Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

x | Preliminary Proxy Statement | ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

¨ | Definitive Proxy Statement | |||||

¨ | Definitive Additional Materials | |||||

¨ | Soliciting Material Pursuant to §240.14a-12 |

Valley National Bancorp

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which the transaction applies: |

| (2) | Aggregate number of securities to which the transaction applies: |

| (3) | Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of the transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Table of Contents

1455 Valley Road

Wayne, New Jersey 07470

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held, Wednesday, April 14, 2010

To Our Shareholders:

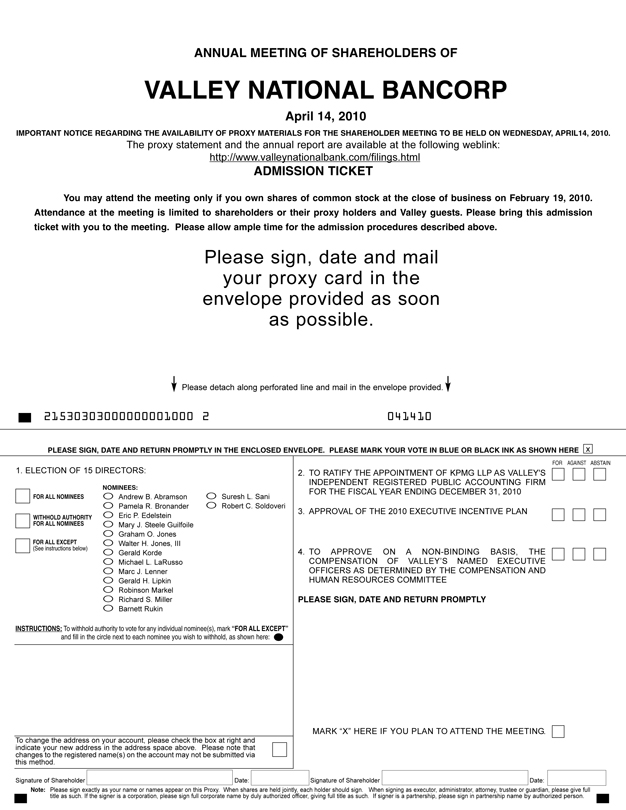

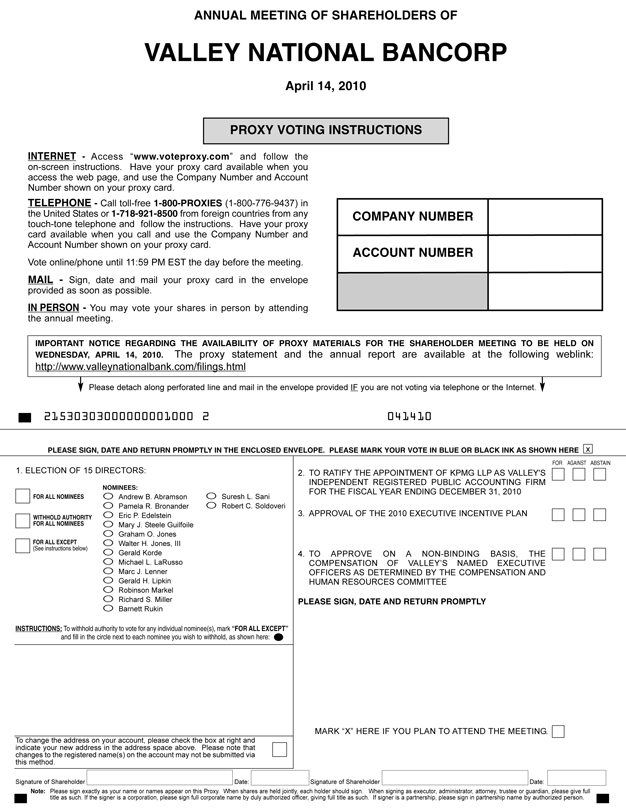

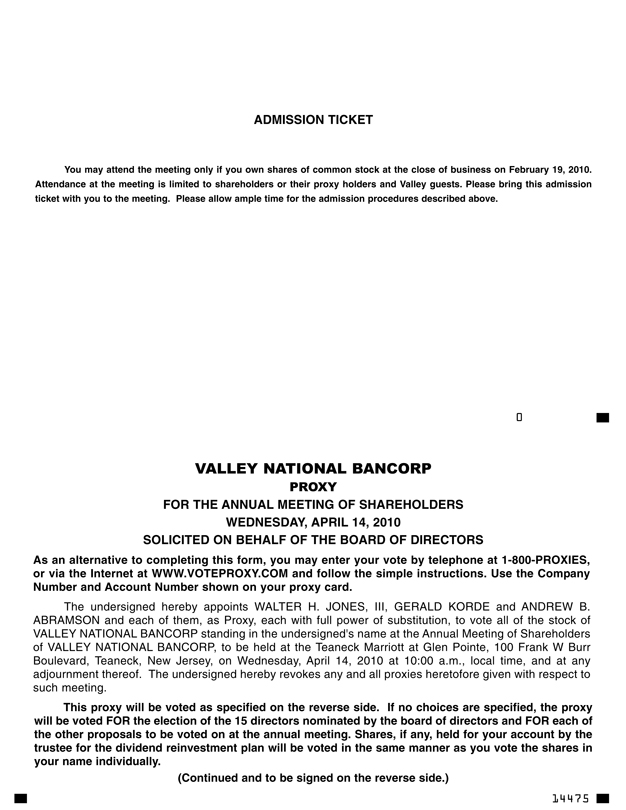

We invite you to the Annual Meeting of Shareholders of Valley National Bancorp (“Valley”) to be held at the Teaneck Marriott at Glen Pointe, 100 Frank W Burr Boulevard, Teaneck, New Jersey, on Wednesday, April 14, 2010 at 10:00 a.m., local time to vote on the following matters:

| 1. | Election of 15 directors. |

| 2. | Ratification of the appointment of KPMG LLP as Valley’s independent registered public accounting firm for the fiscal year ending December 31, 2010. |

| 3. | Approval of the 2010 Executive Incentive Plan. |

| 4. | Non-binding approval of the compensation of Valley’s named executive officers. |

Only shareholders of record at the close of business on February 19, 2010 are entitled to notice of, and to vote at the meeting.Your vote is very important. Whether or not you plan to attend the meeting, please execute and return the enclosed proxy card in the envelope provided or submit your proxy by telephone or the internet as instructed on the enclosed proxy card. The prompt return of your proxy will save Valley the expense of further requests for proxies.

Attendance at the meeting is limited to shareholders or their proxy holders and Valley guests. You will need an admission ticket or evidence of ownership of Valley stock to enter the meeting. If your shares are registered with our transfer agent, American Stock Transfer, bring the admission ticket which is the top section of the proxy card. If you hold your shares in “street name”, you will need to bring evidence of your stock ownership and a valid form of photo identification to the meeting to be allowed access. Evidence of ownership can be in the form of your account statement or a letter from your broker, or other institution reflecting your share ownership as of the record date of February 19, 2010. Please allow ample time for the admission process. See information on page 3 – “Annual Meeting Attendance”.

Important notice regarding the availability of proxy materials for the 2010 annual meeting of shareholders: This Proxy Statement for the 2010 Annual Meeting of Shareholders and our 2009 Annual Report to Shareholders are available at:http://www.valleynationalbank.com/filings.html

We appreciate your participation and interest in Valley.

Sincerely,

|  | |||

| Alan D. Eskow | Gerald H. Lipkin | |||

| Corporate Secretary | Chairman, President and Chief Executive Officer |

Wayne, New Jersey

March 8, 2010

Table of Contents

i

Table of Contents

1455 Valley Road

Wayne, New Jersey 07470

PROXY STATEMENT

GENERAL PROXY STATEMENT INFORMATION

We are providing this proxy statement in connection with the solicitation of proxies by the Board of Directors of Valley National Bancorp (“Valley,” the “Company,” “we,” “our” and “us”) for use at Valley’s 2010 Annual Meeting of Shareholders (the “Annual Meeting”) and at any adjournment of the meeting. You are cordially invited to attend the meeting, which will be held at the Teaneck Marriott at Glen Pointe, 100 Frank W Burr Boulevard, Teaneck, New Jersey, on Wednesday, April 14, 2010 at 10:00 a.m., local time. This proxy statement is first being mailed to shareholders on or about March 8, 2010.

SHAREHOLDERS ENTITLEDTO VOTE. The record date for the meeting is February 19, 2010. Only holders of common stock of record at the close of business on that date are entitled to vote at the meeting.

