- NEOG Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

425 Filing

Neogen (NEOG) 425Business combination disclosure

Filed: 14 Dec 21, 7:06am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) December 13, 2021

NEOGEN CORPORATION

(Exact name of registrant as specified in its charter)

| Michigan | 0-17988 | 38-2367843 | ||

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| 620 Lesher Place Lansing, Michigan | 48912 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code 517-372-9200

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☒ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common Stock, $0.16 par value per share | NEOG | NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 7.01. | Regulation FD Disclosure. |

On December 14, 2021, Neogen Corporation (“Neogen”) and 3M Company (“3M”) issued a joint press release announcing the execution of certain definitive agreements providing for a combination of Neogen and the Food Safety business of 3M on the terms and conditions set forth in such agreements. A copy of the joint press release is furnished as Exhibit 99.1 hereto and incorporated herein by reference. Also on December 14, 2021, Neogen issued an investor presentation in connection with the proposed transaction. A copy of the investor presentation is furnished as Exhibit 99.2 hereto and is incorporated herein by reference.

Important Information About the Transaction and Where to Find It

In connection with the proposed transaction, Neogen and Garden SpinCo Corporation, a wholly owned subsidiary of 3M formed for the transaction (“Garden Spinco”), intend to file relevant materials with the SEC, including a registration statement on Form S-4 that will include a proxy statement/prospectus relating to the proposed transaction. In addition, Garden SpinCo expects to file a registration statement in connection with its separation from 3M. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENTS, PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT NEOGEN, 3M, GARDEN SPINCO AND THE PROPOSED TRANSACTION. The proxy statement, prospectus and/or information statement and other documents relating to the proposed transaction (when they become available) can also be obtained free of charge from the SEC’s website at www.sec.gov. The proxy statement, prospectus and/or information statement and other documents (when they become available) can also be obtained free of charge from 3M upon written request to 3M Investor Relations Department, Bldg. 224-1W-02, St. Paul, MN 55144, or by e-mailing investorrelations@3M.com or upon written request to Neogen’s Investor Relations, 620 Lesher Place, Lansing, Michigan 48912 or by e-mailing ir@neogen.com.

Participants in the Solicitation

This communication is not a solicitation of a proxy from any investor or security holder. However, Neogen, 3M and certain of their respective directors, executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies from shareholders of Neogen in connection with the proposed transaction under the rules of the SEC. Information regarding the persons who are, under the rules of the SEC, participants in the solicitation of the stockholders of Neogen in connection with the proposed transaction, including a description of their direct or indirect interests, by security holdings or otherwise, will be set forth in the proxy statement/prospectus when it is filed with the SEC. Information about the directors and executive officers of Neogen may be found in its Annual Report on Form 10-K filed with the SEC on July 30, 2021, and its definitive proxy statement relating to its 2021 Annual Meeting of Shareholders filed with the SEC on August 31, 2021. Information about the directors and executive officers of 3M may be found in its Annual Report on Form 10-K filed with the SEC on February 4, 2021, and its definitive proxy statement relating to its 2021 Annual Meeting of Stockholders filed with the SEC on March 24, 2021. These documents can be obtained free of charge from the sources indicated above. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the registration statements, prospectuses and proxy statement and other relevant materials to be filed with the SEC when they become available.

No Offer or Solicitation

This communication is not intended to and shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote of approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

Exhibit | Description | |

| 99.1 | Press Release, dated December 14, 2021 | |

| 99.2 | Investor Presentation, dated December 14, 2021 | |

| 104 | The cover page from this Current Report on Form 8-K, formatted in Inline XBRL | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| NEOGEN CORPORATION | ||

| By: | /s/ Steven J. Quinlan | |

| Steven J. Quinlan | ||

| Vice President & CFO | ||

Dated: December 14, 2021

Exhibit 99.1

Joint Announcement Press Release

NEOGEN to Combine 3M’s Food Safety Business With its Existing Operations, Creating a Global Industry Leader

Creates a pure play Food Security company with pro forma revenue of approximately $1 billion and Adjusted EBITDA of approximately $300 million expected in its first full year post-closing.

Pro forma company expected to have stronger growth through substantial cross synergies in product innovation, sales, marketing, distribution and production; an EBITDA margin profile of approximately 30% and increased exposure to higher growth, lower volatility Food Safety end-markets which will represent approximately 70% of total revenue.

Combined company will have the enhanced geographic footprint, innovative product offerings, digitization capabilities, and financial flexibility to capitalize on robust growth trends in sustainability, food safety and supply chain integrity.

Intended tax-efficient transaction will result in 3M shareholders owning 50.1% of NEOGEN and existing NEOGEN shareholders owning 49.9%.

3M to receive consideration valued at approximately $1 billion, subject to closing and other adjustments.

LANSING, Mich., and ST. PAUL, Minn., December 14, 2021 – NEOGEN Corporation (NASDAQ: NEOG) and 3M (NYSE: MMM) announced today that they have entered into a definitive agreement pursuant to which 3M will separate its Food Safety business and simultaneously combine it with NEOGEN in a transaction that is intended to be tax-efficient to 3M and its shareholders for U.S. federal income tax purposes. The combination will create an innovative leader in the food safety sector with a comprehensive product range and a strategic focus on the category’s long-term growth opportunities.

The transaction implies an enterprise value for 3M’s Food Safety business of approximately $5.3 billion, including $1 billion in new debt to be incurred by 3M’s Food Safety business. This represents an implied multiple of approximately 32x and 27x CY 2022E Adjusted EBITDA pre and post run-rate synergies respectively, based on NEOGEN’s closing price as of December 13, 2021. 3M’s Food Safety business will fund to 3M consideration valued at approximately $1 billion, subject to closing and other adjustments. The combined company is expected to have an enterprise value of approximately $9.3 billion, based on NEOGEN’s closing share price as of December 13, 2021. Under the terms of the definitive agreements, which involve a tax-free “Reverse Morris Trust” structure, existing NEOGEN shareholders will continue to own approximately 49.9% of the combined company, and 3M shareholders will receive approximately 50.1% of the combined company. The Boards of Directors of both NEOGEN and 3M have unanimously approved the transaction.

“This combination will enhance NEOGEN’s position in this new era of food security, equipping us with an expanded product line that enables us to capitalize on our growing footprint, reaching more customers, more often, while continuing our track record of strong and consistent growth,” said John Adent, NEOGEN’s President and Chief Executive Officer. “The heightened global focus on food security, sustainability and supply chain solutions around the world presents exciting opportunities for NEOGEN to be positioned as an innovative leader at the forefront of the growth and digitization of the industry. We’re excited to welcome 3M’s Food Safety employees to the NEOGEN team, and we’re looking forward to demonstrating the immense benefits of this combination to our customers, employees and shareholders.”

“NEOGEN and 3M share a deep commitment to quality, innovation and customer satisfaction and long histories of industry leadership. By combining our Food Safety business with NEOGEN, we will create an organization well positioned to capture long-term profitable growth. This transaction further evolves our strategy, focuses our health care business and benefits our stakeholders, as we actively manage our portfolio to drive growth and deliver shareholder value,” said Mike Roman, 3M Chairman and Chief Executive Officer.

An Innovative Global Leader in Food Safety: Key Strategic Benefits

The combination is expected to generate significant long-term value for shareholders of the combined company, as well as customers and employees by:

| • | Creating a leading innovator in an industry benefiting from growing demand: NEOGEN’s pure play food security business, combined with the long-term tailwinds of increased global focus on sustainability, food safety and supply chain solutions, mean NEOGEN is the ideal home for 3M’s Food Safety business. A combination will create a global innovator in food safety with the geographic footprint, product range and innovation capabilities to further capitalize on attractive and enduring growth trends. |

| • | Expanding food safety product offerings to better serve customers: The company will have a significantly expanded product offering in food safety, particularly in indicator testing and pathogen detection areas, which complement NEOGEN’s existing microbiology lines. NEOGEN will also be able to offer 3M food safety customers its genomics services, which deliver innovative DNA testing – a new offering to 3M food safety customers. This expanded product range, along with NEOGEN’s complementary animal safety business, increases the solutions with which NEOGEN helps customers protect the world’s food supply from the farm gate to the dinner plate. |

| • | Generating global growth opportunities: The combined company creates an opportunity to optimize NEOGEN and 3M Food Safety’s high-growth capabilities to add value for customers through a compelling product offering. Beyond the U.S. and Europe, heightened interest in developing nations in improving food safety presents significant growth potential for the combined company. The combination will also provide investment flexibility to pursue international expansion. |

| • | Creating a compelling offering through enhanced R&D capabilities, innovation and analytics: NEOGEN is looking to the future of the industry, and with 3M’s Food Safety business, will possess the breadth and digital capabilities to lead the digitization of the food security industry. The complementary product offerings combined with NEOGEN’s data-driven analytics approach will create a compelling solution as customers seek innovative partners to increase efficiency and enhance food safety protocols. |

| • | Enhancing revenue, margin and earnings stability: The combined company is expected to have an improved financial profile, which is expected to further enhance NEOGEN’s already consistently high-performing revenue stream with improved EBITDA margins by increasing exposure to highly profitable food safety categories and providing substantial run-rate growth and cost synergies of approximately $30 million in EBITDA contribution. These |

| synergies are expected to be achieved by the end of year three following the close of transaction through efficiencies in product innovation, sales, marketing, distribution and production. The combination will boost NEOGEN’s food safety segment to approximately 70% of total revenue post-transaction, with total projected pro forma revenues of approximately $1 billion expected in the first full year post closing. Pro forma EBITDA is expected to be approximately $300 million with a higher overall EBITDA margin profile of approximately 30% expected in the first full year post closing. |

Transaction Details

The transaction involves a tax-free “Reverse Morris Trust” transaction structure, where 3M’s Food Safety business will be spun-off or split-off to 3M shareholders and simultaneously merged with a wholly owned subsidiary of NEOGEN. The transaction is intended to be tax-efficient to 3M and 3M’s shareholders for U.S. federal income tax purposes. At the completion of the transaction, NEOGEN will issue a number of shares to 3M shareholders such that 3M shareholders will receive approximately 50.1% of the combined company and existing NEOGEN shareholders will continue to own approximately 49.9% of the combined company. In connection with the transaction, 3M will also receive consideration valued at approximately $1 billion, subject to closing and other adjustments.

NEOGEN’s expected pro forma net leverage ratio at close is expected to be less than 2.5x, inclusive of the $1 billion of new debt. Strong expected free cash flow generation and EBITDA growth of the combined business enables rapid deleveraging post-closing.

The transaction is expected to close by the end of Q3 2022, subject to approval by NEOGEN shareholders, receipt of required regulatory approvals and the satisfaction of other customary closing conditions.

Leadership and Governance

NEOGEN’s President and Chief Executive Officer, John Adent, and NEOGEN’s existing management team will continue to lead the combined company.

The size of the NEOGEN board will be increased and two new independent board members, to be designated by 3M, will be appointed at closing.

Conference Call and Investor Information

NEOGEN and 3M will together hold a webcast today, December 14, at 8:00 AM ET to discuss this announcement.

To view and listen to the webcast, visit https://www.webcaster4.com/Webcast/Page/1224/43974, or dial in using the below details:

| Participant Dial In (Toll Free): | 1-844-757-5681 | |

| Participant International Dial In: | 1-412-317-5297 | |

| Canada Toll Free: | 1-855-669-9657 |

Participants should ask to be joined into the NEOGEN call.

Advisors

Centerview Partners LLC is serving as exclusive financial advisor and Weil, Gotshal & Manges LLP is serving as legal counsel to NEOGEN.

Goldman Sachs & Co. LLC is serving as exclusive financial advisor and Wachtell, Lipton, Rosen & Katz is serving as legal counsel to 3M. Goldman Sachs Bank USA and JP Morgan Securities are providing committed financing for the transaction.

###

About NEOGEN

NEOGEN Corporation develops and markets comprehensive solutions dedicated to food and animal safety. The company’s Food Safety segment markets dehydrated culture media and diagnostic test kits to detect foodborne bacteria, natural toxins, food allergens, drug residues, plant diseases, and sanitation concerns. NEOGEN’s Animal Safety segment is a leader in the development of genomic solutions along with the manufacturing and distribution of a variety of animal healthcare products, including diagnostics, pharmaceuticals, veterinary instruments, wound care, and disinfectants, as well as rodent and insect control solutions.

About 3M

At 3M (NYSE: MMM), we apply science in collaborative ways to improve lives daily as our employees connect with customers all around the world. Learn more about 3M’s creative solutions to global challenges at www.3M.com or on Twitter @3M or @3MNews.

Cautionary Notes on Forward Looking Statements

This communication includes “forward-looking statements” as that term is defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended by the Private Securities Litigation Reform Act of 1995, including statements regarding the proposed transaction between NEOGEN (“NEOGEN”), 3M (“3M”) and Garden SpinCo (“SpinCo”). These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “forecast,” “outlook,” “target,” “endeavor,” “seek,” “predict,” “intend,” “strategy,” “plan,” “may,” “could,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” or the negative thereof or variations thereon or similar terminology generally intended to identify forward-looking statements. All statements, other than historical facts, including, but not limited to, statements regarding the expected timing and structure of the proposed transaction, the ability of the parties to complete the proposed transaction, the expected benefits of the proposed transaction, including future financial and operating results and strategic benefits, the tax consequences of the proposed transaction, and the combined NEOGEN-SpinCo company’s plans, objectives, expectations and intentions, legal, economic and regulatory conditions, and any assumptions underlying any of the foregoing, are forward looking statements.

