UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-3618

BRIGHTHOUSE FUNDS TRUST II

(Exact name of registrant as specified in charter)

125 High Street, Suite 732

Boston, MA 02110

(Address of principal executive offices)(Zip code)

| | |

(Name and Address of Agent for Service) | | Copy to: |

| |

Kristi Slavin ------------------------------- c/o Brighthouse Investment Advisers, LLC 125 High Street, Suite 732 Boston, MA 02110 | | Brian D. McCabe, Esq. ------------------------------- Ropes and Gray LLP Prudential Tower 800 Boylston Street Boston, MA 02199 |

Registrant’s telephone number, including area code: (980) 949-5121

Date of fiscal year end: December 31

Date of reporting period: June 30, 2023

Item 1: Report to Shareholders.

| (a) | The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (the “Act”). |

Brighthouse Funds Trust II

Baillie Gifford International Stock Portfolio

Managed by Baillie Gifford Overseas Limited

Portfolio Manager Commentary*

PERFORMANCE

For the six months ended June 30, 2023, the Class A, B and E shares of the Baillie Gifford International Stock Portfolio returned 14.96%, 14.90%, and 14.90%, respectively. The Portfolio’s benchmark, the MSCI All Country World ex-U.S. Index¹, returned 9.47%.

MARKET ENVIRONMENT / CONDITIONS

The first six months of 2023 have been dominated by numerous headlines globally. European markets have recovered as fears of a recession abated amid falling inflation and a more positive outlook. Despite the ongoing war in Ukraine, energy prices have subsided and the recession that was thought to be inevitable in 2022 has not come to fruition. The fallout of Silicon Valley Bank demonstrated the fragility of the banking business model but did not spark widespread contagion in the sector. Elsewhere, market participants have been buoyed by a positive economic outlook for Japan as inflation has returned after decades of stagnation. Meanwhile, China’s recovery has stuttered following its reopening.

PORTFOLIO REVIEW / PERIOD END POSITIONING

The Portfolio outperformed its benchmark, the MSCI All Country World ex-U.S. Index, during the reporting period. Europe was the largest contributor to performance during the period. The Portfolio’s overweight towards Europe, coming from a number of high-quality industrials as well as disruptive companies such as Adyen (Netherlands) and Spotify (Sweden), aided performance. Elsewhere, Emerging Markets was the second highest contributing region while Information Technology was the highest contributing sector, followed by Industrials.

Looking at individual contributors to performance, MercadoLibre (Brazil) and Ryanair (Ireland) featured among the top contributors. MercadoLibre, the leading ecommerce and fintech in Latin America, had a strong start to the year. The company achieved record earnings before interest and tax in the first quarter and beat consensus comfortably. Market share continued to grow, with active users surpassing 100 million. In the first quarter their main competitor, Americanas, filed for bankruptcy, which should help the business continue to attract market share and is evidence of their competitive advantage in our view.

Elsewhere, Ryanair, Europe’s largest airline, has continued to go from strength to strength. The company’s share price has continued to recover as air travel has rebounded. Ryanair recently announced plans to double passenger numbers over the next decade and secured a deal with Boeing for additional planes. Ryanair is now a much larger business than pre-pandemic, having grown significantly in its 7 largest markets. In the long term, we believe the company has the ability to continue to take market share from less agile competitors.

The detractors to performance included Hong Kong listed Asian insurer AIA and FinecoBank (Italy). AIA, the Pan-Asian insurance firm, detracted from performance over the period. Recent growth has been slow, and shares have been weak following on from full year 2022 results. New business value declined eight percent year-over-year but grew six percent in the second half. As one might expect, lockdowns were the big reasons for declines, and the business has been affected by the scare Financials had towards the end of the year. The business has a strong balance sheet which underpins the investment case. We believe AIA should benefit from reopening in China in the mid-term and its long-term runway to growth is predicated on the rising tide of wealth within the Asian middle classes.

Finecobank, the leading Italian financial platform, has been negatively impacted by the decline in banking stocks in Europe due to the failure of Silicon Valley Bank in the U.S. In the fourth quarter, the revenue stood at €207.6 million, up 18% year on year, beating estimates by 5%. We continue to remain confident in the company’s fundamentals and in its agile business, which we believe can automate and innovate at a much faster rate than its competition.

As of June 30, 2023, the Portfolio had significant overweight positions in Industrials and Consumer Discretionary, while Health Care and Energy were the largest underweights. These positions are purely the result of our bottom-up stock selection process.

Jenny Davis

Tom Walsh

Steve Vaughan

Portfolio Managers

Baillie Gifford Overseas Limited

* This commentary may include statements that constitute “forward-looking statements” under the U.S. securities laws. Forward-looking statements include, among other things, projections, estimates, and information about possible or future results related to the Portfolio, market or regulatory developments. The views expressed above are not guarantees of future performance or economic results and involve certain risks, uncertainties and assumptions that could cause actual outcomes and results to differ materially from the views expressed herein. The views expressed above are subject to change at any time based upon economic, market, or other conditions and the subadvisory firm undertakes no obligation to update the views expressed herein. Any discussions of specific securities should not be considered a recommendation to buy or sell those securities. The views expressed above (including any forward-looking statement) may not be relied upon as investment advice or as an indication of the Portfolio’s trading intent. Information about the Portfolio’s holdings, asset allocation or country diversification is historical and is not an indication of future Portfolio composition, which may vary. Direct investment in any index is not possible. The performance of any index mentioned in this commentary has not been adjusted for ongoing management, distribution and operating expenses, and sales charges applicable to mutual fund investments. In addition, the returns do not reflect additional fees charged by separate accounts or variable insurance contracts that an investor in the Portfolio may pay. If these additional fees were reflected, performance would have been lower.

1 The MSCI All Country World ex-U.S. Index is an unmanaged free float-adjusted market capitalization index that is designed to measure equity market performance in the global developed and emerging markets, excluding the U.S. The Index returns shown above were calculated with net dividends: they reflect the reinvestment of dividends after the deduction of the maximum possible withholding taxes.

BHFTII-1

Brighthouse Funds Trust II

Baillie Gifford International Stock Portfolio

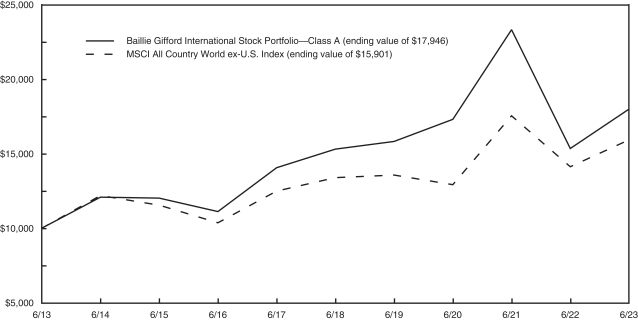

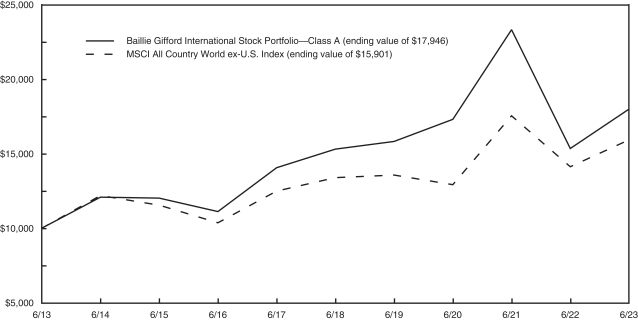

A $10,000 INVESTMENT COMPARED TO THE MSCI ALL COUNTRY WORLD EX-U.S. INDEX

SIX MONTH RETURN & AVERAGE ANNUAL RETURNS (%) AS OF JUNE 30, 2023

| | | | | | | | | | | | | | | | |

| | | | | |

| | | 6 Month | | | 1 Year | | | 5 Year | | | 10 Year | |

| Baillie Gifford International Stock Portfolio | | | | | | | | | | | | | | | | |

Class A | | | 14.96 | | | | 17.19 | | | | 3.27 | | | | 6.02 | |

Class B | | | 14.90 | | | | 17.04 | | | | 3.02 | | | | 5.75 | |

Class E | | | 14.90 | | | | 17.02 | | | | 3.12 | | | | 5.87 | |

| MSCI All Country World ex-U.S. Index | | | 9.47 | | | | 12.72 | | | | 3.52 | | | | 4.75 | |

Portfolio performance is calculated including reinvestment of all income and capital gain distributions. Performance numbers are net of all Portfolio expenses but do not include any insurance, sales, separate account or administrative charges of variable annuity or life insurance contracts or any additional expenses that participants may bear relating to the operations of their plans. If these charges were included, the returns would be lower. The performance of any index referenced above has not been adjusted for ongoing management, distribution and operating expenses, and sales charges applicable to mutual fund investments. Direct investment in any index is not possible. The performance of Class A shares, as set forth in the line graph above, will differ from that of other classes because of the difference in expenses paid by policyholders investing in the different share classes.

This information represents past performance and is not indicative of future results. Investment return and principal value may fluctuate so that shares, upon redemption, may be worth more or less than the original cost.

