UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________________________________

Form 10-K

| |

☑ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended December 31, 2023

| |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 001-08454

ACCO Brands Corporation

(Exact Name of Registrant as Specified in Its Charter)

| | |

Delaware | | 36-2704017 |

(State or Other Jurisdiction of Incorporation or Organization) | | (I.R.S. Employer Identification Number) |

Four Corporate Drive

Lake Zurich, Illinois 60047

(Address of Registrant’s Principal Executive Office, Including Zip Code)

(847) 541-9500

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

| | |

Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered |

Common Stock, par value $.01 per share | ACCO | NYSE |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☑ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | |

Large accelerated filer | ☐ | Accelerated filer | ☑ |

Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☑

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant's executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☑

As of June 30, 2023, the aggregate market value of the shares of Common Stock held by non-affiliates of the registrant was approximately $479.8 million. As of February 15, 2024, the registrant had outstanding 94,928,320 shares of Common Stock.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement to be issued in connection with registrant’s annual stockholders' meeting expected to be held on May 21, 2024, are incorporated by reference into Part III of this report.

Cautionary Statement Regarding Forward-Looking Statements

Certain statements contained in this Annual Report on Form 10-K other than statements of historical fact, particularly those anticipating future financial performance, business prospects, growth, strategies, business operations and similar matters, results of operations, liquidity and financial condition, and those relating to cost reductions and anticipated pre-tax savings and restructuring costs are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based on the beliefs and assumptions of management based on information available to us at the time such statements are made. These statements, which are generally identifiable by the use of the words "will," "believe," "expect," "intend," "anticipate," "estimate," "forecast," "project," "plan," and similar expressions, are subject to certain risks and uncertainties, are made as of the date hereof, and we undertake no duty or obligation to update them. Forward-looking statements are subject to the occurrence of events outside the Company's control and actual results and the timing of events may differ materially from those suggested or implied by such forward-looking statements due to numerous factors that involve substantial known and unknown risks and uncertainties. Investors and others are cautioned not to place undue reliance on forward-looking statements when deciding whether to buy, sell or hold the Company's securities.

Some of the factors that could affect our results or cause our plans, actions and results to differ materially from those expressed in the forward-looking statements contained in this Annual Report Form 10-K are detailed in "Part I, Item 1. Business" and "Part I, Item 1A. Risk Factors" as well as in "Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations" of this Annual Report on Form 10-K and from time to time in our other Securities and Exchange Commission (the "SEC") filings.

Website Access to Securities and Exchange Commission Reports

The Company’s website can be found at www.accobrands.com. The information contained on or connected to our website is not incorporated by reference into this Annual Report on Form 10-K and should not be considered part of this or any other report we file with the SEC. The Company makes available free of charge on or through its website its Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 as soon as practicable after the Company files them with, or furnishes them to, the SEC. We also make available the following documents, among others, on our Internet website: the Audit Committee Charter; the Compensation and Human Capital Committee Charter; the Nominating, Governance and Sustainability Committee Charter; our Corporate Governance Principles; and our Code of Conduct. The Company’s Code of Conduct applies to all of our directors, officers (including the Chief Executive Officer, Chief Financial Officer and Principal Accounting Officer) and employees. You may obtain a copy of any of the foregoing documents, free of charge, if you submit a written request to ACCO Brands Corporation, Four Corporate Drive, Lake Zurich, IL 60047, Attn: Investor Relations.

TABLE OF CONTENTS

PART I

ITEM 1. BUSINESS

As used in this Annual Report on Form 10-K for the fiscal year ended December 31, 2023, the terms "ACCO Brands," "ACCO," the "Company," "we," "us," and "our" refer to ACCO Brands Corporation, a Delaware corporation incorporated in 2005, and its consolidated domestic and international subsidiaries.

For a description of certain factors that may have had, or may in the future have, a significant impact on our business, results of operations or financial condition, see "Part I. Item 1A. Risk Factors" of this report.

Overview of the Company

ACCO Brands is a leading global consumer, technology and business branded products company, providing well-known brands and innovative product solutions used in schools, homes and at work. Approximately 77 percent of our 2023 net sales came from brands that are in the No. 1 or No. 2 position in the product categories in which we compete. Our top 12 brands represented approximately $1.3 billion of our 2023 net sales. Through our strategy, we have expanded into higher growth product categories, while increasing our sales mix to higher growth channels including retail and mass merchants, e-tailers, and technology specialists. We have an experienced management team with a proven ability to grow brands, integrate acquisitions, manage seasonal businesses, run lean organizations and navigate challenging environments. Our products are sold primarily in the U.S., Europe, Australia, Canada, Brazil and Mexico.

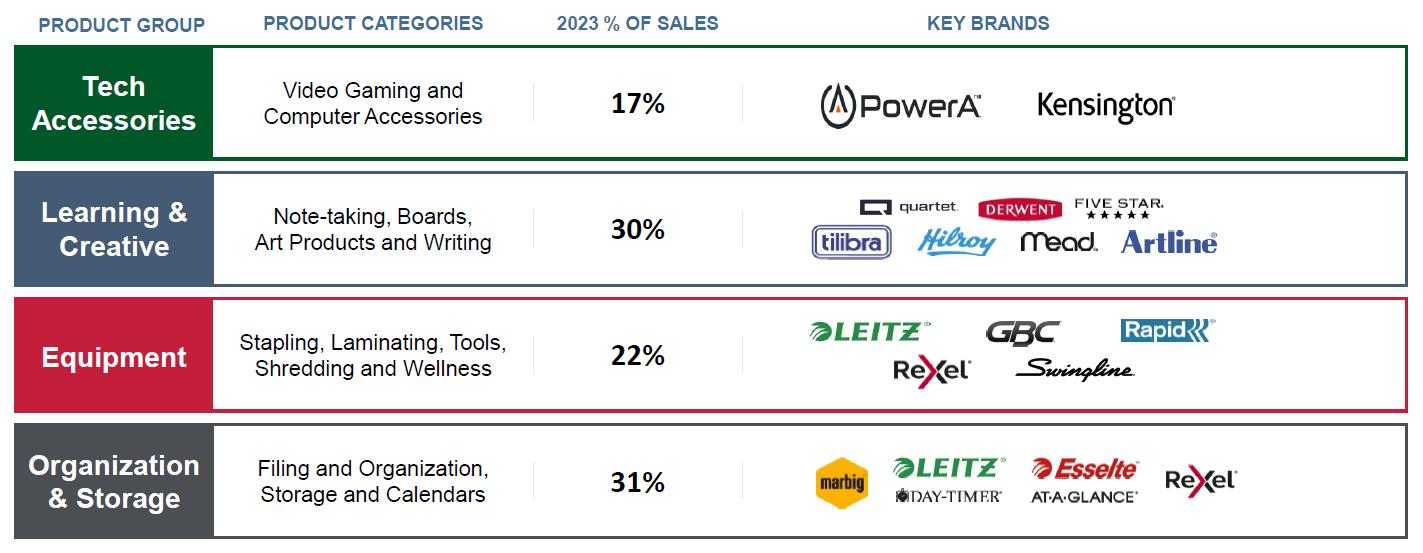

Note: Artline® in Australia/N.Z. only

Business Strategy

The Company is currently executing a strategy that will enable us to achieve long-term sustainable organic growth and profit improvement. Our key strategic priorities are to:

•Drive sustainable organic sales growth by focusing on innovative new product development, strengthening our brand positioning, and increasing our presence in faster growing sales channels.