These forward-looking statements are based on NEOGEN and 3M’s current expectations and are subject to risks and uncertainties, which may cause actual results to differ materially from NEOGEN and 3M’s current expectations. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those indicated or anticipated by such forward-looking statements. The inclusion of such statements should not be regarded as a representation that such plans, estimates or expectations will be achieved. Important factors that could cause actual results to differ materially from such plans, estimates or expectations include, among others, (1) that one or more closing conditions to the transaction, including certain regulatory approvals, may not be satisfied or waived, on a timely basis or otherwise, including that a governmental entity may prohibit, delay or refuse to grant approval

for the consummation of the proposed transaction, may require conditions, limitations or restrictions in connection with such approvals or that the required approval by the stockholders of NEOGEN may not be obtained; (2) the risk that the proposed transaction may not be completed on the terms or in the time frame expected by NEOGEN, 3M and SpinCo, or at all; (3) unexpected costs, charges or expenses resulting from the proposed transaction; (4) uncertainty of the expected financial performance of the combined NEOGEN – SpinCo company following completion of the proposed transaction; (5) failure to realize the anticipated benefits of the proposed transaction, including as a result of delay in completing the proposed transaction or integrating the businesses of NEOGEN and SpinCo, on the expected timeframe or at all; (6) the ability of the combined NEOGEN-SpinCo company to implement its business strategy; (7) difficulties and delays in the combined NEOGEN-SpinCo company achieving revenue and cost synergies; (8) inability of the combined company to retain and hire key personnel; (9) the occurrence of any event that could give rise to termination of the proposed transaction; (10) the risk that stockholder litigation in connection with the proposed transaction or other litigation, settlements or investigations may affect the timing or occurrence of the proposed transaction or result in significant costs of defense, indemnification and liability; (11) evolving legal, regulatory and tax regimes; (12) changes in general economic and/or industry specific conditions; (13) actions by third parties, including government agencies; (14) the risks that the anticipated tax treatment of the proposed transaction is not obtained; (15) the risk of greater than expected difficulty in separating the business of SpinCo from the other businesses of 3M; (16) risks related to the disruption of management time from ongoing business operations due to the pendency of the proposed transaction, or other effects of the pendency of the proposed transaction on the relationship of any of the parties to the transaction with their employees, customers, suppliers, or other counterparties; and (17) other risk factors detailed from time to time in NEOGEN and 3M’s reports filed with the SEC, including NEOGEN and 3M’s annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and other documents filed with the SEC, including documents that will be filed with the SEC in connection with the proposed transaction. The foregoing list of important factors is not exclusive.

Any forward-looking statements speak only as of the date of this communication. None of NEOGEN, 3M or SpinCo undertakes, and each party expressly disclaims, any obligation to update any forward-looking statements, whether as a result of new information or development, future events or otherwise, except as required by law. Readers are cautioned not to place undue reliance on any of these forward-looking statements.

Important Information About the Transaction and Where to Find It

In connection with the proposed transaction, NEOGEN and SpinCo intend to file relevant materials with the SEC, including a registration statement on Form S-4 that will include a proxy statement/prospectus relating to the proposed transaction. In addition, SpinCo expects to file a registration statement in connection with its separation from 3M. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENTS, PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT NEOGEN, 3M, SPINCO AND THE PROPOSED TRANSACTION. The proxy statement, prospectus and/or information statement and other documents relating to the proposed transaction (when they become available) can also be obtained free of charge from the SEC’s website at www.sec.gov. These documents, once available, and each of the companies’ other filings with the SEC, also will be available free of charge on NEOGEN’s website at http:// www.NEOGEN.com/investor-relations or on 3M’s website at http:// www.investors.3M.

Participants in the Solicitation

This communication is not a solicitation of a proxy from any investor or security holder. However, NEOGEN, 3M and certain of their respective directors, executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies from shareholders of NEOGEN in connection with the proposed transaction under the rules of the SEC. Information regarding the persons who are, under the rules of the SEC, participants in the solicitation of the stockholders of NEOGEN in connection with the proposed transaction, including a description of their direct or indirect interests, by security holdings or otherwise, will be set forth in the proxy statement/prospectus when it is filed with the SEC. Information about the directors and executive officers of NEOGEN may be found in its Annual Report on Form 10-K filed with the SEC on July 30, 2021, and its definitive proxy statement relating to its 2021 Annual Meeting of Shareholders filed with the SEC on August 31, 2021. Information about the directors and executive officers of 3M may be found in its Annual Report on Form 10-K filed with the SEC on February 4, 2021, and its definitive proxy statement relating to its 2021 Annual Meeting of Stockholders filed with the SEC on March 24, 2021. These documents can be obtained free of charge from the sources indicated above. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the registration statements, prospectuses and proxy statement and other relevant materials to be filed with the SEC when they become available.

No Offer or Solicitation

This communication is not intended to and shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote of approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

Contact

NEOGEN Media Contact:

Blake Sonnenshein, Partner

Brunswick Group

NEOGEN@brunswickgroup.com

(212) 333-3810

NEOGEN Investor Contact:

Steve Quinlan, Chief Financial Officer

squinlan@NEOGEN.com

(517) 372-9200

3M Media Contact:

Tim Post

(612) 398-4190

3M Investor Contact:

Bruce Jermeland

(651) 733-1807

Tony Riter

(651) 733-1141

Diane Farrow

(612) 202-2449

December 14, 2021 Neogen to Combine with 3M’s Food Safety Business Exhibit 99.2

Disclaimer Cautionary Notes on Forward Looking Statements This communication includes “forward-looking statements” as that term is defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended by the Private Securities Litigation Reform Act of 1995, including statements regarding the proposed transaction between Neogen (“Neogen”), 3M (“3M”) and SpinCo (“SpinCo”). These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “forecast,” “outlook,” “target,” “endeavor,” “seek,” “predict,” “intend,” “strategy,” “plan,” “may,” “could,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” or the negative thereof or variations thereon or similar terminology generally intended to identify forward-looking statements. All statements, other than historical facts, including, but not limited to, statements regarding the expected timing and structure of the proposed transaction, the ability of the parties to complete the proposed transaction, the expected benefits of the proposed transaction, including future financial and operating results and strategic benefits, the tax consequences of the proposed transaction, and the combined Neogen-SpinCo company’s plans, objectives, expectations and intentions, legal, economic and regulatory conditions, and any assumptions underlying any of the foregoing, are forward looking statements. These forward-looking statements are based on Neogen and 3M current expectations and are subject to risks and uncertainties, which may cause actual results to differ materially from Neogen and 3M’s current expectations. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those indicated or anticipated by such forward-looking statements. The inclusion of such statements should not be regarded as a representation that such plans, estimates or expectations will be achieved. Important factors that could cause actual results to differ materially from such plans, estimates or expectations include, among others, (1) that one or more closing conditions to the transaction, including certain regulatory approvals, may not be satisfied or waived, on a timely basis or otherwise, including that a governmental entity may prohibit, delay or refuse to grant approval for the consummation of the proposed transaction, may require conditions, limitations or restrictions in connection with such approvals or that the required approval by the stockholders of Neogen may not be obtained; (2) the risk that the proposed transaction may not be completed on the terms or in the time frame expected by Neogen, 3M and SpinCo, or at all; (3) unexpected costs, charges or expenses resulting from the proposed transaction; (4) uncertainty of the expected financial performance of the combined Neogen – SpinCo company following completion of the proposed transaction; (5) failure to realize the anticipated benefits of the proposed transaction, including as a result of delay in completing the proposed transaction or integrating the businesses of Neogen and SpinCo, on the expected timeframe or at all; (6) the ability of the combined Neogen-SpinCo company to implement its business strategy; (7) difficulties and delays in the combined Neogen-SpinCo company achieving revenue and cost synergies; (8) inability of the combined company to retain and hire key personnel; (9) the occurrence of any event that could give rise to termination of the proposed transaction; (10) the risk that stockholder litigation in connection with the proposed transaction or other litigation, settlements or investigations may affect the timing or occurrence of the proposed transaction or result in significant costs of defense, indemnification and liability; (11) evolving legal, regulatory and tax regimes; (12) changes in general economic and/or industry specific conditions; (13) actions by third parties, including government agencies; (14) the risks that the anticipated tax treatment of the proposed transaction is not obtained; (15) the risk of greater than expected difficulty in separating the business of SpinCo from the other businesses of 3M; (16) risks related to the disruption of management time from ongoing business operations due to the pendency of the proposed transaction, or other effects of the pendency of the proposed transaction on the relationship of any of the parties to the transaction with their employees, customers, suppliers, or other counterparties; and (17) other risk factors detailed from time to time in Neogen and 3M’s reports filed with the SEC, including Neogen and 3M’s annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and other documents filed with the SEC, including documents that will be filed with the SEC in connection with the proposed transaction. The foregoing list of important factors is not exclusive. Any forward-looking statements speak only as of the date of this communication. None of Neogen, 3M or SpinCo undertakes, and each party expressly disclaims, any obligation to update any forward-looking statements, whether as a result of new information or development, future events or otherwise, except as required by law. Readers are cautioned not to place undue reliance on any of these forward-looking statements. Important Information About the Transaction and Where to Find It In connection with the proposed transaction, Neogen and SpinCo intend to file relevant materials with the SEC, including a registration statement on Form S-4 that will include a proxy statement/prospectus relating to the proposed transaction. In addition, SpinCo expects to file a registration statement in connection with its separation from 3M. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENTS, PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT Neogen, 3M, SPINCO AND THE PROPOSED TRANSACTION. The proxy statement, prospectus and/or information statement and other documents relating to the proposed transaction (when they become available) can also be obtained free of charge from the SEC’s website at www.sec.gov. These documents, once available, and each of the companies’ other filings with the SEC, also will be available free of charge on Neogen’s website at http://www.Neogen.com/investor-relations or on 3M's website at https://investors.3m.com/ir-home/default.aspx. Participants in the Solicitation This communication is not a solicitation of a proxy from any investor or security holder. However, Neogen, 3M and certain of their respective directors, executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies from shareholders of Neogen in connection with the proposed transaction under the rules of the SEC. Information regarding the persons who are, under the rules of the SEC, participants in the solicitation of the stockholders of Neogen in connection with the proposed transaction, including a description of their direct or indirect interests, by security holdings or otherwise, will be set forth in the proxy statement/prospectus when it is filed with the SEC. Information about the directors and executive officers of Neogen may be found in its Annual Report on Form 10-K filed with the SEC on July 30, 2021, and its definitive proxy statement relating to its 2021 Annual Meeting of Shareholders filed with the SEC on August 31, 2021. Information about the directors and executive officers of 3M may be found in its Annual Report on Form 10-K filed with the SEC on February 4, 2021, and its definitive proxy statement relating to its 2021 Annual Meeting of Stockholders filed with the SEC on March 24, 2021. These documents can be obtained free of charge from the sources indicated above. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the registration statements, prospectuses and proxy statement and other relevant materials to be filed with the SEC when they become available. No Offer or Solicitation This communication is not intended to and shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote of approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

Today’s Presenters John Adent Chief Executive Officer Steve Quinlan Chief Financial Officer Mojdeh Poul Group President, Health Care CEO of Neogen Since 2017 Previously CEO of Patterson Animal Health and CEO of Animal Health International CFO of Neogen Since 2011 Previously CFO of Detrex Corporation Group President of 3M Health Care Since 2019 Previously President of 3M Canada

