Washington, D.C. 20549

Attention: Elena Stojic, Division of Investment Management

Dear Ms. Stojic:

Set forth below are the Commission staff’s comments in italics regarding the Initial Amendment along with the Trust’s responses to those comments. The Trust is also concurrently filing a draft of Post-Effective Amendment No. 146 under the 1933 Act and Amendment No. 148 under the 1940 Act (the “Amendment”) to the Trust’s Registration Statement on Form N-1A via Edgar correspondence. The Amendment, which will be filed pursuant to Rule 485(b) under the 1933 Act, incorporates the Trust’s responses to the Commission staff’s comments and makes certain non-material updating changes. Capitalized terms used herein and not otherwise defined herein shall have the meanings given to them in the Amendment.

Response: Each “Expense Example” has been revised to include a line item that reflects the imposition of a contingent deferred sales charge on the redemption of certain A Class shares that were not subject to an initial sales charge within 18 months of their purchase.

Response: The Trust notes that: (i) a reference to the amount of the maximum initial sales charge for A Class shares has been added to the Prospectus under the heading “Performance” and (ii) the relevant sentence has been deleted.

Response: The Trust notes that the referenced disclosure applies only to Service Class shares of PMF. As of December 31, 2020, Service Class was the fourth largest of PMF’s five share classes and represented only approximately 4.1% of PMF’s overall net assets. In addition, PMF’s aggregate net assets as of December 31, 2019 and December 31, 2020 were $1.949 billion and $1.916 billion, respectively. As a result, the Trust does not believe the above-described end of period net asset changes raise liquidity concerns that warrant the addition of related disclosure to the Prospectus.

Response: The applicable limits on each Fund’s investments in restricted securities and illiquid securities and the sources of such limits are set forth in the table below.

The Trust acknowledges that: (i) it is responsible for the adequacy and accuracy of the disclosure in the Amendment; (ii) Commission staff comments or changes to disclosure in response to staff comments in the filings reviewed by the staff do not foreclose the Commission from taking any action with respect to the Amendment; and (iii) the Trust may not assert this action as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States.

We believe that the proposed modifications set forth in the Amendment are responsive to the Commission staff’s comments. Please contact me at (212) 508-4578 if you have any related questions or comments.

| Securities Act Registration No. 002-80348 |

| Investment Company Act Registration No. 811-03599 |

| |

| As filed with the Securities and Exchange Commission on April 22, 2021 |

| |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| FORM N-1A |

| REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 | | | | / X / |

| Pre-Effective Amendment No. ______ | | / / | | |

| Post-Effective Amendment No. 146 | | / X / | | |

| | | | | |

| and/or |

| REGISTRATION STATEMENT UNDER THE INVESTMENT COMPANY ACT OF 1940 | | / X / |

| Amendment No. 148 | | / X / | | |

| (Check appropriate box or boxes) |

THE ROYCE FUND

(Exact name of Registrant as specified in charter)

745 Fifth Avenue, New York, New York 10151

(Address of principal executive offices) (Zip Code)

(212) 508-4500

(Registrant’s Telephone Number, including Area Code)

Christopher D. Clark, President

The Royce Fund

745 Fifth Avenue, New York, New York 10151

(Name and Address of Agent for Service)

It is proposed that this filing will become effective (check appropriate box)

/ / immediately upon filing pursuant to paragraph (b)

/ x / on April 23, 2021 pursuant to paragraph (b)

/ / on (Date) pursuant to paragraph (a)(1)

/ / on (Date) pursuant to paragraph (a)(1)

/ / 75 days after filing pursuant to paragraph (a)(2)

/ / on (Date) pursuant to paragraph (a)(2) of Rule 485

If appropriate, check the following box:

/ / this post-effective amendment designates a new effective date for a previously filed post-effective amendment.

Total number of pages: ___

Index to Exhibits is located on page:

Prospectus

A Class Shares

April 23, 2021

FUND

A

Royce Pennsylvania Mutual Fund

PAHPX

Royce Premier Fund

RAAFX

Royce Special Equity Fund

PAHQX

As with all mutual funds, the Securities and Exchange Commission has not approved or disapproved of these securities, or determined that the information in this prospectus is accurate or complete. It is a crime to represent otherwise.

As permitted by regulations adopted by the Securities and Exchange Commission, paper copies of each Fund’s shareholder reports will no longer be sent by mail unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on https://www.royceinvest.com/funds/30e-3, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change, and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund or your financial intermediary electronically by notifying your financial intermediary directly or, if you are a direct investor, by calling 1-800-841-1180.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your reports. If you invest directly with a Fund, you can call 1-800-841-1180. Your election to receive reports in paper will apply to all funds held with The Royce Funds or your financial intermediary

royceinvest.com

Table of Contents

| | |

| | |

| A Class Shares of Royce Pennsylvania Mutual Fund, Royce Premier Fund, and Royce Special Equity Fund are only offered through certain broker-dealers and other financial intermediaries. |

The Royce Fund Prospectus 2021 | 1

Royce Pennsylvania Mutual Fund

Investment Goal

Royce Pennsylvania Mutual Fund's investment goal is long-term growth of capital.

Fees and Expenses of the Fund

The following table presents the fees and expenses that you may pay if you buy and hold shares of the Fund.

You may qualify for Class A sales charge discounts from certain financial intermediaries if you and your family invest, or agree to invest in the future, at least $25,000 in certain Royce, Franklin Templeton, and Legg Mason funds. More information about these and other sales charge discounts and waivers is available from your financial intermediary, under the heading "General Shareholder Information-Sales Charges" in this Prospectus (pages xx-xx), in Appendix A: Sales Charge Waivers and Discounts from Certain Financial Intermediaries, and under the heading "Sales Charge Waivers and Reductions for A Class Shares" in the Funds' Statement of Additional Information. "Financial intermediaries" include banks, brokers, dealers, insurance companies, investment advisers, financial consultants or advisers, mutual fund supermarkets and other financial intermediaries that have entered into an agreement with Royce Fund Services, LLC to sell Fund shares.

| Shareholder Fees (fees paid directly from your investment) | |

| A CLASS |

| Maximum sales charge (load) imposed on purchases | 5.25%1 |

| Maximum deferred sales charge | None2 |

| Maximum sales charge (load) imposed on reinvested dividends | 0.00% |

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | |

| Management fees | 0.76% |

| Distribution (12b-1) fees | 0.25% |

| Other expenses | 0.23% |

| Total annual Fund operating expenses | 1.24% |

The Fund's total annualized operating expense ratios are subject to change in response to changes in the Fund's average net assets or for other reasons. A decline in the Fund's average net assets can be expected to increase the impact of operating expenses on the Fund's total annualized operating expense ratios.

| 1 | Shareholders purchasing A Class shares through certain financial intermediaries or in certain types of accounts may be eligible for a waiver of the sales charge. For additional information, see “General Shareholder Information – Sales Charges” in this Prospectus. |

| 2 | You may buy A Class shares of the Fund at net asset value (without an initial sales charge), at certain financial intermediaries if the amount of such purchase, when combined with certain holdings of various Royce, Franklin Templeton, and Legg Mason funds, equals or exceeds $1,000,000. However, if you redeem those shares within 18 months of their purchase, you will pay a contingent deferred sales charge of 1.00%. |

| Example |

| |

| This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. |

| The example assumes that you invest $10,000 in the Fund for the time periods indicated. The example also assumes that your investment has a 5% return each year and that, except as indicated, the Fund’s total operating expenses remain the same. Although your actual costs may be higher or lower, based on the assumptions your costs would be: |

| |

| | A CLASS | |

| 1 Year (without redemption of any of your shares)3 | $644 | |

| 1 Year (with redemption of all of your shares)4 | $230 | |

| 3 Years (with or without redemption of all of your shares)3 | $898 | |

| 5 Years (with or without redemption of all of your shares)3 | $1,171 | |

| 10 Years (with or without redemption of all of your shares)3 | $1,948 | |

| 3 | Assumes your investment is subject to the maximum initial sales charge of 5.25%. |

| 4 | Assumes your investment is not subject to an initial sales charge but that your redemption of all of your shares is subject to a deferred sales charge of 1.00%. |

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the fiscal year ended December 31, 2020, the Fund’s portfolio turnover rate was 32% of the average value of its portfolio.