•Use our strong brand recognition and supply chain expertise to expand relationships with new and existing customers.

•Improve operating margins by introducing higher margin product offerings, rationalizing product assortments, improving operating productivity, and leveraging SG&A costs.

•Manage declining product categories which remain important profit and cash generators.

Through this strategy we have diversified and expanded our product portfolio, focusing on innovative consumer and end-user products for use in schools, homes and businesses, with an emphasis on faster growing product categories. Our Technology Accessories product group, which consists of our gaming and computer accessories, is one such higher growth category where we seek opportunities to expand sales globally.

Historically we have made acquisitions that have meaningfully expanded our portfolio of well-known brands, enhanced our competitive position from both a product and channel perspective, added scale to our operations and increased our geographic presence. More recently, we have prioritized the use of our operating cash flow to invest in internal capital projects to support our long-term growth, fund our quarterly dividend and reduce our debt. We will also consider opportunistic acquisitions that focus on growing product categories, including adjacencies.

Operating Segments

ACCO Brands has three operating business segments based in different geographic regions: North America, EMEA, and International. Each business segment designs, markets, sources, manufactures, and sells recognized consumer, technology and business branded products used in schools, homes and at work. Product designs are tailored to end-user preferences in each geographic region, and where possible, leverage common engineering, design, and sourcing.

| | | | | | |

Sales Percentage by Operating Segment | | 2023 | | 2022 | | 2021 |

ACCO Brands North America | | 48% | | 51% | | 51% |

ACCO Brands EMEA | | 30% | | 30% | | 33% |

ACCO Brands International | | 22% | | 19% | | 16% |

| | 100% | | 100% | | 100% |

For more information on our operating business segments see "Note 17. Information on Business Segments" to the consolidated financial statements contained in Part II, Item 8. of this report.

Beginning on January 1, 2024, the Company will reorganize its previously reported North America, EMEA and International operating segments into two operating segments, Americas and International. The Americas will include the U.S., Canada, Brazil, Mexico and Chile and the International reportable segment will include EMEA, Australia, New Zealand and Asia. This change will simplify and delayer the Company's operating structure and reduce costs through headcount reductions, supply change optimization, global footprint rationalization, and better leverage of our sourcing capabilities. The Company will recast prior period comparable results in early 2024 to reflect this operating segment change.

Seasonality

Historically, each of our segments has demand that varies based on certain seasonal drivers. For North America, the important seasonal selling periods are related to back-to-school and the holiday season. The North America back-to-school season mainly occurs in the second and third quarters. The holiday season drives significant sales of technology accessories. The EMEA segment experiences much less seasonality than the other segments, but the first and fourth quarters are typically stronger, with the second and third impacted by lower demand due to summer vacations. The International segment historically has strong back-to-school sales in the fourth quarter and into January as Brazil and Australia are in the Southern hemisphere. In Mexico, back-to-school historically straddles the second and third quarters.

As a result of the seasonal nature of the demand for our products, we expect to continue to generate a significant percentage of our sales and profit during the second, third, and fourth quarters, although the amounts generated in each of these quarters may vary due to changing customer behaviors. All our operating cash flow is generated in the second half of the year, as the cash inflows in the first and second quarters are consumed building working capital, and for making our annual performance-based compensation payments when earned. Our third and fourth quarter cash flow comes from completing the working capital cycle.

For further information on the seasonality of our net sales, earnings and cash flow, see "Part II. Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations - Summary of Cash Flow by Quarter and Full-Year."

Customers

We distribute our products through a wide variety of channels to ensure that our products are readily and conveniently available for purchase by consumers and other end-users, wherever they prefer to shop. These channels include mass retailers, e-tailers, discount, drug/grocery and variety chains, warehouse clubs, hardware and specialty stores, independent office product dealers, office superstores, wholesalers, contract stationers, and specialist technology businesses. We also sell directly through e-commerce sites and our direct sales organization.

Competition

ACCO Brands competes with numerous branded consumer products manufacturers, as well as many private label suppliers and importers, including various customers who import their own private label products directly from foreign sources. Examples of branded competitors include Bi-Silque, Blue Sky, Corsair, Dominion Blueline, Fellowes, Hamelin, Logitech, PDP, Razer, SteelSeries, and Targus, among others.

The Company meets competitive challenges by creating and maintaining leading brands and differentiated products that deliver superior value, performance, and benefits to consumers and other end-users. Our products are sold through diverse distribution channels. We further meet consumer and end-user needs by developing, producing, and procuring products at a competitive cost, enabling them to be sold at attractive selling prices. We also believe that our experience and skill in managing complex assortments and large seasonal demand is a competitive advantage, as is our strong relationships with technology and content providers in our technology accessories categories.

Product Development

We seek opportunities to invest in new products and adjacencies. Our innovation efforts focus on generating new, exciting, and differentiated products that meet consumer and other end-user needs and provide the opportunity to meaningfully grow sales and margins. Our commitment to understanding our consumers and end-users and designing products that fulfill their needs drives our product development strategy, which we believe will continue to be a key contributor to our success. Our products are developed by our internal research and development teams or through partnership initiatives with inventors, vendors and technology providers. Costs related to product development when paid directly by ACCO Brands are included in selling, general and administrative expenses.

Marketing and Demand Generation

We support our brands with a significant investment in targeted marketing and advertising, including on-shelf and in-store, and through digital and social media and consumer promotions that increase brand awareness, drive conversion, and highlight the innovation and differentiation of our products. We work with third-party vendors, such as Nielsen, Circana, GfK SE, NEWZOO and Kantar Group, to capture and analyze consumer buying habits and product trends.

Supply Chain

We have built a customer-focused business model with a flexible supply chain to ensure that we are able to supply our customers with value-added, high-quality products at an attractive price. We currently manufacture approximately 40 percent of our products in our own facilities located in the countries where we operate, and source the remaining 60 percent from lower cost countries, primarily in Asia. Using a combination of our own manufacturing and third-party sourcing also enables us to reduce costs and effectively manage our production assets by lowering capital investment and working capital requirements. Our overall strategy is to manufacture locally those products that would incur a relatively high freight and/or duty expense or that have high

customer service needs. Under our global footprint rationalization program, we will continue to rationalize our facilities as appropriate. We use third parties to source those products that require more direct labor to produce. We also look for opportunities to leverage our manufacturing facilities to improve operating efficiencies, as well as customer service.

