German American Symbol: GABC September 7 & 8, 2022 Raymond James- U.S. Bank and Banking on Tech Conference

Presented By 2 D. Neil Dauby, President and Chief Executive Officer (812) 482-0707 neil.dauby@germanamerican.com Bradley M. Rust, Sr. EVP, COO and CFO (812) 482-0718 brad.rust@germanamerican.com

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS When used in this presentation and our oral statements, the words or phrases “believe,” “will likely result,” “are expected to,” “will continue,” “is anticipated,” “estimate,” “project,” “plans,” or similar expressions are intended to identify “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. You are cautioned not to place undue reliance on any forward-looking statements, which speak only as of the date of this presentation, and we do not undertake any obligation to update any forward-looking statement to reflect circumstances or events that occur in the future. By their nature, these statements are subject to numerous risks and uncertainties that could cause actual results to differ materially from those anticipated in the statements. Factors that could cause actual results and performance to vary materially from those expressed or implied by any forward-looking statement include those that are discussed in Item 1, “Business – Forward Looking Statements and Associated Risk,” and Item 1A, “Risk Factors,” in our Annual Report on Form 10-K for 2021 as updated and supplemented by our other SEC reports filed from time to time. 3

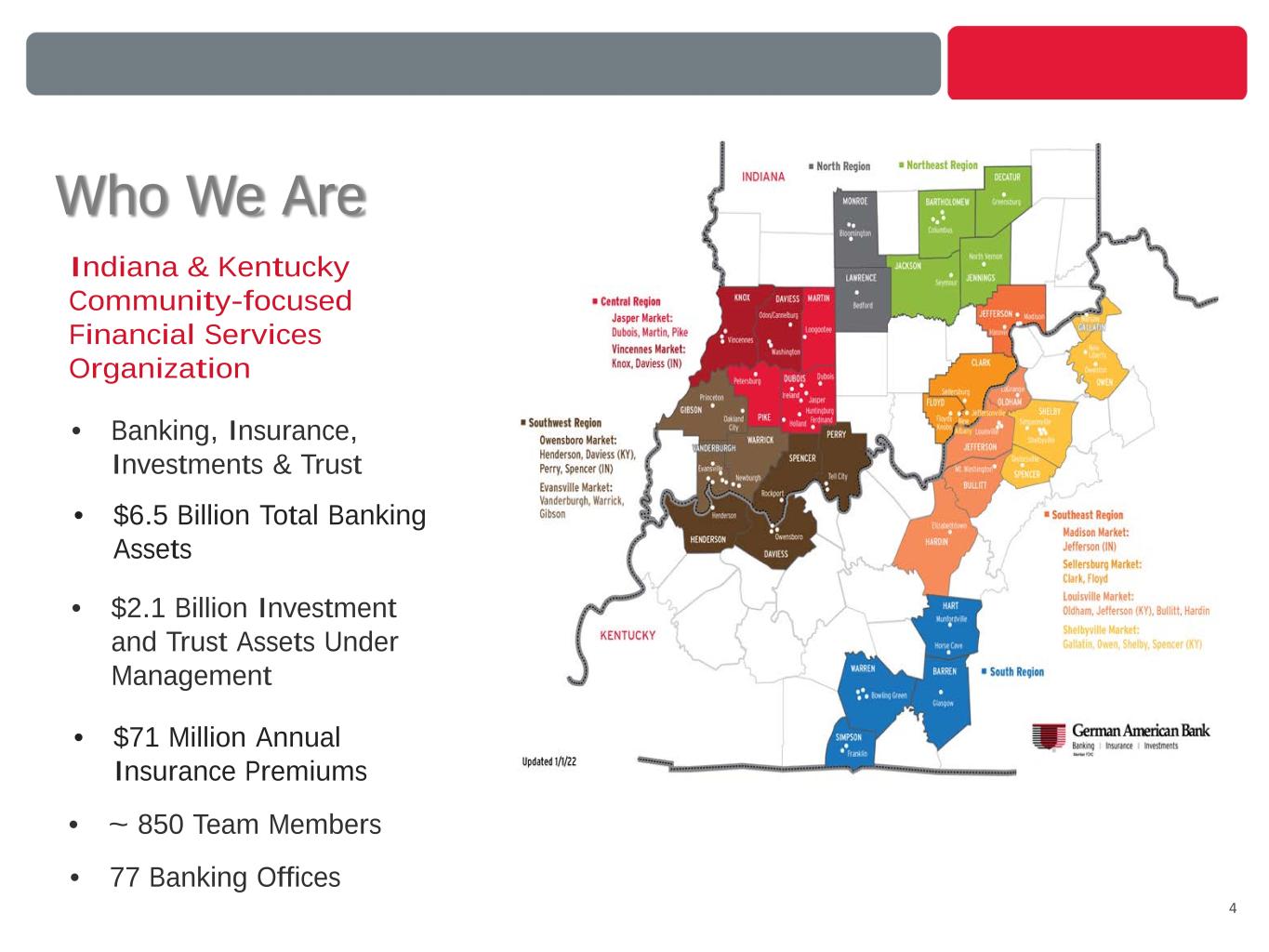

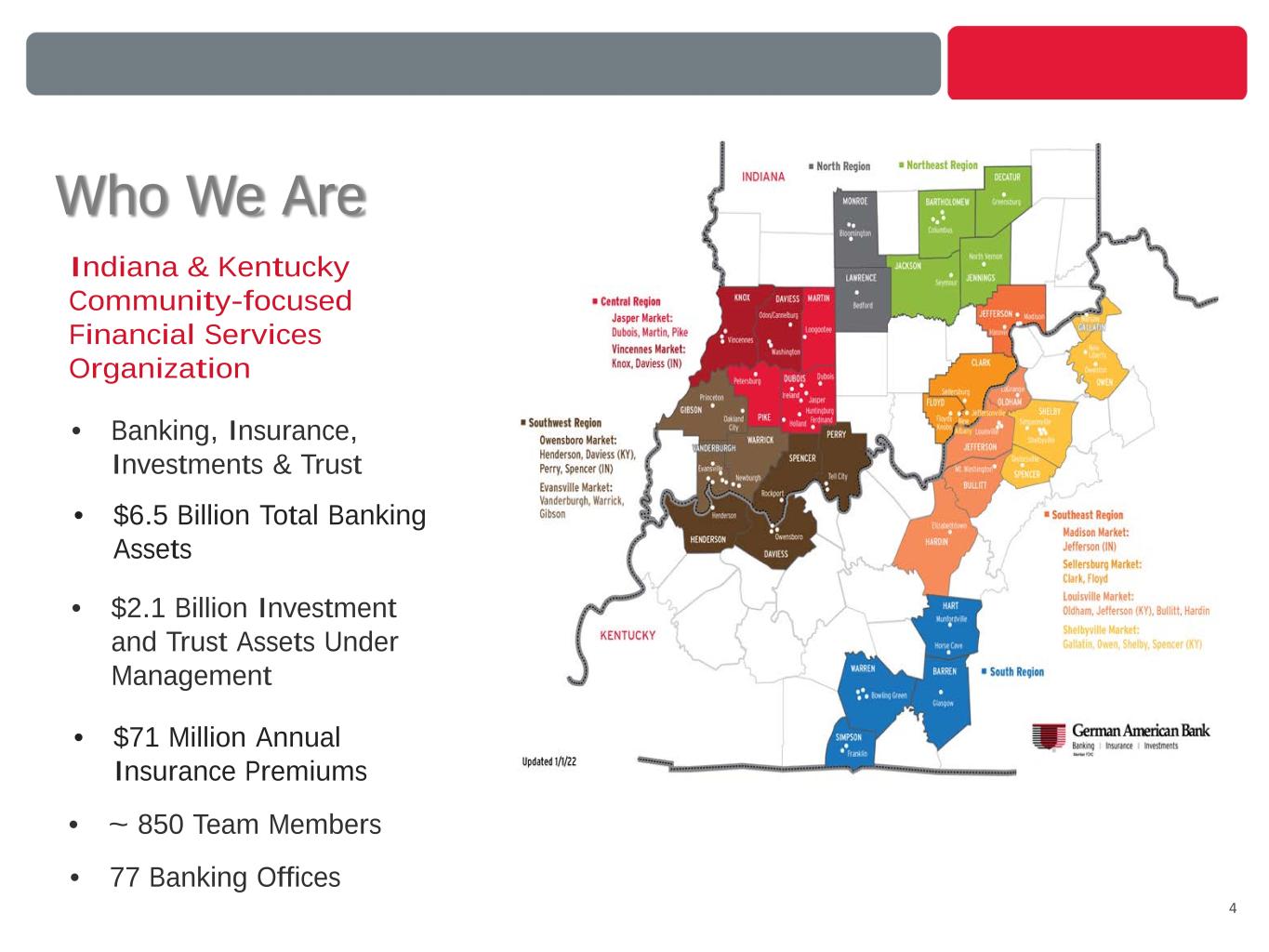

Who We Are Indiana & Kentucky Community-focused Financial Services Organization • Banking, Insurance, Investments & Trust • $6.5 Billion Total Banking Assets • $2.1 Billion Investment and Trust Assets Under Management • $71 Million Annual Insurance Premiums • ~ 850 Team Members • 77 Banking Offices 4