PORTFOLIO COMPOSITION AS OF JUNE 30, 2023

Top Holdings

| | | | |

| | | % of

Net Assets | |

| MercadoLibre, Inc. | | | 4.2 | |

| Taiwan Semiconductor Manufacturing Co., Ltd. | | | 3.3 | |

| AIA Group, Ltd. | | | 3.0 | |

| Ryanair Holdings plc (ADR) | | | 2.9 | |

| Samsung Electronics Co., Ltd. | | | 2.7 | |

| SAP SE | | | 2.6 | |

| CRH plc | | | 2.5 | |

| Cie Financiere Richemont S.A.- Class A | | | 2.4 | |

| Atlas Copco AB- B Shares | | | 2.2 | |

| Nestle S.A. | | | 2.1 | |

Top Countries

| | | | |

| | | % of

Net Assets | |

| Japan | | | 14.5 | |

| Germany | | | 8.5 | |

| France | | | 7.8 | |

| Ireland | | | 7.1 | |

| Netherlands | | | 6.8 | |

| China | | | 5.6 | |

| Switzerland | | | 5.0 | |

| Canada | | | 4.5 | |

| Brazil | | | 4.2 | |

| Sweden | | | 4.2 | |

BHFTII-2

Brighthouse Funds Trust II

Baillie Gifford International Stock Portfolio

Understanding Your Portfolio’s Expenses (Unaudited)

Shareholder Expense Example

As a shareholder of the Portfolio, you incur ongoing costs, including management fees; distribution and service (12b-1) fees; and other Portfolio expenses. This example is intended to help you understand your ongoing costs (in dollars) (referred to as “expenses”) of investing in the Portfolio and compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period, January 1, 2023 through June 30, 2023.

Actual Expenses

The first line for each share class of the Portfolio in the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested in the particular share class of the Portfolio, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class of the Portfolio in the table below provides information about hypothetical account values and hypothetical expenses based on the Portfolio’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Portfolio’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Portfolio and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any fees or charges of your variable insurance product or any additional expenses that participants in certain eligible qualified plans may bear relating to the operations of their plan. Therefore, the second line for each share class in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these other costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | |

Baillie Gifford International Stock Portfolio | | | | Annualized

Expense

Ratio | | | Beginning

Account Value

January 1,

2023 | | | Ending

Account Value

June 30,

2023 | | | Expenses Paid

During Period**

January 1, 2023

to

June 30,

2023 | |

Class A (a) | | Actual | | | 0.74 | % | | $ | 1,000.00 | | | $ | 1,149.60 | | | $ | 3.94 | |

| | Hypothetical* | | | 0.74 | % | | $ | 1,000.00 | | | $ | 1,021.13 | | | $ | 3.71 | |

| | | | | |

Class B (a) | | Actual | | | 0.99 | % | | $ | 1,000.00 | | | $ | 1,149.00 | | | $ | 5.28 | |

| | Hypothetical* | | | 0.99 | % | | $ | 1,000.00 | | | $ | 1,019.89 | | | $ | 4.96 | |

| | | | | |

Class E (a) | | Actual | | | 0.89 | % | | $ | 1,000.00 | | | $ | 1,149.00 | | | $ | 4.74 | |

| | Hypothetical* | | | 0.89 | % | | $ | 1,000.00 | | | $ | 1,020.38 | | | $ | 4.46 | |

| * | Hypothetical assumes a rate of return of 5% per year before expenses. |

| ** | Expenses paid are equal to the Portfolio’s annualized expense ratio for the most recent six month period, as shown above, multiplied by the average account value over the period, multiplied by the number of days (181 days) in the most recent fiscal half-year, divided by 365 (to reflect the one-half year period). |

| (a) | The annualized expense ratio shown reflects the impact of the management fee waiver as described in Note 5 of the Notes to Financial Statements. |

BHFTII-3

Brighthouse Funds Trust II

Baillie Gifford International Stock Portfolio

Schedule of Investments as of June 30, 2023 (Unaudited)

Common Stocks—98.5% of Net Assets

| | | | | | | | |

| Security Description | | Shares | | | Value | |

|

| Brazil—4.2% | |

MercadoLibre, Inc. (a) | | | 54,134 | | | $ | 64,127,137 | |

| | | | | | | | |

|

| Canada—4.5% | |

AbCellera Biologics, Inc. (a) (b) | | | 545,830 | | | | 3,526,062 | |

Constellation Software, Inc. | | | 10,541 | | | | 21,839,981 | |

Lumine Group, Inc. (a) | | | 560,350 | | | | 7,685,646 | |

Shopify, Inc. - Class A (a) | | | 270,882 | | | | 17,498,977 | |

Topicus.com, Inc. (a) | | | 221,778 | | | | 18,189,228 | |

| | | | | | | | |

| | | | | | | 68,739,894 | |

| | | | | | | | |

|

| China—5.6% | |

Alibaba Group Holding, Ltd. (a) | | | 1,028,572 | | | | 10,697,217 | |

Futu Holdings, Ltd. (ADR) (a) (b) | | | 107,345 | | | | 4,265,890 | |

Meituan - Class B (a) | | | 594,170 | | | | 9,339,211 | |

Ping An Insurance Group Co. of China, Ltd. - Class H | | | 1,863,500 | | | | 11,939,795 | |

Prosus NV (a) | | | 164,539 | | | | 12,040,638 | |

Tencent Holdings, Ltd. | | | 469,300 | | | | 19,974,594 | |

Tencent Music Entertainment Group (ADR) (a) | | | 1,839,560 | | | | 13,575,953 | |

