- OLP Dashboard

- Financials

- Filings

-

Holdings

-

Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

PRE 14A Filing

One Liberty Properties (OLP) PRE 14APreliminary proxy

Filed: 3 Apr 20, 4:18pm

Check the appropriate box: | |

| ☒ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under §240.14a-12 |

| One Liberty Properties, Inc. |

| (Name of Registrant as Specified In Its Charter) |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box): | |

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

(1) | Title of each class of securities to which transaction applies: | |

(2) | Aggregate number of securities to which transaction applies: | |

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

(4) | Proposed maximum aggregate value of transaction: | |

(5) | Total fee paid: | |

☐ | Fee paid previously with preliminary materials. | |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

(1) | Amount Previously Paid: | |

(2) | Form, Schedule or Registration Statement No.: | |

(3) | Filing Party: | |

(4) | Date Filed: | |

| 1. | The election of three directors, each to serve until the 2023 Annual Meeting of Stockholders and until his or her successor is duly elected and qualifies; |

| 2. | A proposal to approve a non-binding advisory resolution regarding the compensation of our executive officers for the year ended December 31, 2019, as more fully described in the accompanying proxy statement; |

| 3. | A proposal to ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2020; |

| 4. | Proposals to amend our charter, in each case as more fully described in the accompanying proxy statement, to: |

| A. | increase the Company’s authorized capital stock and its authorized common stock; |

| B. | revise the requirements in our charter to indemnify and advance the expenses of our officers, directors and employees with respect to liabilities arising in connection with their services to us; and |

| C. | change the vote required for our stockholders to approve certain actions. |

| 5. | Proposals to amend our Bylaws, in each case as more fully described in the accompanying proxy statement, to: |

| A. | eliminate certain restrictions on our ability to engage in certain investment, financing, re-leasing and other transactions; and |

| B. | eliminate certain requirements relating to management arrangements; and |

| 6. | Any other business property brought before the meeting. |

By Order of the Board of Directors | |

S. Asher Gaffney, Secretary |

| Page | |

| 1 | |

| 1 | |

| 5 | |

| 5 | |

| 5 | |

| 5 | |

| 5 | |

| 6 | |

| 6 | |

| 7 | |

| 7 | |

| 8 | |

| 8 | |

| 10 | |

| 12 | |

| 12 | |

| 16 | |

| 17 | |

| 17 | |

| 19 | |

| 19 | |

| 19 | |

| 19 | |

| 21 | |

| 24 | |

| 24 | |

| 25 | |

| 28 | |

| 29 | |

| 30 | |

| 30 | |

| 31 | |

| 32 | |

| 33 | |

| 35 | |

| 36 | |

| 37 | |

| 39 | |

| 40 | |

| 41 | |

| 42 | |

| 34 | |

| 43 | |

| A-1 | |

| B-1 |

PROXY STATEMENT |

| • | election of three directors to hold office until the 2023 annual meeting and until their respective successors are duly elected and qualify; |

| • | a proposal to approve a non-binding advisory resolution regarding our executive compensation for the year ended December 31, 2019; |

| • | ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2020; |

| • | the Charter Amendment Proposal; |

| • | the Bylaw Amendment Proposal; and |

| • | such other matters as may properly come before the meeting. |

| • | “FOR” the election of each of Charles Biederman, Patrick J. Callan, Jr., and Karen A. Till (collectively the “Nominees”), each to hold office until the 2023 annual meeting and his or her successor is duly elected and qualifies; |

| • | “FOR” the proposal to approve the non-binding advisory resolution regarding our executive compensation; |

| • | “FOR” the proposal to ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2020; |

| • | “FOR” the Charter Amendment Proposal; and |

| • | “FOR” the Bylaw Amendment Proposal. |

| • | Vote online. You may vote online at www.voteproxy.com. To vote online, you must have your control number provided in the proxy card. |

| • | Vote by telephone. You may vote by telephone by calling 1-800-PROXIES (1-800-776-9437). To vote by telephone, you must have the control number provided in your proxy card. |

| • | Vote by regular mail. If you would like to vote by mail, please mark, sign and date your proxy card and return it promptly in the postage-paid envelope provided. |

| • | Vote by attending the meeting in person. |

• | receive notice of the proposal before March [ ], 2021, and advise stockholders in the proxy statement for our 2021 annual meeting of stockholders of the nature of the proposal and how management intends to vote on such matter; or |

• | do not receive notice of the proposal before March [ ], 2021. |

Name | Audit | Compensation | Nominating | |||||

Charles Biederman(1) | ✔ | Chair | ||||||

Joseph A. DeLuca | ✔ | |||||||

J. Robert Lovejoy(2) | Chair | ✔ | ||||||

Louis P. Karol(3) | Chair | |||||||

Leor Siri(4) | Chair | |||||||

Karen A. Till (5) | ✔ | |||||||

Eugene I. Zuriff(2) | ✔ | Chair | ||||||

Number of Meetings | 4 | 4(6) | 3(6) | |||||

| (1) | Mr. Biederman’s service as chair of this committee began September 11, 2019. |

| (2) | Mr. Zuriff served as chair of this committee through June 13, 2019 at which time Mr. Lovejoy became chair. |

| (3) | Mr. Karol resigned as a director and as chair of the nominating committee on August 2, 2019. |

| (4) | Mr. Siri served as our audit committee financial expert in 2019. |

| (5) | Ms. Till was elected on September 11, 2019 by the Board to serve as a director and as a member of the nominating committee. |

| (6) | Includes a joint meeting of the compensation committee and nominating committee. |

| • | Independence, including independence from management and pursuant to the New York Stock Exchange’s director independence standards; |

| • | Whether the candidate has relevant business experience; |

| • | Judgment, skill, integrity and reputation; |

| • | Financial and accounting background, to enable the nominating committee to determine whether the candidate would be suitable for audit committee membership; |

| • | Executive compensation background, to enable the nominating committee to determine whether the candidate would be suitable for compensation committee membership; and |

| • | The size and composition of the existing board. |

| • | A statement that the writer is a stockholder and is proposing a candidate for consideration by the nominating committee; |

| • | The name of and contact information of the candidate; |

| • | A detailed statement of the candidate’s business and educational experience and an explanation of the reasons why the stockholder believes the candidate is qualified for service on our board of directors; |

| • | Information regarding each of the factors listed above sufficient to enable the nominating committee to evaluate the candidate; |

| • | A statement detailing any relationship between the candidate and any of our competitors, affiliated companies or officers or directors; |

| • | Detailed information about any relationship or understanding between the proposing stockholder and the candidate; and |

| • | A statement that the candidate is willing to be considered and willing to serve as a director if nominated and elected. |

| • | Forward the communication to the director or directors to whom it is addressed; |

| • | Attempt to handle the inquiry directly; for example, where it is a request for information about the company or it is a stock-related matter; or |

| • | Not forward the communication if it is primarily commercial in nature or if it relates to an improper or irrelevant topic. |

| Committee(3) | ||||||||||||||||||

| Board | Audit | Compensation | Nominating | |||||||||||||||

Annual retainer (1) | $ | 32,000 | (2) | $ | 12,000 | $ | 6,000 | $ | 5,000 | |||||||||

Participation in meeting | 1,000 | — | — | — | ||||||||||||||

Chairman’s annual retainer (2) | 289,406 | (3) | 15,000 | 8,500 | 7,000 | |||||||||||||

Vice Chairman’s annual retainer | 115,763 | (3) | — | — | — | |||||||||||||

Lead director’s annual retainer | 25,000 | — | — | — | ||||||||||||||

| (1) | Effective January 1, 2020, the annual retainer for serving as a director or member of the audit, compensation or nominating committee is $33,000, $12,400, $6,200 and $5,200, respectively. |

| (2) | The amounts paid for serving as the chair of the applicable committee are in addition to the annual retainer for service on such committee. |

| (3) | Matthew J. Gould and Fredric H. Gould, members of management, were paid the Chairman’s and Vice Chairman’s annual retainer, respectively. See “Executive Compensation— Compensation Discussion and Analysis — Compensation of the Chairman and Vice Chairman of the Board” and “Certain Relationships and Related Transactions.” |

