SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant x

Filed by a Party other than the Registrant o

Check the appropriate box:

| o | Preliminary Proxy Statement |

| Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| Definitive Additional Materials |

| Soliciting Material Pursuant to 240.14a-11(c) or 240.14a-12 |

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| Fee paid previously with preliminary materials. |

| Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

SORL AUTO PARTS, INC.

No. 1169 Yumeng Road

Ruian Economic Development District

Ruian City, Zhejiang Province, Zip: 325200, People’s Republic of China

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON SEPTEMBER 9, 2008

To our Stockholders:

The 2008 annual meeting of stockholders of SORL Auto Parts, Inc. will be held on Tuesday, September 9, 2008, beginning at 1:00 pm local time (China Standard Time) at Beethoven Room, The St. Regis Hotel Shanghai, 889 Dong Fang Road, Pudong District, Shanghai 200122, China. Only holders of record of shares of our common stock at the close of business on July 16, 2008 (the “Record Date”) are entitled to vote at the meeting and any postponements or adjournments of the meeting. Below are proposals to be voted on at the annual meeting:

| | (1) | To elect seven directors to hold office until the 2009 annual meeting of stockholders and until their successors are elected and qualified; |

| | (2) | To ratify the appointment of our independent registered public accounting firm for fiscal year 2008; and |

| | (3) | To transact any other matters that properly come before the meeting or any adjournments or postponements thereof. |

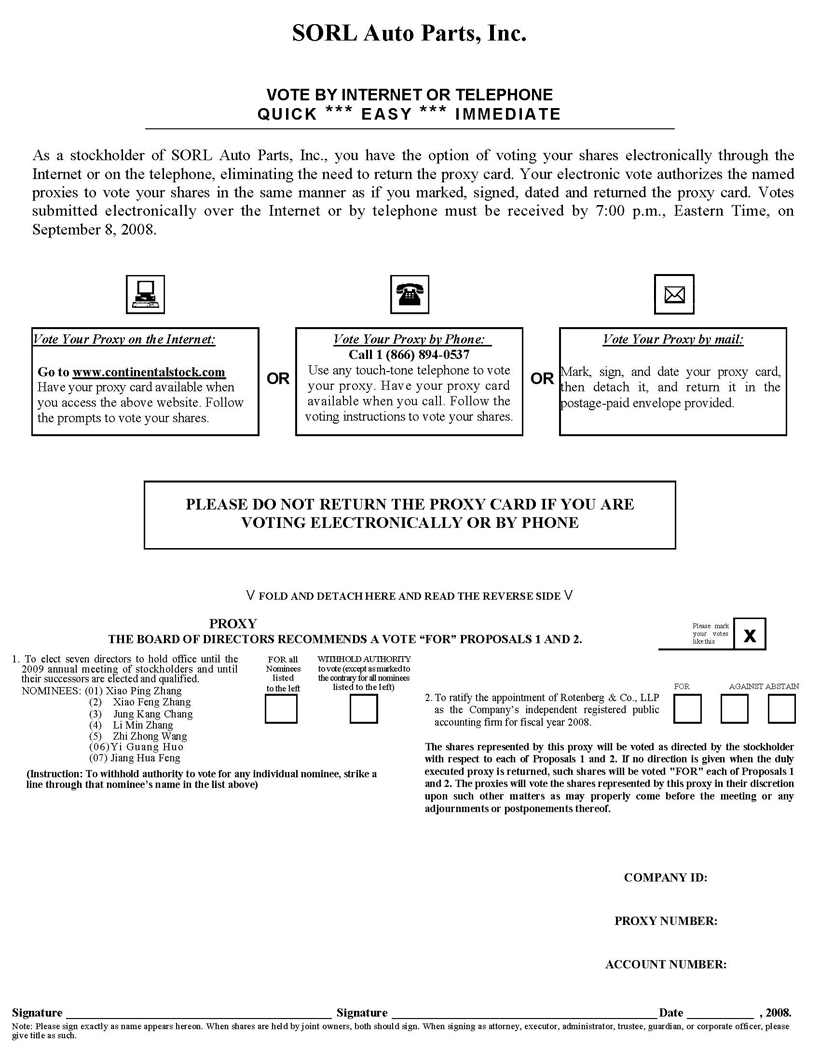

This year, we are making proxy materials available on the Internet. The proxy materials include Notice of Annual Meeting of Stockholders, 2008 proxy statement, annual report to stockholders for the fiscal year ended December 31, 2007, and proxy card. It is important that your shares be represented and voted at the annual meeting. You may vote on the Internet or by telephone, in addition to voting in person or by mail. A Notice of Internet Availability of Proxy Materials is also being sent to you. Please refer to that notice for detailed instructions on how to access the proxy materials, how to cast your vote, and how to receive proxy materials in paper form.

By order of the Board of Directors,

Xiao Ping Zhang

Chairman of the Board of Directors,

Chief Executive Officer

July 30, 2008

Ruian City, China

SORL Auto Parts, Inc.

No. 1169 Yumeng Road

Ruian Economic Development District

Ruian City, Zhejiang Province, Zip: 325200

People’s Republic of China

PROXY STATEMENT

This proxy statement contains information related to the annual meeting of stockholders of SORL Auto Parts, Inc., to be held on Tuesday, September 9, 2008, beginning at 1:00 pm local time (China Standard Time) at Beethoven Room, The St. Regis Hotel Shanghai, 889 Dong Fang Road, Pudong District, Shanghai 200122, China, and any postponements or adjournments thereof. This proxy statement and the accompanying proxy are being mailed to stockholders on or about July 30, 2008 in connection with the solicitation by the Board of Directors of proxies for use at the annual meeting.

Proxy Materials

Why am I receiving these materials?

The Board of Directors (the “Board of Directors” or “Board”) of SORL Auto Parts, Inc. (“SORL,” “our,” “us,” “the Company,” or “we”), a Delaware corporation, is providing these proxy materials for you in connection with our annual meeting of the stockholders, which will take place on September 9, 2008. As a stockholder as of the Record Date (close of business on July 16, 2008), you are invited to attend the annual meeting. Further, you are entitled to, and requested to, vote on the items of business described in this proxy statement.

What information is contained in this proxy statement?

The information included in this proxy statement relates to the proposals to be voted on at the annual meeting, the voting process, the compensation of our directors and most highly paid executive officers, and certain other required information.

How may I obtain SORL’s Annual Report, Form 10-K and/or other financial information?

A copy of our 2007 annual report to stockholders is enclosed. Stockholders may request another free copy of that annual report and/or a free copy of our annual report on Form 10-K plus any amendment, as filed with the United States Securities and Exchange Commission, from:

Corporate Controller

SORL Auto Parts, Inc.

No. 1169 Yumeng Road

Ruian Economic Development District

Ruian City, Zhejiang Province, Zip: 325200

People’s Republic of China

Tel. (86) 577-65817720

Alternatively, you may access our 2007 Form 10-K plus any amendment on our website at http://www.SORL.cn, under “Investor Relations.”

SORL will also furnish any exhibit to our 2007 Form 10-K or to any amendment to the Form 10K, if specifically requested.

Additionally, beginning this year, SORL is making proxy materials, including the 2008 proxy statement and annual report to stockholders for fiscal year 2007, available on the Internet. Please see the Notice of Internet Availability of Proxy Materials provided to you with this proxy statement for detailed instructions on how to access the proxy materials on the Internet and how to request a paper or e-mail form of the proxy materials free of charge.

For those stockholders who share the same address, one copy of the annual report to stockholders or other documents to stockholders may be delivered unless you request separate sets of documents by writing to our address provided above. Upon receiving such written request, the Company will promptly deliver a copy of the requested documents. A stockholder may also send a written notification to the address above requesting to receive a separate copy of the documents instead of sharing with others having the same address.

How may I request a single set of proxy materials for my household?