On the record date there were 153,140,372 shares of common stock outstanding. Each share is entitled to one vote on each matter properly brought before the meeting.

HOUSEHOLDING. When more than one holder of our common stock shares the same address, we may deliver only one annual report and one proxy statement to that address unless we have received contrary instructions from one or more of those shareholders. Similarly, brokers and other intermediaries holding shares of Valley common stock in “street name” for more than one beneficial owner with the same address may deliver only one annual report and one proxy statement to that address if they have received consent from the beneficial owners of the stock.

We will deliver promptly upon written or oral request a separate copy of the annual report and proxy statement to any shareholder, including a beneficial owner of stock held in “street name,” at a shared address to which a single copy of either of those documents was delivered. To receive additional copies of our annual report and proxy statement, you may call or write Dianne M. Grenz, First Senior Vice President, Valley National Bancorp, at 1455 Valley Road, Wayne, New Jersey 07470, telephone (973) 305-3380 or e-mail her at dgrenz@valleynationalbank.com.

ANNUAL REPORT. This Proxy Statement and the Company’s 2009 Annual Report to Shareholders are available electronically at the following weblink:http://www.valleynationalbank.com/filings.html

You may also contact Ms. Grenz at the address or telephone number above if you are a shareholder of record of Valley and you wish to receive a separate annual report and proxy statement in the future, or if you are currently receiving multiple copies of our annual report and proxy statement and want to request delivery of a single copy in the future. If your shares are held in “street name” and you want to increase or decrease the number of copies of our annual report and proxy statement delivered to your household in the future, you should contact the broker or other intermediary who holds the shares on your behalf.

PROXIESAND VOTING PROCEDURES. Your vote is important and you are encouraged to vote your shares promptly. Each proxy submitted will be voted as directed. However, if a proxy solicited by the Board of Directors does not specify how it is to be voted, it will be voted as the Board recommends—that is:

| — | Item 1 – FOR the election of the 15 nominees for director named in this proxy statement; |

| — | Item 2 – FOR the ratification of the appointment of KPMG LLP; |

| — | Item 3 – FOR the approval of the 2010 Executive Incentive Plan; and |

| — | Item 4 – FOR the non-binding approval of the compensation of Valley’s named executive officers. |

If any other matters are properly presented at the meeting for consideration, the persons named as proxies will have discretion to vote on those matters according to their best judgment. As of the date of this proxy statement we did not anticipate that any other matters would be raised at the meeting.

1

Table of Contents

We are offering you three alternative ways to vote your shares:

BY MAIL.To vote your proxy by mail, please sign your name exactly as it appears on your proxy card, date, and mail your proxy card in the envelope provided as soon as possible.

BY TELEPHONE.If you wish to vote by telephone, call toll-free 1-800-776-9437 and follow the voice instructions. Have your proxy card available when you call.

BY INTERNET.If you wish to vote using the internet, you can access the web page at www.voteproxy.com and follow the on-screen instructions. Have your proxy card available when you access the web page.

Regardless of the method that you use to vote, you will be able to vote in person or revoke your proxy if you follow the instructions provided below in the sections entitled “Voting in Person” and “Revoking Your Proxy”.

If you are a participant in the Company’s Dividend Reinvestment Plan, the shares that are held in your dividend reinvestment account will be voted in the same manner as your other shares, whether you vote by mail, by telephone or by internet.

If you are an employee or former employee of the Company, and participate in our Savings and Investment Plan (a 401(k) plan with an employee stock ownership feature—“KSOP”), you will receive one proxy card representing the total shares you own through this plan. The proxy card will serve as a voting instruction card for the trustee of the plan where all accounts are registered in the same name. If you own shares through the KSOP and do not vote, the plan trustee will vote the plan shares for which voting instructions are received in the proportion for which instructions for such shares were received under the plan. The plan trustee will also vote the unvoted shares (for which instructions were not received) in the same proportion as shares for which instructions were received under the plan. Therefore, if you are a participant in the KSOP and vote your shares, the trustee will use your vote when determining the proportion.

VOTINGIN PERSON. The method by which you vote will not limit your right to vote at the meeting if you later decide to attend in person. If your shares are held in the name of a bank, broker or other holder of record, you must obtain a proxy executed in your favor from the holder of record to be able to vote at the meeting. If you submit a proxy and then wish to change your vote or vote in person at the meeting, you will need to revoke the proxy that you have submitted.

REVOKING YOUR PROXY. You can revoke your proxy at any time before it is exercised by:

| — | Delivery of a properly executed, later-dated proxy; or |

| — | A written revocation of your proxy. |

A later-dated proxy or written revocation must be received before the meeting by the Corporate Secretary of the Company, Alan D. Eskow, Valley National Bancorp, at 1455 Valley Road, Wayne, New Jersey 07470, or it must be delivered to the Corporate Secretary at the meeting before proxies are voted. You may also revoke your proxy by submitting a new proxy via telephone or the internet. You will be able to change your vote as many times as you wish prior to the Annual Meeting and the last vote received chronologically will supersede any prior votes.

QUORUM REQUIREDTO HOLDTHE ANNUAL MEETING. The presence, in person or by proxy, of the holders of a majority of the shares entitled to vote generally for the election of directors is necessary to constitute a quorum at the meeting. Abstentions and broker “non-votes” are counted as present and entitled to vote for purposes of determining a quorum. A broker “non-vote” occurs when a nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary power with respect to that item and has not received instructions from the beneficial owner.

REQUIRED VOTE.

| — | Directors will be elected by a plurality of the votes cast at the meeting. Thus, an abstention or a broker “non-vote” will have no effect on the outcome of the vote on election of directors at the meeting. |

| — | The ratification of the appointment of KPMG LLP will be approved if a majority of the votes cast are FOR the proposal. Abstentions and broker “non-votes” will have no impact on the ratification of KPMG LLP. |

| — | The 2010 Executive Incentive Plan will be approved if a majority of the votes cast are FOR the proposal. Abstentions and broker “non-votes” are not counted as votes cast and will have no effect on the outcome. |

2

Table of Contents

| — | The non-binding approval of the compensation of Valley’s named executive officers, requires a majority of the votes cast be FOR the proposal. Abstentions and broker “non-votes” are not counted as votes cast and will have no effect on the outcome. |

ANNUAL MEETING ATTENDANCE. Only shareholders or their proxy holders and Valley guests may attend the annual meeting. For registered shareholders, an admission ticket is attached to your proxy card. Please detach and bring the admission ticket with you to the meeting. If your shares are held in street name, you must bring to the meeting evidence of your stock ownership indicating that you beneficially owned the shares on the record date for voting and a valid form of photo identification to be allowed access.

METHODAND COSTOF PROXY SOLICITATION. This proxy solicitation is being made by our Board of Directors and we will pay the cost of soliciting proxies. Proxies may be solicited by officers, directors and employees of the Company in person, by mail, telephone, facsimile or other electronic means. We will not specially compensate those persons for their solicitation activities. In accordance with the regulations of the Securities and Exchange Commission (“SEC”) and the New York Stock Exchange (“NYSE”), we will reimburse brokerage firms and other custodians, nominees and fiduciaries for their expense incurred in sending proxies and proxy materials to their customers who are beneficial owners of Valley common stock.

ELECTION OF DIRECTORS

DIRECTOR INFORMATION

We are asking you to vote for the election of directors. Under our by-laws, the Board of Directors (the “Board”) fixes the exact number of directors, with a minimum of 5 and a maximum of 25. The Board has fixed the number of directors at 15.

The persons named on the proxy card intend to vote the proxies FOR the election of the 15 persons named below (unless the shareholder otherwise directs). If, for any reason, any nominee becomes unavailable for election and the Board selects a substitute nominee, the proxies will be voted for the substitute nominee selected by the Board. The Board has no reason to believe that any of the named nominees is not available or will not serve if elected. The Board retains the right to reduce the number of directors to be elected if any nominee is not available to be elected.

Each candidate for director has been nominated to serve a one-year term until our 2011 annual meeting and thereafter until the person’s successor has been duly elected and qualified. In considering a nominee as a Valley director, the Board seeks to ensure that the Board is composed of members whose particular experience, qualifications, attributes and skills, as a whole can satisfy its supervision responsibilities effectively. To accomplish this, specific guidelines are set by the Nominating and Corporate Governance Committee, further discussed below under the Corporate Governance section.

