1 INVESTOR PRESENTATION SECOND QUARTER - 2021

2 This presentation contains "forward-looking statements“ within the meaning of, and subject to the protections of, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. In addition, certain statements may be contained in the Colony Bankcorp's (the "Company")’ future filings with the SEC, in press releases, and in oral and written statements made by or with the approval of the Company that are not statements of historical fact and constitute “forward- looking statements” within the meaning of, and subject to the protections of, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Examples of forward-looking statements include, but are not limited to: (i) projections and/or expectations of revenues, income or loss, earnings or loss per share, the payment or nonpayment of dividends, capital structure and other financial items; (ii) statement of plans and objectives of Colony Bankcorp, Inc. or its management or Board of Directors, including those relating to products or services; (iii) statements of future economic performance; (iv) statements regarding growth strategy, capital management, liquidity and funding and future profitability; (v) statements regarding the potential effects of the COVID-19 pandemic on the Company’s business and financial results and conditions;(vi) statements relating to the timing, benefits, costs, and synergies of the proposed merger with SouthCrest Financial Group, Inc. (“SouthCrest”) (the “Merger”) and the proposed acquisition of Barnes Agency (“Barnes”); and (vii) statements of assumptions underlying such statements. Words such as “believes,” “anticipates,” “expects,” “intends,” “targeted” and similar expressions are intended to identify forward-looking statements but are not the exclusive means of identifying such statements. Prospective investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve known and unknown risks and uncertainties. Factors that might cause such differences include, but are not limited to: the impact of the COVID-19 pandemic on the Company’s assets, business, cash flows, financial condition, liquidity, prospects and results of operations; potential increases in the provision for loan losses resulting from the COVID-19 pandemic; the Company’s ability to implement its various strategic and growth initiatives; competitive pressures among financial institutions increasing significantly; economic conditions, either nationally or locally, in areas in which the Company conducts operations being less favorable than expected; interest rate risk; legislation or regulatory changes which adversely affect the ability of the consolidated Company to conduct business combinations or new operations, including changes to statutes, regulations or regulatory policies or practices as a result of, or in response to COVID-19; the risk that the cost savings and any revenue synergies from the Merger and the acquisition of Barnes may not be realized or take longer than anticipated; disruption from the Merger and the acquisition of Barnes with customers, suppliers, employee or other business partners relationships; the occurrence of any event, change or circumstances that could give rise to the termination of the merger agreement with SouthCrest; the risk of successful integration of SouthCrest’s and Barnes’ businesses into the Company; the amount of the costs, fees, expenses and charges related to the Merger and the acquisition of Barnes; reputation risk and the reaction of each of the Company’s and SouthCrest’s customers, suppliers, employees or other business partners to the Merger; the failure of the closing conditions in the merger agreement with SouthCrest to be satisfied, or any unexpected delay in closing of the Merger; the risk that the integration of SouthCrest’s operations into the operations of the Company will be materially delayed or will be more costly or difficult than expected; the possibility that the Merger may be more expensive to complete than anticipated, including as a result of unexpected factors or events; the dilution caused by the Company’s issuance of additional shares of its common stock in the Merger; the risks associated with the Company’s pursuit of future acquisitions; and general competitive, economic, political and market conditions. adverse results from current or future litigation, regulatory examinations or other legal and/or regulatory actions, including as a result of the Company’s participation in and execution of government programs related to the COVID-19 pandemic; and risks that the anticipated benefits from the sale of the Thomaston branch and the transactions with LBC Bancshares, Inc. and PFB Mortgage are not realized in the time frame anticipated or at all as a result of changes in general economic and market conditions or other unexpected factors or events. These and other factors, risks and uncertainties could cause the actual results, performance or achievements of the Company to be materially different from the future results, performance or achievements expressed or implied by such forward-looking statements. Many of these factors are beyond the Company’s ability to control or predict. Forward-looking statements speak only as of the date on which such statements are made. These forward-looking statements are based upon information presently known to the Company’s management and are inherently subjective, uncertain and subject to change due to any number of risks and uncertainties, including, without limitation, the risks and other factors set forth in the Company’s filings with the Securities and Exchange Commission, the Company’s Annual Report on Form 10-K for the year ended December 31, 2020, under the captions “Cautionary Note Regarding Forward-Looking Statements” and “Risk Factors,” and in the Company’s quarterly reports on Form 10-Q and current reports on Form 8-K. The Company undertakes no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made, or to reflect the occurrence of unanticipated events. Readers are cautioned not to place undue reliance on these forward-looking statements. CAUTIONARY STATEMENTS

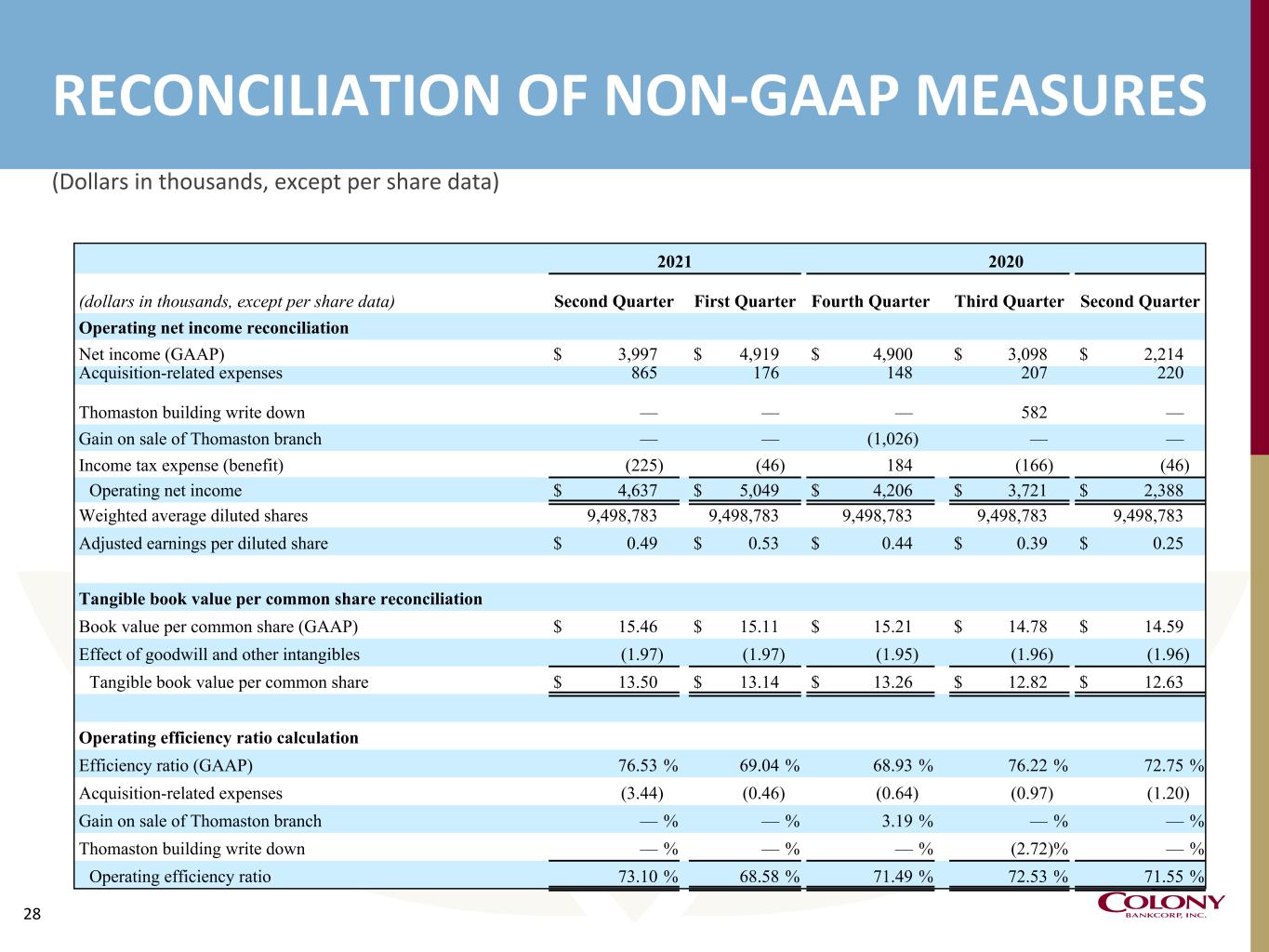

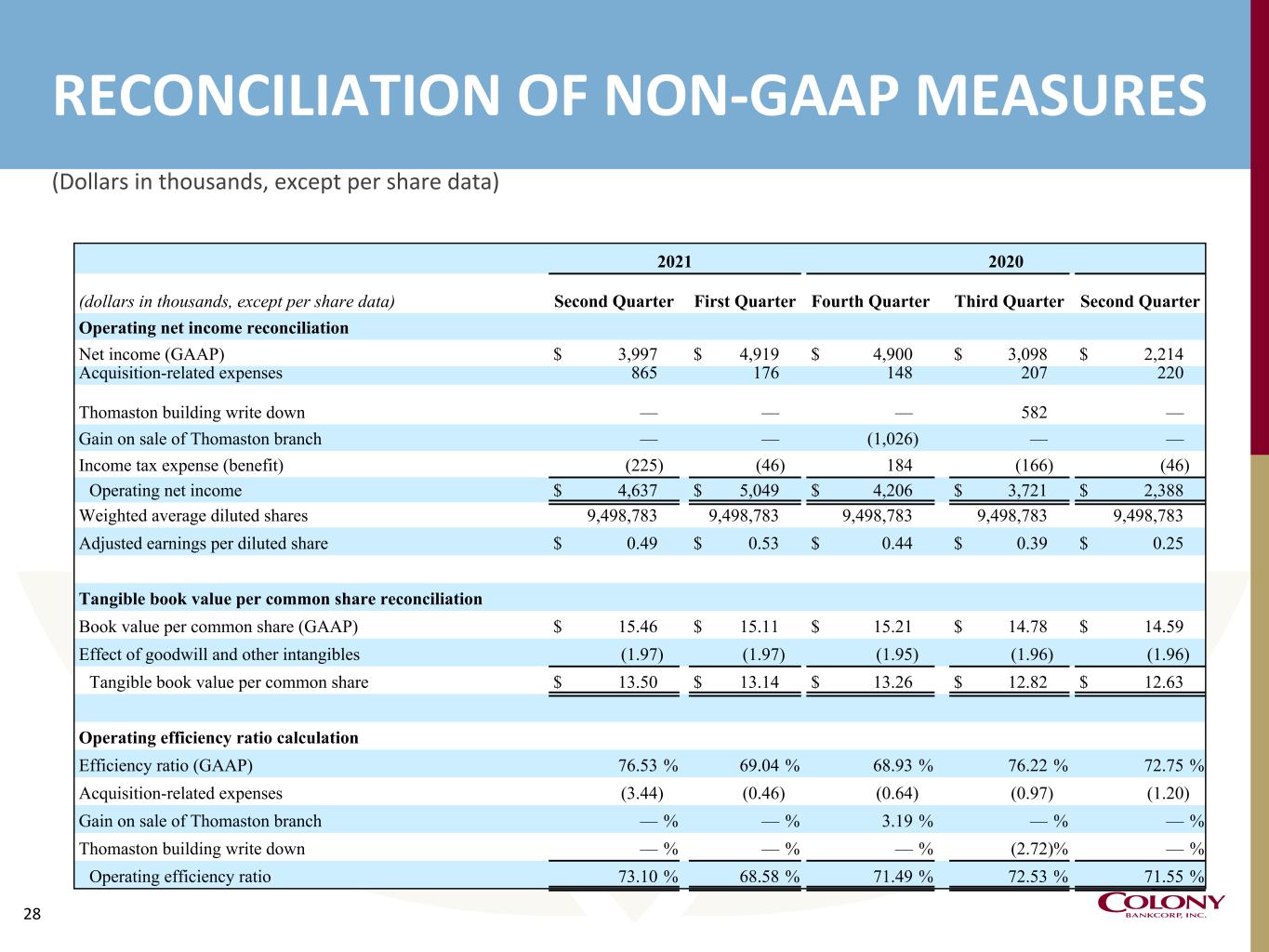

3 Statements included in this presentation include non-GAAP financial measures and should be read along with the accompanying tables, which provide a reconciliation of non-GAAP financial measure to GAAP financial measures. The non-GAAP financial measures used in this presentation include the following: operating net income, adjusted earnings per diluted share, tangible book value per common share and operating efficiency ratio. The most comparable GAAP measures are net income, diluted earnings per share, book value per common share and efficiency ratio, respectively. Operating net income and operating efficiency ratio both exclude acquisition- related expenses. Adjusted earnings per diluted share includes the adjustments to operating net income. Tangible book value excludes goodwill and other intangibles. Management uses these non-GAAP financial measures in its analysis of the Company's performance and believes these presentations provide useful supplemental information, and a clearer understanding of the Company’s performance, and if not provided would be requested by the investor community. The Company believes the non-GAAP measures enhance investors' understanding of the Company's business and performance. These measures are also useful in understanding performance trends and facilitate comparisons with the performance of other financial institutions. The limitations associated with operating measures are the risk that persons might disagree as to the appropriateness of items comprising these measures and that different companies might calculate these measures differently. Non-GAAP financial measures should not be considered as an alternative to any measure of performance or financial condition as promulgated under GAAP, and investors should consider Colony Bankcorp, Inc. performance and financial condition as reported under GAAP and all other relevant information when assessing the performance or financial condition of Colony Bankcorp, Inc. Non-GAAP financial measures have limitations as analytical tools, and investors should not consider them in isolation or as a substitute for analysis of the results or financial condition as reported under GAAP. NON-GAAP FINANCIAL MEASURES

