4 Q 2 1 E a r n i n g s P r e s e n t a t i o n J a n u a r y 2 7 , 2 0 2 2 Exhibit 99.2

Forward Looking Statements The foregoing contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements are not historical facts and include expressions about management’s confidence and strategies and management’s expectations about our business, new and existing programs and products, acquisitions, relationships, opportunities, taxation, technology, market conditions and economic expectations. These statements may be identified by such forward-looking terminology as “should,” “expect,” “believe,” “view,” “opportunity,” “allow,” “continues,” “reflects,” “typically,” “usually,” “anticipate,” or similar statements or variations of such terms. Such forward-looking statements involve certain risks and uncertainties. Actual results may differ materially from such forward-looking statements. Factors that may cause actual results to differ materially from those contemplated by such forward-looking statements include, but are not limited to: the inability to realize expected cost savings and synergies from The Westchester Bank (“Westchester” or “TWB”) and Bank Leumi acquisitions in amounts or in the timeframe anticipated; costs or difficulties relating to Westchester and Bank Leumi integration matters might be greater than expected; the inability to retain customers and qualified employees of Westchester and Bank Leumi; changes in estimates of non-recurring charges related to the Westchester and Bank Leumi acquisitions; the continued impact of COVID-19 on the U.S. and global economies, including business disruptions, inflationary pressures, labor market volatility, reductions in employment, supply chain disruptions and any increase in business failures, specifically among our clients; the continued impact of COVID-19 on our employees and our ability to provide services to our customers and respond to their needs as more cases of COVID-19 may arise in our primary markets; the impact of forbearances or deferrals we are required or agree to as a result of customer requests and/or government actions, including, but not limited to our potential inability to recover fully deferred payments from the borrower or the collateral; the risks related to the discontinuation of the London Interbank Offered Rate and other reference rates, including increased expenses and litigation and the effectiveness of hedging strategies; damage verdicts or settlements or restrictions related to existing or potential class action litigation or individual litigation arising from claims of violations of laws or regulations, contractual claims, breach of fiduciary responsibility, negligence, fraud, environmental laws, patent or trademark infringement, employment related claims, and other matters; a prolonged downturn in the economy, mainly in New Jersey, New York, Florida and Alabama, as well as an unexpected decline in commercial real estate values within our market areas; higher or lower than expected income tax expense or tax rates, including increases or decreases resulting from changes in uncertain tax position liabilities, tax laws, regulations and case law; the inability to grow customer deposits to keep pace with loan growth; a material change in our allowance for credit losses under CECL due to forecasted economic conditions and/or unexpected credit deterioration in our loan and investment portfolios; the need to supplement debt or equity capital to maintain or exceed internal capital thresholds; greater than expected technology related costs due to, among other factors, prolonged or failed implementations, additional project staffing and obsolescence caused by continuous and rapid market innovations; the loss of or decrease in lower-cost funding sources within our deposit base, including our inability to achieve deposit retention targets under Valley's branch transformation strategy; cyber-attacks, ransomware attacks, computer viruses or other malware that may breach the security of our websites or other systems to obtain unauthorized access to confidential information, destroy data, disable or degrade service, or sabotage our systems; results of examinations by the Office of the Comptroller of the Currency (OCC), the Federal Reserve Bank (FRB), the Consumer Financial Protection Bureau (CFPB) and other regulatory authorities, including the possibility that any such regulatory authority may, among other things, require us to increase our allowance for credit losses, write-down assets, reimburse customers, change the way we do business, or limit or eliminate certain other banking activities; our inability or determination not to pay dividends at current levels, or at all, because of inadequate earnings, regulatory restrictions or limitations, changes in our capital requirements or a decision to increase capital by retaining more earnings; unanticipated loan delinquencies, loss of collateral, decreased service revenues, and other potential negative effects on our business caused by severe weather, the COVID-19 pandemic or other external events; and unexpected significant declines in the loan portfolio due to the lack of economic expansion, increased competition, large prepayments, changes in regulatory lending guidance or other factors. A detailed discussion of factors that could affect our results is included in our SEC filings, including the “Risk Factors” section of our Annual Report on Form 10-K for the year ended December 31, 2020 and in Item 1A of our Quarterly Report on Form 10-Q for the quarter ended September 30, 2021. We undertake no duty to update any forward-looking statement to conform the statement to actual results or changes in our expectations. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements.

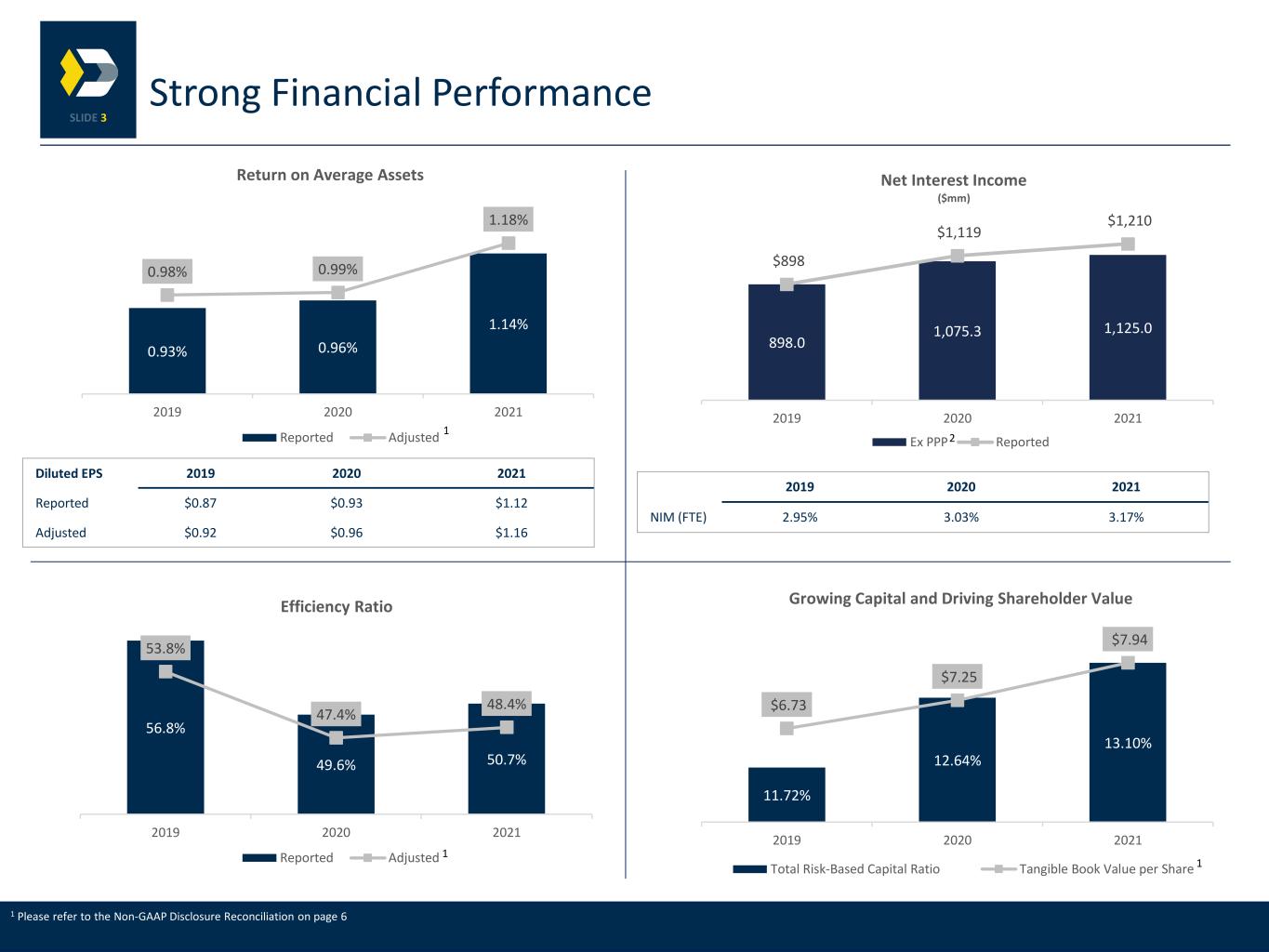

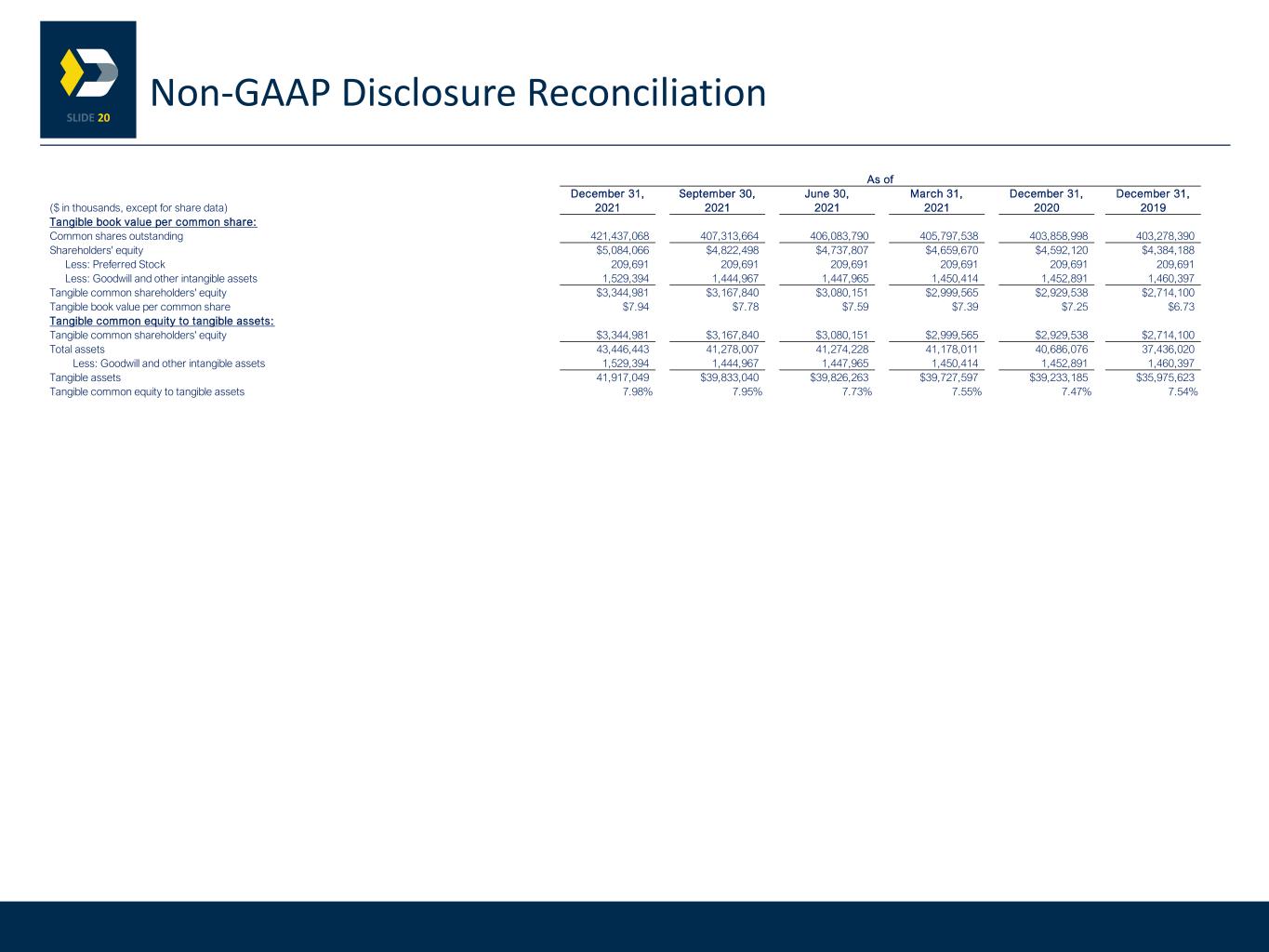

3 1 Please refer to the Non-GAAP Disclosure Reconciliation on page 6 Strong Financial Performance 0.93% 0.96% 1.14% 0.98% 0.99% 1.18% 2019 2020 2021 Return on Average Assets Reported Adjusted 898.0 1,075.3 1,125.0 $898 $1,119 $1,210 2019 2020 2021 Net Interest Income ($mm) Ex PPP Reported 56.8% 49.6% 50.7% 53.8% 47.4% 48.4% 2019 2020 2021 Efficiency Ratio Reported Adjusted 11.72% 12.64% 13.10% $6.73 $7.25 $7.94 2019 2020 2021 Growing Capital and Driving Shareholder Value Total Risk-Based Capital Ratio Tangible Book Value per Share 2 1 1 1 2019 2020 2021 NIM (FTE) 2.95% 3.03% 3.17% Diluted EPS 2019 2020 2021 Reported $0.87 $0.93 $1.12 Adjusted $0.92 $0.96 $1.16

