Symbol: GABC November 2-3, 2023 HOVDE Group Financial Services Conference German American 1

Presented By D. Neil Dauby, Chairman and Chief Executive Officer (812) 482-0707 neil.dauby@germanamerican.com Bradley M. Rust, President and CFO (812) 482-0718 brad.rust@germanamerican.com 2

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS When used in this presentation and our oral statements, the words or phrases “believe,” “will likely result,” “are expected to,” “will continue,” “is anticipated,” “estimate,” “project,” “plans,” or similar expressions are intended to identify “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. You are cautioned not to place undue reliance on any forward-looking statements, which speak only as of the date of this presentation, and we do not undertake any obligation to update any forward-looking statement to reflect circumstances or events that occur in the future. By their nature, these statements are subject to numerous risks and uncertainties that could cause actual results to differ materially from those anticipated in the statements. Factors that could cause actual results and performance to vary materially from those expressed or implied by any forward-looking statement include those that are discussed in Item 1, “Business – Forward Looking Statements and Associated Risk,” and Item 1A, “Risk Factors,” in our Annual Report on Form 10-K for 2022 as updated and supplemented by our other SEC reports filed from time to time. 3

Who We Are Indiana & Kentucky Community-focused Financial Services Organization • Banking, Insurance, Investments & Trust • $6.0 Billion Total Banking Assets • $2.8 Billion Investment and Trust Assets Under Management • $74 Million Annual Insurance Premiums • ~ 900 Team Members • 76 Banking Offices 4

History of Superior Financial Performance Eleven Consecutive Years of Increased Dividends Twelve of the Past Thirteen Years of Improved Earnings Performance Double-Digit Return on Equity for 18 Consecutive Fiscal Years Raymond James 2012-2017 and 2019-2021 Community Bankers Cup Recipient KBW/Stifel 2010 thru 2022 Bank Honor Roll Recipient Piper Sandler Small Cap All-Star 2012-2013 and 2019-2020 Bank Director Magazine - Bank Performance Scorecard Top 15 National Ranking for 2016 – 2019 ($1 - $5 Billion Publicly-traded Companies) Bank Director Magazine - Top 20 of 300 Largest Publicly Traded Banks for 2017 & 2018 Newsweek Best Banks in America (Indiana) 2020 & 2021 2022 S&P Global Top 20 Best Performing Banks between $3 and $10 Billion Bank Director Magazine – 2023 Best US Banks Top 50 Publicly Traded Bank for $5 - $50 Billion 5

FINANCIAL TRENDS 6

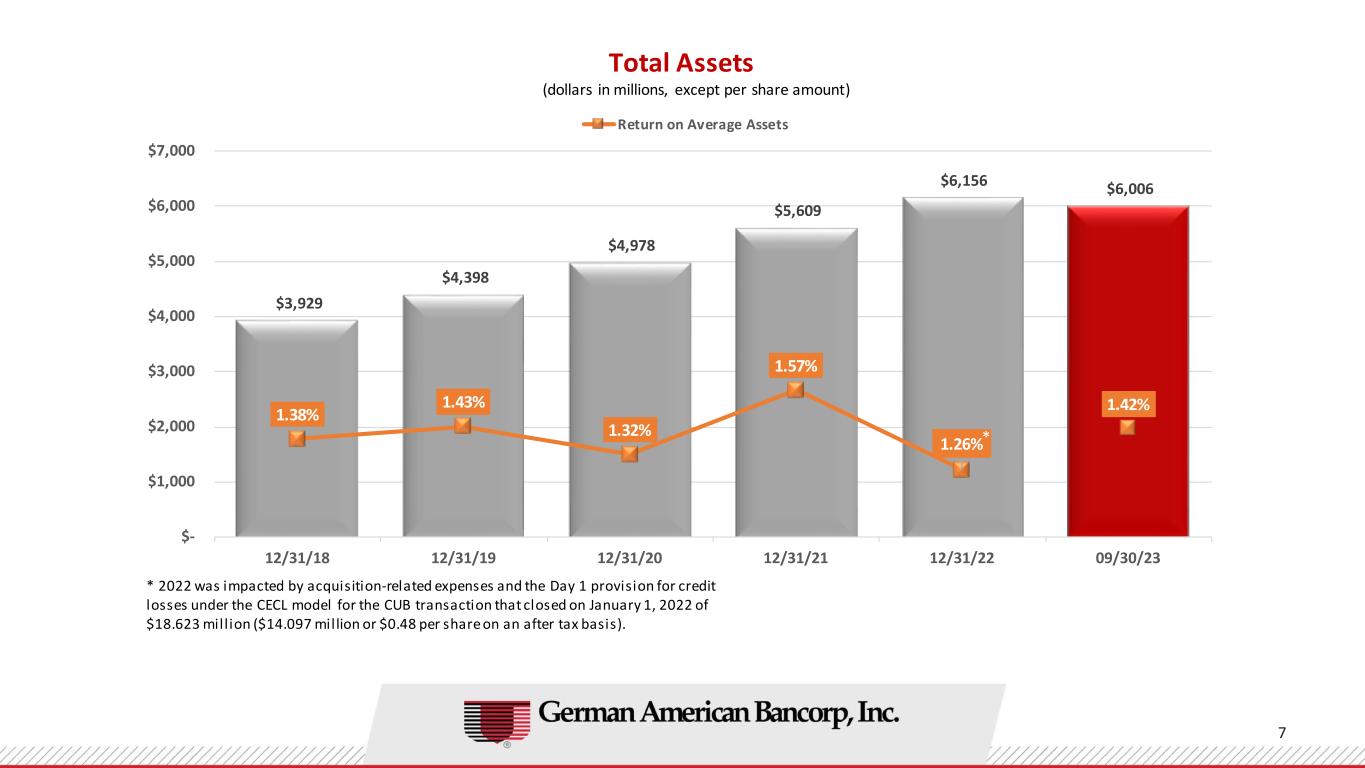

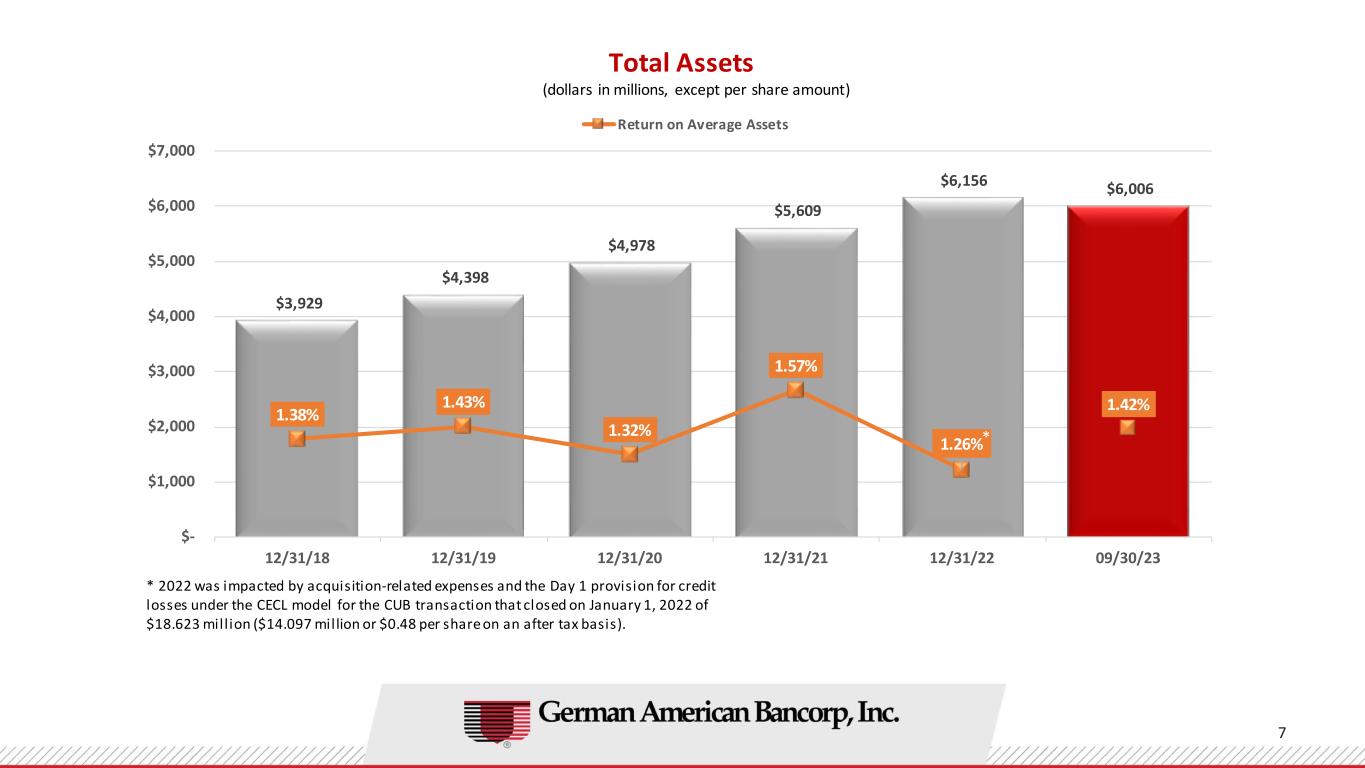

$3,929 $4,398 $4,978 $5,609 $6,156 $6,006 1.38% 1.43% 1.32% 1.57% 1.26% 1.42% $- $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 $7,000 12/31/18 12/31/19 12/31/20 12/31/21 12/31/22 09/30/23 (dollars in millions, except per share amount) Return on Average Assets * 2022 was impacted by acquisition-related expenses and the Day 1 provision for credit losses under the CECL model for the CUB transaction that closed on January 1, 2022 of $18.623 mill ion ($14.097 million or $0.48 per share on an after tax basis). * Total Assets 7