If you share an address with another stockholder and have received multiple copies of our proxy materials, you may write us at the address above to request delivery of a single copy of these materials.

What should I do if I receive more than one set of voting materials?

You may receive more than one set of voting materials, including multiple copies of this proxy statement and multiple proxy cards or voting instruction cards. For example, if you hold your shares in more than one brokerage account, you may receive a separate voting instruction card for each brokerage account in which you hold shares. If you are a stockholder of record and your shares are registered in more than one name, you will receive more than one proxy card. Please submit each SORL proxy card and voting instruction card that you receive by following the instructions attached to the proxy card or voting instruction card.

Voting Information

What items of business will be voted on at the annual meeting?

The items of business scheduled to be voted on at the annual meeting are:

| · | The election of directors |

| · | The ratification of our independent registered public accounting firm for fiscal year 2008 |

We will also consider any other business that properly comes before the annual meeting.

What happens if additional matters are presented at the annual meeting?

Other than the two items of business described in this proxy statement, we are not aware of any other business to be acted upon at the annual meeting. If you grant a proxy, the persons named as proxy holders, Xiao Ping Zhang and Xiao Feng Zhang, will have the discretion to vote your shares on any additional matters properly presented for a vote at the meeting. If for any reason any of our nominees are not available as a candidate for director, the persons named as proxy holders will vote your proxy for such other candidate or candidates as may be nominated by the Board.

What are the Board's recommendations?

Unless you give other instructions on your proxy card, the persons named as proxy holders on the proxy card will vote in accordance with the recommendations of the Board of Directors. The Board's recommendations are set forth together with the description of each item in this proxy statement. In summary, the Board recommends a vote:

| · | For the election of the nominated slate of directors (see Item 1); and |

| · | For the ratification of the appointment of Rotenberg & Co., LLP as our independent registered public accounting firm for fiscal year 2008 (see Item 2). |

With respect to any other matters that properly come before the meeting or any adjournment or postponement thereof, the proxy holders will vote the shares represented by the proxy in their discretion.

What shares can I vote?

Each share of SORL common stock issued and outstanding as of the close of business on July 16, 2008, the Record Date, is entitled to be voted on all items being voted upon at the annual meeting. You may vote all shares owned by you as of this time, including (i) shares held directly in your name as the stockholder of record, and (ii) shares held for you as the beneficial owner through a broker, trustee or other nominee such as a bank. On the Record Date, SORL had approximately 18,279,254 shares of common stock issued and outstanding.

How can I vote my shares?

If you hold shares in your name as the stockholder of record, you may vote:

| | · | In person at the annual meeting. In order to be admitted to the annual meeting, you must present proof of ownership of our stock on the record date and a photo identification such as a driver’s license. The time and location of the annual meeting are: Tuesday, September 9, 2008, beginning at 1:00 pm local time (China Standard Time) at Beethoven Room, The St. Regis Hotel Shanghai, 889 Dong Fang Road, Pudong District, Shanghai 200122, China. Please arrive early to ensure that you are seated by the commencement of the meeting at 1:00 pm. Directions to the meeting location are available at: http://www.SORL.cn/IRhome.asp. You may also refer to your Notice of Internet Availability of Proxy Materials for directions to the meeting location. |

| | · | By telephone. Please see the instructions attached to your proxy card for detailed instructions. |

| | · | On the Internet. Please see the instructions attached to your proxy card for detailed instructions. |

| | · | By mail. Please mark, sign, and date your proxy card, detach it from the instructions, and return it in the postage prepaid envelope provided with the proxy card. |

Returning your proxy or voting electronically does not deprive you of your right to attend the meeting and to vote your shares in person for the matters acted upon at the meeting. Even if you plan to attend the annual meeting, we recommend that you also submit your proxy by telephone, on the Internet, or by mail, as described above, so that your vote will be counted if you later decide not to attend the meeting.

If you hold shares beneficially, but which are not registered as being held by you (such as shares held in street name), you may vote by submitting voting instructions to your broker, trustee or nominee. Specifically:

| · | You may vote in person at the annual meeting only if you obtain a legal proxy from the broker, trustee or nominee that holds your shares giving you the right to vote the shares. To request a legal proxy, please follow the instructions attached to your voting instructions card provided by your broker, trustee or nominee. In order to be admitted to the annual meeting, you must present the legal proxy and a photo identification such as a driver’s license. The time and location of the annual meeting are: Tuesday, September 9, 2008, beginning at 1:00 pm local time (China Standard Time) at Beethoven Room, The St. Regis Hotel Shanghai, 889 Dong Fang Road, Pudong District, Shanghai 200122, China. Please arrive early to ensure that you are seated by the commencement of the meeting at 1:00 pm. Directions to the meeting location are available at: http://www.SORL.cn/IRhome.asp. |

| | · | You may vote by submitting voting instructions by telephone, on the Internet, or by mail. Please follow the instructions attached to your voting instruction card provided by your broker, trustee or nominee on how to submit voting instruction. |

Even if you plan to attend the annual meeting, we recommend that you also submit your voting instructions as described below so that your vote will be counted if you later decide not to attend the meeting.

Can I change my vote?

Yes. Even after you have submitted your proxy, you may change your vote at any time before the proxy is exercised by filing with our Corporate Secretary either a notice of revocation or a duly executed proxy bearing a later date, that is, voting again by telephone, on the Internet, or by mail if we have mailed a written proxy card to you, provided that the new vote is received in a timely manner pursuant to the instructions provided with the proxy card. The powers of the proxy holders will be suspended if you attend the meeting in person and so request, although attendance at the meeting will not by itself revoke a previously granted proxy.

Is my vote confidential?

Proxy instructions, ballots and voting tabulations that identify individual stockholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed either within SORL or to third parties, except: (1) as necessary to meet applicable legal requirements, (2) to allow for the tabulation of votes and certification of the vote, and (3) to facilitate a successful proxy solicitation. Occasionally, stockholders provide on their proxy card written comments, which are then forwarded to SORL management.

What are the voting rights of the holders of our common stock?

For all matters, each outstanding share of our common stock will be entitled to one vote on each matter. Under the law of the state of Delaware, directors shall be elected by a plurality of the votes of the shares (i) presented in person or by proxy at the meeting and (ii) entitled to vote at the meeting. For all other matters, the vote required for approval is the affirmative vote of the majority of the shares (i) present in person or by proxy at the meeting and (ii) entitled to vote at the meeting. Stockholders do not have cumulative voting rights.

Who will bear the cost of soliciting votes for the annual meeting?

We are making this solicitation and will pay substantially all of the costs of preparing, assembling, printing, mailing and distributing these proxy materials and soliciting votes. We will reimburse banks, brokers or other nominees for their costs of sending our proxy materials to beneficial owners. Directors, officers or other employees of ours may also solicit proxies from stockholders in person, by telephone, facsimile transmission or other electronic means of communication without additional compensation.

Where can I find the voting results of the annual meeting?

We intend to announce preliminary voting results at the annual meeting and publish final results in our quarterly report on Form 10-Q for the third quarter of fiscal 2008.

Stock Ownership Information

What is the difference between holding shares as a stockholder of record and as a beneficial owner?

Many SORL stockholders hold their shares through a broker, or other nominee, rather than directly in their own names. As summarized below, there are some distinctions between shares held of record and those owned beneficially.

Stockholder of Record

If your shares are registered directly in your name with our transfer agent, Continental Stock Transfer & Trust Company, you are considered, with respect to those shares, the stockholder of record, and we are sending these proxy materials directly to you. As the stockholder of record, you have the right to grant your voting proxy directly to us or to vote in person at the meeting. We have provided a proxy card for you to use.

Beneficial Owner

If your shares are held by a trust, in a brokerage account, or by another nominee, you are considered the beneficial owner of those shares, and these proxy materials are being forwarded to you together with a voting instruction card. As the beneficial owner, you have the right to direct your broker, trustee or nominee on how to vote and are also invited to attend the annual meeting.