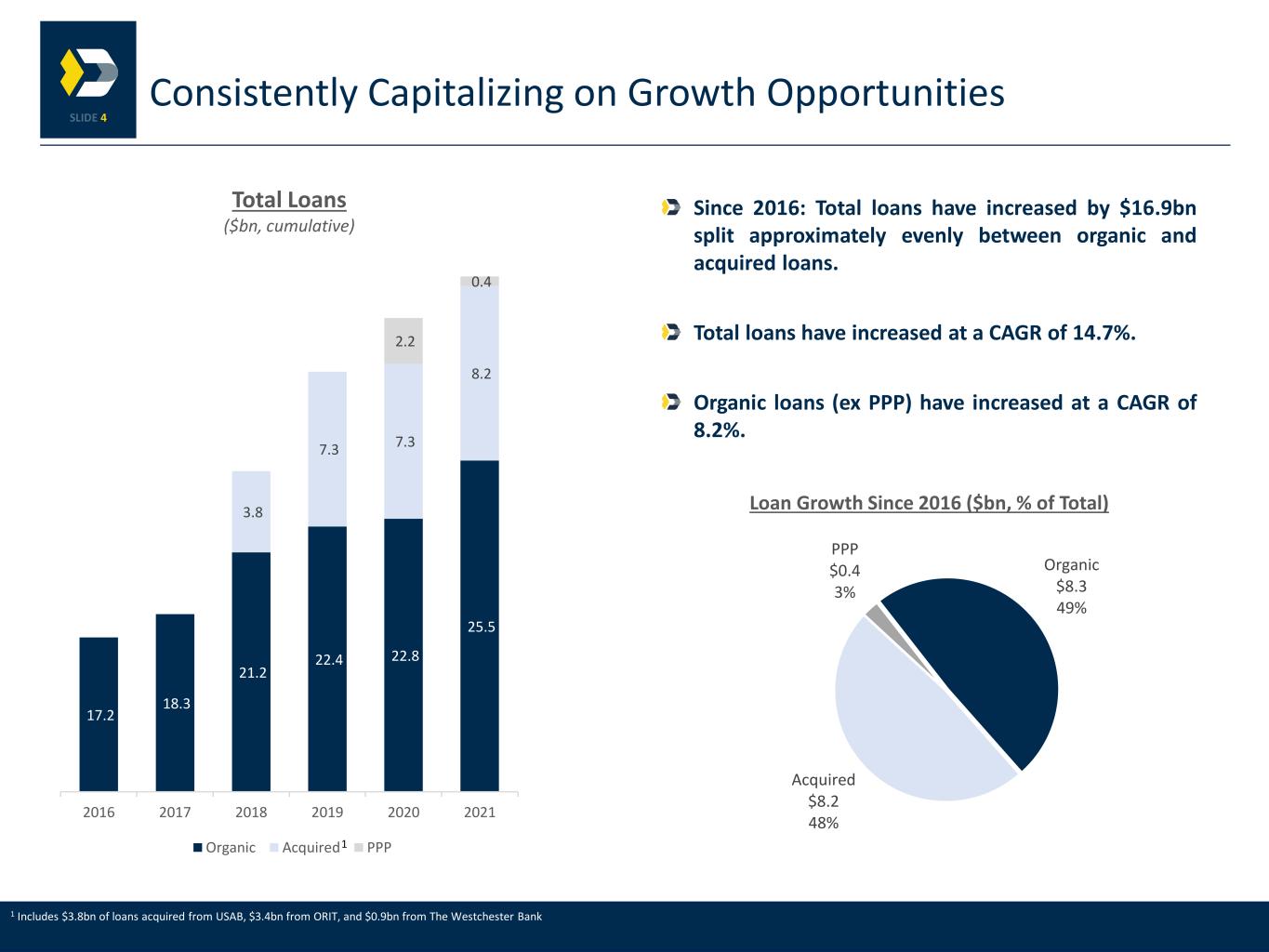

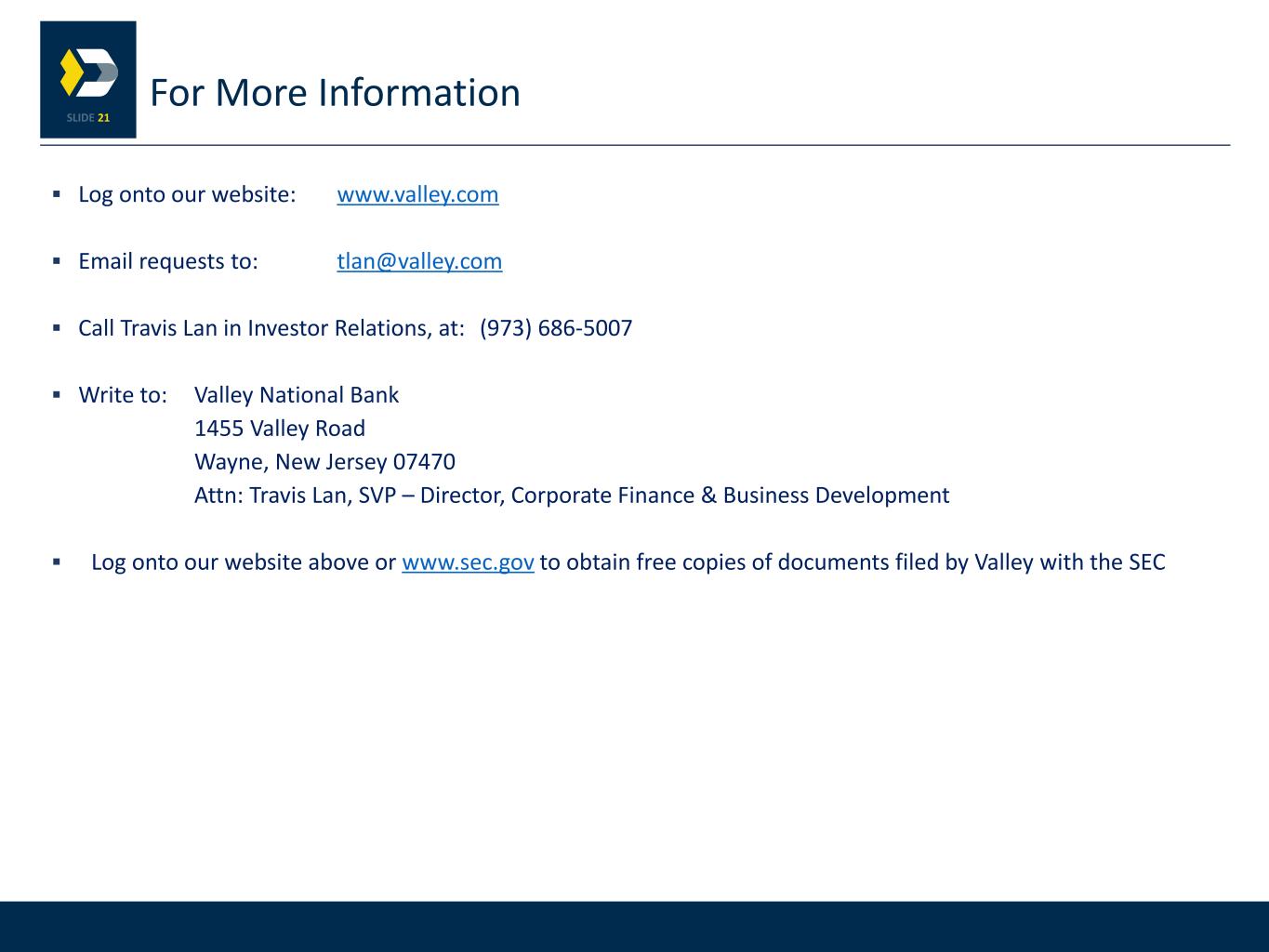

4 Consistently Capitalizing on Growth Opportunities Since 2016: Total loans have increased by $16.9bn split approximately evenly between organic and acquired loans. Total loans have increased at a CAGR of 14.7%. Organic loans (ex PPP) have increased at a CAGR of 8.2%. 17.2 18.3 21.2 22.4 22.8 25.5 3.8 7.3 7.3 8.2 2.2 0.4 2016 2017 2018 2019 2020 2021 Total Loans ($bn, cumulative) Organic Acquired PPP Organic $8.3 49% Acquired $8.2 48% PPP $0.4 3% Loan Growth Since 2016 ($bn, % of Total) 1 1 Includes $3.8bn of loans acquired from USAB, $3.4bn from ORIT, and $0.9bn from The Westchester Bank

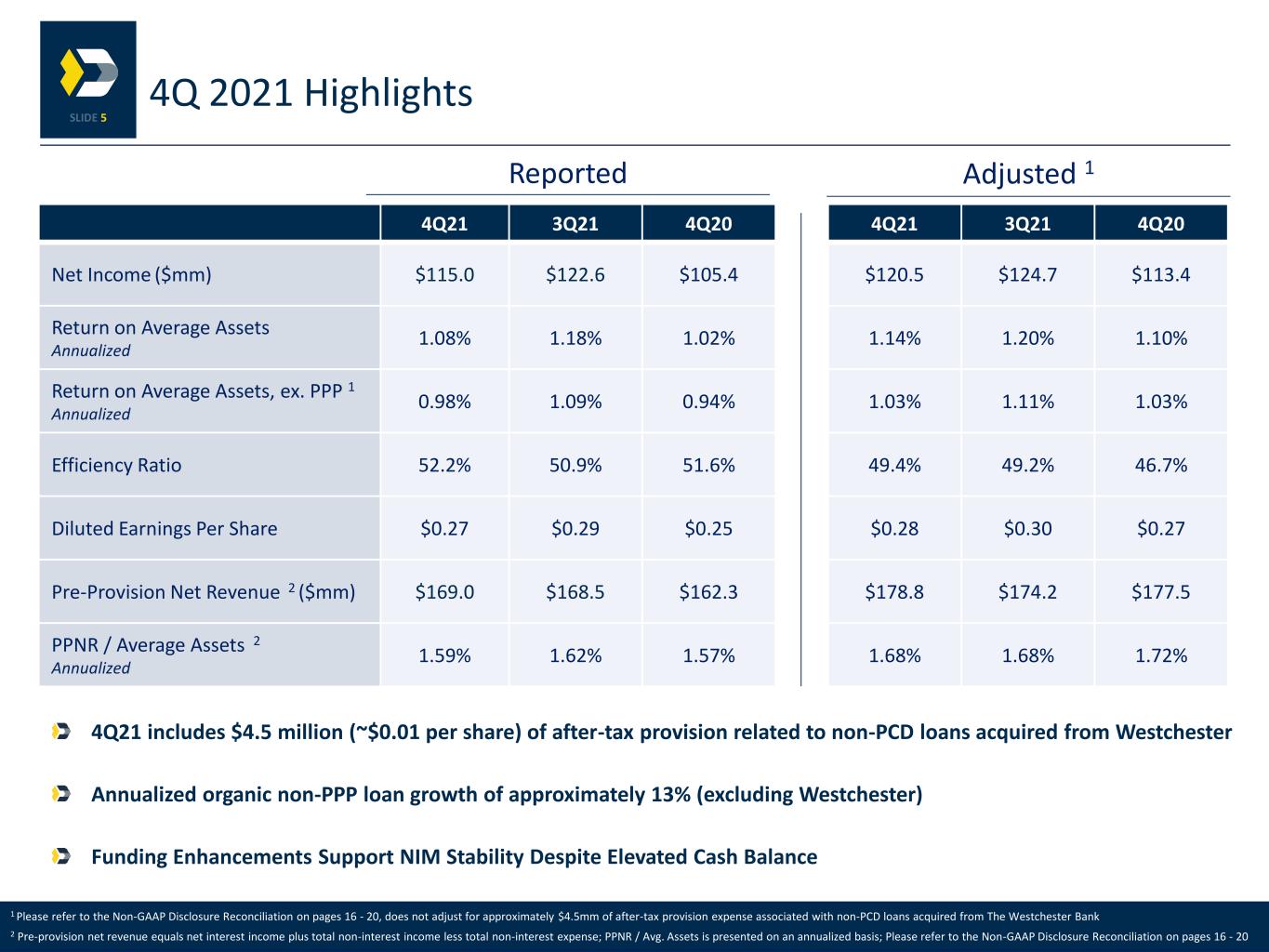

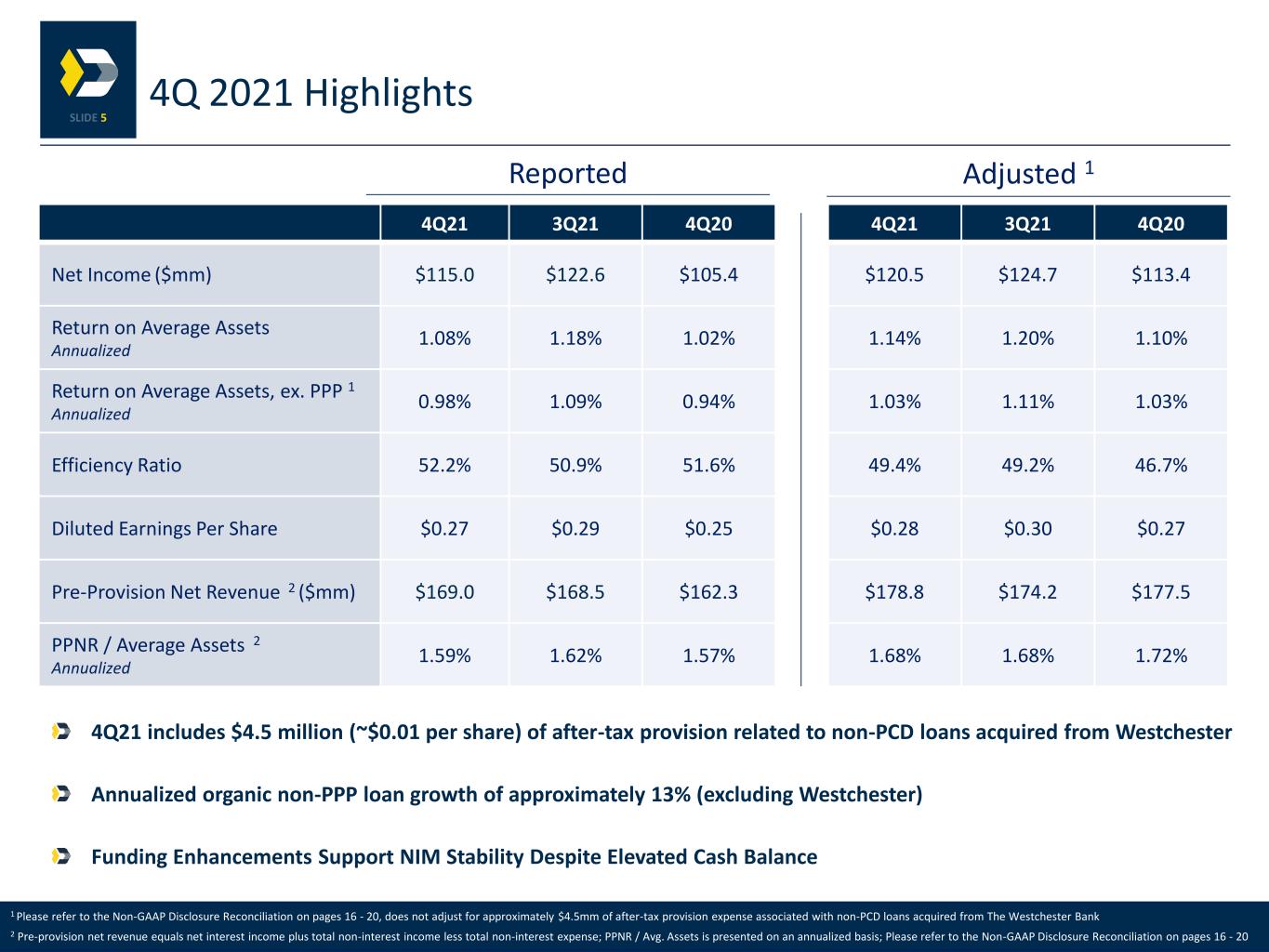

5 4Q21 3Q21 4Q20 4Q21 3Q21 4Q20 Net Income ($mm) $115.0 $122.6 $105.4 $120.5 $124.7 $113.4 Return on Average Assets Annualized 1.08% 1.18% 1.02% 1.14% 1.20% 1.10% Return on Average Assets, ex. PPP 1 Annualized 0.98% 1.09% 0.94% 1.03% 1.11% 1.03% Efficiency Ratio 52.2% 50.9% 51.6% 49.4% 49.2% 46.7% Diluted Earnings Per Share $0.27 $0.29 $0.25 $0.28 $0.30 $0.27 Pre-Provision Net Revenue 2 ($mm) $169.0 $168.5 $162.3 $178.8 $174.2 $177.5 PPNR / Average Assets 2 Annualized 1.59% 1.62% 1.57% 1.68% 1.68% 1.72% Reported Adjusted 1 1 Please refer to the Non-GAAP Disclosure Reconciliation on pages 16 - 20, does not adjust for approximately $4.5mm of after-tax provision expense associated with non-PCD loans acquired from The Westchester Bank 2 Pre-provision net revenue equals net interest income plus total non-interest income less total non-interest expense; PPNR / Avg. Assets is presented on an annualized basis; Please refer to the Non-GAAP Disclosure Reconciliation on pages 16 - 20 4Q 2021 Highlights 4Q21 includes $4.5 million (~$0.01 per share) of after-tax provision related to non-PCD loans acquired from Westchester Annualized organic non-PPP loan growth of approximately 13% (excluding Westchester) Funding Enhancements Support NIM Stability Despite Elevated Cash Balance