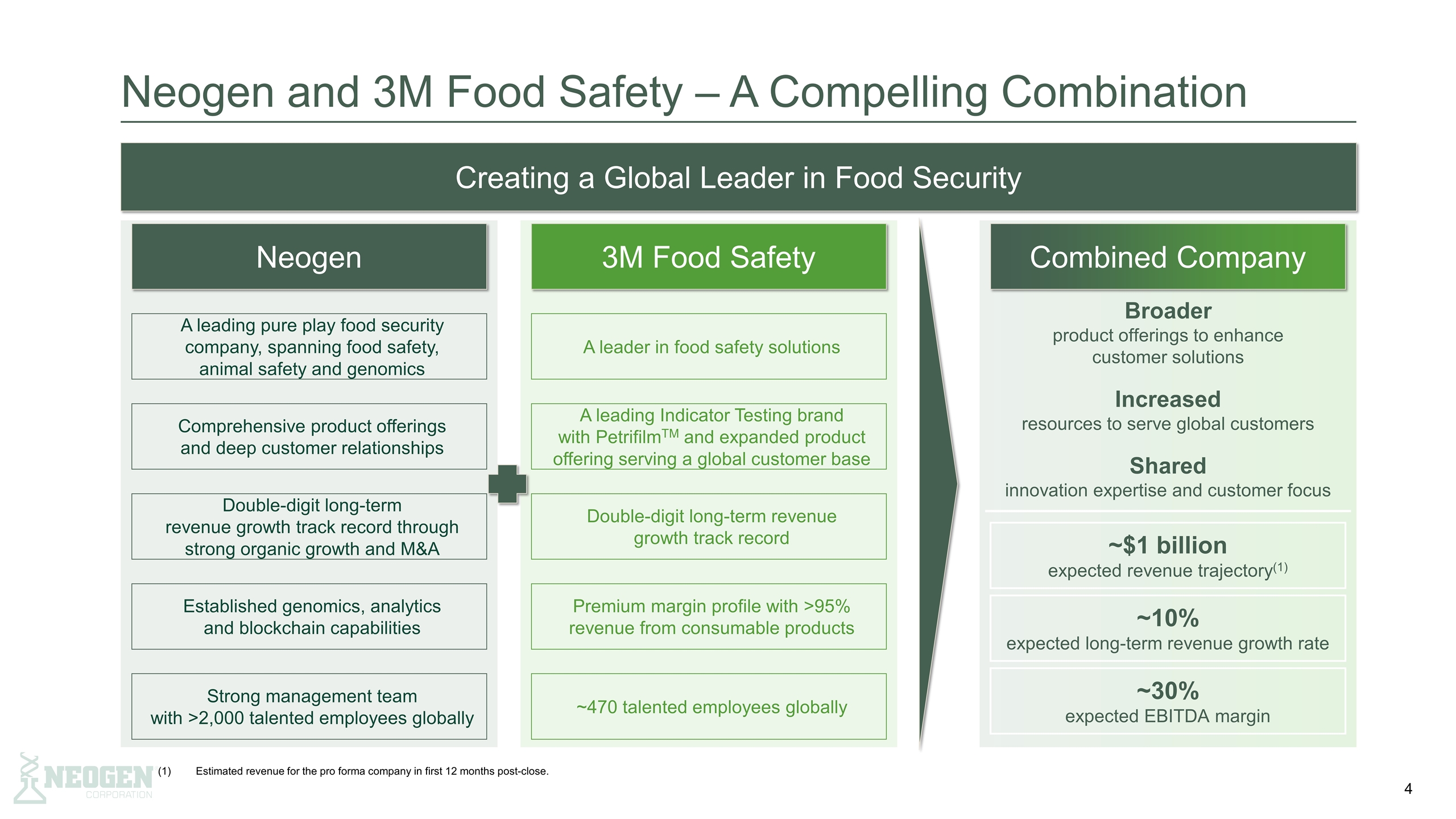

Neogen and 3M Food Safety – A Compelling Combination Creating a Global Leader in Food Security (1)Estimated revenue for the pro forma company in first 12 months post-close. Neogen 3M Food Safety A leading pure play food security company, spanning food safety, animal safety and genomics Comprehensive product offerings and deep customer relationships Double-digit long-term revenue growth track record through strong organic growth and M&A Established genomics, analytics and blockchain capabilities Strong management team with >2,000 talented employees globally A leader in food safety solutions A leading Indicator Testing brand with PetrifilmTM and expanded product offering serving a global customer base Double-digit long-term revenue growth track record Premium margin profile with >95% revenue from consumable products ~470 talented employees globally Combined Company Broader product offerings to enhance customer solutions Increased resources to serve global customers Shared innovation expertise and customer focus ~$1 billion expected revenue trajectory(1) ~10% expected long-term revenue growth rate ~30% expected EBITDA margin

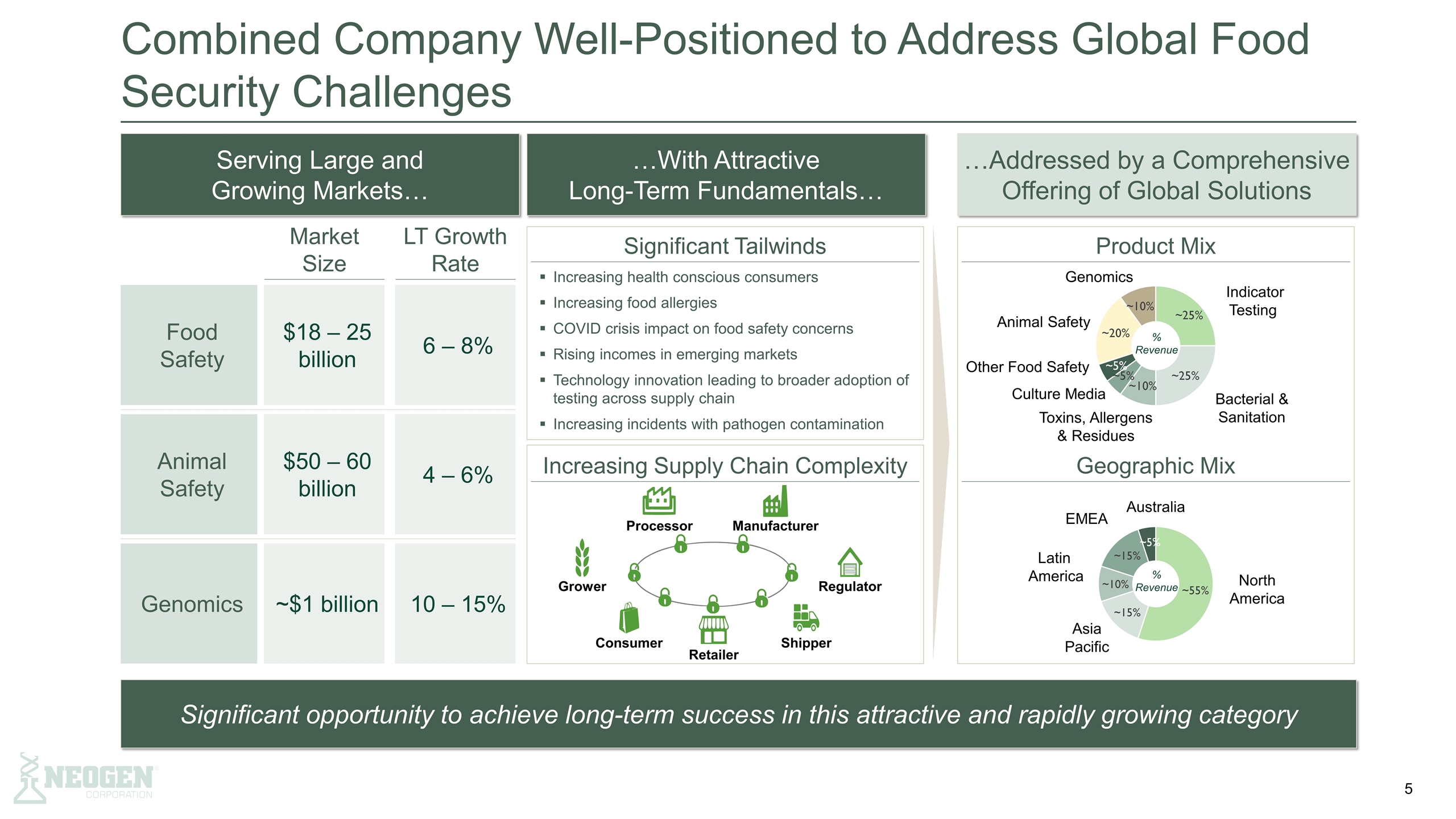

Market Size LT Growth Rate Combined Company Well-Positioned to Address Global Food Security Challenges Serving Large and Growing Markets… …With Attractive Long-Term Fundamentals… …Addressed by a Comprehensive Offering of Global Solutions Significant opportunity to achieve long-term success in this attractive and rapidly growing category Food Safety Animal Safety Genomics $18 – 25 billion 6 – 8% $50 – 60 billion 4 – 6% ~$1 billion 10 – 15% Significant Tailwinds Increasing Supply Chain Complexity Increasing health conscious consumers Increasing food allergies COVID crisis impact on food safety concerns Rising incomes in emerging markets Technology innovation leading to broader adoption of testing across supply chain Increasing incidents with pathogen contamination Processor Manufacturer Regulator Shipper Retailer Consumer Grower Product Mix Geographic Mix Toxins, Allergens & Residues Bacterial & Sanitation Culture Media Other Food Safety Genomics Animal Safety % Revenue Indicator Testing North America Australia Latin America EMEA Asia Pacific % Revenue 5