2 | The Royce Fund Prospectus 2021

Royce Pennsylvania Mutual Fund (continued)

Principal Investment Strategy

Royce Investment Partners (“Royce”), the Fund’s investment adviser, invests the Fund’s assets primarily in equity securities of small- and micro-cap companies that it believes are trading below its estimate of their current worth. Small- and micro-cap companies are those that have a market capitalization not greater than that of the largest company in the Russell 2000® Index at the time of its most recent reconstitution. The Fund uses multiple investment disciplines in an effort to provide exposure to approaches that have historically tended to perform well in different market environments. These disciplines include investing in a “High Quality” approach—companies that Royce believes have competitive advantages and high returns on capital; a “Traditional Value” approach—companies that are currently out of favor, selling at what Royce deems to be low valuations; and a “Special Situations” approach—companies with complex structures that do not lend themselves to traditional valuation metrics, as well as other Royce approaches such as “Growth at a Reasonable Price” and “Deep Value.” The Fund’s portfolio managers generally focus on one or more of these approaches in managing segments of the Fund’s assets, while the Lead Portfolio Manager oversees investments across all segments.

Normally, the Fund invests at least 65% of its net assets in equity securities of such small- and micro-cap companies. Although the Fund normally focuses on securities of U.S. companies, it may invest up to 25% of its net assets (measured at the time of investment) in securities of companies headquartered in foreign countries. The Fund may invest in other investment companies that invest in equity securities. The Fund may sell securities to, among other things, secure gains, limit losses, redeploy assets into what Royce deems to be more promising opportunities, and/or manage cash levels in the Fund’s portfolio. The Fund does not focus its investments in companies the do business in the State of Pennsylvania.

Primary Risks for Fund Investors

As with any mutual fund that invests in common stocks, Royce Pennsylvania Mutual Fund is subject to market risk—the possibility that common stock prices will decline over short or extended periods of time due to overall market, financial, and economic conditions and trends, governmental or central bank actions or interventions, changes in investor sentiment, and other factors, such as the recent COVID-19 pandemic, that may not be directly related to the issuer of a security held by the Fund. This pandemic could adversely affect global economies and markets and individual companies in ways that cannot necessarily be foreseen. As a result, the value of your investment in the Fund will fluctuate, sometimes sharply and unpredictably, and you could lose money over short or long periods of time.

The prices of small- and micro-cap securities are generally more volatile than those of larger-cap securities. In addition, because small- and micro-cap securities tend to have significantly lower trading volumes than larger-cap securities, the Fund may have difficulty selling holdings or may only be able to sell holdings at prices substantially lower than what Royce believes they are worth. Therefore, the Fund may involve considerably more risk of loss and its returns may differ significantly from funds investing in larger-cap companies or other asset classes.

Investment in foreign securities involves risks that may not be encountered in U.S. investments, including adverse political, social, economic, or other developments that are unique to a particular region or country. Prices of foreign securities in particular countries or regions may, at times, move in a different direction and/or be more volatile than those of U.S. securities. Because the Fund does not intend to hedge its foreign currency exposure, the U.S. dollar value of the Fund’s investments may be harmed by declines in the value of foreign currencies in relation to the U.S. dollar.

To the extent the Fund overweights a single market sector or industry relative to its benchmark index, its performance may be tied more directly to the success or failure of a relatively smaller or less well-diversified group of portfolio holdings.

Royce’s estimate of a company’s current worth also may prove to be inaccurate, or this estimate may not be recognized by other investors, which could lead to portfolio losses. Securities in the Fund’s portfolio may not increase as much as the market as a whole and some securities may continue to be undervalued for long periods of time or may never reach what Royce believes are their full market values.

Investments in the Fund are not bank deposits and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. This Prospectus is not a contract.

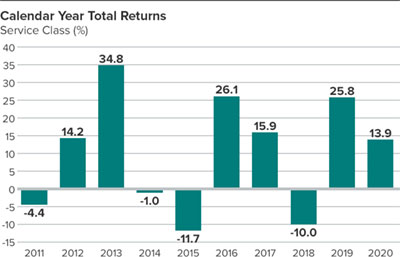

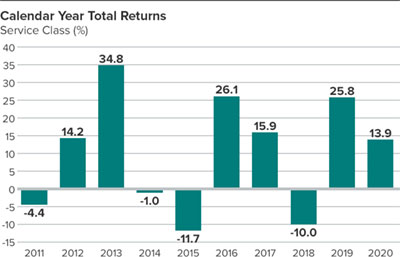

Performance

The following performance information provides an indication of the risks of investing in the Fund. Past performance does not indicate how the Fund will perform in the future. The Calendar Year Total Returns chart shows performance year by year over the last 10 years. Because A Class shares were not sold prior to December 31, 2020, performance information is shown for Service Class shares, not offered in this Prospectus, for illustrative purposes. Purchases of A Class shares are subject to a maximum sales charge of 5.25% while purchases of Service Class shares are not subject to any sales charges. If such maximum sales charge for A Class shares had been reflected, total returns would have been lower.

The Royce Fund Prospectus 2021 | 3

Royce Pennsylvania Mutual Fund (concluded)

During the period shown in the bar chart, the highest return for a calendar quarter was 27.14% (quarter ended 12/31/20) and the lowest return for a calendar quarter was -30.30% (quarter ended 3/31/20).

The Annualized Total Returns table shows how the Fund’s average annual total returns for various periods compare with those of the Russell 2000 Index, the Fund’s benchmark index. (Service Class shown again for illustrative purposes.) The table also presents the impact of taxes on the Fund’s returns. In calculating these figures, we assumed that the shareholder was in the highest federal income tax bracket in effect at the time of each distribution of income or capital gains. We did not consider the impact of state or local income taxes. Your after-tax returns depend on your tax situation, so they may differ from the returns shown. This information does not apply if your investment is in an individual retirement account (IRA), a 401(k) plan, or is otherwise tax deferred because such accounts are subject to income taxes only upon distribution. Current month-end performance information may be obtained at www.royceinvest.com or by calling Investor Services at (800) 221-4268.

| Annualized Total Returns | | | |

| As of 12/31/20 (%) | | | |

| 1 YEAR | 5 YEAR | 10 YEAR |

| Service Class | | | |

| Return Before Taxes | 13.88 | 13.51 | 9.25 |

| Return After Taxes on Distributions | 12.62 | 10.78 | 6.87 |

| Return After Taxes on Distributions and Sale of Fund Shares | 9.08 | 10.33 | 7.00 |

| Russell 2000 Index | | | |

| (Reflects no deductions for fees, expenses, or taxes) | 19.96 | 13.26 | 11.20 |

Investment Adviser and Portfolio Management

Royce & Associates, LP is the Fund’s investment adviser and a limited partnership organized under the laws of Delaware. Royce & Associates primarily conducts its business under the name Royce Investment Partners. Charles M. Royce is the Fund’s lead portfolio manager. Portfolio Managers Jay S. Kaplan, Lauren A. Romeo, Steven G. McBoyle, Miles Lewis, James P. Stoeffel, Andrew S. Palen, and Brendan J. Hartman manage the Fund with him. Mr. Royce has been portfolio manager since 1972. Mr. Kaplan and Ms. Romeo became portfolio managers in 2016 and were previously assistant portfolio managers from 2003 and 2006, respectively, through 2015. Mr. McBoyle became portfolio manager in 2019. Mr. Lewis became portfolio manager on February 1, 2021. Mr. Stoeffel and Mr. Palen became portfolio managers on May 1, 2021 and were previously assistant portfolio managers from 2017 and 2018, respectively. Mr. Hartman became portfolio manager on May 1, 2021.

How to Purchase and Sell Fund Shares

The Fund’s A Class shares are offered only through certain broker-dealers and other financial intermediaries. You may purchase or redeem A Class shares through such broker-dealers and other financial intermediaries.

Tax Information

The Fund intends to make distributions that are expected to be taxable to you as ordinary income or capital gains unless you are tax exempt or your investment is in an individual retirement account (IRA), a 401(k) plan, or is otherwise tax deferred.

