QuickLinks -- Click here to rapidly navigate through this document

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| Filed by the Registrant:ý | ||

| Filed by a Party other than the Registrant:o | ||

Check the appropriate box: | ||

| o | Preliminary Proxy Statement | |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ý | Definitive Proxy Statement | |

| o | Definitive Additional Materials | |

| o | Soliciting Material Pursuant to §240.14a-11(c) or §240.14a-12 | |

MEDIA 100 INC. | ||||

(Name of Registrant as Specified in Its Charter) | ||||

The Board of Directors of Media 100 Inc. | ||||

(Name of Person(s) Filing Proxy Statement) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| ý | No fee required. | |||

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined:) | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

| o | Fee paid previously with preliminary materials. | |||

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement no.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

to be held April 15, 2003

To the Stockholders:

Notice is hereby given that the Annual Meeting of Stockholders of Media 100 Inc., a Delaware corporation (the "Company"), will be held at the offices of the Company, 450 Donald Lynch Boulevard, Marlboro, Massachusetts 01752, on Tuesday, April 15, 2003 at 10:00 a.m. for the following purposes:

1. To elect four directors;

2. To increase the number of shares of Common Stock authorized for issuance under the 1986 Employee Stock Purchase Plan by 400,000 shares to a total of 1,900,000 shares; and

3. To transact any and all other business that may properly come before the meeting and any adjournments or postponements thereof.

All stockholders of record at the close of business on March 7, 2003 are entitled to notice of and to vote at this meeting.

Stockholders are requested to sign and date the enclosed proxy and return it in the enclosed envelope. The envelope requires no postage if mailed in the United States. The Company's 2002 Annual Report to Stockholders, which contains financial statements and other information of interest to stockholders, is enclosed with this Notice and the accompanying Proxy Statement.

| By order of the Board of Directors | ||

Steven D. Shea Secretary | ||

March 13, 2003 |

MEDIA 100 INC.

PROXY STATEMENT

Annual Meeting of Stockholders

April 15, 2003

General

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of Media 100 Inc., a Delaware corporation (the "Company"), for the Annual Meeting of Stockholders of the Company (the "Annual Meeting") to be held on Tuesday, April 15, 2003 at 10:00 a.m. at the principal executive offices of the Company, located at 450 Donald Lynch Boulevard, Marlboro, Massachusetts 01752, and any adjournments or postponements thereof, for the purposes set forth in the accompanying Notice of Annual Meeting.

This Proxy Statement and attached form of proxy are first being distributed to stockholders on or about March 13, 2003. The Company's 2002 Annual Report to Stockholders, which includes the Company's Annual Report on Form 10-K for the fiscal year ended November 30, 2002, accompanies this Proxy Statement.

Voting Rights and Outstanding Shares

As of March 7, 2003, the Company had outstanding 13,083,019 shares of common stock (the "Common Stock"). Each share of Common Stock entitles the holder of record thereof at the close of business on March 7, 2003, the record date for the Annual Meeting, to one vote on the matters to be voted upon at the meeting.

The expenses of preparing, printing and assembling the materials used in the solicitation of proxies will be borne by the Company. In addition to the solicitation of proxies by use of the mails, the Company may also utilize the services of some of its officers and employees (who will receive no compensation therefore in addition to their regular salaries) to solicit proxies personally and by mail, telephone and telegraph from brokerage houses and other stockholders.

If the enclosed form of proxy is properly signed and returned, the shares represented thereby will be voted. If the stockholder specifies in the proxy how the shares are to be voted, they will be voted as specified. If the stockholder does not specify how the shares are to be voted, they will be voted to elect the four nominees listed under "Election of Directors," or the nominees for whom approval has not been withheld. Should any person nominated to serve as a director be unable or unwilling to serve as director, the persons named in the form of proxy for the Annual Meeting intend to vote for such other person as the Board of Directors may recommend. Any stockholder has the right to revoke his or her proxy at any time before it is voted by attending the meeting and voting in person or filing with the Secretary of the Company a written instrument revoking the proxy or delivering another newly executed proxy bearing a later date.

At the date hereof, management of the Company has no knowledge of any business other than that described in the Notice of Annual Meeting that will be presented for consideration at such meeting. If any other business should come before such meeting, the persons appointed by the enclosed form of proxy shall have discretionary authority to vote all such proxies, as they shall decide.

Quorum, Required Votes and Method of Tabulation

Consistent with state law and under the Company's by-laws, a majority of the shares entitled to be cast on a particular matter, present in person or represented by proxy, constitutes a quorum as to such matter. Persons appointed by the Company to act as election inspectors for the meeting will count votes cast by proxy or in person at the Annual Meeting. The four nominees for election as directors at the Annual Meeting who receive the greatest number of votes properly cast for the election of directors shall be elected directors. The affirmative vote of a majority of the shares present or represented by proxy and voting at the Annual Meeting is required for the approval of each of the other matters, if any, that may be voted on.

The election inspectors will count the total number of votes cast "for" approval of proposals (if any), other than the election of directors, for purposes of determining whether sufficient affirmative votes have been cast. The election inspectors will count shares represented by proxies that withhold authority to vote for a nominee for election as a director or that reflect abstentions and "broker non-votes" (i.e., shares represented at the meeting held by brokers or nominees as to which (i) instructions have not been received from the beneficial owners or persons entitled to vote and (ii) the broker or nominee does not have the discretionary voting power on a particular matter) only as shares that are present and entitled to vote on the matter for purposes of determining the presence of a quorum, but neither abstentions nor broker non-votes have any effect on the outcome of voting on the matter.

At the Annual Meeting it is intended that the Company's Board of Directors be elected to hold office until the next Annual Meeting and until their successors shall have been duly elected and qualified. Information regarding nominees is set forth below. All nominees are currently directors of the Company.

| Name | Age | Position with the Company | ||

|---|---|---|---|---|

| John A. Molinari | 40 | Chief Executive Officer, President and Director | ||

| Maurice L. Castonguay | 51 | Director | ||

| Roger W. Redmond | 49 | Director | ||

| Paul J. Severino | 56 | Director |

Mr. Molinari has been a director since June 1995. He was President of the Company from November 1996 until October 1998, resumed that role from June 1999 until May 2000 and again resumed that role in December 2000. He has been Chief Executive Officer of the Company since November 1996.

Mr. Castonguay has been a director since February 1997. Since January 1999, he has been Chief Financial Officer and Senior Vice President of Finance of MatrixOne, Inc., a provider of collaboration product lifecycle management (PLM) solutions. From August 1997 to October 1998, Mr. Castonguay was Chief Financial Officer, Treasurer and Vice President of Finance and Administration of Stratus Computer, Inc., a provider of fault-tolerant computer systems.

Mr. Redmond has been a director since November 2001 and previously served on the Board from February 1998 until May 2000. Since January 2002, he has been Senior Vice President and Portfolio Manager of Windsor Financial Group, a money management company. From June 1999 to January 2002, Mr. Redmond was Managing Director of Goldsmith, Agio, Helms & Lynner, LLC, an investment bank. From August 1997 to October 1998, Mr. Redmond was President and Chief Executive Officer of Teletraining Systems, Inc., a provider of training for distance educators. Mr. Redmond is also a director of Spire Corporation, a provider of photovoltaic module manufacturing equipment, optoelectronic products and biomedical processing services.

Mr. Severino has been a director since April 1985. Since November 1996 Mr. Severino has been a private investor. Mr. Severino served as Chairman and Chief Executive Officer of NetCentric Corporation, a provider of Internet protocol telephony applications from August 1997 to December 1999. Mr. Severino is also the Chairman of the Massachusetts Technology Development Corporation, on the Board of Trustees of Rensselaer Polytechnic Institute, on the Board of Governors of the Massachusetts Telecommunications Council and a director of MCK Communications, Inc., Silverstream Software, Inc., and Sonus Networks, Inc.

