SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement | ||

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||

x Definitive Proxy Statement | ||

¨ Definitive Additional Materials | ||

¨ Soliciting Material under Rule 14a-12 | ||

Applied Micro Circuits Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

¨ | Fee paid previously with preliminary materials. |

¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

APPLIED MICRO CIRCUITS CORPORATION

6290 SEQUENCE DRIVE

SAN DIEGO, CA 92121

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON AUGUST 28, 2002

To The Stockholders of Applied Micro Circuits Corporation:

You are cordially invited to attend the Annual Meeting of Stockholders (the “Annual Meeting”) of Applied Micro Circuits Corporation, a Delaware corporation (the “Company”). The meeting will be held at the principal executive offices of the Company located at 6290 Sequence Drive, San Diego, California on Wednesday, August 28, 2002, at 10:00 a.m., local time, for the following purposes:

| 1. | To elect ten directors to hold office until the 2003 Annual Meeting of Stockholders; |

| 2. | To ratify the selection of Ernst & Young LLP as independent auditor of the Company for the fiscal year ending March 31, 2003; and |

| 3. | To conduct any other business properly brought before the meeting. |

These items of business are more fully described in the Proxy Statement accompanying this Notice.

The record date for the Annual Meeting is July 1, 2002. Only stockholders of record at the close of business on that date may vote at the meeting or any adjournment thereof.

By Order of the Board of Directors,

William E. Bendush

Secretary

San Diego, California

July 10, 2002

IMPORTANT

YOU ARE CORDIALLY INVITED TO ATTEND THE MEETING IN PERSON. WHETHER OR NOT YOU EXPECT TO ATTEND THE MEETING, PLEASE COMPLETE, DATE, SIGN AND RETURN THE ENCLOSED PROXY, OR VOTE OVER THE TELEPHONE OR THE INTERNET AS INSTRUCTED IN THESE MATERIALS, AS PROMPTLY AS POSSIBLE IN ORDER TO ENSURE YOUR REPRESENTATION AT THE MEETING. A RETURN ENVELOPE (WHICH IS POSTAGE PREPAID IF MAILED IN THE UNITED STATES) IS ENCLOSED FOR YOUR CONVENIENCE. EVEN IF YOU HAVE VOTED BY PROXY, YOU MAY STILL VOTE IN PERSON IF YOU ATTEND THE MEETING. PLEASE NOTE, HOWEVER, THAT IF YOUR SHARES ARE HELD OF RECORD BY A BROKER, BANK OR OTHER NOMINEE AND YOU WISH TO VOTE AT THE MEETING, YOU MUST OBTAIN A PROXY ISSUED IN YOUR NAME FROM THAT RECORD HOLDER.

THANK YOU FOR ACTING PROMPTLY.

APPLIED MICRO CIRCUITS CORPORATION

6290 SEQUENCE DRIVE

SAN DIEGO, CA 92121

PROXY STATEMENT

FOR THE 2002 ANNUAL MEETING OF STOCKHOLDERS

AUGUST 28, 2002

QUESTIONS AND ANSWERS ABOUT THIS PROXY MATERIAL AND VOTING

Why am I receiving these materials?

We sent you this proxy statement and the enclosed proxy card because the Board of Directors of Applied Micro Circuits Corporation(sometimes referred to as the “Company” or “AMCC”) is soliciting your proxy to vote at the 2002 Annual Meeting of Stockholders. You are invited to attend the annual meeting and we request that you vote on the proposals described in this proxy statement. However, you do not need to attend the meeting to vote your shares. Instead, you may simply complete, sign and return the enclosed proxy card, or follow the instructions below to submit your proxy over the telephone or on the Internet.

We intend to mail this proxy statement and accompanying proxy card on or about July 10, 2002 to all stockholders of record entitled to vote at the annual meeting.

What am I voting on?

There are two matters scheduled for a vote:

| • | Election of ten directors; |

| • | Ratification of Ernst & Young LLP as independent auditor of the Company for its fiscal year ending March 31, 2003. |

Who can vote at the annual meeting?

Only stockholders of record at the close of business on July 1, 2002 will be entitled to vote at the annual meeting. On this record date, there were300,876,538 shares of common stock outstanding and entitled to vote.

Am I a stockholder of record?

If on July 1, 2002 your shares were registered directly in your name with our transfer agent, Computershare Investor Services, LLC, then you are a stockholder of record. As a stockholder of record, you may vote in person at the meeting or vote by proxy. Whether or not you plan to attend the meeting, we urge you to fill out and return the enclosed proxy card or vote by proxy over the telephone or on the Internet as instructed below to ensure your vote is counted.

What if my AMCC shares are not registered directly in my name but are held in street name?

If on July 1, 2002 your shares were held in an account at a brokerage firm, bank, dealer, or other similar organization, then you are the beneficial owner of shares held in “street name” and these proxy materials have been forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the annual meeting. As a beneficial owner, you have the right to direct your broker or other agent on how to vote the shares in your account. You are also invited to attend the annual meeting. However, since you are not the stockholder of record, you may not vote your shares in person at the meeting unless you request and obtain a valid proxy from your broker or other agent.

If I am a stockholder of record of AMCC shares, how do I cast my vote?

You may either vote “For” all the nominees to the Board of Directors or you may abstain from voting for any nominee you specify. For each of the other matters to be voted on, you may vote “For” or “Against” or abstain from voting. The procedures for voting are fairly simple:

If you are a stockholder of record, you may vote in person at the annual meeting, or vote by proxy using the enclosed proxy card, vote by proxy over the telephone, or vote by proxy on the Internet. To vote in person, come to the annual meeting and we will give you a ballot when you arrive.

| • | To vote using the proxy card, simply complete, sign and date the enclosed proxy card and return it promptly in the envelope provided. If you return your signed proxy card to us before the annual meeting, we will vote your shares as you direct. |

| • | To vote over the telephone, dial the toll-free phone number on your proxy card at the heading “Vote by Phone” using a touch-tone phone and follow the recorded instructions. You will be asked to provide the company number and control number from the enclosed proxy card. Your vote must be received by 11:59 p.m. Eastern Daylight Time on August 27, 2002 to be counted. |

| • | To vote on the Internet, go tohttp://www.proxyvote.com to complete an electronic proxy card. You will be asked to provide the company number and control number from the enclosed proxy card. Your vote must be received by 11:59 p.m. Eastern Daylight Time on August 27, 2002 to be counted. |

We provide Internet proxy voting to allow you to vote your shares on-line with procedures designed to ensure the authenticity and correctness of your proxy vote instructions. However, please be aware that you must bear any costs associated with your Internet access, such as usage charges from Internet access providers and telephone companies.

Whether or not you plan to attend the meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the meeting and vote in person if you have already voted by proxy.

If I am a beneficial owner of AMCC shares, how do I cast my vote?

If you are a beneficial owner of shares registered in the name of your broker, bank, or other agent, you should have received a proxy card and voting instructions with these proxy materials from that organization rather than from AMCC. Simply complete and mail the proxy card to ensure that your vote is counted. Alternatively, you may vote by telephone or over the Internet as instructed by your broker or bank. To vote in person at the annual meeting, you must obtain a valid proxy from your broker, bank, or other agent. Follow the instructions from your broker or bank included with these proxy materials, or contact your broker or bank to request a proxy form.

How many votes are needed to approve each proposal?

| • | For the election of directors, the ten nominees receiving the most “For” votes (among votes properly cast in person or by proxy) will be elected. |

| • | To be approved, Proposal 2, Ratification of Selection of Independent Auditor must receive a “For” vote from the majority of the outstanding shares represented at the meeting either in person or by proxy. If you abstain from voting, it will have the same effect as an “Against” vote. |

2

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of common stock you own as of July 1, 2002.

How are votes counted?

