Exhibit 99.1

Lehman Brothers 2004 Financial Services Conference

September 15, 2004

Information For Investors And Shareholders

This presentation contains forward-looking statements concerning Valley’s future business outlook, financial condition and operating results. Generally, the words “will,” “may,” “should,” “continue,” “believes,” “expects,” “anticipates” or similar expressions identify forward-looking statements. Readers are advised not to place undue reliance on these forward-looking statements as they are influenced by certain risk factors and unpredictable events. Factors that could cause actual results to differ materially from those predicted by the forward-looking statements include among others:

1. Increased competitive pressure among banking and/or financial services companies

2. Adverse changes in the interest rate environment, causing reduced interest margins

3. Unexpected changes in the securities market

4. Decline in general economic conditions, whether nationally or in the market areas where Valley operates

5. New legislation or regulatory changes that may disrupt the course of business

6. Tax strategies and effective income tax rates

NOTE: Valley disclaims any obligation to update or revise forward-looking statements based on the occurrence of future events.

2

Overview of Valley National Bancorp

77 Year Commercial Banking History

Listed on the NYSE: VLY (ten years as of December 5, 2003)

Consistent Shareholder Returns

Strong Financial Performance

Sound Asset Quality

Management Longevity/Ownership

NJ Marketplace Marketing Opportunity

Business Lending Initiative

3

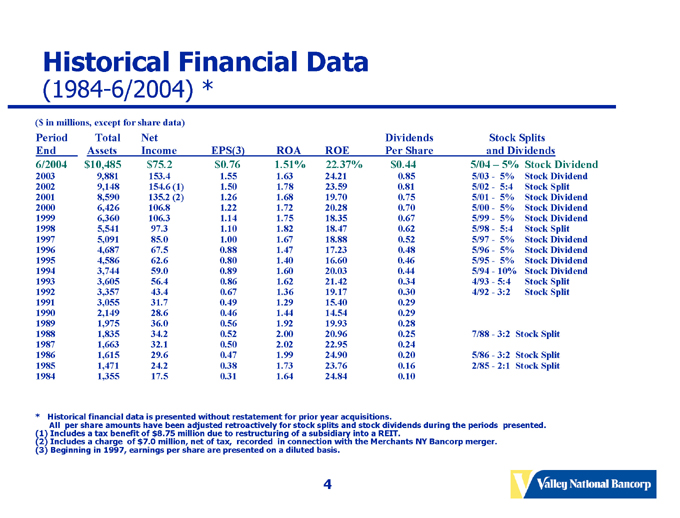

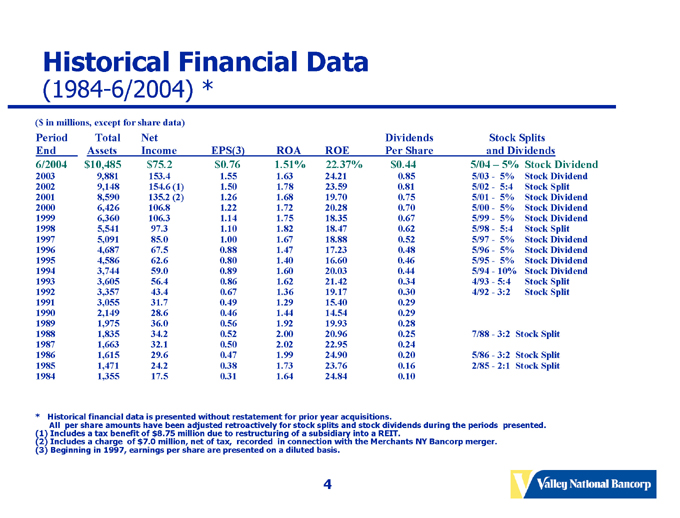

Historical Financial Data

(1984-6/2004) *

($ in millions, except for share data)

Period End Total Assets Net Income EPS(3) ROA ROE Dividends Per Share Stock Splits and Dividends

6/2004 $10,485 $75.2 $0.76 1.51% 22.37% $ 0.44 5/04 – 5% Stock Dividend

2003 9,881 153.4 1.55 1.63 24.21 0.85 5/03 - 5% Stock Dividend

2002 9,148 154.6 (1) 1.50 1.78 23.59 0.81 5/02 - 5:4 Stock Split

2001 8,590 135.2 (2) 1.26 1.68 19.70 0.75 5/01 - 5% Stock Dividend

2000 6,426 106.8 1.22 1.72 20.28 0.70 5/00 - 5% Stock Dividend

1999 6,360 106.3 1.14 1.75 18.35 0.67 5/99 - 5% Stock Dividend

1998 5,541 97.3 1.10 1.82 18.47 0.62 5/98 - 5:4 Stock Split

1997 5,091 85.0 1.00 1.67 18.88 0.52 5/97 - 5% Stock Dividend

1996 4,687 67.5 0.88 1.47 17.23 0.48 5/96 - 5% Stock Dividend

1995 4,586 62.6 0.80 1.40 16.60 0.46 5/95 - 5% Stock Dividend

1994 3,744 59.0 0.89 1.60 20.03 0.44 5/94 - 10% Stock Dividend

1993 3,605 56.4 0.86 1.62 21.42 0.34 4/93 - 5:4 Stock Split

1992 3,357 43.4 0.67 1.36 19.17 0.30 4/92 - 3:2 Stock Split

1991 3,055 31.7 0.49 1.29 15.40 0.29

1990 2,149 28.6 0.46 1.44 14.54 0.29

1989 1,975 36.0 0.56 1.92 19.93 0.28

1988 1,835 34.2 0.52 2.00 20.96 0.25 7/88 - 3:2 Stock Split

1987 1,663 32.1 0.50 2.02 22.95 0.24

1986 1,615 29.6 0.47 1.99 24.90 0.20 5/86 - 3:2 Stock Split

1985 1,471 24.2 0.38 1.73 23.76 0.16 2/85 - 2:1 Stock Split

1984 1,355 17.5 0.31 1.64 24.84 0.10

* Historical financial data is presented without restatement for prior year acquisitions.

All per share amounts have been adjusted retroactively for stock splits and stock dividends during the periods presented. (1) Includes a tax benefit of $8.75 million due to restructuring of a subsidiary into a REIT.

(2) Includes a charge of $7.0 million, net of tax, recorded in connection with the Merchants NY Bancorp merger.