Name(1) | Fees Earned or Paid in Cash ($)(2) | Stock Awards ($)(3) | Total ($) | ||||||||||

Charles Biederman | 47,750 | 82,240 | 129,990 | ||||||||||

Joseph A. DeLuca | 47,000 | 82,240 | 129,240 | ||||||||||

J. Robert Lovejoy | 76,250 | 82,240 | 158,490 | ||||||||||

Louis P. Karol | 36,000 | 82,240 | 118,240 | ||||||||||

Leor Siri | 63,000 | 82,240 | 145,240 | ||||||||||

Karen A. Till | 10,250 | – | 10,250 | ||||||||||

Eugene I. Zuriff | 58,250 | 82,240 | 140,490 | ||||||||||

| (1) | The compensation received by: (a) Matthew J. Gould, Chairman of the Board, Fredric H. Gould, Vice Chairman of the Board and Patrick J. Callan, Jr., President, Chief Executive Officer and a Director, is set forth in the Summary Compensation Table; and (b) Jeffrey A. Gould, a Senior Vice President and Director, is set forth in “Certain Relationships and Related Transactions.” |

| (2) | Includes all fees earned for services as a director, including annual retainer fees, committee and committee chair fees, independent lead director fee and meeting fees of $1,000 per board meeting. Each non-management director is entitled to reimbursement of travel and other expenses incurred in connection with attendance at board and committee meetings, which amounts are not included in this table. |

| (3) | Represents the aggregate grant date fair value of these restricted stock awards computed in accordance with Accounting Standards Codification Topic 718—Stock Compensation, which we refer to as ASC Topic 718. The closing price per share on January 10, 2019, the grant date, was $25.70 – on such date, each of these directors was awarded 3,200 shares of restricted stock. These shares vest in January 2024. On January 17, 2020, each non-management director was granted 3,200 shares of restricted stock with a grant date fair value of $28.10 per share. Such shares vest in January 2025. |

Name(1) | Unvested Restricted Stock (#) | Market Value of Unvested Restricted Stock ($)(2) | |||||||

Charles Biederman | 14,900 | 405,131 | |||||||

Joseph A. DeLuca | 14,900 | 405,131 | |||||||

J. Robert Lovejoy | 14,900 | 405,131 | |||||||

Louis P. Karol | – | – | |||||||

Leor Siri | 14,900 | 405,131 | |||||||

Karen A. Till | – | – | |||||||

Eugene I. Zuriff | 14,900 | 405,131 | |||||||

| (1) | Information regarding the outstanding restricted stock units (“RSUs”) and shares of restricted stock held by Fredric H. Gould, Patrick J. Callan, Jr. and Matthew J. Gould, our named executive officers who also serve as directors, is set forth under “Executive Compensation – Outstanding Equity Awards at Fiscal Year End.” |

| (2) | The closing price on the New York Stock Exchange on December 31, 2019 for a share of our common stock was $27.19. |

Name | Amount of Beneficial Ownership(1) | Percent of Class | |||||||

Charles Biederman(2) | 29,850 | * | |||||||

Patrick J. Callan, Jr. | 243,210 | 1.2 | % | ||||||

Joseph A. DeLuca(3) | 43,936 | * | |||||||

Fredric H. Gould(4)(5) | 2,289,800 | 11.4 | % | ||||||

Jeffrey A. Gould(4)(6) | 2,105,696 | 10.5 | % | ||||||

Matthew J. Gould(4)(7) | 2,065,718 | 10.3 | % | ||||||

David W. Kalish(8) | 338,874 | 1.7 | % | ||||||

J. Robert Lovejoy(9) | 74,580 | * | |||||||

Lawrence G. Ricketts, Jr. | 134,335 | * | |||||||

Leor Siri(10) | 18,100 | * | |||||||

Karen A. Till | 3,200 | * | |||||||

Eugene I. Zuriff(11) | 32,957 | * | |||||||

Directors and executive officers as a group (19 individuals)(4) | 4,327,010 | 21.6 | % | ||||||

Gould Investors L.P.(4)(12) | 1,785,976 | 8.9 | % | ||||||

BlackRock, Inc.(13) | 1,299,784 | 6.5 | % | ||||||

The Vanguard Group(14) | 1,627,762 | 8.1 | % | ||||||

Renaissance Technologies LLC(15) | 1,044,025 | 5.2 | % | ||||||

| * | Less than 1% |

| (1) | Securities are listed as beneficially owned by a person who directly or indirectly holds or shares the power to vote or to dispose of the securities, whether or not the person has an economic interest in the securities. In addition, a person is deemed a beneficial owner if he has the right to acquire beneficial ownership of shares within 60 days of March 25, 2020. The percentage of beneficial ownership is based on 20,081,682 shares of common stock outstanding on March 5, 2020. |

| (2) | Excludes 56,453 shares owned by his spouse, as to which he disclaims any beneficial ownership interest. |

| (3) | Includes shares of common stock owned by a corporation of which he is the sole shareholder. Excludes 500 shares of common stock owned by his wife as to which he disclaims beneficial ownership. |

| (4) | Fredric H. Gould, Matthew J. Gould and Jeffrey A. Gould are the directors of the corporate managing partner of Gould Investors L.P., which we refer to as Gould Investors, and accordingly may be deemed to share voting and dispositive power with respect to the shares owned by Gould Investors. |

| (5) | Includes 490,268 shares of common stock owned directly, 1,785,976 shares of common stock owned by Gould Investors and 13,556 shares of common stock owned by entities over which he has sole or shared voting and dispositive power. Excludes 56,438 shares of common stock owned by his wife, as to which shares he disclaims beneficial ownership. |

| (6) | Includes 305,741 shares of common stock owned directly, 1,785,976 shares of common stock owned by Gould Investors and 13,979 shares of common stock owned by a foundation over which he has shared dispositive power. |

| (7) | Includes 261,719 shares of common stock owned directly, 1,785 shares of common stock owned by Gould Investors and 13,979 shares of common stock owned by a foundation over which he has shared voting and dispositive power. Also include 4,044 shares of common stock owned by a pension trust over which he has shared voting and dispositive power. |

| (8) | Includes 165,624 shares of common stock owned directly and by his IRA and profit sharing trust, of which he is the sole beneficiary, and 173,250 shares of common stock owned by pension trusts over which he has shared voting and dispositive power. Excludes 500 shares of common stock owned by his wife, as to which shares he disclaims beneficial ownership. |

| (9) | Includes shares of common stock owned by his IRA. Excludes 12,458 shares of common stock owned by his wife as to which shares he disclaims beneficial ownership. |

| (10) | Excludes 285 shares held by his spouse, as custodian for their children, as to which shares he disclaims beneficial ownership. |

| (11) | Excludes 5,000 shares of common stock owned by his wife, as to which shares he disclaims beneficial ownership. |

| (12) | Address is 60 Cutter Mill Road, Suite 303, Great Neck, NY 11021. This stockholder is primarily engaged in the ownership and operation of real estate properties held for investment. |

| (13) | As of December 31, 2019, based (other than with respect to percentage ownership) on information set forth in Amendment No. 9 to Schedule 13G filed with the SEC on February 5, 2020 by this reporting person whose business address is 55 East 52nd Street, New York, NY 10055. This reporting person reported that it has sole voting power with respect to 1,260,654 shares and sole dispositive power with respect to 1,299,784 shares and that it does not share voting or dispositive power with respect to the shares it beneficially owns. |

| (14) | As of December 31, 2019, based (other than with respect to percentage ownership) on information set forth in Amendment No. 7 to Schedule 13G filed with the SEC on February 12, 2020 by this reporting person, whose business address is 100 Vanguard Blvd., Malvern, PA, 19355. This reporting person reported that it has sole voting power with respect to 14,589 shares, shared voting power with respect to 1,000 shares, sole dispositive power with respect to 1,612,811 shares and shared dispositive power with respect to 13,951 shares. |

| (15) | As of December 31, 2019, based (other than with respect to percentage ownership) on information set forth in Schedule 13G filed by Renaissance Technologies LLC (“RTC”) and Renaissance Technologies Holding Corporation (“RTHC”; collectively with RTC, the “RTC Reporting Person”) with the SEC on February 12, 2020. The RTC Reporting Person, whose business address is 800 Third Avenue, New York, NY 10022, reported that it has sole voting power with respect to 1,012,236 shares, sole dispositive power with respect to 1,043,525 shares and shared dispositive power with respect to 500 shares. It further reported that 1,044,025 shares reported as beneficially owned by RTHC because of RTHC’s majority ownership of RTC. |