Set forth below are the names and ages of the Board’s nominees for election; the nominees’ position with the Company (if any); the principal occupation or employment of each nominee for the past five years; the period during which each nominee has served as our director; any other directorships during the past five years (if any) held by the nominee with companies registered pursuant to Section 12 of the Exchange Act or subject to the requirements of Section 15(d) of the Exchange Act; and other biographical information for each individual director. In addition, described below are each director nominee’s particular experience, qualification, attributes or skills that has led the Board to conclude that the person should serve as a director of Valley.

| Gerald H. Lipkin, (69). | |

| Chairman of the Board, President and Chief Executive Officer of Valley National Bancorp and Valley National Bank. | ||

Director since 1986. | ||

Mr. Lipkin has spent his entire business career directly in the banking industry. He brings to Valley’s Board of Directors years of experience since graduating from Rutgers University with a Bachelors Degree in Economics and a Masters Degree in Business Administration in Banking and Finance from New York University. He also graduated from the Stonier School of Banking. The next thirteen years following his MBA were spent in various positions with the Comptroller of the Currency as a bank examiner and then Deputy Regional Administrator for the New York region. Mr. Lipkin began his career at Valley in 1975 as a Senior Vice President and as a lending officer. He became CEO and Chairman in 1989. Mr. Lipkin’s education, his lending and commercial banking background for over 36 years in conjunction with his leadership ability make him a valuable member of our Board of Directors. |

3

Table of Contents

| Andrew B. Abramson, (56). | |

President and Chief Executive Officer, Value Companies, Inc. (a real estate development and property management firm).

| ||

Director since 1994.

| ||

| Mr. Abramson graduated from Cornell University with a Bachelor’s Degree, and a Master’s Degree, with degrees in Civil Engineering. He is a licensed real estate broker in the States of New Jersey and New York. His real estate background combined with over 30 years as a business owner, an investor and developer in real estate, he brings management; financial; and current real estate market experience and expertise to Valley’s Board of Directors. |

| Pamela R. Bronander, (53). | |

Vice President, KMC Mechanical, Inc. (mechanical contractor).

| ||

Director since 1993.

| ||

| Ms. Bronander graduated with a Bachelor’s Degree in Economics from Lafayette College. She has full managerial responsibility for the financial and legal aspects of two mechanical contracting companies; namely KMC Mechanical, Inc. and Kaye Mechanical Contractors LLC; and was formerly an officer of Scandia Packaging Machinery Company. Ms. Bronander brings years of general business, managerial, and financial expertise to Valley’s Board of Directors. |

| Eric P. Edelstein, (60) | |||

Retired.

| ||||

Director since 2003.

| ||||

| Other directorships: | Aeroflex Incorporated. | |||

Computer Horizon Corp.

| ||||

| Mr. Edelstein received his Bachelor’s Degree in Business Administration and his Master’s Degree in Professional Accounting from Rutgers University. He is a former Director of Aeroflex, Incorporated and Computer Horizon Corp.; former Executive Vice President and Chief Financial Officer of Griffon Corporation (manufacturer and developer of variety of products); and a former Managing Partner at Arthur Andersen LLP. Mr. Edelstein was employed by Arthur Andersen LLP for 30 years and held various roles in the accounting and audit division, as well as the management consulting division. With 25 years of experience as a practicing CPA, he brings in depth knowledge of generally accepted accounting and auditing standards to our Board. He has worked with audit committees and boards of directors in the past and provides Valley’s Board of Directors with extensive experience in auditing and preparation of financial statements. | ||||

| Mary J. Steele Guilfoile, (55) | |||

Chairman of MG Advisors, Inc. (privately owned financial services merger and acquisition advisory and consulting firm).

| ||||

Director since 2003.

| ||||

| Other directorships: | Interpublic Group of Companies. | |||

Viasys Healthcare, Inc. (now known as CareFusion).

| ||||

| Ms. Guilfoile received her Bachelor’s Degree in Accounting from Boston College Carroll School of Management and her Master’s Degree in Marketing and Finance from Columbia University Graduate School of Business. She is the former Executive Vice President and Corporate Treasurer of J.P. Morgan Chase & Co.; a former Partner, Chief Financial Officer and Chief Operating Officer of The Beacon Group, LLC (a private equity, strategic advisory and wealth management partnership). Ms. Guilfoile is also a Partner of The Beacon Group, a private investment group; a CPA; and was Chairman of the audit committee at Viasys Healthcare, Inc. With her wide range of professional experience and knowledge, Ms. Guilfoile brings a variety of business experience in corporate governance, accounting, auditing, investment and management expertise to Valley’s Board of Directors. | ||||

4

Table of Contents

| Graham O. Jones*, (65). | |

Partner and Attorney, at law firm of Jones & Jones.

| ||

Director since 1997.

| ||

| Mr. Jones received his Bachelor’s Degree from Brown University and his Juris Doctor Degree from the University of North Carolina School of Law. Mr. Jones has been practicing law since 1969, with an emphasis on banking law since 1980. He has been a Partner of Jones & Jones since 1982 and served as the former President and Director of Hoke, Inc., (manufacturer and distributor of fluid control products). He was a Director and General Counsel for 12 years at Midland Bancorporation, Inc., and Midland Bank & Trust Company. Mr. Jones was a partner at Norwood Associates II for 10 years and was a President and Director for Adwildon Corporation (bank holding company). With his business and banking affiliations, including partnerships and directorships, as well as professional and civic affiliations, he brings a long history of banking law expertise and a variety of business experience and professional achievements to Valley’s Board of Directors. |

| Walter H. Jones, III*, (67). | |

Retired.

| ||

Director since 1997.

| ||

| Mr. Jones received a Bachelor’s Degree from Williams College, a Bachelor of Law Degree from Columbia Law School and a Master of Law Degree from New York University. He served as the Executive Chairman of the Board of Directors of Hoke, Inc. (a manufacturer of precision fluid control products) from 1983 to 1998. For 12 years he was the Chairman of the Board for Midland Bank & Trust Company where he also served as acting Chief Executive Officer for an interim period. Prior to this, he was a practicing attorney in New Jersey for 15 years. Mr. Jones brings management experience, legal and business knowledge to Valley’s Board of Directors. |

| Gerald Korde, (66). | |

President, Birch Lumber Company, Inc. (wholesale and retail lumber distribution company).

| ||

Director since 1989.

| ||

| Mr. Korde earned a Bachelor’s Degree in Finance from the University of Cincinnati. He is the owner of Birch Lumber Company, Inc. and has various business interests including real estate investment projects with Chelsea Senior Living and Inglemoor Care Center of Livingston. Mr. Korde’s background as a former owner and manager of motels provides a long history of entrepreneurship and managerial knowledge that remains valuable to Valley’s Board of Directors. |

| Michael LaRusso, (64). | |

Financial Consultant.

| ||

Director since 2004.

| ||

| Mr. LaRusso holds a Bachelor’s Degree in Finance from Seton Hall University. He is also a graduate from the Stonier School of Banking. He is a former Executive Vice President and a Director of Corporate Monitoring Group-Union Bank of California (Bank). Mr. LaRusso held the position of Federal Bank Regulator with the Comptroller of the Currency for 23 years and assumed a senior bank executive role for 15 years in large regional and/or multinational banking companies (Wachovia, Citicorp and Union Bank of California). Mr. LaRusso’s extensive management and leadership experience with these financial institutions positions him well to serve on Valley’s Board of Directors. |

5

Table of Contents

| Marc Lenner, (44). | |

Chief Executive Officer and Chief Financial Officer of Lester M. Entin Associates (a real estate development and management company).

| ||

Director since 2007.

| ||

| Mr. Lenner attended Muhlenberg College where he earned a Bachelor’s Degree in both Business Administration and Accounting. Mr. Lenner became the Chief Executive Officer and Chief Financial Officer at Lester M. Entin Associates in January 2000 after serving in various other executive positions within the Company. He has experience in multiple areas of commercial real estate market throughout the country (specifically in the New York tri-state area), including management, acquisitions, financing, development and leasing. Mr. Lenner is the Co-Director of a charitable foundation where he manages a multi-million dollar equity and bond portfolio. Prior to Lester M. Entin Associates, he was employed by Hoberman Miller Goldstein and Lesser, P.C., a CPA firm. With Mr. Lenner’s vast financial and professional background, he provides management, finance and real estate experience to Valley’s Board of Directors. |

| Robinson Markel, (75). | |

Counsel to the law firm of Katten Muchin Rosenman LLP.

| ||

Director since 2001.

