2 CAUTIONARY STATEMENTS This presentation contains "forward-looking statements“ within the meaning of, and subject to the protections of, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. In addition, certain statements may be contained in Colony Bankcorp, Inc's (the "Company") future filings with the Securities and Exchange Commission (the "SEC"), in press releases, and in oral and written statements made by or with the approval of the Company that are not statements of historical fact and constitute “forward-looking statements” within the meaning of, and subject to the protections of, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Examples of forward-looking statements include, but are not limited to: (i) projections and/or expectations of revenues, income or loss, earnings or loss per share, the payment or nonpayment of dividends, capital structure and other financial items; (ii) statement of plans and objectives of Colony Bankcorp, Inc. or its management or Board of Directors, including those relating to products or services; (iii) statements of future economic performance; (iv) statements regarding growth strategy, capital management, liquidity and funding and future profitability; and (v) statements of assumptions underlying such statements. Words such as “may”, “will”, “anticipate”, “assume”, “should”, “support”, “indicate”, “would”, “believe”, “contemplate”, “expect”, “estimate”, “continue”, “further”, “plan”, “point to”, “project”, “could”, “intend”, “target” and similar expressions are intended to identify forward-looking statements but are not the exclusive means of identifying such statements. Prospective investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve known and unknown risks and uncertainties. Factors that might cause such differences include, but are not limited to: the impact of current and future economic conditions, particularly those affecting the financial services industry, including the effects of declines in the real estate market, high unemployment rates, inflationary pressures, changes in interest rates (including the impact of prolonged elevated interest rates on our financial projections and models) and slowdowns in economic growth, as well as the financial stress on borrowers as a result of the foregoing; the risk of reductions in benchmark interest rates and the resulting impacts on net interest income; potential impacts of adverse developments in the banking industry highlighted by high-profile bank failures, including impacts on customer confidence, deposit outflows, liquidity and the regulatory response thereto; risks arising from media coverage of the banking industry; risks arising from perceived instability in the banking sector; the risks of changes in interest rates and their effects on the level, cost, and composition of, and competition for, deposits, loan demand and timing of payments, the values of loan collateral, securities, and interest sensitive assets and liabilities; the ability to attract new or retain existing deposits, to retain or grow loans or additional interest and fee income, or to control noninterest expense; the effect of pricing pressures on the Company’s net interest margin; the failure of assumptions underlying the establishment of reserves for possible credit losses, fair value for loans and other real estate owned; changes in real estate values; the Company’s ability to implement its various strategic and growth initiatives; increased competition in the financial services industry, particularly from regional and national institutions, as well as from fintech companies; economic conditions, either nationally or locally, in areas in which the Company conducts operations being less favorable than expected; changes in the prices, values and sales volumes of residential and commercial real estate; developments in our mortgage banking business, including loan modifications, general demand, and the effects of judicial or regulatory requirements or guidance; legislation or regulatory changes which adversely affect the ability of the consolidated Company to conduct business combinations or new operations; adverse results from current or future litigation, regulatory examinations or other legal and/or regulatory actions, including as a result of the Company's participation in and execution of government programs; significant turbulence or a disruption in the capital or financial markets and the effect of a fall in stock market prices on our investment securities; the effects of war or other conflicts including the impacts related to or resulting from Russia’s military action in Ukraine or the conflict in Israel and surrounding areas; general risks related to the Company’s merger and acquisition activity, including risks associated with the Company’s pursuit of future acquisitions; the impact of generative artificial intelligence; fraud or misconduct by internal or external actors, and system failures, cybersecurity threats or security breaches and the cost of defending against them; a deterioration of the credit rating for U.S. long-term sovereign debt, actions that the U.S. government may take to avoid exceeding the debt ceiling, and uncertainties surrounding debt ceiling and the federal budget; a potential U.S. federal government shutdown and the resulting impacts; and general competitive, economic, political and market conditions or other unexpected factors or events. These and other factors, risks and uncertainties could cause the actual results, performance or achievements of the Company to be materially different from the future results, performance or achievements expressed or implied by such forward-looking statements. Many of these factors are beyond the Company’s ability to control or predict. Forward-looking statements speak only as of the date on which such statements are made. These forward-looking statements are based upon information presently known to the Company’s management and are inherently subjective, uncertain and subject to change due to any number of risks and uncertainties, including, without limitation, the risks and other factors set forth in the Company’s filings with the Securities and Exchange Commission, the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, under the captions “Cautionary Note Regarding Forward-Looking Statements” and “Risk Factors,” and in the Company’s quarterly reports on Form 10-Q and current reports on Form 8-K. The Company undertakes no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made, or to reflect the occurrence of unanticipated events. Readers are cautioned not to place undue reliance on these forward- looking statements.

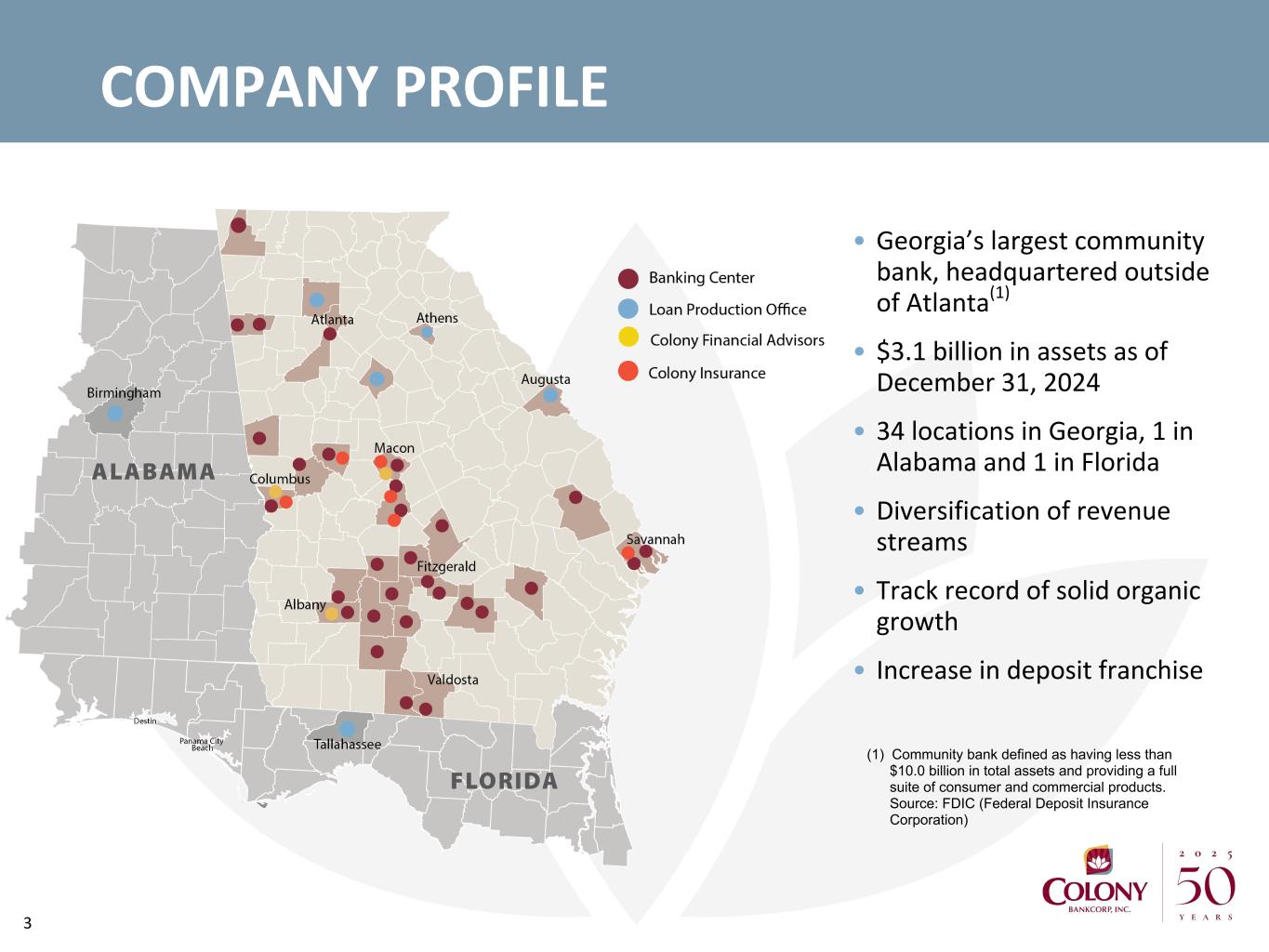

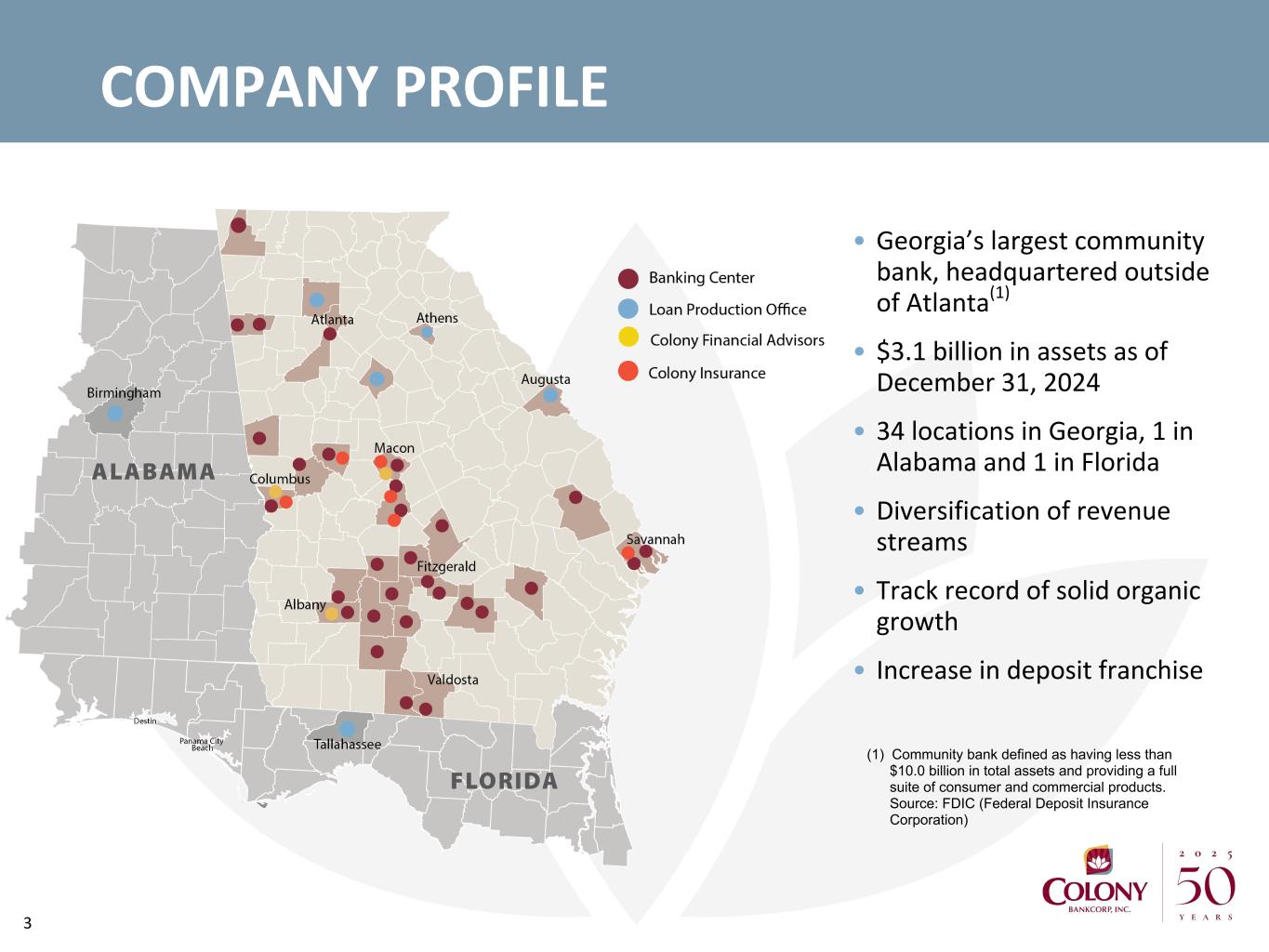

3 (1) Community bank defined as having less than $10.0 billion in total assets and providing a full suite of consumer and commercial products. Source: FDIC (Federal Deposit Insurance Corporation) COMPANY PROFILE • Georgia’s largest community bank, headquartered outside of Atlanta(1) • $3.1 billion in assets as of December 31, 2024 • 34 locations in Georgia, 1 in Alabama and 1 in Florida • Diversification of revenue streams • Track record of solid organic growth • Increase in deposit franchise

6 Name Position Years In Banking Years With Colony Edward "Lee" Bagwell EVP, Chief Risk Officer and General Counsel 21 21 Leonard H. "Lenny" Bateman EVP, Chief Credit Officer 28 5 Ed Canup EVP, Chief Banking Officer 42 2 R. Dallis "D" Copeland, Jr. President 32 3 Kimberly Dockery EVP, Chief of Staff 18 6 T. Heath Fountain Chief Executive Officer 24 6 Daniel Rentz EVP, Chief Information Officer 17 17 Laurie Senn EVP, Chief Administrative Officer 22 4 Derek Shelnutt EVP, Chief Financial Officer 10 4 EXECUTIVE LEADERSHIP TEAM

7 COLONY MOVES TO NYSE • Transitioned to the NYSE in November of 2024 • Provides opportunity for higher trading volumes with lower volatility and tighter spreads • Joins several peers and other community banks listed on the NYSE • Increased liquidity for our stock and long-term value creation for our shareholders

8 OBJECTIVES AND FOCUS • Achieve performance objectives in complementary lines of business • Maintain noninterest expense discipline to align with growth expectations • Achieve return on assets target of 1.00% • Focus on growing core deposits and customer relationships • Growing wallet share and revenue per customer using data advancements Short-Term Objectives Long-Term Objectives • 5 complementary lines of business > $1 million in net income • Improve efficiency through economies of scale • Return on assets in top quartile of peers • Continue to benefit from industry consolidation • Grow our customer base by 8 - 12% per year

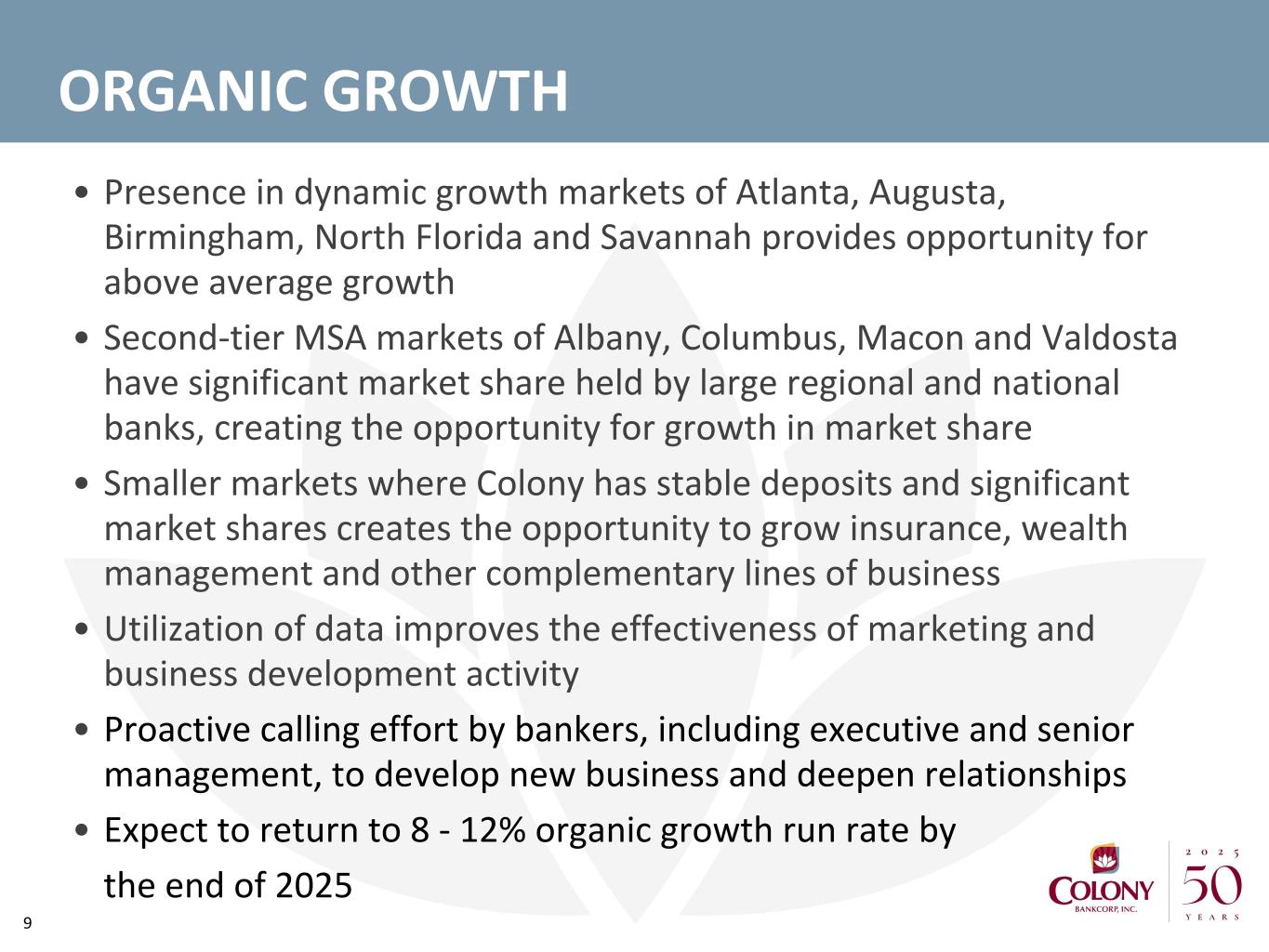

9 ORGANIC GROWTH • Presence in dynamic growth markets of Atlanta, Augusta, Birmingham, North Florida and Savannah provides opportunity for above average growth • Second-tier MSA markets of Albany, Columbus, Macon and Valdosta have significant market share held by large regional and national banks, creating the opportunity for growth in market share • Smaller markets where Colony has stable deposits and significant market shares creates the opportunity to grow insurance, wealth management and other complementary lines of business • Utilization of data improves the effectiveness of marketing and business development activity • Proactive calling effort by bankers, including executive and senior management, to develop new business and deepen relationships • Expect to return to 8 - 12% organic growth run rate by the end of 2025

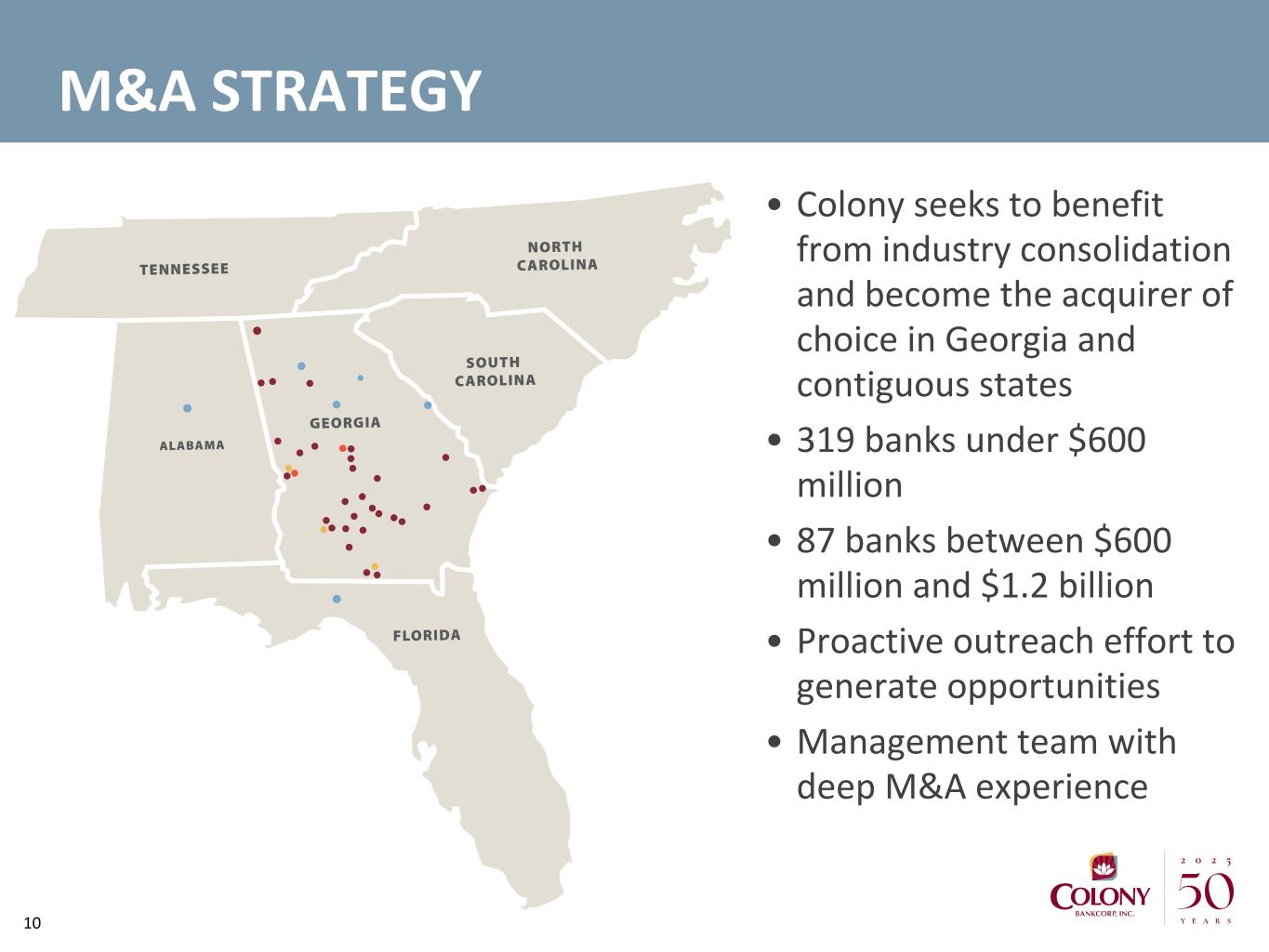

10 M&A STRATEGY • Colony seeks to benefit from industry consolidation and become the acquirer of choice in Georgia and contiguous states • 319 banks under $600 million • 87 banks between $600 million and $1.2 billion • Proactive outreach effort to generate opportunities • Management team with deep M&A experience