Since a beneficial owner is not the stockholder of record, you may not vote these shares in person at the meeting, unless you obtain a "legal proxy" from the broker, trustee or nominee that holds your shares, giving you the right to vote the shares at the meeting. Your broker, trustee or nominee should provide voting instructions for you to use in directing the broker, trustee or nominee on how to vote your shares.

What if I have questions for SORL’s transfer agent?

Please contact SORL's transfer agent, at the phone number or address listed below, with questions concerning stock certificates, dividend checks, transfer of ownership or other matters pertaining to your stock account.

Continental Stock Transfer & Trust Company

17 Battery Place, Eighth Floor

New York, New York 10004

Tel. (212) 509-4000

Fax. (212) 509-5150

Annual Meeting Information

What is the purpose of the annual meeting?

At our annual meeting, stockholders will act upon the matters outlined in the notice of meeting on the cover page of this proxy statement, including the election of directors and ratification of our independent registered public accounting firm. In addition, management will report on our performance during fiscal year 2007 and respond to questions from stockholders.

Who can attend the meeting?

All stockholders as of the Record Date, or their duly appointed proxies, may attend the meeting, and each may be accompanied by one guest. Seating, however, is limited. Please note that space limitations make it necessary to limit attendance to stockholders and their guests. Admission to the meeting will be on a first-come, first-served basis.

What constitutes a quorum?

The presence at the meeting, in person or by proxy, of the holders of a majority of the shares of the common stock that are outstanding on the Record Date will constitute a quorum, permitting the meeting to conduct its business. As of the Record Date, 18,279,254 shares of common stock, representing the same number of votes, were outstanding. Thus, the presence, in person or by proxy, of the holders of common stock representing at least 9,139,628 votes will be required to establish a quorum.

Proxies received, but marked as abstentions, will be included in the calculation of the number of votes considered to be present at the meeting, but they will be treated as unvoted with respect to the matter or matters on which the abstentions are indicated.

If you hold your shares in “street name” through a broker or other nominee, your broker or nominee may not be permitted by applicable rules to exercise voting discretion with respect to some of the matters to be acted upon. If you do not give your broker or nominee specific voting instructions, your shares may not be voted on those matters and will not be counted in determining the number of

votes necessary for approval. However, shares represented by such “broker non-votes” will be counted in determining whether there is a quorum.

Stockholder Proposals, Director Nominations and Related Matters

How can a stockholder propose actions for consideration at the annual meeting of stockholders or to nominate individuals to serve as directors?

You may submit proposals for consideration at our annual stockholders’ meeting.

Stockholder Proposals: For a stockholder proposal that is subject to SEC Rule 14a-8, and is to be considered for inclusion in our proxy statement for the annual meeting next year, the written proposal must be received by our Corporate Secretary, at our principal executive offices, no later than March 26, 2009. If the date of next year's annual meeting is moved more than 30 days before the anniversary date of this year's annual meeting, the deadline for inclusion of proposals in our proxy statement is instead a reasonable time before we begin to print and mail our proxy materials. Such proposals also will need to comply with Securities and Exchange Commission regulations under Rule 14a-8 regarding the inclusion of stockholder proposals in company-sponsored proxy materials. Proposals should be addressed to our corporate address as follows:

Corporate Secretary

c/o Corporate Controller

SORL Auto Parts, Inc.

No. 1169 Yumeng Road

Ruian Economic Development District

Ruian City, Zhejiang Province, Zip: 325200

People’s Republic of China

If notice of a stockholder proposal is submitted outside the process of Rule 14a-8 or is subject to Rule 14a-8 but is not received by March 26, 2009 by our Corporate Secretary, such proposal will not be considered to be a matter that properly comes before the meeting.

Nomination of Director Candidates: You may propose director candidates for consideration by the Board of Directors. Such recommendations should be directed to our Corporate Secretary at the address of our principal executive offices set forth above.

How may I communicate with SORL's Board of Directors?

You may contact our Board via e-mail at boardmembers@sorl.com.cn.

We are committed to having sound corporate governance principles. Having such principles is essential to running our business efficiently and to maintaining our integrity in the marketplace. We have adopted a code of ethics that applies to all of our directors, officers and employees. A copy of our code of ethics is posted on our Internet site at http://www.SORL.cn/IRhome.asp.

Board Members’ Independence

Our Corporate Governance Guidelines and the Rules of the Nasdaq Stock Market provide that a majority of our seven-member Board must consist of independent directors. The Board has determined that each of the following four non-employee director nominees standing for election, which include Li Min Zhang, Zhi Zhong Wang, Yi Guang Huo, and Jiang Hua Feng, is independent within the meaning of Nasdaq Stock Market Marketplace Rule 4200(a)(15).

Director Independence Standards

In determining independence, the Board reviews whether directors have any material relationship with the Company. The Board considers all relevant facts and circumstances. In assessing the materiality of a director's relationship with us, the Board is guided by the standards set forth below and considers the issues from the director's standpoint and from the perspective of the persons or organizations with which the director has an affiliation. The Board reviews commercial, industrial, banking, consulting, legal, accounting, charitable and familial relationships, if applicable. An independent director must not have any material relationship with us, either directly or indirectly as a partner, stockholder or officer of an organization that has a relationship with us, or any other relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

Irrespective of other potentially disqualifying relationships, no director will be considered independent in the following circumstances:

| (1) | The director is, or has been in the past three years, an employee of SORL, or a family member of the director is, or has been in the past three years, an executive officer of SORL. |

| (2) | The director has received, or has a family member who has received, compensation from us in excess of $100,000 in any 12 month period in the past three years, other than compensation for board service, compensation received by the director's family member for service as a non-executive employee, and benefits under a tax-qualified plan or other non-discretionary compensation. |

| (3) | The director is, or has a family member who is, a current partner of our outside auditor, or was a partner or employee of our outside auditor, who worked on our audit at any time during any of the past three years. |

| (4) | The director is a family member of an individual who is, or at any time during the past three years was, employed by the Company as an executive officer. |

| (5) | The director is, or has a family member who is, employed as an executive officer of another entity where, at any time during the past three years, any of our executive officers served on the compensation committee of that other entity. |

| (6) | The director is, or a family member is, a partner in, or a controlling stockholder or an executive officer of, any organization to which we made, or from which we received, payments for property or services in the current or any of the past three fiscal years that exceed the greater of 5% of the recipient's consolidated gross revenues for that year, or $200,000. |

For these purposes, a "family member” includes a director's spouse, parents, children and siblings, whether by blood, marriage, or adoption, and anyone residing in the director's home.

Board and Committee Composition

As of the date of this proxy statement, our Board has seven directors. The Board has recommended the re-election of the seven director nominees who are identified in this proxy statement.

The Board has the following three committees: Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee. The membership during the last fiscal year through the date of this proxy statement, and the function of each of the Committees, are described below. During fiscal year 2007, the Board held 4 meetings. Each director attended at least 75% of all Board and applicable Committee meetings. The Board has determined that each current member of the Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee is independent within the meaning of Nasdaq Rule 4200(a)(15) and 4350(d), and that each current member of the Audit Committee is independent within the meaning of applicable regulations of the Securities and Exchange Commission regarding the independence of audit committee members.

