Acquisition and Business Development • 2009 Acquired the Butler Wick Trust Company • 2010 Created Farmers National Insurance • 2012 Rolled Out Private Client Services • 2013 Acquired National Associates • 2015 Acquired National Bancshares Corporation • 2015 Announced acquisition of Tri-State 1 st Banc, Inc. |

5 (1) Based on FMNB’s stock price of $8.20 on June 23, 2015 Source: SNL Financial FMNB Branches (33) TSOH Branches (5) Pro Forma Highlights Branches 38 Assets $1.8 Billion Loans $1.2 Billion Deposits $1.5 Billion Market Cap $221 Million • Strengthens presence in attractive Columbiana County while underscoring Farmers’ commitment to the community – Pro-forma, Farmers’ will rank 2 nd in market share with ~20% of the county’s deposits, trailing only Huntington – TSOH provides an attractive deposit base with $54.3 million of demand deposits and an overall cost of deposits of 0.19% • Expands wealth management client base • President & CEO Steve Sant to continue as Community President of the South East Market (Southern Columbiana County and Western PA) – Experienced leader with prior experience at Sky and First Western Transaction Highlights TSOH Acquisition 1 |

6 • Each shareholder of TSOH will elect to receive $14.20 per share in cash or 1.747 shares of FMNB, subject to 75% of the shares being exchanged for stock and 25% for cash • $14.2 million based on FMNB’s closing price of $8.20 on June 23, 2015 Structure/Consideration • Deal value/tangible book value of 134% 1,2 • Deal value/ LTM Earnings of 18.7x 1 • Core deposit premium of 2.9% 1,3 Transaction Multiples • Transaction expected to be accretive to earnings per share by approximately 5% in the first full year of combined operations (excluding one-time merger charges) • <2% dilutive to TBV with dilution earned back in 2.3 years • Projected IRR of over 20% Financial Impact • Customary regulatory approvals and TSOH shareholder approval • Estimated close Q4 2015 Required Approvals/ Timing (1) Deal pricing metrics based on aggregate $14.2 million deal value and TSOH 3/31/2015 financials (2) Tangible book value as of 3/31/2015 adjusted for sales of Cooper, Gateminder, and MDH (3) Core deposit premium defined as aggregate deal value less TSOH’s tangible equity divided by TSOH’s deposits less time deposit accounts with balances over $100,000 Transaction Overview |

1 st National Community Bank Loan Mix (Bank Level) Deposit Mix (Bank Level) Regulatory Financial Highlights 1 National Community Bank (5) Parent Name Tri-State 1st Banc, Inc. Date Established 6/1/1987 Industry Commercial Bank Primary Regulator OCC Chief Executive Officer Stephen R. Sant Number of Offices 5 Chief Financial Officer Jean Butch Edwards States of Operation OH(4),PA(1) Branch Map Overview Source: SNL Financial 1 - 4 Family RE 34% Commercial RE 32% C&I 14% Consumer 11% Other 9% Demand Deposits 44% NOW and ATS 8% MMDA and Savings 26% Retail Time 19% Jumbo Time 3% Dollars in thousands 1 - 4 Family RE 22,570 $ Commercial RE 21,427 C&I 9,161 Consumer 7,349 Other 6,443 Gross Loans and Leases 66,950 $ Dollars in thousands Demand Deposits 54,320 $ NOW and ATS 9,999 MMDA and Savings 32,016 Retail Time 23,327 Jumbo Time 3,284 Total Deposits 122,946 $ st 2011 2012 2013 2014 YTD 3/31 Total Assets ($000) 130,195 136,601 124,060 130,363 138,974 Total Net Loans ($000) 60,316 62,100 66,342 66,133 66,125 Total Deposits ($000) 103,223 102,052 108,176 114,308 122,946 Tangible Common Eqty ($000) 12,889 14,075 11,538 12,916 13,325 ROAA (%) 0.61 0.70 0.74 0.72 0.64 ROAE (%) 6.64 7.33 7.77 7.50 6.55 Net Interest Margin (%) 3.62 3.33 3.27 3.48 3.45 TCE / TA (%) 9.90 10.30 9.30 9.91 9.59 Tier 1 Ratio (%) 17.38 17.72 15.91 16.89 18.41 TRBC Ratio (%) 18.64 18.98 17.16 18.09 19.70 NPAs / Assets (%) 1.80 1.30 1.66 1.29 1.25 NCOs / Avg Loans (%) 0.39 0.21 0.14 0.12 0.02 LLRs / Gross Loans (%) 1.99 1.76 1.47 1.23 1.23 |