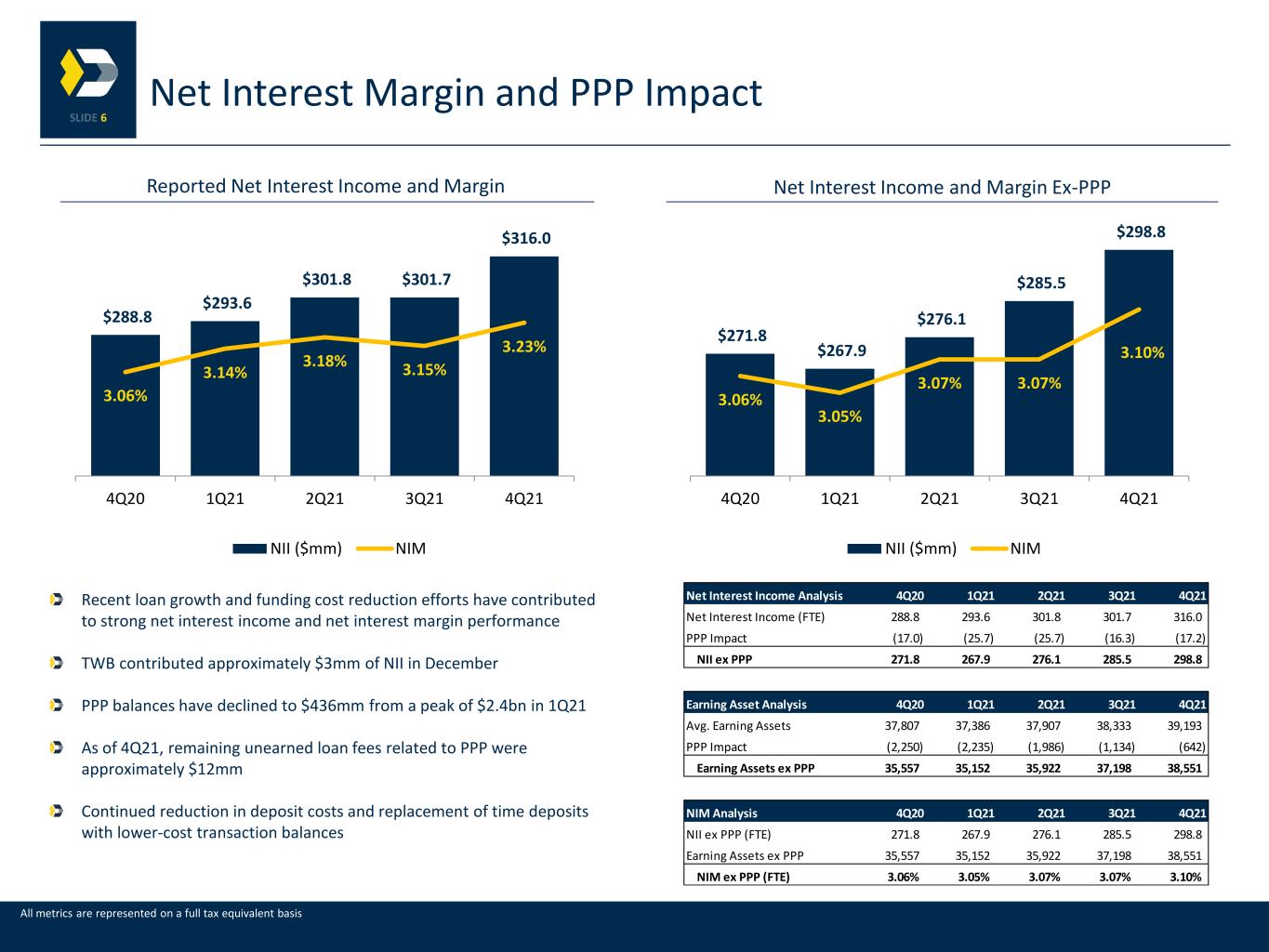

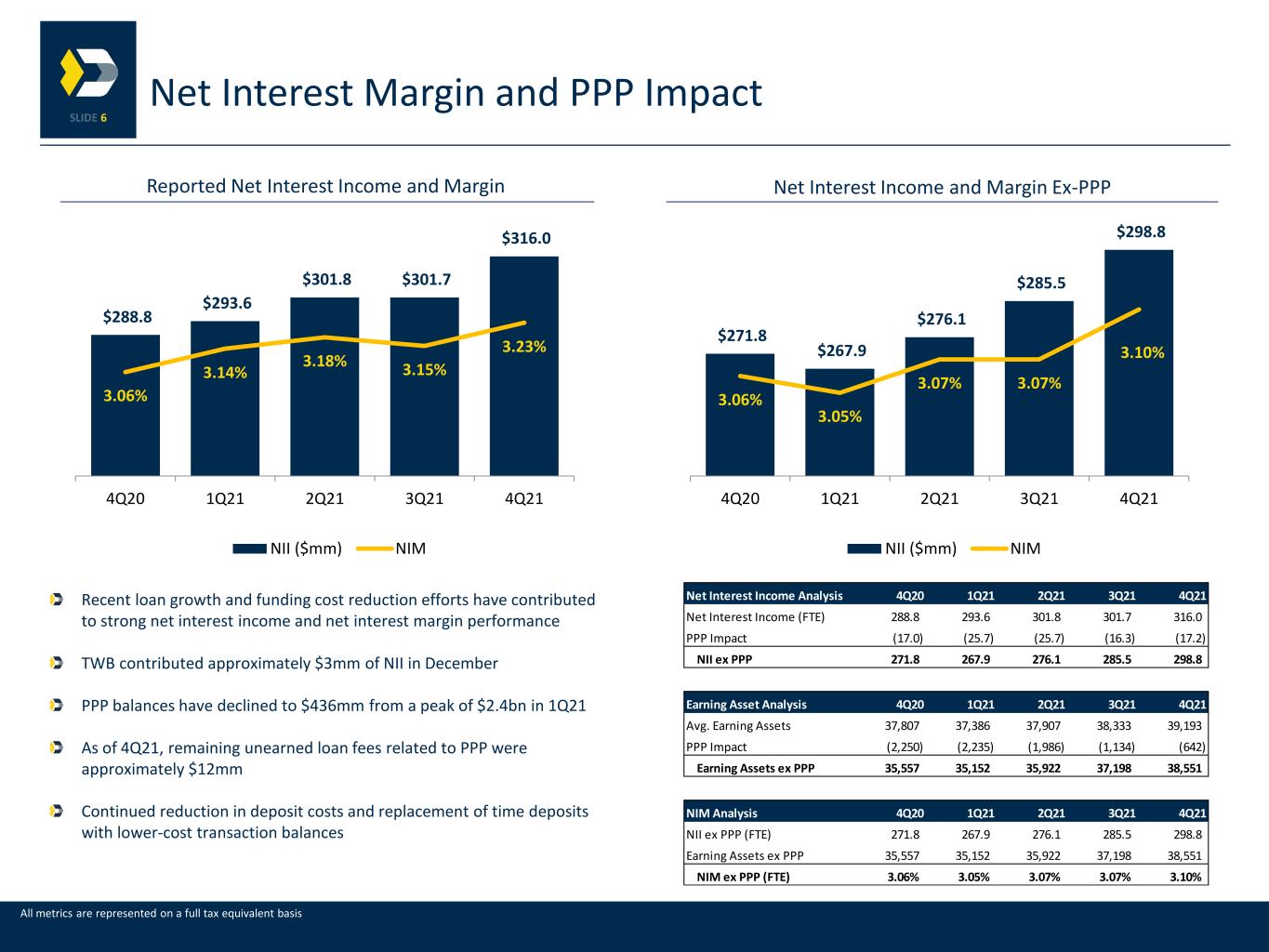

6 Reported Net Interest Income and Margin Recent loan growth and funding cost reduction efforts have contributed to strong net interest income and net interest margin performance TWB contributed approximately $3mm of NII in December PPP balances have declined to $436mm from a peak of $2.4bn in 1Q21 As of 4Q21, remaining unearned loan fees related to PPP were approximately $12mm Continued reduction in deposit costs and replacement of time deposits with lower-cost transaction balances Net Interest Margin and PPP Impact Net Interest Income and Margin Ex-PPP $288.8 $293.6 $301.8 $301.7 $316.0 3.06% 3.14% 3.18% 3.15% 3.23% 4Q20 1Q21 2Q21 3Q21 4Q21 NII ($mm) NIM $271.8 $267.9 $276.1 $285.5 $298.8 3.06% 3.05% 3.07% 3.07% 3.10% 4Q20 1Q21 2Q21 3Q21 4Q21 NII ($mm) NIM All metrics are represented on a full tax equivalent basis Net Interest Income Analysis 4Q20 1Q21 2Q21 3Q21 4Q21 Net Interest Income (FTE) 288.8 293.6 301.8 301.7 316.0 PPP Impact (17.0) (25.7) (25.7) (16.3) (17.2) NII ex PPP 271.8 267.9 276.1 285.5 298.8 Earning Asset Analysis 4Q20 1Q21 2Q21 3Q21 4Q21 Avg. Earning Assets 37,807 37,386 37,907 38,333 39,193 PPP Impact (2,250) (2,235) (1,986) (1,134) (642) Earning Assets ex PPP 35,557 35,152 35,922 37,198 38,551 NIM Analysis 4Q20 1Q21 2Q21 3Q21 4Q21 NII ex PPP (FTE) 271.8 267.9 276.1 285.5 298.8 Earning Assets ex PPP 35,557 35,152 35,922 37,198 38,551 NIM ex PPP (FTE) 3.06% 3.05% 3.07% 3.07% 3.10%

7 44% 14.2 12.0 7.3 7.9 9.5 12.8 9.7 12.9 16.2 0.7 0.9 1.5 4Q19 4Q20 4Q21 CDs & Wholesale Consumer Commercial Niche Deposit Initiatives Non-interest bearing $11.7 Savings, NOW & MMA $20.3 Time $3.7 Short-term borrowings $0.7 Long-term borrowings $1.5 Other $0.4 Avg. Deposit Balance ($MM) and Rate (%) Trends 4Q21 Funding Trends (Deposits & Borrowings, $bn) Total Liabilities 12/31/2021 Deposits, Funding & Liquidity $38.3BN 0.30% 0.27% 0.25% 0.23% 0.20% 0.82% 0.76% 0.54% 0.43% 0.36% $0 $4,000 $8,000 $12,000 $16,000 $20,000 4Q20 1Q21 2Q21 3Q21 4Q21 Savings, NOW & MMA Time Deposits W.Avg Savings, NOW & MMA Rate W.Avg Time Deposits Rate 1 Commercial includes government deposit balances 2 Includes junior subordinated debt within long-term borrowings. Totals may not sum due to rounding. 2 30% 34% Cost of total deposits declined 3bp to 0.15% from 0.18% in 3Q21 Over $1 billion of low-cost core deposits acquired from The Westchester Bank Well-funded balance sheet to support strong loan originations Continued transition from time deposits to non- interest and lower-cost transaction balances 19% 43% 24% 1 2% 4%

8 Multifamily 15% Non Owner-Occupied CRE 26% Healthcare CRE 4% Owner-Occupied CRE 11% C&I 16% C&I (PPP) 1% Consumer 9% Residential R.E. 13% Construction 5% CRE 45% C&I 28% Other 27% $1.4 $1.6 $2.6 $1.9 $2.5 3.35% 3.32% 3.32% 3.37% 3.23% 3.86% 3.85% 3.87% 3.79% 3.83% 4Q20 1Q21 2Q21 3Q21 4Q21 Origination Volume (Gross) New Origination Rate Avg. Portfolio Rate New Loan Originations ($bn) 1 Loan classifications according to call report schedule which may not correspond to classification outlined in earnings release Loans & Loan Growth 4Q21 Loan Composition 1 2021 Loan Growth 1 (7%) 0% 6% 8% 9% 10% 15% 16% 23% Home Equity Multifamily Construction Owner-Occupied CRE Res. Mortgage Other Consumer C&I (ex. PPP) Auto Non-Owner Occupied CRE +$1,935mm +$214mm +$702mm +$87mm +$361mm +$274mm +$109mm +$2mm ($31mm) 2021 4Q21 (ann.) Gross Loans +6.0% +19.0% Gross Loans ex PPP +12.1% +25.0% Gross Loans ex PPP & TWB +9.1% +13.3% CRE +14% / +$1.9bn C&I (ex-PPP) +12% / +$1.0bn Other +9% / +$0.7bn

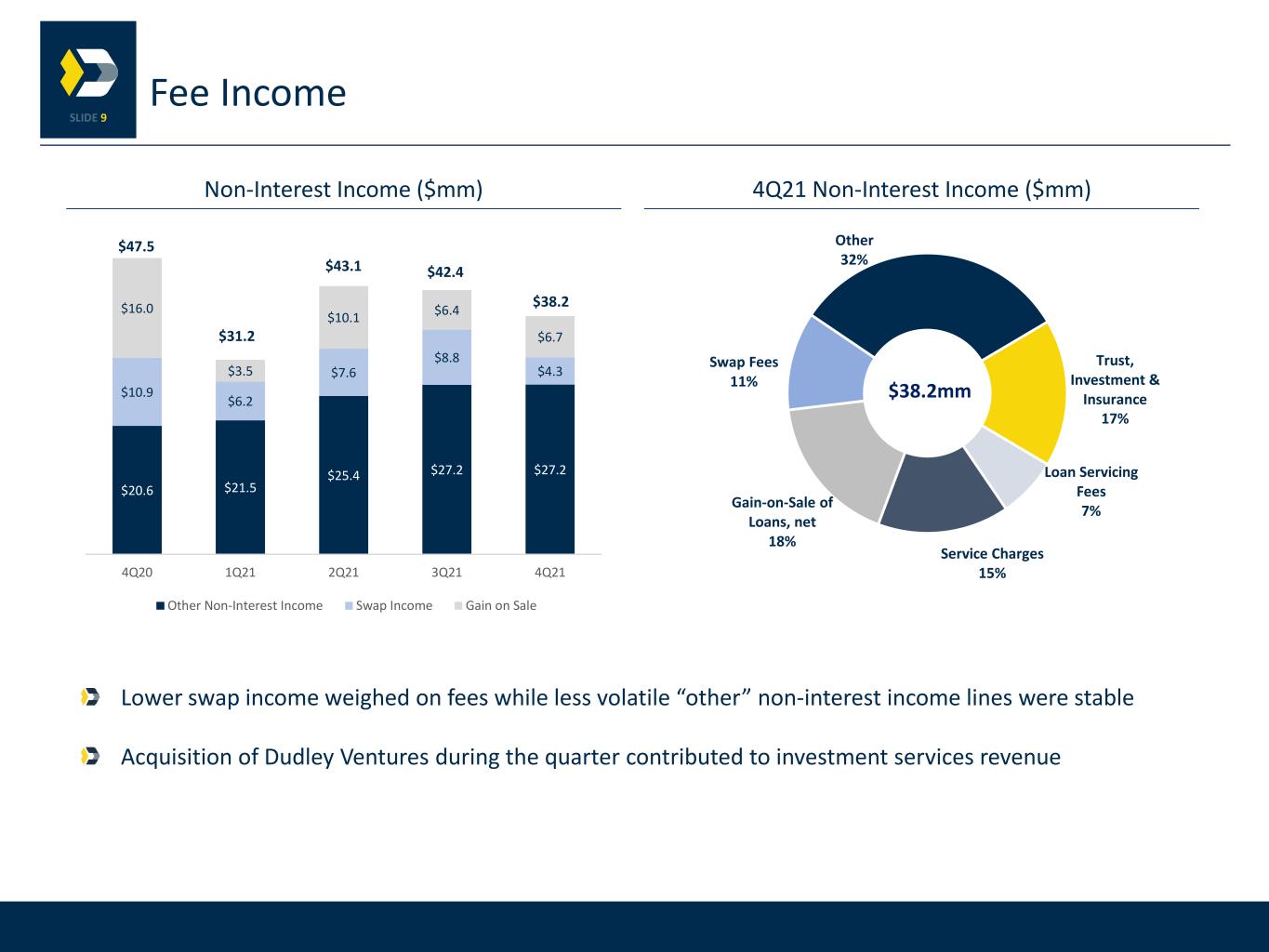

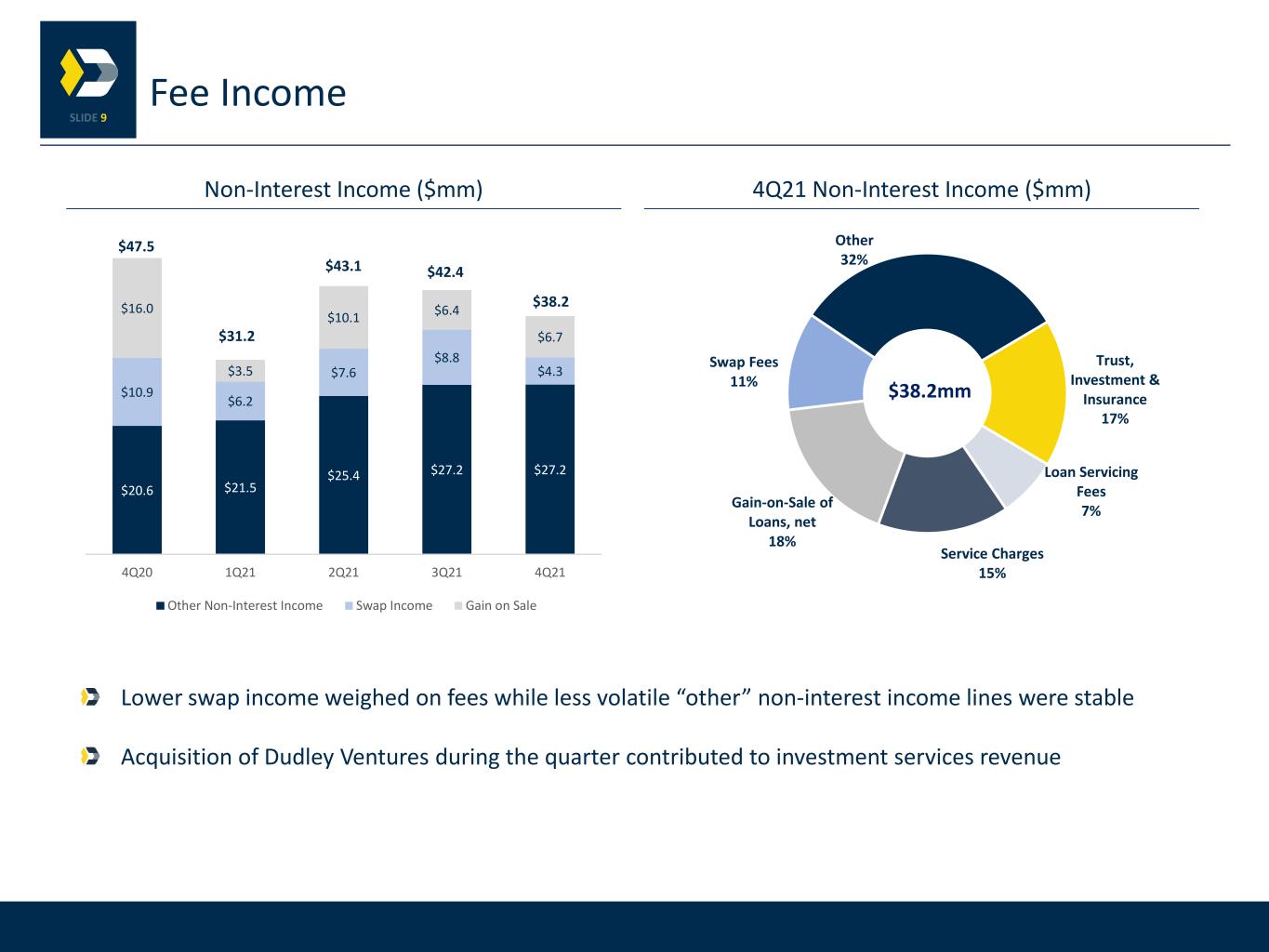

9 4Q21 Non-Interest Income ($mm) Lower swap income weighed on fees while less volatile “other” non-interest income lines were stable Acquisition of Dudley Ventures during the quarter contributed to investment services revenue Fee Income Other 32% Trust, Investment & Insurance 17% Loan Servicing Fees 7% Service Charges 15% Gain-on-Sale of Loans, net 18% Swap Fees 11% $38.2mm Non-Interest Income ($mm) $20.6 $21.5 $25.4 $27.2 $27.2 $10.9 $6.2 $7.6 $8.8 $4.3 $16.0 $3.5 $10.1 $6.4 $6.7 4Q20 1Q21 2Q21 3Q21 4Q21 Other Non-Interest Income Swap Income Gain on Sale $42.4$43.1 $47.5 $31.2 $38.2

