Exhibit 99.1

Deutsche Bank Annual Electric Power Conference

C. John Wilder Chief Executive Officer

June 15, 2005

Safe Harbor Statement & Regulation G

This presentation contains forward-looking statements, which are subject to various risks and uncertainties. Discussion of risks and uncertainties that could cause actual results to differ materially from management’s current projections, forecasts, estimates and expectations is contained in the company’s SEC filings. In addition to the risks and uncertainties set forth in the company’s SEC filings, the forward looking statements in this presentation could be affected by the ability of the company to implement initiatives that are part of the restructuring, operational improvement, and cost reduction program, and the terms under which the company executes those initiatives, and any adjustments as a result of the planned reevaluation of the financial strategy pursuant to the recent change of the company’s credit ratings by Standard & Poor’s Ratings Services.

Regulation G

This presentation includes certain non-GAAP financial measures. A reconciliation of these measures to the most directly comparable GAAP measure is included in the appendix of the printed version of the slides and the version included on the company’s website at www.txucorp.com under Investor Resources/Presentations.

1

Key Questions That Get To The Heart Of Our Business

1. What is TXU’s fundamental business strategy?

2. What are the goals of TXU’s financial strategy?

3. How is the restructured Texas electricity market performing?

4. What is TXU’s exposure to natural gas and heat rate?

5. What are TXU’s perspectives on mid and long term growth?

2

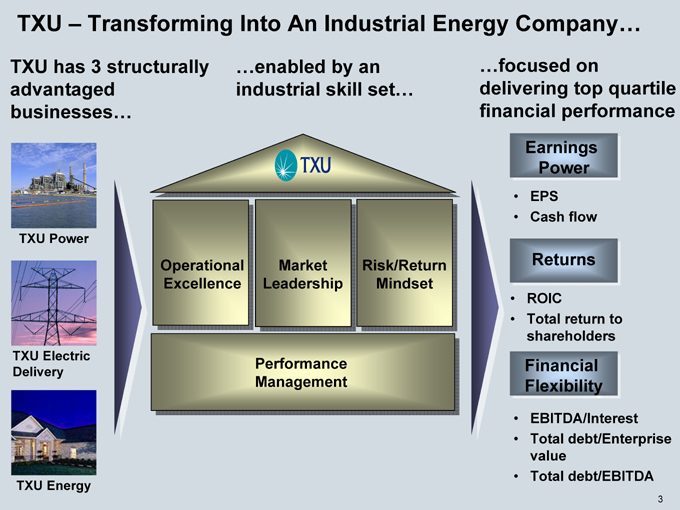

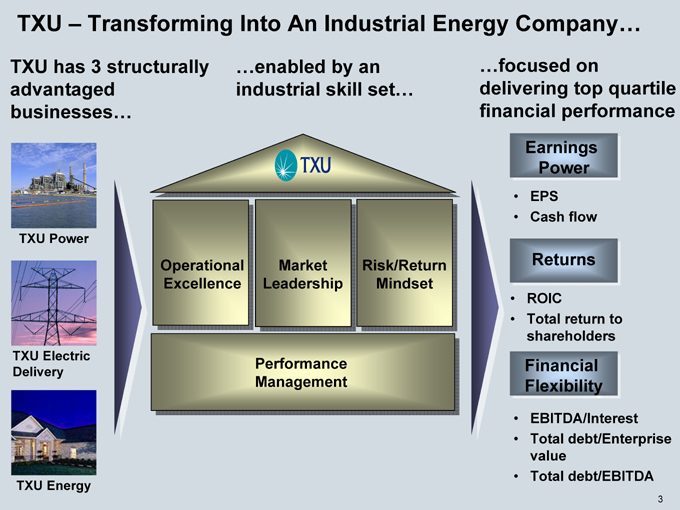

TXU – Transforming Into An Industrial Energy Company…

TXU has 3 structurally advantaged businesses…

…enabled by an industrial skill set…

…focused on delivering top quartile financial performance

TXU Power

TXU Electric Delivery

TXU Energy

Earnings Power

EPS Cash flow

Returns

ROIC

Total return to shareholders

Financial Flexibility

EBITDA/Interest Total debt/Enterprise value Total debt/EBITDA

Operational Market Risk/Return Excellence Leadership Mindset

Performance Management

3

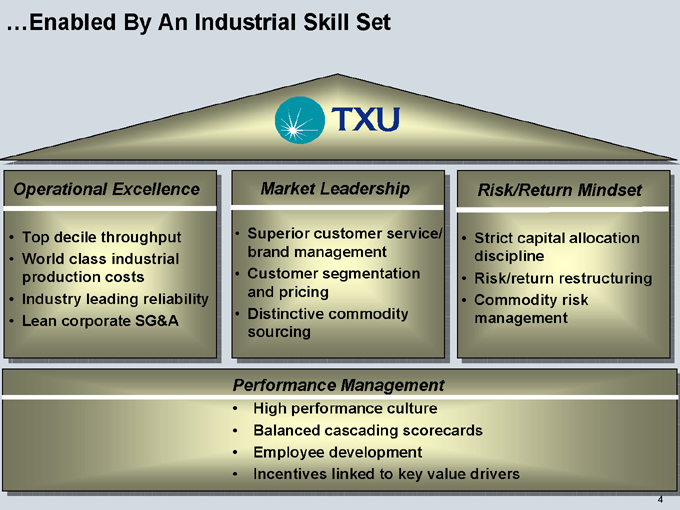

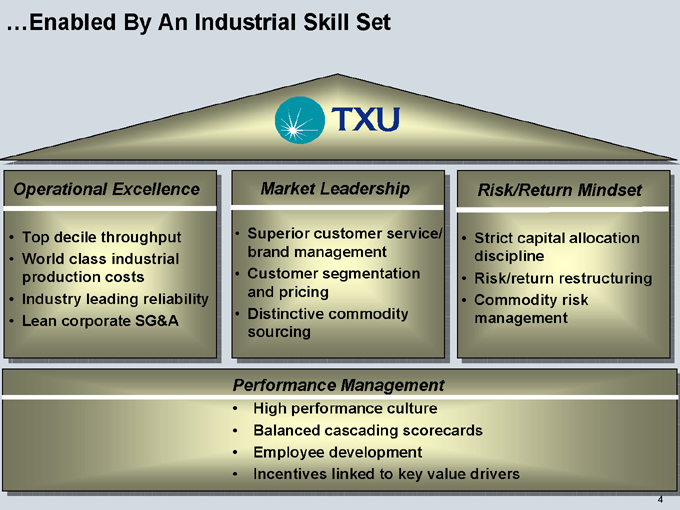

…Enabled By An Industrial Skill Set

Operational Excellence

Top decile throughput World class industrial production costs Industry leading reliability Lean corporate SG&A

Market Leadership

Superior customer service/ brand management Customer segmentation and pricing Distinctive commodity sourcing

Risk/Return Mindset

Strict capital allocation discipline Risk/return restructuring Commodity risk management

Performance Management

High performance culture Balanced cascading scorecards Employee development Incentives linked to key value drivers

4

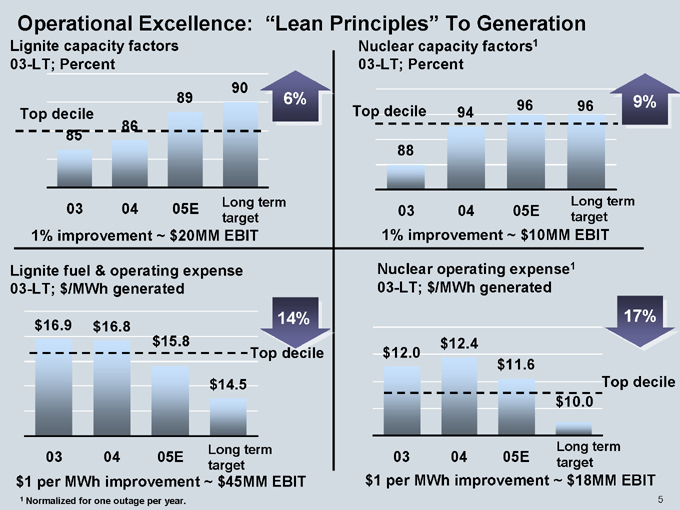

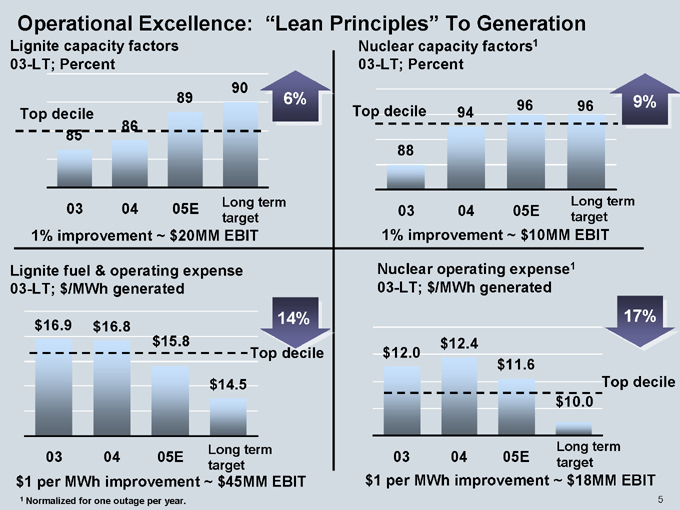

Operational Excellence: “Lean Principles” To Generation

Lignite capacity factors 03-LT; Percent

Top decile

85

86

89

90

6%

03

04

05E

Long term target

1% improvement ~ $20MM EBIT

Lignite fuel & operating expense 03-LT; $/MWh generated $16.9 $16.8 $15.8 $14.5

14%

Top decile

03 04

05E

Long term target $1 per MWh improvement ~ $45MM EBIT

1 Normalized for one outage per year.

Nuclear capacity factors1 03-LT; Percent

Top decile

88

94

96

96

9%

03 04 05E

Long term target

1% improvement ~ $10MM EBIT

Nuclear operating expense1 03-LT; $/MWh generated $12.0 $12.4 $11.6 $10.0

17%

Top decile

03

04

05E

Long term target $1 per MWh improvement ~ $18MM EBIT

5

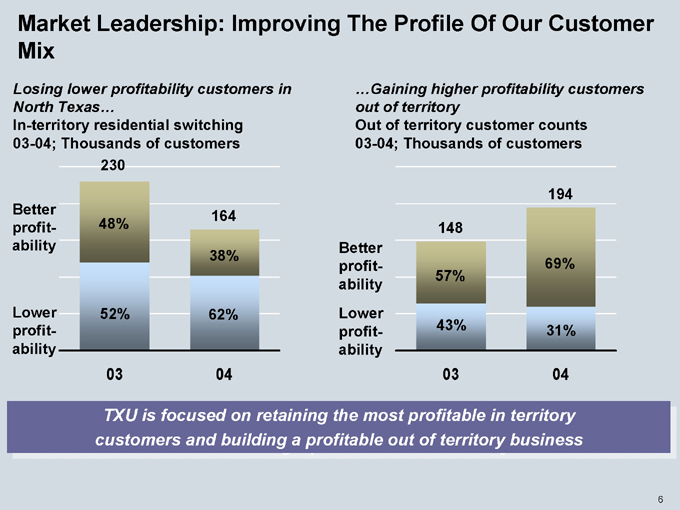

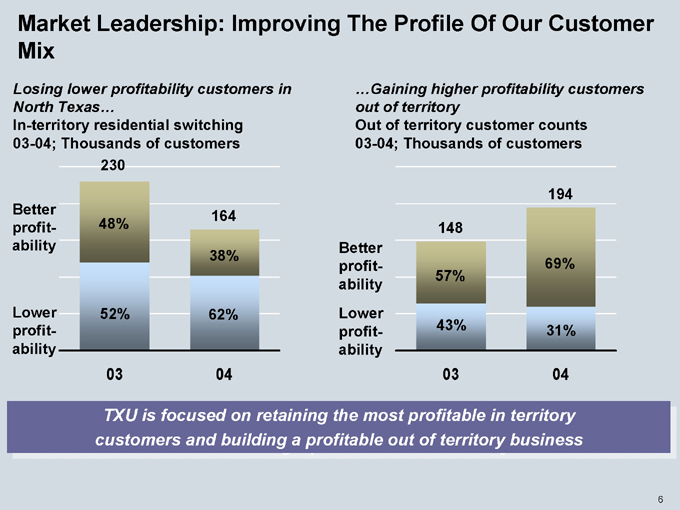

Market Leadership: Improving The Profile Of Our Customer Mix

Losing lower profitability customers in North Texas…

In-territory residential switching 03-04; Thousands of customers

Better profitability

Lower profitability

230

48%

52%

164

38%

62%

03 04

…Gaining higher profitability customers out of territory

Out of territory customer counts 03-04; Thousands of customers

Better profitability Lower profitability

148

57%

43%

194

69%

31%

03 04

TXU is focused on retaining the most profitable in territory customers and building a profitable out of territory business