• Maintains and strengthens community banking presence in Columbiana County – Opportunity to partner with a larger organization, yet still maintaining our community banking culture • Develops deeper, comprehensive banking platform with broader array of products and solutions for our customers • Presents a liquidity opportunity for TSOH shareholders offering them the opportunity to continue to grow their investment with a strong and growing company • Combined Company has additional synergies beyond cost savings: wealth management and increased lending limits 8 TSOH Perspective: Partnering with Farmers |

9 Due Diligence Summary • Estimated credit mark of $1.1 million on the loan portfolio ($313 thousand in excess of 3/31/2015 loan loss reserves) • Fair market value adjustment to fixed assets of $942 thousand • Projected cost savings of approximately 37% based on a bottoms up analysis of TSOH’s non-interest expense base • Assumes no revenue synergies, although we believe opportunities exist to cross sell Farmers’ wealth management products • Total after-tax, one-time merger charges are estimated at $1.7 million Key Modeling Assumptions • Comprehensive due diligence process • Credit due diligence lead by Farmers’ in- house lending team and supplemented by BKD, LLC (“BKD”) • Analyzed credit files, underwriting methodology and policy and portfolio management processes • FMNB’s credit reviews focused on the largest relationships, adversely classified assets and watch list loans • BKD also engaged to provide analysis of potential interest rate marks to TSOH’s assets & liabilities |

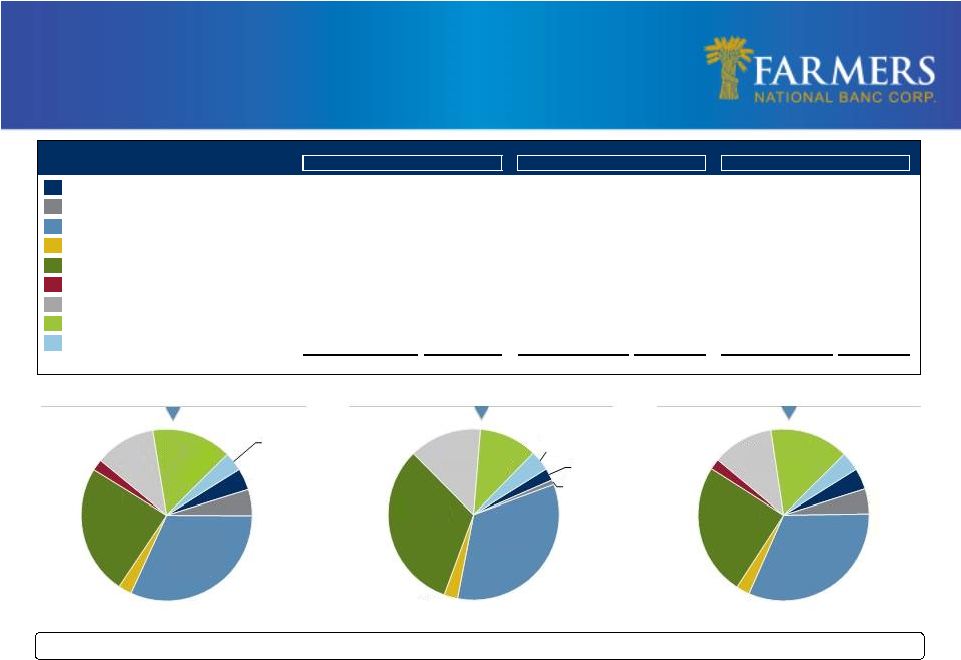

10 Dollars in Thousands For the period ended March 31, 2015 PF Farmers Natl Bk of Canfield 1st National Community Bank Pro Forma Construction & Development 44,662 $ 4.1% 1,558 $ 2.3% 46,220 $ 4.0% Secured by Farmland 52,906 4.9% 593 0.9% 53,499 4.6% 1 - 4 Family Real Estate 345,271 31.8% 22,570 33.7% 367,841 31.9% 5+ Family Real Estate 27,665 2.5% 1,715 2.6% 29,380 2.5% Commercial Real Estate 265,457 24.4% 21,427 32.0% 286,884 24.9% Agricultural 23,099 2.1% - 0.0% 23,099 2.0% Commercial & Industrial 124,529 11.5% 9,161 13.7% 133,690 11.6% Consumer 164,770 15.2% 7,349 11.0% 172,119 14.9% Other 38,644 3.6% 2,577 3.8% 41,221 3.6% Gross Loans and Leases 1,087,003 $ 100.0% 66,950 $ 100.0% 1,153,953 $ 100.0% PF Farmers Natl. Bank of Canfield* 1 National Community Bank Pro Forma Yield: 4.47% 5.16% 4.51% (1) *Pro forma for the acquisition of National Bancshares Corporation (1) Pro forma yield calculated based on loan yield for the quarter ended March 31, 2015, and the weighted average of the loan portfolios Source: SNL Financial Note: Financials reflect reported bank level regulatory data Pro Forma Loan Portfolio C&D 4% Farm 5% 32% 5+ Family 3% Comm. RE 24% Agriculture 2% C&I 11% Consumer 15% Other 4% Family C&D 2% Farm 1% 1 - 4 34% 5+ Family 2% Comm. RE 32% C&I 14% Consumer 11% Other 4% Family C&D 4% Farm 5% 32% 5+ Family 2% Comm. RE 25% Agriculture 2% C&I 12% Consumer 15% Other 4% Family 1 - 4 1 - 4 st |