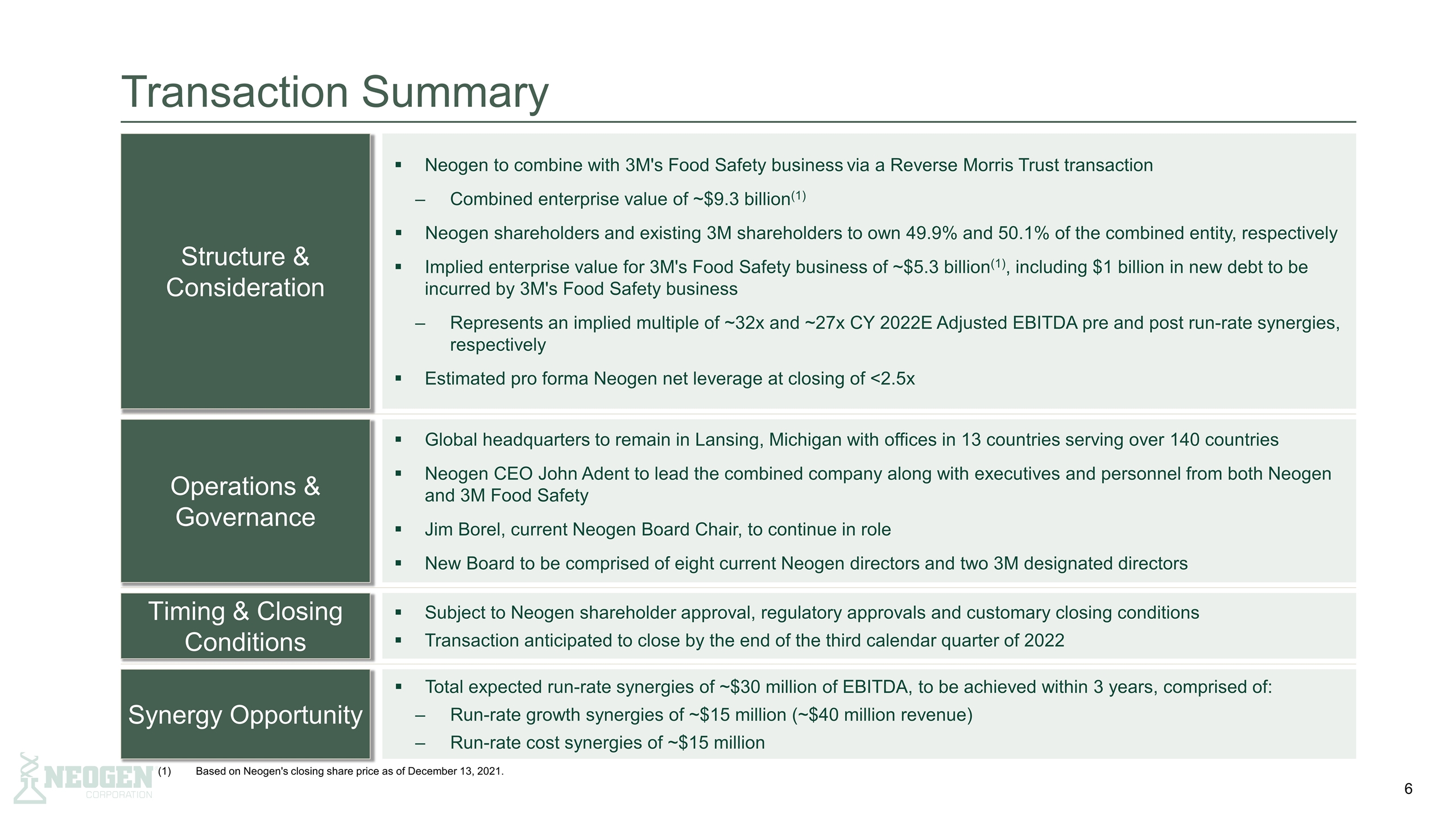

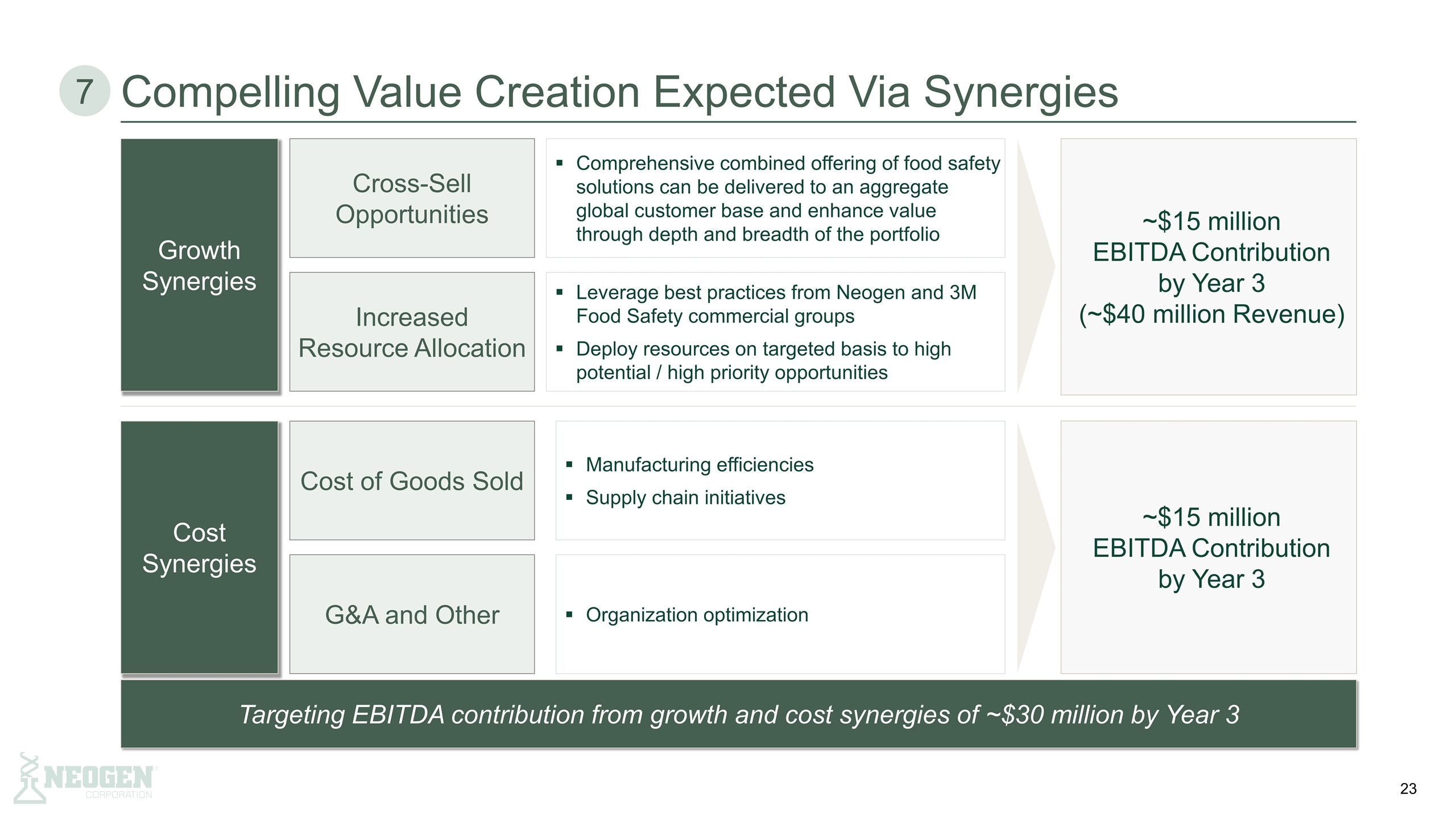

Transaction Summary Structure & Consideration Neogen to combine with 3M's Food Safety business via a Reverse Morris Trust transaction Combined enterprise value of ~$9.3 billion(1) Neogen shareholders and existing 3M shareholders to own 49.9% and 50.1% of the combined entity, respectively Implied enterprise value for 3M's Food Safety business of ~$5.3 billion(1), including $1 billion in new debt to be incurred by 3M's Food Safety business Represents an implied multiple of ~32x and ~27x CY 2022E Adjusted EBITDA pre and post run-rate synergies, respectively Estimated pro forma Neogen net leverage at closing of <2.5x Operations & Governance Global headquarters to remain in Lansing, Michigan with offices in 13 countries serving over 140 countries Neogen CEO John Adent to lead the combined company along with executives and personnel from both Neogen and 3M Food Safety Jim Borel, current Neogen Board Chair, to continue in role New Board to be comprised of eight current Neogen directors and two 3M designated directors Timing & Closing Conditions Subject to Neogen shareholder approval, regulatory approvals and customary closing conditions Transaction anticipated to close by the end of the third calendar quarter of 2022 Synergy Opportunity Based on Neogen's closing share price as of December 13, 2021. Total expected run-rate synergies of ~$30 million of EBITDA, to be achieved within 3 years, comprised of: Run-rate growth synergies of ~$15 million (~$40 million revenue) Run-rate cost synergies of ~$15 million

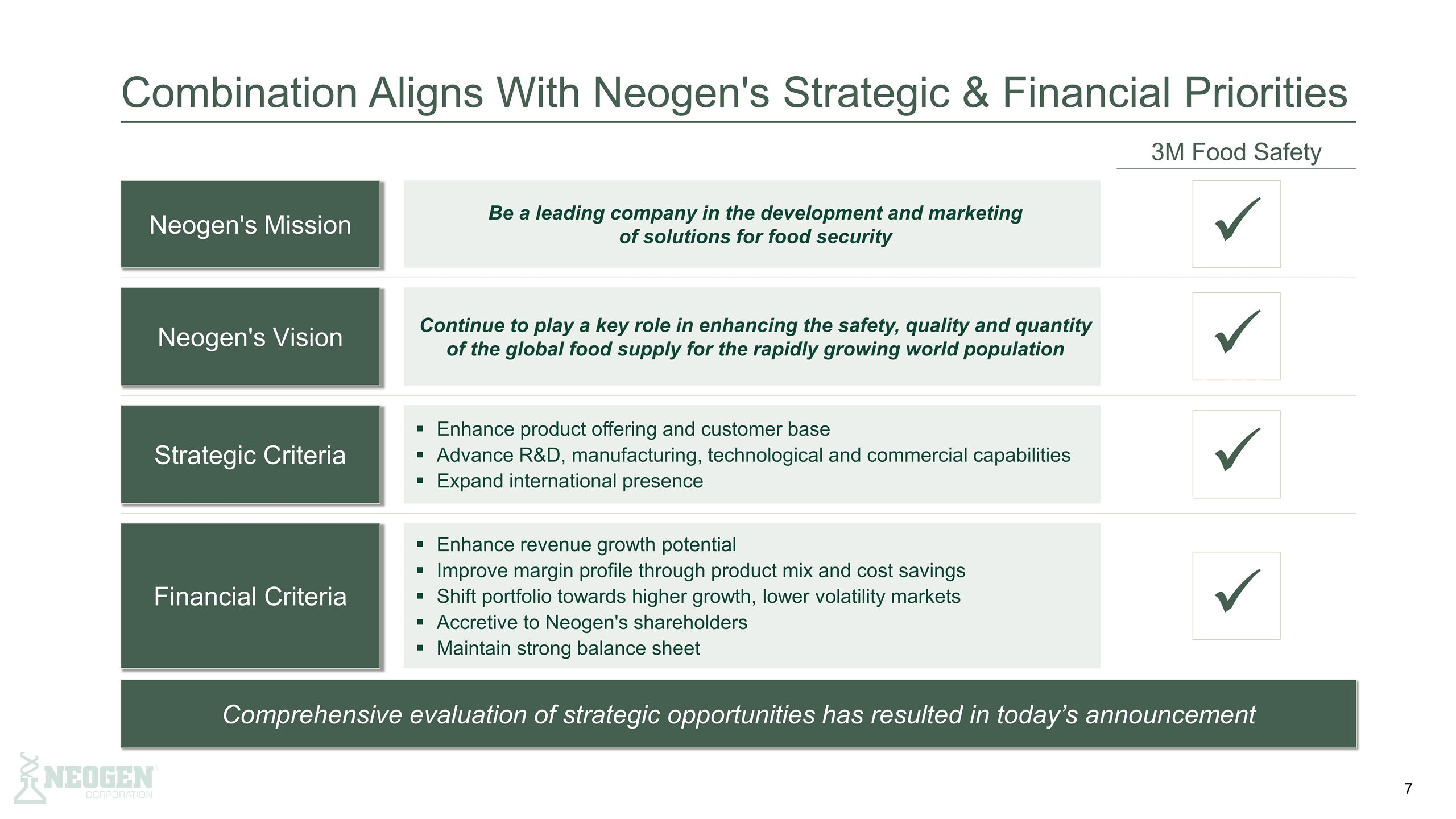

Combination Aligns With Neogen's Strategic & Financial Priorities Neogen's Mission Be a leading company in the development and marketing of solutions for food security 3M Food Safety Neogen's Vision Continue to play a key role in enhancing the safety, quality and quantity of the global food supply for the rapidly growing world population Strategic Criteria Enhance product offering and customer base Advance R&D, manufacturing, technological and commercial capabilities Expand international presence Financial Criteria Enhance revenue growth potential Improve margin profile through product mix and cost savings Shift portfolio towards higher growth, lower volatility markets Accretive to Neogen's shareholders Maintain strong balance sheet Comprehensive evaluation of strategic opportunities has resulted in today’s announcement ü ü ü ü

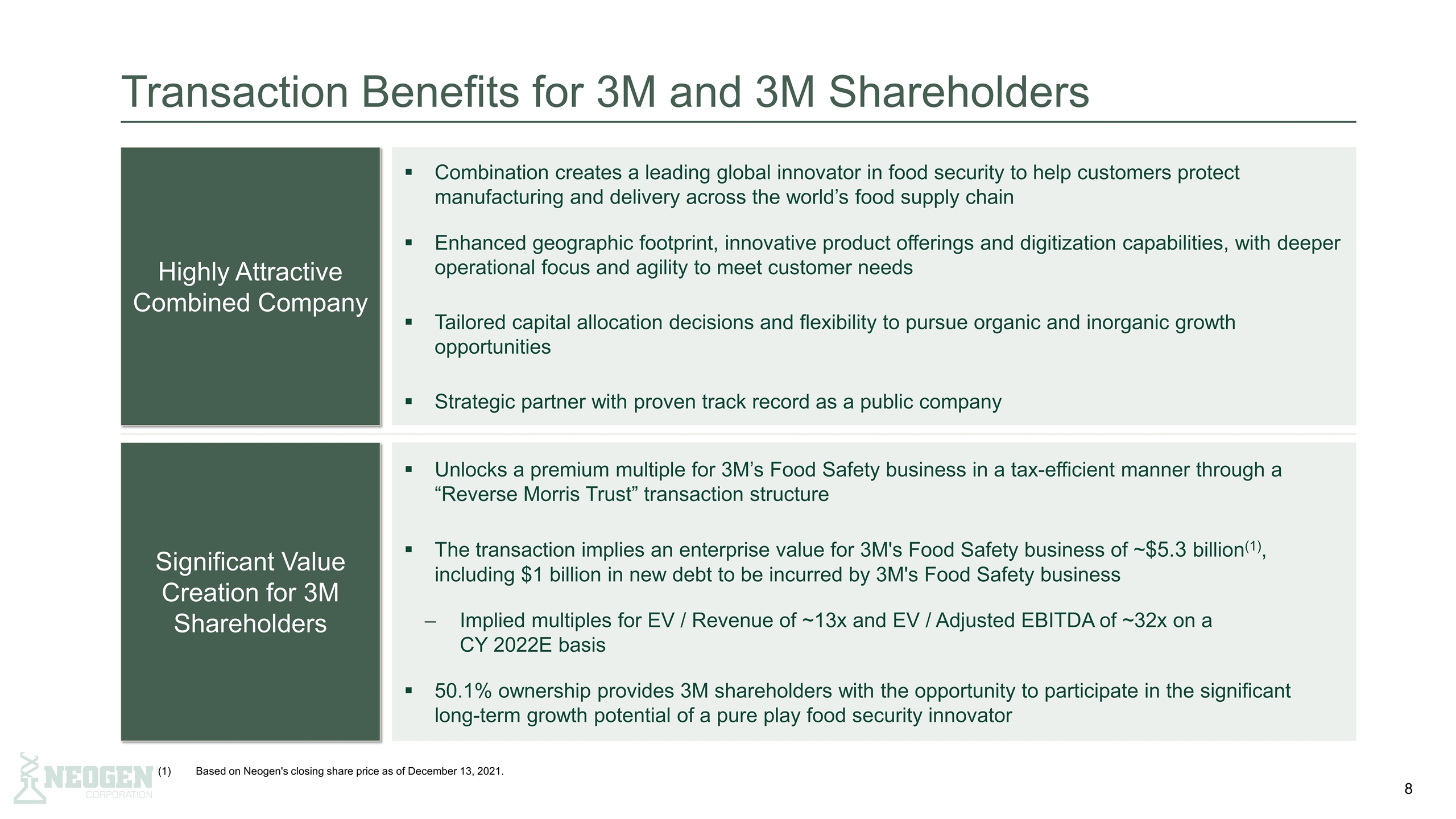

Transaction Benefits for 3M and 3M Shareholders Highly Attractive Combined Company Combination creates a leading global innovator in food security to help customers protect manufacturing and delivery across the world’s food supply chain Enhanced geographic footprint, innovative product offerings and digitization capabilities, with deeper operational focus and agility to meet customer needs Tailored capital allocation decisions and flexibility to pursue organic and inorganic growth opportunities Strategic partner with proven track record as a public company Significant Value Creation for 3M Shareholders Unlocks a premium multiple for 3M’s Food Safety business in a tax-efficient manner through a “Reverse Morris Trust” transaction structure The transaction implies an enterprise value for 3M's Food Safety business of ~$5.3 billion(1), including $1 billion in new debt to be incurred by 3M's Food Safety business Implied multiples for EV / Revenue of ~13x and EV / Adjusted EBITDA of ~32x on a CY 2022E basis 50.1% ownership provides 3M shareholders with the opportunity to participate in the significant long-term growth potential of a pure play food security innovator Based on Neogen's closing share price as of December 13, 2021.