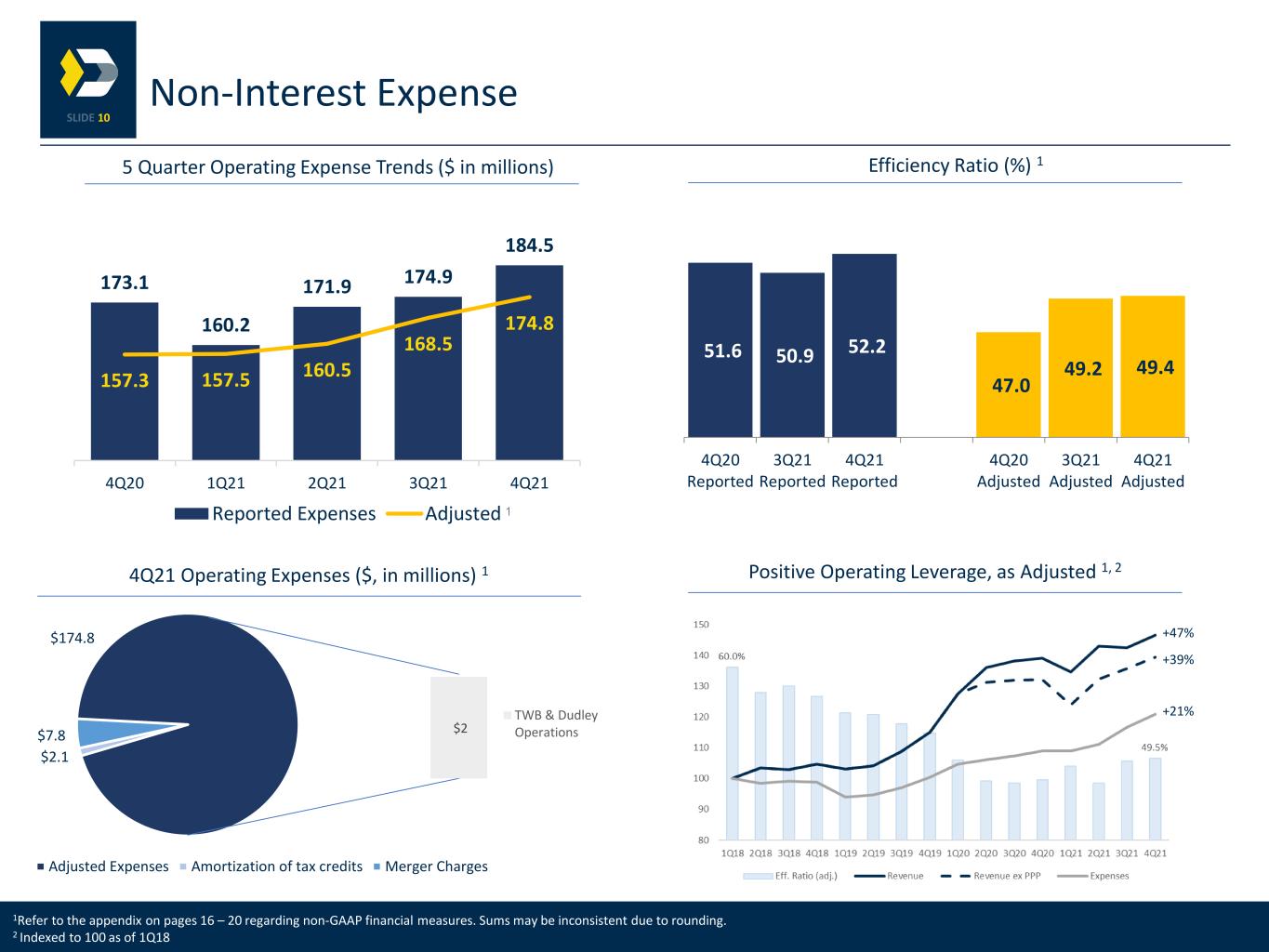

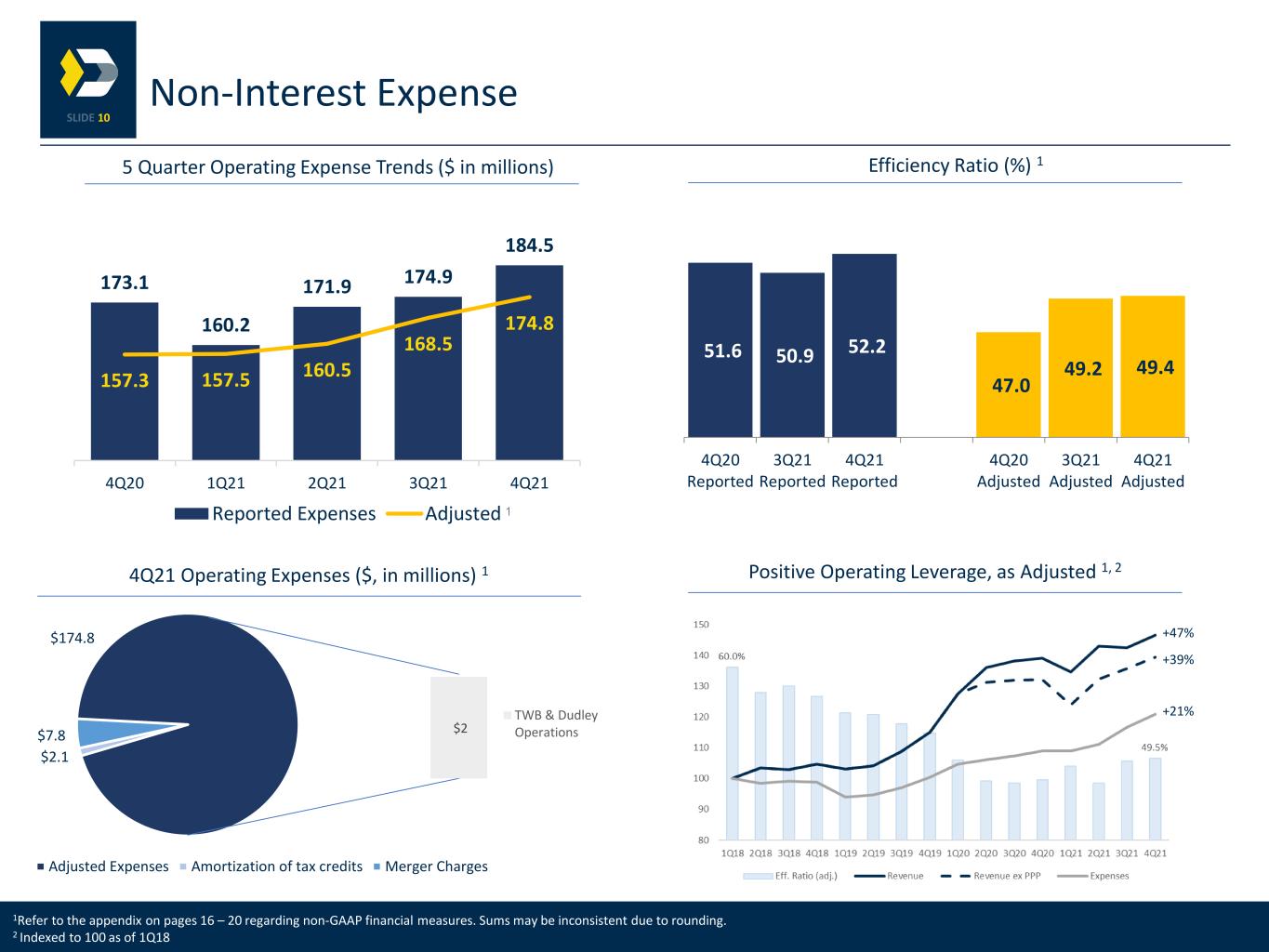

10 173.1 160.2 171.9 174.9 184.5 157.3 157.5 160.5 168.5 174.8 4Q20 1Q21 2Q21 3Q21 4Q21 Reported Expenses Adjusted 5 Quarter Operating Expense Trends ($ in millions) Efficiency Ratio (%) 1 1Refer to the appendix on pages 16 – 20 regarding non-GAAP financial measures. Sums may be inconsistent due to rounding. 2 Indexed to 100 as of 1Q18 4Q21 Operating Expenses ($, in millions) 1 Non-Interest Expense 1 $174.8 $2.1 $7.8 Adjusted Expenses Amortization of tax credits Merger Charges 51.6 50.9 52.2 47.0 49.2 49.4 4Q20 Reported 3Q21 Reported 4Q21 Reported 4Q20 Adjusted 3Q21 Adjusted 4Q21 Adjusted Positive Operating Leverage, as Adjusted 1, 2 +47% +39% +21% $2 TWB & Dudley Operations

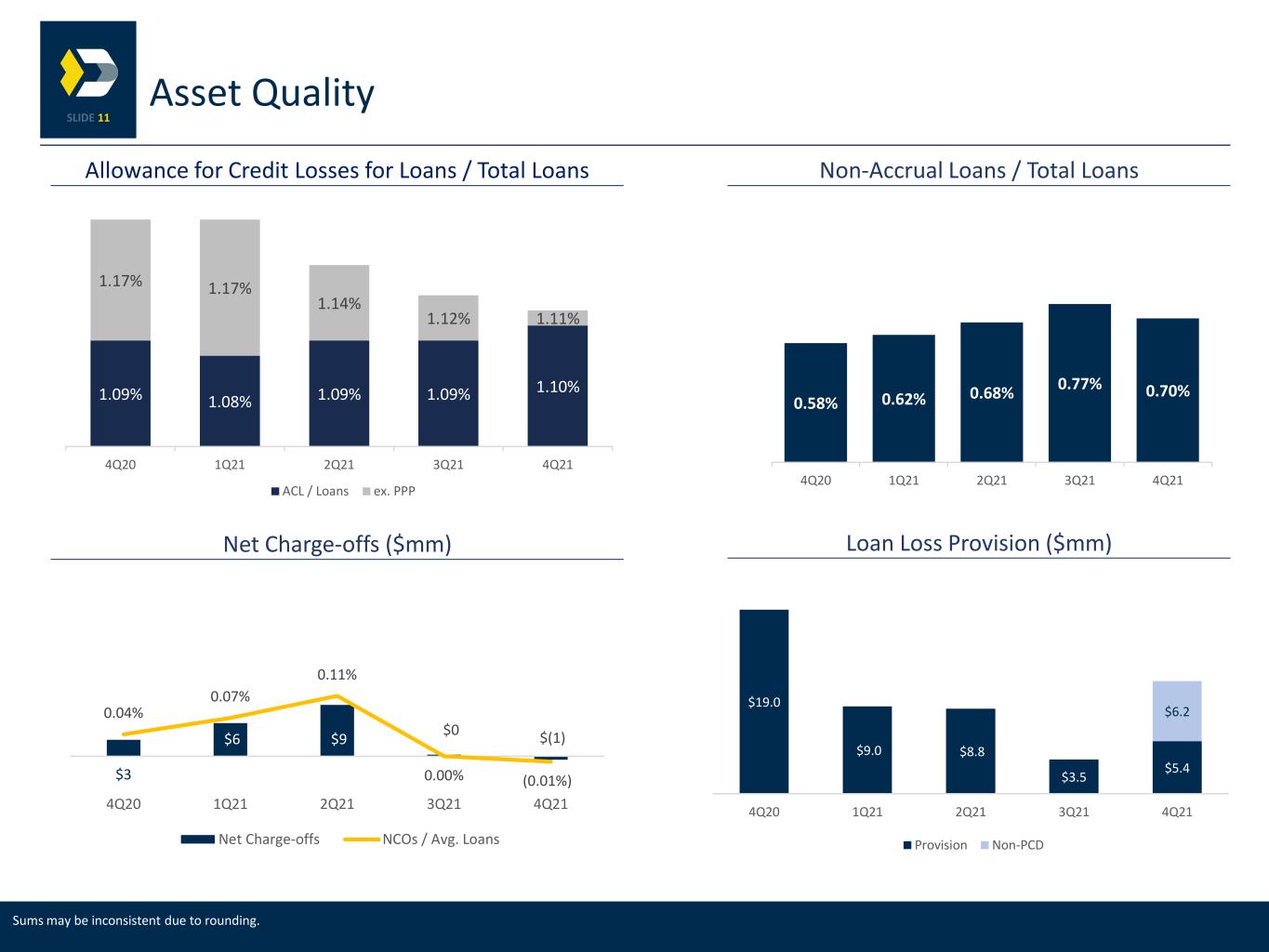

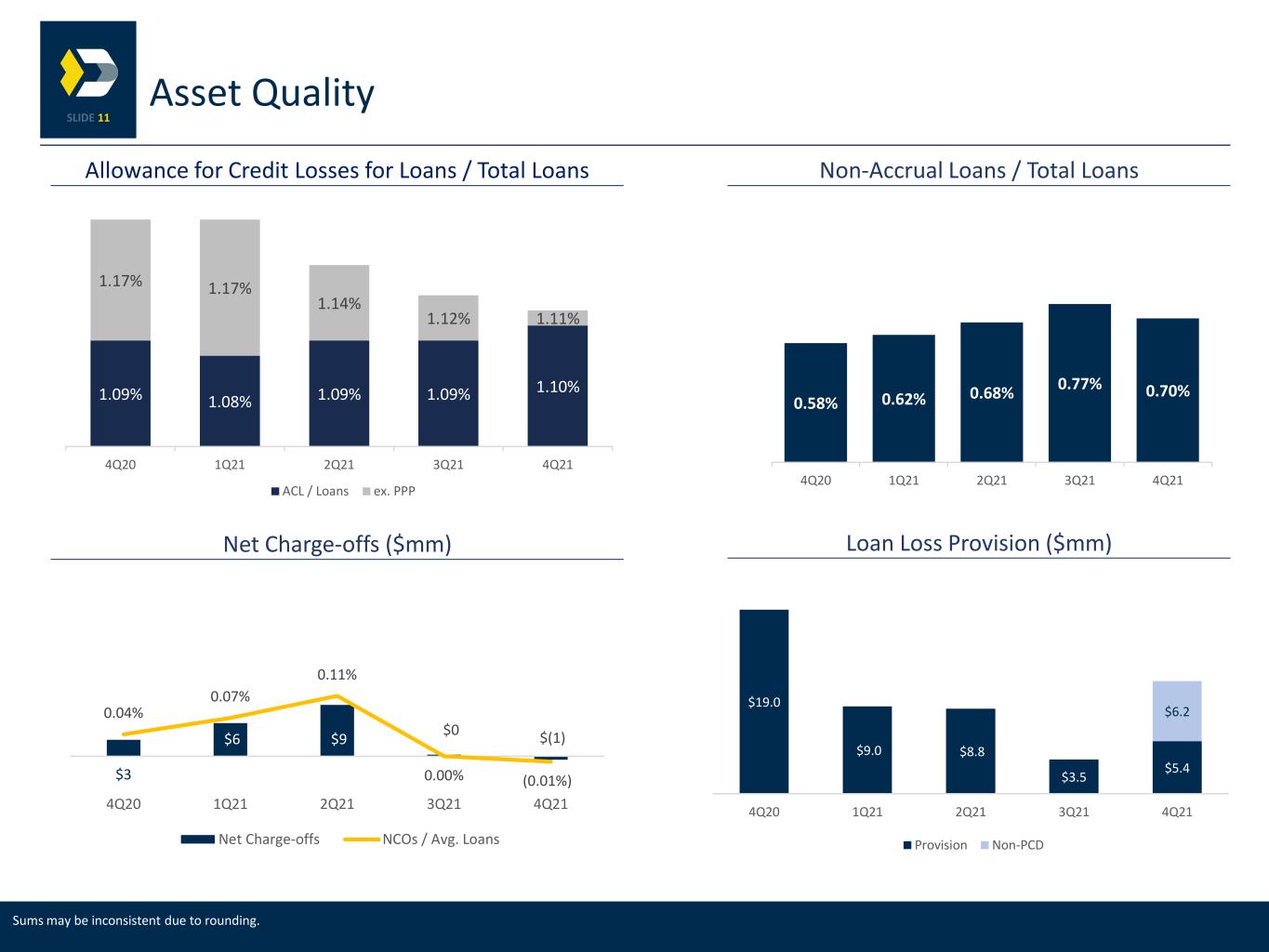

11 0.58% 0.62% 0.68% 0.77% 0.70% 4Q20 1Q21 2Q21 3Q21 4Q21 Asset Quality Non-Accrual Loans / Total Loans Loan Loss Provision ($mm) Allowance for Credit Losses for Loans / Total Loans 0.99% 1.03% 1.09% 1.08% 1.09% 1.09% 1.10% 1.17% 1.17% 1.14% 1.12% 1.11% 4Q20 1Q21 2Q21 3Q21 4Q21 ACL / Loans ex. PPP Net Charge-offs ($mm) Sums may be inconsistent due to rounding. $3 $6 $9 $0 $(1) 0.04% 0.07% 0.11% 0.00% (0.01%) 4Q20 1Q21 2Q21 3Q21 4Q21 Net Charge-offs NCOs / Avg. Loans $19.0 $9.0 $8.8 $3.5 $5.4 $6.2 4Q20 1Q21 2Q21 3Q21 4Q21 Provision Non-PCD