| ||

| Mr. Markel holds a Bachelor’s Degree from New York University’s Stern School of Business and a Juris Doctor Degree from New York University School of Law. Mr. Markel is Of Counsel to Katten Muchin Rosenman LLP, a national law firm, where he specializes in executive compensation and corporate governance matters. Mr. Markel is a former Director of Merchants New York Bancorp, Inc. and The Merchants Bank of New York, which were acquired by Valley in 2001. As an attorney familiar with regulatory matters in these fields, his service on our Board is greatly valued. He brings years of relevant experience and knowledge in corporate governance, executive compensation and Securities and Exchange Commission laws to the Valley Board of Directors. |

| Richard S. Miller, (75). | |

President of the law firm of Williams, Caliri, Miller & Otley, a Professional Corporation.

| ||

Director since 1999.

| ||

| Mr. Miller received his law degree from Rutgers University and has practiced law at Williams, Caliri, Miller & Otley, specializing in banking law and bank regulatory work for 50 years. Prior to joining Valley’s Board, Mr. Miller served as a Director of Ramapo Financial Corporation and The Ramapo Bank for 30 years. Mr. Miller contributed his legal expertise in organizing and chartering seven community banks. He provides Valley’s Board with banking law and bank regulatory work experience, and a banking directorship background. His involvement and understanding of the trust business is also a valuable asset to Valley’s Board of Directors. |

| Barnett Rukin, (69). | |

Chief Executive Officer, SLX Capital Management (asset manager).

| ||

Director since 1991.

| ||

| Mr. Rukin holds a Bachelor’s Degree in Economics from Cornell University. He was the Chief Executive Officer of Short Line (a regional bus line) for 15 years and was a Regional Chief Executive Officer at Coach USA for two years. Mr. Rukin runs an asset management operation and has an in depth knowledge in real estate; federal, state and local regulations; auto, property and casualty insurance operations; administration and maintenance. Mr. Rukin brings 48 years of knowledge and management experience in all aspects of a service organization to Valley’s Board of Directors. |

6

Table of Contents

| Suresh Sani, (45). | |

President, First Pioneer Properties, Inc. (a privately-owned commercial real estate management company).

| ||

Director since 2007.

| ||

| Mr. Sani received his Bachelor’s Degree from Harvard College and a Juris Doctor Degree from the New York University School of Law. Mr. Sani is a former associate at the law firm of Shea & Gould. As president of First Pioneer Properties, Inc., he is responsible for the acquisition, financing, developing, leasing and managing of real estate assets. He has over 20 years of experience in managing and owning commercial real estate in Valley’s lending area. He brings a legal background, small business network management and real estate expertise to Valley’s Board of Directors. his business experience from operating a small business for over 20 years. |

| Robert Soldoveri, (56). Owner/Manager, Solan Management LLC (an investment property management firm).

| |

Director since 2008.

| ||

Other directorships: Greater Community Bancorp.

| ||

| Mr. Soldoveri attended the University of Scranton, where he studied accounting and psychology. He is the Owner and Manager of Solan Management, LLC; a General Partner of Union Boulevard Realty, LLC; and a General Partner of Portledge Realty. Prior to his affiliation with Solan Management, he ran and operated Northeast Equipment Transport, Inc., a heavy equipment operating company and S&S Material Handling, which provided services to land developers and building contractors. Before joining Valley’s Board, Mr. Soldoveri served as a Director of Greater Community Bancorp and Greater Community Bank since 2001. Mr. Soldoveri brings to Valley’s Board of Directors demonstrated leadership and experience with a wide array of real estate, corporate financing and operational matters. |

| * | Mr. Graham Jones and Mr. Walter Jones are brothers. |

RECOMMENDATION AND VOTE REQUIRED ON ITEM 1

THE VALLEY BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE NOMINATED SLATE OF DIRECTORS.

DIRECTORS WILL BE ELECTED BY A PLURALITY OF THE VOTES CAST AT THE MEETING.

7

Table of Contents

RATIFICATION OF THE APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit and Risk Committee has appointed KPMG LLP to audit Valley’s financial statements for 2010. We are asking you to ratify that appointment. On March 5, 2008, Valley, pursuant to the approval of the Company’s Audit and Risk Committee, did not retain Ernst & Young LLP (“E&Y”) as independent registered public accounting firm and engaged KPMG LLP (“KPMG”) as its independent registered public accounting firm.

The reports of E&Y on our financial statements for the year ended December 31, 2007 did not contain an adverse opinion or a disclaimer of opinion and are not qualified or modified as to uncertainty, audit scope or accounting principles. During the year ended December 31, 2007 and through March 5, 2008, there were no disagreements with E&Y on any matters of accounting principles or practices, financial statement disclosure, or auditing scope of procedure, which disagreements, if not resolved to E&Y’s satisfaction, would have caused E&Y to make reference to the subject matter of the disagreement in connection with its audit report on the Company’s financial statements for such year, and there were no reportable events as defined in Item 304(a)(1)(v) of Regulation S-K. During the year ended December 31, 2007 and through March 5, 2008, the Company did not consult with KPMG regarding any of the matters or events set forth in Item 304(a)(2)(i) and (ii) of Regulation S-K. We requested E&Y to furnish a letter addressed to the Securities and Exchange Commission stating whether it agrees with the above statements. A copy of the letter is filed as Exhibit 16 to the Form 8-K filed on March 7, 2008.

KPMG audited our books and records for the years ended December 31, 2008 and 2009, while E&Y performed the audited services for the year ended December 31, 2007. The fees billed for services rendered to us by our independent accountants for the years ended December 31, 2009 and 2008 were as follows:

| 2009* | 2008* | |||||

Audit fees | $ | 948,500 | $ | 627,000 | ||

Audit-related fees | 232,000 | 24,000 | ||||

Tax fees | 0 | 15,000 | ||||

All other fees | 0 | 0 | ||||

Total | $ | 1,180,500 | $ | 666,000 | ||

| * | Amounts exclude $381 thousand and $333 thousand of unbilled fees for KPMG, for the period ended December 31, 2009 and 2008, respectively. |

“Audit-related fees” include fees paid for benefit plan audits and other attestation services not directly related to the audit of our consolidated financial statements. “Tax Fees” include fees paid for tax advice services related to general state and local taxes.

The Audit and Risk Committee adopted a formal policy concerning the pre-approval of audit and non-audit services to be provided by its independent accountants to Valley. The policy requires that all services to be performed by KPMG, Valley’s independent accountants, including audit services, audit-related services and permitted non-audit services, be pre-approved by the Audit and Risk Committee. Specific services being provided by the independent accountants are regularly reviewed in accordance with the pre-approval policy. At each subsequent Audit and Risk Committee meeting, the Committee receives updates on the services actually provided by the independent accountants, and management may present additional services for approval. All services rendered by KPMG are permissible under applicable laws and regulations, and the Audit and Risk Committee pre-approved all audit, audit-related and non-audit services performed by KPMG during fiscal 2009. Representatives of KPMG will be available at the annual meeting and will have the opportunity to make a statement and answer appropriate questions from shareholders regarding 2009 financial results.

RECOMMENDATION AND VOTE REQUIRED ON ITEM 2

THE VALLEY BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” RATIFICATION OF THE APPOINTMENT OF KPMG AS VALLEY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR 2010. RATIFICATION OF THE APPOINTMENT OF KPMG REQUIRES A MAJORITY

OF THE VOTES CAST BE “FOR” THE PROPOSAL.

8

Table of Contents

REPORT OF THE AUDIT AND RISK COMMITTEE

March 8, 2010

To the Board of Directors of Valley National Bancorp:

Management is responsible for the preparation, presentation and integrity of the Company’s financial statements, accounting and financial reporting principles, internal controls, and procedures designed to ensure compliance with accounting standards, applicable laws and regulations. The Company’s independent registered public accounting firm, KPMG LLP, performs an annual independent audit of the financial statements and expresses an opinion on the conformity of those financial statements with generally accepted accounting principles in the United States of America.

The following is the report of the Audit and Risk Committee with respect to the audited financial statements for fiscal 2009. With respect to fiscal year 2009, the Audit and Risk Committee has:

| — | reviewed and discussed Valley’s audited financial statements with management and KPMG; |

| — | discussed with KPMG the scope of its services, including its audit plan; |

| — | reviewed Valley’s internal control procedures; |

| — | discussed with KPMG the matters required to be discussed by the Statement on Auditing Standards No. 61, as amended (AICPA,Professional Standards, vol. 1, AU section 380), as adopted by the Public Company Accounting Oversight Board in Rule 3200T; |

| — | received the written disclosures and the letter from KPMG required by applicable requirements of the Public Company Accounting Oversight Board regarding KPMG’s communications with the Audit and Risk Committee concerning independence, and discussed with KPMG their independence from management and Valley; and |

| — | approved the audit and non-audit services provided during fiscal 2009 by KPMG. |

Based on the foregoing review and discussions, the Audit and Risk Committee recommended to the Board of Directors that the audited financial statements be included in our Annual Report on Form 10-K for fiscal 2009.