Director | | Audit Committee | | Compensation Committee | | Nominating and Corporate Governance Committee |

| Li Min Zhang | | X | | | | X |

| Zhi Zhong Wang | | X | | X | | X |

| Yi Guang Huo | | X | | X | | |

| Jiang Hua Feng | | | | X | | X |

Audit Committee. The members of our Audit Committee are Professor Zhang and Messrs. Wang and Huo. Professor Zhang is the Chairman of the Audit Committee and serves as the Audit Committee’s “financial expert.” His qualifications are described in greater detail under Item 1- Election of Directors. During fiscal year 2007, the Audit Committee held 4 meetings. Our Audit Committee assists our Board of Directors in the Board’s oversight of:

| · | the integrity of our financial statements; |

| · | our independent auditors’ qualifications and independence; and |

| · | the performance of our independent auditors. |

The Audit Committee has the sole and direct responsibility for appointing, evaluating and retaining our independent auditors, and for overseeing their work. All audit services and all non-audit services, other than de minimis non-audit services, to be provided to us by our independent auditors must be approved in advance by our Audit Committee. We believe that the composition of our Audit Committee meets the requirements for independence under the current Nasdaq Capital Market and SEC rules and regulations. We believe that the functioning of our Audit Committee complies with the applicable requirements of the Nasdaq Global Market and SEC rules and regulations. We intend to comply with future requirements as applicable.

The charter of the Audit Committee can be found in Appendix A of our 2007 proxy statement filed on August 24, 2007.

Compensation Committee. The members of the Compensation Committee are Messrs. Wang, Huo, and Feng. During fiscal year 2007, the Compensation Committee held 1 meeting. The purpose of our Compensation Committee is to discharge the responsibilities of our Board of Directors relating to compensation of our executive officers. The Compensation Committee does not have a written charter. With respect to the processes and procedures for the consideration and determination of executive and director compensation, the scope of authority of our Compensation Committee include:

| · | reviewing and recommending approval of compensation of our executive officers; |

| · | administering our stock incentive and employee stock purchase plans; and |

| · | reviewing and making recommendations to our Board with respect to incentive compensation and equity plans. |

Overview of Executive Compensation Program

The Compensation Committee of our Board of Directors is responsible for establishing, implementing and monitoring our executive compensation program philosophy and practices. The Compensation Committee seeks to ensure that the total compensation paid to our named executive officers is fair, reasonable and competitive. Generally, the types of compensation and benefits provided to named executive officers are similar to those provided to our other officers.

Throughout this document, the individuals who served as our Chief Executive Officer and Chief Financial Officer during fiscal 2007, and who are included in the Summary Compensation Table are referred to as the “named executive officers.”

Compensation Philosophy and Objectives

The Compensation Committee believes that an effective executive compensation program should provide base annual compensation that is reasonable in relation to individual executive’s job responsibilities and reward the achievement of both annual and long-term strategic goals of our company.

Because of the size of our Company, the small number of executive officers in our Company, and our Company’s financial priorities, the Committee has decided not to implement or offer any retirement plans, pension benefits, deferred compensation plans, or other similar plans for our executive officers. Accordingly, our executive compensation program currently consists solely of cash salary. The Compensation Committee will consider using stock option grants to provide executives with long-term incentives.

As a manufacturing company operating in Zhejiang Province, China, the Compensation Committee also takes the local average executives’ salary level into account in its compensation decisions. The Compensation Committee may reassess the proper level of equity and cash compensation in light of the Company’s improved profitability and working capital situation.

Role of Executive Officers in Compensation Decisions

The Compensation Committee makes all compensation decisions for the named executive officers and approves recommendations regarding equity awards to all of our officers. Decisions regarding the non-equity compensation of officers other than the named executive officers are made by the Chief Executive Officer.

The Compensation Committee and the Chief Executive Officer annually review the performance of each named executive officer (other than the Chief Executive Officer, whose performance is reviewed only by the Committee). The conclusions reached and recommendations based on these reviews, including with respect to salary adjustments and annual award amounts, are presented to the Committee. The Committee can exercise its discretion in modifying any recommended adjustments or awards to executives.

Setting Executive Compensation

Based on the foregoing objectives, the Committee has structured the Company’s annual cash and incentive-based cash and non-cash executive compensation to motivate executives to achieve the business goals set by the Company, to reward the executives for achieving such goals, and to retain the executives. In doing so, the Committee does not employ outside compensation consultants. The Compensation Committee sets compensation for our executive officers at levels targeted at or around the average of the compensation amounts provided to executives at comparable local companies considering, for each individual, their individual experience level related to their position with us. There is no pre-established policy or target for the allocation between either cash or non-cash incentive compensation.

2007 Executive Compensation Components

For 2007, the sole component of compensation for the named executive officers was base salary.

The Company provides named executive officers and other employees with a base salary to compensate them for services rendered during the fiscal year. Base salary ranges for the named executive officers are determined for each executive based on his or her position and responsibility.

During its review of base salaries for executives, the Committee primarily considers:

| · | the negotiated terms of each executive employment agreement; |

| · | internal review of the executive’s compensation, both individually and relative to other executive officers; and |

| · | individual performance of the executive. |

Salary levels are typically considered annually as part of the Company’s performance review process, as well as upon a change in job responsibility. Merit-based increases to salaries are based on the Compensation Committee’s assessment of the individual’s performance. Base salaries for the named executive officers in 2007 have not been changed from the base salaries in effect during the prior year.

Nominating and Corporate Governance Committee. The Board of Directors of SORL Auto Parts, Inc., has established a Nominating and Corporate Governance Committee consisting of three directors, all of whom meet the requirements for “independent directors”. The members of our Nominating and Corporate Governance Committee are Messrs, Jiang and Wang and Professor Zhang. Mr. Jiang chairs the Nominating and Corporate Governance Committee. The purpose of the Nominating and Corporate Governance Committee is to:

| · | Identify qualified individuals to become Board members; |

| · | Determine the composition of the Board and its committees; |

| · | Monitor a process to assess the effectiveness of the Board and Board committees; and |

| · | Ensure good corporate governance. |

The charter of the Nominating and Corporate Governance Committee is attached to this proxy statement as Appendix A.

Consideration of Director Nominees

After the Company’s last annual meeting of stockholders, the Company has formed a Nominating and Corporate Governance Committee, the duties of which are described above.

Stockholder nominees

The Nominating and Corporate Governance Committee will consider stockholder nominations for candidates for membership on the Board and will evaluate such nominees in its sole discretion, giving due consideration to achieving a balance of knowledge, experience and capability of the Board.

The names of any individuals proposed for consideration by the Committee as potential Board members should be addressed to:

Corporate Controller

SORL Auto Parts, Inc.

No. 1169 Yumeng Road

Ruian Economic Development District

Ruian City, Zhejiang Province, Zip: 325200, People’s Republic of China

Director Qualifications

The Nominating and Corporate Governance Committee believes that members of the Board should have the highest professional and personal ethics and values, consistent with longstanding SORL values and standards. They should have broad experience at the policy-making level in business, government, education, technology or public interest. They should be committed to enhancing stockholder value and should have sufficient time to carry out their duties and to provide insight and practical wisdom based on experience. Their service on other boards of public companies should be limited to a number that permits them, given their individual circumstances, to perform responsibly all director duties. Each director must represent the interests of all stockholders.

Identifying and Evaluating Nominees for Director

The Nominating and Corporate Governance Committee utilizes a variety of methods for identifying and evaluating nominees for director. The Committee will periodically assess the appropriate size of the Board and whether any vacancies on the Board are expected due to retirement or otherwise. In the event that vacancies are anticipated, or otherwise arise, the Committee will consider various potential candidates for director. Candidates may come to the attention of the Committee through current Board members, professional search firms, stockholders or other persons. These candidates will be evaluated at regular or special meetings of the Committee, and may be considered at any point during the year. As described above, the Committee will evaluate any stockholder nominations for candidates for the Board. If any materials are provided by a stockholder in connection with the nomination of a director candidate, such materials will be forwarded to the Committee. The Committee will also review materials provided by professional search firms or other parties in connection with a nominee who is not proposed by a stockholder.

The current term of office of all of our directors expires at the 2008 annual meeting of stockholders. As recommended by the Nominating and Corporate Governance Committee, the Board of Directors proposes that the following seven nominees, all of whom are currently serving as directors, be elected for a new term of one year and until their successors are duly elected and qualified. Each of the nominees has consented to serve if elected. If any of them becomes unavailable to serve as a director, the Board may designate a substitute nominee. In that case, the persons named as proxies will vote for the substitute nominee designated by the Board.