Votes will be counted by the inspector of election appointed for the meeting, who will separately count “For” and “Against” votes, abstentions and broker non-votes. A “broker non-vote” occurs when a stockholder of record, such as a broker, holding shares for a beneficial owner does not vote because the stockholder of record does not have discretionary voting power and has not received voting instructions from the beneficial owner. Abstentions will be counted towards the vote total for Proposal 2, and will have the same effect as “Against” votes. Broker non-votes have no effect and will not be counted towards the vote total for any proposal.

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if at least 150,438,270 shares, a majority of the shares outstanding on July 1, 2002, are represented at the meeting or by proxy. Your shares will be counted towards the quorum only if you submit a valid proxy vote or vote at the meeting.

What does it mean if I receive more than one proxy card?

If you receive more than one proxy card, your shares are registered in more than one name or are registered in different accounts. Please complete, sign and returneach proxy card to ensure that all of your shares are voted.

What if I return a proxy card but do not make specific choices?

If you return a signed and dated proxy card without marking any voting selections, your shares will be voted “For” the election of all ten nominees for director, and “For” the ratification of Ernst & Young LLP as independent auditor of the Company. If any other matter is properly presented at the meeting, your proxy (one of the individuals named on your proxy card) will vote your shares using his best judgment.

Can I change my vote after submitting my proxy?

Yes. You can revoke your proxy at any time before the final vote at the meeting. You may revoke your proxy in any one of three ways:

| • | You may submit another properly completed proxy card with a later date. |

| • | You may send a written notice that you are revoking your proxy to the Secretary of the Company (Attn: William E. Bendush, Applied Micro Circuit Corporation, 6290 Sequence Drive, San Diego, CA 92121). |

| • | You may attend the annual meeting and vote in person. Simply attending the meeting will not, by itself, revoke your proxy. |

How can I find out the results of the voting at the annual meeting?

Preliminary voting results will be announced at the annual meeting. Final voting results will be published in the Company’s quarterly report on Form 10-Q for the second quarter of fiscal 2003, which ends September 30, 2002.

3

Who is paying for this proxy solicitation?

We will pay for the entire cost of soliciting proxies. In addition to these mailed proxy materials, our directors and employees may also solicit proxies in person, by telephone, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

When are stockholder proposals due for next year’s annual meeting?

Stockholders wishing to submit proposals or director nominations for next year’s annual meeting must do so no earlier than April 30, 2003 and no later than May 30, 2003. To be considered for inclusion in our proxy materials for next year’s annual meeting, your proposal must be submitted in writing by March 12, 2003, to the Secretary of the Company (Attn: William E. Bendush, Applied Micro Circuit Corporation, 6290 Sequence Drive, San Diego, CA 92121).

4

PROPOSAL 1

ELECTION OF DIRECTORS

Our Board of Directors currently consists of eleven directors. One of our current directors, William K. Bowes, Jr., has decided to resign from the Board of Directors effective as of the annual meeting. Upon his resignation, the number of directors will become ten pursuant to a resolution adopted by our Board in accordance with our Bylaws and Certificate of Incorporation, and our stockholders will elect the ten directors at the annual meeting.

There are ten nominees for election as directors this year. The ten nominees are identified in the table below. Each nominee listed below is currently a director. All ten directors were elected by the stockholders at our last annual meeting except for Messrs. Cesaratto and Kalkhoven who were elected by our Board of Directors since our last annual meeting.

Name | Age | Position Held With the Company | ||

| David M. Rickey | 46 | Chairman of the Board of Directors and Chief Executive Officer of the Company | ||

| Roger A. Smullen, Sr. | 66 | Vice Chairman of the Board of Directors | ||

| Douglas C. Spreng | 58 | Director, President and Chief Operating Officer | ||

| Cesar Cesaratto | 54 | Director | ||

| Franklin P. Johnson, Jr.(1) | 74 | Director | ||

| Kevin N. Kalkhoven | 58 | Director | ||

| L. Wayne Price(1) | 41 | Director | ||

| S. Atiq Raza(2)(3) | 52 | Director | ||

| Arthur B. Stabenow(2)(3) | 63 | Director | ||

| Harvey P. White(2)(3) | 68 | Director |

| (1) | Member of Audit Committee |

| (2) | Member of Compensation Committee |

| (3) | Member of Nominating Committee |

Each director to be elected will hold office until our next annual meeting of stockholders or until the director’s death, resignation or removal. Directors are elected by a plurality of the votes properly cast in person or by proxy. The ten nominees receiving the highest number of affirmative votes will be elected. Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the ten nominees named above. If any nominee becomes unavailable for election as a result of an unexpected occurrence, your shares will be voted for the election of a substitute nominee proposed by our Board of Directors. Each person nominated for election has agreed to serve if elected. We have no reason to believe that any nominee will be unable to serve.

The following is a brief biography of each nominee for director.

David M. Rickey re-joined the Company in February 1996 as President, Chief Executive Officer and as a Director. In August 2000, Mr. Rickey was appointed Chairman of the Board. In July 2001, Mr. Rickey resigned from the position of President, but has continued to serve as Chairman of the Board and Chief Executive Officer. From August 1993 to May 1995, Mr. Rickey served as the Company’s Vice President of Operations. From May 1995 to February 1996, Mr. Rickey served as Vice President of Operations at NexGen, a semiconductor company. Previously, for eight years, Mr. Rickey was employed by Northern Telecom, Inc., a telecommunications manufacturer now known as Nortel Networks Corporation, where he led the wafer fab engineering and manufacturing operations in both Ottawa, Canada and San Diego, California. Mr. Rickey is a director of Macropore, Inc. Mr. Rickey has earned B.S. degrees from both Marietta College (summa cum laude)

5

and Columbia University. In addition, Mr. Rickey received an M.S. in Materials Science and Engineering from Stanford University.

Roger A. Smullen, Sr. was elected Vice Chairman of the Board in August 2000. Prior to August 2000, Mr. Smullen served as the Chairman of the Board from October 1982. Mr. Smullen also served as Acting Vice President, Operations of the Company from August 1997 through October 1997 and the Company’s Chief Executive Officer from April 1983 until April 1987. Previously, he was Senior Vice President of Operations of Intersil, Inc.’s semiconductor division. In 1967, Mr. Smullen co-founded National Semiconductor Corporation, a manufacturer of integrated circuits. Prior to that, he was Director of Integrated Circuits at Fairchild Semiconductor, a manufacturer of integrated circuits. Mr. Smullen is currently a director of Micro Linear Corporation, a manufacturer of integrated circuits. He holds a B.S. in Mechanical Engineering from the University of Minnesota.

Douglas C. Spreng was promoted to President and Chief Operating Officer of the Company in July 2001. Mr. Spreng joined the Company in October 2000 as Senior Vice President, Switch Fabric and Network Processing when the Company acquired MMC Networks, Inc., of which Mr. Spreng was President and Chief Executive Officer. Mr. Spreng was Executive Vice President of the Client Access Business Unit at 3Com Corporation for seven years. In the early 1990’s, Mr. Spreng was President and Chief Operating Officer of Cellnet Data Systems. He began his career with Hewlett-Packard Company, where he held various marketing, manufacturing and general management positions for more than 23 years. Mr. Spreng is a director of Silicon Image, Inc. He holds a B.S. in Electrical Engineering from the Massachusetts Institute of Technology and an M.B.A. from the Harvard Business School.

Cesar Cesaratto became a director of the Company in April 2002. Mr. Cesaratto currently works with a number of investment groups where he contributes his experience and contacts to the development of select start-up ventures in the communication technology sector. From 1970 to May 2001, Mr. Cesaratto held a number of executive positions with Nortel Networks in semiconductor IC development, spanning product development, operations, and sales and marketing. Most recently he held the position of President Wireless Systems for EMEA. Mr. Cesaratto retired from Nortel Networks in May 2001. He holds a B. S. in Electrical Engineering from McGill University.

Franklin P. Johnson, Jr.has served as a director of the Company since April 1980. He is the general partner of Asset Management Partners, a venture capital limited partnership. Mr. Johnson has been a private venture capital investor for more than 35 years. Mr. Johnson is a director of Amgen, Inc. and IDEC Pharmaceuticals Corporation. Mr. Johnson holds a B.S. from Stanford University and an M.B.A. from the Harvard Business School.