6

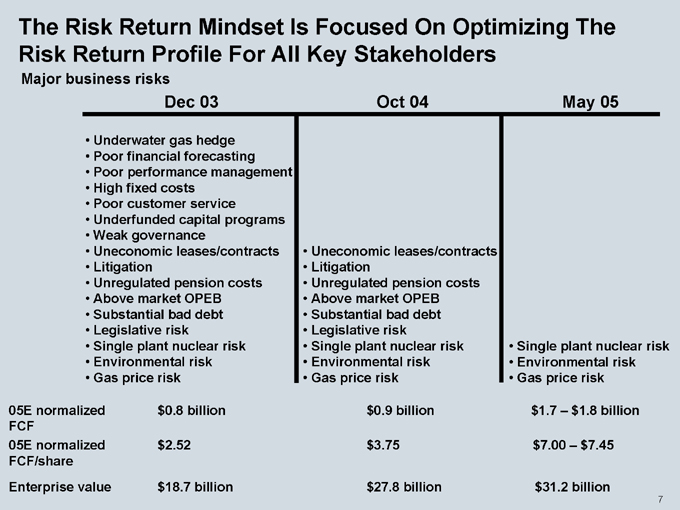

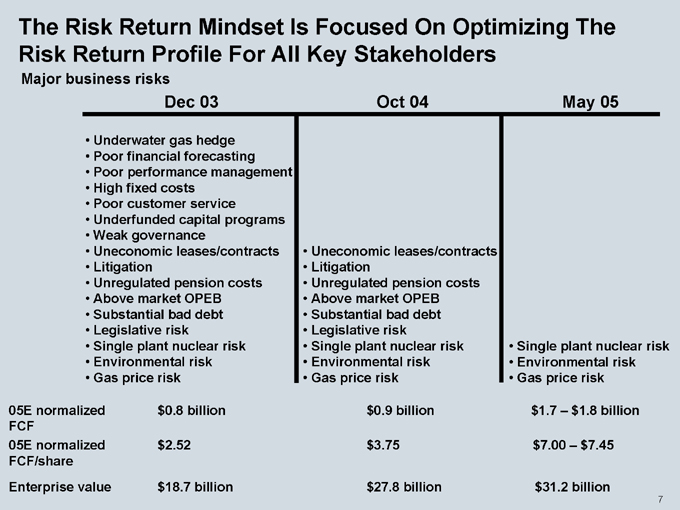

The Risk Return Mindset Is Focused On Optimizing The Risk Return Profile For All Key Stakeholders

Major business risks

Dec 03

Underwater gas hedge Poor financial forecasting Poor performance management High fixed costs Poor customer service Underfunded capital programs Weak governance Uneconomic leases/contracts Litigation Unregulated pension costs Above market OPEB

Substantial bad debt Legislative risk Single plant nuclear risk Environmental risk Gas price risk

Oct 04

Uneconomic leases/contracts Litigation Unregulated pension costs Above market OPEB

Substantial bad debt Legislative risk Single plant nuclear risk Environmental risk Gas price risk

May 05

Single plant nuclear risk Environmental risk Gas price risk

05E normalized $0.8 billion $0.9 billion $1.7 – $1.8 billion FCF

05E normalized $2.52 $3.75 $7.00 – $7.45 FCF/share Enterprise value $18.7 billion $27.8 billion $31.2 billion

7

Key Questions That Get To The Heart Of Our Business

1. What is TXU’s fundamental business strategy?

2. What are the goals of TXU’s financial strategy?

3. How is the restructured Texas electricity market performing?

4. What is TXU’s exposure to natural gas and heat rate?

5. What are TXU’s perspectives on mid and long term growth?

8

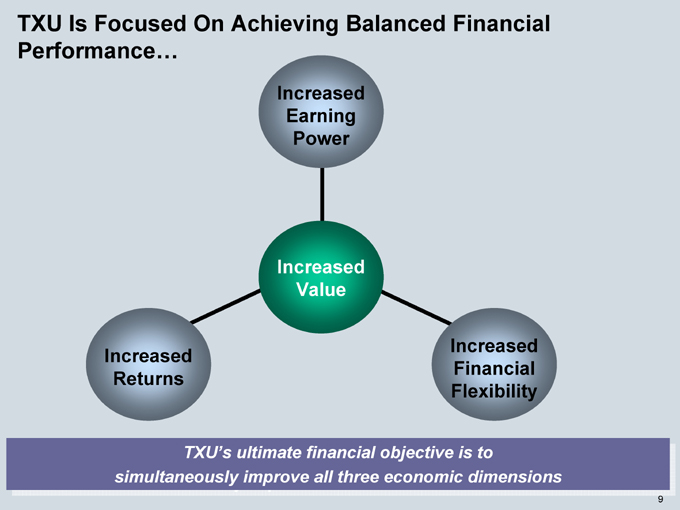

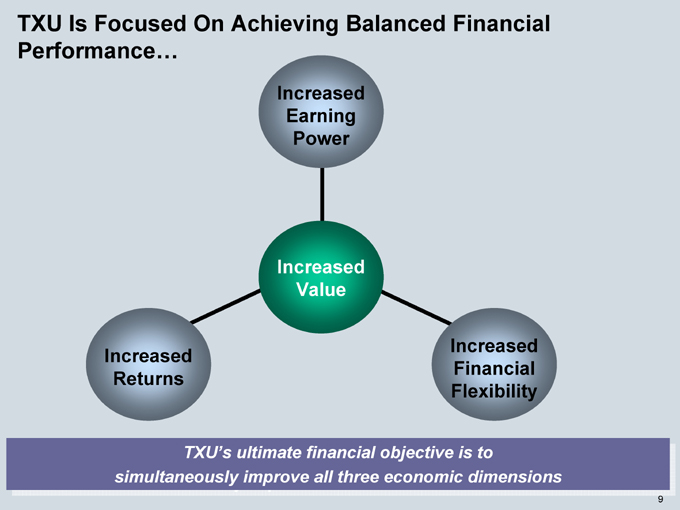

TXU Is Focused On Achieving Balanced Financial Performance…

Increased Earning Power

Increased Value

Increased Returns

Increased Financial Flexibility

TXU’s ultimate financial objective is to simultaneously improve all three economic dimensions

9

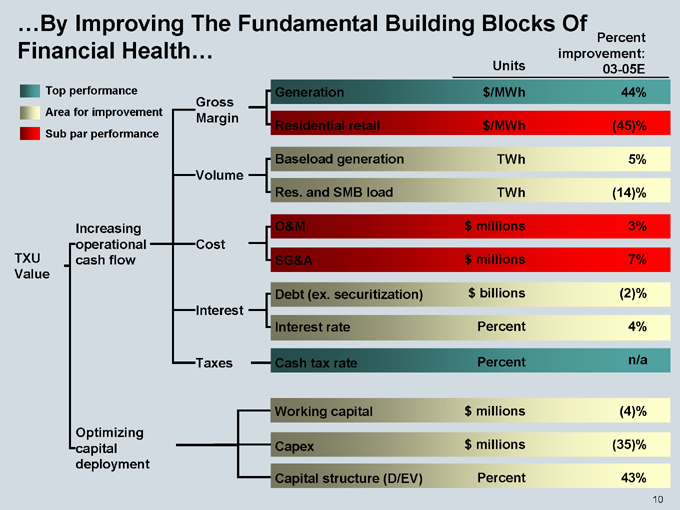

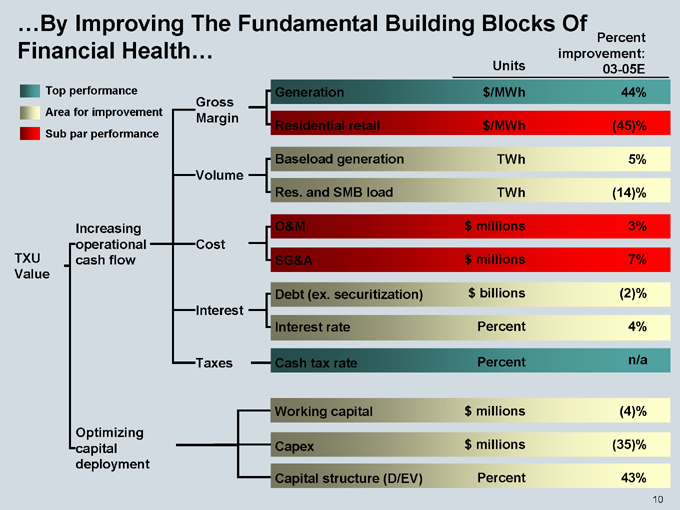

…By Improving The Fundamental Building Blocks Of

Percent

Financial Health… improvement:

Top performance Area for improvement Sub par performance

TXU Value

Increasing operational cash flow

Optimizing capital deployment

Gross Margin

Volume

Cost

Interest

Taxes

Units 03-05E

Generation $/MWh 44%

Residential retail $/MWh (45)%

Baseload generation TWh 5%

Res. and SMB load TWh (14)%

O&M $millions 3%

SG&A $millions 7%

Debt (ex. securitization) $billions (2)%

Interest rate Percent 4%

Cash tax rate Percent n/a

Working capital $millions (4)%

Capex $millions (35)%

Capital structure (D/EV) Percent 43%

10

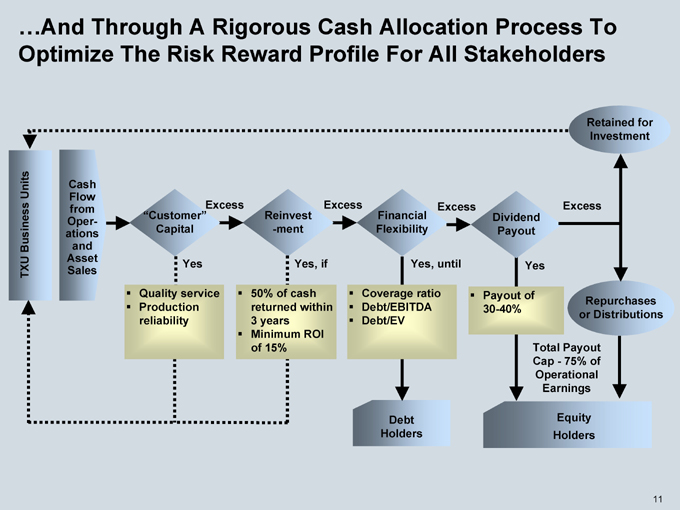

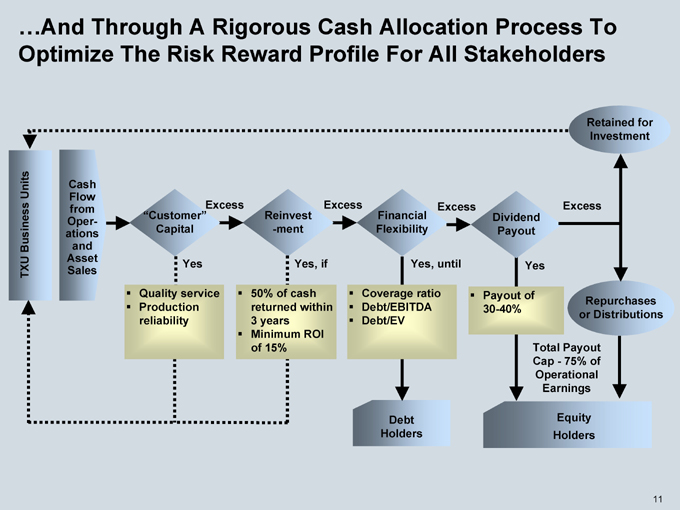

…And Through A Rigorous Cash Allocation Process To Optimize The Risk Reward Profile For All Stakeholders