Hi st or y of S up er io r Fi na nc ia l P er fo rm an ce - Ten Consecutive Years of Increased Dividends - Twelve Years of Consecutive Record Earnings Performance - Double-Digit Return on Equity for 17 Consecutive Fiscal Years - Raymond James 2012-2017 and 2019-2021 Community Bankers Cup Recipient - KBW/Stifel 2010 thru 2022 Bank Honor Roll Recipient - Piper Sandler Small Cap All-Star 2012-2013 and 2019-2020 - Newsweek Best Banks in America (Indiana) 2020 & 2021 5

FINANCIAL TRENDS 6

$3,144 $3,929 $4,398 $4,978 $5,609 $6,472 1.35% 1.38% 1.43% 1.32% 1.57% 0.98% $- $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 $7,000 12/31/17 12/31/18 12/31/19 12/31/20 12/31/21 06/30/22 (Dollars in Millions) Total Assets Annualized Return on Assets 7

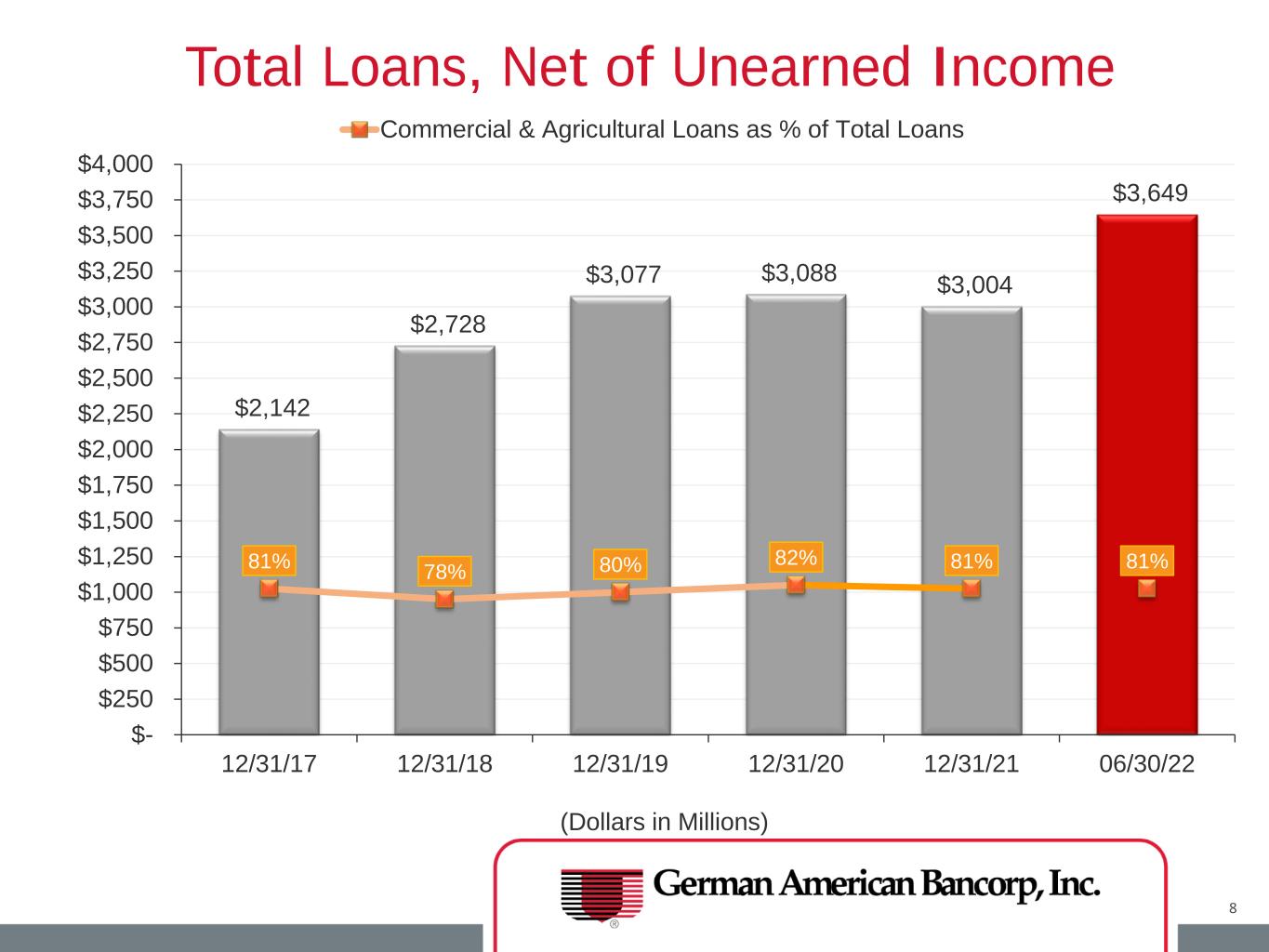

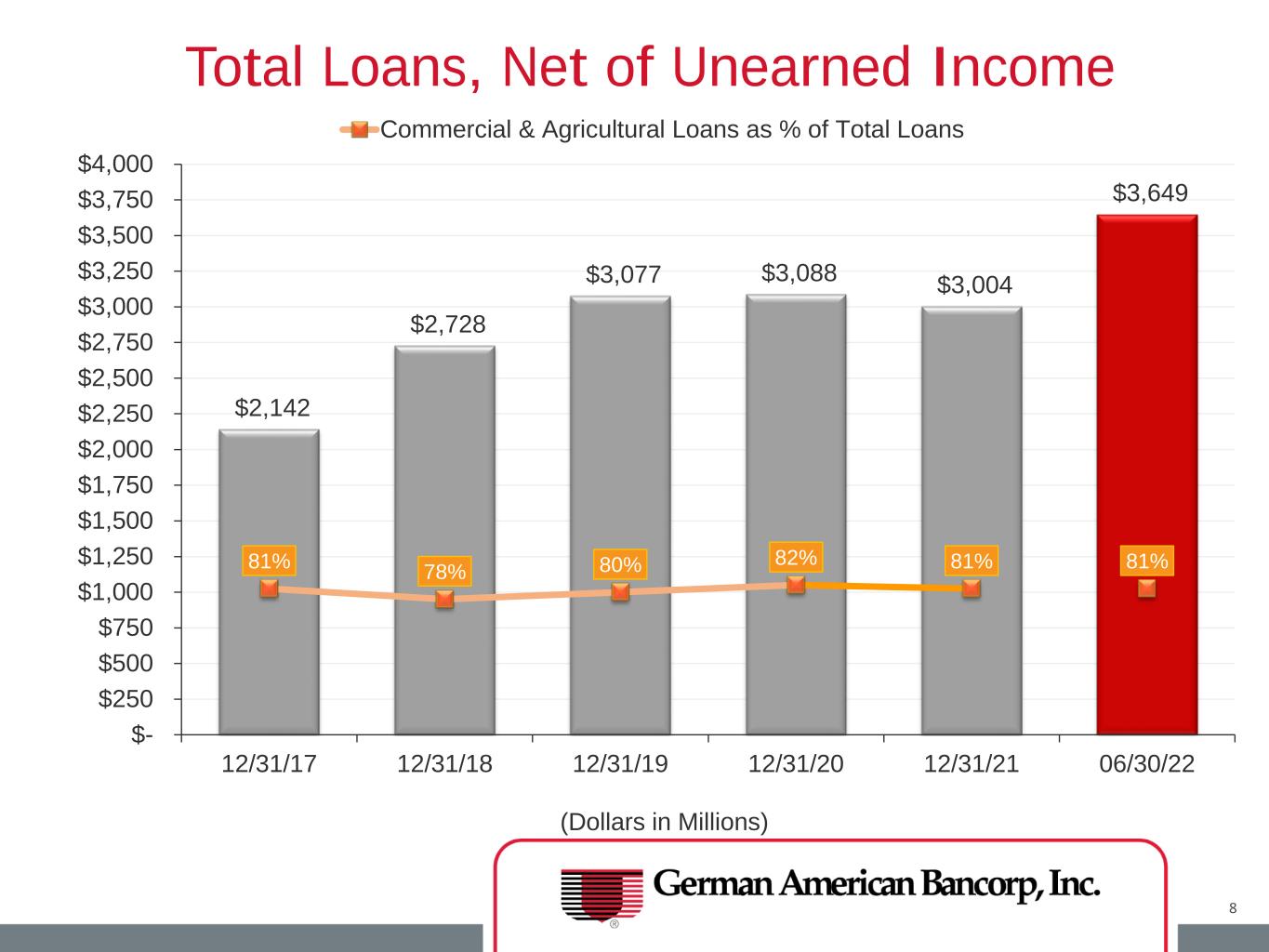

$2,142 $2,728 $3,077 $3,088 $3,004 $3,649 81% 78% 80% 82% 81% 81% $- $250 $500 $750 $1,000 $1,250 $1,500 $1,750 $2,000 $2,250 $2,500 $2,750 $3,000 $3,250 $3,500 $3,750 $4,000 12/31/17 12/31/18 12/31/19 12/31/20 12/31/21 06/30/22 (Dollars in Millions) Total Loans, Net of Unearned Income Commercial & Agricultural Loans as % of Total Loans 8