Kevin N. Kalkhovenhas served as a director of the Company since October 2001. In August 2000, Mr. Kalkoven co-founded Kalkhoven, Pettit & Levin Ventures LLC, a company that invests in early stage fiber-optic and wireless companies. From February 1992 until May 2000, Mr. Kalkhoven was the President, Chief Executive Officer and Chairman of Uniphase Corporation which merged with JDS FITEL in July 1999 to become JDS Uniphase. Preceding his tenure at JDS Uniphase, Kalkhoven held executive positions at a variety of software companies, serving as President and CEO of Demax Software, President and CEO of AIDA Corporation, Vice President of Marketing for the European division of Comshare Corporation and group vice president for the U.S. company.

L. Wayne Price became a director of the Company in March 2001. Mr. Price is currently the Chief Executive Officer and co-founder of WayNet, Inc., a video service provider. Mr. Price co-founded Valiant Networks in November 1999 and served as Chief Executive Officer until November 2001. Prior to founding Valiant Networks, Mr. Price was the Vice President of Network Architecture and Chief Technology Officer at Williams Networks. As Chief Technology Officer of Williams, Mr. Price was responsible for the development of Williams Multi-Service Broadband Network from April 1995 to November 1999. From November of 1986 to April 1995, he was with WilTel. Mr. Price has held engineering positions with MCI, ASA and the United States Air Force. Mr. Price has more than 20 years of experience in the telecommunications industry.

6

S. Atiq Razahas served as a director of the Company since September 1999. Mr. Raza is Chairman of the Board and Chief Executive Officer of Raza Foundries, Inc., a company that builds and operates broadband networking and communications companies, which he founded in October 1999. Mr. Raza was the President and Chief Operating Officer of Advanced Micro Devices, a semiconductor company, from January 1996 to March 1999. From October 1988 to January 1996, he was with NexGen, where he held the positions of Chairman, Chief Executive Officer and President. He also is a director of Pocket Networks, Inc., Nishan Systems and Mellanox Technologies, Ltd. Mr. Raza holds a B.S.E.E. degree from the University of London, and an M.S. in Materials Science from Stanford University.

Arthur B. Stabenowhas served as a director of the Company since July 1988. Mr. Stabenow was Chairman, President and Chief Executive Officer of Micro Linear Corporation, a manufacturer of integrated circuits, from April 1986 until his retirement in January 1999. Mr. Stabenow has over 35 years of experience in the semiconductor industry. From January 1979 to March 1986, he was employed as a vice president and general manager at National Semiconductor Corporation. Mr. Stabenow is currently a director of Zoran, Inc. Mr. Stabenow holds an M.B.A. from the University of New Haven.

Harvey P. Whitehas served as a director of the Company since April 1999. Since September 1998, Mr. White has been Chairman and Chief Executive Officer of Leap Wireless International, an operator of wireless telephone systems. Mr. White was one of the founders of QUALCOMM Incorporated and served as its President from May 1992 through June 1998. Prior to May 1992, he served as Executive Vice President and Chief Operating Officer of QUALCOMM and was on its Board of Directors when it began operations in July 1985 until September 1998. Mr. White holds a B.A. in Economics from Marshall University.

THE BOARD OF DIRECTORS RECOMMENDS

A VOTE IN FAVOR OF EACH NAMED NOMINEE.

Board Committees and Meetings

During the fiscal year ended March 31, 2002, the Board of Directors held seven meetings and acted by unanimous written consent two times. No director attended fewer than 75% of the aggregate number of meetings of the Board and the committees of the Board on which he served. The Board has an Audit Committee, a Compensation Committee and a Nominating Committee.

Audit Committee. The Audit Committee consisted of directors Bowes, Johnson and Price during fiscal 2002 and held five meetings during that fiscal year. The Audit Committee recommends the engagement of the firm of independent auditors to audit the financial statements of the Company and monitors the effectiveness of the audit effort, the Company’s financial and accounting organization and its system of internal accounting controls. The Audit Committee has reviewed and discussed the audited financial statements with management and the Company’s independent auditors.

The Board adopted and approved a charter for the Audit Committee in April 2000. A copy of the charter is attached hereto as Appendix A. The Board has determined that all members of the Audit Committee during fiscal 2002 were “independent” as that term is defined in Rule 4200 of the listing standards of the National Association of Securities Dealers. The Board will appoint the members of the Audit Committee at its meeting following the annual meeting, including a replacement for Mr. Bowes.

Compensation Committee. The Compensation Committee, consisting of directors Raza, Stabenow and White, three of the Company’s non-employee directors, held four meetings during the last fiscal year and acted by unanimous written consent one time. Its functions are to establish and administer the Company’s policies regarding annual executive salaries, cash incentives and stock option and other long-term equity incentives. The Compensation Committee also administers the Company’s stock option program with respect to the Company’s executive officers and Board members.

7

Nominating Committee. In April 2001, the Board formed a Nominating Committee. The Nominating Committee interviews, evaluates, nominates and recommends individuals for membership on the Board and committees thereof. No procedure has been established for the consideration of nominees recommended by stockholders. The Nominating Committee, consisting of directors Raza, Stabenow and White, three of the Company’s non-employee directors, held no meetings during the last fiscal year.

REPORT OF THE AUDIT COMMITTEE OF THE BOARD(1)

The Audit Committee is comprised solely of independent directors, as defined in Rule 4200 of the listing standards of the standards of the National Association of Securities Dealers, and it operates under a written charter adopted by the Board, a copy of which is attached to this proxy statement as Exhibit A. The composition of the Audit Committee, the attributes of its members and the responsibilities of the Audit Committee, as reflected in its charter, are intended to be in accordance with applicable requirements for corporate audit committees. The Audit Committee reviews and assesses the adequacy of its charter on an annual basis.

The Audit Committee oversees the Company’s financial reporting process on behalf of the Board. The purpose of the Audit Committee, as more fully described in its charter, is the general oversight of the Company’s financial reporting, internal control and audit functions. Management is responsible for the preparation, presentation and integrity of the Company’s financial statements, accounting principles, internal controls and procedures designed to ensure compliance with accounting standards, applicable laws and regulations. Ernst & Young LLP, the company’s independent auditing firm, is responsible for performing an independent audit of the consolidated financial statements in accordance with generally accepted auditing standards.

Among other matters, the Audit Committee monitors the activities and performance of the Company’s independent auditor, including the audit scope, external audit fees, auditor independence matters and the extent to which the independent auditor may be retained to perform non-audit services. The Audit Committee and the Board have ultimate authority and responsibility to select, evaluate and, when appropriate, replace the company’s independent auditors. The Audit Committee also reviews the results of the audit work with regard to the adequacy and appropriateness of the company’s financial, accounting and internal controls.

In fulfilling its oversight responsibilities, the Audit Committee has reviewed and discussed the audited consolidated financial statements in the Annual Report with management including a discussion of the quality, not just acceptability, of the accounting principles, reasonableness of significant judgment, and clarity of disclosures in the financial statements.

The Audit Committee reviewed with the independent auditor, who are responsible for expressing an opinion on the conformity of those audited financial statements with generally accepted accounting principles, its judgments as to the quality, not just acceptability, of the accounting principles, reasonableness of significant judgments, and clarity of disclosures in the financial statements. In addition, the independent auditor represented that, its presentations included the matters required to be discussed with the Audit Committee by Statement on Auditing Standards No. 61, as amended, “Communication with Audit Committees.”

The Company’s independent auditor also provided the Audit Committee with the written disclosures required by Independence Standards Board Standard No. 1, “Independence Discussions with Audit Committees,” and the Audit Committee discussed with the independent auditor that firm’s independence.

| (1) | This Section is not “soliciting material,” is not deemed “filed” with the SEC and is not to be incorporated by reference in any filing of the Company under the 1933 Act or the 1934 Act whether made before or after the date hereof and irrespective of any general incorporation language in any such filing. |

8

In reliance on the Audit Committee’s reviews and discussions with management and the independent auditor, the Audit Committee recommended that the Board include the audited consolidated financial statements in the Company’s annual report on Form 10-K for the year ended March 31, 2002.