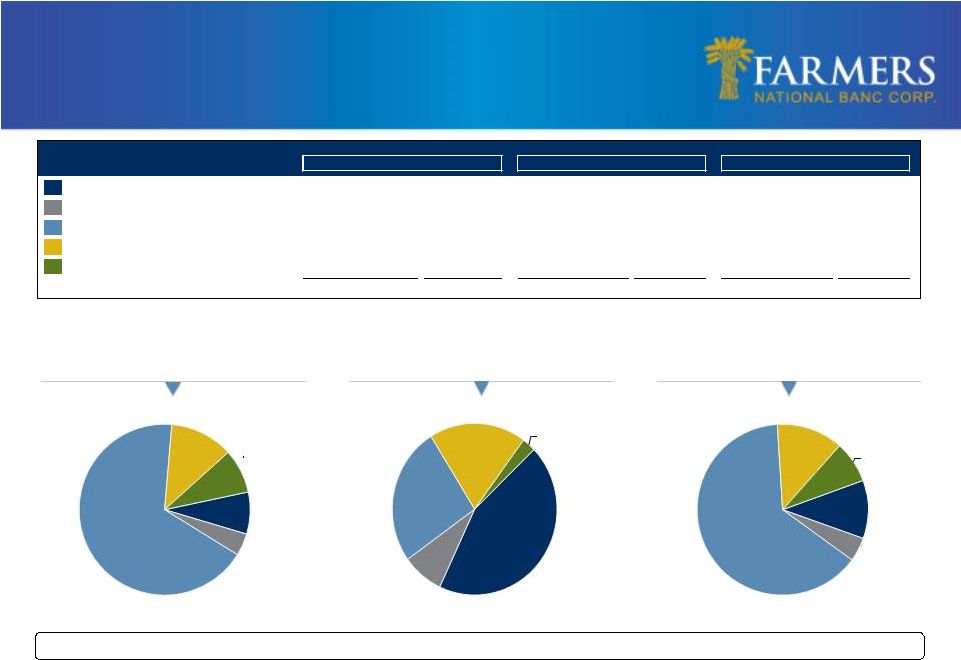

Dollars in Thousands For the period ended March 31, 2015 PF Farmers Natl Bk of Canfield 1st National Community Bank Pro Forma Demand Deposits 105,668 $ 7.9% 54,320 $ 44.2% 159,988 $ 11.0% NOW and ATS 56,049 4.2% 9,999 8.1% 66,048 4.5% MMDA and Savings 897,631 67.5% 32,016 26.0% 929,647 64.0% Retail Time Deposits ( < $100K) 159,078 12.0% 23,327 19.0% 182,405 12.6% Jumbo Time Deposits ( > $100K) 111,077 8.4% 3,284 2.7% 114,361 7.9% Total Deposits 1,329,503 $ 100.0% 122,946 $ 100.0% 1,452,449 $ 100.0% Cost: 0.36% 0.19% 0.35% (1) *Pro forma for the acquisition of National Bancshares Corporation (1) Source: SNL Financial Note: Financials reflect reported bank level regulatory data Pro Forma Deposit Mix Demand Deps. 8% NOW and ATS 4% MMDA and Savings 68% Retail Time 12% Jumbo Time 8% Demand Deps. 44% NOW and ATS 8% MMDA and Savings 26% Retail Time 19% Jumbo Time 3% Demand Deps. 11% NOW and ATS 4% MMDA and Savings 64% Retail Time 13% Jumbo Time 8% PF Farmers Natl. Bank of Canfield* 1 st National Community Bank Pro Forma Pro forma deposit cost calculated based on deposit cost for the quarter ended March 31, 2015, and the weighted average of the deposit portfolios |

• Strengthens Farmers’ presence in Columbiana County and initiates entry into Western Pennsylvania • Financially compelling: EPS accretive, minimal TBV dilution and IRR north of 20% • Attractive core deposit mix • Enhanced Southern Columbiana County and Western Pennsylvania leadership with the addition of Steve Sant • Consistent with Farmers’ strategy of acquiring banks in contiguous/adjacent markets that help the Company grow its earnings and enhance its franchise value 12 Summary Highlights |