Total Loans $3,649.4 million Loan Portfolio Composition as of June 30, 2022 9 Construction & Development Loans, $361.4 million, 10% Agricultural Loans, $405.2 million, 11% Commercial & Industrial Loans, $580.0 , million 16% Commercial Real Estate Owner Occupied, $441.6 million, 12% Commercial Real Estate Non- Owner Occupied, $891.1 million, 24% Multi-Family Residential Properties, $294.4 million, 8% Consumer Loans , $66.7 million, 2% Home Equity Loans, $261.7 million, 7% Residential Mortgage Loans, $347.3 million, 10%

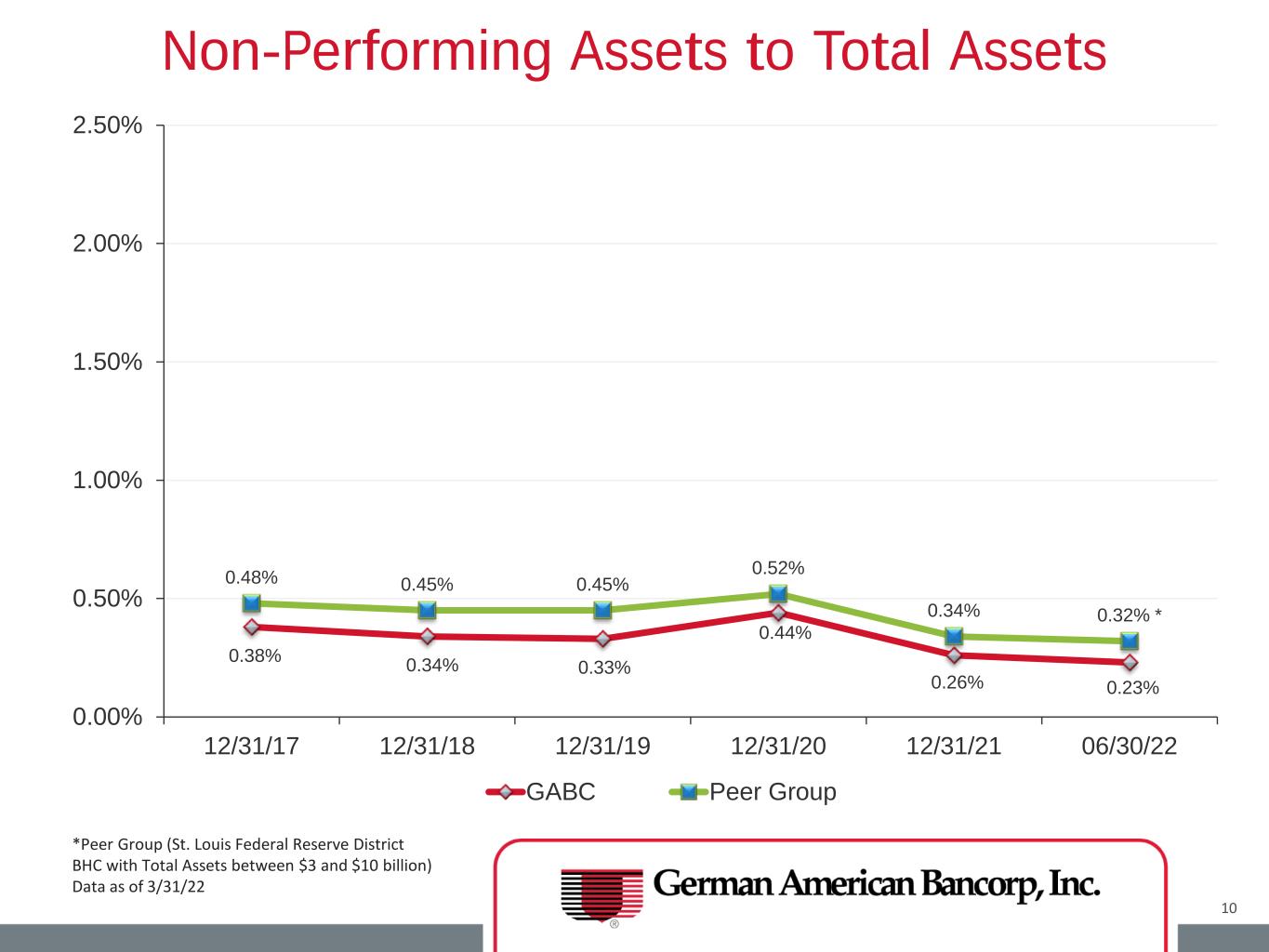

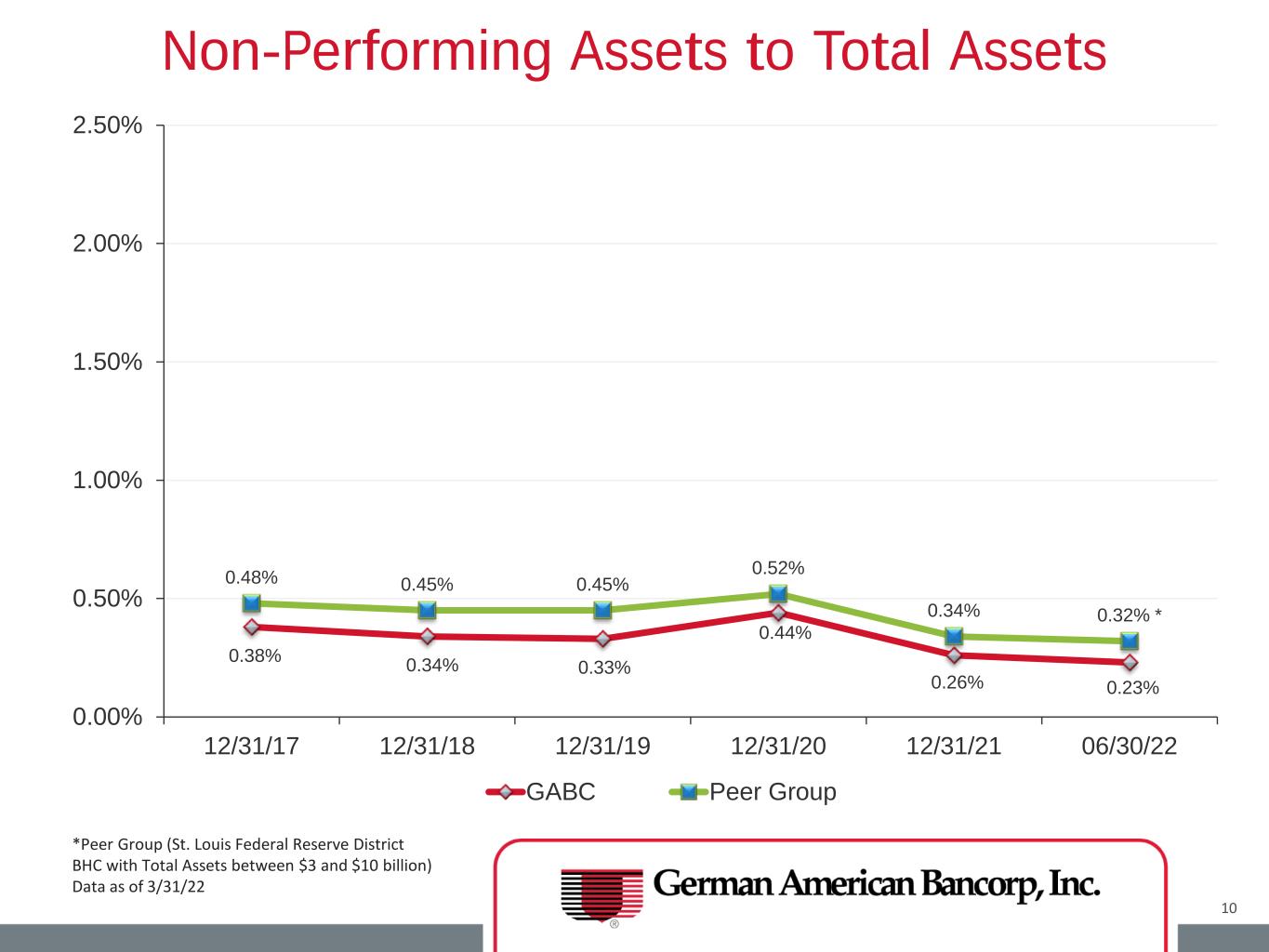

0.38% 0.34% 0.33% 0.44% 0.26% 0.23% 0.48% 0.45% 0.45% 0.52% 0.34% 0.32% * 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 12/31/17 12/31/18 12/31/19 12/31/20 12/31/21 06/30/22 Non-Performing Assets to Total Assets GABC Peer Group 10 *Peer Group (St. Louis Federal Reserve District BHC with Total Assets between $3 and $10 billion) Data as of 3/31/22