(3) Beginning in 1997, earnings per share are presented on a diluted basis.

4

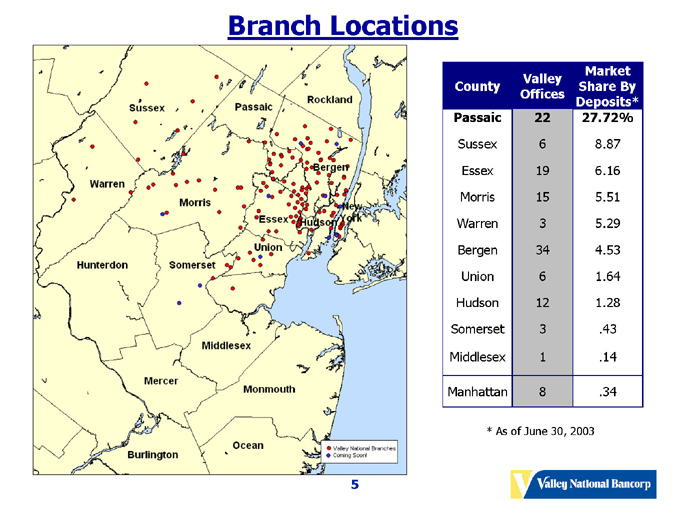

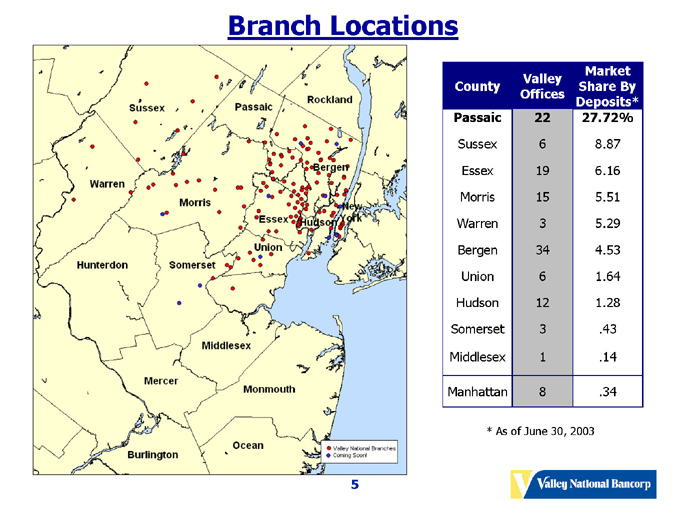

Branch Locations

Market Share By Deposits*

Valley Offices

County

Passaic 22 27.72%

Sussex 6 8.87

Essex 19 6.16

Morris 15 5.51

Warren 3 5.29

Bergen 34 4.53

Union 6 1.64

Hudson 12 1.28

Somerset 3 .43

Middlesex 1 .14

Manhattan 8 .34

* As of June 30, 2003

5

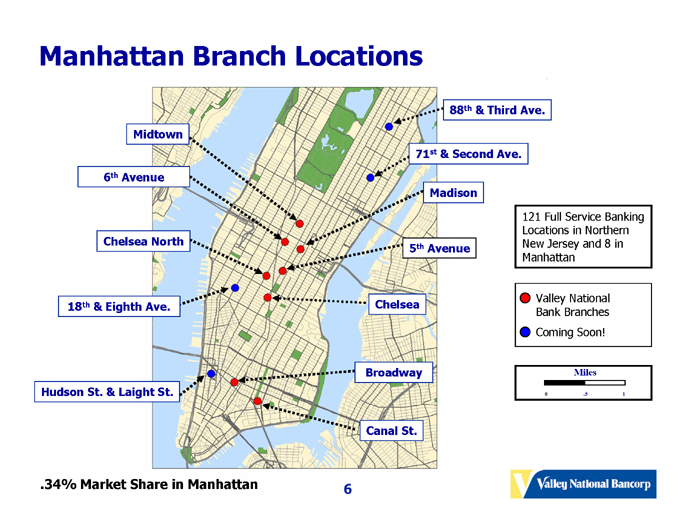

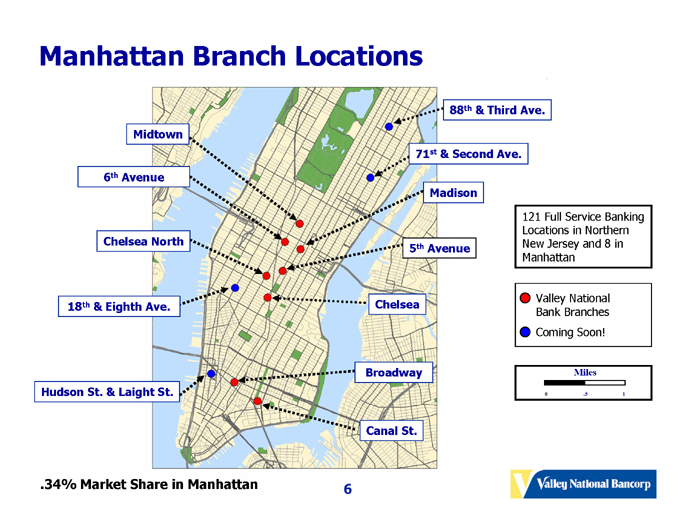

Manhattan Branch Locations

Midtown

6th Avenue

Chelsea North

18th & Eighth Ave.

Hudson St. & Laight St.

88th & Third Ave.

71st & Second Ave.

Madison

5th Avenue

Chelsea

Broadway

Canal St.

121 Full Service Banking Locations in Northern New Jersey and 8 in Manhattan

Valley National Bank Branches Coming Soon!