Wuxi Biologics Cayman, Inc. (a) | | | 708,000 | | | | 3,411,474 | |

| | | | | | | | |

| | | | | | | 85,244,772 | |

| | | | | | | | |

|

| Denmark—4.1% | |

Ambu A/S - Class B | | | 439,317 | | | | 7,186,163 | |

Chr Hansen Holding A/S | | | 135,456 | | | | 9,421,496 | |

DSV A/S | | | 136,777 | | | | 28,784,995 | |

Novozymes A/S - B Shares | | | 348,440 | | | | 16,228,307 | |

| | | | | | | | |

| | | | | | | 61,620,961 | |

| | | | | | | | |

|

| Finland—1.3% | |

Kone Oyj - Class B | | | 366,695 | | | | 19,154,720 | |

| | | | | | | | |

|

| France—7.8% | |

Danone S.A. | | | 389,295 | | | | 23,854,765 | |

Dassault Systemes SE | | | 558,283 | | | | 24,757,676 | |

Edenred | | | 440,918 | | | | 29,524,282 | |

Kering S.A. | | | 38,058 | | | | 21,077,957 | |

Nexans S.A. | | | 86,795 | | | | 7,532,018 | |

Sartorius Stedim Biotech | | | 44,108 | | | | 11,022,442 | |

| | | | | | | | |

| | | | | | | 117,769,140 | |

| | | | | | | | |

|

| Germany—8.5% | |

BioNTech SE (ADR) (a) | | | 84,778 | | | | 9,150,090 | |

Deutsche Boerse AG | | | 154,626 | | | | 28,557,003 | |

Rational AG | | | 32,527 | | | | 23,533,867 | |

SAP SE | | | 283,940 | | | | 38,770,285 | |

Scout24 SE | | | 467,858 | | | | 29,657,475 | |

| | | | | | | | |

| | | | | | | 129,668,720 | |

| | | | | | | | |

|

| Hong Kong—3.8% | |

AIA Group, Ltd. | | | 4,423,800 | | | | 45,136,842 | |

Hong Kong Exchanges & Clearing, Ltd. | | | 350,300 | | | | 13,321,572 | |

| | | | | | | | |

| | | | | | | 58,458,414 | |

| | | | | | | | |

|

| India—2.9% | |

Housing Development Finance Corp., Ltd. | | | 904,246 | | | | 31,136,678 | |

ICICI Lombard General Insurance Co., Ltd. | | | 793,980 | | | | 13,019,247 | |

| | | | | | | | |

| | | | | | | 44,155,925 | |

| | | | | | | | |

|

| Ireland—7.1% | |

CRH plc | | | 682,534 | | | | 37,816,068 | |

Kingspan Group plc | | | 382,449 | | | | 25,462,932 | |

Ryanair Holdings plc (ADR) (a) | | | 395,602 | | | | 43,753,581 | |

| | | | | | | | |

| | | | | | | 107,032,581 | |

| | | | | | | | |

|

| Italy—1.7% | |

FinecoBank Banca Fineco S.p.A. | | | 1,333,522 | | | | 17,987,764 | |

Technoprobe S.p.A. (a) (b) | | | 1,042,634 | | | | 8,244,351 | |

| | | | | | | | |

| | | | | | | 26,232,115 | |

| | | | | | | | |

|

| Japan—14.5% | |

Denso Corp. | | | 380,400 | | | | 25,645,176 | |

FANUC Corp. | | | 661,800 | | | | 23,269,147 | |

Japan Exchange Group, Inc. | | | 902,000 | | | | 15,779,449 | |

Keyence Corp. | | | 35,300 | | | | 16,694,012 | |

MonotaRO Co., Ltd. | | | 1,069,300 | | | | 13,625,924 | |

Nidec Corp. | | | 216,900 | | | | 11,922,113 | |

Nihon M&A Center Holdings, Inc. | | | 1,208,300 | | | | 9,278,520 | |

Nintendo Co., Ltd. | | | 322,800 | | | | 14,683,458 | |

Recruit Holdings Co., Ltd. | | | 192,200 | | | | 6,077,886 | |

Shimano, Inc. (b) | | | 94,900 | | | | 15,885,002 | |

Shiseido Co., Ltd. | | | 432,000 | | | | 19,572,257 | |

SMC Corp. | | | 37,000 | | | | 20,564,614 | |

Sony Group Corp. | | | 302,500 | | | | 27,133,535 | |

| | | | | | | | |

| | | | | | | 220,131,093 | |

| | | | | | | | |

|

| Netherlands—6.8% | |

Adyen NV (a) | | | 18,324 | | | | 31,748,428 | |

ASML Holding NV | | | 41,428 | | | | 29,988,526 | |

EXOR NV (a) | | | 174,939 | | | | 15,631,333 | |

IMCD NV | | | 178,614 | | | | 25,691,734 | |

| | | | | | | | |

| | | | | | | 103,060,021 | |

| | | | | | | | |

|

| Norway—0.6% | |

Aker Carbon Capture ASA (a) | | | 6,509,268 | | | | 8,537,317 | |

| | | | | | | | |

|

| Panama—0.9% | |

Copa Holdings S.A. - Class A (b) | | | 119,529 | | | | 13,217,517 | |

| | | | | | | | |

|

| Russia—0.0% | |

Magnit PJSC (a) (c) (d) | | | 124,832 | | | | 0 | |

Magnit PJSC (GDR) (a) (c) (d) | | | 3 | | | | 0 | |

MMC Norilsk Nickel PJSC (a) (c) (d) | | | 39,210 | | | | 0 | |

MMC Norilsk Nickel PJSC (ADR) (a) (c) (d) | | | 7 | | | | 0 | |

| | | | | | | | |

| | | | | | | 0 | |

| | | | | | | | |

|

| South Africa—1.2% | |

Discovery, Ltd. (a) | | | 2,295,045 | | | | 17,734,352 | |

| | | | | | | | |

See accompanying notes to financial statements.

BHFTII-4

Brighthouse Funds Trust II

Baillie Gifford International Stock Portfolio

Schedule of Investments as of June 30, 2023 (Unaudited)

Common Stocks—(Continued)

| | | | | | | | |

| Security Description | | Shares/

Principal

Amount* | | | Value | |

|

| South Korea—3.6% | |

Coupang, Inc. (a) | | | 758,507 | | | $ | 13,198,022 | |

Samsung Electronics Co., Ltd. | | | 741,004 | | | | 40,841,501 | |

| | | | | | | | |

| | | | | | | 54,039,523 | |

| | | | | | | | |

|

| Spain—1.8% | |

Amadeus IT Group S.A. (a) | | | 360,151 | | | | 27,458,363 | |

| | | | | | | | |

|

| Sweden—4.2% | |

Atlas Copco AB - B Shares | | | 2,675,727 | | | | 33,338,392 | |

Epiroc AB - B Shares | | | 1,353,008 | | | | 21,883,374 | |

MIPS AB (b) | | | 166,328 | | | | 8,257,907 | |

| | | | | | | | |

| | | | | | | 63,479,673 | |

| | | | | | | | |

|

| Switzerland—5.0% | |

Cie Financiere Richemont S.A. - Class A | | | 213,176 | | | | 36,170,351 | |

Nestle S.A. | | | 270,267 | | | | 32,519,796 | |

Wizz Air Holdings plc (a) | | | 194,084 | | | | 6,751,094 | |

| | | | | | | | |

| | | | | | | 75,441,241 | |

| | | | | | | | |

|

| Taiwan—4.0% | |

Sea, Ltd. (ADR) (a) (b) | | | 181,235 | | | | 10,518,879 | |

Taiwan Semiconductor Manufacturing Co., Ltd. | | | 2,686,000 | | | | 50,054,491 | |

| | | | | | | | |

| | | | | | | 60,573,370 | |

| | | | | | | | |

|

| United Kingdom—3.7% | |

Experian plc | | | 597,113 | | | | 22,944,395 | |

Oxford Nanopore Technologies plc (a) | | | 2,100,439 | | | | 5,689,588 | |

Rio Tinto plc | | | 430,512 | | | | 27,350,215 | |

| | | | | | | | |

| | | | | | | 55,984,198 | |

| | | | | | | | |

|

| United States—0.7% | |

Spotify Technology S.A. (a) | | | 64,713 | | | | 10,389,672 | |

| | | | | | | | |

Total Common Stocks

(Cost $1,303,434,901) | | | | | | | 1,492,250,719 | |

| | | | | | | | |

|

| Short-Term Investment—1.4% | |

|

| Repurchase Agreement—1.4% | |

Fixed Income Clearing Corp.

Repurchase Agreement dated 06/30/23 at 2.300%, due on 07/03/23 with a maturity value of $21,232,649; collateralized by U.S. Treasury Note at 4.125%, maturing 06/15/26, with a market value of $21,653,187. | | | 21,228,581 | | | | 21,228,581 | |

| | | | | | | | |

Total Short-Term Investments

(Cost $21,228,581) | | | | | | | 21,228,581 | |

| | | | | | | | |

| Securities Lending Reinvestments (e)—1.6% | |

| Security Description | | Shares/

Principal

Amount* | | | Value | |

|

| Repurchase Agreements—0.3% | |

BofA Securities, Inc.

Repurchase Agreement dated 06/30/23 at 5.050%, due on 07/03/23 with a maturity value of $3,202,859; collateralized by U.S. Treasury Obligations with rates ranging from 1.375% - 2.000%, maturity dates ranging from 11/15/41 - 02/15/51, and an aggregate market value of $3,265,543. | | | 3,201,512 | | | | 3,201,512 | |

National Bank Financial, Inc.

Repurchase Agreement dated 06/30/23 at 5.070%, due on 07/03/23 with a maturity value of $300,127; collateralized by U.S. Treasury Obligations with rates ranging from 0.125% - 3.875%, maturity dates ranging from 04/30/26 - 07/15/30, and an aggregate market value of $306,768. | | | 300,000 | | | | 300,000 | |

Societe Generale

Repurchase Agreement dated 06/30/23 at 5.160%, due on 07/03/23 with a maturity value of $1,000,430; collateralized by various Common Stock with an aggregate market value of $1,113,737. | | | 1,000,000 | | | | 1,000,000 | |

Repurchase Agreement dated 06/30/23 at 5.170%, due on 07/03/23 with a maturity value of $1,000,431; collateralized by various Common Stock with an aggregate market value of $1,112,361. | | | 1,000,000 | | | | 1,000,000 | |

| | | | | | | | |

| | | | | | | 5,501,512 | |

| | | | | | | | |

|

| Mutual Funds—1.3% | |

BlackRock Liquidity Funds FedFund, Institutional Shares 4.990% (f) | | | 2,500 | | | | 2,500 | |

Dreyfus Treasury Obligations Cash Management Fund, Institutional Class 5.000% (f) | | | 1,000,000 | | | | 1,000,000 | |

Fidelity Investments Money Market Government Portfolio, Class I 4.990% (f) | | | 4,000,000 | | | | 4,000,000 | |

Goldman Sachs Financial Square Government Fund, Institutional Shares 5.010% (f) | | | 4,000,000 | | | | 4,000,000 | |

Morgan Stanley Liquidity Funds Government Portfolio, Institutional Shares 5.030% (f) | | | 500,000 | | | | 500,000 | |

RBC U.S. Government Money Market Fund, Institutional Share 4.990% (f) | | | 1,000,000 | | | | 1,000,000 | |

SSGA Institutional U.S. Government Money Market Fund, Premier Class 5.030% (f) | | | 4,000,000 | | | | 4,000,000 | |

STIT-Government & Agency Portfolio, Institutional Class 5.050% (f) | | | 4,000,000 | | | | 4,000,000 | |

Western Asset Institutional Government Reserves Fund, Institutional Class 5.000% (f) | | | 1,000,000 | | | | 1,000,000 | |

| | | | | | | | |

| | | | | | | 19,502,500 | |

| | | | | | | | |

Total Securities Lending Reinvestments

(Cost $25,004,012) | | | | | | | 25,004,012 | |

| | | | | | | | |

Total Investments—101.5%

(Cost $1,349,667,494) | | | | | | | 1,538,483,312 | |

Other assets and liabilities (net)—(1.5)% | | | | | | | (23,265,673 | ) |

| | | | | | | | |

| Net Assets—100.0% | | | | | | $ | 1,515,217,639 | |

| | | | | | | | |

See accompanying notes to financial statements.