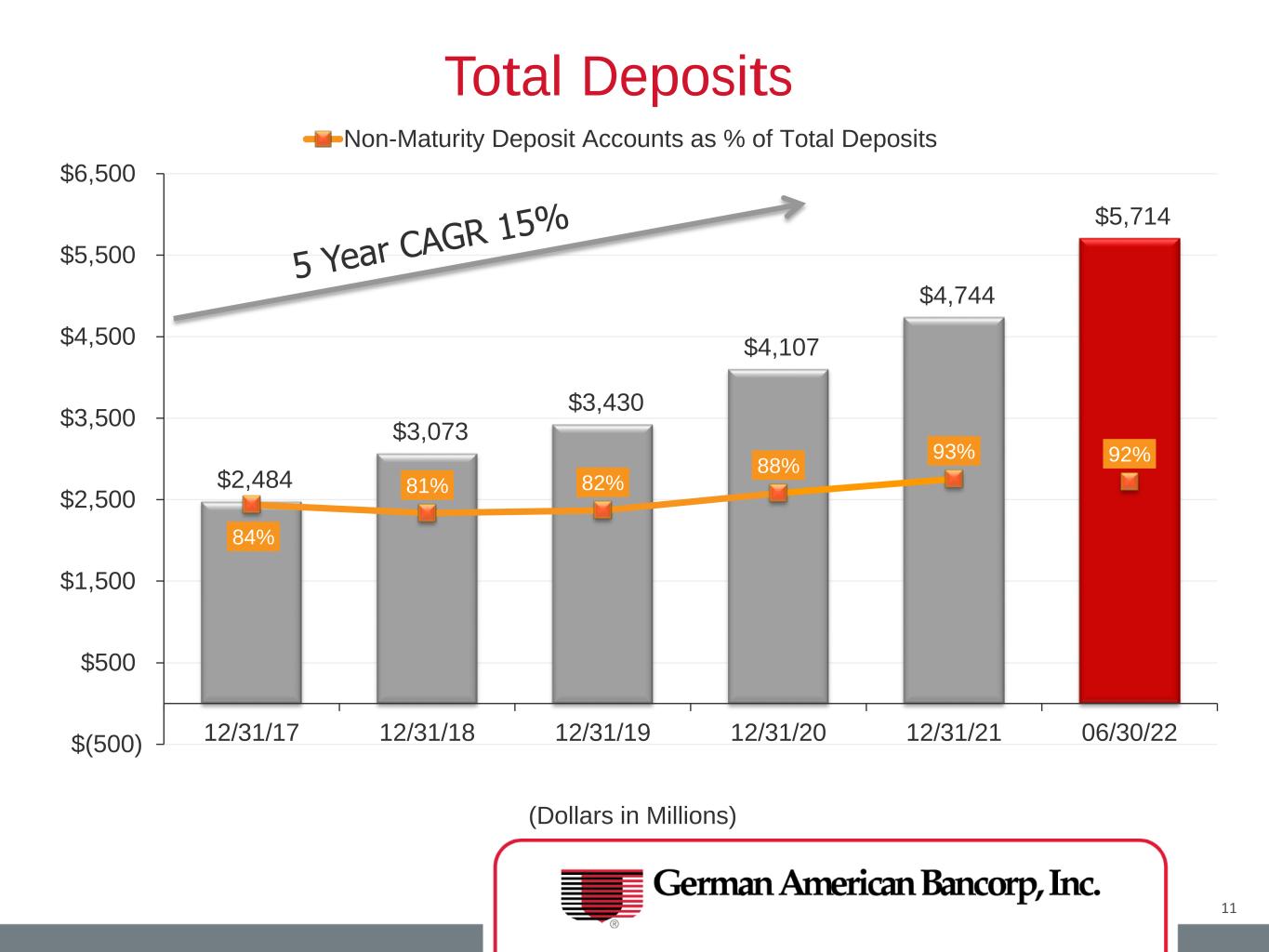

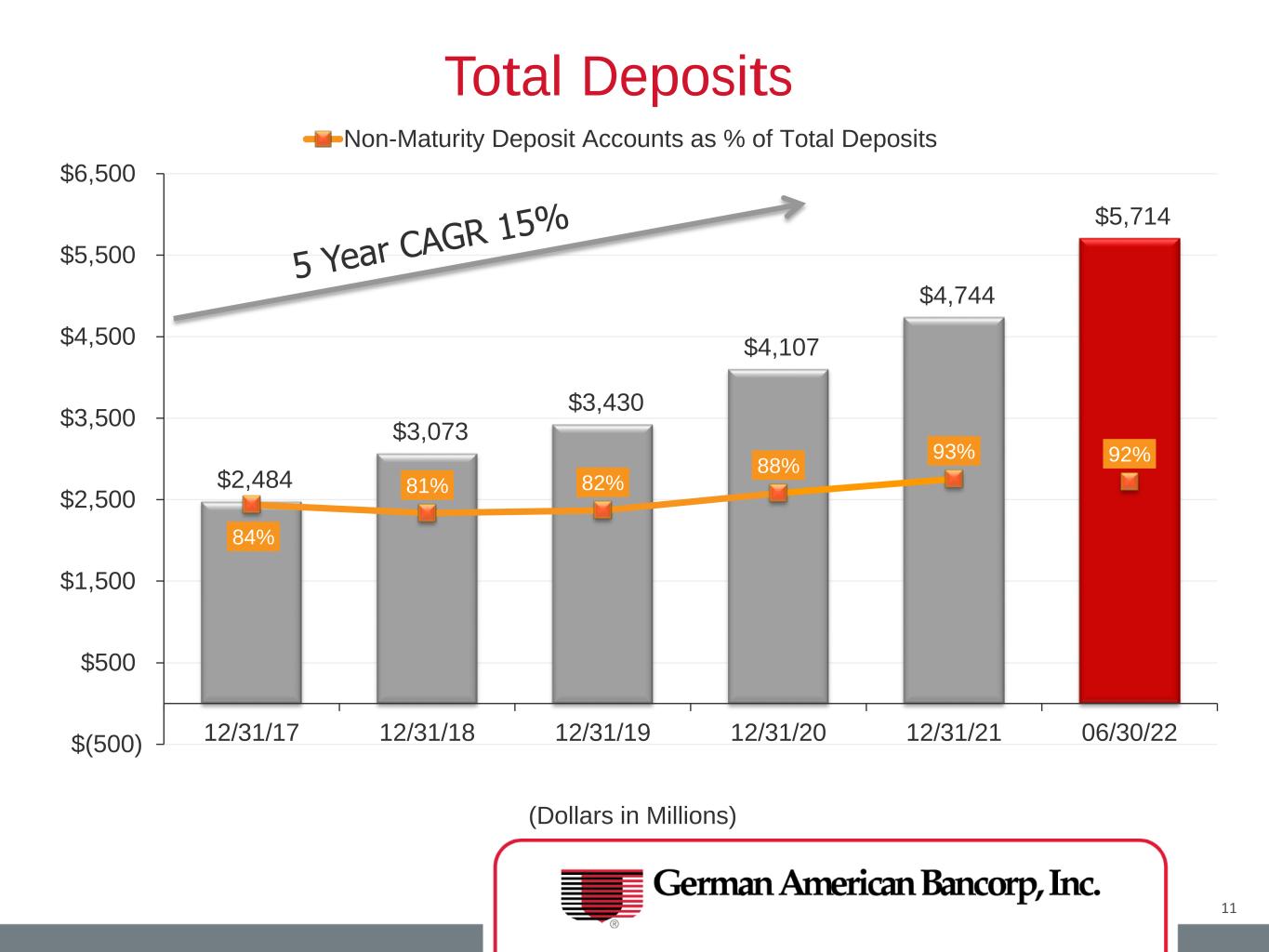

$2,484 $3,073 $3,430 $4,107 $4,744 $5,714 84% 81% 82% 88% 93% 92% $(500) $500 $1,500 $2,500 $3,500 $4,500 $5,500 $6,500 12/31/17 12/31/18 12/31/19 12/31/20 12/31/21 06/30/22 (Dollars in Millions) Total Deposits Non-Maturity Deposit Accounts as % of Total Deposits 11