Financial Intermediary Compensation

If you purchase the Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

4 | The Royce Fund Prospectus 2021

Royce Premier Fund

Investment Goal

Royce Premier Fund’s investment goal is long-term growth of capital.

Fees and Expenses of the Fund

The following table presents the fees and expenses that you may pay if you buy and hold shares of the Fund.

You may qualify for Class A sales charge discounts from certain financial intermediaries if you and your family invest, or agree to invest in the future, at least $25,000 in certain Royce, Franklin Templeton, and Legg Mason funds. More information about these and other sales charge discounts and waivers is available from your financial intermediary, under the heading “General Shareholder Information−Sales Charges” in this Prospectus (pages xx-xx), in Appendix A: Sales Charge Waivers and Discounts from Certain Financial Intermediaries, and under the heading “Sales Charge Waivers and Reductions for A Class Shares” in the Funds’ Statement of Additional Information. “Financial intermediaries” include banks, brokers, dealers, insurance companies, investment advisers, financial consultants or advisers, mutual fund supermarkets and other financial intermediaries that have entered into an agreement with Royce Fund Services, LLC to sell Fund shares.

| Shareholder Fees (fees paid directly from your investment) | | |

| | A CLASS | |

| Maximum sales charge (load) imposed on purchases | 5.25%1 | |

| Maximum deferred sales charge | None2 | |

| Maximum sales charge (load) imposed on reinvested dividends | 0.00% | |

The Fund's total annualized operating expense ratios are subject to change in response to changes in the Fund's average net assets or for other reasons. A decline in the Fund's average net assets can be expected to increase the impact of operating expenses on the Fund's total annualized operating expense ratios.

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) |

| Management fees | 1.00% | |

| Distribution (12b-1) fees | 0.25% | |

| Other expenses | 0.32% | |

| Total annual Fund operating expenses | 1.57% | |

| Fee waivers and/or expense reimbursements | -0.08%3 | |

| Total annual Fund operating expenses after fee waivers and/or expense reimbursements | 1.49%3 | |

The Fund's total annualized operating expense ratios are subject to change in response to changes in the Fund's average net assets or for other reasons. A decline in the Fund's average net assets can be expected to increase the impact of operating expenses on the Fund's total annualized operating expense ratios.

| 1 | Shareholders purchasing A Class shares through certain financial intermediaries or in certain types of accounts may be eligible for a waiver of the sales charge. For additional information, see “General Shareholder Information – Sales Charges” in this Prospectus. |

| 2 | You may buy A Class shares of the Fund at net asset value (without an initial sales charge) at certain financial intermediaries if the amount of such purchase, when combined with certain holdings of various Royce, Franklin Templeton, and Legg Mason funds, equals or exceeds $1,000,000. However, if you redeem those shares within 18 months of their purchase, you will pay a contingent deferred sales charge of 1.00%. |

| 3 | Royce has contractually agreed, without right of termination, to waive fees and/or reimburse expenses to the extent necessary to maintain the A Class’s net annual operating expenses (excluding brokerage commissions, taxes, interest, litigation expenses, acquired fund fees and expenses, and other expenses not borne in the ordinary course of business) at or below 1.49% through April 22, 2022. |

| Example |

| |

| This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. |

| The example assumes that you invest $10,000 in the Fund for the time periods indicated. The example also assumes that your investment has a 5% return each year and that, except as indicated, the Fund’s total operating expenses (net of fee waivers and/or expense reimbursements for the A Class in year one) remain the same. Although your actual costs may be higher or lower, based on the assumptions your costs would be: |

| |

| | A CLASS | |

| 1 Year (without redemption of any of your shares)4 | $668 | |

| 1 Year (with redemption of all of your shares)5 | $255 | |

| 3 Years (with or without redemption of all of your shares)4 | $987 | |

| 5 Years (with or without redemption of all of your shares)4 | $1,329 | |

| 10 Years (with or without redemption of all of your shares)4 | $2,290 | |

| 4 | Assumes your investment is subject to the maximum initial sales charge of 5.25%. |

| 5 | Assumes your investment is not subject to an initial sales charge but that your redemption of all of your shares is subject to a deferred sales charge of 1.00%. |

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the fiscal year ended December 31, 2020, the Fund’s portfolio turnover rate was 23% of the average value of its portfolio.

The Royce Fund Prospectus 2021 | 5

Royce Premier Fund (continued)

Principal Investment Strategy

Royce Investment Partners (“Royce”), the Fund’s investment adviser, invests the Fund’s assets in a limited number (generally less than 100) of equity securities of primarily small-cap companies at the time of investment. Small-cap companies are those that have a market capitalization not greater than that of the largest company in the Russell 2000® Index at the time of its most recent reconstitution. Royce looks for companies that it considers “premier”—those that it believes are trading below its estimate of their current worth that also have excellent business strengths, strong balance sheets and/or improved prospects for growth, the potential for improvement in cash flow levels and internal rates of return, and franchise sustainability.

Normally, the Fund invests at least 80% of its net assets in equity securities of such premier companies. At least 65% of these securities will be issued by small-cap companies at the time of investment. The Fund may continue to hold or, in some cases, build positions in companies with higher market capitalizations. Although the Fund normally focuses on securities of U.S. companies, it may invest up to 25% of its net assets (measured at the time of investment) in securities of companies headquartered in foreign countries. The Fund may invest in other investment companies that invest in equity securities. The Fund may sell securities to, among other things, secure gains, limit losses, redeploy assets into what Royce deems to be more promising opportunities, and/or manage cash levels in the Fund’s portfolio.

Primary Risks for Fund Investors

As with any mutual fund that invests in common stocks, Royce Premier Fund is subject to market risk—the possibility that common stock prices will decline over short or extended periods of time due to overall market, financial, and economic conditions and trends, governmental or central bank actions or interventions, changes in investor sentiment, and other factors, such as the recent COVID-19 pandemic, that may not be directly related to the issuer of a security held by the Fund. This pandemic could adversely affect global economies and markets and individual companies in ways that cannot necessarily be foreseen. As a result, the value of your investment in the Fund will fluctuate, sometimes sharply and unpredictably, and you could lose money over short or long periods of time.

The prices of small-cap securities are generally more volatile than those of larger-cap securities. In addition, because these securities tend to have significantly lower trading volumes than larger-cap securities, the Fund may have difficulty selling holdings or may only be able to sell holdings at prices substantially lower than what Royce believes they are worth. Therefore, the Fund may involve considerably more risk of loss and its returns may differ significantly from funds investing in larger-cap companies or other asset classes. The Fund’s investment in a limited number of issuers and its potential industry and sector overweights may also involve more risk to investors than a more broadly diversified portfolio of small-cap securities because it may be more susceptible to any single corporate, economic, political, regulatory, or market event.

Investment in foreign securities involves risks that may not be encountered in U.S. investments, including adverse political, social, economic, or other developments that are unique to a particular region or country. Prices of foreign securities in particular countries or regions may, at times, move in a different direction and/or be more volatile than those of U.S. securities. Because the Fund does not intend to hedge its foreign currency exposure, the U.S. dollar value of the Fund’s investments may be harmed by declines in the value of foreign currencies in relation to the U.S. dollar.

Royce’s estimate of a company’s current worth may prove to be inaccurate, or this estimate may not be recognized by other investors, which could lead to portfolio losses. Securities in the Fund’s portfolio may not increase as much as the market as a whole and some securities may continue to be undervalued for long periods of time or may never reach what Royce believes are their full market values.

Investments in the Fund are not bank deposits and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. This Prospectus is not a contract.

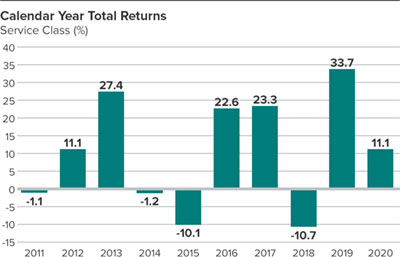

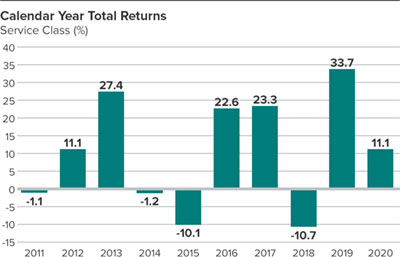

Performance

The following performance information provides an indication of the risks of investing in the Fund. Past performance does not indicate how the Fund will perform in the future. The Calendar Year Total Returns chart shows performance year by year over the last 10 years. Because A Class shares were not sold prior to December 31, 2020, performance information is shown for Service Class shares, not offered in this Prospectus, for illustrative purposes. Purchases of A Class shares are subject to a maximum sales charge of 5.25% while purchases of Service Class shares are not subject to any sales charges. If such maximum sales charge for A Class shares had been reflected, total returns would have been lower.