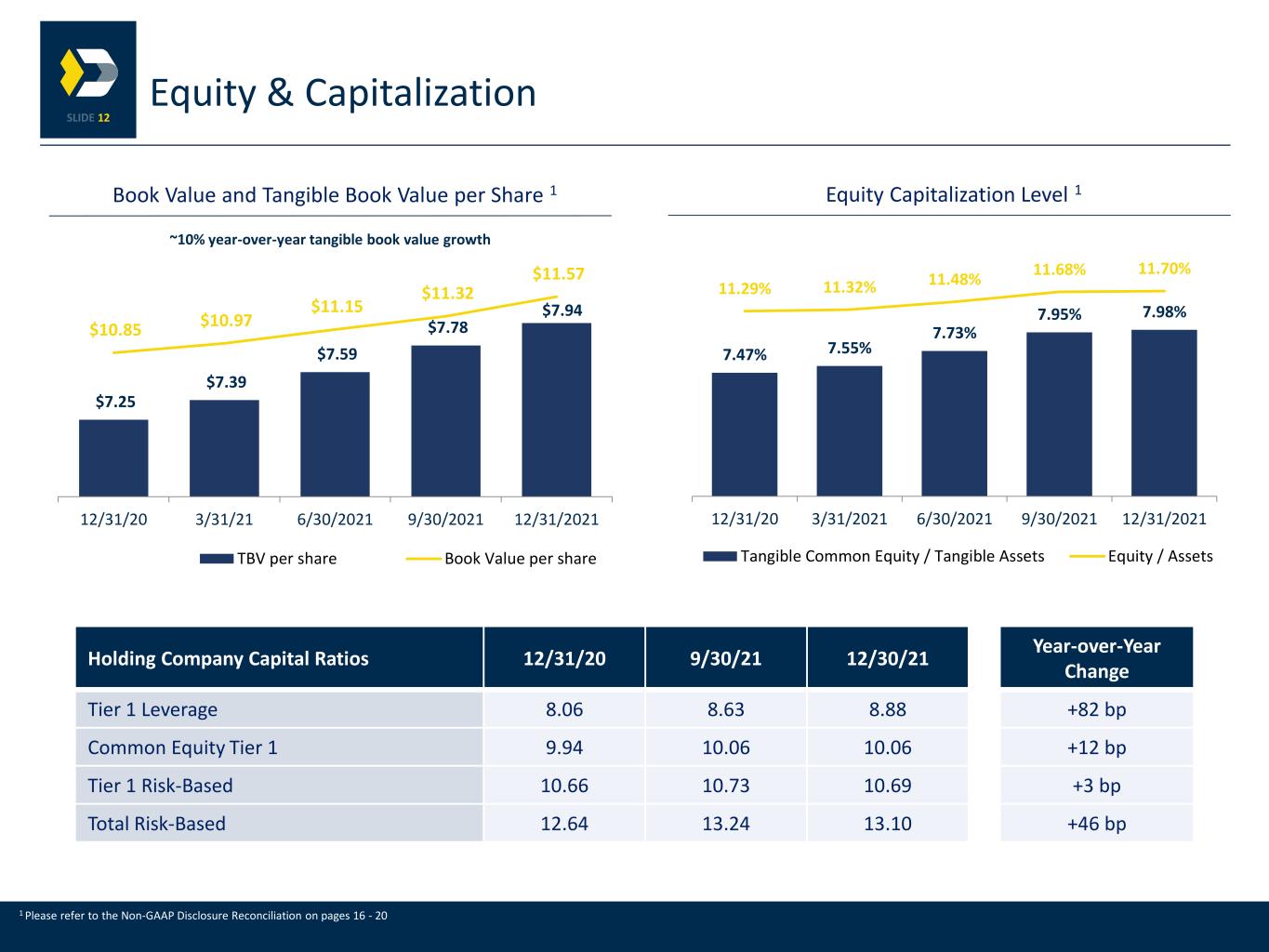

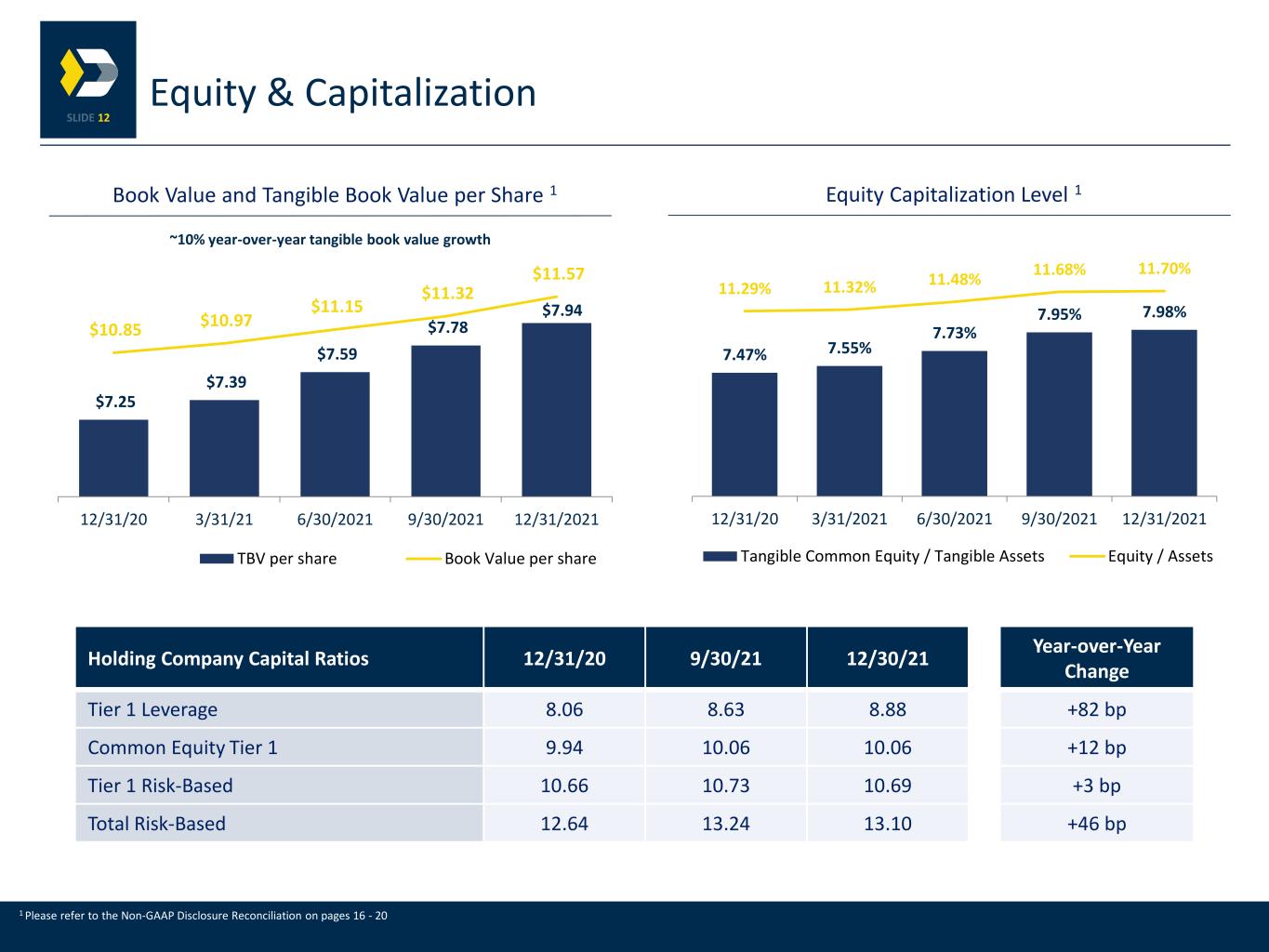

12 Equity & Capitalization $7.25 $7.39 $7.59 $7.78 $7.94 $10.85 $10.97 $11.15 $11.32 $11.57 12/31/20 3/31/21 6/30/2021 9/30/2021 12/31/2021 TBV per share Book Value per share Book Value and Tangible Book Value per Share 1 Equity Capitalization Level 1 1 Please refer to the Non-GAAP Disclosure Reconciliation on pages 16 - 20 ~10% year-over-year tangible book value growth Holding Company Capital Ratios 12/31/20 9/30/21 12/30/21 Year-over-Year Change Tier 1 Leverage 8.06 8.63 8.88 +82 bp Common Equity Tier 1 9.94 10.06 10.06 +12 bp Tier 1 Risk-Based 10.66 10.73 10.69 +3 bp Total Risk-Based 12.64 13.24 13.10 +46 bp 7.47% 7.55% 7.73% 7.95% 7.98% 11.29% 11.32% 11.48% 11.68% 11.70% 12/31/20 3/31/2021 6/30/2021 9/30/2021 12/31/2021 Tangible Common Equity / Tangible Assets Equity / Assets