Pursuant to Section 404 of the Sarbanes-Oxley Act, management is required to prepare as part of the Company’s 2009 Annual Report on Form 10-K, a report by management on its assessment of the Company’s internal control over financial reporting, including management’s assessment of the effectiveness of such internal control. KPMG is also required by Section 404 to prepare and include as part of the Company’s 2009 Annual Report on Form 10-K, the auditors’ attestation report on management’s assessment. During the course of 2009, management regularly discussed the internal control review and assessment process with the Audit and Risk Committee, including the framework used to evaluate the effectiveness of such internal control, and at regular intervals updated the Audit and Risk Committee on the status of this process and actions taken by management to respond to issues identified during this process. The Audit and Risk Committee also discussed this process with KPMG. Management’s assessment report and the auditor’s attestation report are included as part of the 2009 Annual Report on Form 10-K.

Andrew B. Abramson, Committee Chairman

Eric P. Edelstein, Vice Chairman

Pamela R. Bronander

Gerald Korde

Michael L. LaRusso

Marc J. Lenner

9

Table of Contents

APPROVAL OF THE VALLEY NATIONAL BANCORP

2010 EXECUTIVE INCENTIVE PLAN

The Valley National Bancorp 2010 Executive Incentive Plan (the “Plan”) was approved by the Board of Directors on March 2, 2010, subject to shareholder approval at the 2010 Annual Meeting. If approved by the shareholders, the Plan will become effective as of January 1, 2010. This Plan will replace the Executive Incentive Plan (“EIP”) adopted by the Board of Directors in 2000 and approved by shareholders at the 2000 Annual Meeting and reapproved by shareholders at the 2005 Annual Meeting. If the Plan is not approved by shareholders no bonuses will be paid under the Plan. We reserve the right to use other discretionary bonus compensation outside of the Plan.

The Plan is being proposed to create what the Board believes will be effective incentive compensation while at the same time allowing us to deduct for federal income tax purposes certain executive compensation we would otherwise not be able to deduct. The Plan accomplishes the latter purpose by complying with Section 162(m) of the Internal Revenue Code and regulations under Section 162(m). Section 162(m) provides that we are not entitled to a federal income tax deduction for annual compensation in excess of $1,000,000 paid by Valley to any of our named executive officers (named in the Summary Compensation Table each year) subject to certain exceptions. One exception allows us to deduct compensation which meets the requirements for performance-based compensation if the performance-based compensation is paid or distributed pursuant to a plan which has been approved by our shareholders. Thus our shareholder approval is necessary to deduct certain incentive compensation paid under the Plan.

The Plan creates on January 1 of each year a bonus pool consisting of 5% of the net income before taxes which may be earned by us in the coming year. This aspect of the Plan makes the Plan performance-based compensation. The bonus pool which is created is then split into shares by the Compensation and Human Resources Committee (the “Compensation Committee”), which will administer the Plan, and awarded to participants at any time prior to 90 days after the beginning of the calendar year in which the bonus pool will be earned. The Compensation Committee is not required to award 100 percent of the bonus pool and after shares are awarded in the pool the Committee retains the right, in its sole discretion, to reduce (but not to increase) the amount of any award until it is paid to an executive. The Compensation Committee presently expects it would decide the dollar amount of the share award to be received by the executive after the Committee at the end of the year measures performance against a variety of criteria established earlier in the year as described in the Compensation Discussion and Analysis Section on page 22. The Compensation Committee does not expect that any named executive will receive more than a fixed percentage of salary.

The Compensation Committee and the Board determined to replace the EIP with the Plan because they concluded that the EIP inadvertently created unnecessary incentives for risk. The EIP authorized awards to be based upon such hard factors as earnings per share, return on equity and other numbers oriented goals. In practice, the Compensation Committee set bonuses based upon our meeting certain earnings per share goals. While the new Plan targets a percentage of income, the Plan expressly authorizes the Compensation Committee to exercise negative discretion on the size of the awards and thereby allows the Compensation Committee more easily to take into account a broad array of hard and soft goals to determine the actual size of the incentive bonus. Prior to the payment or distribution of any award pursuant to the Plan, the Compensation Committee must certify in writing, which may be in the form of the minutes of the meetings of the Compensation Committee, that all of the performance goals and other material terms of the Plan pertaining to such award have been met. Awards may be paid or distributed, in whole or in part, in cash or in the form of grants of stock-based awards made under our Long-Term Stock Incentive Plan. Since the Plan expressly authorizes the Compensation Committee to pay awards in both cash and stock, the Committee can make awards of restricted stock qualify for a tax deduction under Section 162(m), if they otherwise would not qualify if granted outside the Plan.

The Plan is consistent with our historical emphasis on performance-based compensation as well as our current compensation philosophy, as more fully described in the Compensation Discussion and Analysis beginning on page 22 of this Proxy Statement. The Plan also assists us by preserving the tax-deductibility of senior officer compensation.

It is anticipated that those eligible to participate in the Plan would be limited to the named executive officers; however, the Committee may designate any other officer or employee of Valley or one of its subsidiaries as eligible to participate in the Plan.

The compensation of non- Plan participants is not covered by the above-described provisions of the Section 162(m). The Compensation Committee may, in its discretion, pay supplemental compensation awards outside of the Plan to one or more Plan participants, which supplemental awards may not be deductible.It is intended that any such supplemental awards would be made in circumstances so as not to cause bonus awards under the Plan to be other than performance-based compensation within the requirements of Section 162(m). The Plan may be amended by the Board of Directors at any time, provided that no amendment which requires shareholder approval in order for bonuses paid under the Plan to continue to be deductible under Section 162(m) or another section of the Internal Revenue Code, may be made without shareholder approval.

10

Table of Contents

A copy of the Plan is attached as Appendix A to this proxy statement and the foregoing description is qualified in its entirety by reference to the Plan.

RECOMMENDATION ON ITEM 3

THE VALLEY BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE APPROVAL OF THE 2010 EXECUTIVE INCENTIVE PLAN THE FAVORABLE VOTE OF A MAJORITY OF THE VOTES CAST IS REQUIRED TO APPROVE THIS PROPOSAL.

ADVISORY VOTE ON COMPENSATION OF NAMED EXECUTIVE OFFICERS

We are providing our shareholders with the opportunity to cast an advisory vote on executive compensation for the named executive officers as described below. Last year the Company participated in the Troubled Asset Relief Program (TARP) administered by the United States Treasury and under the American Recovery and Reinvestment Act of 2009, every TARP participant was required to allow shareholders an advisory vote on executive compensation. While we are no longer required to have such a vote because we are no longer a TARP participant, we continue to believe that it is appropriate to seek the views of shareholders on the design and effectiveness of the Company’s executive compensation program.

The Company’s goal for its executive compensation program is to reward executives who provide leadership for and contribute to our financial success. The Company seeks to accomplish this goal in a way that is aligned with the long-term interests of the Company’s shareholders. The Company believes that its executive compensation program satisfies this goal.

The Compensation Discussion and Analysis beginning on page 22 of this Proxy Statement, describes the Company’s executive compensation program and the decisions made by the Compensation and Human Resources Committee in 2009 and early 2010 in detail.

The Company requests shareholder approval of the compensation of the Company’s named executive officers as disclosed pursuant to the SEC’s compensation disclosure rules (which disclosure includes the Compensation Committee Report, the Compensation Discussion and Analysis, and the compensation tables).

As an advisory vote, this proposal is not binding upon the Board of Directors or the Company. However, the Compensation and Human Resources Committee, which is responsible for designing and administering the Company’s executive compensation program, values the opinions expressed by shareholders in their vote on this proposal, and will consider the outcome of the vote when making future compensation decisions for named executive officers.

RECOMMENDATION AND VOTE REQUIRED FOR ITEM 4

THE VALLEY BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE NON-BINDING APPROVAL OF THE COMPENSATION OF THE NAMED EXECUTIVE OFFICERS DETERMINED BY THE COMPENSATION AND HUMAN RESOURCES COMMITTEE. THE “FOR” VOTE OF A MAJORITY OF THE VOTES CAST WILL CONSTITUTE APPROVAL OF THIS ADVISORY PROPOSAL.