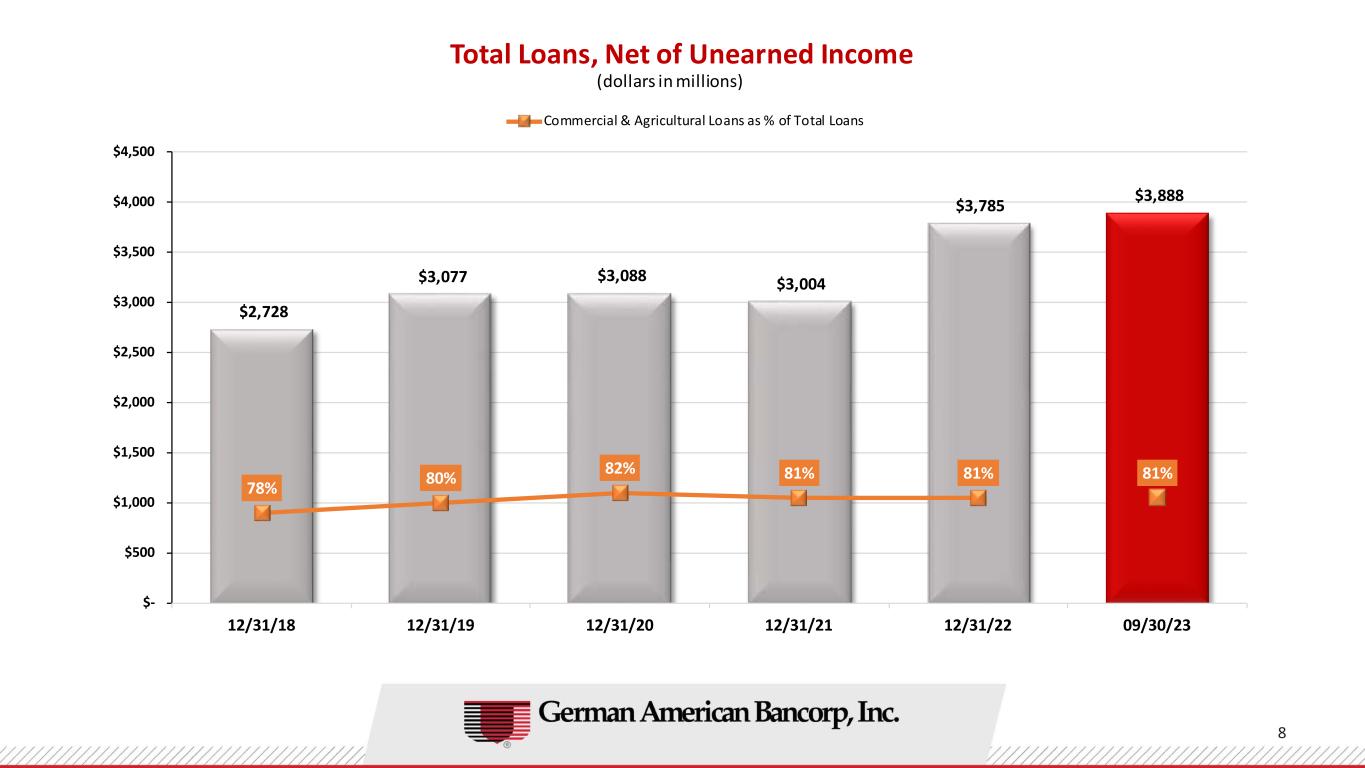

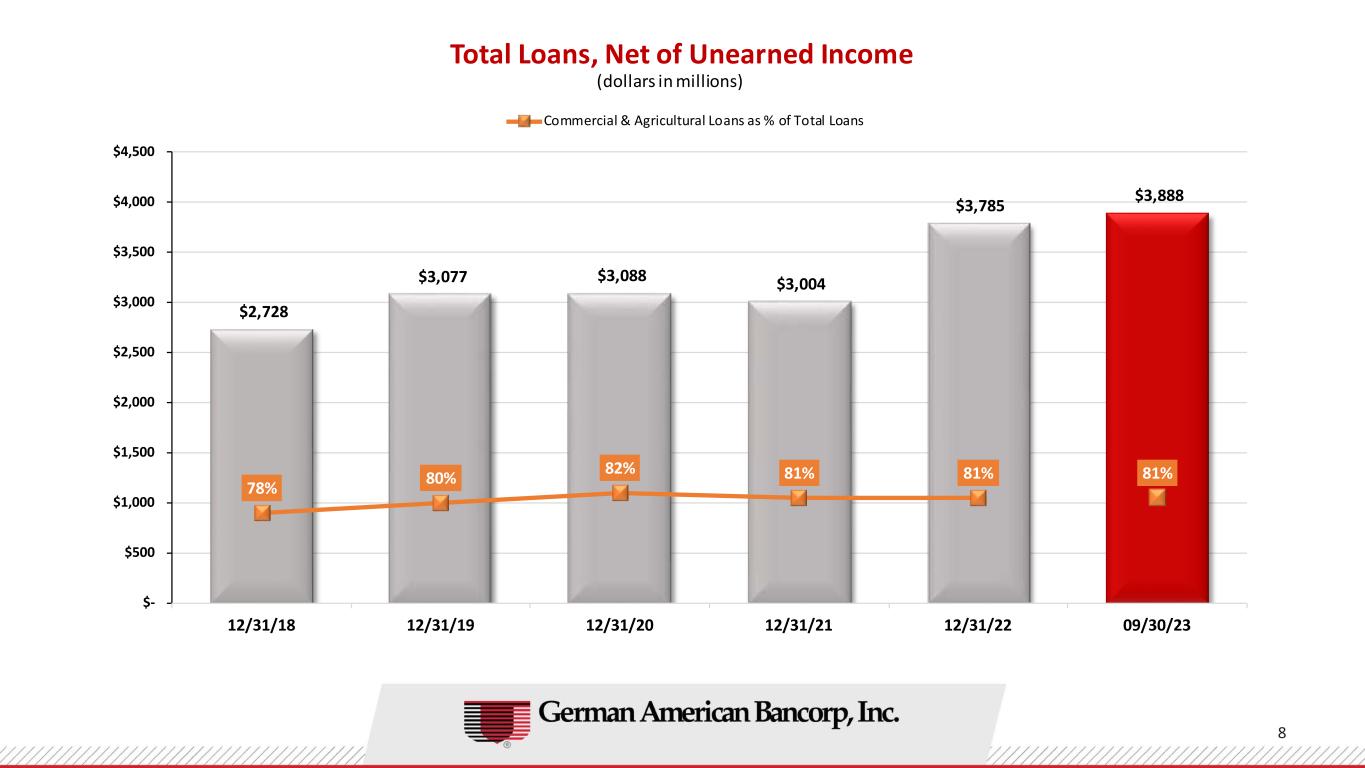

$2,728 $3,077 $3,088 $3,004 $3,785 $3,888 78% 80% 82% 81% 81% 81% $- $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 $4,000 $4,500 12/31/18 12/31/19 12/31/20 12/31/21 12/31/22 09/30/23 Total Loans, Net of Unearned Income Commercial & Agricultural Loans as % of Total Loans (dollars in millions) 8

Construction & Development Loans $ 304.5 million 8% Agricultural Loans $ 407.7 million 11% Commercial & Industrial Loans $ 621.7 million 16% Commerical Real Estate Owner Occupied $ 517.5 million 13% Commercial Real Estate Non- Owner Occupied $ 970.8 million 25% Multi-Family Residential Properties $ 334.4 million 9% Consumer Loans $ 78.9 million 2% Home Equity Loans $ 287.4 million 7% Residential Mortgage Loans $ 364.7 million 9% Loan Portfolio Composition as of September 30, 2023 $ 3,887.6 millionTotal Loans 9

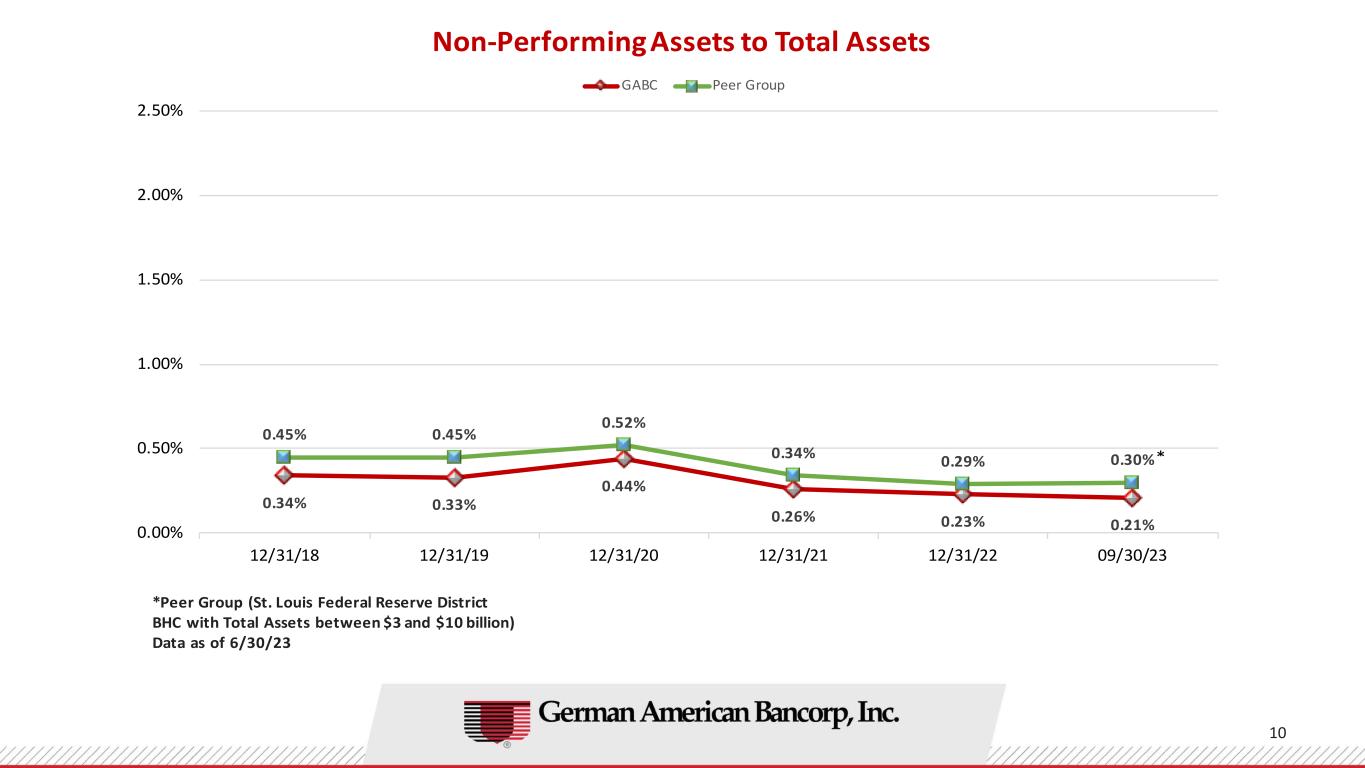

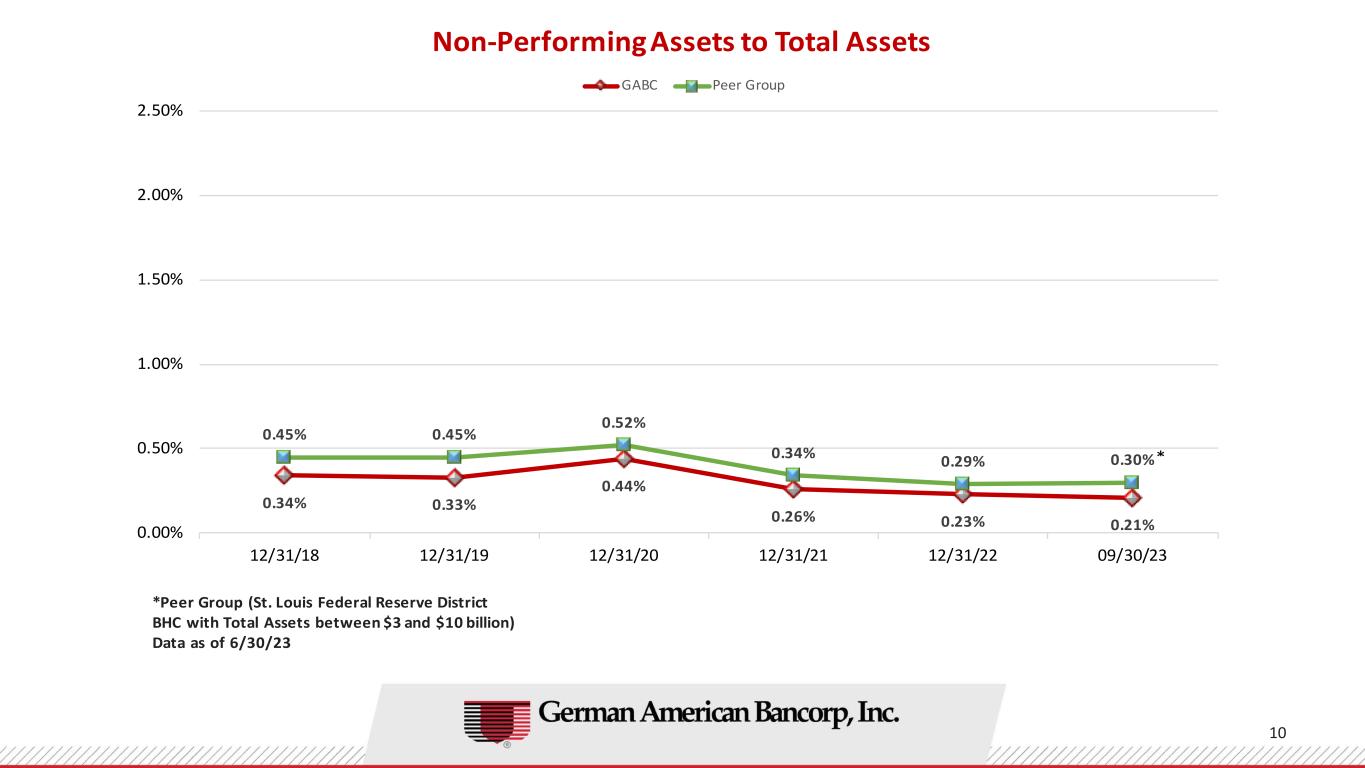

0.34% 0.33% 0.44% 0.26% 0.23% 0.21% 0.45% 0.45% 0.52% 0.34% 0.29% 0.30% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 12/31/18 12/31/19 12/31/20 12/31/21 12/31/22 09/30/23 Non-Performing Assets to Total Assets GABC Peer Group *Peer Group (St. Louis Federal Reserve District BHC with Total Assets between $3 and $10 billion) Data as of 6/30/23 * 10