Name and Age | Principal Occupation For The Past Five Years and other Directorships or Significant Affiliations |

Charles L. Biederman 86 Years | Director since 1989; Chairman from 2008 to 2010 of Universal Development Company, a commercial general contractor engaged in turnkey hotel, commercial and residential projects; Principal of Sunstone Hotel Investors, LLC, a company engaged in the management, ownership and development of hotel properties, from 1994 to 2007; Executive Vice President of Sunstone Hotel Investors, Inc., a real estate investment trust engaged in the ownership of hotel properties, from 1994 to 1998 and Vice Chairman of Sunstone Hotel Investors from 1998 to 1999. Mr. Biederman, a retired professional architect, was involved for many years in the development and construction of residential communities. He subsequently became involved, as an executive officer and a director, in the activities of a publicly traded real estate investment trust engaged in the ownership of hotel properties and developed, as an investor, principal and partner, residential properties and hotels. In his business activities he has been involved in all aspects of real estate ownership and operation and in real estate development, which includes financing and related financial matters. His many years of diverse business experience make him a valued member of our Board. |

Patrick J. Callan, Jr. 57 Years | Director since 2002, President since 2006 and Chief Executive Officer since 2008; Senior Vice President of First Washington Realty, Inc. from 2004 to 2005; Vice President of Real Estate for Kimco Realty Corporation, a real estate investment trust, from 1998 to 2004. Mr. Callan joined us in 2002, as a director, with significant experience in commercial leasing with a publicly traded real estate investment trust and thereafter served as a senior executive officer of another real estate investment trust. His knowledge of our business and industry made him an excellent choice to become our president in 2006 and our chief executive officer in 2008. |

Karen A. Till. 57 Years | Director since 2019; since 2010, Chief Financial Officer of Miller & Milone, P.C., a law firm focused on healthcare law, elder law and estate planning; from 1998 to 2010, employed by Arbor Commercial Mortgage, LLC, a Fannie Mae and Freddie Mac Delegated Underwriting and Servicing (DUS®) lender, including serving as Vice President – Strategic and Taxation from 2006 to 2010 with responsibility for, among other things, tax compliance and strategies for a NYSE listed REIT and various real estate partnerships; from 1988 to 1998 employed by BRT Apartments Corp. (f/k/a BRT Realty Trust), including serving as Vice President, Financial, from 1993 to 1998. Since 2019, she has also served as a board member and treasurer of the Sabrina Audrey Milone Foundation, Inc. Ms. Till is a certified public accountant. Our executive officers suggested to our nominating committee that it consider electing Ms. Till as a director. Ms. Till’s experience as a chief financial officer as well as her diverse experience in strategic business planning, finance, tax and accounting at two NYSE listed REITs brings a broad perspective to our board. |

Name and Age | Principal Occupation For The Past Five Years and other Directorships or Significant Affiliations |

Joseph A. DeLuca 74 Years | Director since 2004; Principal and sole shareholder of Joseph A. DeLuca, Inc., engaged in commercial and multifamily real estate debt and equity investment advisory and restructuring, since 1998; Director of Capmark Bank, a commercial and multifamily Industrial Bank real estate lender from 2011 through its successful resolution, repayment of all deposits, collection / liquidation of assets, return of shareholder (parent) capital and completion of de-banking at year end 2013; Member of Board of Managers of Wrightwood Capital LLC, a private commercial real estate lender and investment manager beginning in 2010 and continuing through June 2015, encompassing modifications to Wrightwood’s financing structure, operating platform and the restructuring/monetization of its real estate assets and portfolios; Consultant to Gramercy Capital Corp. from 2008 to 2011 for restructuring /special servicing /monetization of various real estate investments; Principal of MHD Capital Partners, LLC from 2006 to 2009, an equity oriented real estate investing entity; Director of Real Estate Investments for Equitable Life Assurance Society of America under a consulting contract from 1999 to 2002; Executive Vice President /Managing Director/Group Head of the Real Estate Finance & Real Estate Investment Banking Groups for Chemical Bank from 1990 and continuing in this capacity through the 1992 merger with Manufacturers Hanover Corporation and through the 1996 merger with the Chase Manhattan Bank to 1998. He has served as a Governor of the Real Estate Board of New York and as Chairman of the Advisory Board of the NYU Real Estate Institute. He also has served as a Senior Vice Chairman of the Real Estate Roundtable in Washington, DC and is currently a member of its Real Estate Capital Policy Committee. After leaving the bank in 1998, Mr. DeLuca has been a consultant on real estate matters to various public and private entities. His years of experience in banking and the real estate industry, particularly in real estate finance matters, provides our board with a director who has exceptional knowledge and understanding of real estate finance, credit issues from both the lender’s and borrower’s perspectives, and investment property acquisitions and dispositions. |

Name and Age | Principal Occupation For The Past Five Years and other Directorships or Significant Affiliations |

Fredric H. Gould 84 Years | Vice Chairman since June 2013, Chairman from 1989 through June 2013, Chief Executive Officer from 1999 to 2001 and from 2005 to 2007; From 1997 through 2013, Chairman of Georgetown Partners, Inc., managing general partner of Gould Investors, which is primarily engaged in the ownership and operation of real estate properties held for investment; Since 1984, a director of, and from 1984 through 2013, Chairman of the Board of BRT Apartments Corp., a New York Stock Exchange listed real estate investment trust; Vice President and sole stockholder of Majestic for more than the past five years. Director of EastGroup Properties, Inc., a real estate investment trust engaged in the acquisition, ownership and development of industrial properties, from 1998 through 2019. Fredric H. Gould is the father of Jeffrey A. Gould and Matthew J. Gould. Mr. Fredric H. Gould has been involved in the real estate business for over 50 years, as an investor and owner, and as the chief executive officer of publicly traded real estate entities and real estate investment trusts. He has also served as a director of four real estate investment trusts, including serving as Chairman of the Board of our company, and as a Director and a member of the loan committee of two savings and loan associations. His knowledge and experience in business, finance, tax, accounting and legal matters and his knowledge of our business and history makes him an important member of our board of directors. |

Leor Siri 47 Years | Director since 2014; Since 2014, Chief Financial Officer and a member of the Management Committee of Silverstein Properties, Inc.; Chief Financial Officer of Ian Schrager Company from 2013 to 2014; Chief Financial Officer and member of the Executive Investment Committee of Seavest Inc., from 2011 to 2013; Chief Accounting Officer, Treasurer and Director of Elad Group, Ltd. From 2006 to 2011; from 1996 to 2006, served in various capacities (including senior manager) at Ernst & Young LLP. Mr. Siri is a certified public accountant. His experience as chief financial officer of businesses engaged in the real estate industry adds an informed voice to our board and audit committee. |