Messrs. Xiao Feng Zhang and Xiao Ping Zhang are brothers. There is no other family relationship between any director, executive officer, or person nominated or chosen by the Company to become a director or executive officer.

The director nominees standing for election are:

| Name | | Age | | Position |

| | | | | |

| Xiao Ping Zhang | | 45 | | Chief Executive Officer and Chairman |

| Xiao Feng Zhang | | 40 | | Chief Operating Officer and Director |

| Jung Kang Chang | | 42 | | Vice President of International Sales and Director |

| Li Min Zhang | | 52 | | Director |

| Zhi Zhong Wang | | 63 | | Director |

| Yi Guang Huo | | 65 | | Director |

| Jiang Hua Feng | | 42 | | Director |

XIAO PING ZHANG - CHAIRMAN OF THE BOARD OF DIRECTORS AND CHIEF EXECUTIVE OFFICER (CEO)

Xiao Ping Zhang has been the CEO and chairman of the Board since the 2004 reverse merger with Fairford Holdings Limited, a Hong Kong limited liability company. He founded the Ruili Group, a company specializing in a variety of automotive parts and components, in 1987, and has been serving as chairman of Ruili Group since then. In 2003, he was elected the President of Wenzhou Auto Parts Association, and Vice-President of China Federation of Industry and Commerce Auto & Motorbike Parts Chamber of Commerce. Mr. Zhang is also a member of the Standing Committee of the People’s Congress in Zhejiang Province of China. He is also currently engaged as a mentor in entrepreneurship for graduate students of Zhejiang University. Mr. Zhang graduated from Zhejiang Radio and TV University in 1986 with a major in Industrial Management.

XIAO FENG ZHANG - DIRECTOR AND CHIEF OPERATING OFFICER (COO)

Xiao Feng Zhang has been the COO and a member of the Board of Directors since the reverse merger. He is responsible for sales and marketing. Mr. Zhang co-founded the Ruili Group with his brother, Mr. Xiao Ping Zhang, in 1987, and served as the General Manager of Ruili Group until March 2004. Mr. Zhang received his diploma in economics from Shanghai Fudan University in 1994.

JUNG KANG CHANG - DIRECTOR AND VICE PRESIDENT, INTERNATIONAL SALES

Jung Kang Chang has been a member of our Board of Directors since the reverse merger. He is also in charge of our international sales. From January 1998 to May 2004, Mr. Chang served as the General Manager of JieXiangHao Enterprise Company Limited based in Taipei, Taiwan; before taking office as the general manager, he was the sales engineer and sales manager with JieXiangHao in Taipei. Mr. Chang graduated from Taiwan Taoyuan Longhua Industry College in 1986.

LI MIN ZHANG - DIRECTOR

Dr. Li Min Zhang has been a member of our Board of Directors since August 2004. He chairs the Audit Committee of our Board and is a member of the Nominating and Corporate Governance Committee. Dr. Zhang currently is a professor at Sun Yat-Sen University Management School in Guangdong, China, coaching Ph.D. candidates with an accounting major. During 1994 and 1995, Dr. Zhang conducted academic research at the University of Illinois at Urbana-Champaign, and practiced at Mok & Chang CPAs in USA. In 1986, he conducted academic research at the Office of Auditor General of Canada. Dr. Zhang currently also serves as vice chairman of China Audit Society, and secretary of China Association of Chief Financial Officers. He is a member of American Accounting Association. Also, Dr. Zhang is involved with the China CPA Society Auditing Principles Task Force and China Audit Society Training Committee. Dr. Zhang earned his Ph.D. in Economics in January 1991.

ZHI ZHONG WANG - DIRECTOR

Zhi Zhong Wang has been a member of our Board of Directors, as well as a member of the Audit and the Compensation Committees since August 2004. Mr. Wang is also a member of the Nominating and Corporate Governance Committee. Since 1980, Mr. Wang has been an instructor and professor at Beijing Jiaotong University (formerly Northern Jiaotong University), Department of Electrical Engineering. Before 1980, he was an electrical engineer with Science and Technology Institute of the Qiqihaer Railway Administration, Heilongjiang, China. Mr. Wang has led over twenty research projects such as novel pneumatic generator and streamer discharging, and corona power supply for desulphurization. His numerous publications include Research on the Novel AC Voltage Stabilized Power Supply in Power Electronics. Mr. Wang received his bachelor degree in electrical engineering from Northern Jiaotong University in 1968.

YI GUANG HUO - DIRECTOR

Yi Guang Huo has been a member of our Board of Directors, as well as a member of the Audit Committee and chairman of the Compensation Committee under the Board since August 2004. Mr. Huo has been engaged in scientific and technological work and has been responsible for various national key research projects, such as designing and conducting experiments for automotive products, drafting ministry standards and econo-technological policies. He has been awarded ministry-level First Prize for Technology Innovation. Mr. Huo is Honorary President of China Federation of Industry and Commerce Auto & Motorbike Parts Chamber of Commerce, a Board member and visiting professor of Wuhan University of Technology, and secretary of Society of Auto Engineering - China. Between 1995 and 1996, Mr. Huo conducted academic research as a visiting researcher at Tokyo University Economics Department. During 1987 and 1988, he studied Scientific Research and Management with Japan Automobile Research Institute as well as Japanese automobile companies including Nissan, Hino, Isuzu and Mitsubishi. Mr. Huo earned his B.S. degree from Jilin University Automobile Department in 1965.

JIANG HUA FENG - DIRECTOR

Jiang Hua Feng has been a member of our Board of Directors as well as a member of the Compensation Committee under the Board since August 2004. Mr. Feng Chairs the Nominating and Corporate Governance Committee. Since 1988, Mr. Feng has also been the chief lawyer at Yuhai Law Firm in Ruian, Zhejiang Province. Mr. Feng is a member of China Lawyers Association. He is also a member of the Standing Committee of the People’s Congress in Zhejiang Province of China. Mr. Feng received his bachelor’s degree in law from East China University of Politics and Law.

We have appointed Rotenberg & Co., LLP as our independent registered public accounting firm for fiscal year 2008. Rotenberg & Co., LLP has been our independent registered public accounting firm since the 2005 fiscal year. Services provided to us by Rotenberg & Co., LLP in fiscal year 2007, and/or expected to be provided in fiscal year 2008, include the auditing of our consolidated financial statements, limited reviews of interim financial statements included in our quarterly reports, services related to filings with the Securities and Exchange Commission and consultations on various tax and accounting matters. See “Principal Auditor Fees and Services” for detailed information.

We expect that a representative of Rotenberg & Co., LLP will be present at the annual meeting via teleconference to respond to appropriate questions and to make such statements as they may desire.

The Board of Directors recommends that stockholders vote "FOR" ratification of the appointment of Rotenberg & Co., LLP as the Company's independent registered public accounting firm for fiscal 2008.

In the event stockholders do not ratify the appointment, the appointment will be reconsidered by the Audit Committee.

As of the date of this proxy statement, we know of no business that will be presented for consideration at the annual meeting other than the items referred to above. If any other matter is properly brought before the meeting for action by stockholders, proxies in the enclosed form returned to us will be voted in accordance with the recommendation of the Board of Directors or, in the absence of such a recommendation, in accordance with the judgment of the proxy holders.

The following table sets forth certain information known to us regarding beneficial ownership of our common stock as of June 30, 2008 by:

| · | each person known to us to be the beneficial owner of more than 5% of any class of our voting securities; |

| · | our chief executive officer and chief financial officer, our “named executive officers;” |

| · | each of our directors; and |

| · | all executive officers and directors as a group. |

Beneficial ownership is determined according to the rules of the SEC and generally means that a person has beneficial ownership of a security if he or she possesses sole or shared voting or investment power of that security, and includes options and warrants that are currently exercisable or that become exercisable within 60 days of June 30, 2008. Information with respect to beneficial ownership has been furnished to us by each director, executive officer or 5% or more stockholder, as the case may be. Unless otherwise indicated, to our knowledge, each stockholder possesses sole voting and investment power over the shares listed, except for shares owned jointly with that person’s spouse.