During the period shown in the bar chart, the highest return for a calendar quarter was 24.93% (quarter ended 12/31/20) and the lowest return for a calendar quarter was -27.95% (quarter ended 3/31/20).

6 | The Royce Fund Prospectus 2021

Royce Premier Fund (concluded)

The Annualized Total Returns table shows how the Fund’s average annual total returns for various periods compare with those of the Russell 2000 Index, the Fund’s benchmark index. (Service Class shown again for illustrative purposes.) The table also presents the impact of taxes on the Fund’s returns. In calculating these figures, we assumed that the shareholder was in the highest federal income tax bracket in effect at the time of each distribution of income or capital gains. We did not consider the impact of state or local income taxes. Your after-tax returns depend on your tax situation, so they may differ from the returns shown. This information does not apply if your investment is in an individual retirement account (IRA), a 401(k) plan, or is otherwise tax deferred because such accounts are subject to income taxes only upon distribution. Current month-end performance information may be obtained at www.royceinvest.com or by calling Investor Services at (800) 221-4268.

| Annualized Total Returns | | | |

| As of 12/31/20 (%) | | | |

| 1 YEAR | 5 YEAR | 10 YEAR |

| Service Class1 | | | |

| Return Before Taxes | 11.08 | 14.94 | 9.58 |

| Return After Taxes on Distributions | 9.71 | 11.15 | 6.50 |

| Return After Taxes on Distributions and Sale of Fund Shares | 7.50 | 11.31 | 7.09 |

| Russell 2000 Index | | | |

| (Reflects no deductions for fees, expenses, or taxes) | 19.96 | 13.26 | 11.20 |

| ¹ | Certain immaterial adjustments were made to the net assets of the Fund at 12/31/20 for financial reporting purposes, and as a result the net asset values for shareholder transactions on that date and the total returns based on those net asset values differ from the adjusted net asset values and total returns reported in the Financial Highlights. |

Investment Adviser and Portfolio Management

Royce & Associates, LP is the Fund’s investment adviser and a limited partnership organized under the laws of Delaware. Royce & Associates primarily conducts its business under the name Royce Investment Partners. Charles M. Royce is the Fund’s lead portfolio manager. Portfolio Managers Lauren A. Romeo and Steven G. McBoyle manage the Fund with him. Mr. Royce has been portfolio manager since the Fund’s inception. Ms. Romeo and Mr. McBoyle became portfolio managers in 2016. Ms. Romeo (2006-2015) and Mr. McBoyle (2014-2015) were previously the Fund’s assistant portfolio managers.

How to Purchase and Sell Fund Shares

The Fund’s A Class shares are offered only through certain broker-dealers and other financial intermediaries. You may purchase or redeem A Class shares through such broker-dealers and other financial intermediaries.

Tax Information

The Fund intends to make distributions that are expected to be taxable to you as ordinary income or capital gains unless you are tax exempt or your investment is in an individual retirement account (IRA), a 401(k) plan, or is otherwise tax deferred.

Financial Intermediary Compensation

If you purchase the Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

The Royce Fund Prospectus 2021 | 7

Royce Special Equity Fund

Investment Goal

Royce Special Equity Fund’s investment goal is long-term growth of capital.

Fees and Expenses of the Fund

The following table presents the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for Class A sales charge discounts from certain financial intermediaries if you and your family invest, or agree to invest in the future, at least $25,000 in certain Royce, Franklin Templeton, and Legg Mason funds. More information about these and other sales charge discounts and waivers is available from your financial intermediary, under the heading “General Shareholder Information−Sales Charges” in this Prospectus (pages xx-xx), in Appendix A: Sales Charge Waivers and Discounts from Certain Financial Intermediaries, and under the heading “Sales Charge Waivers and Reductions for A Class Shares” in the Funds’ Statement of Additional Information. “Financial intermediaries” include banks, brokers, dealers,insurance companies, investment advisers, financial consultants or advisers, mutual fund supermarkets and other financial intermediaries that have entered into an agreement with Royce Fund Services, LLC to sell Fund shares.

| Shareholder Fees (fees paid directly from your investment) | |

| | A CLASS |

| Maximum sales charge (load) imposed on purchases | 5.25%1 |

| Maximum deferred sales charge | None2 |

| Maximum sales charge (load) imposed on reinvested dividends | 0.00% |

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) |

| Management fees | 1.00% |

| Distribution (12b-1) fees | 0.25% |

| Other expenses | 0.35% |

| Total annual Fund operating expenses | 1.60% |

| Fee waivers and/or expense reimbursements | -0.11%3 |

| Total annual Fund operating expenses after fee waivers and/or expense reimbursements | 1.49%3 |

The Fund's total annualized operating expense ratios are subject to change in response to changes in the Fund's average net assets or for other reasons. A decline in the Fund's average net assets can be expected to increase the impact of operating expenses on the Fund's total annualized operating expense ratios.

| 1 | Shareholders purchasing A Class shares through certain financial intermediaries or in certain types of accounts may be eligible for a waiver of the sales charge. For additional information, see “General Shareholder Information–Sales Charges” in this Prospectus. |

| 2 | You may buy A Class shares of the Fund at net asset value (without an initial sales charge), at certain financial intermediaries if the amount of such purchase, when combined with certain holdings of various Royce, Franklin Templeton, and Legg Mason funds, equals or exceeds $1,000,000. However, if you redeem those shares within 18 months of their purchase, you will pay a contingent deferred sales charge of 1.00%. |

| 3 | Royce has contractually agreed, without right of termination, to waive fees and/or reimburse expenses to the extent necessary to maintain the A Class’s net annual operating expenses (excluding brokerage commissions, taxes, interest, litigation expenses, acquired fund fees and expenses, and other expenses not borne in the ordinary course of business) at or below 1.49% through April 22, 2022. |

| Example | | |

| | | |

| This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. |

| |

| The example assumes that you invest $10,000 in the Fund for the time periods indicated. The example also assumes that your investment has a 5% return each year and that, except as indicated, the Fund’s total operating expenses (net of fee waivers and/or expense reimbursements for the A Class in year one) remain the same. Although your actual costs may be higher or lower, based on the assumptions your costs would be: |

| |

| | A CLASS | |

| 1 Year (without redemption of any of your shares)4 | $668 | |

| 1 Year (with redemption of all of your shares)5 | $255 | |

| 3 Years (with or without redemption of all of your shares)4 | $993 | |

| 5 Years (with or without redemption of all of your shares)4 | $1,341 | |

| 10 Years (with or without redemption of all of your shares)4 | $2,319 | |

| 4 | Assumes your investment is subject to the maximum initial sales charge of 5.25%. |

| 5 | Assumes your investment is not subject to an initial sales charge but that your redemption of all of your shares is subject to a deferred sales charge of 1.00%. |

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the fiscal year ended December 31, 2020, the Fund’s portfolio turnover rate was 39% of the average value of its portfolio.

8 | The Royce Fund Prospectus 2021

Royce Special Equity Fund (continued)

Principal Investment Strategy

Royce Investment Partners (“Royce”), the Fund’s investment adviser, invests the Fund’s assets primarily in equity securities of small-cap companies. Small-cap companies are those that have a market capitalization not greater than that of the largest company in the Russell 2000® Index at the time of its most recent reconstitution. The portfolio manager applies an intensive value approach in managing the Fund’s assets. This approach, which attempts to combine classic value analysis, the identification of good businesses, and accounting cynicism, has its roots in the teachings of Benjamin Graham and Abraham Briloff.