Board of Directors

During the fiscal year ended November 30, 2002, the Company's Board of Directors held seven meetings. Each of the directors attended at least 75% of the aggregate of the meetings of the Board and all

2

committees of the Board on which he served that were held while he was a director. There are two committees of the Board of Directors: an Audit Committee and a Compensation Committee. There is no Nominating Committee.

The Audit Committee reviews with management and the Company's independent public accountants the Company's financial statements, the accounting principles applied in their preparation, the scope of the audit, any comments made by the public accountants upon the financial condition of the Company and its accounting controls and procedures, and such other matters as the committee deems appropriate. The Audit Committee is comprised of three members, Messrs. Castonguay, Redmond and Severino, none of whom are employees of the Company and each of whom is an "independent director" under the rules of the National Association of Securities Dealers. During the fiscal year ended November 30, 2002, the Audit Committee met on eight occasions. The Audit Committee operates under a written charter adopted by the Board of Directors, a copy of which is attached as Appendix B to this Proxy Statement.

The Compensation Committee reviews salary policies and compensation of officers and other members of management and approves compensation plans. The Compensation Committee also administers the Company's stock option and purchase plans. The Compensation Committee is comprised of two members, Messrs. Redmond and Severino. During the fiscal year ended November 30, 2002, the Compensation Committee met on two occasions.

As compensation for serving on the Board, all non-employee directors receive options to purchase Common Stock of the Company upon their appointment to the Board. In addition, directors may receive additional option grants as compensation for their service on the Board. Directors do not receive any cash compensation for their service on the Board, other than reimbursement of out-of-pocket expenses for travel expenses in connection with their participation on the Board.

Compensation Committee Interlocks and Insider Participation

The members of the Compensation Committee for the fiscal year ended November 30, 2002 were Messrs. Redmond and Severino. None of these members of the Compensation Committee were officers or employees of the Company at anytime during the fiscal year ended November 30, 2002.

None of the Company's executive officers serves, or has served during the last fiscal year, as a member of the board of directors or compensation committee (or any other board committee performing equivalent functions) of any entity that has one or more executive officers serving as a member of the Company's board of directors or compensation committee.

2. APPROVAL OF INCREASE IN NUMBER OF SHARES AUTHORIZED FOR

ISSUANCE UNDER THE 1986 EMPLOYEE STOCK PURCHASE PLAN (THE "1986 PLAN")

Under the 1986 Plan, eligible employees of the Company and its subsidiaries are given the option to purchase shares of Common Stock at the lower of 85% of fair market value at the date of grant of the option or 85% of fair market value at the date of exercise of the option by means of payroll deductions.

In 2001, the Company's stockholders approved an increase in the number of shares authorized for issuance under the 1986 Plan from 1,000,000 to 1,500,000. As of March 7, 2003, 63,906 shares of Common Stock remain available for future grants under the 1986 Plan. The Board of Directors believes that the shares currently available for grant under the Company's 1986 Plan are not sufficient for the Company's stock purchase program. As a result, the Board of Directors has approved, and submitted to the stockholders for approval, an increase of 400,000 in the number of shares that may be purchased under the 1986 Plan for a total of 1,900,000 shares, subject to adjustment as described below. The Board of Directors recommends a vote in favor of this increase.

3

The Compensation Committee administers the 1986 Plan, determines all questions arising thereunder, and adopts, administers and interprets such rules and regulations relating to the Plan as it deems necessary or advisable.

The 1986 Plan permits the Company to grant six-month options to participating employees to purchase shares. Each employee of the Company or one of its subsidiaries having at least one month of continuous service on the date of grant is eligible to participate in the 1986 Plan, except for any employee who immediately after the grant of an option would be deemed under the Internal Revenue Code of 1986, as amended, to own 5% or more of the Common Stock.

Options are granted twice yearly, on January 1 and July 1, and are exercisable through accumulations of payroll deductions (of not less than 2% nor more than 10% of compensation), for the number of whole shares determined by dividing the balance in the employee's withholding account on the last day of the option period by the purchase price per share for the stock determined under the 1986 Plan. The purchase price for the shares will be the lower of 85% of the fair market value of the stock at the time of grant or 85% of said value at the time of exercise.

The number of shares each employee is entitled to purchase is subject to proportionate reduction in the event the number of shares then available under the 1986 Plan is otherwise insufficient. No employee will be granted an option under the 1986 Plan that would permit his or her right to purchase shares to accrue at a rate that exceeds $25,000 in fair market value of Common Stock (determined at the time the option is granted) for any calendar year (or $12,500 for any option period).

An employee may at any time prior to exercise cancel his or her option, and upon such cancellation, payments made by the employee shall be returned to him or her without interest. Each employee's rights in an option will be exercisable during his or her lifetime only by him or her and may not be sold, pledged, assigned, or otherwise transferred other than by will or the laws of descent and distribution. Upon termination of an employee, any option shall be deemed cancelled and all payments made by the employee shall be returned to him or her without interest. The employee may elect to have the amount credited to his or her withholding account at the time of his or her death applied to the exercise of his or her option for the benefit of named beneficiaries. Nothing in the 1986 Plan is to be construed so as to give an employee the right to be retained in the service of the Company.

In the event there is a change in the outstanding stock of the Company due to a stock dividend, stock split, combination of shares, recapitalization, merger or other change in the capital stock of the Company, the aggregate number of shares available under the 1986 Plan and under any outstanding options, the option price, and other relevant provisions, will be appropriately adjusted. The Company will have the right to amend the 1986 Plan at any time, but cannot make an amendment (other than as stated above) relating to the aggregate number of shares available under the Plan or the option price without the approval of the stockholders. The Company may suspend or terminate the 1986 Plan at any time, but such termination will not affect the rights of employees holding options at the time of termination.

Federal Tax Effects. THE FOLLOWING DISCUSSION OF UNITED STATES FEDERAL INCOME TAX CONSEQUENCES OF THE ISSUANCE AND EXERCISE OF STOCK RIGHTS GRANTED UNDER THE 1986 PLAN IS BASED UPON THE PROVISIONS OF THE CODE AS IN EFFECT ON THE DATE OF THIS PROXY STATEMENT, CURRENT REGULATIONS, AND EXISTING ADMINISTRATIVE RULINGS OF THE INTERNAL REVENUE SERVICE. IT IS NOT INTENDED TO BE A COMPLETE DISCUSSION OF ALL OF THE UNITED STATES FEDERAL INCOME TAX CONSEQUENCES OF THE 1986 PLAN OR OF THE REQUIREMENTS THAT MUST BE MET IN ORDER TO QUALIFY FOR THE DESCRIBED TAX TREATMENT. IN ADDITION, THERE MAY BE FOREIGN, STATE OR LOCAL TAX CONSEQUENCES THAT ARE NOT DISCUSSED HEREIN.

4

In general, for United States federal income tax purposes, a participating employee will not recognize taxable income upon the grant or exercise of an option awarded under the 1986 Plan, although a participating employee will be taxed on amounts withheld as if actually received in cash.

An employee who purchases shares under the 1986 Plan and disposes of such shares, including by way of gift (although not by death), within two years after the first day of the applicable option period will recognize ordinary income on the difference between the price paid per share and the fair market value on the last day of that option period. The Company will generally be entitled to a deduction in the amount of this income, subject to possible limitation in the case of certain of the Company's officers. In addition, the Company may be required to withhold income taxes with respect to the amount of the ordinary income.

In addition to ordinary income, an employee who sells shares within this two-year period will recognize a capital gain or loss on the difference between the amount realized on the sale and the employee's basis in the shares (i.e., the price paid by the employee under the 1986 Plan plus ordinary income recognized by reason of the sale). A loss in connection with a sale to a family member or certain other related parties would not be allowable for federal income tax purposes. Any such capital gain or loss will be long- or short-term depending on whether the shares have been held for more than one year.