AUDIT COMMITTEE

Franklin P. Johnson, Jr., Chairman

William K. Bowes

L. Wayne Price

9

PROPOSAL 2

RATIFICATION OF SELECTION OF INDEPENDENT AUDITOR

The Board of Directors has selected Ernst & Young LLP as the Company’s independent auditor for the fiscal year ending March 31, 2002 and has further directed that management submit the selection of independent auditor for ratification by the stockholders at the Annual Meeting. Ernst & Young LLP has audited the Company’s financial statements since its inception in 1980. Representatives of Ernst & Young LLP are expected to be present at the Annual Meeting. They will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions.

Neither Applied Micro Circuit Corporation’s Bylaws nor other governing documents or law requirestockholder ratification of the selection of Ernst & Young LLP as the Company’s independent auditor. However, the Board is submitting the selection of Ernst & Young LLP to the stockholders for ratification as a matter of good corporate practice. If the stockholders fail to ratify the selection, the Audit Committee and the Board will reconsider whether or not to retain that firm. Even if the selection is ratified, the Audit Committee and the Board in their discretion may direct the appointment of a different independent auditor at any time during the year if they determine that such a change would be in the best interests of the Company and its stockholders.

The affirmative vote of the holders of a majority of the shares present in person or represented by proxy and entitled to vote at the annual meeting will be required to ratify the selection of Ernst & Young LLP. Abstentions will be counted toward the tabulation of votes cast on this proposal and will have the same effect as negative votes. Broker non-votes are not counted for any purpose in determining whether this proposal has been approved.

Audit Fees. During the fiscal year ended March 31, 2002, the aggregate fees billed by Ernst & Young LLP for audit and audit related fees was $448,168, of which $231,136 was for the audit of the Company’s financial statements for such fiscal year and for the review of the Company’s interim financial statements.

Financial Information Systems Design and Implementation Fees. There were no fees billed by Ernst & Young LLP for information technology consulting during the fiscal year ended March 31, 2002.

All Other Fees. During fiscal year ended March 31, 2002, the aggregate fees billed by Ernst & Young LLP for professional tax consulting services was $904,467.

The Audit Committee has determined the rendering of the information technology consulting fees and all other non-audit services by Ernst & Young LLP is compatible with maintaining the auditor’s independence.

THE BOARD OF DIRECTORS RECOMMENDS

A VOTE IN FAVOR OF PROPOSAL 2.

10

SECURITY OWNERSHIP OF

CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding the ownership of the Company’s Common Stock as of June 1, 2002 by: (i) each director; (ii) each of the executive officers named in the Summary Compensation Table; (iii) all executive officers and directors of the Company as a group; and (iv) all those known by the Company to be beneficial owners of more than five percent of its Common Stock.

Beneficial Ownership | |||||

Beneficial Owner and Address(1) | Number of Shares(2) | Percent of Total(2)(3) | |||

| Capital Group International, Inc.(4) | 34,728,410 | 11.5 | % | ||

| Capital Research & Management(5) | 17,783,400 | 5.9 | % | ||

| David M. Rickey(6) | 4,355,190 | 1.4 | % | ||

| Roger A. Smullen, Sr.(7) | 2,612,355 | * | |||

| Franklin P. Johnson, Jr.(8) | 1,762,765 | * | |||

| Douglas C. Spreng(9) | 1,371,586 | * | |||

| Brent E. Little(10) | 1,352,908 | * | |||

| Thomas L. Tullie(11) | 929,931 | * | |||

| William E. Bendush(12) | 679,066 | * | |||

| Arthur B. Stabenow(13) | 408,009 | * | |||

| William K. Bowes, Jr.(14) | 358,819 | * | |||

| Harvey P. White(15) | 262,083 | * | |||

| S. Atiq Raza(16) | 173,641 | * | |||

| L. Wayne Price(17) | 102,083 | * | |||

| Kevin N. Kalkhoven(18) | 77,083 | * | |||

| Cesar Cesaratto(19) | 25,000 | * | |||

| All executive officers and directors as a group (20 persons)(20) | 28,837,049 | 9.6 | % | ||

| * | Less than one percent. |

| (1) | The address for the executive officers and directors of the Company is: c/o AMCC, 6290 Sequence Drive, San Diego, CA 92121 |

| (2) | The persons named in this table have sole voting and investment power with respect to all shares of Common Stock shown as beneficially owned by them, subject to community property laws where applicable and except as indicated in the other footnotes to this table. |

| (3) | In computing the number of shares beneficially owned by a person and the percentage ownership of that person, shares of Common Stock subject to options or warrants held by that person that are exercisable within 60 days after June 1, 2002 are deemed outstanding. Such shares, however, are not deemed outstanding for the purpose of computing the percentage ownership of any other person. Applicable percentages are based on 300,819,111 shares of Common Stock outstanding on June 1, 2002 together with applicable options for such stockholders. |

| (4) | Based on a Schedule 13G/A filed by Capital Group International, Inc. and Capital Guardian Trust Company on June 27, 2002. Capital Group International, Inc. is the parent holding company of a group of investment management companies that hold investment power and, in some cases, voting power over the shares of Common Stock included in this table. The investment management companies, which include Capital Guardian Trust Company, a “bank” as defined in Section 3(a)(6) of the Securities Exchange Act of 1934 (the “1934 Act”) and a wholly owned subsidiary of Capital Group International, Inc., and several investment advisers registered under Section 203 of the Investment Advisers Act of 1940, provide investment advisory services for their respective clients, which include registered investment companies and institutional accounts. Capital Group International, Inc. does not have investment power or voting power over any of the shares of Common Stock and disclaims beneficial ownership of such shares pursuant to Rule 13d-4. Capital Guardian Trust Company is deemed to be the beneficial owner of 16,131,830 of these shares of Common Stock as a result of its serving as the investment manager of |

11

| various institutional accounts. Capital Guardian Trust Company disclaims beneficial ownership of such shares pursuant to Rule 13d-4. The address for Capital Group International, Inc. and Capital Guardian Trust Company is 11100 Santa Monica Blvd., Los Angeles, CA 90025. |

| (5) | Based on a Schedule 13G filed by Capital Research & Management on February 11, 2002. The address for Capital Research & Management is 333 South Hope Street, 55th Floor, Los Angeles, CA 90071-1447. |

| (6) | Includes 1,235,567 shares of Common Stock owned by the David Rickey & Jan E. Nielsen Family Trust, 7,585 shares held by Mr. Rickey’s wife and 3,106,667 shares of Common Stock issuable upon the exercise of vested options that are exercisable within 60 days of June 1, 2002. |

| (7) | Includes 292,333 shares of Common Stock issuable upon the exercise of vested options that are exercisable within 60 days of June 1, 2002. |

| (8) | Includes 611,611 shares of Common Stock issuable upon the exercise of vested options that are exercisable within 60 days of June 1, 2002. Also includes 561,328 shares held by Mr. Johnson’s wife. |

| (9) | Includes 14,871 shares of Common Stock owned by Douglas and Barbara Spreng Family Trust and 1,356,715 shares issuable upon the exercise of options that are exercisable within 60 days of June 1, 2002. |

| (10) | Includes 90,564 shares of Common Stock owned by the Little Family Trust and 1,227,506 shares of Common Stock issuable upon the exercise of options that are exercisable within 60 days of June 1, 2002. |

| (11) | Includes 689,721 shares of Common Stock issuable upon the exercise of vested options that are exercisable within 60 days of June 1, 2002. |

| (12) | Includes 663,287 shares of Common Stock issuable upon the exercise of options that are exercisable within 60 days of June 1, 2002. |

| (13) | Includes 152,083 shares of Common Stock issuable upon the exercise of options that are exercisable within 60 days of June 1, 2002. |