Miles

0 .5 1

.34% Market Share in Manhattan

6

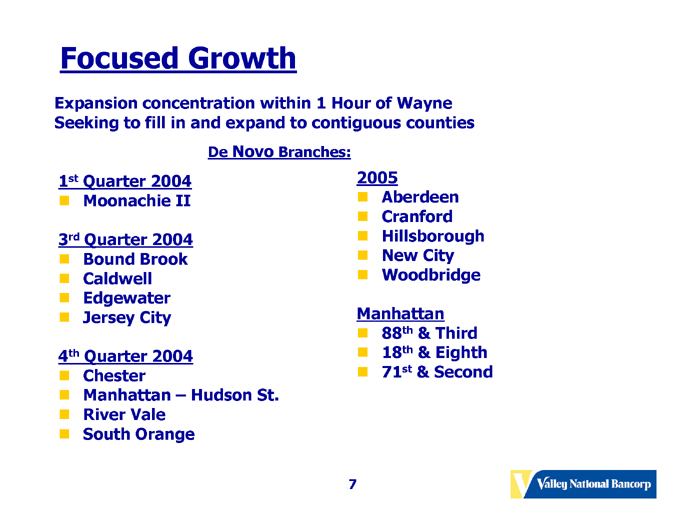

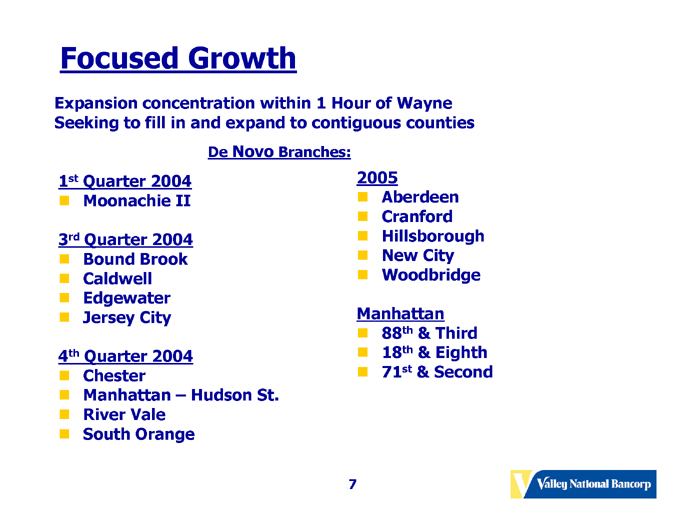

Focused Growth

Expansion concentration within 1 Hour of Wayne Seeking to fill in and expand to contiguous counties

De Novo Branches:

1st Quarter 2004

Moonachie II

3rd Quarter 2004

Bound Brook

Caldwell

Edgewater

Jersey City

4th Quarter 2004

Chester

Manhattan – Hudson St.

River Vale

South Orange

2005

Aberdeen

Cranford

Hillsborough

New City

Woodbridge

Manhattan

88th & Third

18th & Eighth

71st & Second

7

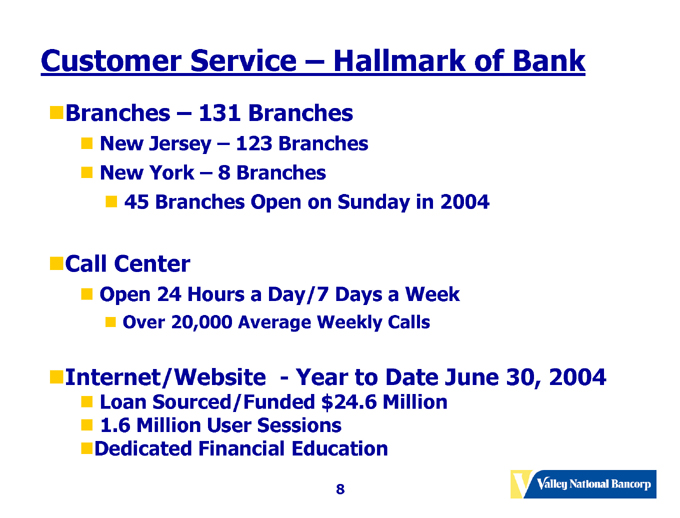

Customer Service – Hallmark of Bank

Branches – 131 Branches

New Jersey – 123 Branches

New York – 8 Branches

45 Branches Open on Sunday in 2004

Call Center

Open 24 Hours a Day/7 Days a Week

Over 20,000 Average Weekly Calls

Internet/Website—Year to Date June 30, 2004

Loan Sourced/Funded $24.6 Million

1.6 Million User Sessions

Dedicated Financial Education

8

Focus on Earnings

Loan Driven Asset Growth

Strong Credit Culture

Centralized Lending - Character Lending - Personal Guarantees

Small Business Lending Initiative

BDO Effort

Exceptional Asset Quality

Low Level of Net Charge-offs, NPAs, and Delinquencies

Effective Cost Control

Total Overhead Expense as a Percentage of Average Assets

Valley – 2.15% Peer Group – 2.88%

Stable Net Interest Margin

Historical Range 4.00% - 4.65%

9

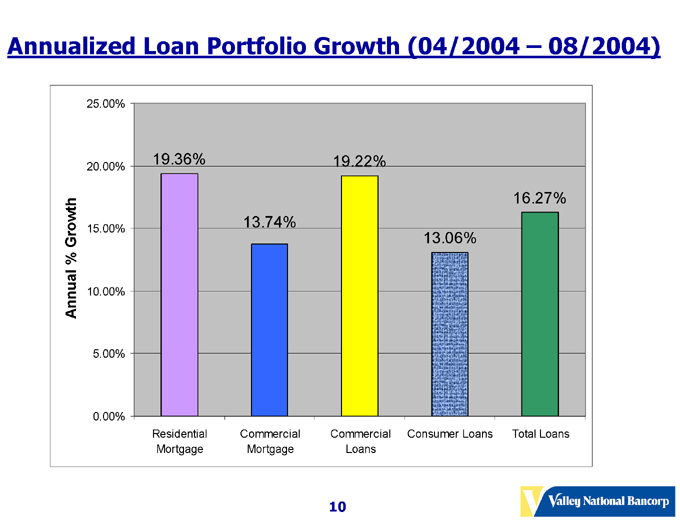

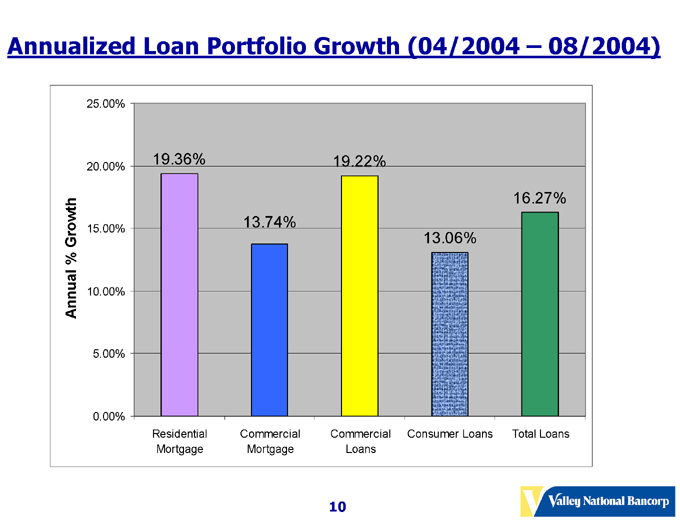

Annualized Loan Portfolio Growth (04/2004 – 08/2004)