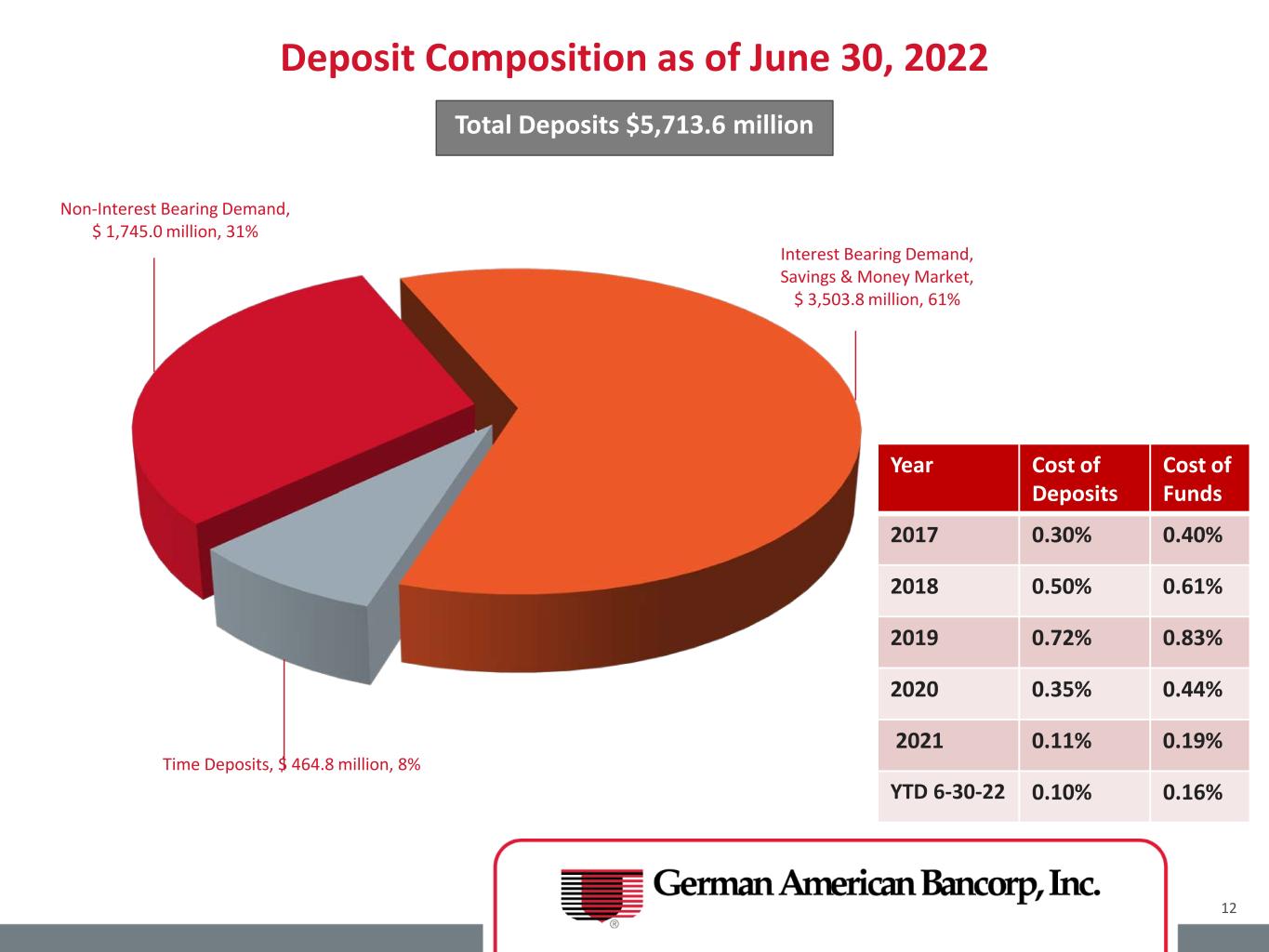

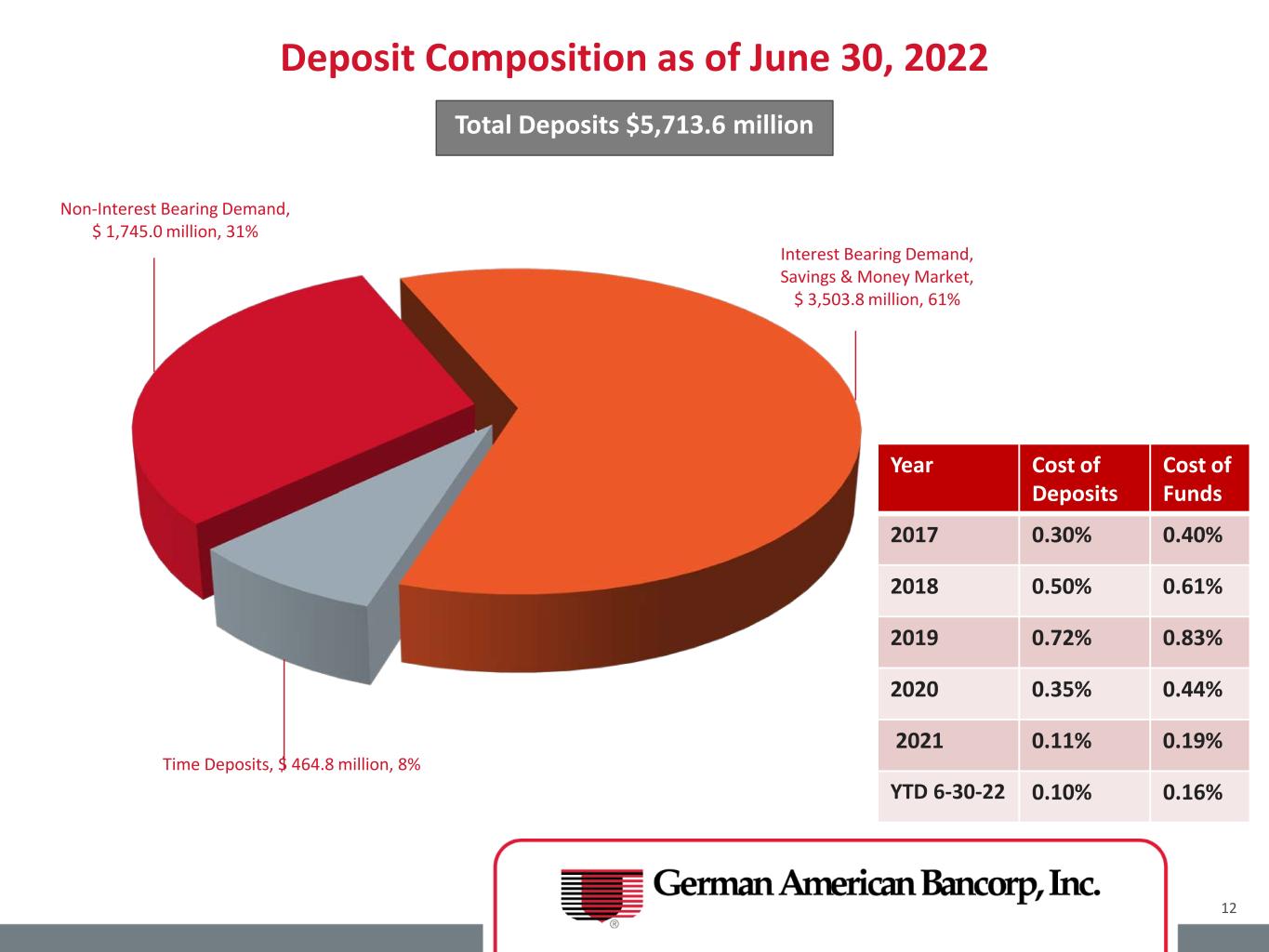

Non-Interest Bearing Demand, $ 1,745.0 million, 31% Interest Bearing Demand, Savings & Money Market, $ 3,503.8 million, 61% Time Deposits, $ 464.8 million, 8% Deposit Composition as of June 30, 2022 Total Deposits $5,713.6 million 12 Year Cost of Deposits Cost of Funds 2017 0.30% 0.40% 2018 0.50% 0.61% 2019 0.72% 0.83% 2020 0.35% 0.44% 2021 0.11% 0.19% YTD 6-30-22 0.10% 0.16%

$365 $459 $574 $625 $668 $574 13.82% 14.82% 14.98% 13.46% 16.38% 13.68% $- $50 $100 $150 $200 $250 $300 $350 $400 $450 $500 $550 $600 $650 $700 $750 12/31/17 12/31/18 12/31/19 12/31/20 12/31/21 06/30/22 (Dollars in Millions) Total Shareholders’ Equity Annualized Return on Tangible Equity 13 13.68

$99,909 $114,610 $145,225 $155,243 $160,830 $78,812 $96,505 3.76% 3.75% 3.92% 3.63% 3.31% 3.35% 3.24% 3.00% 3.50% 4.00% 4.50% 5.00% 5.50% $- $20,000 $40,000 $60,000 $80,000 $100,000 $120,000 $140,000 $160,000 $180,000 12/31/17 12/31/18 12/31/19 12/31/20 12/31/21 YTD 06/30/21 YTD 06/30/22 (Dollars in Thousands) Net Interest Income Net Interest Margin (Tax-Equivalent) 14

$1,750 $2,070 $5,325 $17,550 $(6,500) $(6,500) $5,500 $(800) 0.04% 0.08% 0.17% 0.08% 0.11% 0.02% 0.03% $(9,000) $(7,000) $(5,000) $(3,000) $(1,000) $1,000 $3,000 $5,000 $7,000 $9,000 $11,000 $13,000 $15,000 $17,000 $19,000 12/31/17 12/31/18 12/31/19 12/31/20 12/31/21 YTD 06/30/21 YTD 06/30/22 YTD 06/30/22 (Dollars in Thousands) Provision for Credit Losses Net Charge-off to Average Loans (As Adjusted *) 15 *Adjusted Provision for Credit Losses is a non-GAAP financial measure. Refer to “Use of Non-GAAP Financial Measures” for additional information, including a reconciliation to the comparable GAAP financial measure.