Retained for Investment

TXU Business Units

Cash Flow from Operations and Asset Sales

“Customer” Capital

Excess

Reinvestment

Excess

Financial Flexibility

Excess

Dividend Payout

Excess

Yes

Yes, if

Yes, until

Yes

Quality service Production reliability

50% of cash returned within 3 years Minimum ROI of 15%

Coverage ratio Debt/EBITDA Debt/EV

Payout of 30-40%

Repurchases or Distributions

Total Payout Cap—75% of Operational Earnings

Debt Holders

Equity Holders

11

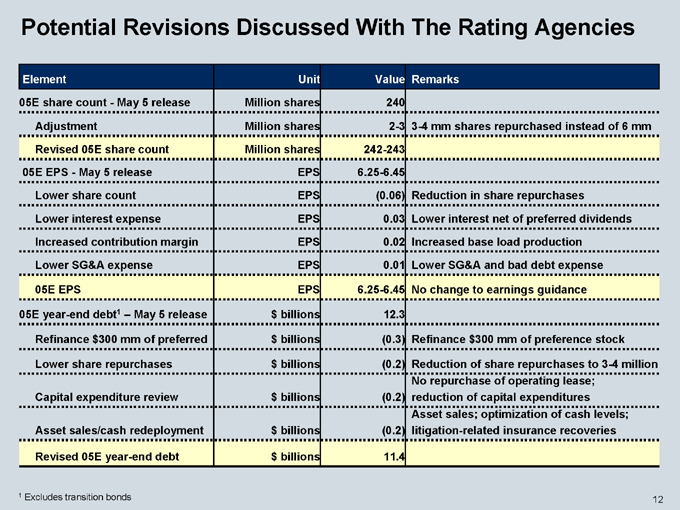

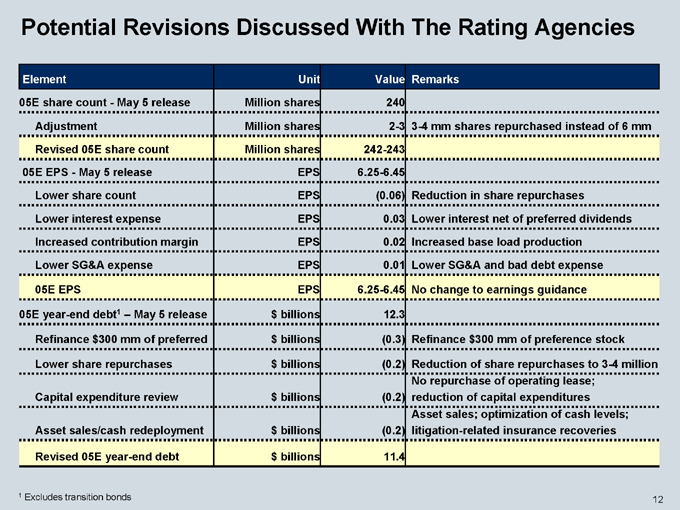

Potential Revisions Discussed With The Rating Agencies

Element Unit Value Remarks

05E share count—May 5 release Million shares 240

Adjustment Million shares 2-3 3-4 mm shares repurchased instead of 6 mm

Revised 05E share count Million shares 242-243

05E EPS—May 5 release EPS 6.25-6.45

Lower share count EPS (0.06) Reduction in share repurchases

Lower interest expense EPS 0.03 Lower interest net of preferred dividends

Increased contribution margin EPS 0.02 Increased base load production

Lower SG&A expense EPS 0.01 Lower SG&A and bad debt expense

05E EPS EPS 6.25-6.45 No change to earnings guidance

05E year-end debt1 – May 5 release $billions 12.3

Refinance $300 mm of preferred $billions (0.3) Refinance $300 mm of preference stock

Lower share repurchases $billions (0.2) Reduction of share repurchases to 3-4 million

No repurchase of operating lease;

Capital expenditure review $billions (0.2) reduction of capital expenditures

Asset sales; optimization of cash levels;

Asset sales/cash redeployment $billions (0.2) litigation-related insurance recoveries

Revised 05E year-end debt $billions 11.4

1 Excludes transition bonds

12

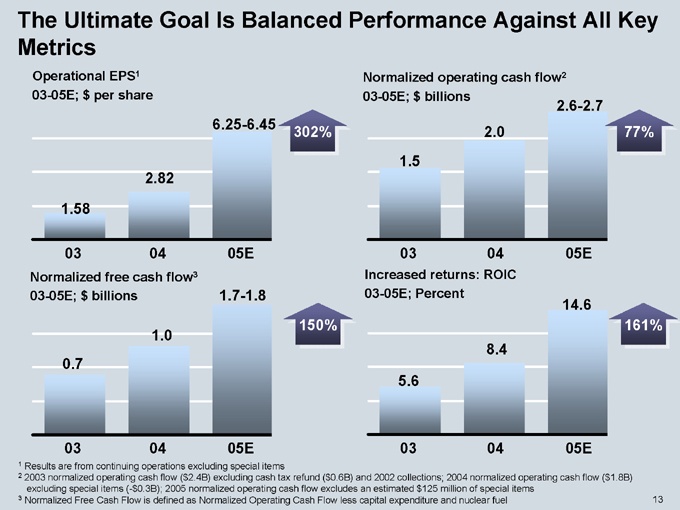

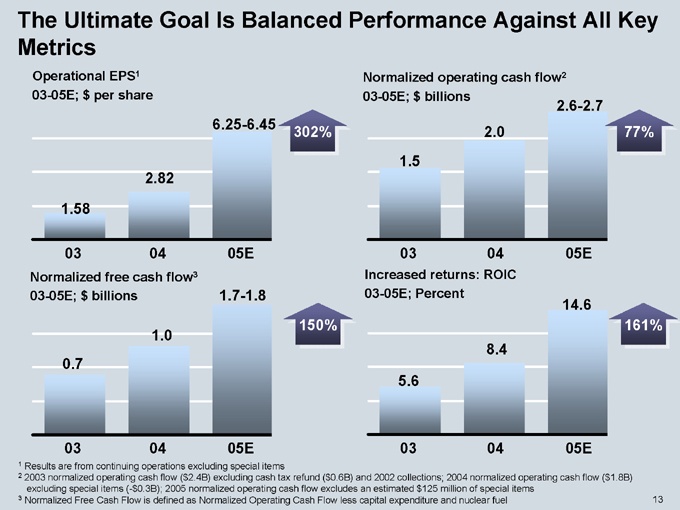

The Ultimate Goal Is Balanced Performance Against All Key Metrics

Operational EPS1 03-05E; $per share

1.58

2.82

6.25-6.45

03 04 05E

302%

Normalized free cash flow3 03-05E; $billions

0.7

1.0

1.7-1.8

03 04 05E

150%

Normalized operating cash flow2 03-05E; $billions

1.5

2.0

2.6-2.7

77%

03 04 05E

Increased returns: ROIC 03-05E; Percent

5.6

8.4

14.6

03 04 05E

161%

1 Results are from continuing operations excluding special items

2 2003 normalized operating cash flow ($2.4B) excluding cash tax refund ($0.6B) and 2002 collections; 2004 normalized operating cash flow ($1.8B) excluding special items (-$0.3B); 2005 normalized operating cash flow excludes an estimated $125 million of special items

3 Normalized Free Cash Flow is defined as Normalized Operating Cash Flow less capital expenditure and nuclear fuel

13

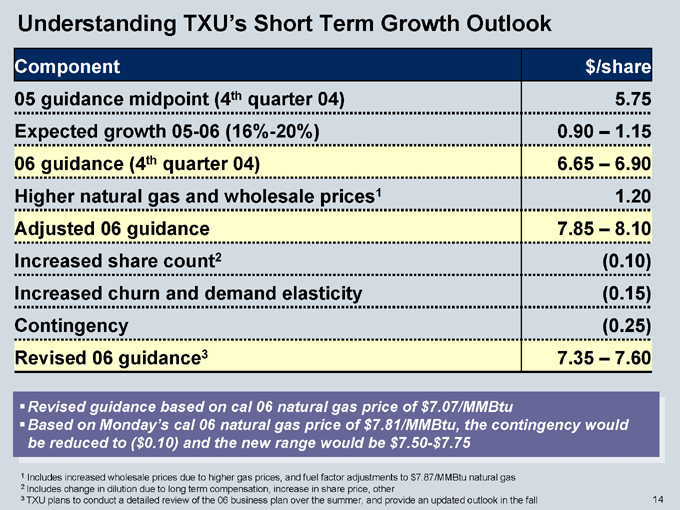

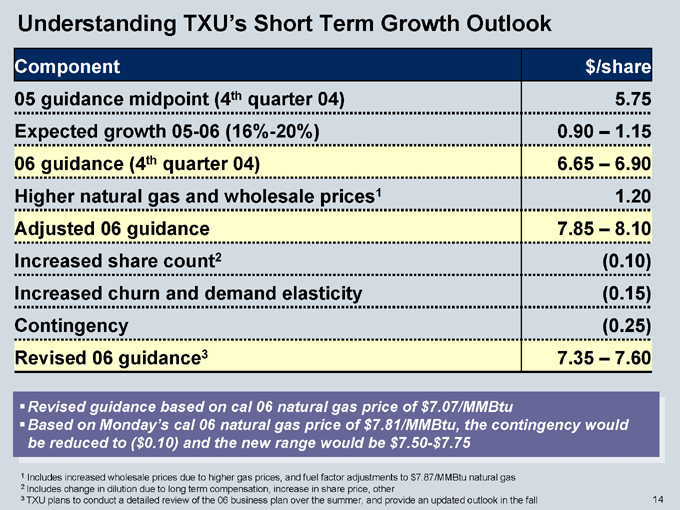

Understanding TXU’s Short Term Growth Outlook

Component $/share

05 guidance midpoint (4th quarter 04) 5.75

Expected growth 05-06 (16%-20%) 0.90 – 1.15

06 guidance (4th quarter 04) 6.65 – 6.90

Higher natural gas and wholesale prices1 1.20

Adjusted 06 guidance 7.85 – 8.10

Increased share count2 (0.10)

Increased churn and demand elasticity (0.15)

Contingency (0.25)

Revised 06 guidance3 7.35 – 7.60

Revised guidance based on cal 06 natural gas price ofRevised guidance based on cal 06 natural gas price of $7.07/MMBtu

Based on Monday’s cal 06 natural gas price of $7.81/MMBtu, the contingency would reduced to ($0.10) and the new range would be $7.75-$7.75

1 Includes increased wholesale prices due to higher gas prices, and fuel factor adjustments to $7.87/MMBtu natural gas

2 Includes change in dilution due to long term compensation, increase in share price, other

3 TXU plans to conduct a detailed review of the 06 business plan over the summer, and provide an updated outlook in the fall

14

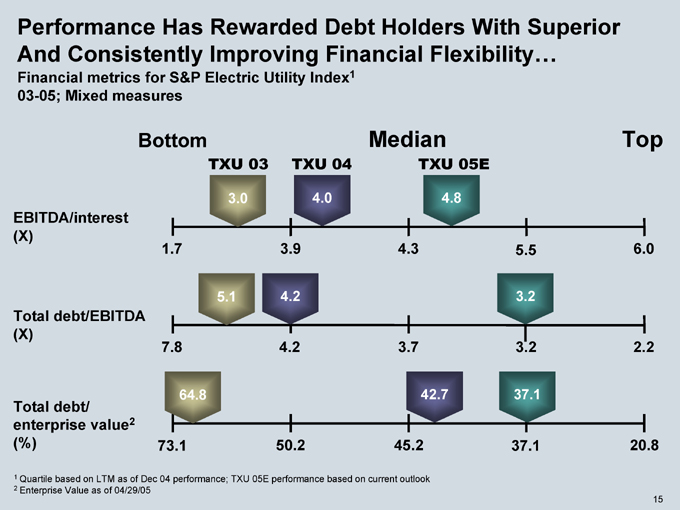

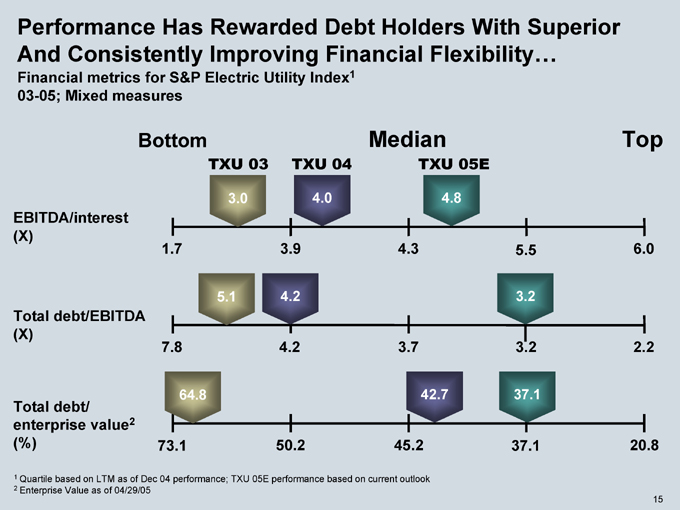

Performance Has Rewarded Debt Holders With Superior And Consistently Improving Financial Flexibility…

Financial metrics for S&P Electric Utility Index1 03-05; Mixed measures

Bottom Median Top

TXU 03 TXU 04 TXU 05E

EBITDA/interest (X)

Total debt/EBITDA (X)

Total debt/ enterprise value2 (%)