11 EFFICIENCY AND SCALING • Focused on process improvement and ensuring it is easy to do business with Colony Bank • Hired a Director of Optimization with experience from a large regional bank to oversee process improvement and customer experience • Utilization of Robotic Process Automation ("RPA") and other innovative technology to improve the customer experience • Implementation of cross functional teams to reduce friction and improve the customer experience • Building operational capacity in order to maintain efficiency through organic growth and M&A

12 INNOVATION AND DATA STRATEGY • Successful digital banking implementation offering customers an elevated, seamless and convenient banking experience • Research and develop all potential technology-based opportunities • Increase customer wallet share through data gathering and analytics • Full implementation of Salesforce based customer relationship management ("CRM") system to influence a more complete customer relationship through calling efforts and targeted marketing • Implemented nCino to allow an upgrade of the customer loan experience and reduce operational friction, leading to increased production capacity and efficiency • Implemented middleware for applying API-based technology to allow seamless integration for Fintech partnerships • Implement data warehouse to allow improved data usage across all lines of business

13 COMPLEMENTARY LINES OF BUSINESS 4Q 2023 1Q 2024 2Q 2024 3Q 2024 4Q 2024 (Dollars in thousands) Pre-tax Profit/ Loss Pre-tax Profit/ Loss Pre-tax Profit/ Loss Pre-tax Profit/ Loss Pre-tax Profit/ Loss Mortgage $ 26 $ (13) $ 180 $ 346 $ (101) SBSL 686 1109 1,674 1,819 2,242 Marine/RV Lending 16 (71) (58) 22 211 Merchant Services (28) (37) 7 — (10) Wealth Advisors 20 36 36 41 38 Insurance 56 56 4 33 68 TOTAL $ 776 $ 1,080 $ 1,843 $ 2,261 $ 2,448

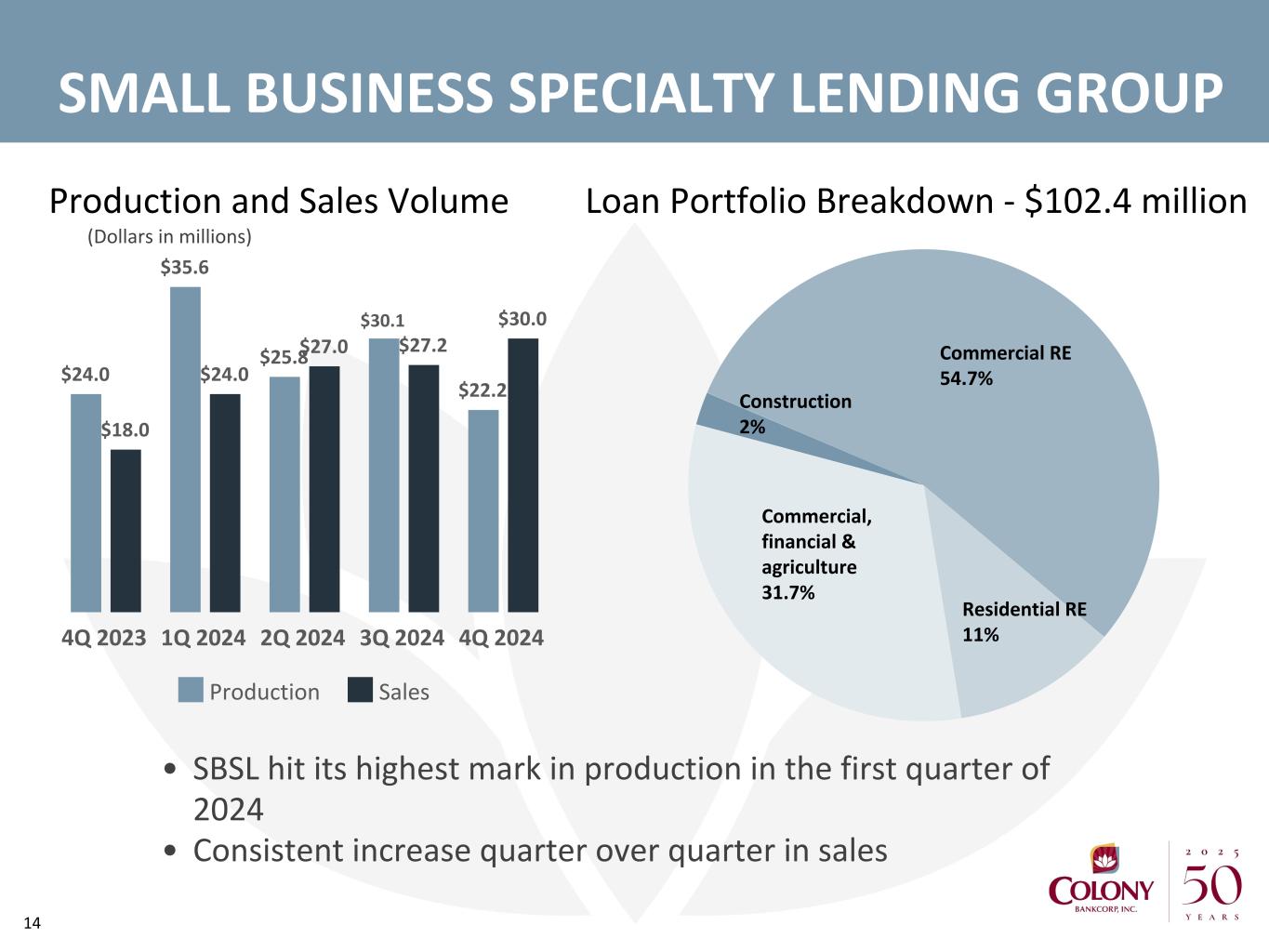

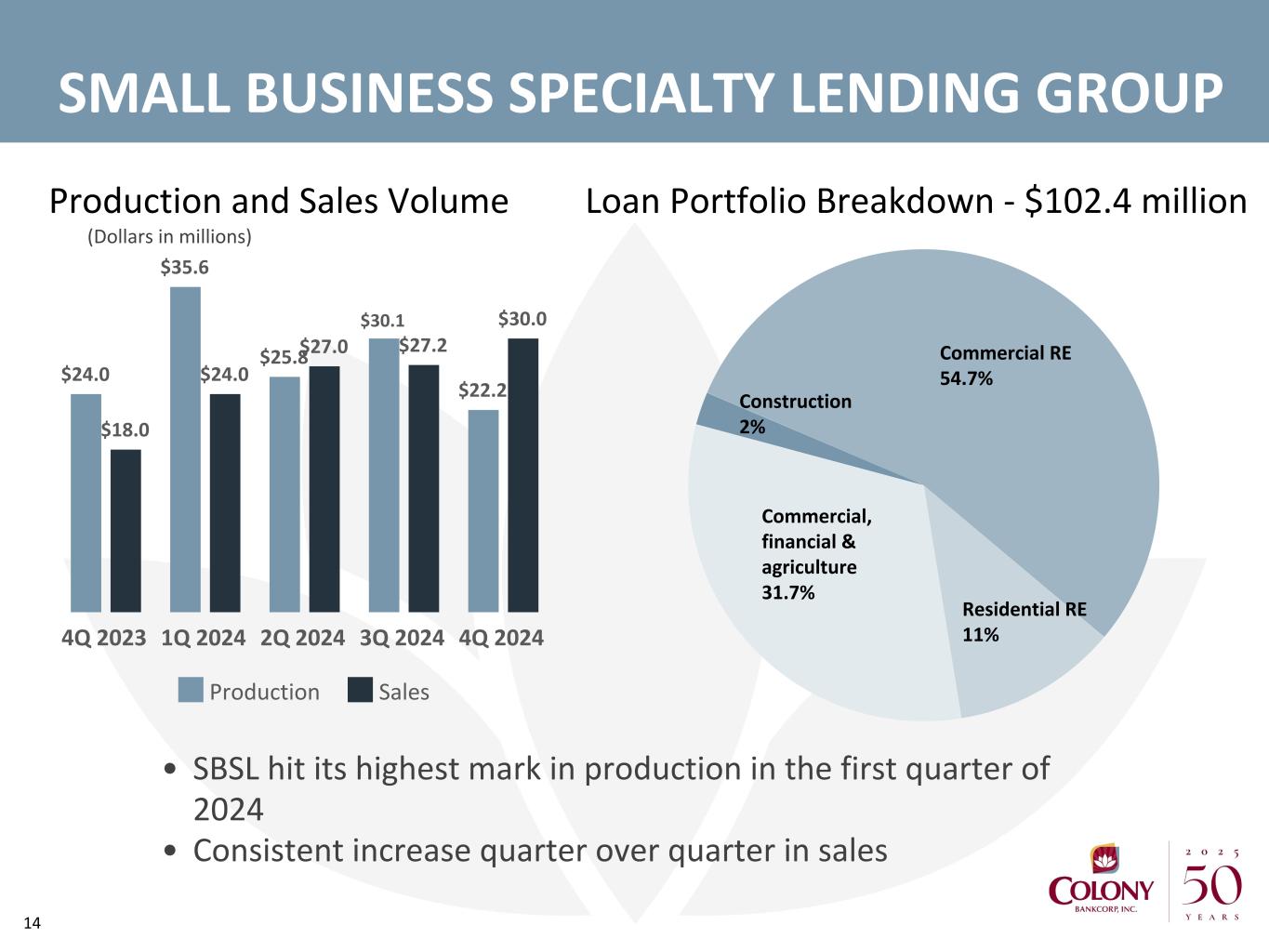

14 SMALL BUSINESS SPECIALTY LENDING GROUP (Dollars in millions) Production and Sales Volume $24.0 $35.6 $25.8 $30.1 $22.2 $18.0 $24.0 $27.0 $27.2 $30.0 Production Sales 4Q 2023 1Q 2024 2Q 2024 3Q 2024 4Q 2024 • SBSL hit its highest mark in production in the first quarter of 2024 • Consistent increase quarter over quarter in sales Loan Portfolio Breakdown - $102.4 million Construction 2% Commercial RE 54.7% Residential RE 11% Commercial, financial & agriculture 31.7%

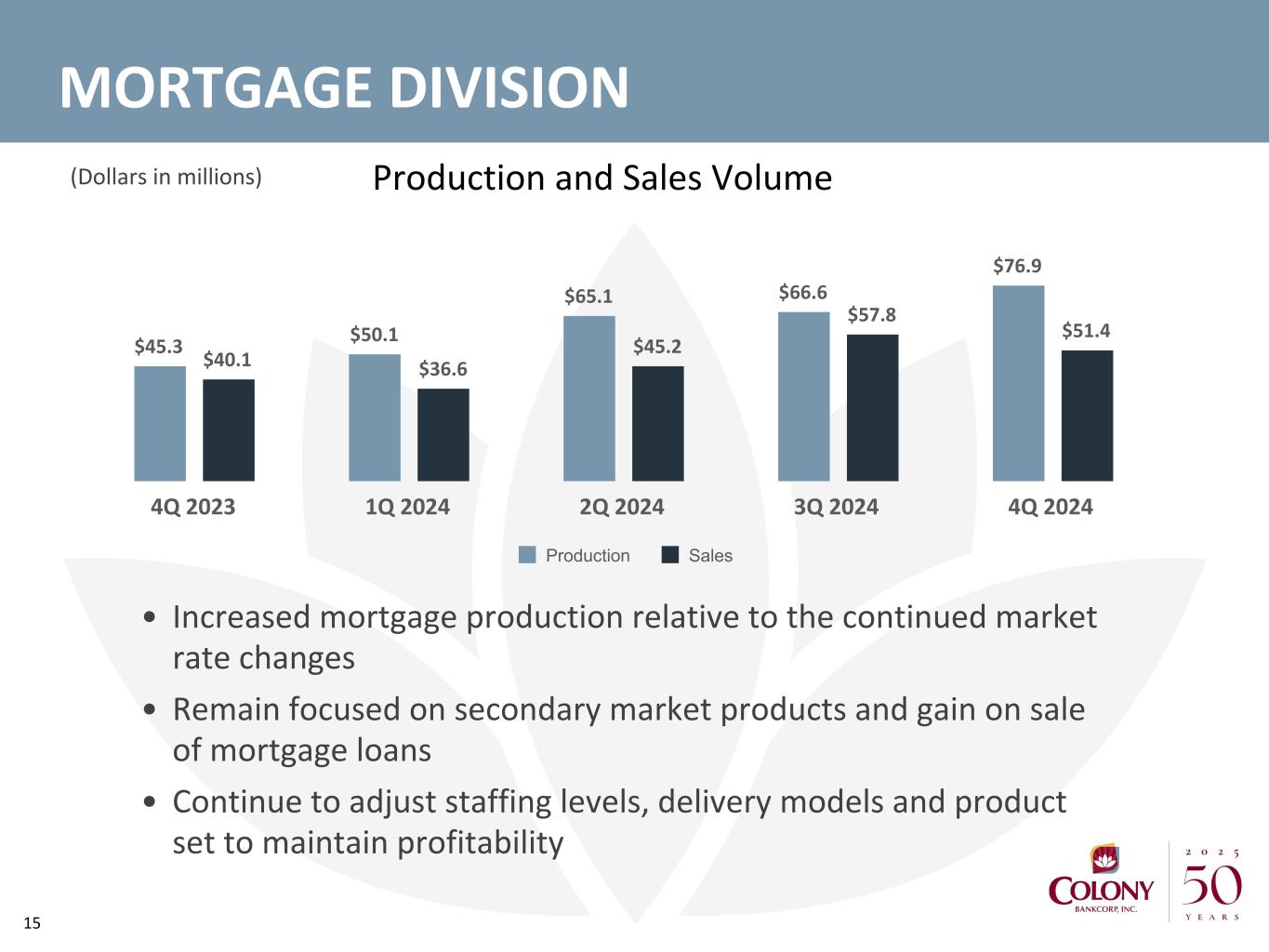

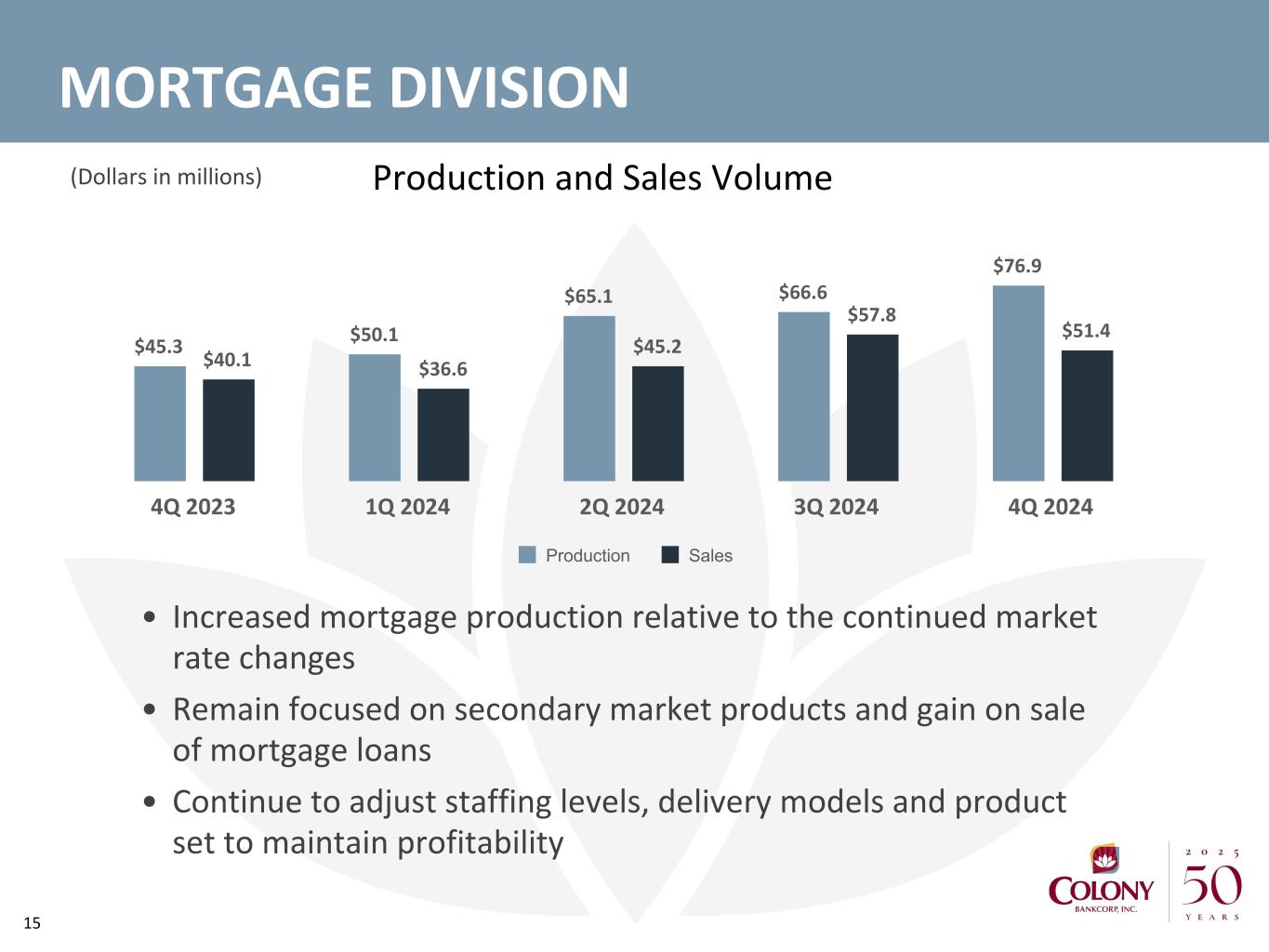

15 MORTGAGE DIVISION (Dollars in millions) • Increased mortgage production relative to the continued market rate changes • Remain focused on secondary market products and gain on sale of mortgage loans • Continue to adjust staffing levels, delivery models and product set to maintain profitability $45.3 $50.1 $65.1 $66.6 $76.9 $40.1 $36.6 $45.2 $57.8 $51.4 Production Sales 4Q 2023 1Q 2024 2Q 2024 3Q 2024 4Q 2024 Production and Sales Volume

16 The current indicated annual rate is $0.46 per share, equating to a yield of 2.9%.(2) SHAREHOLDER FOCUSED DIVIDEND POLICY (1) The Board of Directors declared a dividend to be paid on its common stock on February 19, 2025, to shareholders of record as of the close of business on February 5, 2025. (2) Yield is based on closing stock price on January 20, 2025 of $15.84. Quarterly Dividend Payment $0.1025 $0.1075 $0.1100 $0.1125 $0.1150 2021 2022 2023 2024 2025(¹)