Eugene I. Zuriff 80 Years | Director since 2005; Consultant to the restaurant industry from 2010 through 2017; Vice Chairman of PBS Real Estate LLC, real estate brokers, from 2008 through 2010; President of The Smith & Wollensky Restaurant Group, Inc., a developer, owner and operator of a diversified portfolio of white tablecloth restaurants in the United States, from 2004 to 2007; Consultant to The Smith & Wollensky Restaurant Group, Inc., from 1997 to 2004 and a Director of The Smith & Wollensky Restaurant Group, Inc., from 1997 to 2007; Director of Israel Discount Bank of New York from 2014 through 2018; Director of Doral Federal Savings Bank from 2001 to 2007 and Chairman of its audit committee from 2001 to 2003. Mr. Zuriff’s experience as President and a Director of a publicly traded entity, as a director and committee member of various banks, provide him with knowledge and experience that is important to our board in its deliberations. |

Name and Age | Principal Occupation For The Past Five Years and other Directorships or Significant Affiliations |

Jeffrey A. Gould 54 Years | Director since 1999, Vice President from 1989 to 1999 and Senior Vice President since 1999; Since 1996, President, from 1996 through 2001, Chief Operating Officer, and since 2002, Chief Executive Officer of BRT Apartments Corp., a New York Stock Exchange listed real estate investment trust; Director of BRT Apartments since 1997; Since 1996, Senior Vice President and since 2013, director of Georgetown Partners, Inc., the managing general partner of Gould Investors. Jeffrey A. Gould is the son of Fredric H. Gould and brother of Matthew J. Gould. Mr. Gould has spent his entire career in the real estate business. His principal activity for more than the past 17 years has been first as chief operating officer and then as chief executive officer of BRT Apartments. His experience in operating a public REIT and expertise in evaluating real estate acquisitions and dispositions, makes him a valued member of our board. |

Matthew J. Gould 60 Years | Chairman since June 2013, Vice Chairman from 2011 through June 2013; Director since 1999; President and Chief Executive Officer from 1989 to 1999 and a Senior Vice President from 1999 through 2011; From 1996 through 2013, President, and from 2013, Chairman of the Board and Chief Executive Officer of Georgetown Partners, the managing general partner of Gould Investors; Senior Vice President of BRT Apartments since 1993 and director since 2001; Vice President of Majestic for more than the past five years. Matthew J. Gould is the son of Fredric H. Gould and brother of Jeffrey A. Gould. In addition to his general knowledge of real estate matters, he devotes a significant amount of his business time to the acquisition and sale of real property, and he brings his knowledge and expertise in these areas to his board activities. He also has experience in mortgage financing and real estate management, activities in which he is frequently involved. His more than 35 years’ experience as a real estate executive is a valuable asset to our board of directors. |

J. Robert Lovejoy 75 Years | Director since 2004 and Independent Lead Director since 2011; Founder and principal of J.R. Lovejoy & Co. LLC, providing consulting and advisory services to corporate, investment and financial clients; Partner and Chief Administrative Officer of Deimos Asset Management LLC, a privately owned multi-strategy fund management company, from 2015 to 2016. Director from 2000 to 2013, Chairman from 2011 to 2013, and Interim Chief Executive Officer from 2011 to 2012 of Orient-Express Hotels Ltd., (now called Belmond Ltd.), a luxury lodging and adventure travel company which was acquired in 2019 by LVMH Moët Hennessey Louis Vuitton; Partner, Chief Administrative Officer and General Counsel of Coatue Management LLC, a privately owned investment management company, from 2009 through 2010; Managing Director of Groton Partners, LLC, merchant bankers, from 2006 to 2009; Senior Managing Director of Ripplewood Holdings, LLC, a private equity investment firm, from 2000 to 2005; Managing Director of Lazard Freres & Co. LLC and General Partner of Lazard’s predecessor partnership from 1984 to 2000; Partner, and previously Associate, of Davis Polk & Wardwell, law firm, from 1971 to 1984. Mr. Lovejoy, an attorney, has extensive experience in asset management and investment and merchant banking, and throughout his career has been involved in raising capital in private and public transactions, mergers and acquisitions, business law and accounting issues. His extensive experience in these areas makes him a valued member of our board of directors. |

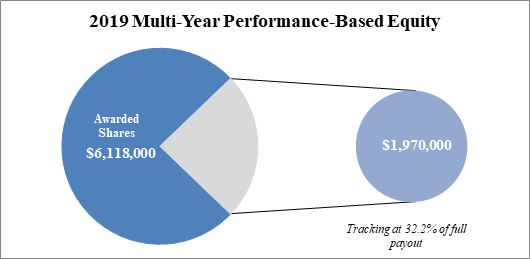

| ✔ | Use rigorous performance goals. Only 32.2% of the RSUs awarded to our executive officers in 2017, 2018 and 2019 would have vested as of December 31, 2019 (assuming the measurement and vesting date was December 31, 2019, demonstrating the rigorous performance and market conditions established for our equity incentive awards. |

