EXHIBIT 99.1

Valley National Bancorp

Investor Presentation

September 14, 2005

Information For Investors And Shareholders

This presentation contains forward looking statements concerning Valley’s future business outlook, financial condition and operating results. Generally, the words “will,” “may,” “should,” “continue,” “believes,” “expects,” “anticipates” or similar expressions identify forward looking statements. Readers are advised not to place undue reliance on these forward looking statements as they are influenced by certain risk factors and unpredictable events. Factors that could cause actual results to differ materially from those predicted by the forward looking statements include among others:

Increased competitive pressure among banking and/or financial services companies

Adverse changes in the interest rate environment, causing reduced interest margins

Unexpected changes in the debt securities market

Decline in general economic conditions, whether nationally or in the market areas where Valley operates

New legislation or regulatory changes that may disrupt the course of business

The disallowance of prior tax strategies and increases in the effective income tax rate

NOTE: Valley disclaims any obligation to update or revise forward looking statements for any reason.

1

Overview of Valley National Bancorp

78 Year Commercial Banking History

Listed on the NYSE: VLY (eleven years as of December 5, 2004)

Consistent Shareholder Returns

Strong Financial Performance

Sound Asset Quality

Management Longevity/Ownership

Marketplace

Marketing Opportunity

Business Lending Initiative

2

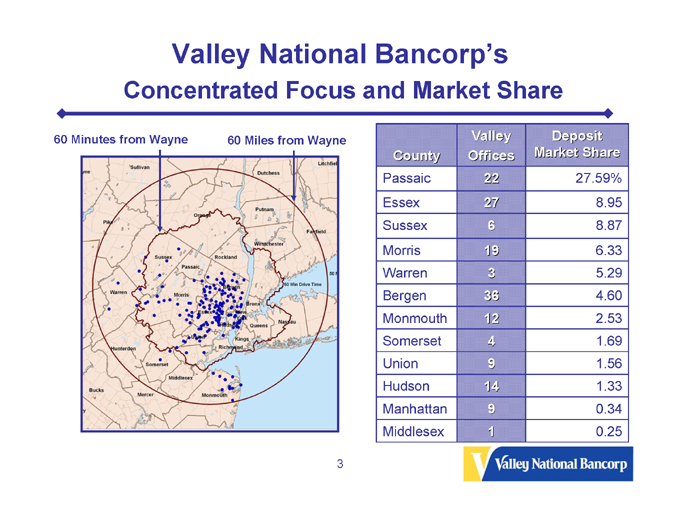

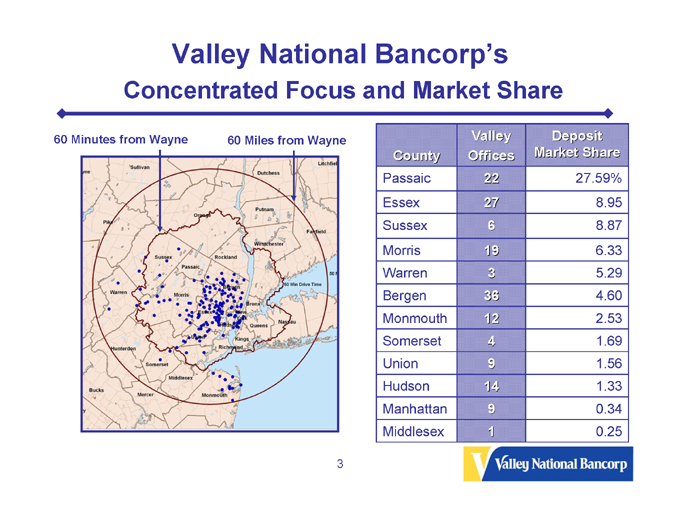

Valley National Bancorp’s

Concentrated Focus and Market Share

60 Minutes from Wayne

60 Miles from Wayne

County

Valley Offices

Deposit Market Share

Passaic

22

27.59%

Essex

27

8.95

Sussex

6

8.87

Morris

19

6.33

Warren

3

5.29

Bergen

36

4.60

Monmouth

12

2.53

Somerset

4

1.69

Union

9

1.56

Hudson

14

1.33

Manhattan

9

0.34

Middlesex

1

0.25

3

Acquisition Strategy

Target

Closing Date

Target Total Assets ($000)

