UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| Filed by the Registrant ¨ | Filed by a Party other than the Registrant ¨ |

| Check the appropriate box: | |

| ¨ | Preliminary Proxy Statement |

| | |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e) (2)) |

| | |

| x | Definitive Proxy Statement |

| | |

| ¨ | Definitive Additional Materials |

| | |

| ¨ | Soliciting Material under §240.14a-12 |

| NEWBRIDGE BANCORP |

| |

| (Name of Registrant as Specified In Its Charter) |

| |

| (Name of Person(s) Filing Proxy Statement if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | | |

| | 1) | Title of each class of securities to which transaction applies: |

| | | |

| | | |

| | 2) | Aggregate number of securities to which transaction applies: |

| | | |

| | | |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11: |

| | | |

| | | |

| | 4) | Proposed maximum aggregate value of transaction: |

| | | |

| | | |

| | 5) | Total fee paid |

| ¨ | Fee paid previously with preliminary materials |

| | |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | |

| | 1) | Amount Previously Paid: |

| | | |

| | | |

| | 2) | Form, Schedule or Registration Statement No.: |

| | | |

| | | |

| | 3) | Filing Party: |

| | | |

| | | |

| | 4) | Date Filed: |

| | | |

| | | |

1501 Highwoods Boulevard, Suite 400

Greensboro, North Carolina 27410

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

To be held on February 20, 2013

To the Shareholders of NewBridge Bancorp:

Notice is hereby given that the Special Meeting of Shareholders (the “Special Meeting”) of NewBridge Bancorp (the “Company”) will be held as follows:

| Place: | Community Room |

| | NewBridge Bancorp Corporate Office |

| 1501 Highwoods Boulevard, Suite 400 |

| | Greensboro, North Carolina 27410 |

| | |

| Date: | February 20, 2013 |

| | |

| Time: | 1:00 p.m., Eastern Time |

The purpose of the Special Meeting is to consider and act upon the following proposals:

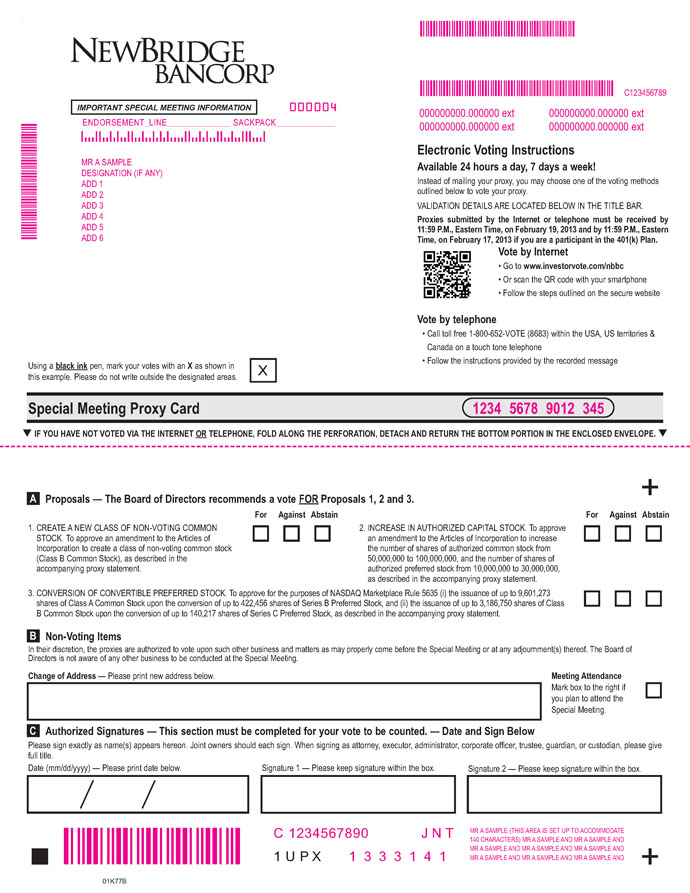

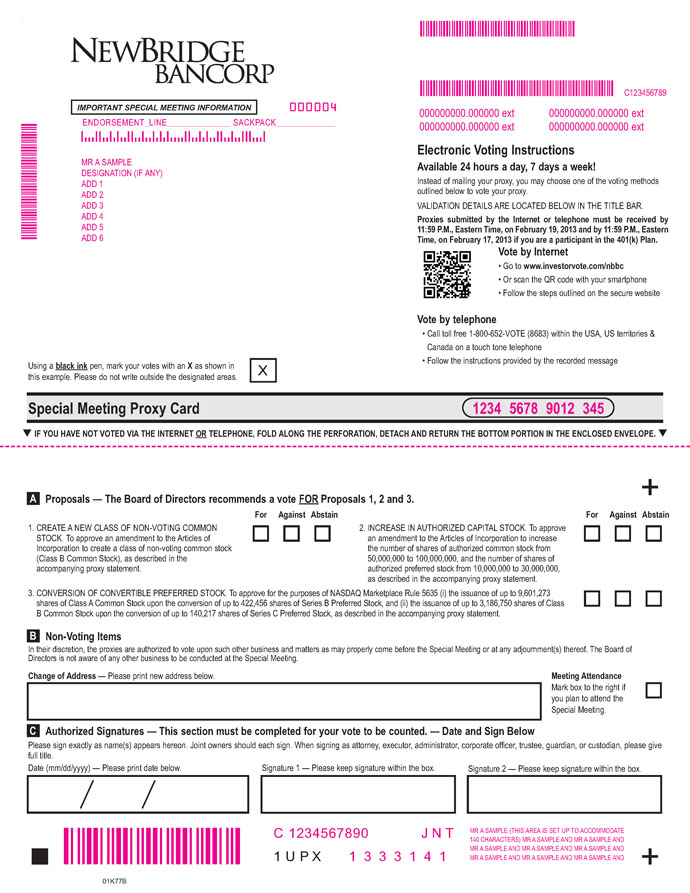

1. CREATE A NEW CLASS OF NON-VOTING COMMON STOCK. To approve an amendment to the Articles of Incorporation to create a class of non-voting common stock (Class B Common Stock), as described in the accompanying proxy statement;