Annual % Growth

25.00% 20.00% 15.00% 10.00% 5.00% 0.00%

Residential Mortgage Commercial Mortgage Commercial Loans Consumer Loans Total Loans

19.36% 13.74% 19.22% 13.06% 16.27%

10

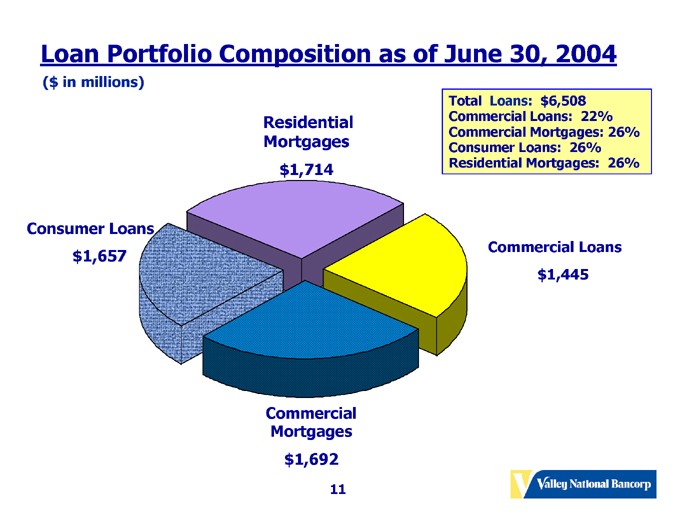

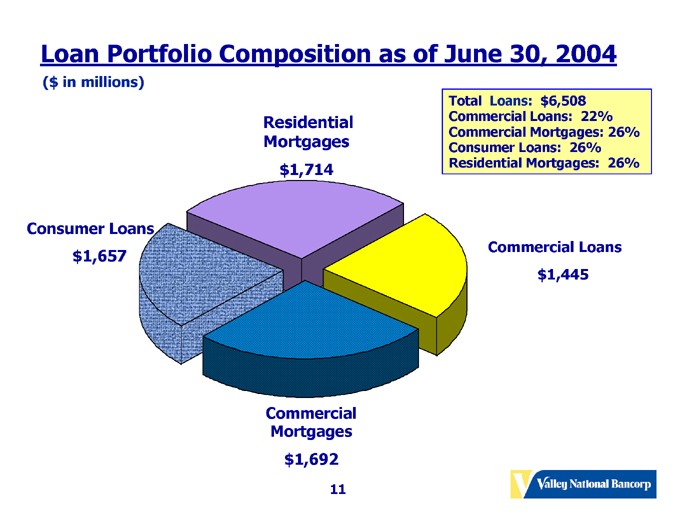

Loan Portfolio Composition as of June 30, 2004

($ in millions)

Total Loans: $6,508

Commercial Loans: 22%

Commercial Mortgages: 26%

Consumer Loans: 26%

Residential Mortgages: 26%

Residential Mortgages $1,714

Consumer Loans $1,657

Commercial Mortgages $1,692

Commercial Loans $1,445

11

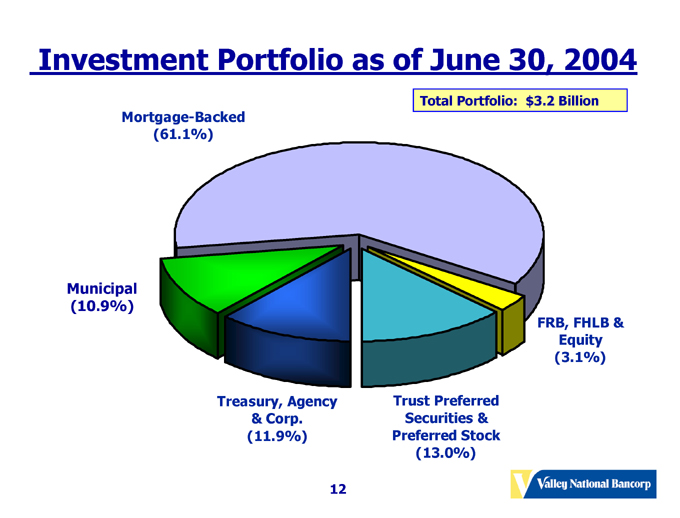

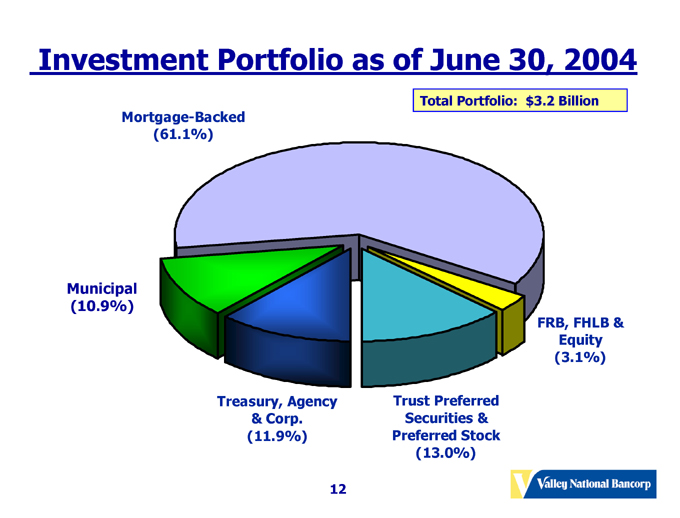

Investment Portfolio as of June 30, 2004

Mortgage-Backed (61.1%)

Total Portfolio: $3.2 Billion

Municipal (10.9%)

Treasury, Agency & Corp. (11.9%)

Trust Preferred Securities & Preferred Stock (13.0%)

FRB, FHLB & Equity (3.1%)