NorCrown Bank

6/3/2005

621,966

Shrewsbury Bancorp

3/31/2005

424,588

Merchants New York Bancorp, Inc

1/19/2001

1,369,676

Ramapo Financial Corporation

6/11/1999

327,779

Wayne Bancorp, Inc

10/16/1998

272,007

Midland Bancorporation, Inc

2/28/1997

405,027

Lakeland First Financial Group, Inc

6/30/1995

661,393

American Union Bank

2/28/1995

53,695

Rock Financial Corporation

11/30/1994

187,378

Peoples Bank

6/18/1993

217,161

Mayflower Financial Corporation

12/31/1990

122,760

4

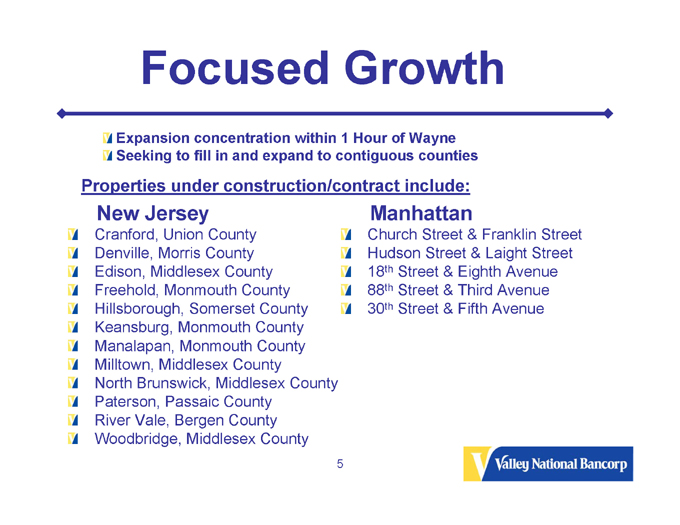

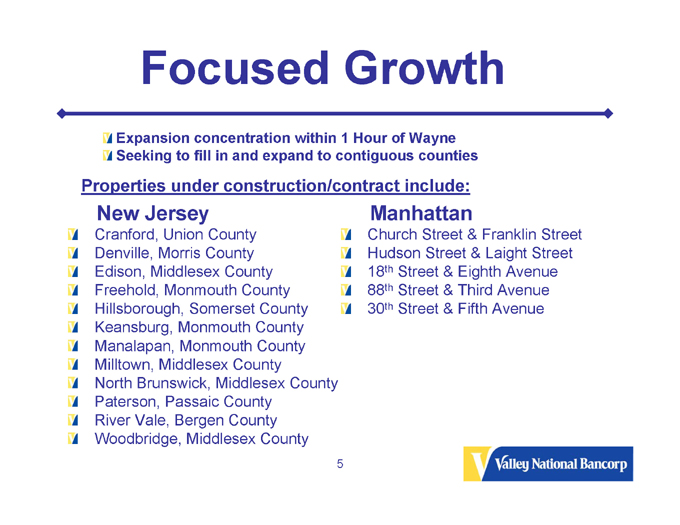

Focused Growth

Expansion concentration within 1 Hour of Wayne

Seeking to fill in and expand to contiguous counties

Properties under construction/contract include:

New Jersey

Cranford, Union County

Denville, Morris County

Edison, Middlesex County

Freehold, Monmouth County

Hillsborough, Somerset County

Keansburg, Monmouth County

Manalapan, Monmouth County

Milltown, Middlesex County

North Brunswick, Middlesex County

Paterson, Passaic County

River Vale, Bergen County

Woodbridge, Middlesex County

Manhattan

Church Street & Franklin Street

Hudson Street & Laight Street

18th Street & Eighth Avenue

88th Street & Third Avenue

30th Street & Fifth Avenue

5

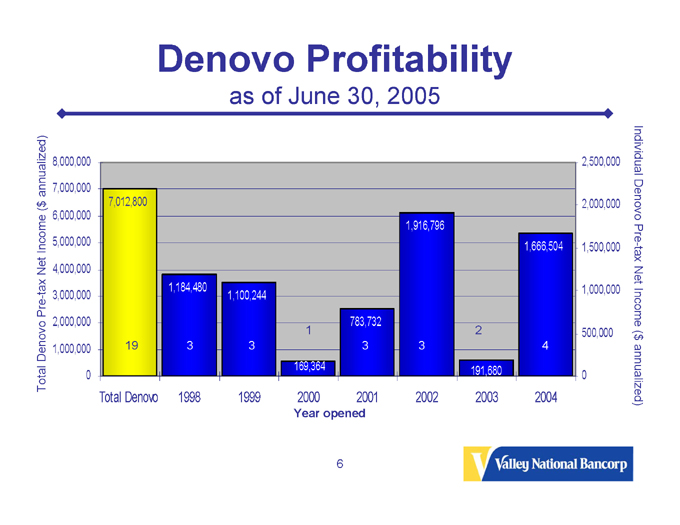

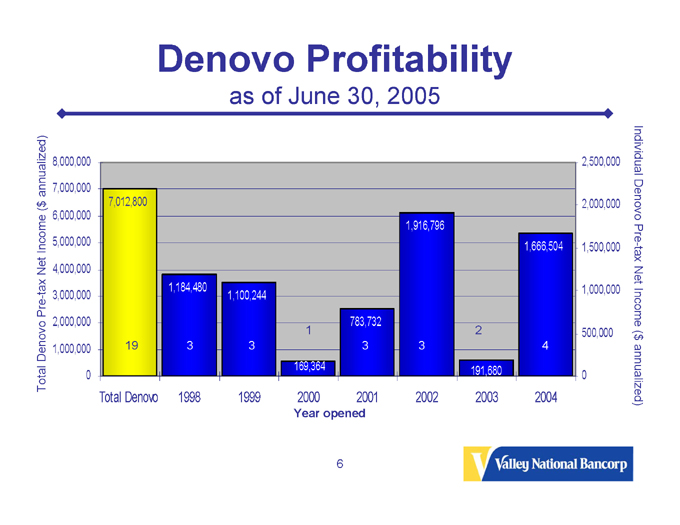

Denovo Profitability

as of June 30, 2005

Total Denovo Pre-tax Net Income ($ annualized)

8,000,000

7,000,000

6,000,000

5,000,000

4,000,000

3,000,000

2,000,000

1,000,000

0

7,012,800

19

Total Denovo

1,184,480

3

1998

1,100,244

3

1999

1

169,364

2000

783,732

3

2001

1,916,796

3

2002

2

191,680

2003

1,666,504

4

2004

2,500,000

2,000,000

1,500,000

1,000,000

500,000

0

Individual Denovo Pre-tax Net Income ($ annualized)

Year opened

6

Total Loan Portfolio Composition

as of June 30, 2005

Total Loans $ 6,934

Pre-merger

25%

26%

24%

25%

Commercial Loans

Residential Mortgages

Total Loans $ 7,845

Post-merger

28%

26%

23%

23%

Commercial Mortgages

Consumer Loans

($ in millions)