BHFTII-5

Brighthouse Funds Trust II

Baillie Gifford International Stock Portfolio

Schedule of Investments as of June 30, 2023 (Unaudited)

| | | | |

| * | | Principal amount stated in U.S. dollars unless otherwise noted. |

| (a) | | Non-income producing security. |

| (b) | | All or a portion of the security was held on loan. As of June 30, 2023, the market value of securities loaned was $27,605,181 and the collateral received consisted of cash in the amount of $25,004,012 and non-cash collateral with a value of $3,387,076. The cash collateral investments are disclosed in the Schedule of Investments and categorized as Securities Lending Reinvestments. The non-cash collateral received consists of U.S. government securities that are held in safe-keeping by the lending agent, or a third- party custodian, and cannot be sold or repledged by the Portfolio. As such, this collateral is excluded from the Statement of Assets and Liabilities. |

| (c) | | Security was valued in good faith under procedures subject to oversight by the Board of Trustees. As of June 30, 2023, these securities represent less than 0.05% of net assets. |

| (d) | | Significant unobservable inputs were used in the valuation of this portfolio security; i.e. Level 3. |

| (e) | | Represents investment of cash collateral received from securities on loan as of June 30, 2023. |

| (f) | | The rate shown represents the annualized seven-day yield as of June 30, 2023. |

| | | | |

Ten Largest Industries as of

June 30, 2023 (Unaudited) | | % of

Net Assets | |

Machinery | | | 9.4 | |

Software | | | 7.3 | |

Financial Services | | | 7.1 | |

Broadline Retail | | | 6.6 | |

Semiconductors & Semiconductor Equipment | | | 5.8 | |

Insurance | | | 5.8 | |

Passenger Airlines | | | 4.2 | |

Capital Markets | | | 4.1 | |

Textiles, Apparel & Luxury Goods | | | 3.8 | |

Food Products | | | 3.7 | |

Glossary of Abbreviations

Other Abbreviations

| | | | |

| (ADR)— | | American Depositary Receipt |

| (GDR)— | | Global Depositary Receipt |

See accompanying notes to financial statements.

BHFTII-6

Brighthouse Funds Trust II

Baillie Gifford International Stock Portfolio

Schedule of Investments as of June 30, 2023 (Unaudited)

Fair Value Hierarchy

Accounting principles generally accepted in the United States of America (“GAAP”) define fair market value as the price that the Portfolio would receive to sell an asset or pay to transfer a liability in an orderly transaction between market participants at the measurement date. It establishes a fair value hierarchy that prioritizes inputs to valuation methods and requires disclosure of the fair value hierarchy, separately for each major category of assets and liabilities, that segregates fair value measurements into three levels. Levels 1, 2 and 3 of the fair value hierarchy are defined as follows:

Level 1 - unadjusted quoted prices in active markets for identical investments

Level 2 - other significant observable inputs (including, but not limited to, quoted prices for similar assets or liabilities in markets that are either active or inactive; inputs other than quoted prices that are observable such as interest rates, yield curves, volatilities, prepayment speeds, loss severities, credit risks, default rates, or other market corroborated inputs)

Level 3 - significant unobservable inputs based on the best information available in the circumstances, to the extent observable inputs are unavailable (including the Portfolio’s own assumptions used in determining the fair value of investments and derivative financial instruments)

The inputs or methodologies used for valuing investments are not necessarily an indication of the risk associated with investing in them. Changes to the inputs or methodologies used may result in transfers between levels. A reconciliation of Level 3 securities, if any, will be disclosed following the fair value hierarchy table. For more information about the Portfolio’s policy regarding the valuation of investments, please refer to the Notes to Financial Statements.

The following table summarizes the fair value hierarchy of the Portfolio’s investments as of June 30, 2023:

| | | | | | | | | | | | | | | | |

| Description | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stocks | |

Brazil | | $ | 64,127,137 | | | $ | — | | | $ | — | | | $ | 64,127,137 | |

Canada | | | 68,739,894 | | | | — | | | | — | | | | 68,739,894 | |

China | | | 17,841,843 | | | | 67,402,929 | | | | — | | | | 85,244,772 | |

Denmark | | | — | | | | 61,620,961 | | | | — | | | | 61,620,961 | |

Finland | | | — | | | | 19,154,720 | | | | — | | | | 19,154,720 | |

France | | | — | | | | 117,769,140 | | | | — | | | | 117,769,140 | |

Germany | | | 9,150,090 | | | | 120,518,630 | | | | — | | | | 129,668,720 | |

Hong Kong | | | — | | | | 58,458,414 | | | | — | | | | 58,458,414 | |

India | | | — | | | | 44,155,925 | | | | — | | | | 44,155,925 | |

Ireland | | | 43,753,581 | | | | 63,279,000 | | | | — | | | | 107,032,581 | |

Italy | | | — | | | | 26,232,115 | | | | — | | | | 26,232,115 | |

Japan | | | 6,077,886 | | | | 214,053,207 | | | | — | | | | 220,131,093 | |

Netherlands | | | — | | | | 103,060,021 | | | | — | | | | 103,060,021 | |

Norway | | | — | | | | 8,537,317 | | | | — | | | | 8,537,317 | |

Panama | | | 13,217,517 | | | | — | | | | — | | | | 13,217,517 | |

Russia | | | — | | | | — | | | | 0 | | | | 0 | |

South Africa | | | — | | | | 17,734,352 | | | | — | | | | 17,734,352 | |

South Korea | | | 13,198,022 | | | | 40,841,501 | | | | — | | | | 54,039,523 | |

Spain | | | — | | | | 27,458,363 | | | | — | | | | 27,458,363 | |

Sweden | | | — | | | | 63,479,673 | | | | — | | | | 63,479,673 | |

Switzerland | | | — | | | | 75,441,241 | | | | — | | | | 75,441,241 | |

Taiwan | | | 10,518,879 | | | | 50,054,491 | | | | — | | | | 60,573,370 | |

United Kingdom | | | — | | | | 55,984,198 | | | | — | | | | 55,984,198 | |

United States | | | 10,389,672 | | | | — | | | | — | | | | 10,389,672 | |

Total Common Stocks | | | 257,014,521 | | | | 1,235,236,198 | | | | 0 | | | | 1,492,250,719 | |

Total Short-Term Investment* | | | — | | | | 21,228,581 | | | | — | | | | 21,228,581 | |

| Securities Lending Reinvestments | |

Repurchase Agreements | | | — | | | | 5,501,512 | | | | — | | | | 5,501,512 | |

Mutual Funds | | | 19,502,500 | | | | — | | | | — | | | | 19,502,500 | |

Total Securities Lending Reinvestments | | | 19,502,500 | | | | 5,501,512 | | | | — | | | | 25,004,012 | |

Total Investments | | | 276,517,021 | | | | 1,261,966,291 | | | $ | 0 | | | $ | 1,538,483,312 | |

| | | | | | | | | | | | | | | | | |

Collateral for Securities Loaned (Liability) | | $ | — | | | $ | (25,004,012 | ) | | $ | — | | | $ | (25,004,012 | ) |

| | | | |

| * | | See Schedule of Investments for additional detailed categorizations. |

Level 3 investments at the beginning and/or end of the period in relation to net assets were not significant and accordingly, a reconciliation of Level 3 assets for the six months ended June 30, 2023 is not presented.

See accompanying notes to financial statements.

BHFTII-7

Brighthouse Funds Trust II

Baillie Gifford International Stock Portfolio

Statement of Assets and Liabilities

June 30, 2023 (Unaudited)

| | | | |

Assets | | | | |

Investments at value (a) (b) | | $ | 1,538,483,312 | |

Cash denominated in foreign currencies (c) | | | 337,887 | |

Receivable for: | | | | |

Investments sold | | | 7,863,304 | |

Fund shares sold | | | 754,766 | |

Dividends and interest | | | 3,025,968 | |

Prepaid expenses | | | 12,309 | |

| | | | |

Total Assets | | | 1,550,477,546 | |

Liabilities | | | | |

Collateral for securities loaned | | | 25,004,012 | |

Payables for: | | | | |

Investments purchased | | | 8,005,246 | |

Fund shares redeemed | | | 67,073 | |

Foreign taxes | | | 794,171 | |

Accrued Expenses: | | | | |

Management fees | | | 851,425 | |

Distribution and service fees | | | 52,254 | |

Deferred trustees’ fees | | | 177,625 | |

Other expenses | | | 308,101 | |

| | | | |

Total Liabilities | | | 35,259,907 | |

| | | | |

Net Assets | | $ | 1,515,217,639 | |

| | | | |

Net Assets Consist of: | | | | |

Paid in surplus | | $ | 1,269,769,415 | |

Distributable earnings (Accumulated losses) (d) | | | 245,448,224 | |

| | | | |

Net Assets | | $ | 1,515,217,639 | |

| | | | |

Net Assets | | | | |

Class A | | $ | 1,255,540,527 | |

Class B | | | 246,479,360 | |

Class E | | | 13,197,752 | |

Capital Shares Outstanding* | | | | |

Class A | | | 123,718,409 | |

Class B | | | 24,807,294 | |

Class E | | | 1,318,338 | |

Net Asset Value, Offering Price and Redemption Price Per Share | | | | |

Class A | | $ | 10.15 | |

Class B | | | 9.94 | |

Class E | | | 10.01 | |

| | | | |

| * | | The Portfolio is authorized to issue an unlimited number of shares. |

| (a) | | Identified cost of investments was $1,349,667,494. |

| (b) | | Includes securities loaned at value of $27,605,181. |

| (c) | | Identified cost of cash denominated in foreign currencies was $336,627. |