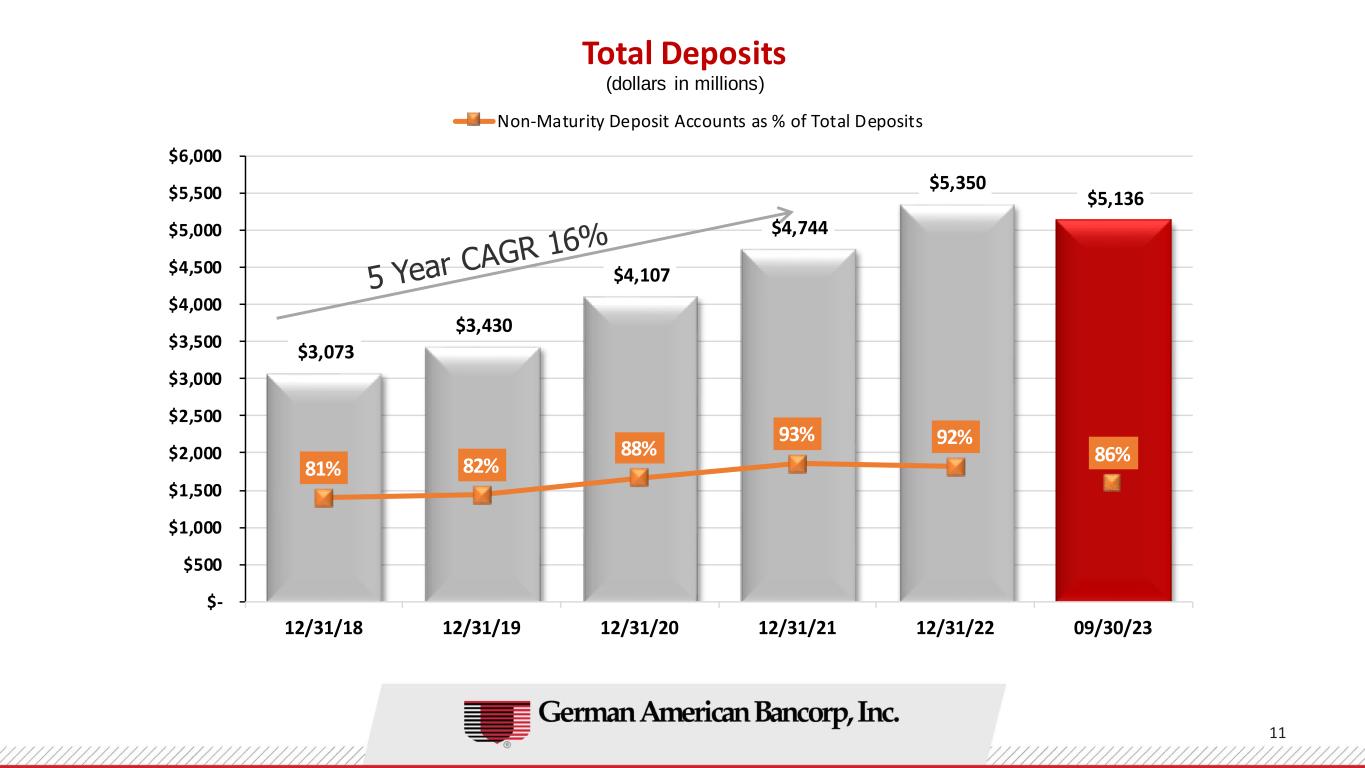

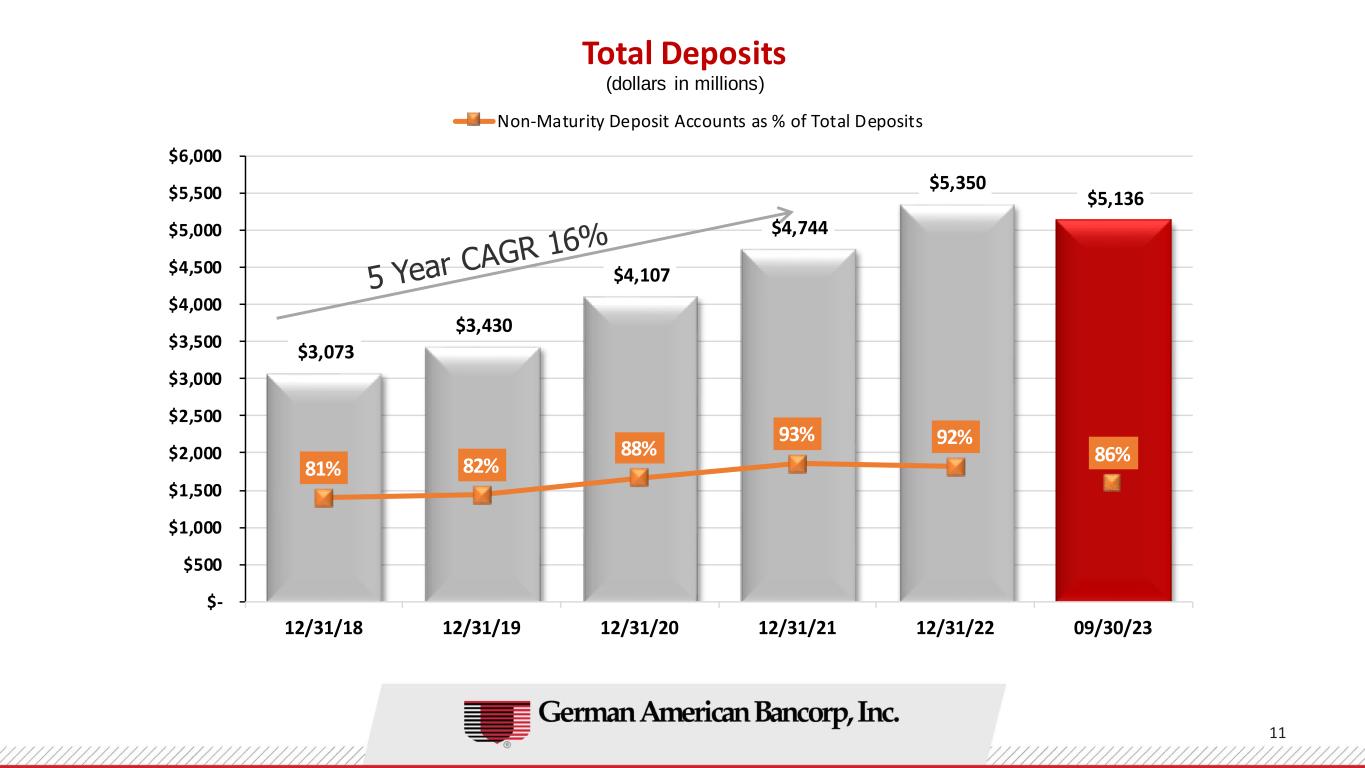

$3,073 $3,430 $4,107 $4,744 $5,350 $5,136 81% 82% 88% 93% 92% 86% $- $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 $4,000 $4,500 $5,000 $5,500 $6,000 12/31/18 12/31/19 12/31/20 12/31/21 12/31/22 09/30/23 Total Deposits Non-Maturity Deposit Accounts as % of Total Deposits (dollars in millions) 11

Non-Interest Bearing Demand $1,502 million 29% Interest Bearing Demand, Savings & Money Market $2,932 million 57% Time Deposits > $100,000 $432 million 9% Time Deposits < $100,000 $270 million 5% Total Deposit Composition as of 9/30/23 Total Deposits: $5,136 million21% of Total Deposits are Uninsured and Uncollateralized as of 9/30/2023. Average Deposit Account Size equals $25,075 Deposit Composition at End of Period 9/30/23 6/30/23 12/31/22 12/31/19 Non-interest Bearing Demand Deposits 29% 30% 32% 24% Interest Bearing Demand, Savings & MMDA 57% 59% 60% 58% Time Deposits > $100,000 9% 6% 4% 9% Time Deposits < $100,000 5% 5% 4% 9% Total Deposits 100% 100% 100% 100% Total Deposits (millions) 5,136$ 5,180$ 5,350$ 3,430$ Cost of Deposits 1.20% 1.03% 0.51% 0.71% 12

