Exhibit 99.3

THE COOPER COMPANIES, INC.

FORWARD LOOKING

STATEMENTS

This presentation contains forward-looking projections of Cooper’s results. Actual results could differ materially from these projections. Additional information concerning factors that could cause material differences can be found in Cooper’s periodic filings with the Securities and Exchange Commission. They are available publicly and on request from Cooper’s investor relations department.

THE COOPER COMPANIES, INC.

AGENDA

Introductions – Tom Bender

Soft Contact Lens Market Overview – Tom Bender

Integration of COO and OCLR – Greg Fryling

R&D Portfolio – Chris Marmo

Financial Overview and Guidance – Bob Weiss

THE COOPER COMPANIES, INC.

Tom Bender

Chairman of the Board,

President and

Chief Executive Officer

The Cooper Companies, Inc.

THE COOPER COMPANIES, INC.

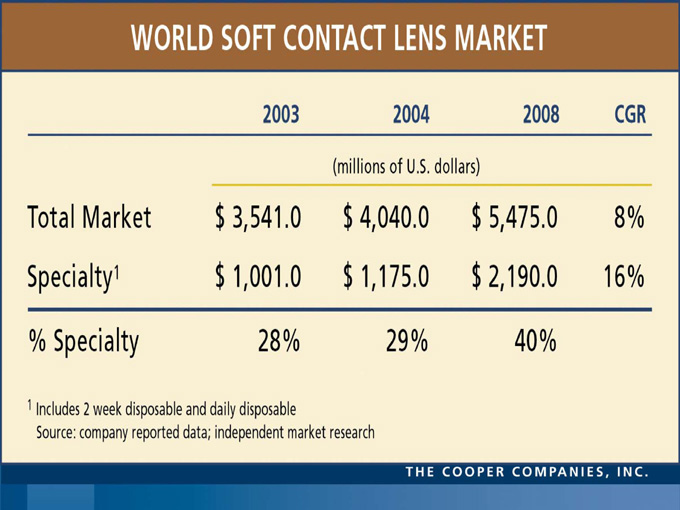

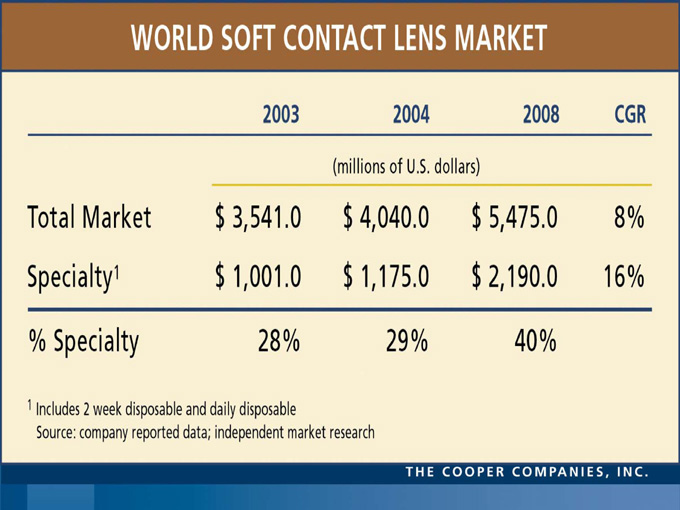

WORLD SOFT CONTACT LENS MARKET

2003 2004 2008 CGR

(millions of U.S. dollars)

Total Market $3,541.0 $4,040.0 $5,475.0 8%

Specialty1 $1,001.0 $1,175.0 $2,190.0 16%

% Specialty 28% 29% 40%

1Includes 2 week disposable and daily disposable

Source: company reported data; independent market research

THE COOPPER COMPANIES, INC.

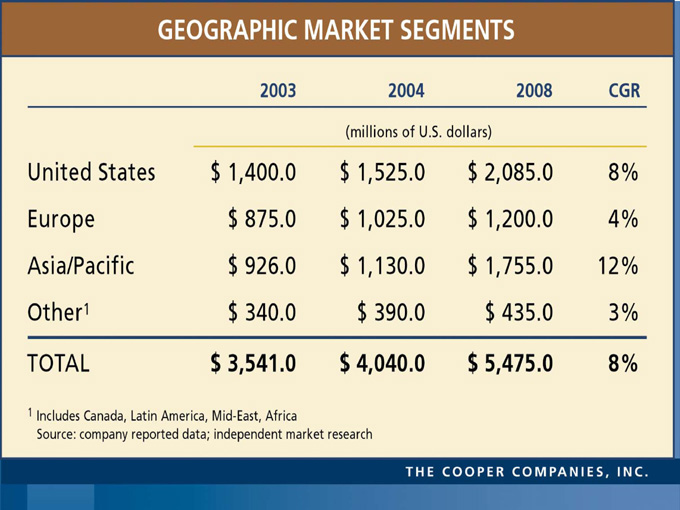

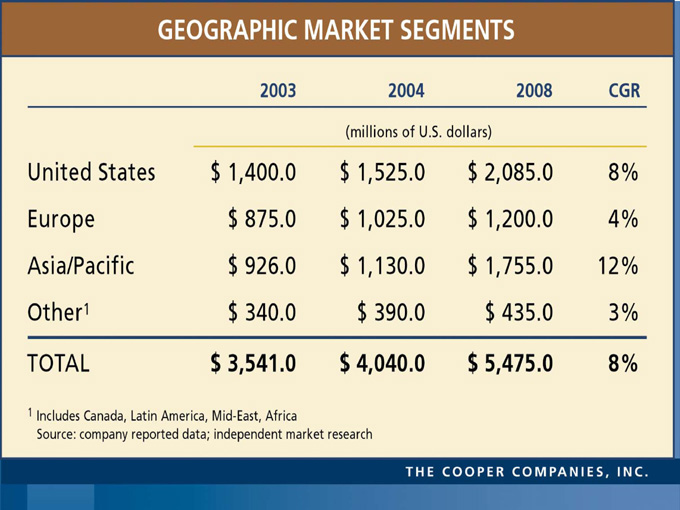

GEOGRAPHIC MARKET SEGMENTS

2003 2004 2008 CGR

(millions of U.S. dollars)

United States $1,400.0 $1,525.0 $2,085.0 8%

Europe $875.0 $1,025.0 $1,200.0 4%

Asia/Pacific $926.0 $1,130.0 $1,755.0 12%

Other1 $340.0 $390.0 $435.0 3%

TOTAL $3,541.0 $4,040.0 $5,475.0` 8%

1 Includes Canada, Latin America, Mid-East, Africa

Source: company reported data; independent market research

THE COOPER COMPANIES, INC.

WORLD SOFT CONTACT LENS SPECIALTY SEGMENTS

2003 2004 2008 CGR

(millions of U.S. dollars)

Toric $460.0 $535.0 $935.0 14%

Bifocal $91.0 $115.0 $285.0 25%

Cosmetic $300.0 $285.0 $285.0 FLAT

Dry Eye $150.0 $1,175.0 $685.0 30%

Specialty $1,001.0 $3,865.0 $2,190.0 16%

Nonspecialty $2,540.0 $4,040.0 $3,285.0 4%

TOTAL $3,541.0 $240.0$5,475.0 8%

1 Includes 2 week disposable and daily disposable

Source: company reported data; independent market research

THE COOPER COMPANIES, INC.

WORLD SOFT CONTACT LENS COMPETITION

2003 2004 2008 CGR

millions of U.S. dollars

Vistakon $1,300.0 $1,470.0 $1,950.0 8%

CIBA Vision $950.0 $1,120.0 $1,310.0 4%

CooperVision $651.0 $730.0 $1,190.0 13%

Bausch & Lomb $560.0 $635.0 $925.0 10%

Other $80.00 $85.0 $100.0 4%

$3,541.0 $4,040.0 $5,475.0 8%

Source: Company reported data; independent market research

THE COOPER COMPANIES, INC.

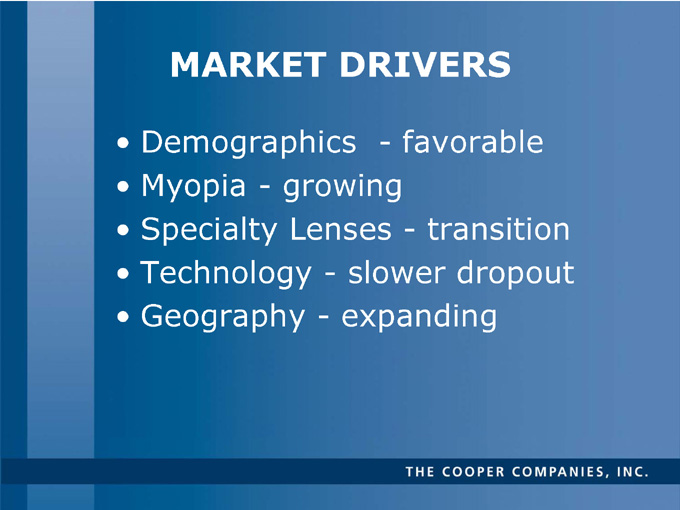

MARKET DRIVERS

Demographics - favorable

Myopia - growing

Specialty Lenses - transition

Technology - slower dropout

Geography - expanding

THE COOPER COMPANIES, INC.

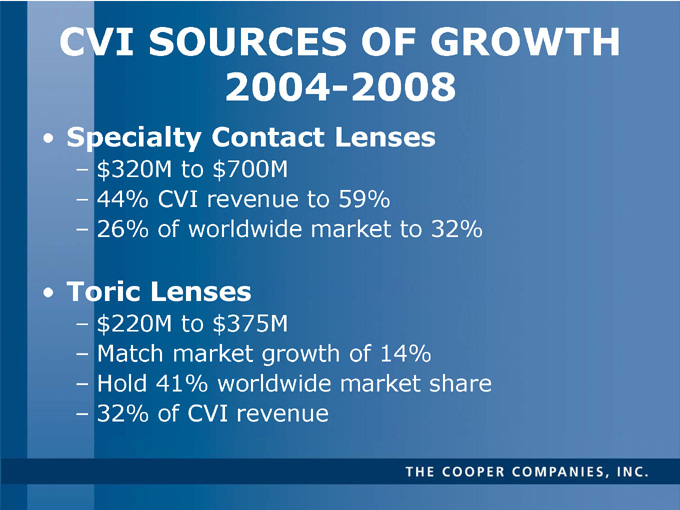

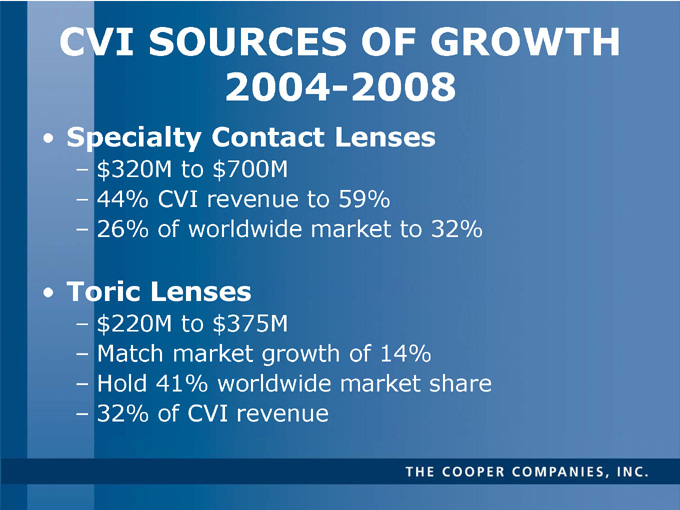

CVI SOURCES OF GROWTH

2004-2008

Specialty Contact Lenses

– $ 320M to $700M

– 44% CVI revenue to 59%

– 26% of worldwide market to 32%

Toric Lenses

– $ 220M to $375M

– Match market growth of 14%

– Hold 41% worldwide market share

– 32% of CVI revenue

THE COOPER COMPANIES, INC.

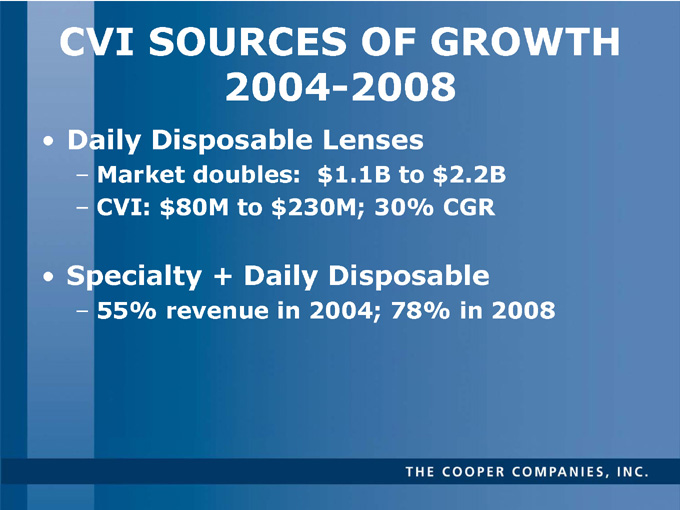

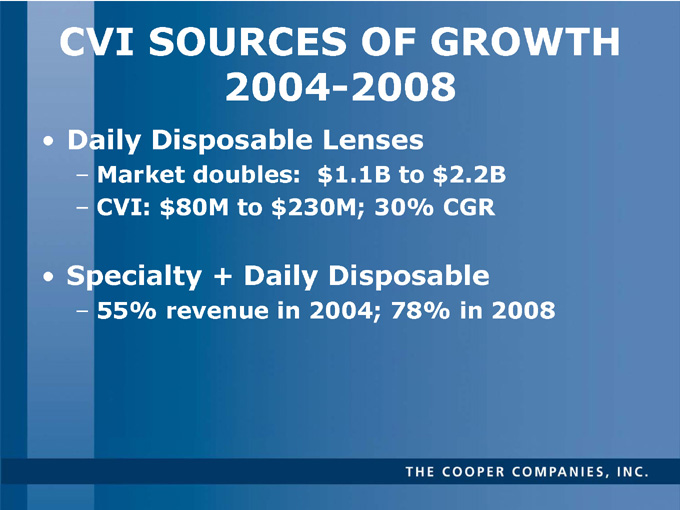

CVI SOURCES OF GROWTH

2004-2008

Daily Disposable Lenses

– Market doubles: $1.1B to $2.2B

– CVI: $80M to $230M; 30% CGR

Specialty + Daily Disposable

– 55% revenue in 2004; 78% in 2008

THE COOPER COMPANIES, INC.