2. INCREASE IN AUTHORIZED CAPITAL STOCK. To approve an amendment to the Articles of Incorporation to increase the number of shares of authorized common stock from 50,000,000 to 100,000,000, and the number of shares of authorized preferred stock from 10,000,000 to 30,000,000, as described in the accompanying proxy statement;

3. CONVERSION OF CONVERTIBLE PREFERRED STOCK.To approve for the purposes of NASDAQ Marketplace Rule 5635 (i) the issuance of up to 9,601,273 shares of Class A Common Stock upon the conversion of up to 422,456 shares of Series B Preferred Stock, and (ii) the issuance of up to 3,186,750 shares of Class B Common Stock upon the conversion of up to 140,217 shares of Series C Preferred Stock, as described in the accompanying proxy statement; and

4. OTHER BUSINESS. To consider such other business as may properly come before the Special Meeting or any adjournment(s) thereof. The Board is not aware of any other business to be conducted at the Special Meeting.

Shareholders of record at the close of business on January 11, 2013 are entitled to notice of and to vote at the Special Meeting and any adjournment(s) thereof. We urge you to attend the Special Meeting. It is extremely important that your shares be represented regardless of the number you own. Whether or not you expect to be present at the Special Meeting, please sign and return your proxy card to us in the enclosed envelope at your earliest convenience. You may also vote your shares over the Internet or by using a toll-free number. Unless you indicate to the contrary, your proxy will be castFOReach proposal, each as described in more detail in the accompanying proxy statement. If any other matters are properly presented for consideration at the Special Meeting, the persons named as proxies and acting thereunder will have discretion to vote on those matters according to their best judgment to the same extent as the person delivering the proxy would be entitled to vote. In the event that you attend the Special Meeting in person, you may revoke your proxy and vote your shares in person.

| This 18th day of January, 2013. | Yours very truly, |

| | |

| | Michael S. Albert |

| | Chairman |

Important Notice Regarding the Availability of Proxy Materials for the Special Meeting to Be Held on February 20, 2013.

The Notice and Proxy Statement are also available athttp://www.snl.com/irweblinkx/GenPage.aspx?IID=100346&GKP=1073745413. You may also access the above off-site website by going towww.newbridgebank.com, under the headingInvestor Relations.

PROXY STATEMENT

Special Meeting of Shareholders

To be held on February 20, 2013

This Proxy Statement is being mailed to our shareholders on or about January 18, 2013 for solicitation of proxies by the Board of Directors (the “Board”) of your company, NewBridge Bancorp. Our principal executive offices are located at 1501 Highwoods Boulevard, Suite 400, Greensboro, North Carolina 27410.

In this Proxy Statement, terms such as “we,” “us,” “our” and the “Company” refer to NewBridge Bancorp. The term “Bank” means NewBridge Bank, our wholly-owned, North Carolina bank subsidiary. The terms “you” and “your” refer to the shareholders of the Company.

Important Notice Regarding the Availability of Proxy Materials for the Special Meeting to Be Held on February 20, 2013.

The Notice and Proxy Statement are also available athttp://www.snl.com/irweblinkx/GenPage.aspx?IID=100346&GKP=1073745413. You may also access the above off-site website by going towww.newbridgebank.com, under the headingInvestor Relations.

INFORMATION ABOUT THE SPECIAL MEETING

Your vote is very important. For this reason, our Board is requesting that you allow your shares of our common stock (“Common Stock”) to be represented at the Special Meeting of Shareholders (the “Special Meeting”) by the proxies named on the enclosed proxy card.

| When is the Special Meeting? | | February 20, 2013 at 1:00 p.m., Eastern Time |

| | | |

| Where will the Special Meeting be held? | | In the Community Room at our Corporate Office, located at 1501 Highwoods Boulevard, Suite 400, Greensboro, North Carolina 27410 |

| | | |

| What items will be voted on at the Special Meeting? | | 1. CREATE A NEW CLASS OF NON-VOTING COMMON STOCK. To approve an amendment to the Articles of Incorporation to create a class of non-voting Common Stock (Class B Common Stock), as described herein; 2. INCREASE IN AUTHORIZED CAPITAL STOCK. To approve an amendment to the Articles of Incorporation to increase the number of shares of authorized Common Stock from 50,000,000 to 100,000,000, and the number of shares of authorized preferred stock from 10,000,000 to 30,000,000, as described herein; 3. CONVERSION OF CONVERTIBLE PREFERRED STOCK.To approve for the purposes of NASDAQ Marketplace Rule 5635 (“NASDAQ Rule 5635”) (i) the issuance of up to 9,601,273 shares of Class A Common Stock upon the conversion of up to 422,456 shares of Series B Preferred Stock, and (ii) the issuance of up to 3,186,750 shares of Class B Common Stock upon the conversion of up to 140,217 shares of Series C Preferred Stock, as described herein; and |

| | | 4. OTHER BUSINESS. To consider such other business as may properly come before the Special Meeting or any adjournment(s) thereof. The Board is not aware of any other business to be conducted at the Special Meeting. |

| | | |

| Who can vote? | | Only holders of record of our Common Stock at the close of business on January 11, 2013 (the “Record Date”) will be entitled to notice of and to vote at the Special Meeting or any adjournment(s) thereof. On the Record Date, there were 15,655,868 shares of our Common Stock outstanding and entitled to vote and approximately 2,831 shareholders of record. There is currently no other class of voting stock outstanding. |

