| As filed with the Securities and Exchange Commission on March 28 , 2019 |

| | File No.: 333-230063 |

| | File No.: 811-03599 |

| U.S. SECURITIES AND EXCHANGE COMMISSION |

| |

| Washington, DC 20549 |

| | |

| | FORM N-14 |

| | |

| | REGISTRATION STATEMENT |

| UNDER THE SECURITIES ACT OF 1933 ☐ |

| Pre-Effective Amendment No. 1 ☒ |

| Post-Effective Amendment No. ☐ |

| (Check appropriate box or boxes) |

| | |

| | The Royce Fund |

| (Exact Name of Registrant as Specified in Charter) |

| | |

| | (212) 508-4500 |

| (Area Code and Telephone Number) |

| | 745 Fifth Avenue |

| New York, New York 10151 |

| Address of Principal Executive Offices: |

| (Number, Street, City, State, Zip Code) |

| | John E. Denneen, Esq. |

| Secretary, The Royce Fund |

| 745 Fifth Avenue |

| New York, New York 10151 |

| Name and Address of Agent for Service: |

| (Number and Street) (City) (State) (Zip Code) |

| | Approximate Date of Proposed Public Offering: |

| As soon as practicable after this Registration Statement becomes effective |

| under the Securities Act of 1933, as amended. |

| | |

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OF 1933 OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(a), MAY DETERMINE.

Title of the securities being registered: Shares of beneficial interest of (i) Royce Pennsylvania Mutual Fund; (ii) Royce Micro-Cap Fund; and (iii) Royce Opportunity Fund.

No filing fee is due because Registrant is relying on Section 24(f) of the Investment Company Act of 1940, as amended.

THE ROYCE FUND

745 FIFTH AVENUE

NEW YORK, NEW YORK 10151

April 1 , 2019

Dear Shareholders of:

Royce Small-Cap Leaders Fund

Royce Small/Mid-Cap Premier Fund

We are sending this information to you because you are a shareholder of Royce Small-Cap Leaders Fund (“Small-Cap Leaders”) and/or Royce Small/Mid-Cap Premier Fund (“Small/Mid-Cap Premier”). Shareholders of Small-Cap Leaders are being invited to vote on the proposed reorganization of that Fund into Royce Pennsylvania Mutual Fund (“Pennsylvania Mutual”). Likewise, Small/Mid-Cap Premier shareholders are being invited to vote on a separate proposed reorganization of Small/Mid-Cap Premier into Pennsylvania Mutual. Each of Small-Cap Leaders, Small/Mid-Cap Premier, and Pennsylvania Mutual is a series of The Royce Fund (the “Trust”).

For ease of reference and clarity of presentation, we sometimes refer to:

| | • | each of Small-Cap Leaders and Small/Mid-Cap Premier as a “Target Fund” |

| | • | each proposed transaction as a “Reorganization” and |

| | • | the fund resulting from either or both of the Reorganizations as the “Combined Fund.” |

A special meeting of the shareholders of each Target Fund is scheduled for May 28, 2019 (each, a “Meeting”) to consider and approve the proposed Reorganization for that Target Fund. If a Reorganization receives the required approval of the shareholders of the applicable Target Fund and is completed, shareholders of that Target Fund will become shareholders of Pennsylvania Mutual and will cease to own shares of that Target Fund and that Target Fund will be liquidated and terminated as a series of the Trust. Please note that the Reorganizations are separate transactions. Only shareholders of the particular Target Fund will vote on the Reorganization involving that Target Fund. Shareholder approval of one Reorganization is not contingent upon, and will not affect, shareholder approval of the other Reorganization. Likewise, completion of one Reorganization is not contingent upon, and will not affect, completion of the other Reorganization. This package contains information about each proposal and includes materials you will need to vote.

Proposed Reorganization of Royce Small-Cap Leaders Fund into Royce Pennsylvania Mutual Fund

In order to help Small-Cap Leaders shareholders vote on the proposed Reorganization, below is a short summary of the similarities and differences between those Funds and certain other factors to be considered by Small-Cap Leaders shareholders when voting on the Reorganization.

Small-Cap Leaders and Pennsylvania Mutual are similar to one another in that they:

| | • | have the same investment objective; |

| | • | use a bottom-up, small-cap core investment approach; |

| | • | invest primarily in small-cap equity securities; |

| | • | invest a substantial portion of their respective assets in U.S. issuers; |

| | • | have the same benchmark index; and |

| | • | are subject to substantially similar investment policies and restrictions. |

Small-Cap Leaders and Pennsylvania Mutual are, however, different from one another in that Small-Cap Leaders normally invests in a limited number (generally up to 100) of issuers while Pennsylvania Mutual normally has a more broadly diversified portfolio in terms of number of holdings. As of December 31, 2018, Small-Cap Leaders had 78 portfolio holdings while Pennsylvania Mutual had 269 portfolio holdings. In addition, the portfolio turnover rate for Small-Cap Leaders was significantly higher than that of Pennsylvania Mutual during the fiscal year ended December 31, 2018 (i.e., 62% for Small-Cap Leaders and 35% for Pennsylvania Mutual).

Overall, Small-Cap Leaders and Pennsylvania Mutual are subject to substantially similar principal investment risks due to their common investment approaches and their focus on U.S. small-cap equity securities. However, Small-Cap Leaders’ investment in a limited number of issuers may involve more risk than Pennsylvania Mutual because Small-Cap Leaders may be more susceptible to any single corporate, economic, political, regulatory, or market event. In addition, Small-Cap Leaders' higher portfolio turnover rate than that of Pennsylvania Mutual may indicate higher transaction costs and may result in larger distributions of net realized capital gains and, therefore, higher taxes for shareholders whose fund shares are held in a taxable account.

We note that Pennsylvania Mutual is subject to a lower contractual investment advisory fee than Small-Cap Leaders and that Pennsylvania Mutual was much larger than Small-Cap Leaders in terms of net assets as of December 31, 2018 (i.e., approximate net assets of $1.58 billion for Pennsylvania Mutual versus approximate net assets of $55.2 million for Small-Cap Leaders). We further note, as set forth in more detail in the fee tables under the heading “Fees and Expenses for Royce Small-Cap Leaders Fund Shareholders,” that both the annualized operating expense ratio of Pennsylvania Mutual and the pro forma annualized operating expense ratio of the Combined Fund assuming completion of the Small-Cap Leaders Reorganization were lower than the annualized expense ratio of Small-Cap Leaders.

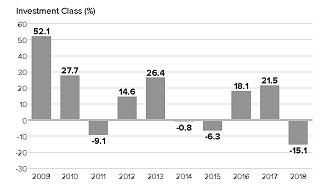

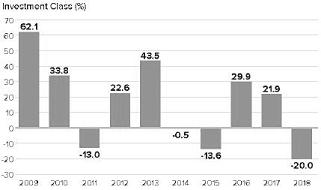

Performance comparisons presented to the Board of Trustees of the Trust in connection with its consideration and approval of the Small-Cap Leaders Reorganization at a meeting held on December 13, 2018 illustrated that Pennsylvania Mutual had generally outperformed Small-Cap Leaders during various periods ended September 30, 2018. Detailed information regarding the investment performance of Small-Cap Leaders and Pennsylvania Mutual for certain periods ended December 31, 2018 is set forth in the accompanying Joint Proxy Statement and Prospectus under the heading “Comparison of Royce Small-Cap Leaders Fund and Royce Pennsylvania Mutual Fund.” Past performance is no guarantee of future results.

Lauren A. Romeo serves as the sole portfolio manager for Small-Cap Leaders. Charles M. Royce is Pennsylvania Mutual’s lead portfolio manager, with Portfolio Managers Jay S. Kaplan and Lauren A. Romeo managing the Fund with him. Messrs. Royce and Kaplan and Ms. Romeo are assisted by Portfolio Managers James P. Stoeffel, Chris E. Flynn, and Andrew S. Palen in managing Pennsylvania Mutual. It is currently expected that such Portfolio Managers for Pennsylvania Mutual will continue in their respective roles assuming completion of the Small-Cap Leaders Reorganization.

We believe that completion of this Reorganization would give Small-Cap Leaders shareholders the opportunity to participate in a fund that: (i) has the same investment objective; (ii) uses a small-cap core investment approach; (iii) is subject to a lower contractual investment advisory fee; and (iv) has a significantly larger asset base over which expenses may be spread. The Board of Trustees of the Trust has approved the Reorganization and recommends that Small-Cap Leaders shareholders vote “FOR” the related proposal. Although the Trustees have determined that the Reorganization is in the best interests of Small-Cap Leaders and its shareholders, the final decision rests with those shareholders.

Proposed Reorganization of Royce Small/Mid-Cap Premier Fund into Royce Pennsylvania Mutual Fund

In order to help Small/Mid-Cap Premier shareholders vote on the proposed Reorganization, below is a short summary of the similarities and differences between those Funds and certain other factors to be considered by Small/Mid-Cap Premier shareholders when voting on the Reorganization.