3.0

4.0

4.8

5.1

4.2

3.2

1.7 3.9 4.3 5.5 6.0

7.8 4.2 3.7 3.2 2.2

64.8

42.7

37.1

73.1 50.2 45.2 37.1 20.8

1 Quartile based on LTM as of Dec 04 performance; TXU 05E performance based on current outlook

2 Enterprise Value as of 04/29/05

15

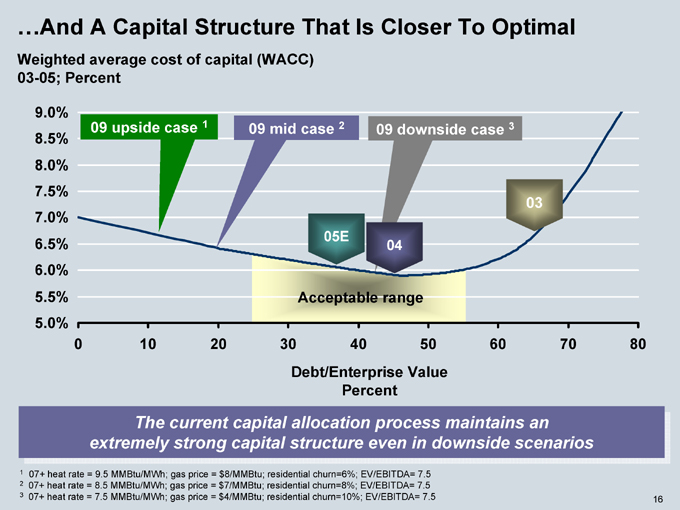

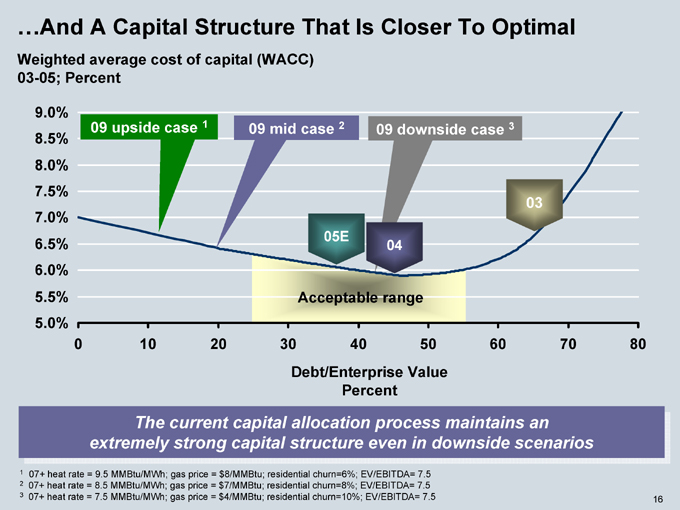

…And A Capital Structure That Is Closer To Optimal

Weighted average cost of capital (WACC) 03-05; Percent

9.0% 8.5% 8.0% 7.5% 7.0% 6.5% 6.0% 5.5% 5.0%

09 upside case 1

09 mid case 2

09 downside case 3

05E

04

03

Acceptable range

0 10 20 30 40 50 60 70 80

Debt/Enterprise Value Percent

The current capital allocation process maintains an extremely strong capital structure even in downside scenarios

1 07+ heat rate = 9.5 MMBtu/MWh; gas price = $8/MMBtu; residential churn=6%; EV/EBITDA= 7.5

2 07+ heat rate = 8.5 MMBtu/MWh; gas price = $7/MMBtu; residential churn=8%; EV/EBITDA= 7.5

3 07+ heat rate = 7.5 MMBtu/MWh; gas price = $4/MMBtu; residential churn=10%; EV/EBITDA= 7.5

16

Key Questions That Get To The Heart Of Our Business

1. What is TXU’s fundamental business strategy?

2. What are the goals of TXU’s financial strategy?

3. How is the restructured Texas electricity market performing?

4. What is TXU’s exposure to natural gas and heat rate?

5. What are TXU’s perspectives on mid and long term growth?

17

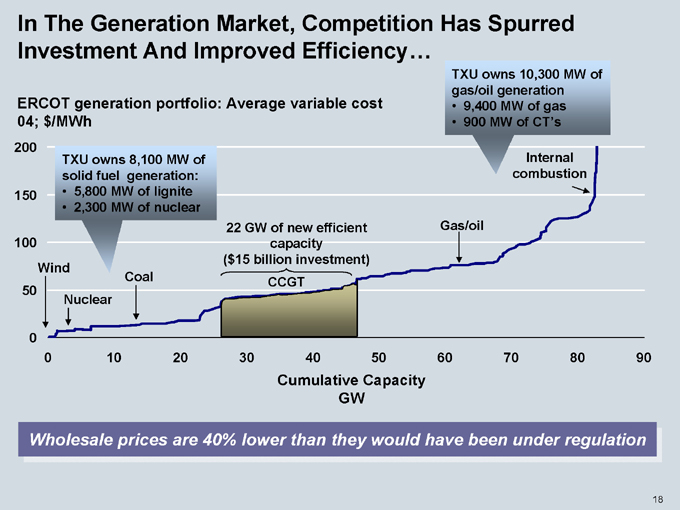

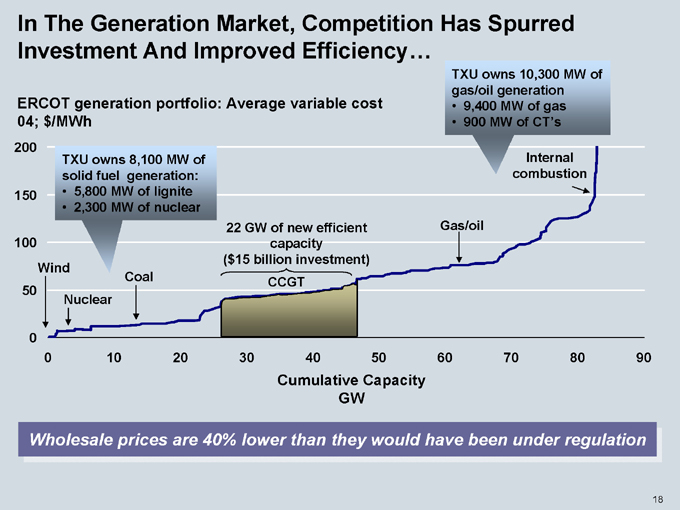

In The Generation Market, Competition Has Spurred Investment And Improved Efficiency…

TXU owns 10,300 MW of gas/oil generation

9,400 MW of gas 900 MW of CT’s

ERCOT generation portfolio: Average variable cost 04; $/MWh

200 150 100 50 0

TXU owns 8,100 MW of solid fuel generation:

5,800 MW of lignite 2,300 MW of nuclear

Wind

Nuclear

Coal

22 GW of new efficient capacity

($15 billion investment) CCGT

Gas/oil

Internal combustion

0 10 20 30 40 50 60 70 80 90

Cumulative Capacity GW

Wholesale prices are 40% lower than they would have been under regulation

18

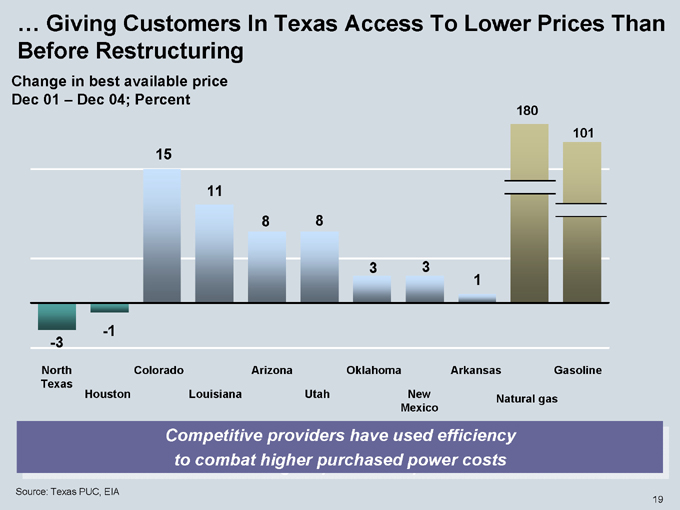

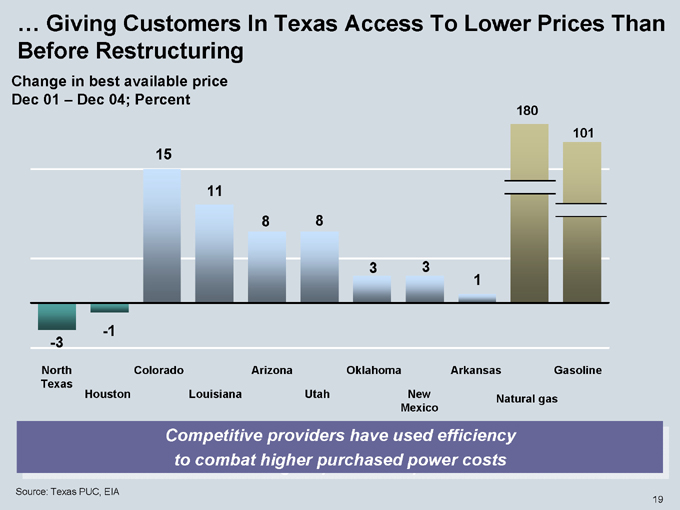

… Giving Customers In Texas Access To Lower Prices Than Before Restructuring

Change in best available price Dec 01 – Dec 04; Percent

15

11

8

8

3

3

1

180

101

-3

-1

North Texas

Houston

Colorado

Louisiana

Arizona

Utah

Oklahoma

New Mexico

Arkansas

Natural gas

Gasoline

Competitive providers have used efficiency to combat higher purchased power costs

Source: Texas PUC, EIA

19

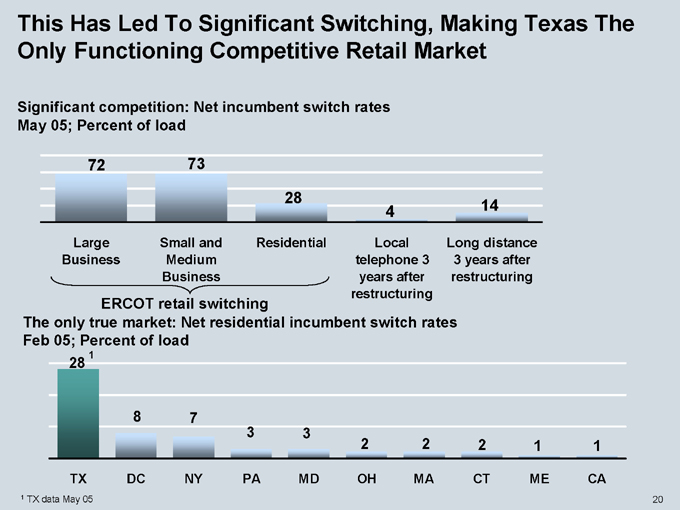

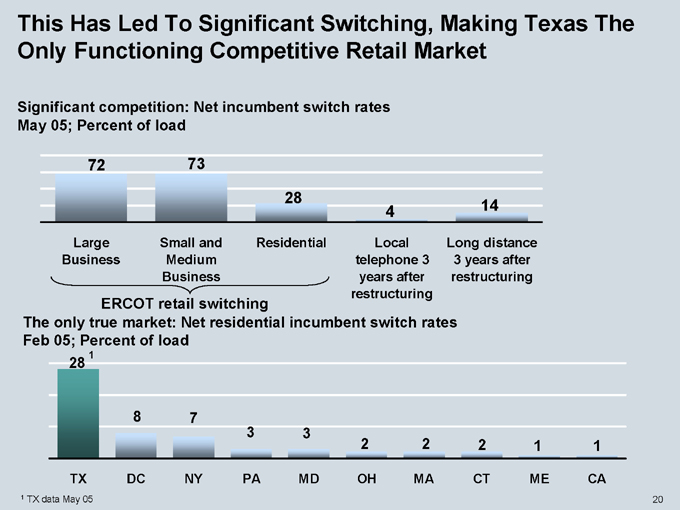

This Has Led To Significant Switching, Making Texas The Only Functioning Competitive Retail Market

Significant competition: Net incumbent switch rates May 05; Percent of load

72

73

28

4

14

Large Business

Small and Medium Business

Residential

Local telephone 3 years after restructuring

Long distance 3 years after restructuring

ERCOT retail switching

The only true market: Net residential incumbent switch rates Feb 05; Percent of load

28 1

8

7

3

3

2

2

2

1

1

TX DC NY PA MD OH MA CT ME CA

1 TX data May 05

20

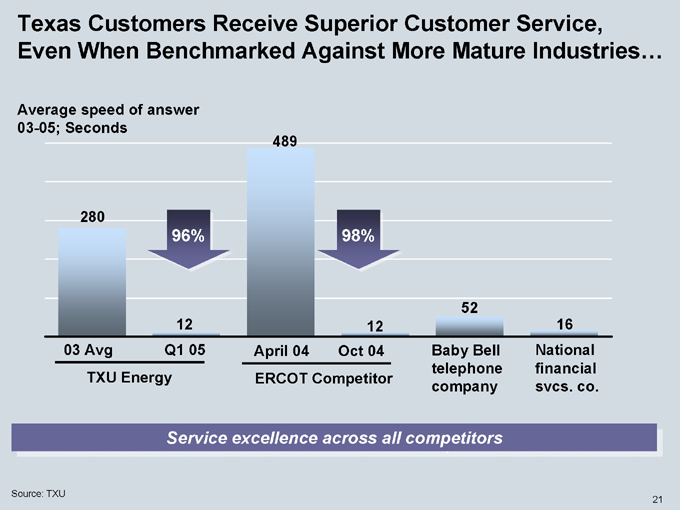

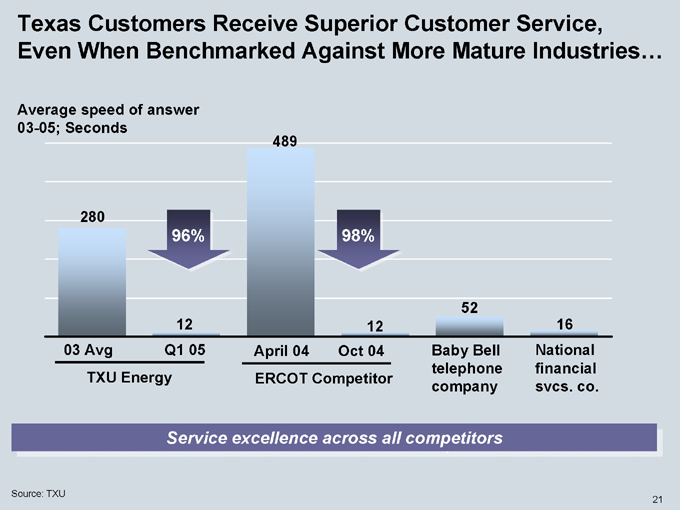

Texas Customers Receive Superior Customer Service, Even When Benchmarked Against More Mature Industries…

Average speed of answer 03-05; Seconds

280

96%

489

98%

12

12

52

16

03 Avg

Q1 05

TXU Energy

April 04

Oct 04

ERCOT Competitor

Baby Bell telephone company

National financial svcs. co.