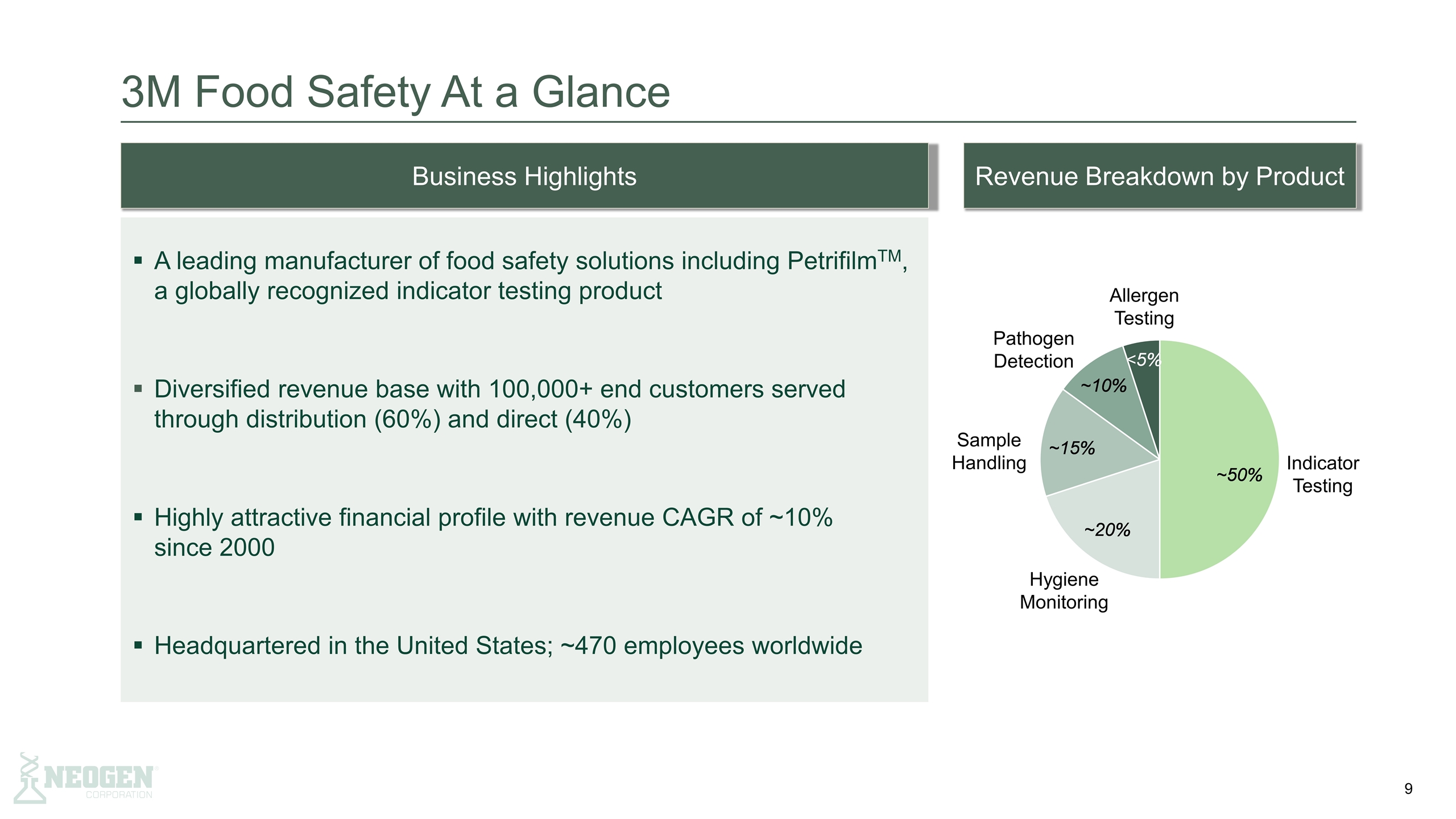

3M Food Safety At a Glance Business Highlights Revenue Breakdown by Product A leading manufacturer of food safety solutions including PetrifilmTM, a globally recognized indicator testing product Diversified revenue base with 100,000+ end customers served through distribution (60%) and direct (40%) Highly attractive financial profile with revenue CAGR of ~10% since 2000 Headquartered in the United States; ~470 employees worldwide Indicator Testing Allergen Testing Hygiene Monitoring Sample Handling Pathogen Detection

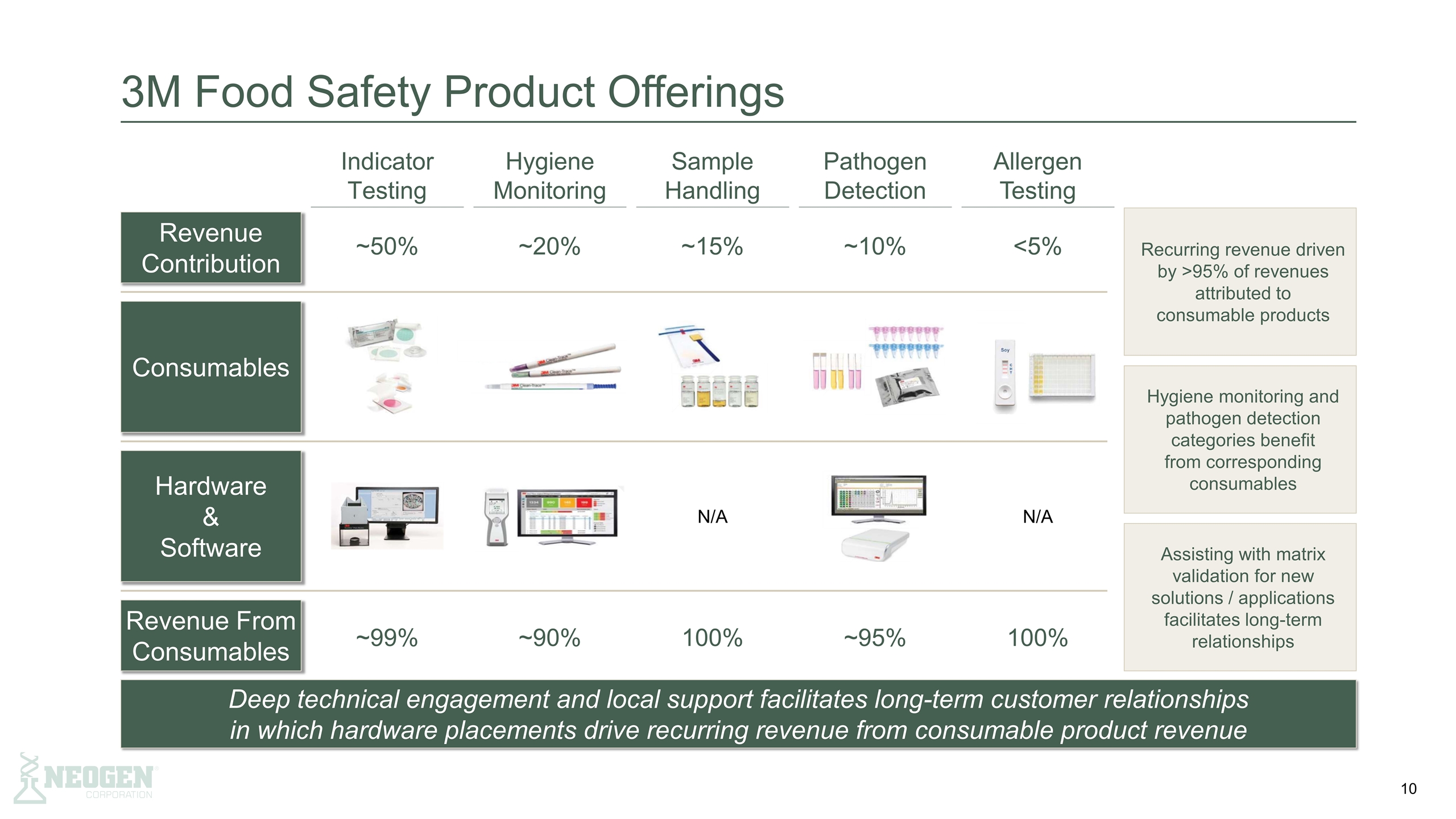

3M Food Safety Product Offerings Consumables Indicator Testing Hygiene Monitoring Sample Handling Pathogen Detection Allergen Testing Revenue Contribution Hardware & Software Revenue From Consumables ~50% ~20% ~15% ~10% <5% N/A N/A ~99% ~90% 100% ~95% 100% Deep technical engagement and local support facilitates long-term customer relationships in which hardware placements drive recurring revenue from consumable product revenue Recurring revenue driven by >95% of revenues attributed to consumable products Hygiene monitoring and pathogen detection categories benefit from corresponding consumables Assisting with matrix validation for new solutions / applications facilitates long-term relationships

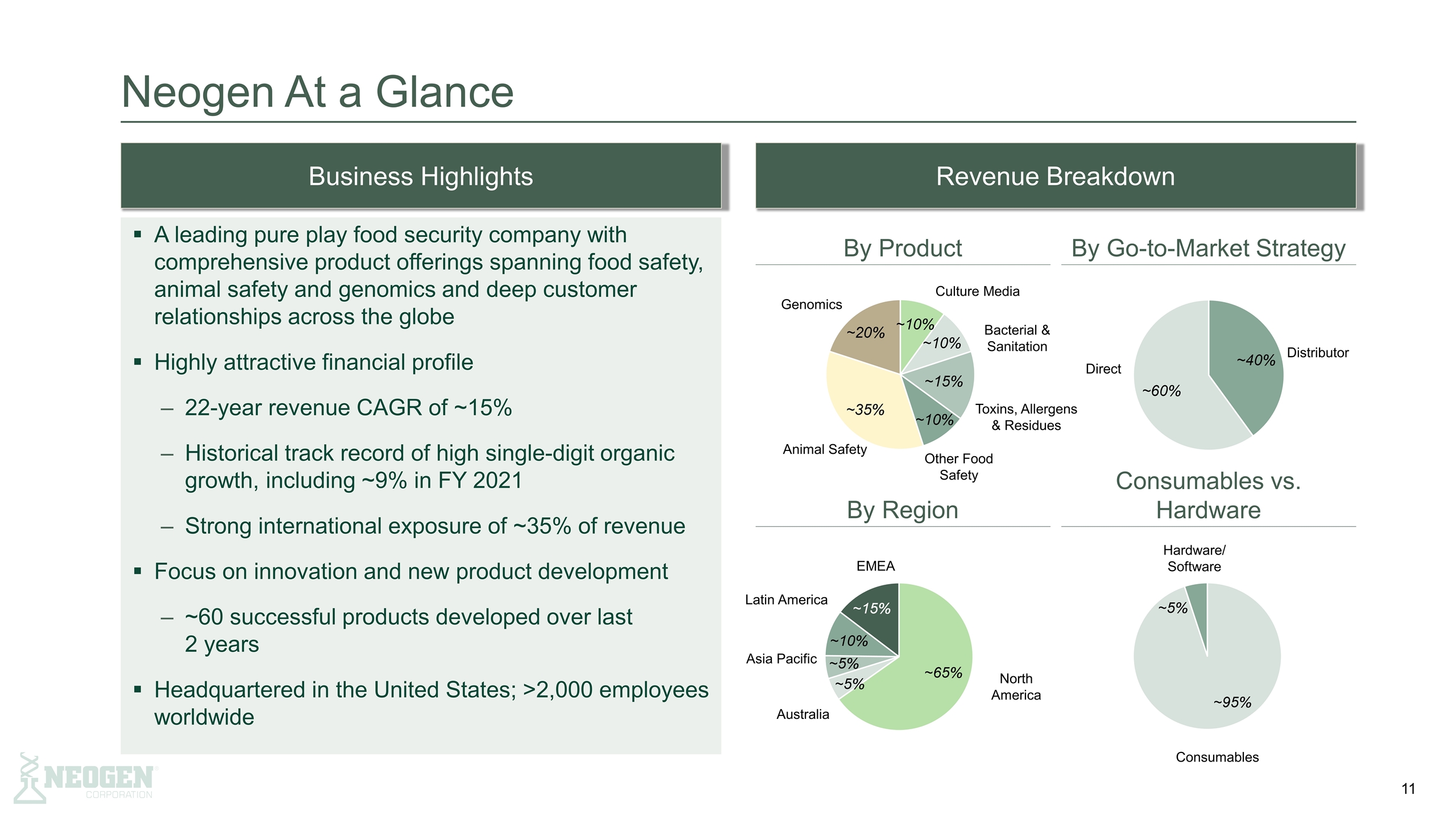

Neogen At a Glance Business Highlights Revenue Breakdown A leading pure play food security company with comprehensive product offerings spanning food safety, animal safety and genomics and deep customer relationships across the globe Highly attractive financial profile 22-year revenue CAGR of ~15% Historical track record of high single-digit organic growth, including ~9% in FY 2021 Strong international exposure of ~35% of revenue Focus on innovation and new product development ~60 successful products developed over last 2 years Headquartered in the United States; >2,000 employees worldwide Toxins, Allergens & Residues Bacterial & Sanitation Culture Media Other Food Safety Animal Safety North America Australia Latin America EMEA Asia Pacific Distributor Direct Consumables Hardware/ Software By Product By Go-to-Market Strategy Consumables vs. Hardware By Region Genomics