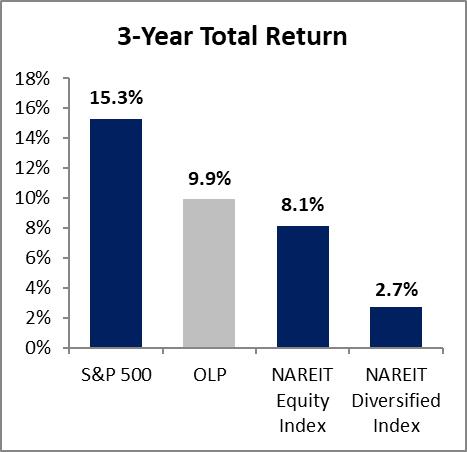

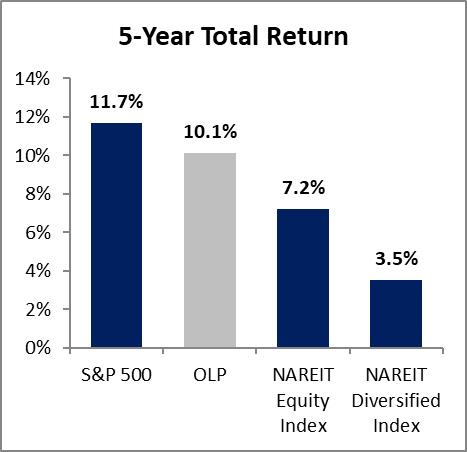

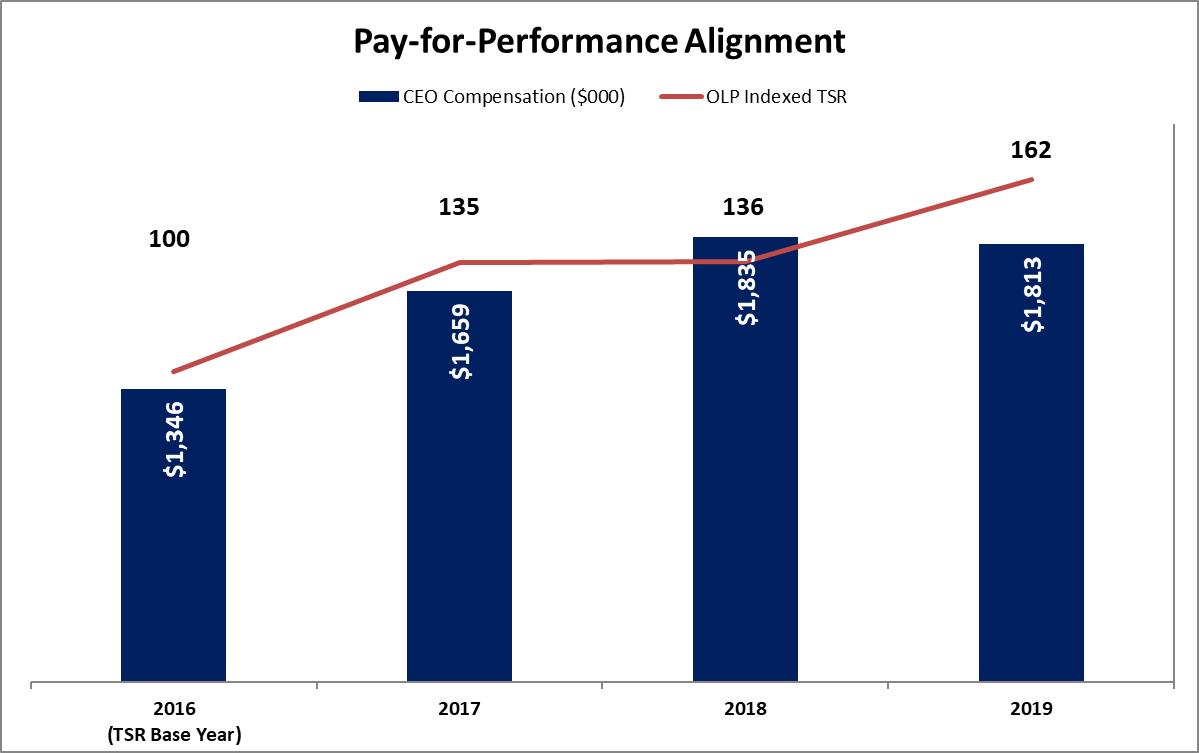

| ✔ | Alignment of pay and performance. For the three years ended December 31, 2019, our total stockholder return was 62.1% and Messrs. Callan and Ricketts base compensation (i.e. salary, bonus and grant date fair value of restricted stock and restricted stock units) increased 34.7% over such period. |

| ✔ | Emphasize equity awards as a significant portion of the performance/incentive component of compensation. Long-term equity (i.e., the grant date fair value of the restricted stock awarded in 2020 for 2019 performance) and equity incentive awards (i.e., the grant date fair value of RSUs awarded in 2019; the long-term equity and equity incentive awards referred to collectively as the “Equity Awards”), accounted for 90.0% and 90.4% of the performance/incentive based component of compensation awarded to Messrs. Callan and Ricketts, respectively, in 2019. |

| ✔ | Equity awards as a significant component of annual base compensation. In 2019, Equity Awards, as a percentage of base annual compensation (i.e., salary, cash bonus and the grant date fair value of the Equity Awards), were 45.6% and 52.2% for Messrs. Callan and Ricketts, respectively. |

| ✔ | Mitigate undue risk in compensation programs. The executive compensation program includes features that reduce the possibility of our executive officers, either individually or as a group, making excessively risky business decisions that could maximize short-term results at the expense of longer-term value. |

| ✔ | Balance of short-term and long-term incentives. Our incentive programs provide an appropriate balance between shorter and longer-term incentives. |

| ✔ | Capped equity award payouts. Shares that can be earned under the long-term incentive program are capped. |

| ✔ | Independent compensation committee. Our compensation committee is comprised entirely of independent directors and it oversees risks with respect to our compensation practices. |

| ✔ | Clawback policy. We are entitled to recoup compensation or cause the forfeiture of compensation as more fully described under “– Components of Executive Compensation – Clawbacks”. |

| ✔ | Stock ownership guidelines. All of our named executive officers and non-management directors own a meaningful amount of our stock– see “Components of Executive Compensation – Stock Ownership Guidelines.” |

| ✔ | Diversity; Responsiveness to Stockholder’s Corporate Governance Comments. We are responsive to comments and concerns raised by our stockholders. In response to comments raised by stockholders regarding board diversity, we added a highly qualified woman, Karen A. Till, to our board. Ms. Till has served as director since 2019 and we have nominated her for election as a director at the Annual Meeting |

| û | No employment agreements. None of our officers have employment agreements. Employment of all of our full-time executive officers is “at will.” |

| û | No severance arrangements. There are no severance or similar arrangements for our executive officers, other than accelerated vesting of shares of restricted stock and RSUs upon the occurrence of specified events (e.g., death, disability, retirement or change of control). |

| û | No golden parachute tax gross-ups. There are no excise tax gross ups or similar arrangements for our executive officers. |

| û | No dividend or dividend equivalents on unearned equity incentive awards. No dividends are paid on RSUs until the underlying shares are earned. |

| û | Grant multi-year or guaranteed bonuses or equity grants. We do not pay guaranteed bonuses to anyone and currently have no guaranteed commitments to grant any equity-based awards. This ensures that we are able to base all compensation awards to measurable performance factors and business results. |

| û | Offer costly defined benefit pension or supplemental retirement plans. We do not provide costly retirement benefits to our executive officers that reward longevity rather than contributions to our performance. |

Compensation Element | Philosophy Statement | Retention | Reward short-term Performance | Reward long-term Performance | Align to Stockholder Interests | Participation of Part-Time Executive Officers | ||||||

| Base Pay | We intend to provide base pay competitive with the compensation paid by our peers. Base pay maintains a standard of living, is used to compete in the market for talent and forms the foundation for our other reward vehicles. | X | ||||||||||

Performance-based Cash Bonus Plan | Rewards annual performance in the form of an annual cash bonus. The amount of the cash bonus is recommended by the compensation committee which takes into account funds from operations, tenant occupancy rates, overall management of the portfolio and discretionary factors. | X | X | X | ||||||||

Pay-for- Performance Incentive Plan | Provides for long-term equity based incentive award in the form of RSUs that rewards, after three years and assuming a continued relationship with us, achievement of pre-established performance targets relating to average annual total stockholder return and/or average annual return on capital. | X | X | X | X | |||||||

Time-Based Restricted Stock Awards | Focus directly on retention while providing an opportunity for increased rewards as stockholder return increases. These awards vest on a cliff vesting basis after five years, assuming a continued relationship with us. | X | X | X | X | |||||||

Other Compensation and Benefits Programs | We offer benefits programs that provide health and retirement benefits for all employees. | X |

| • | base salary; |

| • | annual cash bonus; |

| • | long-term equity in the form of restricted stock and long-term equity incentives in the form of RSUs; and |

| • | benefits and perquisites (e.g., contributions to our defined contribution plan, an education benefit, additional disability insurance, an automobile allowance and automobile maintenance and repairs). |

Long–Term Equity Incentive Awards Performance Criteria | Weight | Minimum Performance Criteria | Maximum Performance Criteria |

Return on Capital (ROC) | 50% | Average of the annual ROC greater than 7% | Average of the annual ROC of 9.75% or greater |

| If the average of the annual ROC exceeds 7%, but is less than 9.75% for the three- year period, then a pro rata number of Units vest and the shares of our common stock underlying the vested Units will be issued. | |||

Total Stockholder Return (TSR) | 50% | Average of the annual TSR greater than 7% | Average of the annual TSR of 12.75% or greater |

| If the average of our annual TSR for the three- year period exceeds 7%, but is less than 12.75%, then a pro rata number of Units vest and the shares of our common stock underlying the vested Units will be issued. | |||

| Base Salary | Cash Bonus | Equity Grants | ||||||||||||||||||||||||||||||||||

| Name | 2019 ($) | 2018 ($) | % Change | 2019 ($)(2) | 2018 ($)(2) | % Change | 2019 ($) (3) | 2018 ($) (4) | % Change | |||||||||||||||||||||||||||

Patrick J. Callan, Jr. (1) | 837,100 | 812,700 | 3.0 | 86,000 | 86,000 | — | 774,325 | 750,991 | 3.1 | |||||||||||||||||||||||||||