Greg Fryling

President and

Chief Operating Officer

CooperVision, Inc.

THE COOPER COMPANIES, INC.

THE COOPER COMPANIES, INC.

Why We Did the Deal

Grow revenue faster than the two companies could achieve on a stand-alone basis

$ 50 Million Operating Income Synergies After 3 Years

THE COOPER COMPANIES, INC.

Synergistic Revenue Opportunities

THE COOPER COMPANIES, INC.

Revenue Opportunities

Complimentary Product Lines

Product Category CVI OSI Market Size (Billion)

Daily Disposable No Yes $1.2

2 Week & Monthly Sphere Yes Yes $1.7

Color Yes Yes $0.3

Toric Yes Yes $0.5

Multifocal (Disposable) Yes No $ 0.1

Silicon Hydrogel * (Continuous Wear) No No $ 0.2

Total $ 4.0

*Launch Date FY05-06

Ability to bundle or pull through a family of products

THE COOPER COMPANIES, INC.

Revenue Opportunities

Ability to Go Direct

Location CVI OSI

Japan Distributor Direct

Germany Distributor Direct

Korea Distributor Direct

Sweden/Norway Direct Distributor

Spain Direct Distributor

Brazil Direct Distributor

Portugal Direct Distributor

Combined Market Size (excluding Japan): $400MM

Current Distributor Business (excluding Japan): $30MM

THE COOPER COMPANIES, INC.

Revenue Opportunities

Provide a Stronger Sales Force in Overlapping Markets

United States

Canada

Australia

United Kingdom

Italy

France

Benelux

THE COOPER COMPANIES, INC.

Revenue Opportunities

Stronger R&D Organization to Provide

New Products to the Market over a Quicker Timeline

THE COOPER COMPANIES, INC.

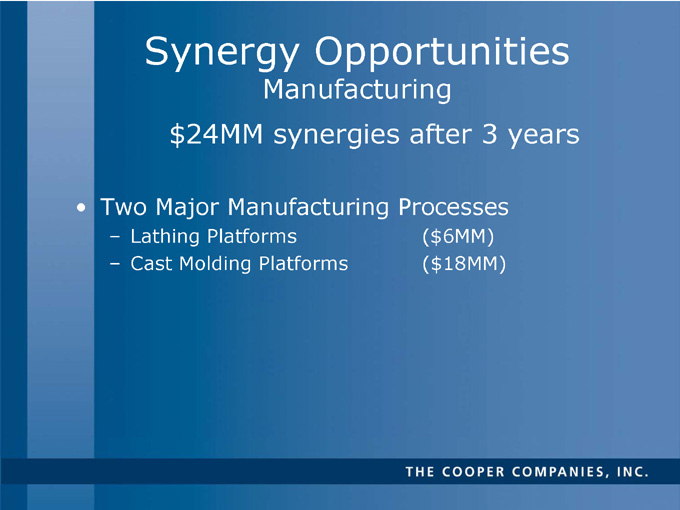

Synergy Opportunities

Manufacturing

$24MM synergies after 3 years

Two Major Manufacturing Processes

Lathing Platforms ($6MM)

Cast Molding Platforms ($18MM)

THE COOPER COMPANIES, INC.

Lathing MFG Synergies

(Three Years Out)

$6.0M Annual Savings

$ 1.4 from Facilities Consolidation

$ 4.6 from Manufacturing Platform Conversions (including labor)

Consolidate Lathing locations (currently 7)

Total Value of Production: $45MM

FY05 Budget Unit Production: 21MM

Revenue from Lathing Operations: ~$150MM

THE COOPER COMPANIES, INC.

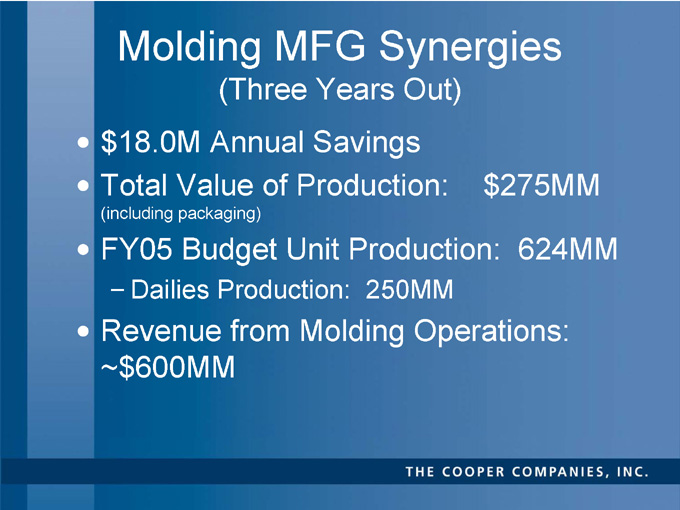

Molding MFG Synergies

(Three Years Out)

$18.0M Annual Savings

Total Value of Production: $275MM

(including packaging)

FY05 Budget Unit Production: 624MM

Dailies Production: 250MM

Revenue from Molding Operations: ~$600MM

THE COOPER COMPANIES, INC.

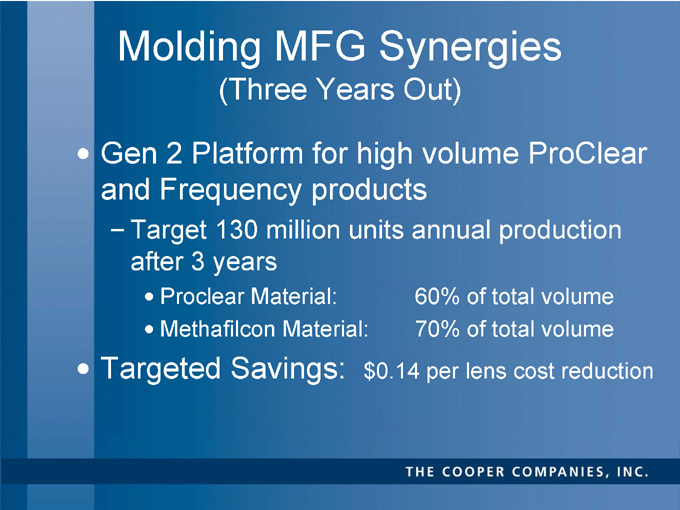

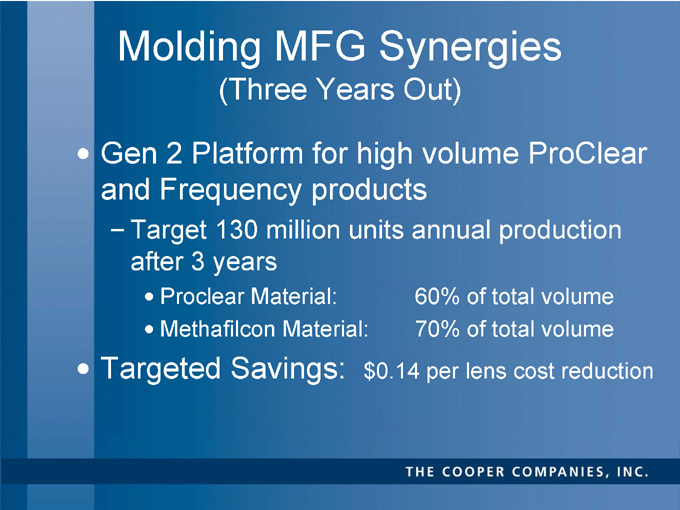

Molding MFG Synergies

(Three Years Out)

Gen 2 Platform for high volume ProClear and Frequency products

Target 130 million units annual production after 3 years

Proclear Material: 60% of total volume

Methafilcon Material: 70% of total volume

Targeted Savings: $0.14 per lens cost reduction

THE COOPER COMPANIES, INC.

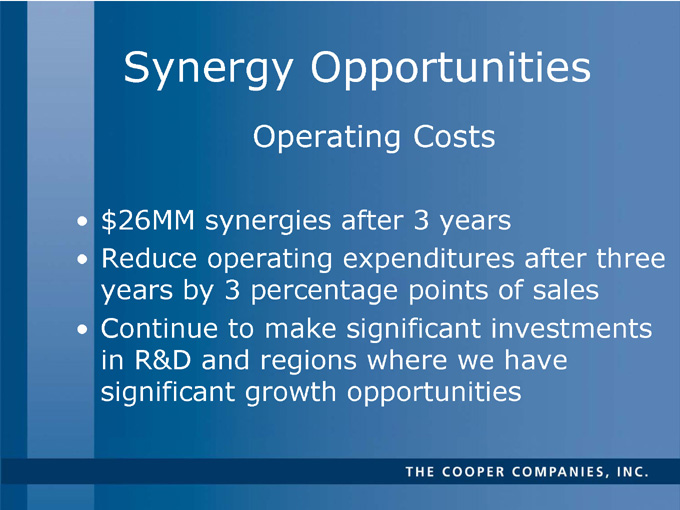

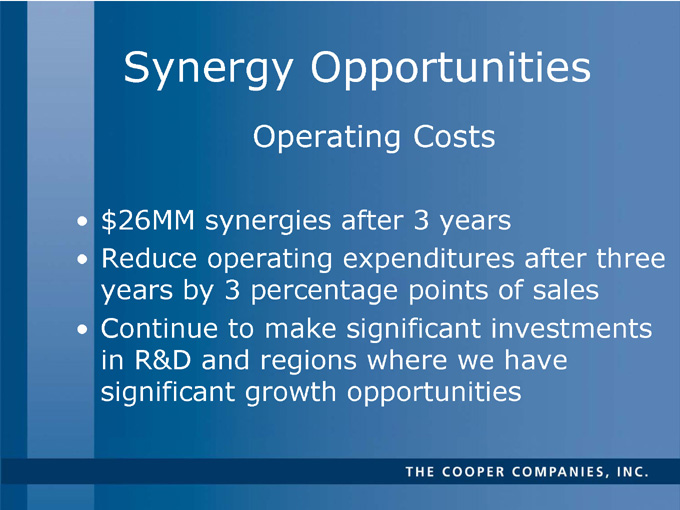

Synergy Opportunities

Operating Costs

$26MM synergies after 3 years

Reduce operating expenditures after three years by 3 percentage points of sales

Continue to make significant investments in R&D and regions where we have significant growth opportunities

THE COOPER COMPANIES, INC.

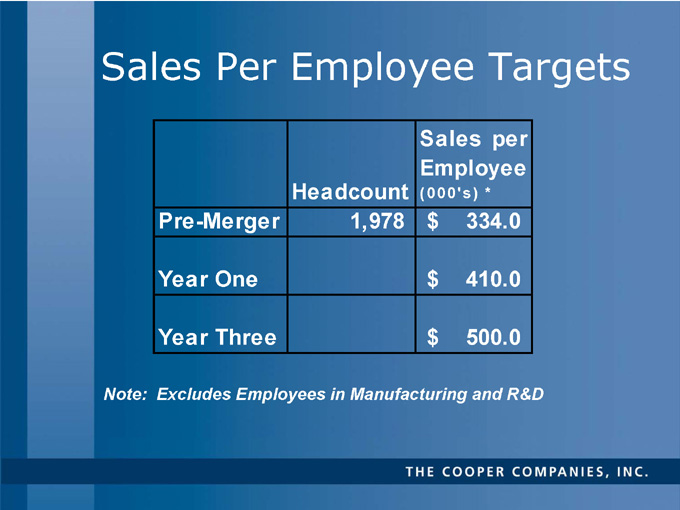

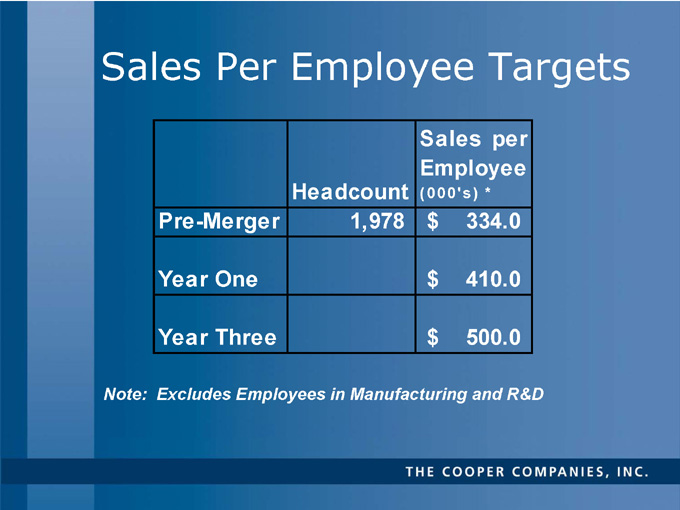

Sales Per Employee Targets

Sales per Employee Headcount (000’s) *

Pre-Merger 1,978 $ 334.0

Year One $ 410.0

Year Three $ 500.0

Note: Excludes Employees in Manufacturing and R&D

THE COOPER COMPANIES, INC.