| | | |

| How do I vote by proxy? | | You may vote your shares by marking, signing and dating the enclosed proxy card and returning it in the enclosed postage-paid envelope. The shares represented by a proxy card will be voted at the Special Meeting if the proxy card is properly signed, dated and received by Computershare Trust Company, N.A. (“Computershare”), our transfer agent, prior to the time of the Special Meeting. You may also vote your shares over the Internet or by using a toll-free number. You should refer to the proxy card or the information forwarded by your bank, broker or other holder of record to see what voting options are available to you. If you return your signed proxy card before the Special Meeting, the proxies will vote your shares as you direct. Michael S. Albert, Barry Z. Dodson, Robert F. Lowe and Pressley A. Ridgill, each a director of the Company and the Bank, have been appointed proxies by the Board. The Internet and telephone voting facilities will close at 11:59 p.m., Eastern Time, on February 19, 2013. If you vote over the Internet you may incur costs, such as telephone, and Internet access charges for which you will be responsible. If you are interested in voting via the Internet or telephone, specific instructions are shown on the enclosed proxy card. The Internet and telephone voting procedures are designed to authenticate your identity and to allow you to vote your shares and confirm that your instructions have been properly recorded. In the event that the proxy card does not reference Internet or telephone voting information because you are not the registered owner of the shares, please complete and return the proxy card in the self-addressed, postage-paid envelope provided. |

| | | If you are a shareholder of record and a participant in the Computershare Investment Plan or the NewBridge Bancorp Employees’ 401(k) Plan (the “401(k) Plan”), the proxy represents the number of shares of Common Stock in your Computershare Investment Plan account and/or 401(k) Plan account, as applicable, and the number of shares of Common Stock held of record directly by you. Shares allocated to participant accounts in the 401(k) Plan will be voted by the trustee of the 401(k) Plan in accordance with the instructions received from participants who timely return their proxy cards to Computershare or timely indicate their voting instructions pursuant to the Internet or telephone voting procedures. The Internet and telephone voting facilities for participants in the 401(k) Plan will close at 11:59 p.m. Eastern Time on February 17, 2013. Shares of Common Stock held under the 401(k) Plan for which no voting instructions are received will not be voted by the trustee. Shareholders’ voting instructions with respect to shares of Common Stock held under the 401(k) Plan will be held in strict confidence. If you return your signed proxy card but do not specify how you want to vote your shares, the proxies will vote them “FOR” each proposal.If any other matters are properly presented for consideration at the Special Meeting, the persons named as proxies and acting thereunder will have discretion to vote on those matters according to their best judgment to the same extent as the person delivering the proxy would be entitled to vote.If your shares are held in the name of a broker or other nominee (i.e., held in “street name”), you will need to obtain a proxy instruction form from the broker or other nominee holding your shares and return the form as directed by your broker or other nominee. We are not aware of any other matters to be brought before the Special Meeting. If matters other than those discussed above are properly brought before the Special Meeting, the proxies may vote your shares in accordance with their best judgment. |

| | | |

| How do I change or revoke my proxy? | | You may change or revoke your proxy at any time before it is voted at the Special Meeting in any of three ways: (i) by delivering a written notice of revocation to Computershare; (ii) by delivering another properly signed proxy card to Computershare with a more recent date than that of the proxy first given; or (iii) by attending the Special Meeting and voting in person. You should deliver your written notice or superseding proxy to Computershare at the address noted on the proxy card. If you vote by Internet or telephone, you may also revoke your proxy or change your vote with a timely and valid later Internet or telephone vote, as the case may be. |

| | | |

| How many votes may I cast? | | You are entitled to one vote for each share of Common Stock held of record on January 11, 2013for each matter presented for a vote at the Special Meeting. |

| How many votes are required to approve the proposals? | | Each proposal will be approved if the votes cast in favor exceed the votes cast in opposition. Abstentions and broker non-votes will not be included in determining the number of votes cast on a proposal and, accordingly, will have no effect on the outcome of such vote. |

| | | Any other matters properly coming before the Special Meeting will require the approval of the holders of Common Stock as required by applicable law or our governing documents. If you hold your shares in “street name” through a broker or other nominee, your broker or nominee may not be permitted to exercise voting discretion with respect to some or all of the matters to be acted upon. Thus, if you do not give your broker or nominee specific instructions, your shares may not be voted on those matters. Shares represented by such “broker non-votes” will, however, be counted in determining whether there is a quorum at the Special Meeting or any adjournment(s) thereof. A “broker non-vote” occurs when a broker or other nominee who holds shares for another does not vote on a particular matter because the broker or other nominee does not have discretionary authority on that matter and has not received instructions from the owner of the shares. In the event there are insufficient votes present at the Special Meeting for a quorum or to approve or ratify any proposal, the Special Meeting may be adjourned in order to permit the further solicitation of proxies. |

| | | |

| What constitutes a “quorum” for the Special Meeting? | | A majority of the outstanding shares of our Common Stock entitled to vote at the Special Meeting, present in person or represented by proxy, constitutes a quorum (a quorum is necessary to conduct business at the Special Meeting). Your shares will be considered part of the quorum if you have voted by proxy. Once a share is represented for any purpose at the Special Meeting, it is deemed present for quorum purposes for the remainder of the Special Meeting and any adjournment(s) thereof. Abstentions and broker non-votes count as shares present at the Special Meeting for purposes of determining a quorum. |

| | | |

| How are the votes counted? | | Computershare, our transfer agent, has been appointed by the Board as the Inspector of Elections for the Special Meeting. Computershare will tabulate the votes received for each proposal and all other items of business at the Special Meeting. Computershare will announce at the Special Meeting and will subsequently certify to the Board, the result of each vote. |

| | | |

| How do I obtain directions to the Special Meeting? | | Directions to the Special Meeting are available on our website,www.newbridgebank.com, under the headingInvestorRelations. You may also obtain directions to the Special Meeting by contacting Rebecca Gibson, Assistant Vice President and Assistant Secretary at (336) 369-0960. |

| Who pays for the solicitation of proxies? | | We will pay the cost of preparing, printing and mailing materials in connection with this solicitation of proxies. In addition to solicitation by mail, officers, directors (including those nominees for election as a director) and employees of the Company and the Bank, may make solicitations personally, by telephone or otherwise without additional compensation for doing so. We have also made arrangements with Georgeson Inc. to assist in soliciting proxies and have agreed to pay that firm a fee not expected to exceed $14,500 for these services. In addition, we will, upon request, reimburse brokerage firms, banks and others for their reasonable out-of-pocket expenses in forwarding proxy materials to beneficial owners of our Common Stock or otherwise in connection with this solicitation of proxies. |