12

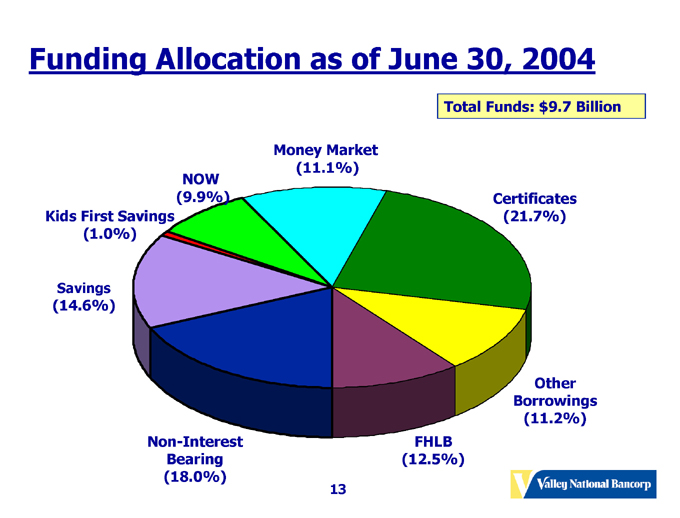

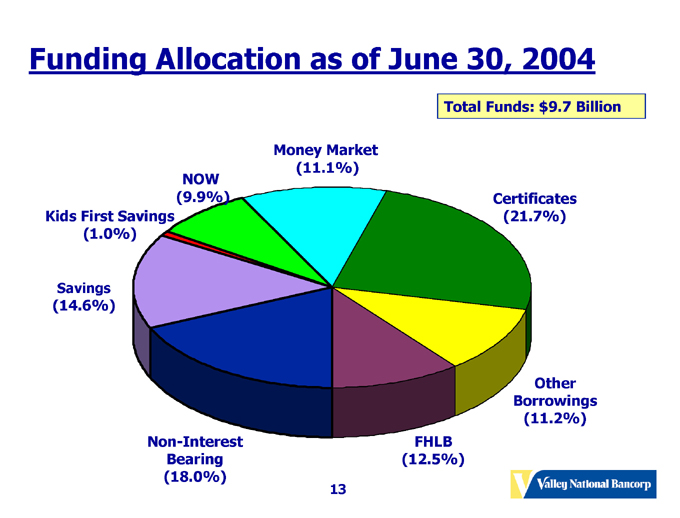

Funding Allocation as of June 30, 2004

Total Funds: $9.7 Billion

Money Market (11.1%)

NOW (9.9%)

Kids First Savings (1.0%)

Savings (14.6%)

Non-Interest Bearing (18.0%)

Certificates (21.7%)

Borrowings (11.2%)

FHLB (12.5%)

13

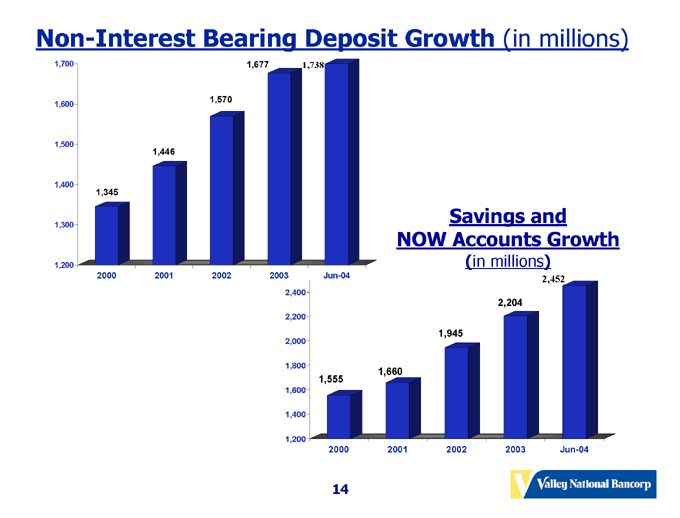

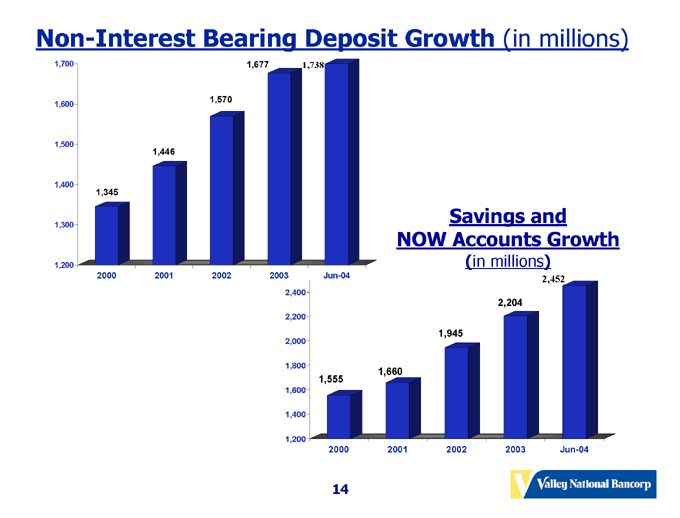

Non-Interest Bearing Deposit Growth (in millions)

1,700 1,600 1,500 1,400 1,300 1,200

1,345 1,446 1,570 1,677 1,738

Savings and NOW Accounts Growth

(in millions)