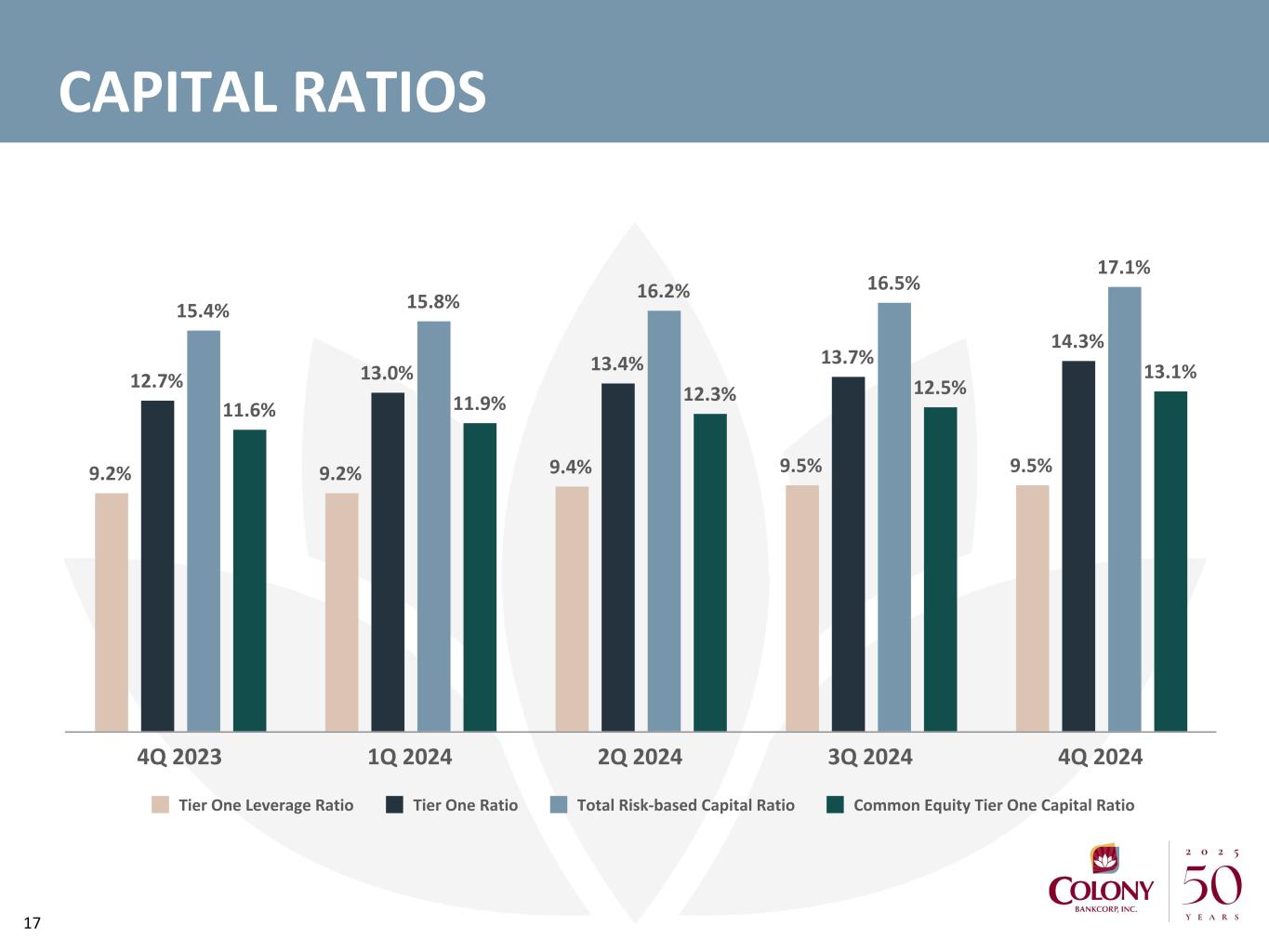

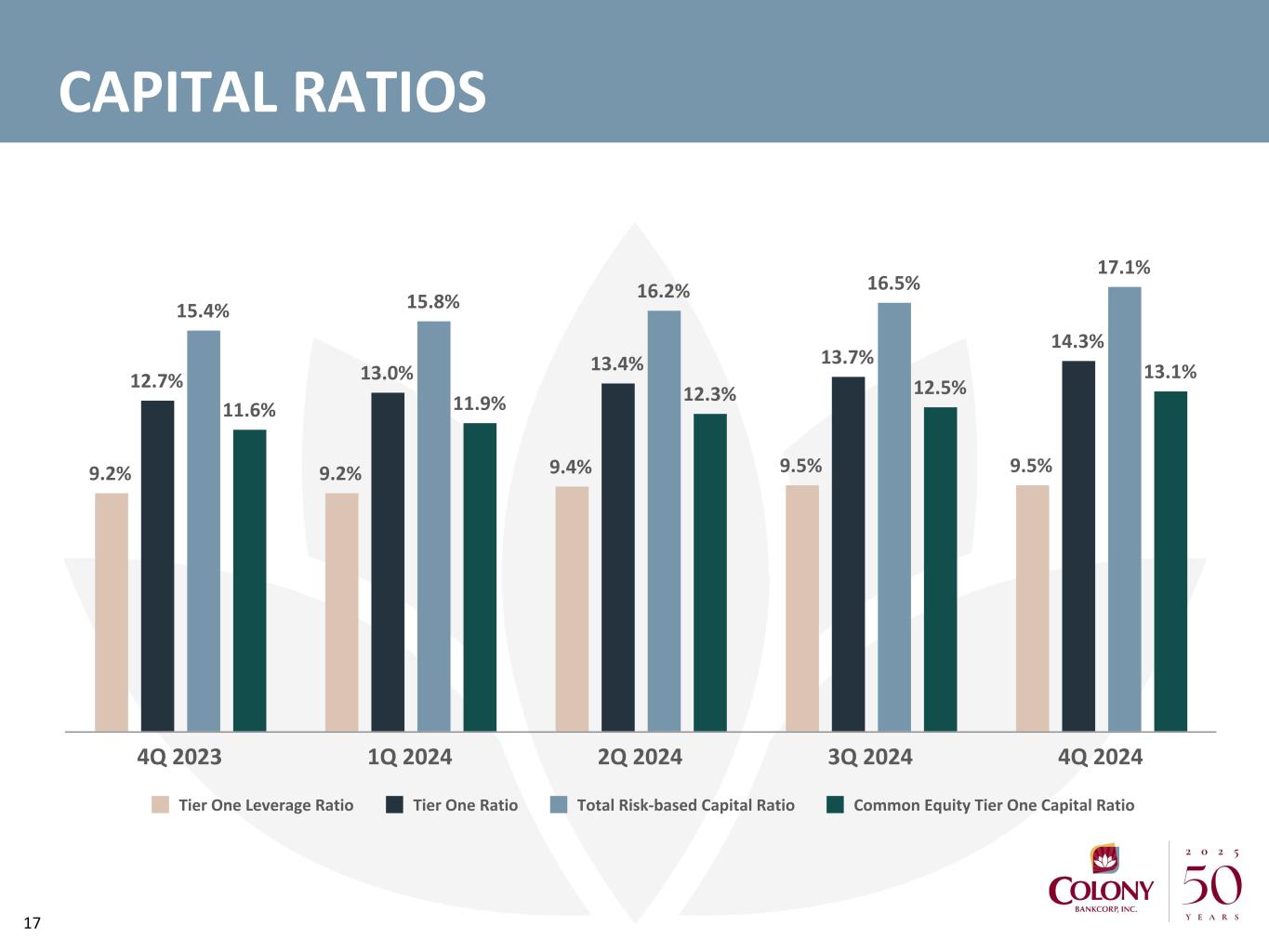

17 CAPITAL RATIOS 9.2% 9.2% 9.4% 9.5% 9.5% 12.7% 13.0% 13.4% 13.7% 14.3% 15.4% 15.8% 16.2% 16.5% 17.1% 11.6% 11.9% 12.3% 12.5% 13.1% Tier One Leverage Ratio Tier One Ratio Total Risk-based Capital Ratio Common Equity Tier One Capital Ratio 4Q 2023 1Q 2024 2Q 2024 3Q 2024 4Q 2024

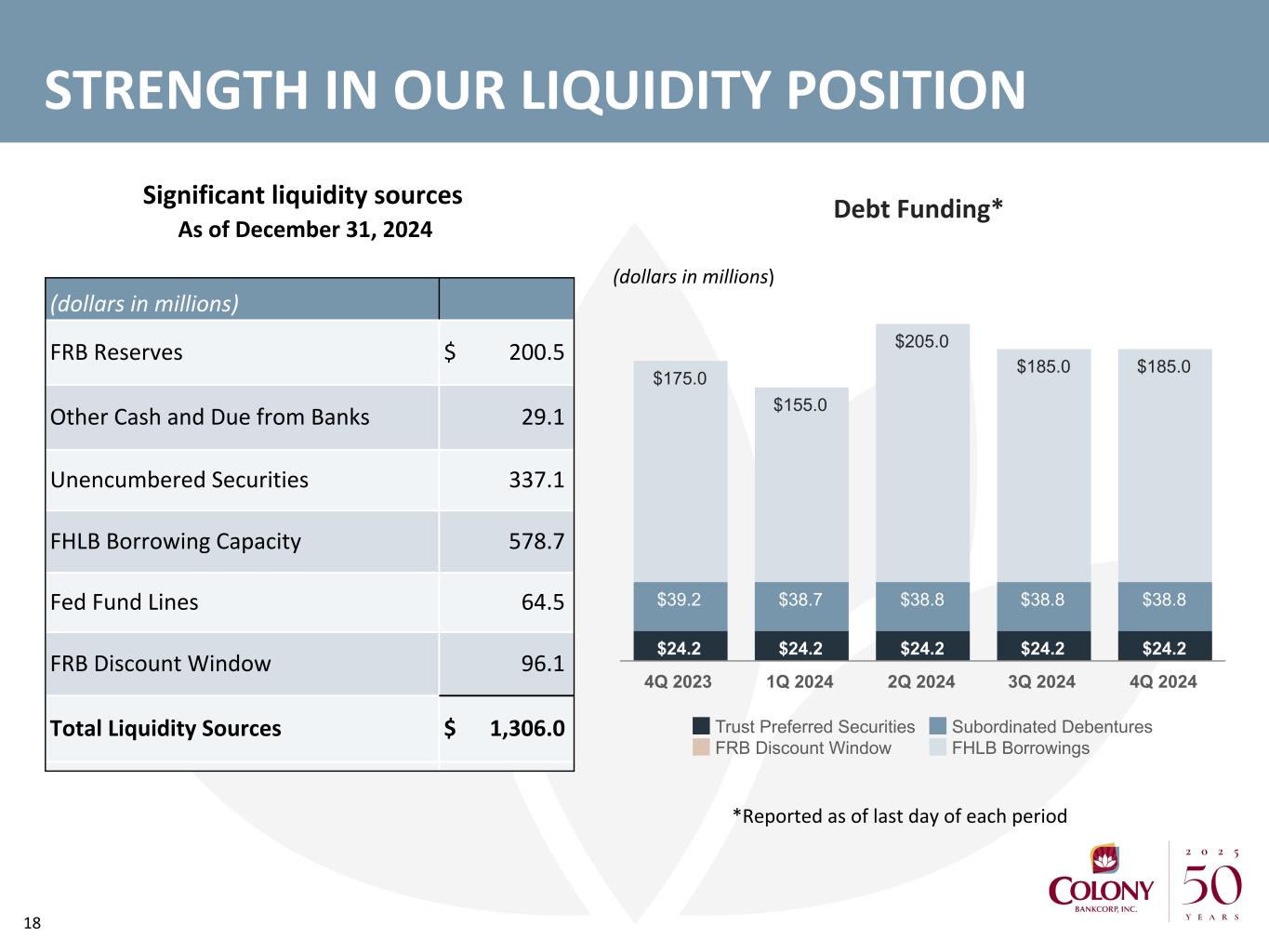

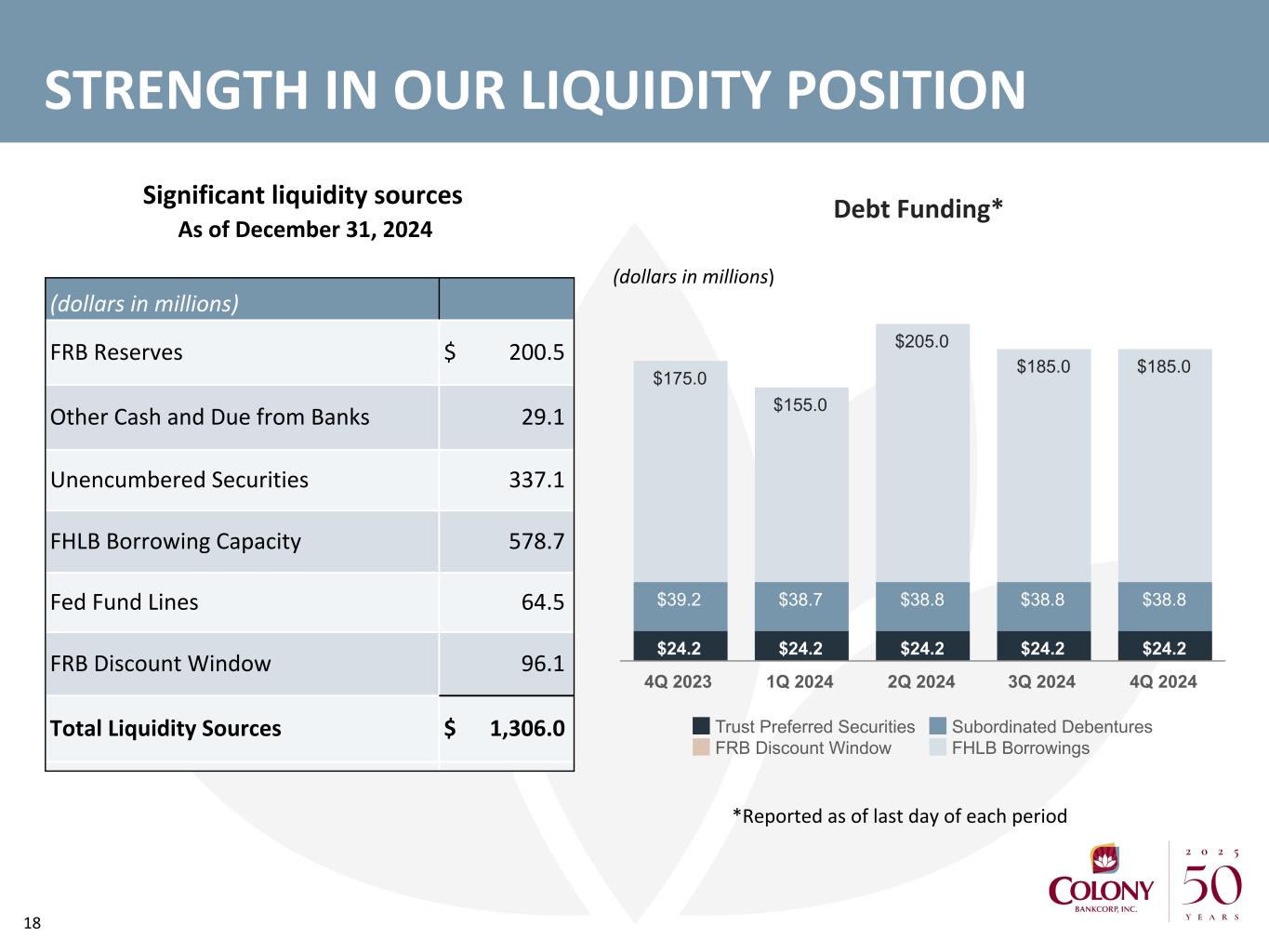

18 STRENGTH IN OUR LIQUIDITY POSITION Significant liquidity sources (dollars in millions) FRB Reserves $ 200.5 Other Cash and Due from Banks 29.1 Unencumbered Securities 337.1 FHLB Borrowing Capacity 578.7 Fed Fund Lines 64.5 FRB Discount Window 96.1 Total Liquidity Sources $ 1,306.0 $24.2 $24.2 $24.2 $24.2 $24.2 $39.2 $38.7 $38.8 $38.8 $38.8 $175.0 $155.0 $205.0 $185.0 $185.0 Trust Preferred Securities Subordinated Debentures FRB Discount Window FHLB Borrowings 4Q 2023 1Q 2024 2Q 2024 3Q 2024 4Q 2024 Debt Funding* (dollars in millions) *Reported as of last day of each period As of December 31, 2024