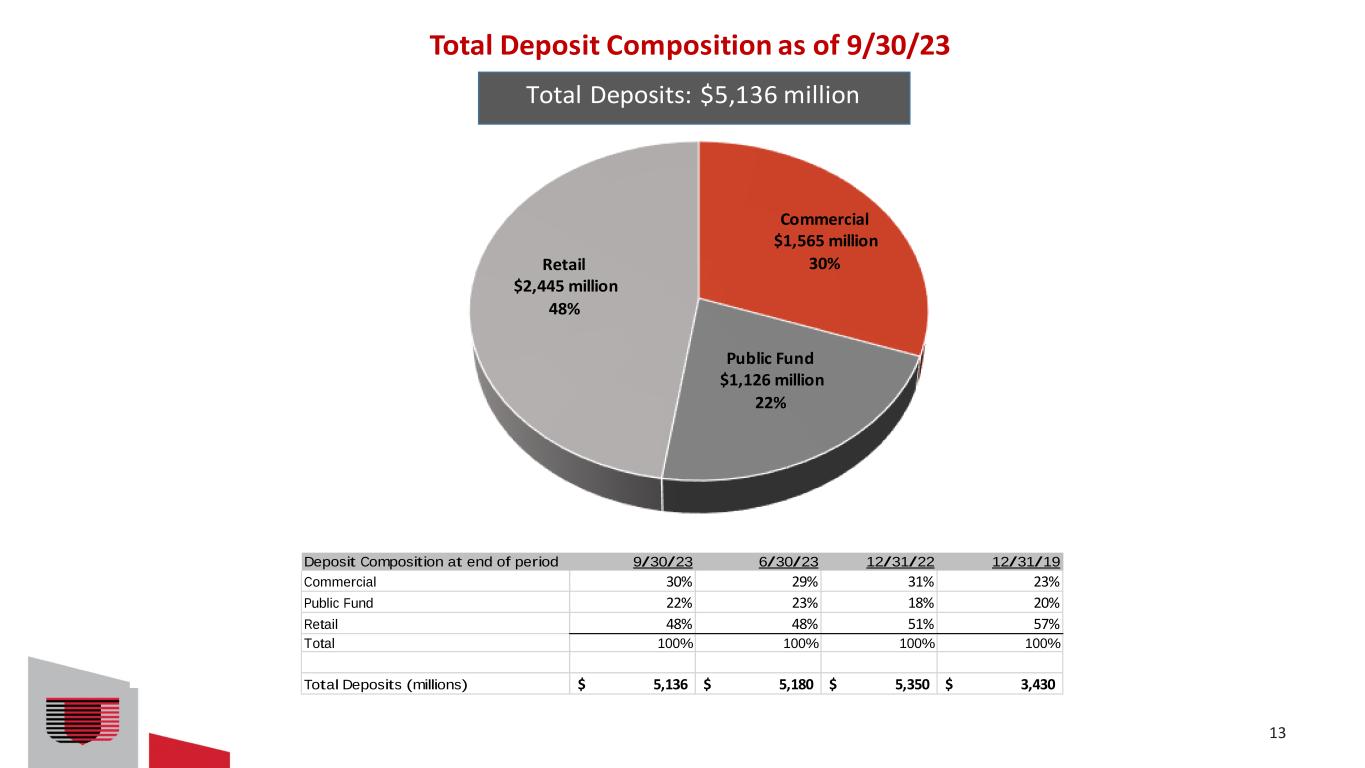

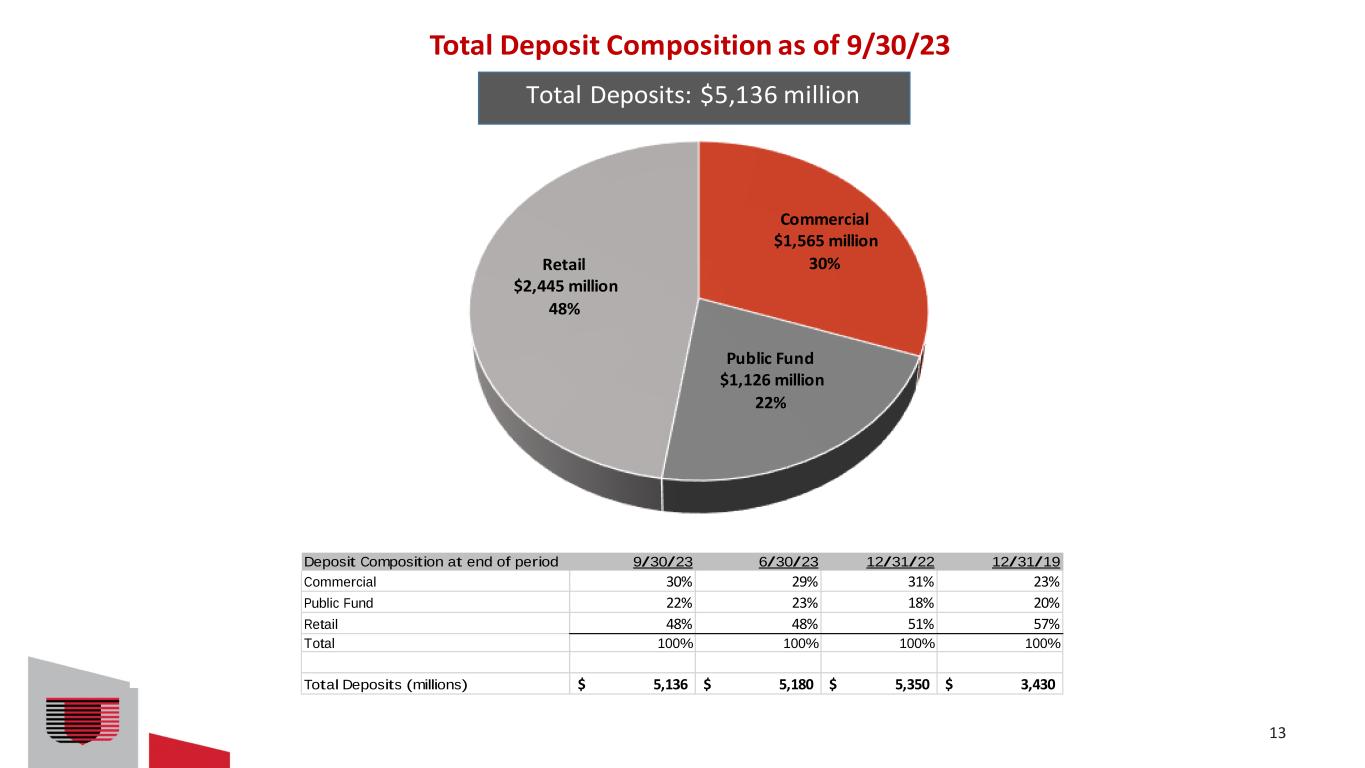

Commercial $1,565 million 30% Public Fund $1,126 million 22% Retail $2,445 million 48% Total Deposit Composition as of 9/30/23 Total Deposits: $5,136 million 13 Deposit Composition at end of period 9/30/23 6/30/23 12/31/22 12/31/19 Commercial 30% 29% 31% 23% Public Fund 22% 23% 18% 20% Retail 48% 48% 51% 57% Total 100% 100% 100% 100% Total Deposits (millions) 5,136$ 5,180$ 5,350$ 3,430$

$459 $574 $625 $668 $558 $538 14.82% 14.98% 13.46% 16.38% 19.51% 21.21% $- $100 $200 $300 $400 $500 $600 $700 $800 12/31/18 12/31/19 12/31/20 12/31/21 12/31/22 09/30/23 Total Shareholders' Equity Return on Average Tangible Equity * 2022 was impacted by acquisition-related expenses and the Day 1 provision for credit losses under the CECL model for the CUB transaction that closed on January 1, 2022 of $18.623 million ($14.097 million or $0.48 per share on an after tax basis). * (dollars in millions, except per share amount) 14