Neogen's Product Offerings Food Safety Protecting the Food Supply Animal Safety Ensuring Wellbeing of Livestock & Pets Genomics Improving Food Security Product offerings across Neogen's food safety, animal safety and genomics platforms help solve our customers’ global food security challenges Corporate and Food Safety Headquarters: Lansing, Michigan Headquarters: Lexington, Kentucky Headquarters: Lincoln, Nebraska Develop solutions that allow protein producers to make educated breeding decisions Solutions improve efficiency of herds, help breed associations verify parentage, and enable food safety professionals to identify bacterial strains associated with disease outbreaks Develop solutions for animal protein, animal performance and companion animal segments Offer veterinary instruments and supplies, cleaners and disinfectants for farm and veterinary settings, insecticides and rodenticides to limit the spread of disease Food safety products that reach all segments of the food, beverage and feed industries Solutions include: rapid diagnostics for the detection of unintended substances, sanitation verification tools and innovative pathogen tests

Neogen's Integrated Offering Covering the Food Security Chain Feed Production Agriculture and Farm Production Consumer Testing and Compliance Processing Diagnostic Screening Biosecurity & Hygiene Genomic Improvement Regulatory Focus Food Security

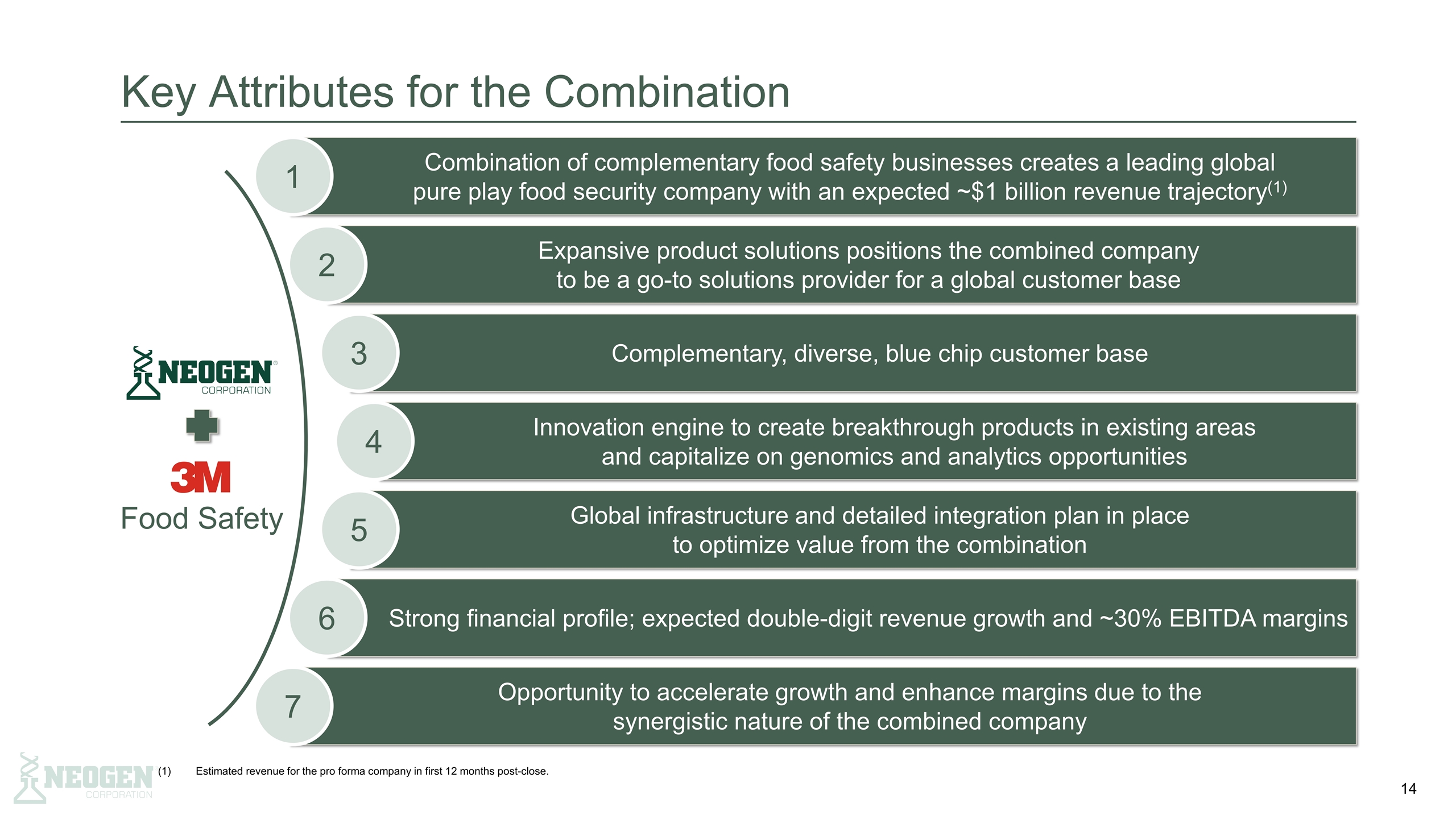

Key Attributes for the Combination Combination of complementary food safety businesses creates a leading global pure play food security company with an expected ~$1 billion revenue trajectory(1) 1 Opportunity to accelerate growth and enhance margins due to the synergistic nature of the combined company 7 Expansive product solutions positions the combined company to be a go-to solutions provider for a global customer base 2 Food Safety Strong financial profile; expected double-digit revenue growth and ~30% EBITDA margins 6 Global infrastructure and detailed integration plan in place to optimize value from the combination 5 Complementary, diverse, blue chip customer base 3 Innovation engine to create breakthrough products in existing areas and capitalize on genomics and analytics opportunities 4 (1)Estimated revenue for the pro forma company in first 12 months post-close.

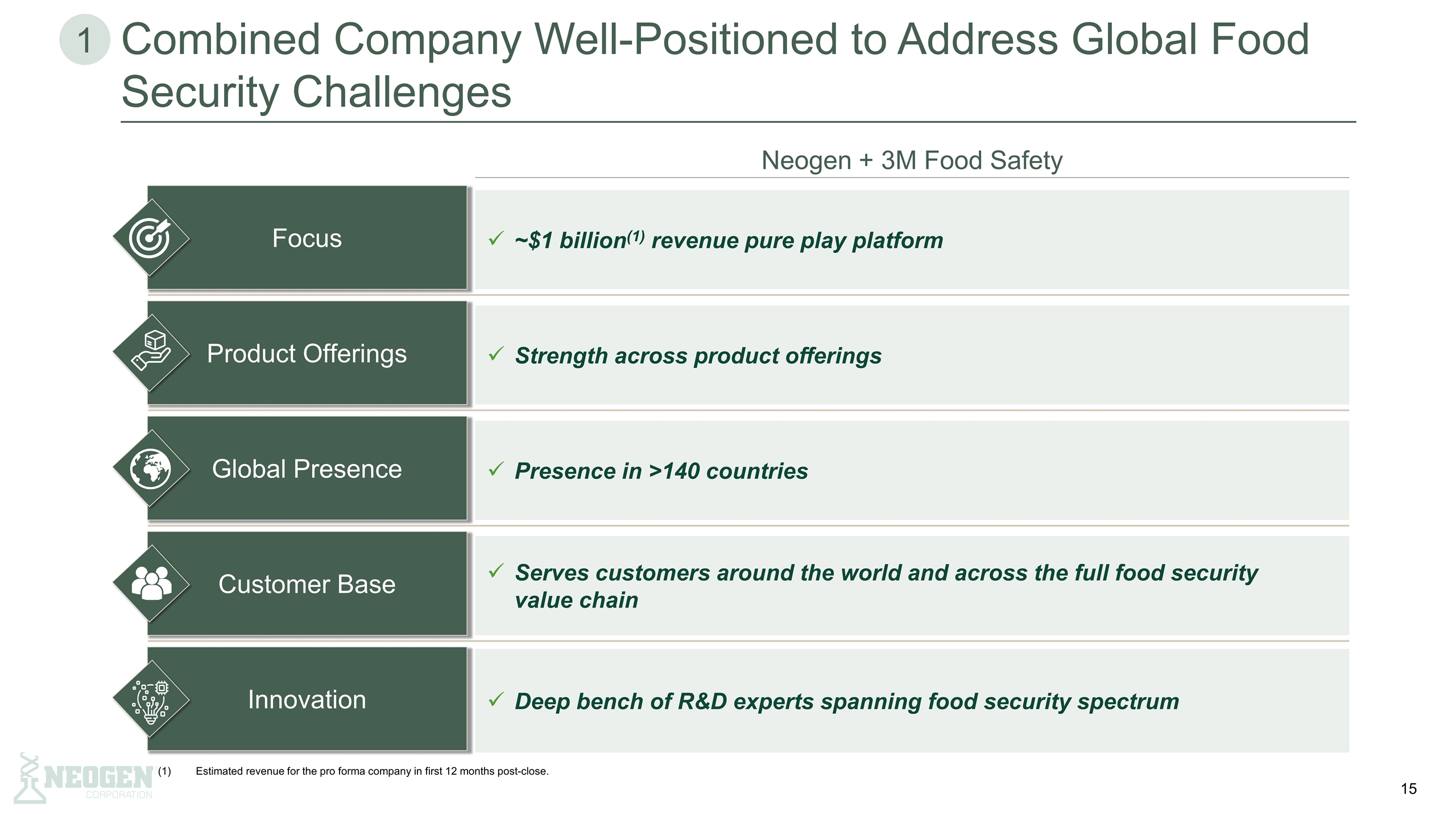

~$1 billion(1) revenue pure play platform Strength across product offerings Presence in >140 countries Combined Company Well-Positioned to Address Global Food Security Challenges Focus Product Offerings Global Presence Customer Base Innovation Neogen + 3M Food Safety Serves customers around the world and across the full food security value chain Deep bench of R&D experts spanning food security spectrum 1 (1)Estimated revenue for the pro forma company in first 12 months post-close.