Intellectual Property

Our products are marketed under a variety of trademarks. Some of our more significant trademarks include ACCO®, AT-A-GLANCE®, Barrilito®, Derwent®, Esselte®, Five Star®, Foroni®, GBC®, Hilroy®, Kensington®, Leitz®, Marbig®, Mead®, NOBO®, PowerA®, Quartet®, Rapid®, Rexel®, Swingline®, and Tilibra®. We own rights to these trademarks in various countries throughout the world. We protect these trademarks as appropriate through registrations in the U.S. and other jurisdictions. Depending on the jurisdiction, trademarks are generally valid as long as they are in use or their registrations are properly maintained and they have not been found to have become generic. Registrations of trademarks can generally be renewed indefinitely as long as the trademarks are in use. We also own numerous patents worldwide. Additionally, our gaming accessories business depends on maintaining our licensing rights with key gaming console manufacturers and video game publishers.

Human Capital Resources

As the Home of Great Brands Built by Great People, we believe our employees are our greatest assets and key enablers of our success. In alignment with our Vision, Values and Leadership Promise, we are intentional about providing a great work experience that attracts top talent and motivates them to stay and contribute to our winning team.

As of December 31, 2023, we had approximately 5,600 full-time and part-time employees worldwide, with approximately 4,100 employees based outside of the U.S. Approximately 500 manufacturing and distribution employees in our North America operating segment are covered by collective bargaining agreements. Outside the U.S., we have government-mandated collective bargaining arrangements in certain countries, particularly in Europe and Brazil. There have been no strikes or material labor disputes at any of our facilities during the past five years.

Diversity and Inclusion

At ACCO Brands, our values include respecting the individual and embracing diversity. We believe that an equitable and inclusive environment with diverse teams produces more creative solutions, results in improved and more innovative products and services, and is crucial to our efforts to attract and retain key talent. We also believe that our leadership should closely reflect the diversity of our employees. ACCO Brands’ diversity goals are to increase the percentage of director-level-and-above female leaders to 33 percent by 2025. For the total Company, we made excellent progress in 2023, moving from our 2019 baseline of 26.6 percent to reach our goal ending the year at 33.0 percent.

To continue to drive our diversity goals and build a culture of inclusion, we have established a multi-year roadmap and a governance model that engages leadership at all levels of the organization. We have also developed an enhanced diversity and inclusion dashboard to track our actions and outcomes. Our roadmap is focused on three key priorities: ensuring diverse candidate slates for all director-level-and-above job opportunities, integrating talent development and succession planning, and building manager capability to lead inclusively.

Talent Management

Building and sustaining strong talent is critical to our success. We know that offering the right mix of developmental roles and learning experiences will support our goal of building strong talent to lead the Company. At the same time, we recognize that building new capabilities may also require adding external talent in key roles to accelerate growth. This focus was key to our ability to fill 60 percent of our director-level and above open positions in 2023 with internal talent. Additionally, 18 percent of our director-level employees have mentors, while 54 percent have completed our "Raising the Bar" leadership development program. Throughout the year, we also deliver Company-required learning to ensure compliance with our Code of Conduct and other important policies.

Employee Health and Safety ("EHS")

We are committed to Mission Zero— pursuing continuous improvement in health and safety within all our locations and to attain our goal of zero accidents and zero incidents. We have implemented our Comprehensive Environmental and Safety Management Plan ("CESMP") as an overall management system for our manufacturing and distribution locations. CESMP audits are completed by our EHS teams to measure the proactive steps each location is taking to prevent injuries. We have been recognized as one of the safest companies in America and the U.K. on multiple occasions.

Community Involvement

We aim to give back to the communities where we live and work. Our corporate values include acting responsibly in our global communities through numerous employee volunteer and outreach initiatives. We encourage our employees to make a difference in our Company and in their communities by building on a fundamental commitment to integrity, teamwork, respect and inclusivity. We support a wide range of charities worldwide, the most significant of which is the City of Hope in the U.S. which has been ongoing for many years.

Sustainability/Environment

We continued to make progress on our three Planet, People and Products global sustainability goals relating to energy efficiency, diversity and third-party certification that we announced in 2020. These commitments are 1) improving the energy efficiency of our facilities, 2) increasing the percentage of female leaders globally, and 3) raising the percentage of our revenue generated from certified or sustainable products. We published our fifth annual ESG Report for 2022. We strive for greater efficiencies in the procurement, use and disposal of resources and are committed to reducing our greenhouse gas emissions. We also report key metrics which we have determined are significant to our business according to the Sustainability Accounting Standards Board (SASB) Materiality Matrix. These metrics are focused in the areas of Energy Management, Data Security, Workforce Diversity and Inclusion, Product Sourcing, Packaging and Marketing, and Labor Conditions in the Supply Chain.

Executive Leadership of the Company

As of February 23, 2024, the executive leadership team of the Company consisted of the following executive officers. Ages are as of December 31, 2023.

| | |

Mark C. Anderson, age 61 •2007 - present, Senior Vice President, Corporate Development •Joined the Company in 2007 Patrick H. Buchenroth, age 56 •2024 - present, Executive Vice President and President, Americas •2017 - 2023, Executive Vice President and President, ACCO Brands International •2013 - 2017, Senior Vice President and President, Emerging Markets •Joined the Company in 2002 Paul P. Daniel, age 58 •August 2022 - present, Senior Vice President and Chief Information Officer •February 2020 - August 2022, Vice President, Infrastructure and Operations •April 2017 - February 2020 - Vice President, Global IT Operations, Tate & Lyle PLC •Joined the Company in 2020 James M. Dudek, Jr., age 52 •2020 - present, Senior Vice President, Corporate Controller and Chief Accounting Officer •2017 - 2020, Vice President and Corporate Controller •2016 - 2017, Chief Accounting Officer, Innerworkings, Inc. •Joined the Company in 2017 Boris Elisman, age 61 •2023 - present, Executive Chairman •2021 - 2023, Chairman and Chief Executive Officer •2016 - 2021, Chairman, President and Chief Executive Officer •Joined the Company in 2004 Angela Jones, age 60 •2020 - present, Senior Vice President and Global Chief People Officer •2018 - 2020, Senior Vice President and Chief People Officer, Compass Minerals •2016 - 2018, Vice President, Human Resources Rembrandt Foods •Joined the Company in 2020 | | Gregory J. McCormack, age 60 •2024 - present - Senior Vice President, Global Operations and Supply Chain •2018 - 2023, Senior Vice President, Global Products and Operations •2013 - 2018, Senior Vice President, Global Products •Joined the Company in 1996 Cezary L. Monko, age 62 •2024 - present, Executive Vice President and President, International •2017 - 2023, Executive Vice President and President, ACCO Brands EMEA •2014 - 2017, President and Chief Executive Officer, Esselte •Joined the Company in 1992 Deborah A. O'Connor, age 61 •2022 - present, Executive Vice President and Chief Financial Officer •2020 - 2021, President and Chief Financial Officer, True Value Company •2015 - 2020, Senior Vice President and Chief Financial Officer, True Value Company •Joined the Company in 2022 Pamela R. Schneider, age 64 •2012 - present, Senior Vice President, General Counsel and Secretary •2010 - 2012, General Counsel, Accertify, Inc. •Joined the Company in 2012 Thomas W. Tedford, age 53 •2023 - present, President and Chief Executive Officer •2021 - 2023, President and Chief Operating Officer •2015 - 2021, Executive Vice President and President, ACCO Brands North America •Joined the Company in 2010 |

ITEM 1A. RISK FACTORS

The factors that are discussed below, as well as the matters that are generally set forth in this Annual Report on Form 10-K and the documents incorporated by reference herein, could materially and adversely affect the Company’s business, results of operations and financial condition. Additional risks and uncertainties that are not presently known to us or that are not deemed material also may materially adversely affect the Company’s business, results of operations and financial condition in the future.

