The information in this Prospectus/Proxy Statement is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This Prospectus/Proxy Statement is not an offer to sell these securities, and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION

PRELIMINARY PROSPECTUS/PROXY STATEMENT

DATED FEBRUARY 14, 2025

THE PRUDENTIAL SERIES FUND

PROXY STATEMENT

for

PSF NATURAL RESOURCES PORTFOLIO,

A SERIES OF THE PRUDENTIAL SERIES FUND

and

PROSPECTUS

for

PSF PGIM JENNISON BLEND PORTFOLIO,

A SERIES OF THE PRUDENTIAL SERIES FUND

Dated February 14, 2025

655 Broad Street

Newark, New Jersey 07102

Telephone 888-778-2888

Reorganization of the PSF Natural Resources Portfolio

into the PSF PGIM Jennison Blend Portfolio

This Prospectus/Proxy Statement is furnished in connection with a Special Meeting of Shareholders (the "Meeting") of the PSF Natural Resources Portfolio (the "Target Portfolio"), a series of The Prudential Series Fund (the "Trust"). At the Meeting, you will be asked to consider and approve a Plan of Reorganization of the Trust (the "Plan") that provides for the reorganization of the Target Portfolio into the PSF PGIM Jennison Blend Portfolio (the "Acquiring Portfolio," and together with the Target Portfolio, the "Portfolios"), a separate series of the Trust.

As described in more detail below, the Plan provides for the transfer of all of the Target Portfolio's assets to the Acquiring Portfolio in exchange for (i) the Acquiring Portfolio's assumption of all of the Target Portfolio's liabilities and (ii) the Acquiring Portfolio's issuance to the Target Portfolio of shares of beneficial interest in the Acquiring Portfolio (the "Acquiring Portfolio Shares"). The Acquiring Portfolio Shares received by the Target Portfolio will have an aggregate net asset value that is equal to the aggregate net asset value of the Target Portfolio shares that are outstanding immediately prior to the reorganization transaction. As a result of such transaction, the Target Portfolio will be completely liquidated, and contract owners will beneficially own shares of the Acquiring Portfolio having an aggregate value equal to their Target Portfolio shares. A vote in favor of the Plan by shareholders of the Target Portfolio will constitute a vote in favor of the liquidation of the Target Portfolio and the termination of the Target Portfolio as a separate series of the Trust.

The acquisition of all of the assets of the Target Portfolio by the Acquiring Portfolio in exchange for the Acquiring Portfolio's assumption of all of the liabilities of the Target Portfolio, and the issuance of Acquiring Portfolio Shares to the Target Portfolio, which will distribute such shares to its shareholders, is referred to herein as the "Reorganization." If shareholders of the Target Portfolio approve the Plan and the Reorganization is consummated, they will become shareholders of the Acquiring Portfolio and the Target Portfolio will liquidate.

The Meeting will be held at the offices of the Trust, 655 Broad Street, Newark, New Jersey 07102, on March 25, 2025, at 10:30 a.m. Eastern Time. The Board of Trustees of the Trust (the "Board") is soliciting these voting instructions on behalf of the Target Portfolio and has fixed the close of business on January 3, 2025 (the "Record Date"), as the record date for determining shareholders of the Target Portfolio entitled to notice of, and to vote at, the Meeting or any adjournment thereof. Only holders of record of shares of the Target Portfolio at the close of business on the Record Date are entitled to notice of, and to vote at, the Meeting or any adjournment thereof. This Prospectus/Proxy Statement is first being sent to contract owners on or about February [17], 2025.

The investment objectives of the Target Portfolio and the Acquiring Portfolio are the same and are listed below:

| Target Portfolio Name | | Investment Objective |

| PSF Natural Resources Portfolio | | The investment objective of the Portfolio is long-term growth of capital. |

| Acquiring Portfolio Name | | Investment Objective |

| PSF PGIM Jennison Blend Portfolio | | The investment objective of the Portfolio is long-term growth of capital. |

The Target Portfolio and the Acquiring Portfolio serve as underlying mutual funds for variable annuity contracts and variable life insurance policies (each, a "Contract," and collectively, the "Contracts") issued by life insurance companies (each, a "Participating Life Insurance Company," and collectively, the "Participating Insurance Companies"). Each Participating Insurance Company holds assets invested in these Contracts in various separate accounts, each of which is divided into sub-accounts investing exclusively in a mutual fund or in a portfolio of a mutual fund. Therefore, Contract owners who have allocated their account values to applicable sub-accounts are indirectly invested in the Target Portfolio through the Contracts and should consider themselves shareholders of the Target Portfolio for purposes of this Prospectus/Proxy Statement. Each Participating Insurance Company is required to offer Contract owners the opportunity to instruct it, as owner of record of shares held in the Target Portfolio by its separate or general accounts, how it should vote on the Plan at the Meeting and at any adjournments thereof.

This Prospectus/Proxy Statement gives the information about the Reorganization and the issuance of the Acquiring Portfolio Shares that you should know before investing or voting on the Plan. You should read it carefully and retain it for future reference. A copy of this Prospectus/Proxy Statement is available on the internet at www.prudential.com/variableinsuranceportfolios. The following documents containing additional information about the Portfolios have been filed with the Securities and Exchange Commission (the "SEC") and are incorporated by reference into this Prospectus/Proxy Statement:

You may request a free copy of this Prospectus/Proxy Statement, the Statement of Additional Information relating to this Prospectus/Proxy Statement, and the Prospectus and Statement of Additional Information of the Trust with respect to the Portfolios, or other documents relating to the Trust and the Portfolios without charge by calling 1-800-346-3778 or by writing to the Trust at 655 Broad Street, Newark, New Jersey 07102. The SEC maintains a website (www.sec.gov) that contains this Prospectus/Proxy Statement, reports, and other information relating to the Trust and the Portfolios that have been filed with the SEC.

The SEC has not approved or disapproved these securities or passed upon the adequacy of this Prospectus/Proxy Statement. Any representation to the contrary is a criminal offense.

Mutual fund shares are not deposits or obligations of, or guaranteed or endorsed by, any bank, and are not insured by the Federal Deposit Insurance Corporation or any other U.S. government agency. Mutual fund shares involve investment risks, including the possible loss of principal.

PROSPECTUS/PROXY STATEMENT

TABLE OF CONTENTS

| Page | | | |

| 4 | | Summary | |

| 7 | | Information About the Reorganization | |

| 9 | | Comparison of Target Portfolio, Acquiring Portfolio and Combined Portfolio | |

| 17 | | Management of the Target Portfolio, the Acquiring Portfolio, and the Combined Portfolio | |

| 19 | | Voting Information | |

| 19 | | Additional Information About the Target Portfolio and the Acquiring Portfolio | |

| 20 | | Principal Holders of Shares | |

| 22 | | Financial Highlights | |

SUMMARY

This section is only a summary of certain information contained in this Prospectus/Proxy Statement. You should read the more complete information in the rest of this Prospectus/Proxy Statement, including the form of Plan (Exhibit A) and the additional information regarding the Acquiring Portfolio set forth in Exhibit B.

As explained in more detail below, you are being asked to consider and approve the Plan with respect to the Target Portfolio for which you are a beneficial shareholder. Shareholder approval of the Plan and consummation of the Reorganization will have the effect of reorganizing the Target Portfolio into the Acquiring Portfolio, resulting in a single mutual fund.

As further explained in "Management of the Target Portfolio and the Acquiring Portfolio," PGIM Investments (the "Manager") serves as investment manager to the Target Portfolio and the Acquiring Portfolio. The Acquiring Portfolio will be the accounting and performance survivor of the Reorganization, and the combined portfolio resulting from the Reorganization is sometimes referred to herein as the "Combined Portfolio."