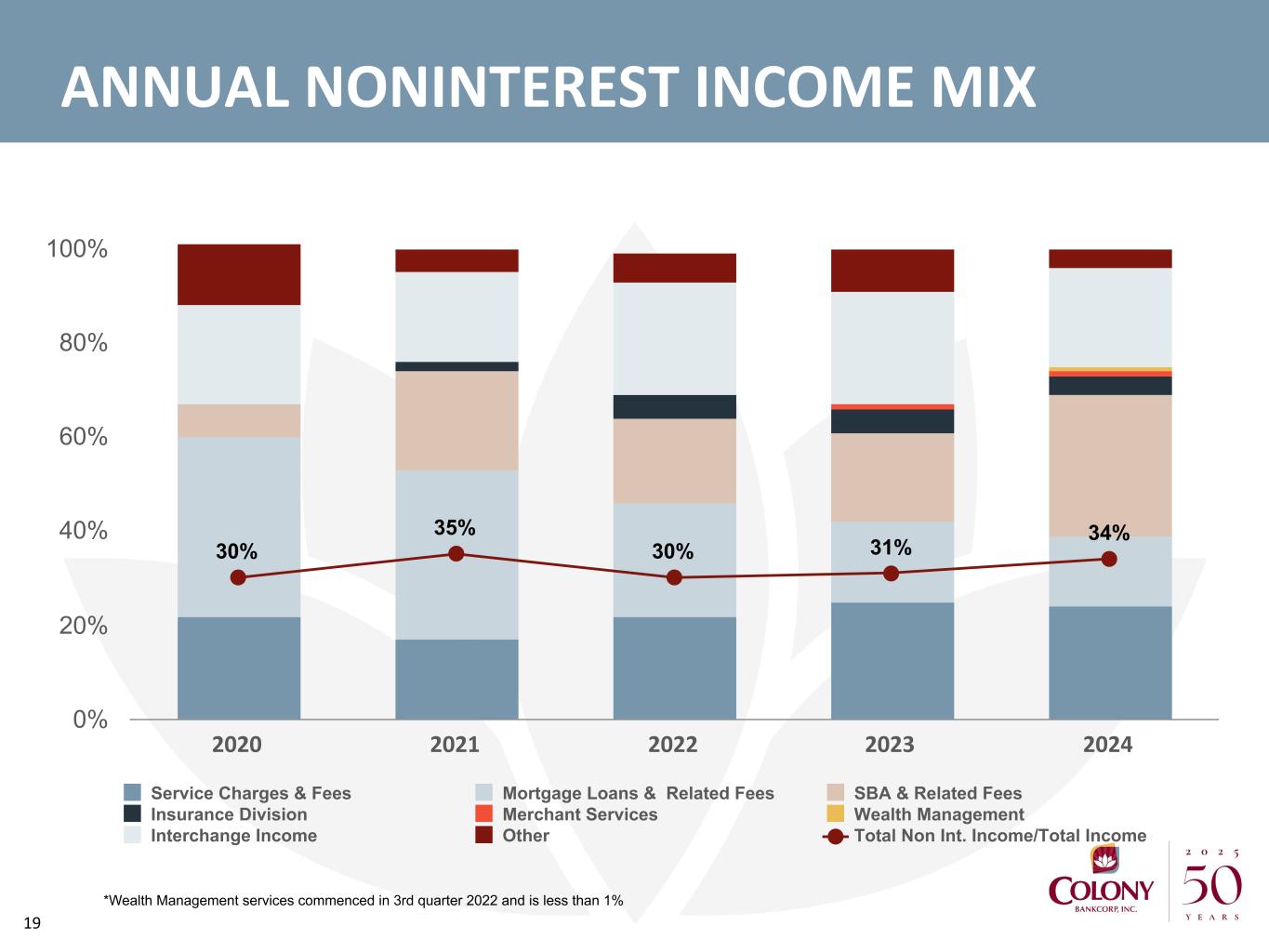

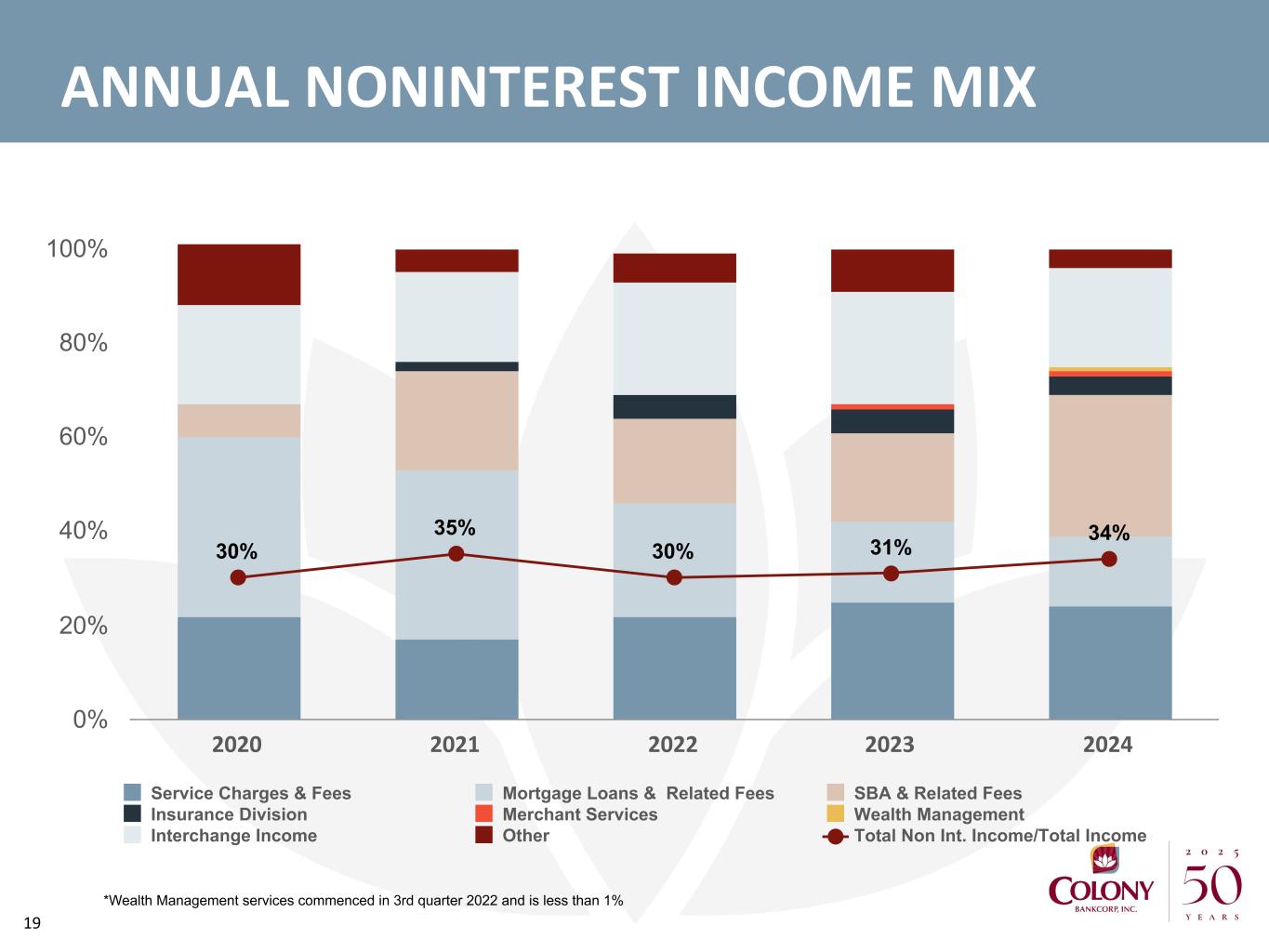

19 30% 35% 30% 31% 34% Service Charges & Fees Mortgage Loans & Related Fees SBA & Related Fees Insurance Division Merchant Services Wealth Management Interchange Income Other Total Non Int. Income/Total Income 2020 2021 2022 2023 2024 0% 20% 40% 60% 80% 100% ANNUAL NONINTEREST INCOME MIX *Wealth Management services commenced in 3rd quarter 2022 and is less than 1%

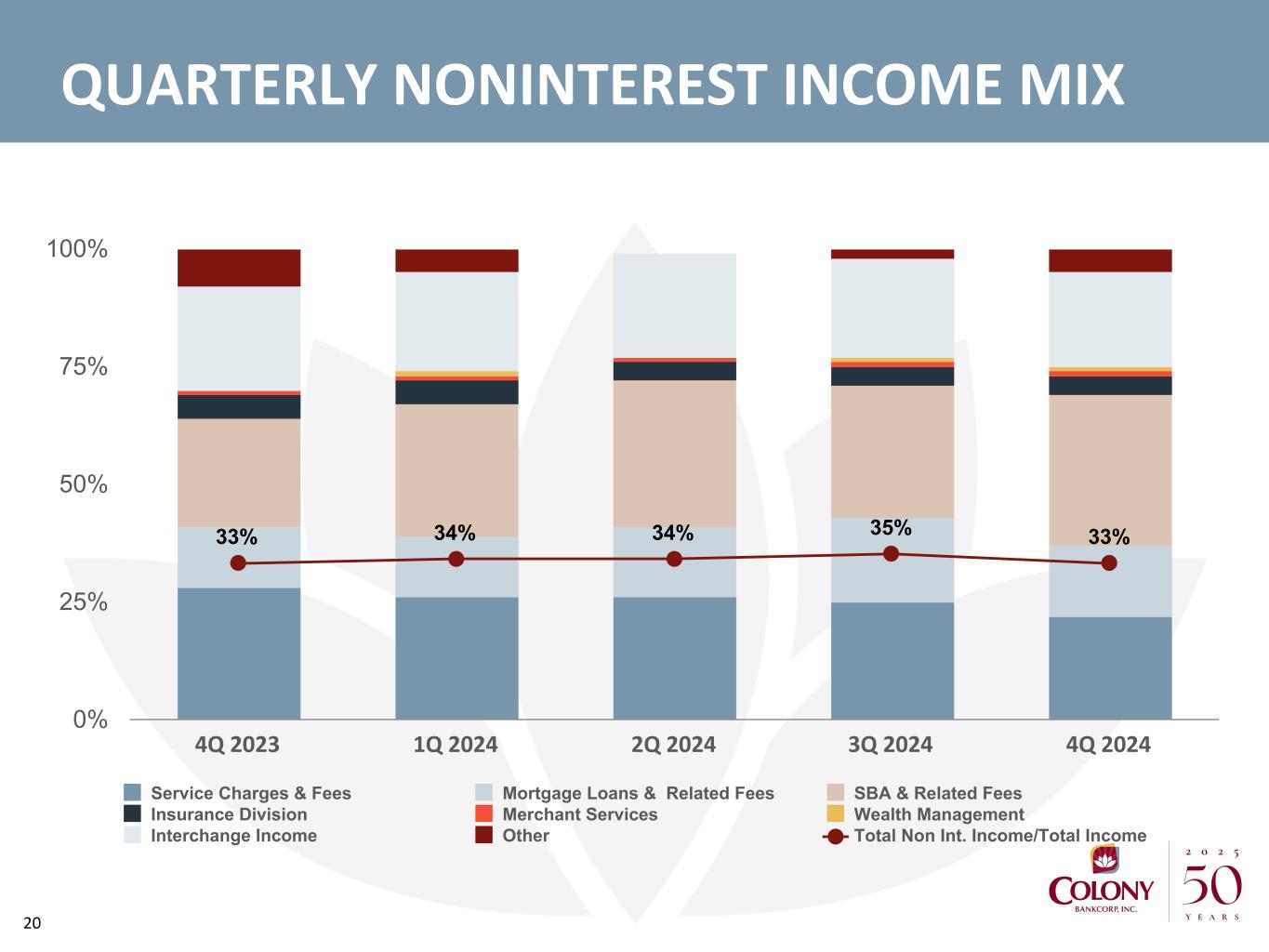

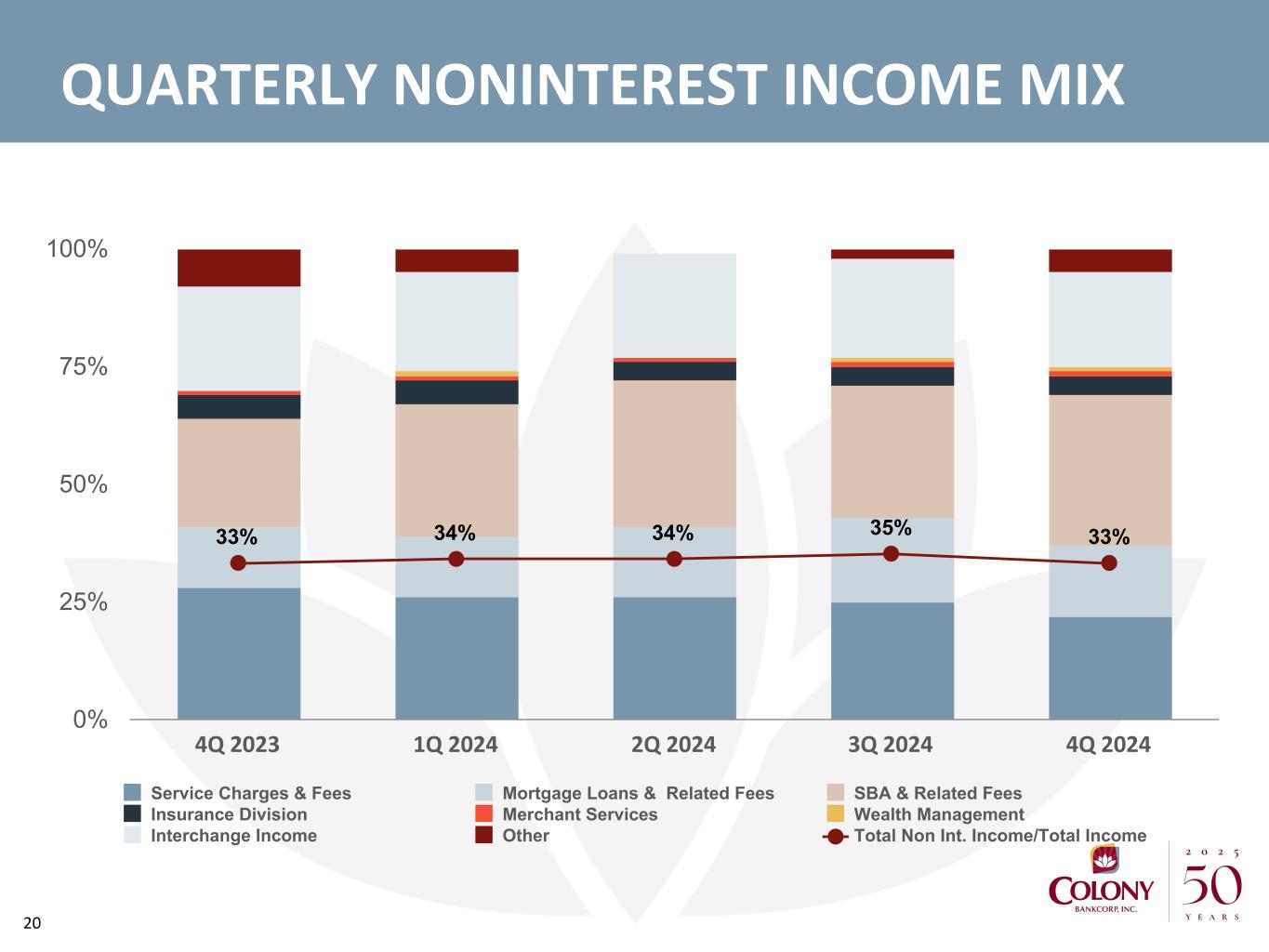

20 33% 34% 34% 35% 33% Service Charges & Fees Mortgage Loans & Related Fees SBA & Related Fees Insurance Division Merchant Services Wealth Management Interchange Income Other Total Non Int. Income/Total Income 4Q 2023 1Q 2024 2Q 2024 3Q 2024 4Q 2024 0% 25% 50% 75% 100% QUARTERLY NONINTEREST INCOME MIX

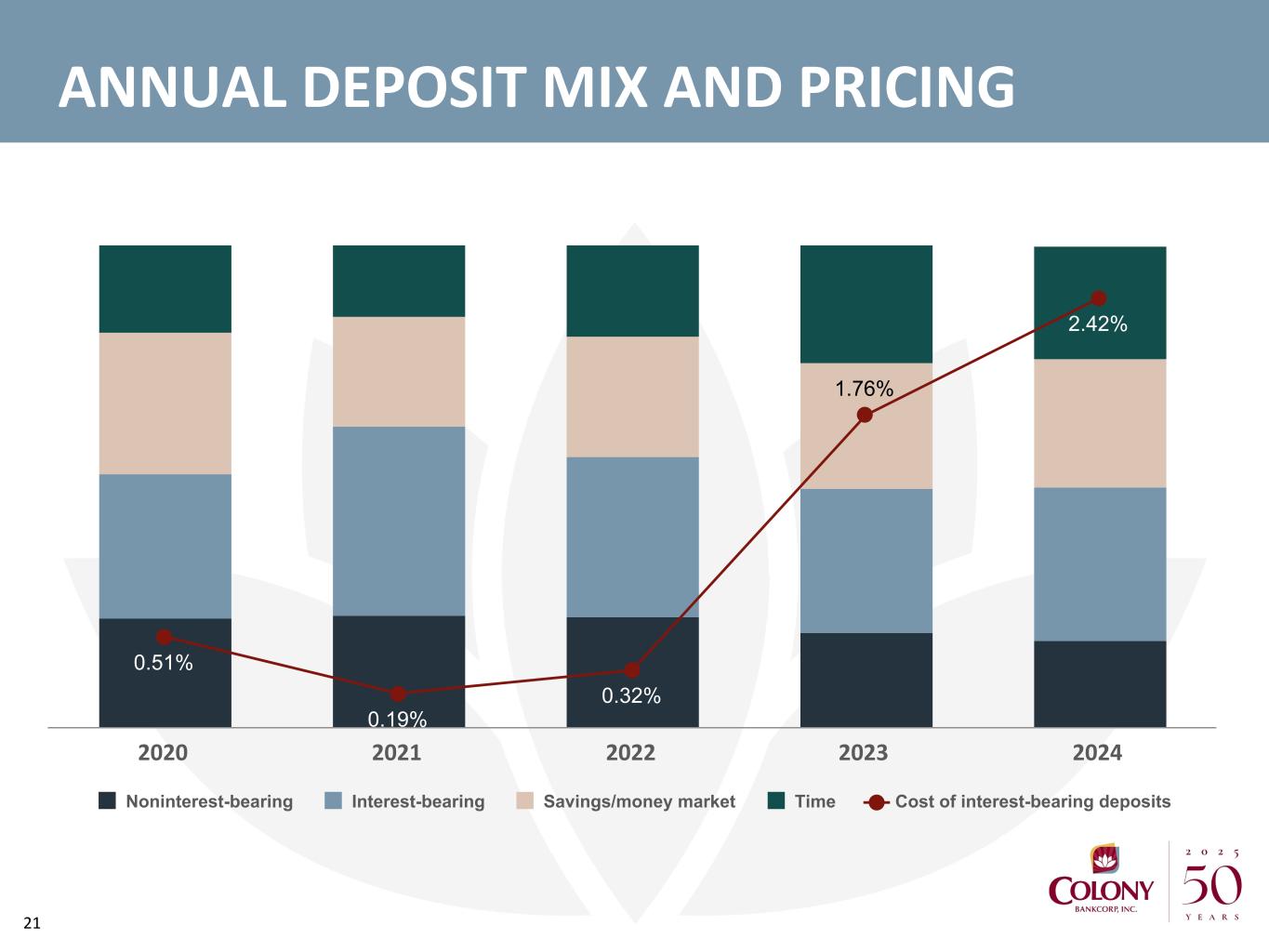

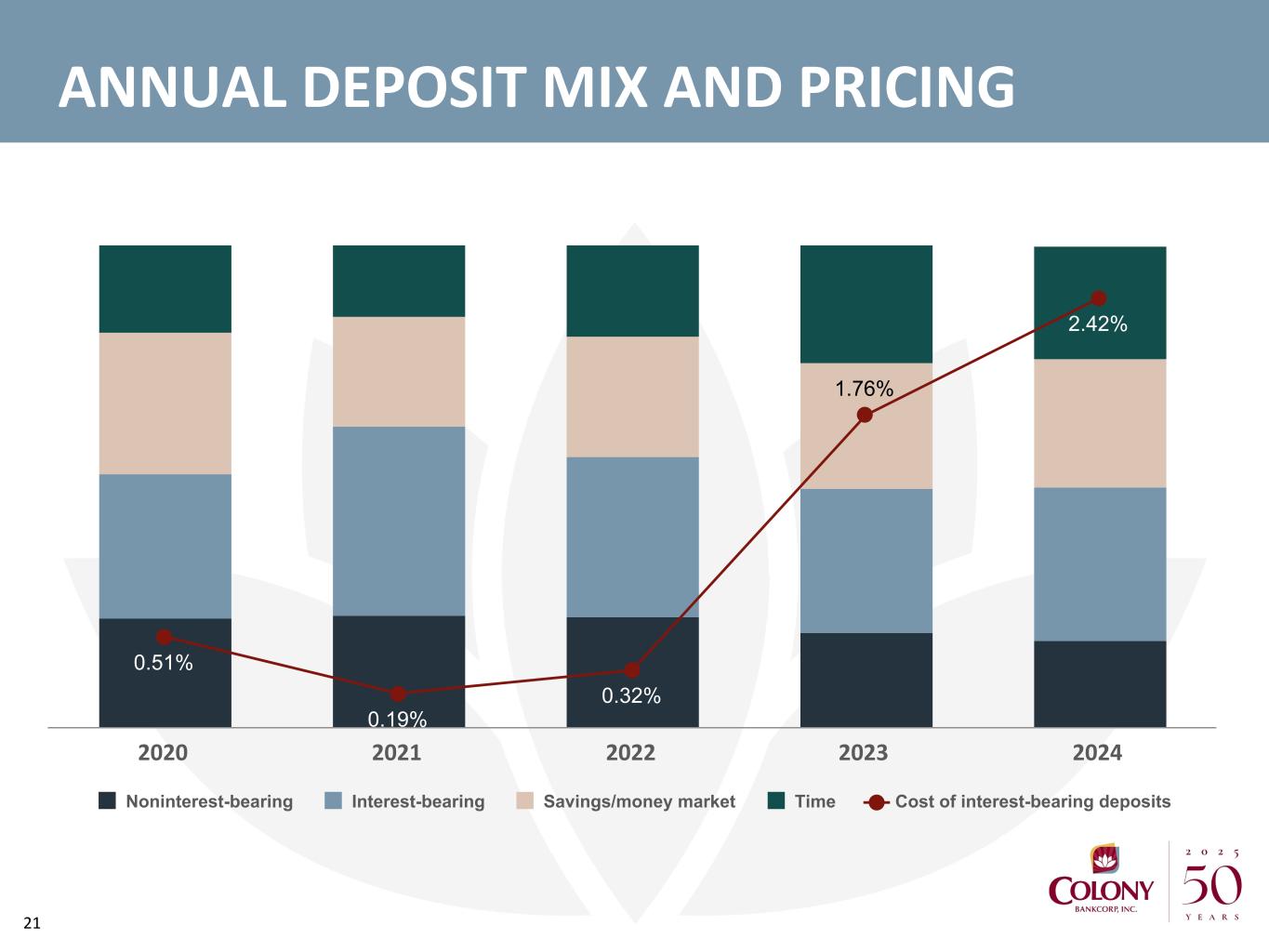

21 0.51% 0.19% 0.32% 1.76% 2.42% Noninterest-bearing Interest-bearing Savings/money market Time Cost of interest-bearing deposits 2020 2021 2022 2023 2024 ANNUAL DEPOSIT MIX AND PRICING