| When are proposals for the 2013 Annual Meeting of Shareholders due? | | It is presently anticipated that the 2013 Annual Meeting of Shareholders of the Company will be held in May of 2013. To be considered for inclusion in the proxy solicitation materials of the Board for the 2013 Annual Meeting, shareholder proposals must have been received by the Secretary of the Company at our principal executive offices at 1501 Highwoods Boulevard, Suite 400, Greensboro, North Carolina 27410 no later than December 10, 2012. To be eligible for inclusion, such proposals must have also complied with our Bylaws, Rule 14a-8 and all other applicable provisions of Regulation 14A under the Securities Exchange Act of 1934, as amended. Any proposal not intended to be included in the proxy statement for the 2013 Annual Meeting of Shareholders, but intended to be presented from the floor at that Annual Meeting, must be received by us at our principal executive offices listed above no later than February 22, 2013. |

BACKGROUND TO THE PROPOSALS AND

THE PRIVATE PLACEMENT

On December 12, 2008, as part of the Troubled Asset Relief Program (“TARP”) Capital Purchase Program, the Company sold the United States Department of the Treasury (“Treasury”) 52,372 shares of Fixed Rate Cumulative Perpetual Preferred Stock, Series A (the “TARP Preferred Stock”) and a warrant (the “TARP Warrant”) to purchase 2,567,255 shares of Common Stock, for an aggregate purchase price of $52.3 million, which capital qualifies as tier 1 capital for regulatory purposes. The Company has been paying Treasury cumulative dividends on the TARP Preferred Stock at a rate of 5% per annum; however, this rate will increase to 9% per annum on and after February 15, 2014. In anticipation of this scheduled increase, our Board and management have been actively considering a number of alternative strategies to repurchase and redeem the TARP Preferred Stock, while continuing to maintain the Company and the Bank’s capital ratios at levels above those required to be considered well-capitalized for regulatory purposes.

In early 2012, FIG Partners, LLC (“FIG”) and Keefe, Bruyette & Woods, Inc. (“KBW”) were engaged by the Company to advise its Board and to ultimately contact potential investors to assess interest in a potential private placement of equity securities. Based on the advice of FIG and KBW, the Company engaged several firms to review and evaluate various portions of the Bank’s loan portfolio and its other real estate owned (real estate interests acquired by the Bank through foreclosure or otherwise acquired from borrowers). These reviews were completed in July of 2012. Although informal contacts with potential investors occurred during this review period, discussions of the specific terms of potential equity investments were deferred until completion of the reviews and the Company’s assessments of the evaluations received.

In August of 2012, FIG and KBW began discussions on the Company’s behalf with a number of potential “key” investors. At the outset, the Company, FIG and KBW understood that it would be necessary and desirable to identify one or more “key” investors to facilitate due diligence for all potential investors and the negotiation of investment terms and pricing acceptable to the Company and those investors selected to invest in the Company. During August and September, FIG and KBW spoke to a number of investment firms which expressed interest in being “key” investors. During this time several potential “key” investors conducted due diligence of the Company.

In the latter part of September, FIG, KBW and the Company conducted discussions with several “key” investors. Although the indications of interest of these investors included the same financial terms, the structures of their potential investments varied and presented differing regulatory considerations. In early October, management of the Company recommended to the Board those potential “key” investors whose indicators of interest were best structured in light of regulatory control requirements, NASDAQ listing standards and shareholder approvals. The Board authorized management to proceed with discussions with these investors with the assistance of FIG and KBW.

The Company and the investors agreed at the outset that the structure of the investment should emphasize common stock, reflecting the increased market and regulatory focus on tier 1 capital and the corresponding tier 1 capital ratio. Depending on the size of investment by each “key” investor, it was also anticipated that in order to satisfy regulatory restrictions on ownership of voting securities, a portion of the securities issued to “key” investors may have to be issued in the form of a new class of non-voting common stock. During October, discussions continued with a view to refining the terms of an investment and addressing structuring issues. The various investors, the Company, FIG and KBW understood that, as a result of the proposed size of the private placement and their mutual intent that the investment ultimately be in the form of tier 1 capital (voting and non-voting common stock), the approval of the Company’s shareholders would be required. In addition, the Company recognized that in order to provide an incentive to each of the investors to fully fund its investment prior to the receipt of such approval, it would be reasonable and necessary for the securities issued to include elements to compensate the investors in the event such approval was not received. Throughout this period, the Company’s senior management, the placement agents and the Company’s corporate counsel regularly updated the Board regarding the progress of discussions and the potential terms of the private placement. Discussions between the Company and the individual investors continued and terms for the private placement were finalized in late October.

On November 1, 2012, the Company entered into securities purchase agreements (the “Securities Purchase Agreements”) with approximately 22 investors, including certain directors and officers of the Company (the “Investors”), and on November 30, 2012, the Company completed the private placement (the “Private Placement”) in which it issued, in exchange for gross aggregate proceeds of approximately $56 million, a total of approximately 422,456 shares of its Series B Mandatorily Convertible Adjustable Rate Cumulative Perpetual Preferred Stock (“Series B Preferred Stock”) and approximately 140,217 shares of its Series C Mandatorily Convertible Adjustable Rate Cumulative Perpetual Preferred Stock (“Series C Preferred Stock,” and together with the Series B Preferred Stock, the “Series B and C Preferred Stock”). The Company intends to use these proceeds to (i) repurchase and redeem the TARP Preferred Stock and repurchase the TARP Warrant, (ii) support the Bank’s disposition of selected classified and non-performing assets in accordance with the Bank’s asset disposition plan and (iii) support the operations of the Company and the Bank, while maintaining the Company and the Bank’s capital ratios at levels above those required to be considered well-capitalized for regulatory purposes.