The Target Portfolio and the Acquiring Portfolio are managed under a manager-of-managers structure, which means that the Manager has engaged each subadviser listed below to conduct the investment program of the relevant Portfolio, including the purchase, retention, and sale of portfolio securities and other financial instruments. The Target Portfolio and the Acquiring Portfolio have the same distribution and purchase procedures and exchange rights, and redemption procedures.

| Portfolio | | Subadvisers |

| PSF Natural Resources Portfolio | | T. Rowe Price Associates, Inc. ("T. Rowe Price") |

| PSF PGIM Jennison Blend Portfolio | | Jennison Associates LLC ("Jennison") |

| Combined Portfolio | | Jennison |

The Reorganization is not expected to result in taxable gains or losses or capital gains or losses, for U.S. federal income tax purposes, to Contract owners that beneficially own shares of the Target Portfolio immediately prior to the Reorganization.

Comparison of Investment Objectives and Principal Investment Strategies of the Portfolios

The investment objectives of the Target Portfolio and the Acquiring Portfolio are identical. The investment objective of the Target Portfolio and the Acquiring Portfolio is long-term growth of capital. The investment objectives of the Target Portfolio and the Acquiring Portfolio are non-fundamental, meaning that they can be changed by the Board without shareholder approval.

The Portfolios have similar principal investment strategies in that both the Target Portfolio and the Acquiring Portfolio invest primarily in equity securities. In particular, the Target Portfolio normally invests at least 80% of its assets (net assets plus any borrowings made for investment purposes) in equity securities of companies that are associated with natural resources companies, including those companies that are principally engaged in the research, development, manufacturing, extraction, distribution or sale of materials, energy, or goods related to the agriculture, energy, materials, or commodity-related industrials sectors. Although the Acquiring Portfolio does not have a focus on natural resources companies, it invests at least 80% of its assets (net assets plus any borrowings made for investment purposes) in the stock of companies with market capitalizations within the market capitalization range of the Russell 1000® Index. The Acquiring Portfolio may also invest in mid- and small-capitalization companies. The Target Portfolio may also invest up to 10% of its assets in debt securities rated below investment grade whereas the Acquiring Portfolio may invest up to 20% of its assets in debt obligations, convertible and nonconvertible preferred stock and other equity-related securities, 5% of which may be rated below investment grade. Despite these differences, each Portfolio is substantially invested in global equities. As of August 31, 2024, the Target Portfolio and the Acquiring Portfolio each invested approximately 99% of its assets in global equities (with approximately 40% of the Target Portfolio invested in foreign equities and about 10% of the Acquiring Portfolio invested in foreign equities).

As a result of the Reorganization, shareholders of the Target Portfolio will continue to benefit from significant exposure to equity investments as shareholders of the Combined Portfolio. However, such exposure will be more to domestic equities, which tend to be less volatile, than global natural resources companies.

Principal Risks of the Portfolios

The principal risks associated with the Target Portfolio and the Combined Portfolio are substantially similar, but there are differences. Both Portfolios are subject to economic and market events risk, equity securities risk, expense risk, fixed income securities risk, foreign investment risk, high yield risk, market and management risk, small sized company risk and regulatory risk. In addition, the Target Portfolio, but not the Combined Portfolio, is subject to liquidity and valuation risk, natural resources investment risk, emerging markets risk, focus risk, commodity risk, exchange traded funds (ETF) risk, illiquid investment risk, investment company risk, and portfolio turnover risk. The Combined Portfolio, but not the Target Portfolio, is subject to blend style risk, credit risk, interest rate risk, large company risk, mid-sized company risk, market capitalization risk, and prepayment or call risk. Detailed descriptions of the principal risks associated with the Target Portfolio, the Acquiring Portfolio, and the Combined Portfolio are set forth in this Prospectus/Proxy Statement under the caption "Comparison of the Target Portfolio, the Acquiring Portfolio and the Combined Portfolio—Principal Risks of the Portfolios."

There is no guarantee that shares of the Combined Portfolio will not lose value. This means that the value of the Combined Portfolio's investments, and therefore, the value of the Combined Portfolio's shares, may fluctuate.

Comparison of Investment Management Fees and Total Fund Operating Expenses

The current contractual investment management fee rate for the Acquiring Portfolio is identical to the Target Portfolio. The contractual investment management fee rate for the Combined Portfolio is expected to be identical to the Target Portfolio after the Reorganization is completed. Contractual investment management fees are the management fees payable to the Manager and do not reflect any waivers or reimbursements.

Assuming completion of the Reorganization on December 31, 2023, based on assets under management for each of the Portfolios on that date, the pro forma annualized total operating expense ratio (gross and net) of the Combined Portfolio is lower than the annualized total operating expense ratio (gross and net) of the Target Portfolio. This means that the Target Portfolio shareholders will benefit from reduced total expenses as a result of the Reorganization.

The following tables describe the fees and expenses that owners of the Contracts may pay if they invest in the Target Portfolio or the Acquiring Portfolio, as well as the projected fees and expenses of the Combined Portfolio after the Reorganization. The following table does not reflect any Contract charges. Because Contract charges are not included, the total fees and expenses that you will incur will be higher than the fees and expenses set forth below. The Contract charges will not change as a result of the Reorganization. See your Contract prospectus for more information about Contract charges.

Shareholder Fees^

(fees paid directly from your investment)

| | | | Target

Portfolio | | | | Acquiring

Portfolio | | | | Combined Portfolio

(Pro Forma Surviving) | |

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) | | | NA | * | | | NA | * | | | NA | * |

| Maximum deferred sales charge (load) | | | NA | * | | | NA | * | | | NA | * |

| Maximum sales charge (load) imposed on reinvested dividends | | | NA | * | | | NA | * | | | NA | * |

| Redemption Fee | | | NA | * | | | NA | * | | | NA | * |

| Exchange Fee | | | NA | * | | | NA | * | | | NA | * |

^ Charges and expenses of the Contract will not change as a result of the Reorganization.

* Because shares of both the Target Portfolio and the Acquiring Portfolio are purchased through Contracts, the relevant Contract prospectus should be carefully reviewed for information on the charges and expenses of the Contract. This table does not reflect any such charges; and the expenses shown would be higher if such charges were reflected.

Annual Portfolio Operating Expenses (as of December 31, 2023)

(expenses that are deducted from Portfolio assets)

| | | Target

Portfolio (Class I) | | | Acquiring

Portfolio (Class I) | | | Combined Portfolio

(Pro Forma Surviving) (Class I) | |

| Management Fees | | | 0.45 | % | | | 0.45 | % | | | 0.45 | % |

| Distribution and/or Service Fees (12b-1 Fees) | | | 0.00 | % | | | 0.00 | % | | | 0.00 | % |

| Administration Fees | | | 0.00 | % | | | 0.00 | % | | | 0.00 | % |

| Other Expenses | | | 0.06 | % | | | 0.01 | % | | | 0.01 | % |

| Total Annual Portfolio Operating Expenses | | | 0.51 | % | | | 0.46 | % | | | 0.46 | % |

| Fee Waiver and/or Expense Reimbursement | | | -0.01 | %(1) | | | N/A | | | | -0.01 | %(2) |

| Total Annual Portfolio Operating Expenses After Fee Waiver and/or Expense Reimbursement | | | 0.50 | % | | | 0.46 | % | | | 0.45 | % |

(1) The Manager has contractually agreed to waive 0.008% of its management fee through June 30, 2025. This arrangement may not be terminated or modified without the prior approval of the Trust’s Board.

(2) Subject to shareholder approval of the Merger, the Manager will contractually agree to waive 0.012% of its management fee through June 30, 2026. This arrangement may not be terminated or modified without the prior approval of the Trust’s Board.

| | | Target

Portfolio (Class II) | | | Acquiring

Portfolio (Class II) | | | Combined Portfolio

(Pro Forma Surviving) (Class II) | |

| Management Fees | | | 0.45 | % | | | 0.45 | % | | | 0.45 | % |

| Distribution and/or Service Fees (12b-1 Fees) | | | 0.25 | % | | | 0.25 | % | | | 0.25 | % |

| Administration Fees | | | 0.15 | % | | | 0.15 | % | | | 0.15 | % |

| Other Expenses | | | 0.06 | % | | | 0.01 | % | | | 0.01 | % |

| Total Annual Portfolio Operating Expenses | | | 0.91 | % | | | 0.86 | % | | | 0.86 | % |

| Fee Waiver and/or Expense Reimbursement | | | -0.01 | %(1) | | | N/A | | | | -0.01 | %(2) |

| Total Annual Portfolio Operating Expenses After Fee Waiver and/or Expense Reimbursement | | | 0.90 | % | | | 0.86 | % | | | 0.85 | % |

(1) The Manager has contractually agreed to waive 0.008% of its management fee through June 30, 2025. This arrangement may not be terminated or modified without the prior approval of the Trust’s Board.