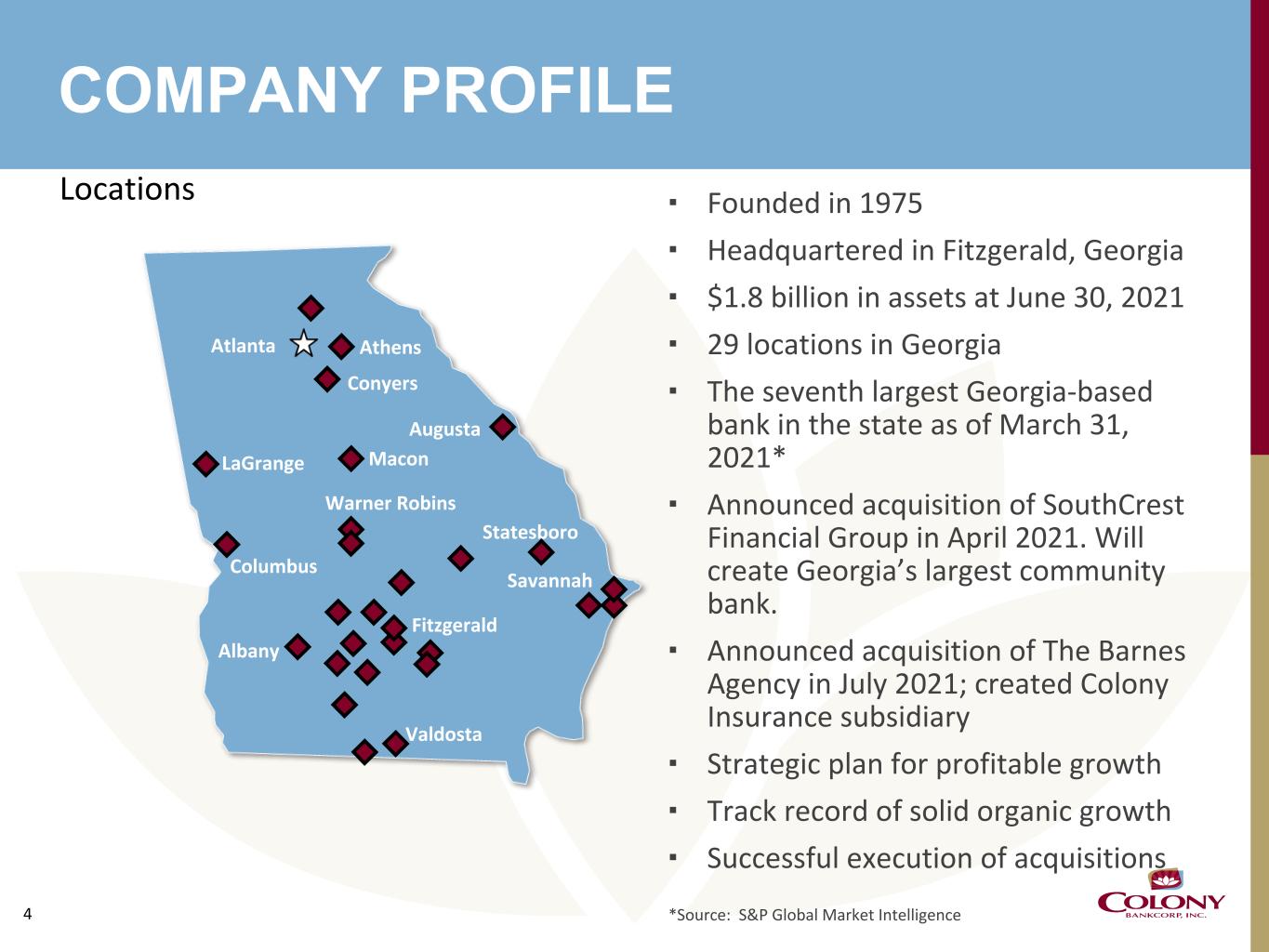

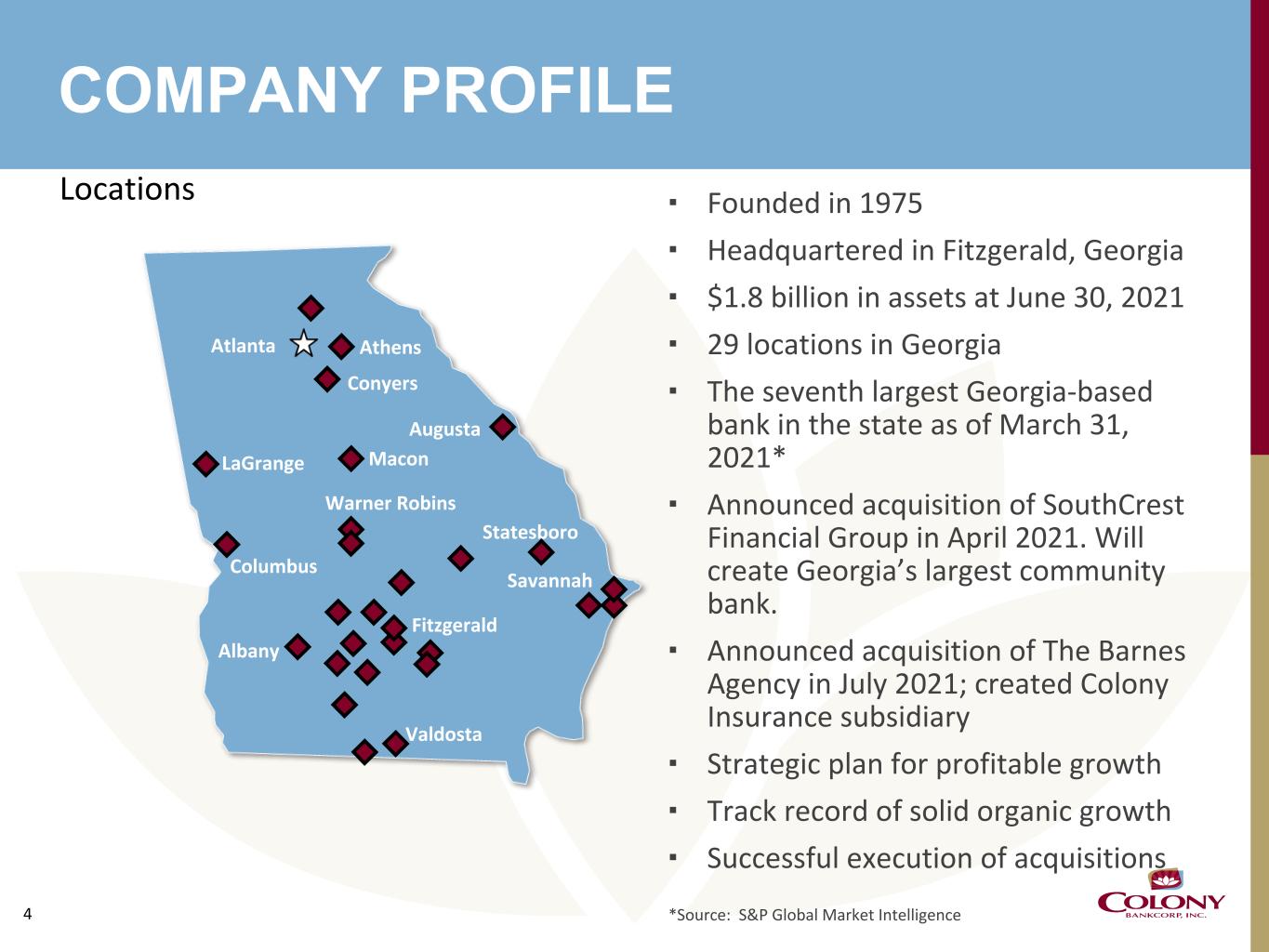

4 COMPANY PROFILE Locations ▪ Founded in 1975 ▪ Headquartered in Fitzgerald, Georgia ▪ $1.8 billion in assets at June 30, 2021 ▪ 29 locations in Georgia ▪ The seventh largest Georgia-based bank in the state as of March 31, 2021* ▪ Announced acquisition of SouthCrest Financial Group in April 2021. Will create Georgia’s largest community bank. ▪ Announced acquisition of The Barnes Agency in July 2021; created Colony Insurance subsidiary ▪ Strategic plan for profitable growth ▪ Track record of solid organic growth ▪ Successful execution of acquisitions *Source: S&P Global Market Intelligence Atlanta Warner Robins Statesboro Savannah Columbus Albany Fitzgerald Valdosta Athens Conyers Augusta LaGrange Macon

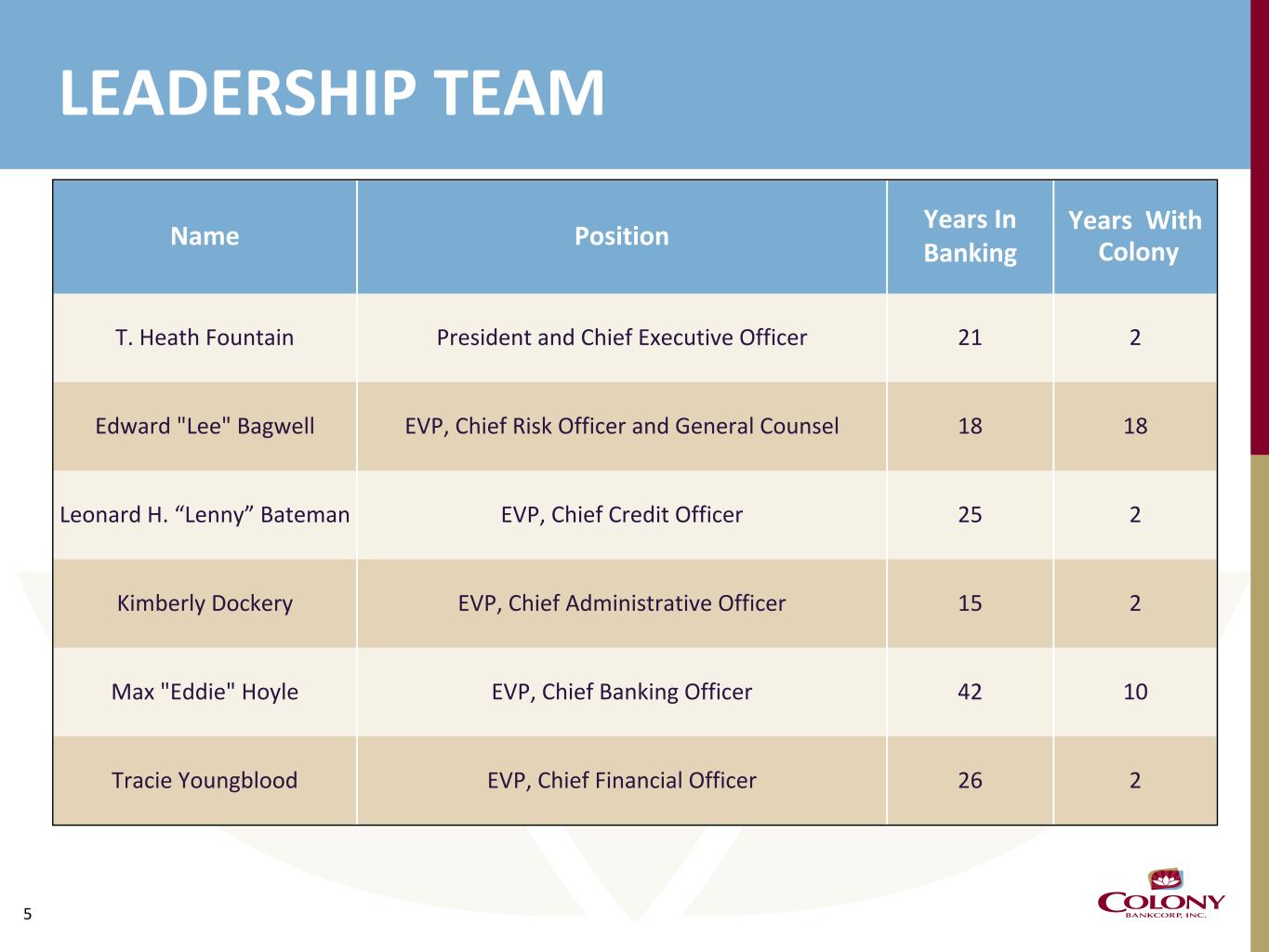

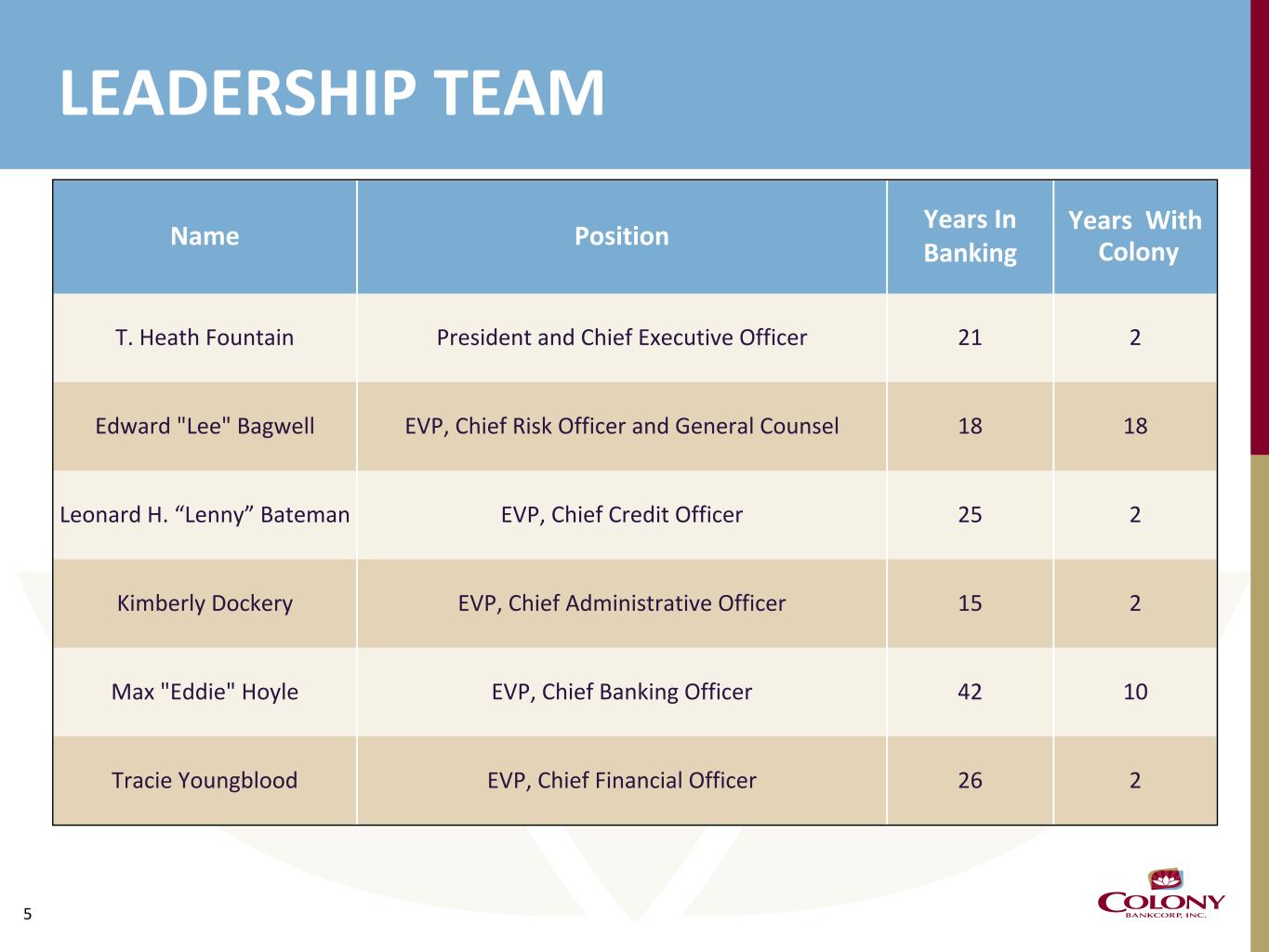

5 Name Position Years In Banking Years With Colony T. Heath Fountain President and Chief Executive Officer 21 2 Edward "Lee" Bagwell EVP, Chief Risk Officer and General Counsel 18 18 Leonard H. “Lenny” Bateman EVP, Chief Credit Officer 25 2 Kimberly Dockery EVP, Chief Administrative Officer 15 2 Max "Eddie" Hoyle EVP, Chief Banking Officer 42 10 Tracie Youngblood EVP, Chief Financial Officer 26 2 LEADERSHIP TEAM