Small/Mid-Cap Premier and Pennsylvania Mutual are similar to one another in that they:

| | • | have the same investment objective; |

| | • | use a bottom-up, core investment approach; |

| | • | invest a substantial portion of their respective assets in the equity securities of U.S. issuers; and |

| | • | are subject to similar investment policies and restrictions. |

Small/Mid-Cap Premier and Pennsylvania Mutual, however, differ from one another in certain ways. For example, these Funds focus on overlapping yet distinct market capitalization segments within the equity securities market. Pursuant to its investment policies, Small/Mid-Cap Premier must normally invest at least 80% of its net assets in small- and mid-cap companies with stock market capitalizations up to $15 billion. Pennsylvania Mutual, on the other hand, must normally invest at least 65% of its net assets in small- and micro-cap companies with stock market capitalizations up to $3 billion under its investment policies. As a result of the potential difference in market cap focus permitted by their respective investment policies, these Funds have different benchmark indexes (i.e., the Russell 2500 Index is the primary benchmark index for Small/Mid-Cap Premier while the Russell 2000 Index is the benchmark index for Pennsylvania Mutual) and had meaningfully different geometric average market capitalizations as of December 31, 2018 (i.e., approximately $4.1 billion for Small/Mid-Cap Premier versus approximately $1.72 billion for Pennsylvania Mutual). Geometric average market capitalization is a weighted calculation that uses the market capitalization of each portfolio holding in an attempt to avoid skewing the effect of very large or small holdings; instead, it aims to better identify each Fund's center. Royce believes that geometric average market capitalization offers a more accurate measure of a Fund's average market cap than a simple mean or median.

Small/Mid-Cap Premier and Pennsylvania Mutual are also different from one another in that Small/Mid-Cap Premier normally invests in a limited number (generally less than 100) of issuers while Pennsylvania Mutual normally has a more broadly diversified portfolio in terms of number of holdings. As of December 31, 2018, Small/Mid-Cap Premier had 66 portfolio holdings while Pennsylvania Mutual had 269 portfolio holdings. In addition, the portfolio turnover rate for Small/Mid-Cap Premier was significantly higher than that of Pennsylvania Mutual during the fiscal year ended December 31, 2018 (i.e., 69% for Small/Mid-Cap Premier and 35% for Pennsylvania Mutual). Finally, Pennsylvania Mutual invested a significantly higher percentage of its net assets in foreign securities than did Small/Mid-Cap Premier as of December 31, 2018 (i.e., 10.7% for Pennsylvania Mutual and 2.8% for Small/Mid-Cap Premier).

Overall, Small/Mid-Cap Premier and Pennsylvania Mutual are subject to similar principal investment risks due to their bottom-up, core investment approaches and their focus on U.S. equity securities. However, the prices of equity securities of companies with stock market capitalizations up to $3 billion are generally more volatile than those of equity securities of companies with stock market capitalizations between $3 billion and $15 billion. As a result, an investment in Pennsylvania Mutual may involve more risk of loss and its returns may differ from Small/Mid-Cap Premier because, relative to one another, Pennsylvania Mutual generally invests a greater portion of its assets in the equity securities of companies with stock market capitalizations up to $3 billion while Small/Mid-Cap Premier generally invests a greater portion of its assets in the equity securities of companies with stock market capitalizations between $3 billion and $15 billion. Small/Mid-Cap Premier’s investment in a limited number of issuers may, however, involve more risk than Pennsylvania Mutual because Small/Mid-Cap Premier may be more susceptible to any single corporate, economic, political, regulatory, or market event. In addition, Small/Mid-Cap Premier's higher portfolio turnover rate than that of Pennsylvania Mutual may indicate higher transaction costs and may result in larger distributions of net realized capital gains and, therefore, higher taxes for shareholders whose fund shares are held in a taxable account. Finally, Pennsylvania Mutual may be more subject to foreign securities risk than Small/Mid-Cap Premier to the extent Pennsylvania Mutual invests, relative to Small/Mid-Cap Premier, a greater portion of its assets in foreign securities.

2

We note that Pennsylvania Mutual was much larger than Small/Mid-Cap Premier in terms of net assets as of December 31, 2018 (i.e., approximate net assets of $1.58 billion for Pennsylvania Mutual versus approximate net assets of $155.1 million for Small/Mid-Cap Premier). The contractual investment advisory fee rates and asset breakpoint levels at which those fee rates are applied are different for Small/Mid-Cap Premier and Pennsylvania Mutual. A comparison of such rates and asset breakpoint levels illustrates that Small/Mid-Cap Premier is subject to lower investment advisory fee rates on the first $100 million in average net assets, Pennsylvania Mutual is subject to lower investment advisory fee rates on the next $3.9 billion in average net assets, and Small/Mid-Cap Premier is subject to lower investment advisory fee rates on additional average net assets over $4 billion. Accordingly, we note, based on the December 31, 2018 asset levels for Small/Mid-Cap Premier (i.e., approximate net assets of $155.1 million) and Pennsylvania Mutual (i.e., approximate net assets of $1.58 billion), that: (i) Pennsylvania Mutual would be subject to a lower effective investment advisory fee rate than Small/Mid-Cap Premier and (ii) the Combined Fund, assuming completion of the Small/Mid-Cap Premier Reorganization, would be subject to a lower effective investment advisory fee rate than Small/Mid-Cap Premier. Detailed information regarding the contractual investment advisory fee rates and asset breakpoints for Pennsylvania Mutual and Small/Mid-Cap Premier is set forth in this Prospectus/Proxy Statement under the heading “Investment Advisory Fee Rates for Royce Small/Mid-Cap Premier Fund and Royce Pennsylvania Mutual Fund.” We further note, as set forth in more detail in the fee tables under the heading “Fees and Expenses for Royce Small/Mid-Cap Premier Fund Shareholders,” that the annualized operating expense ratio of Pennsylvania Mutual and the pro forma annualized operating expense ratio of the Combined Fund assuming completion of the Small/Mid-Cap Premier Reorganization are lower than the annualized expense ratio of Small/Mid-Cap Premier.

Performance comparisons presented to the Board of Trustees of the Trust in connection with its consideration and approval of the Small/Mid-Cap Premier Reorganization at a meeting held on December 13, 2018 illustrated that Pennsylvania Mutual had generally outperformed Small/Mid-Cap Premier during various periods ended September 30, 2018. Detailed information regarding the investment performance of Small/Mid-Cap Premier and Pennsylvania Mutual for certain periods ended December 31, 2018 is set forth in the accompanying Joint Proxy Statement and Prospectus under the heading “Comparison of Royce Small/Mid-Cap Premier Fund and Royce Pennsylvania Mutual Fund.” Past performance is no guarantee of future results.

Steven G. McBoyle serves as Small/Mid-Cap Premier’s sole portfolio manager. Charles M. Royce is Pennsylvania Mutual’s lead portfolio manager, with Portfolio Managers Jay S. Kaplan and Lauren A. Romeo managing the Fund with him. Messrs. Royce and Kaplan and Ms. Romeo are assisted by Portfolio Managers James P. Stoeffel, Chris E. Flynn, and Andrew S. Palen in managing Pennsylvania Mutual. It is currently expected that such Portfolio Managers for Pennsylvania Mutual will continue in their respective roles assuming completion of the Small/Mid-Cap Premier Reorganization. It is further expected that Mr. McBoyle will join the portfolio management group for Pennsylvania Mutual assuming completion of the Small/Mid-Cap Premier Reorganization.

We believe that completion of this Reorganization would give Small/Mid-Cap Premier shareholders the opportunity to participate in a fund that: (i) has the same investment objective; (ii) uses a bottom-up, core investment approach; (iii) is subject to a lower effective investment advisory fee at current asset levels; and (iv) has a significantly larger asset base over which expenses may be spread. The Board of Trustees of the Trust has approved the Reorganization and recommends that Small/Mid-Cap Premier shareholders vote “FOR” the related proposal. Although the Trustees have determined that the Reorganization is in the best interests of Small/Mid-Cap Premier and its shareholders, the final decision rests with those shareholders.

Conclusion

The enclosed materials explain these proposals in more detail and we encourage you to review them carefully. We hope that you will respond today to ensure that your shares will be represented at the relevant Meeting. You may authorize a proxy to vote your shares by using one of the methods below by following the instructions on your proxy card:

| | • | By touch-tone telephone; |

| | • | By internet; or |

| | • | By completing and returning the enclosed proxy card in the postage-paid envelope. |

You may also vote in person at the relevant Meeting.

Please call Investor Services toll-free at 1-800-221-4268 with any questions you may have about either Reorganization.