(2) Subject to shareholder approval of the Merger, the Manager will contractually agree to waive 0.012% of its management fee through June 30, 2026. This arrangement may not be terminated or modified without the prior approval of the Trust’s Board.

| | | Target

Portfolio (Class III) | | | Acquiring

Portfolio (Class III) | | | Combined Portfolio

(Pro Forma Surviving) (Class III) | |

| Management Fees | | | 0.45 | % | | | 0.45 | % | | | 0.45 | % |

| Distribution and/or Service Fees (12b-1 Fees) | | | 0.25 | % | | | 0.25 | % | | | 0.25 | % |

| Administration Fees | | | 0.00 | % | | | 0.00 | % | | | 0.00 | % |

| Other Expenses | | | 0.06 | % | | | 0.01 | % | | | 0.01 | % |

| Total Annual Portfolio Operating Expenses | | | 0.76 | % | | | 0.71 | % | | | 0.71 | % |

| Fee Waiver and/or Expense Reimbursement | | | -0.01 | %(1) | | | N/A | | | | -0.01 | %(2) |

| Total Annual Portfolio Operating Expenses After Fee Waiver and/or Expense Reimbursement | | | 0.75 | % | | | 0.71 | % | | | 0.70 | % |

(1) The Manager has contractually agreed to waive 0.008% of its management fee through June 30, 2025. This arrangement may not be terminated or modified without the prior approval of the Trust’s Board.

(2) Subject to shareholder approval of the Merger, the Manager will contractually agree to waive 0.012% of its management fee through June 30, 2026. This arrangement may not be terminated or modified without the prior approval of the Trust’s Board.

Expense Examples

The examples assume that you invest $10,000 in each of the Portfolios for the time periods indicated. The examples also assume that your investment has a 5% return each year, that each Portfolio's total operating expenses remain the same, and include the contractual expense cap only for the one-year period for the Target Portfolio, the Acquiring Portfolio and the Combined Portfolio (Pro Forma Surviving), as applicable. These examples do not reflect any charges or expenses for the Contracts. The expenses shown below would be higher if these charges or expenses were included. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| | | One Year | | | Three Years | | | Five Years | | | Ten Years | |

| Target Portfolio (Class I)(1) | | $ | 51 | | | $ | 163 | | | $ | 284 | | | $ | 640 | |

| Acquiring Portfolio (Class I)(1) | | $ | 47 | | | $ | 148 | | | $ | 258 | | | $ | 579 | |

| Combined Portfolio (Class I) (Pro Forma Surviving)(1) | | $ | 46 | | | $ | 147 | | | $ | 257 | | | $ | 578 | |

(1) Based on total annual operating expense ratios reflected in the table above entitled "Annual Portfolio Operating Expenses (as of December 31, 2023)."

| | | One Year | | | Three Years | | | Five Years | | | Ten Years | |

| Target Portfolio (Class II)(1) | | $ | 92 | | | $ | 289 | | | $ | 503 | | | $ | 1,119 | |

| Acquiring Portfolio (Class II)(1) | | $ | 88 | | | $ | 274 | | | $ | 477 | | | $ | 1,061 | |

| Combined Portfolio (Class II) (Pro Forma Surviving)(1) | | $ | 87 | | | $ | 273 | | | $ | 476 | | | $ | 1,060 | |

(1) Based on total annual operating expense ratios reflected in the table above entitled "Annual Portfolio Operating Expenses (as of December 31, 2023)."

| | | One Year | | | Three Years | | | Five Years | | | | Ten Years | |

| Target Portfolio (Class III)(1) | | $ | 77 | | | $ | 242 | | | $ | 421 | | | $ | 941 | |

| Acquiring Portfolio (Class III)(1) | | $ | 73 | | | $ | 227 | | | $ | 395 | | | $ | 883 | |

| Combined Portfolio (Class III) (Pro Forma Surviving)(1) | | $ | 72 | | | $ | 226 | | | $ | 394 | | | $ | 882 | |

(1) Based on total annual operating expense ratios reflected in the table above entitled "Annual Portfolio Operating Expenses (as of December 31, 2023)."

Portfolio Turnover

The Portfolios pay transaction costs, such as commissions, when each buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs. These costs, which are not reflected in annual portfolio operating expenses or in the example, affect a portfolio's performance. During the most recent fiscal year ended December 31, 2023, the Target Portfolio's turnover rate was 94% of the average value of its portfolio, and the Acquiring Portfolio's turnover rate was 77% of the average value of its portfolio.

Reorganization Details and Reasons for the Reorganization

As a result of the Reorganization, you will cease to be a beneficial shareholder of the Target Portfolio and will become a beneficial shareholder of the Acquiring Portfolio. The Acquiring Portfolio Shares received by the Target Portfolio will have an aggregate net asset value that is equal to the aggregate net asset value of the Target Portfolio's shares that are outstanding immediately prior to the Reorganization. As a result of such transaction, the Target Portfolio will be completely liquidated, and shareholders thereof will own shares of the Acquiring Portfolio having an aggregate net asset value equal to the shares of the Target Portfolio held by that shareholder as of the close of regular trading on the New York Stock Exchange on the closing date of the Reorganization.

Both the Target Portfolio and the Acquiring Portfolio serve as underlying mutual funds for the Contracts issued by Participating Insurance Companies. Each Participating Insurance Company holds assets invested in these Contracts in various separate accounts, each of which is divided into sub-accounts investing exclusively in a mutual fund or in a portfolio of a mutual fund. Therefore, Contract owners who have allocated their account values to applicable sub-accounts are indirectly invested in the applicable Portfolio through the Contracts and should consider themselves shareholders of the applicable Portfolio for purposes of this Prospectus/Proxy Statement.

Based on the factors set forth in the "Information About the Reorganization—Board Considerations" section, the Board has determined that the Reorganization is in the best interests of the shareholders of each of the Portfolios and has also concluded that no dilution in value would result to the shareholders of either Portfolio as a result of the Reorganization.

The Board, on behalf of the Target Portfolio and the Acquiring Portfolio, has approved the Plan and unanimously recommends that you vote to approve the Plan.

In deciding whether to vote to approve the Plan, you should consider the information considered by the Board and the information provided in this Prospectus/Proxy Statement.

INFORMATION ABOUT THE REORGANIZATION

This section describes the Reorganization of the Target Portfolio and the Acquiring Portfolio. This section is only a summary of the Plan. You should read the actual form of the Plan attached as Exhibit A.

Board Considerations

On November 19-20, 2024, the Board met to evaluate and consider the proposed Reorganization of the Target Portfolio, a series of the Trust, into the Acquiring Portfolio, also a series of the Trust. In connection with its consideration of whether to approve the Reorganization, the Board was provided with, among other information, presentations by management regarding the proposed Reorganization and information related to the Target Portfolio, the Acquiring Portfolio and the Combined Portfolio. As part of their review process, the Trustees who are not interested persons of the Trust (as defined in the Investment Company Act of 1940, as amended (the "1940 Act")) (the "Independent Trustees") were represented by independent legal counsel. The Independent Trustees were provided with information both in writing and during oral presentations made at that meeting, including, among other matters, historical and projected asset flows, historical performance information, historical fee and expense information, and the projected fee and expense information of the Combined Portfolio following the Reorganization.