Lawrence G. Ricketts, Jr.(1) | 494,550 | 471,000 | 5.0 | 65,000 | 65,000 | — | 611,042 | 590,512 | 3.5 | |||||||||||||||||||||||||||

| (1) | Messrs. Callan’s and Ricketts’ base salaries for 2020, determined in December 2019, are $865,000 and $520,000, respectively. |

| (2) | Reflects the cash bonuses paid in recognition of performance for such year, which bonuses are paid in the following year. |

| (3) | Represents the aggregate grant date fair value of the shares of restricted stock granted in 2020 for 2019 performance and the RSUs granted in 2019. Messrs. Callan and Ricketts were granted (i) in 2020, for 2019 performance, 21,750 and 17,100 shares of restricted stock, respectively, and (ii) in 2019, 13,750 and 11,000 RSUs, respectively. |

| (4) | Represents the aggregate grant date fair value of shares of the restricted stock granted in 2019 for 2018 performance and the RSUs granted in 2018. Messrs. Callan and Ricketts were granted (i) in 2019, for 2018 performance, 21,250 and 16,600 shares of restricted stock, respectively and (ii) in 2018, 13,750 and 11,000 RSUs, respectively. |

| • | Equity Awards accounting for 90.0% and 90.4% of the performance/incentive based component of compensation awarded to Messrs. Callan and Ricketts, respectively, in 2019; and |

| • | Equity Awards accounting for 45.6% and 52.2% of base annual compensation (i.e., salary, cash bonus and the grant date fair value of the Equity Awards), for Messrs. Callan and Ricketts, respectively, in 2019. |

| • | in the event we are required to restate our financial statements due to our material non-compliance, as a result of misconduct, with any financial reporting requirement under the securities laws, our chief executive officer and chief financial officer are required to reimburse us for (i) any bonus or other incentive based compensation or equity based compensation they receive from us during the 12 months following the initial public issuance of the financial document embodying such financial reporting requirement and (ii) the profits from the sale of our common stock during such 12 months; |

| • | if an executive officer’s relationship with us is terminated for cause (e.g., insubordination, dishonesty, incompetence, moral turpitude, the refusal to perform such person’s duties and responsibilities and other misconduct of any kind, as determined by the compensation committee), then the officer’s rights to all restricted stock, RSUs and performance share awards (except to the extent such awards have vested) are forfeited immediately; and |

| • | in accordance with any additional claw-back policy implemented by us, whether implemented prior to or after the grant of an award pursuant to our equity incentive plans, with respect to such awards. |

Upon Death or Disability(1) | Upon a Change of Control | |||||||||||||||

| Name | Restricted Stock ($) | RSUs ($)(2) | Restricted Stock ($) | RSUs ($) | ||||||||||||

| Patrick J. Callan, Jr.(3) | 2,651,025 | 561,817 | 2,651,025 | 872,119 | ||||||||||||

| David W. Kalish | 1,296,419 | 185,910 | 1,296,419 | 288,592 | ||||||||||||

| Lawrence G. Ricketts, Jr.(3) | 2,139,853 | 449,454 | 2,139,853 | 697,695 | ||||||||||||

| Matthew J. Gould | 1,296,419 | 194,082 | 1,296,419 | 301,278 | ||||||||||||

| Fredric H. Gould | 1,296,419 | 194,082 | 1,296,419 | 301,278 | ||||||||||||

| (1) | Because they have reached the age of 65 and have satisfied the period of service requirements, only the RSUs (assuming satisfaction of performance and market conditions as of the end of applicable performance cycle) and restricted stock owned by Messrs. Kalish and Fredric H. Gould would vest upon their retirement as of December 31, 2019; the market value of such person’s restricted stock awards and RSUs are reflected in the applicable column. |

| (2) | Assumes that the maximum level of market and performance conditions is achieved at the end of the applicable performance cycle. See “— Outstanding Equity Awards at Fiscal Year End.” |

| (3) | See “— Summary Compensation Table” for information regarding the amount accumulated for this individual pursuant to our defined contribution plan. |

| Title | Minimum Ownership Requirement | |

Chief Executive Officer | 4 times current base salary | |

Full-Time NEO | 2 times current base salary | |

Part-Time NEO | The number of shares required to be owned by the full-time NEO with the lowest base salary | |

Non-Employee Directors | 3 times annual base retainer |

| Name and Principal Position | Year | Salary ($) | Bonus ($)(1) | Stock Awards ($)(2) | All Other Compensation ($)(3) | Total ($) | |||||||||||||||||

| Patrick J. Callan, Jr. | 2019 | 837,100 | 86,000 | 709,275 | 180,626 | (6 | ) | 1,813,001 | |||||||||||||||

| President and Chief Executive | 2018 | 812,700 | 86,000 | 717,394 | 218,454 | 1,834,548 | |||||||||||||||||

| Officer(4) | 2017 | 789,000 | 78,900 | 659,842 | 131,217 | 1,658,959 | |||||||||||||||||

| David W. Kalish | 2019 | — | — | 319,473 | 164,595 | 484,068 | |||||||||||||||||

| Senior Vice President and | 2018 | — | — | 319,628 | 176,856 | 496,484 | |||||||||||||||||

| Chief Financial Officer(5) | 2017 | — | — | 296,249 | 190,124 | 486,373 | |||||||||||||||||

| Lawrence G. Ricketts, Jr. | 2019 | 494,550 | 65,000 | 557,152 | 51,016 | (7 | ) | 1,167,718 | |||||||||||||||

| Executive Vice President and | 2018 | 471,000 | 65,000 | 571,383 | 50,329 | 1,157,712 | |||||||||||||||||

| Chief Operating Officer(4) | 2017 | 448,500 | 56,700 | 525,389 | 48,371 | 1,078,960 | |||||||||||||||||

| Matthew J. Gould | 2019 | 289,406 | — | 321,851 | 308,997 | 920,254 | |||||||||||||||||

| Chairman of the Board(5) | 2018 | 275,625 | — | 322,605 | 331,762 | 929,992 | |||||||||||||||||

| 2017 | 275,625 | — | 298,811 | 354,809 | 929,245 | ||||||||||||||||||

| Fredric H. Gould | 2019 | 115,763 | — | 321,851 | — | 437,614 | |||||||||||||||||

| Vice Chairman of the Board(5) | 2018 | 110,250 | — | 322,605 | — | 432,855 | |||||||||||||||||

| 2017 | 110,250 | — | 298,811 | — | 409,061 | ||||||||||||||||||

| (1) | Reflects bonuses paid in 2020, 2019 and 2018 for services rendered in 2019, 2018 and 2017, respectively. |

| (2) | Represents RSUs and restricted stock granted in 2019, 2018 and 2017 at the grant date fair value of such awards calculated in accordance with Item 402 of Regulation S-K and Accounting Standards Codification Topic 718—Stock Compensation. These amounts do not correspond to the actual values that will be realized by the named executives. Grant date fair value assumptions are consistent with those disclosed in Note 12 — Stockholders’ Equity – Stock Based Compensation, in the consolidated financial statements included in our 2019 Annual Report on Form 10-K. See “ – Grant of Plan Based Awards During 2019” for additional information as to the grant date fair value of the RSUs. On January 17, 2020, we granted: (a) 21,750 and 17,100 shares of restricted stock to Messrs. Callan and Ricketts, respectively, with a grant date fair value of $611,175 and $480,510, respectively; and (b) 10,670 shares of restricted stock to each of Messrs. Kalish, M. Gould and F. Gould, with a grant date fair value of $299,827 for each such award. |

| (3) | Includes for Messrs. M. Gould, F. Gould and Kalish the amounts, if any, Majestic paid them for services they performed on our behalf. See “Executive Compensation – Compensation Disclosure and Analysis –Background” and “Certain Relationships and Related Transactions.” |

| (4) | All compensation received by Messrs. Callan and Ricketts is paid solely and directly by us. |

| (5) | Other than the restricted stock awarded to these individuals and the fees paid to Messrs. M. Gould and F. Gould for serving as Chairman and Vice Chairman, respectively: (a) we did not pay, nor were we allocated, any portion of such person’s base salary, bonus, defined contribution plan payments or perquisites in 2019, 2018 and 2017; and (b) the services of these individuals is provided to us pursuant to the compensation and services agreement with Majestic. |

| (6) | Includes a $42,000 contribution to our defined contribution plan and perquisites aggregating $138,626, of which $114,896 represents an education benefit, $17,805 represents an automobile allowance and related insurance, maintenance and repairs and $5,925 represents the annual premium for additional disability insurance. Approximately $792,000 has accumulated for this individual pursuant to our defined contribution plan. |