As always, thank you for your continued support of our work. We look forward to serving you for many years to come.

| | Sincerely, |

| | |

| | |

| | CHRISTOPHER D. CLARK |

| | President of The Royce Fund |

| Please vote now. Your vote is important. |

To avoid the wasteful and unnecessary expense of further proxy solicitation, we urge you to indicate your voting instructions on the enclosed proxy card, date and sign it and return it promptly in the envelope provided, or record your voting instructions by touch-tone telephone or via the internet, no matter how large or small your holdings may be. If you submit a properly executed proxy but do not indicate how you wish your shares to be voted, your shares will be voted “FOR” the relevant proposal. |

3

THE ROYCE FUND

745 FIFTH AVENUE

NEW YORK, NEW YORK 10151

NOTICE OF SPECIAL MEETINGS OF SHAREHOLDERS TO BE HELD ON MAY 28, 2019

NOTICE IS HEREBY GIVEN that Special Meetings of Shareholders (each, a “Meeting” and together, the “Meetings”) of the following funds (each, a “Target Fund” and together, the “Target Funds”), will be held at the offices of The Royce Fund (the “Trust”), 745 Fifth Avenue, New York, New York 10151, on May 28, 2019 at the times indicated below:

| Legal Name of Target Fund | Referred to Herein As | Meeting Time |

| Royce Small-Cap Leaders Fund | Small-Cap Leaders | 11:00 a.m. Eastern time |

| Royce Small/Mid-Cap Premier Fund | Small/Mid-Cap Premier | 10:00 a.m. Eastern time |

Each Meeting will be held for the following purposes:

| | 1. To approve a Plan of Reorganization of the Trust (the “Plan”), on behalf of each Target Fund and Royce Pennsylvania Mutual Fund (“Pennsylvania Mutual”). As described in more detail in the accompanying Joint Proxy Statement and Prospectus, the Plan provides for the transfer of substantially all of the assets of the relevant Target Fund to Pennsylvania Mutual in exchange for Pennsylvania Mutual’s assumption of substantially all of the liabilities of that Target Fund and Pennsylvania Mutual’s issuance to that Target Fund of shares of beneficial interest of Pennsylvania Mutual (the “Pennsylvania Mutual Shares”). The Pennsylvania Mutual Shares received by a Target Fund in a reorganization transaction will have an aggregate net asset value that is equal to the aggregate net asset value of all of the shares of that Target Fund that are outstanding immediately prior to such reorganization. The Plan also provides for the distribution by a Target Fund, on a pro rata basis, of the Pennsylvania Mutual Shares to its shareholders in complete liquidation of the relevant Target Fund. Shareholders of a Target Fund would receive the same class of Pennsylvania Mutual Shares as they held in the relevant Target Fund immediately prior to such reorganization. A vote in favor of the Plan by shareholders of a Target Fund will constitute a vote in favor of the liquidation and termination of that Target Fund as a separate series of the Trust. |

| | |

| | 2. To transact such other business as may come before the relevant Meeting or any adjournment thereof. |

The Board of Trustees of the Trust has fixed the close of business on March 18, 2019 as the record date (the “Record Date”) for the determination of those Target Fund shareholders entitled to vote at the relevant Meeting or any adjournment thereof. Only holders of record of shares of a Target Fund at the close of business on the Record Date will be entitled to vote at the relevant Meeting or any adjournment thereof. A complete list of the Target Fund shareholders entitled to vote at the relevant Meeting will be available and open to the examination of any shareholder of that Target Fund for any purpose relevant to such Meeting during ordinary business hours from and after May 14, 2019, at the offices of the Trust, 745 Fifth Avenue, New York, New York 10151.

Each of Small-Cap Leaders, Small/Mid-Cap Premier, and Pennsylvania Mutual is a separate series of the Trust. The reorganization transaction involving Small-Cap Leaders is separate from the transaction involving Small/Mid-Cap Premier. Only shareholders of Small-Cap Leaders will vote in connection with the reorganization transaction involving that Target Fund. Likewise, only shareholders of Small/Mid-Cap Premier will vote in connection with the reorganization transaction involving that Target Fund. Under the Plan, shareholder approval of one reorganization transaction is not contingent upon, and will not affect in any way, shareholder approval of the other reorganization transaction. In addition, the consummation of one reorganization transaction is not contingent upon, and will not affect in any way, the consummation of the other reorganization transaction. Target Fund shareholders should consider each proposal independently of the other proposal.

If the Plan receives the required shareholder approval and the reorganization transaction in respect of the Target Fund in which you own shares is completed, you will become a shareholder of Pennsylvania Mutual, you will no longer own shares of your Target Fund, and your Target Fund will be liquidated and terminated as a series of the Trust. In the event the Plan does not receive the required shareholder approval or the reorganization transaction in respect of the Target Fund in which you own shares is otherwise not completed, the relevant Target Fund and Pennsylvania Mutual will continue to operate as separate series of the Trust and you will remain a shareholder of the Target Fund in which you own shares.

Please call Investor Services toll-free at 1-800-221-4268 with any questions you may have about either reorganization transaction. If you need assistance voting, please call Computershare, the proxy solicitor, toll-free at 1-866-209-8568.

IMPORTANT

To avoid the wasteful and unnecessary expense of further proxy solicitation, please mark your instructions on the enclosed proxy card, date and sign it, and return it in the enclosed envelope (which requires no postage if mailed in the United States), even if you expect to be present at the relevant Meeting. You may also authorize a proxy to vote your shares via touch-tone telephone or the Internet by following the instructions on the proxy card. Please take advantage of these prompt and efficient proxy authorization options. The accompanying proxy is solicited on behalf of the Board of Trustees of the Trust, is revocable, and will not affect your right to vote in person in the event that you attend the relevant Meeting.

| | By Order of the Board of Trustees of The Royce Fund |

| | |

| | |

| | |

| | |

| | John E. Denneen |

| | Secretary |

April 1 , 2019

JOINT PROXY STATEMENT

for

ROYCE SMALL-CAP LEADERS FUND

and

ROYCE SMALL/MID-CAP PREMIER FUND,

EACH A SERIES OF THE ROYCE FUND

and

PROSPECTUS

for

ROYCE PENNSYLVANIA MUTUAL FUND,

A SERIES OF THE ROYCE FUND

745 Fifth Avenue

New York, New York 10151

1-800-221-4268

Reorganization of Royce Small-Cap Leaders Fund into Royce Pennsylvania Mutual Fund

and

Reorganization of Royce Small/Mid-Cap Premier Fund into Royce Pennsylvania Mutual Fund

This Joint Proxy Statement and Prospectus (this “Prospectus/Proxy Statement”) is furnished in connection with the Special Meetings of Shareholders (each, a “Meeting” and together, the “Meetings”) of the funds listed below (each, a “Target Fund” and together, the “Target Funds”). Each Target Fund is a separate series of The Royce Fund (the “Trust”). Shareholders of the relevant Target Fund will be asked at the Meeting to approve the Plan of Reorganization of the Trust (the “Plan”) in respect of that Target Fund. The proposal for Target Fund shareholders to consider and approve the Plan at the relevant Meeting is generically referred to as "Proposal No. 1" in this Prospectus/Proxy Statement. As described in more detail herein, the Plan provides for the reorganization of each Target Fund into the acquiring fund listed below, which is also a series of the Trust.

| Target Fund | Acquiring Fund | Name of Reorganization |

| Royce Small-Cap Leaders Fund | Royce Pennsylvania Mutual Fund | Small-Cap Leaders Reorganization |

| Royce Small/Mid-Cap Premier Fund | Royce Pennsylvania Mutual Fund | Small/Mid-Cap Premier Reorganization |

The Plan provides for the transfer of substantially all of the assets of the relevant Target Fund to Royce Pennsylvania Mutual Fund (“Pennsylvania Mutual”) in exchange for Pennsylvania Mutual’s assumption of substantially all of the liabilities of that Target Fund and Pennsylvania Mutual’s issuance to that Target Fund of shares of beneficial interest of Pennsylvania Mutual (the “Pennsylvania Mutual Shares”). The Pennsylvania Mutual Shares received by a Target Fund in a reorganization transaction will have an aggregate net asset value that is equal to the aggregate net asset value of all of the shares of that Target Fund that are outstanding immediately prior to such reorganization. The Plan also provides for the distribution by a Target Fund, on a pro rata basis, of the Pennsylvania Mutual Shares to its shareholders in complete liquidation of the relevant Target Fund. Target Fund shareholders would receive the same class of Pennsylvania Mutual Shares as they held in the relevant Target Fund immediately prior to such reorganization.

The Trust is a Delaware statutory trust that is registered with the Securities and Exchange Commission (the “SEC”) as an open-end management investment company. This Prospectus/Proxy Statement will first be sent to shareholders of the Target Funds on or about April 1 , 2019.