The Board, in reaching its decision to approve the Reorganization, considered a number of factors, including, but not limited to, the following:

| ● | The Portfolios have identical investment objectives and similar principal investment strategies and principal risks. The Target Portfolio and the Acquiring Portfolio seek long-term growth of capital. Both the Target Portfolio and the Acquiring Portfolio invest primarily in equity securities; |

| ● | The Combined Portfolio will be larger than the Target Portfolio with an estimated $7.1 billion based on net assets as of August 31, 2024, which will improve overall economies of scale; |

| ● | The Acquiring Portfolio has outperformed the Target Portfolio for the one-, five-, and ten-year periods ended December 31, 2023 and August 31, 2024; |

| ● | Assuming the Reorganization had been in effect for the one-year period ended December 31, 2023, the pro forma total gross and net operating expense ratios for the Combined Portfolio are lower than the total gross and net operating expense ratios, respectively, for the Target Portfolio and the Acquiring Portfolio; |

| ● | The annualized estimated Target Portfolio shareholder savings from the Reorganization will be approximately $255,000, based on portfolio assets for a one-year period, based on current assets as of August 31, 2024; |

| ● | The Portfolios currently have the same investment manager, although the Board noted that the Target Portfolio has a different subadviser than the Acquiring Portfolio; |

| ● | The Target Portfolio and the Acquiring Portfolio each utilize the same custodian, distributor, Fund counsel, and independent public accounting firm, and that those would remain the same immediately after the Reorganization; and |

| ● | The Reorganization is not expected to be a taxable event for U.S. federal income tax purposes for Contract owners. |

For the foregoing reasons, the Board determined that the Reorganization would be in the best interests of the Target Portfolio and Acquiring Portfolio and that the interests of the Target Portfolio's and Acquiring Portfolio's Contract owners and shareholders would not be diluted as a result of the Reorganization. The Board, including a majority of the Independent Trustees, voted to approve the Reorganization and recommends that you vote "FOR" the Reorganization.

Closing of the Reorganization

If shareholders of the Target Portfolio approve the Plan, the Reorganization will take place after various conditions are satisfied by the Trust on behalf of the Target Portfolio and the Acquiring Portfolio. The Trust will determine a specific date for the actual Reorganization to take place, which is presently expected to occur on or about April 14, 2025. This is called the "Closing Date." If the shareholders of the Target Portfolio do not approve the Plan, the Reorganization will not take place, and the Board will consider alternative courses of actions, as described above.

If the shareholders of the Target Portfolio approve the Plan, the Target Portfolio will deliver to the Acquiring Portfolio all of its assets on the Closing Date, the Acquiring Portfolio will assume all of the liabilities of the Target Portfolio on the Closing Date, and the Acquiring Portfolio will issue Acquiring Portfolio Shares to the Target Portfolio. The Acquiring Portfolio Shares received by the Target Portfolio will have an aggregate net asset value that is equal to the aggregate net asset value of the Target Portfolio shares that are outstanding immediately prior to the Reorganization. The Target Portfolio will then distribute the Acquiring Portfolio Shares to its shareholders and liquidate. The Participating Insurance Companies will then make a conforming exchange of units between the applicable sub-accounts in their separate accounts. As a result, shareholders of the Target Portfolio will beneficially own shares of the Acquiring Portfolio that, as of the date of the exchange, have an aggregate value equal to the dollar value of the assets delivered to the Acquiring Portfolio by the Target Portfolio. The stock transfer books of the Target Portfolio will be permanently closed on the Closing Date. Requests to transfer or redeem assets from the Target Portfolio may be submitted at any time before the close of regular trading on the New York Stock Exchange on the Closing Date, and requests that are received in proper form prior to that time will be effected prior to the closing.

To the extent permitted by law, the Trust may amend the Plan without shareholder approval. The Trust may also agree to terminate and abandon the Reorganization at any time before or, to the extent permitted by law, after the approval by shareholders of the Target Portfolio.

Expenses of the Reorganization

All costs incurred in entering into and carrying out the terms and conditions of the Reorganization, other than transaction costs, regardless of whether approved by shareholders, including (without limitation) outside legal counsel and independent registered public accounting firm costs and costs incurred in connection with the printing and mailing of this Prospectus/Proxy Statement and related materials, will be paid by the Manager or its affiliates, not the Target Portfolio or the Acquiring Portfolio. The estimated expenses for this Prospectus/Proxy Statement, including printing and mailing, the shareholder meeting, any proxy solicitation expenses, prospectus updates and proxy solicitation is $207,000.

The Manager expects that approximately 4.2% of the Target Portfolio's holdings (less than 1% of the Combined Portfolio's net assets) will be retained and transferred in kind to the Acquiring Portfolio in connection with the Reorganization. It is anticipated that, in advance of the Reorganization, the remaining 95.8% of the Target Portfolio's holdings will be aligned or sold and the proceeds invested in securities that the Acquiring Portfolio wishes to hold. Prior to the Reorganization, the Manager may use a transition manager to assist in the transition of the Target Portfolio. The Target Portfolio will bear the transaction costs related to the Reorganization, which typically include, but are not limited to, trade commissions, related fees and taxes, and any foreign exchange spread costs, where applicable. The Manager currently estimates such transaction costs, including costs associated with the use of a transition manager, to be approximately $130,000 (0.023% of the Target Portfolio's net assets).

Certain U.S. Federal Income Tax Considerations

For U.S. federal income tax purposes, each Portfolio is treated as a partnership that is not a "publicly traded partnership" as defined in Section 7704 of the Internal Revenue Code of 1986, as amended (the "Code"). If a Portfolio were not to qualify for such treatment, it could be subject to U.S. federal income tax at the Portfolio level, which may reduce the value of an investment therein. As a result of a Portfolio's treatment as a partnership that is not a publicly traded partnership, it is generally not itself subject to U.S. federal income tax. Instead, a Portfolio's income, gains, losses, deductions, credits and other tax items are "passed through" pro rata directly to the Participating Insurance Companies and retain the same character for U.S. federal income tax purposes (without regard as to whether such corresponding amounts are actually distributed from a Portfolio). Distributions may be made to the various separate accounts of the Participating Insurance Companies in the form of additional shares (not in cash).

Each Portfolio intends to comply with the diversification requirements of Section 817(h) of the Code and the U.S. Treasury regulations promulgated thereunder on separate accounts of insurance companies as a condition of maintaining the favorable tax status of the Contracts issued by separate accounts of Participating Insurance Companies. If a Portfolio does not meet such diversification requirements, the Contracts could lose their favorable tax treatment, and thus income and gain allocable to the Contracts could be currently taxable to shareholders of the Portfolio. This could also occur if Contract holders are found to have an impermissible level of control over the investments underlying their Contracts.

Contract owners should consult the applicable prospectus or description of the plan for a discussion and information on the tax consequences of the Contract, policy or plan. In addition, Contract owners may wish to consult with their own tax advisors as to the tax consequences of an investment in one of the Portfolios, including the application of U.S. federal, state, and local and non-U.S. taxes.

The Reorganization may entail various consequences, which are discussed below under the caption "U.S. Federal Income Tax Consequences of the Reorganization."

U.S. Federal Income Tax Consequences of the Reorganization

The following discussion is applicable to the Reorganization. The Reorganization is expected to be treated as a "partnership merger" under Section 708 of the Code and the U.S. Treasury regulations promulgated thereunder. Very generally, pursuant to the partnership merger rules, for U.S. federal income tax purposes, (i) the Combined Portfolio is treated as a continuation of the Portfolio that has the greater net asset value on the Closing Date (the "Continuing Portfolio") and the other Portfolio is treated as terminating (the "Terminating Portfolio"), and (ii) the Terminating Portfolio is treated as contributing all of its assets and liabilities to the Continuing Portfolio in exchange for equity interests of the Continuing Portfolio and immediately thereafter distributing the Continuing Portfolio interests to its shareholders in liquidation of the Terminating Portfolio. Which one of the Portfolios will be treated as the Terminating Portfolio and the Continuing Portfolio for U.S. federal income tax purposes depends on the relative size of each Portfolio at the time of the Reorganization and thus cannot be determined prior to the Reorganization. If the Reorganization had occurred on August 31, 2024, the Target Portfolio would have been treated as the Terminating Portfolio and Acquiring Portfolio would have been treated as the Continuing Portfolio for U.S. federal income tax purposes.