| (d) | | Includes foreign capital gains tax of $794,171. |

Statement of Operations

Six Months Ended June 30, 2023 (Unaudited)

| | | | |

Investment Income | | | | |

Dividends (a) | | $ | 14,428,584 | |

Interest | | | 171,835 | |

Securities lending income | | | 102,873 | |

| | | | |

Total investment income | | | 14,703,292 | |

Expenses | | | | |

Management fees | | | 6,173,617 | |

Administration fees | | | 35,549 | |

Custodian and accounting fees | | | 205,591 | |

Distribution and service fees—Class B | | | 308,969 | |

Distribution and service fees—Class E | | | 9,833 | |

Audit and tax services | | | 26,080 | |

Legal | | | 21,516 | |

Trustees’ fees and expenses | | | 17,766 | |

Shareholder reporting | | | 28,998 | |

Insurance | | | 6,759 | |

Miscellaneous | | | 59,250 | |

| | | | |

Total expenses | | | 6,893,928 | |

Less management fee waiver | | | (909,915 | ) |

| | | | |

Net expenses | | | 5,984,013 | |

| | | | |

Net Investment Income | | | 8,719,279 | |

| | | | |

Net Realized and Unrealized Gain (Loss) | | | | |

| Net realized gain (loss) on: | | | | |

Investments (b) | | | 63,398,486 | |

Foreign currency transactions | | | (108,426 | ) |

| | | | |

Net realized gain (loss) | | | 63,290,060 | |

| | | | |

| Net change in unrealized appreciation (depreciation) on: | | | | |

Investments (c) | | | 146,910,599 | |

Foreign currency transactions | | | 63,105 | |

| | | | |

Net change in unrealized appreciation (depreciation) | | | 146,973,704 | |

| | | | |

Net realized and unrealized gain (loss) | | | 210,263,764 | |

| | | | |

Net Increase (Decrease) in Net Assets From Operations | | $ | 218,983,043 | |

| | | | |

| | | | |

| (a) | | Net of foreign withholding taxes of $1,955,398. |

| (b) | | Net of foreign capital gains tax of $353,866. |

| (c) | | Includes change in foreign capital gains tax of $44,582. |

See accompanying notes to financial statements.

BHFTII-8

Brighthouse Funds Trust II

Baillie Gifford International Stock Portfolio

Statements of Changes in Net Assets

| | | | | | | | |

| | | Six Months Ended

June 30,

2023

(Unaudited) | | | Year Ended

December 31,

2022 | |

Increase (Decrease) in Net Assets: | | | | | | | | |

From Operations | | | | | | | | |

Net investment income (loss) | | $ | 8,719,279 | | | $ | 14,049,843 | |

Net realized gain (loss) | | | 63,290,060 | | | | (7,159,041 | ) |

Net change in unrealized appreciation (depreciation) | | | 146,973,704 | | | | (566,852,538 | ) |

| | | | | | | | |

Increase (decrease) in net assets from operations | | | 218,983,043 | | | | (559,961,736 | ) |

| | | | | | | | |

From Distributions to Shareholders | | | | | | | | |

Class A | | | (15,780,357 | ) | | | (134,239,803 | ) |

Class B | | | (2,542,855 | ) | | | (26,054,352 | ) |

Class E | | | (149,458 | ) | | | (1,305,016 | ) |

| | | | | | | | |

Total distributions | | | (18,472,670 | ) | | | (161,599,171 | ) |

| | | | | | | | |

Increase (decrease) in net assets from capital share transactions | | | (198,858,731 | ) | | | 284,393,897 | |

| | | | | | | | |

Total increase (decrease) in net assets | | | 1,651,642 | | | | (437,167,010 | ) |

| | |

Net Assets | | | | | | | | |

Beginning of period | | | 1,513,565,997 | | | | 1,950,733,007 | |

| | | | | | | | |

End of period | | $ | 1,515,217,639 | | | $ | 1,513,565,997 | |

| | | | | | | | |

Other Information:

Capital Shares

Transactions in capital shares were as follows:

| | | | | | | | | | | | | | | | |

| | | Six Months Ended

June 30, 2023

(Unaudited) | | | Year Ended

December 31, 2022 | |

| | | Shares | | | Value | | | Shares | | | Value | |

Class A | | | | | | | | | | | | | | | | |

Sales | | | 640,813 | | | $ | 6,465,427 | | | | 17,224,110 | | | $ | 168,503,659 | |

Reinvestments | | | 1,538,046 | | | | 15,780,357 | | | | 15,202,696 | | | | 134,239,803 | |

Redemptions | | | (19,435,885 | ) | | | (193,115,440 | ) | | | (5,820,248 | ) | | | (54,499,542 | ) |

| | | | | | | | | | | | | | | | |

Net increase (decrease) | | | (17,257,026 | ) | | $ | (170,869,656 | ) | | | 26,606,558 | | | $ | 248,243,920 | |

| | | | | | | | | | | | | | | | |

Class B | | | | | | | | | | | | | | | | |

Sales | | | 210,977 | | | $ | 2,046,991 | | | | 3,446,318 | | | $ | 34,824,334 | |

Reinvestments | | | 253,020 | | | | 2,542,855 | | | | 3,015,550 | | | | 26,054,352 | |

Redemptions | | | (3,312,400 | ) | | | (31,941,820 | ) | | | (2,622,705 | ) | | | (25,523,509 | ) |

| | | | | | | | | | | | | | | | |

Net increase (decrease) | | | (2,848,403 | ) | | $ | (27,351,974 | ) | | | 3,839,163 | | | $ | 35,355,177 | |

| | | | | | | | | | | | | | | | |

Class E | | | | | | | | | | | | | | | | |

Sales | | | 43,822 | | | $ | 405,030 | | | | 140,004 | | | $ | 1,326,914 | |

Reinvestments | | | 14,754 | | | | 149,458 | | | | 149,830 | | | | 1,305,016 | |

Redemptions | | | (122,173 | ) | | | (1,191,589 | ) | | | (188,517 | ) | | | (1,837,130 | ) |

| | | | | | | | | | | | | | | | |

Net increase (decrease) | | | (63,597 | ) | | $ | (637,101 | ) | | | 101,317 | | | $ | 794,800 | |

| | | | | | | | | | | | | | | | |

Increase (decrease) derived from capital shares transactions | | | | | | $ | (198,858,731 | ) | | | | | | $ | 284,393,897 | |

| | | | | | | | | | | | | | | | |

See accompanying notes to financial statements.

BHFTII-9

Brighthouse Funds Trust II

Baillie Gifford International Stock Portfolio

Financial Highlights

| | | | | | | | | | | | | | | | | | | | | | | | |

| Selected per share data | |

| | | Class A | |

| | | Six Months Ended

June 30, 2023

(Unaudited) | | | Year Ended December 31, | |

| | | 2022

| | | 2021 | | | 2020 | | | 2019 | | | 2018 | |

Net Asset Value, Beginning of Period | | $ | 8.94 | | | $ | 14.04 | | | $ | 15.78 | | | $ | 13.58 | | | $ | 11.02 | | | $ | 13.43 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Income (Loss) from Investment Operations | |

Net investment income (loss) (a) | | | 0.06 | | | | 0.09 | | | | 0.14 | | | | 0.09 | | | | 0.25 | | | | 0.16 | |

Net realized and unrealized gain (loss) | | | 1.28 | | | | (4.12 | ) | | | (0.16 | ) | | | 3.18 | | | | 3.24 | | | | (2.42 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total income (loss) from investment operations | | | 1.34 | | | | (4.03 | ) | | | (0.02 | ) | | | 3.27 | | | | 3.49 | | | | (2.26 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Less Distributions | |

Distributions from net investment income | | | (0.13 | ) | | | (0.12 | ) | | | (0.15 | ) | | | (0.27 | ) | | | (0.17 | ) | | | (0.15 | ) |

Distributions from net realized capital gains | | | 0.00 | | | | (0.95 | ) | | | (1.57 | ) | | | (0.80 | ) | | | (0.76 | ) | | | 0.00 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total distributions | | | (0.13 | ) | | | (1.07 | ) | | | (1.72 | ) | | | (1.07 | ) | | | (0.93 | ) | | | (0.15 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net Asset Value, End of Period | | $ | 10.15 | | | $ | 8.94 | | | $ | 14.04 | | | $ | 15.78 | | | $ | 13.58 | | | $ | 11.02 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total Return (%) (b) | | | 14.96 | (c) | | | (28.60 | ) | | | (0.76 | ) | | | 26.58 | | | | 32.82 | | | | (17.01 | ) |

|

Ratios/Supplemental Data | |

Gross ratio of expenses to average net assets (%) | | | 0.85 | (d) | | | 0.85 | | | | 0.84 | | | | 0.84 | | | | 0.84 | | | | 0.85 | |