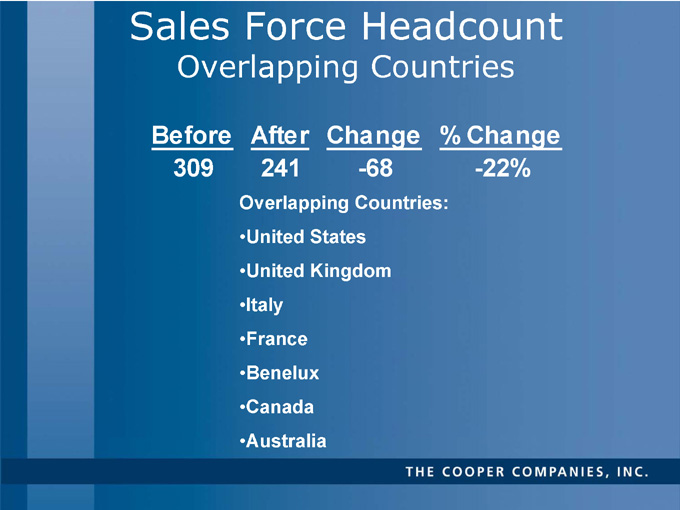

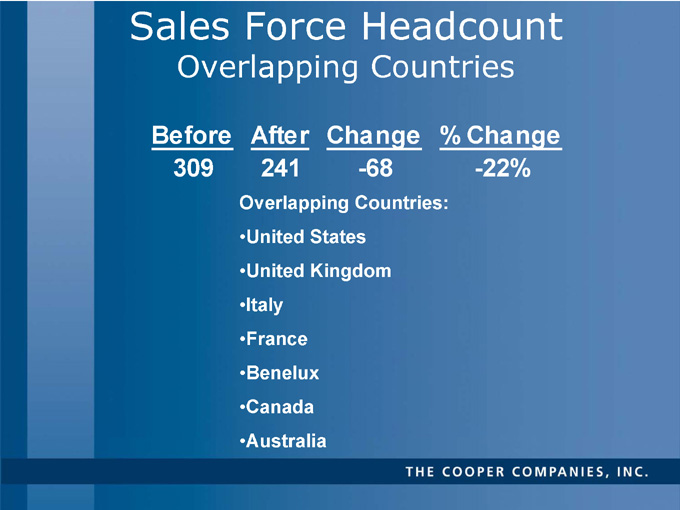

Sales Force Headcount

Overlapping Countries

Before After Change % Change

309 241 -68 -22%

Overlapping Countries:

United States

United Kingdom

Italy

France

Benelux

Canada

Australia

THE COOPER COMPANIES, INC.

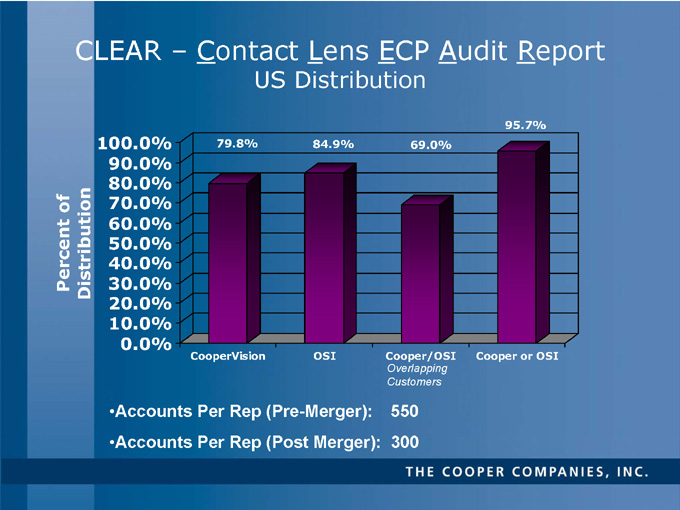

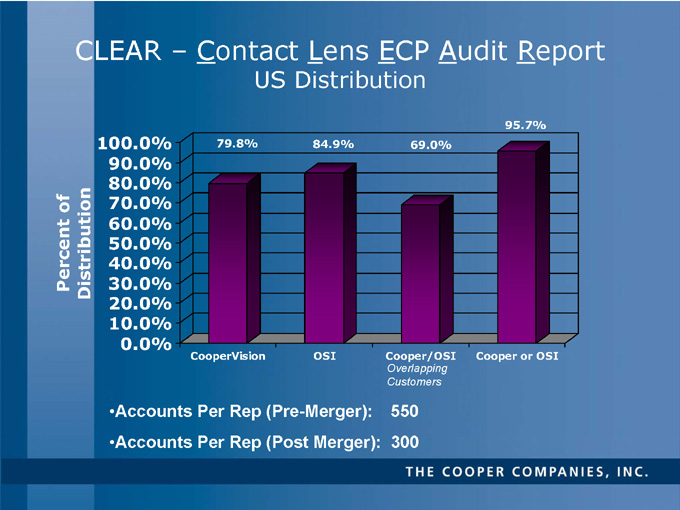

CLEAR – Contact Lens ECP Audit Report

US Distribution

95.7% 79.8% 84.9% 69.0%

100.0%

90.0%

80.0%

70.0%

60.0%

Percent of Distribution

50.0%

40.0%

30.0%

20.0%

10.0%

0.0%

CooperVision

OSI

Cooper/OSI

Overlapping Customers

Cooper or OSI

Accounts Per Rep (Pre-Merger): 550

Accounts Per Rep (Post Merger): 300

THE COOPER COMPANIES, INC.

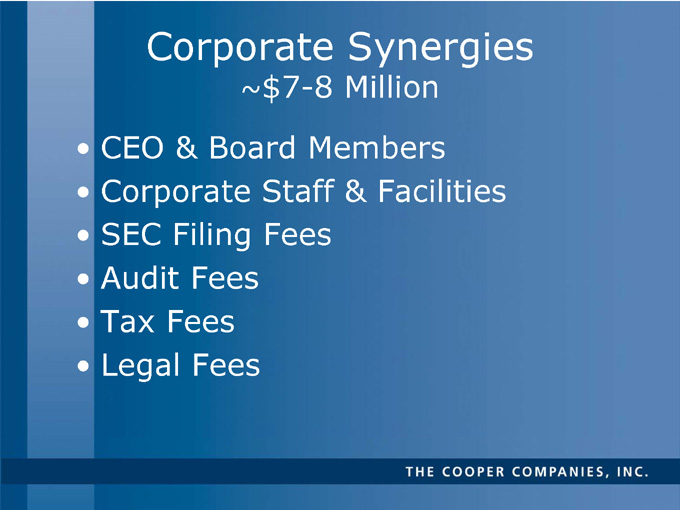

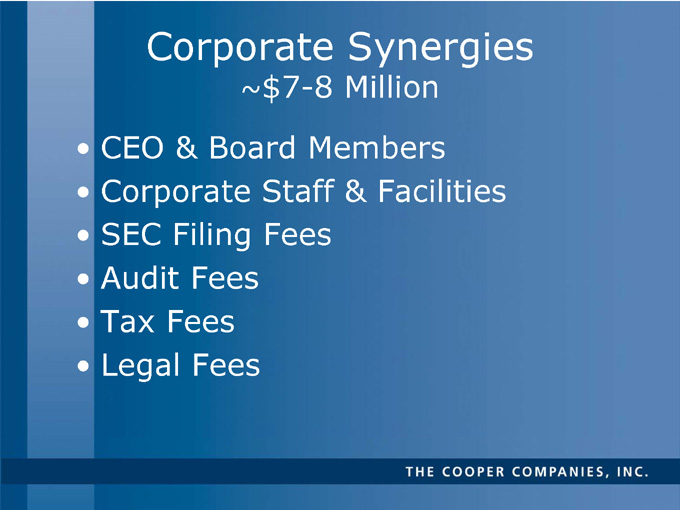

Corporate Synergies

~$ 7-8 Million

CEO & Board Members

Corporate Staff & Facilities

SEC Filing Fees

Audit Fees

Tax Fees

Legal Fees

THE COOPER COMPANIES, INC.

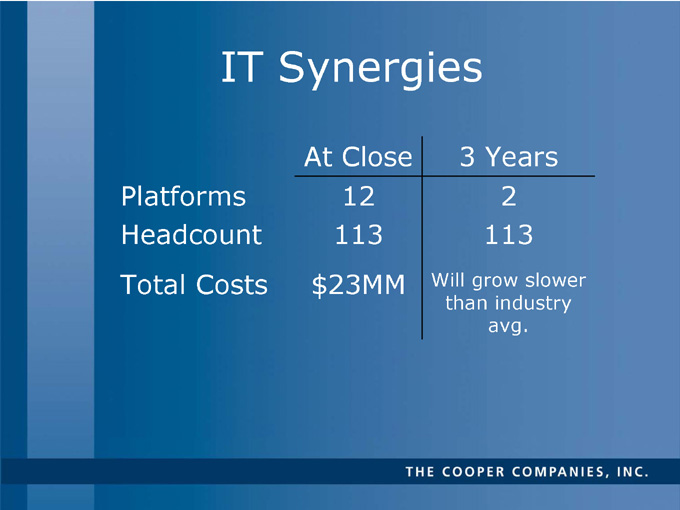

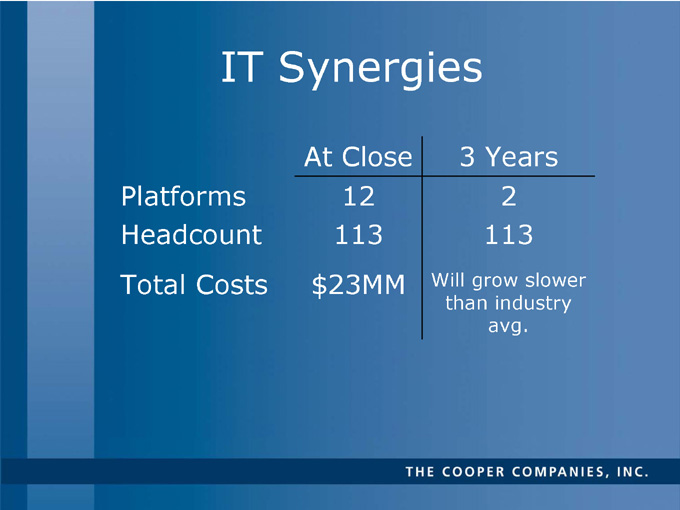

IT Synergies

At Close 3 Years

Platforms 12 2

Headcount 113 113

Total Costs $23MM Will grow slower than industry avg.

THE COOPER COMPANIES, INC.

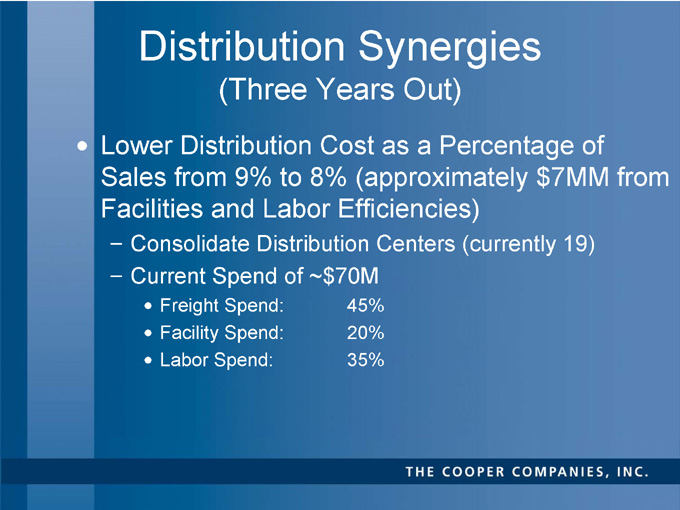

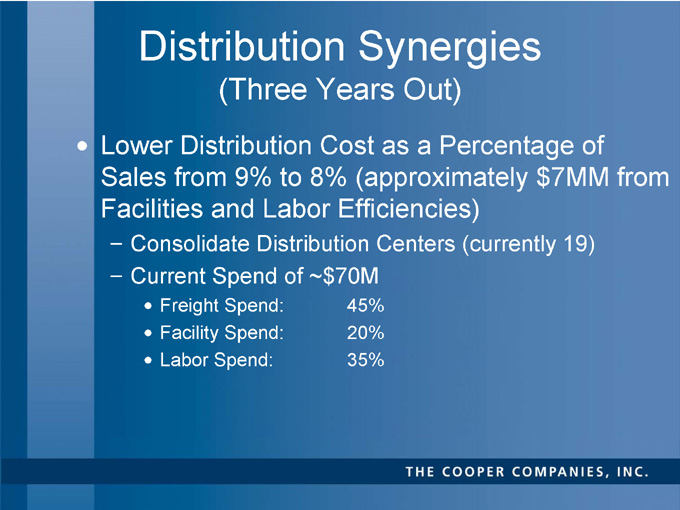

Distribution Synergies

(Three Years Out)

Lower Distribution Cost as a Percentage of Sales from 9% to 8% (approximately $7MM from Facilities and Labor Efficiencies)

Consolidate Distribution Centers (currently 19)

Current Spend of ~$70M

Freight Spend: 45%

Facility Spend: 20%

Labor Spend: 35%

THE COOPER COMPANIES, INC.

Ultimate Goal

Grow the business at a double digit rate over the next 5 years

Achieve cost synergies of $50MM in Production and Operating costs

THE COOPER COMPANIES, INC.

CVI Philosophy

Best of the Best

Best Practices

Maintain a Passionate Spirit

THE COOPER COMPANIES, INC.