If the employee disposes of shares purchased under the 1986 Plan more than two years after the first day of the applicable participation period or dies at any time while holding the shares, ordinary income will be recognized equal to the lesser of (i) the excess of the fair market value of the shares at the time of disposition or death over the price paid under the 1986 Plan, or (ii) 15% of the fair market value of the shares on the first day of the applicable participation period (i.e., the purchase price discount from the fair market value of the shares on the first day of the applicable participation period). The Company would not be entitled to a deduction for this amount. In addition to ordinary income, a capital gain will be recognized on the excess, if any, of the amount realized on a sale over the employee's basis in the shares (i.e., the price paid by the employee under the 1986 Plan plus any ordinary income recognized by reason of such sale).

As of March 7, 2003, approximately 130 employees were eligible to participate in the 1986 Plan. Participation in the plan is discretionary on the part of eligible employees, and the number of shares allocable to any participant depends on the amount of that person's payroll deduction and the applicable purchase price of the shares with respect to any option period. Therefore, the Company cannot now determine the number of shares that may be received by any particular person or group under the Plan. As of March 7, 2003, the last reported sale price of the Common Stock on the Nasdaq National Market was $0.75.

Stock Options Granted under the 1986 Plan Since Its Inception. Since its inception, and through December 31, 2002, the following persons have received stock options pursuant to the 1986 Plan:

| Name and Principal Position | Number of Options(1) | |

|---|---|---|

| Maurice L. Castonguay, Director | — | |

| David Cobosco, Vice President, Sales and Marketing | 24,135 | |

| John A. Molinari, Chief Executive Officer and Director | — | |

| Giles Rae, Vice President, Engineering | 9,773 | |

| Roger Redmond, Director | — | |

| Steven D. Shea, Chief Financial Officer, Treasurer and Secretary | 13,222 | |

| Paul J. Severino, Director | — | |

| All Current Executive Officers as a Group | 47,130 | |

| All Current Directors who are not Executive Officers as a Group | — | |

| All Employees who are not Executive Officers as a Group | 1,388,964 |

- (1)

- Such number represents the total number of options granted to the person or group in question under the 1986 Plan, without taking into account those options which have been exercised, terminated or expired. The dollar value of options is equal to the difference between the exercise price of the options granted and the fair market value of the Company's Common Stock at the date of exercise. Accordingly, such dollar value is not readily ascertainable.

5

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL

OWNERS AND MANAGEMENT

The following table sets forth certain information regarding the Company's Common Stock owned as of February 1, 2003 (except as noted below) by (i) each person (or group of affiliated persons) known by the Company to be the beneficial owner of more than 5% of the Company's Common Stock, (ii) each of the Company's directors, (iii) the Chief Executive Officer and each of the other individuals named in the Summary Compensation Table (hereafter referred to as the "Named Executive Officers") and (iv) all current executive officers and directors as a group. Except as otherwise indicated in the footnotes to this table, the Company believes that each of the persons or entities named in this table has sole voting and investment power with respect to all the shares of Common Stock indicated.

| | Number of Shares Beneficially | ||||

|---|---|---|---|---|---|

| Directors and Named Executive Officers | |||||

| Owned(1) | Percent(1) | ||||

| Maurice L. Castonguay (2) | 55,000 | * | |||

| David Cobosco (3) | 88,198 | * | |||

| John A. Molinari (4) | 481,019 | 3.49 | % | ||

| Giles Rae (5) | 94,747 | * | |||

| Steven D. Shea (6) | 153,829 | 1.12 | % | ||

| Roger W. Redmond (7) | 12,190 | * | |||

| Paul J. Severino (8) | 120,340 | * | |||

| All executive officers and directors as a group (7 persons in all) | 1,005,323 | 7.30 | % | ||

Additional 5% Stockholders | |||||

| Coghill Capital Management (9) One North Wacker Drive, Suite 4725 Chicago, Illinois 60606 | 1,522,496 | 11.06 | % | ||

| The Clark Estates (10) One Rockefeller Plaza 31st Floor New York, New York 10020 | 1,092,800 | 7.94 | % | ||

- *

- Represents less than 1%.

- (1)

- The number and percent of the outstanding shares of Common Stock treat as outstanding all shares issuable on options exercisable within sixty days of February 1, 2003 held by a particular beneficial owner that are included in the first column.

- (2)

- Includes 30,000 shares subject to options exercisable within sixty days of February 1, 2003.

- (3)

- Includes 64,063 shares subject to options exercisable within sixty days of February 1, 2003.

- (4)

- Includes 332,032 shares subject to options exercisable within sixty days of February 1, 2003.

- (5)

- Includes 86,875 shares subject to options exercisable within sixty days of February 1, 2003.

- (6)

- Includes 142,063 shares subject to options exercisable within sixty days of February 1, 2003.

- (7)

- Includes 6,250 shares subject to options exercisable within sixty days of February 1, 2003.

- (8)

- Includes 20,000 shares subject to options exercisable within sixty days of February 1, 2003.

- (9)

- As reported in, and based solely upon, a 13D/A dated November 1, 2002 filed with the Securities and Exchange Commission by Coghill Capital Management, LLC.

- (10)

- As reported in, and based solely upon, a 13G/A dated February 14, 2003 filed with the Securities and Exchange Commission by The Clark Estates, Inc.

6

The executive officers of the Company as of March 12, 2003 are as follows:

| Name | Age | Position with the Company | ||

|---|---|---|---|---|

| John A. Molinari | 40 | Chief Executive Officer, President and Director | ||

| Steven D. Shea | 36 | Chief Financial Officer, Treasurer and Secretary | ||

| David Cobosco | 46 | Vice President, Sales and Marketing | ||

| Giles Rae | 42 | Vice President, Engineering |

Mr. Molinari was President from November 1996 until October 1998, resumed that role from June 1999 until May 2000 and again resumed that role in December 2000, and has been Chief Executive Officer since November 1996. See "Election of Directors."

Mr. Shea has been Chief Financial Officer since May 2000, Corporate Secretary since June 1998 and Treasurer since April 1998. From October 1998 to May 2000, he served as Vice President of Finance. Prior to that he was the Corporate Controller from December 1996 to October 1998.

Mr. Cobosco has been Vice President, Sales and Marketing since January 2003. Prior to that, he served as Vice President, Marketing from April 2002 to January 2003 and Vice President, Product Marketing from March 2001 to April 2002. Prior to joining the Company, Mr. Cobosco held senior product marketing positions at FairMarket, Inc., Avid Technology, Inc. and Cadence Design Systems, Inc.

Mr. Rae has been Vice President, Engineering since December 2001. Prior to that, he served as Vice President, Operations from December 1996 to December 2001.

7

Summary of Cash and Certain Other Compensation

The following table provides certain summary information concerning compensation paid or accrued by the Company and its subsidiaries to or on behalf of the Chief Executive Officer and each of the other Named Executive Officers for the fiscal years ended November 30, 2002, 2001 and 2000:

| | | | | Long-Term Compensation Awards(1) | | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Annual Compensation | | |||||||||||

| Name and Principal Position | Securities Underlying Options(#) | All Other Compensation($)(2) | |||||||||||

| Year | Salary($) | Bonus($) | |||||||||||

| John A. Molinari (3) Chief Executive Officer | 2002 2001 2000 | $ | 237,500 250,000 233,529 | $ | 25,000 0 0 | 30,000 392,250 250,000 | $ | 296 312 291 | |||||

Steven D. Shea (4) Chief Financial Officer, Treasurer and Secretary | 2002 2001 2000 | $ | 166,250 175,000 160,009 | $ | 25,000 0 30,000 | 20,000 246,500 150,000 | $ | 3,207 3,218 3,200 | |||||

David Cobosco (5) Vice President, Sales and Marketing | 2002 2001 2000 | $ | 166,250 0 0 | $ | 0 0 0 | 60,775 0 0 | $ | 3,207 0 0 | |||||

Giles Rae (6) Vice President, Engineering | 2002 2001 2000 | $ | 166,250 0 0 | $ | 0 0 0 | 45,775 0 0 | $ | 3,207 0 0 | |||||

- (1)

- The Company has not issued stock appreciation rights or granted restricted stock awards. In addition, the Company does not maintain a "long-term incentive plan," as that term is defined in applicable rules. The amounts shown reflect options granted pursuant to the Stock Option Cancellation and FY01 Stock Option Grant Plan. Under this plan, in fiscal 2001, Messrs. Molinari and Shea cancelled and subsequently received 352,250 and 221,500 options, respectively.