The Reorganization is not expected to be a taxable event for U.S. federal income tax purposes for Contract owners. In addition, assuming the Contracts qualify for U.S. federal tax-deferred treatment applicable to certain variable insurance products, Contract owners generally should not have any reportable gain or loss for U.S. federal income tax purposes even if the Reorganization was a taxable transaction. It is a condition to each Portfolio's obligation to complete its Reorganization that the Portfolios will have received an opinion from Ropes & Gray LLP, counsel to the Portfolios, based upon representations made by the Trust on behalf of the Target Portfolio and the Acquiring Portfolio, existing provisions of the Code, U.S. Treasury regulations promulgated thereunder, current administrative rules, pronouncements and court decisions, and certain assumptions, and subject to certain qualifications, substantially to the effect that:

1. Under Section 723 of the Code, the Continuing Portfolio's tax basis in the assets of the Terminating Portfolio transferred to the Continuing Portfolio in the Reorganization should be the same as the Terminating Portfolio's tax basis in such assets immediately prior to the Reorganization (except and to the extent provided in Section 704(c)(1)(C) of the Code with respect to contributions of "built in loss" property); and

2. Under Section 1223(2) of the Code, the Continuing Portfolio's holding periods in the assets received from the Terminating Portfolio in the Reorganization should include the Terminating Portfolio's holding periods in such assets.

An opinion of counsel is not binding on the U.S. Internal Revenue Service or the courts. Shareholders of the Target Portfolio should consult their tax advisors regarding the tax consequences of the Reorganization to them in light of their individual circumstances.

A Contract owner should consult the prospectus for his or her Contract on the tax consequences of owning the Contract. Contract owners should also consult their tax advisors as to state, local and non-U.S. tax consequences, if any, of the Reorganization, because this discussion only relates to U.S. federal income tax consequences.

Characteristics of Acquiring Portfolio Shares

The Acquiring Portfolio Shares to be distributed to Target Portfolio shareholders will have substantially identical legal characteristics as shares of beneficial interest of the Target Portfolio with respect to such matters as voting rights, accessibility, conversion rights, and transferability.

The Target Portfolio and the Acquiring Portfolio are each organized as a series of the Trust. There are no material differences between the rights of shareholders of the Portfolios.

COMPARISON OF THE TARGET PORTFOLIO, THE ACQUIRING PORTFOLIO, AND THE COMBINED PORTFOLIO

Additional information regarding the Acquiring Portfolio's investments and risks, the management of the Acquiring Portfolio, the purchase and sale of Acquiring Portfolio Shares, annual portfolio operating expenses, certain U.S. federal income tax considerations, and financial intermediary compensation is set forth in Exhibit B to this Prospectus/Proxy Statement.

Analysis of Investment Objectives and Principal Investment Strategies of the Portfolios

The investment objectives of the Target Portfolio and the Acquiring Portfolio are identical. The investment objective of the Target Portfolio and the Acquiring Portfolio is long-term growth of capital. The investment objectives of the Target Portfolio and the Acquiring Portfolio are non-fundamental, meaning that they can be changed by the Board without shareholder approval.

The Portfolios also have similar principal investment strategies in that both the Target Portfolio and the Acquiring Portfolio invest primarily in equity securities. In particular the Target Portfolio normally invests at least 80% of its assets (net assets plus any borrowings made for investment purposes) in equity securities of companies that are associated with natural resources companies, including those companies that are principally engaged in the research, development, manufacturing, extraction, distribution or sale of materials, energy, or goods related to the agriculture, energy, materials, or commodity-related industrials sectors. Although the Acquiring Portfolio does not have a focus on natural resources companies, it invests at least 80% of its assets (net assets plus any borrowings made for investment purposes) in the stock of companies with market capitalizations within the market capitalization range of the Russell 1000® Index. The Acquiring Portfolio may also invest in mid- and small-capitalization companies. The Target Portfolio may also invest up to 10% of its assets in debt securities rated below investment grade whereas the Acquiring Portfolio may invest up to 20% of its assets in debt obligations, convertible and nonconvertible preferred stock and other equity-related securities, 5% of which may be rated below investment grade. Despite these differences, each Portfolio is substantially invested in global equities. As of August 31, 2024, the Target Portfolio and the Acquiring Portfolio each invested approximately 99% of its assets in global equities (with approximately 40% of the Target Portfolio invested in foreign equities and about 10% of the Acquiring Portfolio invested in foreign equities).

As a result of the Reorganization, shareholders of the Target Portfolio will continue to benefit from significant exposure to equity investments as shareholders of the Combined Portfolio. However, such exposure will be more to domestic equities, which tend to be less volatile, than global natural resources companies.

As of the effective date of the Reorganization, the Combined Portfolio will be managed by the Acquiring Portfolio's subadviser (Jennison) according to the investment objective and principal investment strategies of the Acquiring Portfolio. It is not expected that the Acquiring Portfolio will revise any of its investment policies following the Reorganization to reflect those of the Target Portfolio.

| | | Target Portfolio | | Acquiring Portfolio and Combined Portfolio |

| Investment Objective: | | The investment objective of the Target Portfolio is long-term growth of capital. | | The investment objective of the Acquiring Portfolio and the Combined Portfolio is long-term growth of capital. |

| Principal Investment Strategies: | | In pursuing its investment objective, the Target Portfolio normally invests at least 80% of its assets (net assets plus any borrowings made for investment purposes) in equity securities of companies that are associated with natural resources companies, including those companies that are principally engaged in the research, development, manufacturing, extraction, distribution or sale of materials, energy, or goods related to the agriculture, energy, materials, or commodity-related industrials sectors. The Target Portfolio may also invest up to 50% of its total assets in foreign and emerging markets securities, including American Depositary Receipts (ADRs) and securities of companies in developing countries, which offer increasing opportunities for natural resource-related growth. Additionally, the Portfolio may invest in debt securities, including up to 10% of its total assets in debt securities rated below investment grade. The Target Portfolio’s subadviser, T. Rowe Price Associates, Inc. (T. Rowe Price), invests primarily in the common stocks of natural resource companies whose earnings and tangible assets could benefit from accelerating inflation. The Target Portfolio also may invest in other growth companies that T. Rowe Price believes have strong potential for earnings growth but do not own or develop natural resources. The relative percentages invested in natural resource and non-natural resource companies can vary depending on economic and monetary conditions and the Target Portfolio’s subadviser’s outlook for inflation. Natural resource companies in which the Target Portfolio invests typically own, develop, refine, service or transport resources, including energy, metals, forest products, industrials, utilities, chemicals, real estate, and other basic commodities that can be produced and marketed profitably when both labor costs and prices are rising. In pursuing its investment objective, the Target Portfolio has the discretion to deviate from its normal investment criteria and purchase securities that the subadviser believes will provide an opportunity for substantial appreciation. These situations might arise when the subadviser believes a security could increase in value for a variety of reasons, including an extraordinary corporate event, a new product introduction or innovation, a favorable competitive development, or a change in management. The Target Portfolio may also invest in other investment companies, including exchange-traded funds, and illiquid investments. | | In pursuing its investment objective, the Acquiring Portfolio and the Combined Portfolio normally invest at least 80% of its assets (net assets plus any borrowings made for investment purposes) in common stock. The Acquiring Portfolio and the Combined Portfolios primarily invest in the stock of companies with market capitalizations within the market capitalization range of the Russell 1000® Index (measured at the time of purchase). The market capitalization within the range will vary, but as of January 31, 2024, the weighted average market capitalization of companies included in the Russell 1000® Index was approximately $682 billion, and the market capitalization of the largest company included in the Russell 1000® Index was approximately $2.9 trillion. In addition, the Acquiring Portfolio and the Combined Portfolio may invest in mid- and small-capitalization companies. The Acquiring Portfolio's and the Combined Portfolio's subadviser, Jennison Associates LLC, employs a bottom-up fundamental stock research process which sources the investment universe from Jennison’s growth, value, and small/mid cap investment teams. The growth research team seeks companies with unique business models with sustained competitive advantages; catalysts that drive growth rates well above that of the market; superior financial characteristics; and attractive long-term valuations. The value research team seeks companies the team believes are being valued at a discount to their intrinsic value, seeking companies with attractive valuation metrics that are unique to that business, high levels of durability and viability of the business and good business models that are being mispriced. The small/mid cap research process is designed to capitalize on inefficiencies in small-cap asset classes, seeking companies with attractive valuations, strong competitive positions, quality management teams, demonstrated growth in sales and earnings, balance sheet flexibility and strength, and strong earnings growth prospects. The Acquiring Portfolio and the Combined Portfolio may invest up to 30% of its total assets in foreign securities (not including American Depositary Receipts and similar instruments). Up to 20% of the Acquiring Portfolio's and the Combined Portfolio’s investable assets may be invested in short-, intermediate- or long-term debt obligations, convertible and nonconvertible preferred stock and other equity-related securities. Up to 5% of these investable assets may be rated below investment grade. These securities are considered speculative and are sometimes referred to as “junk bonds.” |