7

Competitive Advantage

Commercial Lending

Customer access to senior management

Service and relationship oriented

All decision makers are local

Diversified loan portfolio

Market trend awareness and adaptability

Longevity in marketplace

Exceptional distribution network

Quick turn around time

Flexibility with respect to terms

Consumer Lending

Unequivocal reputation and recognition

High efficiency

Preferred* auto lender in New Jersey

Quick turn-around time

Longevity in marketplace

Exceptional distribution network

Competitive products

FICO Score-based Tiered Lending

Instant Credit program

*Preferred Lender for AAA auto club of New Jersey

8

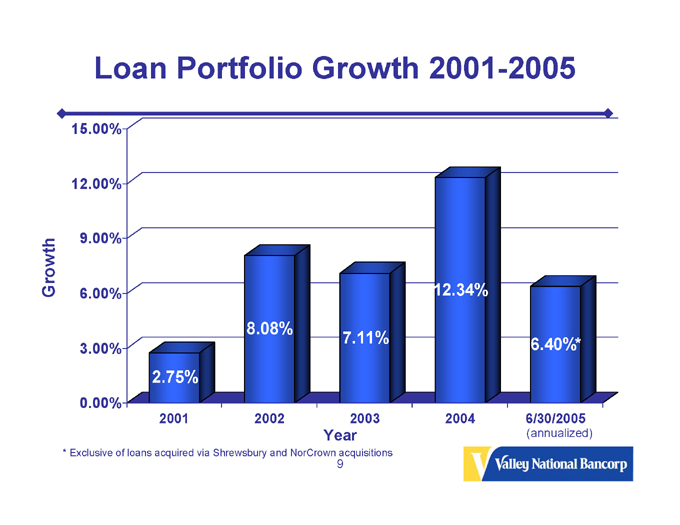

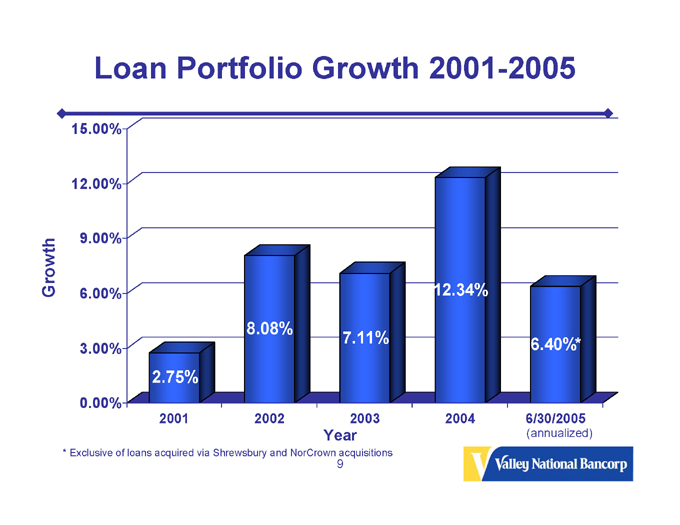

Loan Portfolio Growth 2001-2005

Growth

15.00%

12.00%

9.00%

6.00%

3.00%

0.00%

2.75%

2001

8.08%

2002

7.11%

2003

12.34%

2004

6.40%*

6/30/2005

Year

(annualized)