Following shareholder approval of the Proposals (the “Shareholder Approvals”) and the filing of articles of amendment in the form attached hereto asAppendix A (the “Common Stock Articles of Amendment”) with the North Carolina Secretary of State, the shares of Series B Preferred Stock will automatically convert into shares of voting Common Stock, and the shares of Series C Preferred Stock will automatically convert into shares of non-voting Common Stock (the “Conversion”). If we obtain the Shareholder Approvals and the Conversion occurs before May 30, 2013, no dividends will be owed on the Series B and C Preferred Stock. If we do not receive the Shareholder Approvals and the Conversion does not occur before May 30, 2013, cumulative dividends will be payable to the Investors at a rate of (i) 5% for the initial six month period following issuance, (ii) 6% for the next six months, (iii) 7% for the next six months and (iv) 8% thereafter.

Also on November 1, 2012, the Company and each of the Investors entered into Registration Rights Agreements, which provide the Investors with certain registration rights with respect to the Series B and C Preferred Stock and the shares of voting and non-voting Common Stock into which the Series B and C Preferred Stock convert. Among other things, the Registration Rights Agreements require the Company to file a resale registration statement, or statements if necessary, within 30 days following the Company’s receipt of the Shareholder Approvals.

The closing price of our Common Stock as reported by NASDAQ on October 31, 2012, the trading day immediately prior to the execution of the Securities Purchase Agreements, was $4.26. The Securities Purchase Agreements fix the conversion price at $4.40 per share.

In order for the Company to avoid paying dividends on the Series B and C Preferred Stock, and to assure favorable tier 1 capital treatment for the Company on the net proceeds received in the Private Placement, the Company's shareholders must approve Proposals 1, 2 and 3. Our Board unanimously recommends that our shareholders vote “FOR” each of the proposals at the Special Meeting.

PROPOSAL 1

CREATE A NEW CLASS OF NON-VOTING COMMON STOCK

AND

PROPOSAL 2

INCREASE IN AUTHORIZED CAPITAL STOCK

General

On November 14, 2012, our Board unanimously approved and adopted for submission to shareholders an amendment to our Articles of Incorporation, as amended (“Articles of Incorporation”), to (i) create a new class of non-voting Common Stock, no par value per share (the “Class B Common Stock”), with the existing class of voting Common Stock being re-designated “Class A Common Stock,” no par value per share, (ii) increase the number of shares of Common Stock available for issuance from 50,000,000 to 100,000,000, of which 90,000,000 shares shall be designated Class A Common Stock and 10,000,000 shares shall be designated Class B Common Stock, and (iii) increase the number of shares of preferred stock available for issuance from 10,000,000 to 30,000,000. The proposed Common Stock Articles of Amendment are set out inAppendix A to this Proxy Statement.

Purpose of Creating a New Class of Non-Voting Common Stock and Increasing Authorized Capital Stock

Tier 1 capital and the corresponding tier 1 capital ratio have become increasingly important in measuring and comparing the capital strength of financial institutions. The current stress in the banking industry and the large losses recorded by many financial institutions in recent periods have caused investors to focus on the ability of particular banks, on an absolute and comparative basis to peers, to absorb further losses and the resulting diminution in the institution’s capital. The tier 1 capital ratio gives investors a consistent barometer from one bank to the next to measure and compare the capital strength of financial institutions. Accordingly, in order to maximize the benefit to the Company, the Investors agreed at the outset that the structure of the Private Placement would emphasize the core component of tier 1 capital - common stock. However, in order to satisfy certain regulatory restrictions on ownership of voting securities by certain of our Investors, it was necessary to structure the Private Placement so as to limit the total voting securities that these Investors would own after the Conversion. The issuance of non-voting common stock (in the form of Class B Common Stock) satisfies both these criteria, however under our existing Articles of Incorporation, we are not authorized to issue non-voting common stock. Therefore, in order to maximize the effect that the Private Placement will have on the Company’s tier 1 capital and corresponding tier 1 capital ratio, and satisfy the regulatory restrictions on ownership of our voting securities by certain of our Investors, it is necessary to amend our Articles of Incorporation to create the Class B Common Stock.

Currently, our Articles of Incorporation authorize the issuance of only 50,000,000 shares of Common Stock, and do not permit us to issue shares of non-voting Common Stock. As of the Record Date, there were 15,655,868 shares of Common Stock outstanding. In addition, as of the Record Date, we have reserved for issuance an additional 4,296,605 shares of Common Stock pursuant to our stock compensation plans and the TARP Warrant. The proposed increase in our authorized capital stock is necessary to allow for the conversion of the Series B and C Preferred Stock, as described above, to provide greater flexibility for declaration of stock dividends and for other proper corporate purposes, and to provide maximum flexibility with respect to our ability to augment our capital in the future.

As is the case with the shares of Common Stock that currently are authorized but unissued, if the Common Stock Articles of Amendment are approved by our shareholders, our Board will have authority to issue additional shares of Class A Common Stock and Class B Common Stock from time to time without the expense and delay of a special meeting of shareholders or other shareholder action, except as may be required by applicable laws, regulatory authorities, or the rules of any stock exchange on which our securities are then listed.

If we receive the Shareholder Approvals, the Company will issue approximately 9,601,273 shares of Class A Common Stock upon the conversion of the Series B Preferred Stock, and approximately 3,186,750 shares of Class B Common Stock upon the conversion of the Series C Preferred Stock. Therefore, following the Conversion, there will be approximately 25,257,141 shares of Class A Common Stock issued and outstanding, and approximately 3,186,750 shares of Class B Common Stockissued and outstanding.

Description of the Class A Common Stock

The preferences, limitations and relative rights of the Class A Common Stock shall be identical to the preferences, limitations and relative rights of the existing Common Stock. See “Description of our Class A Common Stock and Class B Common Stock” on page 18, and the Common Stock Articles of Amendment attached hereto asAppendix A.

Description of the Class B Common Stock

Except as to voting rights, the shares of Class B Common Stock to be issued upon the Conversion shall have the same preferences, limitations and relative rights as, share ratably with and be identical in all respects to shares of Class A Common Stock as to all matters. See “Description of our Class A Common Stock and Class B Common Stock” on page 18, and the Common Stock Articles of Amendment attached hereto asAppendix A.