CVI Organization

Greg Fryling

President & COO

***

Claire Dickerson

Exec. Administrator

John Calcagno

Chief Financial Officer

Global Finance

Global IT

Greg Zimmerman

Vice President

HR

Jeff McLean

President

US

Jack Gibson

President

Canada

Jim Welch

President

International

Northern Europe-Andrew Sedgwick

Southern Europe-Giacomo Grassi

Asia Pacific-Michael Kotow

Japan-Masakazu Niwa

Latin America-Juan Carlos Aragon

John Weber

Vice President

WW Operations

Christopher Marmo

Vice President

R & D

Christine Moench

Director

RA / QA

Dave Fancher

President

CooperVision Surgical

THE COOPER COMPANIES, INC.

Chris Marmo

Vice President

Research & Development

CooperVision, Inc.

THE COOPER COMPANIES, INC.

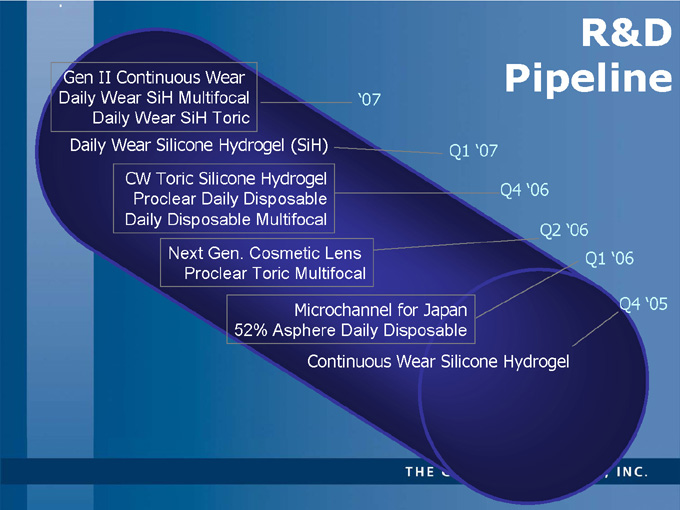

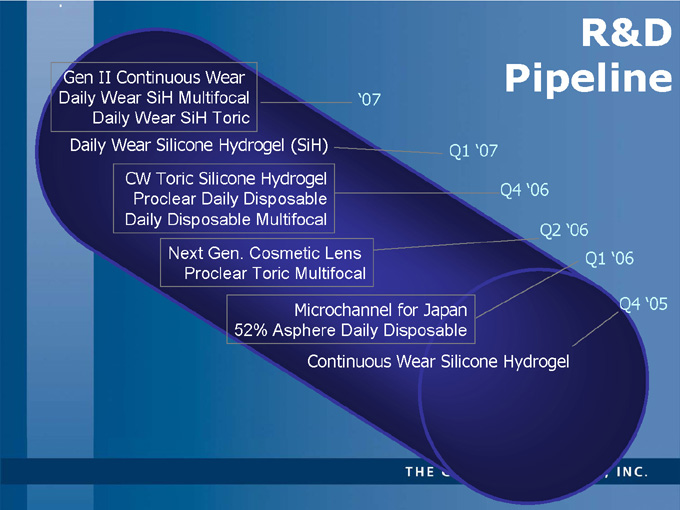

R&D

Pipeline

Gen II Continuous Wear

Daily Wear SiH Multifocal

Daily Wear SiH Toric ‘07

Daily Wear Silicone Hydrogel (SiH) Q1 ‘07

CW Toric Silicone Hydrogel Q4 ‘06

Proclear Daily Disposable

Daily Disposable Multifocal

Next Gen. Cosmetic Lens

Proclear Toric Multifocal Q2 ‘06

Microchannel for Japan Q1 ‘06

52% Asphere Daily Disposable

Continuous Wear Silicone Hydrogel Q4 ‘05

THE COOPER COMPANIES, INC.

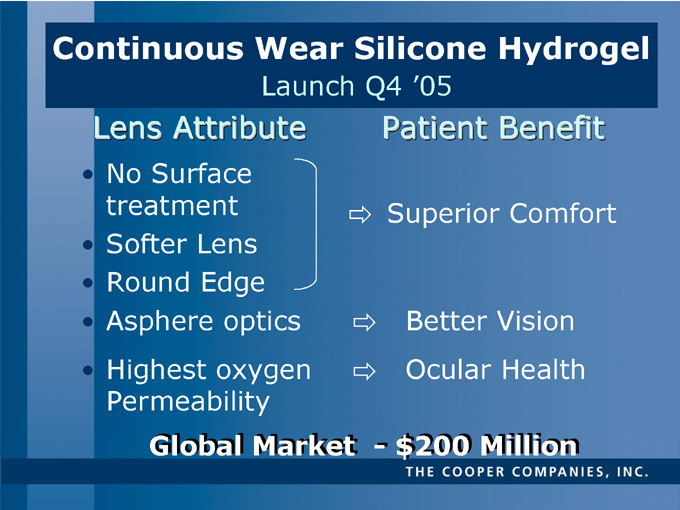

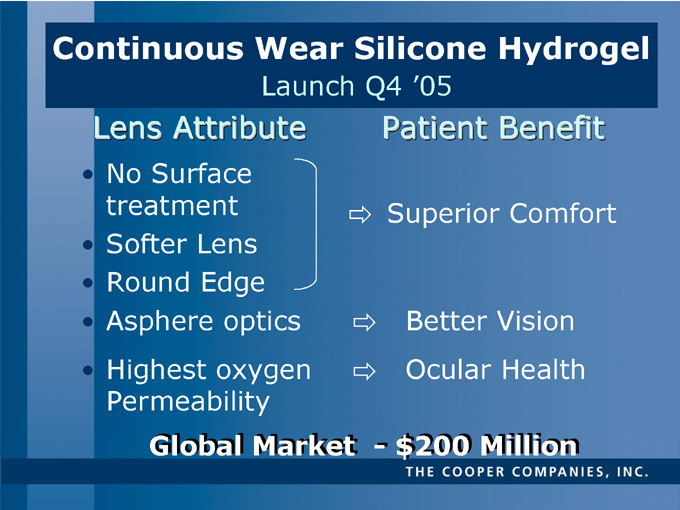

Continuous Wear Silicone Hydrogel

Launch Q4 ‘05

Lens Attribute Patient Benefit

No Surface treatment

Softer Lens

Round Edge Superior Comfort

Asphere optics Better Vision

Highest oxygen

Permeability Ocular Health

Global Market - $200 Million

THE COOPER COMPANIES, INC.

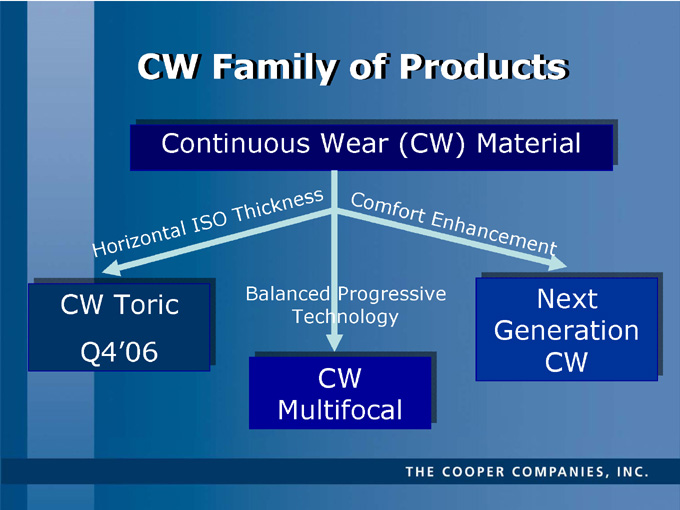

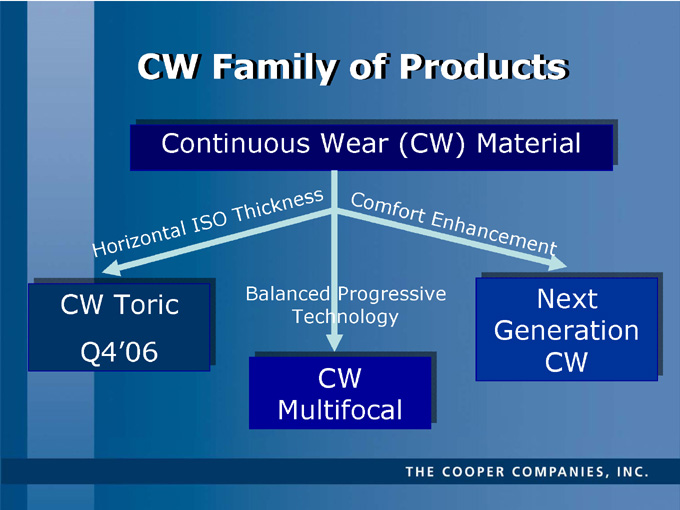

CW Family of Products

Continuous Wear (CW) Material

Horizontal ISO Thickness

Comfort Enhancement

CW Toric Q4’06

Balanced Progressive

Technology

Next Generation CW

CW Multifocal

THE COOPER COMPANIES, INC.

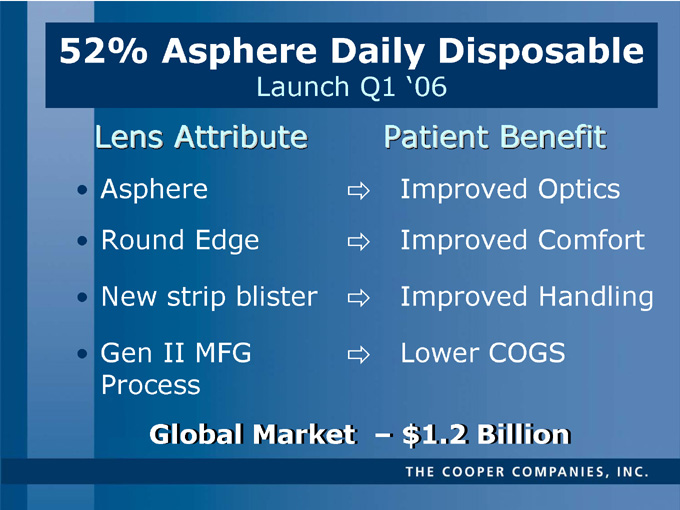

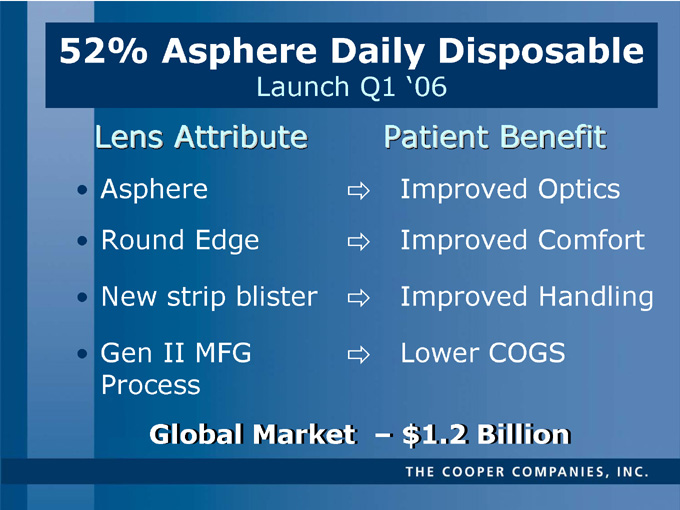

52% Asphere Daily Disposable

Launch Q1 ‘06

Lens Attribute Patient Benefit

Asphere Improved Optics

Round Edge Improved Comfort

New strip blister Improved Handling

Gen II MFG Process Lower COGS

Global Market – $1.2 Billion

THE COOPER COMPANIES, INC.

Microchannel

Japanese Launch Q1 ‘06

Japanese Ophthalmologists desire increased tear film exchange

Increased tear exchange better ocular health

Microchannel

Japanese 2-week Market – $500 Million

THE COOPER COMPANIES, INC.

Proclear Toric Multifocal

Launch Q2 ‘06

Lens Attribute Patient Benefit

Proclear Material Increased end of day comfort

Toric Expertise

Consistent Visual Outcome

Balanced Progressive Multifocal Technology

THE COOPER COMPANIES, INC.

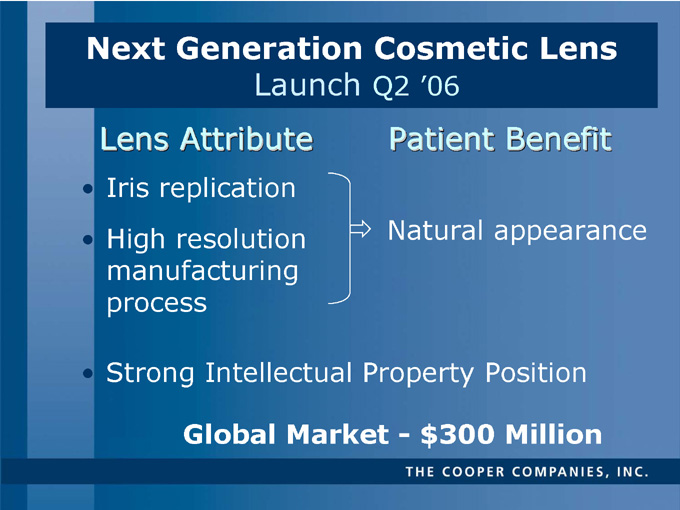

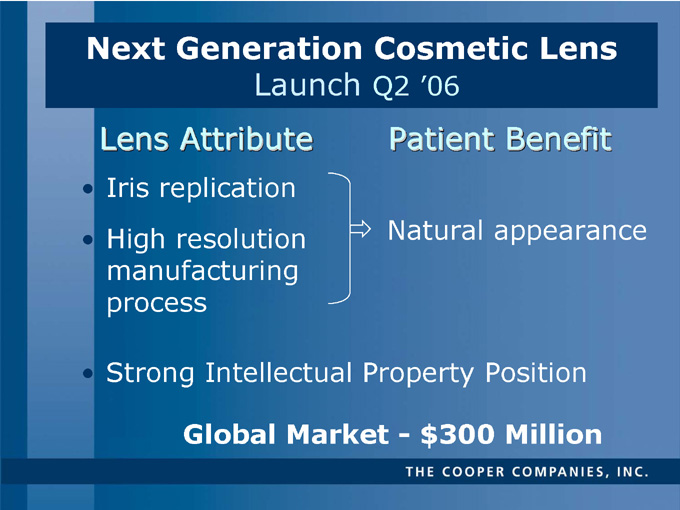

Next Generation Cosmetic Lens

Launch Q2 ‘06

Lens Attribute Patient Benefit

Iris replication

High resolution manufacturing process

Natural appearance

Strong Intellectual Property Position

Global Market - $300 Million

THE COOPER COMPANIES, INC.