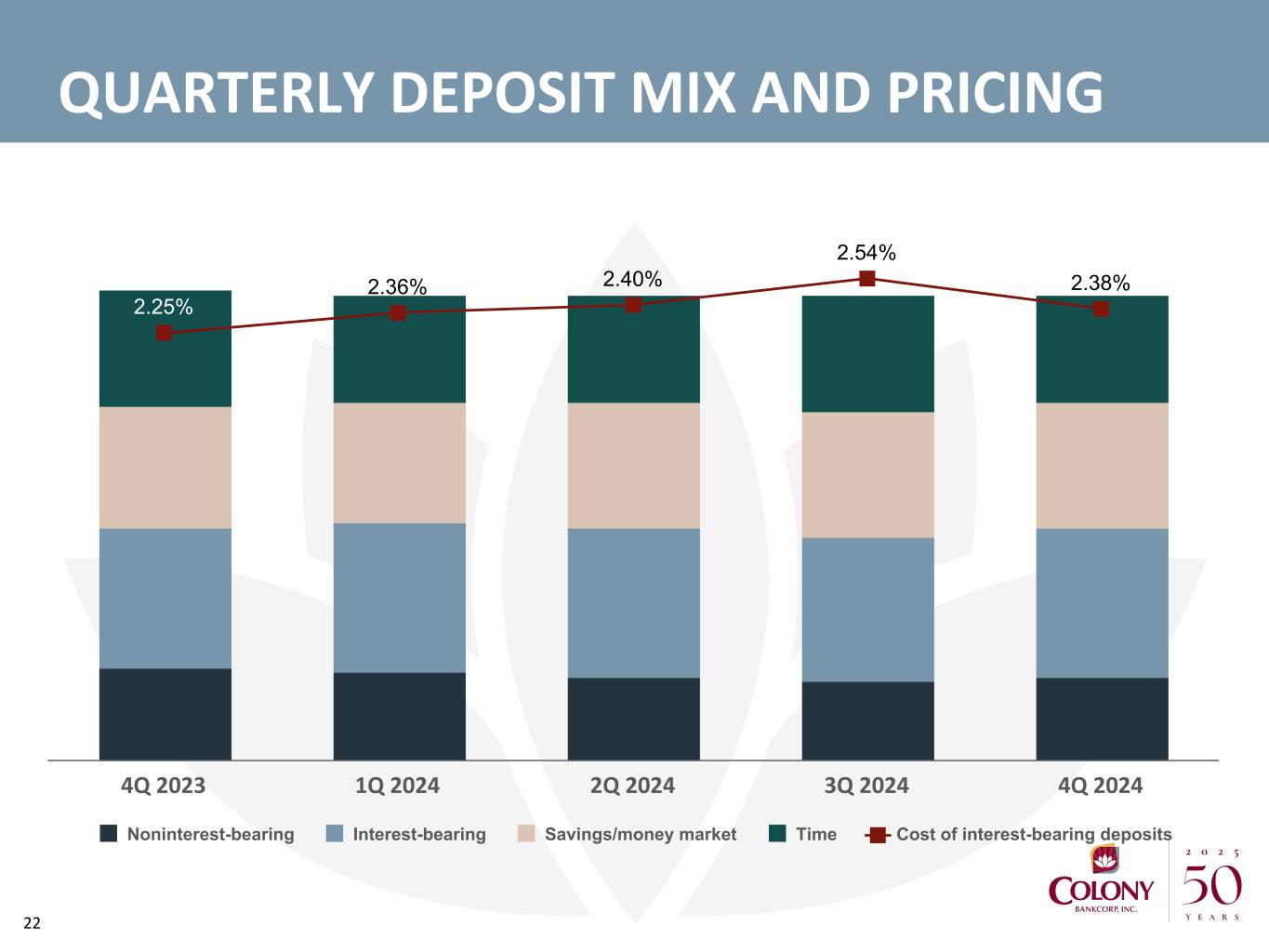

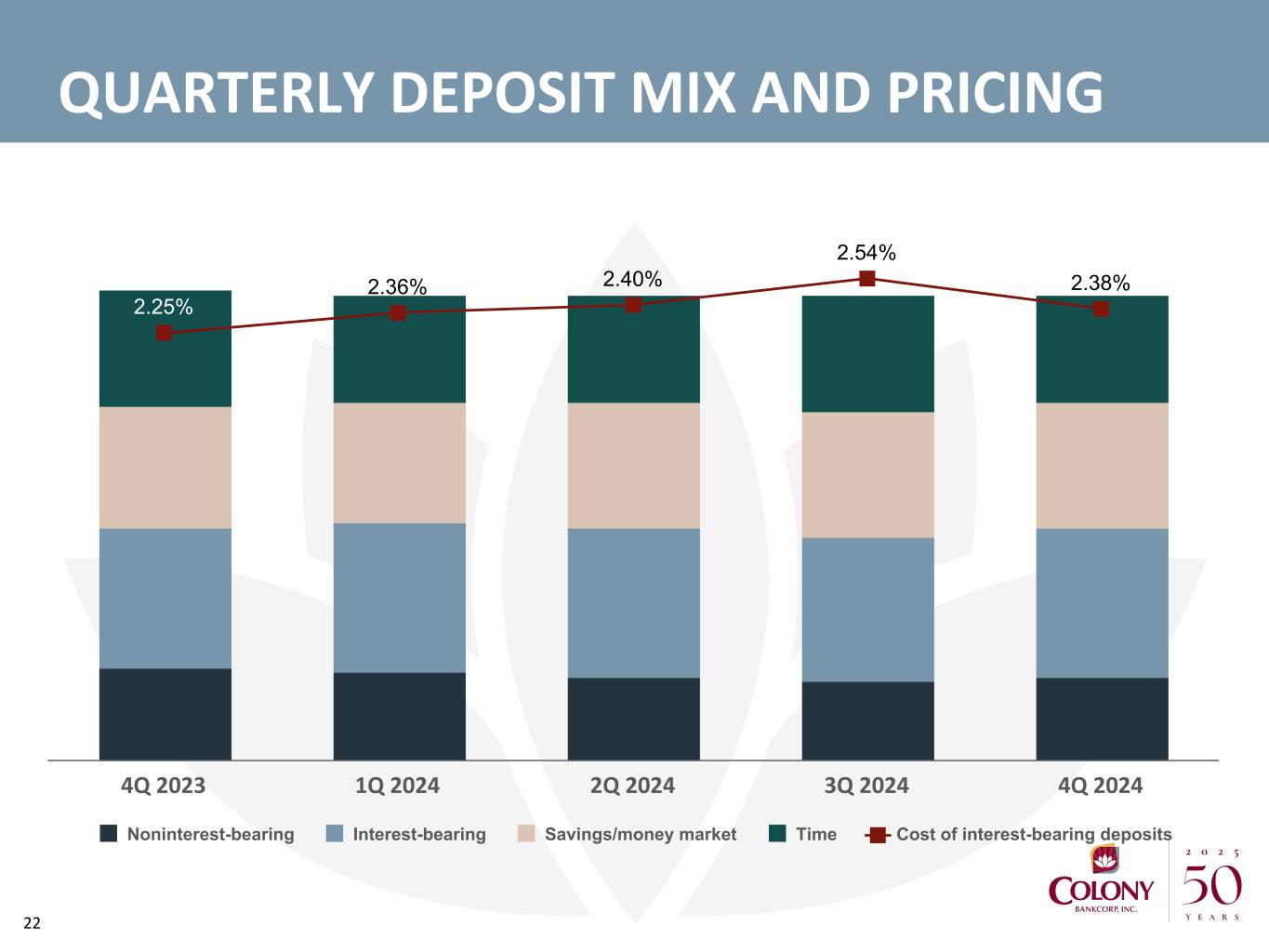

22 2.25% 2.36% 2.40% 2.54% 2.38% Noninterest-bearing Interest-bearing Savings/money market Time Cost of interest-bearing deposits 4Q 2023 1Q 2024 2Q 2024 3Q 2024 4Q 2024 QUARTERLY DEPOSIT MIX AND PRICING

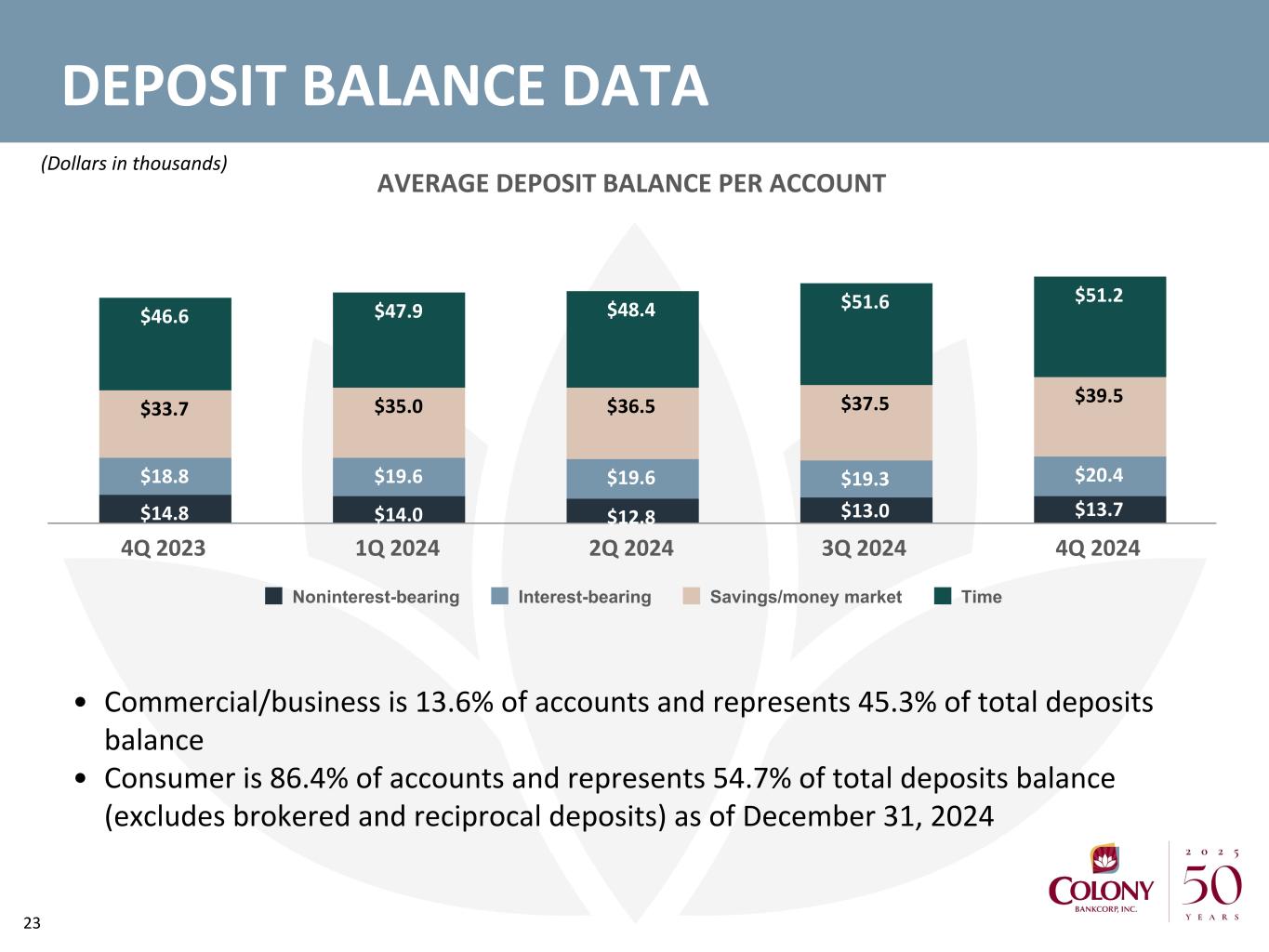

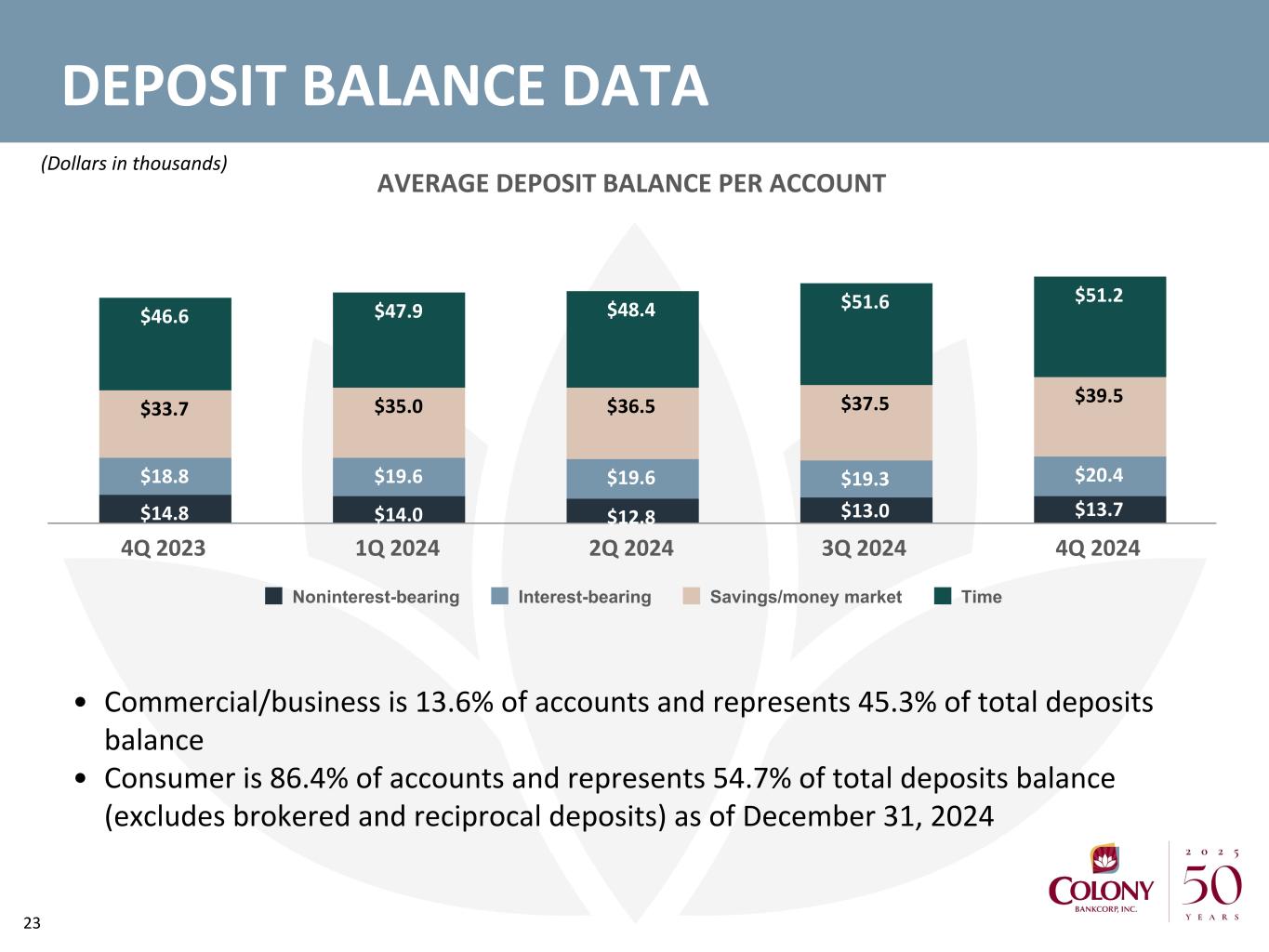

23 AVERAGE DEPOSIT BALANCE PER ACCOUNT $14.8 $14.0 $12.8 $13.0 $13.7 $18.8 $19.6 $19.6 $19.3 $20.4 $33.7 $35.0 $36.5 $37.5 $39.5 $46.6 $47.9 $48.4 $51.6 $51.2 Noninterest-bearing Interest-bearing Savings/money market Time 4Q 2023 1Q 2024 2Q 2024 3Q 2024 4Q 2024 DEPOSIT BALANCE DATA • Commercial/business is 13.6% of accounts and represents 45.3% of total deposits balance • Consumer is 86.4% of accounts and represents 54.7% of total deposits balance (excludes brokered and reciprocal deposits) as of December 31, 2024 (Dollars in thousands)

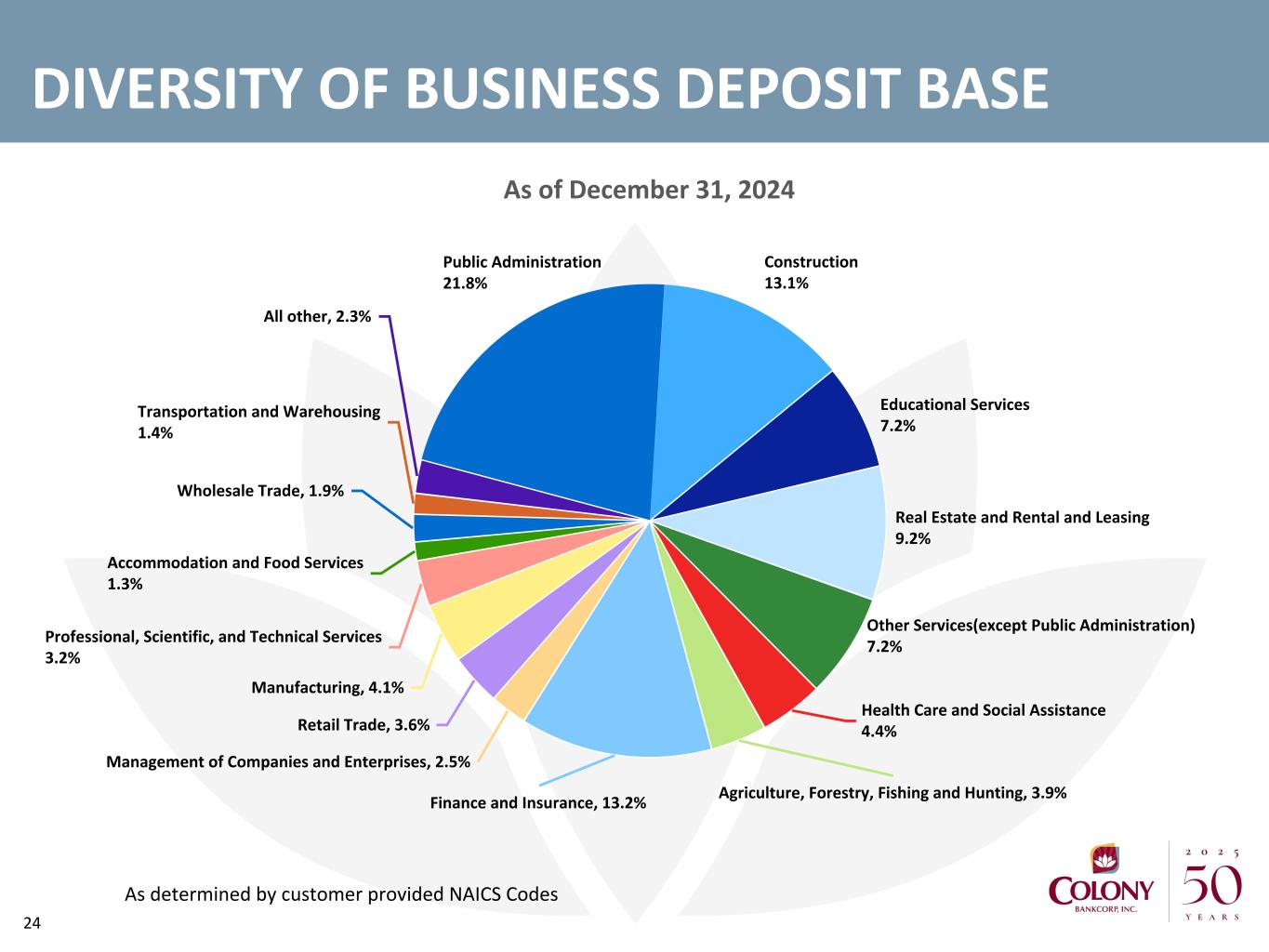

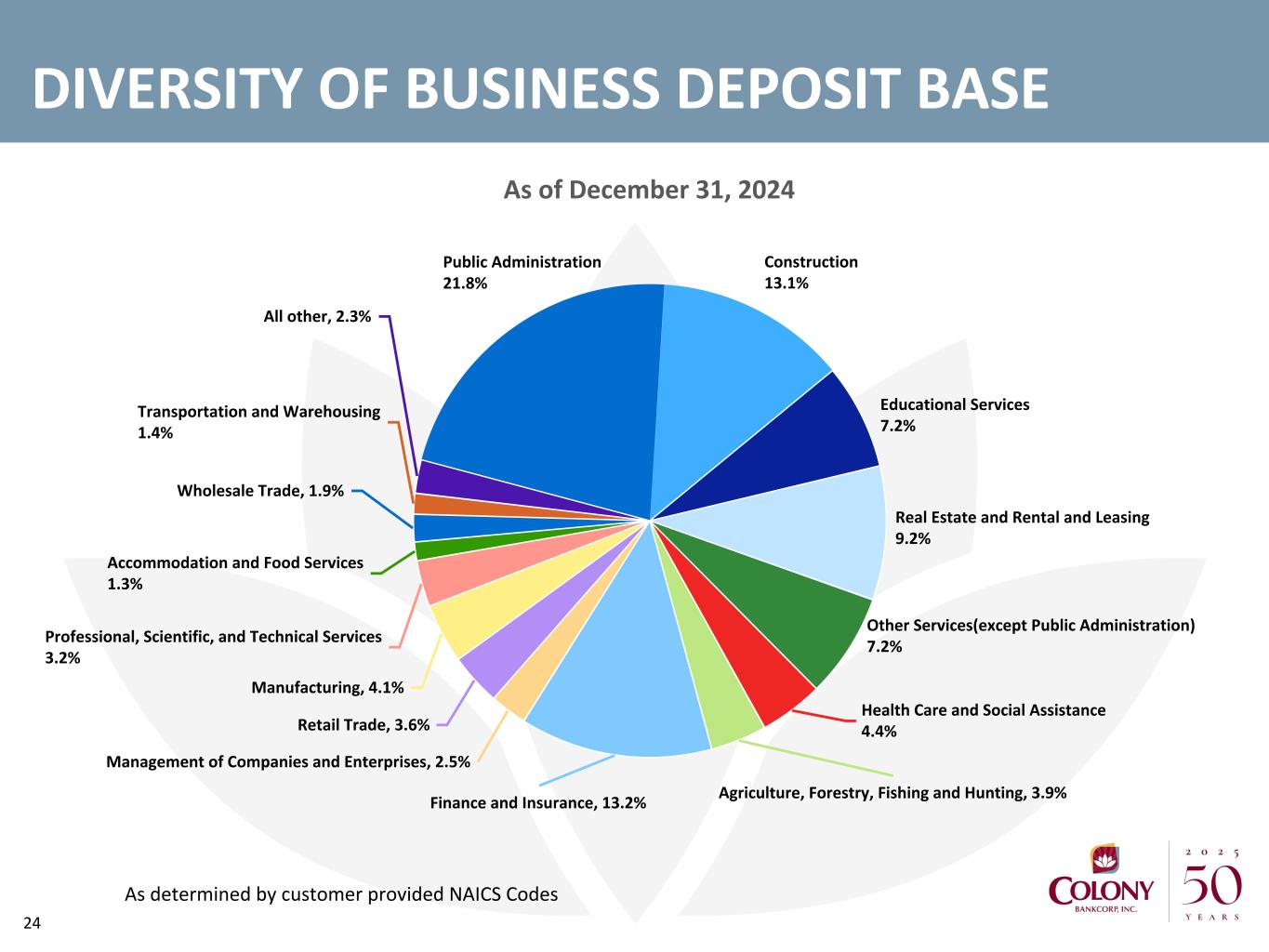

24 DIVERSITY OF BUSINESS DEPOSIT BASE As of December 31, 2024 Public Administration 21.8% Construction 13.1% Educational Services 7.2% Real Estate and Rental and Leasing 9.2% Other Services(except Public Administration) 7.2% Health Care and Social Assistance 4.4% Agriculture, Forestry, Fishing and Hunting, 3.9%Finance and Insurance, 13.2% Management of Companies and Enterprises, 2.5% Retail Trade, 3.6% Manufacturing, 4.1% Professional, Scientific, and Technical Services 3.2% Accommodation and Food Services 1.3% Wholesale Trade, 1.9% Transportation and Warehousing 1.4% All other, 2.3% As determined by customer provided NAICS Codes

