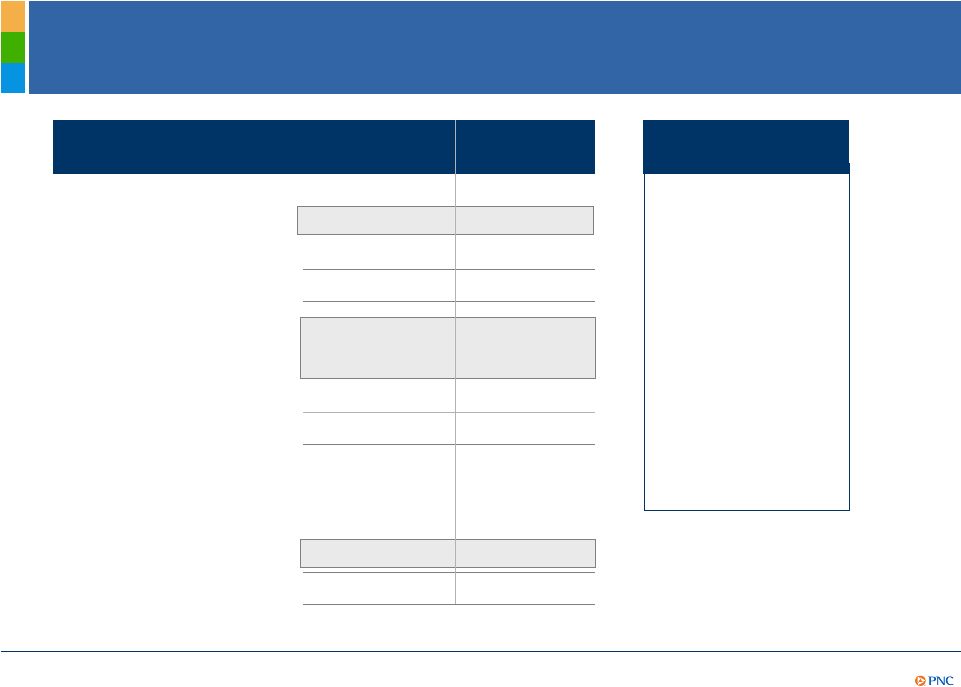

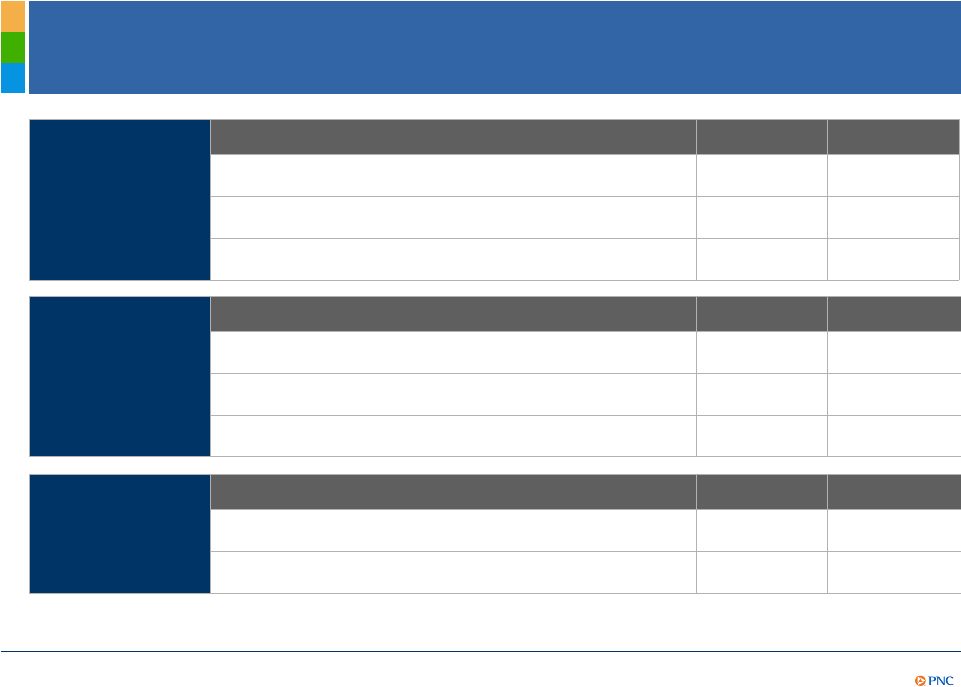

18 Non-GAAP to GAAP Reconcilement Appendix In millions except per share data Adjustments, pretax Income taxes (benefit) 1 Net income Net income attributable to common shareholders Diluted EPS from net income Net income and diluted EPS, as reported $1,474 $1,119 $2.15 Adjustments: Integration costs $213 ($75) 138 138 .27 TARP preferred stock accelerated discount accretion 2 250 .49 Net income and diluted EPS, as adjusted $1,612 $1,507 $2.91 In millions except per share data Adjustments, pretax Income taxes (benefit) 1 Net income Net income attributable to common shareholders Diluted EPS from net income Net income and diluted EPS, as reported $737 $525 $1.16 Adjustments: Integration costs $177 ($52) 125 125 .28 Net income and diluted EPS, as adjusted $862 $650 $1.44 For the six months ended June 30, 2009 (1) Calculated using a marginal federal income tax rate of 35% and includes applicable income tax adjustments. (2) Represents accelerated accretion of the remaining issuance discount on redemption of the TARP preferred stock in February 2010. PNC believes that information adjusted for the impact of certain items may be useful due to the extent to which the items are not indicative of our ongoing operations. For the six months ended June 30, 2010 Three months ended Six months ended June 30, 2010 March 31, 2010 June 30, 2010 in millions Total revenue $3,912 $3,763 $7,675 Noninterest expense 2,002 2,113 4,115 Pretax pre-provision earnings $1,910 $1,650 $3,560 Provision $823 $751 $1,574 Excess of pretax pre-provision earnings over provision $1,087 $899 $1,986 Pretax pre-provision earnings/provision 2.32 2.20 2.26 PNC believes that pretax pre-provision earnings is useful as a tool to help evaluate the ability to provide for credit costs through operations. |