Service excellence across all competitors

Source: TXU

21

Key Questions That Get To The Heart Of Our Business

1. What is TXU’s fundamental business strategy?

2. What are the goals of TXU’s financial strategy?

3. How is the restructured Texas electricity market performing?

4. What is TXU’s exposure to natural gas and heat rate?

5. What are TXU’s perspectives on mid and long term growth?

22

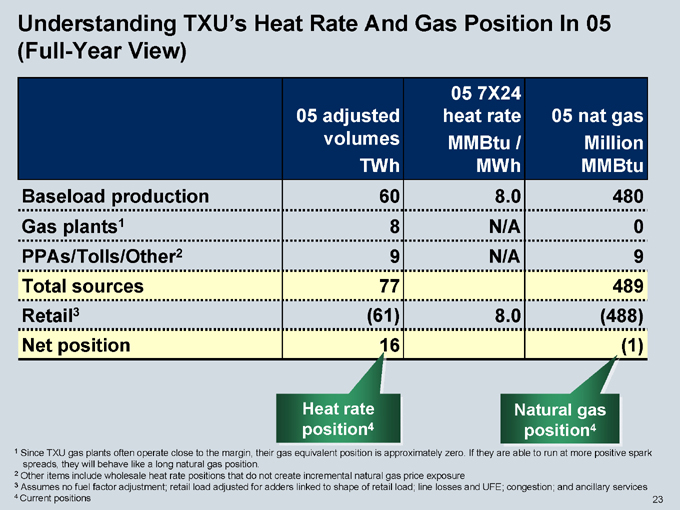

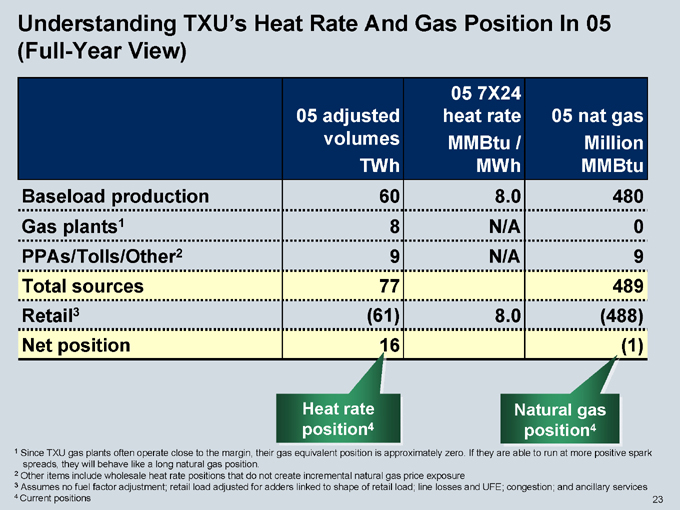

Understanding TXU’s Heat Rate And Gas Position In 05 (Full-Year View)

05 7X24

05 adjusted heat rate 05 nat gas

volumes MMBtu / Million

TWh MWh MMBtu

Baseload production 60 8.0 480

Gas plants1 8 N/A 0

PPAs/Tolls/Other2 9 N/A 9

Total sources 77 489

Retail3 (61) 8.0 (488)

Net position 16 (1)

Heat rate position4

Natural gas position4

1 Since TXU gas plants often operate close to the margin, their gas equivalent position is approximately zero. If they are able to run at more positive spark spreads, they will behave like a long natural gas position.

2 Other items include wholesale heat rate positions that do not create incremental natural gas price exposure

3 Assumes no fuel factor adjustment; retail load adjusted for adders linked to shape of retail load; line losses and UFE; congestion; and ancillary services

4 Current positions

23

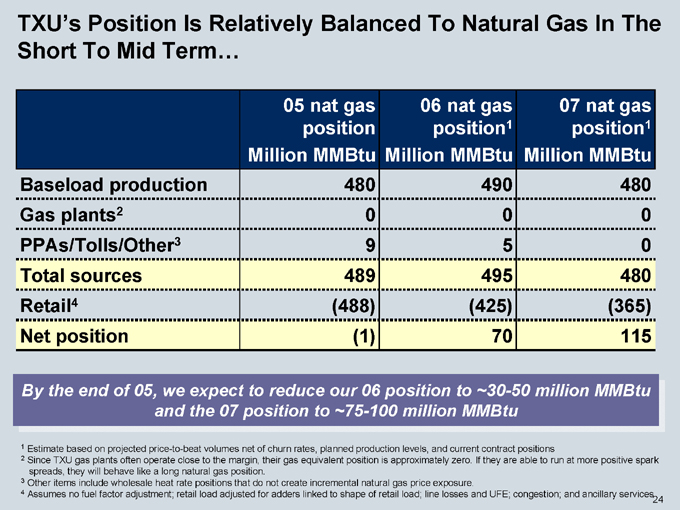

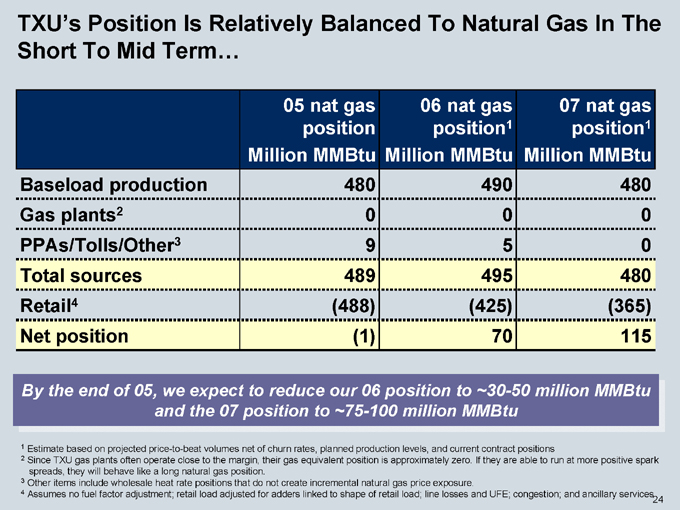

TXU’s Position Is Relatively Balanced To Natural Gas In The Short To Mid Term…

05 nat gas 06 nat gas 07 nat gas

position position1 position1

Million MMBtu Million MMBtu Million MMBtu

Baseload production 480 490 480

Gas plants2 0 0 0

PPAs/Tolls/Other3 9 5 0

Total sources 489 495 480

Retail4 (488) (425) (365)

Net position (1) 70 115

By the end of 05, we expect to reduce our 06 position to ~30-50 million MMBtu and the 07 position to ~75-100 million MMBtu

1 Estimate based on projected price-to-beat volumes net of churn rates, planned production levels, and current contract positions

2 Since TXU gas plants often operate close to the margin, their gas equivalent position is approximately zero. If they are able to run at more positive spark spreads, they will behave like a long natural gas position.

3 Other items include wholesale heat rate positions that do not create incremental natural gas price exposure.

4 Assumes no fuel factor adjustment; retail load adjusted for adders linked to shape of retail load; line losses and UFE; congestion; and ancillary services

24

… Especially Relative To Other Players In The Industry

Equivalent gas production1 Million MMBtu

Equivalent fixed price short2 Million MMBtu

Net gas position3 Million MMBtu

Company A Company B Company C

Company D

TXU Long-Term1

Company E

Company F

700

650

290

240

490

85

75

255

345

0

15

300

0

0

449

305

290

225

190

85

75

1 Estimated long term exposure (2010+)

2 Includes adders to account for shaping, line losses and congestion; Assumes residential, small, medium, and large business are short positions

3 Native risk position; excludes gas contracts and hedges

25

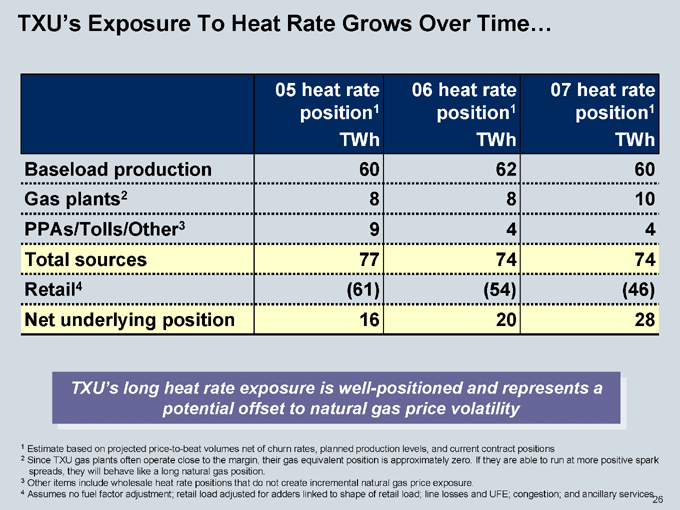

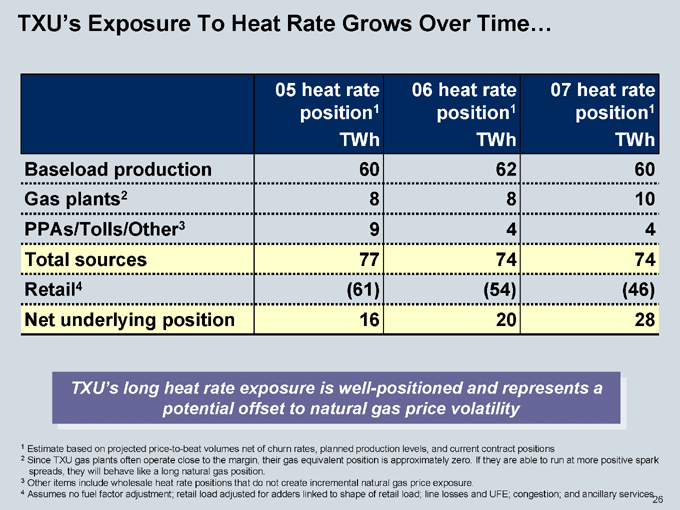

TXU’s Exposure To Heat Rate Grows Over Time…

05 heat rate 06 heat rate 07 heat rate

position1 position1 position1

TWh TWh TWh

Baseload production 60 62 60

Gas plants2 8 8 10

PPAs/Tolls/Other3 9 4 4

Total sources 77 74 74

Retail4 (61) (54) (46)

Net underlying position 16 20 28

TXU’s long heat rate exposure is well-positioned and represents a potential offset to natural gas price volatility

1 Estimate based on projected price-to-beat volumes net of churn rates, planned production levels, and current contract positions

2 Since TXU gas plants often operate close to the margin, their gas equivalent position is approximately zero. If they are able to run at more positive spark spreads, they will behave like a long natural gas position.

3 Other items include wholesale heat rate positions that do not create incremental natural gas price exposure.

4 Assumes no fuel factor adjustment; retail load adjusted for adders linked to shape of retail load; line losses and UFE; congestion; and ancillary services

26

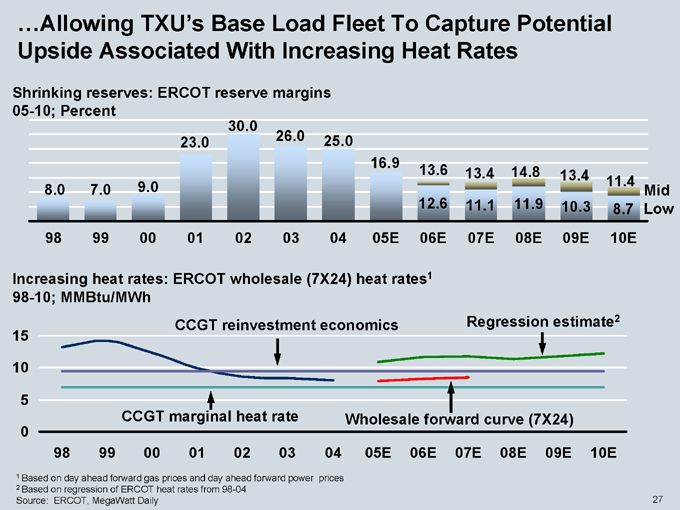

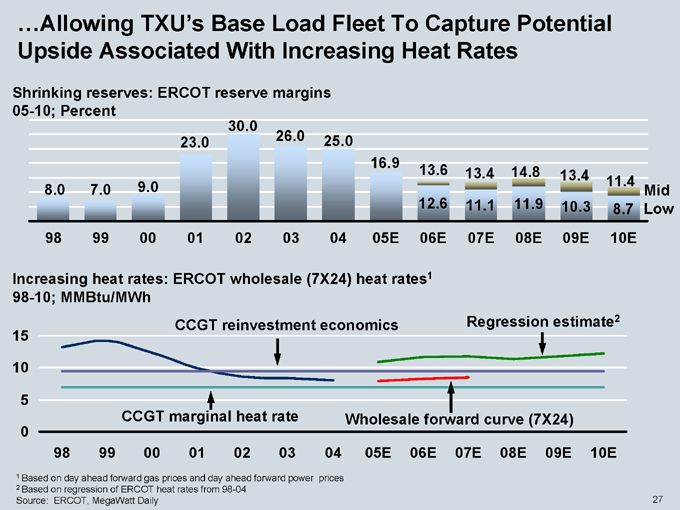

…Allowing TXU’s Base Load Fleet To Capture Potential Upside Associated With Increasing Heat Rates