Our business and affairs are managed under the direction of the Board of Directors. Members of the Board are kept informed of Valley’s business through discussions with the Chairman and our other officers, by reviewing materials provided to them and by participating in meetings of the Board and its committees. In this regard, to further educate directors about Valley and assist committees in their work, committees are encouraged to invite non-member directors to attend committee meetings to learn about the workings of the Board. All members of the Board also served as directors of our subsidiary bank, Valley National Bank (the “Bank”), during 2009. It is our policy that all directors attend the annual meeting absent a compelling reason, such as family or medical emergencies. In 2009, all directors then serving attended our annual meeting.

Our Board of Directors believes that the purpose of corporate governance is to ensure that we maximize shareholder value in a manner consistent with legal requirements and safe and sound banking principles. The Board has adopted corporate governance practices, which the Board and senior management believe promote this purpose. Periodically these governance practices, as well as the rules and listing standards of NASDAQ and the NYSE and the regulations of the SEC, are reviewed by senior management, outside expert legal counsel and the Board.

11

Table of Contents

BOARD LEADERSHIP STRUCTUREANDTHE BOARD’S ROLEIN RISK OVERSIGHT. Valley is led by Mr. Gerald Lipkin, who has served as our Chairman and CEO since 1989. Our Board is comprised of Mr. Lipkin and 14 other directors, of whom 10 are independent under NYSE and NASDAQ guidelines. The Board has three standing independent committees with separate chairpersons – the Audit and Risk Committee, a Nominating and Corporate Governance Committee, and a Compensation and Human Resources Committee. Our Audit and Risk Committee is responsible for overseeing risk management, and our full board regularly engages in discussions of risk management and receives reports on risk from our executive management, other company officers and the chair of the Audit Committee. Each of our other board committees also considers the risk within its area of responsibilities. We do not have a lead director, but our corporate governance guidelines provide that our non-management directors will meet in executive session at least once a year and that the three chairs of our board committees will rotate in presiding at these executive sessions.

We have employed this same basic leadership structure since Mr. Lipkin became Chairman and CEO in 1989. We believe that this leadership structure has been effective. Our corporate leadership structure is commonly utilized by other public companies in the United States. We believe that having a combined chairman/CEO and independent chairpersons for each of our Board committees provides the right form of leadership. We have a single leader for our company who can present a consistent vision, and he is seen by our customers, business partners, investors and other stakeholders as providing strong leadership for Valley and in our industry. We believe that our Chairman/CEO together with the Audit and Risk Committee and the full board of directors, provide effective oversight of the risk management function.

DIRECTOR INDEPENDENCE. The Board has determined that a majority of the directors and all current members of the Nominating and Corporate Governance, Compensation and Human Resources, and Audit and Risk Committees are “independent” for purposes of the independence standards of both the New York Stock Exchange and NASDAQ, and that all of the members of the Audit and Risk Committee are also “independent” for purposes of Section 10A(m)(3) of the Securities Exchange Act of 1934 and the independence standards of both the New York Stock Exchange and NASDAQ. The Board based these determinations primarily on a review of the responses of the directors to questions regarding employment and transaction history, affiliations and family and other relationships and on discussions with the directors. Our independent directors are: Andrew B. Abramson, Pamela R. Bronander, Eric P. Edelstein, Gerald Korde, Michael L. LaRusso, Marc J. Lenner, Robinson Markel, Richard S. Miller, Barnett Rukin and Suresh L. Sani.

To assist in making determinations of independence, the Board has concluded that the following relationships are immaterial and that a director whose only relationships with the Company fall within these categories is independent:

| — | A loan made by the Bank to a director, his or her immediate family or an entity affiliated with a director or his or her immediate family, or a loan personally guaranteed by such persons if such loan (i) complies with federal regulations on insider loans, where applicable; and (ii) is not classified by the Bank’s credit risk department or independent loan review department, or by any bank regulatory agency which supervises the Bank; |

| — | A deposit, trust, insurance brokerage, investment advisory, securities brokerage or similar customer relationship between Valley or its subsidiaries and a director, his or her immediate family or an affiliate of his or her immediate family if such relationship is on customary and usual market terms and conditions; |

| — | The employment by Valley or its subsidiaries of any immediate family member of the director if the employee serves below the level of a senior vice president; |

| — | Annual contributions by Valley or its subsidiaries to any charity or non-profit corporation with which a director is affiliated if the contributions do not exceed an aggregate of $30,000 in any calendar year; |

| — | Purchases of goods or services by Valley or any of its subsidiaries from a business in which a director or his or her spouse or minor children is a partner, shareholder or officer, if the director, his or her spouse and minor children own five percent (5%) or less of the equity interests of that business and do not serve as an executive officer of the business; or |

| — | Purchases of goods or services by Valley, or any of its subsidiaries, from a director or a business in which the director or his or her spouse or minor children is a partner, shareholder or officer if the annual aggregate purchases of goods or services from the director, his or her spouse or minor children or such business in the last calendar year does not exceed the greater of $120,000 or 5% of the gross revenues of the business. |

12

Table of Contents

The Board considered the following categories of items for each director it determined was independent:

| Name | Loans* | Trust Services/Assets Under Management | Banking Relationship with VNB | Professional Services to Valley | ||||

Andrew B. Abramson | Commercial and Personal | Trust Services | Checking, Savings, Certificate of Deposit | None | ||||

Pamela R. Bronander | Commercial and Personal Line of Credit, Home Equity | None | Checking, Savings, Certificate of Deposit | None | ||||

Eric P. Edelstein | Residential Mortgage | None | Checking | None | ||||

Gerald Korde | Commercial, Commercial and Personal Line of Credit | Trust Services | Checking, Money Market | None | ||||

Michael L. LaRusso | Mortgage, Home Equity | None | Checking, Money Market, Safekeeping | None | ||||

Marc J. Lenner | Commercial Mortgage, Residential Mortgage, Personal Line of Credit and Home Equity | None | Checking, Money Market, Certificate of Deposit, IRA | None | ||||

Robinson Markel | None | None | Checking | Legal | ||||

Richard S. Miller | Home Equity Line of Credit | None | Checking, Savings | Legal | ||||

Barnett Rukin | Commercial and Home Mortgages, Line of credit | Assets Under Management | Checking, Safe Deposit Box | None | ||||

Suresh L. Sani | Commercial Mortgage | None | Checking, Money Market | None |

| * | In compliance with Regulation O. |

EXECUTIVE SESSIONSOF NON-MANAGEMENT DIRECTORS. Valley’s Corporate Governance Guidelines require the Board to provide for executive sessions with only independent, non-management directors participating. At least once a year, the Board holds an executive session including only independent, non-management directors. Valley’s Board has chosen to rotate the presiding director for each meeting among the respective chairmen of the Audit and Risk, Compensation and Human Resources, and Nominating and Corporate Governance Committees.

SHAREHOLDERAND INTERESTED PARTIES COMMUNICATIONSWITH DIRECTORS. The Board of Directors has established the following procedures for shareholder or interested party communications with the Board of Directors; or with the rotating chairman of the executive sessions of the non-management directors of the Board:

| — | Shareholders or interested parties wishing to communicate with the Board of Directors; or with the presiding director of executive sessions, should send any communication to Valley National Bancorp, c/o Alan D. Eskow, Corporate Secretary, at 1455 Valley Road, Wayne, New Jersey 07470. Any such communication should state the number of shares owned by the shareholder. |

| — | The Corporate Secretary will forward such communication to the Board of Directors or, as appropriate, to the particular committee chairman; or to the then presiding director, unless the communication is a personal or similar grievance, a shareholder proposal or related communication, an abusive or inappropriate communication, or a communication not related to the duties or responsibilities of the Board of Directors; or of the non-management directors, in which case the Corporate Secretary has the authority to determine the appropriate disposition of the communication. All such communications will be kept confidential to the extent possible. |

| — | The Corporate Secretary will maintain a log of, and copies of, all such communications for inspection and review by any Board member; or by the presiding director of executive sessions, and will regularly review all such communications with the Board or the appropriate committee chairman; or with the presiding director at the next meeting. |

The Board of Directors has also established the following procedures for shareholder or interested party communications with the rotating chairman of the executive sessions of the non-management directors of the Board:

| — | The Corporate Secretary will maintain a log of, and copies of, all such communications for inspection and review by the presiding director of executive sessions, and shall regularly review all such communications with the presiding director at the next meeting. |

COMMITTEESOFTHE BOARDOF DIRECTORS; BOARDOF DIRECTORS MEETINGS

In 2009, the Board of Directors maintained an Audit and Risk Committee, a Nominating and Corporate Governance Committee, and a Compensation and Human Resources Committee. Only independent directors serve on these committees.