The Small-Cap Leaders Reorganization is separate from the Small/Mid-Cap Premier Reorganization. Only shareholders of Royce Small-Cap Leaders Fund (“Small-Cap Leaders”) will vote in connection with the Small-Cap Leaders Reorganization. Likewise, only shareholders of Royce Small/Mid-Cap Premier Fund (“Small/Mid-Cap Premier”) will vote in connection with the Small/Mid-Cap Premier Reorganization. Target Fund shareholders should consider each proposal independently of the other proposal.

For ease of reference and clarity of presentation, we sometimes refer to:

| | • | each acquisition of substantially all of a Target Fund’s assets by Pennsylvania Mutual in exchange for Pennsylvania Mutual’s assumption of substantially all of the Target Fund’s liabilities and the issuance and distribution of the Pennsylvania Mutual Shares to the Target Fund and its shareholders individually as a “Reorganization” and together as the “Reorganizations;” |

| | • | the fund resulting from either Reorganization or both of the Reorganizations as the “Combined Fund;” and |

| | • | Small-Cap Leaders, Small/Mid-Cap Premier, and Pennsylvania Mutual individually as a “Fund” and collectively as the “Funds”. |

Under the Plan, shareholder approval of one Reorganization is not contingent upon, and will not affect in any way, shareholder approval of the other Reorganization. In addition, the consummation of one Reorganization is not contingent upon, and will not affect in any way, the consummation of the other Reorganization.

If the Plan receives the required shareholder approval and the corresponding Reorganization in respect of a Target Fund in which you own shares is completed, you will become a shareholder of Pennsylvania Mutual, you will no longer own shares of your Target Fund, and your Target Fund will be liquidated and terminated as a series of the Trust. The Combined Fund will be managed in accordance with Pennsylvania Mutual’s investment objective and principal investment policies and strategies and will be subject to Pennsylvania Mutual’s investment advisory agreement upon completion of one or both of the Reorganizations. In the event the Plan does not receive the required shareholder approval or the corresponding Reorganization in respect of a Target Fund in which you own shares is not otherwise completed, such Target Fund and Pennsylvania Mutual will continue to operate as separate series of the Trust and you will remain a shareholder of the Target Fund in which you own shares.

The Board of Trustees of the Trust (the “Board”) has approved the Reorganizations and has determined that each Reorganization is in the best interest of the applicable Target Fund and its shareholders. The Board has fixed the close of business on March 18, 2019 as the record date (the “Record Date”) for the determination of those Target Fund shareholders entitled to vote at the relevant Meeting or any adjournment thereof. Only holders of record of shares of a Target Fund at the close of business on the Record Date will be entitled to vote at the relevant Meeting or any adjournment thereof.

The Meetings will be held at the offices of the Trust, 745 Fifth Avenue, New York, New York 10151, on May 28, 2019 at the times indicated below:

| Target Fund | Meeting Time |

| Royce Small-Cap Leaders Fund | 11:00 a.m. Eastern time |

| Royce Small/Mid-Cap Premier Fund | 10:00 a.m. Eastern time |

Royce & Associates, LP (“Royce”), the investment adviser to each of Small-Cap Leaders, Small/Mid-Cap Premier, and Pennsylvania Mutual, has retained Computershare Fund Services, 250 Royall Street, Canton, MA 02021 (the “Solicitor”), to solicit proxies for the Meetings. If you need assistance voting, please call the Solicitor toll-free at 1-866-209-8568. The Solicitor is responsible for printing proxy cards, mailing proxy materials to Target Fund shareholders, soliciting broker-dealer firms, custodians, nominees and fiduciaries, tabulating the returned proxies, and performing other proxy solicitation services. The estimated cost for these solicitation services is approximately $46,000. Such costs and all other fees and expenses resulting from the Reorganizations, including, without limitation, printing this Prospectus/Proxy Statement and legal and audit fees, will be allocated among, and paid by, the Funds as follows: Small-Cap Leaders (45%), Small/Mid-Cap Premier (45%), and Pennsylvania Mutual (10%). However, any brokerage or other trading costs incurred by a Fund in connection with buying or selling portfolio securities prior to a Reorganization will be borne by that Fund and its shareholders, while brokerage or other trading costs incurred in connection with buying or selling portfolio securities after a Reorganization will be borne by the Combined Fund and its shareholders.

In addition to solicitation through the mail, proxies may be solicited by representatives of the Trust and Royce Fund Services, LLC, each Fund’s distributor (“RFS”), without cost to the Funds. Such solicitation may be made by telephone, facsimile, or otherwise. It is anticipated that banks, broker-dealers, custodians, nominees, fiduciaries, and other financial institutions will be requested to forward proxy materials to beneficial owners and to obtain approval for the execution of proxies. Upon request, Royce will reimburse brokers, custodians, nominees, and fiduciaries for the reasonable expenses incurred by them in connection with forwarding solicitation material to the beneficial owners of Fund shares held of record by such persons.

This Prospectus/Proxy Statement is both a Prospectus for Pennsylvania Mutual and a Joint Proxy Statement for Small-Cap Leaders and Small/Mid-Cap Premier. This Prospectus/Proxy Statement sets forth concisely the information about each Reorganization and Pennsylvania Mutual that you should know before voting. You should review it carefully and retain it for future reference. The Funds are subject to the informational requirements of the Securities Exchange Act of 1934, as amended, and in accordance therewith, file reports and other information, including proxy materials and charter documents, with the SEC.

2

The following document has been filed with the SEC, and is incorporated herein by reference into (legally forms a part of) this Prospectus/Proxy Statement:

| | • | The Statement of Additional Information relating to this Prospectus/Proxy Statement and certain potential reorganization transactions involving other series of the Trust, dated April 1 , 2019 (the “Reorganization SAI”) (File Number 333-230063 ). |

| | | |

| The following documents relating to the Funds have also been filed with the SEC: |

| | | |

| | • | The Prospectus relating to each series of the Trust, including Pennsylvania Mutual, Small-Cap Leaders, and Small/Mid-Cap Premier, dated May 1, 2018 and as amended and supplemented to date; |

| | • | The Statement of Additional Information relating to each series of the Trust, including Pennsylvania Mutual, Small-Cap Leaders, and Small/Mid-Cap Premier, dated May 1, 2018 and as amended and supplemented to date (the “SAI”); and |

| | • | The Annual Report to Shareholders of each series of the Trust, including Pennsylvania Mutual, Small-Cap Leaders, and Small/Mid-Cap Premier, for the fiscal year ended December 31, 2018 (the “Annual Report”). |

The documents listed above are available free of charge by calling Investor Services toll-free at 1-800-221-4268, or by writing to the Funds at 745 Fifth Avenue, New York, New York 10151. You also may view or obtain copies (at prescribed rates) of these documents from the SEC:

| | In Person:

By Mail: | | At the SEC’s Public Reference Room at 100 F Street, N.E., Washington, DC 20549

Public Reference Section

Office of Consumer Affairs and Information Services Securities and Exchange Commission

100 F Street, N.E. Washington, DC 20549 (duplicating fee required) |

| | By E-mail:

By Internet: | | publicinfo@sec.gov (duplicating fee required)

www.sec.gov |

Mutual fund shares are not deposits or obligations of, or guaranteed or endorsed by, any bank, and are not insured by the Federal Deposit Insurance Corporation or any other U.S. government agency. Mutual fund shares involve investment risks, including the possible loss of principal.

——————————

The SEC has not approved or disapproved these securities or passed upon the adequacy of this Prospectus/Proxy Statement.

Any representation to the contrary is a criminal offense

——————————

The date of this Prospectus/Proxy Statement is April 1 , 2019

3

| TABLE OF CONTENTS | |

| | |

| FEES AND EXPENSES FOR ROYCE SMALL-CAP LEADERS FUND SHAREHOLDERS | 5 |

| | |

| PORTFOLIO TURNOVER FOR ROYCE SMALL-CAP LEADERS FUND AND ROYCE PENNSYLVANIA MUTUAL FUND | 8 |

| | |

| SUMMARY OF SMALL-CAP LEADERS REORGANIZATION | 9 |

| | |

| FEES AND EXPENSES FOR ROYCE SMALL/MID-CAP PREMIER FUND SHAREHOLDERS | 13 |

| | |

| PORTFOLIO TURNOVER FOR ROYCE SMALL/MID-CAP PREMIER FUND AND ROYCE PENNSYLVANIA MUTUAL FUND | 19 |

| | |

| SUMMARY OF SMALL/MID-CAP PREMIER REORGANIZATION | 20 |

| | |

| INFORMATION ABOUT THE REORGANIZATIONS | 25 |

| | |

| COMPARISON OF ROYCE SMALL-CAP LEADERS FUND AND ROYCE PENNSYLVANIA MUTUAL FUND | 36 |

| | |

| COMPARISON OF ROYCE SMALL/MID-CAP PREMIER FUND AND ROYCE PENNSYLVANIA MUTUAL FUND | 42 |

| | |

| ADDITIONAL INFORMATION ABOUT THE FUNDS | 48 |

| | |

| ADDITIONAL VOTING INFORMATION | 54 |

| | |

| RECORD DATE SHARES OUTSTANDING AND PRINCIPAL HOLDERS OF SHARES | 55 |

| | |

| ADDITIONAL INFORMATION FOR DIRECT SHAREHOLDERS | 57 |

| | |

| OTHER BUSINESS | 62 |

| | |

| APPENDIX A – FORM OF PLAN OF REORGANIZATION OF THE ROYCE FUND | A-1 |

| | |

4

FEES AND EXPENSES FOR ROYCE SMALL-CAP LEADERS FUND SHAREHOLDERS (INVESTMENT CLASS)

Shareholders of all mutual funds pay various expenses, either directly or indirectly. Transaction expenses are charged directly to your account. Operating expenses are paid from a fund’s assets and, therefore, are paid by shareholders indirectly.