Economic and Strategic Risks

A limited number of large customers account for a significant percentage of our net sales, and the loss of, or a substantial reduction in sales to, or gross profit from, or significant decline in the financial condition of one or more of these customers has and may continue to adversely impact our business and results of operations.

Our top ten customers accounted for 41.6 percent of our net sales for the year ended December 31, 2023. The loss of, or a significant reduction in sales to, or gross profit from, one or more of our top customers, or significant adverse changes to the terms on which we sell our products to one or more of our top customers, has and may continue to have a material adverse effect on our business, results of operations and financial condition.

The size, scale and relative competitive market position of certain large customers gives them significant leverage in business negotiations. Additionally, the competitive environment in which our large customers operate has made and will continue to make our business with them challenging and unpredictable.

Our customer concentration increases our customer credit risk. If any of our larger customers were to face liquidity issues, become insolvent or file for bankruptcy, we could be adversely impacted due to not only a reduction in future sales but also delays or defaults in the payment of existing accounts receivable balances. Such a result could adversely impact our cash flows, results of operations, and financial condition.

Sales of our products have been, and we expect they will continue to be, materially and adversely affected by general economic and business conditions globally and in the countries in which we operate, including high inflation, fear of recession and overall economic uncertainty or weakness.

Our business depends on discretionary spending, and, as a result, our sales and operating results are highly dependent on consumer and business confidence and the health of the economies in the countries in which we operate. During periods of economic uncertainty or weakness, we have experienced and may continue to experience lower demand from our reseller customers who often reduce inventories, both to reduce their own working capital investments and because demand for our products decreases as consumers switch to private label and other branded and/or generic products that compete on price and quality, or forgo purchases altogether. Overall, adverse economic conditions and sustained periods of economic uncertainty or weakness in one or more of the geographic markets in which we operate, whatever the cause, have negatively affected, and we expect will continue to negatively affect, our sales and profitability, results of operations, cash flow and financial condition.

The Company has foreign currency translation and transaction exposure that has, and is likely to continue to, materially affect the Company’s sales, results of operations, financial condition and liquidity.

Approximately 57 percent of our net sales for the year ended December 31, 2023, were transacted in a currency other than the U.S. dollar. Our primary exposure to currency movements relative to the U.S. dollar is in the Euro, the Swedish krona, the British pound, the Brazilian real, the Australian dollar, the Canadian dollar, and the Mexican peso. Currency exchange rates can be volatile especially in times of global, political and economic tension or uncertainty. Additionally, government actions such as currency devaluations, foreign exchange controls, imposition of tariffs or other trade restrictions, and price or profit controls can further negatively impact, and increase the volatility of, foreign currency exchange rates.

The fluctuations in the foreign currency rates relative to the U.S. dollar can cause translation, transaction, and other gains and losses in our non-U.S.-based businesses, which impact our sales, profitability and cash flow. Our primary exposure is from translation of our foreign operations' results. Generally, the strengthening of the U.S. dollar against foreign currencies negatively impacts the Company’s reported sales and operating margins. Conversely, the weakening of the U.S. dollar against foreign currencies generally has a positive effect.

We source approximately 60 percent of our products from lower cost countries, primarily in Asia using U.S. dollars. This creates transactional exposure in our foreign markets. The strengthening of the U.S. dollar against local foreign currencies increases our cost of goods and reduces our margins on products sold in local currency. When this occurs, we seek to raise prices in our foreign markets to recover the lost margin. Due to competitive pressures and the timing of these price increases relative to the changes in the foreign currency exchange rates, it is often difficult to increase prices fast enough to fully offset the cumulative impact of the foreign-exchange-related inflation on our cost of goods sold in these markets.

We use hedging instruments to mitigate transactional exposure to changes in foreign currencies. The effectiveness of our hedges in part depends on our ability to accurately forecast future cash flows, which is particularly difficult during periods of uncertain demand for our products and highly volatile exchange rates. For additional information, see "Part II, Item 7A. Quantitative and Qualitative Disclosures About Market Risk - Foreign Exchange Risk Management" of this report.

Challenges related to the highly competitive business environment in which we operate has, and may continue to have, a material adverse effect on our business, results of operations and financial condition.

We operate in a highly competitive environment characterized by large, sophisticated customers, low barriers to entry for certain of our products, and competition from a wide range of products and services (including private label products and electronic and digital products and services that can replace or render certain of our products obsolete). We have seen, and expect to continue to see, increased competition from private label brands, especially in periods of economic uncertainty and weakness when customers and consumers turn to alternative or lower cost products.

ACCO Brands competes with numerous branded consumer products manufacturers, as well as numerous private label suppliers and importers, including many of our customers who import their own private label products directly from foreign sources. Many of our competitors have strong, sought-after brands. Their ability to manufacture products locally at a lower cost or source them from other countries with lower production costs can give them a competitive advantage in terms of price under certain circumstances. In addition, as economic and competitive pressures cause our customers to close or reduce the size of their retail locations, and diversify their product offerings, the available retail space devoted to our products is further limited.

Our business has been, and we expect it will continue to be, affected by actions taken by our customers and competitors to compete more effectively. Such actions have, and in the future may, result in lost sales and lower margins, and adversely affect our business, results of operations, and financial condition.

Our success depends on our ability to develop and market innovative products that meet consumer and other end-user demands, including price expectations, and to expand into new and adjacent product categories that we believe will have higher long-term growth rates.

Our success depends on our ability to invest in innovation and product development and successfully anticipate, develop and market products that appeal to the changing needs and preferences of consumers and other end-users. Additionally, part of our strategy is to develop new, exciting and differentiated products in our technology accessories and learning and creative categories which we believe offer significant long-term growth opportunities. There can be no assurance that we will make the right investment choice or be successful in developing innovative products in these and other categories. If we are unable to successfully increase sales and margins by expanding our product assortment, our business, results of operations and financial condition could be adversely affected.

Our business and results of operations have been and may continue to be adversely affected by the long-term impacts of the COVID-19 global pandemic.

The long-term impacts of the COVID-19 pandemic, including the prevalence of hybrid work, and changes in the behavior of customers, consumers and end-users, has had, and will continue to have, a negative effect on our business and results of operations. During 2023, office occupancy rates stabilized at levels well below pre-pandemic levels and the rate of decline in the demand for our traditional paper-based and related products continues to accelerate. The extent of the impact of these trends on our future business and financial results depends on future developments that are uncertain. The continued longer-term impacts of the COVID-19 pandemic may also exacerbate other risks discussed in this "Part I, Item 1A. Risk Factors," any of which could have a material effect on the business, results of operations or financial condition of the Company.