6 DRIVING HIGH PERFORMANCE ◦ Achieve strong organic growth each year • Proactive business development system • Increased accountability for loan and deposit production • Created incentive plans to motivate bankers • Retail marketing plan to grow deposits • Streamlined our consumer and commercial deposits products • Larger national and regional banks with large market share in our footprint are more focused on large MSAs • Organic growth of checking and money market accounts of 7% in first half of 2021

7 DRIVING HIGH PERFORMANCE ◦ Achieve strong organic growth each year ◦ Seize on expansion opportunities • Announced acquisition of SouthCrest Financial in April 2021 for $84 million, expected to close by third quarter of 2021. • Acquisition provides entry into attractive Northern Georgia markets and increased access to highly populous suburban Atlanta markets • Establishes Colony as acquirer of choice for community banks in the Southeast • Announced acquisition of The Barnes Agency in July 2021; created Colony Insurance subsidiary, an Allstate agency • Technology and regulatory headwinds are causing industry consolidation • Industry consolidation creates an opportunity to acquire customers and talent

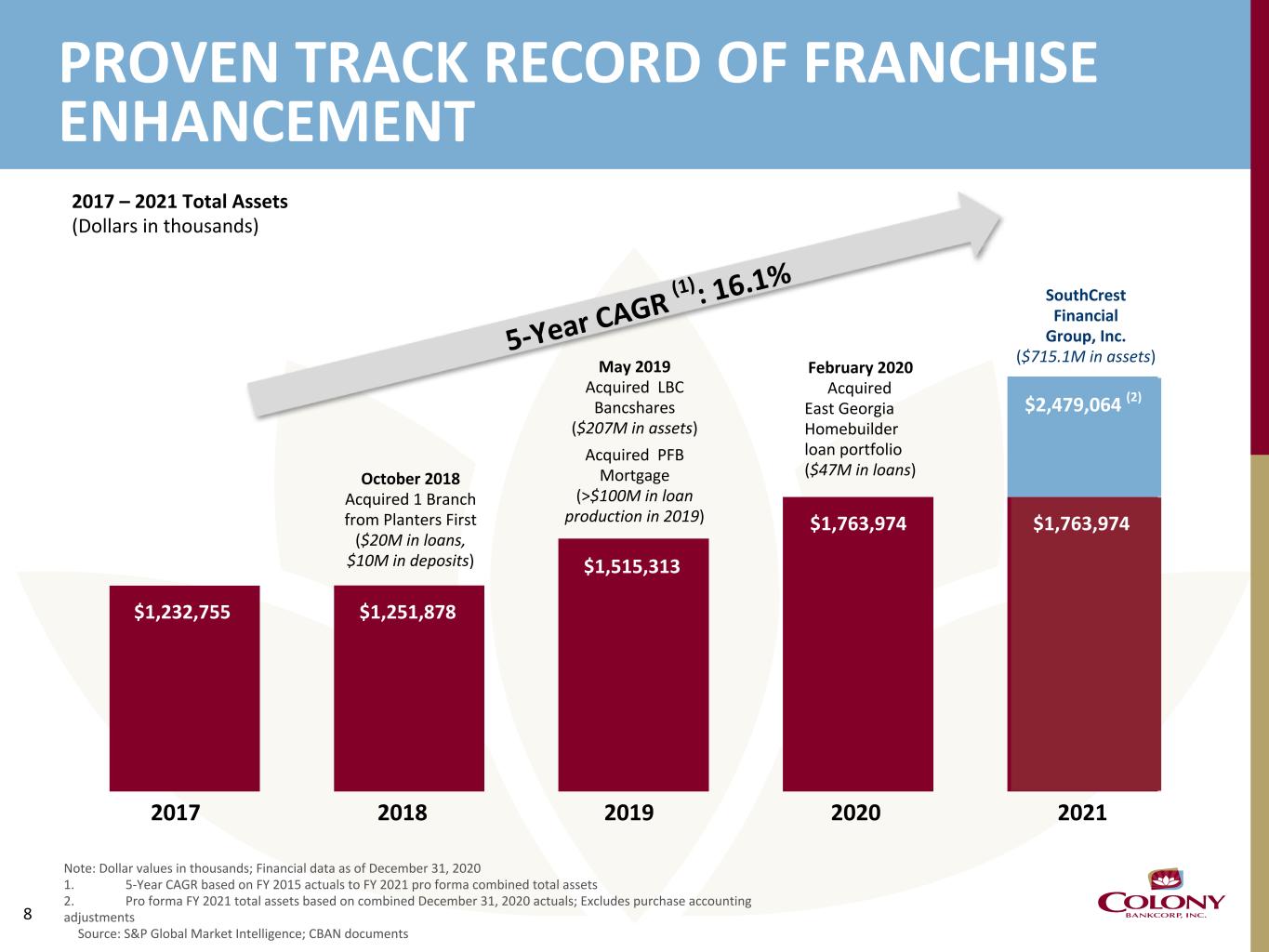

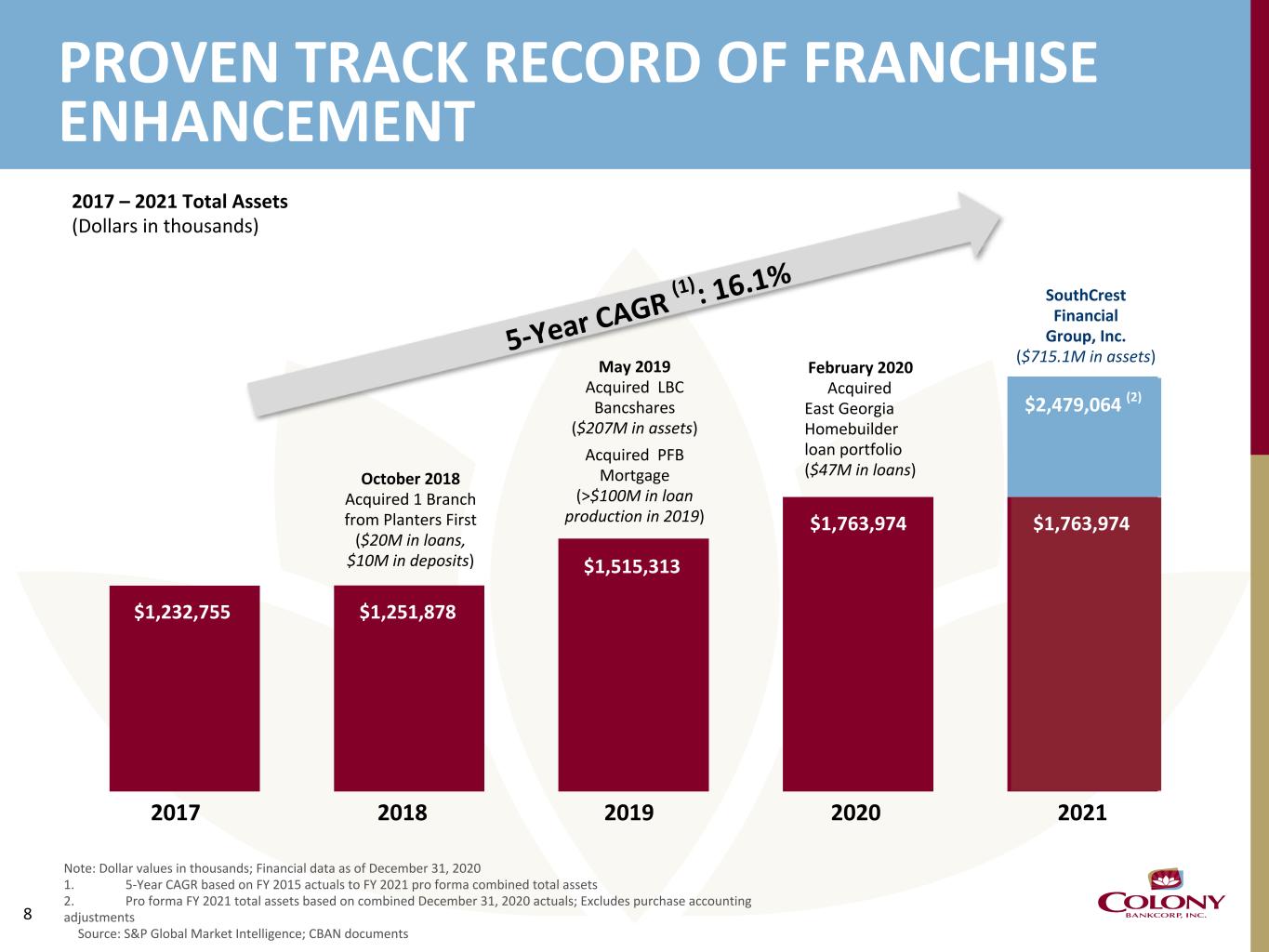

8 2020 2021 Note: Dollar values in thousands; Financial data as of December 31, 2020 1. 5-Year CAGR based on FY 2015 actuals to FY 2021 pro forma combined total assets 2. Pro forma FY 2021 total assets based on combined December 31, 2020 actuals; Excludes purchase accounting adjustments Source: S&P Global Market Intelligence; CBAN documents SouthCrest Financial Group, Inc. ($715.1M in assets) February 2020 Acquired East Georgia Homebuilder loan portfolio ($47M in loans) May 2019 Acquired LBC Bancshares ($207M in assets) Acquired PFB Mortgage (>$100M in loan production in 2019) October 2018 Acquired 1 Branch from Planters First ($20M in loans, $10M in deposits) 2017 – 2021 Total Assets (Dollars in thousands) 201920182017 PROVEN TRACK RECORD OF FRANCHISE ENHANCEMENT $1,232,755 $1,251,878 $1,515,313 $1,763,974 $1,763,974 $2,479,064 (2) 5-Year CAGR (1 ) : 16.1%

9 SOUTHCREST FINANCIAL OPPORTUNITY • Creates Georgia’s largest community bank and fourth largest bank in the State1 • Expands Colony into new markets • Enhanced scale, growth, profitability and performance • Significant revenue growth opportunities identified in the areas of mortgage, SBA and consumer lending • Positions Colony as the acquirer of choice for community banks looking to partner in Georgia and the surrounding region • Expected to be meaningfully accretive to Colony's fully diluted earnings per share in year one, excluding transaction costs • Solidifies management team with key executives from SouthCrest (1) Community bank defined as having less than $10.0 billion in total assets and providing a full suite of consumer and commercial products, as of December 31, 2020 Source: S&P Global Market Intelligence

