1

Forward-Looking Statement & Reg. G

q This presentation contains statements which may constitute "forward-looking" statements as that term is defined in the Private Securities Litigation Reform Act of 1995.

These forward-looking statements are subject to certain risks and uncertainties, are made as of the date hereof and the company assumes no obligation to update them.

ACCO Brands' ability to predict results or the actual effect of future plans or strategies is inherently uncertain. Because actual results may differ from those predicted by

such forward-looking statements, you should not place undue reliance on them when deciding to buy, sell or hold the company’s securities. Among the factors that

could cause our plans, actions and results to differ materially from current expectations are: fluctuations in the cost and availability of raw materials; competition within

the markets in which the company operates; the effects of both general and extraordinary economic, political and social conditions, including any volatility and disruption

in the capital and credit markets; the effect of consolidation in the office products industry; the liquidity and solvency of our major customers; our continued ability to

access the capital and credit markets; the dependence of the company on certain suppliers of manufactured products; the risk that targeted cost savings and synergies

from previous business combinations may not be fully realized or take longer to realize than expected; future goodwill and/or impairment charges; foreign exchange rate

fluctuations; the development, introduction and acceptance of new products; the degree to which higher raw material costs, and freight and distribution costs, can be

passed on to customers through selling price increases and the effect on sales volumes as a result thereof; increases in health care, pension and other employee welfare

costs; as well as other risks and uncertainties detailed in the company’s Annual Report on Form 10-K for the year ended December 31, 2011, under Item 1A, “Risk

Factors,” and in the company's other SEC filings.

q Forward-looking statements relating to the proposed merger involving ACCO Brands and the Consumer & Office Products business of MeadWestvaco Corporation

include, but are not limited to: statements about the benefits of the proposed merger, including future financial and operating results; ACCO Brands’ plans, objectives,

expectations and intentions; the expected timing of completion of the merger; and other statements relating to the merger that are not historical facts. With respect to the

proposed merger, important factors could cause actual results to differ materially from those indicated by such forward-looking statements, including, but not limited to:

risks and uncertainties relating to the ability to obtain the requisite ACCO Brands Corporation shareholder approval; the risk that ACCO Brands or MeadWestvaco

Corporation may be unable to obtain governmental and regulatory approvals required for the merger; the risk that a condition to closing of the merger may not be

satisfied; the length of time necessary to consummate the merger; the risk that the cost savings and any other synergies from the transaction may not be fully realized or

may take longer to realize than expected and the impact of additional indebtedness. These risks, as well as other risks associated with the proposed merger, are more

fully discussed in the proxy statement/prospectus included in the registration statement on Form S-4 that ACCO Brands filed with the United States Securities and

Exchange Commission (“SEC”) on March 22, 2012 in connection with the proposed merger.

q In connection with the proposed merger, the registration statement filed by ACCO Brands on March 22, 2012 has been declared effective by the SEC. This registration

statement includes a proxy statement of ACCO Brands that also constitutes a prospectus of ACCO Brands, and has been mailed to the shareholders of ACCO Brands.

Shareholders are urged to read the proxy statement/prospectus and any other relevant documents, because they contain important information about ACCO Brands and

the proposed merger. The proxy statement/prospectus and other documents relating to the proposed merger can be obtained free of charge from the SEC’s website at

www.sec.gov. The proxy statement/prospectus and other documents can also be obtained free of charge from ACCO Brands upon written request to ACCO Brands

Corporation, Investor Relations, 300 Tower Parkway, Lincolnshire, Illinois 60069, or by calling (847) 484-3020.

q This communication is not a solicitation of a proxy from any security holder of ACCO Brands. However, ACCO Brands and certain of its directors and executive officers

may be deemed to be participants in the solicitation of proxies from shareholders in connection with the proposed merger under the rules of the SEC. Information about

the directors and executive officers of ACCO Brands may be found in its 2011 Annual Report on Form 10-K filed with the SEC on February 23, 2012, and its definitive

proxy statement relating to its 2011 Annual Meeting of Shareholders filed with the SEC on April 4, 2011.