Normally, the Fund invests at least 80% of its net assets in equity securities. At least 65% of these securities will be issued by small-cap companies at the time of investment. Although the Fund normally focuses on securities of U.S. companies, it may invest up to 10% of its net assets (measured at the time of investment) in securities of companies headquartered in foreign countries. The Fund may sell securities to, among other things, secure gains, limit losses, redeploy assets into what Royce deems to be more promising opportunities, and/or manage cash levels in the Fund’s portfolio.

Primary Risks for Fund Investors

As with any mutual fund that invests in common stocks, Royce Special Equity Fund is subject to market risk—the possibility that common stock prices will decline over short or extended periods of time due to overall market, financial, and economic conditions and trends, governmental or central bank actions or interventions, changes in investor sentiment, and other factors, such as the recent COVID-19 pandemic, that may not be directly related to the issuer of a security held by the Fund. This pandemic could adversely affect global economies and markets and individual companies in ways that cannot necessarily be foreseen. As a result, the value of an investment in the Fund will fluctuate, sometimes sharply and unpredictably, and you could lose money over short or long periods of time.

The prices of small-cap securities are generally more volatile than those of larger-cap securities. In addition, because small-cap securities tend to have significantly lower trading volumes than larger-cap securities, the Fund may have difficulty selling holdings or may only be able to sell holdings at prices substantially lower than what Royce believes they are worth. Therefore, the Fund may involve considerably more risk of loss and its returns may differ significantly from funds investing in larger-cap companies or other asset classes. In addition, as of December 31, 2020 the Fund invested a significant portion of its assets in a limited number of securities. The Fund’s investment in a limited number of issuers and its potential industry and sector overweights may involve more risk to investors than a more broadly diversified portfolio of small-cap securities because it may be more susceptible to any single corporate, economic, political, regulatory, or market event.

The Fund’s intensive value approach may not be successful and could result in portfolio losses. Securities in the Fund’s portfolio may not increase as much as the market as a whole and some securities may continue to be undervalued for long periods of time or may never reach what Royce believes are their full market values.

Investments in the Fund are not bank deposits and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. This Prospectus is not a contract.

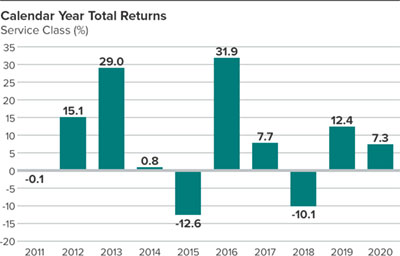

Performance

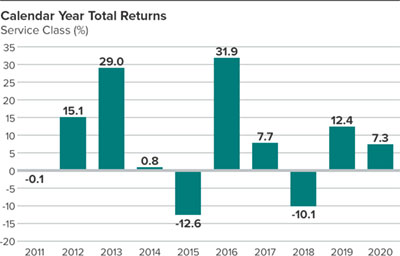

The following performance information provides an indication of the risks of investing in the Fund. Past performance does not indicate how the Fund will perform in the future. The Calendar Year Total Returns chart shows performance year by year over the last 10 years. Because A Class shares were not sold prior to December 31, 2020, performance information is shown for Service Class shares, not offered in this Prospectus, for illustrative purposes. Purchases of A Class shares are subject to a maximum sales charge of 5.25% while purchases of Service Class shares are not subject to any sales charges. If such maximum sales charge for A Class shares had been reflected, total returns would have been lower.

During the period shown in the bar chart, the highest return for a calendar quarter was 19.06% (quarter ended 6/30/20) and the lowest return for a calendar quarter was -24.80% (quarter ended 3/31/20).

The Annualized Total Returns table shows how the Fund’s average annual total returns for various periods compare with those of the Russell 2000 Value Index, the Fund’s benchmark, and the Russell 2000 Index. (Service Class shown again for illustrative purposes.) The table also presents the impact of taxes on the Fund’s returns. In calculating these figures, we assumed that the shareholder was in the highest federal income tax bracket in effect at the time of each distribution of income or capital gains. We did not consider the impact of state or local income taxes. Your after-tax returns depend on your tax situation,so they may differ from the returns shown. This information does not apply if your investment is in an individual retirement account (IRA), a 401(k) plan, or is otherwise tax deferred because such accounts are subject to income taxes only upon distribution. Current month-end performance information may be obtained at www.roycefunds.com or by calling Investor Services at (800) 221-4268.

The Royce Fund Prospectus 2021 | 9

Royce Special Equity Fund (concluded)

Annualized Total Returns As of 12/31/20 (%) |

| 1 YEAR | 5 YEAR | 10 YEAR |

| Service Class | | | |

| Return Before Taxes | 7.29 | 9.01 | 7.25 |

| Return After Taxes on Distributions | 6.41 | 6.94 | 5.32 |

| Return After Taxes on Distributions and Sale of Fund Shares | 4.95 | 6.96 | 5.61 |

| Russell 2000 Value Index | | | |

| (Reflects no deductions for fees, expenses, or taxes) | 4.63 | 9.65 | 8.66 |

| Russell 2000 Index | | | |

| (Reflects no deductions for fees, expenses, or taxes) | 19.96 | 13.26 | 11.20 |

Investment Adviser and Portfolio Management

Royce & Associates, LP is the Fund’s investment adviser and a limited partnership organized under the laws of Delaware. Royce & Associates primarily conducts its business under the name Royce Investment Partners. Charles R. Dreifus is the Fund’s portfolio manager. He is assisted by Portfolio Manager Steven G. McBoyle. Mr. Dreifus has been portfolio manager since the Fund’s inception. Mr. McBoyle became assistant portfolio manager in 2014.

How to Purchase and Sell Fund Shares

The Fund’s A Class shares are offered only through certain broker-dealers and other financial intermediaries. You may purchase or redeem A Class shares through such broker-dealers and other financial intermediaries.

Tax Information

The Fund intends to make distributions that are expected to be taxable to you as ordinary income or capital gains unless you are tax exempt or your investment is in an individual retirement account (IRA), a 401(k) plan, or is otherwise tax deferred.

Financial Intermediary Compensation

If you purchase the Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

10 | The Royce Fund Prospectus 2021

Financial Highlights

This table is intended to help you understand the Fund’s financial performance for the past five years. The table reflects financial results for a single share (Service Class used for illustrative purposes only). The total returns in the table represent the rate that an investor would have earned (or lost) on an investment in the Fund’s Service Class (assuming reinvestment of all distributions).

The financial highlights for the fiscal years ended December 31, 2020, 2019, 2018, 2017, and 2016 were part of the financial statements audited by Pricewaterhouse Coopers LLP, the Fund’s independent registered public accounting firm, whose reports on these financial statements were unqualified. The report of Pricewaterhouse Coopers LLP for the fiscal year ended December 31, 2020 is included in the Fund’s 2020 Annual Report to Shareholders, which is available at www.royceinvest.com or upon request.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Ratio of Expenses to Average Net Assets | | | | | | | |

| | | | Net Asset Value, Beginning of Period | | | Net Investment Income (Loss) | | | Net Realized and Unrealized Gain (Loss) on Investments and Foreign Currency | | | Total from Investment Operations | | | Distributions from Net Investment Income | | | Distributions from Net Realized Gain on Investments and Foreign Currency | | | Total Distributions | | | Net Asset Value, End of Period | | | Total Return | | | Net Assets, End of Period (in thousands) | | | Prior to Fee Waivers,

Expense Reimbursements

and Balance Credits | | | Prior to Fee Waivers and Expense Reimbursements | | | Net of Fee Waivers and Expense Reimbursements | | | Ratio of Net Investment Income (Loss) to