The fee tables below describe the fees and expenses that you pay if you buy and hold Investment Class shares of Small-Cap Leaders and Pennsylvania Mutual and the pro forma combined fees and expenses that you may pay if you buy and hold shares of the Combined Fund after giving effect to one or both of the Reorganizations. The annualized expense ratios below for Small-Cap Leaders and Pennsylvania Mutual are based on their respective operating expenses and average net assets for the fiscal year ended December 31, 2018, as adjusted to give effect to any contractual annual expense caps that were in effect during that period. The pro forma fees and expenses for the Investment Class shares of the Combined Fund further assume that one or both of the Reorganizations, as applicable, occurred on December 31, 2018.

The estimated pro forma Combined Fund fees and expenses presented below are based upon numerous material assumptions. Although these projections represent good faith estimates, no assurance can be given that any particular level of expenses will be achieved, because expenses depend on a variety of factors, including the future level of Fund assets, many of which are beyond the control of the Funds and Royce. Future expenses may be higher than those shown below.

| Investment Class |

| Shareholder Fees (fees paid directly from your investment) |

| | Royce

Small-Cap

Leaders Fund | Royce

Pennsylvania

Mutual Fund | Pro Forma Combined

Fund Assuming

Completion of Small-

Cap Leaders Reorganization | Pro Forma Combined

Fund Assuming

Completion of Both

Reorganizations* |

Maximum sales charge (load)

imposed on purchases | 0.00% | 0.00% | 0.00% | 0.00% |

| Maximum deferred sales charge | 0.00% | 0.00% | 0.00% | 0.00% |

Maximum sales charge (load)

imposed on reinvested dividends | 0.00% | 0.00% | 0.00% | 0.00% |

Redemption fee (as a percentage

of amount redeemed on shares

held for less than 30 days) | 1.00% | 1.00% | 1.00% | 1.00% |

| |

| * Shareholder approval of one Reorganization is not contingent upon, and will not affect in any way, shareholder approval of the other Reorganization. In addition, the consummation of one Reorganization is not contingent upon, and will not affect in any way, the consummation of the other Reorganization. Small-Cap Leaders shareholders should consider the Small-Cap Leaders Reorganization independently of the Small/Mid-Cap Premier Reorganization. |

| Investment Class |

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) |

| Royce

Small-Cap

Leaders

Fund | Royce

Pennsylvania

Mutual Fund | Pro Forma Combined

Fund Assuming

Completion of Small-

Cap Leaders

Reorganization | Pro Forma Combined

Fund Assuming

Completion of

Both Reorganizations* |

| Management fees | 1.00% | 0.76% | 0.76% | 0.76% |

| Distribution (12b-1) fees | 0.00% | 0.00% | 0.00% | 0.00% |

| Other expenses | 0.27% | 0.16% | 0.16% | 0.16% |

Total annual Fund

operating expenses prior to fee waivers and/or expense reimbursements | 1.27% | 0.92% | 0.92% | 0.92% |

Fee waivers and/or

expense reimbursements | (0.03)%** | (0.00)% | (0.00)% | (0.00)% |

Total annual Fund

operating expenses after

fee waivers and/or

expense reimbursements | 1.24%** | 0.92% | 0.92% | 0.92% |

| | | | | |

| * Shareholder approval of one Reorganization is not contingent upon, and will not affect in any way, shareholder approval of the other Reorganization. In addition, the consummation of one Reorganization is not contingent upon, and will not affect in any way, the consummation of the other Reorganization. Small-Cap Leaders shareholders should consider the Small-Cap Leaders Reorganization independently of the Small/Mid-Cap Premier Reorganization. |

| ** Royce has contractually agreed, without right of termination, to waive fees and/or reimburse expenses to the extent necessary to maintain the Investment Class’s net annual operating expenses (excluding brokerage commissions, taxes, interest, litigation expenses, acquired fund fees and expenses, and other expenses not borne in the ordinary course of business) at or below 1.24% through December 31, 2019. |

5

Investment Class Expense Example

This example is intended to help you compare the cost of investing in Investment Class shares of Small-Cap Leaders, Pennsylvania Mutual, and the Combined Fund after giving effect to one or both of the Reorganizations based on their annualized expense ratios as shown in the fee table above with the cost of investing in other mutual funds.

The example assumes that you invest $10,000 in the relevant Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that the relevant Fund’s total operating expenses remain the same (net of the fee waivers/and or expense reimbursements for the periods noted above in which such fee waivers/and or expense reimbursements would be operative). Although your actual costs may be higher or lower, based on the assumptions your costs would be:

| | Royce

Small-Cap

Leaders Fund | Royce

Pennsylvania

Mutual Fund | Pro Forma Combined Fund

Assuming Completion of

Small-Cap Leaders

Reorganization | Pro Forma Combined Fund

Assuming Completion of

Both Reorganizations* |

| 1 Year | $126 | $94 | $94 | $94 |

| 3 Years | $400 | $293 | $293 | $293 |

| 5 Years | $694 | $509 | $509 | $509 |

| 10 Years | $1,531 | $1,131 | $1,131 | $1,131 |

* Shareholder approval of one Reorganization is not contingent upon, and will not affect in any way, shareholder approval of the other Reorganization. In addition, the consummation of one Reorganization is not contingent upon, and will not affect in any way, the consummation of the other Reorganization. Small-Cap Leaders shareholders should consider the Small-Cap Leaders Reorganization independently of the Small/Mid-Cap Premier Reorganization. |

6

FEES AND EXPENSES FOR ROYCE SMALL-CAP LEADERS FUND SHAREHOLDERS (SERVICE CLASS)

Shareholders of all mutual funds pay various expenses, either directly or indirectly. Transaction expenses are charged directly to your account. Operating expenses are paid from a fund’s assets and, therefore, are paid by shareholders indirectly.

The fee tables below describe the fees and expenses that you pay if you buy and hold Service Class shares of Small-Cap Leaders and Pennsylvania Mutual and the pro forma combined fees and expenses that you may pay if you buy and hold shares of the Combined Fund after giving effect to one or both of the Reorganizations. The annualized expense ratios below for Small-Cap Leaders and Pennsylvania Mutual are based on their respective operating expenses and average net assets for the fiscal year ended December 31, 2018, as adjusted to give effect to any contractual annual expense caps that were in effect during that period. The pro forma fees and expenses for the Service Class shares of the Combined Fund further assume that one or both of the Reorganizations, as applicable, occurred on December 31, 2018.

The estimated pro forma Combined Fund fees and expenses presented below are based upon numerous material assumptions. Although these projections represent good faith estimates, no assurance can be given that any particular level of expenses will be achieved, because expenses depend on a variety of factors, including the future level of Fund assets, many of which are beyond the control of the Funds and Royce. Future expenses may be higher than those shown below.

| Service Class |

| Shareholder Fees (fees paid directly from your investment) |

| | Royce

Small-Cap

Leaders

Fund | Royce

Pennsylvania

Mutual Fund | Pro Forma Combined

Fund Assuming

Completion of Small-

Cap Leaders

Reorganization | Pro Forma Combined

Fund Assuming

Completion of Both

Reorganizations* |

Maximum sales charge (load)

imposed on purchases | 0.00% | 0.00% | 0.00% | 0.00% |

| Maximum deferred sales charge | 0.00% | 0.00% | 0.00% | 0.00% |

Maximum sales charge (load)

imposed on reinvested dividends | 0.00% | 0.00% | 0.00% | 0.00% |

Redemption fee (as a percentage

of amount redeemed on shares

held for less than 30 days) | 1.00% | 1.00% | 1.00% | 1.00% |

| | | | | |

* Shareholder approval of one Reorganization is not contingent upon, and will not affect in any way, shareholder approval of the other Reorganization. In addition, the consummation of one Reorganization is not contingent upon, and will not affect in any way, the consummation of the other Reorganization. Small-Cap Leaders shareholders should consider the Small-Cap Leaders Reorganization independently of the Small/Mid-Cap Premier Reorganization. |

| Service Class |

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) |

| | Royce

Small-Cap

Leaders

Fund | Royce

Pennsylvania

Mutual Fund | Pro Forma Combined

Fund Assuming

Completion of Small-

Cap Leaders

Reorganization | Pro Forma Combined

Fund Assuming

Completion of Both

Reorganizations* |

| Management fees | 1.00% | 0.76% | 0.76% | 0.76% |

| Distribution (12b-1) fees | 0.25% | 0.25% | 0.25% | 0.25% |

| Other expenses | 0.37% | 0.29% | 0.28% | 0.22% |

Total annual Fund

operating expenses prior to fee waivers and/or expense reimbursements | 1.62% | 1.30% | 1.29% | 1.23% |