Proclear Daily Disposable

Launch Q4 ‘06

Lens Attribute Patient Benefit

Proclear Material

Better end of day comfort

Gen II MFG Process

Lower COGS

Premium Daily Disposable

Global Market – $1.2 Billion

THE COOPER COMPANIES, INC.

Daily Disposable Multifocal

Launch Q4 ‘06

Lens Attribute

Patient Benefit

Ease of fit High Satisfaction

Gen II Lower COGS Manufacturing

Product targeted to emerging presbyope

Global Market – $100 Million

THE COOPER COMPANIES, INC.

CW Toric Silicone Hydrogel

Launch Q4 ‘06

Patented Toric Design

CW Toric

Innovative CW material

Next Generation of Toric Lenses

Global Market - $500 Million

THE COOPER COMPANIES, INC.

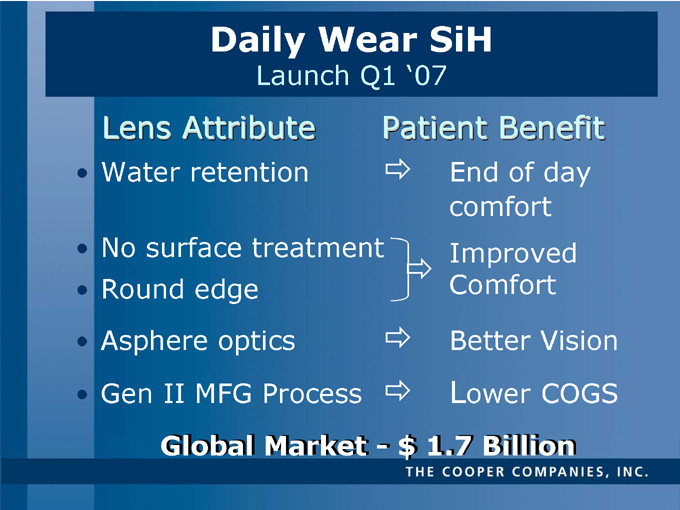

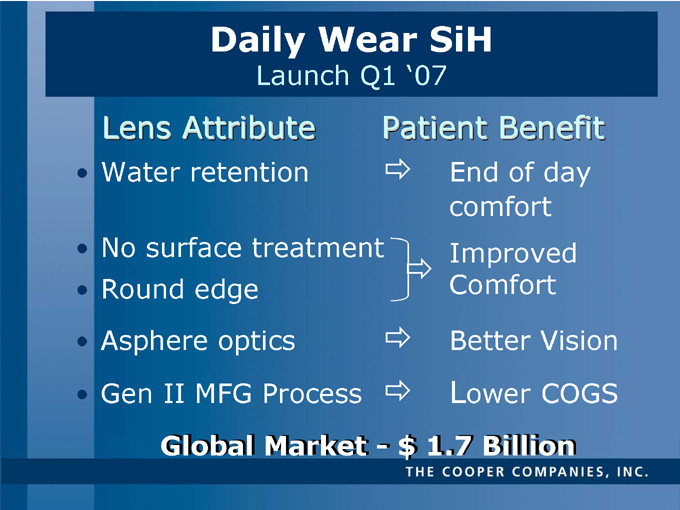

Daily Wear SiH

Launch Q1 ‘07

Lens Attribute Patient Benefit

Water retention

End of day comfort

No surface treatment

Improved Comfort

Round edge

Asphere optics

Better Vision

Gen II MFG Process

Lower COGS

Global Market - $ 1.7 Billion

THE COOPER COMPANIES, INC.

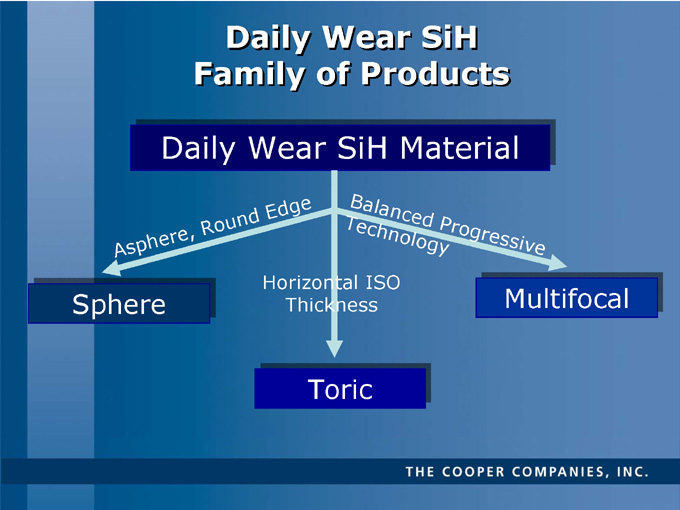

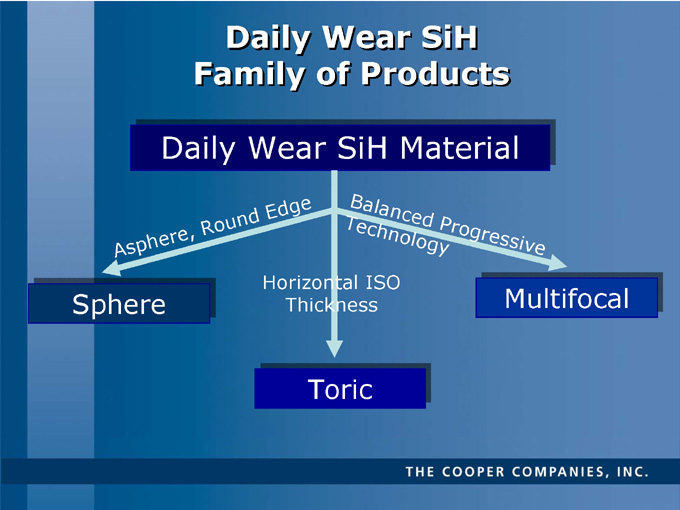

Daily Wear SiH

Family of Products

Daily Wear SiH Material

Asphere, Round Edge

Balanced Progressive

Technology

Sphere

Horizontal ISO

Thickness

Multifocal

Toric

THE COOPER COMPANIES, INC.

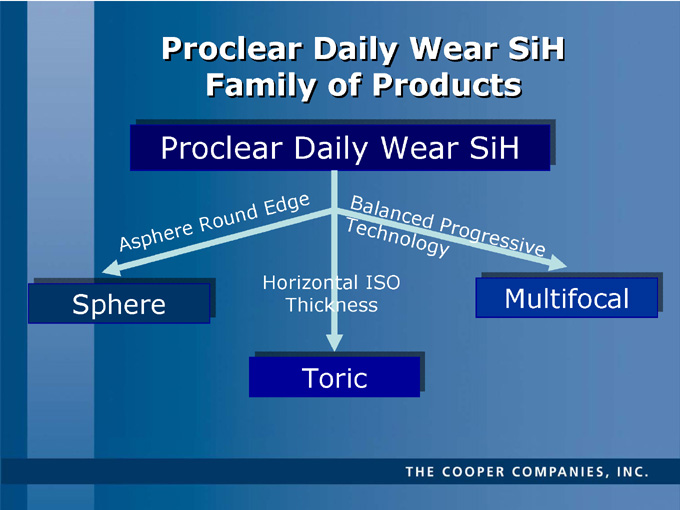

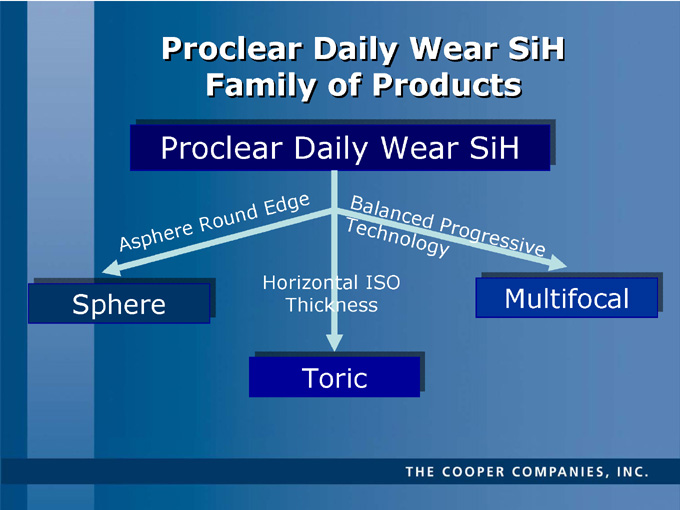

Proclear Daily Wear SiH

Family of Products

Proclear Daily Wear SiH

Asphere Round Edge

Balanced Progressive

Technology

Sphere

Horizontal ISO

Thickness

Multifocal

Toric

THE COOPER COMPANIES, INC.

Bob Weiss

Executive Vice President

and Chief Financial Officer

The Cooper Companies, Inc.

THE COOPER COMPANIES, INC.

Financial Highlights

THE COOPER COMPANIES, INC.

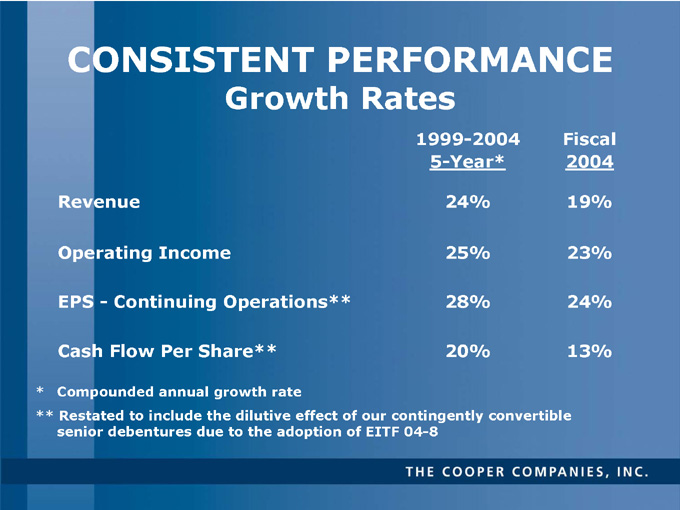

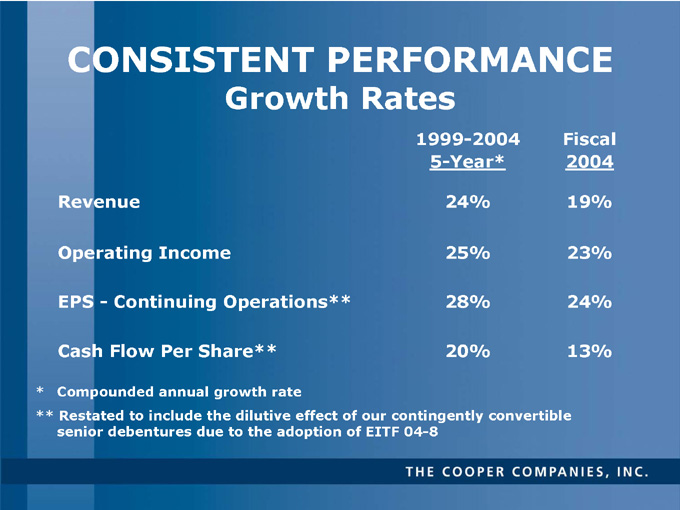

CONSISTENT PERFORMANCE

Growth Rates

1999-2004

5-Year*

24%

25%

28%

20%

Fiscal

2004

19%

23%

24%

13%

Revenue

Operating Income

EPS - Continuing Operations**

Cash Flow Per Share**

* Compounded annual growth rate

** Restated to include the dilutive effect of our contingently convertible senior debentures due to the adoption of EITF 04-8

THE COOPER COMPANIES, INC.