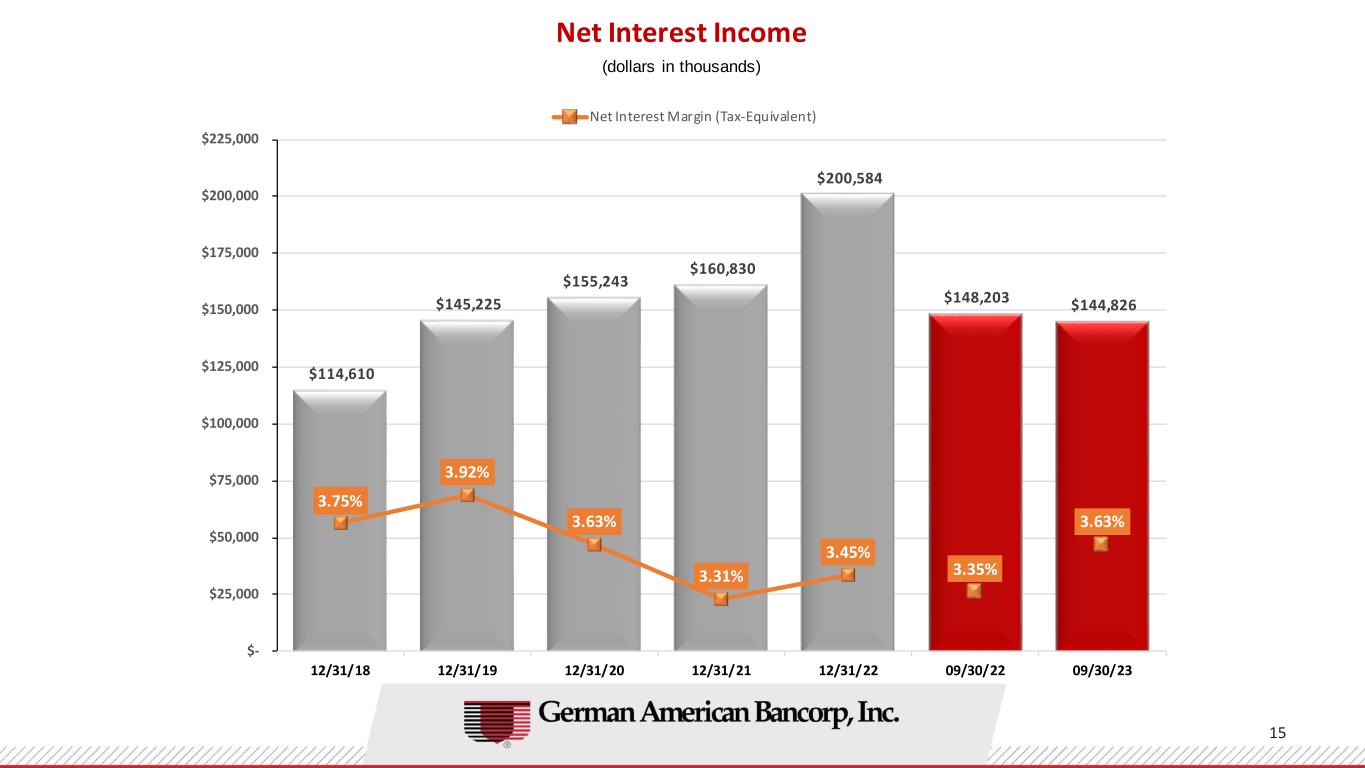

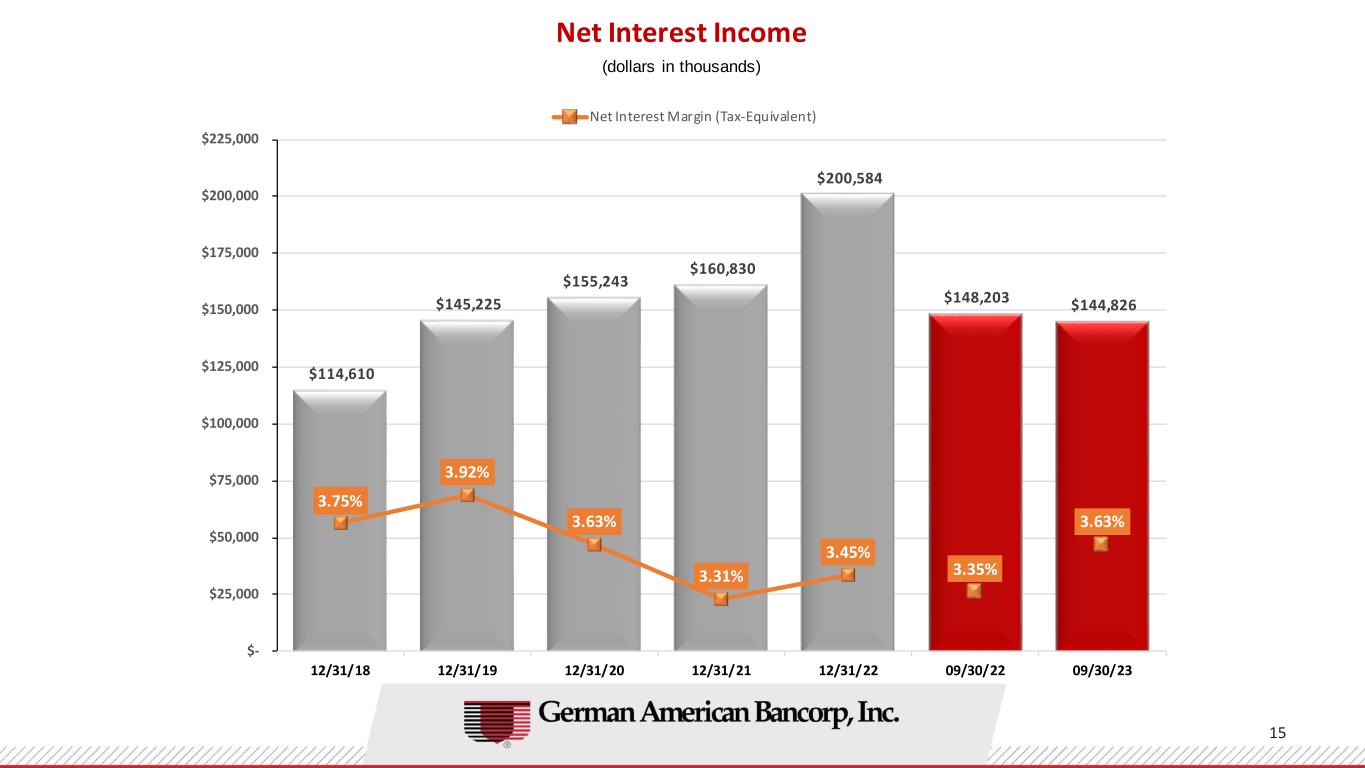

$114,610 $145,225 $155,243 $160,830 $200,584 $148,203 $144,826 3.75% 3.92% 3.63% 3.31% 3.45% 3.35% 3.63% $- $25,000 $50,000 $75,000 $100,000 $125,000 $150,000 $175,000 $200,000 $225,000 12/31/18 12/31/19 12/31/20 12/31/21 12/31/22 09/30/22 09/30/23 Net Interest Income Net Interest Margin (Tax-Equivalent) (dollars in thousands) 15

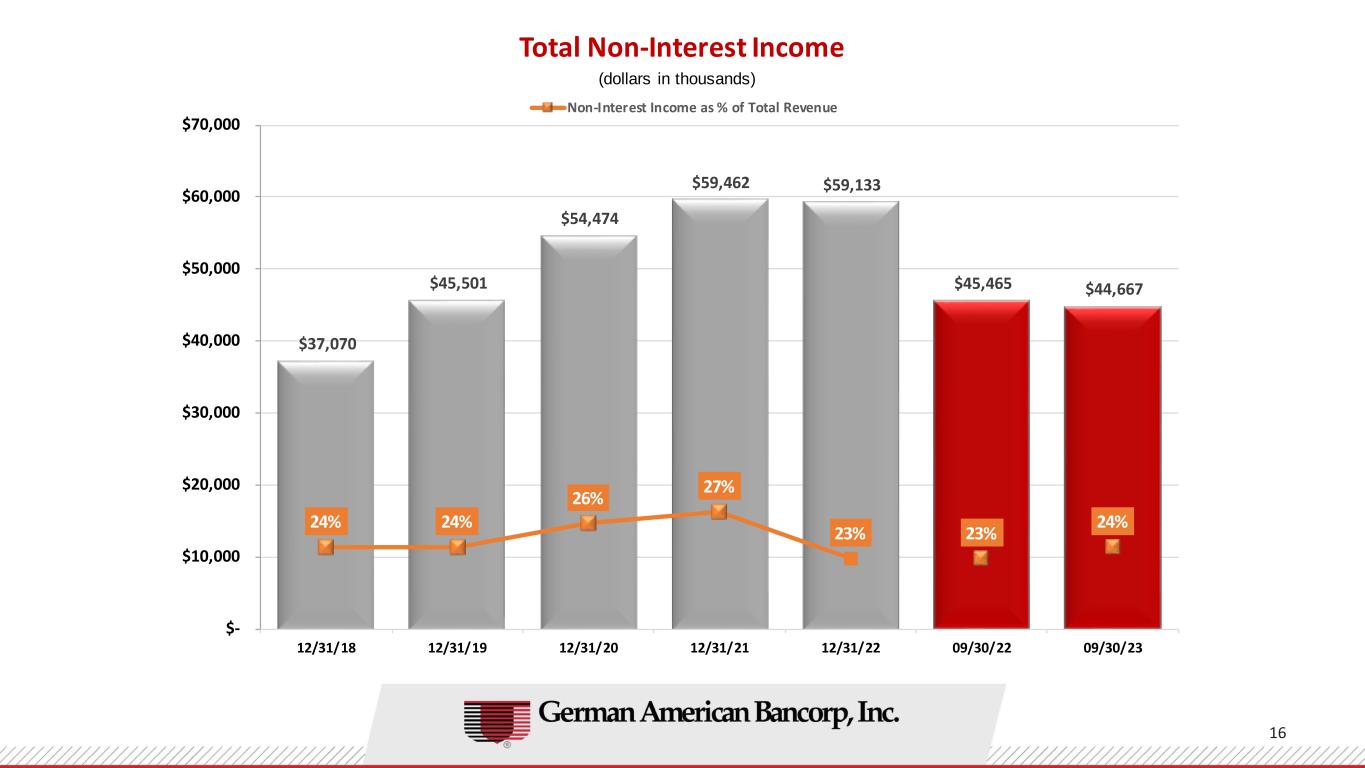

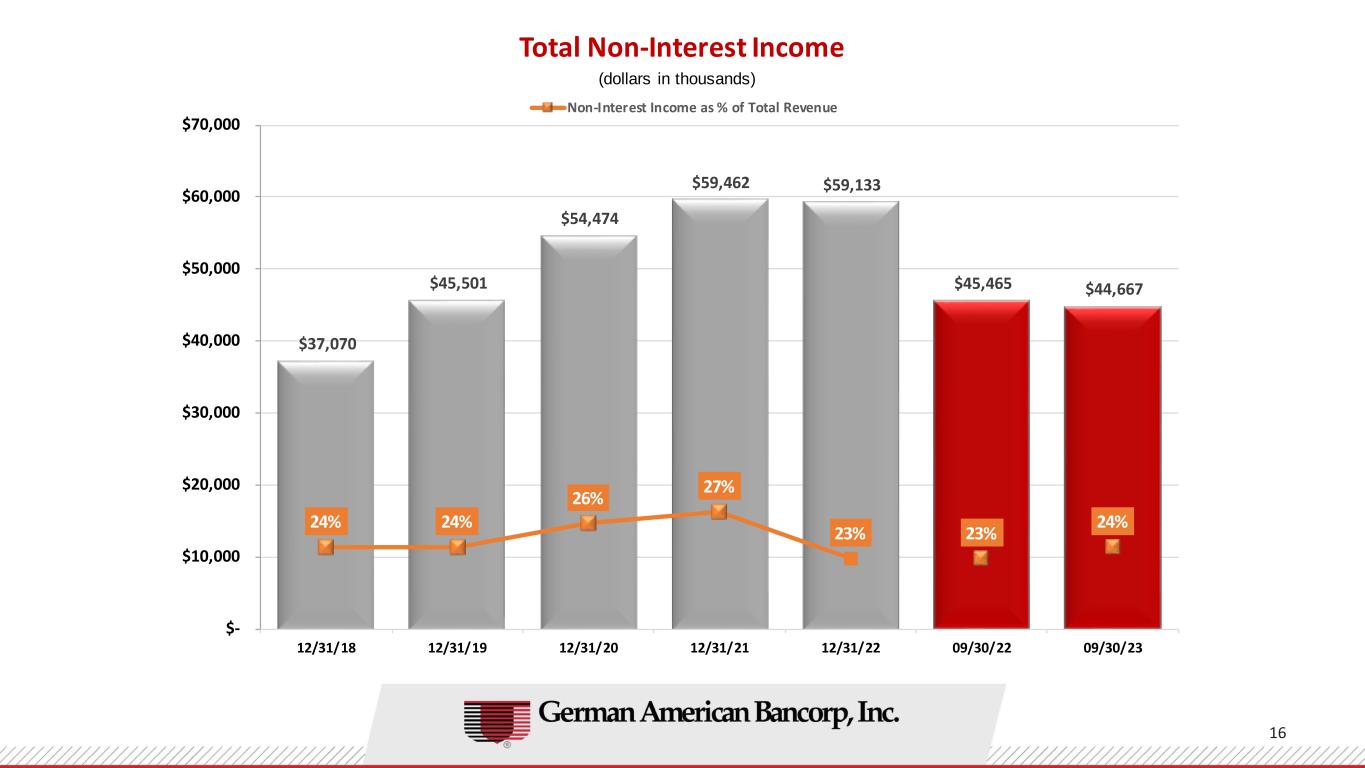

$37,070 $45,501 $54,474 $59,462 $59,133 $45,465 $44,667 24% 24% 26% 27% 23% 23% 24% $- $10,000 $20,000 $30,000 $40,000 $50,000 $60,000 $70,000 12/31/18 12/31/19 12/31/20 12/31/21 12/31/22 09/30/22 09/30/23 Total Non-Interest Income Non-Interest Income as % of Total Revenue (dollars in thousands) 16