Growth in emerging geographies may be difficult to achieve and exposes us to financial, operational, regulatory, compliance, and other risks not present, or not as prevalent, in more established markets.

The profitable growth of our business in emerging markets is a key element to our long-term growth strategy. Emerging markets generally involve more financial, operational, regulatory and compliance risks than more mature markets. As we expand and grow in these markets, we increase our exposure to these risks. These risks include currency transfer restrictions, currency fluctuations, changes in international trade and tax policies and regulations (including import and export restrictions), and a lack of well-established or reliable legal systems. Additionally, in some cases, emerging markets also have greater political and economic volatility, greater vulnerability to infrastructure and labor disruptions, and are more susceptible to corruption, civil unrest, military disruptions, terrorism, public health emergencies, severe weather conditions, and natural disasters. Weak or corrupt legal systems may affect our ability to protect and enforce our intellectual property, contractual and other rights. Further, these emerging markets are generally more remote from our headquarters' location and have different cultures that may make it be more difficult to impose corporate standards and procedures and the extraterritorial laws of the U.S. and other jurisdictions, including the U.S. Foreign Corrupt Practices Act, the U.K. Bribery Act and other similar laws.

If we are unable to profitably grow our existing emerging market businesses or expand into other emerging markets, achieve the return on capital we expect as a result of our investments, or effectively manage the risks inherent in operating in these markets, our business, results of operations and financial condition could be adversely affected.

Continued declines in the use of certain of our products have and will continue to adversely affect our business.

A number of our products and brands consist of paper-based and related products. As use of technology-based tools continues to rise worldwide and the nature of work and school evolves demand for many of our products, especially for our traditional paper-based and related products has declined. This trend was accelerated by the COVID-19 pandemic and we expect that demand for these products will continue to decline. The decline in the overall demand for certain of the products we sell has adversely impacted our business and results of operations, and we expect it will continue to do so.

Our school and technology accessories businesses are seasonal, which has impacted, and may in the future impact, our ability to accurately forecast our operating results and working capital requirements.

Historically, each of our segments has demand that varies based on certain seasonal drivers related to the product categories it sells as discussed in "Part I. Item 1. Business - Seasonality" of this report.

As a result of this seasonality, our inventory and working capital needs fluctuate significantly throughout the year. In addition, our customers often change their order patterns for the peak season, making forecasting of production schedules and inventory purchases more challenging. These fluctuations have impacted our ability to accurately forecast our inventory and working capital needs as well as our operating results. When we are unable to accurately forecast and prepare for customer orders or our working capital needs, or if there is a downturn in business or economic conditions during these periods, our business,

results of operations, liquidity and financial condition have been, and in the future could be, adversely affected. Additionally, because of these quarterly fluctuations, comparisons of our operating results across different fiscal quarters may not be meaningful.

The level of investment returns on pension plan assets and the assumptions used for valuation purposes have affected the Company's earnings, and could affect the Company’s earnings and cash flows in future periods. Changes in government regulations, as well as the significant unfunded liabilities, including the unfunded liabilities of the U.S. multi-employer pension plan in which we are a participant, could also affect the Company’s pension plan expenses and funding requirements.

As of December 31, 2023, the Company had $162.1 million recorded as pension liabilities in its Consolidated Balance Sheet. Funding obligations are determined by government regulations and are measured each year based on the value of assets and liabilities on a specific date. When the financial markets do not provide the long-term returns that are expected, or discount rates increase the present value of liabilities, the Company has been, and in the future could be, required to make larger contributions and/or record higher non-cash expenses related to its pension liabilities. The markets can be, and recently have been, very volatile, and therefore the Company’s estimate of future contribution requirements and/or non-cash expenses can change dramatically in relatively short periods of time. Similarly, changes in interest rates and legislation enacted by governmental authorities can impact the timing and amounts of contribution requirements and/or non-cash expenses. An adverse change in the funded status of the plans could significantly increase our required future contributions and/or non-cash expenses and adversely impact our liquidity.

We also participate in a multi-employer pension plan for our union employees at our Ogdensburg, New York facility. The plan has reported significant underfunded liabilities and declared itself in critical and declining status. As a result, the trustees of the plan adopted a rehabilitation plan in an effort to forestall insolvency. Our current contributions to this plan (which are not significant) could increase due to the shrinking contribution base resulting from the insolvency or withdrawal of other participating employers, the inability or the failure of withdrawing participating employers to pay their withdrawal liability, lower than expected returns on pension fund assets, and other funding deficiencies. The present value of our withdrawal liability payments could be significant and would be recorded as an expense in our Consolidated Statements of Income and as a liability on our Consolidated Balance Sheets in the first year of our withdrawal. See also "Note 5. Pension and Other Retiree Benefits" to the consolidated financial statements contained in Part II, Item 8. of this report.

Impairment of goodwill and indefinite-lived intangible assets have had, and could in the future have, a material adverse effect on our financial results.

We have approximately $1.4 billion of goodwill and other specifically identifiable intangible assets as of December 31, 2023. During the fourth quarter of 2023, we recorded a $89.5 million non-cash goodwill impairment charge related to our North America reporting unit. This follows a $98.7 million non-cash goodwill impairment charge related to our North America reporting unit recorded during the third quarter of 2022. Future events may occur that could adversely affect the reported value, or fair value, of our goodwill or indefinite-lived intangible assets that would require future impairment charges which would negatively impact our financial results. Such events may include, but are not limited to, strategic decisions made in response to changes in economic and competitive conditions, the impact of the economic environment on our sales and customer base, the unfavorable resolution of litigation, a material adverse change in our relationship with significant customers, or a sustained decline in our stock price. We continue to evaluate the impact of developments from our reporting units to assess whether impairment indicators are present. See also "Note 9. Goodwill and Identifiable Intangible Assets" to the consolidated financial statements contained in Part II, Item 8. of this report.

Our inability to secure, protect and maintain rights to intellectual property could have an adverse impact on our business. In particular, the success and future growth of our gaming accessories business depends on its ability to license the right to use the trademarks and other intellectual property of the major gaming console makers and video game publishers.

We consider our intellectual property rights, particularly and most notably our trademarks and trade names, but also our patents, trade secrets, trade dress, copyrights, and licensing agreements, to be an important and valuable part of our business. Our failure to obtain or adequately protect our intellectual property rights, or any change in law or other changes that serve to lessen or remove the current legal protections of our intellectual property, may diminish our competitiveness, dilute the value of our brands, cause confusion in the marketplace, and materially impact our sales and profitability.

Our gaming accessories business licenses trademarks and other intellectual property from the three major gaming console manufacturers and numerous video game publishers. The loss or non-renewal of one or more of these licenses would, in all likelihood, materially and adversely impact our sales, results of operations and financial condition. Additionally, our ability to expand our gaming accessories business into certain new geographies requires that we obtain additional licensing rights from the gaming console manufacturers and video game publishers. There can be no assurance that we will be able to obtain these additional licensing rights.

Operational Risks

Failure to successfully implement our multi-year restructuring and cost savings program could adversely affect our future results of operations and cash flow.