- (2)

- The amounts reported represent (i) the dollar value of premiums paid by the Company on term life insurance for the benefit of the Named Executive Officers and (ii) contributions to a defined contribution plan with respect to Messrs. Shea, Cobosco and Rae.

- (3)

- Mr. Molinari was President from November 1996 until October 1998, resumed the role of President from June 1999 until May 2000 and again resumed that role in December 2000, and has been Chief Executive Officer since November 1996. From 1990 to November 1996, he was Vice President and General Manager of the Company's multimedia group.

- (4)

- Mr. Shea was appointed an executive officer of the Company effective May 2000.

- (5)

- Mr. Cobosco was appointed an executive officer of the Company effective February 14, 2003.

- (6)

- Mr. Rae was appointed an executive officer of the Company effective February 14, 2003.

8

Employment Contracts, Termination of Employment and Change-in-Control Arrangements

Mr. Cobosco's employment offer includes a provision that upon a change of control of the Company, defined as the purchase of greater than 50% of the outstanding common stock, 100% of his then outstanding stock options vest immediately, so long as the accelerated vesting does not jeopardize a potential business combination.

Stock Options

The following table provides information concerning the grant of stock options under the Key Employee Incentive Plan (1992) and (2002) to the Named Executive Officers:

Option Grants in Last Fiscal Year

| | | | | | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | Individual Grants | |||||||||||||

| | Number of Securities Underlying Options Granted(#) | % of Total Options Granted to Employees in Fiscal Year | | | |||||||||||

| | Exercise or Base Price ($/Sh) (1) | | |||||||||||||

| Name | Expiration Date | 5% ($) | 10% ($) | ||||||||||||

| John A. Molinari | 30,000 | 2.79% | $ | 1.63 | 1/8/12 | $ | 30,752.95 | $ | 77,934.01 | ||||||

Steven D. Shea | 20,000 | 1.86% | $ | 1.63 | 1/8/12 | $ | 20,501.96 | $ | 51,956.00 | ||||||

David Cobosco | 15,000 45,775 | 1.39% 4.26% | $ $ | 1.69 2.45 | 12/21/11 6/5/12 | $ $ | 15,942.48 70,529.74 | $ $ | 40,401.37 178,736.22 | ||||||

Giles Rae | 40,000 5,775 | 3.72% 0.54% | $ $ | 1.75 2.45 | 12/20/11 6/5/12 | $ $ | 44,022.62 8,898.07 | $ $ | 111,561.97 22,549.46 | ||||||

- (1)

- These options, when initially granted, become exercisable over four years; 25% on the first anniversary of the grant, 6.25% every three months thereafter until the fourth anniversary of the grant, and expire ten years from date of grant.

Option Exercises and Holdings

The following table provides information, with respect to the Named Executive Officers, concerning the unexercised options held as of the end of the fiscal year:

Aggregated Option Exercises in Last Fiscal Year and FY-End Option Values

| | | | Number of Securities Underlying Unexercised Options at FY-End (#) | Value of Unexercised In-The-Money Options at FY-End ($)(1) | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Name | Shares Acquired on Exercise (#) | Value Realized ($) | |||||||||||||

| Exercisable | Unexercisable | Exercisable | Unexercisable | ||||||||||||

| John A. Molinari | 0 | $ | 0.00 | 301,266 | 199,109 | $ | 1,800 | $ | 5,400 | ||||||

Steven D. Shea | 4,500 | $ | 3,150.00 | 122,594 | 124,406 | $ | 900 | $ | 2,700 | ||||||

David Cobosco | 0 | $ | 0.00 | 53,437 | 102,338 | $ | 0 | $ | 0 | ||||||

Giles Rae | 0 | $ | 0.00 | 68,437 | 87,338 | $ | 0 | $ | 0 | ||||||

- (1)

- Market value of underlying securities at November 30, 2002, minus the exercise price of "in-the-money" options.

9

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

The Compensation Committee is responsible for reviewing the compensation of the executive officers of the Company. The committee also grants stock options under the Company's stock option plans and administers the Company's employee stock purchase plan.

Compensation Philosophy. The Company operates in a highly competitive and rapidly evolving high technology business. The committee seeks to establish compensation policies that provide management with a performance incentive, and that align the interests of senior management with stockholder interests. The program includes three principal components: salary, annual incentives, and stock option awards. The committee considers the past performance and anticipated future contribution of each executive officer in establishing the total amount and the mix of each element of compensation.

Salary. The committee reviews the salaries of the executive officers (including the Chief Executive Officer) annually. From time to time, this review may include survey information developed by independent compensation and benefits consultants. The committee considers the median compensation levels for comparable positions at other technology companies, but does not, as a matter of policy, fix compensation of all executive officers as a percentage of such median levels. Accordingly, compensation levels for an executive officer may be set by the committee above or below such median levels, based on the committee's subjective assessment of other factors, including the scope of an individual's responsibilities, his or her prior level of experience and competition for executives with the skills required by the Company. Based on the above considerations, the base salaries of the executive officers remained unchanged at the beginning of fiscal year 2002 versus the levels in effect at the end of fiscal 2001. In June 2002, management recommended and the committee approved a decrease in the salaries of each executive officer of 10% effective June 1, 2002. The decrease in June 2002 reflected the need to conserve cash in a challenging economic climate.

Annual Incentives. The committee annually reviews and from time to time approves an executive incentive plan that provides executive officers (including the Chief Executive Officer) with the opportunity to earn specified percentages of their base salary based upon targeted financial goals and, in certain instances, on the achievement of individual objectives and a subjective assessment of the executive's performance. For the last fiscal year, there was no annual incentive plan approved by the committee. In December 2001, the chief executive officer and chief financial officer each received a bonus of $25,000 for the completion of specific milestones identified by the Board of Directors as critical to the Company.

Stock Option Awards. Stock option awards are designed to align the interests of the executive officers with the long-term interests of the stockholders. The committee awards stock options generally at fair market value on the date of grant, and such awards are subject to vesting periods that are intended to encourage the executive officer to remain with the Company. The timing and amount of stock option awards given to the executive officers in fiscal 2002 were based in each case on the committee's subjective judgment of the particular circumstances of the individual.

Compensation of the Chief Executive Officer. The committee in accordance with the philosophy described above determined Mr. Molinari's salary, annual incentive opportunity and stock option award for fiscal 2002. At the beginning of fiscal 2002, Mr. Molinari's annual base salary was fixed at $250,000, the same amount as was in effect at the end of fiscal 2001. On June 1, 2002 Mr. Molinari's salary was reduced by 10% as mentioned above. Mr. Molinari received a bonus of $25,000 in December 2001 for the completion of specific milestones identified by the Board of Directors as critical to the Company. In fiscal 2002, Mr. Molinari was granted incentive stock options to purchase 30,000 shares at the then fair market value of $1.63 per share, such options becoming exercisable as follows: 25% one year from the date of grant and 6.25% quarterly thereafter until the fourth anniversary of the grant. All such options expire ten years from the date of grant. This grant was determined by the committee to be appropriate, in light of Mr. Molinari's performance as chief executive officer, as well as his existing level of stock options.