This table lists applicable percentage ownership based on 18,279,254 shares of common stock outstanding as of June 30, 2008.

The address for each of the stockholders in the table is c/o of the Company.

NAME OF BENEFICIAL OWNER | | AMOUNT AND NATURE BENEFICIAL OWNER | | POSITION | | PERCENT OF CLASS | |

| | | | | | | | |

| Xiao Ping Zhang | | | 9,087,527 | | | Chief Executive Officer and Chairman | | | 49.7 | % |

| Xiao Feng Zhang | | | 1,135,938 | | | Chief Operating Officer and Director | | | 6.2 | % |

| Zong Yun Zhou | | | — | | | Chief Financial Officer | | | * | |

| Jung Kang Chang | | | — | | | VP of International Sales and Director | | | * | |

| Li Min Zhang | | | — | | | Director | | | * | |

| Zhizhong Wang | | | — | | | Director | | | * | |

| Yiguang Huo | | | — | | | Director | | | * | |

| Jianghua Feng | | | — | | | Director | | | * | |

| Officers and Directors as a Group (8 persons) | | | 10,223,465 | | | | | | 55.9 | % |

| PRINCIPAL STOCKHOLDERS | | | | | | | | | | |

| Shu Ping Chi | | | 1,135,938 | | | | | | 6.2 | % |

| | | | | | | | | | |

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires our directors, executive officers and holders of more than 10% of our common stock to file with the Securities and Exchange Commission reports regarding their ownership and changes in ownership of our securities. We believe that, during fiscal year 2007, our directors, executive officers and 10% stockholders complied with all Section 16(a) filing requirements. In making this statement, we have relied upon our examination of the copies of Forms 3, 4 and 5, and amendments thereto, provided to us and the written representations of our directors, executive officers and 10% stockholders.

Capital Stock Issuances in the Reverse Acquisition

Pursuant to the reverse acquisition between Fairford Holdings Limited and the Company, Mr. Xiao Ping Zhang, our Chief Executive Officer, and Mr. Xiao Feng Zhang, our Chief Operating Officer, received 9,087,527 shares and 1,135,938 shares, respectively, of our common stock representing 68.4% and 8.55% respectively, of our then outstanding shares.

Ruili Group

The Company has a 90% ownership interest in the Ruili Group Ruian Auto Parts Co., Ltd., a Sino-foreign joint venture (the “Joint Venture”). The Ruili Group Co., Ltd. (the “Ruili Group”) has the remaining 10% of the ownership interest in the Joint Venture. Mr. Xiao Ping Zhang has a 63.13% of the ownership interest in the Ruili Group, and Mr. Xiao Feng Zhang has a 0.92% of the interest in the Ruili Group. We purchase non-valve automotive products and packaging material from the Ruili Group. In 2007, we purchased approximately $26.59 million of products from the Ruili Group. We generate only a small profit on these sales, but our sales of these products represent an important marketing benefit as they enable us to fill out our product line and reduce our customers’ transaction costs. The Ruili Group also guaranteed certain bank loans to the Joint Venture without fee and licensed two patents and the trademark “SORL” to the Joint Venture on a royalty free basis. The two patents licensed were assigned to the Joint Venture in 2007 for $50,000.

The Joint Venture has leased two apartment building from Ruili Goup Co., Ltd.for its management personnel and ordinary staff, respectively. The lease term is from January 2007 to December 2011 for one apartment building, and is from January 2007 to December 2012 for the other. The annual rental of the two apartment buildings is approximately $242,043.

On September 28, 2007, the Joint Venture purchased land rights, a manufacturing plant, and an office building from Ruili Group Co. Ltd., with purchase price of approximately RMB152 million (approximately US$20.2 million at the time). DTZ Debenham Tie Leung Ltd., an internationally recognized appraiser, appraised the total asset value at RMB154 million (approximately US$20.5 million at the time). The purchase price was paid by the Company by transferring to Ruili Group the Company’s $9 million investment in an existing project that includes a new-facility-in-progress and prepayment of land use rights. The remaining balance of $11 million was paid by the cash generated from operation and a bank credit line.

The Company believes that the above-mentioned transactions were made at arm’s length, and all prices charged and payments made between the parties are at least as favorable to the Joint Venture as would be obtained from a third party.

The following table sets forth our executive officers, directors and key employees, their ages and the positions they held as of December 31, 2007.

| Name | | Age | | Position |

| Xiao Ping Zhang (1) | | 45 | | Chief Executive Officer and Chairman |

| Xiao Feng Zhang (1) | | 40 | | Chief Operating Officers and Director |

| Jung Kang Chang (1) | | 42 | | Vice President of International Sales and Director |

| Zong Yun Zhou | | 53 | | Chief Financial Officer |

| Jason Zhang | | 44 | | Deputy General Manager |

| | | | |

| (1) | The business experience of Messrs. Xiao Ping Zhang, Xiao Feng Zhang, and Jung Kang Chang is described above under “Item 1 - Election of Directors.” |

ZONG YUN ZHOU - CHIEF FINANCIAL OFFICER

Zong Yun Zhou has been our CFO since our inception. Between April 2002 and May 2004, Ms. Zhou served as the Financial Controller of Shanghai Huhao Auto Parts Manufacturing Company Limited, a joint venture between Ruili Group and Shanghai Automotive Industry Corporation. From January 1996 until April 2002, Ms. Zhou worked for the Auditing Department of Anhui Province, China, in charge of auditing state-owned companies in Anhui Province. Ms. Zhou is a Chinese Certified Public Accountant, and a member of the Institute of Internal Auditors (IIA). Ms. Zhou completed her undergraduate studies at Anhui University.

JASON ZHANG - DEPUTY GENERAL MANAGER

Jason Zhang joined us in May 2006 as Deputy General Manager, supervising our capital market operations and M&A strategies. Before joining us, Mr. Zhang served as the Managing Director of JPK Capital Inc., an investment company based in Shenzhen, China. From 1999 to 2001, he worked for Qiao Xing Group Corporation as the Manager of Capital Market Business Department. From 1996 to 1999, he served as the General Manager of Shenzhen Zhihui Finance Co., Ltd. 1994 till 1996, he served as the General Manager of the Underwriting Division of Shenzhen Non-Ferrous Metals Finance Co., Ltd. From 1992 to 1994, he served as the General Manager of the Investment Department of Shenzhen Lantern Fund Management Company. Mr. Zhang received his master degree in economics from Xiamen University.

Summary Compensation Table

The following table presents summary information concerning all compensation paid or accrued by us for services rendered in all capacities during 2006 and 2007 by Mr. Xiao Ping Zhang and Ms. Zong Yun Zhou, who are the only individuals who served as our principal executive and financial officers during the fiscal years ended December 31, 2007 and 2006. No other executive officer received compensation in excess of $100,000 for each of the fiscal years ended December 31, 2007 and 2006.