Fee waivers and/or

expense reimbursements | (0.13)%** | (0.00)% | (0.00)% | (0.00)% |

Total annual Fund

operating expenses after

fee waivers and/or

expense reimbursements | 1.49%** | 1.30% | 1.29% | 1.23% |

| | | | | |

* Shareholder approval of one Reorganization is not contingent upon, and will not affect in any way, shareholder approval of the other Reorganization. In addition, the consummation of one Reorganization is not contingent upon, and will not affect in any way, the consummation of the other Reorganization. Small-Cap Leaders shareholders should consider the Small-Cap Leaders Reorganization independently of the Small/Mid-Cap Premier Reorganization. |

** Royce has contractually agreed, without right of termination, to waive fees and/or reimburse expenses to the extent necessary to maintain the Service Class’s net annual operating expenses (excluding brokerage commissions, taxes, interest, litigation expenses, acquired fund fees and expenses, and other expenses not borne in the ordinary course of business) at or below 1.49% through December 31, 2019. |

7

Service Class Expense Example

This example is intended to help you compare the cost of investing in Service Class shares of Small-Cap Leaders, Pennsylvania Mutual, and the Combined Fund after giving effect to one or both of the Reorganizations based on their annualized expense ratios as shown in the fee table above with the cost of investing in other mutual funds.

The example assumes that you invest $10,000 in the relevant Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that the relevant Fund’s total operating expenses remain the same (net of the fee waivers/and or expense reimbursements for the periods noted above in which such fee waivers/and or expense reimbursements would be operative). Although your actual costs may be higher or lower, based on the assumptions your costs would be:

| | Royce

Small-Cap

Leaders Fund | Royce

Pennsylvania

Mutual Fund | Pro Forma Combined Fund

Assuming Completion of

Small-Cap Leaders

Reorganization | Pro Forma Combined Fund

Assuming Completion of

Both Reorganizations* |

| 1 Year | $152 | $132 | $131 | $125 |

| 3 Years | $498 | $412 | $409 | $390 |

| 5 Years | $869 | $713 | $708 | $676 |

| 10 Years | $1,911 | $1,568 | $1,556 | $1,489 |

* Shareholder approval of one Reorganization is not contingent upon, and will not affect in any way, shareholder approval of the other Reorganization. In addition, the consummation of one Reorganization is not contingent upon, and will not affect in any way, the consummation of the other Reorganization. Small-Cap Leaders shareholders should consider the Small-Cap Leaders Reorganization independently of the Small/Mid-Cap Premier Reorganization. |

PORTFOLIO TURNOVER FOR

ROYCE SMALL-CAP LEADERS FUND AND ROYCE PENNSYLVANIA MUTUAL FUND

Each of Small-Cap Leaders and Pennsylvania Mutual pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in larger distributions of net realized capital gains and, therefore, higher taxes for shareholders whose fund shares are held in a taxable account. These costs, which are not reflected in the fee tables or expense examples of Small-Cap Leaders and Pennsylvania Mutual set forth above, affect the performance of these Funds. The portfolio turnover rates for Small-Cap Leaders and Pennsylvania Mutual during the fiscal year ended December 31, 2018 are shown below.

| Royce Small-Cap Leaders Fund | Royce Pennsylvania Mutual Fund |

| 62% of the average value of its portfolio | 35% of the average value of its portfolio |

8

SUMMARY OF SMALL-CAP LEADERS REORGANIZATION

The following is a summary of certain information contained elsewhere in this Prospectus/Proxy Statement relating to the Small-Cap Leaders Reorganization, including the form of Plan, a copy of which is attached as Appendix A hereto. You should read the more complete information in the rest of this Prospectus/Proxy Statement.

General Information Regarding Small-Cap Leaders and Pennsylvania Mutual

The Trust is a Delaware statutory trust that is registered with the SEC as an open-end management investment company. Each of Small-Cap Leaders and Pennsylvania Mutual is organized as a separate series of the Trust. Small-Cap Leaders and Pennsylvania Mutual are “diversified” investment companies within the meaning of the Investment Company Act of 1940 (the “1940 Act”). A “diversified” fund is a mutual fund that, with respect to 75% of the value of its total assets, may not: (i) have more than 5% of the value of its total assets invested in the securities of any one issuer and (ii) own more than 10% of the outstanding voting securities of any one issuer.

Lauren A. Romeo serves as the sole portfolio manager for Small-Cap Leaders. Charles M. Royce is Pennsylvania Mutual’s lead portfolio manager. Portfolio Managers Jay S. Kaplan and Lauren A. Romeo manage Pennsylvania Mutual with him. They are assisted by Portfolio Managers James P. Stoeffel, Chris E. Flynn, and Andrew S. Palen. It is currently expected that such Portfolio Managers for Pennsylvania Mutual will continue in their respective roles for the Combined Fund assuming completion of the Small-Cap Leaders Reorganization.

Upon completion of the Small-Cap Leaders Reorganization, the Combined Fund will be managed in accordance with Pennsylvania Mutual’s investment objective and principal investment policies and strategies and will be subject to Pennsylvania Mutual’s legal agreements.

Key Features of Small-Cap Leaders Reorganization

The Board of Trustees of the Trust (the “Board”) approved the Plan in connection with the Small-Cap Leaders Reorganization and unanimously recommends that Small-Cap Leaders shareholders vote to approve the Plan. The Plan provides, among other things, for:

| | • | the transfer of substantially all of the assets of Small-Cap Leaders to Pennsylvania Mutual in exchange for Pennsylvania Mutual’s assumption of substantially all of the liabilities of Small-Cap Leaders and Pennsylvania Mutual’s issuance to Small-Cap Leaders of the Pennsylvania Mutual Shares; |

| | • | the pro rata distribution of the Pennsylvania Mutual Shares by Small-Cap Leaders to its shareholders; |

| | • | the liquidation of Small-Cap Leaders and its termination as a series of the Trust. |

The Pennsylvania Mutual Shares issued by Pennsylvania Mutual to Small-Cap Leaders as part of the Small-Cap Leaders Reorganization will have an aggregate net asset value that is equal to the aggregate net asset value of all of the Small-Cap Leaders shares that are outstanding immediately prior to such Reorganization. Small-Cap Leaders will, in turn, distribute those Pennsylvania Mutual Shares to its shareholders. The Pennsylvania Mutual Shares received by each Small-Cap Leaders shareholder as part of the Small-Cap Leaders Reorganization will be of the same class and will have an aggregate net asset value that is equal to the aggregate net asset value of their Small-Cap Leaders shares immediately prior to such Reorganization. Please see “Information About the Reorganizations–Summary of the Terms of the Plan” for more detailed information regarding the Plan.

Completion of the Small-Cap Leaders Reorganization is subject to the approval of Small-Cap Leaders shareholders as described in this Prospectus/Proxy Statement under the heading “Additional Voting Information–Required Vote” and the satisfaction of certain other conditions. If the Plan receives the required shareholder approval and the Small-Cap Leaders Reorganization is completed, Small-Cap Leaders shareholders will become shareholders of Pennsylvania Mutual and will no longer own Small-Cap Leaders shares, and Small-Cap Leaders will be liquidated and terminated as a series of the Trust. In the event the Plan does not receive the required shareholder approval or the Small-Cap Leaders Reorganization is not otherwise completed, Small-Cap Leaders and Pennsylvania Mutual will continue to operate as separate series of the Trust and Small-Cap Leaders shareholders will remain shareholders of that Fund.

Shareholder approval of one Reorganization is not contingent upon, and will not affect in any way, shareholder approval of the other Reorganization. In addition, the consummation of one Reorganization is not contingent upon, and will not affect in any way, the consummation of the other Reorganization. Small-Cap Leaders shareholders should consider the Small-Cap Leaders Reorganization independently of the Small/Mid-Cap Premier Reorganization.

The Trustees unanimously concluded that the interests of existing shareholders of Small-Cap Leaders would not be diluted as a result of the consummation of the Plan and that the consummation of the Plan is in the best interests of each of Small-Cap Leaders and Pennsylvania Mutual. Please see “Information About the Reorganizations–Reasons for the Proposed Small-Cap Leaders Reorganization” for detailed information about the factors considered by the Board in approving the Plan with respect to Small-Cap Leaders and certain other information supporting approval of the Small-Cap Leaders Reorganization.