10

Section 162(m) of the Internal Revenue Code of 1986, as amended, generally disallows a tax deduction to public companies for compensation over $1,000,000 in any year to the company's chief executive officer or any of the four other highest paid executive officers. Qualifying performance-based compensation will not be subject to the deduction limit if certain requirements are satisfied. The Company has considered the limitations on deductions imposed by Section 162(m) of the Code, and it is the Compensation Committee's present intention that, for so long as it is consistent with its overall compensation objective, substantially all tax deductions attributable to executive compensation will not be subject to the deduction limitations of Section 162(m) of the Code.

COMPENSATION COMMITTEE

Roger W. Redmond

Paul J. Severino

11

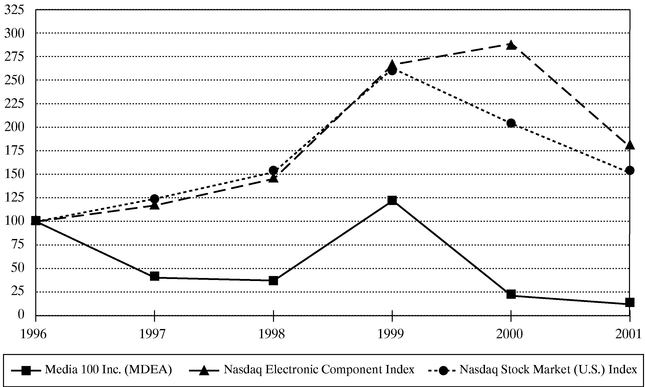

Set forth below is a line graph comparing the yearly percentage change in the cumulative total stockholder return on the Company's Common Stock against the cumulative total return of the CRSP Total Return Index for The Nasdaq Stock Market (U.S. Companies) (the "Nasdaq Stock Market (U.S.) Index") and the CRSP Index for Nasdaq Electronic Component Stocks (the "Nasdaq Electronic Component Index") for the period of five fiscal years commencing with the fiscal year ended November 30, 1998 and ending with the fiscal year ended November 30, 2002.

| | 1997 | 1998 | 1999 | 2000 | 2001 | 2002 | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| NASDAQ STOCK MARKET (U.S.) INDEX | $ | 100.00 | $ | 152.70 | $ | 262.81 | $ | 203.67 | $ | 151.72 | $ | 117.04 | ||||||

| NASDAQ ELECTRONIC COMPONENT INDEX | $ | 100.00 | $ | 145.68 | $ | 266.88 | $ | 289.01 | $ | 178.68 | $ | 114.42 | ||||||

| MEDIA 100 INC. (MDEA) | $ | 100.00 | $ | 37.36 | $ | 121.98 | $ | 21.43 | $ | 12.31 | $ | 10.20 | ||||||

The above graph compares the performance of the Company with that of the Nasdaq Stock Market (U.S.) Index, which is an index comprising all domestic shares traded on the Nasdaq National Market and the Nasdaq SmallCap Market, and the Nasdaq Electronic Component Index, which is an industry index. Both these indices are prepared by the Center of Research in Securities Prices at the University of Chicago, and weigh investment on the basis of market capitalization.

The comparison of total return of investment (change in year-end stock price plus reinvested dividends) for each of the periods assumes that $100 was invested at the close of the market on November 30, 1997 in each of the Nasdaq Stock Market (U.S.) Index and the Nasdaq Electronic Component Index and the Company.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires the Company's officers and directors and persons who beneficially own more than 10% of the Company's Common Stock to file reports of

12

ownership and changes in ownership with the Securities and Exchange Commission and the National Association of Securities Dealers, Inc. Based solely on its review of the copies of such reports received by it, and written representations from certain reporting persons that no Forms 5 were required for those persons, the Company believes that during the fiscal year ended November 30, 2002 all officers, directors and such 10% beneficial owners complied with all applicable filing requirements.

In the event that sufficient votes in favor of the election of the nominees for director listed in this Proxy Statement (the "Nominees") or any other matter presented hereunder are not received by April 15, 2003, the persons named as proxies may propose one or more adjournments of the meeting to permit further solicitation of proxies. Any such adjournment will require the affirmative vote of a majority of the shares present in person or by proxy at the session of the meeting to be adjourned. The persons named as proxies will vote in favor of such adjournment those proxies that they are entitled to vote in favor of the Nominees and all such other matters. They will vote against any such adjournment those proxies withholding authority to vote on any Nominee and voting against or abstaining with respect to all other such matters. The Company will pay the costs of any additional solicitation and of any adjourned meetings.

Stockholder proposals intended to be presented at the 2004 Annual Meeting of Stockholders must be received at the Company's principal executive offices located at 450 Donald Lynch Boulevard, Marlboro, Massachusetts 01752 not later than November 17, 2003, in order to be considered for inclusion in the proxy statement and form of proxy relating to that meeting. The deadline for providing timely notice to the Company of matters that stockholders of the Company otherwise desire to introduce at the 2004 Annual Meeting of Stockholders is January 29, 2004.

13

INDEPENDENT PUBLIC ACCOUNTANTS

On June 19, 2002, the Company's Board of Directors and its Audit Committee decided to dismiss Arthur Andersen LLP ("Arthur Andersen") as the Company's independent auditors and engaged Ernst & Young LLP ("Ernst & Young") to serve as the Company's independent auditors for the fiscal year 2002, effective June 19, 2002.

Arthur Andersen's reports on the Company's consolidated financial statements for each of the fiscal years ended November 30, 2001 and 2000 did not contain any adverse opinion or disclaimer of opinion, nor were they qualified or modified as to uncertainty, audit scope or accounting principles. During the fiscal years ended November 30, 2001 and 2000 and during the subsequent interim period preceding the replacement of Arthur Andersen on June 19, 2002, there were no disagreements with Arthur Andersen on any matter of accounting principle or practice, financial statement disclosure, or auditing scope or procedure which, if not resolved to Arthur Andersen's satisfaction, would have caused it to make reference to the subject matter in conjunction with their report on the Company's consolidated financial statements for such years; and there were no reportable events as defined in Item 304(a)(1)(v) of Regulation S-K.

The Company provided Arthur Andersen with a copy of the above disclosures, which were also set forth in the Company's current report on Form 8-K filed with the SEC on June 24, 2002. Arthur Andersen's letter dated June 24, 2002, stating its agreement with the above statements was filed as an exhibit to the Form 8-K.

During the fiscal years ended November 30, 2001 and 2000 and during the subsequent interim period preceding the replacement of Arthur Andersen on June 19, 2002, neither the Company, nor anyone acting on it's behalf, consulted Ernst and Young with respect to the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Company's financial statements, or any other matters or reportable events as set forth in Items 304 (a)(2)(i) and (ii) of Regulation S-K.

The Company expects that representatives of Ernst & Young will be present at the Annual Meeting to respond to appropriate questions, and such representatives will be given the opportunity to make a statement if they desire to do so.

The Company paid Ernst & Young and Arthur Anderson the following fees:

| | Fiscal Year Ended November 30, 2002 | |||||

|---|---|---|---|---|---|---|

| | Ernst & Young | Arthur Anderson | ||||

| Audit Fees | $ | 134,986 | $ | 13,650 | ||

| Audit-Related Fees | $ | 12,500 | $ | 21,000 | ||

| Tax Fees | $ | 52,634 | $ | 20,811 | ||

| All Other Fees | $ | 0 | $ | 0 | ||

| Total | $ | 200,120 | $ | 55,461 | ||

Ernst & Young billed the Company an aggregate of $12,500 for a 401(k) plan audit and $52,634 for tax preparation services in connection with the Company's state and federal income tax returns. The Company's previous auditors, Arthur Andersen, billed the Company $21,000 for a 401(k) plan audit and audit-related services in connection with a review of certain prior transactions and $20,811 for tax related services.

Pursuant to its written charter (included in this proxy statement as Appendix B), the Audit Committee, or a subcommittee thereof comprised of one or more independent directors, is responsible for pre-approving all audit and permitted non-audit services to be performed for the Company by its independent auditors or any other auditing or accounting firm. The Audit Committee is currently in the

14

process of establishing general guidelines for the permissible scope and nature of any permitted non-audit services in connection with its annual review of the audit plan and will review such guidelines with the Board of Directors at the appropriate time.