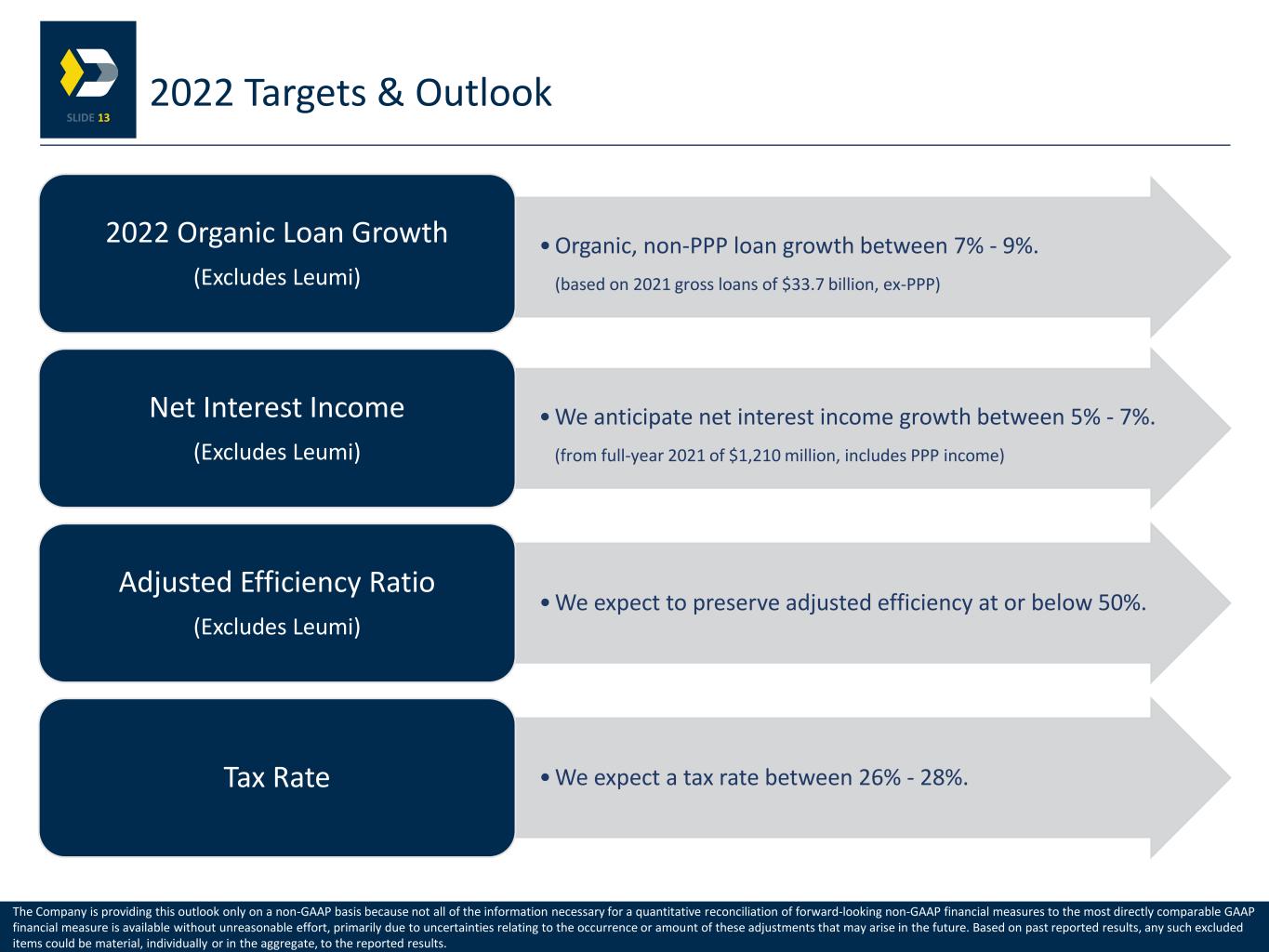

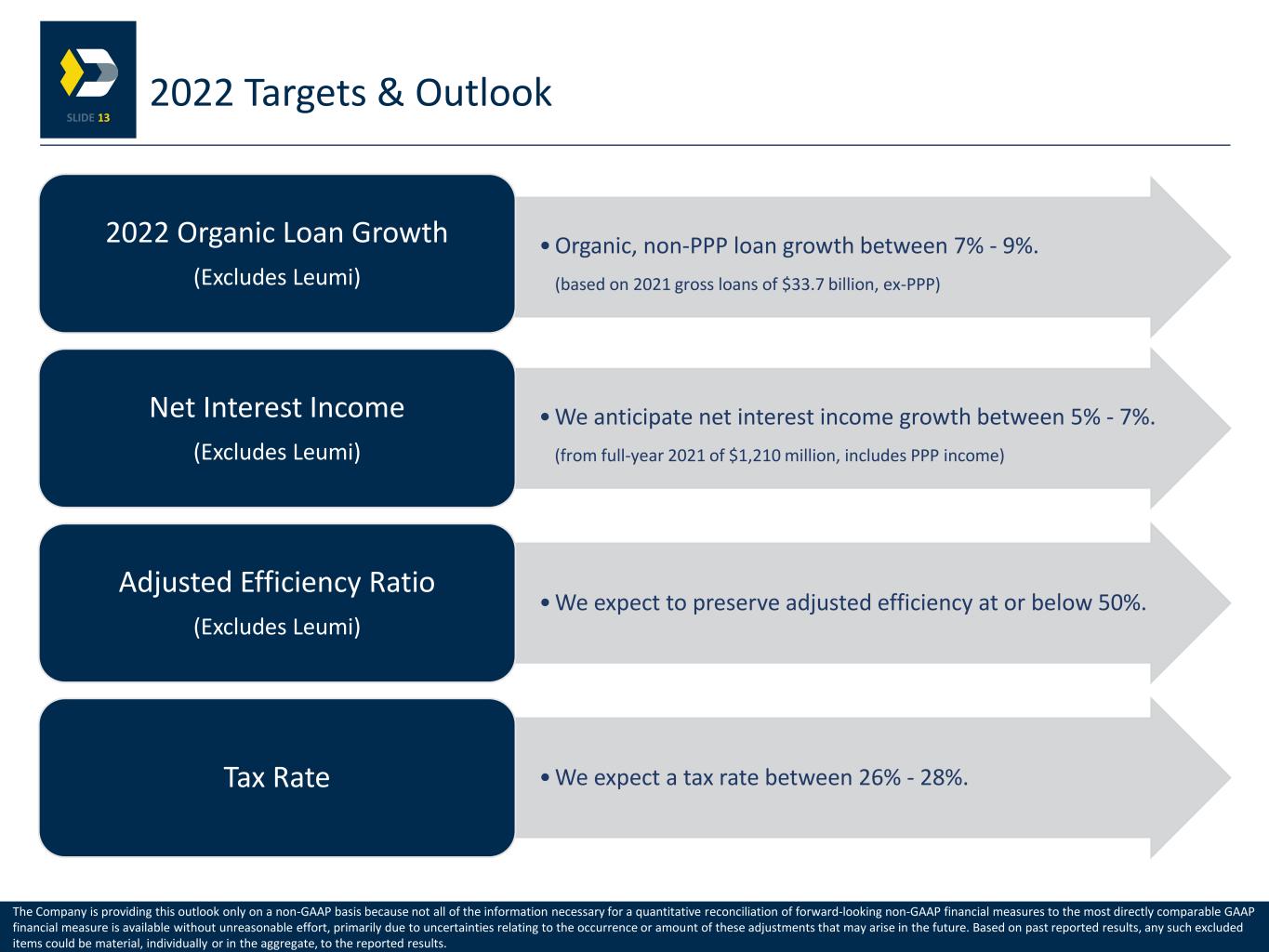

13 • Organic, non-PPP loan growth between 7% - 9%. (based on 2021 gross loans of $33.7 billion, ex-PPP) 2022 Organic Loan Growth (Excludes Leumi) • We anticipate net interest income growth between 5% - 7%. (from full-year 2021 of $1,210 million, includes PPP income) Net Interest Income (Excludes Leumi) • We expect to preserve adjusted efficiency at or below 50%. Adjusted Efficiency Ratio (Excludes Leumi) • We expect a tax rate between 26% - 28%.Tax Rate 2022 Targets & Outlook The Company is providing this outlook only on a non-GAAP basis because not all of the information necessary for a quantitative reconciliation of forward-looking non-GAAP financial measures to the most directly comparable GAAP financial measure is available without unreasonable effort, primarily due to uncertainties relating to the occurrence or amount of these adjustments that may arise in the future. Based on past reported results, any such excluded items could be material, individually or in the aggregate, to the reported results.

A p p e n d i x

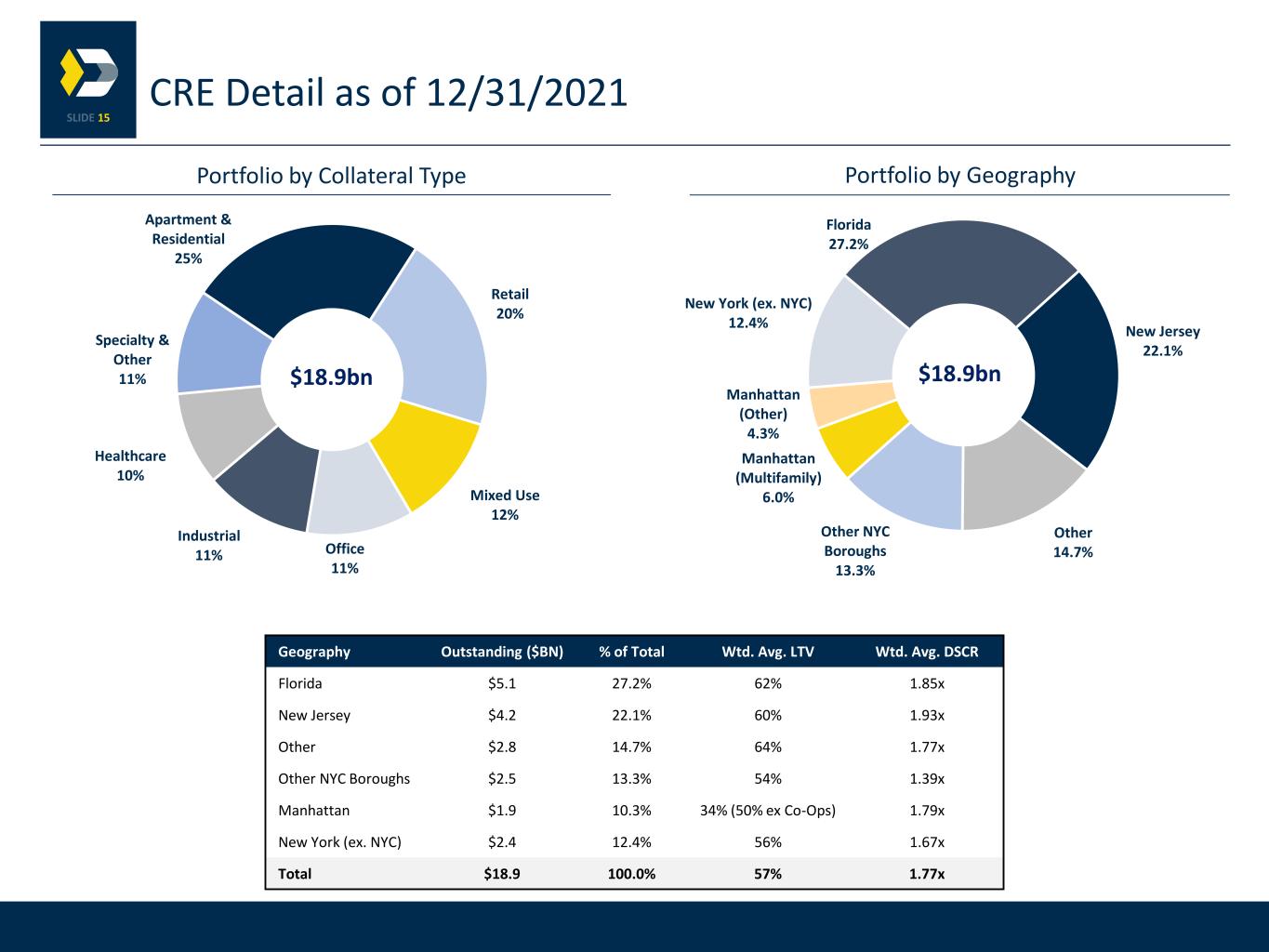

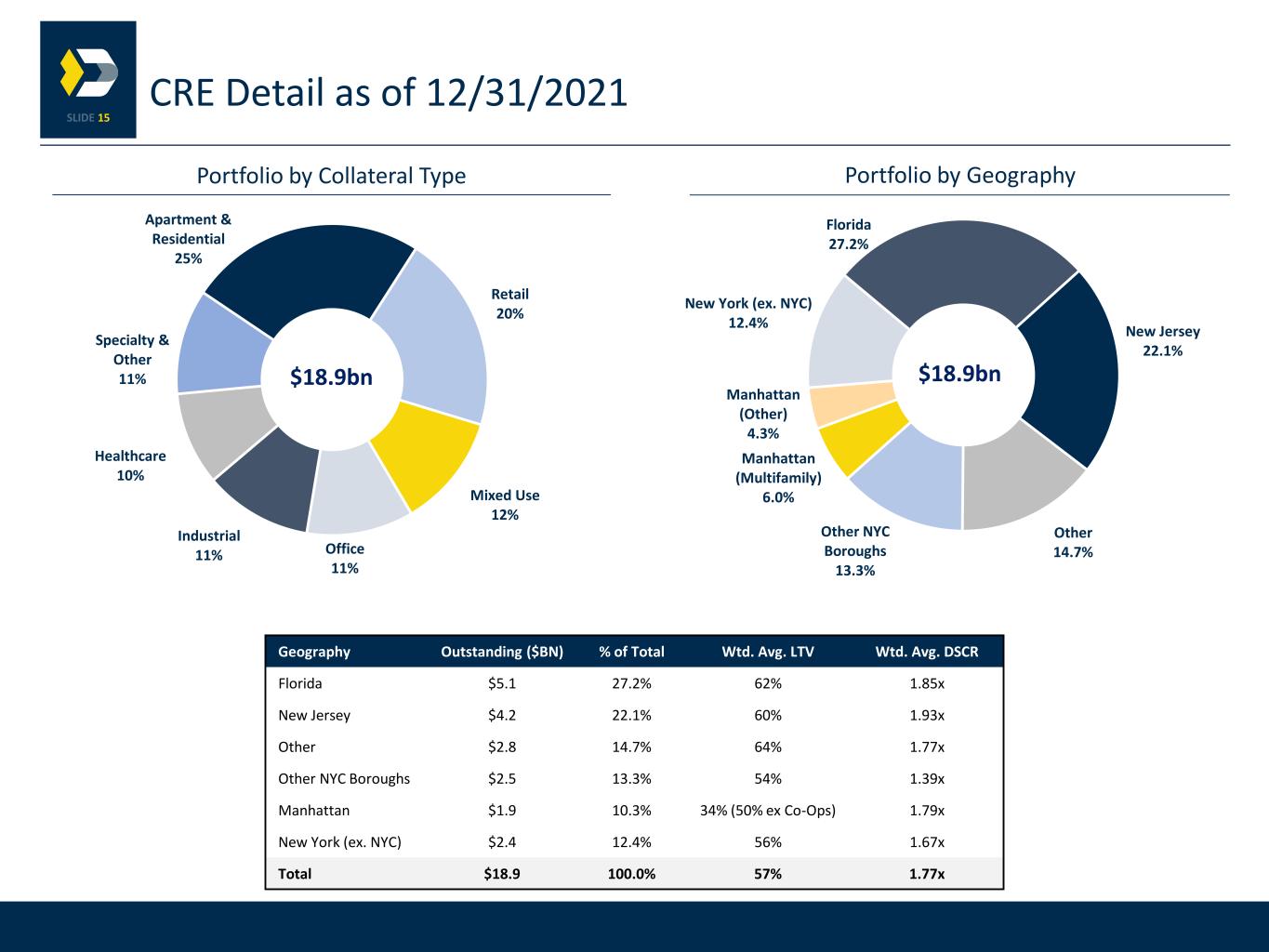

15 CRE Detail as of 12/31/2021 Portfolio by Collateral Type Apartment & Residential 25% Retail 20% Mixed Use 12% Office 11% Industrial 11% Healthcare 10% Specialty & Other 11% Portfolio by Geography Florida 27.2% New Jersey 22.1% Other 14.7% Other NYC Boroughs 13.3% Manhattan (Multifamily) 6.0% Manhattan (Other) 4.3% New York (ex. NYC) 12.4% Geography Outstanding ($BN) % of Total Wtd. Avg. LTV Wtd. Avg. DSCR Florida $5.1 27.2% 62% 1.85x New Jersey $4.2 22.1% 60% 1.93x Other $2.8 14.7% 64% 1.77x Other NYC Boroughs $2.5 13.3% 54% 1.39x Manhattan $1.9 10.3% 34% (50% ex Co-Ops) 1.79x New York (ex. NYC) $2.4 12.4% 56% 1.67x Total $18.9 100.0% 57% 1.77x $18.9bn $18.9bn