Shrinking reserves: ERCOT reserve margins 05-10; Percent

8.0

7.0

9.0

23.0

30.0

26.0

25.0

16.9

13.6

13.4

14.8

13.4

11.4

Mid

12.6

11.1

11.9

10.3

8.7

Low

98 99 00 01 02 03 04 05E 06E 07E 08E 09E 10E

Increasing heat rates: ERCOT wholesale (7X24) heat rates1 98-10; MMBtu/MWh

CCGT reinvestment economics

Regression estimate2

15 10 5 0

CCGT marginal heat rate

Wholesale forward curve (7X24)

98 99 00 01 02 03 04 05E 06E 07E 08E 09E 10E

1 Based on day ahead forward gas prices and day ahead forward power prices

2 Based on regression of ERCOT heat rates from 98-04 Source: ERCOT, MegaWatt Daily

27

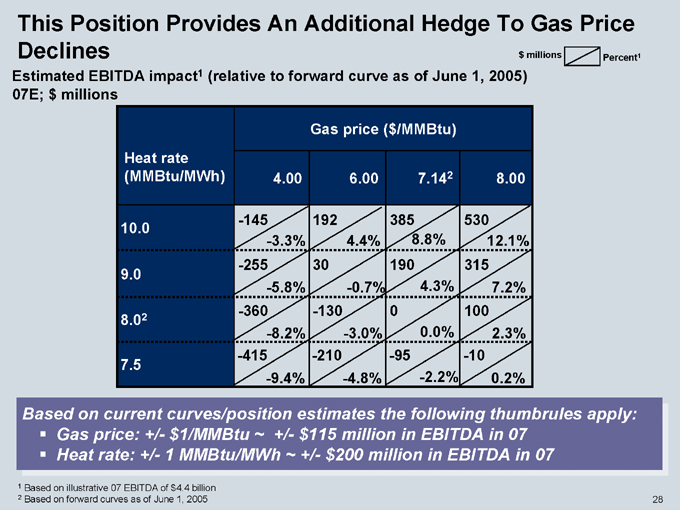

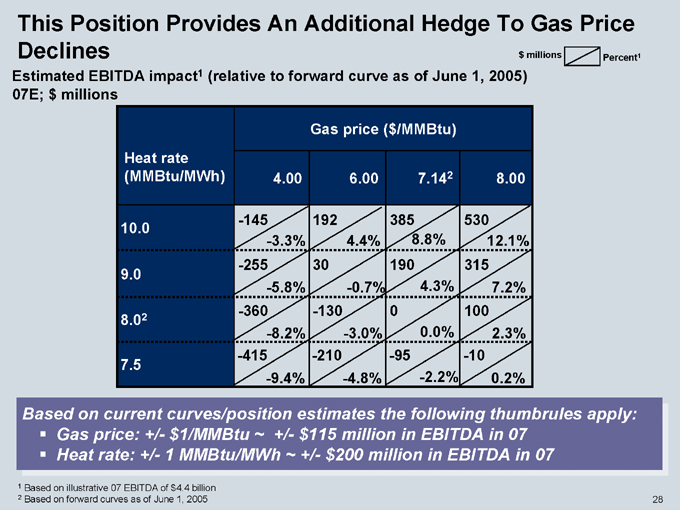

This Position Provides An Additional Hedge To Gas Price

Declines $millions Percent1

Estimated EBITDA impact1 (relative to forward curve as of June 1, 2005) 07E; $millions

Gas price ( $/MMBtu)

Heat rate

(MMBtu/MWh) 4.00 6.00 7.142 8.00

-145 192 385 530

10.0

-3.3% 4.4% 8.8% 12.1%

-255 30 190 315

9.0

-5.8% -0.7% 4.3% 7.2%

-360 -130 0 100

8.02

-8.2% -3.0% 0.0% 2.3%

-415 -210 -95 -10

7.5

-9.4% - -4.8% -2.2% 0.2%

Based on current curves/position estimates the following thumbrules apply: Gas price: +/-$1/MMBtu ~ +/- $115 million in EBITDA in 07 Heat rate: +/- 1 MMBtu/MWh~ +/-$200 million in EBITDA in 07

1 Based on illustrative 07 EBITDA of $4.4 billion

2 Based on forward curves as of June 1, 2005

28

Key Questions That Get To The Heart Of Our Business

1. What is TXU’s fundamental business strategy?

2. What are the goals of TXU’s financial strategy?

3. How is the restructured Texas electricity market performing?

4. What is TXU’s exposure to natural gas and heat rate?

5. What are TXU’s perspectives on mid and long term growth?

29

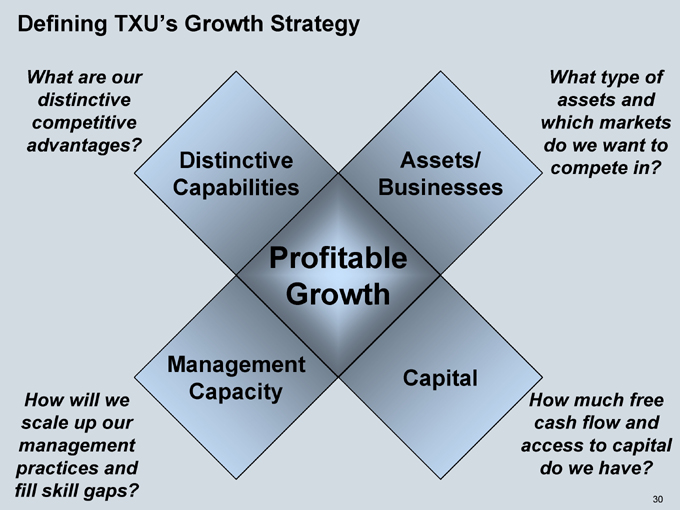

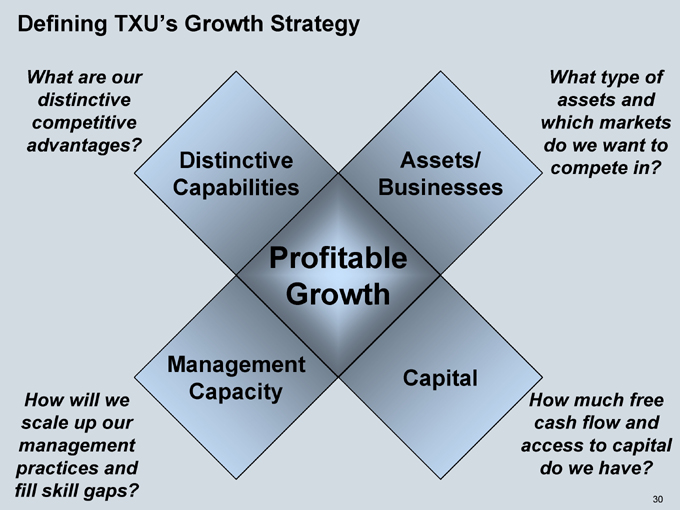

Defining TXU’s Growth Strategy

What are our distinctive competitive advantages?

Distinctive Capabilities

Assets/ Businesses

Profitable Growth

Management Capacity

Capital

What type of assets and which markets do we want to compete in?

How will we scale up our management practices and fill skill gaps?

How much free cash flow and access to capital do we have?

30

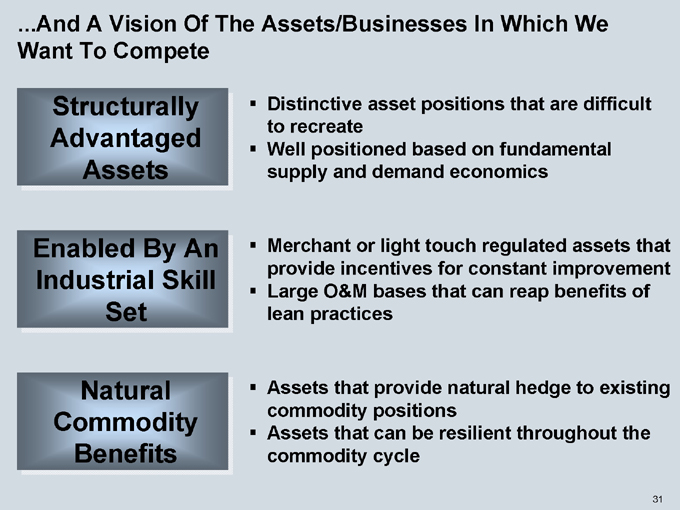

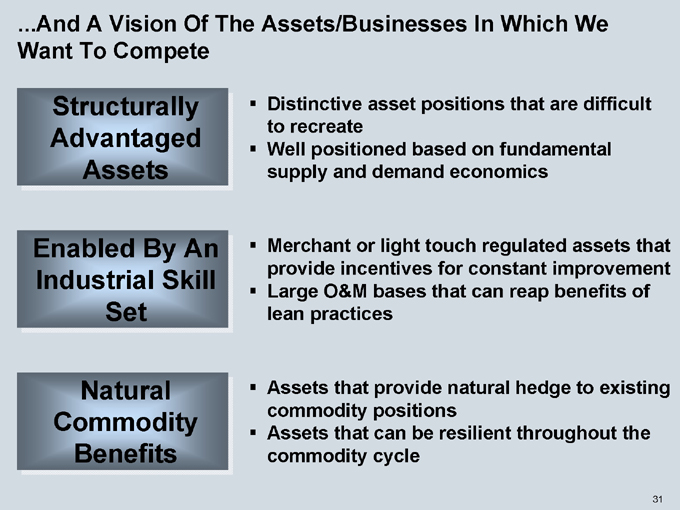

…And A Vision Of The Assets/Businesses In Which We Want To Compete

Structurally Advantaged Assets

Distinctive asset positions that are difficult to recreate Well positioned based on fundamental supply and demand economics

Enabled By An Industrial Skill Set

Merchant or light touch regulated assets that provide incentives for constant improvement Large O&M bases that can reap benefits of lean practices

Natural Commodity Benefits

Assets that provide natural hedge to existing commodity positions Assets that can be resilient throughout the commodity cycle

31

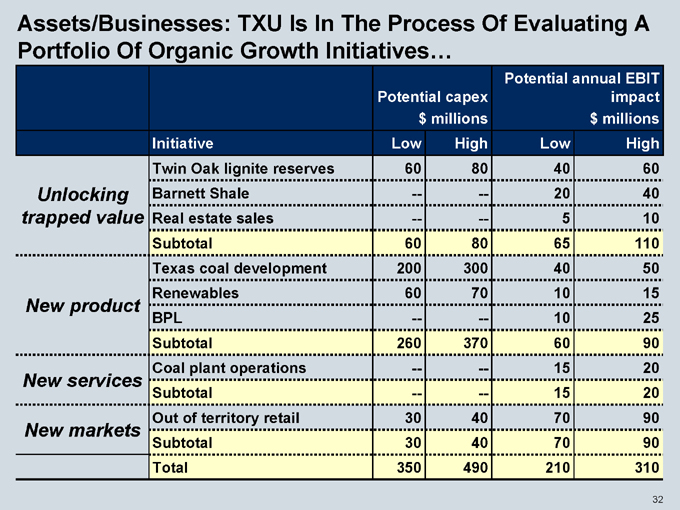

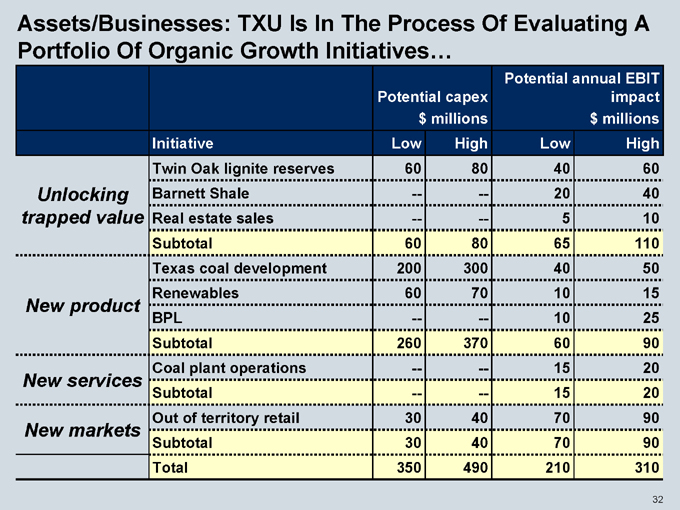

Potential annual EBIT

Potential capex impact

$millions $millions

Initiative Low High Low High

Twin Oak lignite reserves 60 80 40 60

Unlocking Barnett Shale — — 20 40

trapped value Real estate sales — — 5 10

Subtotal 60 80 65 110

Texas coal development 200 300 40 50

Renewables 60 70 10 15

New product

BPL — — 10 25

Subtotal 260 370 60 90

Coal plant operations — — 15 20

New services

Subtotal — — 15 20

Out of territory retail 30 40 70 90

New markets

Subtotal 30 40 70 90

Total 350 490 210 310

Assets/Businesses: TXU Is In The Process Of Evaluating A Portfolio Of Organic Growth Initiatives…