Effect of Proposal 1 and Proposal 2

If Proposal 1 and 2 are approved, there will be a sufficient number of authorized shares of Class A Common Stock to permit the full conversion of the Series B Preferred Stock and a sufficient number of authorized shares of Class B Common Stock to permit the full conversion of the Series C Preferred Stock, and leave additional shares of each class available for potential future issuances. Any future issuance of additional shares of Class A Common Stock or Class B Common Stock could have a dilutive effect on the book value and earnings per share of the outstanding shares and would decrease the relative voting power of current shareholders. The Company does not currently have any material commitments, arrangements, or understanding which would require the issuance of additional shares of Class A Common Stock or Class B Common Stock, other than as described in this Proxy Statement in connection with the Private Placement.

Our Board does not believe that an increase in the number of authorized shares of Common Stock or the creation of an additional class of common stock will have a significant impact on any future (and currently unknown) attempt to gain control of the Company. It is possible, however, that the availability of authorized but unissued shares of Class A Common Stock could discourage third parties from attempting to gain control since the Board could authorize the issuance of shares of Class A Common Stock in a manner that could dilute the voting power of a person attempting to acquire control of the Company, increase the cost of acquiring such control or otherwise hinder such efforts. The Board is not aware of any present threat or attempt to gain control of the Company and neither Proposal 1 nor Proposal 2 is in response to any such action nor is it being presented with the intent that it be utilized as a type of anti-takeover device.

Effectiveness of Change

If Proposals 1, 2 and 3 areall approved at the Special Meeting, we will deliver, as soon as reasonably practicable, to the North Carolina Secretary of State the Common Stock Articles of Amendment and the changes will be effective as of the date of such filing. Accordingly, if one or more of the Proposals is not approved, then the Common Stock Articles of Amendment willnot become effective.

Additional Important Information

See also “ADDITIONAL IMPORTANT INFORMATION” on page 12.

Vote Required

Proposal 1 and 2 will each be approved if the votes cast in favor of such Proposal exceed the votes cast in opposition. Abstentions and broker non-votes will not be included in determining the number of votes cast on the Proposals and, accordingly, will have no effect on the outcome of such vote.

Recommendation

The Board unanimously recommends a vote “FOR” Proposal 1 and “FOR” Proposal 2.

PROPOSAL 3

CONVERSION OF PREFERRED STOCK

General and Purpose of Approving the Proposal

As discussed above, on November 1, 2012, the Company entered into the Securities Purchase Agreements with the Investors, and on November 30, 2012, the Company completed the Private Placement in which it issued a total of approximately 422,456 shares of its Series B Preferred Stock and approximately 140,217 shares of its Series C Preferred Stock. The Company intends to use the net proceeds from the Private Placement to (i) repurchase and redeem the TARP Preferred Stock and repurchase the TARP Warrant, (ii) support the Bank’s disposition of selected classified and non-performing assets in accordance with the Bank’s asset disposition plan and (iii) support the operations of the Company and the Bank, while maintaining the Company and the Bank’s capital ratios at levels above those required to be considered well-capitalized for regulatory purposes.

Because our Common Stock is listed on the NASDAQ Global Select Market, we are subject to NASDAQ Rule 5635, which requires shareholder approval prior to the issuance of securities in connection with a transaction, other than a public offering, involving the sale, issuance or potential issuance by a company of common stock (or securities convertible into or exercisable for common stock) equal to 20% or more of the common stock or 20% or more of the voting power outstanding before the issuance for less than the greater of book or market value of the stock.

The approximately 9,601,273 shares of Class A Common Stock issuable upon conversion of the Series B Preferred Stock and the approximately 3,186,750 shares of Class B Common Stock issuable upon conversion of the Series C Preferred Stock, will exceed 20% of both the voting power and the number of shares of our Common Stock outstanding prior to the issuance.

Although the $4.40 per share conversion price is greater than $4.26, which was the closing price of our Common Stock as reported by NASDAQ on October 31, 2012, the trading day immediately prior to the execution of the Securities Purchase Agreements, it is less than $5.56, which was the book value of our Common Stock based on our common shareholders’ equity divided by the total number of shares of Common Stock outstanding as reported in our Quarterly Report on Form 10-Q for the quarter ended September 30, 2012, our most recent public filing with the Securities and Exchange Commission (the “SEC”). Accordingly, shareholder approval is required pursuant to NASDAQ Rule 5635 to permit us to complete the Conversion and issue the shares of Class A Common Stock and Class B Common Stock, as described above.

Effect of Proposal 3

If this Proposal, together with Proposal 1 and 2, is approved:

| • | Each share of Series B Preferred Stock will automatically convert into shares of Class A Common Stock on the business day after the date on which the Common Stock Articles of Amendment are accepted for filing by the North Carolina Secretary of State. Each outstanding share of Series B Preferred Stock will automatically convert into such number of shares of Class A Common Stock as determined by dividing (i) $100 (the purchase price per share of the Series B Preferred Stock) by (ii) $4.40 (the conversion price of the Series B Preferred Stock). Accordingly, the conversion of the Series B Preferred Stock would result in the issuance of approximately 9,601,273 shares of Class A Common Stock. |

| • | Each share of Series C Preferred Stock will automatically convert into shares of Class B Common Stock on the business day after the date on which the Common Stock Articles of Amendment are accepted for filing by the North Carolina Secretary of State. Each outstanding share of Series C Preferred Stock will automatically convert into such number of shares of Class B Common Stock as determined by dividing (i) $100 (the purchase price per share of the Series C Preferred Stock) by (ii) $4.40, the conversion price of the Series C Preferred Stock. Accordingly, the conversion of the Series C Preferred Stock would result in the issuance of approximately 3,186,750 shares of Class B Common Stock. |

| • | No fractional shares of either Class A Common Stock or Class B Common Stock will be issued as a result of the Conversion. In lieu of any fractional share otherwise issuable as a result of the Conversion, the Investors will receive a cash payment equal to the corresponding fraction of a share based on the closing price of the Common Stock on the NASDAQ Global Stock Market on the second trading day immediately preceding the date of the Conversion. |

| • | Upon the Conversion, all shares of Series B and C Preferred Stock will be cancelled. As a result, the dividend rights and liquidation preferences existing in favor of the Series B and C Preferred Stock will be eliminated. |

Effectiveness of Change

If Proposals 1, 2 and 3 are all approved at the Special Meeting, we will deliver, as soon as reasonably practicable, to the North Carolina Secretary of State the Common Stock Articles of Amendment and the changes will be effective as of the date of such filing. Accordingly, if one or more of the Proposals is not approved, then the Common Stock Articles of Amendment willnot become effective.