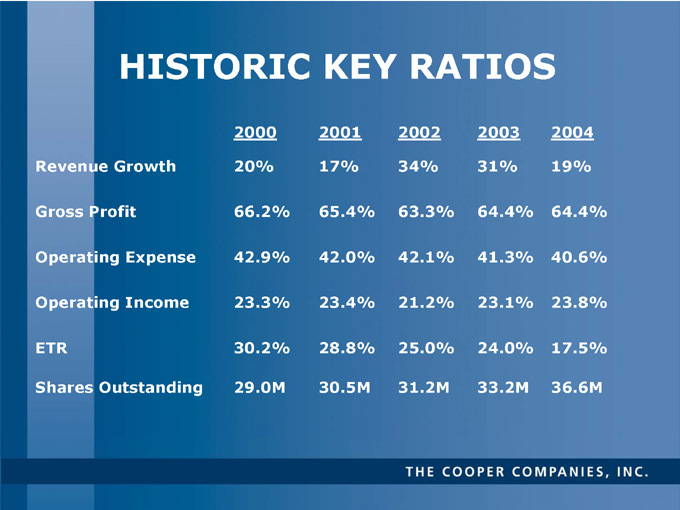

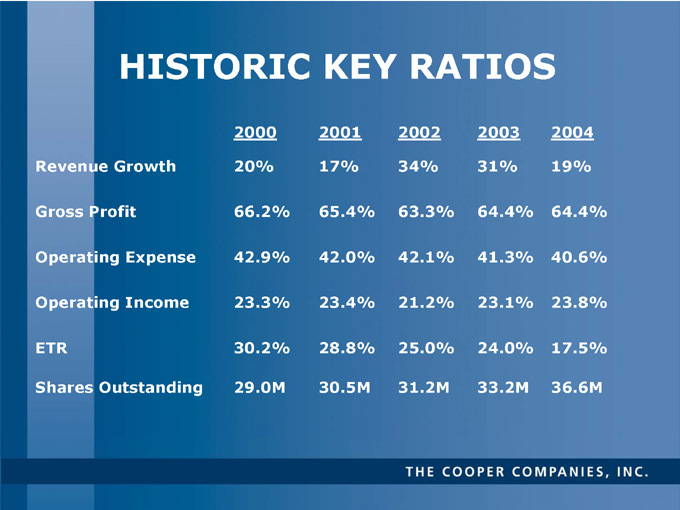

HISTORIC KEY RATIOS

2000

2001

2002

2003

2004

Revenue Growth

20%

17%

34%

31%

19%

Gross Profit

66.2%

65.4%

63.3%

64.4%

64.4%

Operating Expense

42.9%

42.0%

42.1%

41.3%

40.6%

Operating Income

23.3%

23.4%

21.2%

23.1%

23.8%

ETR

30.2%

28.8%

25.0%

24.0%

17.5%

Shares Outstanding

29.0M

30.5M

31.2M

33.2M

36.6M

THE COOPER COMPANIES, INC.

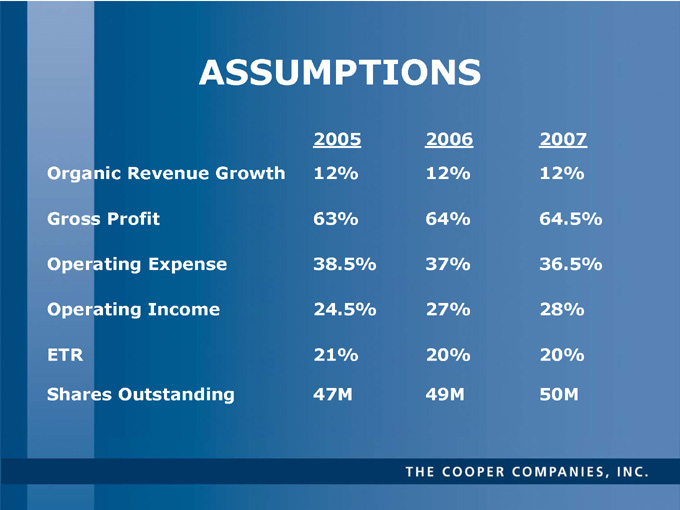

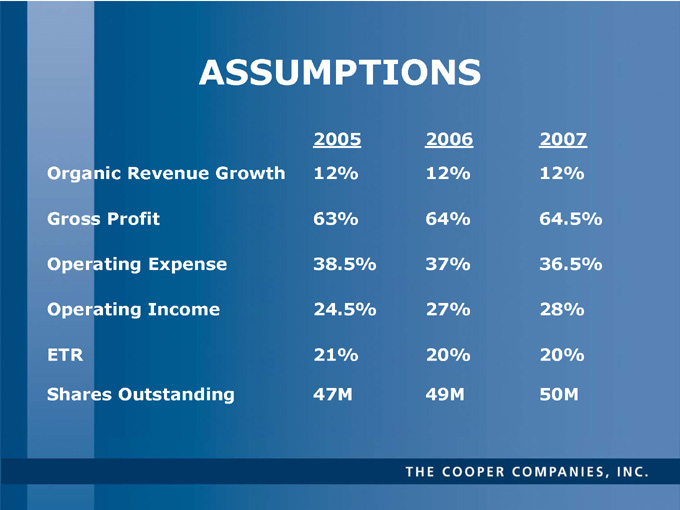

ASSUMPTIONS

2005 2006 2007

Organic Revenue Growth 12% 12% 12%

Gross Profit 63% 64% 64.5%

Operating Expense 38.5% 37% 36.5%

Operating Income 24.5% 27% 28%

ETR 21% 20% 20%

Shares Outstanding 47M 49M 50M

THE COOPER COMPANIES, INC.

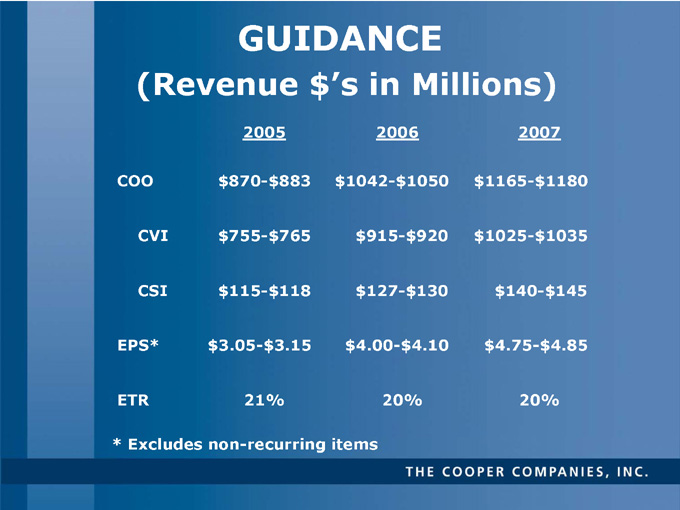

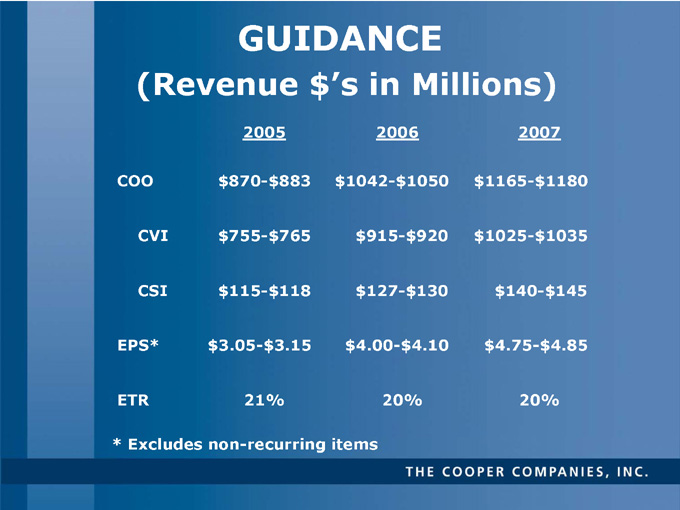

GUIDANCE

(Revenue $’s in Millions)

2005 2006 2007

COO $870-$883 $1042-$1050 $1165-$1180

CVI $755-$765 $915-$920 $1025-$1035

CSI $115-$118 $127-$130 $140-$145

EPS* $3.05-$3.15 $4.00-$4.10 $4.75-$4.85

ETR 21% 20% 20%

* Excludes non-recurring items

THE COOPER COMPANIES, INC.

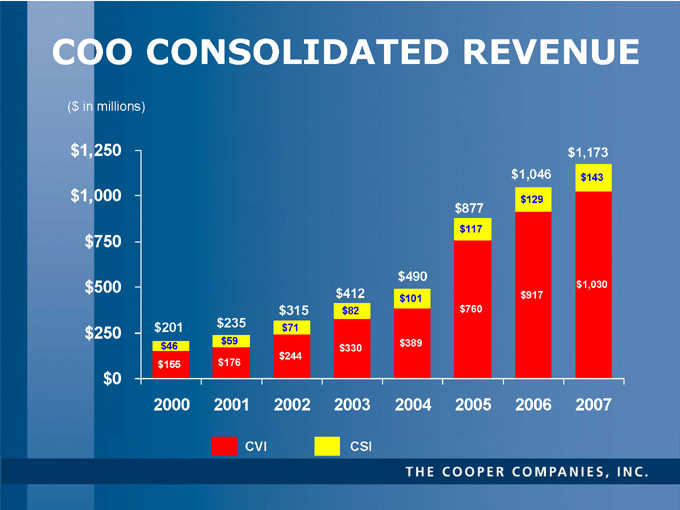

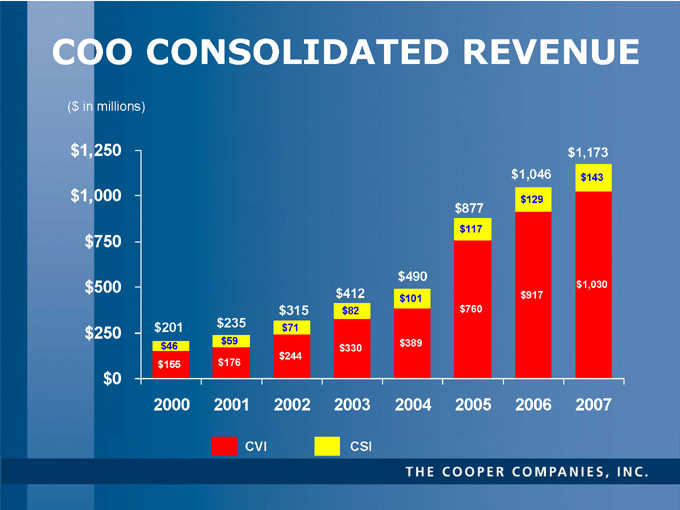

COO CONSOLIDATED REVENUE

($ in millions)

$1,250

$1,000

$750

$500

$250

$0

$1,173

$1,046

$143

$877

$490

$412

$315

$129

$235

$201

$117

$1,030

$101

$917

$82

$760

$71

$59

$389

$46

$330

$244

$155

$176

2000 2001 2002 2003 2004 2005 2006 2007

CVI CSI

THE COOPER COMPANIES, INC.

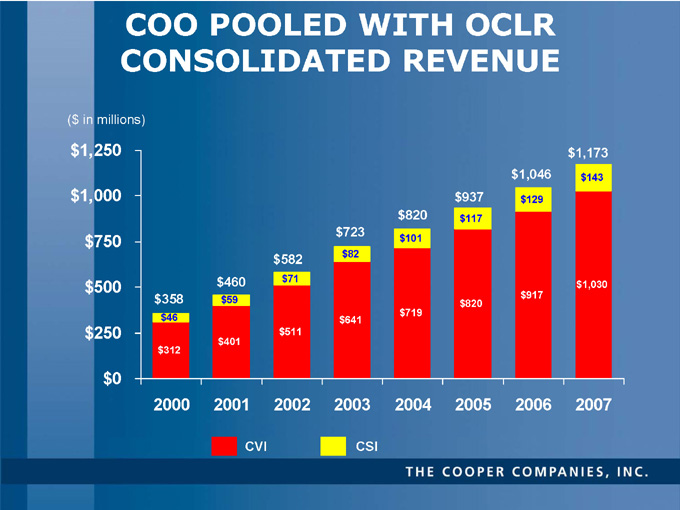

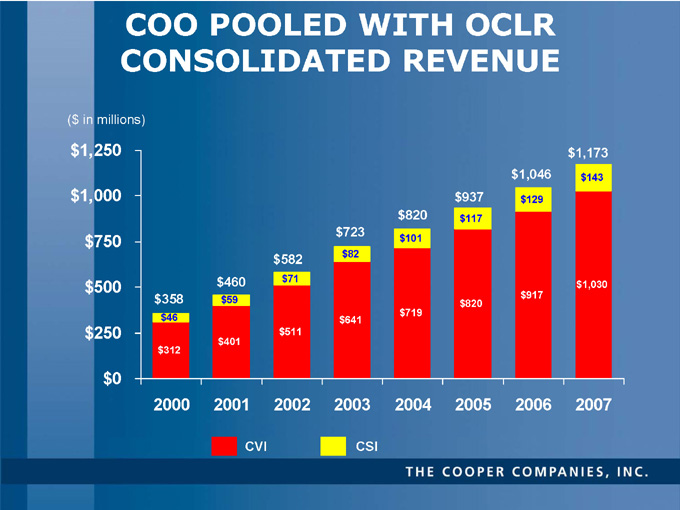

COO POOLED WITH OCLR CONSOLIDATED REVENUE

($ in millions)

$1,250

$1,173

$1,046

$143

$1,000

$937

$129

$820

$117

$723

$750

$101

$582

$82

$460

$71

$500

$1,030

$917

$358

$59

$820

$719

$46

$641

$250

$511

$401

$312

$0

2000

2001

2002

2003

2004

2005

2006

2007

CVI CSI

THE COOPER COMPANIES, INC.