32

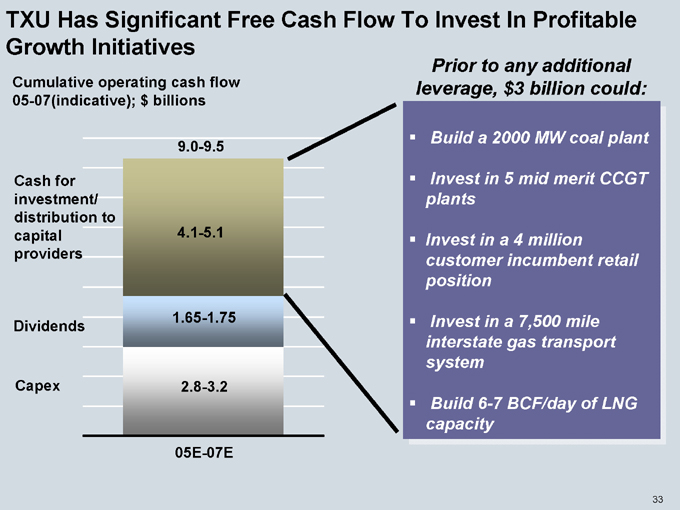

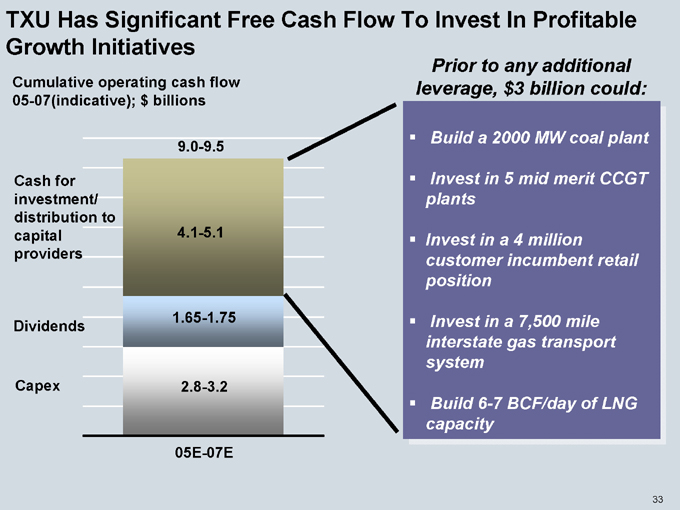

TXU Has Significant Free Cash Flow To Invest In Profitable Growth Initiatives

Cumulative operating cash flow 05-07(indicative); $billions

Cash for investment/ distribution to capital providers

Dividends

Capex

9.0-9.5

4.1-5.1

1.65-1.75

2.8-3.2

05E-07E

Prior to any additional leverage, $3 billion could:

Build a 2000 MW coal plant

Invest in 5 mid merit CCGT

Invest in a 4 million customer incumbent retail position

Invest in a 7,500 mile interstate gas transport system

Build 6-7 BCF/day of LNG capacity

33

TXU: A Structurally Advantaged Portfolio With Significant Upside

Focused on continuous improvement of three structurally advantaged core businesses to deliver superior financial metrics

2X earnings power

Double digit ROIC

Top quartile financial flexibility

Financial strategy based around maximizing cash returns to stakeholders

Integrated business model is resilient under multiple scenarios with relatively low gas risk and with large heat rate upside

Evaluating intrinsic and extrinsic growth options while maintaining a disciplined capital allocation approach

34

Q & A Discussion

35

Appendix – Financial Definitions and Regulation G Reconciliations

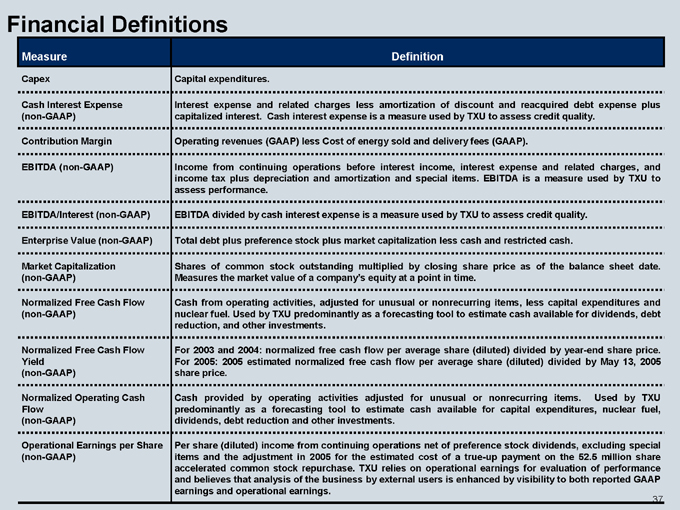

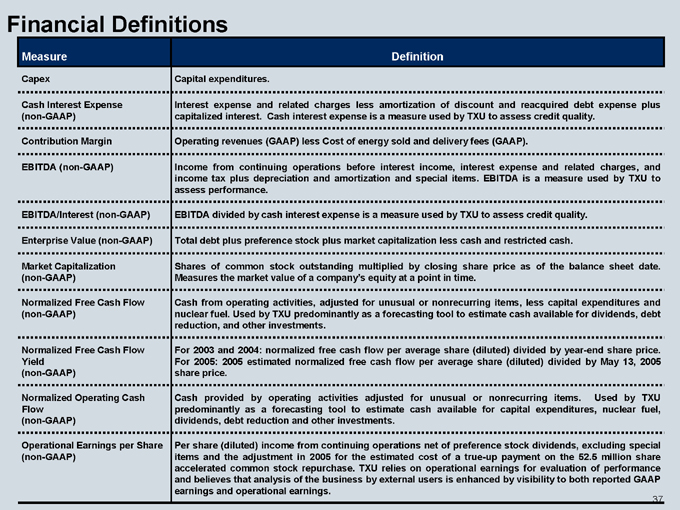

Financial Definitions

Measure Definition

Capex Capital expenditures.

Cash Interest Expense Interest expense and related charges less amortization of discount and reacquired debt expense plus

(non-GAAP) capitalized interest. Cash interest expense is a measure used by TXU to assess credit quality.

Contribution Margin Operating revenues (GAAP) less Cost of energy sold and delivery fees (GAAP).

EBITDA (non-GAAP) Income from continuing operations before interest income, interest expense and related charges, and

income tax plus depreciation and amortization and special items. EBITDA is a measure used by TXU to

assess performance.

EBITDA/Interest (non-GAAP) EBITDA divided by cash interest expense is a measure used by TXU to assess credit quality.

Enterprise Value (non-GAAP) Total debt plus preference stock plus market capitalization less cash and restricted cash.

Market Capitalization Shares of common stock outstanding multiplied by closing share price as of the balance sheet date.

(non-GAAP) Measures the market value of a company’s equity at a point in time.

Normalized Free Cash Flow Cash from operating activities, adjusted for unusual or nonrecurring items, less capital expenditures and

(non-GAAP) nuclear fuel. Used by TXU predominantly as a forecasting tool to estimate cash available for dividends, debt

reduction, and other investments.

Normalized Free Cash Flow For 2003 and 2004: normalized free cash flow per average share (diluted) divided by year-end share price.

Yield For 2005: 2005 estimated normalized free cash flow per average share (diluted) divided by May 13, 2005

(non-GAAP) share price.

Normalized Operating Cash Cash provided by operating activities adjusted for unusual or nonrecurring items. Used by TXU

Flow predominantly as a forecasting tool to estimate cash available for capital expenditures, nuclear fuel,

(non-GAAP) dividends, debt reduction and other investments.

Operational Earnings per Share Per share (diluted) income from continuing operations net of preference stock dividends, excluding special

(non-GAAP) items and the adjustment in 2005 for the estimated cost of a true-up payment on the 52.5 million share

accelerated common stock repurchase. TXU relies on operational earnings for evaluation of performance

and believes that analysis of the business by external users is enhanced by visibility to both reported GAAP

earnings and operational earnings.

37

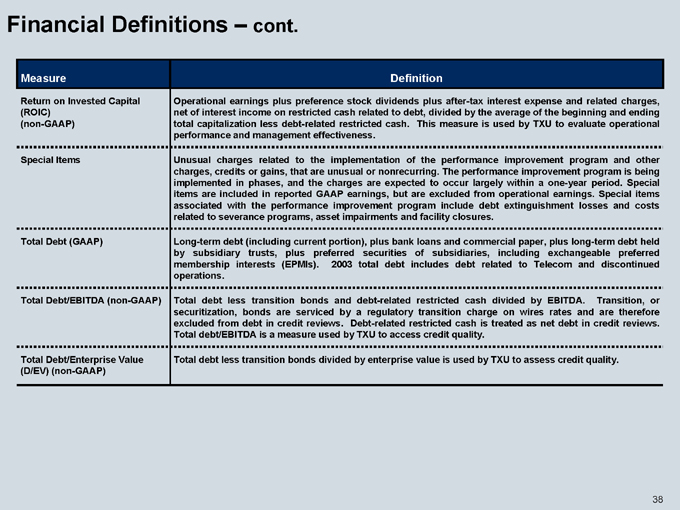

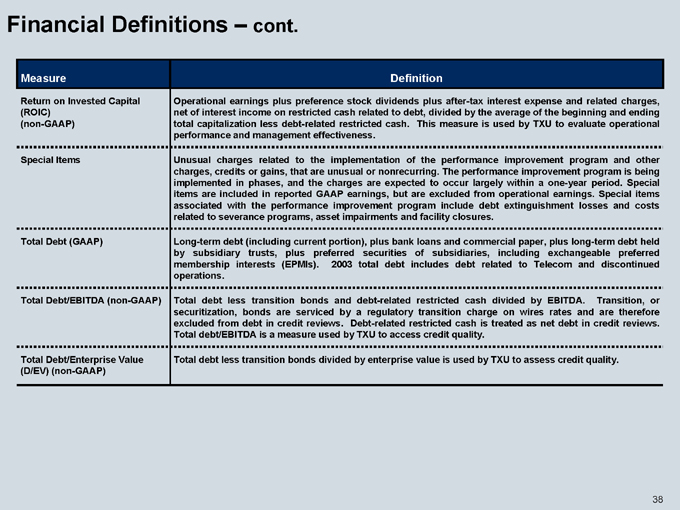

Financial Definitions – cont.

Measure Definition

Return on Invested Capital Operational earnings plus preference stock dividends plus after-tax interest expense and related charges,

(ROIC) net of interest income on restricted cash related to debt, divided by the average of the beginning and ending

(non-GAAP) total capitalization less debt-related restricted cash. This measure is used by TXU to evaluate operational

performance and management effectiveness.

Special Items Unusual charges related to the implementation of the performance improvement program and other

charges, credits or gains, that are unusual or nonrecurring. The performance improvement program is being

implemented in phases, and the charges are expected to occur largely within a one-year period. Special

items are included in reported GAAP earnings, but are excluded from operational earnings. Special items

associated with the performance improvement program include debt extinguishment losses and costs

related to severance programs, asset impairments and facility closures.

Total Debt (GAAP) Long-term debt (including current portion), plus bank loans and commercial paper, plus long-term debt held

by subsidiary trusts, plus preferred securities of subsidiaries, including exchangeable preferred

membership interests (EPMIs). 2003 total debt includes debt related to Telecom and discontinued

operations.

Total Debt/EBITDA (non-GAAP) Total debt less transition bonds and debt-related restricted cash divided by EBITDA. Transition, or

securitization, bonds are serviced by a regulatory transition charge on wires rates and are therefore

excluded from debt in credit reviews. Debt-related restricted cash is treated as net debt in credit reviews.

Total debt/EBITDA is a measure used by TXU to access credit quality.

Total Debt/Enterprise Value Total debt less transition bonds divided by enterprise value is used by TXU to assess credit quality.