$31,854 $37,070 $45,501 $54,474 $59,462 $28,939 $31,368 24% 24% 24% 26% 27% 27% 25% 22% 27% 32% 37% 42% 47% 52% 57% 62% 67% $- $10,000 $20,000 $30,000 $40,000 $50,000 $60,000 $70,000 12/31/17 12/31/18 12/31/19 12/31/20 12/31/21 YTD 06/30/21 YTD 06/30/22(Dollars in Thousands) Non-Interest Income Non-Interest Income as % of Total Revenue 16

17 Wealth Management Fees, $5,280, 17% Service Charges on Deposit Accounts, $5,554, 18% Insurance Revenues, $5,975, 19% Interchange Fee Income, $7,794, 25% Other Operating Income, $3,845, 12% Net Gains on Sales of Loans, $2,470, 8% Net Gains on Sales of Securities, $450, 1% Non-Interest Income as of June 30, 2022 Total Non-Interest Income $31.4 million (Dollars in Thousands)

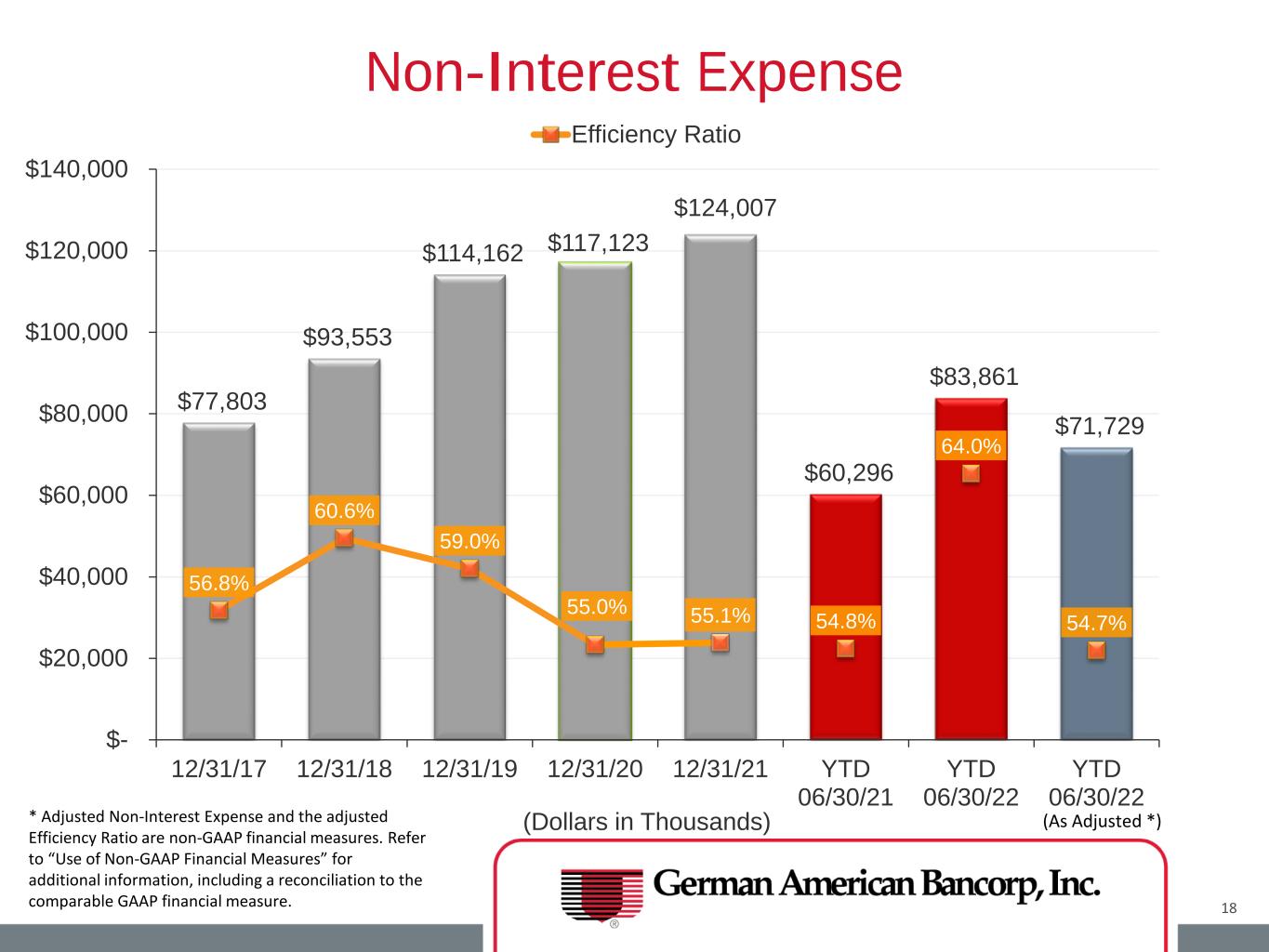

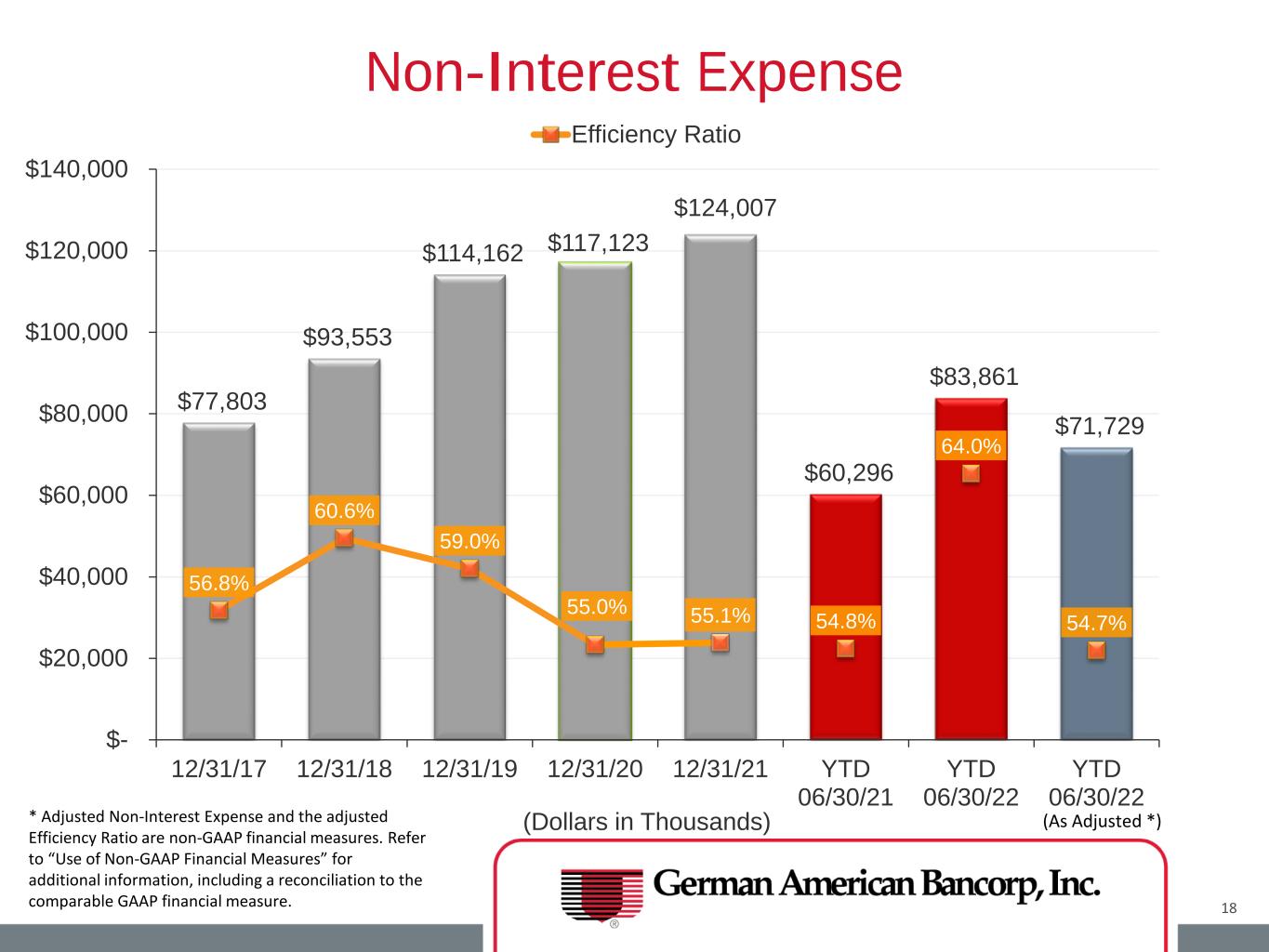

$77,803 $93,553 $114,162 $117,123 $124,007 $60,296 $83,861 $71,729 56.8% 60.6% 59.0% 55.0% 55.1% 54.8% 64.0% 54.7% 50.0% 55.0% 60.0% 65.0% 70.0% 75.0% 80.0% $- $20,000 $40,000 $60,000 $80,000 $100,000 $120,000 $140,000 12/31/17 12/31/18 12/31/19 12/31/20 12/31/21 YTD 06/30/21 YTD 06/30/22 YTD 06/30/22 (Dollars in Thousands) Non-Interest Expense Efficiency Ratio (As Adjusted *) 18 * Adjusted Non-Interest Expense and the adjusted Efficiency Ratio are non-GAAP financial measures. Refer to “Use of Non-GAAP Financial Measures” for additional information, including a reconciliation to the comparable GAAP financial measure.

$40,676 $46,529 $59,222 $62,210 $84,137 $43,379 $32,814 $46,767 $1.77 $1.99 $2.29 $2.34 $3.17 $1.64 $1.11 $1.58 $- $1.00 $2.00 $3.00 $4.00 $5.00 $6.00 $7.00 $8.00 $9.00 $10.00 $- $10,000 $20,000 $30,000 $40,000 $50,000 $60,000 $70,000 $80,000 $90,000 12/31/17 12/31/18 12/31/19 12/31/20 12/31/21 YTD 06/30/21 YTD 06/30/22 YTD 06/30/22 Net Income & Earnings Per Share Earnings Per Share (As Adjusted *) 19 * Adjusted Net-Income and adjusted Earnings per Share are non-GAAP financial measures. Refer to “Use of Non- GAAP Financial Measures” for additional information, including a reconciliation to the comparable GAAP financial measure.