Additional Important Information

See also “ADDITIONAL IMPORTANT INFORMATION,” below.

Vote Required

Proposal 3 will be approved if the votes cast in favor of such Proposal exceed the votes cast in opposition. Abstentions and broker non-votes will not be included in determining the number of votes cast on the Proposal and, accordingly, will have no effect on the outcome of such vote.

Recommendation

The Board unanimously recommends a vote “FOR” Proposal 3.

ADDITIONAL IMPORTANT INFORMATION

Pro Forma Financial Information

To assist in your understanding of the impact of the Private Placement and the Proposals, we are providing pro forma financial information. The following pro forma table contains certain financial information as of September 30, 2012 and for the nine months ended September 30, 2012, and as of December 31, 2011 and for the year ended December 31, 2011.

This pro forma table should be read together with our consolidated historical financial statements and Management’s Discussion and Analysis of Financial Condition and Results of Operations (which appeared in our Annual Report on Form 10-K for the year ended December 31, 2011 filed with the SEC on March 22, 2012), and our Quarterly Report on Form 10-Q for the quarter ended September 30, 2012 filed with the SEC on November 14, 2012. SeeAppendix C, D, E and F, attached hereto.

| | | September 30, 2012 | | | December 31, 2011 | |

| | | Actual | | | As Adjusted

Assuming

Proposals

are not

Approved(1) | | | As Adjusted

Assuming

Proposals

are

Approved(2) | | | Actual | | | As Adjusted

Assuming

Proposals

are not

Approved(1) | | | As Adjusted

Assuming

Proposals

are

Approved(2) | |

| | | | | | | | | | | | | | | | | | | |

| | | (Dollars in thousands, except per share data) | |

| Assets: | | | | | | | | | | | | | | | | | | | | | | | | |

| Cash | | $ | 42,741 | | | $ | 94,935 | | | $ | 94,935 | | | $ | 53,992 | | | $ | 106,186 | | | $ | 106,186 | |

| Securities | | | 387,376 | | | | 387,376 | | | | 387,376 | | | | 337,811 | | | | 337,811 | | | | 337,811 | |

| Net loans | | | 1,133,731 | | | | 1,133,731 | | | | 1,133,731 | | | | 1,171,226 | | | | 1,171,226 | | | | 1,171,226 | |

| Loans held for sale | | | 7,074 | | | | 7,074 | | | | 7,074 | | | | 7,851 | | | | 7,851 | | | | 7,851 | |

| Other assets | | | 142,987 | | | | 142,987 | | | | 142,987 | | | | 163,684 | | | | 163,684 | | | | 163,684 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Total assets | | $ | 1,713,909 | | | $ | 1,766,103 | | | $ | 1,766,103 | | | $ | 1,734,564 | | | $ | 1,786,758 | | | $ | 1,786,758 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Liabilities: | | | | | | | | | | | | | | | | | | | | | | | | |

| Deposits | | $ | 1,389,736 | | | $ | 1,389,736 | | | $ | 1,389,736 | | | $ | 1,418,676 | | | $ | 1,418,676 | | | $ | 1,418,676 | |

| Borrowings | | | 163,974 | | | | 163,974 | | | | 163,974 | | | | 133,474 | | | | 133,474 | | | | 133,474 | |

| Other liabilities | | | 20,834 | | | | 20,834 | | | | 20,834 | | | | 19,027 | | | | 19,027 | | | | 19,027 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Total liabilities | | $ | 1,574,544 | | | $ | 1,574,544 | | | $ | 1,574,544 | | | $ | 1,571,177 | | | $ | 1,571,177 | | | $ | 1,571,177 | |

| Shareholders’ Equity: | | | | | | | | | | | | | | | | | | | | | | | | |

| Series A Preferred Stock | | $ | 52,014 | | | $ | 52,014 | | | $ | 52,014 | | | $ | 51,789 | | | $ | 51,789 | | | $ | 51,789 | |

| Series B Preferred Stock | | | | | | | 42,245 | | | | | | | | | | | | 42,245 | | | | | |

| Series C Preferred Stock | | | | | | | 14,022 | | | | | | | | | | | | 14,022 | | | | | |

| Class A Common Stock | | | 78,279 | | | | 78,279 | | | | 120,524 | | | | 78,279 | | | | 78,279 | | | | 120,524 | |

| Class B Common Stock | | | | | | | | | | | 14,022 | | | | | | | | | | | | 14,022 | |

| Additional paid in capital | | | 87,276 | | | | 83,203 | | | | 83,203 | | | | 87,190 | | | | 83,117 | | | | 83,117 | |

| Retained earnings | | | (79,731 | ) | | | (79,731 | ) | | | (79,731 | ) | | | (47,525 | ) | | | (47,525 | ) | | | (47,525 | ) |

| Accumulated other comprehensive income | | | 1,995 | | | | 1,995 | | | | 1,995 | | | | (5,771 | ) | | | (5,771 | ) | | | (5,771 | ) |

| Other equity | | | (468 | ) | | | (468 | ) | | | (468 | ) | | | (575 | ) | | | (575 | ) | | | (575 | ) |