2000 2001 2002 2003 Jun-04

2,400 2,200 2,000 1,800 1,600 1,400 1,200

2000 2001 2002 2003 Jun-04

1,555 1,660 1,945 2,204 2,452

14

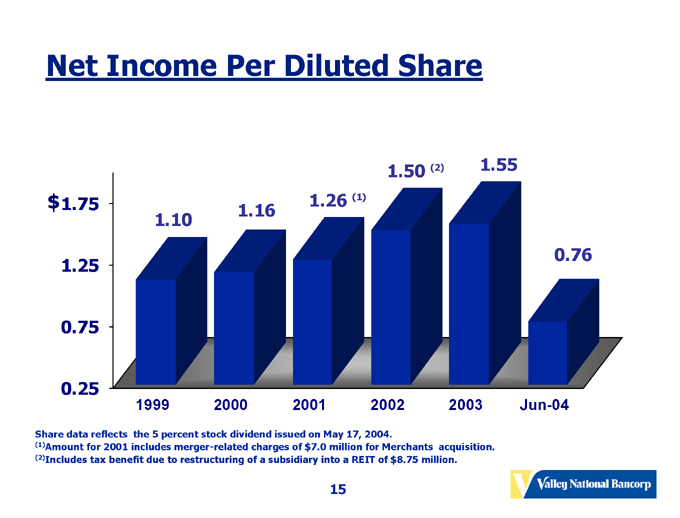

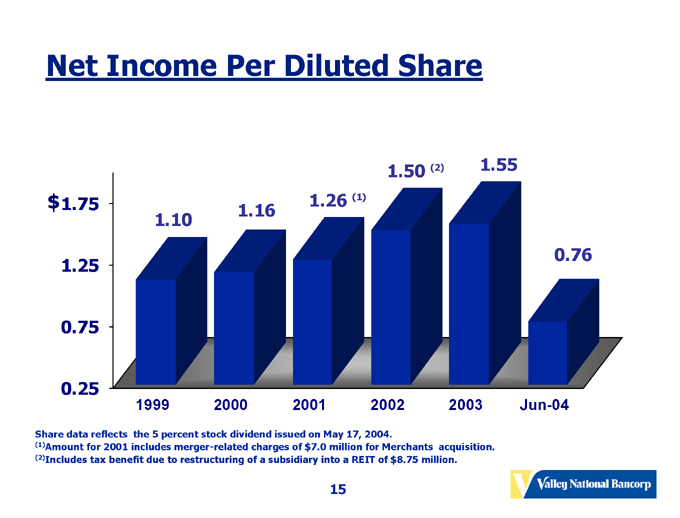

Net Income Per Diluted Share

$1.75 1.25 0.75 0.25

1.10 1.16 1.26 (1) 1.50 (2) 1.55 0.76

1999 2000 2001 2002 2003 Jun-04

Share data reflects the 5 percent stock dividend issued on May 17, 2004.

(1)Amount for 2001 includes merger-related charges of $7.0 million for Merchants acquisition.

(2)Includes tax benefit due to restructuring of a subsidiary into a REIT of $8.75 million.

15

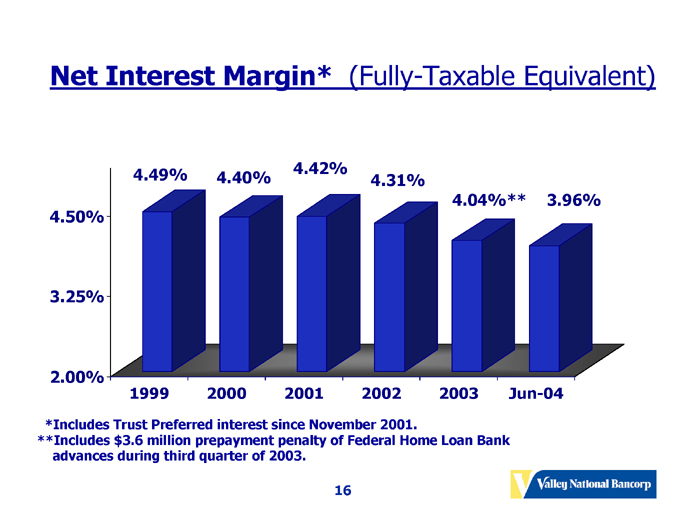

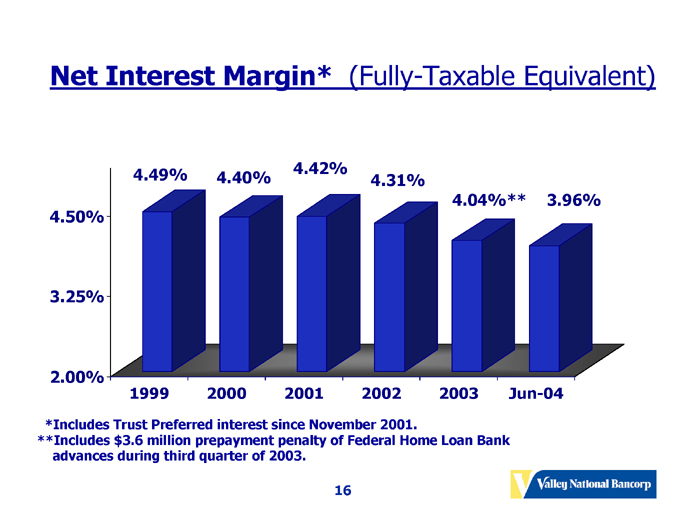

Net Interest Margin* (Fully-Taxable Equivalent)

4.50% 3.25% 2.00%

4.49% 4.40% 4.42% 4.31% 4.04%** 3.96%

1999 2000 2001 2002 2003 Jun-04

*Includes Trust Preferred interest since November 2001.

**Includes $3.6 million prepayment penalty of Federal Home Loan Bank advances during third quarter of 2003.

16

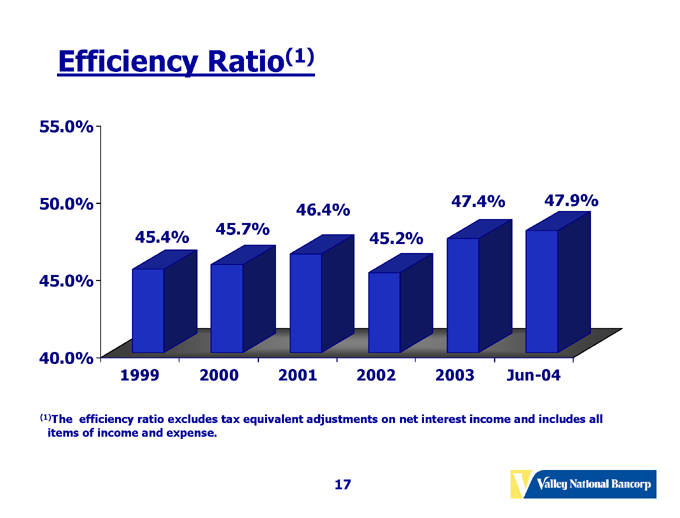

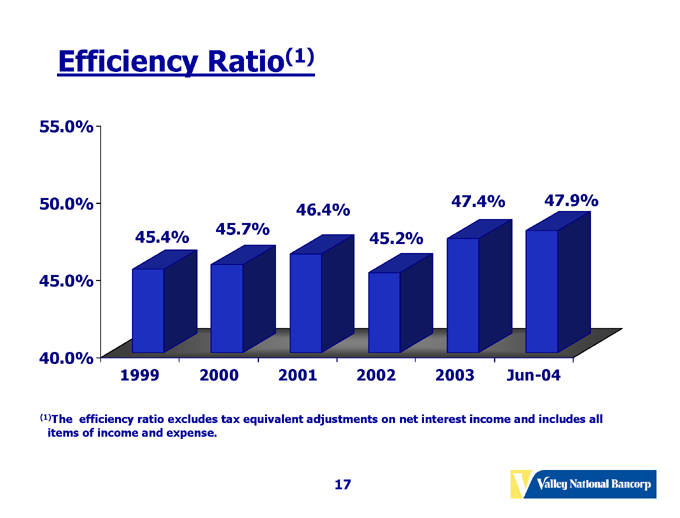

Efficiency Ratio(1)