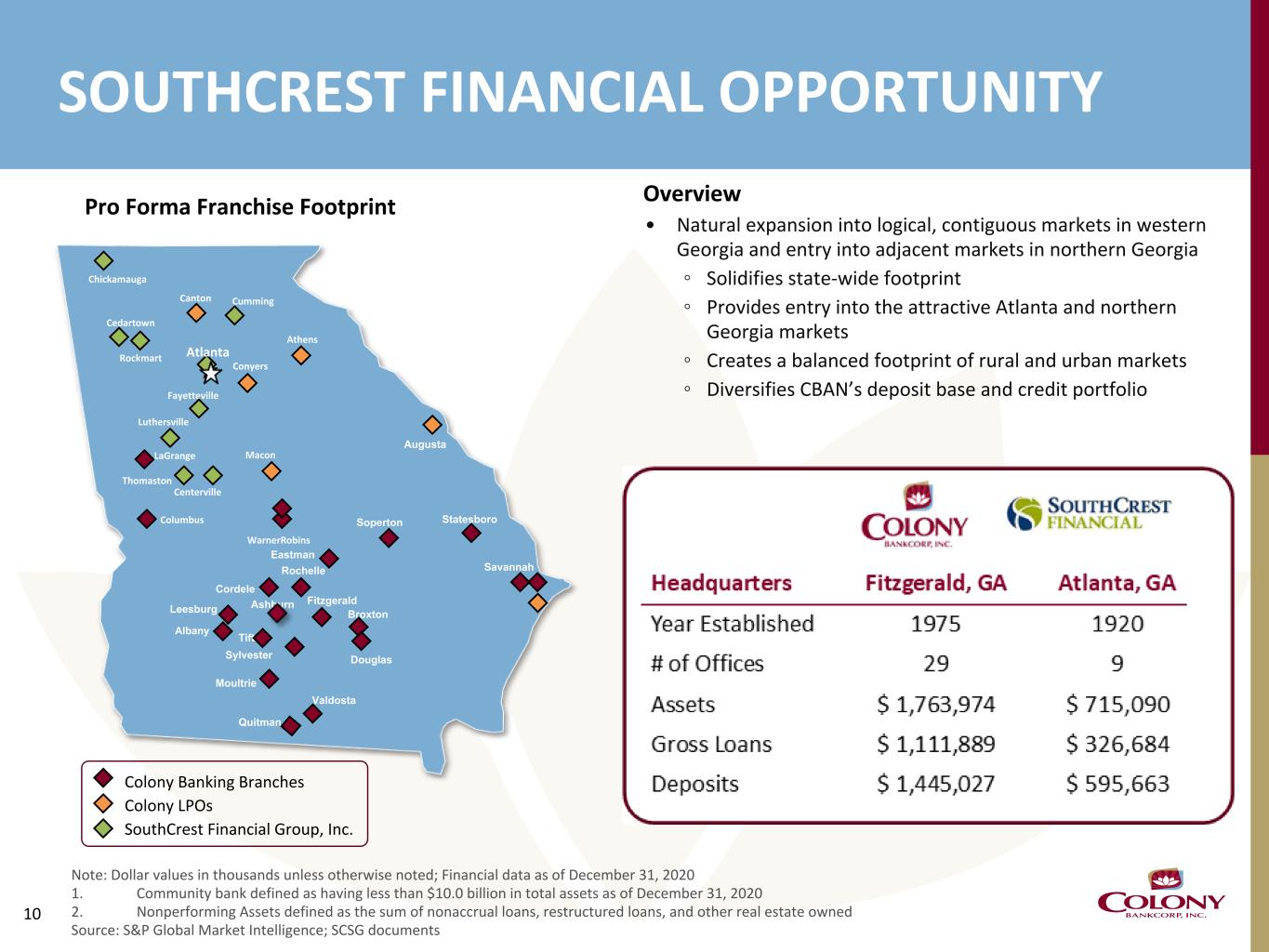

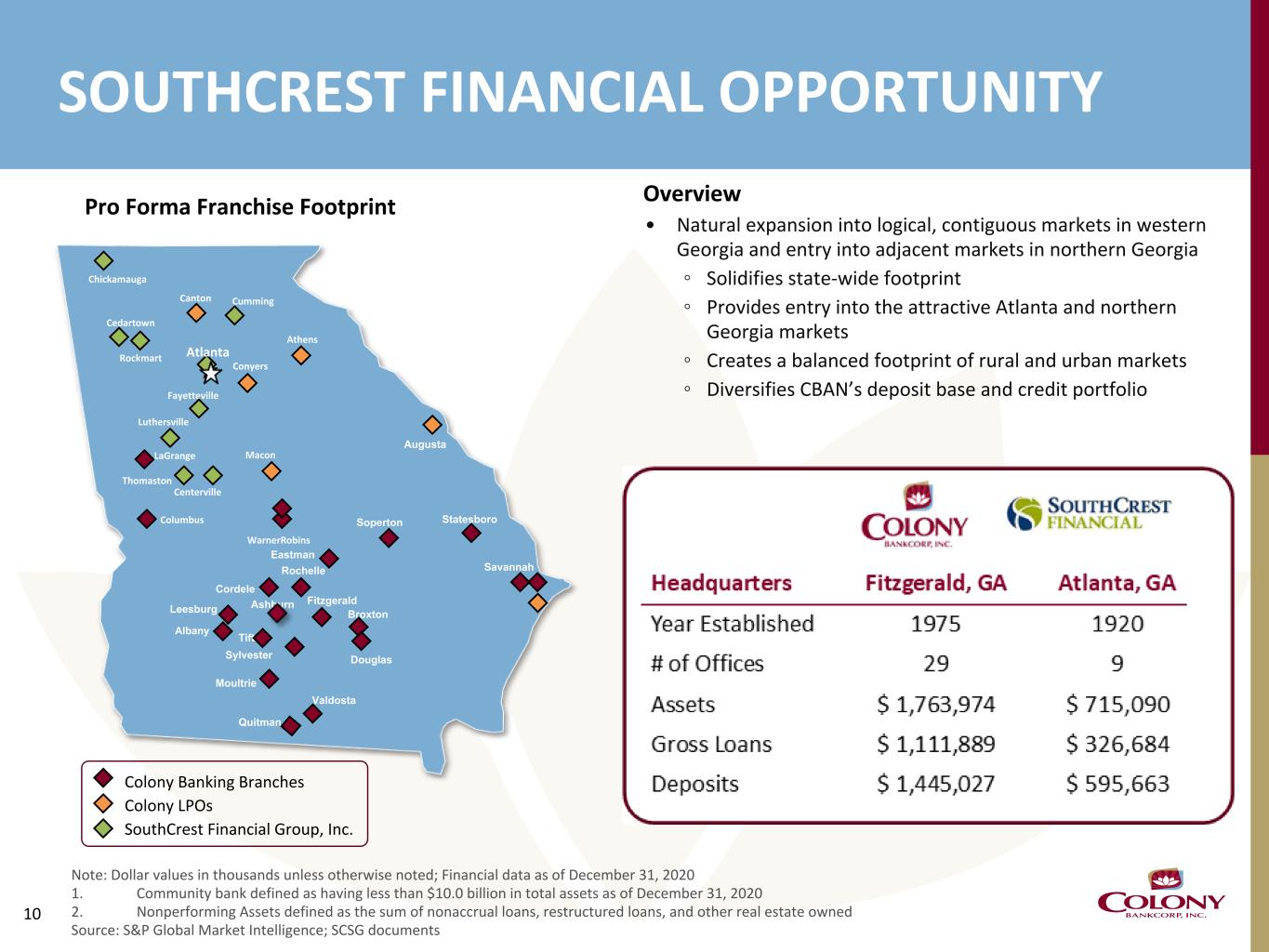

10 Note: Dollar values in thousands unless otherwise noted; Financial data as of December 31, 2020 1. Community bank defined as having less than $10.0 billion in total assets as of December 31, 2020 2. Nonperforming Assets defined as the sum of nonaccrual loans, restructured loans, and other real estate owned Source: S&P Global Market Intelligence; SCSG documents Colony Banking Branches Colony LPOs SouthCrest Financial Group, Inc. Pro Forma Franchise Footprint Overview • Natural expansion into logical, contiguous markets in western Georgia and entry into adjacent markets in northern Georgia ◦ Solidifies state-wide footprint ◦ Provides entry into the attractive Atlanta and northern Georgia markets ◦ Creates a balanced footprint of rural and urban markets ◦ Diversifies CBAN’s deposit base and credit portfolio SOUTHCREST FINANCIAL OPPORTUNITY Statesboro Savannah Conyers Augusta Fayetteville Albany Tifton Soperton Eastman Rochelle Chickamauga Douglas Fitzgerald Broxton Cordele AshburnLeesburg Sylvester Rockmart Athens Moultrie Valdosta Quitman Atlanta Cedartown Canton Cumming Luthersville MaconLaGrange Centerville Thomaston Columbus WarnerRobins

11 DRIVING HIGH PERFORMANCE ◦ Achieve strong organic growth each year ◦ Seize on expansion opportunities ◦ Increase operating efficiency • Realignment plan with focus on operating expense savings of $1 million annually • Optimize our balance sheet for improved earnings • Improve processes for efficiency and better controls • Run a more efficiently staffed branch network • Utilize technology to lower operating costs through investment in our popular digital banking channels • Align our staffing and procedures to adhere to industry best practices for service and efficiency

12 DRIVING HIGH PERFORMANCE ◦ Increase non-interest income • Acquiring The Barnes Agency in August 2021 - forming Colony Insurance to offer consumer insurance solutions • Growing our deposit account customer base increases service charge and interchange revenue • Acquisition of PFB Mortgage added to our mortgage team in 2019 • Started a Small Business Specialty Lending division to offer SBA, USDA and other government guaranteed loan products • Look to add wealth management and other lines of business ◦ Achieve strong organic growth each year ◦ Seize on expansion opportunities ◦ Increase operating efficiency

13 COLONY INSURANCE • Agreed to acquire The Barnes Agency, an Allstate appointed consumer property and casualty insurance agency in Macon, GA • Formed a new subsidiary, Colony Insurance, which will offer a suite of consumer insurance solutions • Named Jason Barnes President of Colony Insurance • Logical extension to existing range of financial products and services • Diversifies revenue stream and increases non-interest income • Opportunities to grow insurance offerings and enhance profitability of the branch network through cross-selling of products and services

14 ◦ In May 2019, Colony Bank acquired PFB Mortgage, which had more than $100 million in annual mortgage production in 2019 • Added to our team by adding originators in Albany, Athens, Macon, Savannah, Statesboro and Warner Robins • Added seasoned mortgage executives through acquisition ◦ Increased volume in Mortgage division production: • $101.8 million in production in the first quarter of 2021 • $151.4 million in production in the second quarter of 2021 ◦ Added experienced origination teams in Augusta, LaGrange, and Savannah, focused on expanding business MORTGAGE DIVISION

15 SMALL BUSINESS SPECIALTY LENDING GROUP ◦ In July 2019, opened a metro Atlanta office for Small Business Specialty Lending (SBSL) Group focused on Small Business Administration (SBA) lending and other government guaranteed loans ◦ 11 team members added, including three business development officers, led by two veteran bankers, Darren Davis, President, and Stephen T. Kruto, Director of Operations ◦ Originated loans under SBA Paycheck Protection Program (PPP) related to the Economic Aid Act, resulting in 950 loans totaling over $52.4 million in 2021 ◦ Closed $15.1 million in loans in the second quarter and $6.0 million remains in the pipeline

16 DRIVING HIGH PERFORMANCE ◦ Increase non-interest income ◦ Create a culture of high performance • Instill behaviors and habits that lead to great results • Coaching team members to improve performance • Increase incentive and performance based compensation • Pursue open communication and honest feedback ◦ Achieve strong organic growth each year ◦ Seize on expansion opportunities ◦ Improve operating efficiency

17 ◦ Since our founding in 1975, our mission is to provide an alternative to traditional banking that our customers deserve ◦ Focus on relationships that are beneficial to the customer and the Bank – one-sided relationships and transactions do not create value ◦ Strive to be trusted advisors and give consultative advice ◦ Nimble and responsive to customer needs ◦ Team members are passionate about delivering solutions VALUE PROPOSITION TO OUR CUSTOMERS