13

Table of Contents

During 2009, each director attended at least 95% or more of the meetings of the Board of Directors, the Bank Board and of each committee on which he or she served. Our Board met five times during 2009 and the Bank’s Board met fourteen times during 2009.

The following table presents 2009 membership information for each of our Audit and Risk, Nominating and Corporate Governance, and Compensation and Human Resources Committees.

| Name | Audit and Risk | Nominating and Corporate Governance | Compensation and Human Resources | ||||||

Andrew B. Abramson | X | * | X | X | |||||

Pamela R. Bronander | X | ||||||||

Eric P. Edelstein | X | ** | X | ** | |||||

Gerald Korde | X | X | X | * | |||||

Michael L. LaRusso | X | X | |||||||

Marc J. Lenner | X | ||||||||

Robinson Markel | X | * | X | ** | |||||

Richard S. Miller | X | ||||||||

Barnett Rukin | X |

| * | Committee Chairman |

| ** | Vice Chairman |

AUDITAND RISK COMMITTEE. The Audit and Risk Committee met eight times during 2009, (and in addition, the Committee Chairman and typically one other member of the Audit and Risk Committee met with the Chief Audit Executive and Chief Risk Officer monthly for the purpose of communicating closely with those officers and receiving updates on significant developments.) The Board of Directors has determined that each member of the Audit and Risk Committee is financially literate and that more than one member of the Audit and Risk Committee has the accounting or related financial management expertise required by the NYSE. The Board of Directors has also determined that Mr. Edelstein meets the SEC criteria of an “Audit Committee Financial Expert.”

The charter for the Audit and Risk Committee can be viewed at the “Corporate Profile” link on our website www.valleynationalbank.com. The charter gives the Committee the authority and responsibility for the appointment, retention, compensation and oversight of our independent registered public accounting firm, including pre-approval of all audit and non-audit services to be performed by our independent registered public accounting firm. Each member of the Audit and Risk Committee is independent under both NYSE and NASDAQ listing rules. Other responsibilities of the Audit and Risk Committee pursuant to the charter include:

| — | Reviewing the scope and results of the audit with Valley’s independent registered public accounting firm; |

| — | Reviewing with management and Valley’s independent registered public accounting firm Valley’s interim and year-end operating results including SEC periodic reports and press releases; |

| — | Considering the appropriateness of the internal accounting and auditing procedures of Valley; |

| — | Considering Valley’s outside auditors’ independence; |

| — | Overseeing the risk management, internal audit and internal compliance functions; |

| — | Reviewing examination reports by regulatory agencies, together with management’s response and follow-up; |

| — | Reviewing the significant findings and recommended action plans prepared by the internal audit function, together with management’s response and follow-up; and |

| — | Reporting to the full Board concerning significant matters coming to the attention of the committee. |

14

Table of Contents

NOMINATINGAND CORPORATE GOVERNANCE COMMITTEE. The Committee met four times during 2009. This Committee reviews qualifications of and recommends to the Board candidates for election as director of Valley and the Bank, considers the composition of the Board, recommends committee assignments, and discusses management succession for the Chairman and the CEO positions. The Nominating and Corporate Governance Committee develops corporate governance guidelines which include:

| — | Director qualifications and standards; |

| — | Director responsibilities; |

| — | Director orientation and continuing education; |

| — | Limitations on board members serving on other boards of directors; |

| — | Director access to management and records; and |

| — | Criteria for annual self-assessment of the Board, its committees, and management and their effectiveness. |

The Nominating and Corporate Governance Committee is also charged with overseeing the Board’s adherence to our corporate governance standards and the Code of Conduct and Ethics. The Nominating and Corporate Governance Committee reviews recommendations from shareholders regarding corporate governance and director candidates. The procedure for submitting recommendations of director candidates is set forth below under the caption “Nomination of Directors.” Each member of the Nominating and Corporate Governance Committee is independent under both NYSE and NASDAQ listing rules.

COMPENSATIONAND HUMAN RESOURCES COMMITTEE. The Committee met five times during 2009. The Committee determines CEO compensation, sets general compensation levels for directors, all officers and employees and sets specific compensation for named executive officers (“NEOs”) and other executive officers. It also administers our non-equity and the equity incentive plans, including the 2009 Long-Term Stock Incentive Plan and makes awards pursuant to those plans.The Board has approved its charter, available at the “Corporate Profile” link on our website located at www.valleynationalbank.com, which delegates to the Committee the responsibility to recommend Board compensation. Each member of the Compensation and Human Resources Committee is independent under both NYSE and NASDAQ listing rules.

EXECUTIVE OFFICERS COMPENSATION. In undertaking its responsibilities, annually, the Committee receives from the CEO recommendations for salary, non-equity incentive awards, stock option and restricted stock awards for NEOs and other executive officers. After considering the possible payments under our 2009 Long-Term Incentive Plan and discussing the recommendations with the CEO, the Committee meets in executive session to make the final decisions on these elements of compensation. All stock awards are made using the closing stock price on the date that the awards are approved.

The Committee also determines the CEO’s compensation based on various factors including performance, personal goals and objectives as well as operating targets and the peer group analysis. The determination of the Committee is final.

The salaries, non-equity compensation and stock awards to other officers are proposed by the CEO to the Committee after he has consulted with the other executive officers. These recommendations are reviewed by the Committee and after discussion (and in certain cases amendments) are approved. All stock awards are made using the closing stock price on the date that the awards are approved. For the Chief Audit Executive and the Chief Risk Officer, salaries are approved by the Chairman of the Audit and Risk Committee.

Under authority delegated by the Committee, all other employee salaries and non-equity compensation are determined by executive management. For stock awards, based on operational considerations, prior awards and staff numbers, a block of shares is allocated by the Committee. The individual stock option and restricted stock awards are then allocated by the CEO and his executive staff. All stock awards are made using the closing stock price on the date that the awards are approved.

Under authority delegated by the Committee, during the year, the CEO is authorized to make limited stock option grants and restricted stock awards in specific circumstances (special incentive awards for non-officers, awards to new employees and grants on completion of advanced degrees.) All stock awards are made at the closing stock price on the date that the awards are approved.

All awards not specifically approved in advance by the Committee, but awarded under the authority delegated, are reported to the Committee at its next meeting at which time the Committee ratifies the action taken.

15

Table of Contents

COMPENSATION CONSULTANTS. In 2009 the Committee in its sole discretion employed Fredrick W. Cook & Co. as compensation consultants. The Cook firm was employed to review compensation and performance data of a peer group of comparable financial organizations that had been selected by the Committee and in relationship to these data provide an overview and comments on Valley’s executive compensation. Also, the Cook firm was requested to provide trend information relating to executive compensation matters (specifically, the benefit equalization plan in 2008.) In addition, the Cook firm has reviewed and provided comments on the compensation disclosures contained in this proxy statement.

In addition, the Committee also employed Watson Wyatt Worldwide as compensation analysts to provide an analysis and information relating to our NEOs’ potential post-employment payments described below, under the “Compensation Discussion & Analysis – Potential Payments on Termination of Employment or Change-in-Control” section.

COMPENSATIONASTHEYRELATETORISKMANAGEMENT. The Chief Risk Officer evaluated all incentive-based compensation for all employees of the Company and reported to the Compensation and Human Resources Committee that none individually, or taken together, was reasonably likely to have a material adverse effect on Valley. Each NEO’s compensation was not considered excessive; NEOs did not receive cash incentive payments in 2009. None of the other forms of compensation or incentives were considered to encourage undue or unwarranted risk. The Compensation and Human Resources Committee accepted the Chief Risk Officer’s report.

AVAILABILITYOF COMMITTEE CHARTERS

The Audit and Risk Committee, Nominating and Corporate Governance Committee, and Compensation and Human Resources Committee each operates pursuant to a separate written charter adopted by the Board. Each committee reviews its charter at least annually. All of the committee charters can be viewed at the “Corporate Profile” link on our website www.valleynationalbank.com. Each charter is also available in print to any shareholder who requests it. The information contained on the website is not incorporated by reference or otherwise considered a part of this document.