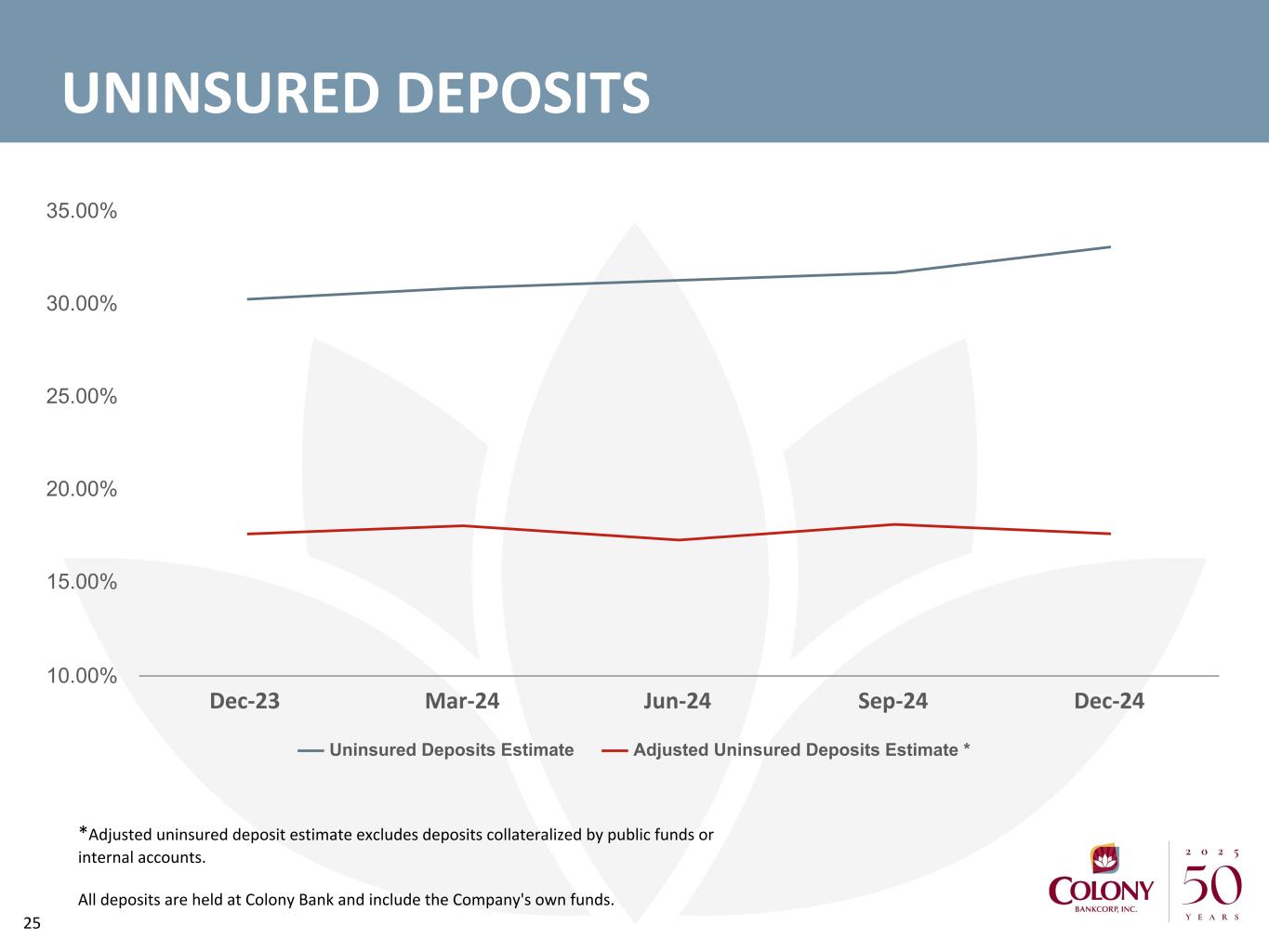

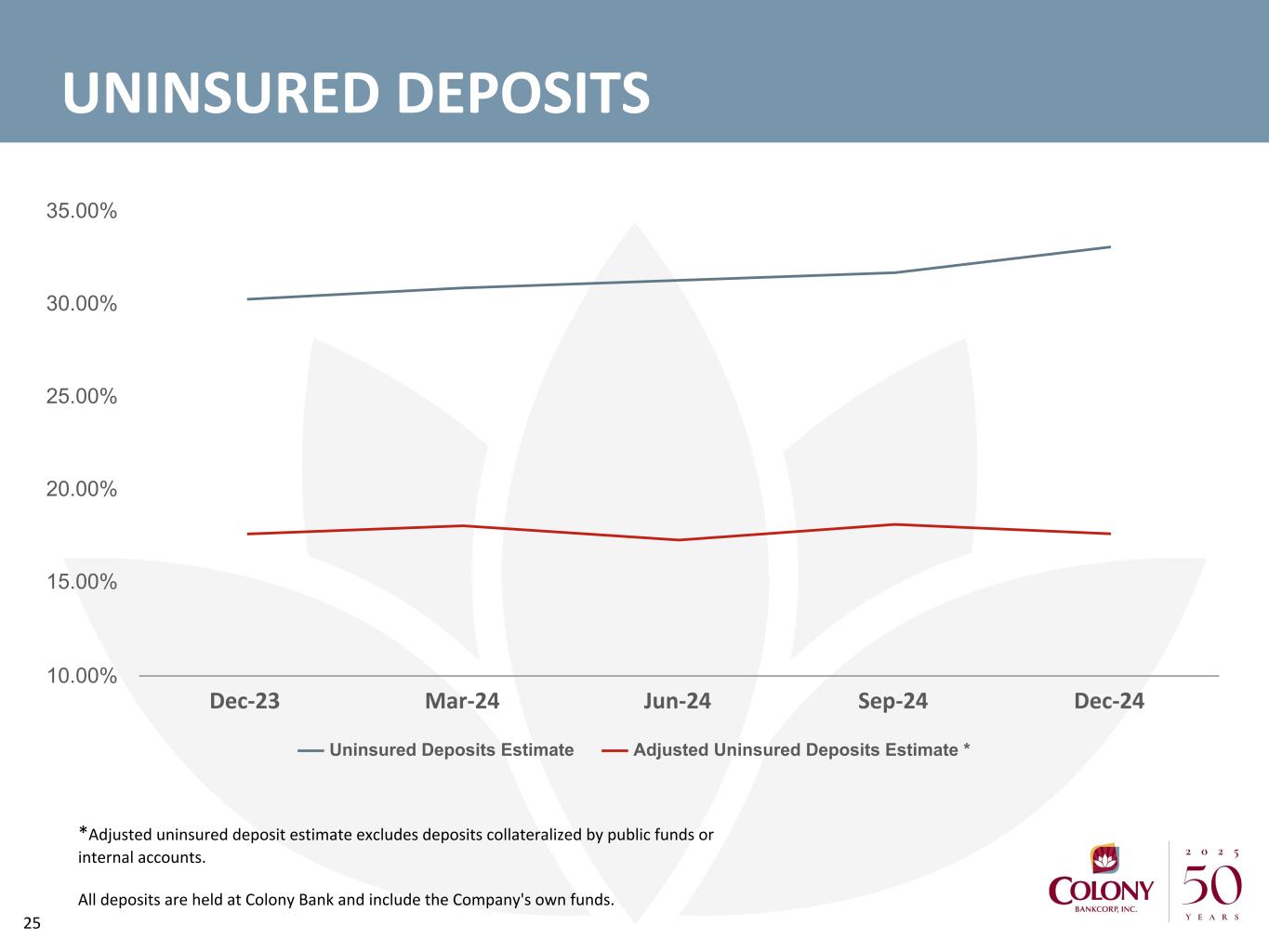

25 Uninsured Deposits Estimate Adjusted Uninsured Deposits Estimate * Dec-23 Mar-24 Jun-24 Sep-24 Dec-24 10.00% 15.00% 20.00% 25.00% 30.00% 35.00% UNINSURED DEPOSITS *Adjusted uninsured deposit estimate excludes deposits collateralized by public funds or internal accounts. All deposits are held at Colony Bank and include the Company's own funds.

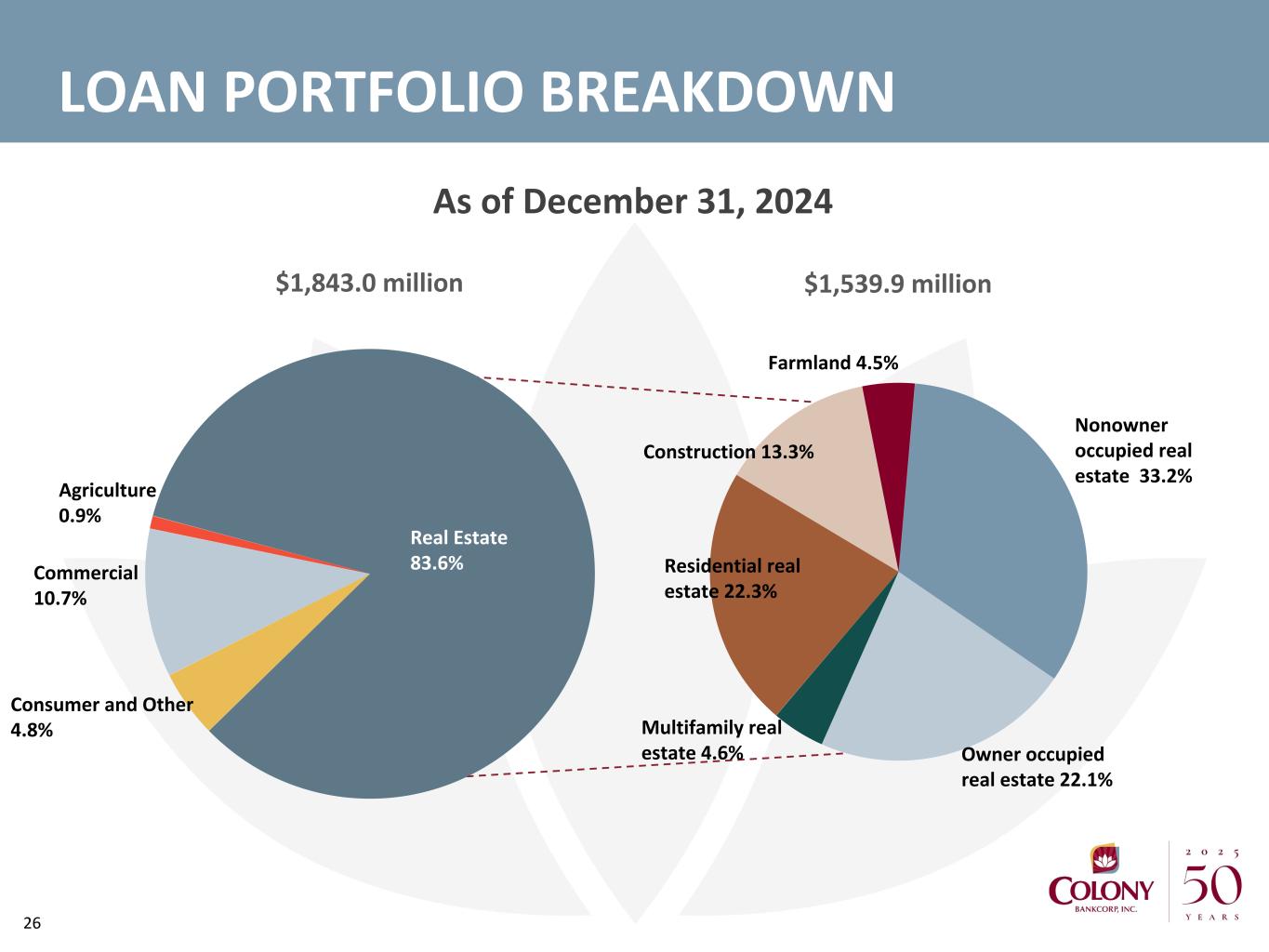

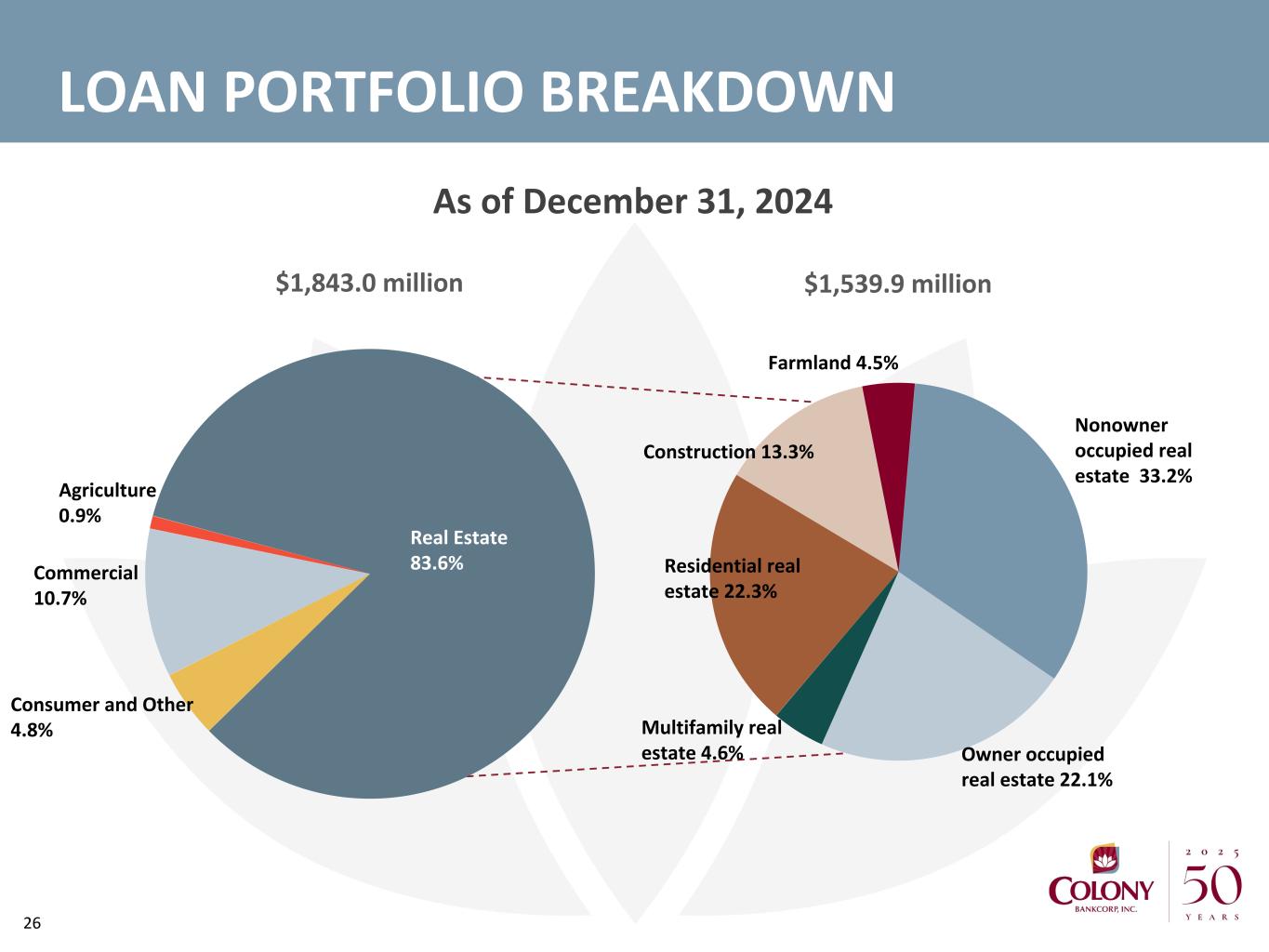

26 LOAN PORTFOLIO BREAKDOWN As of December 31, 2024 $1,843.0 million Real Estate 83.6% Consumer and Other 4.8% Commercial 10.7% Agriculture 0.9% $1,539.9 million Multifamily real estate 4.6% Residential real estate 22.3% Construction 13.3% Farmland 4.5% Nonowner occupied real estate 33.2% Owner occupied real estate 22.1%