The audit committee provides independent oversight of the Company's accounting functions and monitors the objectivity of the financial statements prepared under the direction of management. In addition, the audit committee retains the Company's independent auditors, reviews major accounting policy changes, reviews and approves the scope of the annual internal and independent audit processes, pre-approves non-audit services provided by the independent auditors, approves all audit and non-audit service fees paid to the independent auditors, and monitors Company activities designed to assure compliance with the Company's ethical standards. The audit committee is composed of 3 directors who are "independent" as that term is defined under Nasdaq National Market listing requirements. The audit committee operates under a written charter (included in this proxy statement as Appendix B) adopted by the Company's Board of Directors.

The audit committee reviewed the Company's audited financial statements for the fiscal year ended November 30, 2002 and discussed these financial statements with the Company's management, which has represented to the audit committee that these financial statements were prepared in accordance with accounting principles generally accepted in the United States. The audit committee discussed with management the quality and the acceptability of the accounting principles employed, the reasonableness of judgments made, and the clarity of the disclosures included in the statements.

The audit committee also reviewed with the independent auditors, who are responsible for expressing an opinion on the conformity of the audited financial statements with generally accepted accounting principles, their judgments as to the quality, not just the acceptability, of the Company's accounting principles and such other matters as are required to be discussed with the committee under generally accepted auditing standards. In addition, the audit committee has discussed with the independent auditors the matters required to be discussed by Statement on Accounting Standards No. 61 (Communication with Audit Committees) and the auditors' independence from the Company and its management, including the matters in the written disclosures and the letter we received from the auditors as required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), and has considered the compatibility of non-audit services with the auditors' independence.

Based on its review and the discussions described above, the audit committee recommended to the Company's Board of Directors that the audited financial statements be included in the Company's annual report on Form 10-K for the fiscal year ended November 30, 2002. The audit committee has selected Ernst & Young as the Company's independent auditors for 2003.

AUDIT COMMITTEE

Maurice L. Castonguay

Roger W. Redmond

Paul J. Severino

15

APPENDIX A

MEDIA 100 INC.

1986 EMPLOYEE STOCK PURCHASE PLAN,

AS AMENDED THROUGH JUNE 12, 2001

Section 1. Purpose of Plan.

The Media 100 Inc. ("Media 100") 1986 Employee Stock Purchase Plan (the "Plan") is intended to provide a method by which eligible employees of Media 100 (formerly Data Translation, Inc.) and its subsidiaries (collectively, the "Company") may use voluntary, systematic payroll deductions to purchase shares of Common Stock of Media 100 ("stock") and thereby acquire an interest in the future of the Company. For purposes of the Plan, a subsidiary is any corporation in which Media 100 owns, directly or indirectly, stock possessing 50% or more of the total combined voting power of all classes of stock.

Section 2. Options to Purchase Stock.

Under the Plan, there is available an aggregate of not more than 1,500,0001 shares of stock (subject to adjustment as provided in Section 16) for sale pursuant to the exercise of options ("options") granted under the Plan to employees of the Company ("employees"). The stock to be delivered upon exercise of options under the Plan may be either shares of Media 100's authorized but unissued stock, or shares of reacquired stock, as the Board of Directors of Media 100 (the "Board of Directors") shall determine.

- 1

- An increase in the number of shares authorized for issuance under the Plan by 500,000 to a total of 1,500,000 shares was approved by the requisite vote of stockholders at the Annual Meeting of Stockholders of Media 100 held on June 12, 2001.

Section 3. Eligible Employees.

Except as otherwise provided in Section 20, each employee who has completed one month of continuous service in the employ of the Company shall be eligible to participate in the Plan.

Section 4. Method of Participation.

Subject to the second paragraph of Section 8, the periods January 1 to June 30 and July 1 to December 31 of each year shall be option periods. Each person who will be an eligible employee on the first day of any option period may elect to participate in the Plan by executing and delivering, at least 15 days prior to such day, a payroll deduction authorization in accordance with Section 5. Such employee shall thereby become a participant ("participant") on the first day of such option period and shall remain a participant until his participation is terminated as provided in the Plan. Each participant shall execute, prior to or contemporaneously with his election to participate in the Plan, the Company's then standard form of Employee Agreement relating to confidentiality, inventions and the like.

Section 5. Payroll Deductions.

The payroll deduction authorization shall request withholding, at a rate of not less than 2% nor more than 10%, from the participant's compensation, by means of substantially equal payroll deductions over the option period. For purposes of the Plan, "compensation" shall mean all compensation paid to the participant by the Company including compensation paid as bonuses and commissions, but excluding overrides, overseas allowances, and payments under stock option plans and other employee benefit plans A participant may change the withholding rate of his payroll deduction authorization by written notice delivered to the Company at least 15 days prior to the first day of the option period as to which the change is to be effective. All amounts withheld in accordance with a participant's payroll deduction authorization shall be credited to a withholding account for such participant.

A-1

Section 6. Grant of Options.

Each person who is a participant on the first day of an option period shall as of such day be granted an option for such period. Such option shall be for the number of shares of stock to be determined by dividing (a) the balance in the participant's withholding account on the last day of the option period by (b) the purchase price per share of the stock determined under Section 7, and eliminating any fractional share from the quotient. The Company shall reduce on a substantially proportionate basis the number of shares of stock receivable by each participant upon exercise of his option for an option period in the event that the number of shares then available under the Plan is otherwise insufficient.

Section 7. Purchase Price.

The purchase price of stock issued pursuant to the exercise of an option shall be 85% of the fair market value of the stock at (a) the time of grant of the option or (b) the time at which the option is deemed exercised, whichever is less. Fair market value shall be determined in accordance with the applicable provisions of the Internal Revenue Code of 1986, as amended or restated from time to time (the "Code") or regulations issued thereunder, or in the absence of any such provisions or regulations, shall be deemed to be the last sale price at which the stock is traded on the day in question or the last prior date on which a trade occurred as reported in the Wall Street Journal; or, if the Wall Street Journal is not published or does not list the stock, then in such other appropriate newspaper of general circulation as the Board of Directors may prescribe; or, if the last price at which the stock traded is not generally reported, then the mean between the reported bid and asked prices at the close of the market on the day in question or the last prior date when such prices were reported.

Section 8. Exercise of Options.

If an employee is a participant in the Plan on the last business day of an option period, he shall be deemed to have exercised the option granted to him for that period. Upon such exercise, the Company shall apply the balance of the participant's withholding account to the purchase of the number of whole shares of stock determined under Section 6, and as soon as practicable thereafter shall issue and deliver certificates for said shares to the participant and shall return to him the balance, if any, of his withholding account in excess of the total purchase price of the shares so issued. No fractional shares shall be issued hereunder.

Notwithstanding anything herein to the contrary, the Company shall not be obligated to deliver any shares unless and until, in the opinion of the Company's counsel, all requirements of applicable federal and state laws and regulations (including any requirements as to legends) have been complied with, nor, if the outstanding stock is at the time listed on any securities exchange, unless and until the shares to be delivered have been listed (or authorized to be added to the list upon official notice of issuance) upon such exchange, nor unless or until all other legal matters in connection with the issuance and delivery of shares have been approved by the Company's counsel.

Section 9. Interest.

No interest will be payable on withholding accounts.

Section 10. Cancellation and Withdrawal.

A participant who holds an option under the Plan may at any time prior to exercise thereof under Section 8 cancel all (but not less than all) of his option by written notice delivered to the Company. Upon such cancellation, the balance in his withholding account shall be returned to him.

A participant may terminate his payroll deduction authorization as of any date by written notice delivered to the Company and shall thereby cease to be a participant as of such date. Any participant who voluntarily terminates his payroll deduction authorization prior to the last business day of an option period shall be deemed to have canceled his option.