* Exclusive of loans acquired via Shrewsbury and NorCrown acquisitions

9

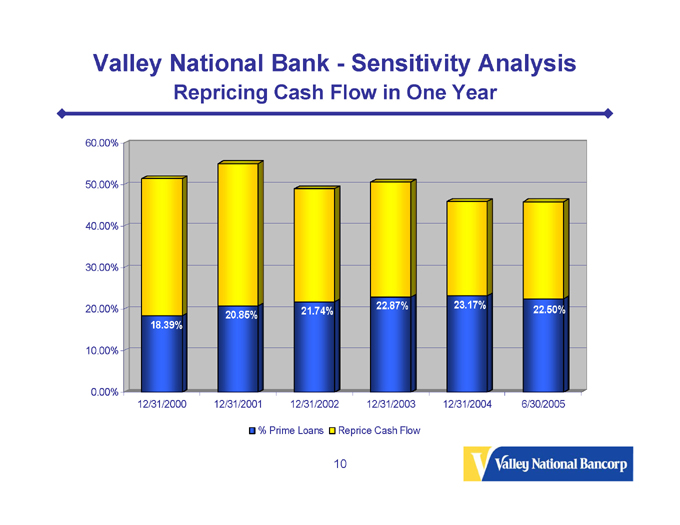

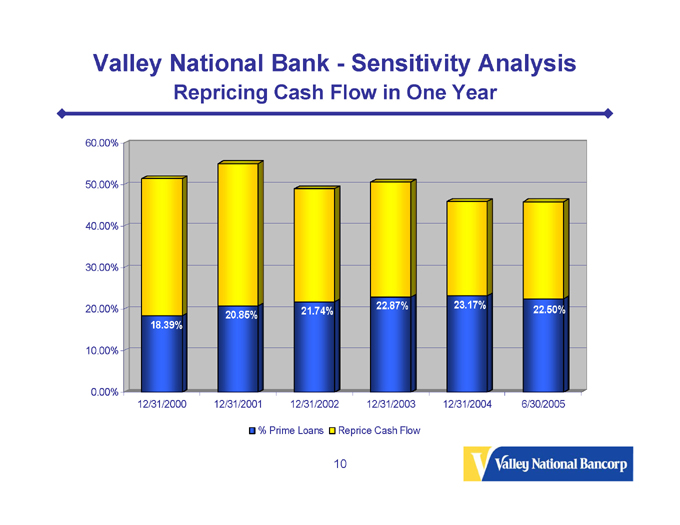

Valley National Bank - Sensitivity Analysis

Repricing Cash Flow in One Year

60.00%

50.00%

40.00%

30.00%

20.00%

10.00%

0.00%

18.39%

12/31/2000

20.85%

12/31/2001

21.74%

12/31/2002

22.87%

12/31/2003

23.17%

12/31/2004

22.50%

6/30/2005

% Prime Loans

Reprice Cash Flow

10

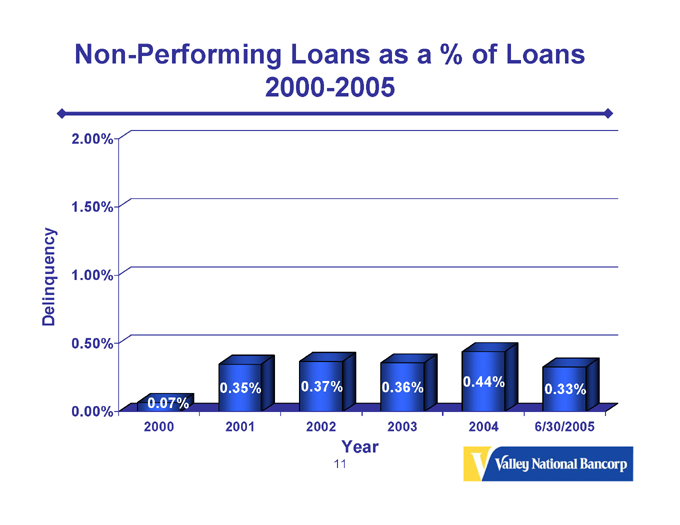

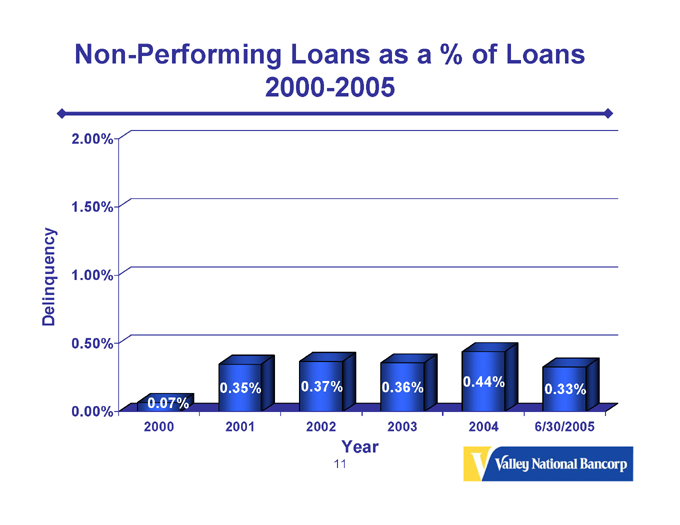

Non-Performing Loans as a % of Loans

2000-2005

Delinquency

2.00%

1.50%

1.00%

0.50%

0.00%

0.07%

2000

0.35%

2001

0.37%

2002

0.36%

2003

0.44%

2004

0.33%

6/30/2005

Year

11

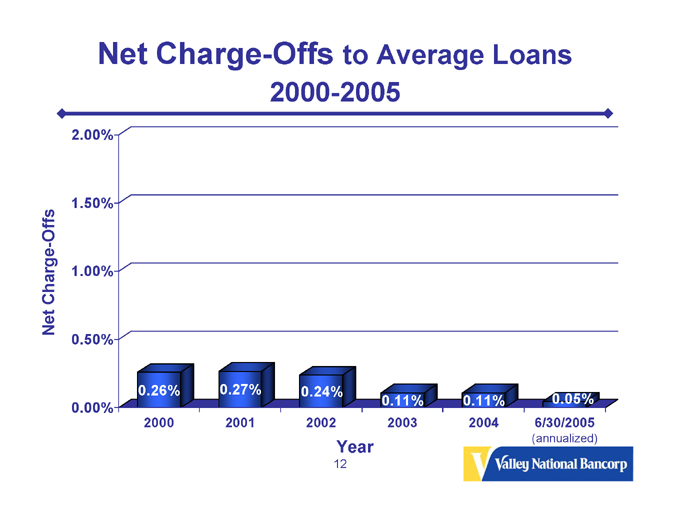

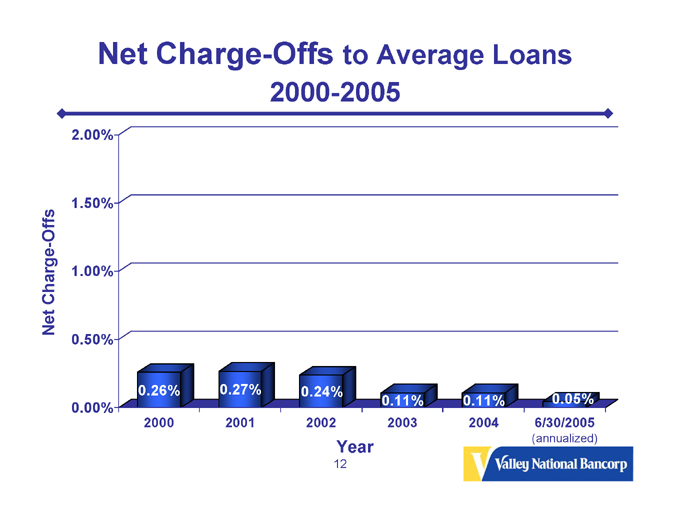

Net Charge-Offs to Average Loans

2000-2005

Net Charge-Offs

2.00%

1.50%

1.00%

0.50%

0.00%

0.26%

2000

0.27%

2001

0.24%

2002

0.11%

2003

0.11%

2004

0.05%

6/30/2005

(annualized)

