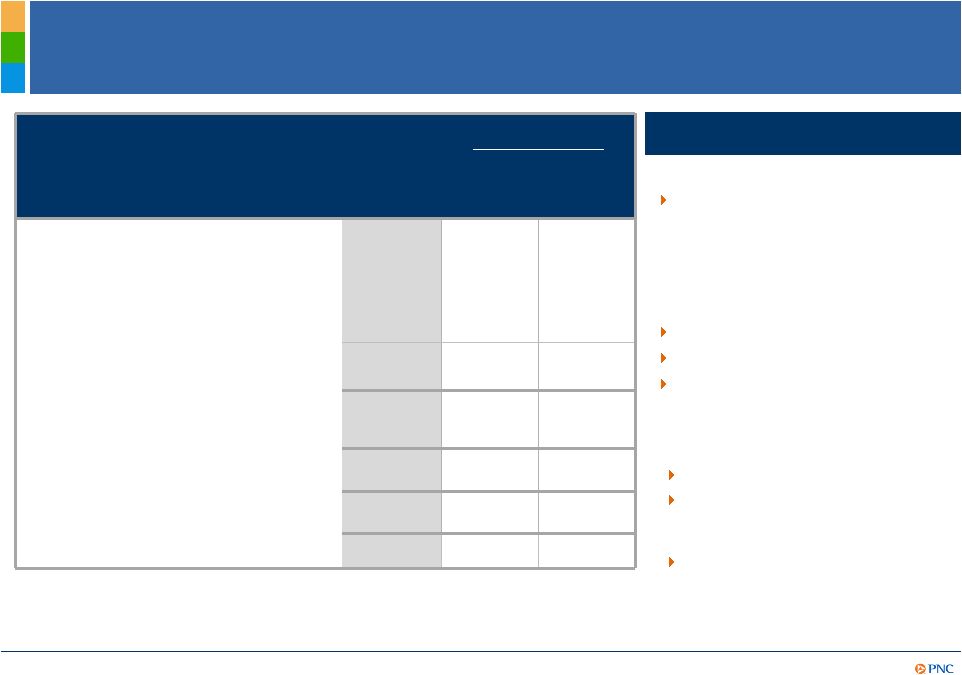

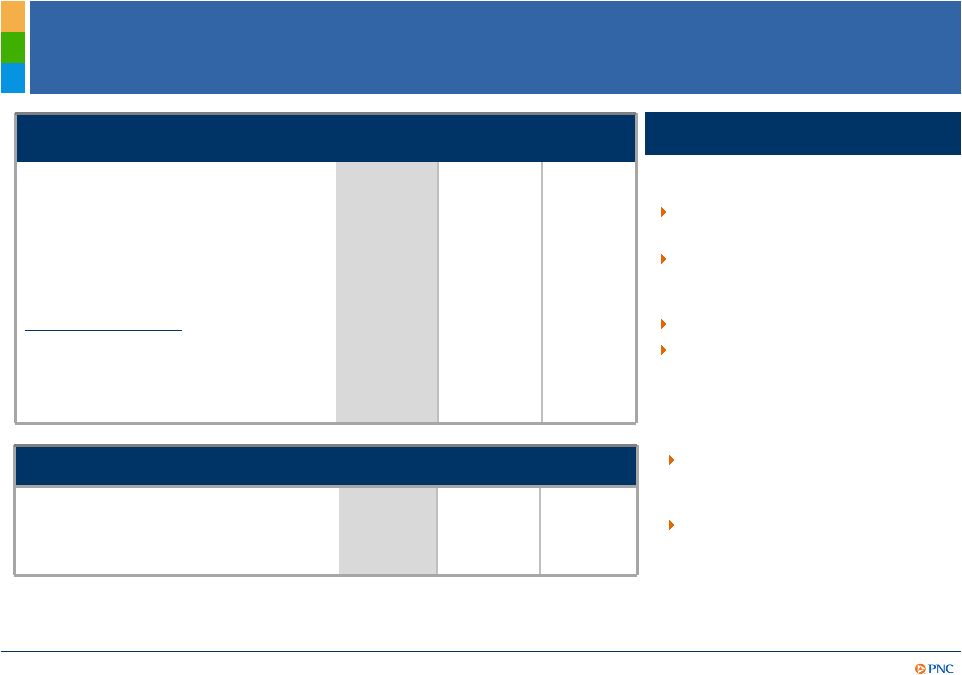

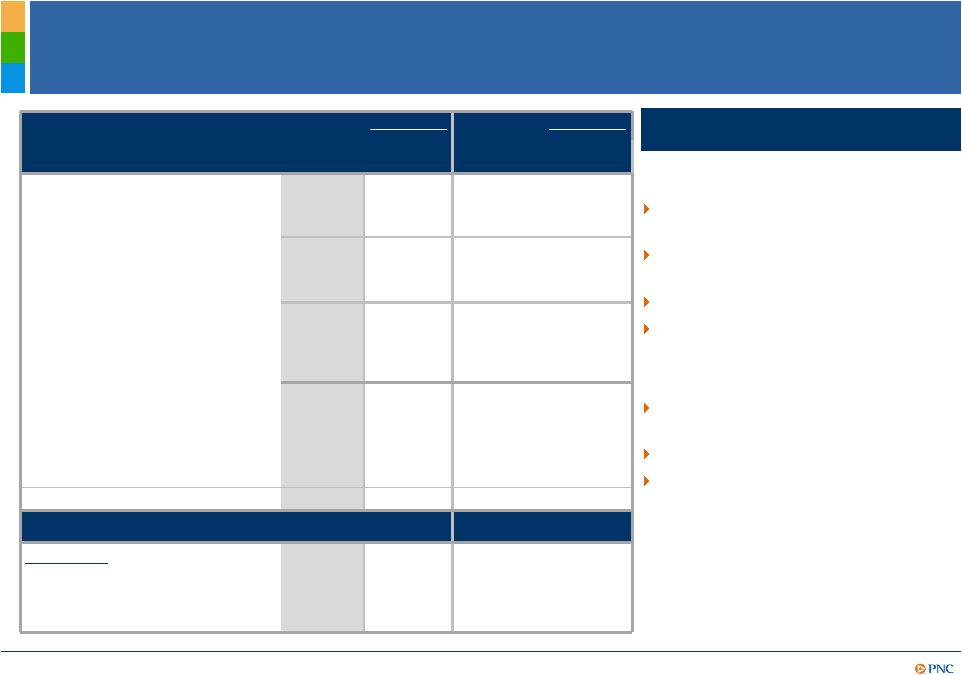

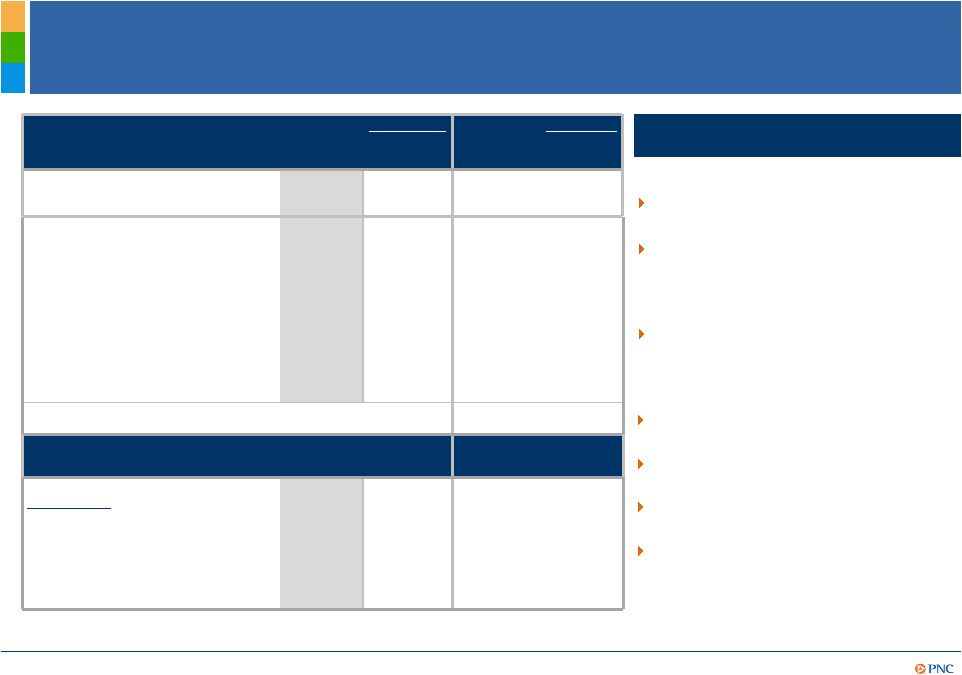

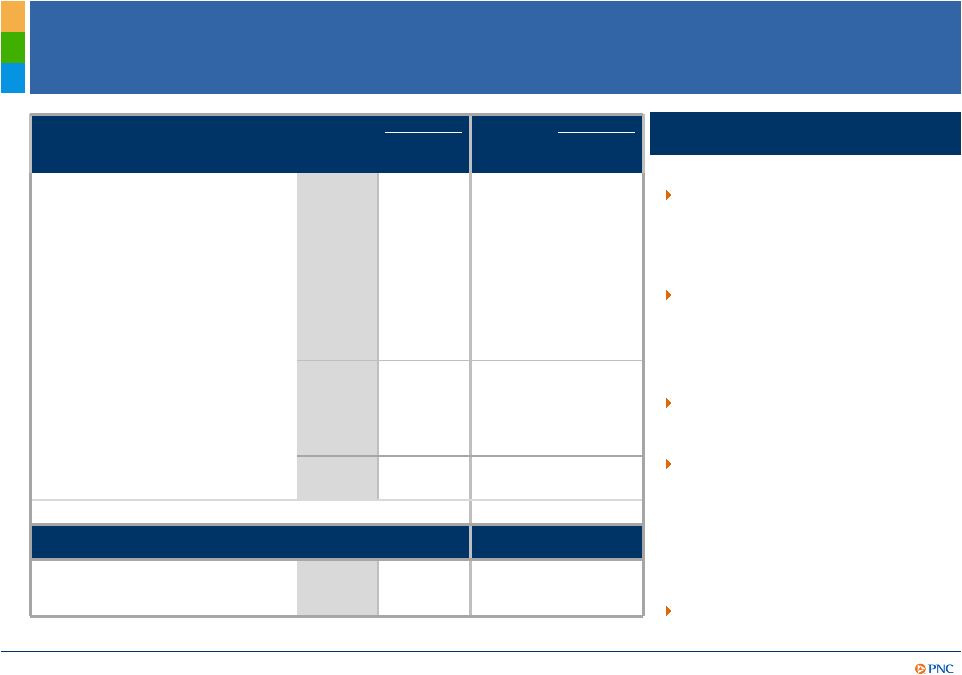

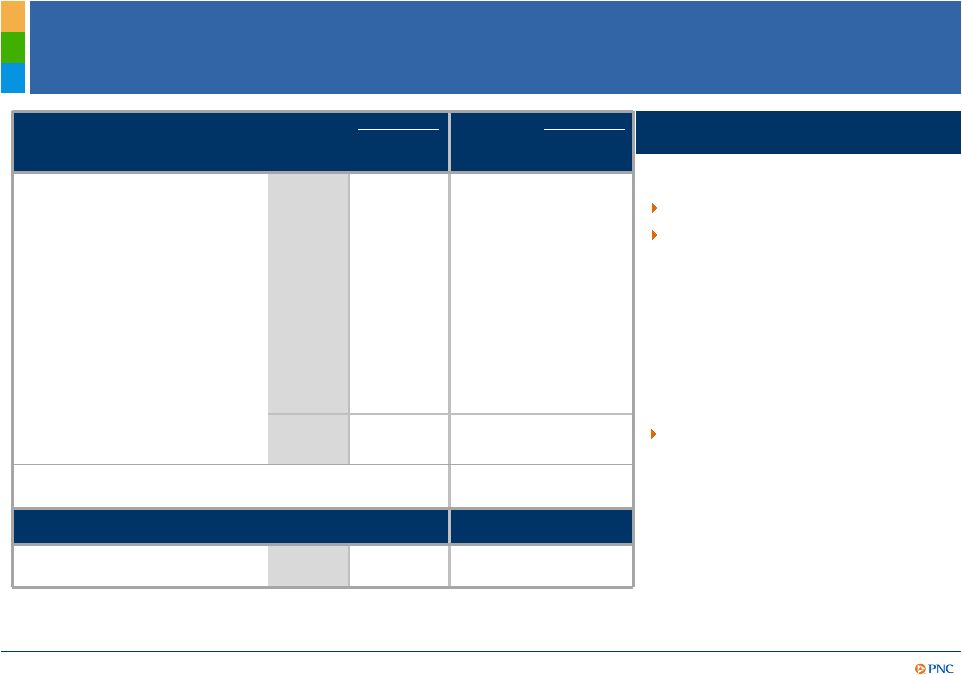

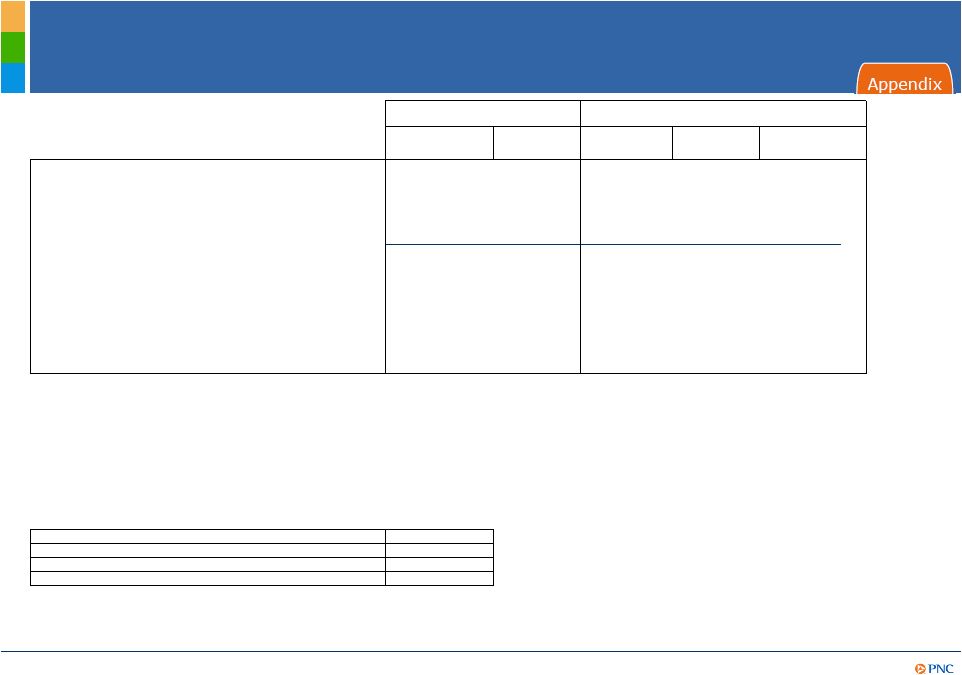

17 Estimated Transitional Basel III and Pro forma Fully Phased- In Basel III Common Equity Tier 1 Capital Ratios Transitional Basel III Pro forma Fully Phased-In Basel III Dollars in millions December 31, 2014 September 30, 2014 December 31, 2014 September 30, 2014 December 31, 2013(a) Common stock, related surplus, and retained earnings, net of treasury stock $40,102 $39,808 $40,102 $39,808 $38,031 Less regulatory capital adjustments: Goodwill and disallowed intangibles, net of deferred tax liabilities (8,939) (8,914) (9,276) (9,234) (9,321) Basel III total threshold deductions (217) (214) (1,085) (1,067) (1,386) Accumulated