Net ratio of expenses to average net assets (%) (e) | | | 0.74 | (d) | | | 0.73 | | | | 0.71 | | | | 0.72 | | | | 0.72 | | | | 0.72 | |

Ratio of net investment income (loss) to average net assets (%) | | | 1.17 | (d) | | | 0.93 | | | | 0.93 | | | | 0.67 | | | | 2.02 | | | | 1.28 | |

Portfolio turnover rate (%) | | | 4 | (c) | | | 18 | | | | 14 | | | | 20 | | | | 12 | | | | 23 | |

Net assets, end of period (in millions) | | $ | 1,255.5 | | | $ | 1,259.7 | | | $ | 1,605.6 | | | $ | 1,681.6 | | | $ | 1,598.2 | | | $ | 1,407.8 | |

| |

| | | Class B | |

| | | Six Months Ended

June 30, 2023

(Unaudited) | | | Year Ended December 31, | |

| | | 2022 | | | 2021 | | | 2020 | | | 2019 | | | 2018 | |

Net Asset Value, Beginning of Period | | $ | 8.74 | | | $ | 13.75 | | | $ | 15.49 | | | $ | 13.35 | | | $ | 10.85 | | | $ | 13.22 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Income (Loss) from Investment Operations | |

Net investment income (loss) (a) | | | 0.04 | | | | 0.07 | | | | 0.10 | | | | 0.05 | | | | 0.22 | | | | 0.14 | |

Net realized and unrealized gain (loss) | | | 1.26 | | | | (4.04 | ) | | | (0.15 | ) | | | 3.13 | | | | 3.18 | | | | (2.39 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total income (loss) from investment operations | | | 1.30 | | | | (3.97 | ) | | | (0.05 | ) | | | 3.18 | | | | 3.40 | | | | (2.25 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Less Distributions | |

Distributions from net investment income | | | (0.10 | ) | | | (0.09 | ) | | | (0.12 | ) | | | (0.24 | ) | | | (0.14 | ) | | | (0.12 | ) |

Distributions from net realized capital gains | | | 0.00 | | | | (0.95 | ) | | | (1.57 | ) | | | (0.80 | ) | | | (0.76 | ) | | | 0.00 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total distributions | | | (0.10 | ) | | | (1.04 | ) | | | (1.69 | ) | | | (1.04 | ) | | | (0.90 | ) | | | (0.12 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net Asset Value, End of Period | | $ | 9.94 | | | $ | 8.74 | | | $ | 13.75 | | | $ | 15.49 | | | $ | 13.35 | | | $ | 10.85 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total Return (%) (b) | | | 14.90 | (c) | | | (28.81 | ) | | | (0.99 | ) | | | 26.26 | | | | 32.41 | | | | (17.19 | ) |

|

Ratios/Supplemental Data | |

Gross ratio of expenses to average net assets (%) | | | 1.10 | (d) | | | 1.10 | | | | 1.09 | | | | 1.09 | | | | 1.09 | | | | 1.10 | |

Net ratio of expenses to average net assets (%) (e) | | | 0.99 | (d) | | | 0.98 | | | | 0.96 | | | | 0.97 | | | | 0.97 | | | | 0.97 | |

Ratio of net investment income (loss) to average net assets (%) | | | 0.93 | (d) | | | 0.69 | | | | 0.69 | | | | 0.41 | | | | 1.76 | | | | 1.09 | |

Portfolio turnover rate (%) | | | 4 | (c) | | | 18 | | | | 14 | | | | 20 | | | | 12 | | | | 23 | |

Net assets, end of period (in millions) | | $ | 246.5 | | | $ | 241.7 | | | $ | 327.4 | | | $ | 353.2 | | | $ | 315.3 | | | $ | 277.6 | |

Please see following page for Financial Highlights footnote legend.

See accompanying notes to financial statements.

BHFTII-10

Brighthouse Funds Trust II

Baillie Gifford International Stock Portfolio

Financial Highlights

| | | | | | | | | | | | | | | | | | | | | | | | |

| Selected per share data | |

| | | Class E | |

| | | Six Months Ended

June 30, 2023

(Unaudited) | | | Year Ended December 31, | |

| | | 2022 | | | 2021 | | | 2020 | | | 2019 | | | 2018 | |

Net Asset Value, Beginning of Period | | $ | 8.81 | | | $ | 13.85 | | | $ | 15.59 | | | $ | 13.43 | | | $ | 10.91 | | | $ | 13.29 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Income (Loss) from Investment Operations | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) (a) | | | 0.05 | | | | 0.08 | | | | 0.12 | | | | 0.07 | | | | 0.23 | | | | 0.15 | |

Net realized and unrealized gain (loss) | | | 1.26 | | | | (4.07 | ) | | | (0.16 | ) | | | 3.14 | | | | 3.20 | | | | (2.40 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total income (loss) from investment operations | | | 1.31 | | | | (3.99 | ) | | | (0.04 | ) | | | 3.21 | | | | 3.43 | | | | (2.25 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Less Distributions | | | | | | | | | | | | | | | | | | | | | | | | |

Distributions from net investment income | | | (0.11 | ) | | | (0.10 | ) | | | (0.13 | ) | | | (0.25 | ) | | | (0.15 | ) | | | (0.13 | ) |

Distributions from net realized capital gains | | | 0.00 | | | | (0.95 | ) | | | (1.57 | ) | | | (0.80 | ) | | | (0.76 | ) | | | 0.00 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total distributions | | | (0.11 | ) | | | (1.05 | ) | | | (1.70 | ) | | | (1.05 | ) | | | (0.91 | ) | | | (0.13 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net Asset Value, End of Period | | $ | 10.01 | | | $ | 8.81 | | | $ | 13.85 | | | $ | 15.59 | | | $ | 13.43 | | | $ | 10.91 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total Return (%) (b) | | | 14.90 | (c) | | | (28.74 | ) | | | (0.91 | ) | | | 26.37 | | | | 32.56 | | | | (17.09 | ) |

| | | | | | |

Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | | | | | |

Gross ratio of expenses to average net assets (%) | | | 1.00 | (d) | | | 1.00 | | | | 0.99 | | | | 0.99 | | | | 0.99 | | | | 1.00 | |

Net ratio of expenses to average net assets (%) (e) | | | 0.89 | (d) | | | 0.88 | | | | 0.86 | | | | 0.87 | | | | 0.87 | | | | 0.87 | |

Ratio of net investment income (loss) to average net assets (%) | | | 1.03 | (d) | | | 0.79 | | | | 0.79 | | | | 0.50 | | | | 1.87 | | | | 1.19 | |

Portfolio turnover rate (%) | | | 4 | (c) | | | 18 | | | | 14 | | | | 20 | | | | 12 | | | | 23 | |

Net assets, end of period (in millions) | | $ | 13.2 | | | $ | 12.2 | | | $ | 17.7 | | | $ | 19.9 | | | $ | 18.2 | | | $ | 16.2 | |

| | | | |

| (a) | | Per share amounts based on average shares outstanding during the period. |

| (b) | | Total return does not reflect any insurance, sales, separate account or administrative charges of variable annuity or life insurance contracts or any additional expenses that contract owners may bear under their variable contracts. If these charges were included, the returns would be lower. |

| (c) | | Periods less than one year are not computed on an annualized basis. |

| (d) | | Computed on an annualized basis. |

| (e) | | Includes the effects of management fee waivers (see Note 5 of the Notes to Financial Statements). |

See accompanying notes to financial statements.

BHFTII-11

Brighthouse Funds Trust II

Baillie Gifford International Stock Portfolio

Notes to Financial Statements—June 30, 2023 (Unaudited)

1. Organization

Brighthouse Funds Trust II (the “Trust”) is organized as a Delaware statutory trust and registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. The Trust, which is managed by Brighthouse Investment Advisers, LLC (“Brighthouse Investment Advisers” or the “Adviser”), currently offers twenty-nine series (the “Portfolios”), each of which operates as a distinct investment vehicle of the Trust. The series included in this report is Baillie Gifford International Stock Portfolio (the “Portfolio”), which is diversified. Shares of the Portfolio are not offered directly to the general public and are currently available only to separate accounts of insurance companies, including insurance companies affiliated with the Adviser.

The Portfolio has registered and offers three classes of shares: Class A, B and E shares. Shares of each class of the Portfolio represent an equal pro rata interest in the Portfolio and generally give the shareholder the same voting, dividend, liquidation, and other rights. Investment income, realized and unrealized capital gains and losses, the common expenses of the Portfolio, and certain Portfolio-level expense reductions, if any, are allocated on a pro rata basis to each class based on the relative net assets of each class to the net assets of the Portfolio. Each class of shares differs in its respective distribution plan and such distribution expenses are allocated to the corresponding class of shares.

2. Significant Accounting Policies

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America (“GAAP”) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities as of the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates. In the preparation of these financial statements, management has evaluated events and transactions subsequent to June 30, 2023 through the date the financial statements were issued.

The Portfolio is an investment company and follows the accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946- Financial Services- Investment Companies. The following is a summary of significant accounting policies consistently followed by the Portfolio in the preparation of its financial statements.