A-2

Section 11. Termination of Employment.

Except as otherwise provided in Section 12, upon the termination of a participant's employment with the Company for any reason whatsoever, he shall cease to be a participant, and any option held by him under the Plan shall be deemed cancelled, the balance of his withholding account shall be returned to him, and he shall have no further rights under the Plan. For purposes of this Section 11, a participant's employment will not be considered terminated in the case of sick leave or other bona fide leave of absence approved for purposes of this Plan by Media 100 or a subsidiary or in the case of a transfer to the employment of a subsidiary or to the employment of Media 100.

Section 12. Death or Retirement of Participant.

In the event a participant holds any option hereunder at the time his employment with the Company is terminated (1) by his retirement with the consent of the Company, and such retirement is within three months of the time such option becomes exercisable, or (2) by his death whenever occurring, then such participant (or in the event of death, his legal representative) may, by a writing delivered to the Company on or before the date such option is exercisable, elect either (a) to cancel any such option and receive in cash the balance in his withholding account, or (b) to have the balance in his withholding account applied as of the last day of the option period to the exercise of his option pursuant to Section 8. In the event such participant (or his legal representative) does not file a written election as provided above, any outstanding option shall be treated as if an election had been filed pursuant to subparagraph (a) above.

Section 13. Participant's Rights Not Transferable, Etc.

All participants granted options under the Plan shall have the same rights and privileges. Each participant's rights and privileges under any option granted under the Plan shall be exercisable during his lifetime only by him, and shall not be sold, pledged, assigned, or otherwise transferred in any manner whatsoever except by will or the laws of descent and distribution. In the event any participant violates the terms of this Section, any options held by him may be terminated by the Company and upon return to the participant of the balance of his withholding account, all his rights under the Plan shall terminate.

Section 14. Employment Rights.

Neither the adoption of the Plan nor any of the provisions of the Plan shall confer upon any participant any right to continued employment with Media 100 or a subsidiary or affect in any way the right of the Company to terminate the employment of a participant at any time.

Section 15. Rights as a Shareholder.

A participant shall have the rights of a shareholder only as to stock actually acquired by him under the Plan.

Section 16. Change in Capitalization.

In the event of a stock dividend, stock split or combination of shares, recapitalization, merger in which Media 100 is the surviving corporation or other change in Media 100's capital stock, the number and kind of shares of stock or securities of Media 100 to be subject to the Plan and to options then outstanding or to be granted hereunder, the maximum number of shares or securities which may be delivered under the Plan, the option price and other relevant provisions shall be appropriately adjusted by the Board of Directors, whose determination shall be binding on all persons. In the event of a consolidation or merger in which Media 100 is not the surviving corporation or in the event of the sale or transfer of substantially all Media 100's assets (other than by the grant of a mortgage or security interest), all outstanding options shall thereupon terminate, provided that prior to the effective date of any such merger, consolidation or sale of assets, the Board of Directors shall either (a) return the balance in all withholding accounts and cancel all outstanding options, or (b) accelerate the exercise date provided for in Section 8, or (c) if there is a surviving or acquiring corporation, arrange to have that corporation or an affiliate of that corporation

A-3

grant to the participants replacement options having equivalent terms and conditions as determined by the Board of Directors.

Section 17. Administration of Plan.

The Plan will be administered by the Board of Directors. The Board of Directors will have authority, not inconsistent with the express provisions of the Plan, to take all action necessary or appropriate hereunder, to interpret its provisions, and to decide all questions and resolve all disputes which may arise in connection therewith. Such determinations of the Board of Directors shall be conclusive and shall bind all parties.

The Board may, in its discretion, delegate its powers with respect to the Plan to an Employee Benefit Plan Committee or any other committee (the "Committee"), in which event all references to the Board of Directors hereunder, including without limitation the references in Section 18, shall be deemed to refer to the Committee. A majority of the members of any such Committee shall constitute a quorum, and all determinations of the Committee shall be made by a majority of its members. Any determination of the Committee under the Plan may be made without notice or meeting of the Committee by a writing signed by a majority of the Committee members.

Section 18. Amendment and Termination of Plan.

The Board of Directors may at any time or times amend the Plan or amend any outstanding option or options for the purpose of satisfying the requirements of any changes in applicable laws or regulations or for any other purpose which may at the time be permitted by law, provided that (except to the extent explicitly required or permitted herein) no such amendment will, without the approval of the shareholders of Media 100, (a) increase the maximum number of shares available under the Plan, (b) reduce the option price of outstanding options or reduce the price at which options may be granted, or (c) amend the provisions of this Section 18 of the Plan, and no such amendment will adversely affect the rights of any participant (without his consent) under any option theretofore granted.

The Plan may be terminated at any time by the Board of Directors, but no such termination shall adversely affect the rights and privileges of holders of the outstanding options.

Section 19. Approval of Shareholders.

The Plan shall be subject to the approval of the shareholders of the Company, which approval shall be secured within twelve months after the date the Plan is adopted by the Board of Directors. Notwithstanding any other provisions of the Plan, no option shall be exercised prior to the date of such approval. For purposes of the foregoing, any increase in the number of shares described in Section 2, other than pursuant to adjustment as provided in Section 16, shall be treated as an adoption of the Plan with respect to the additional shares.

Section 20. Limitations on Eligibility.

Notwithstanding any other provision of the Plan,

(a) An employee shall not be eligible to receive an option pursuant to the Plan if, immediately after the grant of such option to him, he would (in accordance with the provisions of Sections 423 and 425(d) of the Code) own or be deemed to own stock possessing 5% or more of the total combined voting power or value of all classes of stock of the employer corporation or of its parent or subsidiary corporation, as defined in Section 425 of the Code.

(b) No employee shall be granted an option under the Plan which would permit his rights to purchase shares of stock under all employee stock purchase plans of the Company and any parent and subsidiary corporations to accrue at a rate which exceeds $25,000 in fair market value of such stock (determined at the time the option is granted) for each calendar year during which any such option granted to such employee is outstanding at any time, as provided in Sections 423 and 425 of the Code. Without limiting the foregoing, the maximum number of shares for which an employee may be granted an option under the Plan for any six-month option period shall be the number of whole shares obtained by dividing $12,500 by the fair market value of one share of Common Stock on the date of grant.

A-4

APPENDIX B

MEDIA 100 INC.

Audit Committee Charter

(as modified on January 16, 2003)

A. PURPOSE AND SCOPE

The primary functions of the Audit Committee (the "Committee") are to (a) assist the Board of Directors in fulfilling its responsibilities by reviewing: (i) the financial reports provided by the Corporation to the Securities and Exchange Commission ("SEC"), the Corporation's shareholders or to the general public, and (ii) the Corporation's internal financial and accounting controls; (b) oversee the engagement of and work performed by any independent public accountants and (c) oversee the Corporation's procedures designed to improve the quality and reliability of the disclosure of the Corporation's financial condition and results of operations.

B. COMPOSITION

The Committee shall be comprised of a minimum of three directors as appointed by the Board of Directors, who shall meet the independence and audit committee composition requirements under any rules or regulations of the Securities and Exchange Commission and The Nasdaq National Market, as in effect from time to time, and shall be free from any relationship that, in the opinion of the Board of Directors, would interfere with the exercise of his or her independent judgment as a member of the Committee.

All members of the Committee shall either (i) be able to read and understand fundamental financial statements, including a balance sheet, cash flow statement and income statement, or (ii) be able to do so within a reasonable period of time after appointment to the Committee. At least one member of the Committee shall have employment experience in finance or accounting, requisite professional certification in accounting, or other comparable experience or background which results in the individual's financial sophistication, including being or having been a chief executive officer, chief financial officer or other senior officer with financial oversight responsibilities. Further, no later than the earliest time required by applicable law or regulation, at least one member of the Committee shall qualify as a "financial expert" (as such term will be defined by SEC rulemaking).