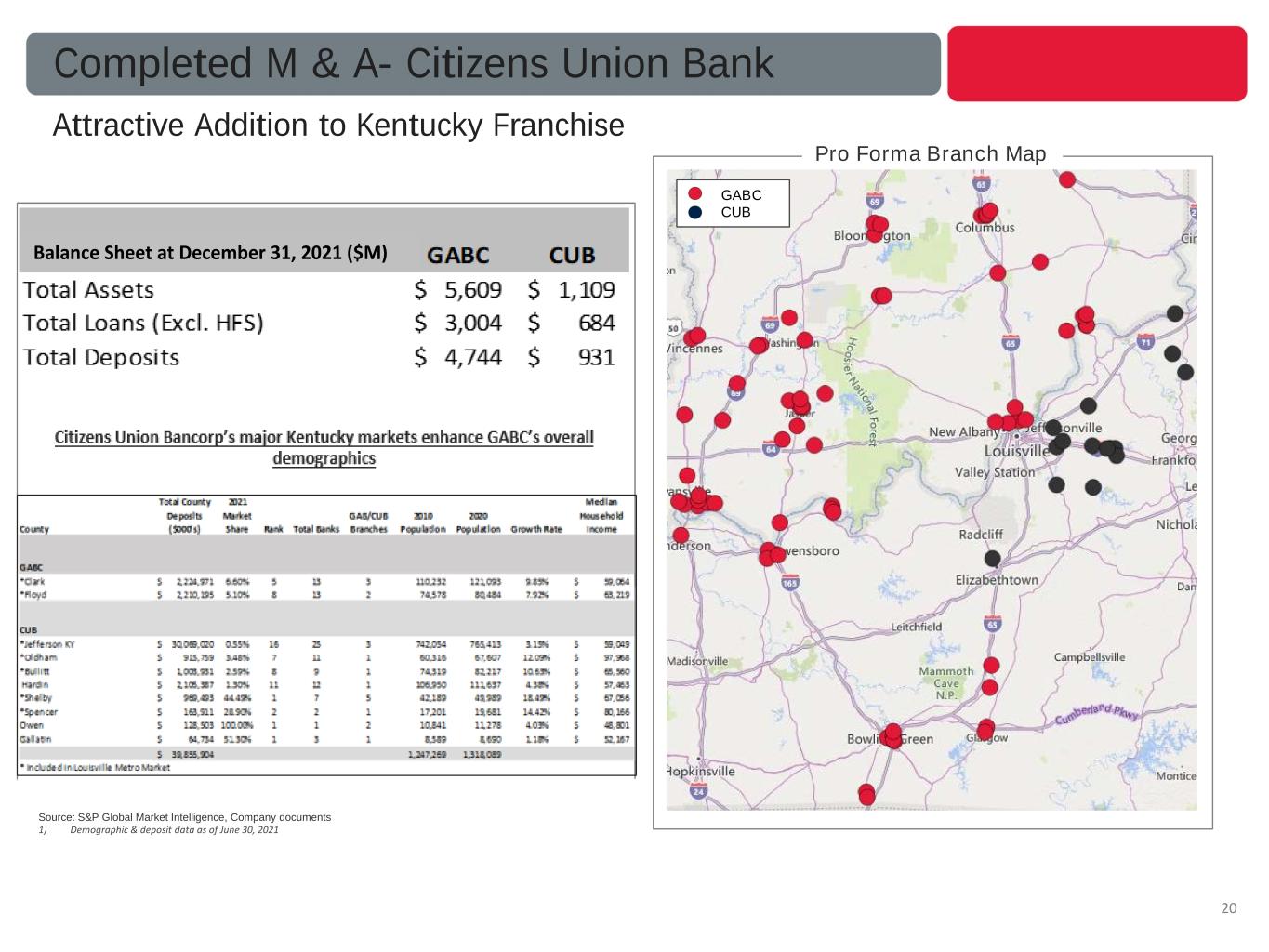

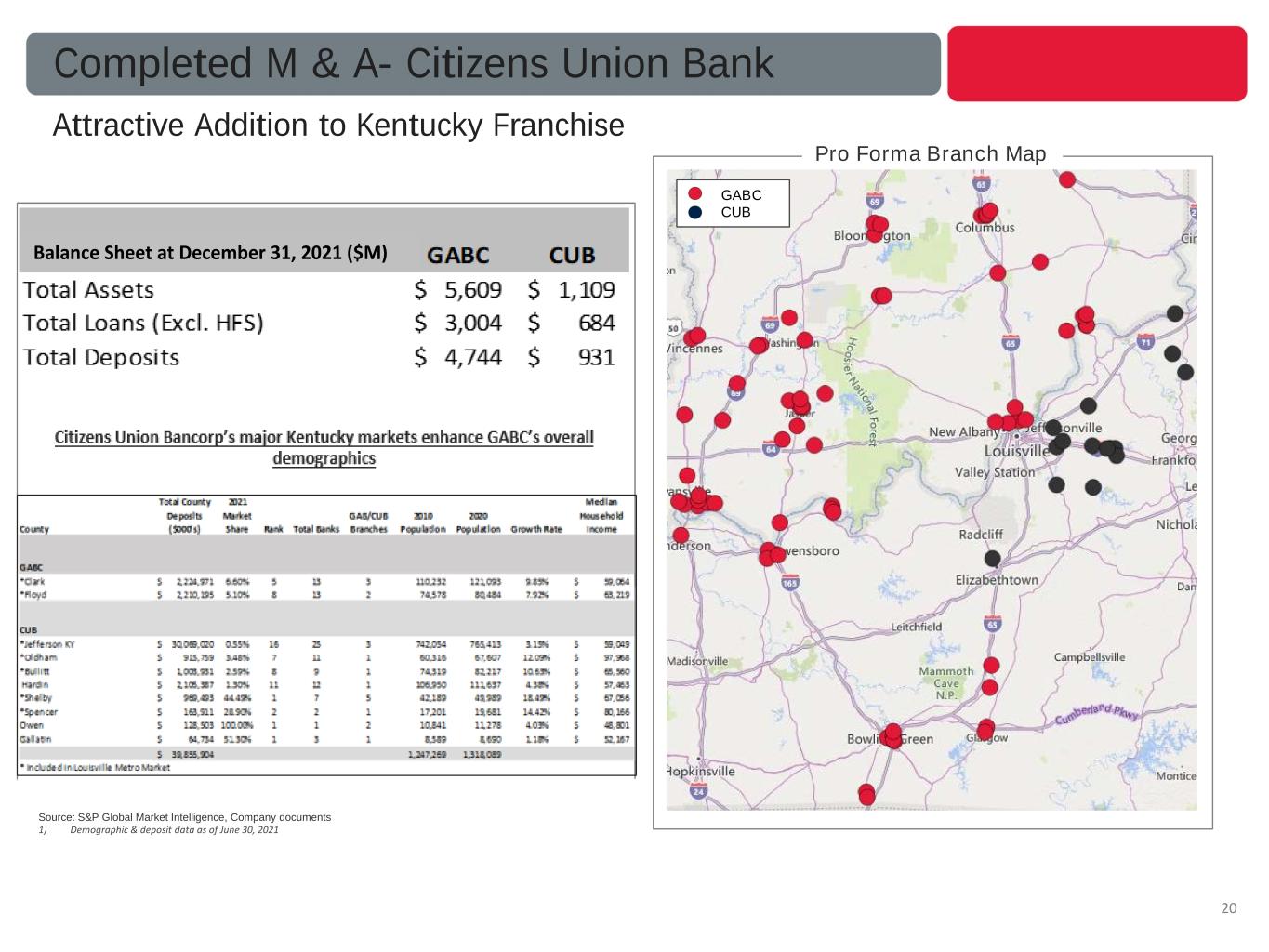

Attractive Addition to Kentucky Franchise GABC CUB Pro Forma Branch Map 20 Completed M & A- Citizens Union Bank Balance Sheet at December 31, 2021 ($M) Source: S&P Global Market Intelligence, Company documents 1) Demographic & deposit data as of June 30, 2021

21 • Attractive addition to German American franchise effective January 1, 2022: – Expands GABC’s market share position in the attractive Louisville, KY market (1) • Tripling market share to 2.47%, a top-10 overall market share position in a major metro market • Increases German American’s deposit market share rank to #4 of banks with less than $20 billion assets • Logical expansion within the Louisville market, enhancing the Company’s existing Indiana footprint and Louisville Commercial LPO • Further expands German American’s Kentucky footprint following upon the Citizens First Corp. merger in 2019 and First Security, Inc. merger in 2018 – Complimentary community banking model & culture with opportunity to expand relationships with Citizens Union customers • Financially Compelling: – ~14% accretive to first full year EPS(2) – ~2.50 year earn back period and 3.2% dilutive to TBV at closing(3) – Price / LTM Net Income + Cost Savings of 8.2x(4) 1) Defined as MSA of Louisville, KY 2) Excludes one-time costs. Assumes 100% phase-in of projected cost savings 3) Tangible book value per share earn back period defined as the number of years for pro forma tangible book value per share to exceed projected standalone tangible book value per share (“crossover”) 4) Based on GABC’s 10 Day VWAP $35.99 as of September 17, 2021