| | | Target Portfolio | | Acquiring Portfolio and Combined Portfolio |

| | | | | Jennison employs a systematic portfolio construction process to incorporate its fundamental analysis with a systematic analysis of factors, such as stock price momentum and stock valuation. Incorporating information from both Jennison’s fundamental and systematic analyses, Jennison constructs a diversified portfolio with sector and risk factor exposures managed relative to the Russell 1000® Index, using a technique known generally as portfolio optimization. |

Principal Risks of the Portfolios

The table below compares the principal risks of investing in the Portfolios. A shareholder should refer to the prospectus of the relevant Portfolio for that Portfolio’s full risk profile because the principal risks table below cannot alone be used fully to determine the risk profile of a Portfolio. All investments have risks to some degree, and it is possible that you could lose money by investing in each of the Portfolios. An investment in the Target Portfolio involves similar risks as an investment in the Acquiring Portfolio or the Combined Portfolio, as noted below. An investment in each of the Portfolios is not a deposit with a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. While each of the Portfolios makes every effort to achieve its objective, it can't guarantee success. To the extent the Portfolio invests in underlying investment companies or other underlying portfolios, the Portfolio may be exposed to these risks directly through securities and other investments held directly by the Portfolio or indirectly through investments made by underlying portfolios in which the Portfolio invests.

| Principal Risks | | Target

Portfolio | | Acquiring

Portfolio and

Combined

Portfolio |

| Economic and Market Events Risk. Economic and market events risk is the risk that one or more markets in which the Portfolio invests will decline in value, including the possibility that the markets will decline sharply and unpredictably. While a Portfolio's Manager or Subadviser(s) may make efforts to control the risks associated with market changes, and may attempt to identify changes as they occur, market environment changes can be sudden and extreme. Significant shocks to or disruptions of the financial markets or the economy, including those relating to general economic, political, or financial market conditions; significant or unexpected failures, near-failures or credit downgrades of key institutions; investor sentiment and market perceptions; unexpected changes in the prices of key commodities; government actions; geopolitical events or changes; and factors related to a specific issuer, geography, industry or sector, could adversely affect the liquidity and volatility of securities held by the Portfolio. In periods of market volatility and/or declines, the Portfolio may experience high levels of shareholder redemptions, and may have to sell securities at times when it would otherwise not do so, and at unfavorable prices. | | Yes | | Yes |

| Equity Securities Risk. The value of a particular stock or equity-related security held by the Portfolio could fluctuate, perhaps greatly, in response to a number of factors, such as changes in the issuer's financial condition or the value of the equity markets or a sector of those markets. Such events may result in losses to the Portfolio. In addition, due to decreases in liquidity, the Portfolio may be unable to sell its securities holdings within a reasonable time at the price it values the security or at any price. | | Yes | | Yes |

| Expense Risk. The actual cost of investing in the Portfolio may be higher than the expenses shown in the "Annual Portfolio Operating Expenses" table above for a variety of reasons, including, for example, if the Portfolio's average net assets decrease. | | Yes | | Yes |

| Fixed Income Securities Risk. Investment in fixed income securities involves a variety of risks, including that: an issuer or guarantor of a security will be unable or unwilling to pay obligations when due; due to decreases in liquidity, the Portfolio may be unable to sell its securities holdings within a reasonable time at the price it values the security or at any price; and the Portfolio’s investment may decrease in value when interest rates rise. Volatility in interest rates and in fixed income markets may increase the risk that the Portfolio’s investment in fixed income securities will go down in value. In recent years, the Federal Open Market Committee (FOMC) began implementing increases to the federal funds interest rate and there may be further rate increases. To the extent rates increase substantially and/or rapidly, a Portfolio with significant investment in fixed income investments may be subject to significant losses. Changes in interest rates may also affect the liquidity of the Portfolio’s investments in fixed income securities. | | Yes | | Yes |

| Foreign Investment Risk. Foreign markets tend to be more volatile than US markets and are generally not subject to regulatory requirements comparable to those in the US. Foreign securities include investments in securities of foreign issuers denominated in foreign currencies, as well as securities of foreign issuers denominated in US dollars and American Depositary Receipts. Foreign investment risk includes the risk that: changes in currency exchange rates may affect the value of foreign securities held by the Portfolio; foreign markets generally are more volatile than, and generally are not subject to regulatory requirements comparable to, US markets; foreign financial reporting and tax standards usually differ from those in the US; foreign exchanges are often less liquid than US markets; political or social developments may adversely affect the value of foreign securities; foreign holdings may be subject to special taxation and limitations on repatriating investment proceeds; and certain events in foreign markets may adversely affect foreign and domestic issuers, including, among others, military conflict, geopolitical developments, interruptions in the global supply chain, natural disasters, and outbreaks of infectious diseases. | | Yes | | Yes |

| Principal Risks | | Target

Portfolio | | Acquiring

Portfolio and

Combined

Portfolio |

| High Yield Risk. Investments in fixed income instruments rated below investment grade and unrated instruments of similar credit quality (i.e., “high yield securities” or “junk bonds”) may be more sensitive to interest rate, credit, call, and liquidity risks than investments in investment grade securities, and have predominantly speculative characteristics. An economic downturn generally leads to a higher non-payment rate, and a high yield investment may lose significant value before a default occurs. | | Yes | | Yes |

| Large Company Risk. Large-capitalization stocks as a group could fall out of favor with the market, causing the Portfolio to underperform investments that focus on small- or medium-capitalization stocks. Larger, more established companies may be slow to respond to challenges and may grow more slowly than smaller companies. | | No | | Yes |

| Liquidity and Valuation Risk. The Portfolio may hold one or more securities for which there are no or few buyers and sellers or the securities are subject to limitations on transfer. The Portfolio may be unable to sell those portfolio holdings at the desired time or price, and may have difficulty determining the value of such securities for the purpose of determining the Portfolio's net asset value. In such cases, investments owned by the Portfolio may be valued at fair value pursuant to policies and procedures adopted and implemented by the Manager. No assurance can be given that the fair value prices accurately reflect the value of the security. The Portfolio is subject to a liquidity risk management program, which limits the ability of the Portfolio to invest in illiquid investments. | | Yes | | No |

| Market and Management Risk. Markets in which the Portfolio invests may experience volatility and go down in value, and possibly sharply and unpredictably in short periods of time. Investment techniques, risk analyses, and investment strategies, which may include quantitative models or methods, used by a subadviser in making investment decisions for the Portfolio are subject to human error and may not produce the intended or desired results. The value of the Portfolio's investments may be negatively affected by the occurrence of domestic or global events, including war, terrorism, environmental disasters, natural disasters, sanctions, cybersecurity events, supply chain disruptions, political or civil instability, and public health emergencies, among others. Such events may reduce consumer demand or economic output, result in market closures, travel restrictions or quarantines, and significantly adversely impact the economy. There is no guarantee that the investment objective of the Portfolio will be achieved. | | Yes | | Yes |

| Mid-Sized Company Risk. The shares of mid-sized companies tend to trade less frequently than those of larger, more established companies, which can have an adverse effect on the pricing and volatility of these securities and on the Portfolio's ability to sell the securities. | | No | | Yes |