In January 2024, the Company announced a multi-year restructuring and cost savings program, with anticipated annualized pre-tax cost savings of at least $60 million when fully implemented in 2026. The program incorporates initiatives to simplify and delayer the Company's operating structure and reduce costs through headcount reductions, supply chain optimization, global footprint rationalization, and better leveraging of the Company's sourcing capabilities. We may not be able to successfully execute these initiatives in a timely manner or realize the anticipated cost savings and operational synergies. Failure to implement these initiatives and realize the anticipated cost savings and operational synergies as planned could adversely affect our future results of operations and cash flow. Further, the changes to our operating structure, including the leadership changes, have resulted in a significant amount of organization change which, could divert management's attention from other priorities, disrupt the Company's day-to-day operations and have a negative impact on employee morale and retention. If we are not able to effectively manage the restructuring process our business and financial results could suffer.

Our business, results of operations and cash flow have been, and may continue to be, adversely impacted by disruptions in the global supply chain.

We manufacture approximately 40 percent of the products we sell where we operate and purchase the remaining 60 percent from suppliers in lower cost countries, primarily in Asia. We also purchase component parts and raw materials for our manufactured products from third parties many of which are also imported from Asia. Additionally, we rely on international freight carriers and domestic trucking and rail lanes to import and distribute products to our customers throughout the world. We have experienced disruptions in our global supply chain due to insufficient freight carrier capacity, port delays and closures, the cost and availability of international and domestic freight carriers, labor shortages and geopolitical unrest. Although we saw a significant reduction in supply chain disruptions and deflation in transportation costs during 2023, recent geopolitical unrest in the Middle East is once again impacting our supply chain and adversely affecting our business operations. These events as well as further supply chain disruptions could adversely affect our operations, sales, profitability and cash flow.

Our operating results have been, and continue to be, adversely affected by inflation and changes in the cost or availability of raw materials, transportation, labor and other necessary supplies and services, including the cost of finished goods.

The price and availability of raw materials, transportation, labor, and other necessary supplies and services used in our business, as well as the cost of finished goods, can be volatile due to numerous factors beyond our control, including general economic and competitive conditions, inflation, supply chain disruptions, supplier business strategies, and political instability, war and other geopolitical tensions. In recent years, the global economy has experienced the highest levels of inflation in decades. Additionally, the global imbalance between the supply and demand for commodities, component parts, transportation and labor have impacted their availability and increased their cost. This has been exacerbated by the geopolitical unrest in Europe and the Middle East. As a result, we have experienced cost increases from our suppliers of raw materials, component parts and purchased finished goods, as well as increased labor, energy and commodity costs. During the fourth quarter of 2023, we began to see signs of moderating inflation. While we believe that inflationary costs for most raw materials, purchased finished goods, and freight and transportation will continue to moderate, there can be no assurance that inflation will abate.

During periods of inflation and rising costs, we manage this volatility through a variety of actions, including targeted advance or periodic purchases, future delivery purchases, long-term contracts, sales price increases and the use of certain derivative instruments. We implemented price increases in 2022 and throughout 2023, and will implement additional price increases if necessary to offset future inflationary and supply-chain related cost increases. Historically, we have not been able to raise prices fast enough to effectively mitigate the adverse impact of these cost increases on our margins and there can be no assurance that we will be able to do so in the future. Additionally, we have lost, and may continue to lose, sales due to increasing our selling prices to our customers. We have also seen customers and consumers purchase lower priced products which generate lower margins due to our price increases and we expect this trend may continue.

Outsourcing the development and production of certain of our products, our information technology systems and other administrative functions could materially adversely affect our business, results of operations and financial condition.

We outsource certain product development and manufacturing functions, such as product design and production, to third-party suppliers. This creates a number of risks, including decreased control over the engineering and manufacturing processes which can result in cost overruns, delayed deliveries or shortages, inferior product quality, and loss or misappropriation of trade secrets and intellectual property. Additionally, we rely on our suppliers to ensure that our products meet our design and product content specifications, and all applicable laws, including product safety, security, labor, sustainability and environmental laws. We also expect our suppliers to conform to our and our customers’ and licensors' codes of conduct and expectations with respect to product safety, product quality, social responsibility and environmental sustainability, and be responsive to our audits. Failure to meet any of these requirements may result in our having to cease doing business with a supplier or cease production at a particular facility, stop selling or recall non-conforming products, or having imported products detained at the port or subject to exclusion or seizure. Substitute suppliers might not be available or, if available, might be unwilling or unable to offer products on acceptable terms or in a timely manner. Moreover, if one or more of our suppliers is unable or unwilling to continue to provide products of acceptable quality, at acceptable cost or in a timely manner due to financial difficulties, insolvency or otherwise, including as a result of disruptions associated with circumstances outside their control, or if customer demand for our products increases, we may be unable to secure sufficient additional capacity from our current suppliers, or others, in a timely manner or on acceptable terms. Any of these events could result in unforeseen production delays and increased costs and negatively affect our ability to deliver our products to our customers, all of which could adversely affect our business, sales, results of operations, and financial condition.

We also outsource important portions of our information technology infrastructure and systems support to third-party service providers. Outsourcing of information technology services creates risks to our business, which are similar to those created by our product production outsourcing.

In addition, we outsource certain administrative functions, such as payroll processing and benefit plan administration, to third-party service providers and may outsource other functions in the future to achieve cost savings and efficiencies. If the service providers to whom we outsource these functions do not perform effectively or experience deficiencies or material weaknesses in their internal controls, we may not be able to achieve the expected cost savings and may incur additional costs to correct errors they make. Depending on the function involved, such issues may also lead to business disruption, processing inefficiencies, internal control deficiencies, loss of or damage to intellectual property, legal and regulatory exposure, or harm to employee morale.

Technology and Cybersecurity Risks

We rely extensively on information technology systems to operate, transact and otherwise manage our business. Any material failure, inadequacy, or interruption of that technology or its supporting infrastructure could materially adversely affect our business, results of operations and financial condition.

We rely extensively on our information technology systems, many of which are outsourced to third-party service providers. We depend on these systems and our third-party service providers to effectively manage our business and execute the production, distribution and sale of our products, as well as to manage and report our financial results and run other support functions. Although we have implemented service level agreements and have established monitoring controls, if our third-party service providers fail to perform their obligations in a timely manner or at satisfactory levels, our business could suffer. Additionally, if one or more of our information technology suppliers is unable or unwilling to continue to provide services at acceptable cost due to financial difficulties, insolvency or otherwise, our business could be adversely affected.

Further, our failure to properly maintain and successfully upgrade or replace any of these systems, especially our enterprise resource planning systems, could disrupt our business and our ability to service our customers or negatively impact our ability to report our financial results in a timely and accurate manner.

If our day-to-day business operations or our ability to service our customers is negatively impacted by the failure or disruption of our information technology systems, if we are unable to accurately and timely report our financial results, or if we conclude that we do not have effective internal control over financial reporting and effective disclosure controls and procedures, it could damage our reputation and adversely affect our business, results of operations and financial condition.

Security breaches could compromise our confidential and proprietary information, as well as any personally identifiable information we hold, and expose us to operational and legal risks that could cause our business and reputation to suffer and materially adversely affect our results of operations and financial condition.