55.0% 50.0% 45.0% 40.0%

45.4% 45.7% 46.4% 45.2% 47.4% 47.9%

1999 2000 2001 2002 2003 Jun-04

(1)The efficiency ratio excludes tax equivalent adjustments on net interest income and includes all items of income and expense.

17

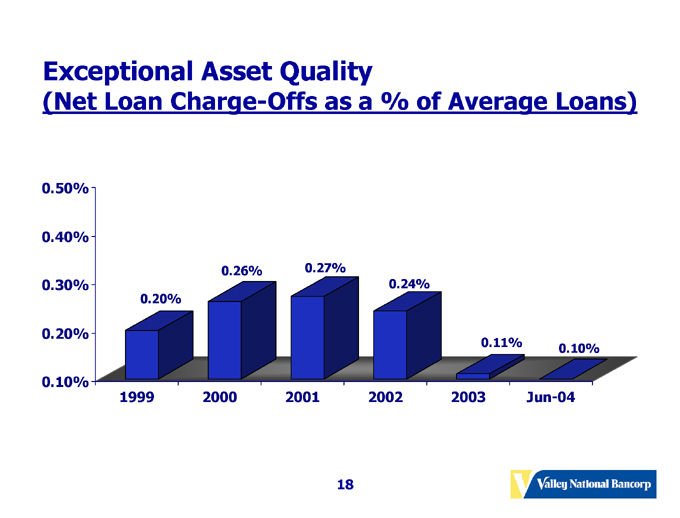

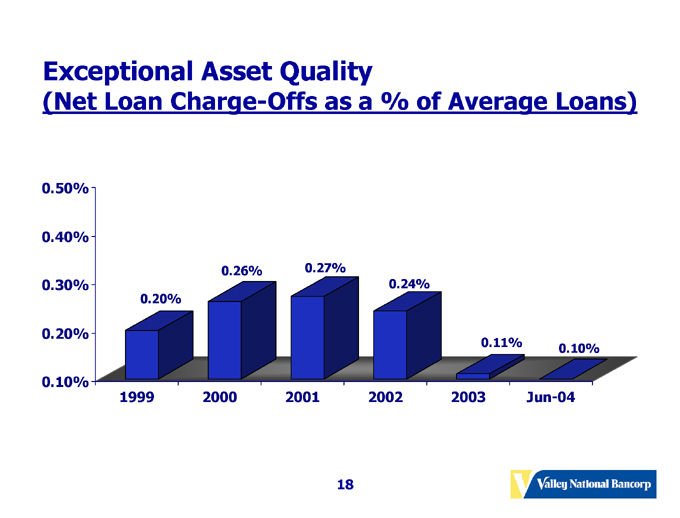

Exceptional Asset Quality

(Net Loan Charge-Offs as a % of Average Loans)