Average Net Assets | | | Portfolio

Turnover Rate | |

| Royce Pennsylvania Mutual Fund–Service Class |

| 2020 | | | $ | 9.42 | | | $ | 0.02 | | | $ | 1.28 | | | $ | 1.30 | | | $ | (0.03 | ) | | $ | (0.46 | ) | | $ | (0.49 | ) | | $ | 10.23 | | | | 13.88 | % | | $ | 78,789 | | | | 1.25 | % | | | 1.24 | % | | | 1.13 | % | | | 0.23 | % | | | 32 | % |

| 2019 | | | | 7.77 | | | | (0.00 | ) | | | 2.00 | | | | 2.00 | | | | (0.01 | ) | | | (0.34 | ) | | | (0.35 | ) | | | 9.42 | | | | 25.75 | | | | 142,864 | | | | 1.31 | | | | 1.30 | | | | 1.30 | | | | (0.01 | ) | | | 30 | |

| 2018 | | | | 10.56 | | | | (0.01 | ) | | | (0.96 | ) | | | (0.97 | ) | | | – | | | | (1.82 | ) | | | (1.82 | ) | | | 7.77 | | | | (9.96 | ) | | | 32,191 | | | | 1.30 | | | | 1.30 | | | | 1.30 | | | | (0.07 | ) | | | 35 | |

| 2017 | | | | 11.03 | | | | 0.01 | | | | 1.69 | | | | 1.70 | | | | – | | | | (2.17 | ) | | | (2.17 | ) | | | 10.56 | | | | 15.88 | | | | 54,938 | | | | 1.27 | | | | 1.27 | | | | 1.27 | | | | 0.07 | | | | 27 | |

| 2016 | | | | 9.35 | | | | 0.03 | | | | 2.41 | | | | 2.44 | | | | (0.01 | ) | | | (0.75 | ) | | | (0.76 | ) | | | 11.03 | | | | 25.99 | | | | 100,598 | | | | 1.26 | | | | 1.26 | | | | 1.26 | | | | 0.27 | | | | 18 | |

| Royce Premier Fund–Service Class |

| 2020 | | | $ | 12.54 | | | $ | 0.01 | | | $ | 1.37 | | | $ | 1.38 | | | $ | (0.09 | ) | | $ | (0.61 | ) | | $ | (0.70 | ) | | $ | 13.22 | | | | 11.16 | % | | $ | 29,588 | | | | 1.57 | % | | | 1.57 | % | | | 1.49 | % | | | 0.12 | % | | | 23 | % |

| 2019 | | | | 11.31 | | | | (0.01 | ) | | | 3.78 | | | | 3.77 | | | | – | | | | (2.54 | ) | | | (2.54 | ) | | | 12.54 | | | | 33.65 | | | | 29,696 | | | | 1.57 | | | | 1.57 | | | | 1.46 | | | | (0.06 | ) | | | 19 | |

| 2018 | | | | 16.15 | | | | (0.03 | ) | | | (1.55 | ) | | | (1.58 | ) | | | – | | | | (3.26 | ) | | | (3.26 | ) | | | 11.31 | | | | (10.66 | ) | | | 41,738 | | | | 1.52 | | | | 1.52 | | | | 1.48 | | | | (0.19 | ) | | | 23 | |

| 2017 | | | | 15.13 | | | | (0.06 | ) | | | 3.53 | | | | 3.47 | | | | – | | | | (2.45 | ) | | | (2.45 | ) | | | 16.15 | | | | 23.32 | | | | 54,557 | | | | 1.53 | | | | 1.53 | | | | 1.49 | | | | (0.34 | ) | | | 8 | |

| 2016 | | | | 13.98 | | | | 0.00 | | | | 3.19 | | | | 3.19 | | | | – | | | | (2.04 | ) | | | (2.04 | ) | | | 15.13 | | | | 22.63 | | | | 46,550 | | | | 1.50 | | | | 1.50 | | | | 1.49 | | | | 0.02 | | | | 15 | |

| Royce Special Equity Fund–Service Class |

| 2020 | | | $ | 17.56 | | | $ | 0.24 | | | $ | 1.04 | | | $ | 1.28 | | | $ | (0.24 | ) | | $ | (0.41 | ) | | $ | (0.65 | ) | | $ | 18.19 | | | | 7.29 | % | | $ | 46,671 | | | | 1.60 | % | | | 1.60 | % | | | 1.39 | % | | | 1.49 | % | | | 39 | % |

| 2019 | | | | 17.41 | | | | 0.16 | | | | 1.99 | | | | 2.15 | | | | (0.17 | ) | | | (1.83 | ) | | | (2.00 | ) | | | 17.56 | | | | 12.40 | | | | 60,070 | | | | 1.58 | | | | 1.58 | | | | 1.39 | | | | 0.80 | | | | 20 | |

| 2018 | | | | 21.76 | | | | 0.20 | | | | (2.33 | ) | | | (2.13 | ) | | | (0.18 | ) | | | (2.04 | ) | | | (2.22 | ) | | | 17.41 | | | | (10.13 | ) | | | 62,706 | | | | 1.51 | | | | 1.50 | | | | 1.39 | | | | 0.88 | | | | 21 | |

| 2017 | | | | 21.98 | | | | 0.08 | | | | 1.56 | | | | 1.64 | | | | (0.07 | ) | | | (1.79 | ) | | | (1.86 | ) | | | 21.76 | | | | 7.66 | | | | 108,001 | | | | 1.50 | | | | 1.50 | | | | 1.39 | | | | 0.32 | | | | 15 | |

| 2016 | | | | 17.92 | | | | 0.16 | | | | 5.56 | | | | 5.72 | | | | (0.17 | ) | | | (1.49 | ) | | | (1.66 | ) | | | 21.98 | | | | 31.92 | | | | 128,102 | | | | 1.50 | | | | 1.50 | | | | 1.39 | | | | 0.77 | | | | 29 | |

The Royce Fund Prospectus 2021 | 11

| Royce’s Investment Universe |  |

Investing in Small-Cap Companies

The large and diverse universe of small-cap companies available for investment by each Fund consists primarily of those that have a market capitalization not greater than that of the largest company in the Russell 2000® Index at the time of its most recent reconstitution, which was $4.4 billion in May 2020 Royce Premier Fund may also invest in mid-cap securities. Royce defines mid-cap as those companies that have a market capitalization not greater than that of the largest company in the Russell Midcap® Index at the time of its most recent reconstitution –$31.7 billion in May 2020

Small-cap companies offer investment opportunities and additional risks. They may not be well known to the investing public, may not be significantly owned by institutional investors, and may not have steady earnings growth. The securities of such companies may also be more volatile in price, have wider spreads between their bid and ask prices, and have significantly lower trading volumes than the securities of larger capitalization companies. As a result, the Funds may have difficulty selling holdings or may only be able to sell holdings at prices substantially lower than what Royce believes they are worth. In addition, the purchase or sale of more than a limited number of shares of the securities of a small-cap company may affect its market price. Royce may need a considerable amount of time to purchase or sell its positions in these securities, particularly when other Royce-managed accounts or other investors are also seeking to purchase or sell them. Accordingly, Royce’s investment focus on the securities of small-cap companies generally leads it to have a long-term investment outlook of at least two years for a portfolio security.

| Small-capitalization stocks are those issued by companies that have a market capitalization not greater than that of the largest company in the Russell 2000® Index at the time of its most recent reconstitution. |

Within small-cap, Royce further defines companies as micro-cap that have a market capitalization not greater than that of the largest company in the Russell Microcap® Index at the time of its most recent reconstitution, which was $840 million in May 2020. This segment consisted of more than 1,300 companies at the time of the index’s most recent reconstitution in May 2020. These companies are followed by few, if any, securities analysts, and there tends to be less publicly available information about them. Their securities generally have even more limited trading volumes and are subject to even more abrupt or erratic market price movements than are larger small-cap securities and mid-cap securities, and Royce may be able to deal with only a few market-makers when purchasing and selling micro-cap securities. Such companies may also have limited markets, financial resources or product lines, may lack management depth, and may be more vulnerable to adverse business or market developments. These conditions, which create greater opportunities to find securities trading below Royce’s estimate of the company’s current worth, also involve increased risk.

In May 2020, at the time of the reconstitution of the Russell 2000 Index, there were approximately 700 additional small-cap companies with higher market caps than the largest company in the Russell Microcap Index. In this segment, there is a relatively higher level of institutional investor ownership and more research coverage by securities analysts than generally exists for micro-cap companies. This greater attention makes the market for such securities more efficient compared to micro-cap securities because they have somewhat greater trading volumes and narrower bid/ask prices. In general, mid-caps share many of the same characteristics as those larger small-cap companies. As a result, Royce may employ a more concentrated approach when investing in these companies, holding proportionately larger positions in a relatively limited number of securities.

The Funds may invest in other investment companies that invest in equity securities.