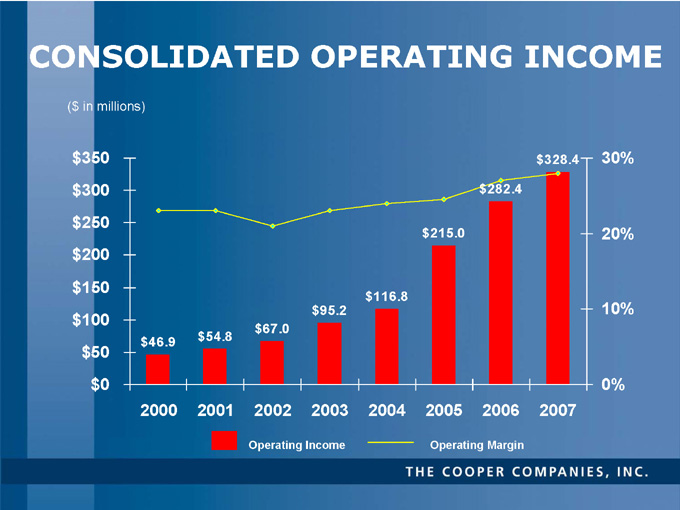

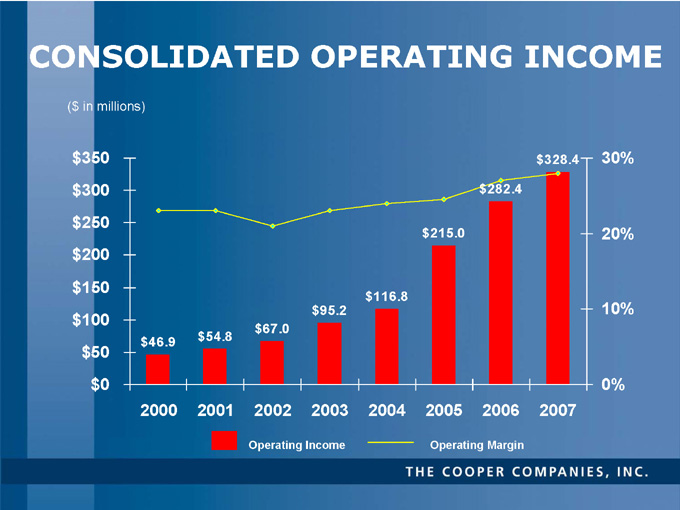

CONSOLIDATED OPERATING INCOME

($ in millions)

$350

$328.4

30%

$300

$282.4

$250

$215.0

20%

$200

$150

$116.8

$95.2

10%

$100

$67.0

$46.9

$54.8

$50

$0

0%

2000

2001

2002

2003

2004

2005

2006

2007

Operating Income Operating Margin

THE COOPER COMPANIES, INC.

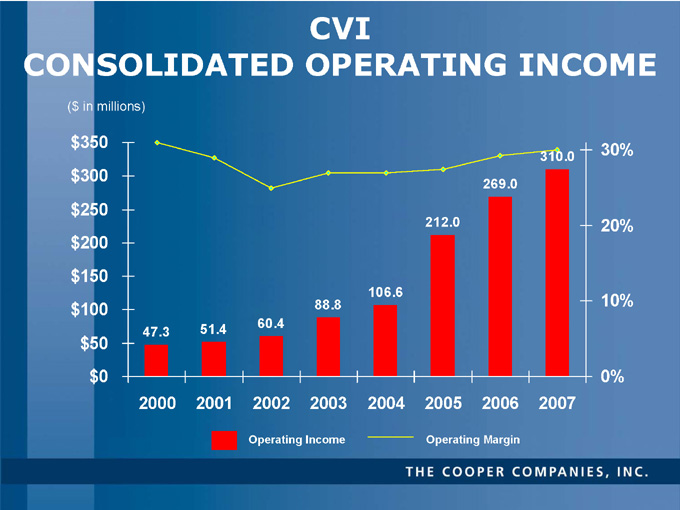

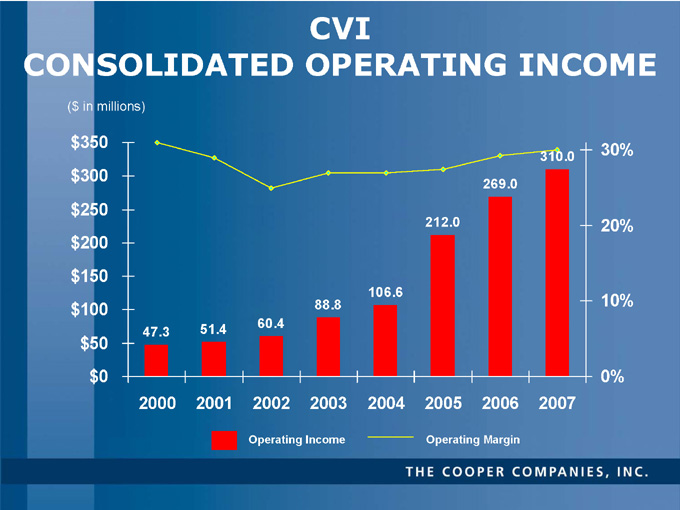

CVI

CONSOLIDATED OPERATING INCOME

($ in millions)

$350

30%

310.0

$300

269.0

$250

212.0

20%

$200

$150

106.6

88.8

10%

$100

51.4

60.4

47.3

$50

$0

0%

2000

2001

2002

2003

2004

2005

2006

2007

Operating Income Operating Margin

THE COOPER COMPANIES, INC.

CSI

CONSOLIDATED OPERATING INCOME

($ in millions)

$40

25%

35.8

29.7

20%

$30

23.4

$20.9

15%

$20

18.2

14.1

10%

10.1

$10

6.3

5%

$0

0%

2000

2001

2002

2003

2004

2005

2006

2007

Operating Income - Operating Margin

THE COOPER COMPANIES, INC.

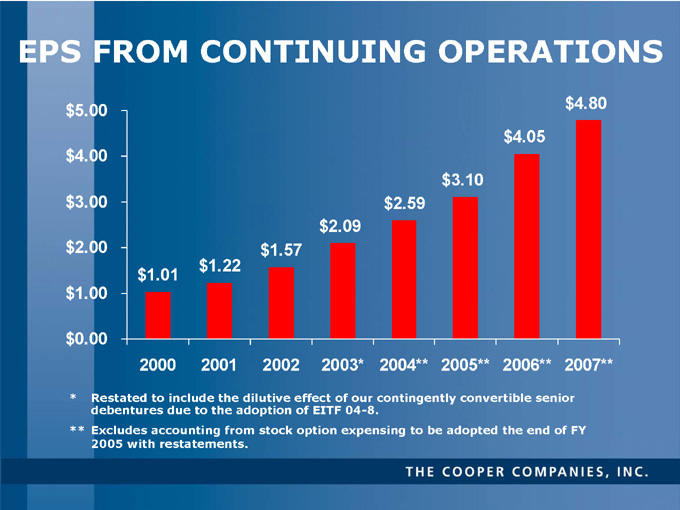

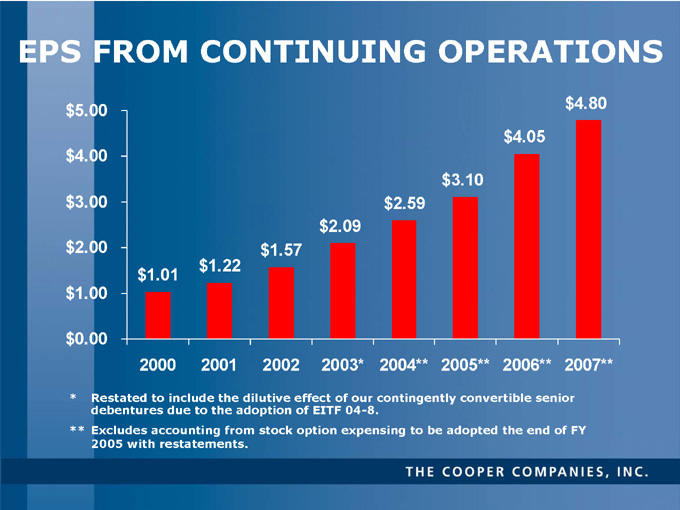

EPS FROM CONTINUING OPERATIONS

$5.00

$4.80

$4.05

$4.00

$3.10

$3.00

$2.59

$2.09

$2.00

$1.57

$1.22

$1.01

$1.00

$0.00

2000

2001

2002

2003*

2004**

2005**

2006**

2007**

*Restated to include the dilutive effect of our contingently convertible senior debentures due to the adoption of EITF 04-8.

**Excludes accounting from stock option expensing to be adopted the end of FY 2005 with restatements.

THE COOPER COMPANIES, INC.

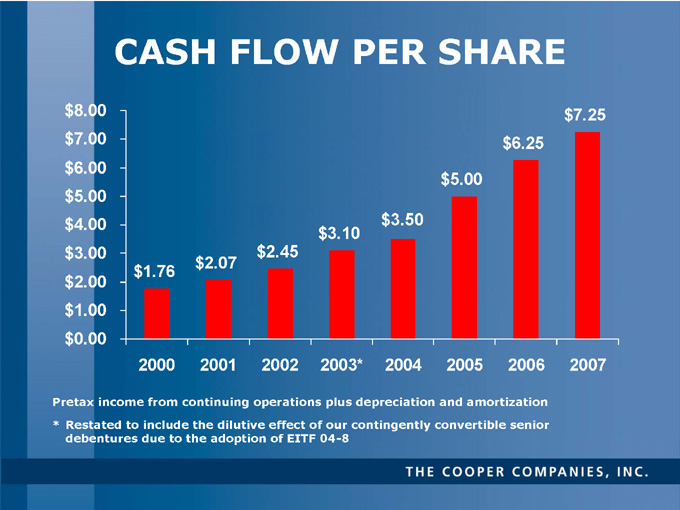

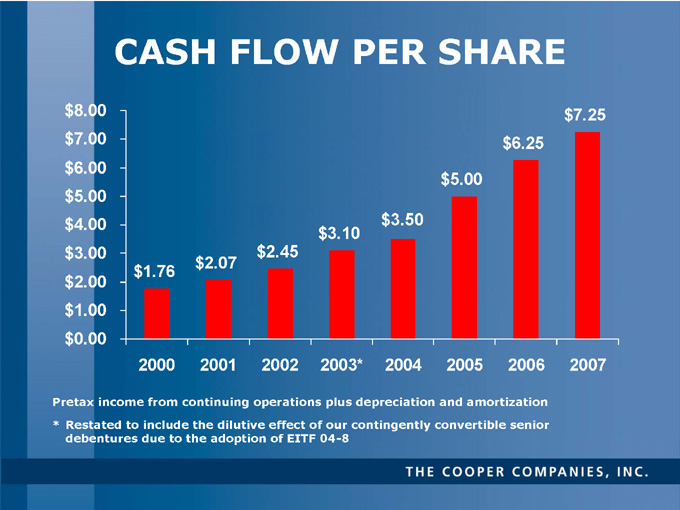

CASH FLOW PER SHARE

$8.00

$7.25

$7.00

$6.25

$6.00

$5.00

$5.00

$4.00

$3.50

$3.10

$3.00

$2.45

$2.07

$1.76

$2.00

$1.00

$0.00

2000

2001

2002

2003*

2004

2005

2006

2007

Pretax income from continuing operations plus depreciation and amortization

* Restated to include the dilutive effect of our contingently convertible senior debentures due to the adoption of EITF 04-8

THE COOPER COMPANIES, INC.

LIQUIDITY

Cash Flow from Operations

NOL’s

Free Cash Flow

THE COOPER COMPANIES, INC.

TAXES

Net Operating Loss Carryforwards $91 Million

Deferred Tax Assets $31 Million

Global Tax Arrangement

Effective Tax Rates

THE COOPER COMPANIES, INC.

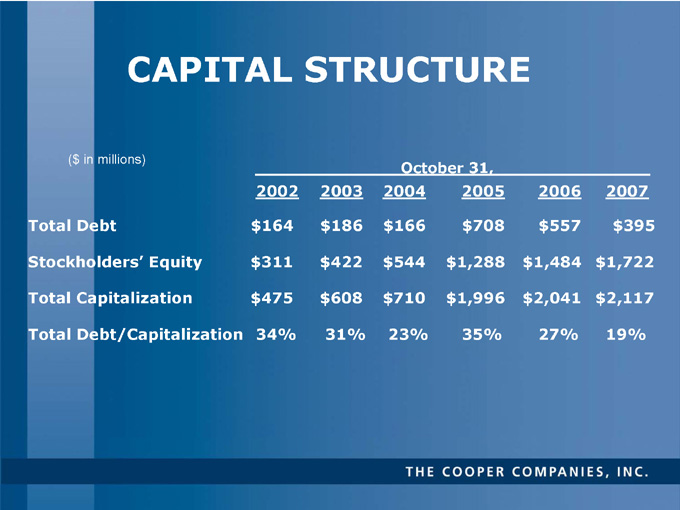

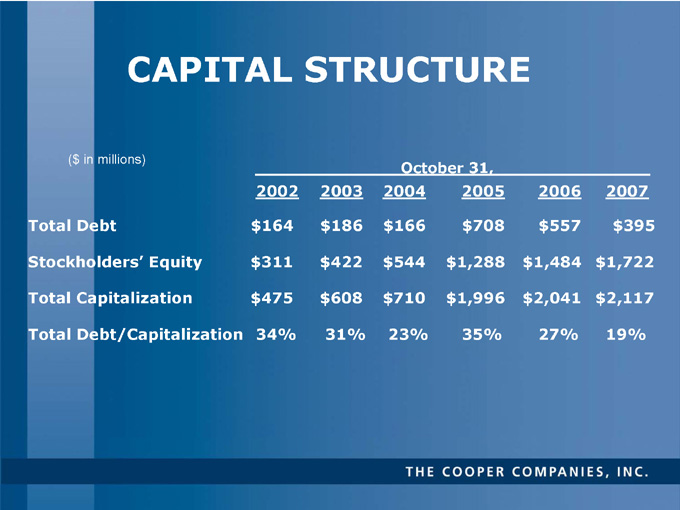

CAPITAL STRUCTURE

($ in millions)

October 31,

2002

2003

2004

2005

2006

2007

Total Debt

$164

$186

$166

$708

$557

$395

Stockholders’ Equity

$311

$422

$544

$1,288

$1,484

$1,722

Total Capitalization

$475

$608

$710

$1,996

$2,041

$2,117

Total Debt/Capitalization

34%

31%

23%

35%

27%

19%

THE COOPER COMPANIES, INC.