9

Summary of Investment Objectives, Principal Investment Policies and Strategies, and Benchmarks for Royce Small-Cap Leaders Fund and Royce Pennsylvania Mutual Fund

This section summarizes the investment objectives, principal investment policies and strategies, and benchmarks for Small-Cap Leaders and Pennsylvania Mutual.

| | Royce Small-Cap Leaders Fund | | Royce Pennsylvania Mutual Fund |

Investment

Objective | Long-term growth of capital | Long-term growth of capital |

Primary

Investments | Normally, the Fund invests at least 80% of its net assets in equity securities of small-cap companies with stock market capitalizations up to $3 billion at the time of investment. | Normally, the Fund at least 65% of its net assets in equity securities of small- and micro-cap companies with stock market capitalizations up to $3 billion. |

Investment

Approach | The Fund generally invests in a limited number (generally up to 100) of issuers. Royce selects securities of “leading” companies—those that in its view are trading at attractive valuations that also have excellent business strengths, strong balance sheets, and/or improved prospects for growth, as well as those with the potential for improvement in cash flow levels and internal rates of return. | The Fund uses multiple investment disciplines in an effort to provide exposure to approaches that have historically tended to perform well in different market environments. These disciplines include investing in a “High Quality” approach—companies that Royce believes have competitive advantages and high returns on capital; a “Traditional Value” approach—companies that are currently out of favor, selling at what Royce deems to be low valuations; and a “Special Situations” approach—companies with complex structures that do not lend themselves to traditional valuation metrics, as well as other Royce approaches such as “Growth at a Reasonable Price” and “Deep Value.” The Fund’s portfolio managers generally focus on one or more of these approaches in managing segments of the Fund’s assets, while the Lead Portfolio Manager oversees investments across all segments. |

Number of

Holdings | As of December 31, 2018, the Fund had 78 holdings. | As of December 31, 2018, the Fund had 269 holdings. |

Foreign

Investments | Although the Fund normally focuses on securities of U.S. companies, it may invest up to 25% of its net assets (measured at the time of investment) in securities of companies headquartered in foreign countries. The Fund does not expect to hedge against declines in the U.S. dollar or to lock in the value of any foreign securities that it purchases.

As of December 31, 2018: Approximately 11% of the Fund’s net assets was invested in foreign securities. | Although the Fund normally focuses on securities of U.S. companies, it may invest up to 25% of its net assets (measured at the time of investment) in securities of companies headquartered in foreign countries. The Fund does not expect to hedge against declines in the U.S. dollar or to lock in the value of any foreign securities that it purchases.

As of December 31, 2018: Approximately 10.7% of the Fund’s net assets was invested in foreign securities. |

Benchmark

Index | Russell 2000 Index | Russell 2000 Index |

10

Overall, Small-Cap Leaders and Pennsylvania Mutual are similar to one another in that they:

| | • | have the same investment objective; |

| | | |

| | • | use a bottom-up, small-cap core investment approach; |

| | | |

| | • | invest primarily in small-cap equity securities; |

| | | |

| | • | invest a substantial portion of their respective assets in U.S. issuers; |

| | | |

| | • | have the same benchmark index; |

| | | |

| | • | are subject to the same restrictions on their respective investments in foreign securities; and |

| | | |

| | • | do not expect to engage in hedging transactions to protect against declines in the U.S. dollar or to lock in the value of their |

| | | foreign security holdings. |

| | | |

However, Small-Cap Leaders and Pennsylvania Mutual differ from one another in that Small-Cap Leaders invested in a limited number of issuers as of December 31, 2018 (i.e., 78 holdings) while Pennsylvania Mutual had a more broadly diversified portfolio in terms of number of holdings as of such date (i.e., 269 holdings). In addition, the portfolio turnover rate for Small-Cap Leaders was significantly higher than that of Pennsylvania Mutual during the fiscal year ended December 31, 2018 (i.e., 62% for Small-Cap Leaders and 35% for Pennsylvania Mutual).

Summary of Principal Investment Risks for Small-Cap Leaders and Pennsylvania Mutual

The principal investment risks associated with an investment in Small-Cap Leaders and Pennsylvania Mutual are identified in the table below. For detailed descriptions of these risks, please see “Comparison of Royce Small-Cap Leaders Fund and Royce Pennsylvania Mutual Fund” in this Prospectus/Proxy Statement.

Overall, Small-Cap Leaders and Pennsylvania Mutual are subject to substantially similar principal investment risks due to their common investment approaches and their focus on U.S. small-cap equity securities. However, Small-Cap Leaders’ investment in a limited number of issuers may involve considerably more risk to investors than Pennsylvania Mutual’s more broadly diversified portfolio of securities because Small-Cap Leaders’ portfolio may be more susceptible to any single corporate, economic, political, regulatory, or market event. In addition, Small-Cap Leaders' higher portfolio turnover rate than that of Pennsylvania Mutual may indicate higher transaction costs and may result in larger distributions of net realized capital gains and, therefore, higher taxes for shareholders whose fund shares are held in a taxable account.

| Principal Investment Risk | Royce Small-Cap Leaders Fund | Royce Pennsylvania Mutual Fund |

| Market Risk | Yes | Yes |

| Risk of Investing in Small-Cap Securities | Yes | Yes |

| Investment in a Limited Number of Issuers | Yes | No |

| Industry and Sector Overweights | Yes | Yes |

| Foreign Securities Risk | Yes | Yes |

No assurance can be given that shares of the Combined Fund will not lose value. As with any Fund, the value of the Combined Fund’s investments, and, therefore, the value of the Combined Fund’s shares, may fluctuate.

Primary U.S. Federal Income Tax Consequences of Small-Cap Leaders Reorganization

The Reorganization is intended to qualify for U.S. federal income tax purposes as a tax-free reorganization under the Internal Revenue Code of 1986, as amended (the “Code”). It is expected that Small-Cap Leaders shareholders will not recognize gain or loss for U.S. federal income tax purposes upon the exchange of all of their Small-Cap Leaders shares solely for shares of Pennsylvania Mutual, as described herein and in the Plan. In addition, in general, it is expected that Small-Cap Leaders and Pennsylvania Mutual will not recognize gain or loss for U.S. federal income tax purposes upon the transactions contemplated by the Reorganization, except for any gain or loss that may be required to be recognized solely as a result of the close of the taxable year of Small-Cap Leaders due to the Reorganization or as a result of the transfer of certain assets, and any tax on any such gain would be borne by Small-Cap Leaders shareholders. Small-Cap Leaders does not expect to sell or otherwise dispose of any investments in a significant amount prior to the implementation of the Reorganization, except pursuant to transactions made in the ordinary course of business or with respect to investments that are not freely transferable or are otherwise restricted. If Small-Cap Leaders were to sell investments in anticipation of the Reorganization, Small-Cap Leaders could generate capital gains for its shareholders, which would be taxable.

11

Purchase and Redemption Procedures, Fee Structures, and Exchange Rights

Investment Class and Service Class shares of each of Small-Cap Leaders and Pennsylvania Mutual are subject to identical purchase and redemption procedures and have identical exchange rights. Investment Class and Service Class shares of Small-Cap Leaders are, however, subject to a higher contractual investment advisory fee rate than the corresponding shares of Pennsylvania Mutual. Shareholders of Small-Cap Leaders and Pennsylvania Mutual will not be subject to any redemption fees in connection with any redemptions of shares of the Combined Fund that are made within the first 30 days after the completion of the Small-Cap Leaders Reorganization.

Shareholder Voting for Small-Cap Leaders Reorganization

Only shareholders of Small-Cap Leaders will vote in connection with the Small-Cap Leaders Reorganization. The Board has set the close of business on March 18, 2019 as the record date (the “Record Date”) for determining those Small-Cap Leaders shareholders entitled to vote at the Small-Cap Leaders Meeting or any adjournment thereof. Only holders of record of Small-Cap Leaders shares at the close of business on the Record Date will be entitled to vote at such Meeting or any adjournment thereof. Small-Cap Leaders shareholders on the Record Date will be entitled one vote for each full Small-Cap Leaders share and a fractional vote for each Small-Cap Leaders fractional share that they hold, with no shares having cumulative voting rights.

Approval of the Plan in respect of the Small-Cap Leaders Reorganization requires the affirmative vote of a majority of the outstanding voting securities of Small-Cap Leaders, which is defined in the 1940 Act as the lesser of: (i) 67% or more of the shares of Small-Cap Leaders present at the relevant Meeting, if the holders of more than 50% of the outstanding shares of Small-Cap Leaders are present or represented by proxy at such Meeting; or (ii) more than 50% of the outstanding shares of Small-Cap Leaders.