Year

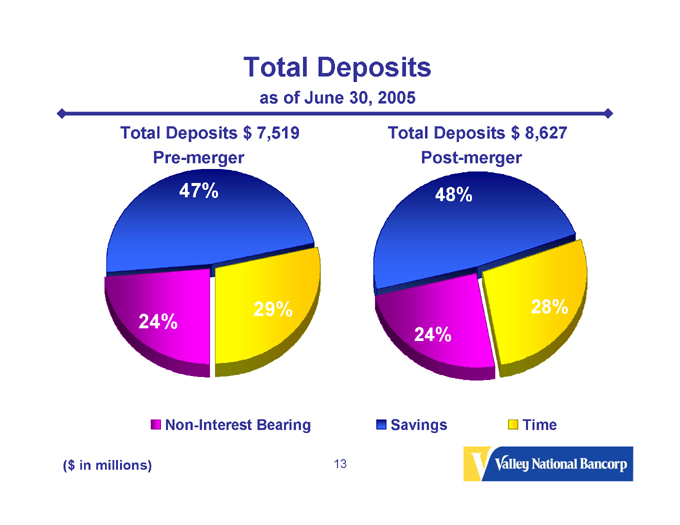

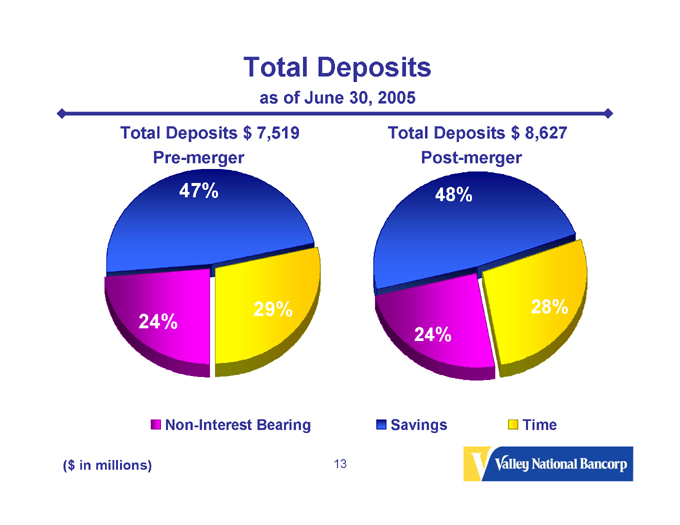

Total Deposits

as of June 30, 2005

Total Deposits $ 7,519

Pre-merger

47%

24%

29%

Non-Interest Bearing

Total Deposits $ 8,627

Post-merger

48%

24%

28%

Savings

Time

($ in millions)