We maintain information and applications necessary to conduct our business in data centers, on our networks and with third-party cloud services, including confidential and proprietary information, as well as personally identifiable information regarding our customers and employees. Our information technology infrastructure may be vulnerable to attacks by hackers or breached due to employee error, malfeasance, or other disruptions which creates the risk that our digital information could be stolen or tampered with or that our business operations could be materially and adversely impacted. This risk is heightened now that most of our office-based employees work remotely several days a week.

We maintain systems designed to prevent and monitor for such intrusion, tampering, and theft, and we continue to enhance and update these technologies as security threats evolve and become more sophisticated. We also obtain assurances from outsourced service providers regarding the sufficiency of their security procedures and, where appropriate, assess the protections employed by these third parties. Despite these efforts, there can be no assurance that we will successfully identify an incident of intrusion, tampering or theft in a timely manner or at all, and in advance of it impacting the Company, and any such impact could be material. Further, our costs to maintain and upgrade our security systems could increase significantly as cybersecurity threats increase.

Despite our efforts to secure and monitor our information technology systems, the possibility of intrusion, tampering, and theft cannot be eliminated entirely. We have from time to time experienced cybersecurity breaches, such as "phishing" attacks, business email compromises, employee or insider error, brute force attacks, unauthorized parties gaining access to our information technology systems, and similar incidents. To date these incidents have not had a material impact on our business, but there can be no assurance that future incidents will not cause material impacts. The techniques used to obtain unauthorized access, disable or degrade service, or sabotage systems change frequently and often are not recognized until launched against a target. Additionally, there can be no assurance that the actions we and our outsourced providers take will prevent a breach of, or attack on the information technology systems which support the day-to-day operation of our business or house our confidential, proprietary and personally identifiable information.

Any such intrusion, tampering or theft (and any resulting disclosure or use of confidential, proprietary or personally identifiable information) could compromise our network, the network or data center of a third-party hosting key operating systems or data, or to whom we have disclosed confidential, proprietary or personally identifiable information, or a third-party cloud service provider. Any of these impacts could result in a disruption to our information technology infrastructure, interruption of our business operations, violation of applicable privacy and other laws or standards, significant legal and financial exposure beyond the scope or limits of any insurance coverage (including legal claims and proceedings and regulatory enforcement actions and penalties), increased operating costs associated with remediation activities, and a loss of confidence in our security measures, all of which could harm our reputation with our customers, end-users, employees and other stakeholders and materially adversely affect our business and results of operations. Contractual provisions with third parties, including cloud service providers, may limit our ability to recover these losses.

In the event a significant cybersecurity event is detected, we maintain disclosure controls and procedures that are designed to enable us to promptly analyze the impact on our business, respond expediently, appropriately and effectively and repair any damage caused by such incident, as well as consider whether such incident should be disclosed publicly. The Company also employs technology designed to detect potential incidents of intrusion, tampering and theft before they impact the Company, and we continue to enhance and update these technologies. However, there can be no assurance that we will successfully identify such an incident in a timely manner or at all, and in advance of it impacting the Company, and any such impact could be material.

Merger and Acquisition Risks

Our strategy is partially based on growth through acquisitions. Failure to properly identify, value and manage acquisitions, and successfully integrate them may materially impact our business, results of operations and financial condition.

Our strategy is partially based on growth through acquisitions. We may not be successful in identifying suitable acquisition opportunities, prevailing against competing potential acquirers, negotiating appropriate acquisition terms, obtaining financing, or completing proposed acquisitions. In addition, an acquisition may not perform as anticipated, be accretive to earnings, or prove to be beneficial to our operations and cash flow. If we fail to effectively identify, value, consummate, or manage any acquired company, we may not achieve the financial results, including cost savings and synergies, anticipated at the time of its acquisition. An acquisition could also adversely impact our operating performance or cash flow due to the issuance of acquisition-related debt, pre-acquisition assumed liabilities, undisclosed facts about the business, expenses incurred to consummate the acquisition, increases in amortization due to the acquisition, or possible future impairments of goodwill or intangible assets associated with the acquisition.

We may face challenges in integrating our acquisitions with our existing operations and expanding the acquired business geographically. The process of integrating and expanding operations also could cause an interruption of, or loss of momentum in, the activities of one or more of our businesses due to the considerable time and attention needed for the process. If we are not able to effectively manage the integration process, or if any significant business activities are interrupted as a result thereof, our business and financial results could suffer.

The integration of any acquisition will involve changes to or implementation of critical information technology systems, modifications to our internal control systems, processes and accounting and financial systems, and the establishment of disclosure controls and procedures and internal control over financial reporting necessary to meet our obligations as a public company. If we are unable to successfully complete these tasks and accurately report our financial results in a timely manner and establish internal control over financial reporting and disclosure controls and procedures that are effective, our business, results of operations and financial condition, investor, supplier and customer confidence in our reported financial information, the market perception of our Company and/or the trading price of our common stock could be materially adversely affected.

Liquidity, Capital Resources and Capital Allocation Risks

Our existing borrowing arrangements limit our ability to engage in certain activities. If we are contractually restricted from pursuing activities or transactions that we believe are in our long-term best interests, or are unable to meet our obligations under our loan agreements, our business, results of operations and financial condition could be materially adversely affected.

The terms of our debt agreements limit our ability to engage in certain activities and transactions that may be in our and our stockholders' long-term interests. Among other things, the covenants and financial ratios and tests contained in our debt agreements restrict or limit our ability to incur additional indebtedness, grant certain liens on our assets, issue preferred stock or certain disqualified stock, make restricted payments (including dividends and share repurchases), make investments, sell our assets or merge with other companies, and enter into certain transactions with affiliates. We are also required to maintain specified financial ratios under certain circumstances and satisfy financial condition tests. Our ability to comply with these covenants and financial ratios and tests may be affected by events beyond our control, and we may not be able to continue to meet those covenants, ratios and tests.

Our debt service obligations require us to dedicate a portion of our cash flow from operating activities to make interest and principal payments on our indebtedness, which reduces the availability of our cash flow to fund working capital, capital expenditures, research and product development efforts, potential acquisitions and other general corporate purposes. A portion of our outstanding indebtedness bears interest at a floating rate which fluctuates with changes in interest rates.

Our ability to meet our debt obligations, including our financial covenants, and to refinance our existing indebtedness upon maturity, will depend upon our future operating performance, which will be affected by general economic, financial, competitive, regulatory, business, and other factors. Breach of any of the covenants, ratios, and tests contained in the agreements governing our indebtedness, or our inability to pay interest on, or principal of, our outstanding debt as it becomes due, could result in an event of default, in which case our lenders could declare all amounts outstanding to be immediately due and payable. If our lenders accelerate our indebtedness, or we are not able to refinance our debts at maturity, our assets may not be sufficient to repay in full such indebtedness and any other indebtedness that would become due as a result of such acceleration. If we then are unable to obtain replacement financing or any such replacement financing is on terms that are less favorable than the indebtedness being replaced, our liquidity, results of operations, and financial condition would be adversely affected.