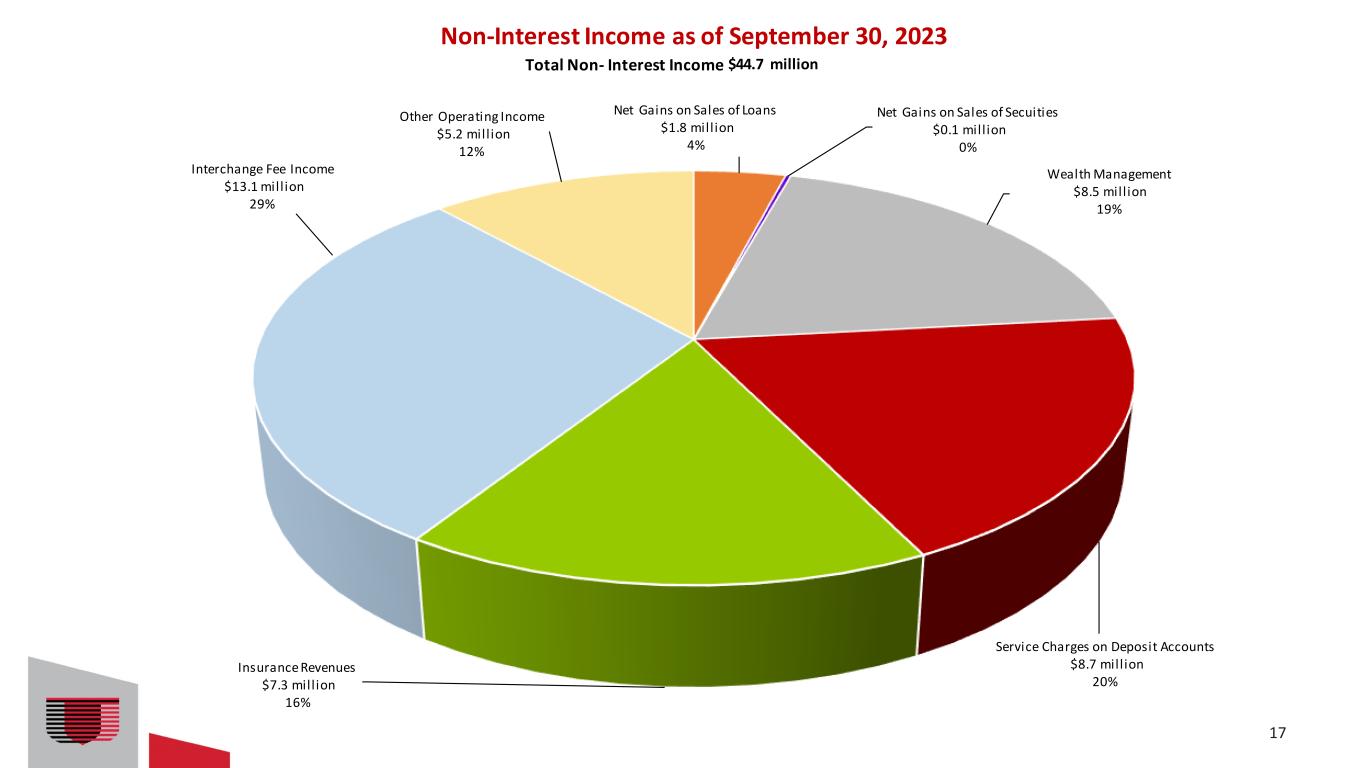

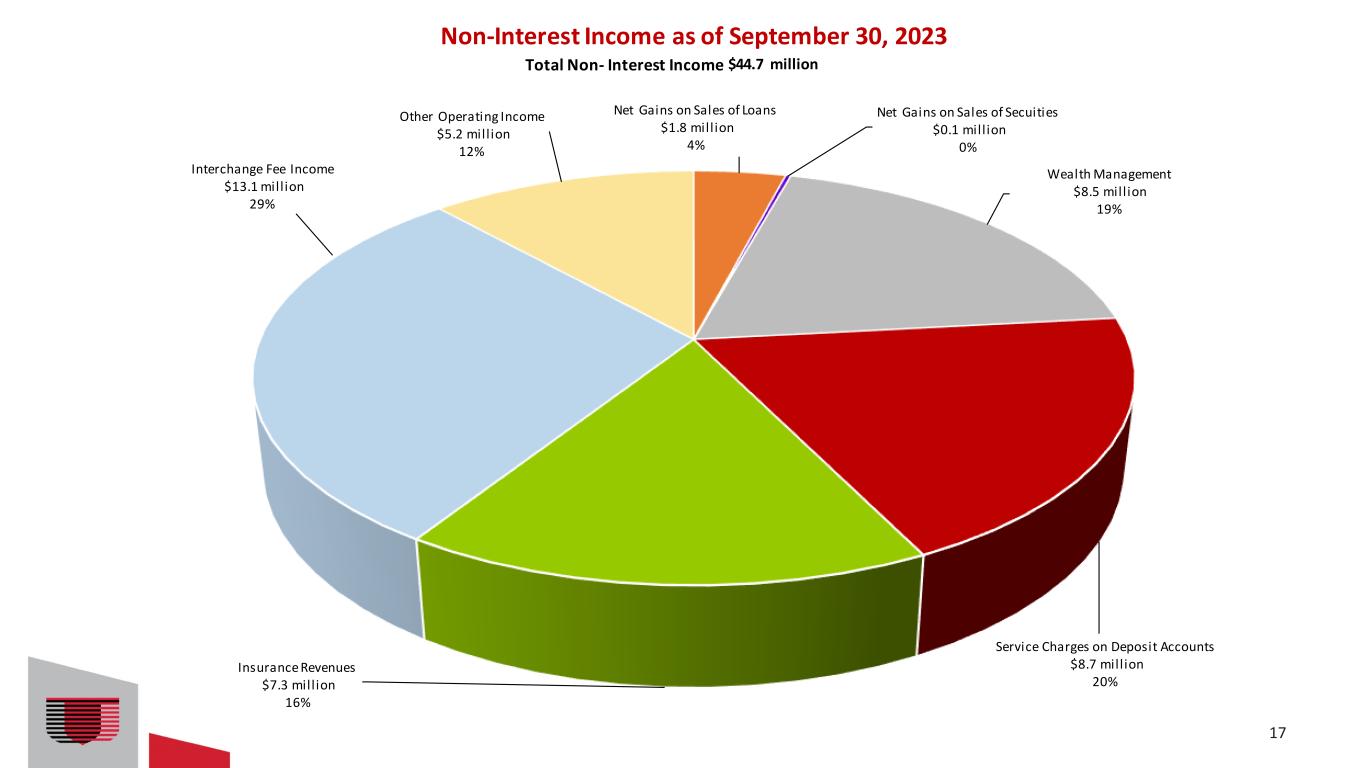

Net Gains on Sales of Loans $1.8 mill ion 4% Net Gains on Sales of Secuities $0.1 mill ion 0% Wealth Management $8.5 mill ion 19% Service Charges on Deposit Accounts $8.7 mill ion 20% Insurance Revenues $7.3 mill ion 16% Interchange Fee Income $13.1 mill ion 29% Other Operating Income $5.2 mill ion 12% Non-Interest Income as of September 30, 2023 $44.7 Total Non- Interest Income million 17

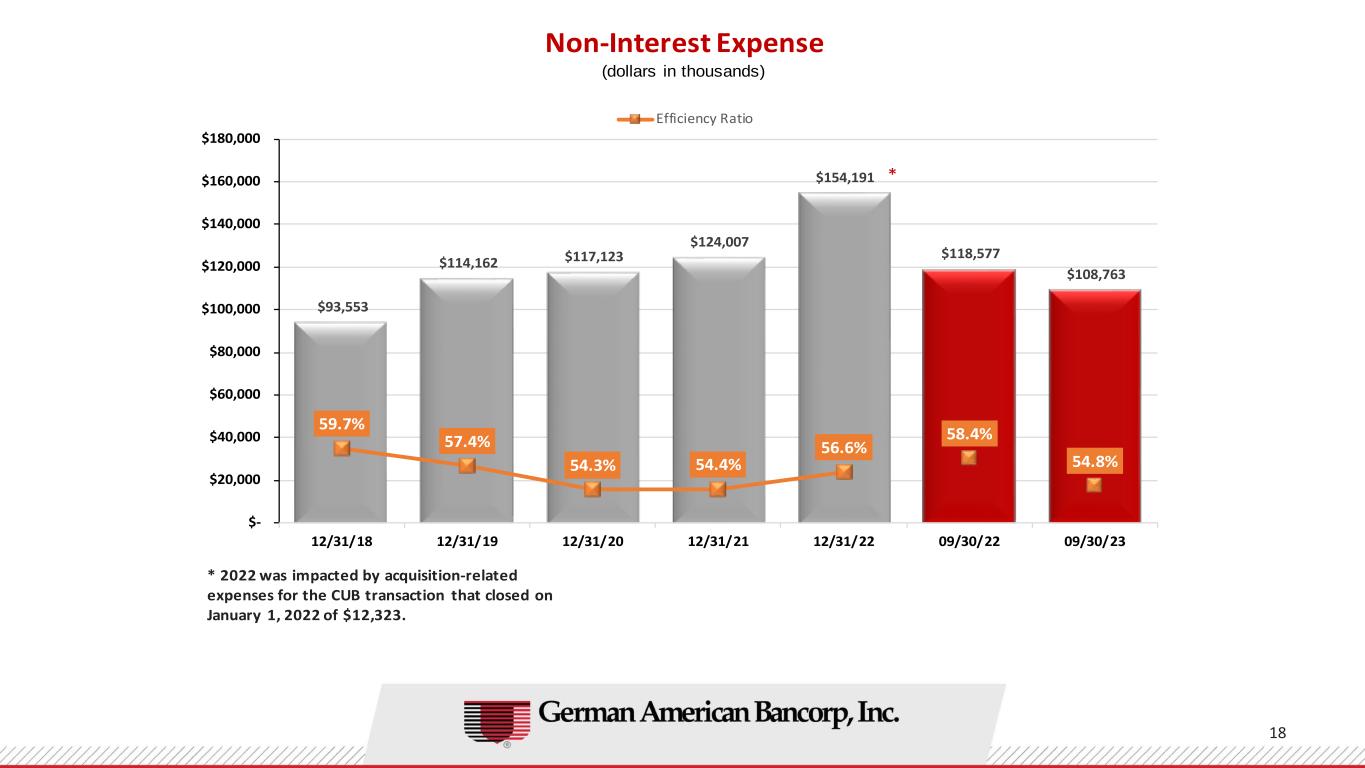

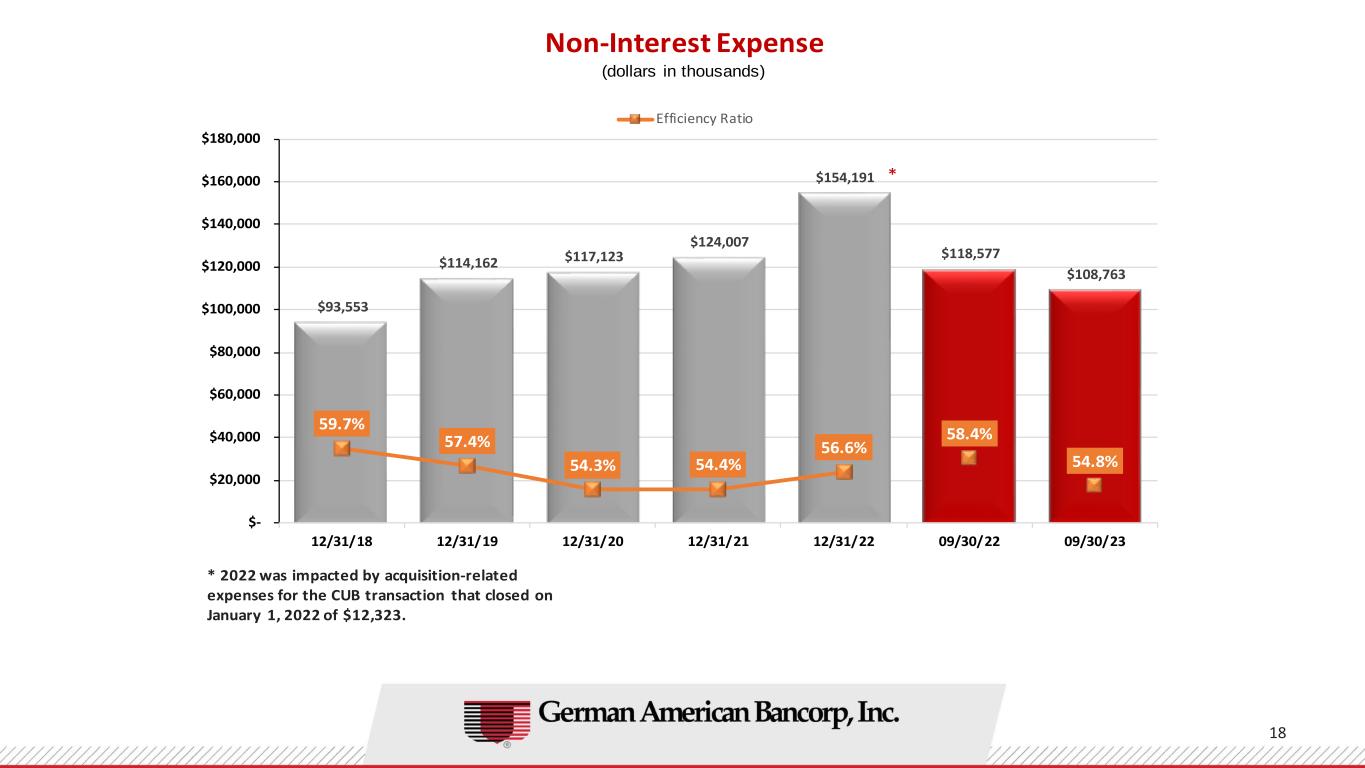

$93,553 $114,162 $117,123 $124,007 $154,191 $118,577 $108,763 59.7% 57.4% 54.3% 54.4% 56.6% 58.4% 54.8% $- $20,000 $40,000 $60,000 $80,000 $100,000 $120,000 $140,000 $160,000 $180,000 12/31/18 12/31/19 12/31/20 12/31/21 12/31/22 09/30/22 09/30/23 Non-Interest Expense Efficiency Ratio * 2022 was impacted by acquisition-related expenses for the CUB transaction that closed on January 1, 2022 of $12,323. * (dollars in thousands) 18