All properly executed proxy cards received prior to the Small-Cap Leaders Meeting will be voted at such Meeting in accordance with the instructions marked thereon or otherwise as provided therein. Unless instructions to the contrary are marked, proxy cards will be voted “FOR” Proposal No. 1. You may revoke your proxy at any time before it is exercised by sending written instructions to the Secretary of the Trust at 745 Fifth Avenue, New York, New York 10151 or by submitting a new proxy card with a later date. In addition, any shareholder attending the Small-Cap Leaders Meeting may vote in person, whether or not he or she has previously submitted a proxy card. The Board knows of no business other than that mentioned in Proposal No. 1 of the Notice of Special Meeting that will be presented for consideration at the Small-Cap Leaders Meeting. If any other matter is properly presented at the Small-Cap Leaders Meeting or any adjournment thereof, it is the intention of the persons named on the enclosed proxy card to vote in accordance with their best judgment.

Shareholder approval of the Small-Cap Leaders Reorganization is not contingent upon, and will not affect in any way, shareholder approval of the Small/Mid-Cap Premier Reorganization. In addition, the consummation of the Small-Cap Leaders Reorganization is not contingent upon, and will not affect in any way, the consummation of the Small/Mid-Cap Premier Reorganization. Small-Cap Leaders shareholders should consider the proposal relating to the Small-Cap Leaders Reorganization independently of the proposal relating to the Small/Mid-Cap Premier Reorganization.

12

FEES AND EXPENSES FOR ROYCE SMALL/MID-CAP PREMIER FUND SHAREHOLDERS (INVESTMENT CLASS)

Shareholders of all mutual funds pay various expenses, either directly or indirectly. Transaction expenses are charged directly to your account. Operating expenses are paid from a fund’s assets and, therefore, are paid by shareholders indirectly.

The fee tables below describe the fees and expenses that you pay if you buy and hold Investment Class shares of Small/Mid-Cap Premier and Pennsylvania Mutual and the pro forma combined fees and expenses that you may pay if you buy and hold shares of the Combined Fund after giving effect to one or both of the Reorganizations. The annualized expense ratios below for Small/Mid-Cap Premier and Pennsylvania Mutual are based on their respective operating expenses and average net assets for the fiscal year ended December 31, 2018. The pro forma fees and expenses for the Investment Class shares of the Combined Fund further assume that one or both of the Reorganizations, as applicable, occurred on December 31, 2018.

The estimated pro forma Combined Fund fees and expenses presented below are based upon numerous material assumptions. Although these projections represent good faith estimates, no assurance can be given that any particular level of expenses will be achieved, because expenses depend on a variety of factors, including the future level of Fund assets, many of which are beyond the control of the Funds and Royce. Future expenses may be higher than those shown below.

| Investment Class |

| Shareholder Fees (fees paid directly from your investment) |

| | Royce

Small/Mid-

Cap Premier

Fund | Royce

Pennsylvania

Mutual Fund | Pro Forma Combined

Fund Assuming

Completion of

Small/Mid-Cap

Premier

Reorganization | Pro Forma Combined

Fund Assuming

Completion of Both

Reorganizations* |

Maximum sales charge (load)

imposed on purchases | 0.00% | 0.00% | 0.00% | 0.00% |

| Maximum deferred sales charge | 0.00% | 0.00% | 0.00% | 0.00% |

Maximum sales charge (load)

imposed on reinvested dividends | 0.00% | 0.00% | 0.00% | 0.00% |

Annual Trustee’s Fee–applies

only to GiftShare Accounts | $50** | N/A** | $50** | $50** |

Redemption fee (as a percentage

of amount redeemed on shares

held for less than 30 days) | 1.00% | 1.00% | 1.00% | 1.00% |

| |

* Shareholder approval of one Reorganization is not contingent upon, and will not affect in any way, shareholder approval of the other Reorganization. In addition, the consummation of one Reorganization is not contingent upon, and will not affect in any way, the consummation of the other Reorganization. Small/Mid-Cap Premier shareholders should consider the Small/Mid-Cap Premier Reorganization independently of the Small-Cap Leaders Reorganization. |

** Investment Class shares of Small/Mid-Cap Premier may be held in GiftShare Accounts. Pennsylvania Mutual, however, does not offer GiftShare Accounts as of the date hereof. Each GiftShare Account that holds Investment Class shares of Small/Mid-Cap Premier will receive the relevant number of Investment Class shares of the Combined Fund upon completion of the Small/Mid-Cap Premier Reorganization as contemplated under the Plan. In addition, the Trust Agreement governing such GiftShare Accounts will be amended, effective as of the completion of the Small/Mid-Cap Premier Reorganization, to provide for the investment of trust assets in the relevant shares of Pennsylvania Mutual rather than Small-Mid-Cap Premier. |

| Investment Class |

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) |

| | Royce

Small/Mid-

Cap Premier

Fund | Royce

Pennsylvania

Mutual Fund | Pro Forma Combined Fund

Assuming Completion of

Small/Mid-Cap Premier

Reorganization | Pro Forma Combined Fund

Assuming Completion of Both

Reorganizations* |

| Management fees | 0.85% | 0.76% | 0.76% | 0.76% |

| Distribution (12b-1) fees | 0.00% | 0.00% | 0.00% | 0.00% |

| Other expenses | 0.17% | 0.16% | 0.16% | 0.16% |

Total annual Fund

operating expenses | 1.02% | 0.92% | 0.92% | 0.92% |

| |

* Shareholder approval of one Reorganization is not contingent upon, and will not affect in any way, shareholder approval of the other Reorganization. In addition, the consummation of one Reorganization is not contingent upon, and will not affect in any way, the consummation of the other Reorganization. Small/Mid-Cap Premier shareholders should consider the Small/Mid-Cap Premier Reorganization independently of the Small-Cap Leaders Reorganization. |

13

Investment Class Expense Example

This example is intended to help you compare the cost of investing in Investment Class shares of Small/Mid-Cap Premier, Pennsylvania Mutual, and the Combined Fund after giving effect to one or both of the Reorganizations based on their annualized expense ratios as shown in the fee table above with the cost of investing in other mutual funds.

The example assumes that you invest $10,000 in the relevant Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that the relevant Fund’s total operating expenses remain the same (net of the fee waivers/and or expense reimbursements for the periods noted above in which such fee waivers/and or expense reimbursements would be operative). Although your actual costs may be higher or lower, based on the assumptions your costs would be:

| | Royce

Small/Mid-Cap

Premier Fund | Royce

Pennsylvania

Mutual Fund | Pro Forma Combined Fund

Assuming Completion of

Small/Mid-Cap Premier

Reorganization | Pro Forma Combined Fund

Assuming Completion of Both

Reorganizations* |

| 1 Year | $104** | $94 | $94** | $94** |

| 3 Years | $325** | $293 | $293** | $293** |

| 5 Years | $563** | $509 | $509** | $509** |

| 10 Years | $1,248** | $1,131 | $1,131** | $1,131** |

* Shareholder approval of one Reorganization is not contingent upon, and will not affect in any way, shareholder approval of the other Reorganization. In addition, the consummation of one Reorganization is not contingent upon, and will not affect in any way, the consummation of the other Reorganization. Small/Mid-Cap Premier shareholders should consider the Small/Mid-Cap Premier Reorganization independently of the Small-Cap Leaders Reorganization. |

** Exclusive of $50 Annual Trustee’s Fee for GiftShare Accounts. |

14

FEES AND EXPENSES FOR ROYCE SMALL/MID-CAP PREMIER FUND SHAREHOLDERS (SERVICE CLASS)

Shareholders of all mutual funds pay various expenses, either directly or indirectly. Transaction expenses are charged directly to your account. Operating expenses are paid from a fund’s assets and, therefore, are paid by shareholders indirectly.

The fee tables below describe the fees and expenses that you pay if you buy and hold Service Class shares of Small/Mid-Cap Premier and Pennsylvania Mutual and the pro forma combined fees and expenses that you may pay if you buy and hold shares of the Combined Fund after giving effect to one or both of the Reorganizations. The annualized expense ratios below for Small/Mid-Cap Premier and Pennsylvania Mutual are based on their respective operating expenses and average net assets for the fiscal year ended December 31, 2018. The pro forma fees and expenses for the Service Class shares of the Combined Fund further assume that one or both of the Reorganizations, as applicable, occurred on December 31, 2018.

The estimated pro forma Combined Fund fees and expenses presented below are based upon numerous material assumptions. Although these projections represent good faith estimates, no assurance can be given that any particular level of expenses will be achieved, because expenses depend on a variety of factors, including the future level of Fund assets, many of which are beyond the control of the Funds and Royce. Future expenses may be higher than those shown below.

| Service Class |

| Shareholder Fees (fees paid directly from your investment) |

| | Royce

Small/Mid-

Cap Premier

Fund | Royce

Pennsylvania

Mutual Fund | Pro Forma Combined

Fund Assuming Completion of

Small/Mid-Cap Premier

Reorganization | Pro Forma Combined Fund

Assuming Completion of Both