(D/EV) (non-GAAP)

38

Table 1: TXU Corp. Operational Earnings Reconciliation Twelve Months Ended December 31, 2004 and 2003 $per share after tax

04 03

Net income (loss) to common (1.29) 1.62

Discontinued operations (1.26) (0.20)

Extraordinary gain (0.05) -

Cum. effect of changes in accounting principles (0.03) 0.15

Premium on EPMIs 2.83 -

Preference stock dividends 0.07 0.06

Income from continuing operations 0.27 1.63

Preference stock dividends (0.07) (0.06)

Effect of diluted shares calculation 0.04 0.01

Special items 2.58 -

Operational earnings 2.82 1.58

39

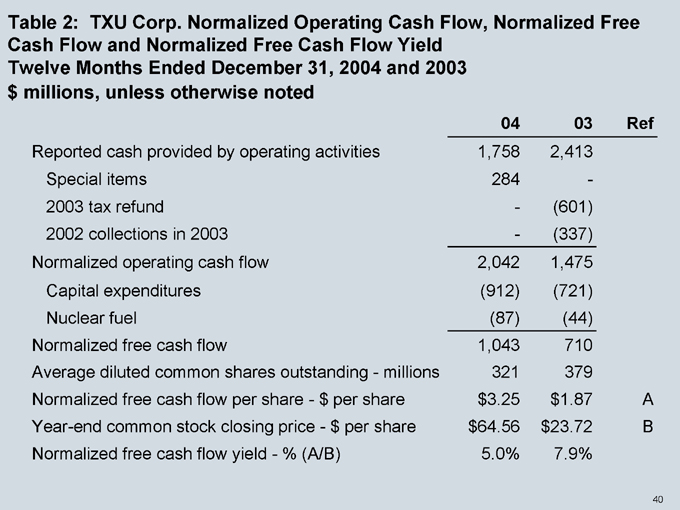

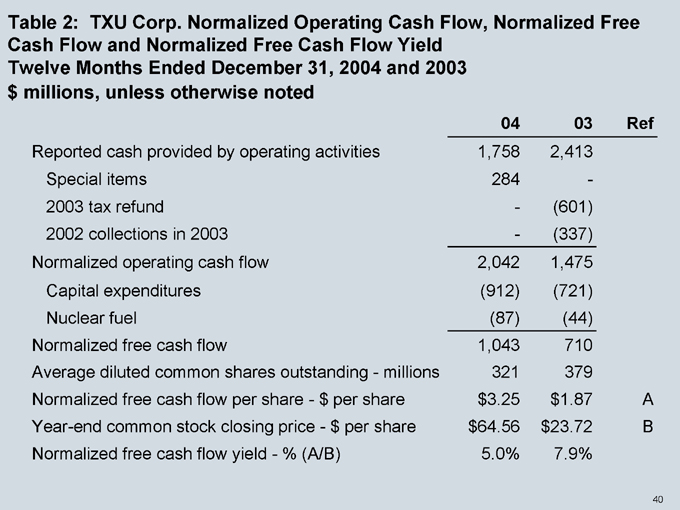

Table 2: TXU Corp. Normalized Operating Cash Flow, Normalized Free Cash Flow and Normalized Free Cash Flow Yield Twelve Months Ended December 31, 2004 and 2003 $millions, unless otherwise noted

04 03 Ref

Reported cash provided by operating activities 1,758 2,413

Special items 284 -

2003 tax refund - (601)

2002 collections in 2003 - (337)

Normalized operating cash flow 2,042 1,475

Capital expenditures (912) (721)

Nuclear fuel (87) (44)

Normalized free cash flow 1,043 710

Average diluted common shares outstanding—millions 321 379

Normalized free cash flow per share—$per share $ 3.25 $1.87 A

Year-end common stock closing price - $per share $ 64.56 $ 23.72 B

Normalized free cash flow yield - % (A/B) 5.0% 7.9%

40

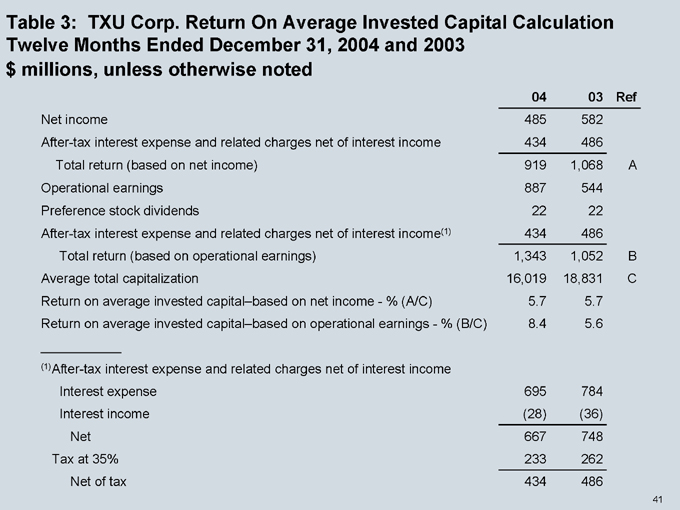

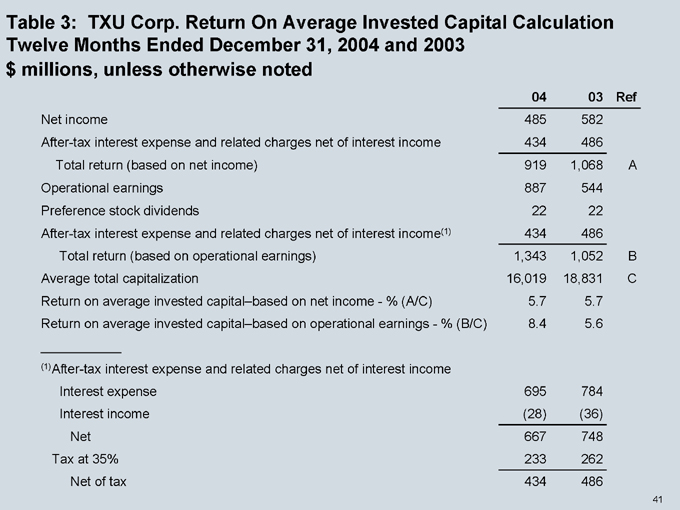

Table 3: TXU Corp. Return On Average Invested Capital Calculation Twelve Months Ended December 31, 2004 and 2003 $millions, unless otherwise noted

04 03 Ref

Net income 485 582

After-tax interest expense and related charges net of interest income 434 486

Total return (based on net income) 919 1,068 A

Operational earnings 887 544

Preference stock dividends 22 22

After-tax interest expense and related charges net of interest income(1) 434 486

Total return (based on operational earnings) 1,343 1,052 B

Average total capitalization 16,019 18,831 C

Return on average invested capital–based on net income - % (A/C) 5.7 5.7

Return on average invested capital–based on operational earnings - % (B/C) 8.4 5.6

(1)After-tax interest expense and related charges net of interest income

Interest expense 695 784

Interest income (28) (36)

Net 667 748

Tax at 35% 233 262

Net of tax 434 486

41

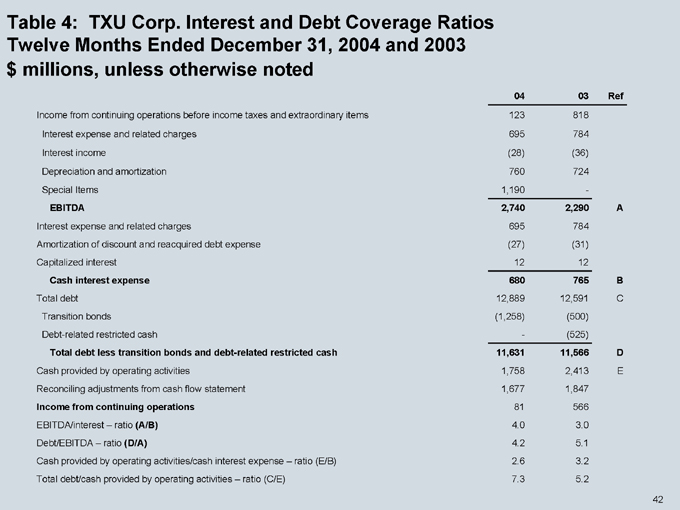

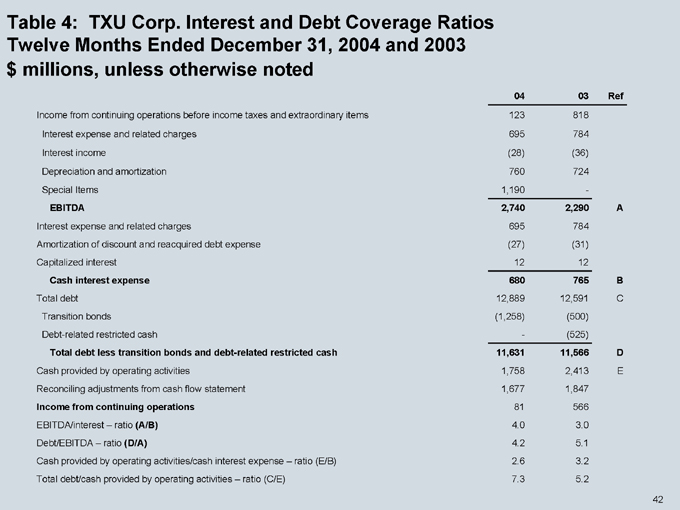

Table 4: TXU Corp. Interest and Debt Coverage Ratios Twelve Months Ended December 31, 2004 and 2003 $millions, unless otherwise noted

04 03 Ref

Income from continuing operations before income taxes and extraordinary items 123 818

Interest expense and related charges 695 784

Interest income (28) (36)

Depreciation and amortization 760 724

Special Items 1,190 -

EBITDA 2,740 2,290 A

Interest expense and related charges 695 784

Amortization of discount and reacquired debt expense (27) (31)

Capitalized interest 12 12

Cash interest expense 680 765 B

Total debt 12,889 12,591 C

Transition bonds (1,258) (500)

Debt-related restricted cash - (525)

Total debt less transition bonds and debt-related restricted cash 11,631 11,566 D

Cash provided by operating activities 1,758 2,413 E

Reconciling adjustments from cash flow statement 1,677 1,847

Income from continuing operations 81 566

EBITDA/interest – ratio (A/B) 4.0 3.0

Debt/EBITDA – ratio (D/A) 4.2 5.1

Cash provided by operating activities/cash interest expense – ratio (E/B) 2.6 3.2

Total debt/cash provided by operating activities – ratio (C/E) 7.3 5.2

42

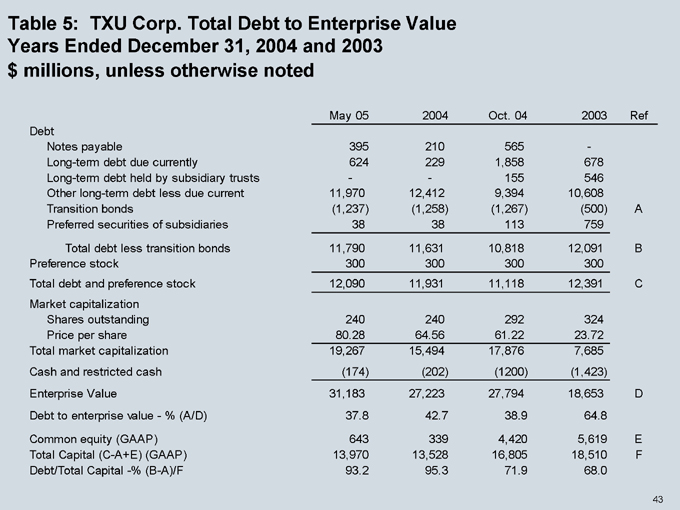

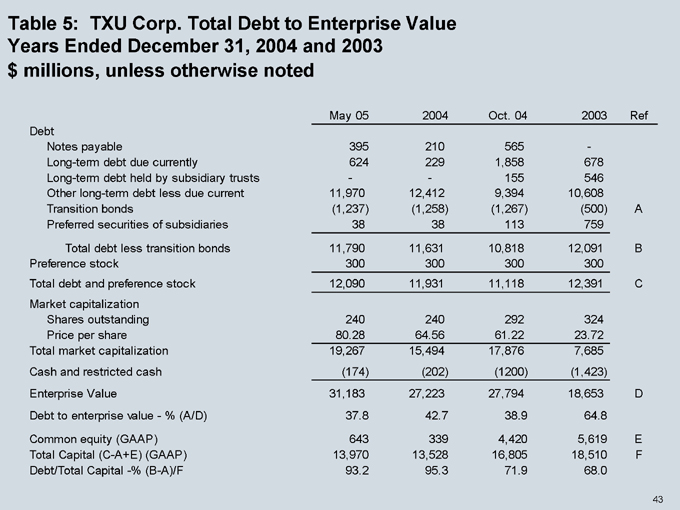

Table 5: TXU Corp. Total Debt to Enterprise Value Years Ended December 31, 2004 and 2003 $millions, unless otherwise noted

May 05 2004 Oct. 04 2003 Ref

Debt

Notes payable 395 210 565 -

Long-term debt due currently 624 229 1,858 678

Long-term debt held by subsidiary trusts - - 155 546

Other long-term debt less due current 11,970 12,412 9,394 10,608

Transition bonds (1,237) (1,258) (1,267) (500) A

Preferred securities of subsidiaries 38 38 113 759

Total debt less transition bonds 11,790 11,631 10,818 12,091 B

Preference stock 300 300 300 300

Total debt and preference stock 12,090 11,931 11,118 12,391 C

Market capitalization

Shares outstanding 240 240 292 324

Price per share 80.28 64.56 61.22 23.72

Total market capitalization 19,267 15,494 17,876 7,685

Cash and restricted cash (174) (202) (1200) (1,423)

Enterprise Value 31,183 27,223 27,794 18,653 D

Debt to enterprise value—% (A/D) 37.8 42.7 38.9 64.8

Common equity (GAAP) 643 339 4,420 5,619 E

Total Capital (C-A+E) (GAAP) 13,970 13,528 16,805 18,510 F

Debt/Total Capital -% (B-A)/F 93.2 95.3 71.9 68.0

43