13

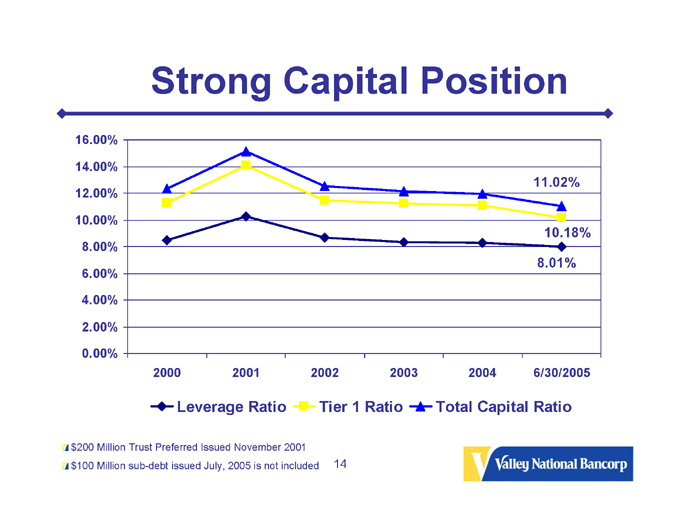

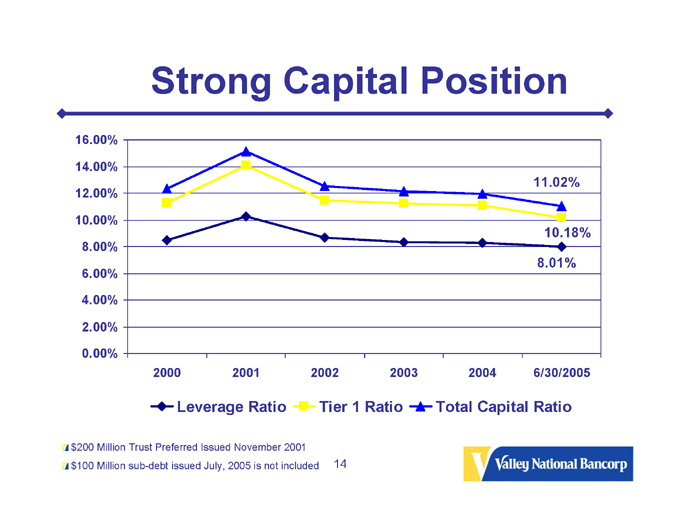

Strong Capital Position

16.00%

14.00%

12.00%

10.00%

8.00%

6.00%

4.00%

2.00%

0.00%

11.02%

10.18%

8.01%

2000

2001

2002

2003

2004

6/30/2005

Leverage Ratio

Tier 1 Ratio

Total Capital Ratio

$200 Million Trust Preferred Issued November 2001

$100 Million sub-debt issued July, 2005 is not included

14

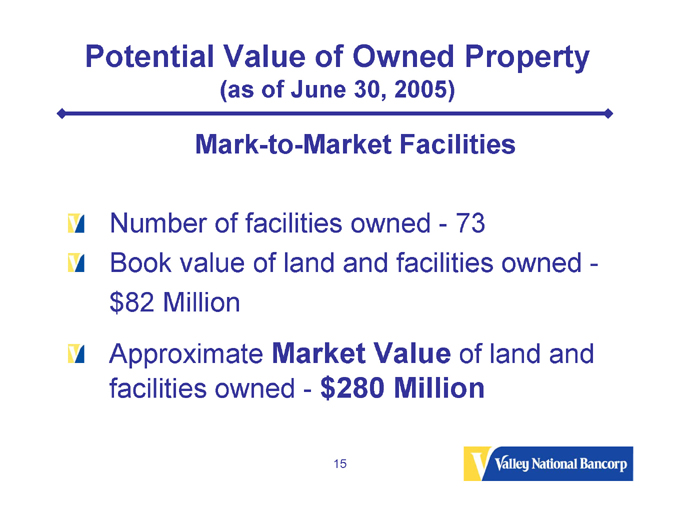

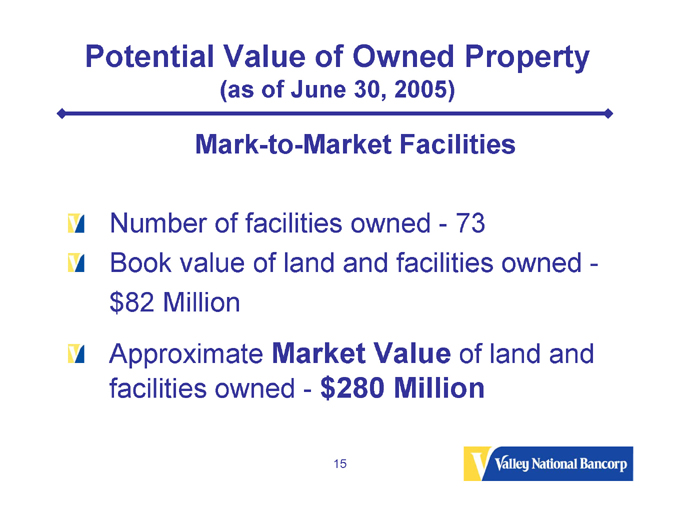

Potential Value of Owned Property

(as of June 30, 2005)

Mark-to-Market Facilities

Number of facilities owned - 73

Book value of land and facilities owned - $82 Million

Approximate Market Value of land and facilities owned - $280 Million

15

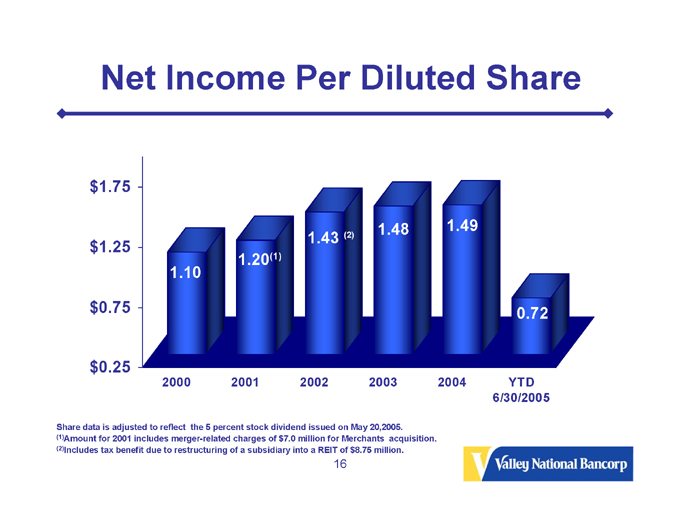

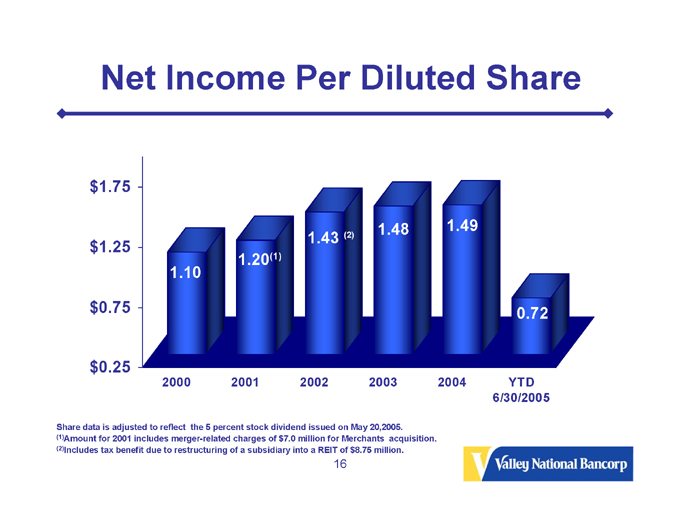

Net Income Per Diluted Share

$1.75

$1.25

$0.75

$0.25

1.10

2000

1.20(1)

2001

1.43(2)

2002

1.48

2003

1.49

2004

0.72

YTD

6/30/2005

Share data is adjusted to reflect the 5 percent stock dividend issued on May 20, 2005.

(1)Amount for 2001 includes merger-related charges of $7.0 million for Merchants acquisition.

(2)Includes tax benefit due to restructuring of a subsidiary into a REIT of $8.75 million.