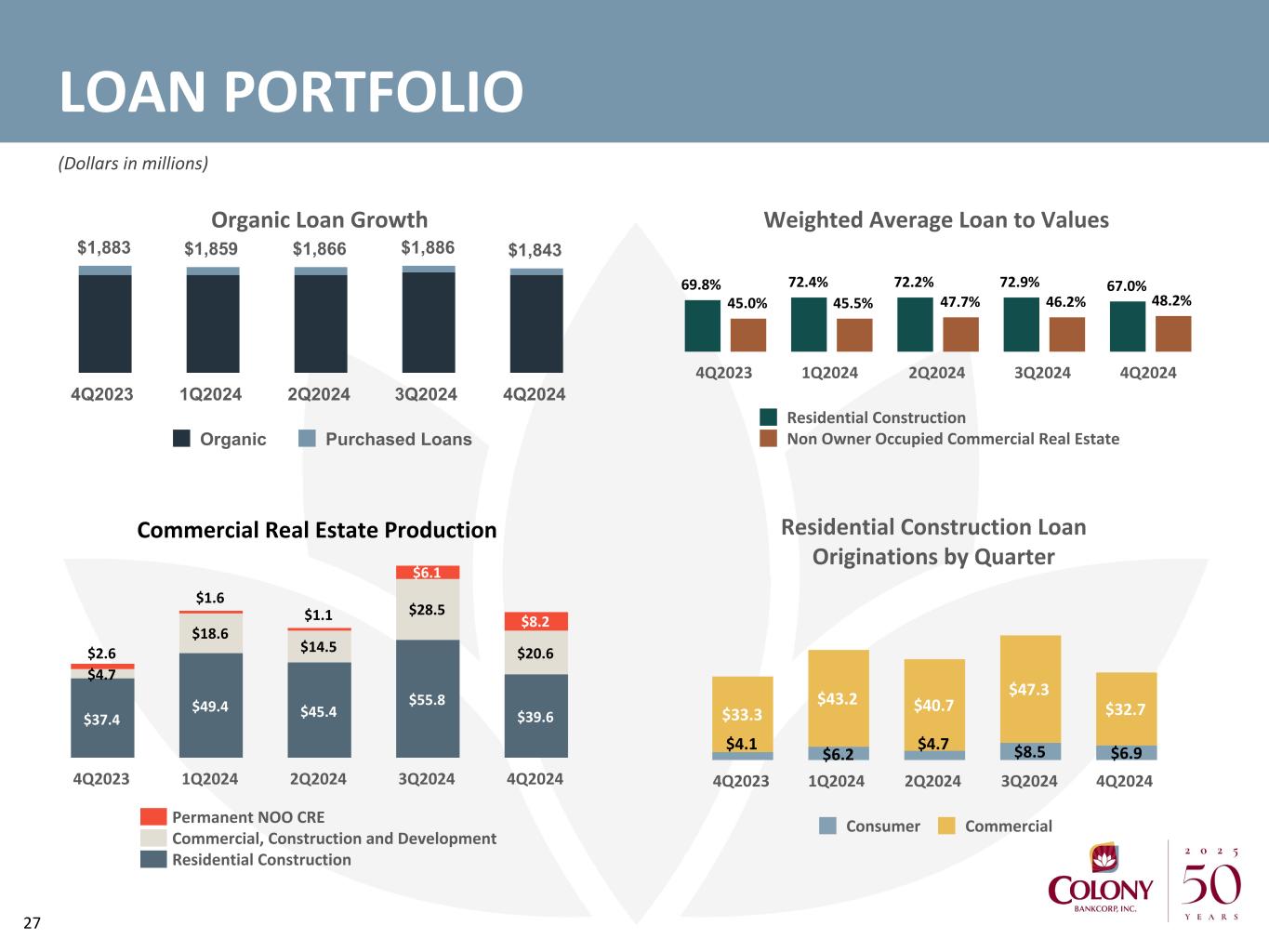

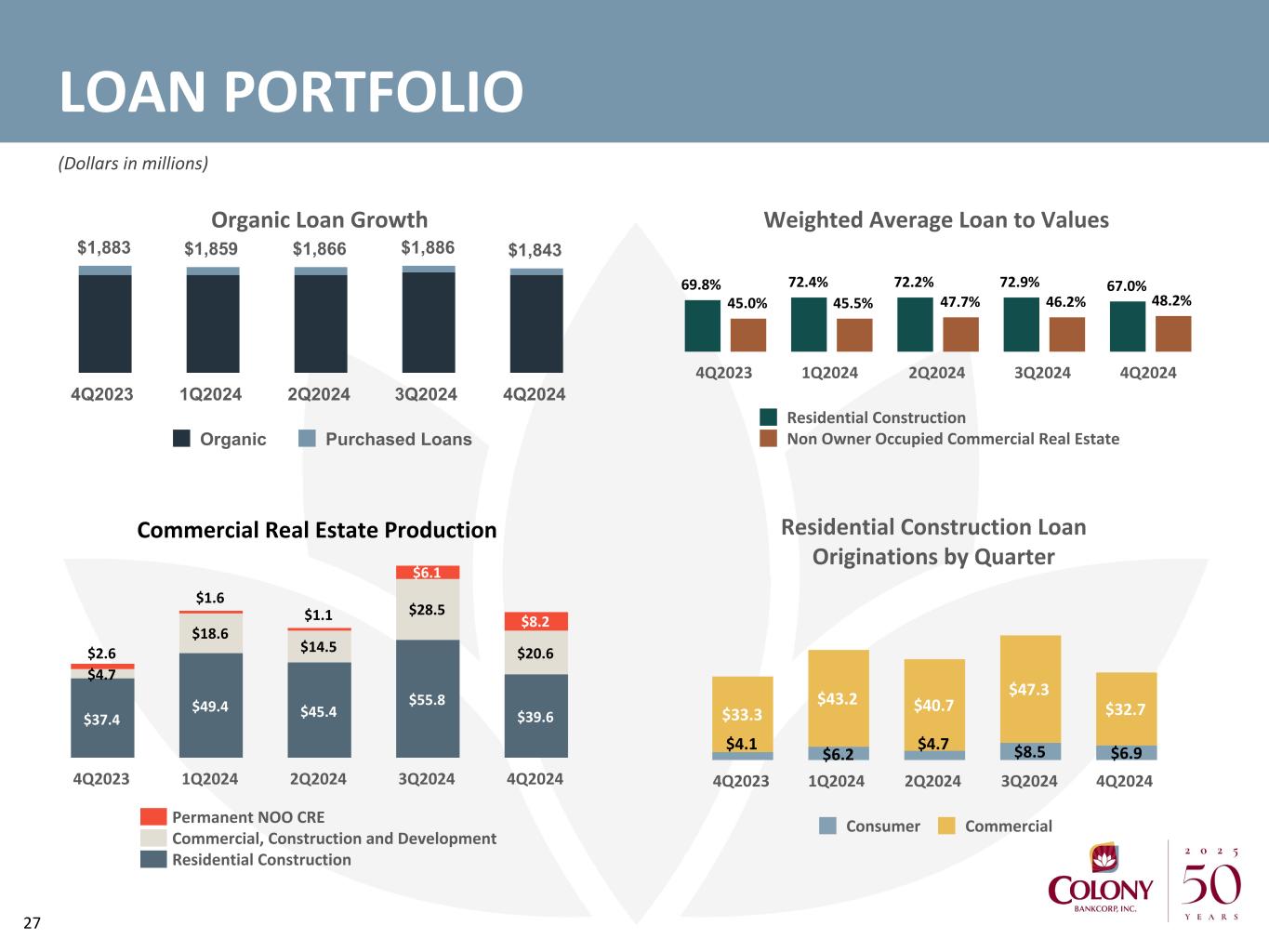

27 LOAN PORTFOLIO (Dollars in millions) Organic Loan Growth $1,883 $1,859 $1,866 $1,886 $1,843 Organic Purchased Loans 4Q2023 1Q2024 2Q2024 3Q2024 4Q2024 Weighted Average Loan to Values 69.8% 72.4% 72.2% 72.9% 67.0% 45.0% 45.5% 47.7% 46.2% 48.2% Residential Construction Non Owner Occupied Commercial Real Estate 4Q2023 1Q2024 2Q2024 3Q2024 4Q2024 $37.4 $49.4 $45.4 $55.8 $39.6 $4.7 $18.6 $14.5 $28.5 $20.6$2.6 $1.6 $1.1 $6.1 $8.2 Permanent NOO CRE Commercial, Construction and Development Residential Construction 4Q2023 1Q2024 2Q2024 3Q2024 4Q2024 Commercial Real Estate Production Residential Construction Loan Originations by Quarter $4.1 $6.2 $4.7 $8.5 $6.9 $33.3 $43.2 $40.7 $47.3 $32.7 Consumer Commercial 4Q2023 1Q2024 2Q2024 3Q2024 4Q2024

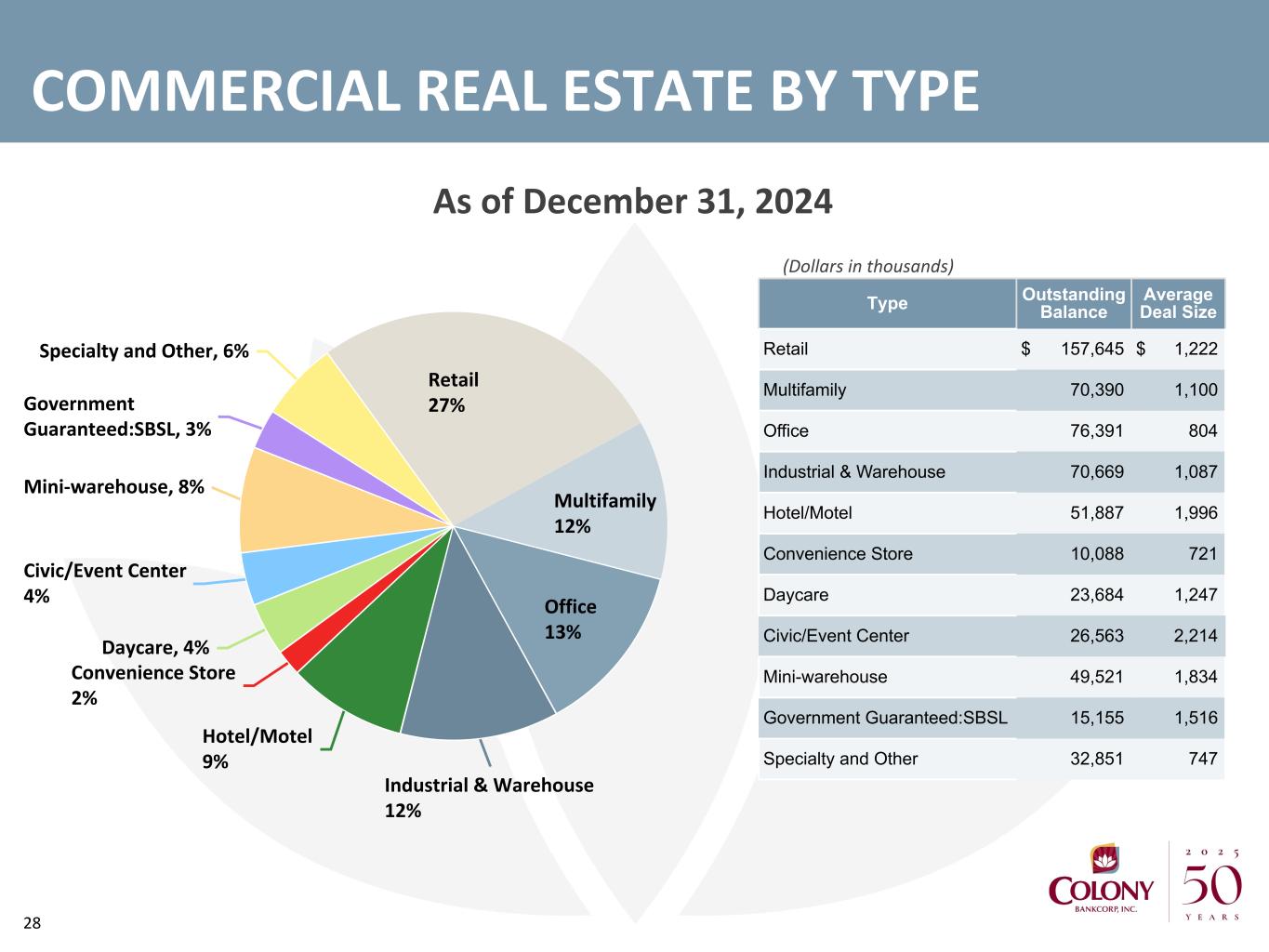

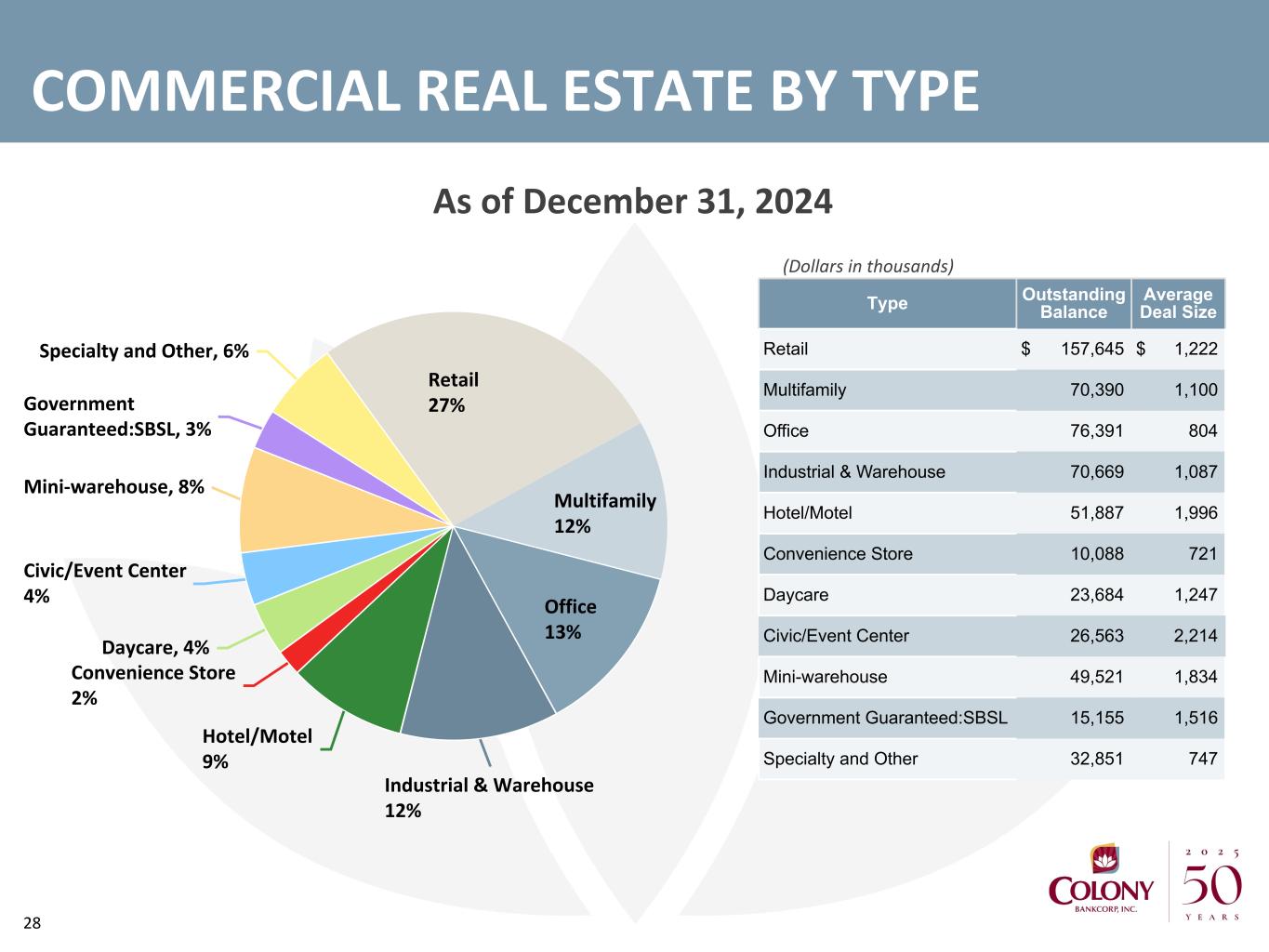

28 COMMERCIAL REAL ESTATE BY TYPE Retail 27% Multifamily 12% Office 13% Industrial & Warehouse 12% Hotel/Motel 9% Convenience Store 2% Daycare, 4% Civic/Event Center 4% Mini-warehouse, 8% Government Guaranteed:SBSL, 3% Specialty and Other, 6% Type Outstanding Balance Average Deal Size Retail $ 157,645 $ 1,222 Multifamily 70,390 1,100 Office 76,391 804 Industrial & Warehouse 70,669 1,087 Hotel/Motel 51,887 1,996 Convenience Store 10,088 721 Daycare 23,684 1,247 Civic/Event Center 26,563 2,214 Mini-warehouse 49,521 1,834 Government Guaranteed:SBSL 15,155 1,516 Specialty and Other 32,851 747 (Dollars in thousands) As of December 31, 2024

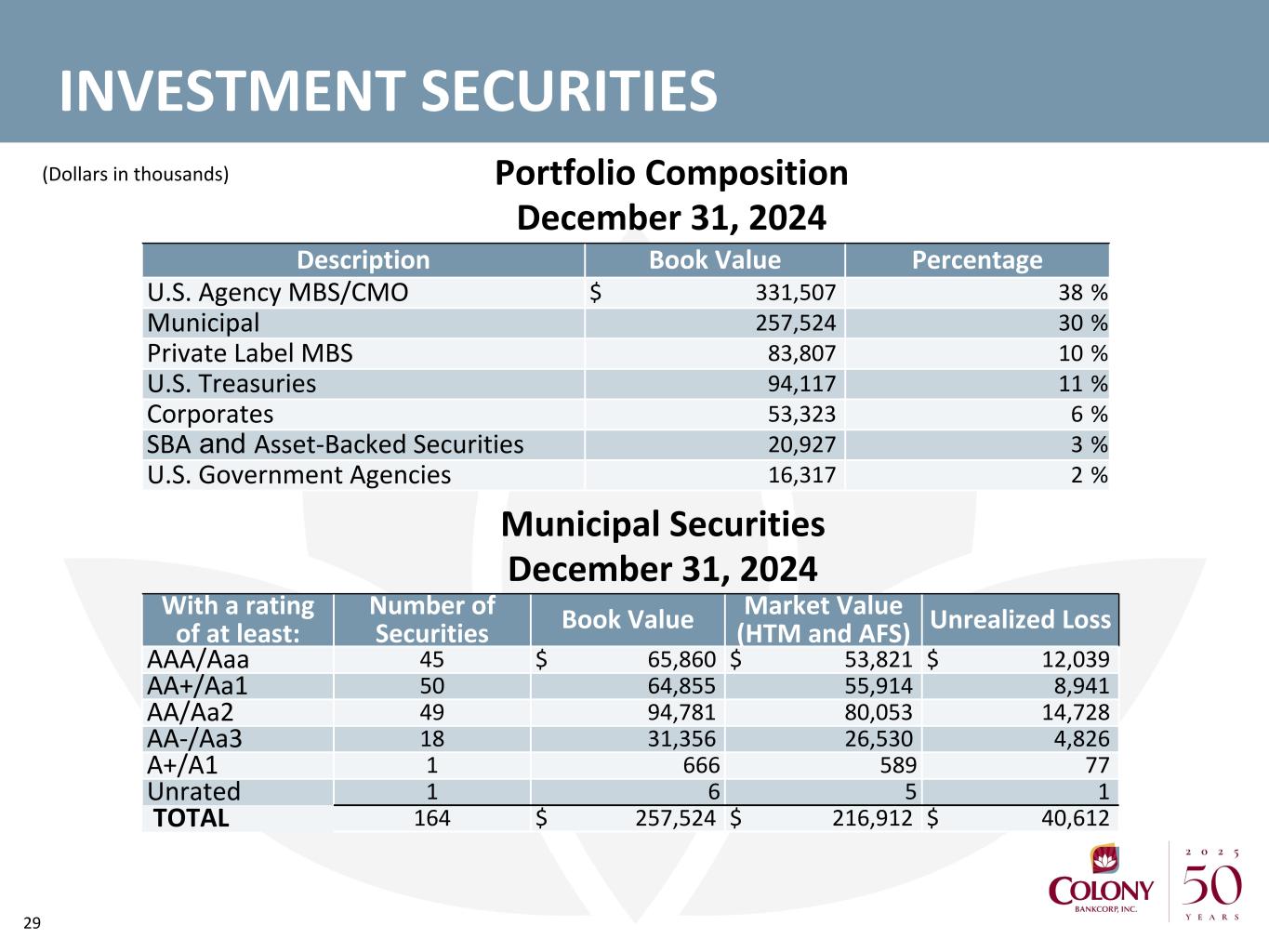

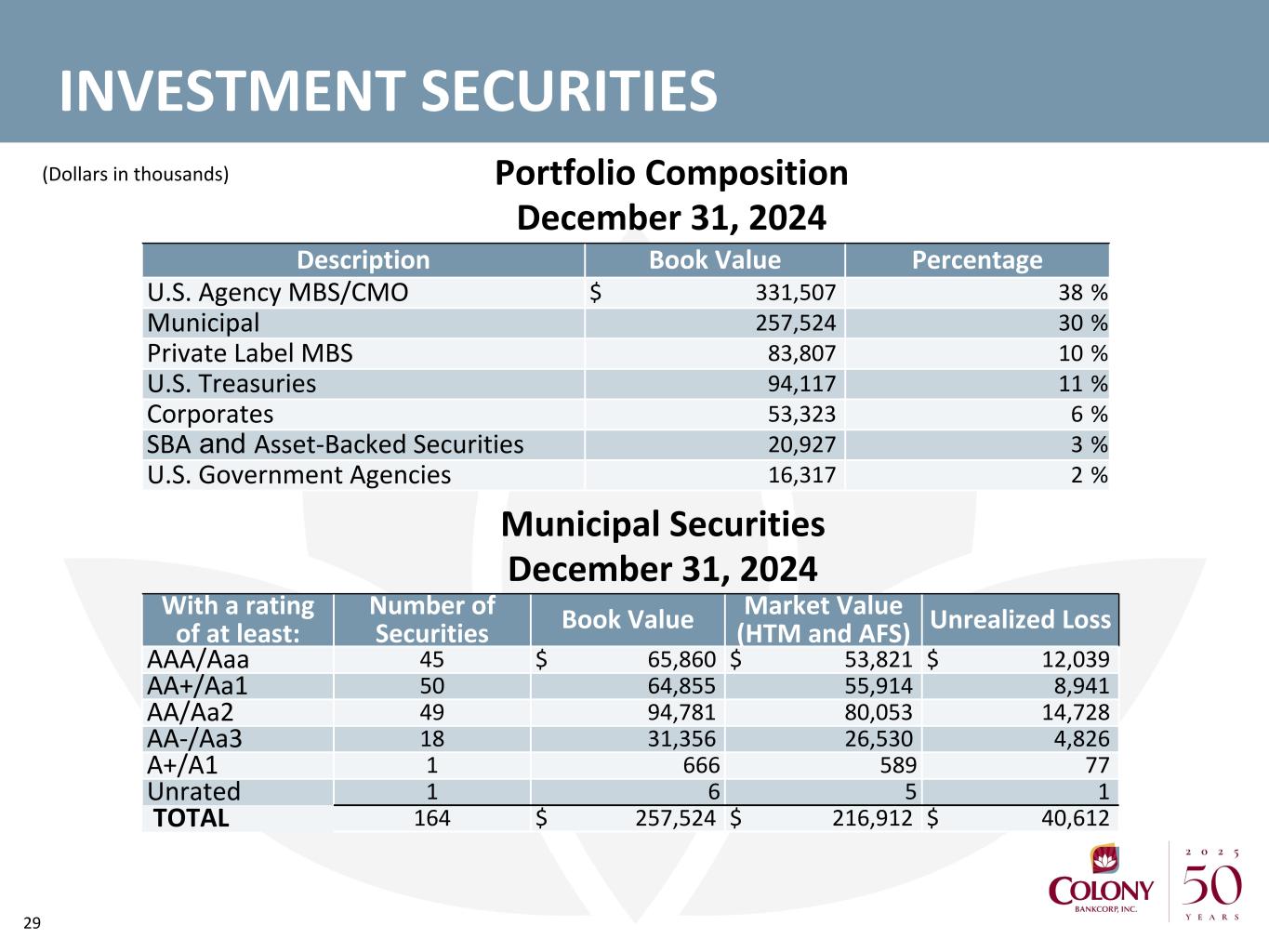

29 INVESTMENT SECURITIES Description Book Value Percentage U.S. Agency MBS/CMO $ 331,507 38 % Municipal 257,524 30 % Private Label MBS 83,807 10 % U.S. Treasuries 94,117 11 % Corporates 53,323 6 % SBA and Asset-Backed Securities 20,927 3 % U.S. Government Agencies 16,317 2 % (Dollars in thousands) Portfolio Composition December 31, 2024 Municipal Securities December 31, 2024 With a rating of at least: Number of Securities Book Value Market Value (HTM and AFS) Unrealized Loss AAA/Aaa 45 $ 65,860 $ 53,821 $ 12,039 AA+/Aa1 50 64,855 55,914 8,941 AA/Aa2 49 94,781 80,053 14,728 AA-/Aa3 18 31,356 26,530 4,826 A+/A1 1 666 589 77 Unrated 1 6 5 1 TOTAL 164 $ 257,524 $ 216,912 $ 40,612