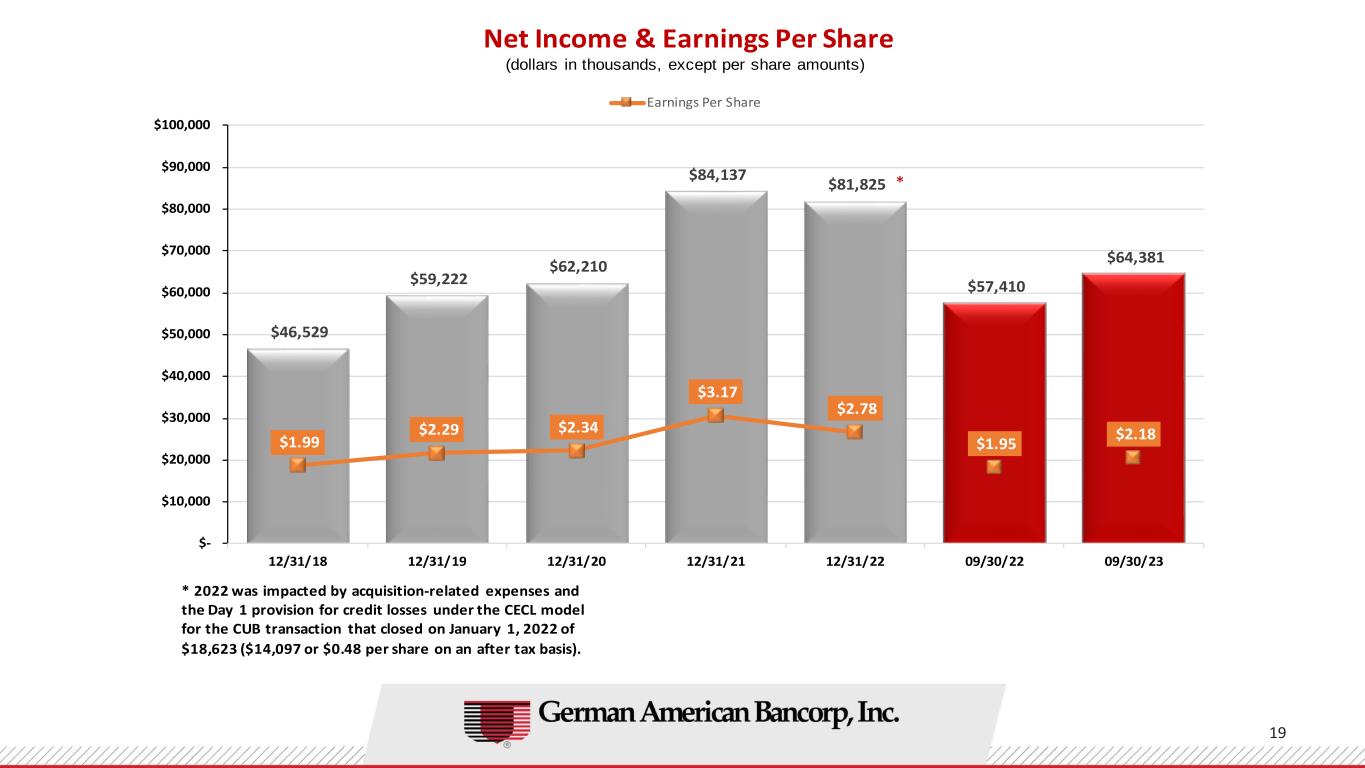

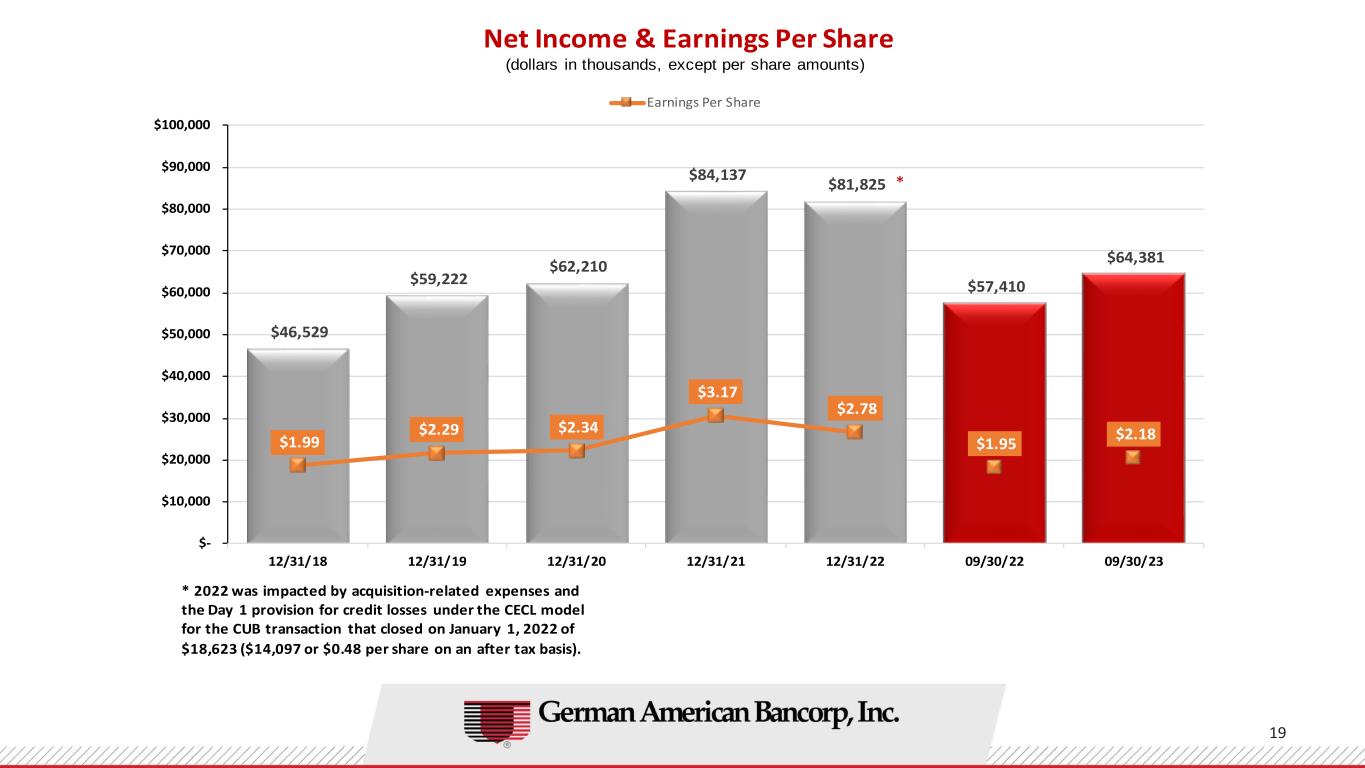

$46,529 $59,222 $62,210 $84,137 $81,825 $57,410 $64,381 $1.99 $2.29 $2.34 $3.17 $2.78 $1.95 $2.18 $- $10,000 $20,000 $30,000 $40,000 $50,000 $60,000 $70,000 $80,000 $90,000 $100,000 12/31/18 12/31/19 12/31/20 12/31/21 12/31/22 09/30/22 09/30/23 Net Income & Earnings Per Share Earnings Per Share * 2022 was impacted by acquisition-related expenses and the Day 1 provision for credit losses under the CECL model for the CUB transaction that closed on January 1, 2022 of $18,623 ($14,097 or $0.48 per share on an after tax basis). * (dollars in thousands, except per share amounts) 19