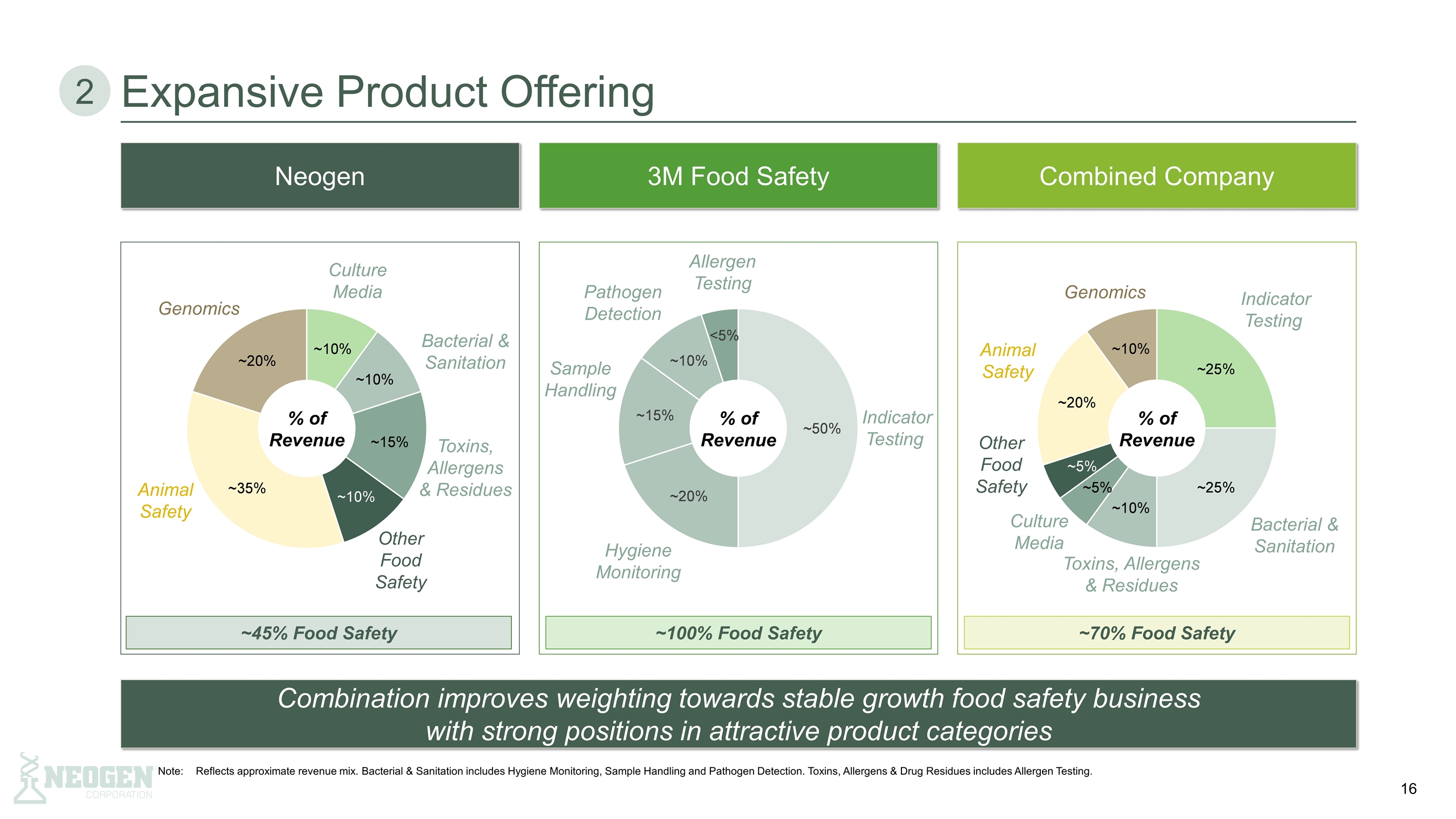

Expansive Product Offering 2 Combination improves weighting towards stable growth food safety business with strong positions in attractive product categories Neogen 3M Food Safety Combined Company Toxins, Allergens & Residues Bacterial & Sanitation Culture Media Other Food Safety Genomics Animal Safety Indicator Testing Genomics Culture Media Bacterial & Sanitation Other Food Safety Toxins, Allergens & Residues Animal Safety Indicator Testing Hygiene Monitoring Sample Handling Pathogen Detection Allergen Testing ~45% Food Safety ~100% Food Safety ~70% Food Safety Note:Reflects approximate revenue mix. Bacterial & Sanitation includes Hygiene Monitoring, Sample Handling and Pathogen Detection. Toxins, Allergens & Drug Residues includes Allergen Testing. % of Revenue % of Revenue % of Revenue

Complementary, Diverse, Blue Chip Customer Base 3 Food & Beverage Contract Labs Other Deep relationships with a diverse group of customers across the world better served by the combined company

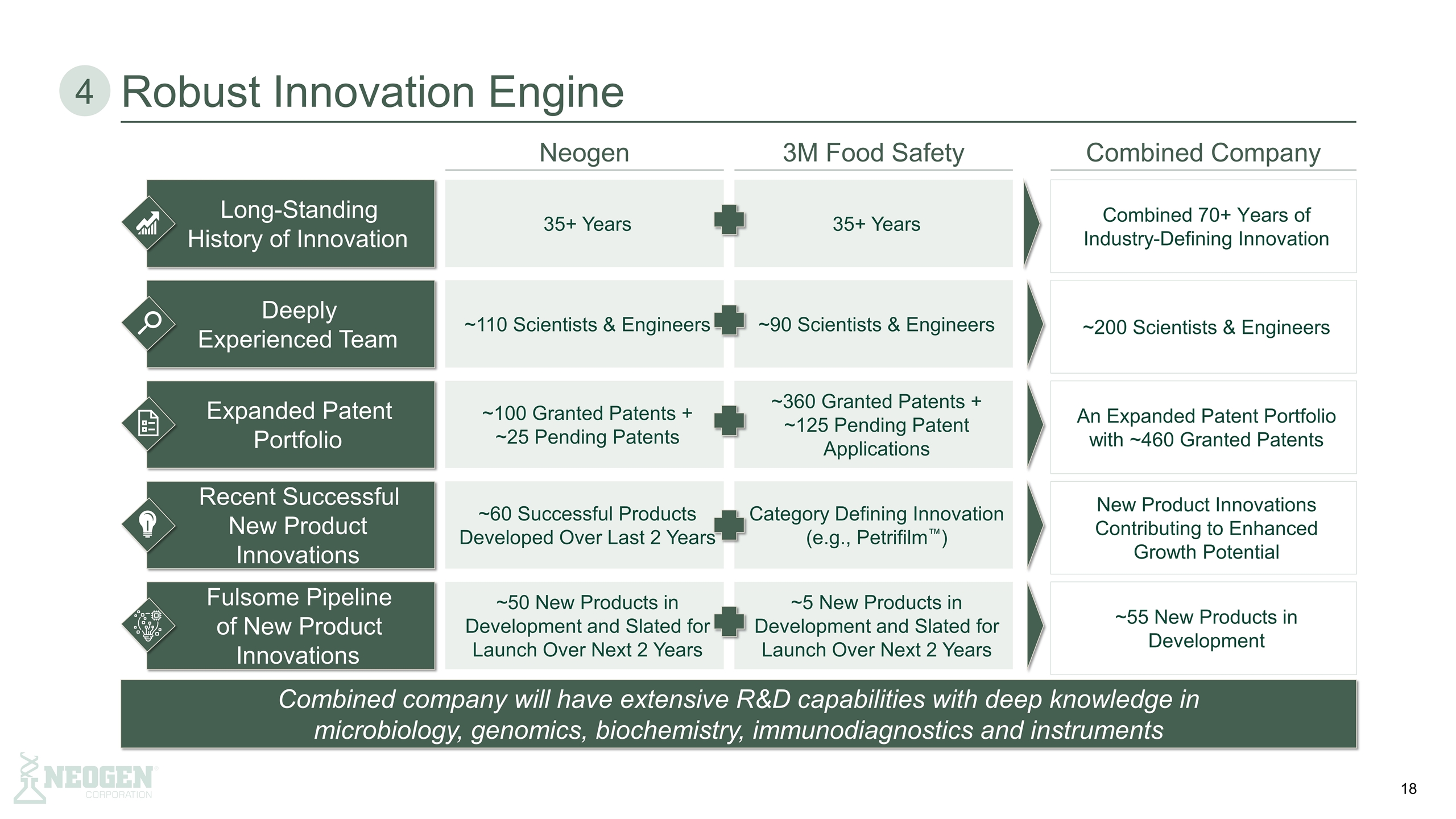

Robust Innovation Engine 4 Neogen 3M Food Safety Long-Standing History of Innovation 35+ Years 35+ Years Combined 70+ Years of Industry-Defining Innovation Combined Company ~60 Successful Products Developed Over Last 2 Years Category Defining Innovation (e.g., Petrifilm™) New Product Innovations Contributing to Enhanced Growth Potential Recent Successful New Product Innovations ~100 Granted Patents + ~25 Pending Patents ~360 Granted Patents + ~125 Pending Patent Applications An Expanded Patent Portfolio with ~460 Granted Patents Expanded Patent Portfolio ~110 Scientists & Engineers ~90 Scientists & Engineers ~200 Scientists & Engineers Deeply Experienced Team Combined company will have extensive R&D capabilities with deep knowledge in microbiology, genomics, biochemistry, immunodiagnostics and instruments ~50 New Products in Development and Slated for Launch Over Next 2 Years ~5 New Products in Development and Slated for Launch Over Next 2 Years ~55 New Products in Development Fulsome Pipeline of New Product Innovations

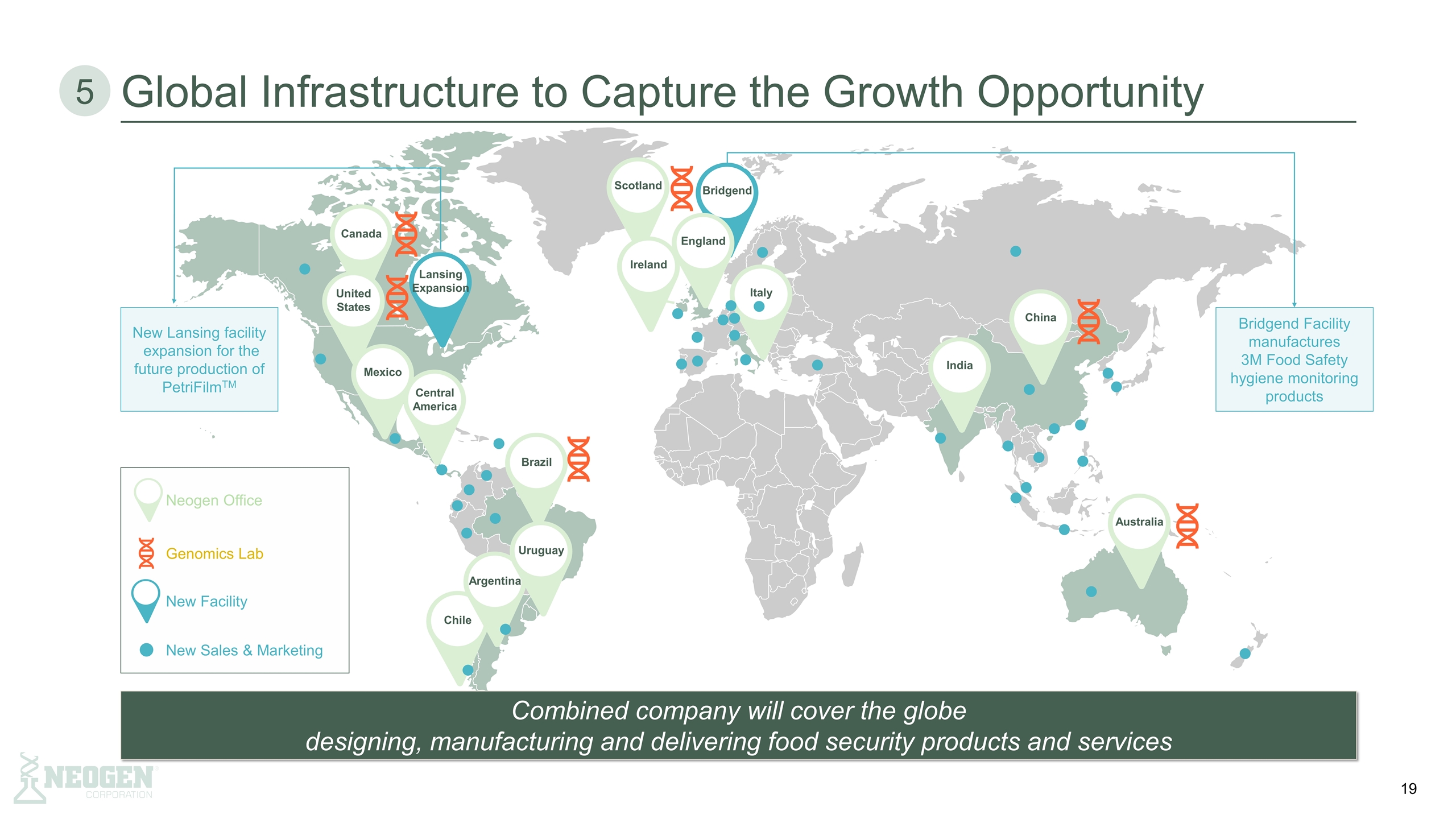

Bridgend Global Infrastructure to Capture the Growth Opportunity Canada United States Mexico Chile Argentina Brazil Uruguay Scotland Ireland England Italy India China Australia Neogen Office Genomics Lab 5 Central America Lansing Expansion New Sales & Marketing New Facility New Lansing facility expansion for the future production of PetriFilmTM Bridgend Facility manufactures 3M Food Safety hygiene monitoring products Combined company will cover the globe designing, manufacturing and delivering food security products and services