Name and Position | | Year | | Salary ($) | | Bonus ($) | | Option Awards ($) | | Total ($) | |

| Mr. Xiao Ping Zhang, CEO (1) | | | 2007 | | | 50,000 | | | — | | | — | | | 50,000 | |

| | | | 2006 | | | 50,000 | | | — | | | — | | | 50,000 | |

| | | | | | | | | | | | | | | | |

| Ms. Zong Yun Zhou, CFO (2) | | | 2007 | | | 20,000 | | | — | | | — | | | 20,000 | |

| | | 2006 | | | 20,000 | | | — | | | — | | | 20,000 | |

| | | | | | | | | | | | | | | | |

| (1) | Mr. Zhang is also employed by the Ruili Group which makes separate payments to him for his services to that company. Mr. Zhang did not receive any compensation other than the cash salary of $50,000 listed herein from the Company in each of 2006 and 2007. |

| (2) | Ms. Zhou did not receive any of compensation other than the cash salary of $20,000 listed herein from the Company in each of 2006 and 2007. |

Employment Agreements

Effective May 1, 2006, the Company entered into employment agreements with Mr. Xiao Ping Zhang, our Chief Executive Officer, Mr. Xiao Feng Zhang, our Chief Operating Officer, and Ms. Zong Yun Zhou, our Chief Financial Officer. The term of their employment with the Company is for a period of five years with an additional one year period unless the Company decides not to renew. Their compensation is subject to an annual review by the Compensation Committee of the Board of Directors. The agreements also set forth their respective duties and confidentiality responsibilities.

Severance and Change of Control Arrangements

There are no severance or change of control arrangements.

Equity Benefit Plans

Our 2005 Stock Compensation Plan, or the Plan, was adopted by our Board of Directors in July 2005.

Share Reserve. We have reserved 1,700,000 shares for issuance under the 2005 Stock Compensation Plan. To date, the Company has granted 53,628 shares and options to purchase an additional 64,128 shares under the Plan.

Administration. The Compensation Committee of our Board of Directors administers the 2005 Compensation Plan and has complete discretion to make all decisions relating to our 2005 Compensation Plan as are permitted therein.

Eligibility. Employees, non-employee members of our Board of Directors, advisors and consultants are eligible to participate in our 2005 Stock Compensation Plan.

Types of Awards. Our 2005 Stock Compensation Plan provides for awards of stock options, restricted shares, stock appreciation rights and performance shares.

Change in Control. If we are merged or consolidated with another company, and such merger or consolidation results in a change in control, any award under the 2005 Stock Compensation Plan will be subject to the terms of the merger agreement. Such terms may provide that the option continues, is assumed or substituted, fully vests or is settled for the full value of such option in cash, followed by the cancellation of such option.

Amendments or Termination. Our Board of Directors may amend, suspend or terminate the 2005 Stock Compensation Plan at any time. If our Board amends the Plan, it does not need to seek stockholder approval of the amendment unless such consent is required in order to comply with any applicable tax or regulatory requirement. No award may be made under the 2005 Stock Compensation Plan after the tenth anniversary of the effective date of the Plan.

Options. The Board may determine the number of shares covered by each option, the exercise price therefor, the conditions and limitations on the exercise and any restrictions on the shares issuable. Optionees may pay the exercise price by using cash, shares of common stock that the optionee already owns or, at the election of the Board, a promissory note, an immediate sale of the option shares through a broker designated by us, or other property.

Performance Shares. The Board may make performance share awards entitling recipients to acquire shares of Common Stock upon the attainment of specified performance goals.

Stock Appreciation Rights. A participant who exercises a stock appreciation right receives the increase in fair market value of our common stock over the fair market value on the date of grant.

Restricted Shares. Restricted shares may be awarded under the 2005 Stock Compensation Plan. Restricted shares vest at the times and payment terms therefor shall be determined by our Compensation Committee.

Adjustments. If there is a subdivision of our outstanding shares of common stock, a dividend declared in stock or a combination or consolidation of our outstanding shares of common stock into a lesser number of shares, corresponding adjustments will be automatically made in each of the following: (a) the number of shares of common stock available for future awards under the 2005 Stock Compensation Plan; (b) any limitation on the maximum number of shares of common stock that may be subject to awards in a fiscal year; (c) the number of shares of common stock covered by each outstanding option or stock appreciation right, as well as the exercise price under each such award; (d) the number of shares of common stock covered by the options to be granted under the automatic option grant program; or (e) the number of stock units included in any prior award that has not yet been settled.

Stock Option Grants

None of the Company’s executive officers have received any grant of stock options or stock awards.

Equity Compensation Plan Information

Our 2005 Stock Compensation Plan was adopted by our Board of Directors in July 2005. We have reserved 1,700,000 shares for issuance under the 2005 Stock Compensation Plan. To date, options to purchase 64,128 shares and 53,628 shares have been awarded under the Plan. Therefore, at the present time, the number of securities available for future issuance under the plan is 1,582,244.

The following table sets forth the compensation paid to our directors other than our Chief Executive Officer for 2007:

Director Compensation Table

| Name (1) | | Fees Earned or Paid in Cash ($) (2) | | Option Awards ($) (3) | | All other compensation ($) | | Total ($) | |

| | | | | | | | | | |

| Xiao Feng Zhang (4) | | | — | | | | | | 30,000 | | | 30,000 | |

| COO & Director | | | | | | | | | | | | | |

| Jung Kang Chang (5) | | | | | | | | | 15,000 | | | 15,000 | |

| VP of International Sales & Director | | | | | | | | | | | | | |

| Li Min Zhang | | | 10,000 | | | 14,909 | | | | | | 24,909 | |

| Director | | | | | | | | | | | | | |

| Zhi Zhong Wang | | | 10,000 | | | 14,909 | | | | | | 24,909 | |

| Director | | | | | | | | | | | | | |

| Yi Guang Huo | | | 10,000 | | | 14,909 | | | | | | 24,909 | |

| Director | | | | | | | | | | | | | |

| Jiang Hua Feng | | | 10,000 | | | 14,909 | | | | | | 24,909 | |

| Director | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| (1) | Mr. Xiao Ping Zhang does not receive additional compensation for his role as a Director. For information relating to Mr. Xiao Ping Zhang’s compensation as Chairman and Chief Executive Officer, see the Summary Compensation Table later in this proxy statement. |

| (2) | The amounts in this column represent cash payments made to Non-Employee Directors for attendance at meetings during the year. |

| (3) | The amounts in this column represent the compensation cost of stock options awarded by the Compensation Committee in 2006. These amounts do not include any estimate for forfeitures. On March 1, 2006, the Board of Directors approved a grant of a total of 60,000 options (See Note 17 of the Notes to Consolidated Financial Statements in Part II Item 8 of our 2007 annual report) to be issued to the four non-employee directors. Each non-employee director received options to purchase 15,000 shares of common stock with an exercise price of $4.79 per share. The contractual term of the options is three years. The grant date fair market value of option awards granted were determined in accordance with Statement of Financial Accounting Standards No. 123R (SFAS123(R)) and are recognized as compensation cost over the requisite service period. The amount recognized for these awards was calculated using the Black Scholes option-pricing model. Our 2005 Compensation Plan is described in “EXECUTIVE COMPENSATION.” |

| (4) | Mr. Xiao Feng Zhang is an employee of the Company and did not receive cash compensation or other stock options for attending Board meetings in 2007. However, he received cash compensation of $30,000 as salary for his managerial role with the Company. Mr. Zhang is also employed by the Ruili Group which makes separate payments to him for his services to that company. |

| (5) | Mr. Jung Kang Chang is an employee of the Company and did not receive cash compensation or other stock options for attending Board meetings in 2007. However, he received cash compensation of $15,000 as salary for his managerial role with the Company. |

We use a combination of cash and stock-based compensation to attract and retain qualified candidates to serve on our Board of Directors. Directors who are also employees of our company currently receive no compensation for their service as directors. In setting director compensation, we consider the significant amount of time that directors dedicate to the fulfillment of their director responsibilities, as well as the competency and skills required of members of our Board. The directors’ current compensation schedule has been in place since March 2007. The directors’ annual compensation year begins with the annual election of directors at the annual meeting of stockholders. The annual retainer year period has been in place for directors since 2007. Periodically, our Board of Directors reviews our director compensation policies and, from time to time, makes changes to such policies based on various criteria the Board deems relevant.

Non-employee directors are reimbursed for travel, lodging and other reasonable out-of-pocket expenses incurred in attending meetings of our Board of Directors and for meetings of any Committees of our Board of Directors on which they serve. During 2007, our non-employee directors had each received or earned cash compensation of $10,000 for attending Board or Committee meetings.