Nominations for a director may be made only by the Board of Directors, the Nominating and Corporate Governance Committee of the Board, or by a shareholder of record entitled to vote. The Board of Directors has established minimum criteria for members of the Board. These include:

| — | Directors may not be nominated for election to the Board in the calendar year after the year in which the director turns 75; except that a director past 75 years of age who remains employed full time in his or her primary business can be nominated for reelection. The Nominating and Corporate Governance Committee must excuse such a director from participating in the discussion of his/her own renomination; |

| — | The maximum age for an individual to join the Board shall be age 60; |

| — | Each Board member must demonstrate that he or she is mentally and physically able to serve regardless of age; |

| — | Each Board member must be a U.S. citizen and comply with all qualifications set forth in 12 USC §72; |

| — | A majority of the Board members must maintain their principal residence within 100 miles of Wayne, New Jersey (Valley’s primary service area); |

| — | Board members may not stand for re-election to the Board for more than four terms following his or her establishment of a legal residence outside of New Jersey, New York, or Connecticut; |

| — | Each Board member must own a minimum of 5,000 shares of our common stock of which 1,000 shares must be in his or her own name (or jointly with the director’s spouse) and not pledged or hypothecated; |

| — | Unless there are mitigating circumstances (such as medical or family emergencies), any Board member who attends less than 85% of the Board and assigned committee meetings for two consecutive years, will not be nominated for re-election; |

| — | Each Board member must prepare for meetings by reading information provided prior to the meeting. Each Board member should participate in meetings, for example, by asking questions and by inquiring about policies, procedures or practices of Valley; |

16

Table of Contents

| — | Each Board member should be available for continuing education opportunities throughout the year; |

| — | Each Board member is expected to be above reproach in their personal and professional lives and their financial dealings with Valley, the Bank and the community; |

| — | If a Board member (a) has his or her integrity challenged by a governmental agency (indictment or conviction), (b) files for personal or business bankruptcy, (c) materially violates Valley’s Code of Conduct and Ethics, or (d) has a loan made to or guaranteed by the director classified as substandard or doubtful, the Board member shall resign upon request of the Board; |

| — | No Board member should serve on the board of any other bank or financial institution or on more than two boards of other public companies while a member of Valley’s Board without the approval of Valley’s Board of Directors; |

| — | Each Board member should be an advocate for Valley within the community; and |

| — | It is expected that the Bank will be utilized by the Board member for his or her personal and business affiliations. |

The Nominating and Corporate Governance Committee has adopted a policy regarding consideration of director candidates recommended by shareholders. The Nominating and Corporate Governance Committee will consider nominations recommended by shareholders. In order for a shareholder to recommend a nomination, the shareholder must provide the recommendation along with the additional information and supporting materials to our Corporate Secretary not less than 120 days nor more than 150 days prior to the first anniversary of the date of the preceding year’s annual meeting. The shareholder wishing to propose a candidate for consideration by the Nominating and Corporate Governance Committee must own at least 1% of Valley’s outstanding common stock. In addition, the Nominating and Corporate Governance Committee has the right to require any additional background or other information from any director candidate or the recommending shareholder as it may deem appropriate. For Valley’s annual meeting in 2011, we must receive this notice on or after November 15, 2010, and on or before December 15, 2010. The following factors, at a minimum, are considered by the Nominating and Corporate Governance Committee as part of its review of all director candidates and in recommending potential director candidates to the Board:

| — | Appropriate mix of educational background, professional background and business experience to make a significant contribution to the overall composition of the Board; |

| — | If the Nominating and Corporate Governance Committee deems it applicable, whether the candidate would be considered a financial expert or financially literate as described in SEC, NYSE and NASDAQ rules or an Audit and Risk Committee financial expert as defined by SEC rules; |

| — | If the Nominating and Corporate Governance Committee deems it applicable, whether the candidate would be considered independent under NYSE and NASDAQ rules and the Board’s additional independence guidelines set forth in the Company’s Corporate Governance Guidelines; |

| — | Demonstrated character and reputation, both personal and professional, consistent with that required for a bank director; |

| — | Willingness to apply sound and independent business judgment; |

| — | Ability to work productively with the other members of the Board; |

| — | Availability for the substantial duties and responsibilities of a Valley director; and |

| — | Meets the additional criteria set forth in Valley’s Corporate Governance Guidelines. |

Diversity is one of the factors that the Nominating Committee considers in identifying nominees for director. In selecting director nominees the Nominating Committee considers, among other factors, (1) the competencies and skills that the candidate possesses and the candidate’s areas of qualification and expertise that would enhance the composition of the Board, and (2) how the candidate would contribute to the Board’s overall balance of expertise, perspectives, backgrounds and experiences in substantive matters pertaining to the Company’s business. The Nominating Committee has not adopted a formal diversity policy with regard to the selection of director nominees.

You can obtain a copy of the full text of our policy regarding shareholder nominations by writing toDianne M. Grenz, First Senior Vice President, Valley National Bancorp, 1455 Valley Road, Wayne, New Jersey 07470.

17

Table of Contents

COMPENSATIONAND HUMAN RESOURCES COMMITTEE PROCESSESAND PROCEDURES

The Board has delegated the responsibility for executive compensation matters to the Compensation and Human Resources Committee. The minutes of the Committee meetings are provided at Board meetings and the chair of the Committee reports to the Board significant issues dealt with by the Committee.

The Committee operates pursuant to a charter, determines CEO compensation, sets general compensation levels for all officers and employees and sets specific compensation for NEOs and other executive officers. It also administers our non-equity compensation plan and the equity compensation plans, including the 2009 Long-Term Stock Incentive Plan and makes awards pursuant to those plans. The Board has approved its charter, available at the “Corporate Profile” link on the Company’s website located at www.valleynationalbank.com, which delegates to the Committee the responsibility to recommend Board compensation.

CODEOF CONDUCTAND ETHICSAND CORPORATE GOVERNANCE GUIDELINES

We have adopted a Code of Conduct and Ethics which applies to our chief executive officer, principal financial officer, principal accounting officer and to all of our other directors, officers and employees. The Code of Conduct and Ethics is available in the “Corporate Profile” section of our website located at www.valleynationalbank.com. The Code of Conduct and Ethics is also available in print to any shareholder who requests it. We will disclose any substantive amendments to or waiver from provisions of the Code of Conduct and Ethics made with respect to the chief executive officer, principal financial officer or principal accounting officer on that website.

We have also adopted Corporate Governance Guidelines, which are intended to provide guidelines for the governance by the Board and its committees. The Corporate Governance Guidelines are available at the “Corporate Profile” section of our website located at www.valleynationalbank.com. The Corporate Governance Guidelines are also available in print to any shareholder who requests them.

COMPENSATIONOF DIRECTORS. Annual compensation of non-employee directors for 2009 was comprised of the following components: cash compensation consisting of annual retainer; meeting and committee fees; and, to the extent that a director elects to forego all or a portion of the annual retainer and board meeting fees, participation in the 2004 Directors Restricted Stock Plan. In addition, there is also a Directors Retirement Plan. Each of these compensation components is described in detail below. The total 2009 compensation of the non-employee directors is shown in the following table.

2009 DIRECTOR COMPENSATION

| Name | Fees Earned or Paid in Cash (2) | Stock Awards (3) | Change in Pension Qualified Deferred | All Other Compensation (5) | Total | ||||||||||

Andrew B. Abramson (1) | $ | 45,500 | $ | 74,689 | $ | 3,822 | $ | 14,925 | $ | 138,936 | |||||

Pamela R. Bronander | 30,000 | 74,689 | 2,870 | 12,574 | 120,133 | ||||||||||

Eric P. Edelstein (1) | 101,250 | 0 | 5,018 | 9,219 | 115,487 | ||||||||||

Mary J. Steele Guilfoile | 24,000 | 73,355 | 3,540 | 62,931 | 163,826 | ||||||||||

Graham O. Jones | 79,500 | 0 | 8,056 | 0 | 87,556 | ||||||||||

Walter H. Jones, III | 66,000 | 0 | 9,449 | 0 | 75,449 | ||||||||||

Gerald Korde (1) | 98,500 | 0 | 10,027 | 0 | 108,527 | ||||||||||

Michael L. LaRusso | 59,750 | 37,351 | 6,500 | 6,502 | 110,103 | ||||||||||

Marc J. Lenner | 76,500 | 0 | 1,828 | 0 | 78,328 | ||||||||||

Robinson Markel (1) | 86,000 | 0 | 15,527 | 0 | 101,527 | ||||||||||

Richard S. Miller | 89,000 | 0 | 16,546 | 0 | 105,546 | ||||||||||

Barnett Rukin | 71,750 | 0 | 12,308 | 12,642 | 96,700 | ||||||||||

Suresh L. Sani | 60,000 | 0 | 1,943 | 0 | 61,943 | ||||||||||