| (14) | Includes 45,600 shares of Common Stock owned by the William K. Bowes, Jr. Foundation and 205,411 shares of Common Stock issuable upon the exercise of vested options that are exercisable within 60 days of June 1, 2002. |

| (15) | Includes 252,083 shares of Common Stock issuable upon the exercise of options that are exercisable within 60 days of June 1, 2002. |

| (16) | Includes 2,868 shares of Common Stock owned by a Limited Partnership and 160,417 shares of Common Stock issuable upon the exercise of options that are exercisable within 60 days of June 1, 2002. |

| (17) | Includes 102,083 shares issuable upon the exercise of options that are exercisable within 60 days of June 1, 2002. |

| (18) | Includes 77,083 shares issuable upon the exercise of options that are exercisable within 60 days of June 1, 2002. |

| (19) | Includes 25,000 shares issuable upon the exercise of options that are exercisable within 60 days of June 1, 2002. |

| (20) | Includes 22,061,878 shares issuable upon the exercise of options that are exercisable within 60 days of June 1, 2002. |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the 1934 Act requires the Company’s directors and executive officers, and persons who own more than ten percent of a registered class of the Company’s equity securities, to file with the SEC initial reports of ownership and reports of changes in ownership of common stock and other equity securities of the Company. Officers, directors and greater than ten percent stockholders are required by SEC regulation to furnish the Company with copies of all Section 16(a) forms they file.

To the Company’s knowledge, based solely on a review of the copies of such reports furnished to the Company and written representations that no other reports were required, during the fiscal year ended March 31, 2002, all Section 16(a) filing requirements applicable to its officers, directors and greater than ten percent beneficial owners were complied with except that Mr. Raza made one late filing.

12

EXECUTIVE COMPENSATION

Compensation of Directors

Each non-employee director of the Company receives an annual retainer of $12,000. Effective April 1, 2002, each non-employee director will receive a fee of $1,000 for each regular board meeting attended and each special board meeting or committee meeting attended in person and $500 for each special board meeting or committee meeting attended by telephone. In the fiscal year ended March 31, 2002, the total compensation paid to all non-employee directors as a group was $89,933. Directors are also reimbursed for customary and usual travel expenses incurred in connection with attendance at meetings of the Board.

The Company’s 1997 Directors’ Stock Option Plan (the “Directors’ Plan”) provides that each person who becomes a non-employee director of the Company will be granted a stock option to purchase 100,000 shares of Common Stock on the date on which the optionee first becomes a non-employee director. Thereafter, on April 1 of each year (starting in 2000 for non-employee directors who were serving as of November 24, 1997), each non-employee director is granted an option to purchase 50,000 shares of Common Stock if on such date, he or she has served on the Company’s Board for at least six months. The exercise price of each stock option granted under the Directors’ Plan is equal to the fair market value of one share of Common Stock on the date of grant. Options granted under the Directors’ Plan become exercisable or “vest” in 12 equal monthly installments following the date of grant. In the event of the dissolution or liquidation of the Company, a sale of the Company or substantially all of the assets of the Company, the merger of the Company with or into another corporation or other change-in-control transaction involving the Company, the vesting of each option will accelerate, and the option will terminate unless the option is assumed by the successor corporation.

During the last fiscal year, the Company granted options covering 250,000 shares in aggregate (50,000 shares each) to the non-employee directors of the Company at an exercise price per share of $16.50. In addition, Mr. Kalkhoven received an option grant under the Directors’ Plan of 100,000 shares at an exercise price of $10.24 upon his election to the Board on October 19, 2001.

The Company has agreed to indemnify each director and officer against certain claims and expenses for which the director might be held liable in connection with past or future services to the Company and its subsidiaries. In addition, the Company maintains an insurance policy insuring its officers and directors against such liabilities.

13

COMPENSATION OF EXECUTIVE OFFICERS

Summary of Compensation

The following table shows the compensation awarded or paid to, or earned by, the Company’s Chief Executive Officer and its other four most highly compensated individuals who served as executive officers during the fiscal year ending March 31, 2002 (the “Named Executive Officers”), and the compensation received by each officer in the prior two fiscal years:

SUMMARY COMPENSATION TABLE

Year | Long-Term Compensation Awards Securities Underlying Options(#)(3) | |||||||||||||||

Name and Principal Position | Annual Compensation | Other Annual Compensation ($)(2) | All Other Compensation($) | |||||||||||||

Salary ($)(1) | Bonus ($) | |||||||||||||||

| David M. Rickey | 2002 | 480,297 | (4) | — | 2,000 | (5) | 400,000 | 3,120 | (6) | |||||||

| Chairman of the Board | 2001 | 415,000 | 500,000 | (7) | 2,000 | (5) | 800,000 | 3,120 | (6) | |||||||

| and Chief Executive Officer | 2000 | 348,550 | 350,000 | (8) | 2,205 | (5) | 5,280,000 | 3,120 | (6) | |||||||

| Douglas C. Spreng | 2002 | 344,391 | (9) | — | 3,414 | (5) | 400,000 | — | ||||||||

| President and Chief | 2001 | 168,750 | (10) | 25,000 | (7) | 1,542 | (5) | 1,000,000 | — | |||||||

| Operating Officer | 2000 | — | — | — | — | — | ||||||||||

| Thomas L. Tullie | 2002 | 251,777 | (11) | — | — | 125,000 | — | |||||||||

| Senior Vice President, | 2001 | 526,077 | (12) | 25,000 | (7) | 2,000 | (5) | 225,000 | — | |||||||

| Sales | 2000 | 268,473 | (13) | 35,000 | (8) | 2,000 | (5) | 540,000 | — | |||||||

| William E. Bendush | 2002 | 235,000 | (14) | — | 2,000 | (5) | 85,000 | — | ||||||||

| Senior Vice President | 2001 | 225,058 | 175,000 | (7) | 2,217 | (5) | 125,000 | — | ||||||||

| and Chief Financial Officer | 2000 | 199,288 | (15) | 100,000 | (8) | 1,364 | (5) | 1,300,000 | — | |||||||

| Brent E. Little | 2002 | 229,615 | — | 2,000 | (5) | 100,000 | — | |||||||||

| Senior Vice President, | 2001 | 188,942 | 175,000 | (7) | 2,000 | (5) | 150,000 | — | ||||||||

| Corporate Marketing and General Manager, Mixed Signal Products Division | 2000 | 163,231 | 100,000 | (8) | 2,107 | (5) | 800,000 | — | ||||||||

| (1) | Includes pre-tax contributions to the AMCC 401(k) Plan. |

| (2) | Excludes certain “perquisites” which, for any Named Executive Officer, did not in aggregate exceed the lesser of $50,000 or 10 percent of such named executive officer’s total annual salary and bonus for that year. |

| (3) | Options granted in a given fiscal year may include grants based on the officer’s performance in the prior fiscal year and have been adjusted to reflect the September 1999, March 2000 and October 2000 two-for-one stock splits. We have not granted stock appreciation rights to executive officers. |

| (4) | Mr. Rickey received no salary increase in fiscal 2002. |

| (5) | Includes matching contribution under the AMCC 401(k) Plan. |

| (6) | Includes annual premiums in the amount of $3,120 paid by the Company on a term life insurance policy. |

| (7) | Includes fiscal 2001 bonus paid in April 2001 (fiscal 2002). |

| (8) | Includes fiscal 2000 bonus paid in April 2000 (fiscal 2001). |

| (9) | Mr. Spreng received no salary increase in fiscal 2002. |

| (10) | Salary earned from October 25, 2000 (date of acquisition of MMC Networks, Inc.) to March 31, 2001. |

| (11) | Includes commissions earned by Mr. Tullie in the amount of $113,315. |

| (12) | Includes commissions earned by Mr. Tullie in the amount of $333,961. |

| (13) | Includes commissions earned by Mr. Tullie in the amount of $107,521. |

14

| (14) | Mr. Bendush received no salary increase in fiscal 2002. |

| (15) | Includes a sign-on bonus in the amount of $25,000. |

OPTION GRANTS IN LAST FISCAL YEAR

The following table shows information regarding options granted to the Named Executive Officers for the fiscal year ended March 31, 2002 and hypothetical gains on those options based on a 5% or 10% annual compound stock price appreciation during the ten-year option term:

Individual Grants(1) | Potential Realizable Value at Assumed Annual Rates of | |||||||||||||||

Number of Securities Underlying Options Granted(#) | % of Total Options Granted to Employees in Fiscal Year(3) | Exercise Price ($/Sh)(4) | Stock Price Appreciation for Option Term(2) | |||||||||||||

Expiration | Original Option | Replacement Option | ||||||||||||||

Name | Date | 5%($) | 10%($) | 5%($) | 10%($) | |||||||||||

| David M. Rickey | 400,000 | 3.9992 | 14.62 | 7/11/11 | 3,677,776 | 9,320,206 | 1,466,214 | 3,623,671 | ||||||||

| Douglas C. Spreng | 400,000 | 3.9992 | 14.62 | 7/11/11 | 3,677,776 | 9,320,206 | 1,466,214 | 3,623,671 | ||||||||

| Thomas L. Tullie | 125,000 | 1.2497 | 14.62 | 7/11/11 | 1,149,305 | 2,912,564 | 458,192 | 1,132,397 | ||||||||

| William E. Bendush | 85,000 | .8498 | 14.62 | 7/11/11 | 781,527 | 1,980,544 | 311,570 | 770,030 | ||||||||

| Brent E. Little | 100,000 | .9998 | 14.62 | 7/11/11 | 919,444 | 2,330,051 | 366,553 | 905,918 | ||||||||

| (1) | We granted these options pursuant to the 1992 Stock Option Plan. The options become exercisable on a monthly basis over a period of 48 months from the date of grant. |

| (2) | We calculated these values based on (i) $14.62 the exercise price of the options originally granted to the Named Executive Officers in fiscal 2002 and (ii) $6.54, the exercise price of the replacement options granted after the end of fiscal 2002 in exchange for the original options pursuant to our company-wide option exchange program. The remaining vesting schedule and term of each replacement option are identical to those terms in the original option. We are required by the rules of the SEC to calculate these values using the 5% and 10% assumed annual rates of compounded stock price appreciation. We do not know what the actual stock price appreciation rate over the ten-year option term will be, and we cannot assure you that it will be at either the assumed 5% or 10% levels. The Named Executive Officers and our other optionees will only realize value from these options if the market price of the common stock appreciates over the option term. |

| (3) | We granted options to purchase an aggregate of 10,264,029 shares of our common stock during fiscal 2002, of which options to purchase an aggregate of 8,100,529 shares were granted to employees. |

| (4) | The exercise prices shown in the table are for the original options granted to the Named Executive Officers during fiscal 2002. The Named Executive Officers elected to tender those options to us for cancellation in exchange for replacement options under our option exchange program. The replacement options were granted in May 2002. Each replacement option has an exercise price of $6.54 per share, the closing price of our common stock on The Nasdaq National Market on the date of grant. Optionees may pay the exercise price and tax withholding obligations related to exercise by delivering shares that they already own or by offset against the shares subject to their options. |

15

AGGREGATED OPTION EXERCISES IN LAST FISCAL YEAR AND FISCAL YEAR END OPTION VALUES

The following table shows certain information regarding options exercised during fiscal 2002 and options held at March 31, 2002 by the Named Executive Officers:

Options Held at Fiscal Year End(1) | ||||||||||||

Options Exercised During Fiscal 2002 | Number of Unexercised Options | Value of Unexercised In-the-Money Options | ||||||||||

Shares | Exercisable/Unexercisable(#) | Exercisable/Unexercisable($) | ||||||||||

Name | Acquired on Exercise(#) | Value Realized($)(2) | Outstanding Options Only | Including Replacement Options(3) | Outstanding Options Only | Including Replacement Options(4) | ||||||

| Mr. Rickey | 520,000 | 4,034,524 | 40,000/320,000 | 2,836,666/2,683,334 | 107,706/484,992 | 4,144,498/3,932,494 | ||||||

| Mr. Spreng | — | — | 716,050/335,289 | 1,246,797/1,204,542 | —/— | 699,581/1,344,419 | ||||||

| Mr. Tullie | 81,802 | 415,296 | 370,242/60,000 | 652,638/427,604 | 1,232,931/90,936 | 1,645,785/627,082 | ||||||

| Mr. Bendush | — | — | 334,225/249,996 | 600,371/493,850 | 658,005/492,180 | 1,067,777/827.008 | ||||||

| Mr. Little | 64,992 | 637,706 | 819,172/257,500 | 1,156,671/620,001 | 1,983,550/393,394 | 2,486,532/912,412 | ||||||

| (1) | We had no stock appreciation rights outstanding during fiscal 2002. |

| (2) | We calculated the value realized on exercise of an option based on the closing price of our common stock on The Nasdaq National Market on the date of exercise (or when the option was exercised via a same-day sale, the actual sale price of the common stock sold) minus the applicable per share exercise price. |

| (3) | We have also provided information on the number of options that would have been outstanding at fiscal year end if the replacement options that were granted after the fiscal year ended had been included. |

| (4) | We have also provided information on the value of options that would have been outstanding at fiscal year end and would have been in-the-money if the replacement options that were granted after the fiscal year ended had been included. We determined which options, including the replacement options, were in-the-money and calculated their value based on $8.00 per share, the closing price of our common stock on The Nasdaq National Market on March 28, 2002, less the exercise price of the options. |

16

EMPLOYMENT, SEVERANCE AND CHANGE OF CONTROL AGREEMENTS

In January 1996, the Company entered into a letter agreement with Mr. Rickey. This agreement entitles Mr. Rickey to a salary to be set by the Compensation Committee and term life insurance purchased by the Company for the benefit of Mr. Rickey’s estate. The agreement provides that if the Company is acquired and the per share value of the Company’s Common Stock is less than $0.75 per share, the Company will compensate Mr. Rickey for the difference between $0.75 per share and the per share merger or sale price determined by the Company’s Board. The letter agreement provides that Mr. Rickey’s employment is at will and terminable by the Company or Mr. Rickey for any reason, with or without cause, and with or without notice.

In October 2000, the Company entered into an employment agreement with Mr. Spreng in connection with the Company’s acquisition of MMC Networks. The agreement provides that after an initial one year term, Mr. Spreng’s employment is at will and terminable by the Company or Mr. Spreng for any reason, with or without cause. The agreement also provides that if Mr. Spreng’s employment by the Company is terminated either without cause or constructively, the Company will pay Mr. Spreng his base salary for the six months following termination and Mr. Spreng may continue his health insurance benefits for up to six months at the Company’s expense.

In accordance with the terms of the Company’s stock option plans, if the Company enters into certain change-of-control transactions, any option granted to purchase shares of Common Stock shall vest and become immediately exercisable for the number of shares that would otherwise be vested and exercisable under the terms of the option one year after the date of the change-of-control transaction. This would apply to options granted to any of the Named Executive Officers.

REPORT OF THE COMPENSATION COMMITTEE OF THE

BOARD ON EXECUTIVE COMPENSATION(1)

The following is a report of the Compensation Committee of the Board (the “Committee”) describing the compensation policies applicable to the Company’s executive officers during the fiscal year ended March 31, 2002.

The Committee is responsible for establishing and monitoring the general compensation policies and compensation plans of the Company, as well as the specific compensation levels for executive officers. It also grants options under the Company’s equity incentive plans. Executive officers who also are directors have not participated in deliberations or decisions involving their own compensation.