The following Report of the Audit Committee does not constitute soliciting material and should not be deemed filed or incorporated by reference into any of our other filings under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent we specifically incorporate this Report of the Audit Committee by reference therein.

The Audit Committee has reviewed and discussed the audited financial statements with management and has discussed with the independent auditors the matters required to be discussed by the statement on Auditing Standards No. 61, as amended (AICPA, Professional Standards, Vol. 1, AU section 380) as adopted by the Public Company Accounting Oversight Board in Rule 3200T. The Audit Committee has also received the written disclosures and the letter from the independent accountants required by Independence Standards Board Standard No. 1 (Independence Standards Board Standard No. 1, Independence Discussions with Audit Committees) as adopted by the Public Company Accounting Oversight Board in Rule 3600T, and has discussed with the independent accountant the independent accountant’s independence. Based on the Audit Committee’s review and discussions, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Company's annual report on Form 10-K.

Yi Guang Huo | | Zhi Zhong Wang | | Li Min Zhang |

| | | | | |

Rotenberg & Co., LLP, Certified Public Accountants, was the Registrant’s independent registered public accounting firm engaged to examine the financial statements of the Registrant for the fiscal years ended December 31, 2007, 2006 and 2005. Rotenberg & Co., LLP performed the following services and has been paid the following fees.

FISCAL YEARS ENDED DECEMBER 31, 2007 and 2006

AUDIT FEES

Rotenberg & Co., LLP was paid aggregate fees of approximately $170,500 and $120,000 in each fiscal year ended December 31, 2007 and 2006, respectively, for professional services rendered for the audit of the Registrant’s annual financial statements and for the reviews of the financial statements included in the Registrant’s quarterly reports on Form 10-Q for the periods ended March 31, June 30, September 30 of 2007 and 2006.

AUDIT-RELATED FEES

Rotenberg & Co., LLP was not paid additional fees for the fiscal years ended December 31, 2007 or 2006 for assurance or related services reasonably related to the performance of the audit or review of the Registrant’s financial statements.

TAX FEES

Rotenberg & Co., LLP was not paid any fees for the fiscal years ended December 31, 2007 or 2006 for professional services rendered for tax compliance, tax advice and tax planning. This service was not provided.

ALL OTHER FEES

Rotenberg & Co., LLP was paid no other fees for professional services during the fiscal years ended December 31, 2007 and December 31, 2006.

Our Audit Committee’s policy is to pre-approve all audit and permissible non-audit services provided by our independent auditors. These services may include audit services, audit-related services, tax services and other services. Pre-approval is generally provided for up to one year and any pre-approval is detailed as to the particular service or category of services. The independent auditor and management are required to periodically report to the Audit Committee regarding the extent of services provided by the independent auditor in accordance with this pre-approval.

STOCKHOLDERS ENTITLED TO VOTE AT THE ANNUAL MEETING MAY OBTAIN, WITHOUT CHARGE, A COPY OF OUR ANNUAL REPORT ON FORM 10-K FOR THE FISCAL YEAR ENDED DECEMBER 31, 2007, OTHER THAN EXHIBITS TO SUCH REPORT, UPON WRITTEN OR ORAL REQUEST TO SORL AUTO PARTS, INC, NO. 1169 YUMENG ROAD, RUIAN ECONOMIC DEVELOPMENT DISTRICT, RUIAN CITY, ZHEJIANG PROVINCE, ZIP 325200, PEOPLE’S REPUBLIC OF CHINA, ATTENTION JASON ZHANG. WE WILL ALSO FURNISH TO SUCH PERSONS A COPY OF ANY EXHIBITS TO OUR ANNUAL REPORT ON FORM 10-K FOR A FEE OF $.20 PER PAGE, PAYABLE IN ADVANCE. THIS FEE COVERS ONLY OUR REASONABLE EXPENSES IN FURNISHING THE EXHIBITS.

SORL AUTO PARTS, INC.

NOMINATING AND CORPORATE GOVERNANCE COMMITTEE

CHARTER

(As adopted by the Board of Directors on March 8, 2008)

The Nominating and Corporate Governance Committee (the “Committee”) is established by the Board of Directors (the “Board”) of SORL Auto Parts, Inc. (the “Corporation”) primarily to assist the Board in (i) identifying qualified individuals to become Board members, (ii) determining the composition of the Board and its committees, (iii) monitoring a process to assess the effectiveness of the Board and Board committees, and (iv) ensuring good corporate governance.

The Committee shall be comprised of three or more directors, who shall be appointed by the Board and meet the independence requirements under the Securities and Exchange Commission regulations, Nasdaq rules and other criteria as the Board may establish from time to time.

Unless the Board appoints a Chair of the Committee, the members of the Committee may designate a Chair by a majority vote of all members of the Committee.

The Committee shall meet at least twice annually, either in person or by telecommunications, at such times and places as the Committee determines. A majority of the members of the Committee constitutes a quorum. The Committee may invite members of the management or others to attend any meeting and provide information or advice as the Committee deems appropriate.

IV. | POWERS, DUTIES AND RESPONSIBILITIES |

The Committee shall have the powers, duties and responsibilities to:

Board Membership

| (1) | Make recommendations to the Board regarding the size and composition of the Board and the criteria for the selection of candidates for membership on the Board. |

| (2) | Oversee the search for individuals qualified to become members of the Board, through measures such as evaluating persons suggested by stockholders or others and supervising appropriate inquiries into the backgrounds and qualifications of possible candidates. |

| (3) | Make recommendations to the Board regarding director nominees to be presented for stockholder approval at each annual meeting of stockholders and to fill any vacancies on the Board between annual meetings. |

Other Board Committee(s)

| (4) | Monitor the performance of other committee(s) of the Board and make recommendations to the Board with respect to the committee(s)’ performance. |

| (5) | Recommend to the Board the membership of the Board committees. |

Management Succession

| (6) | Review management succession plans with the Chief Executive Officer (the “CEO”) and/or other senior officers of the Corporation. |

| (7) | Select and present to the Board the names of persons to be considered as successors to the CEO, the President and other senior officers of the Corporation. |

Corporate Governance

| (8) | Develop and recommend to the Board for the Board’s approval an annual self-evaluation process for the Board and each of the Board committees, and oversee the annual self-evaluations. |

| (9) | Annually evaluate, in conjunction with the Chairman of the Board, the performance of the Board, the CEO and other senior officers of the Corporation against mutually agreed goals and objectives. |

| (10) | Develop and recommend to the Board for the Board’s approval a set of corporate governance guidelines, review those guidelines periodically and recommend changes to the Board as the Committee deems appropriate. |

| (11) | Develop and recommend to the Board for the Board’s approval a standard of business conduct for the Corporation, review such standard periodically and recommend changes to the Board as the Committee deems appropriate. |

| (12) | Periodically review the frequency, structure and content of Board meetings and recommend changes to the Board as the Committee deems appropriate. |

| (13) | Periodically review director fees and other compensation and advise the Board on these matters. |

| (14) | Annually evaluate the performance of the Board and its members. |

Other

| (15) | Consider any other matters of corporate governance raised by the Committee, the Board or the management. |

After each Committee meeting, the Committee shall report its actions and recommendations to the Board.

The Committee shall conduct and present to the Board an annual review of the Committee’s performance. In addition, the Committee shall review this Charter periodically and recommend any proposed revisions to the Board for approval.

The Committee shall have the authority to delegate any of its responsibilities to its subcommittees, as the Committee may establish from time to time. The Committee shall also have the authority to engage a search firm to assist in identifying director candidates and to engage outside counsel and other advisors, in each case as it deems appropriate, and to set the terms (including fees) of all such engagements. The Corporation shall provide for appropriate funding, as determined by the Committee, for paying fees to outside advisors engaged by the Committee.