The members of the Committee shall be elected by the Board of Directors at the meeting of the Board of Directors following each annual meeting of stockholders and shall serve until their successors shall be duly elected and qualified or until their earlier resignation or removal. Unless a Chair is elected by the full Board of Directors, the members of the Committee may designate a Chair by majority vote of the full Committee membership. The Audit Committee may delegate to one or more designated members of the Audit Committee the authority to pre-approve audit and permissible non-audit services and fees, provided such pre-approval decision is presented to the full Audit Committee at its scheduled meetings.

C. RESPONSIBILITIES AND DUTIES

To fulfill its responsibilities and duties the Committee shall:

Document Review

- 1.

- Review and assess the adequacy of this Charter periodically as conditions dictate, but at least annually (and update this Charter if and when appropriate).

- 2.

- Review with representatives of management and representatives of the independent accounting firm the Corporation's audited annual financial statements prior to their filing as part of the Annual Report on Form 10-K. After such review and discussion, the Committee shall recommend to the

B-1

Board of Directors whether such audited financial statements should be published in the Corporation's annual report on Form 10-K. The Committee shall also review the Corporation's quarterly financial statements prior to their inclusion in the Corporation's quarterly SEC filings on Form 10-Q.

- 3.

- Take steps designed to insure that the independent accounting firm reviews the Corporation's interim financial statements prior to their inclusion in the Corporation's quarterly reports on Form 10-Q.

Independent Accounting Firm

- 4.

- Be directly responsible for the selection, compensation and oversight of any independent accounting firms engaged by the Corporation for the purpose of preparing or issuing any audit report or related work; and instruct the independent accounting firm that it should report directly to the Committee on matters relating to the work performed during its engagement and on matters required by applicable laws and regulations. The Committee shall have the ultimate authority and responsibility to select, evaluate and, when warranted, replace such independent accounting firm (or to recommend such replacement for shareholder approval in any proxy statement).

- 5.

- Resolve any disagreement between management and the independent accounting firm as to financial reporting matters.

- 6.

- On an annual basis, receive from the independent accounting firm a formal written statement identifying all relationships between the independent accounting firm and the Corporation consistent with Independence Standards Board ("ISB") Standard 1. The Committee shall actively engage in a dialogue with the independent accounting firm as to any disclosed relationships or services that may impact its independence. The Committee shall take appropriate action to oversee the independence of the independent accounting firm.

- 7.

- On an annual basis, discuss with representatives of the independent accounting firm the matters required to be discussed by Statement on Auditing Standards ("SAS") 61, as it may be modified or supplemented.

- 8.

- Meet with the independent accounting firm prior to the audit to review the planning and staffing of the audit.

- 9.

- Consider in advance whether or not to approve any non-audit services proposed to be provided to the Corporation by the independent accounting firm (or subsequently approve non-audit services in those circumstances where a subsequent approval is necessary and permissible).

Financial Reporting Processes

- 10.

- In consultation with the independent accounting firm and management, review annually the adequacy of the Corporation's internal financial and accounting controls.

- 11.

- Require the Corporation's chief executive officer and chief financial officer to report prior to the date of filing of each Form 10-K or Form 10-Q to the Committee regarding the design and operation of the Corporation's internal financial and accounting controls, and disclosing (a) any significant deficiencies discovered in the design and operation of the internal controls which could adversely affect the Corporation's ability to record, process, summarize, and report financial data; and (b) any fraud, whether or not material, that involves management or other employees who have a significant role in the Corporation's internal controls. The Committee shall direct the actions to be taken and/or make recommendations to the Board of Directors of actions to be taken to the extent such report indicates the finding of any significant deficiencies in internal controls or fraud.

B-2

Conflicts of Interest

- 12.

- Review all related party transactions involving executive officers and members of the Board and, as required by any applicable laws or regulations, consider approval of such transactions.

- 13.

- Reviewing, approving and monitoring the Corporation's code of ethics for its senior financial officers.

Compliance

- 14.

- Establish procedures, no later than the date required by any applicable laws or regulations, for (a) the receipt, retention, and treatment of complaints received by the Corporation regarding accounting, internal accounting controls, or auditing matters; and (b) the confidential, anonymous submission by employees of the Corporation of concerns regarding questionable accounting or auditing matters.

- 15.

- Investigate any allegations that any officer or director of the Corporation, or any other person acting under the direction of any such person, took any action fraudulently to influence, coerce, manipulate, or mislead any independent public or certified accountant engaged in the performance of an audit of the financial statements of the Corporation for the purpose of rendering such financial statements materially misleading and, if such allegations prove to be correct, take or recommend to the Board of Directors appropriate disciplinary action.

- 16.

- To the extent deemed necessary by the Committee, engage outside counsel, independent accounting consultants, and/or other experts to review any matter under its responsibility.

Reporting

- 17.

- Prepare, in accordance with the rules of the SEC as modified or supplemented from time to time, a written report of the audit committee to be included in the Corporation's annual proxy statement for each annual meeting of stockholders occurring after December 14, 2000.

- 18.

- Instruct the Corporation's management to disclose in its Form 10-K and Form 10-Q's the approval by the Committee of any non-audit services performed by the independent accounting firm, and review the substance of any such disclosure.

- 19.

- Instruct the Corporation's management to include the full text of this Audit Committee charter in the Corporation's proxy statement not less than once every three years.

While the Audit Committee has the responsibilities and powers set forth in this Charter, it is not the duty of the Audit Committee to plan or conduct audits or to determine that the Corporation's financial statements are complete and accurate and are in accordance with generally accepted accounting principles.

B-3

/*\ DETACH HERE /*\ |

PROXY

MEDIA 100 INC.

ANNUAL MEETING OF STOCKHOLDERS

April 15, 2003

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

The undersigned hereby appoints John A. Molinari and Steven D. Shea, each of them with power of substitution to each, to represent and to vote at the Annual Meeting of Stockholders to be held on April 15, 2003 at 10:00 a.m., and at any adjournments or postponements thereof all shares of Common Stock of the Company as to which the undersigned would be entitled to vote if present. The undersigned instructs such proxies, or their substitutes, to vote in such manner as they may determine on any matters that may come before the meeting, and to vote on the following as specified by the undersigned. All proxies heretofore given by the undersigned in respect of said meeting are hereby revoked.

Unless otherwise specified in the boxes provided on the reverse side hereof, the proxy will be votedFOR the election as directors of all nominees named hereon or any of such nominees for which approval is not withheld andIN FAVOR of an increase in the number of shares of Common Stock authorized for issuance under the 1986 Employee Stock Purchase Plan by 400,000 shares to a total of 1,900,000 shares and in the discretion of the named proxies as to any other matter not known a reasonable time before this solicitation that may come before this meeting or any adjournments or postponements thereof.

CONTINUED AND TO BE SIGNED ON REVERSE [SEE REVERSE SIDE]

/*\ DETACH HERE /*\ |

| | | |

|---|---|---|

| ý | PLEASE MARK VOTES AS IN THIS EXAMPLE. |

The Board of Directors recommends a vote FOR the following proposals:

PLEASE DO NOT FOLD THIS PROXY.

Proposal No. 1—Election of Directors.

Nominees: John A. Molinari, Maurice L. Castonguay, Roger W. Redmond, and Paul J. Severino

| | | | | | | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| / / | FOR ALL NOMINEES | / / | WITHHELD FROM ALL NOMINEES | / / | FOR ALL NOMINEES EXCEPT AS NOTED BELOW: | |||||

Proposal No. 2—Increasing the number of shares of Common Stock authorized for issuance under the 1986 Employee Stock Purchase Plan by 400,000 shares to a total of 1,900,000 shares

| | | | | ||

|---|---|---|---|---|---|

| Increasing the number of shares of Common Stock authorized for issuance under the 1986 Employee Stock Purchase Plan by 400,000 Shares to a total of 1,900,000 shares. | FOR / / | AGAINST / / | ABSTAIN / / |