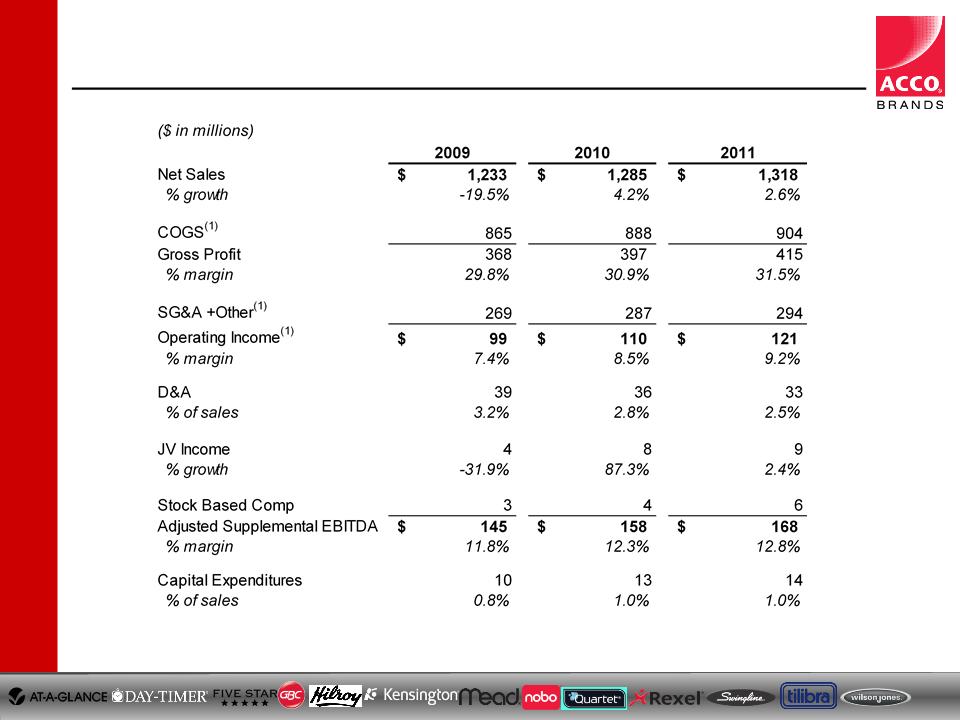

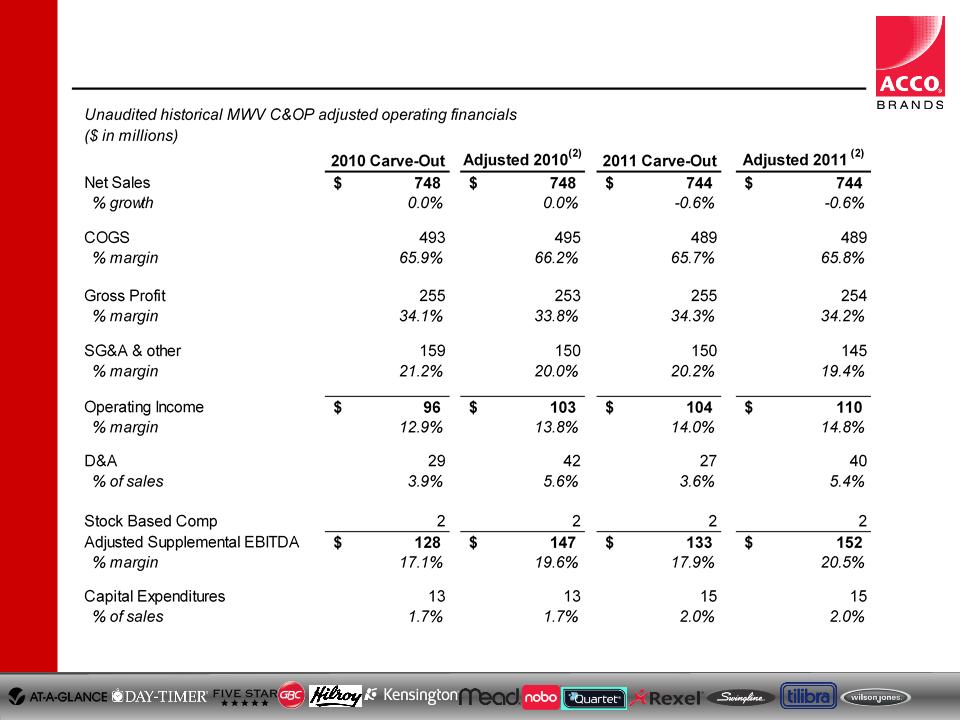

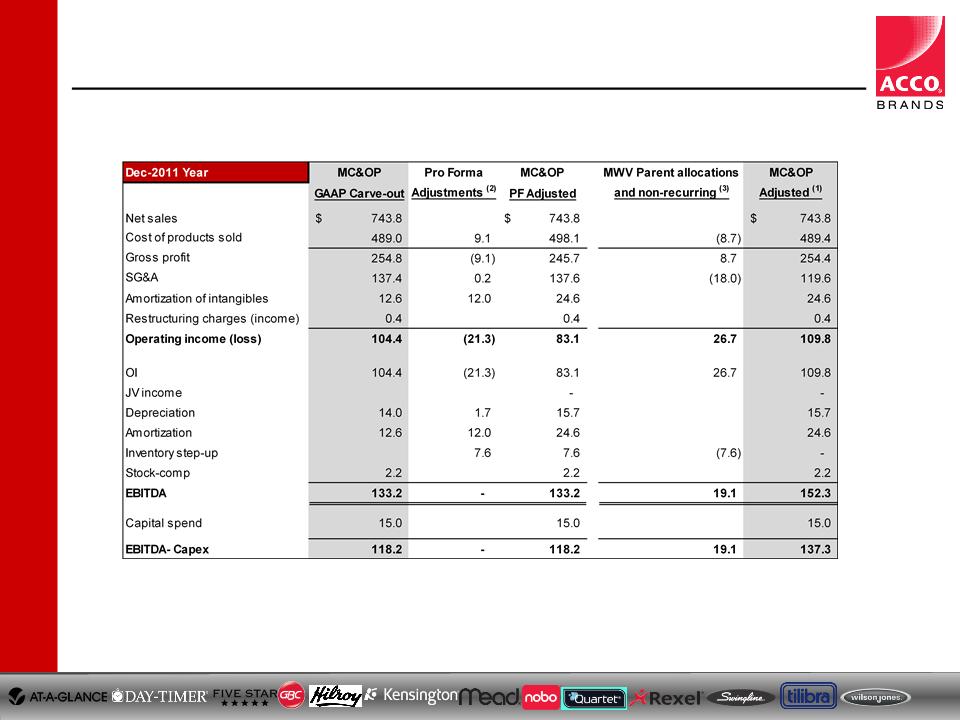

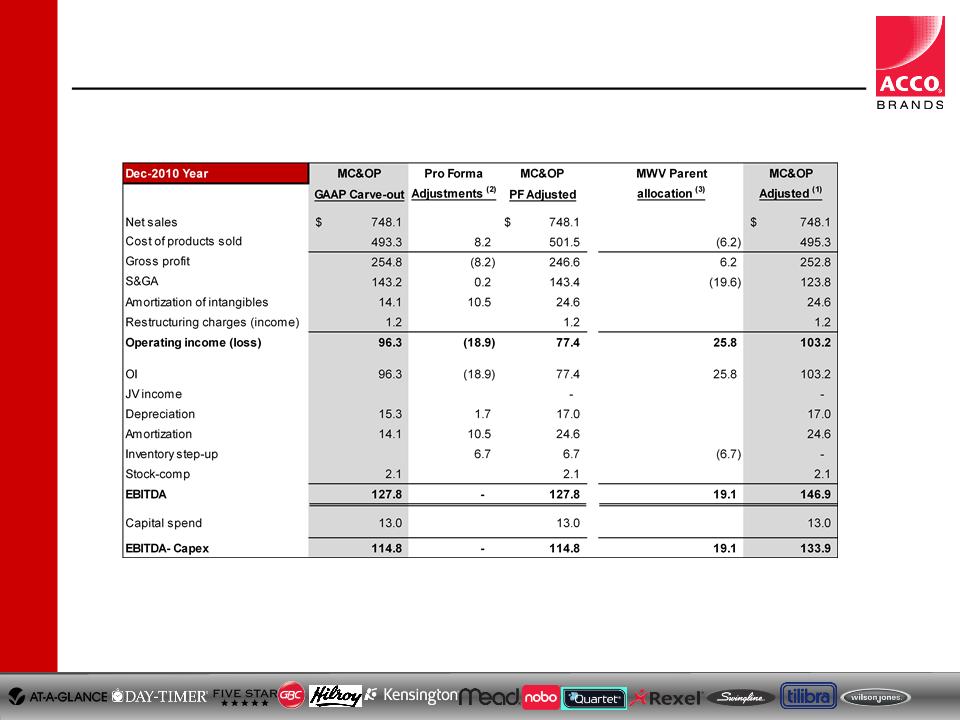

Non-GAAP Financial Measures

q “Adjusted” results exclude all unusual tax items. Adjusted supplemental EBITDA from continuing operations also excludes other non-operating items, including other

income/expense and stock-based compensation expense and costs associated with the pending acquisition of the MeadWestvaco’s Consumer and Office Products

business. Adjusted results and supplemental EBITDA from continuing operations are non-GAAP measures. There could be limitations associated with the use of non-

GAAP financial measures as compared to the use of the most directly comparable GAAP financial measure. Management uses the adjusted measures to determine the

returns generated by its operating segments and to evaluate and identify cost-reduction initiatives. Management believes these measures provide investors with helpful

supplemental information regarding the underlying performance of the company from year to year. These measures may be inconsistent with measures presented by

other companies.