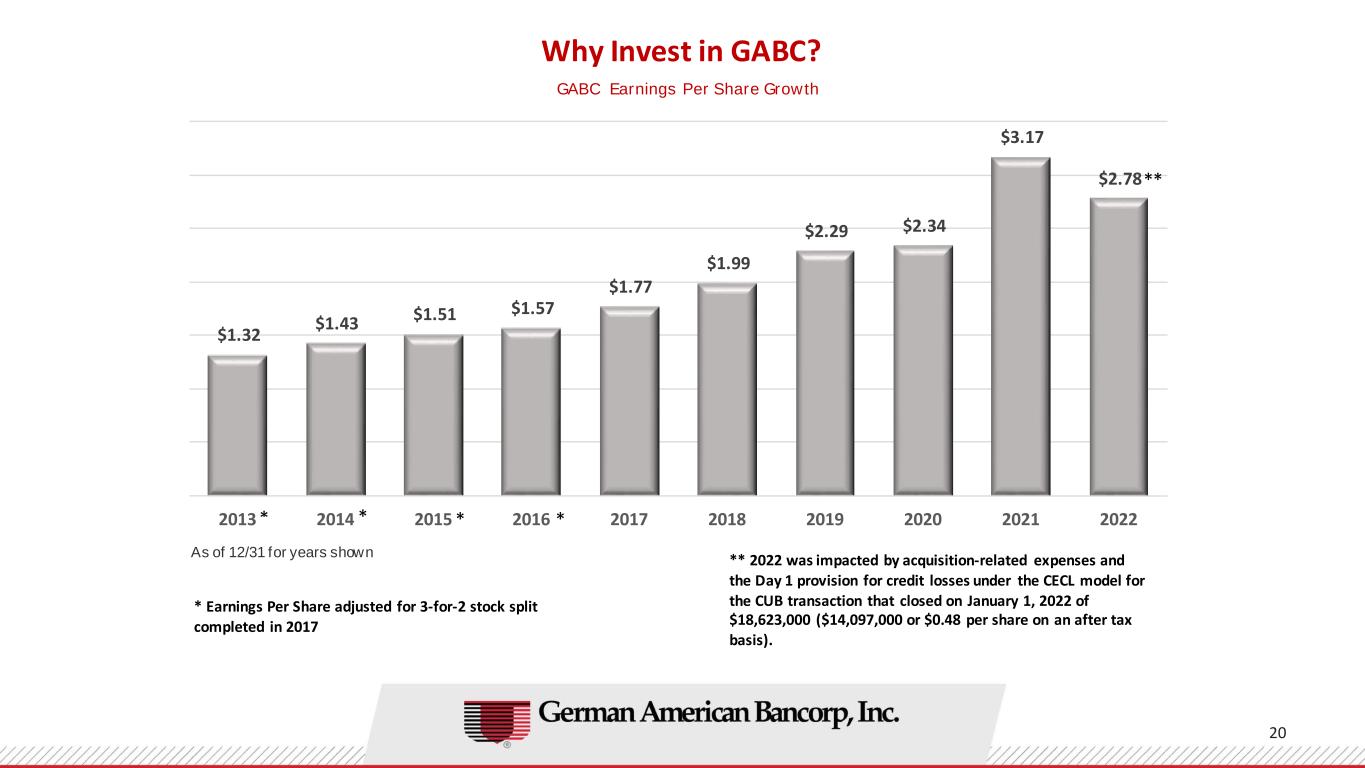

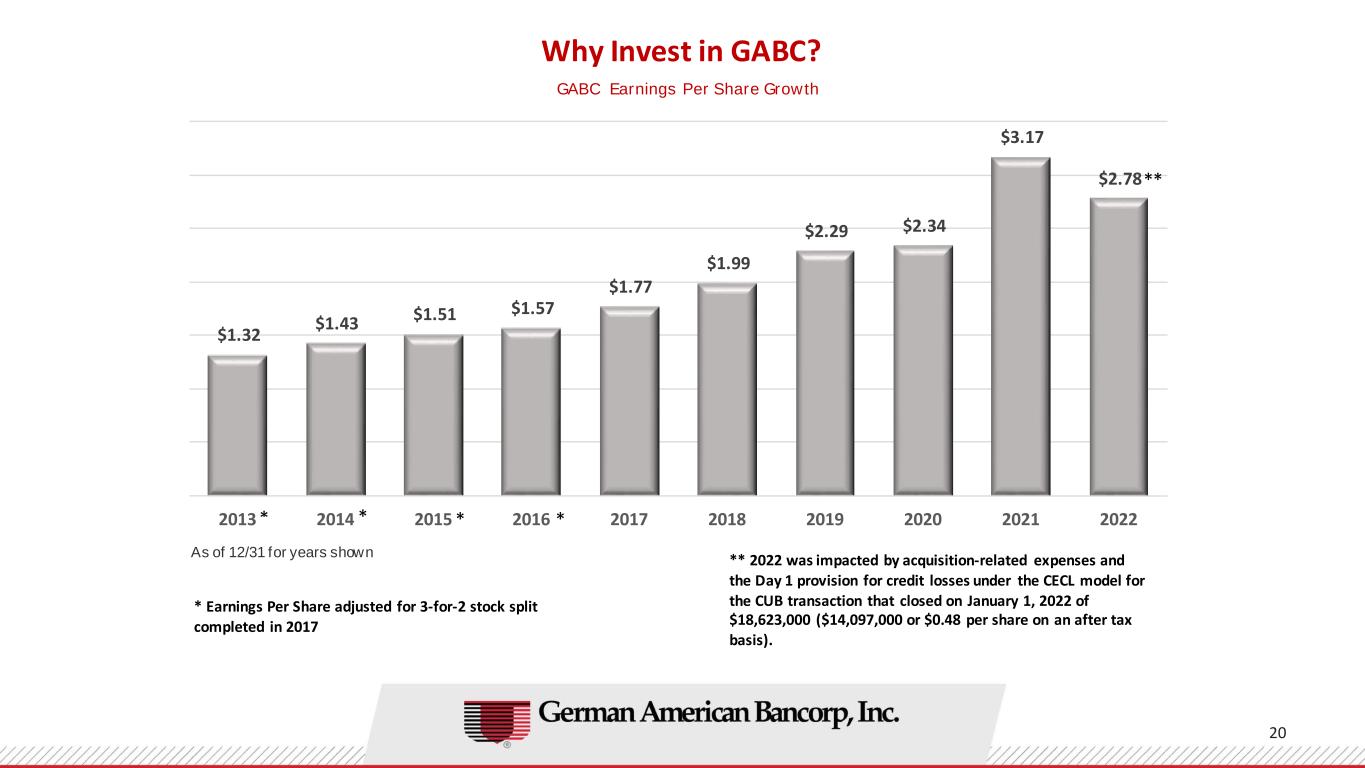

$1.32 $1.43 $1.51 $1.57 $1.77 $1.99 $2.29 $2.34 $3.17 $2.78 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 Why Invest in GABC? GABC Earnings Per Share Growth As of 12/31 for years shown * Earnings Per Share adjusted for 3-for-2 stock split completed in 2017 ** 2022 was impacted by acquisition-related expenses and the Day 1 provision for credit losses under the CECL model for the CUB transaction that closed on January 1, 2022 of $18,623,000 ($14,097,000 or $0.48 per share on an after tax basis). ** * * * * 20

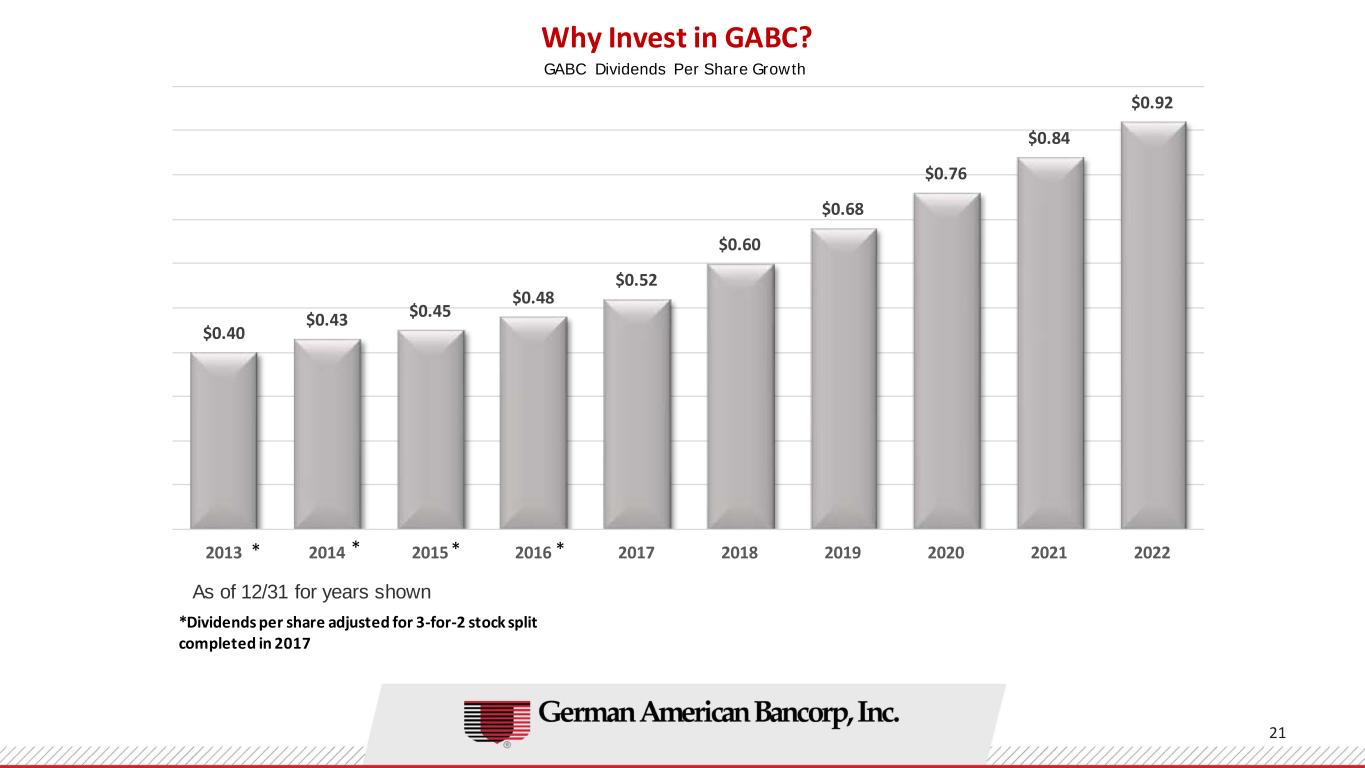

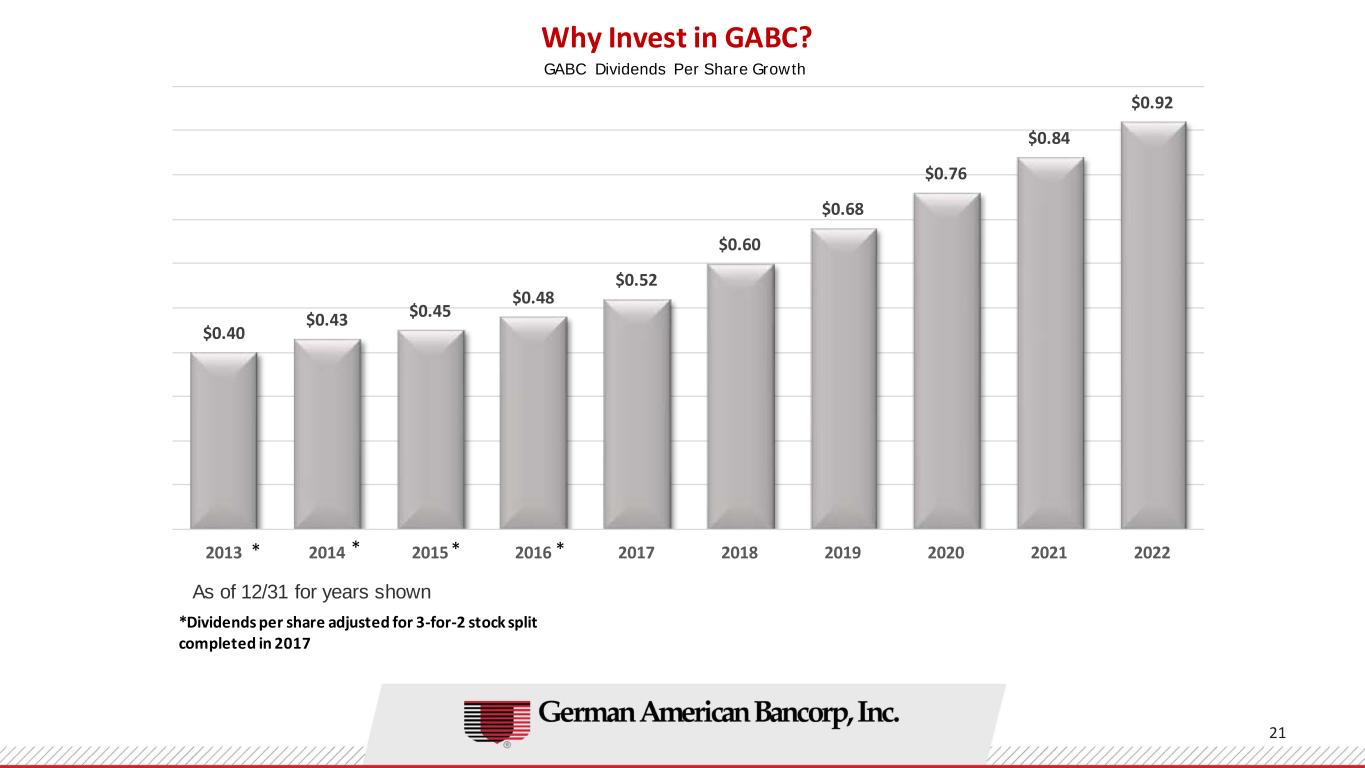

$0.40 $0.43 $0.45 $0.48 $0.52 $0.60 $0.68 $0.76 $0.84 $0.92 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 Why Invest in GABC? *Dividends per share adjusted for 3-for-2 stock split completed in 2017 As of 12/31 for years shown * * * * GABC Dividends Per Share Growth 21

Why Invest in GABC? • Proven Executive Management Team • Track Record of Consistent Top Quartile Financial Performance • Experienced in Operating Plan Execution and M & A Transitions • Organic Growth Opportunities within New Market Areas – Small MSA and Large Major Metro • Existing Platform for Continuous Improvement and Operating Efficiency • Infrastructure in Place for Perpetuating Ongoing EPS Growth • Consistent Strong Dividend Yield and Dividend Pay-out Capacity • Long Term Focus and Investment in Digital Optimization and Delivery 22

23