The Funds may also invest in foreign securities to varying degrees. For more information regarding investing in foreign securities, see page 14.

Investment Approaches

Royce’s portfolio managers use various methods primarily rooted in the valuation of each stock and evaluation of each company in managing the Funds’ assets. In selecting securities for the Funds, they evaluate the quality of a company’s balance sheet and other measures of a company’s financial condition and profitability, such as the history and/or potential for improvement in cash flow generation, internal rates of return, and sustainable earnings. The portfolio managers may also consider other factors, such as a company’s unrecognized asset values, its future growth prospects or its turnaround potential following an earnings disappointment or other business difficulties. The portfolio managers then use these factors to assess the company’s current worth, basing this

12 | The Royce Fund Prospectus 2021

assessment on either what they believe a knowledgeable buyer might pay to acquire the entire company or what they think the value of the company should be in the stock market.

Royce’s portfolio managers generally invest in equity securities of companies that are trading below their estimate of the company’s current worth in an attempt to reduce the risk of overpaying for such companies. For these purposes, the term “equity security” has the meaning set forth in the Securities Exchange Act of 1934, as amended, and includes (without limitation) common stocks, preferred stocks, convertible securities, warrants, and rights. In addition, seeking long-term growth of capital, Royce’s portfolio managers generally consider the prospects for the market price of the company’s securities to increase over a two- to five-year period toward this estimate.

Royce’s valuation-based approaches to stock selection strive to reduce some of the other risks of investing in the securities of small-cap and/or mid-cap companies (for each Fund’s portfolio taken as a whole) by evaluating other risk factors. For example, its portfolio managers generally attempt to lessen financial risk by buying companies with strong balance sheets. Royce attempts to mitigate company-specific risk for Royce Pennsylvania Mutual Fund by investing in a relatively larger number of issuers. On the other hand, each of Royce Premier Fund and Royce Special Equity Fund may invest a substantial portion of its assets in a limited number of issuers. This investment approach for Royce Premier Fund and Royce Special Equity Fund may involve considerably more risk to investors than a more broadly diversified portfolio of securities because it may be more susceptible to any single corporate, economic, regulatory, or market event.

While there can be no assurance that these risk-averse approaches will be successful, Royce believes that it can reduce some of the risks of investing in small-cap and mid-cap companies, whose businesses can be less diversified and whose securities exhibit substantially greater market price volatility than those of larger-cap companies. For more information regarding the specific approach used for each Fund’s portfolio, see pages 2-10.

Although Royce’s approaches to security selection seek to reduce downside risk to Fund portfolios, especially during periods of broad small-company stock market declines, they may also potentially have the effect of limiting gains in strong small-company up markets.

Certain risks are much broader than the company-specific risks described above. The market values of equity securities will fluctuate, sometimes sharply and unpredictably, due to changes in general market conditions, overall economic trends or events, governmental or central bank actions or interventions, market disruptions caused by trade

| Market capitalization is the number of a company’s outstanding shares of stock multiplied by its most recent closing price per share. |

disputes or other factors, political developments, investor sentiment,the global and domestic effects of a pandemic, and other factors that may or may not be related to the issuer of a security. Economic, financial, or political events, trading and tariff arrangements, public health events, terrorism, natural disasters, and other circumstances in one country or region could have profound impacts on global economies or markets. In particular, the recent COVID-19 pandemic has resulted in travel restrictions, temporary business closings, strained healthcare systems, disruptions to supply chains, consumer demand and employee availability, and widespread uncertainty. The COVID-19 pandemic or any other widespread public health event may result in a sustained economic downturn or a global recession, domestic and foreign political and social instability, and increased volatility and/or decreased liquidity in the securities markets. As a result, whether or not a Fund invests in securities of issuers located in, or with significant exposure to, the countries directly affected by such an event, the value and liquidity of the Fund’s investments may be adversely affected. In addition, any actions taken by governments and central banks to counter the negative effects of a widespread public health event may not work as intended and may, in fact, have unintended adverse consequences.

An investment in a Fund may not be appropriate for all investors. None of the Funds is intended to be a complete investment program or a short-term trading vehicle. The Funds are designed for long-term investors who can accept the risks associated with owning shares in an actively managed fund that invests (i) primarily in small-cap companies (in the case of Royce Pennsylvania Mutual Fund) and (ii) in a limited number of small-cap companies (in the case of Royce Premier Fund and Royce Special Equity Fund).

Temporary Investments

Each of the Funds may invest without limit in short-term fixed income securities for temporary defensive purposes. If a Fund should implement a temporary investment policy, such policy would be inconsistent with its investment goal and the Fund may not achieve its investment goal while that policy is in effect. Each Fund also may invest in short-term fixed income securities in order to invest uncommitted cash balances or to maintain liquidity to meet shareholder redemptions.

.

The Royce Fund Prospectus 2021 | 13

| Investing in Foreign Securities |  |

Royce defines “foreign” as those securities of companies headquartered outside of the United States. Royce believes that investing in foreign securities offers both enhanced investment opportunities and additional risks beyond those present in U.S. securities. Investing in foreign securities may provide increased diversification by adding securities from various foreign countries (i) that offer different investment opportunities, (ii) that generally are affected by different economic trends, and (iii) whose stock markets may not be correlated with U.S. markets. At the same time, these opportunities and trends involve risks that may not be encountered in U.S. investments. Each Fund may invest in the securities of companies whose economic fortunes are linked to non-U.S. countries but that do not meet the Fund’s definition of a foreign security. To the extent a Fund invests in this manner, the percentage of the Fund’s portfolio that is exposed to non-U.S. country risks may be greater than the percentage of the Fund’s assets that the Fund defines as representing foreign securities.

The following considerations comprise both risks and opportunities not typically associated with investing in U.S. securities: fluctuations in exchange rates of foreign currencies because the Funds do not intend to hedge their foreign currency exposure; possible imposition of exchange control regulations or currency restrictions that would prevent cash from being brought back to the United States; less public information with respect to issuers of securities; less government supervision of stock exchanges, securities brokers, and issuers of securities; lack of uniform accounting, auditing, and financial reporting standards; lack of uniform settlement periods and trading practices; less liquidity and frequently greater price volatility in foreign markets than in the United States; possible imposition of foreign taxes; the possibility of expropriation or confiscatory taxation, seizure, or nationalization of foreign bank deposits or other assets, the adoption of foreign government restrictions, and other adverse political, social, or diplomatic developments that could affect investment; possible difficulties in obtaining and/or enforcing legal judgments in foreign courts; restrictions or prohibitions on foreign investment, including prohibitions or restrictions on investments in specific industries or market sectors; limitations on the total amount or type of position in any single issue; possible imposition by foreign governments of prohibitions or substantial restrictions on foreign investments in their capital markets or in certain industries; sometimes less advantageous legal, operational, and financial protections applicable to foreign sub-custodial arrangements; and the historically lower level of responsiveness of foreign management to shareholder concerns (such as dividends and return on investment).

Developing Countries

The risks described above for foreign securities, including the risks of nationalization and expropriation of assets, are typically increased to the extent that a Fund invests in companies headquartered in developing, or emerging market, countries. Developing (or emerging markets) countries include every country in the world other than the United States, Canada, Japan, Australia, New Zealand, Hong Kong, Singapore, South Korea, Taiwan, Bermuda, Israel, and Western European countries (as defined in the Funds’ Statement of Additional Information). Investments in securities of companies headquartered in such countries may be considered speculative and subject to certain special risks. The political and economic structures in many of these countries may be in their infancy and developing rapidly, and such countries may lack the social, political, legal, and economic characteristics of more developed countries. Certain of these countries have in the past failed to recognize private property rights and have at times nationalized and expropriated the assets of private companies. Some countries have inhibited the conversion of their currency to another. The currencies of certain developing countries have experienced devaluation relative to the U.S. dollar, and future devaluations may adversely affect the value of each Fund���s assets denominated in such currencies because the Funds do not intend to hedge their foreign currency exposure. Some developing countries have experienced substantial rates of inflation for many years. Continued inflation may adversely affect the economies and securities markets of such countries. In addition, unanticipated political or social developments may affect the value of a Fund’s investments in these countries and the availability to the Fund of additional investments in these countries. The small size, limited trading volume, and relative inexperience of the securities markets in these countries may make a Fund’s investments in such countries illiquid and more volatile than investments in more developed countries, and the Fund may be required to establish special custodial or other arrangements before making investments in these countries. There may be little financial or accounting information available with respect to companies domiciled in these countries, and it may be difficult as a result to assess the value or prospects of an investment in such companies.