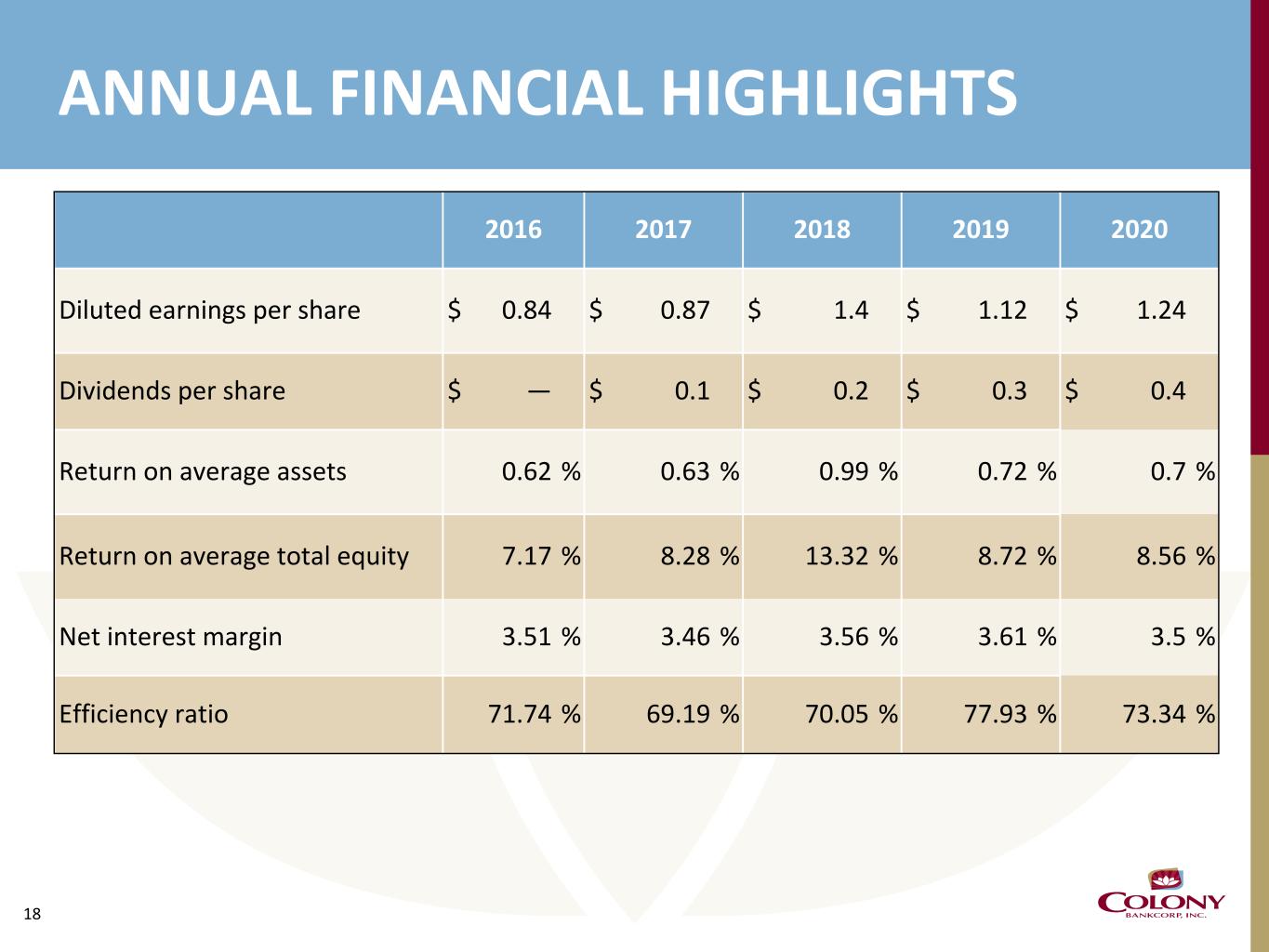

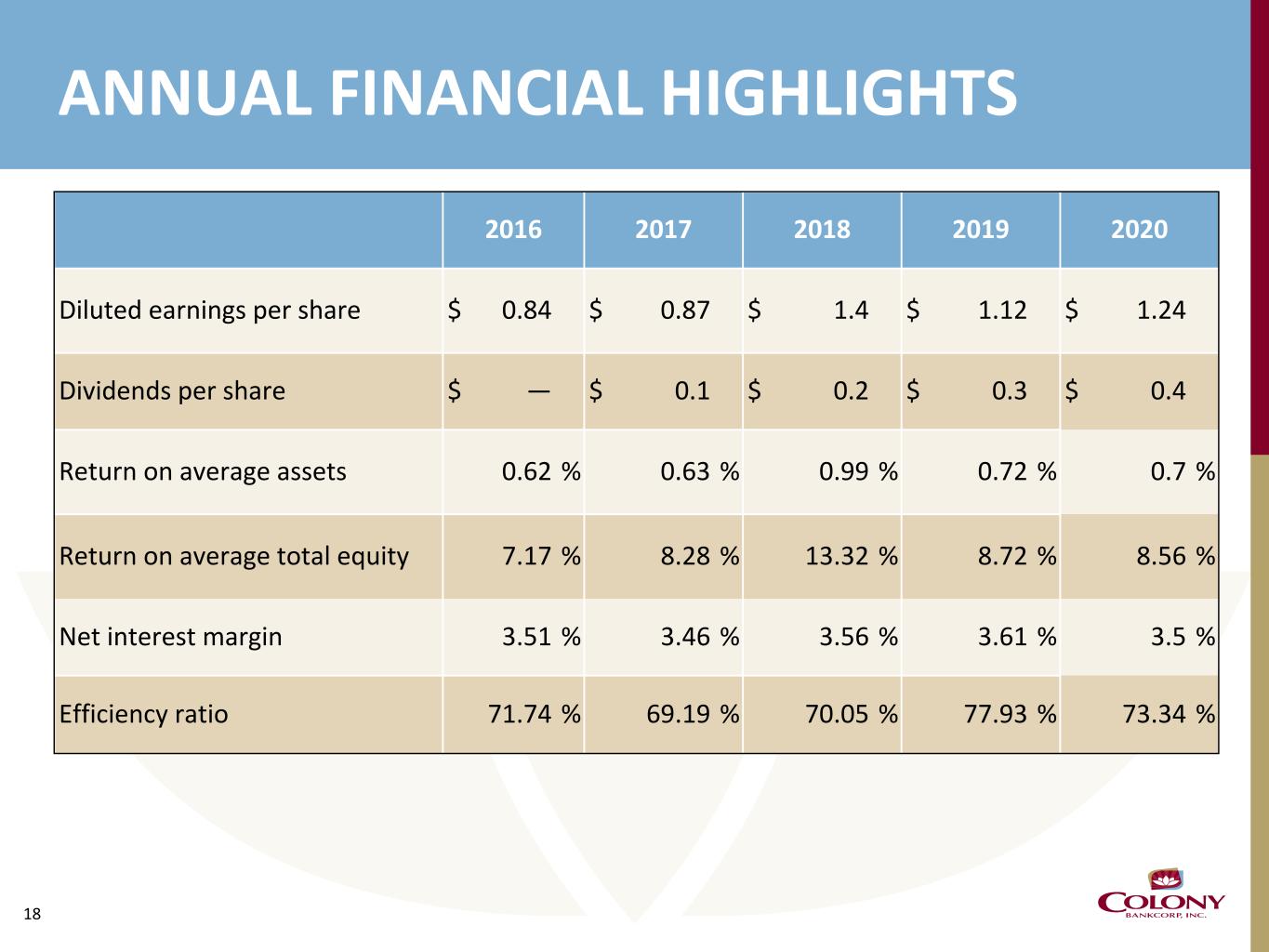

18 2016 2017 2018 2019 2020 Diluted earnings per share $ 0.84 $ 0.87 $ 1.4 $ 1.12 $ 1.24 Dividends per share $ — $ 0.1 $ 0.2 $ 0.3 $ 0.4 Return on average assets 0.62 % 0.63 % 0.99 % 0.72 % 0.7 % Return on average total equity 7.17 % 8.28 % 13.32 % 8.72 % 8.56 % Net interest margin 3.51 % 3.46 % 3.56 % 3.61 % 3.5 % Efficiency ratio 71.74 % 69.19 % 70.05 % 77.93 % 73.34 % ANNUAL FINANCIAL HIGHLIGHTS

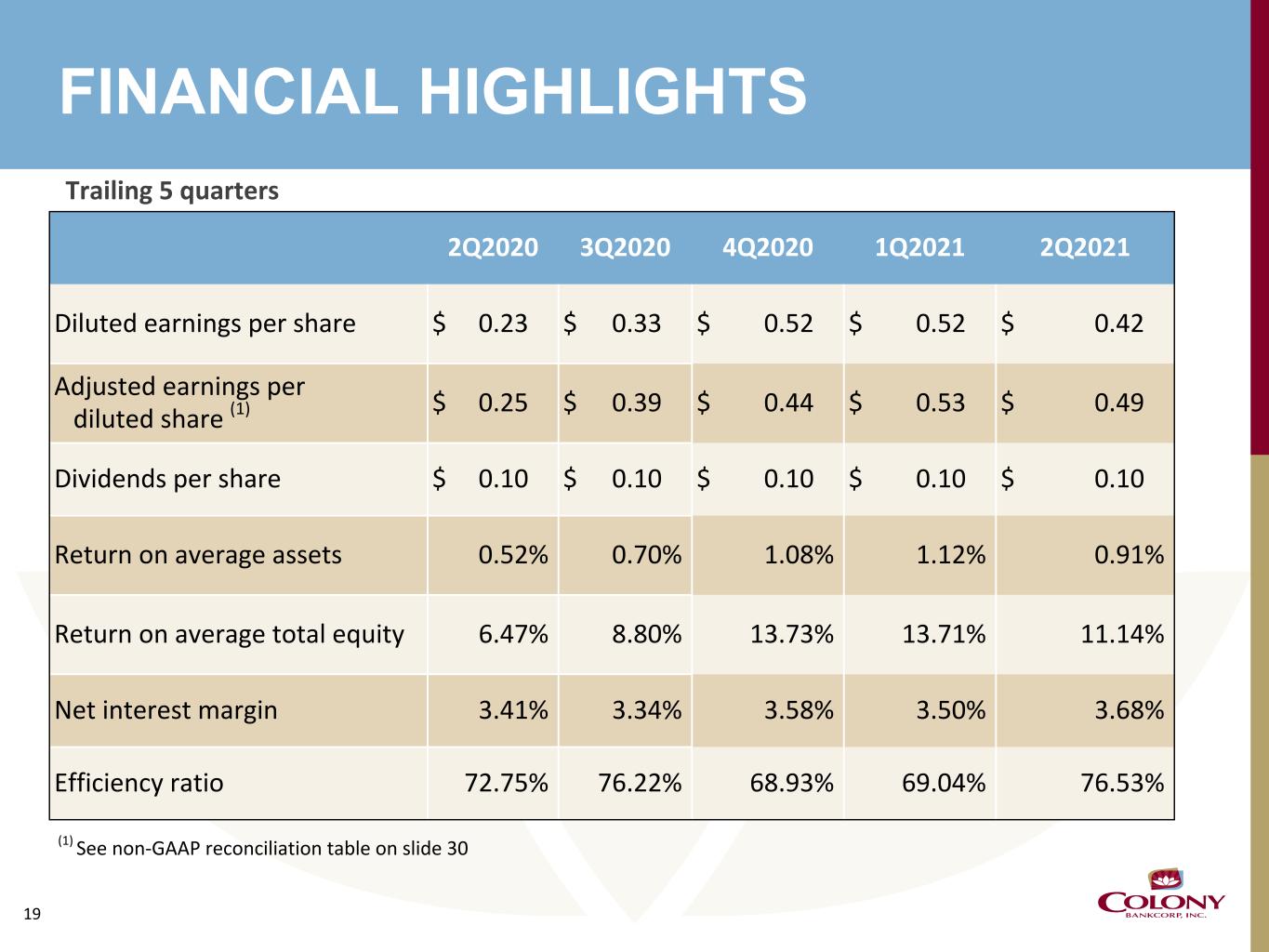

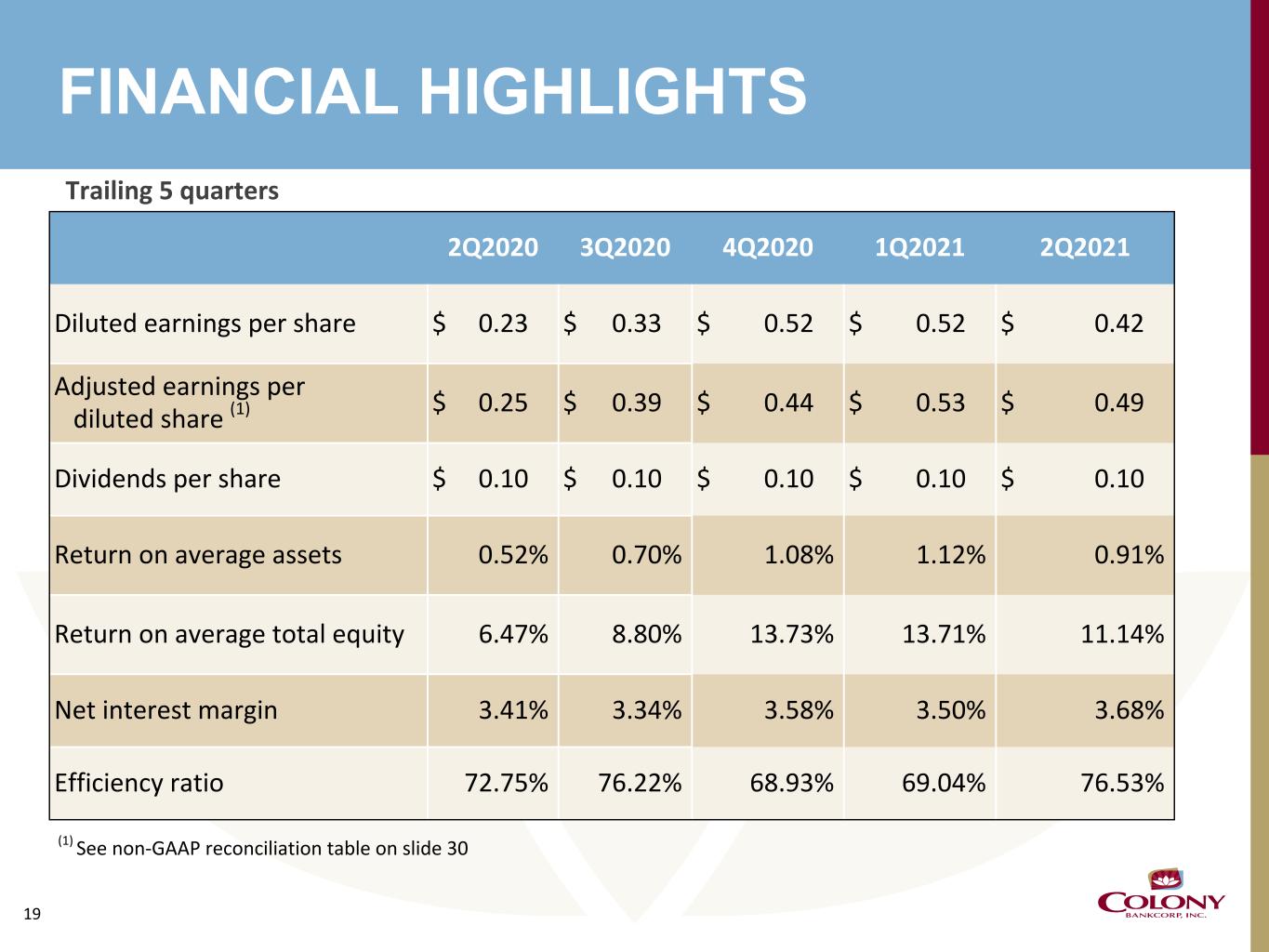

19 2Q2020 3Q2020 4Q2020 1Q2021 2Q2021 Diluted earnings per share $ 0.23 $ 0.33 $ 0.52 $ 0.52 $ 0.42 Adjusted earnings per diluted share (1) $ 0.25 $ 0.39 $ 0.44 $ 0.53 $ 0.49 Dividends per share $ 0.10 $ 0.10 $ 0.10 $ 0.10 $ 0.10 Return on average assets 0.52% 0.70% 1.08% 1.12% 0.91% Return on average total equity 6.47% 8.80% 13.73% 13.71% 11.14% Net interest margin 3.41% 3.34% 3.58% 3.50% 3.68% Efficiency ratio 72.75% 76.22% 68.93% 69.04% 76.53% FINANCIAL HIGHLIGHTS (1) See non-GAAP reconciliation table on slide 30 Trailing 5 quarters