0.50% 0.40% 0.30% 0.20% 0.10%

1999 2000 2001 2002 2003 Jun-04

0.20% 0.26% 0.27% 0.24% 0.11% 0.10%

18

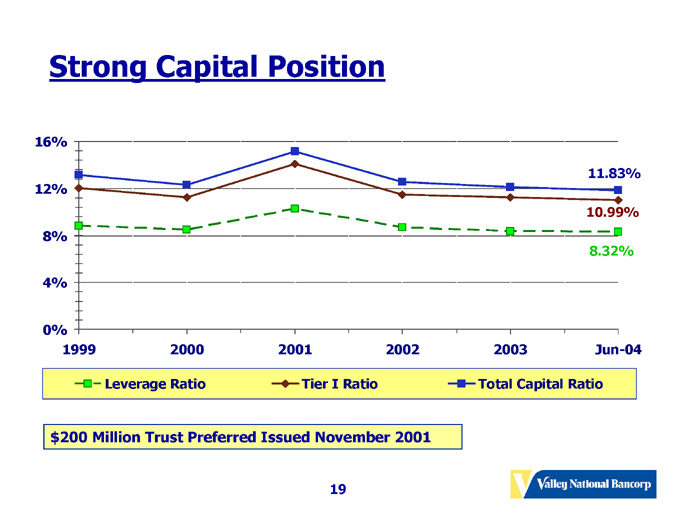

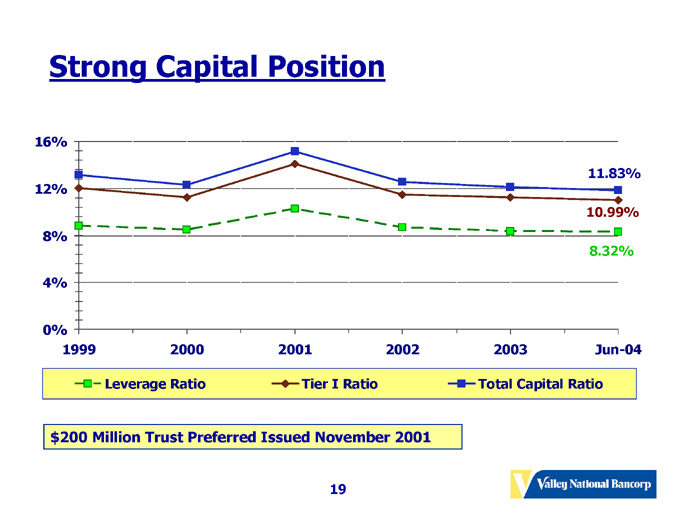

Strong Capital Position

16% 12% 8% 4% 0%

1999 2000 2001 2002 2003 Jun-04

11.83%

10.99%

8.32%

Leverage Ratio Tier I Ratio Total Capital Ratio

$200 Million Trust Preferred Issued November 2001

19

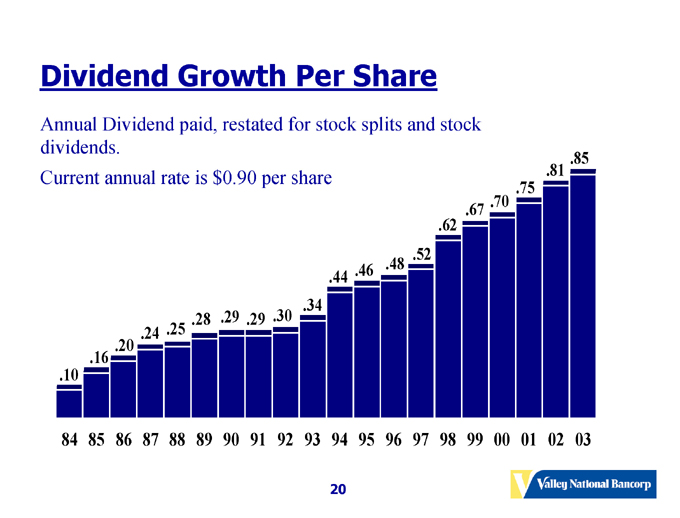

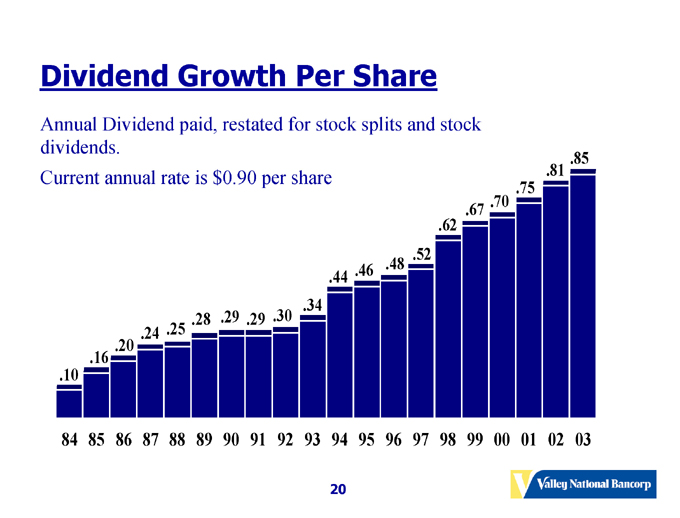

Dividend Growth Per Share

Annual Dividend paid, restated for stock splits and stock dividends.

Current annual rate is $0.90 per share

.10 .16 .20 .24 .25 .28 .29 .29 .30 .34 .44 .46 .48 .52 .62 .67 .70 .75 .81 .85

84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 00 01 02 03

20

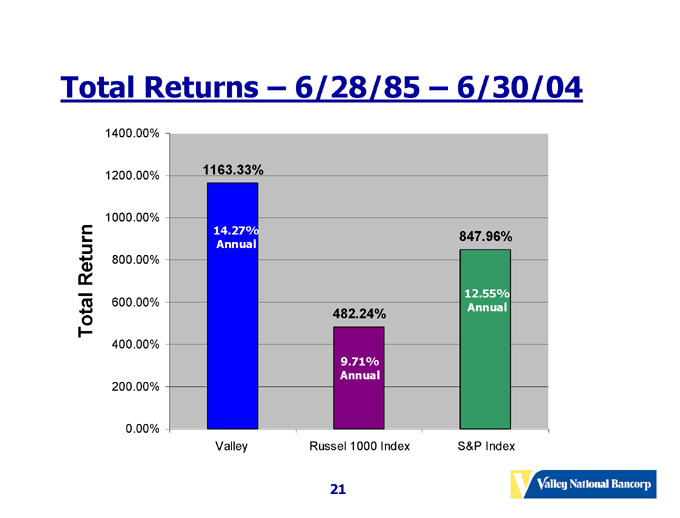

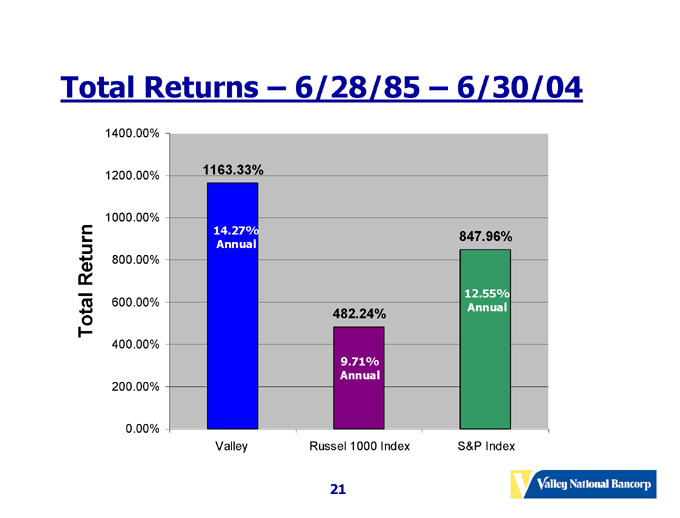

Total Returns – 6/28/85 – 6/30/04

Total Return

1400.00% 1200.00% 1000.00% 800.00% 600.00% 400.00% 200.00% 0.00%

1163.33%

14.27% Annual

847.96%

12.55% Annual

482.24%

9.71% Annual

Valley Russel 1000 Index S&P Index

21

Valley Goals

Maintain Exceptional Asset Quality

Plan to Open Approximately Ten New Branches Annually

Increase Market Share

Grow Core Deposits With Focus on Demand Deposits

Expand Non-Interest Income Sources

Seek to Maintain ROAA of at least 1.50% and keep ROAE over 20%

Emphasize Business Lending

Take Advantage of Changing Market in NJ

Objective Towards Independence

22

For More Information On Valley National Bank

Log onto our web site: www.valleynationalbank.com

Visit our kids site: www.vnbkids.com

E-mail requests to: dgrenz@valleynationalbank.com

Call Shareholder Relations at: (973) 305-3380

Write to: Valley National Bank

1455 Valley Road

Wayne, New Jersey 07470

Attn: Dianne M. Grenz, Senior Vice President Director of Shareholder & Public Relations

Log onto www.sec.gov to obtain free copies of documents filed by Valley with the SEC

23