Investment Valuation and Fair Value Measurements - The Portfolio values its investments for purposes of calculating its net asset value (“NAV”) using procedures that allow for a variety of methodologies to be used to value the Portfolio’s investments. The specific methodology used for an investment may vary based on the market data available for a specific investment at the time the Portfolio calculates its NAV or based on other considerations. The procedures also permit a level of judgment to be used in the valuation process.

Domestic and foreign equity securities, such as common stock, exchange-traded funds, rights, warrants, and preferred stock, that are traded on a securities exchange on a valuation date are generally valued at their last quoted sale price or official closing price on the primary exchange for such security, or, if no sales occurred on that day, at the last reported bid price. Equity securities traded over-the-counter (“OTC”) are generally valued at the last reported bid price. In the event of a major exchange closing during the trading day, the Adviser may use other market information obtained from quotation reporting systems, established market makers, or pricing services in valuing the securities. Valuation adjustments may be applied to certain foreign equity securities that are traded solely on foreign exchanges that close before the time as of which the Portfolio determines its NAV to account for the market movement between the close of the foreign exchanges and the time as of which the Portfolio determines its NAV. The Portfolio may use a systematic fair valuation model provided by a pricing service to value securities principally traded in these foreign markets to adjust for possible market movements or other changes that may occur between the close of the foreign exchanges and the time as of which the Portfolio determines its NAV. Foreign equity securities valued using these valuation adjustments are generally categorized as Level 2 within the fair value hierarchy. Equity securities that are actively traded, and have no valuation adjustments applied, are categorized as Level 1 within the fair value hierarchy. Other equity securities traded on inactive markets or valued in reference to similar instruments traded on active markets are generally categorized as Level 2 within the fair value hierarchy.

Investments in registered open-end management investment companies are valued at reported NAV per share on the valuation date and are categorized as Level 1 within the fair value hierarchy.

Debt securities, including corporate, convertible and municipal bonds and notes; obligations of the U.S. Treasury and U.S. government agencies; foreign sovereign issues; and non-U.S. bonds, are generally valued based upon evaluated or composite bid quotations obtained from third-party pricing services and/or brokers and dealers selected by the Adviser (each a “pricing service”). Such pricing services may use matrix pricing, which considers observable inputs including, among other things, issuer details, maturity dates, interest rates, yield curves, rates of prepayment, credit risks/spreads, default rates, reported trades, broker-dealer quotes and quoted prices for similar assets. Short-term obligations with a remaining maturity of sixty days or less may be valued at amortized cost in the absence of market quotes, so long as the amortized cost value of such short-term debt instrument is approximately the same as the fair

BHFTII-12

Brighthouse Funds Trust II

Baillie Gifford International Stock Portfolio

Notes to Financial Statements—June 30, 2023—(Continued)

value of the instrument as determined without the use of amortized cost valuation. Floating rate loans are generally valued based upon an evaluated or composite average of aggregate bid and ask quotations supplied by brokers or dealers, as obtained from the pricing service. Securities that use similar valuation techniques and inputs as described above are generally categorized as Level 2 within the fair value hierarchy.

Foreign currency forward contracts are valued through a third-party pricing service by interpolating between forward and spot currency rates in the London foreign exchange markets as of a designated hour on a valuation day. These contracts are generally categorized as Level 2 within the fair value hierarchy.

Options, whether on securities, indices, futures contracts, or otherwise, traded on exchanges are valued at the last sale price available as of the close of business on a valuation day or, if there is no such price available, at the last reported bid price. These types of options are categorized as Level 1 within the fair value hierarchy. Futures contracts that are traded on commodity exchanges are valued at their settlement prices established by the exchanges on which they are traded as of the close of such exchanges and are categorized as Level 1 within the fair value hierarchy.

Options, including options on swaps (“swaptions”) and currencies, and synthetic futures contracts that are traded OTC are generally valued based upon interdealer bid and ask prices or prices provided by pricing service providers who use a series of techniques, including simulation pricing models, to determine the value of the contracts. The pricing models use inputs that are observed from actively quoted markets such as issuer details, indices, spreads, interest rates, yield curves, credit curves, measures of volatility and exchange rates. These contracts are generally categorized as Level 2 within the fair value hierarchy.

If no current market quotation is readily available or market value quotations are deemed to be unreliable for an investment, the fair value of the investment will be determined in accordance with procedures. A market quotation is readily available only when that quotation is a quoted price (unadjusted) in active markets for identical investments that the Portfolio can access at the measurement date, provided that a quotation will not be readily available if it is not reliable.

Pursuant to Rule 2a-5 under the 1940 Act, the Board of Trustees (the “Board” or “Trustees” ) of the Trust has designated Brighthouse Investment Advisers, acting through its Valuation Committee (“Committee”), as the Portfolio’s “valuation designee” to perform the Portfolio’s fair value determinations. The Board oversees Brighthouse Investment Advisers in its role as the Valuation Designee and receives reports from Brighthouse Investment Advisers regarding its process and the valuation of the Portfolio’s investments to assist with such oversight.

No single standard for determining the fair value of an investment can be set forth because fair value depends upon the facts and circumstances with respect to each investment. Information relating to any relevant factors may be obtained by the Committee from any appropriate source, including the subadviser of the Portfolio, the Custodian, a pricing service, market maker and/or broker for such security or the issuer. Appropriate methodologies for determining fair value under particular circumstances may include: matrix pricing, a discounted cash flow analysis, comparisons of securities with comparable characteristics, value based on multiples of earnings, discount from market price of similar marketable securities, or a combination of these and other methods.

Foreign Currency Translation - The books and records of the Portfolio are maintained in U.S. dollars. The values of securities, currencies, and other assets and liabilities denominated in currencies other than the U.S. dollar are translated into U.S. dollars based upon foreign exchange rates prevailing at the end of the period. Purchases and sales of investment securities, income, and expenses are translated on the respective dates of such transactions. Because the values of investment securities are translated at the foreign exchange rates prevailing at the end of the period, that portion of the results of operations arising from changes in exchange rates and that portion of the results of operations reflecting fluctuations arising from changes in market prices of the investment securities are not separated. Such fluctuations are included in the net realized and unrealized gain or loss on investments.

Net realized foreign exchange gains or losses arise from activity in forward foreign currency exchange contracts, sales of foreign currency, currency gains or losses realized between the trade and settlement dates on securities transactions, and the difference between the amounts of dividends, interest, and foreign withholding taxes recorded by the Portfolio and the U.S. dollar-equivalent of the amounts actually received or paid by the Portfolio. Net unrealized foreign exchange gains and losses arise from changes in the value of assets and liabilities, other than investment securities, resulting from changes in foreign exchange rates.

Investment Transactions and Related Investment Income - Portfolio security transactions are recorded on the trade date. Dividend income is recorded on the ex-dividend date or, for certain foreign securities, when notified. Interest income, which includes amortization of premium and accretion of discount on debt securities, is recorded on the accrual basis. Realized gains and losses on investments are determined on the identified cost basis, which is the same basis used for federal income tax purposes. Foreign income and foreign capital gains on some foreign securities may be subject to foreign taxes, which are accrued as applicable. These foreign taxes have been provided for in accordance with the Portfolio’s understanding of the applicable countries’ tax rules and rates.

In consideration of recent decisions rendered by European courts, the Portfolio has filed tax reclaims for previously withheld taxes on dividends earned in certain European Union (“EU”) countries. These filings are subject to various administrative and judicial

BHFTII-13

Brighthouse Funds Trust II

Baillie Gifford International Stock Portfolio

Notes to Financial Statements—June 30, 2023—(Continued)

proceedings within these countries. During the six months ended June 30, 2023, the Portfolio received EU tax reclaim payments in the amount of $113,391 that were not previously accrued for due to uncertainty of collectability. Such amount is included in dividends on the Statement of Operations. No other amounts for additional tax reclaims are reflected in the financial statements due to the uncertainty as to the ultimate resolution of proceedings, the likelihood of receipt of these reclaims, and the potential timing of payment.

Dividends and Distributions to Shareholders - The Portfolio records dividends and distributions on the ex-dividend date. Net realized gains from securities transactions (if any) are generally distributed annually to shareholders. The timing and characterization of certain income and capital gains distributions are determined in accordance with federal tax regulations that may differ from GAAP. Permanent book and tax basis differences relating to shareholder distributions will result in reclassification between distributable earnings (accumulated losses) and paid in surplus. These adjustments have no impact on net assets or the results of operations.

Income Taxes - It is the Portfolio’s policy to comply with the requirements of the Internal Revenue Code of 1986, as amended, and regulations thereunder, applicable to regulated investment companies, and to distribute, with respect to each taxable year, all of its taxable income to shareholders. Therefore, no federal income tax provision is required. The Portfolio files U.S. federal tax returns. No income tax returns are currently under examination. The Portfolio’s federal tax returns remain subject to examination by the Internal Revenue Service for three fiscal years after the returns are filed. As of June 30, 2023, the Portfolio had no uncertain tax positions that would require financial statement recognition, derecognition or disclosure.