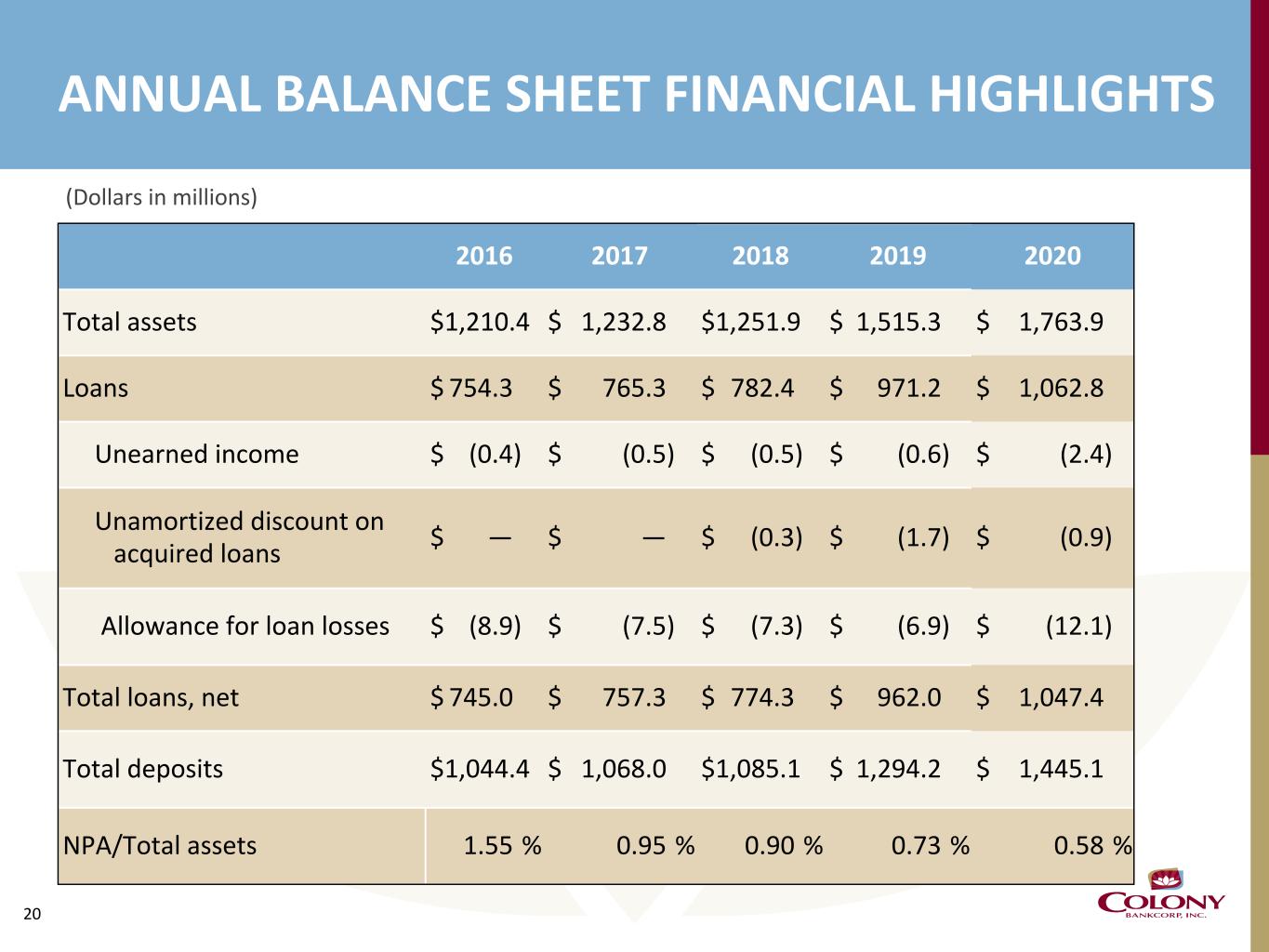

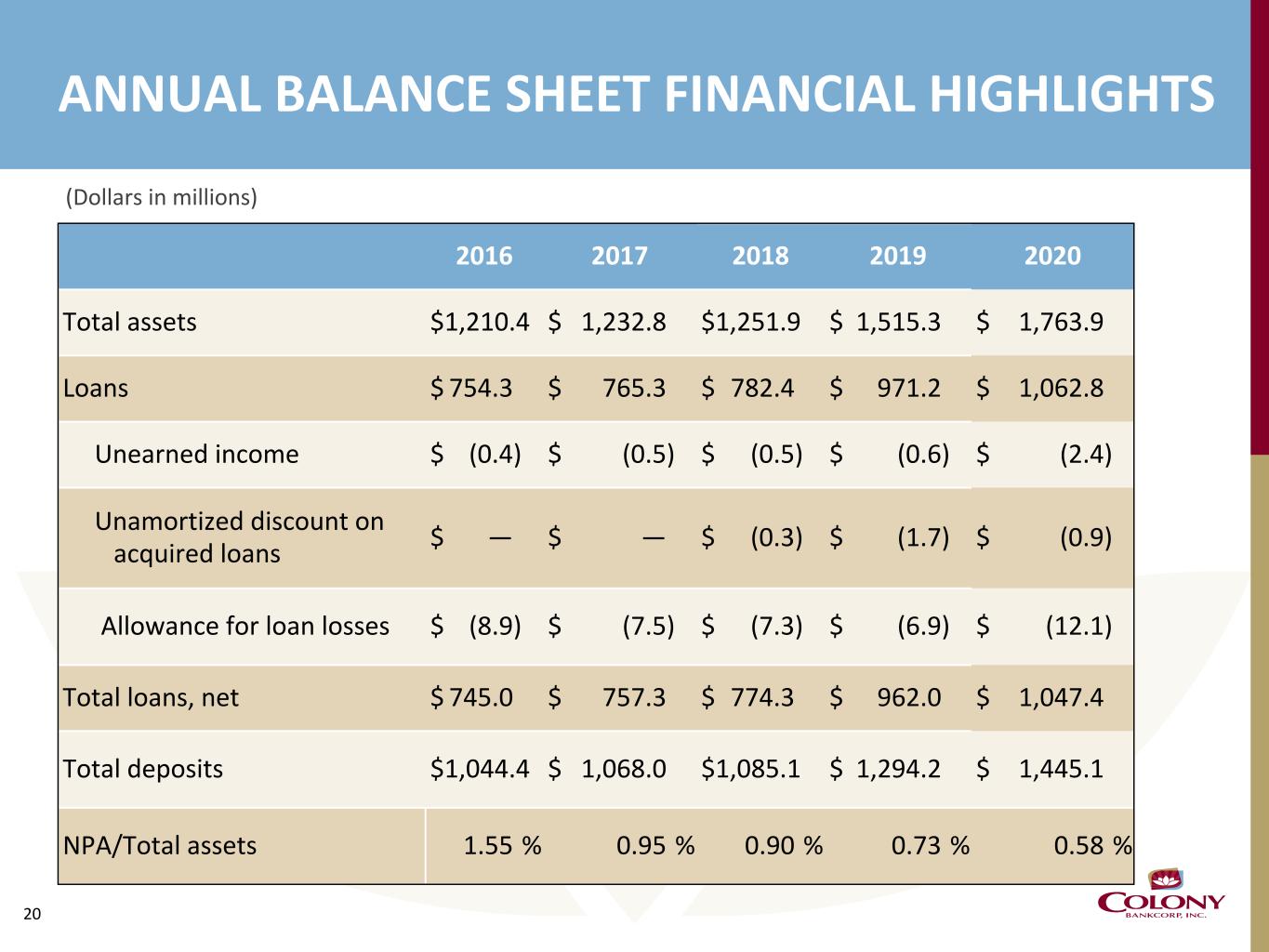

20 2016 2017 2018 2019 2020 Total assets $ 1,210.4 $ 1,232.8 $ 1,251.9 $ 1,515.3 $ 1,763.9 Loans $ 754.3 $ 765.3 $ 782.4 $ 971.2 $ 1,062.8 Unearned income $ (0.4) $ (0.5) $ (0.5) $ (0.6) $ (2.4) Unamortized discount on acquired loans $ — $ — $ (0.3) $ (1.7) $ (0.9) Allowance for loan losses $ (8.9) $ (7.5) $ (7.3) $ (6.9) $ (12.1) Total loans, net $ 745.0 $ 757.3 $ 774.3 $ 962.0 $ 1,047.4 Total deposits $ 1,044.4 $ 1,068.0 $ 1,085.1 $ 1,294.2 $ 1,445.1 NPA/Total assets 1.55 % 0.95 % 0.90 % 0.73 % 0.58 % ANNUAL BALANCE SHEET FINANCIAL HIGHLIGHTS (Dollars in millions)

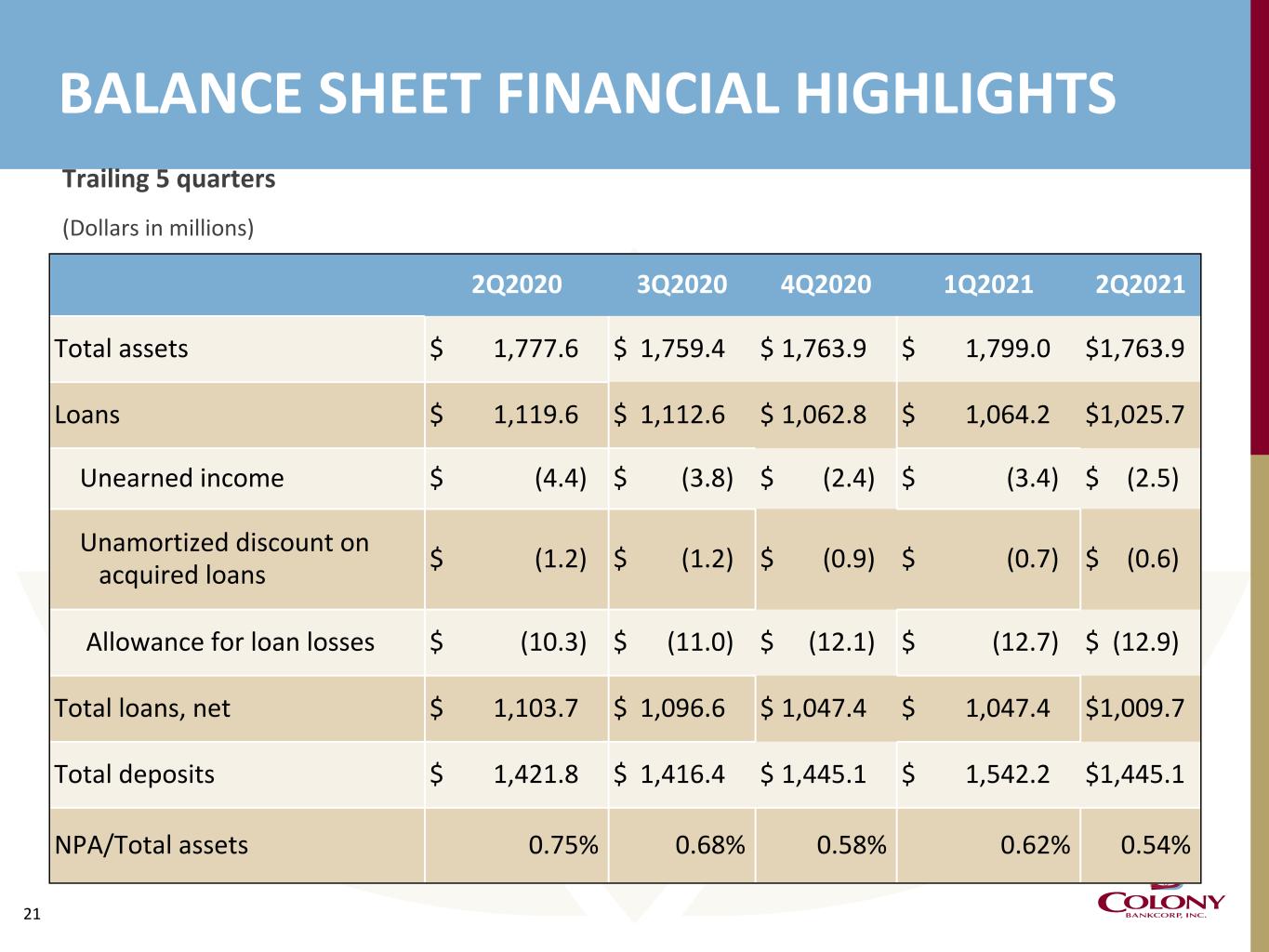

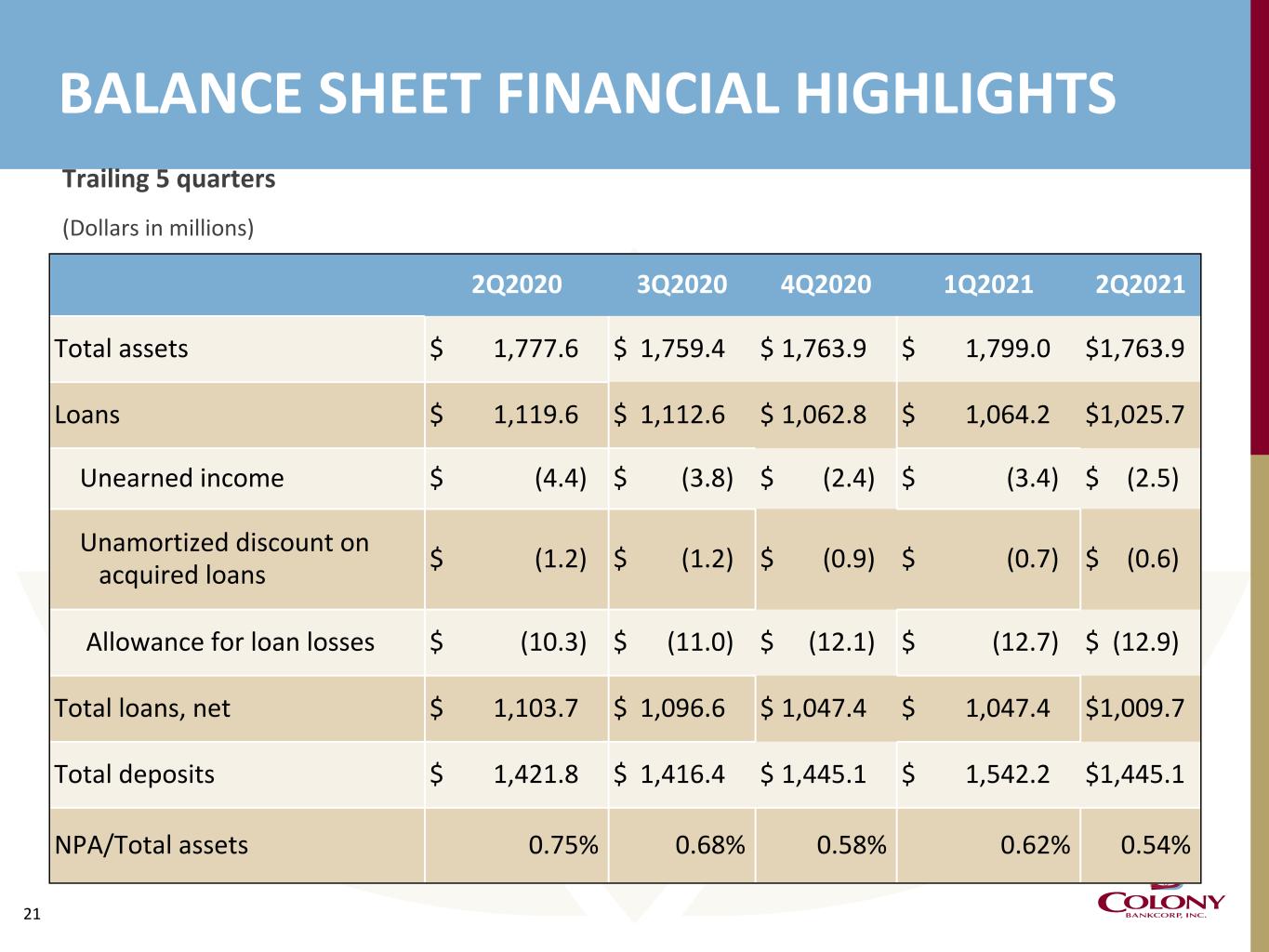

21 2Q2020 3Q2020 4Q2020 1Q2021 2Q2021 Total assets $ 1,777.6 $ 1,759.4 $ 1,763.9 $ 1,799.0 $ 1,763.9 Loans $ 1,119.6 $ 1,112.6 $ 1,062.8 $ 1,064.2 $ 1,025.7 Unearned income $ (4.4) $ (3.8) $ (2.4) $ (3.4) $ (2.5) Unamortized discount on acquired loans $ (1.2) $ (1.2) $ (0.9) $ (0.7) $ (0.6) Allowance for loan losses $ (10.3) $ (11.0) $ (12.1) $ (12.7) $ (12.9) Total loans, net $ 1,103.7 $ 1,096.6 $ 1,047.4 $ 1,047.4 $ 1,009.7 Total deposits $ 1,421.8 $ 1,416.4 $ 1,445.1 $ 1,542.2 $ 1,445.1 NPA/Total assets 0.75% 0.68% 0.58% 0.62% 0.54% BALANCE SHEET FINANCIAL HIGHLIGHTS (Dollars in millions) Trailing 5 quarters

