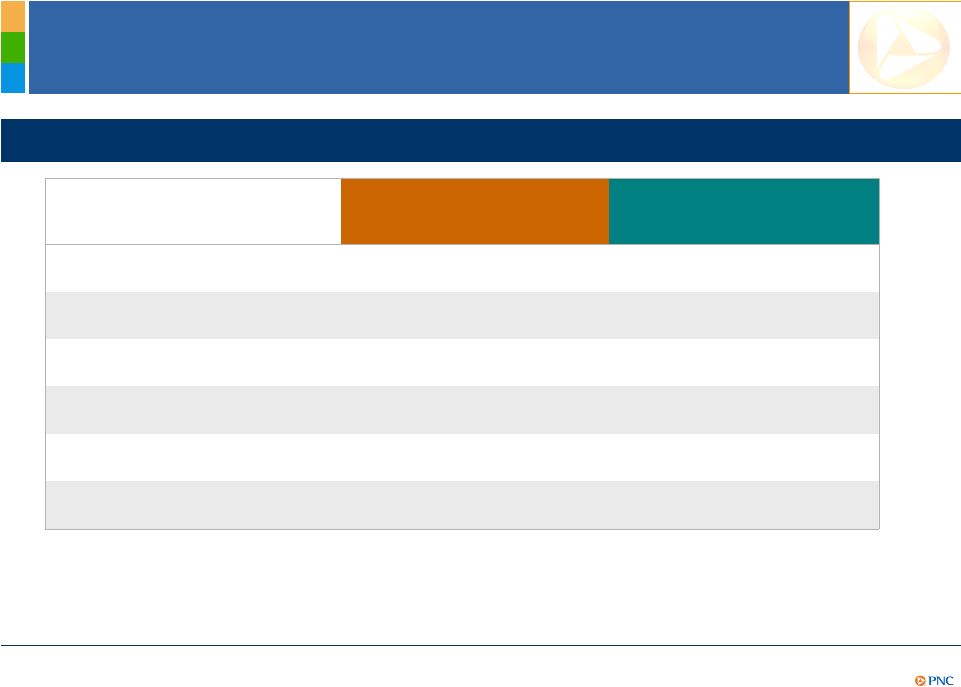

30 Non-GAAP to GAAP Reconcilement Appendix Sept. 30, 2010 Sept. 30, 2009 In millions except ratio Total revenue $11,273 $11,342 Noninterest expense 6,273 6,864 Pretax pre-provision earnings $5,000 $4,478 Provision $2,060 $2,881 Income from continuing operations before income taxes and noncontrolling interests (Pretax earnings) $2,940 $1,597 Pretax pre-provision earnings/provision 2.4 1.6 PNC believes that pretax pre-provision earnings, a non-GAAP measure, is useful as a tool to help evaluate the ability to provide for credit costs through operations. For the nine months ended In millions except per percentages March 31 June 30 Sept. 30 Dec. 31 March 31 June 30 Sept. 30 Common shareholders' equity $18,546 $19,363 $20,997 $22,011 $26,466 $27,725 $29,394 Intangible assets 12,178 12,890 12,734 12,909 12,714 12,138 10,518 Common shareholders' equity less intangible assets 6,368 6,473 8,263 9,102 13,752 15,587 18,876 Net income $530 $207 $559 $1,107 $671 $803 $1,103 Net income, if annualized $2,120 $828 $2,236 $4,428 $2,684 $3,212 $4,412 Return on common shareholders' equity 11% 4% 11% 20% 10% 12% 15% Return on tangible common equity 33% 13% 27% 49% 20% 21% 23% After-tax BLK/BGI gain, $1,076 pretax (687) After-tax gain on sale of GIS, $639 pretax (328) Net income excluding BLK/BGI and GIS gains $420 $775 Net income excluding BLK/BGI and GIS gains, if annualized $1,680 $3,100 Return on common shareholders' equity excluding gains 8% 11% Return on tangible common equity excluding gains 18% 16% 2009 2010 PNC believes that return on tangible common equity, a non-GAAP measure, is useful as a tool to help measure and assess a company's use of equity and that information adjusted for the impact of the BLK/BGI and GIS gains, respectively, may be useful due to the extent to which those items are not indicative of our ongoing operations. After-tax gains are calculated using a marginal federal income tax rate of 35% and include applicable income tax adjustments. The after- tax gain on the sale of GIS also reflects the impact of state income taxes. For the three months ended |