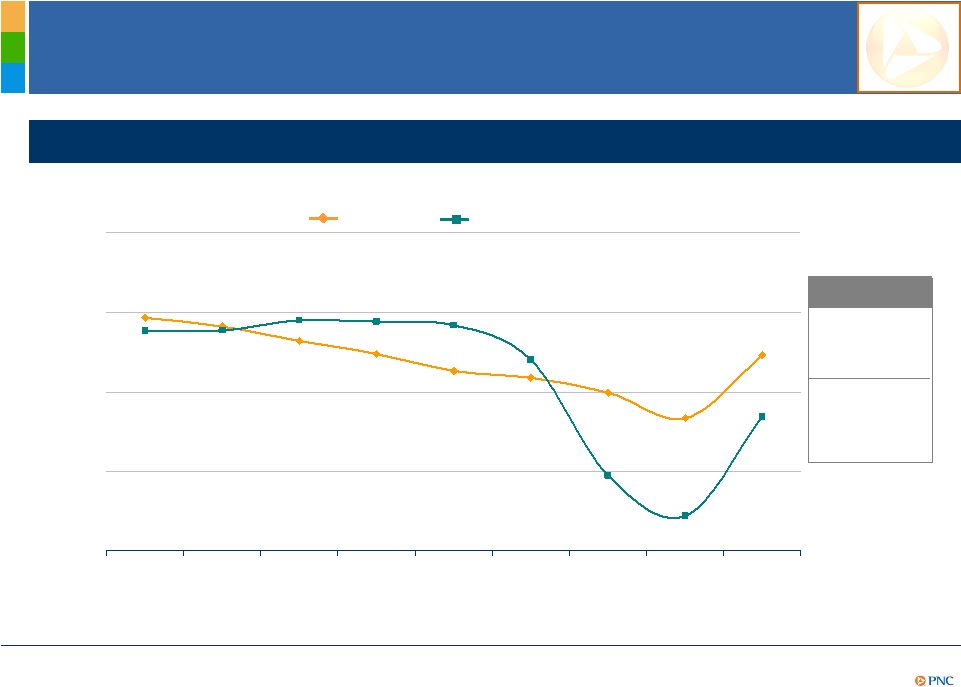

27 Non-GAAP to GAAP Reconcilement Appendix For the three months ended Sept. 30, 2010 June 30, 2010 Mar. 31, 2010 Dec. 31, 2009 Sept. 30, 2009 In millions except ratio and per share data Total revenue $3,598 $3,912 $3,763 $4,886 $3,853 Noninterest expense 2,158 2,002 2,113 2,209 2,214 Pretax pre-provision earnings $1,440 $1,910 $1,650 $2,677 $1,639 Provision $486 $823 $751 $1,049 $914 Income from continuing operations before income taxes and noncontrolling interests (Pretax earnings) $954 $1,087 $899 $1,628 $725 Pretax pre-provision earnings/provision 3.0 2.3 2.2 2.6 1.8 Gain on BLK/BGI transaction $1,076 Pretax earnings excluding BLK/BGI gain $1,601 Pretax pre-provision earnings excluding BLK/BGI gain/provision 1.5 PNC believes that pretax pre-provision earnings, a non-GAAP measure, is useful as a tool to help evaluate the ability to provide for credit costs through operations, and that information adjusted for the impact of the BLK/BGI gain may be useful due to the extent to which that item is not indicative of our ongoing operations. For the three months ended $ in millions Sept. 30, 2010 June 30, 2010 Mar. 31, 2010 Dec. 31, 2009 Sept. 30, 2009 Net interest margin 3.96% 4.35% 4.24% 4.05% 3.76% Provision for credit losses $486 $823 $751 $1,049 $914 Avg. interest-earning assets $223,677 $224,580 $226,992 $230,998 $235,694 Annualized provision/Avg. interest-earning assets 0.86% 1.47% 1.34% 1.80% 1.54% Credit risk-adjusted net interest margin (1) 3.10% 2.88% 2.90% 2.25% 2.22% For the nine months ended $ in millions Sept. 30, 2010 Sept. 30, 2009 Net interest margin 4.18% 3.72% Provision for credit losses $2,060 $2,881 Avg. interest-earning assets $225,071 $241,010 Annualized provision/Avg. interest-earning assets 1.22% 1.60% Credit risk-adjusted net interest margin (1) 2.96% 2.12% PNC believes that credit risk-adjusted net interest margin, a non-GAAP measure, is useful as a tool to help evaluate the amount of credit related risk associated with interest-earning assets. (1) The adjustment represents annualized provision for credit losses divided by average interest-earning assets. |