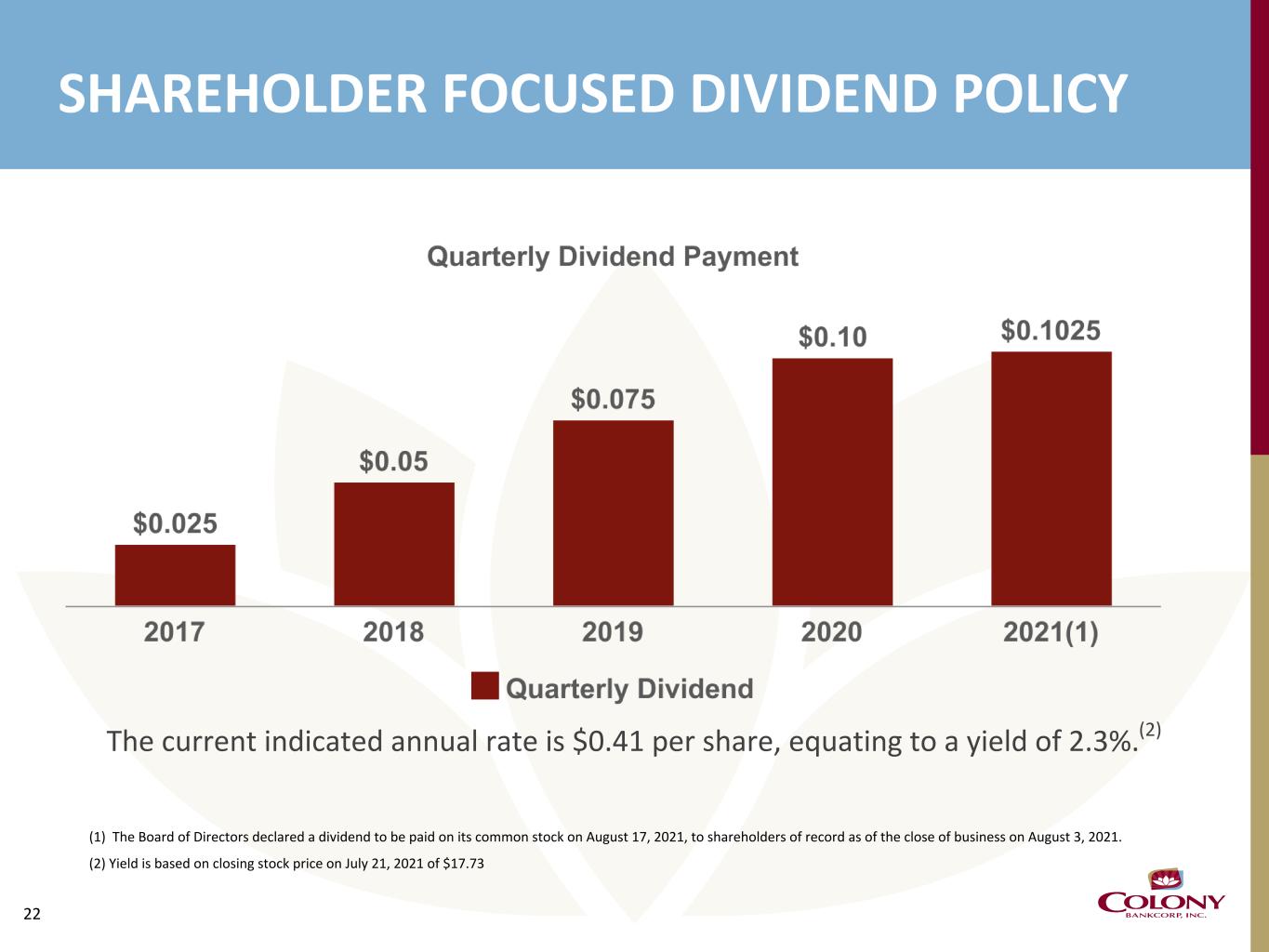

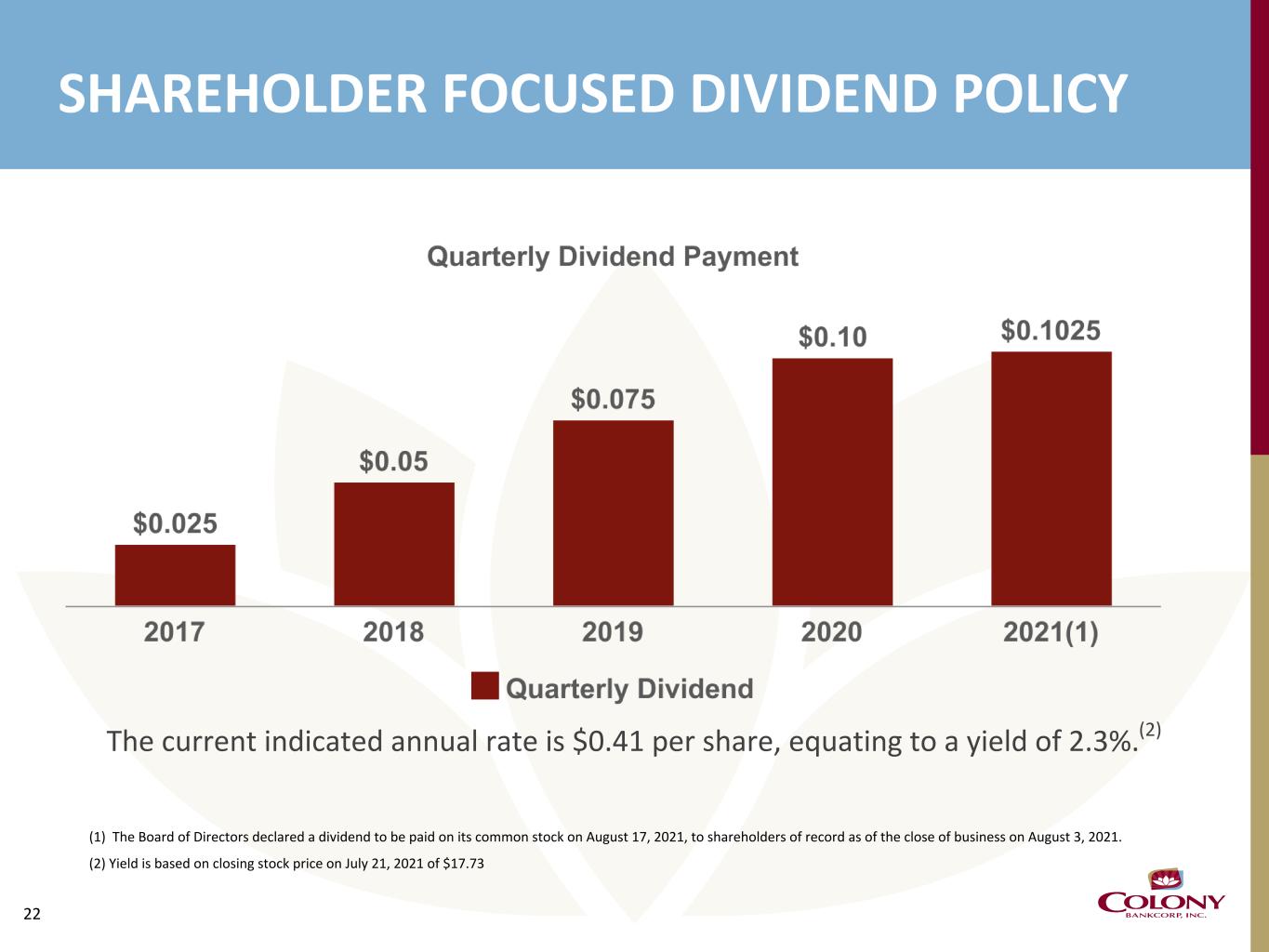

22 The current indicated annual rate is $0.41 per share, equating to a yield of 2.3%.(2) SHAREHOLDER FOCUSED DIVIDEND POLICY (1) The Board of Directors declared a dividend to be paid on its common stock on August 17, 2021, to shareholders of record as of the close of business on August 3, 2021. (2) Yield is based on closing stock price on July 21, 2021 of $17.73

23 CAPITAL RATIOS 10.2% 9.0% 9.6% 9.2% 8.5% 15.0% 12.5% 14.3% 12.4% 13.4% 15.9% 13.2% 15.4% 13.3% 14.6% 12.2% 10.3% 10.3% 10.3% 11.3% Tier One Leverage Ratio Tier One Ratio Total Risk-based Capital Ratio Common Equity Tier One Capital Ratio 2018 2019 2020 6/30/2020 6/30/2021