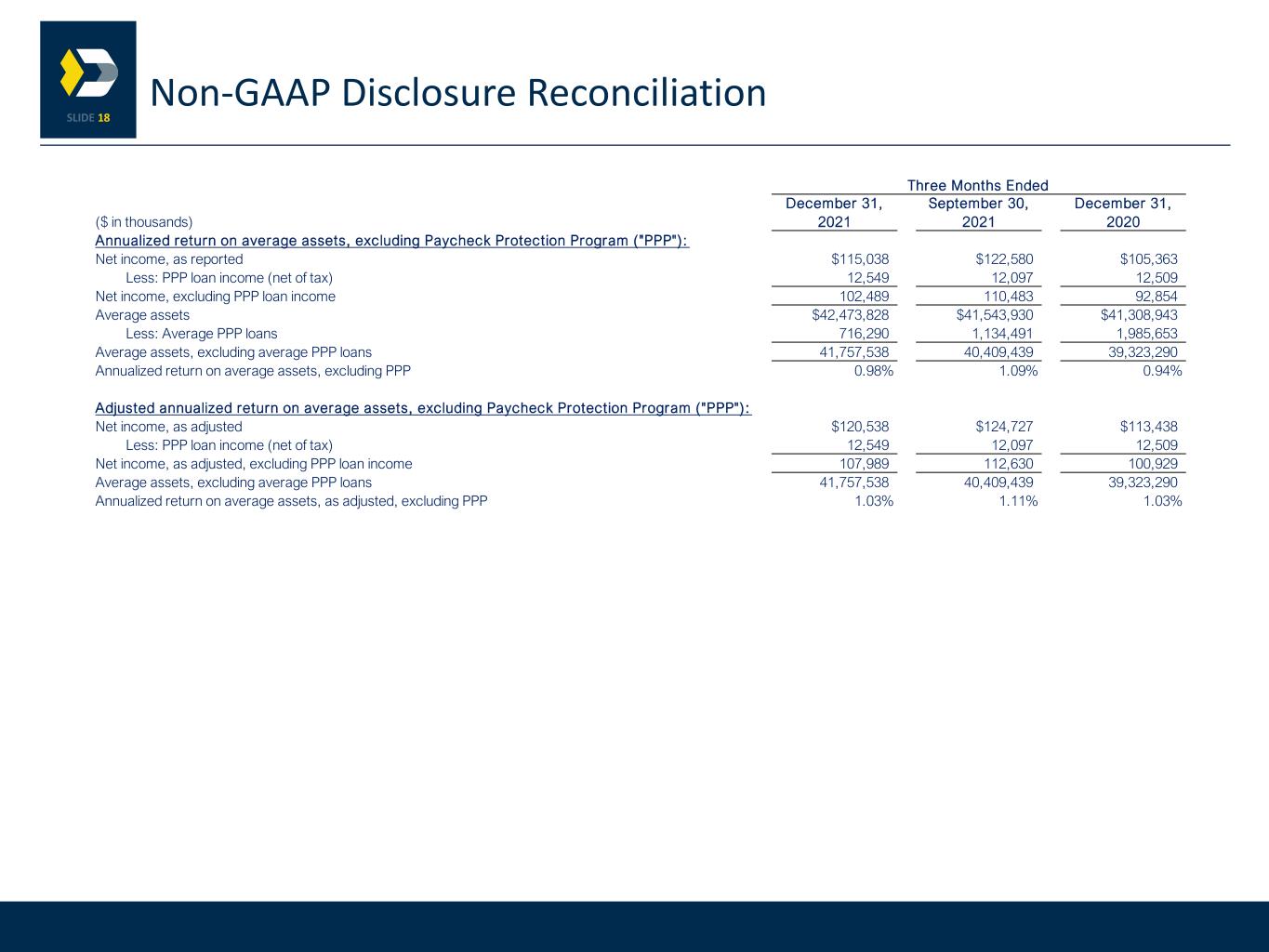

16 Non-GAAP Disclosure Reconciliation December 31, September 30, December 31, December 31, December 31, December 31, ($ in thousands, except for share data) 2021 2021 2020 2021 2020 2019 Adjusted net income available to common shareholders: Net income, as reported $115,038 $122,580 $105,363 $473,840 $390,606 $309,793 Less: Gain on sale leaseback transactions (net of tax) (a) — — — — — (56,414) Add: Losses on extinguishment of debt (net of tax) — — 6,958 6,024 8,649 22,992 Add: Net impairment losses on securities (net of tax) — — — — — 2,104 Add: Losses (gains) on available for sale and held to maturity securities transactions (net of tax) (b) 9 (565) (468) (390) (377) 108 Add: Severance expense (net of tax) (c) — — 1,489 1,489 1,489 3,477 Add: Tax credit investment impairment (net of tax) (d) — — — — — 1,746 Add: Litigation reserves (net of tax) (e) — 1,505 — 1,505 — — Add: Merger related expenses (net of tax) (f) 5,491 1,207 96 6,698 1,371 11,929 Add: Income tax expense (benefit) (g) — — — — — 31,123 Net income, as adjusted $120,538 $124,727 $113,438 $487,677 $401,738 $326,858 Dividends on preferred stock 3,172 3,172 3,172 12,688 12,688 12,688 Net income available to common shareholders, as adjusted $117,366 $121,555 $110,266 $474,989 $389,050 $314,170 (a) The gain on sale leaseback transactions is included in gains on the sales of assets within other non-interest income. (b) Included in gains on securities transactions, net within other non-interest income. (c) Severance expenses are included in salary and employee benefits expense. (d) Impairment is included in the amortization of tax credit investments. (e) Litigation reserve included in professional and legal fees. (f) Merger related expenses are primarily within salary and employee benefits expense, professional and legal fees, and other expense. (g) Income tax expense related to reserves for uncertain tax positions in 2019. Adjusted per common share data: Net income available to common shareholders, as adjusted $117,366 $121,555 $110,266 $474,989 $389,050 $314,170 Average number of shares outstanding 411,775,590 406,824,160 403,872,459 407,445,379 403,754,356 337,792,270 Basic earnings, as adjusted $0.29 $0.30 $0.27 $1.17 $0.96 $0.93 Average number of diluted shares outstanding 414,472,820 409,238,001 405,799,507 410,018,328 405,046,207 340,117,808 Diluted earnings, as adjusted $0.28 $0.30 $0.27 $1.16 $0.96 $0.92 Adjusted annualized return on average tangible shareholders' equity: Net income, as adjusted $120,538 $124,727 $113,438 $487,677 $401,738 $326,858 Average shareholders' equity 4,905,343 4,794,843 4,582,329 4,747,745 4,500,067 3,555,483 Less: Average goodwill and other intangible assets 1,481,951 1,446,760 1,447,838 1,457,519 1,454,349 1,182,140 Average tangible shareholders' equity 3,423,392 3,348,083 3,134,491 3,290,226 3,045,718 2,373,343 Annualized return on average tangible shareholders' equity, as adjusted 14.08% 14.90% 14.48% 14.82% 13.19% 13.77% Adjusted annualized return on average assets: Net income, as adjusted $120,538 $124,727 $113,438 $487,677 $401,738 $326,858 Average assets $42,473,828 $41,543,930 $41,308,943 $41,475,682 $40,557,346 $33,442,738 Annualized return on average assets, as adjusted 1.14% 1.20% 1.10% 1.18% 0.99% 0.98% Adjusted annualized return on average shareholders' equity: Net income, as adjusted $120,538 $124,727 $113,438 $487,677 $401,738 $326,858 Average shareholders' equity 4,905,343 4,794,843 $4,582,329 4,747,745 $4,500,067 $3,555,483 Annualized return on average shareholders' equity, as adjusted 9.83% 10.41% 9.90% 10.27% 8.93% 9.19% Three Months Ended Years Ended

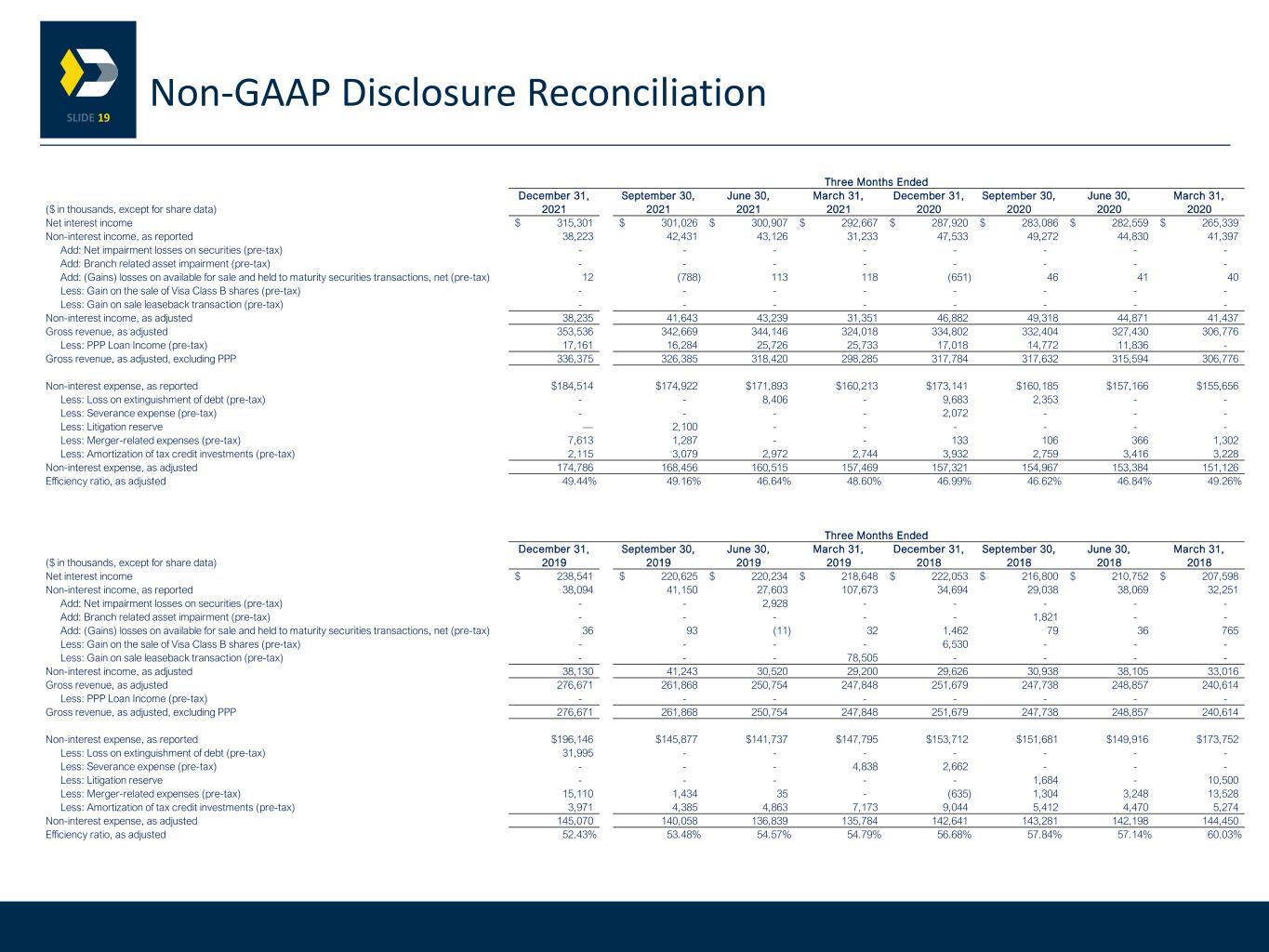

17 December 31, September 30, December 31, December 31, December 31, December 31, ($ in thousands) 2021 2021 2020 2021 2020 2019 Annualized return on average tangible shareholders' equity: Net income, as reported $115,038 $122,580 $105,363 $473,840 $390,606 $309,793 Average shareholders' equity 4,905,343 4,794,843 4,582,329 4,747,745 4,500,067 3,555,483 Less: Average goodwill and other intangible assets 1,481,951 1,446,760 1,447,838 1,457,519 1,454,349 1,182,140 Average tangible shareholders' equity 3,423,392 3,348,083 3,134,491 3,290,226 3,045,718 2,373,343 Annualized return on average tangible shareholders' equity 13.44% 14.64% 13.45% 14.40% 12.82% 13.05% Adjusted efficiency ratio: Non-interest expense, as reported $184,514 $174,922 $173,141 $691,542 $646,148 $631,555 Less: Loss on extinguishment of debt (pre-tax) — — 9,683 8,406 12,036 31,995 Less: Severance expense (pre-tax) — — 2,072 — 2,072 4,838 Less: Litigation reserve (pre-tax) — 2,100 — 2,100 — — Less: Merger-related expenses (pre-tax) 7,613 1,287 133 8,900 1,907 16,579 Less: Amortization of tax credit investments (pre-tax) 2,115 3,079 3,932 10,910 13,335 20,392 Non-interest expense, as adjusted $174,786 $168,456 $157,321 $661,226 $616,798 $557,751 Net interest income 315,301 301,026 287,920 1,209,901 1,118,904 898,048 Non-interest income, as reported 38,223 42,431 47,533 155,013 183,032 214,520 Add: (Gains) losses on available for sale and held to maturity securities transactions, net (pre-tax) 12 (788) (651) (545) (524) 150 Non-interest income, as adjusted $38,235 $41,643 $46,882 $154,468 $182,508 $139,093 Gross operating income, as adjusted 353,536 $342,669 $334,802 1,364,369 $1,301,412 $1,037,141 Efficiency ratio, as adjusted 49.44% 49.16% 46.99% 48.46% 47.39% 53.78% Annualized pre-provision net revenue / average assets Net interest income $315,301 $301,026 $287,920 $1,209,901 $1,118,904 $898,048 Non-interest income, as reported 38,223 42,431 47,533 155,013 183,032 214,520 Less: Non-interest expense, as reported 184,514 174,922 173,141 691,542 646,148 631,555 Pre-provision net revenue $169,010 $168,535 $162,312 $673,372 $655,788 $481,013 Average assets $42,473,828 $41,543,930 $41,308,943 $41,475,682 $40,557,346 $33,442,738 Annualized pre-provision net revenue / average assets 1.59% 1.62% 1.57% 1.62% 1.62% 1.44% Annualized pre-provision net revenue / average assets, as adjusted Net interest income $315,301 $301,026 $287,920 $1,209,901 $1,118,904 $898,048 Non-interest income, as adjusted 38,235 41,643 46,882 154,468 182,508 139,093 Less: Non-interest expense, as adjusted 174,786 168,456 157,321 661,226 616,798 557,751 Pre-provision net revenue, as adjusted $178,750 $174,213 $177,481 $703,143 $684,614 $479,390 Average assets $42,473,828 $41,543,930 $41,308,943 $41,475,682 $40,557,346 $33,442,738 Annualized pre-provision net revenue / average assets, as adjusted 1.68% 1.68% 1.72% 1.70% 1.69% 1.43% Three Months Ended Years Ended Non-GAAP Disclosure Reconciliation

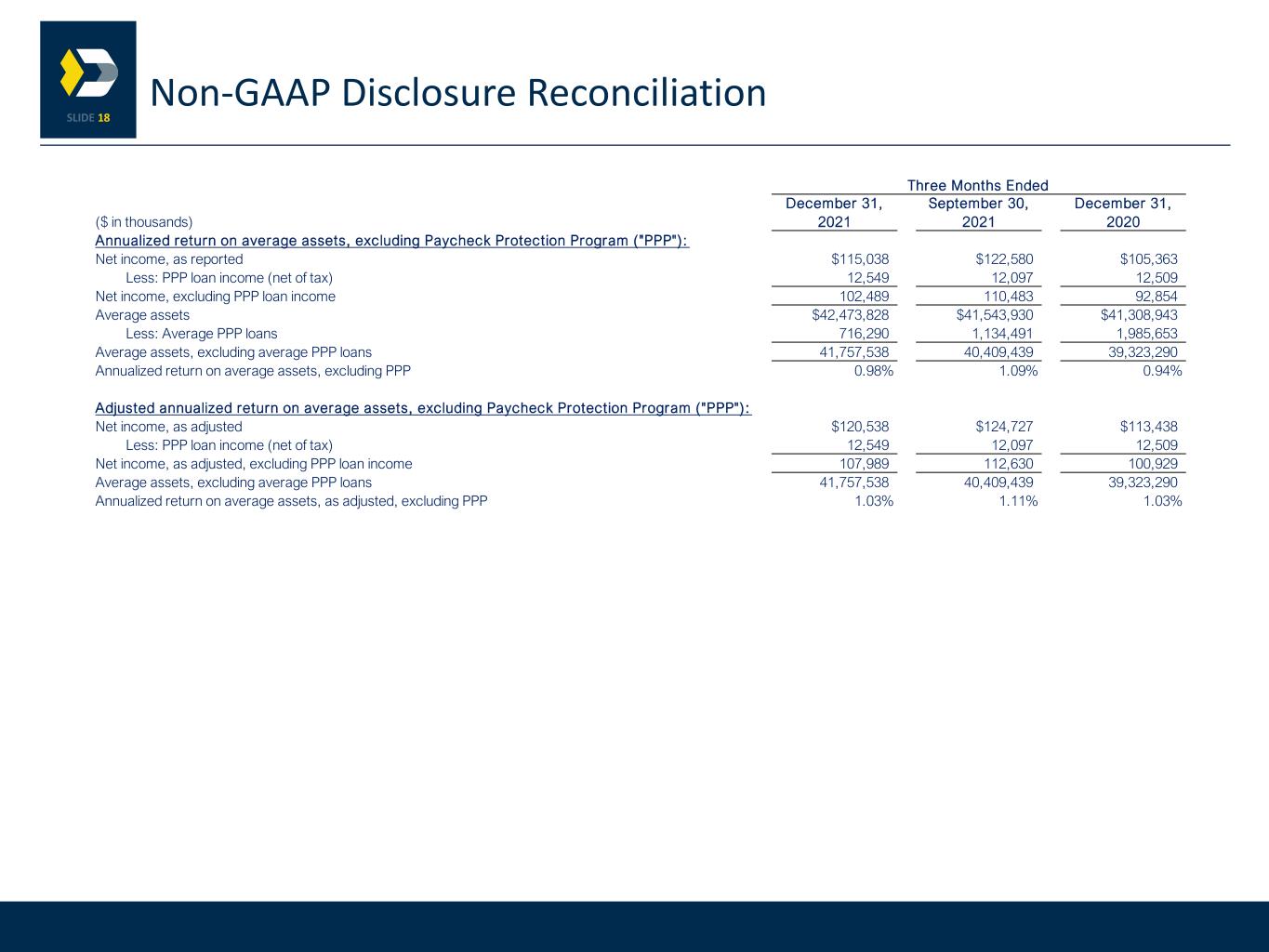

18 December 31, September 30, December 31, ($ in thousands) 2021 2021 2020 Annualized return on average assets, excluding Paycheck Protection Program ("PPP"): Net income, as reported $115,038 $122,580 $105,363 Less: PPP loan income (net of tax) 12,549 12,097 12,509 Net income, excluding PPP loan income 102,489 110,483 92,854 Average assets $42,473,828 $41,543,930 $41,308,943 Less: Average PPP loans 716,290 1,134,491 1,985,653 Average assets, excluding average PPP loans 41,757,538 40,409,439 39,323,290 Annualized return on average assets, excluding PPP 0.98% 1.09% 0.94% Adjusted annualized return on average assets, excluding Paycheck Protection Program ("PPP"): Net income, as adjusted $120,538 $124,727 $113,438 Less: PPP loan income (net of tax) 12,549 12,097 12,509 Net income, as adjusted, excluding PPP loan income 107,989 112,630 100,929 Average assets, excluding average PPP loans 41,757,538 40,409,439 39,323,290 Annualized return on average assets, as adjusted, excluding PPP 1.03% 1.11% 1.03% Three Months Ended Non-GAAP Disclosure Reconciliation