| (7) | Includes a contribution of $42,000 to our defined contribution plan and perquisites of $9,016, representing an automobile allowance and related expenses. Approximately $989,000 has accumulated for this individual pursuant to our defined contribution plan. |

| Name | Grant Date | Grant Type | Estimated Future Payouts under Equity Incentive Plan Awards: Maximum(#)(1) | All Other Stock Awards: Number of Shares of Stocks or Units (#)(2) | Grant Date Fair Value of Stock Awards ($)(3) | |||||||||||

| Patrick J. Callan, Jr. | 1/10/2019 | RS | — | 21,250 | 546,125 | |||||||||||

| 7/1/2019 | RSU-TSR(4) | 6,875 | — | 65,931 | ||||||||||||

| 7/1/2019 | RSU-ROC(5) | 6,875 | — | 97,219 | ||||||||||||

David W. Kalish | 1/10/2019 | RS | — | 10,330 | 265,481 | |||||||||||

| 7/1/2019 | RSU-TSR(4) | 2,275 | — | 21,817 | ||||||||||||

| 7/1/2019 | RSU-ROC(5) | 2,275 | — | 32,175 | ||||||||||||

Lawrence G. Ricketts, Jr. | 1/10/2019 | RS | — | 16,600 | 426,620 | |||||||||||

| 7/1/2019 | RSU-TSR(4) | 5,500 | — | 52,745 | ||||||||||||

| 7/1/2019 | RSU-ROC(5) | 5,500 | — | 77,787 | ||||||||||||

Matthew J. Gould | 1/10/2019 | RS | — | 10,330 | 265,481 | |||||||||||

| 7/1/2019 | RSU-TSR(4) | 2,375 | — | 22,776 | ||||||||||||

| 7/1/2019 | RSU-ROC(5) | 2,375 | — | 33,594 | ||||||||||||

Fredric H. Gould | 1/10/2019 | RS | — | 10,330 | 265,481 | |||||||||||

| 7/1/2019 | RSU-TSR(4) | 2,375 | — | 22,776 | ||||||||||||

| 7/1/2019 | RSU-ROC(5) | 2,375 | — | 33,594 | ||||||||||||

| (1) | Represents the maximum number of shares underlying RSUs that will be issued if all the applicable market and performance conditions are met. |

| (2) | Reflects restricted stock awards. These shares generally vest, on a cliff vesting basis, five years from the grant date, subject to such persons continued relationship with us. Dividends are paid on restricted stock unless such shares are forfeited prior to vesting due to the termination, with certain exceptions, of the relationship between us and the executive. In the event the shares are forfeited, the recipient is (i) entitled to retain the dividends paid prior to the forfeiture, and (ii) is not entitled to any dividends paid after the forfeiture of such shares. |

| (3) | The grant date fair value of the restricted stock, RSU – TSR and RSU – ROC awards are $25.70, $9.59 and $28.96, respectively, per share. These amounts do not correspond to the actual values that will be realized by the executives. The aggregate grant date fair value for the RSU-ROC awards gives effect to management’s assessment of the probable outcome as to whether, and the extent to which, the RSU-ROCs will vest. |

| (4) | Represents shares underlying RSUs that vest on June 30, 2022 if, and to the extent, a market condition (i.e., average of annual total stockholder return) is satisfied. If the average of our annual total stockholder return (including dividends) on our common stock from July 1, 2019 through June 30, 2022, equals or exceeds 12.75%, all the shares underlying such RSUs vest; equals or is less than 7%, no shares vest; and is more than 7% and less than 12.75%, a pro rata portion of the shares underlying such RSUs vest. There are no dividends or voting rights associated with these RSUs. |

| (5) | Represents shares underlying RSUs that vest on June 30, 2022 if, and to the extent, a performance condition (i.e., average annual return on capital) is satisfied. If the average of our annual return on capital (as explained below) from July 1, 2019 through June 30, 2022 exceeds 9.75%, all the shares underlying such RSUs vests; equals or is less than 7%, no shares vest; and exceeds 7% but is less than 9.75%, a pro rata portion of the shares underlying such RSUs vest. Return on capital means adjusted funds from operations, as described below, divided by average capital, as described below. Adjusted funds from operations is determined by using funds from operations as determined in accordance with the NAREIT definition, adjusted for straight-line rent accruals and amortization of lease intangibles, and adding and deducting gains and losses (as determined pursuant to the applicable award), respectively, on sales of properties. Average capital is stockholders’ equity, plus depreciation and amortization, adjusted for intangibles, as measured over the applicable periods. There are no dividend or voting rights associated with these RSUs. |

| Stock Awards | ||||||||||||||||

| Name | Number of Shares of Restricted Stock That Have Not Vested (#) | Market Value of Shares of Restricted Stock That Have Not Vested ($)(1) | Equity Incentive Plan Awards: Number of Shares Subject to RSUs That Have Not Vested (#)(2) | Equity Incentive Plan Awards: Market or Payout Value of Shares Subject to RSUs That Have Not Vested ($)(1)(2)(3) | ||||||||||||

| Patrick J. Callan, Jr. | 97,500(4 | ) | 2,651,025 | 41,250 | 1,121,588 | |||||||||||

| David W. Kalish | 47,680(5 | ) | 1,296,419 | 13,650 | 371,144 | |||||||||||

| Lawrence G. Ricketts, Jr. | 78,700(6 | ) | 2,139,853 | 33,000 | 897,270 | |||||||||||

| Matthew J. Gould | 47,680(5 | ) | 1,296,419 | 14,250 | 387,458 | |||||||||||

| Fredric H. Gould | 47,680(5 | ) | 1,296,419 | 14,250 | 387,458 | |||||||||||

| (1) | The market value represents the product of the closing price of our common stock as of December 31, 2019, which was $27.19, multiplied by the number of shares subject to or underlying such award. |

| (2) | Assumes that all of the RSUs vest. |

| (3) | If the measurement and vesting dates were December 31, 2019, only 32.2% of the RSUs would have vested and the balance of the RSUs would have been forfeited (i.e., 30.9% of the RSU-TSR would have vested and 33.4% of the RSU-ROC would have vested). |

| (4) | With respect to this individual, 18,000 shares vest in January 2020, 18,500 shares vest in January 2021, 19,500 shares vest in January 2022, 20,250 shares vest in January 2023, and 21,250 shares vest in January 2024. |

| (5) | With respect to this individual, 8,600 shares vest in January 2020, 9,200 shares vest in January 2021, 9,600 shares vest in January 2022, 9,950 shares vest in January 2023, and 10,330 shares vest in January 2024. |

| (6) | With respect to this individual, 15,000 shares vest in January 2020, 15,500 shares vest in each of January 2021 and 2022, 16,100 shares vest in January 2023, and 16,600 shares vest in January 2024. |

| Stock Awards | ||||||||

| Name | Number of Shares Acquired on Vesting (#)(1) | Value Realized on Vesting ($)(1) | ||||||

| Patrick J. Callan, Jr. | 14,500 | 355,105 | ||||||

| David W. Kalish | 8,600 | 210,614 | ||||||

| Lawrence G. Ricketts, Jr. | 11,500 | 281,635 | ||||||

| Matthew J. Gould | 8,600 | 210,614 | ||||||

| Fredric H. Gould | 8,600 | 210,614 | ||||||

| (1) | Reflects the aggregate market value of the shares that vested as of the applicable vesting date. The closing market price of a share of our common stock on the vesting date of the restricted stock awards (i.e., January 4, 2019) was $24.49. |

| • | the annual total compensation of our CEO, as reported in the Summary Compensation Table, was $1,813,000; |

| • | the median annual total compensation of all our employees (other than our CEO) was $237,000; and |

| • | our CEO’s annual total compensation was 7.7 times that of the median of the annual total compensation of all our employees (other than our CEO). |