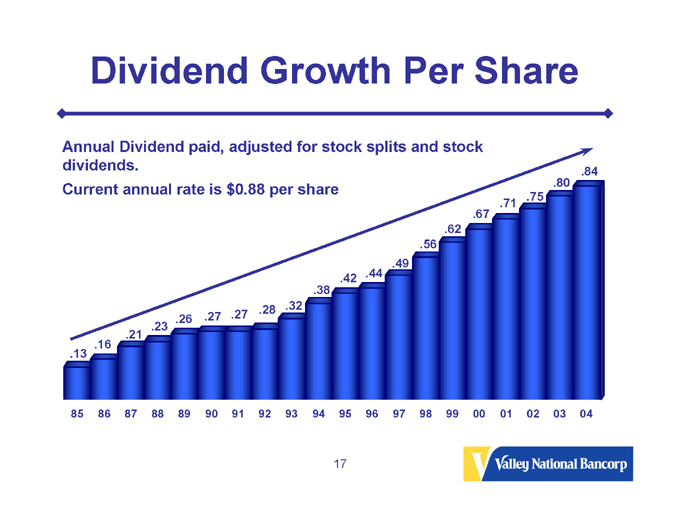

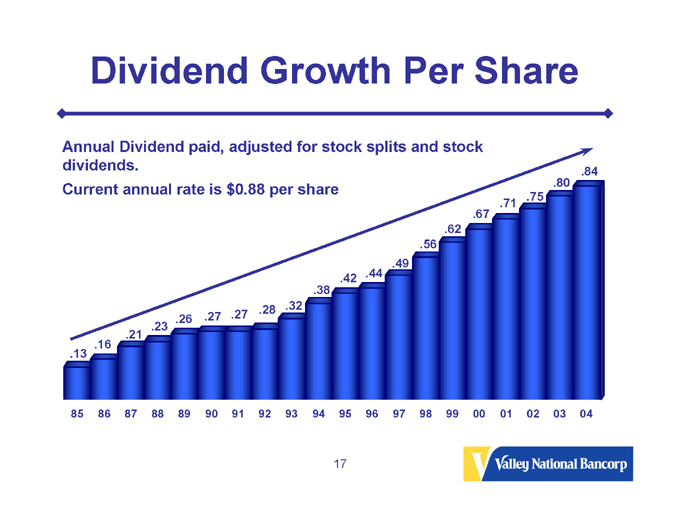

Dividend Growth Per Share

Annual Dividend paid, adjusted for stock splits and stock dividends.

Current annual rate is $0.88 per share

.13

85

.16

86

.21

87

.23

88

.26

89

.27

90

.27

91

.28

92

.32

93

.38

94

.42

95

.44

96

.49

97

.56

98

.62

99

.67

00

.71

01

.75

02

.80

03

.84

04

17

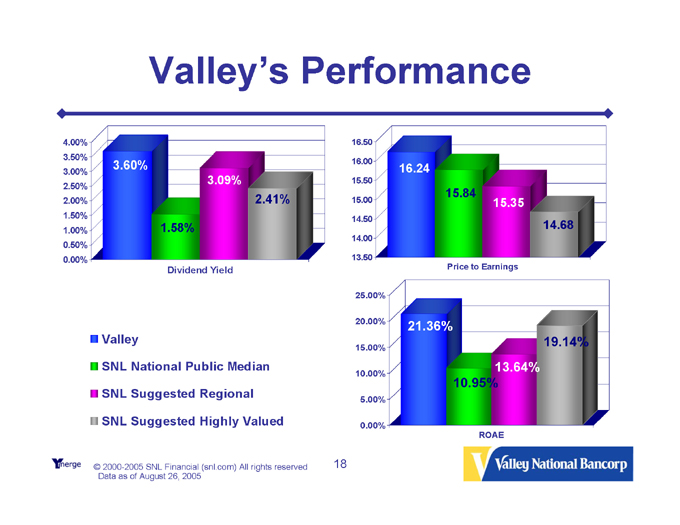

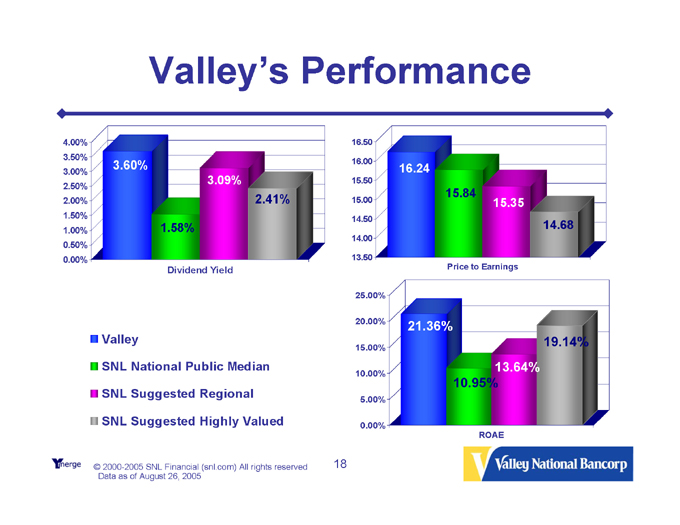

Valley’s Performance

4.00%

3.50%

3.00%

2.50%

2.00%

1.50%

1.00%

0.50%

0.00%

3.60%

1.58%

3.09%

2.41%

Dividend Yield

16.50

16.00

15.50

15.00

14.50

14.00

13.50

16.24

15.84

15.35

14.68

Price to Earnings

Valley

SNL National Public Median

SNL Suggested Regional

SNL Suggested Highly Valued

25.00%

20.00%

15.00%

10.00%

5.00%

0.00%

21.36%

10.95%

13.64%

19.14%

ROAE

© 2000-2005 SNL Financial (snl.com) All rights reserved Data as of August 26, 2005