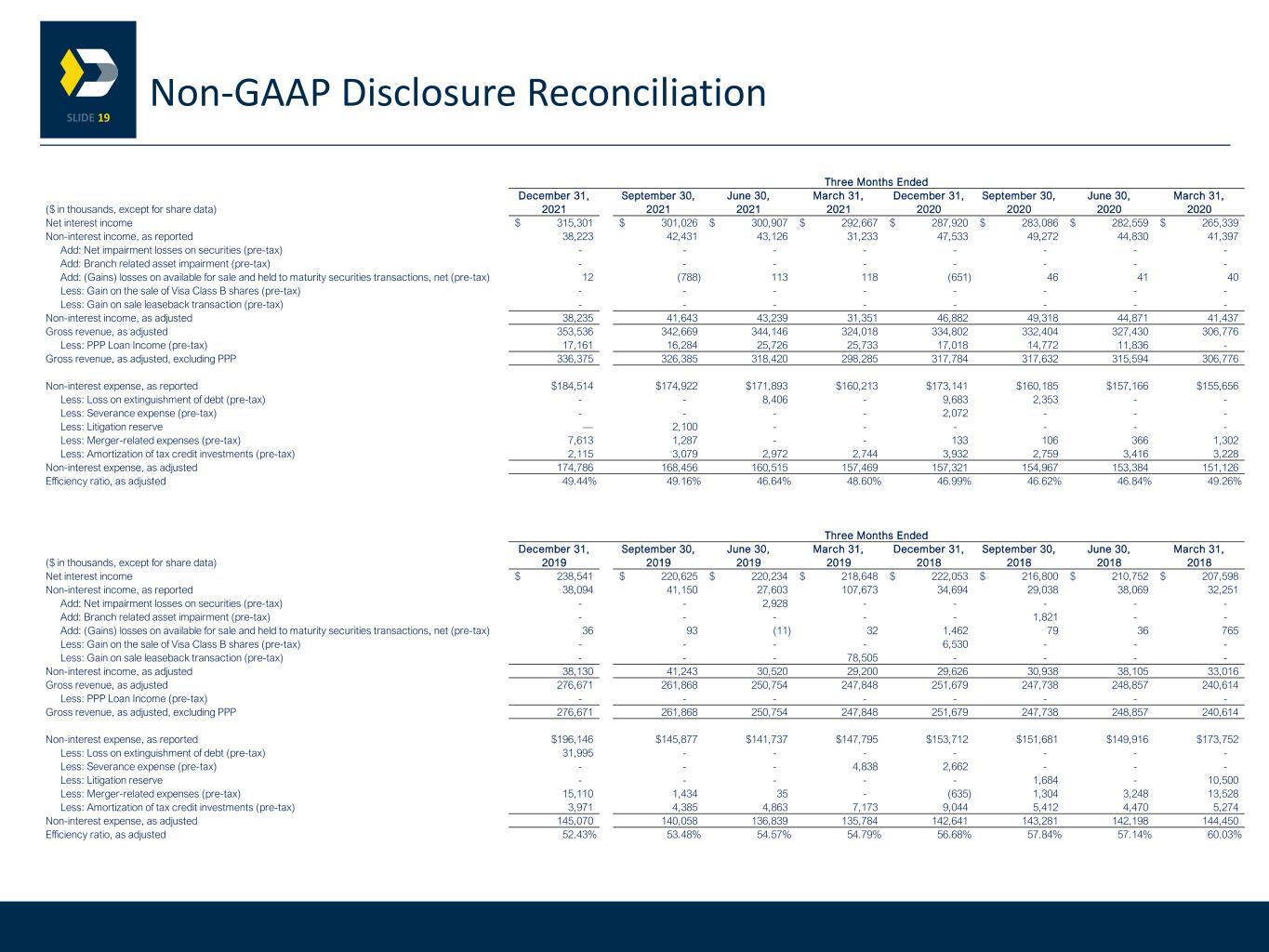

19 December 31, September 30, June 30, March 31, December 31, September 30, June 30, March 31, ($ in thousands, except for share data) 2021 2021 2021 2021 2020 2020 2020 2020 Net interest income 315,301$ 301,026$ 300,907$ 292,667$ 287,920$ 283,086$ 282,559$ 265,339$ Non-interest income, as reported 38,223 42,431 43,126 31,233 47,533 49,272 44,830 41,397 Add: Net impairment losses on securities (pre-tax) - - - - - - - - Add: Branch related asset impairment (pre-tax) - - - - - - - - Add: (Gains) losses on available for sale and held to maturity securities transactions, net (pre-tax) 12 (788) 113 118 (651) 46 41 40 Less: Gain on the sale of Visa Class B shares (pre-tax) - - - - - - - - Less: Gain on sale leaseback transaction (pre-tax) - - - - - - - - Non-interest income, as adjusted 38,235 41,643 43,239 31,351 46,882 49,318 44,871 41,437 Gross revenue, as adjusted 353,536 342,669 344,146 324,018 334,802 332,404 327,430 306,776 Less: PPP Loan Income (pre-tax) 17,161 16,284 25,726 25,733 17,018 14,772 11,836 - Gross revenue, as adjusted, excluding PPP 336,375 326,385 318,420 298,285 317,784 317,632 315,594 306,776 Non-interest expense, as reported $184,514 $174,922 $171,893 $160,213 $173,141 $160,185 $157,166 $155,656 Less: Loss on extinguishment of debt (pre-tax) - - 8,406 - 9,683 2,353 - - Less: Severance expense (pre-tax) - - - - 2,072 - - - Less: Litigation reserve — 2,100 - - - - - - Less: Merger-related expenses (pre-tax) 7,613 1,287 - - 133 106 366 1,302 Less: Amortization of tax credit investments (pre-tax) 2,115 3,079 2,972 2,744 3,932 2,759 3,416 3,228 Non-interest expense, as adjusted 174,786 168,456 160,515 157,469 157,321 154,967 153,384 151,126 Efficiency ratio, as adjusted 49.44% 49.16% 46.64% 48.60% 46.99% 46.62% 46.84% 49.26% December 31, September 30, June 30, March 31, December 31, September 30, June 30, March 31, ($ in thousands, except for share data) 2019 2019 2019 2019 2018 2018 2018 2018 Net interest income 238,541$ 220,625$ 220,234$ 218,648$ 222,053$ 216,800$ 210,752$ 207,598$ Non-interest income, as reported 38,094 41,150 27,603 107,673 34,694 29,038 38,069 32,251 Add: Net impairment losses on securities (pre-tax) - - 2,928 - - - - - Add: Branch related asset impairment (pre-tax) - - - - - 1,821 - - Add: (Gains) losses on available for sale and held to maturity securities transactions, net (pre-tax) 36 93 (11) 32 1,462 79 36 765 Less: Gain on the sale of Visa Class B shares (pre-tax) - - - - 6,530 - - - Less: Gain on sale leaseback transaction (pre-tax) - - - 78,505 - - - - Non-interest income, as adjusted 38,130 41,243 30,520 29,200 29,626 30,938 38,105 33,016 Gross revenue, as adjusted 276,671 261,868 250,754 247,848 251,679 247,738 248,857 240,614 Less: PPP Loan Income (pre-tax) - - - - - - - - Gross revenue, as adjusted, excluding PPP 276,671 261,868 250,754 247,848 251,679 247,738 248,857 240,614 Non-interest expense, as reported $196,146 $145,877 $141,737 $147,795 $153,712 $151,681 $149,916 $173,752 Less: Loss on extinguishment of debt (pre-tax) 31,995 - - - - - - - Less: Severance expense (pre-tax) - - - 4,838 2,662 - - - Less: Litigation reserve - - - - - 1,684 - 10,500 Less: Merger-related expenses (pre-tax) 15,110 1,434 35 - (635) 1,304 3,248 13,528 Less: Amortization of tax credit investments (pre-tax) 3,971 4,385 4,863 7,173 9,044 5,412 4,470 5,274 Non-interest expense, as adjusted 145,070 140,058 136,839 135,784 142,641 143,281 142,198 144,450 Efficiency ratio, as adjusted 52.43% 53.48% 54.57% 54.79% 56.68% 57.84% 57.14% 60.03% Three Months Ended Three Months Ended Non-GAAP Disclosure Reconciliation

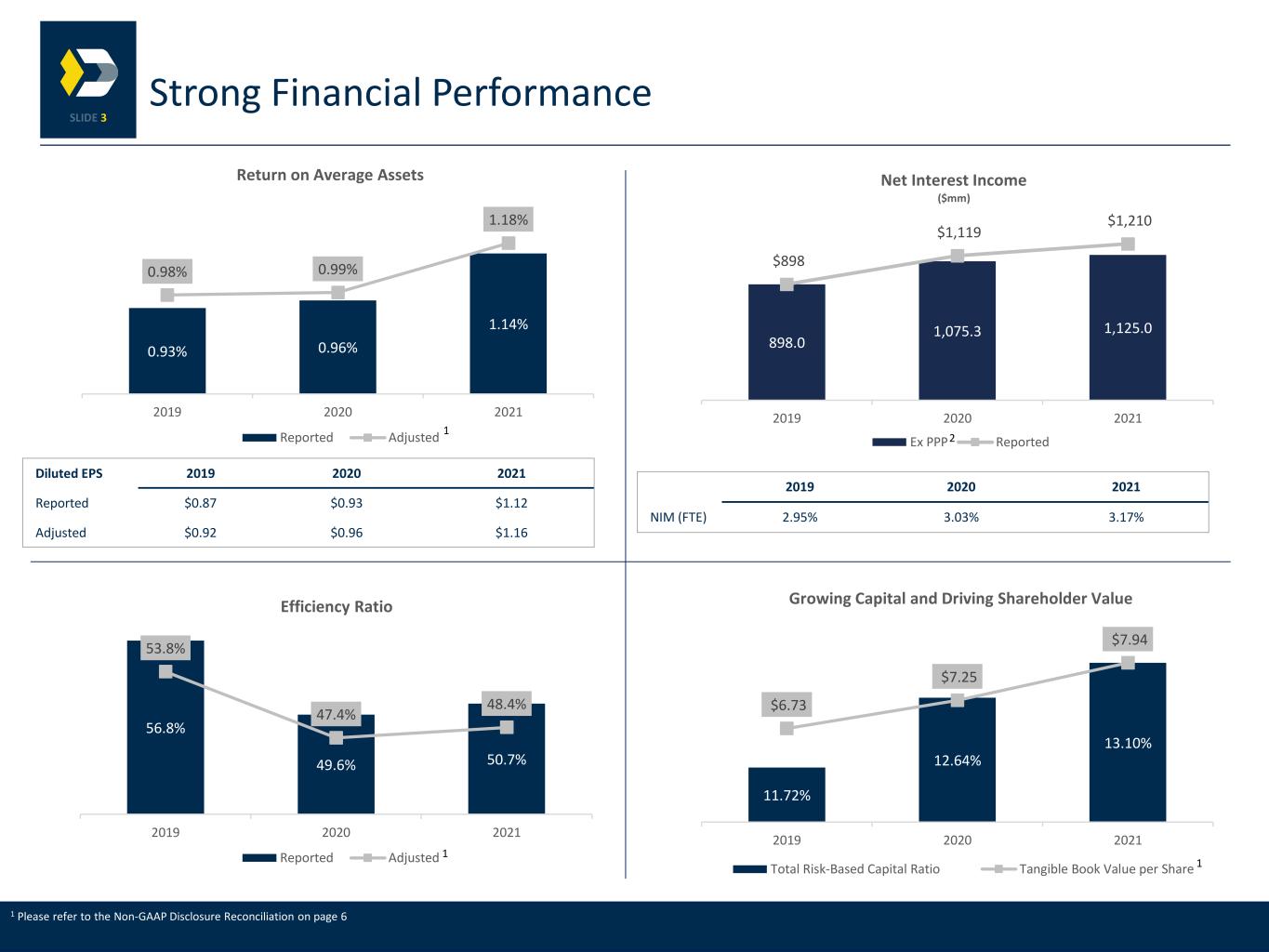

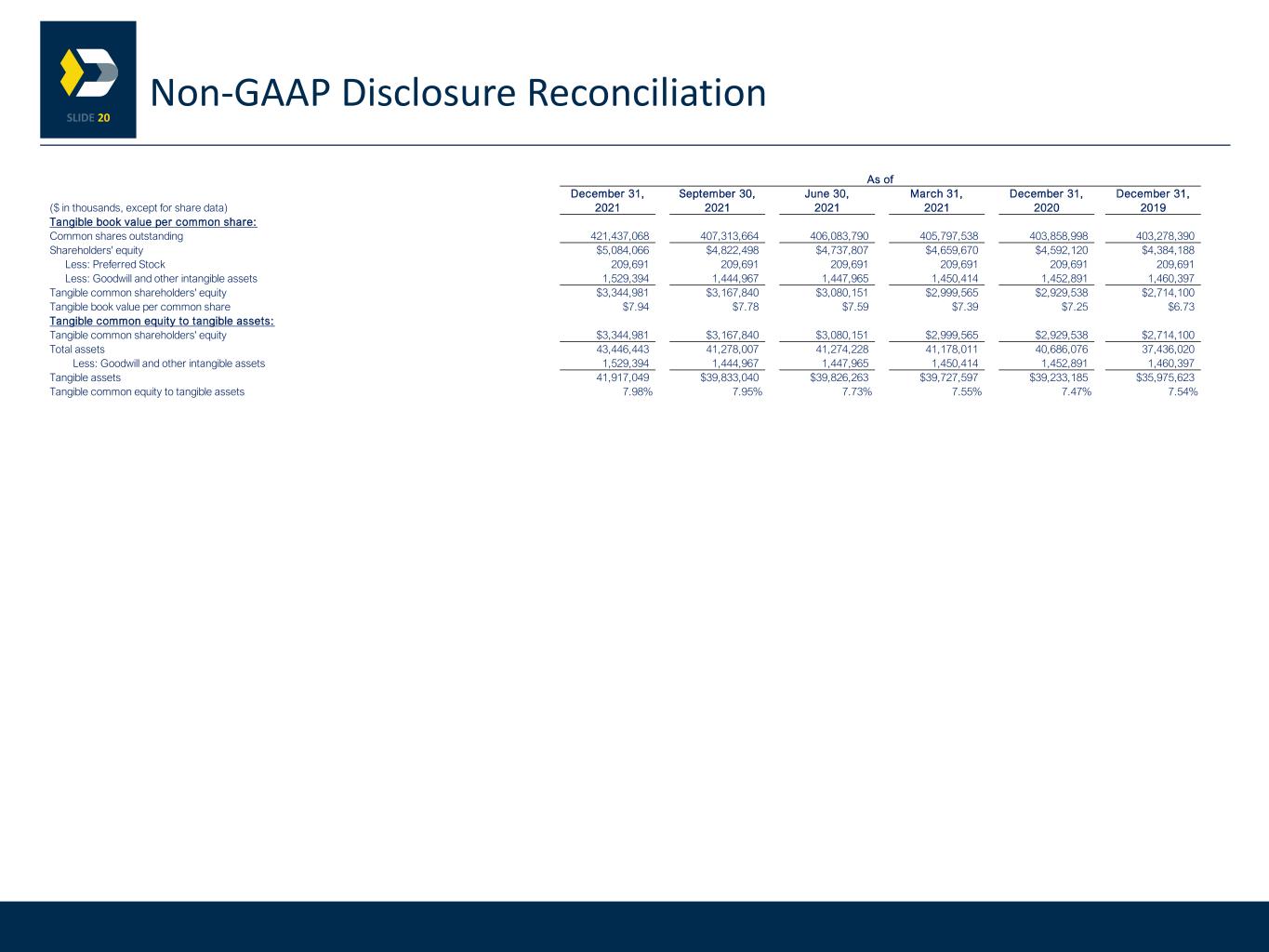

20 December 31, September 30, June 30, March 31, December 31, December 31, ($ in thousands, except for share data) 2021 2021 2021 2021 2020 2019 Tangible book value per common share: Common shares outstanding 421,437,068 407,313,664 406,083,790 405,797,538 403,858,998 403,278,390 Shareholders' equity $5,084,066 $4,822,498 $4,737,807 $4,659,670 $4,592,120 $4,384,188 Less: Preferred Stock 209,691 209,691 209,691 209,691 209,691 209,691 Less: Goodwill and other intangible assets 1,529,394 1,444,967 1,447,965 1,450,414 1,452,891 1,460,397 Tangible common shareholders' equity $3,344,981 $3,167,840 $3,080,151 $2,999,565 $2,929,538 $2,714,100 Tangible book value per common share $7.94 $7.78 $7.59 $7.39 $7.25 $6.73 Tangible common equity to tangible assets: Tangible common shareholders' equity $3,344,981 $3,167,840 $3,080,151 $2,999,565 $2,929,538 $2,714,100 Total assets 43,446,443 41,278,007 41,274,228 41,178,011 40,686,076 37,436,020 Less: Goodwill and other intangible assets 1,529,394 1,444,967 1,447,965 1,450,414 1,452,891 1,460,397 Tangible assets 41,917,049 $39,833,040 $39,826,263 $39,727,597 $39,233,185 $35,975,623 Tangible common equity to tangible assets 7.98% 7.95% 7.73% 7.55% 7.47% 7.54% As of Non-GAAP Disclosure Reconciliation

21 ▪ Log onto our website: www.valley.com ▪ Email requests to: tlan@valley.com ▪ Call Travis Lan in Investor Relations, at: (973) 686-5007 ▪ Write to: Valley National Bank 1455 Valley Road Wayne, New Jersey 07470 Attn: Travis Lan, SVP – Director, Corporate Finance & Business Development ▪ Log onto our website above or www.sec.gov to obtain free copies of documents filed by Valley with the SEC For More Information