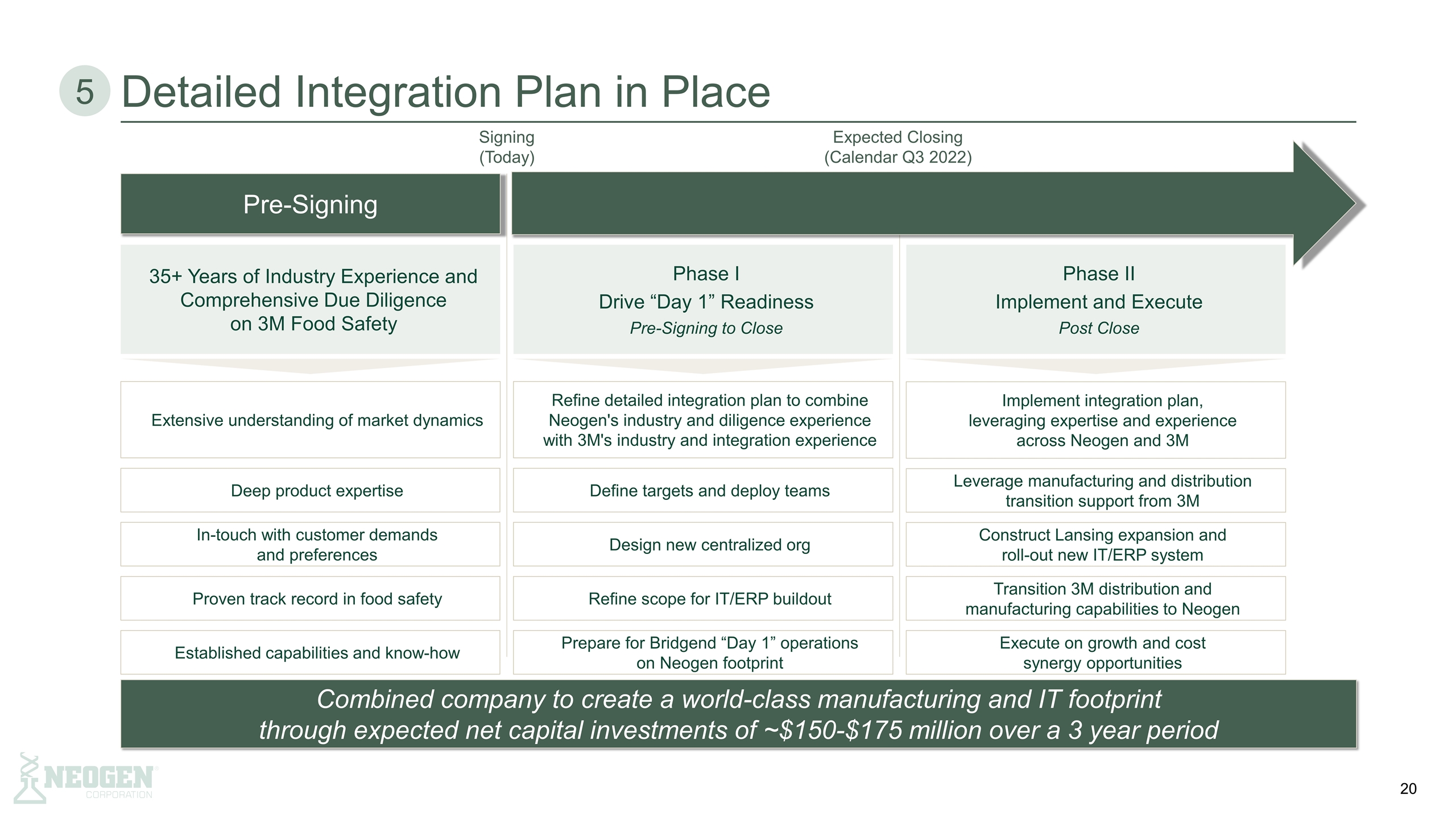

Phase II Implement and Execute Post Close Phase I Drive “Day 1” Readiness Pre-Signing to Close 35+ Years of Industry Experience and Comprehensive Due Diligence on 3M Food Safety Detailed Integration Plan in Place 5 Signing (Today) Expected Closing (Calendar Q3 2022) Pre-Signing Define targets and deploy teams Deep product expertise In-touch with customer demands and preferences Proven track record in food safety Established capabilities and know-how Design new centralized org Refine scope for IT/ERP buildout Prepare for Bridgend “Day 1” operations on Neogen footprint Extensive understanding of market dynamics Leverage manufacturing and distribution transition support from 3M Construct Lansing expansion and roll-out new IT/ERP system Transition 3M distribution and manufacturing capabilities to Neogen Execute on growth and cost synergy opportunities Refine detailed integration plan to combine Neogen's industry and diligence experience with 3M's industry and integration experience Implement integration plan, leveraging expertise and experience across Neogen and 3M Combined company to create a world-class manufacturing and IT footprint through expected net capital investments of ~$150-$175 million over a 3 year period

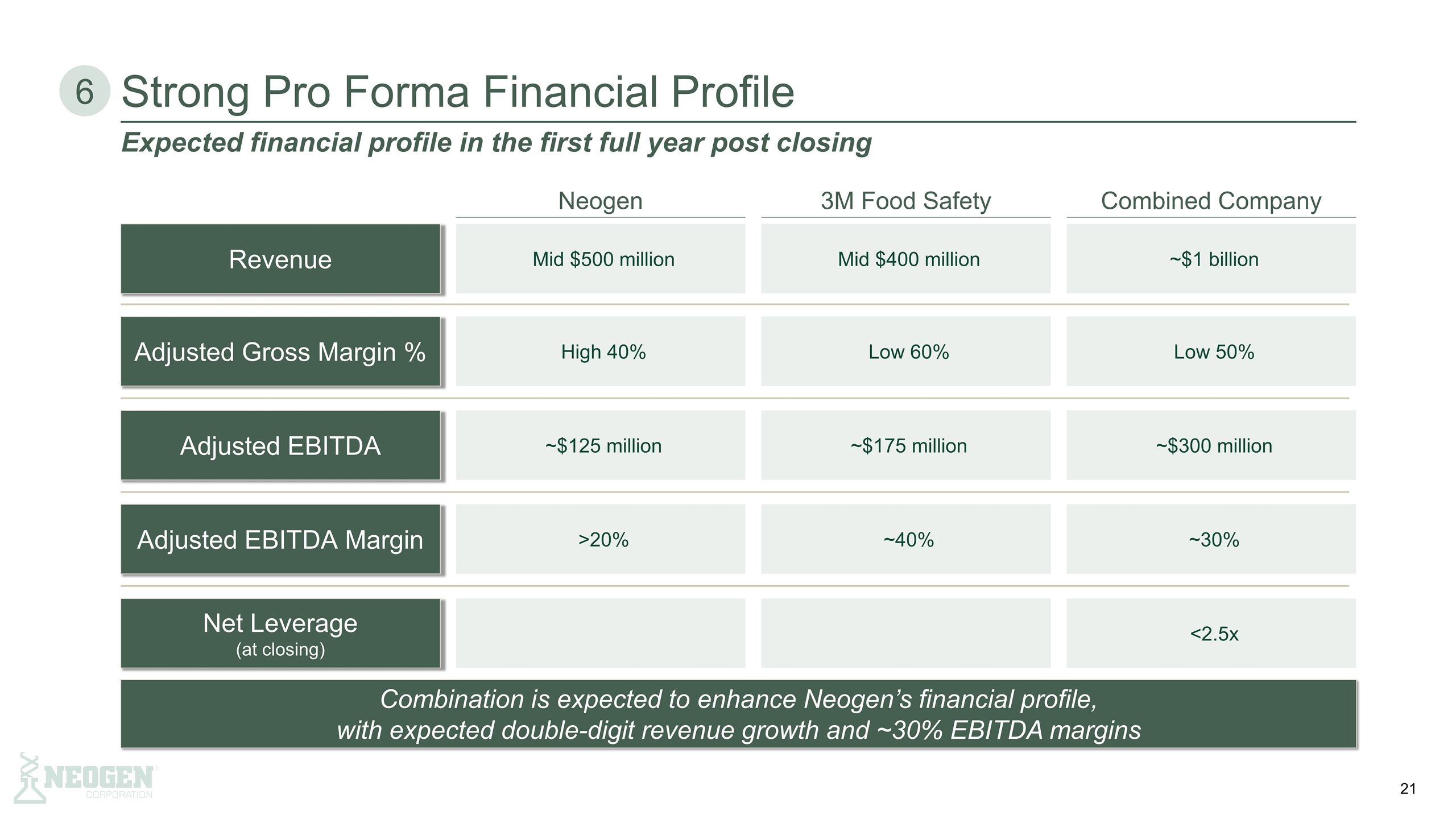

Strong Pro Forma Financial Profile Revenue Adjusted EBITDA Adjusted EBITDA Margin Net Leverage (at closing) Neogen 3M Food Safety Combined Company 6 Mid $500 million Mid $400 million ~$1 billion ~$125 million ~$175 million ~$300 million >20% ~40% ~30% <2.5x Combination is expected to enhance Neogen’s financial profile, with expected double-digit revenue growth and ~30% EBITDA margins Expected financial profile in the first full year post closing Adjusted Gross Margin % High 40% Low 60% Low 50%

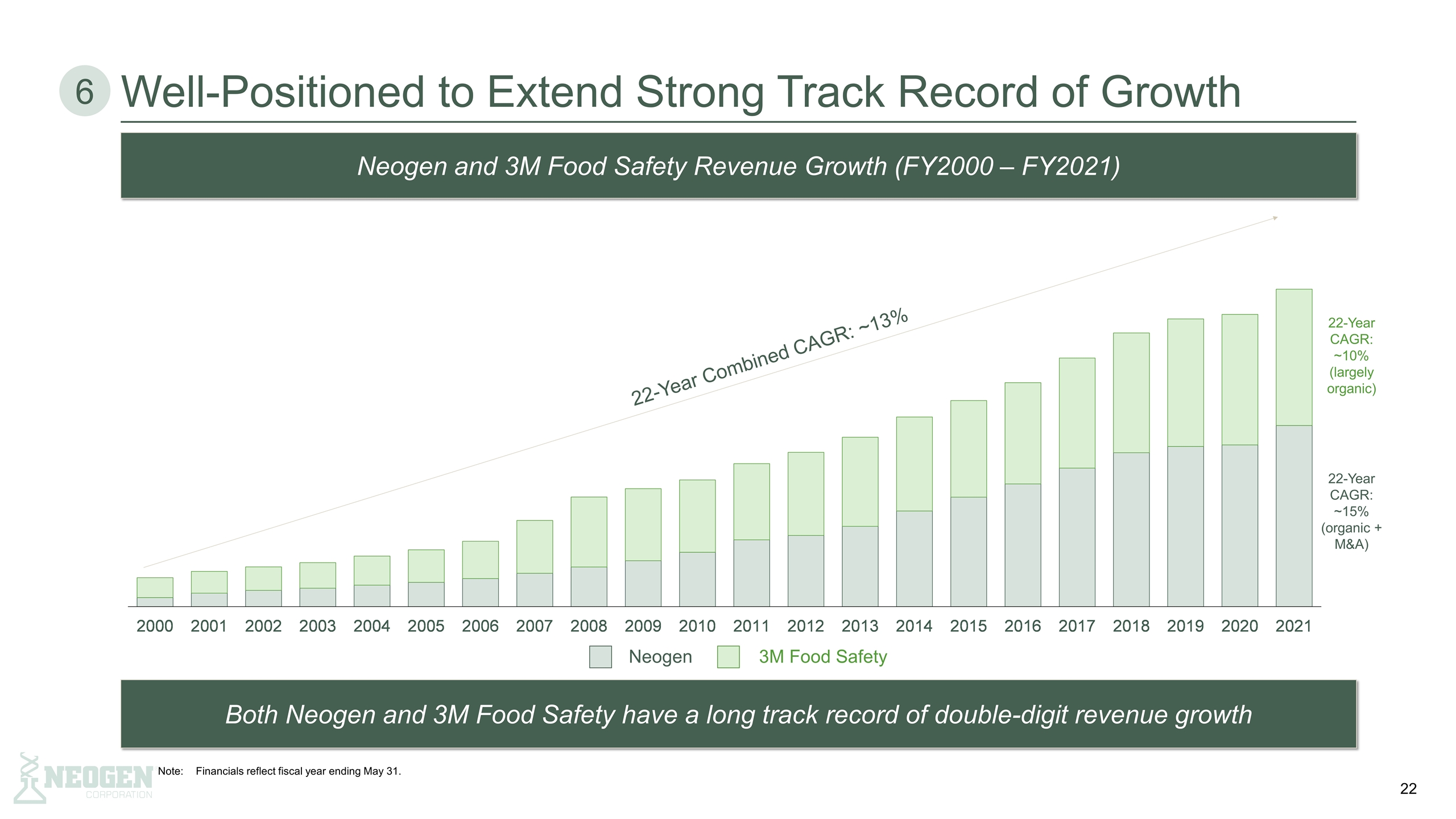

Well-Positioned to Extend Strong Track Record of Growth 6 22-Year CAGR: ~15% (organic + M&A) 22-Year CAGR: ~10% (largely organic) Neogen 3M Food Safety 22-Year Combined CAGR: ~13% Both Neogen and 3M Food Safety have a long track record of double-digit revenue growth Neogen and 3M Food Safety Revenue Growth (FY2000 – FY2021) Note:Financials reflect fiscal year ending May 31.

Manufacturing efficiencies Supply chain initiatives Organization optimization Leverage best practices from Neogen and 3M Food Safety commercial groups Deploy resources on targeted basis to high potential / high priority opportunities Comprehensive combined offering of food safety solutions can be delivered to an aggregate global customer base and enhance value through depth and breadth of the portfolio Compelling Value Creation Expected Via Synergies Growth Synergies ~$15 million EBITDA Contribution by Year 3 (~$40 million Revenue) Cost Synergies ~$15 million EBITDA Contribution by Year 3 7 Cross-Sell Opportunities Increased Resource Allocation Cost of Goods Sold G&A and Other Targeting EBITDA contribution from growth and cost synergies of ~$30 million by Year 3

Combined company expected to deliver ~10% revenue growth with ~30% EBITDA margins Compelling product offering and footprint to address food security challenges globally and serve a diverse customer base Combination of complementary food safety leaders creating a pure play food security company with ~$1 billion revenue trajectory Concluding Perspectives Compelling value creation opportunity for shareholders through synergies and enhanced financial metrics