Investor Quarterly Call Investor Quarterly Call For the quarter ended For the quarter ended December 31, 2006 December 31, 2006

This presentation contains forward This presentation contains forward - looking looking statements that involve risks and uncertainties. In statements that involve risks and uncertainties. In such instances, the actual results could differ such instances, the actual results could differ materially as a result of a variety of factors materially as a result of a variety of factors including failure to obtain regulatory approvals including failure to obtain regulatory approvals which could have material adverse effects on the which could have material adverse effects on the Company Company ’ s business, competition developments s business, competition developments which could hinder the company which could hinder the company ’ s ability to s ability to compete effectively and other risk factors listed compete effectively and other risk factors listed from time to time in the Company from time to time in the Company ’ s reports to the s reports to the Securities and Exchange Commission. Securities and Exchange Commission. “Safe Harbor Safe Harbor”

” Reimbursement Level Reimbursement Level Laser Placements: 311 @ Dec 31, 2006 Laser Placements: 311 @ Dec 31, 2006 Good Reimb Moderate Reimb Weak Reimb Placement Target: 3200 Placement Target: 3200 derms derms

derms Average Treatments per Day Average Treatments per Day .42 to 3.54 1.47 FLORIDA* 1.00 to 6.53 2.33 MICHIGAN* .48 to 6.23 2.45 MD/VA* .32 to 7.39 2.17 Ohio* .95 to 6.60 2.18 New York Metro* 1.48 to 7.39 2.66 Top 100 Accounts 2.22 to 7.39 3.55 Top 50 Accounts 5.76 to 7.39 6.50 Top Five Accounts RANGE AVG. TX/DAY Fourth Quarter 2006 XTRAC Analysis *Active Accounts Only

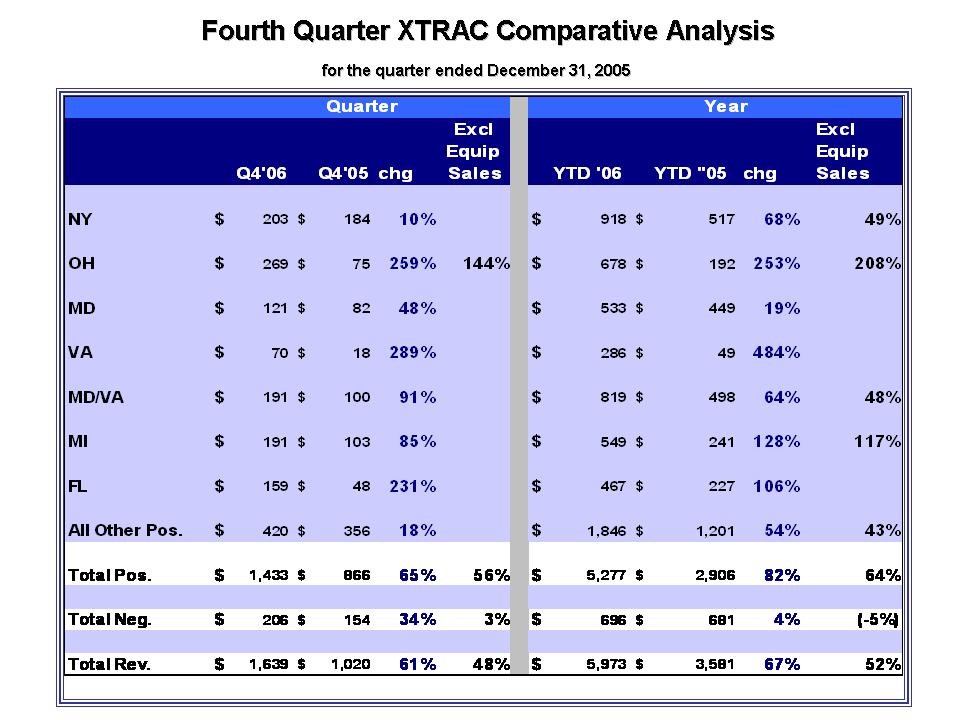

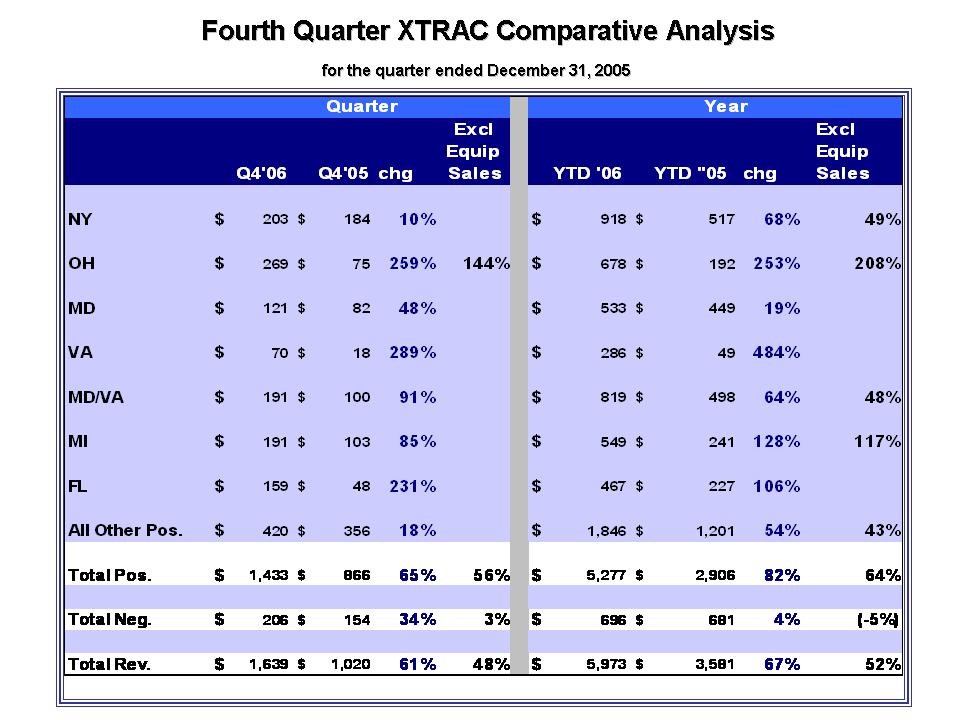

Only Fourth Quarter XTRAC Comparative Analysis Fourth Quarter XTRAC Comparative Analysis for the quarter ended December 31, 2005 for the quarter ended December 31, 2005 Q4'06 Q4'05 chg Excl Equip Sales YTD '06 YTD "05 chg Excl Equip Sales NY $ 203 $ 184 10% $ 918 $ 517 68% 49% OH $ 269 $ 75 259% 144% $ 678 $ 192 253% 208% MD $ 121 $ 82 48% $ 533 $ 449 19% VA $ 70 $ 18 289% $ 286 $ 49 484% MD/VA $ 191 $ 100 91% $ 819 $ 498 64% 48% MI $ 191 $ 103 85% $ 549 $ 241 128% 117% FL $ 159 $ 48 231% $ 467 $ 227 106% All Other Pos. $ 420 $ 356 18% $ 1,846 $ 1,201 54% 43% Total Pos. $ 1,433 $ 866 65% 56% $ 5,277 $ 2,906 82% 64% Total Neg. $ 206 $ 154 34% 3% $ 696 $ 681 4% (-5%) Total Rev. $ 1,639 $ 1,020 61% 48% $ 5,973 $ 3,581 67% 52% Quarter Year