18

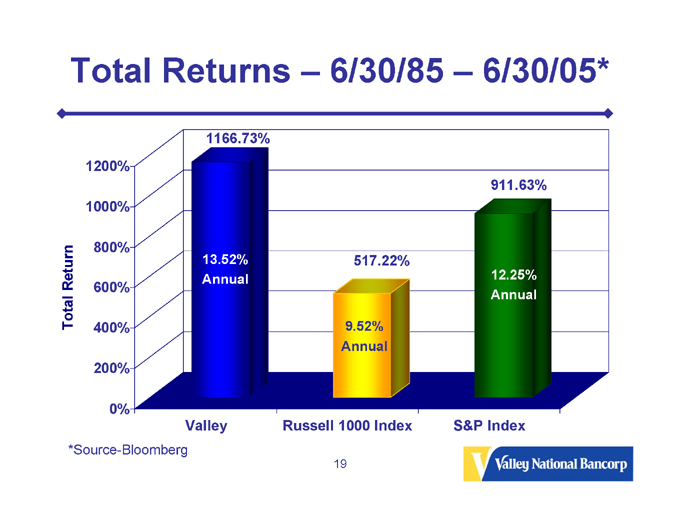

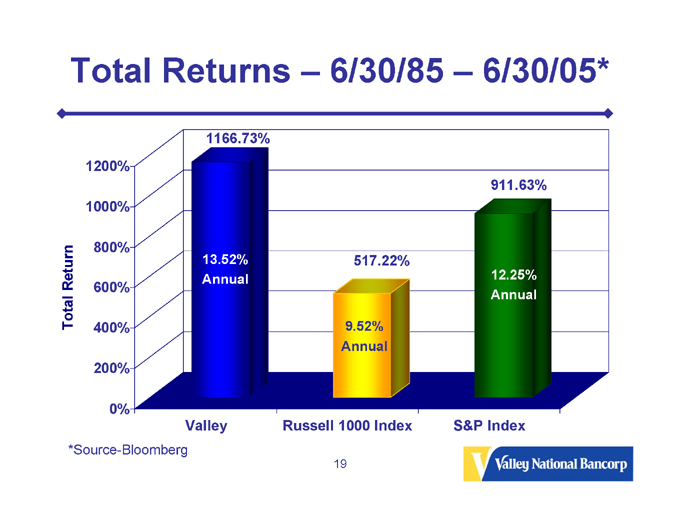

Total Returns – 6/30/85 – 6/30/05*

Total Return

1200%

1000%

800%

600%

400%

200%

0%

1166.73%

13.52%

Annual

Valley

517.22%

9.52%

Annual

Russell 1000 Index

911.63%

12.25%

Annual

S&P Index

*Source-Bloomberg

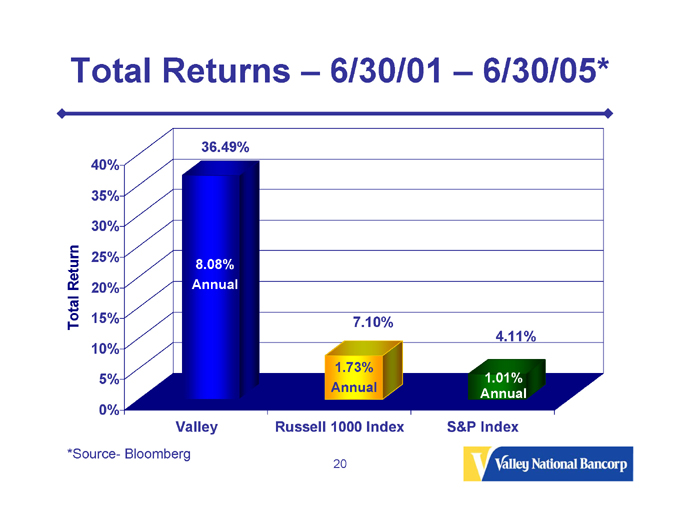

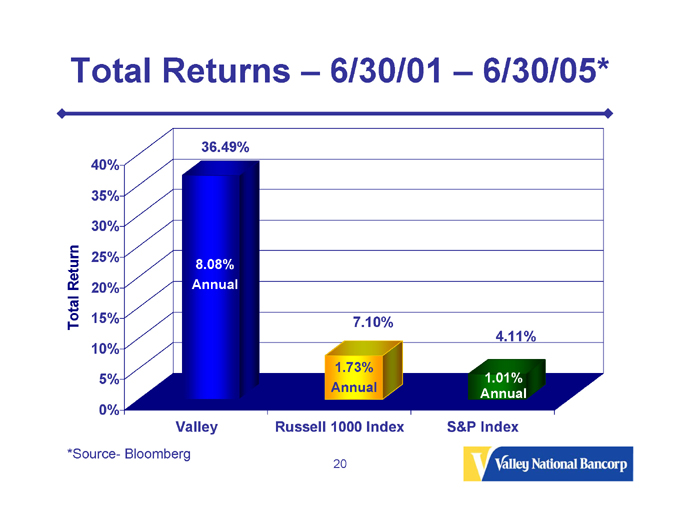

Total Returns – 6/30/01 – 6/30/05*

Total Return

40%

35%

30%

25%

20%

15%

10%

5%

0%

36.49%

8.08%

Annual

Valley

7.10%

1.73%

Annual

Russell 1000 Index

4.11%

1.01%

Annual

S&P Index

*Source- Bloomberg

20

Future Goals

Maintain exceptional asset quality

Remain aggressive and active in the lending community

Emphasize business lending

Take advantage of changing market in the Tri-State area

Focused growth within sixty miles of Valley’s headquarters through new branches and acquisitions of other financial institutions with a similar customer culture

21

For More Information

Log onto our web site: www.valleynationalbank.com

Visit our kids site: www.vnbkids.com

E-mail requests to: dgrenz@valleynationalbank.com

Call Shareholder Relations at: (973) 305-3380

Write to: Valley National Bank

1455 Valley Road

Wayne, New Jersey 07470

Attn: Dianne M. Grenz, Senior Vice President

Director of Shareholder & Public Relations

Log onto www.sec.gov to obtain free copies of documents filed by Valley with the SEC

22