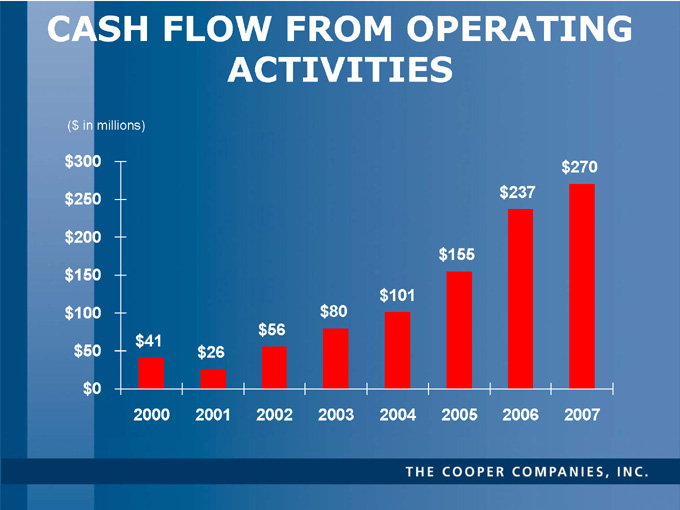

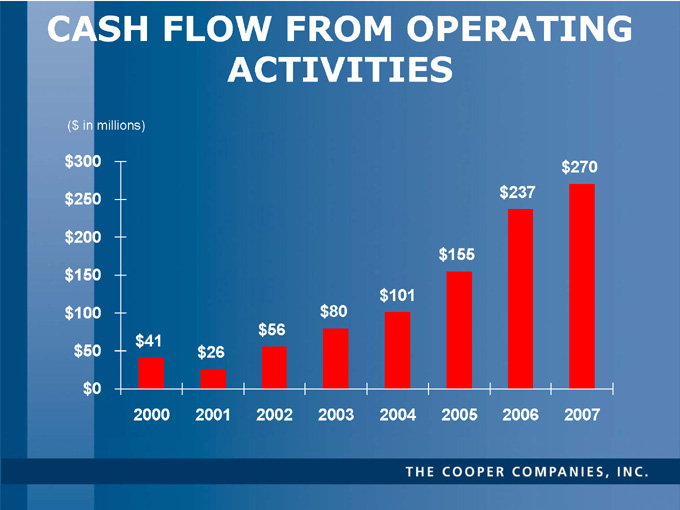

CASH FLOW FROM OPERATING

ACTIVITIES

($ in millions)

$300

$270

$250

$237

$200

$155

$150

$101

$100

$80

$56

$41

$50

$26

$0

2000

2001

2002

2003

2004

2005

2006

2007

THE COOPER COMPANIES, INC.

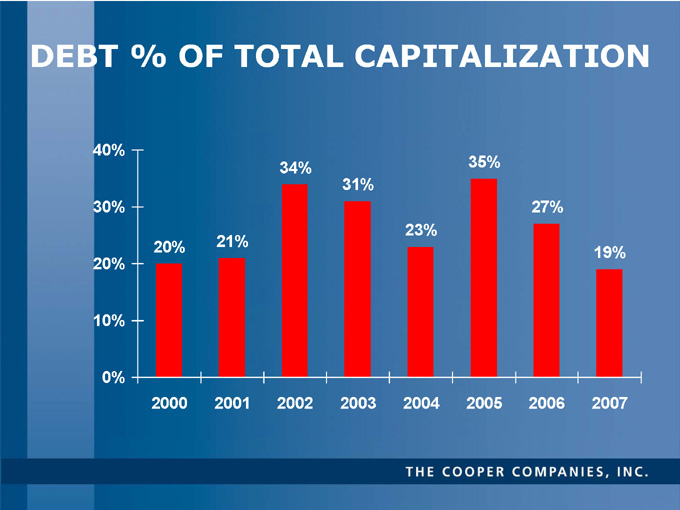

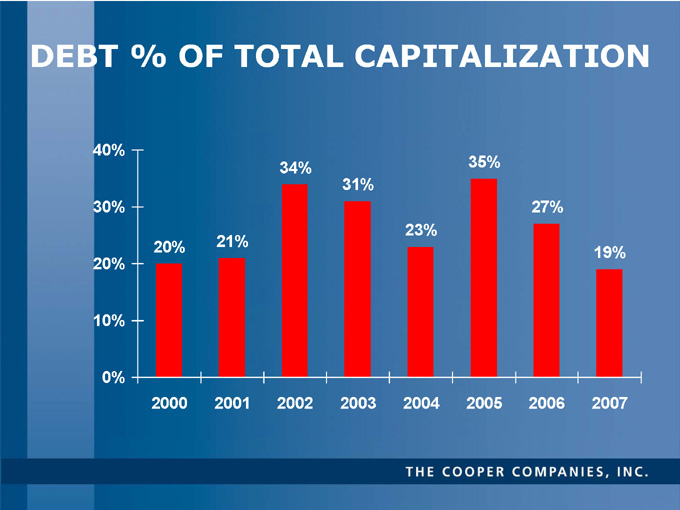

DEBT % OF TOTAL CAPITALIZATION

40%

34%

35%

31%

30%

27%

23%

20%

21%

19%

20%

10%

0%

2000

2001

2002

2003

2004

2005

2006

2007

THE COOPER COMPANIES, INC.

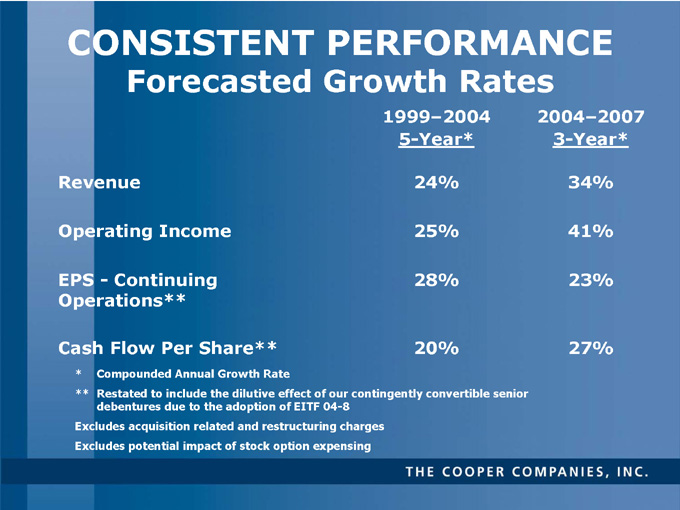

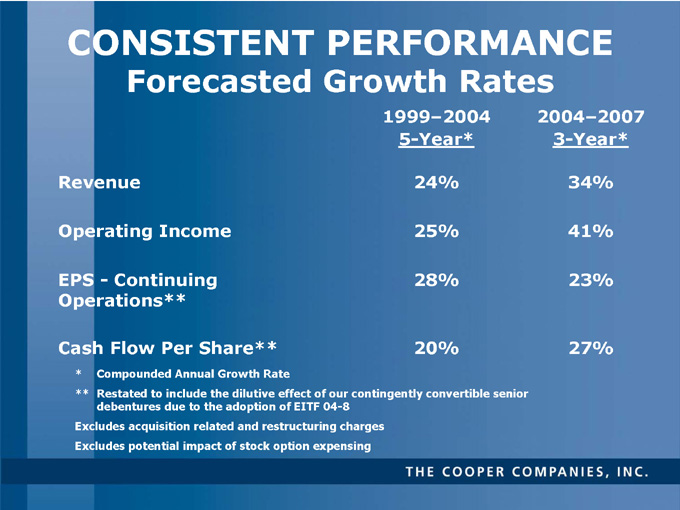

CONSISTENT PERFORMANCE

Forecasted Growth Rates

1999–2004

2004–2007

5-Year*

3-Year*

Revenue 24% 34%

Operating Income 25% 41%

EPS - Continuing 28% 23%

Operations**

Cash Flow Per Share** 20% 27%

* Compounded Annual Growth Rate

** Restated to include the dilutive effect of our contingently convertible senior debentures due to the adoption of EITF 04-8 Excludes acquisition related and restructuring charges Excludes potential impact of stock option expensing

THE COOPER COMPANIES, INC.

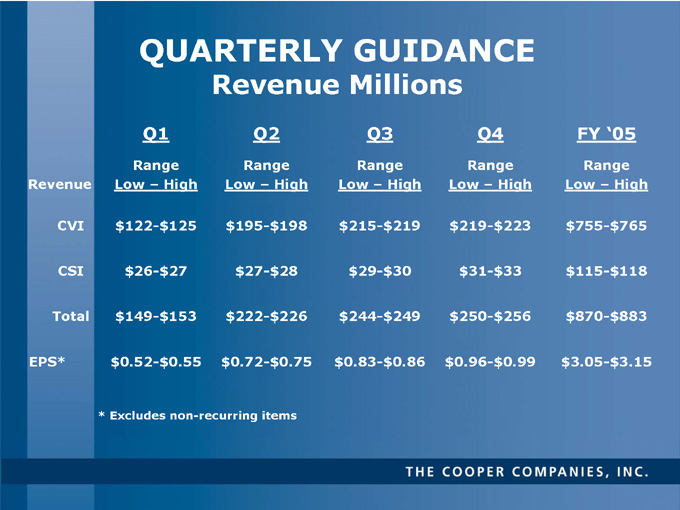

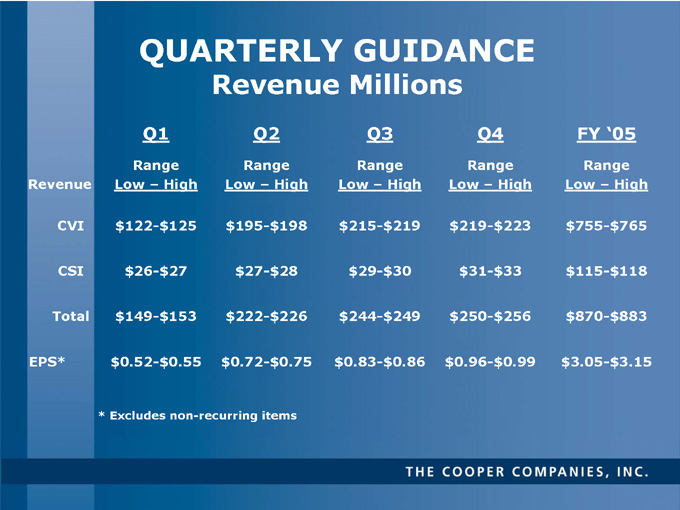

QUARTERLY GUIDANCE

Revenue Millions

Q1

Q2

Q3

Q4

FY ‘05

Range

Low – High

Range

Low – High

Range

Low – High

Range

Low – High

Range

Low – High

Revenue

CVI

$122-$125

$195-$198

$215-$219

$219-$223

$755-$765

CSI

$26-$27

$27-$28

$29-$30

$31-$33

$115-$118

Total

$149-$153

$222-$226

$244-$249

$250-$256

$870-$883

EPS*

$0.52-$0.55

$0.72-$0.75

$0.83-$0.86

$0.96-$0.99

$3.05-$3.15

* Excludes non-recurring items

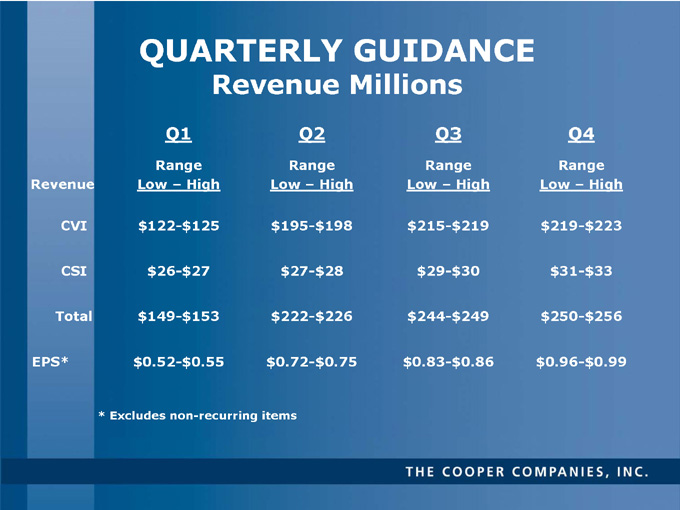

THE COOPER COMPANIES, INC.

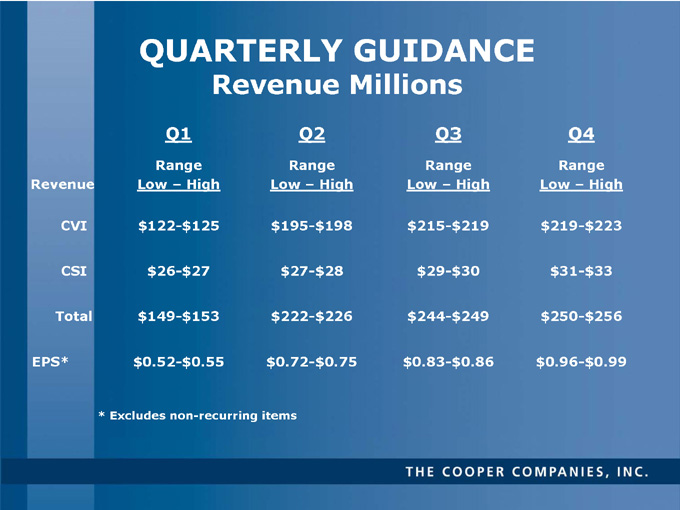

QUARTERLY GUIDANCE

Revenue Millions

Q1

Q2

Q3

Q4

Range

Range

Range

Range

Low – High

Low – High

Low – High

Low – High

Revenue

CVI

$122-$125

$195-$198

$215-$219

$219-$223

CSI

$26-$27

$27-$28

$29-$30

$31-$33

Total

$149-$153

$222-$226

$244-$249

$250-$256

EPS*

$0.52-$0.55

$0.72-$0.75

$0.83-$0.86

$0.96-$0.99

* Excludes non-recurring items

THE COOPER COMPANIES, INC.

THE COOPER COMPANIES, INC.