14 | The Royce Fund Prospectus 2021

| Management of the Funds |  |

Royce & Associates, LP, a limited partnership organized under the laws of Delaware, is the Funds’ investment adviser and is responsible for the management of their assets. Royce & Associates primarily conducts its business under the name Royce Investment Partners (“Royce”). Royce has been investing in smaller-company securities with a value approach for more than 45 years. Its offices are located at 745 Fifth Avenue, New York, NY 10151.

On July 31, 2020, Franklin Resources, Inc. (“Franklin Resources”) acquired Legg Mason, Inc. in an all-cash transaction. As a result of the transaction, Royce, the investment adviser to each Fund, became a majority-owned subsidiary of Franklin Resources. Under the Investment Company Act of 1940, consummation of the transaction automatically terminated the investment advisory agreement that was in place for each Fund prior to the transaction. Royce continues to provide uninterrupted services to each Fund pursuant to a new investment advisory agreement that was approved by the Fund’s shareholders. The terms and conditions of the new investment advisory agreement for each Fund are substantially identical to those of its prior investment advisory agreement. Each Fund’s contractual investment advisory fee rate under the new investment advisory agreement did not change from the prior investment advisory agreement. Royce has continued to operate as an independent investment organization with its own brand after completion of the transaction. There have been no changes to the management or investment teams at Royce as a result of the transaction.

| Charles Royce Portfolio Manager Founded Royce in 1972 Portfolio Manager for: Royce Pennsylvania Mutual Fund (Lead) Royce Premier Fund (Lead) |

| Christopher D. Clark Chief Executive Officer, President, Co-Chief Investment Officer Employed by Royce since 2007 |

| Francis D. Gannon Co-Chief Investment Officer Employed by Royce since 2006 |

| Charles R. Dreifus Portfolio Manager Employed by Royce since 1998 Portfolio Manager for: Royce Special Equity Fund |

| Jay S. Kaplan Portfolio Manager Employed by Royce since 2000 Portfolio Manager for: Royce Pennsylvania Mutual Fund |

| Lauren A. Romeo Portfolio Manager Employed by Royce since 2004 Portfolio Manager for: Royce Pennsylvania Mutual Fund Royce Premier Fund |

| Steven G. McBoyle Portfolio Manager Employed by Royce since 2007 Portfolio Manager for: Royce Pennsylvania Mutual Fund Royce Premier Fund Assistant Portfolio Manager for: Royce Special Equity Fund |

| James P. Stoeffel Portfolio Manager Employed by Royce since 2009 Portfolio Manager for: Royce Pennsylvania Mutual Fund |

| Miles Lewis Portfolio Manager Employed by Royce since 2020 Portfolio Manager for: Royce Pennsylvania Mutual Fund Previously a Portfolio Manager (2014-2020) and investment analyst (2010-2014) for the Small-Cap Value Fund and Strategy at American Century Investments. |

| Andrew S. Palen Portfolio Manager Employed by Royce since 2015 Portfolio Manager for: Royce Pennsylvania Mutual Fund Previously a Senior Analyst at Armistice Capital (2013-2015), a Summer Associate at UBS Global Management (2012), and an Associate at Comvest Partners (2008-2011). |

| Brendan J. Hartman Portfolio Manager Employed by Royce since 2009 Portfolio Manager for: Royce Pennsylvania Mutual Fund |

The Royce Fund Prospectus 2021 | 15

Franklin Resources, whose principal executive offices are at One Franklin Parkway, San Mateo, California 94403, is a global investment management organization operating, together with its subsidiaries, as Franklin Templeton. As of June 30, 2020, after giving effect to the transaction described above, Franklin Templeton’s asset management operations had aggregate assets under management of approximately $1.4 trillion.

Assistant portfolio managers may have investment discretion over a portion of a Fund’s portfolio subject to supervision by the Fund’s portfolio manager(s).

The Funds’ Statement of Additional Information provides more information about the structure of the portfolio managers’ compensation, other accounts that they manage, and their ownership of shares in the Fund(s) that each manages.

Royce Fund Services, LLC (“RFS”) distributes the Funds’ shares pursuant to the terms of its distribution agreements with the Funds. The Royce Fund has adopted a distribution plan under Rule 12b-1 that covers the A Class shares of the Funds. Under this plan and the distribution agreements, the A Class is obligated to pay a fee to RFS of up 0.25% per year of its average net assets. RFS will use these fees primarily to cover sales-related and account maintenance costs and to pay service and other fees to broker-dealers that introduce investors to A Class shares of the Funds. Because these fees are paid out of each Fund’s assets that are attributable to A Class shares on an ongoing basis, over time these fees will increase the cost of your investment and may cost you more than paying other types of sales charges. Neither the distribution plan nor the distribution agreements currently provide for any suspension or reduction of the 0.25% fee payable by the A Class shares of the respective Funds if one closes to new investors.

If you purchase Fund shares through a third party, such as a discount or full-service broker-dealer, bank, or other financial intermediary, or through a firm that provides recordkeeping and other shareholder services to employee benefit plans (“Retirement Plan Recordkeepers”), the shares may be held in the name of that party on the Fund’s books. RFS and/or Royce may compensate broker-dealers, Retirement Plan Recordkeepers, and other financial intermediaries that introduce investors to the Fund, provide the opportunity to distribute the Fund through their sales personnel, provide access to their sales personnel and branch offices, and/or provide certain administrative services to their customers who own Fund shares. These payments are sometimes referred to as “revenue sharing.” In addition, the Board has authorized the Funds to compensate such third parties to the extent the Board has determined that any of the services which these parties render to a Fund are non-distribution-related shareholder services, including recordkeeping and account maintenance services.

Payments to third parties (each, a “financial intermediary”) may: (i) be substantial to any given financial intermediary, (ii) be more or less than the payments received by a financial intermediary with respect to other mutual funds, and (iii) exceed the costs and expenses incurred by the financial intermediary for any servicing activities in respect of the Funds. Revenue sharing arrangements are separately negotiated between Royce and/or its affiliates and the financial intermediaries receiving these payments.

Revenue sharing and shareholder servicing payments may influence financial intermediaries to recommend or sell a Fund over other mutual funds. You may ask your financial intermediary about these differing interests and how the financial intermediary and its employees and associated persons are compensated for administering your Fund investment. Revenue-sharing and shareholder servicing payments may benefit Royce to the extent that the payments result in more assets, on which fees are charged by Royce, being invested in a Fund.

State Street Bank and Trust Company (“State Street”) is the custodian of the Funds’ securities, cash, and other assets. DST Asset Manager Solutions, Inc. (“DST AMS”) is the Funds’ transfer agent.

Investment Advisory Services Provided By Royce

Royce receives advisory fees monthly as compensation for its services to the Funds. The annual rates of these fees, before any waiver or expense reimbursements to cap the expense ratios for A Class shares of certain Funds at specified levels as shown under each Fund’s respective“Fees and Expenses” table, are as follows:

Annual Rate of Fund’s Average Net Assets

Royce Pennsylvania Mutual Fund

• 1.00% of the first $50,000,000

• 0.875% of the next $50,000,000

• 0.75% of any additional average net assets

Royce Premier and Special Equity Funds

• 1.00% of the first $2,000,000,000

• 0.95% of the next $1,000,000,000

• 0.90% of the next $1,000,000,000

• 0.85% of any additional average net assets

| 2020 Actual Net Fees (After waivers, paid to Royce on average net assets) |

| Royce Pennsylvania Mutual Fund | 0.76% |

| Royce Premier Fund | 1.00% |

| Royce Special Equity Fund | 1.00% |

For a discussion of the basis of the Board’s most recent approval of the Funds’ investment advisory agreements, please see the Funds’ 2020 Semiannual Report to Shareholders.

16 | The Royce Fund Prospectus 2021

| General Shareholder Information |  |

Purchasing Shares