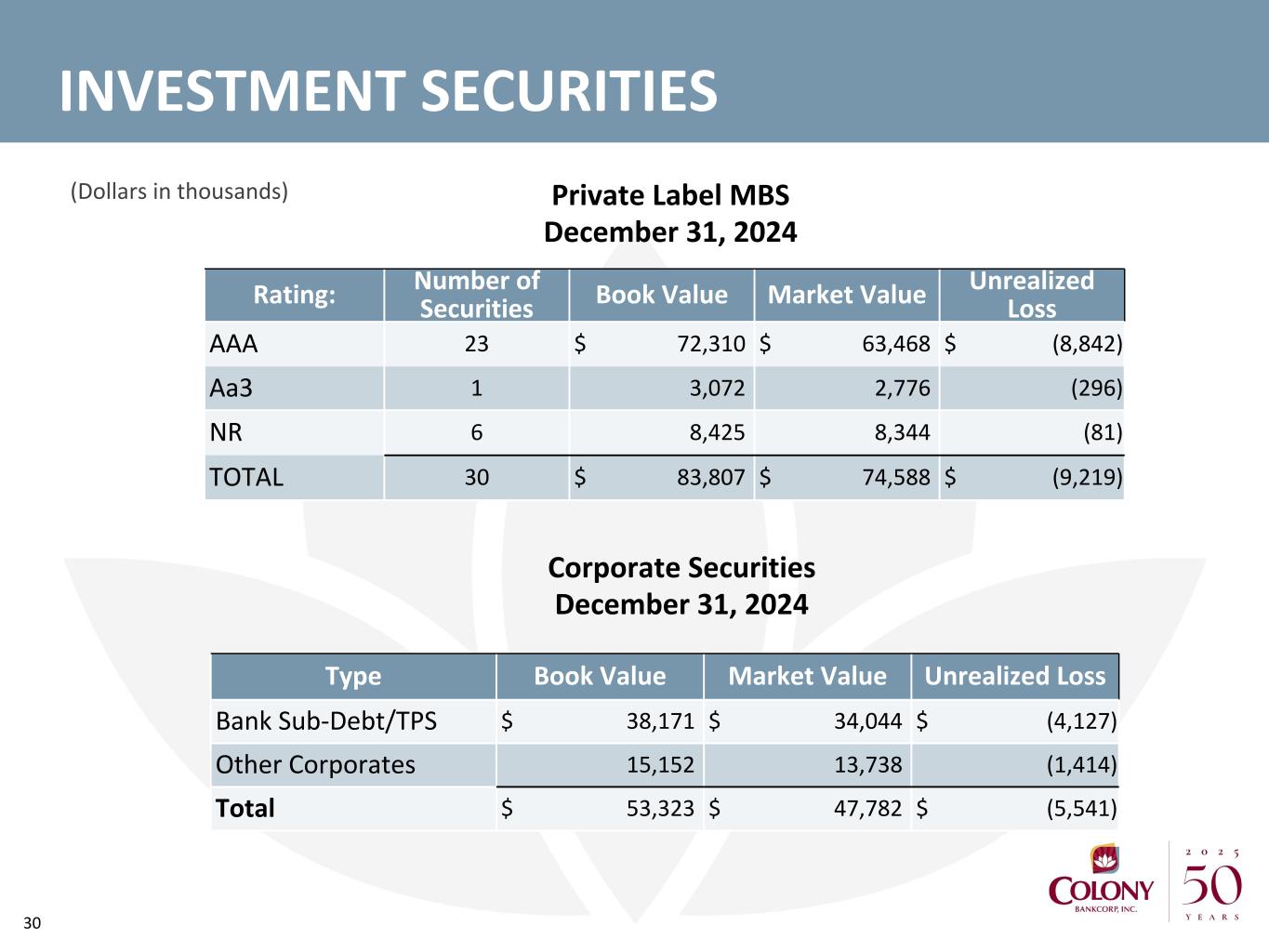

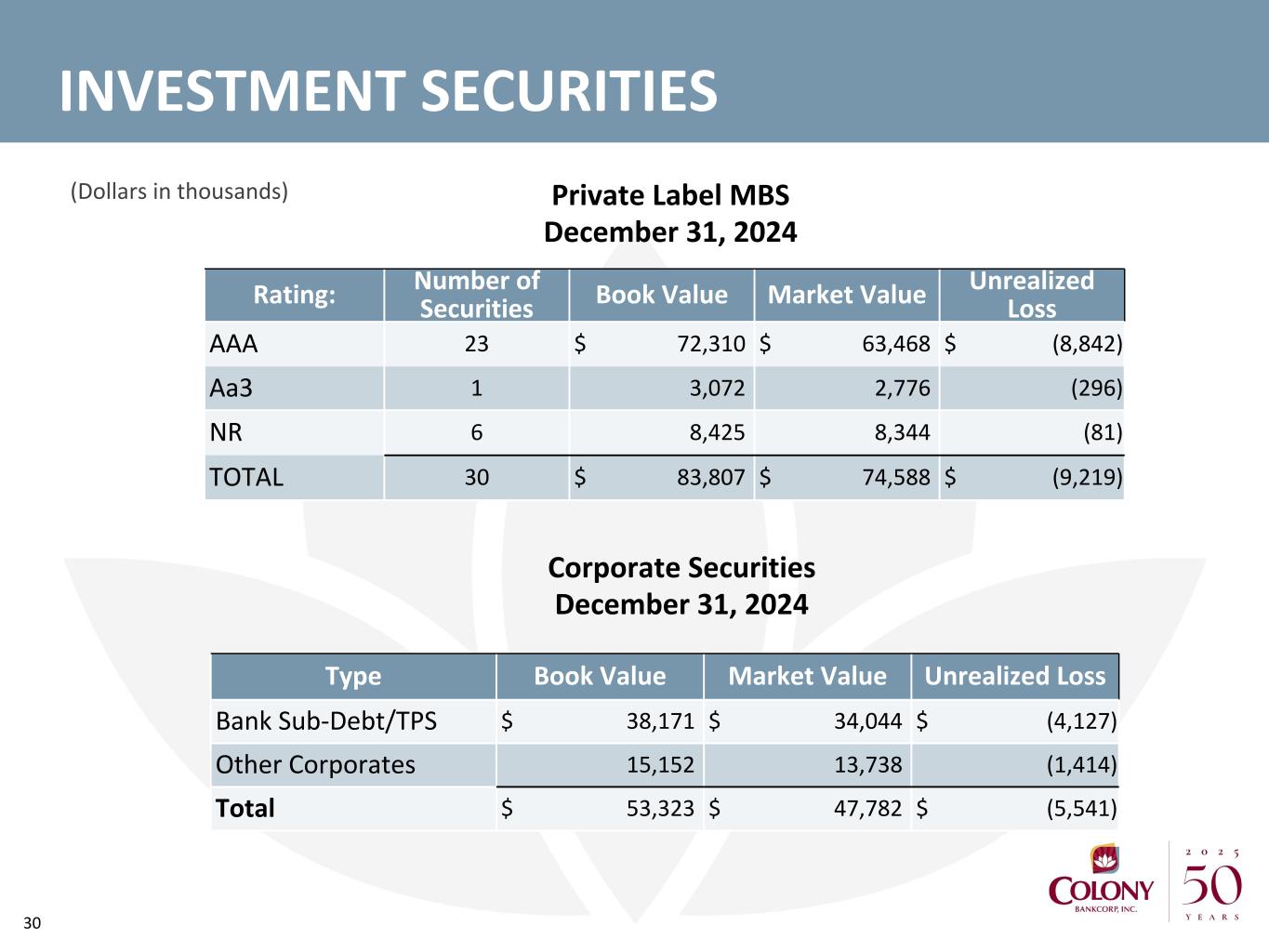

30 INVESTMENT SECURITIES (Dollars in thousands) Rating: Number of Securities Book Value Market Value Unrealized Loss AAA 23 $ 72,310 $ 63,468 $ (8,842) Aa3 1 3,072 2,776 (296) NR 6 8,425 8,344 (81) TOTAL 30 $ 83,807 $ 74,588 $ (9,219) Private Label MBS December 31, 2024 Type Book Value Market Value Unrealized Loss Bank Sub-Debt/TPS $ 38,171 $ 34,044 $ (4,127) Other Corporates 15,152 13,738 (1,414) Total $ 53,323 $ 47,782 $ (5,541) Corporate Securities December 31, 2024

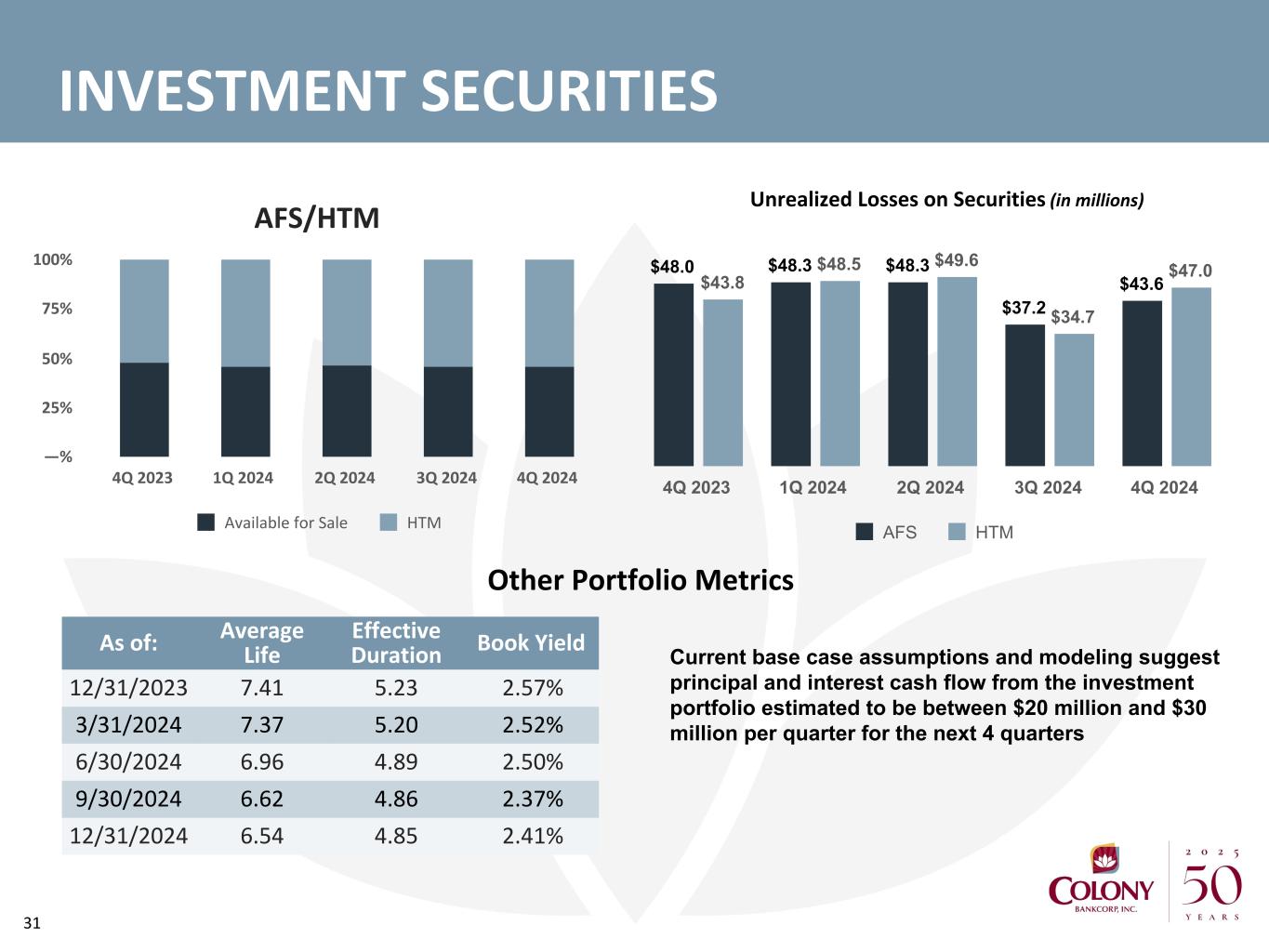

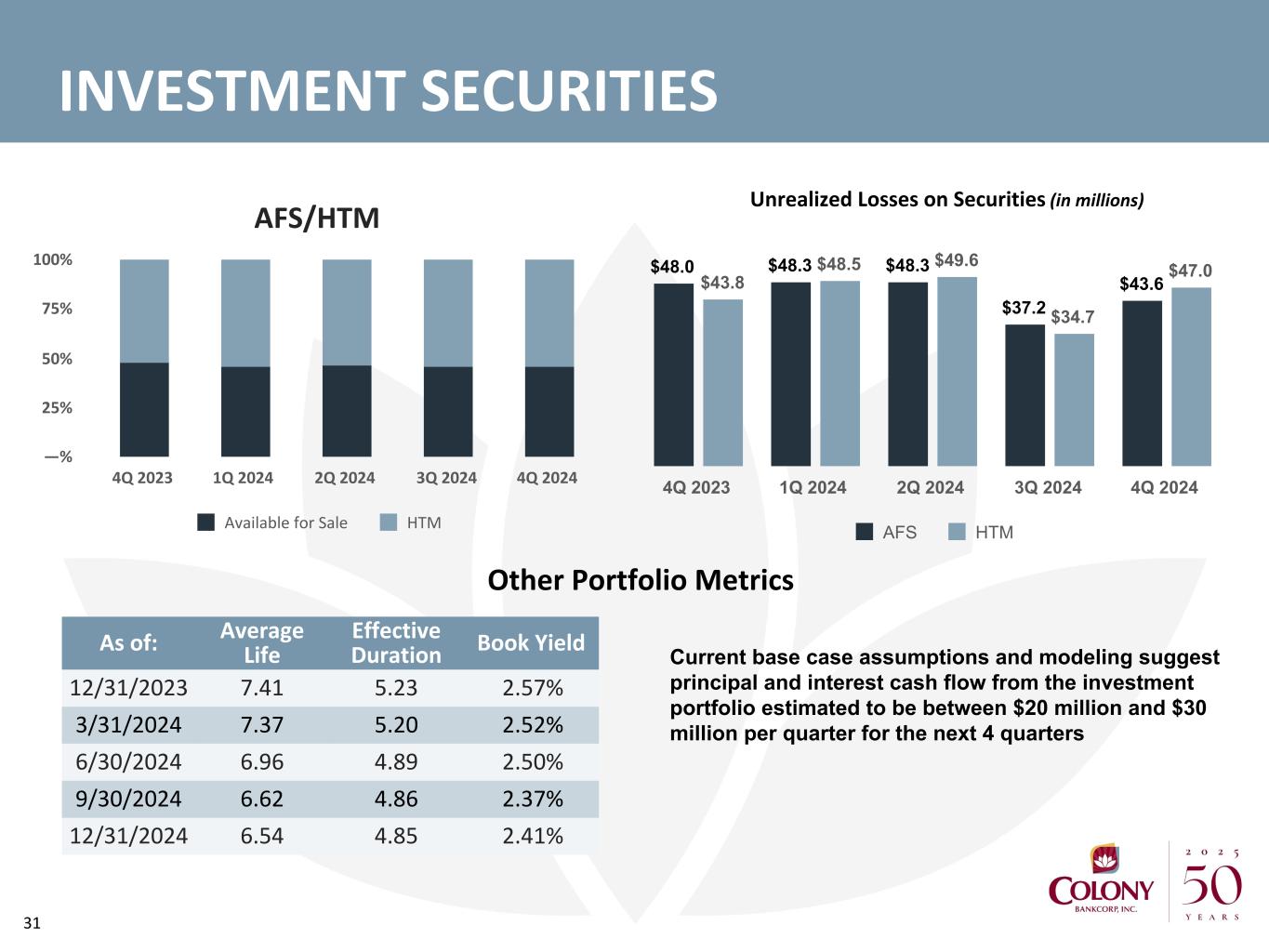

31 INVESTMENT SECURITIES As of: Average Life Effective Duration Book Yield 12/31/2023 7.41 5.23 2.57% 3/31/2024 7.37 5.20 2.52% 6/30/2024 6.96 4.89 2.50% 9/30/2024 6.62 4.86 2.37% 12/31/2024 6.54 4.85 2.41% Other Portfolio Metrics Unrealized Losses on Securities (in millions) AFS/HTM Available for Sale HTM 4Q 2023 1Q 2024 2Q 2024 3Q 2024 4Q 2024 —% 25% 50% 75% 100% $48.0 $48.3 $48.3 $37.2 $43.6$43.8 $48.5 $49.6 $34.7 $47.0 AFS HTM 4Q 2023 1Q 2024 2Q 2024 3Q 2024 4Q 2024 Current base case assumptions and modeling suggest principal and interest cash flow from the investment portfolio estimated to be between $20 million and $30 million per quarter for the next 4 quarters

32 Q4 2024 INVESTMENT SECURITIES SALES •Sold securities with a fair value of $8.3 million •Transaction resulted in a loss on sale of $401 thousand •Combined book yield of 2.15% on sold securities •Conservative earnback estimates are approximately 2 years or less •Purpose of transaction was to restructure underperforming assets and reinvest at higher yields •With changes in the interest rate environment, improved margin, and improved on-hand liquidity, we expect to pause our quarterly security sales going forward.

33 INVESTMENT CONSIDERATIONS •Premier Southeast community bank located in growing markets •Core deposit funded with minimal reliance on wholesale funding •Diversified sources of revenue • Improving earnings outlook as new business lines and markets mature •Upside to tangible book value as unrealized losses improve •Deep leadership bench with a proven track record •Ability to manage expenses in an uncertain economy • Investing in technology and leveraging data for revenue growth

NYSE: CBAN