Repurchase Agreements - The Portfolio may enter into repurchase agreements, under the terms of a Master Repurchase Agreement (“MRA”), or Global Master Repurchase Agreement (“GMRA”), with selected commercial banks and broker-dealers, under which the Portfolio acquires securities as collateral and agrees to resell the securities at an agreed-upon time and at an agreed-upon price. The Portfolio, through the Custodian or a subcustodian, under a tri-party repurchase agreement, receives delivery of the underlying securities collateralizing any repurchase agreements. It is the Portfolio’s policy that the market value of the collateral be equal to at least 100% of the repurchase price in the case of a repurchase agreement of one-day duration and equal to at least 102% of the repurchase price in the case of all other repurchase agreements. In the event of default or failure by a party to perform an obligation in connection with any repurchase transaction, the MRA or GMRA gives the non-defaulting party the right to set-off claims and to apply property held by it in connection with any repurchase transaction against obligations owed to it under the agreement.

At June 30, 2023, the Portfolio had direct investments in repurchase agreements with a gross value of $21,228,581. Additionally, the Portfolio invested cash collateral for loans of portfolio securities in repurchase agreements with a gross value of $5,501,512. The combined value of all repurchase agreements is included as part of investments at value on the Statement of Assets and Liabilities. The value of the related collateral exceeded the value of the repurchase agreements at June 30, 2023.

Securities Lending - The Portfolio may lend its portfolio securities to certain qualified brokers who borrow securities in order to complete certain securities transactions. By lending its portfolio securities, the Portfolio attempts to increase its net investment income through the receipt of income on collateral held from securities on loan. Any gain or loss in the market price of the loaned securities that might occur, any interest earned, and any dividends declared during the term of the loan, would accrue to the account of the Portfolio.

The Trust has entered into a Non-Custodial Securities Lending Agreement with JPMorgan Chase Bank, N.A. (the “Lending Agent”). Under the agreement, the Lending Agent is authorized to loan portfolio securities on the Portfolio’s behalf. In exchange, the Portfolio generally receives cash, U.S. Government securities, letters of credit, or other collateral deemed appropriate by the Adviser. The Portfolio receives collateral equal to at least 102% of the market value for loans secured by government securities or cash in the same currency as the loaned shares and 105% for all other loaned securities at each loan’s inception. Collateral representing at least 100% of the market value of the loaned securities is maintained for the duration of the loan. Any cash collateral received by the Portfolio is generally invested by the Lending Agent in short-term investments, which may include certificates of deposit, commercial paper, repurchase agreements, including repurchase agreements with respect to equity securities, time deposits, master demand notes and money market funds. The market value of investments made with cash collateral received are disclosed in the Schedule of Investments and the valuation techniques are described in Note 2. The value of the securities on loan may change each business day. If the market value of the collateral at the close of trading on a business day is less than 100% of the market value of the loaned securities at the close of trading on that day, the borrower is required to deliver, by the close of business on the following business day, an additional amount of collateral, so that the total amount of posted collateral is equal to at least 100% of the market value of all the loaned securities as of such preceding day. A portion of the income earned on the collateral is rebated to the borrower of the securities and the remainder is split between the Lending Agent and the Portfolio. On loans collateralized by U.S. government securities, a fee is received from the borrower and is allocated between the Portfolio and the Lending Agent.

Income received by the Portfolio in securities lending transactions during the six months ended June 30, 2023 is reflected as securities lending income on the Statement of Operations. The values of any securities loaned by the Portfolio and the related collateral at June 30, 2023 are disclosed in the footnotes to the Schedule of Investments. The value of the related collateral received by the Portfolio exceeded the value of the securities out on loan at June 30, 2023.

BHFTII-14

Brighthouse Funds Trust II

Baillie Gifford International Stock Portfolio

Notes to Financial Statements—June 30, 2023—(Continued)

The risks associated with lending portfolio securities include, but are not limited to, possible delays in receiving additional collateral or in the recovery of the loaned securities, possible loss of rights in the collateral should the borrower fail financially, as well as risk of loss in the value of the collateral or the value of the investments made with the collateral. To the extent the Portfolio uses cash collateral it receives to invest in repurchase agreements with respect to equity securities, it is subject to the risk of loss if the value of the equity securities declines and the counterparty defaults on its obligation to repurchase such securities. The Lending Agent shall indemnify the Portfolio in the case of default of any securities borrower, subject to the terms of the Non-Custodial Securities Lending Agreement.

All securities on loan are classified as Common Stocks in the Portfolio’s Schedule of Investments as of June 30, 2023. For all securities on loan, the remaining contractual maturity of the agreements is overnight and continuous.

3. Certain Risks

In the normal course of business, the Portfolio invests in securities and enters into transactions where risks exist. Those risks include:

Market Risk: The value of securities held by the Portfolio may decline in response to certain events, including those directly involving the issuers whose securities are owned by the Portfolio; conditions affecting the general economy; overall market changes; local, regional or global political, social or economic instability; currency, interest rate, and price fluctuations, or other factors including terrorism, war, natural disasters and the spread of infectious illness including epidemics or pandemics such as the COVID-19 pandemic. These events may also adversely affect the liquidity of securities held by the Portfolio.

In addition, geopolitical and other risks, including environmental and public health risks, may add to instability in world economies and markets generally. The COVID-19 pandemic has resulted in travel restrictions and disruptions, closed borders, enhanced health screenings at ports of entry and elsewhere, disruption of and delays in healthcare service preparation and delivery, quarantines, event cancellations and restrictions, service cancellations or reductions, disruptions to business operations, supply chains and customer activity, lower consumer demand for goods and services, as well as general concern and uncertainty that has negatively affected the economic environment. COVID-19 vaccine distribution in the United States has resulted in more flexible quarantine guidelines, increased consumer demand, and resurgence of travel. However, vaccination rates and vaccine availability abroad, specifically in developing and emerging market countries, continue to lag, and new COVID-19 variants have led to waves of increased hospitalizations and deaths. The impact of this pandemic, and any other epidemic or pandemic that may arise in the future could adversely affect the economies of many nations or the entire global economy, the financial performance of individual issuers, borrowers and sectors and the health of capital markets and other markets generally in potentially significant and unforeseen ways. This crisis or other public health crises may also exacerbate other pre-existing political, social and economic risks in certain countries or globally. At this time, it is still not possible to estimate the severity or duration of the COVID-19 pandemic, including the severity, duration and frequency of any additional “waves” or emerging variants of COVID-19. It is also still not possible to estimate the duration or frequency of the utilization of any therapeutic treatments and vaccines for COVID-19 or variants thereof. It is likewise still not possible to predict or estimate the longer-term effects of the COVID-19 pandemic, or any actions taken to contain or address the pandemic, on the Portfolio, the financial markets, and economy at large. The foregoing could lead to a significant economic downturn or recession, increased market volatility, a greater number of market closures, higher default rates and adverse effects on the values and liquidity of securities or other assets. Such impacts, which may vary across asset classes, may adversely affect the performance of the Portfolio’s investments, the Portfolio and your investment in the Portfolio.

In late February 2022, Russian military forces invaded Ukraine, significantly amplifying already existing geopolitical tensions among Russia, Ukraine, Europe, NATO, and the West. Russia’s invasion, the responses of countries and political bodies to Russia’s actions, and the potential for wider conflict may increase financial market volatility and could have severe adverse effects on regional and global economic markets, including the markets for certain securities and commodities such as oil and natural gas. Following Russia’s actions, various countries, including the U.S., Canada, the United Kingdom, Germany, and France, as well as the European Union, issued broad-ranging economic sanctions against Russia. The United States and other countries have also imposed economic sanctions on Belarus and may impose sanctions on other countries that support Russia’s military invasion. A number of large corporations and U.S. states have also announced plans to divest interests or otherwise curtail business dealings with certain Russian businesses. These sanctions and any additional sanctions or other intergovernmental actions that have been or may be undertaken in the future, against Russia, Russian entities or individuals, or other countries that support Russia’s military invasion, may result in the devaluation of Russian currency, a downgrade in the country’s credit rating, an immediate freeze of Russian assets, a decline in the value and liquidity of Russian securities, property or interests, and/or other adverse consequences to the Russian economy or the Portfolio. Further, due to market closures and trading restrictions, the value of Russian securities could be significantly impacted, which could lead to such securities being valued at zero. The scope and scale of sanctions in place at a particular time may be expanded or otherwise modified in a way that have negative effects on the Portfolio. Sanctions, or the threat of new or modified sanctions, could impair the ability of the Portfolio to buy, sell, hold, receive, deliver or otherwise transact in certain affected securities or other investment instruments. Sanctions could also result in Russia taking counter measures or other actions in response (including cyberattacks and espionage), which may further impair the value and liquidity of Russian securities. These sanctions, and the resulting

BHFTII-15

Brighthouse Funds Trust II

Baillie Gifford International Stock Portfolio

Notes to Financial Statements—June 30, 2023—(Continued)

disruption of the Russian economy, may cause volatility in other regional and global markets and may negatively impact the performance of various sectors and industries, as well as companies in other countries, which could have a negative effect on the performance of the Portfolio, even if the Portfolio does not have direct exposure to securities of Russian issuers.