We may not continue to pay dividends at historic rates, or at all, or engage in stock repurchases.

We have a history of paying quarterly dividends and engaging in stock repurchase programs; however, any determination to continue to pay cash dividends at recent rates or at all, or resume repurchasing our shares in the market, is contingent on a variety of factors, including our financial condition, results of operations, business requirements, and our board of directors' continuing determination that such dividends or share repurchases are in the best interests of our stockholders and in compliance with all applicable laws and agreements. Under certain circumstances, the terms of our debt agreements limit our ability to return

capital to stockholders through stock repurchases, dividends or otherwise. There is no assurance that we will continue to make dividend payments or repurchase stock.

Legal and Regulatory Risks

Product liability claims, recalls or regulatory actions could materially adversely affect our financial results or harm our reputation or brands.

Claims for losses or injuries purportedly caused by one of our products arise in the ordinary course of our business. Litigation or regulatory enforcement actions and the associated costs and potential for monetary judgments and penalties could have an adverse effect on our results of operations and financial condition. Additionally, product liability claims or regulatory actions, regardless of merit, could result in negative publicity that could harm our reputation in the marketplace or the value of our brands. We also may be, and in the past have been, required to recall and discontinue the sale of allegedly defective or unsafe products, which has resulted in lost sales and unplanned expenses. Any future recall or quality issue could result in lost sales, adverse publicity, and significant expenses, and adversely impact our results of operations or financial condition.

Litigation or legal proceedings could expose us to significant liabilities and damage our reputation.

We are party to various lawsuits and regulatory proceedings, primarily related to alleged patent infringement, as well as other claims incidental to our business. In addition, we may be unaware of third-party claims of intellectual property infringement relating to our technology, brands, or products, and we may face other claims related to business operations. Any litigation regarding patents or other intellectual property could be costly and time-consuming and might require us to pay monetary damages or enter into costly license agreements. We also may be subject to injunctions against development and sale of certain of our products.

It is the opinion of management that (other than the Brazil Tax Assessments described below) the ultimate resolution of currently outstanding matters will not have a material adverse effect on our financial condition, results of operations or cash flow. However, there is no assurance that we will ultimately be successful in our defense of any of these matters or that an adverse outcome in any matter will not affect our results of operations, financial condition, or cash flow. Further, future claims, lawsuits and legal proceedings could materially adversely affect our business, reputation, results of operations, and financial condition.

In connection with our May 1, 2012 acquisition of the Mead Consumer and Office Products business, we assumed all of the tax liabilities for its acquired foreign operations, including its operating entity in Brazil ("ACCO Brazil"). In December of 2012, the Federal Revenue Department of the Ministry of Finance of Brazil ("FRD") issued a tax assessment against ACCO Brazil, challenging the tax deduction of goodwill from ACCO Brazil’s taxable income for the year 2007 (the "First Assessment"). A second assessment challenging the deduction of goodwill from ACCO Brazil’s taxable income for the years 2008, 2009 and 2010 was issued by FRD in October 2013 (the "Second Assessment" and together with the First Assessment, the "Brazil Tax Assessments"). ACCO Brazil continues to dispute both of the Brazil Tax Assessments. If the FRD’s initial position is ultimately sustained, payment of the amount assessed would materially adversely affect our cash flow in the year of settlement. For additional details regarding the Brazil Tax Assessments, see "Note 11. Income Taxes – Brazil Tax Assessments" to the consolidated financial statements contained in Part II, Item 8. of this report.

Additional tax liabilities stemming from our global operations and changes in tax legislation, regulation and tax rates have, and may continue to, adversely affect our financial results.

We face a variety of risks of increased future taxation on our earnings as a corporate taxpayer in the countries in which we have operations. Moving funds between countries can produce adverse tax consequences. In addition, since our operations are global, we can face challenges in effectively gaining a tax benefit for costs incurred in one country that benefit our operations in other countries.

Changes in tax legislation or tax rates may occur in one or more jurisdictions in which we operate that may materially impact the cost of operating our business. Recent legislative changes in the United States include the 2017 Tax Cuts and Jobs Act and the 2022 Inflation Reduction Act, which have introduced limitations on business-related deductions and increased taxation of foreign earnings in the U.S., and a corporate minimum tax, all of which could increase our future tax expense.

In addition, the potential exists for significant legislative policy change in the taxation of multinational corporations, as has recently been the subject of the “Pillar One” and “Pillar Two” initiatives of the Organization for Economic Co-operation and Development, the European Union Anti-Tax Avoidance Directives, and legislation inspired or required by those initiatives. It is also possible that some governments will make significant changes to their tax policies in response to factors such as budgetary needs, feedback from the business community and the public view on applicable tax planning activities. Further, interpretations of existing tax law in various countries may change due to the regulatory and examination policies of the tax authorities and the decisions of courts.

Adverse or unanticipated tax consequences can negatively impact our performance. We are uncertain as to the ultimate results of these potential changes or what their effects will be on our business.

Laws, rules and regulations and self-regulatory requirements that affect our business, including the costs of compliance, as well as the impact of changes in such laws, could materially adversely affect our business, reputation and results of operations.

We are subject to national, state, provincial and/or local laws, rules and regulations, as well as self-regulatory requirements, in numerous countries due to the nature of our operations and the products we sell, including:

•Laws and regulations applicable to U.S. public companies with securities listed on the New York Stock Exchange;

•Laws relating to the discharge and emission of certain materials and waste, and laws establishing standards for their use, disposal, and management;

•Laws governing the content of toxic chemicals and materials in the products we sell;

•Laws relating to corporate governance, the environmental sustainability of our operations and products (including packaging) and the protection of human rights in our supply chain, including reporting obligations;

•International trade laws, including tariffs, trade sanctions and embargoes;

•Privacy and data security laws and self-regulatory requirements regarding the acceptance, processing, storage, and transmission of credit card data;

•Laws governing fair competition and marketing and advertising, including laws and regulations regarding "green" claims; and

•Anti-bribery, anti-corruption and anti-money laundering laws.

All of these legal frameworks are complex and change frequently. Moreover, the requirements of these and other laws can vary significantly from jurisdiction to jurisdiction. Additionally, laws relating to sustainability and human rights, including enhanced transparency and reporting obligations, are rapidly being adopted around the world. Capital and operating expenses required to establish and maintain compliance with all of these laws, rules and regulations and self-regulatory requirements can be significant, and violations may result in substantial fines, penalties, and civil damages as well as damage to our reputation. In addition, as we continue to expand our business into new markets and into new product categories, we increase the number of legal and self-regulatory requirements with which we are required to comply, which increases the complexity and costs of compliance, as well as the risks of noncompliance. Any significant increase in our costs to comply with applicable legal and self-regulatory requirements, or any liability arising from noncompliance, could have a material adverse effect on our business, results of operations, and financial condition.

Additionally, our future results of operations could be adversely impacted by changes in these laws. Changes in income tax laws could change our effective tax rate while changes in U.S. trade policies, including tariffs on imports from China and on commodities we use in our manufacturing operations, could affect our cost of products sold and margins.

General Risk Factors

Our success depends on our ability to attract and retain qualified personnel.