| • | Matthew J. Gould, Chairman of our Board of Directors, served as a Senior Vice President and director of BRT Apartments Corp., a real estate investment trust focused on the ownership, operation and development of multi-family properties and listed on the New York Stock Exchange, as Chairman of the Board and Chief Executive Officer of the managing general partner of Gould Investors (which owns approximately 8.9% of our outstanding shares of common stock), and as a Vice President of Majestic; |

| • | Fredric H. Gould, Vice Chairman of our Board of Directors, served as a director of BRT Apartments, as Chairman of the Board of Directors and sole stockholder of Majestic and as a director and sole stockholder of Georgetown Partners, the managing general partner of Gould Investors; and |

| • | Jeffrey A. Gould, a Director and Senior Vice President of our company, served as a Director, President and Chief Executive Officer of BRT Apartments, as a Senior Vice President and Director of the managing general partner of Gould Investors and as a Vice President of Majestic. |

| 2019 | 2018 | |||||||

| Audit fees(1) | $ | 1,026,000 | $ | 936,000 | ||||

| Audit-related fees | — | — | ||||||

| Tax fees(2) | 16,000 | 15,000 | ||||||

| All other fees | — | — | ||||||

| Total fees | $ | 1,042,000 | $ | 951,000 | ||||

| (1) | Includes fees for audit services and related expenses associated with the annual audit of our consolidated financial statements, including the audit of internal control over financial reporting, reviews of our quarterly reports, comfort letters, consents, and review of documents filed with the SEC. |

| (2) | Tax fees consist of fees for certain tax compliance services and tax advice. |

| • | met and held discussions with management, the independent registered public accounting firm and the accounting firm performing the internal control audit function on our behalf; |

| • | discussed with the independent registered public accounting firm the overall plan for its 2019 audit and other activities and reviewed with the accounting firm performing the internal control function its work plan and the scope of its activities; |

| • | reviewed and discussed the year end consolidated financial statements, report of internal controls over financial reporting and the Annual Report on Form 10-K with management and the independent registered public accounting firm; |

| • | reviewed prior to issuance or release, the (i) unaudited quarterly financial statements prior to filing each Form 10-Q with the Securities and Exchange Commission and (ii) quarterly earnings press releases; |

| • | discussed our internal control procedures and their evaluation of our internal controls (including compliance with COSO 2013 principles), with management, the independent registered public accounting firm and the accounting firm performing the internal control audit function; |

| • | reviewed with management the process used for the certifications under the Sarbanes-Oxley Act of 2002 of our filings with the Securities and Exchange Commission; |

| • | discussed with the independent registered public accounting firm matters required to be discussed by the Public Company Accounting Oversight Board (the “PCAOB”) Auditing Standard (“AS”) No. 1301 (formerly AS 16), Communications with Audit Committees; |

| • | received from the independent registered public accounting firm the written disclosures regarding the auditors’ independence required by PCAOB Ethics and Independence Rule 3526, Communications with Audit Committees Governing Independence, and discussed with such firm its independence; and |

| • | reviewed and approved the independent registered public accounting firm’s fees, both for performing audit and non-audit services, and considered whether the provision of non-audit services by the independent registered public accounting firm was compatible with maintaining the independent registered public accounting firm’s independence and concluded that it was compatible. |

Respectfully submitted, | |

Leor Siri, Chair | |

Joseph A. DeLuca | |

Eugene I. Zuriff |

| A. | increase the total number of authorized shares of our common stock from 25,000,000 shares to 50,000,000 shares, with a corresponding increase in the total number of shares that we are authorized to issue; |

| B. | revise and modernize the requirements in our Current Charter to indemnify and advance the expenses of our officers, directors and employees; and |

| C. | reduce the vote required for our stockholders to approve certain actions, to eliminate the majority of the outstanding shares voting requirement to approve routine actions, including the election of directors, and eliminate the supermajority voting requirement for certain charter amendments. |

| • | any present or former director or officer, but only to the extent such director or officer is made or threatened to be made a party to, or witness in, a proceeding by reason of his or her service in such capacity; and |

| • | any individual who, while a director or officer of ours and at our request, serves or has served as a director, officer, trustee, member, manager, or partner of another corporation, real estate investment trust, limited liability company, partnership, joint venture, trust, employee benefit plan or any other enterprise, and only if he or she is made or threatened to be made a party to, or witness in, a proceeding by reason of his or her service in such capacity. |

| • | the act or omission of the director or officer was material to the matter giving rise to the proceeding and (a) was committed in bad faith or (b) was the result of active and deliberate dishonesty; |

| • | the director or officer actually received an improper personal benefit in money, property or services; or |

| • | in the case of any criminal proceeding, the director or officer had reasonable cause to believe that the act or omission was unlawful. |

| • | a written affirmation by the director or officer of his or her good faith belief that he or she has met the standard of conduct necessary for indemnification by the corporation; and |

| • | a written undertaking by the director or officer or on the director’s or officer’s behalf to repay the amount paid or reimbursed by the corporation if it is ultimately determined that the director or officer did not meet the standard of conduct. |

| A. | Repeal Section 17 of Article III of our Bylaws, which currently provides, in general, that we may invest in any type of real property, mortgage loans or other assets, as long as the investment does not adversely affect our ability to qualify as a REIT or require us to register as an investment company under the Investment Company Act of 1940, as amended; and |

| B. | Repeal Section 18 of Article III of our Bylaws, which currently permits us to delegate the day-to-day operations of our business to a third-party management company. |

Great Neck, NY | |

April [ ], 2020 | By order of the Board of Directors |

S. Asher Gaffney, Secretary |

| (a) | It shall be the duty of the Board of Directors to ensure that the purchase, sale, retention and disposal of Corporation assets and the investment policies of the Corporation and the limitations thereon or amendment thereto are at all times in compliance with the restrictions applicable to real estate investment trusts pursuant to the Internal Revenue Code of 1986, as amended and as may be hereafter amended (the "Code"). |

| (b) | The Corporation may invest in any type of real property, mortgage loans (and, in both cases, in interests therein) and in other investments of any nature whatsoever; provided that the investment does not adversely affect the Corporation's ability to continue to qualify as a real estate investment trust under the Code; and provided further that the investment does not necessitate that the Corporation register as an investment company under the Investment Company Act of 1940 as amended and as may be hereafter amended. |

| (c) | The Corporation may finance and refinance its investments in whatever manner the Directors determine to be in the best interests of the stockholders. The method of financing and refinancing may include short, intermediate or long-term borrowings, whether secured or unsecured, subject to the limitations set forth below. Borrowings may be in the form of bank borrowings, including unsecured borrowings or borrowings secured by a mortgage on the Corporation's current properties and/or the properties acquired, the issuance of commercial paper, or the issuance in public or private transactions of senior or subordinated notes or debentures, including notes or debentures convertible into shares of the Corporation's Common Stock. The Corporation may also, in public or private transactions, issue additional shares of its Common Stock, and may, in the discretion of the Board of Directors, combine any two or more of such financing methods. |

| (d) | The cash proceeds of a sale or other disposition of the Corporation's assets may be reinvested in long-term investments, if such reinvestment can be made without adversely affecting the Corporation's ability to qualify as a real estate investment trust under the Code. |

| (e) | The Corporation shall not (i) invest in the securities of other issuers for the purpose of exercising control (except where real property is the principal asset of a corporation and the acquisition of such property can best be effected by the acquisition of the stock of the corporation), nor (ii) underwrite securities of other issuers. The Corporation may purchase or otherwise reacquire its outstanding shares of Common Stock whenever necessary to maintain qualification as a real estate investment trust under the Code and also at any time and for such prices as the Directors deem appropriate without adversely affecting the ability of the Corporation to qualify as a real estate investment trust under the Code. |

| (f) | The provisions of this Section 17 of Article III of these By-Laws are not subject to alteration, modification or repeal by the Board of Directors and may be altered, modified or repealed only by majority vote of the stockholders. |