| Regulatory Risk. The Portfolio is subject to a variety of laws and regulations which govern its operations. The Portfolio is subject to regulation by the Securities and Exchange Commission (the SEC). Similarly, the businesses and other issuers of the securities and other instruments in which the Portfolio invests are also subject to considerable regulation. Changes in laws and regulations may materially impact the Portfolio, a security, business, sector, or market. | | Yes | | Yes |

| Natural Resources Investment Risk. The Portfolio’s investments will expose the Portfolio to the risk of investment in natural resource companies. The market value of securities of natural resource companies may be affected by numerous factors, including changes in commodity prices, events occurring in nature, inflationary pressures, imposition of import controls, international political and economic developments, environmental incidents, resources conservation, the success of exploration projects, and tax and other government regulations. For example, events occurring in nature (such as earthquakes or fires in prime natural resource areas) and political events (such as coups, military confrontations or acts of terrorism) can affect the overall supply of a natural resource and the value of companies involved in such natural resource. Companies in the natural resources industry are at risk for environmental damage claims. Political risks and the other risks to which non-US securities are subject may affect domestic companies if they have significant operations or investments in non-US countries. In addition, rising interest rates and general economic conditions may affect the demand for natural resources. | | Yes | | No |

| Emerging Markets Risk. The risks of non-US investments are greater for investments in or exposed to emerging markets. Emerging market countries typically have economic, political, and social systems that are less developed, and can be expected to be less stable, than those of more developed countries. As a result, there could be less information available about issuers in emerging market countries, which could negatively affect the ability of the manager or a Portfolio’s subadviser(s) to evaluate local companies or their potential impact on a Portfolio’s performance. Characteristics of emerging market economies can include heavy economic dependence on international aid, agriculture or exports (particularly commodities), undeveloped or overburdened infrastructures and legal systems, vulnerability to natural disasters, significant and unpredictable government intervention in markets or the economy, volatile currency exchange rates, currency devaluations, runaway inflation, business practices that depart from norms for developed countries, and generally less liquid markets. For example, the economies of such countries can be subject to currency devaluations and rapid and unpredictable (and in some cases, extremely high) rates of inflation or deflation. Low trading volumes may result in a lack of liquidity, price volatility, and valuation difficulties. Regulatory regimes outside of the US may not require or enforce corporate governance standards comparable to that of the US, which may result in less protections for investors in such issuers and make such issuers more susceptible to actions not in the best interest of the issuer or its investors. Emerging market countries may have policies that restrict investments by foreign investors, or that prevent foreign investors from withdrawing their money at will, which may make it difficult for a Portfolio to invest in such countries or increase the administrative costs of such investments. Countries with emerging markets can be found in regions including, but not limited to, Asia, Latin America, the Middle East, Southern Europe, Eastern Europe, Africa and the region comprising the former Soviet Union. A Portfolio may invest in some emerging markets through trading structures or protocols that subject it to risks such as those associated with decreased liquidity, custody of assets, different settlement and clearance procedures, and asserting legal title under a developing legal and regulatory regime to a greater degree than in developed markets or even in other emerging markets. | | Yes | | No |

| Principal Risks | | Target

Portfolio | | Acquiring

Portfolio and

Combined

Portfolio |

Small Sized Company Risk. Securities of small sized companies tend to be less liquid than those of larger, more established companies, which can have an adverse effect on the price of these securities and on the Portfolio’s ability to sell these securities. The market price of such investments also may rise more in response to buying demand and fall more in response to selling pressure and be more volatile than investments in larger companies. | | Yes | | Yes |

| Focus Risk. The Portfolio focuses or may focus its investments in particular countries, regions, industries, sectors, markets, or types of investments and may accumulate large positions in such areas. As a result, the Portfolio invests in the securities of a small number of issuers and has greater exposure to adverse developments affecting those issuers and a resulting decline in the market price of those issuers’ securities as compared to a portfolio that invests in the securities of a larger number of issuers. | | Yes | | No |

| Commodity Risk. The value of a commodity-linked investment is affected by, among other things, overall market movements, factors affecting a particular industry or commodity, and changes in interest and exchange rates and may be more volatile than traditional equity and debt securities. The value of the commodities underlying commodity-linked instruments may be subject to various economic and non-economic factors, such as drought, floods or other weather conditions, livestock disease, embargoes, competition from substitute products, transportation bottlenecks or shortages, fluctuations in supply and demand, tariffs, war and international economic, political, and regulatory developments. | | Yes | | No |

Exchange-Traded Funds (ETF) Risk. An investment in an ETF generally presents the same primary risks as an investment in a mutual fund that has the same investment objective, strategies, and policies. In addition, the market price of an ETF’s shares may trade above or below its net asset value and there may not be an active trading market for an ETF’s shares. The Portfolio could lose money investing in an ETF if the prices of the securities owned by the ETF go down. | | Yes | | No |

| Illiquid Investments Risk. Illiquid investments risk exists when particular investments made by the Portfolio are difficult to purchase or sell. The Portfolio may make investments that may become less liquid in response to market developments, lack of a trading market, or adverse investor perceptions. If the Portfolio is forced to sell these investments to pay redemption proceeds or for other reasons, the Portfolio may lose money. In addition, when there is no willing buyer and investments cannot be readily sold at the desired time or price, the Portfolio may have to accept a lower price or may not be able to sell the instrument at all. It also may be the case that other market participants may be attempting to liquidate illiquid holdings at the same time as the Portfolio, causing increased supply in the market and contributing to liquidity risk and downward pricing pressure. An inability to sell a portfolio position can adversely affect the Portfolio’s value or prevent the Portfolio from being able to take advantage of other investment opportunities. | | Yes | | No |

| Investment Company Risk. The risks of owning another investment company are generally similar to the risks of investing directly in the securities in which that investment company invests. However, an investment company may not achieve its investment objective or execute its investment strategy effectively, which may adversely affect the Portfolio’s performance. In addition, because closed-end funds and exchange-traded funds trade on a secondary market, their shares may trade at a premium or discount to the actual net asset value of their portfolio securities and their shares may have greater volatility because of the potential lack of liquidity. | | Yes | | No |

| Portfolio Turnover Risk. A subadviser may engage in active trading on behalf of the Portfolio—that is, frequent trading of the Portfolio’s securities—in order to take advantage of new investment opportunities or yield differentials. The Portfolio’s turnover rate may be higher than that of other mutual funds. Portfolio turnover generally involves some expense to the Portfolio, including brokerage commissions or dealer mark-ups and other transaction costs on the sale of securities and reinvestment in other securities. | | Yes | | No |

| Blend Style Risk. A Portfolio’s blend investment style may subject the Portfolio to risks of both value and growth investing. The portion of the Portfolio’s portfolio that makes investments pursuant to a growth strategy may be subject to above-average market price fluctuations as a result of seeking high-quality stocks with good future growth prospects. The portion of the Portfolio’s portfolio that makes investments pursuant to a value strategy may be subject to the risk that the market may not recognize a security’s intrinsic value for long periods of time or that a stock judged to be undervalued may actually be appropriately priced. Issuers of value stocks may have experienced adverse business developments or may be subject to special risks that have caused the stock to be out of favor. If the Portfolio’s assessment of market conditions or a company’s value is inaccurate, the Portfolio could suffer losses or produce poor performance relative to other funds. Historically, growth stocks have performed best during later stages of economic expansion and value stocks have performed best during periods of economic recovery. Therefore, both styles may over time go in and out of favor depending on market conditions. At times when a style is out of favor, that portion of the portfolio may lag the other portion of the portfolio, which may cause the Portfolio to underperform the market in general, its benchmark, and other mutual funds. | | No | | Yes |

| Credit Risk. This is the risk that the issuer, the guarantor, or the insurer of a fixed income security, the counterparty to an investment or derivatives contract, or obligor of an obligation underlying an asset-backed security may be unable or unwilling to make timely principal and interest payments or to otherwise honor its obligations. Litigation, legislation or other political events, business or economic conditions, or the bankruptcy of the issuer could have a significant effect on an issuer’s or obligor’s ability to make payments of principal and/or interest. The lower the credit quality of a bond, the more sensitive it is to credit risk, and the credit quality of an investment can deteriorate rapidly. | | No | | Yes |