other comprehensive income (b) (9) 100 153 501 196 All other adjustments (c) (15) (28) (77) (93) (64) Estimated Basel III Common equity Tier 1 capital 30,922 $ 30,752 $ 29,817 $ 29,915 $ 27,456 $ Estimated Basel I risk-weighted assets calculated in accordance with transition rules for 2014 (d) 281,379 $ 277,348 $ N/A N/A N/A Estimated Basel III standardized approach risk-weighted assets (e) N/A N/A 299,360 $ 295,665 $ 291,977 $ Estimated Basel III advanced approaches risk-weighted assets (f) N/A N/A 286,450 $ 289,405 $ 290,080 $ Estimated Basel III Common equity Tier 1 capital ratio 11.0% 11.1% 10.0% 10.1% 9.4% Risk-weight and associated rules utilized Basel I (with 2014 transition adjustments) Basel I (with 2014 transition adjustments) Standardized Standardized Standardized (a) Amounts have not been updated to reflect the first quarter 2014 adoption of ASU 2014-01 related to investments in low income housing tax credits. (b) Represents net adjustments related to accumulated other comprehensive income for securities currently and previously held as available for sale, as well as pension and other postretirement plans. (c) Includes adjustments as required based on whether the standardized approach or advanced approaches is utilized. (d) Includes credit and market risk-weighted assets. (e) Basel III standardized approach risk-weighted assets were estimated based on the Basel III standardized approach rules and include credit and market risk-weighted assets. (f) Basel III advanced approaches risk-weighted assets were estimated based on the Basel III advanced approaches rules, and include credit, market and operational risk-weighted assets. 2013 Basel I Tier 1 Common Capital Ratios (a) (b) Dollars in millions Dec. 31, 2013 Basel I Tier 1 common capital $28,484 Basel I risk-weighted assets 272,169 Basel I Tier 1 common capital ratio 10.5% (a) Effective January 1, 2014, the Basel I Tier 1 common capital ratio no longer applies to PNC (except for stress testing purposes). Our 2013 Form 10-K included additional information regarding our Basel I capital ratios. PNC utilizes the pro forma fully phased-in Basel III capital ratios to assess its capital position (without the benefit of phase-ins), including comparison to similar estimates made by other financial institutions. Our Basel III capital ratios and estimates may be impacted by additional regulatory guidance or analysis, and in the case of those ratios calculated using the advanced approaches, the ongoing evolution, validation and regulatory approval of PNC’s models integral to the calculation of advanced approaches risk-weighted assets. (b) Amounts have not been updated to reflect the first quarter 2014 adoption of ASU 2014-01 related to investments in low income housing tax credits. |