General Compensation Philosophy

Under the supervision of the Committee, the Company’s compensation policy is designed to attract, motivate and retain qualified key executives critical to the Company’s growth. It is the objective of the Company to have a portion of each executive’s compensation dependent upon the Company’s performance as well as upon the executive’s individual performance. Accordingly, each executive officer’s compensation package is comprised of three elements: (i) base salary which reflects individual performance and expertise, (ii) variable bonus payable in cash and tied to achievement of both Company and individual annual performance goals and (iii) stock options which are designed to align the long-term interests of the executive officer with those of the Company’s stockholders.

| (1) | This Section is not “soliciting material,” is not deemed “filed” with the SEC and is not to be incorporated by reference in any filing of the Company under the 1933 Act or the 1934 Act whether made before or after the date hereof and irrespective of any general incorporation language in any such filing. |

17

The Committee considers the total compensation of each executive officer in establishing each element of compensation. All incentive compensation plans are reviewed at least annually to assure they meet the current strategies and needs of the Company.

The summary below describes in more detail the factors that the Committee considers in establishing each of the three primary components of the compensation package provided to the executive officers.

Base Salary

Base salaries are established based on benchmark data from nationally recognized surveys of similar high-technology companies that compete with the Company for executive officers and Company research of peer companies. Peer companies include semiconductor companies operating in similar markets. Each executive officer’s base salary is established on the basis of the individual’s qualifications and relevant experience, their contribution and performance and the compensation levels of executives at similar high-technology companies. Base salary is generally reviewed once each year.

Variable Bonus

The Committee believes that a substantial portion of the annual compensation of each executive should be in the form of variable incentive pay to reinforce the attainment of Company goals. The Executive Bonus Plan rewards achievement of specified levels of corporate profitability. A pre-determined formula, which takes into account profitability against the annual plan approved by the Board, is used to determine the bonus pool. The individual executive officer’s share of the bonus pool is based upon discretionary assessment of each officer’s performance during the prior fiscal year and is benchmarked against bonus practices of peer high-technology companies.

Stock Options

The goal of the Company’s long-term, equity based incentive awards is to align the interests of executive offices and employees with stockholders of the Company and to provide each executive officer with a significant incentive to manage the Company from the perspective of an owner with a long-term stake in the business.

The Committee determines the appropriate value to be delivered to each executive officer via stock option awards based on the individual’s position and responsibilities with the Company, his or her performance and contribution, the value of his or her current unvested stock option holdings and market grant practices among peer high-technology companies. Each option grant allows the executive officer to acquire shares of Common Stock at a fixed price per share (the fair market value on the date of grant) over a specified period of time (up to 10 years from the date of grant). The options typically vest in periodic installments over a four-year period contingent upon the executive officer’s continued employment with the Company. Accordingly, the options will provide a return to the executive officer only if he or she remains in the Company’s service, and then only if the market price of the Common Stock appreciates over the option term.

Compensation for the Chief Executive Officer

David M. Rickey has served as the Company’s Chief Executive Officer since February 1996. In August 2000, Mr. Rickey was named as Chairman of the Board.

Base Salary: The Committee reviews the Chief Executive Officer’s major accomplishments and reported base salary information for the chief executive officers of other companies in the Company’s peer group. Based on this information, the Committee recommends any salary actions to the Board. The Committee determined that Mr. Rickey would receive no salary increase this year. Mr. Rickey’s salary will remain at $480,000, which places him between the 50th and 60th percentile of peer organizations’ Chief Executive Officer base pay.

18

Cash Incentive: The committee exercises judgment in awarding a cash incentive to the Chief Executive Officer, based on the achievement of overall company financial and business goals. No cash incentive was provided to Mr. Rickey this year.

Long Term Incentive: The Committee approves stock option grants for the Chief Executive Officer consistent with its evaluation of company performance, competitive practice and executive retention. The Committee exercises its judgment in determining a final award, as there is no pre-established formula for determining the award. In July 2001, Mr. Rickey was granted a stock option award to purchase 400,000 shares of common stock at a fair market value exercise price of $14.62 per share.

Tax Deductibility

The committee has considered the impact of Section 162(m) of the IRS Code, which disallows a deduction for any publicly held corporation for individual compensation exceeding $1 million in any taxable year for the CEO and four most highly compensated executive officers unless such compensation meets the requirements for the “performance based compensation”. As the cash compensation paid by the Company to each of its executives is expected to be below $1 million and the Committee believes that options granted under the Company’s 1992 Stock Option Plan to such officers will meet the requirements for qualifying as performance based compensation, the Committee believes that Section 162(m) will not affect the tax deductions available to the Company with respect to the compensation of its executives. It is the Committee’s policy to qualify to the extent reasonable its executive officers’ compensation for deductibility under applicable tax law. However, the Company may, from time to time, pay compensation to its officers that may not be deductible.

COMPENSATION COMMITTEE

Arthur B. Stabenow, Chairman

S. Atiq Raza

Harvey P. White

Compensation Committee Interlocks and Insider Participation

As noted above, the Company’s Compensation Committee consists of Messrs. Raza, Stabenow and White. None of these directors has at any time been an officer or employee of the Company or any subsidiary of the Company. During the last fiscal year, no interlocking relationship existed between the Company’s Board of Directors or Compensation Committee and the board of directors or compensation committee of any other company.

19

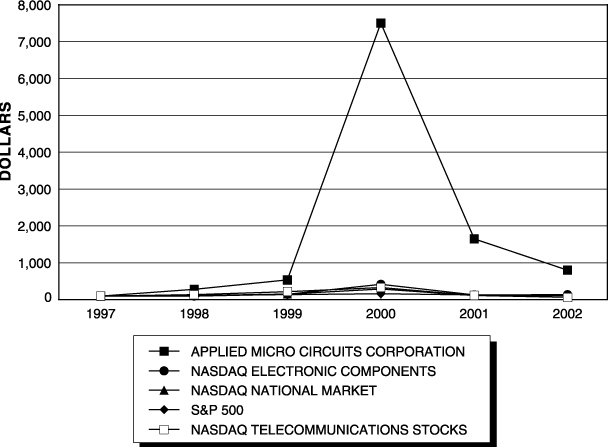

PERFORMANCE MEASUREMENT COMPARISON(1)

The following graph compares the cumulative total stockholder return data for the Company’s stock since November 25, 1997 (the date on which the Company’s stock was first registered under Section 12 of the Securities Exchange Act of 1934, as amended) to the cumulative return over such period of (i) The Nasdaq National Market Composite Index (ii) the Nasdaq Electronic Components Stock Index and (iii) the S & P 500. The graph assumes that $100 was invested in the Common Stock of the Company and in each of the comparative indices on November 25, 1997, the date on which the Company completed the initial public offering of its Common Stock. The graph further assumes that such amount was initially invested in the Common Stock of the Company at a per share price of $1.00, the price to which such stock was first offered to the public by the Company on the date of its initial public offering (adjusted to reflect the September 1999, March 2000 and October 2000 two-for-one stock splits) and reinvestment of any dividends. The stock price performance on the following graph is not necessarily indicative of future stock price performance.

| (1) | This Section is not “soliciting material,” is not deemed “filed” with the SEC and is not to be incorporated by reference in any filing of the Company under the 1933 Act or the 1934 Act whether made before or after the date hereof and irrespective of any general incorporation language in any such filing. |

20

CERTAIN TRANSACTIONS

From time to time, the Company charters an aircraft for business travel purposes by Company personnel from an aircraft charter company. The aircraft is owned by a company that Mr. Rickey controls. In fiscal 2002, the Company paid approximately $200,000 to the aircraft charter company, which the Company believes was equal to the charter fees that would have resulted from an arm’s length transaction.

The Company has entered into indemnification agreements with its officers and directors containing provisions that may require the Company, among other things, to indemnify its officers and directors against certain liabilities that may arise by reason of their status or service as officers or directors (other than liabilities arising from willful misconduct of a culpable nature) and to advance their expenses incurred as a result of any proceeding against them as to which they could be indemnified.

The Company believes that all of the transactions set forth above were made on terms no less favorable to the Company than could have been obtained from unaffiliated third parties. All future transactions, including loans, between the Company and its officers, directors, principal stockholders and affiliates will be approved by a majority of the Board, including a majority of the independent and disinterested outside directors on the Board, and will be on terms no less favorable to the Company than could be obtained from unaffiliated third parties.