| Principal Risks | | Target

Portfolio | | Acquiring

Portfolio and

Combined

Portfolio |

| Interest Rate Risk. The value of your investment may go down when interest rates rise. A rise in interest rates tends to have a greater impact on the prices of longer term or duration securities. When interest rates fall, the issuers of debt obligations may prepay principal more quickly than expected, and the Portfolio may be required to reinvest the proceeds at a lower interest rate. This is referred to as “prepayment risk.” When interest rates rise, debt obligations may be repaid more slowly than expected, and the value of the Portfolio’s holdings may fall sharply. This is referred to as “extension risk.” The Portfolio currently faces a heightened level of interest rate risk because of recent increases in interest rates in the US and globally. In recent years, the Federal Open Market Committee (FOMC) began implementing increases to the federal funds interest rate and there may be further rate increases. As interest rates rise, the value of fixed income investments typically decreases and there is risk that rates across the financial system also may rise. To the extent rates increase substantially and/or rapidly, a Portfolio with significant investment in fixed income investments may be subject to significant losses. Interest rates may continue to increase, possibly suddenly and significantly, with unpredictable effects on the markets and the Portfolio’s investments. The Portfolio may lose money if short-term or long-term interest rates rise sharply or in a manner not anticipated by the subadviser. | | No | | Yes |

| Market Capitalization Risk. Investing in issuers within the same market capitalization category carries the risk that the category may be out of favor due to current market conditions or investor sentiment. Because the Portfolio may invest a portion of its assets in securities issued by small-cap companies, it is likely to be more volatile than a portfolio that focuses on securities issued by larger companies. Small-sized companies often have less experienced management, narrower product lines, more limited financial resources, and less publicly available information than larger companies. In addition, smaller companies are typically more sensitive to changes in overall economic conditions and their securities may be difficult to trade. | | No | | Yes |

Prepayment or Call Risk. Prepayment or call risk is the risk that issuers will prepay fixed-rate obligations held by the Portfolio when interest rates fall, forcing a Portfolio to reinvest in obligations with lower interest rates than the original obligations. Mortgage-related securities and asset-backed securities are particularly subject to prepayment risk. | | No | | Yes |

Analysis of the Fundamental Investment Policies of the Portfolios:

The Target Portfolio, the Acquiring Portfolio, and the Combined Portfolio have the same fundamental investment policies. Fundamental investment policies may not be changed without a majority vote of shareholders as required by the 1940 Act.

| Target Portfolio, Acquiring Portfolio, and Combined Portfolio |

Under its fundamental investment restrictions, each Portfolio may not: |

1. Buy or sell real estate, except that investments in securities of issuers that invest in real estate and investments in mortgage-backed securities, mortgage participations or other instruments supported or secured by interests in real estate are not subject to this limitation, and except that the Portfolios may exercise rights relating to such securities, including the right to enforce security interests and to hold real estate acquired by reason of such enforcement until that real estate can be liquidated in an orderly manner. None of the Portfolios will buy or sell commodities or commodity contracts, except that a Portfolio may, consistent with its investment style, purchase and sell financial futures contracts and options thereon. For purposes of this restriction, futures contracts on currencies and on securities indices and forward foreign currency exchange contracts are not deemed to be commodities or commodity contracts. |

2. Purchase securities on margin (but a Portfolio may obtain such short-term credits as may be necessary for the clearance of transactions); provided that the deposit or payment by a Portfolio of initial or maintenance margin in connection with otherwise permissible futures or options is not considered the purchase of a security on margin. None of the Portfolios will issue senior securities, borrow money or pledge assets, except as permitted by the 1940 Act and rules thereunder, or by exemptive order, SEC release, no-action letter, or similar relief or interpretations. For purposes of this restriction, the purchase or sale of securities on a when-issued or delayed-delivery basis, reverse repurchase agreements, short sales, derivative and hedging transactions and collateral arrangements with respect thereto, and obligations of the Trust to Trustees pursuant to deferred compensation agreements are not deemed to be a pledge of assets or the issuance of a senior security. |

3. Make loans, except through loans of assets of a Portfolio, repurchase agreements, trade claims, loan participations or similar investments, or as permitted by the 1940 Act and rules thereunder, or by exemptive order, SEC release, no-action letter or similar relief or interpretations. Provided that for purposes of this limitation, the acquisition of bonds, debentures, other debt securities or instruments, or participations or other interests therein and investments in government obligations, commercial paper, certificates of deposit, bankers' acceptances or instruments similar to any of the foregoing will not be considered the making of a loan. |

4. Act as underwriter except to the extent that, in connection with the disposition of portfolio securities, it may be deemed to be an underwriter under certain federal securities laws. |

| 5. Purchase securities of a company in any industry if, as a result of the purchase, a Portfolio's holdings of securities issued by companies in that industry would exceed 25% of the value of the Portfolio, except that this restriction does not apply to purchases of obligations issued or guaranteed by the US Government, its agencies and instrumentalities or issued by domestic banks. For purposes of this restriction, neither finance companies as a group nor utility companies as a group are considered to be a single industry and will be grouped instead according to their services; for example, gas, electric, and telephone utilities will each be considered a separate industry. For purposes of this exception, domestic banks shall include all banks which are organized under the laws of the United States or a state (as defined in the 1940 Act), US branches of foreign banks that are subject to the same regulations as US banks and foreign branches of domestic banks (as permitted by the SEC). For purposes of this limitation, investments in other investment companies shall not be considered an investment in any particular industry. |

Performance of the Target Portfolio

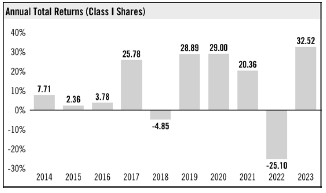

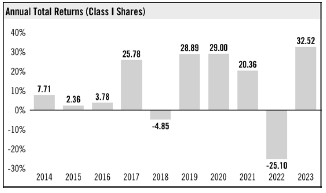

A number of factors, including risk, can affect how the Target Portfolio performs. The information below provides some indication of the risks of investing in the Target Portfolio by showing changes in its performance from year to year, and by showing how its average annual returns over various time periods compare with those of a broad-based securities market index that reflects the performance of the overall market applicable to the Target Portfolio and an additional index that represents the market sectors in which the Target Portfolio primarily invests. Past performance does not mean that the Target Portfolio will achieve similar results in the future.

The annual returns and average annual returns shown in the chart and tables are after deduction of expenses and do not include Contract charges. If Contract charges were included, the returns shown would have been lower than those shown. Consult your Contract prospectus for information about Contract charges.

Note: The PSF Natural Resources Portfolio changed its subadviser and changed its investment policies and strategy effective June 15, 2022. The performance figures prior to June 15, 2022 for the Portfolio reflect the Portfolio’s former investment operations, policies, and strategies prior to this date. Such performance is not representative of the Portfolio’s current investment operations, policies, and strategies that took effect as of this date, and the Portfolio’s performance after this date could be materially different.

Effective May 1, 2024, the Portfolio’s broad-based performance index changed to the S&P 500 Index. The S&P 500 Index is an appropriate broad-based securities market index that represents the overall market applicable to the Portfolio. The Portfolio will retain the Lipper Global Natural Resources Index as its additional benchmark for performance comparison.

BEST QUARTER: 26.29% (4th Quarter of 2020) WORST QUARTER: -34.18% (1st Quarter of 2020)

Average Annual Total Returns (as of December 31, 2023)

| | | 1 YEAR | | | 5 YEARS | | | 10 YEARS | | | SINCE

INCEPTION -

CLASS III

(4/26/21) | |

| Target Portfolio (Class I Shares) | | | 1.98 | % | | | 14.19 | % | | | 1.36 | % | | | N/A | |

| Target Portfolio (Class II Shares) | | | 1.58 | % | | | 13.73 | % | | | 0.96 | % | | | N/A | |

| Target Portfolio (Class III Shares) | | | 1.75 | % | | | N/A | | | | N/A | | | | 12.40 | % |