WHY INVEST IN GABC? 22

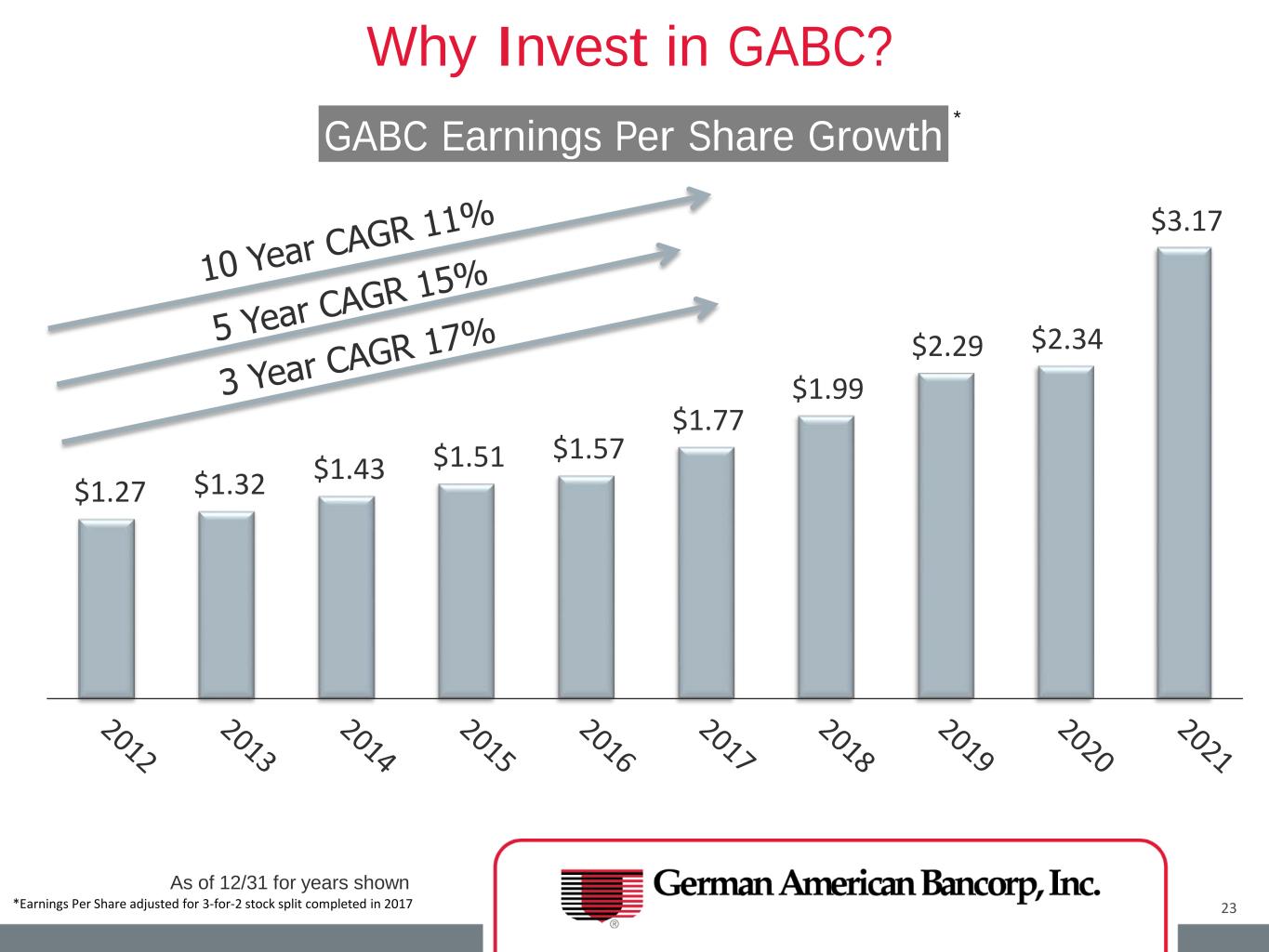

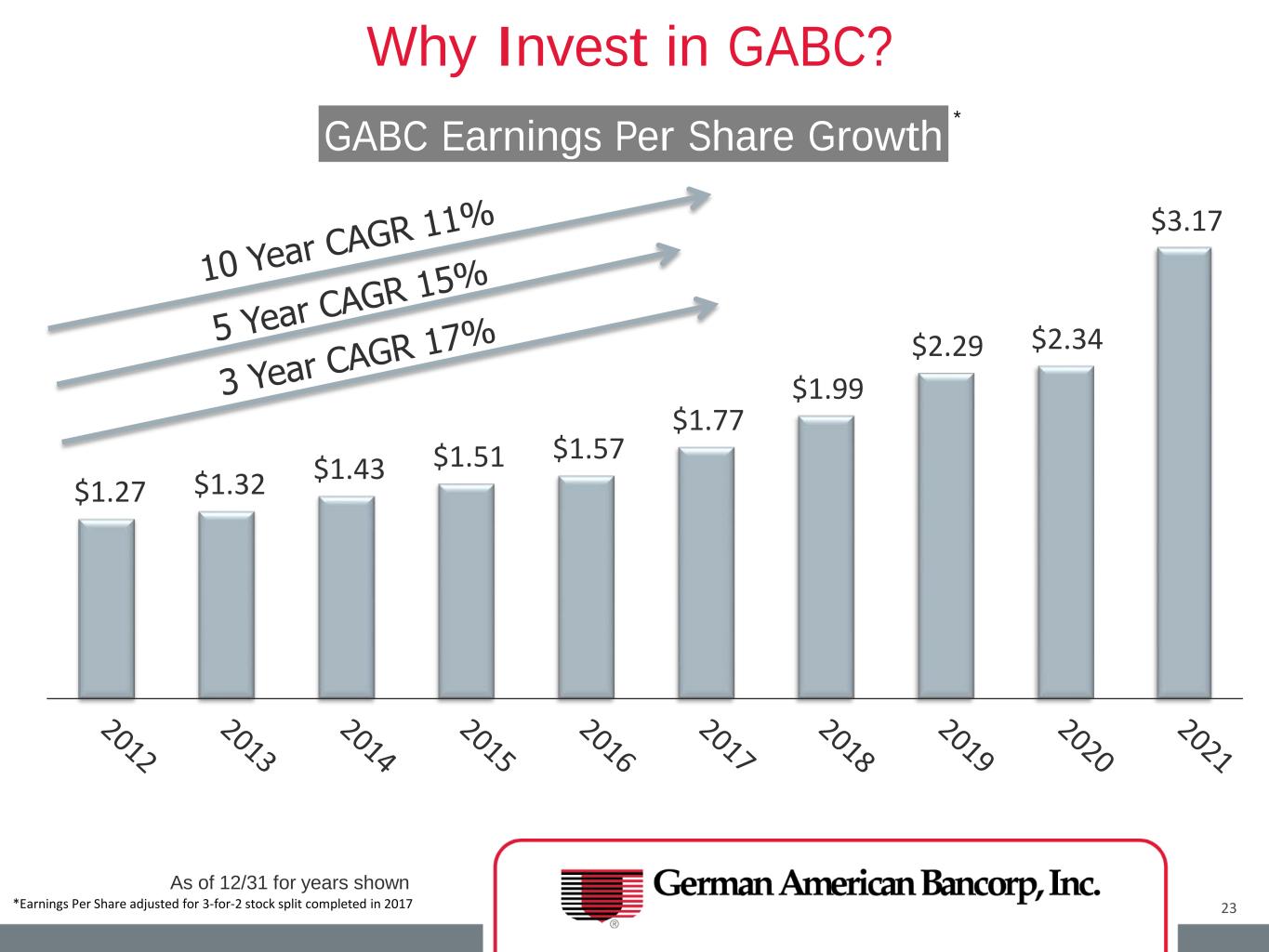

23 Why Invest in GABC? $1.27 $1.32 $1.43 $1.51 $1.57 $1.77 $1.99 $2.29 $2.34 $3.17 GABC Earnings Per Share Growth * As of 12/31 for years shown *Earnings Per Share adjusted for 3-for-2 stock split completed in 2017

24 $8.62 $8.92 $10.40 $11.57 $11.94 $13.45 $13.81 $16.49 $18.63 $20.37 GABC Tangible Book Value Per Share Why Invest in GABC? * As of 12/31 for years shown *Tangible Book Value Per Share adjusted for 3-for-2 stock split completed in 2017

25 $14.48 $18.95 $20.35 $22.21 $35.07 $35.33 $27.77 $35.62 $33.09 $38.98 GABC Stock Price Appreciation Why Invest in GABC? As of 12/31 for years shown * *Stock Price adjusted for 3-for-2 stock split completed in 2017

Why Invest in GABC 26 • Proven Executive Management Team • Track Record of Consistent Top Quartile Financial Performance • Experienced in Operating Plan Execution and M & A Transitions • Potential Growth within New Market Areas – Small MSA Focus and Large Major Metro Opportunity • Existing Platform for Continuous Improvement and Operating Efficiency • Infrastructure in Place for Perpetuating Ongoing EPS Growth • Consistent Strong Dividend Yield and Dividend Pay-out Capacity • Long Term Focus and Investment in Digital Optimization and Delivery

USE OF NON-GAAP MEASURES 27

USE OF NON-GAAP MEASURES 28

29