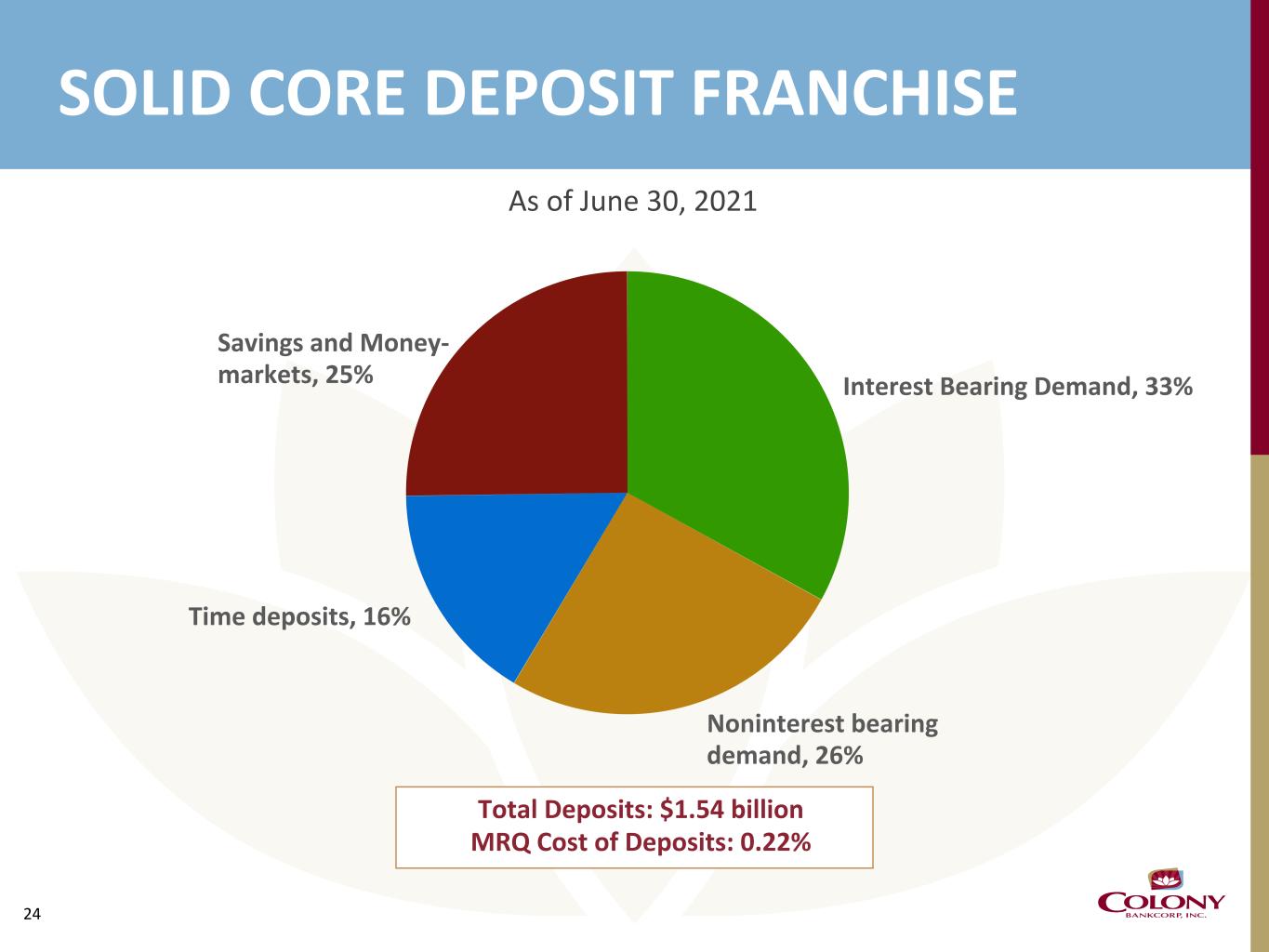

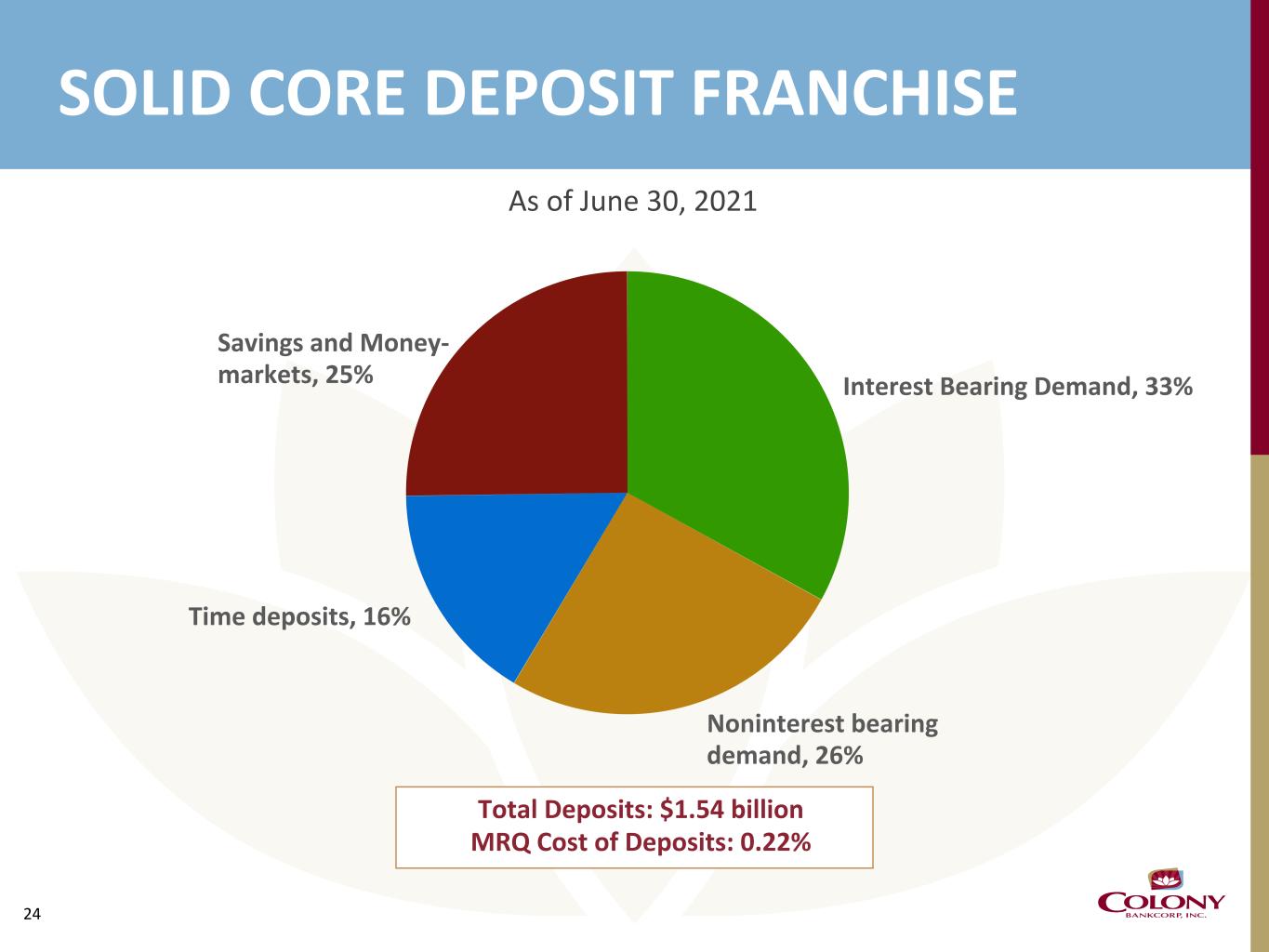

24 SOLID CORE DEPOSIT FRANCHISE As of June 30, 2021 Total Deposits: $1.54 billion MRQ Cost of Deposits: 0.22% Interest Bearing Demand, 33% Noninterest bearing demand, 26% Time deposits, 16% Savings and Money- markets, 25%

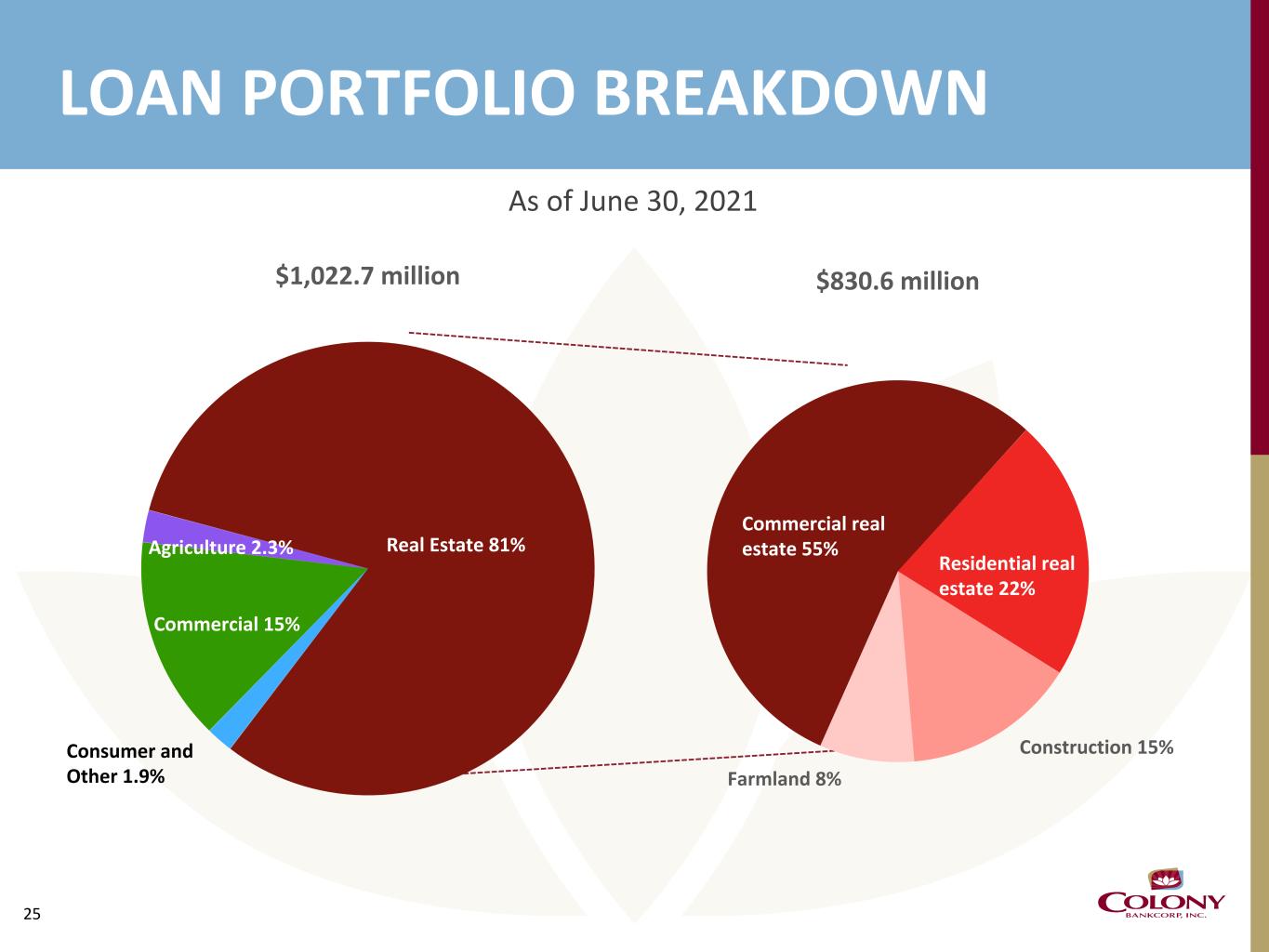

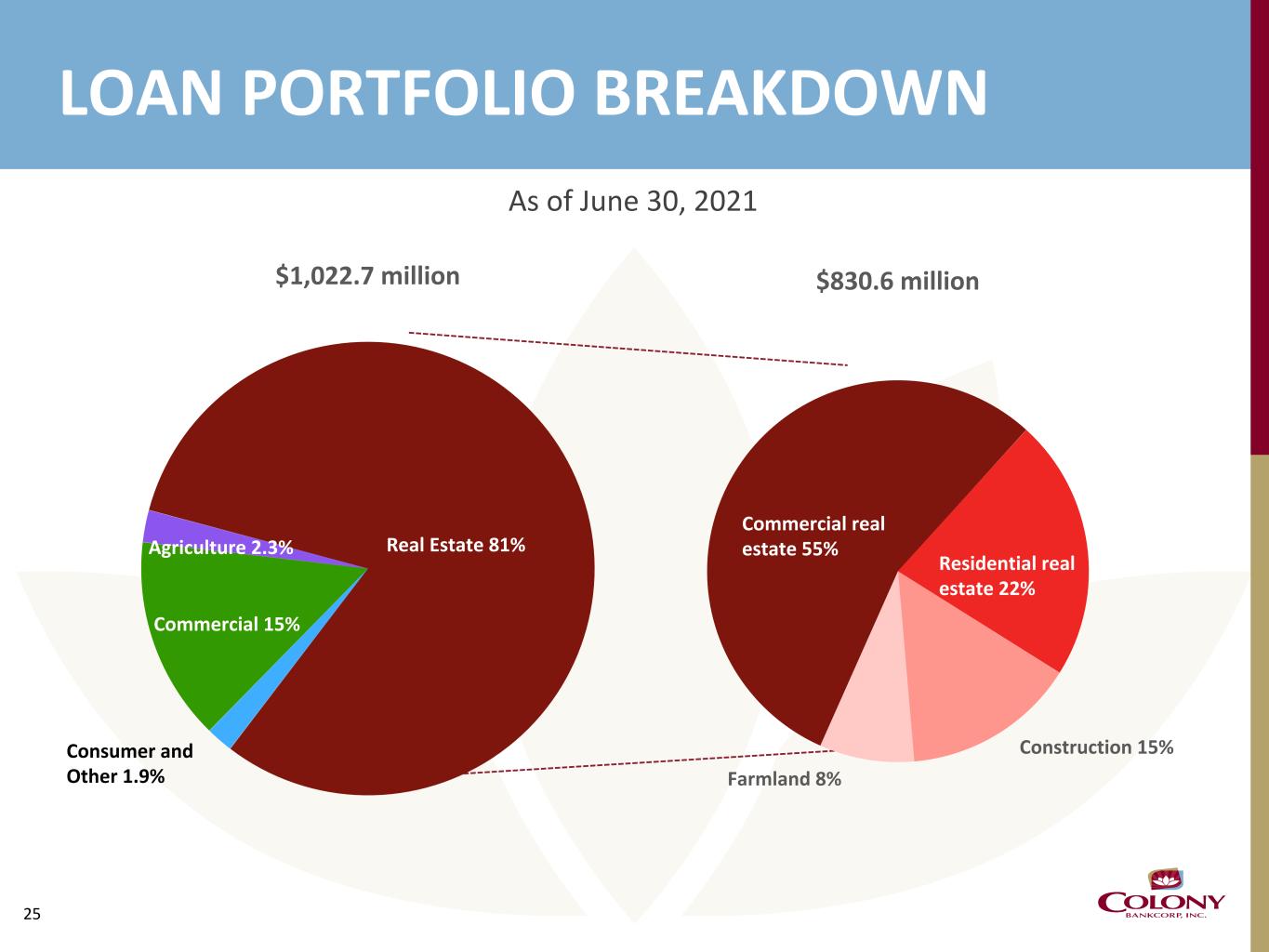

25 LOAN PORTFOLIO BREAKDOWN As of June 30, 2021 $1,022.7 million Real Estate 81% Consumer and Other 1.9% Commercial 15% Agriculture 2.3% $830.6 million Commercial real estate 55% Residential real estate 22% Construction 15% Farmland 8%

26 LOAN PORTFOLIO(1) (Dollars in millions) Organic Loan Growth (Excluding PPP Loans) (1) Represents gross loan balances. Excludes PPP loans totaling $58.8 million, $102.6 million, $101.1 million $133.8 million, $133.2 million at 6/30/2021, 3/31/2021, 12/31/2020,9/30/2020 and 6/30/2020, respectively $980.9 $967.8 $958.3 $960.1 $964.0 Organic Total Loans 06/30/20 09/30/20 12/31/2020 03/31/21 06/30/21 $— $250.0 $500.0 $750.0 $1,000.0 $1,250.0

27 ◦ SouthCrest acquisition to accelerate growth ◦ Well positioned for continued organic growth ◦ Improving earnings outlook ◦ Shareholder friendly dividend policy ◦ Opportunities created by industry consolidation ◦ Seasoned leadership with a proven track record INVESTMENT CONSIDERATIONS

28 RECONCILIATION OF NON-GAAP MEASURES (Dollars in thousands, except per share data) 2021 2020 (dollars in thousands, except per share data) Second Quarter First Quarter Fourth Quarter Third Quarter Second Quarter Operating net income reconciliation Net income (GAAP) $ 3,997 $ 4,919 $ 4,900 $ 3,098 $ 2,214 Acquisition-related expenses 865 176 148 207 220 Thomaston building write down — — — 582 — Gain on sale of Thomaston branch — — (1,026) — — Income tax expense (benefit) (225) (46) 184 (166) (46) Operating net income $ 4,637 $ 5,049 $ 4,206 $ 3,721 $ 2,388 Weighted average diluted shares 9,498,783 9,498,783 9,498,783 9,498,783 9,498,783 Adjusted earnings per diluted share $ 0.49 $ 0.53 $ 0.44 $ 0.39 $ 0.25 Tangible book value per common share reconciliation Book value per common share (GAAP) $ 15.46 $ 15.11 $ 15.21 $ 14.78 $ 14.59 Effect of goodwill and other intangibles (1.97) (1.97) (1.95) (1.96) (1.96) Tangible book value per common share $ 13.50 $ 13.14 $ 13.26 $ 12.82 $ 12.63 Operating efficiency ratio calculation Efficiency ratio (GAAP) 76.53 % 69.04 % 68.93 % 76.22 % 72.75 % Acquisition-related expenses (3.44) (0.46) (0.64) (0.97) (1.20) Gain on sale of Thomaston branch — % — % 3.19 % — % — % Thomaston building write down — % — % — % (2.72) % — % Operating efficiency ratio 73.10 % 68.58 % 71.49 % 72.53 % 71.55 %

29 NASDAQ: CBAN