OTHER MATTERS

The Board of Directors knows of no other matters that will be presented for consideration at the Annual Meeting. If any other matters are properly brought before the meeting, it is the intention of the persons named in the accompanying proxy to vote on such matters in accordance with their best judgment.

By Order of the Board of Directors

William E. Bendush

Secretary

July 10, 2002

A copy of the Company’s Annual Report to the Securities and Exchange Commission on Form 10-K for the fiscal year ended March 31, 2002 is available without charge upon written request to: Investor Relations, Applied Micro Circuits Corporation, 6290 Sequence Drive, San Diego, California 92121.

21

APPENDIX A

CHARTER OF THE AUDIT COMMITTEE

OF THE BOARD OF DIRECTORS OF

APPLIED MICRO CIRCUITS CORPORATION

Purpose and Policy

The Audit Committee shall provide assistance and guidance to the Board of Directors of the Company in fulfilling its oversight responsibilities to the Company’s stockholders with respect to the Company’s corporate accounting and reporting practices as well as the quality and integrity of the Company’s financial statements and reports. The policy of the Audit Committee, in discharging these obligations, shall be to maintain and foster an open avenue of communication among the Audit Committee, the independent auditors and the Company’s financial management.

Composition and Organization

The Audit Committee shall consist of at least three members of the Board of Directors. The members of the Audit Committee shall satisfy the independence and experience requirements of the Nasdaq National Market.

The Audit Committee shall hold such regular or special meetings as its members shall deem necessary or appropriate. Minutes of each meeting of the Audit Committee shall be prepared and distributed to each director of the Company promptly after each meeting. The operation of the Audit Committee shall be subject to the Bylaws of the Company as in effect from time to time and Section 141 of the Delaware General Corporation Law.

Responsibilities

In fulfilling its responsibilities, the Audit Committee believes that its functions and procedures should remain flexible in order to address changing conditions most effectively. To implement the policy of the Audit Committee, the Committee shall be charged with the following functions:

1. To recommend annually to the Board of Directors the firm of certified public accountants to be employed by the Company as its independent auditors for the ensuing year, which firm is ultimately accountable to the Audit Committee and the Board, as representatives of the Company’s stockholders.

2. To review the engagement of the independent auditors, including the scope, extent and procedures of the audit and the compensation to be paid therefor, and all other matters the Audit Committee deems appropriate.

3. To evaluate, together with the Board, the performance of the independent auditors and, if so determined by the Audit Committee, to recommend that the Board replace the independent auditors.

4. To receive written statements from the independent auditors delineating all relationships between the auditors and the Company consistent with Independence Standards Board Standard No. 1, to consider and discuss with the auditors any disclosed relationships or services that could affect the auditors’ objectivity and independence and otherwise to take, and if so determined by the Audit Committee, to recommend that the Board take, appropriate action to oversee the independence of the auditors.

5. To review, upon completion of the audit, the financial statements to be included in the Company’s Annual Report on Form 10-K.

6. The committee shall review the interim financial statements with management and the independent auditors prior to the public announcement of the quarterly results. Also, the committee shall discuss the results of the quarterly review and any other matters required to be communicated to the committee by the independent auditors under generally accepted auditing standards. The chair of the committee or a specified designee may represent the entire committee for the purposes of this review.

A-1

7. To discuss with the independent auditors the results of the annual audit, including the auditors’ assessment of the quality, not just acceptability, of accounting principles, the reasonableness of significant judgments, the nature of significant risks and exposures, the adequacy of the disclosures in the financial statements and any other matters required to be communicated to the Committee by the independent auditors under generally accepted accounting standards.

8. To evaluate the cooperation received by the independent auditors during their audit examination, including any restrictions on the scope of their activities or access to required records, data and information.

9. To confer with the independent auditors and with the senior management of the Company regarding the scope, adequacy and effectiveness of internal accounting and financial reporting controls in effect.

10. To confer with the independent auditors and senior management in separate executive sessions to discuss any matters that the Audit Committee, the independent auditors or senior management believe should be discussed privately with the Audit Committee.

11. To investigate any matter brought to the attention of the Audit Committee within the scope of its duties, with the power to retain outside counsel and a separate accounting firm for this purpose if, in the judgment of the Audit Committee, such investigation or retention is necessary or appropriate.

12. To prepare the report required by the rules of the Securities and Exchange Commission to be included in the Company’s annual proxy statement.

13. To review and assess the adequacy of this charter annually and recommend any proposed changes to the Board for approval.

14. To report to the Board of Directors from time to time or whenever it shall be called upon to do so.

15. To perform such other functions and to have such powers as may be necessary or appropriate in the efficient and lawful discharge of the foregoing.

A-2

APPLIED MICRO CIRCUITS CORPORATION

6290 SEQUENCE DRIVE

SAN DIEGO, CA 92121

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON AUGUST 28, 2002

TO THE STOCKHOLDERS OF APPLIED MICRO CIRCUITS CORPORATION:

The Annual Meeting of Stockholders of Applied Micro Circuits Corporation, a Delaware corporation, will be held at AMCC’s principal executive offices, located at 6290 Sequence Drive, San Diego, California 92121 on Wednesday, August 28, 2002, at 10:00 a.m., local time, for the purposes stated on the reverse side. The undersigned hereby appoints William E. Bendush, David M. Rickey and Roger A. Smullen, Sr., or any of them, as proxies, each with the power to appoint his substitute, and hereby authorizes them to represent and to vote as designated on the reverse side all of the shares of stock of Applied Micro Circuits Corporation that the undersigned is entitled to vote at the Annual Meeting of Stockholders.

THIS PROXY, WHEN PROPERLY EXECUTED, WILL BE VOTED AS DIRECTED BY THE UNDERSIGNED STOCKHOLDER. IF NO SUCH DIRECTIONS ARE MADE, THIS PROXY WILL BE VOTED FOR THE NOMINEES LISTED ON THE REVERSE SIDE FOR ELECTION TO THE BOARD OF DIRECTORS AND FOR PROPOSAL 2. IF ANY OTHER MATTER IS PROPERLY PRESENTED AT THE ANNUAL MEETING, THIS PROXY WILL BE VOTED IN THE BEST JUDGMENT OF THE PROXIES.

PLEASE MARK, SIGN, DATE AND RETURN THIS PROXY CARD PROMPTLY USING THE ENCLOSED REPLY ENVELOPE.

(CONTINUED AND TO BE SIGNED ON REVERSE SIDE)

APPLIED MICRO CIRCUITS CORPORATION

Vote On Directors 02 0000000000 214853454031

1. | To elect ten directors to hold office until the 2003 Annual Meeting of Stockholders: | |||||||

| 01) David M. Rickey | For All | Withhold All | For All Except | |||||

| 02) Roger A. Smullen, Sr. | ¨ | ¨ | ¨ | |||||

| 03) Douglas C. Spreng | ||||||||

| 04) Cesar Cesaratto | ||||||||

| 05) Franklin P. Johnson, Jr. | ||||||||

| 06) Kevin N. Kalkhoven | ||||||||

| 07) L. Wayne Price | ||||||||

| 08) S. Atiq Raza | ||||||||

| 09) Arthur B. Stabenow | ||||||||

| 10) Harvey P. White | ||||||||

| To withhold authority to vote, mark “For All Except” and write the nominee’s number on the line below | ||||||||

Vote On Proposal | ||||||||

For | Against | Abstain | ||||||

2. | To ratify the selection of Ernst & Young LLP as independent auditor of the Company for its fiscal year ending March 31, 2003; and | ¨ | ¨ | ¨ | ||||

3. | To conduct any other business properly brought before the meeting. | |||||||

| If you plan to attend the meeting, please check box to the right. | ¨ | |||||||

P57485 | 123,456,789,012 03822WJ99 39 | |||||||||

Signature (PLEASE SIGN WITHIN BOX) | Date | Signature (Joint Owners) | Date |