| Total equity | | $ | 139,365 | | | $ | 191,559 | | | $ | 191,559 | | | $ | 163,387 | | | $ | 215,581 | | | $ | 215,581 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Total liabilities and shareholders’ equity: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Tangible common book value per share | | $ | 5.35 | | | $ | 5.09 | | | $ | 4.78 | | | $ | 6.85 | | | $ | 6.59 | | | $ | 5.60 | |

| Common book value per share | | $ | 5.56 | | | $ | 5.30 | | | $ | 4.89 | | | $ | 7.09 | | | $ | 6.83 | | | $ | 5.74 | |

| Capital Ratios: | | | | | | | | | | | | | | | | | | | | | | | | |

| Tier 1 leverage ratio | | | 8.53 | % | | | 9.24 | % | | | 11.50 | % | | | 10.65 | % | | | 11.81 | % | | | 13.31 | % |

| Tier 1 risk based capital ratio | | | 10.78 | % | | | 12.03 | % | | | 14.97 | % | | | 13.28 | % | | | 15.19 | % | | | 17.11 | % |

| Total risk based capital ratio | | | 12.07 | % | | | 16.08 | % | | | 16.26 | % | | | 14.55 | % | | | 18.39 | % | | | 18.39 | % |

| (1) | Reflects the net proceeds of the Private Placement of approximately $52.2 million after deducting commissions and our estimated expenses of approximately $4.1 million. Assumes that the Proposals are not approved and therefore the Series B and C Preferred Stock remain outstanding. If the Conversion does not occur before May 30, 2013, cumulative dividends will be payable to the Investors at a rate of (i) 5% for the initial six month period following issuance, (ii) 6% for the next six months, (iii) 7% for the next six months and (iv) 8% thereafter. |

| (2) | Reflects the net proceeds of the Private Placement of approximately $52.2 million after deducting commissions and our estimated expenses of approximately $4.1 million. Assumes the conversion of approximately 422,456 shares of Series B Preferred Stock into approximately 9,601,273 shares of Class A Common Stock and the conversion of approximately 140,217 shares of Series C Preferred Stock into approximately 3,186,750 shares of Class B Common Stock, based on the conversion price of $4.40 per share |

Financial Statements

Our Audited Consolidated Financial Statements (including notes thereto) at December 31, 2011 and 2010 and for the years in the three-year period ended December 31, 2011, as included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2011, are attached to this Proxy Statement asAppendix C and incorporated by reference herein. Our Unaudited Consolidated Financial Statements (including notes thereto) at September 30, 2012 and December 31, 2011 and for the three-month and nine-month periods ended September 30, 2012 and September 30, 2011, as included in our Quarterly Report on Form 10-Q for the fiscal quarter ended September 30, 2012, are attached to this Proxy Statement asAppendix E and incorporated by reference herein.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Management’s Discussion and Analysis of Financial Condition at December 31, 2011 and December 31, 2010 and Results of Operations for the years in the three-year period ended December 31, 2011, as included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2011, is attached to this Proxy Statement asAppendix D and incorporated by reference herein. Management’s Discussion and Analysis of Financial Condition at September 30, 2012 and December 31, 2011 and Results of Operations for the three-month and nine-month periods ended September 30, 2012 and September 30, 2011, as included in our Quarterly Report on Form 10-Q for the fiscal quarter ended September 30, 2012, is attached to this Proxy Statement asAppendix F and incorporated by reference herein.

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

There have been no changes in or disagreements with our accountants required to be disclosed pursuant to Item 304 of Regulation S-K.

Quantitative and Qualitative Disclosures about Market Risk

Information regarding our quantitative and qualitative disclosures about market risk is contained in Management’s Discussion and Analysis of Financial Condition and Results of Operations as reported in our Annual Report on Form 10-K and attached hereto asAppendix D in the section thereof entitled “QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK.” See also the section entitled “Interest Rate Risk Management” in Management’s Discussion and Analysis of Financial Condition and Results of Operations contained in our Quarterly Report on Form 10-Q for the fiscal quarter ended September 30, 2012, which is attached hereto asAppendix F.

Consequences if the Proposals are Approved

Conversion of the Series B Preferred Stock into Class A Common Stock. Each share of Series B Preferred Stock will automatically convert into shares of Class A Common Stock on the business day after the date on which the Common Stock Articles of Amendment are accepted for filing by the North Carolina Secretary of State. Each outstanding share of Series B Preferred Stock will automatically convert into such number of shares of Class A Common Stock as determined by dividing (i) $100 (the purchase price per share of the Series B Preferred Stock) by (ii) $4.40 (the conversion price of the Series B Preferred Stock). Accordingly, the conversion of the Series B Preferred Stock would result in the issuance of approximately 9,601,273 shares of Class A Common Stock.

Conversion of the Series C Preferred Stock into Class B Common Stock. Each share of Series C Preferred Stock will automatically convert into shares of Class B Common Stock on the business day after the date on which the Common Stock Articles of Amendment are accepted for filing by the North Carolina Secretary of State. Each outstanding share of Series C Preferred Stock will automatically convert into such number of shares of Class B Common Stock as determined by dividing (i) $100 (the purchase price per share

of the Series C Preferred Stock) by (ii) $4.40, the conversion price of the Series C Preferred Stock. Accordingly, the conversion of the Series C Preferred Stock would result in the issuance of approximately 3,186,750 shares of Class B Common Stock.

Cash Payments in Lieu of Fractional Shares. No fractional shares of either Class A Common Stock or Class B Common Stock will be issued as a result of the Conversion. In lieu of any fractional share otherwise issuable as a result of the Conversion, the Investors will receive a cash payment equal to the corresponding fraction of a share based on the closing price of the Common Stock on the NASDAQ Global Stock Market on the second trading day immediately preceding the date of the Conversion.

Rights of Investors.The preferences, limitations and relative rights of the shares of Class A Common Stock issued upon the Conversion will be identical to the preferences, limitations and relative rights of the shares of Common Stock held by our existing shareholders. Except as to voting rights, the shares of Class B Common Stock issued upon the Conversion shall have the same preferences, limitations and relative rights as, share ratably with and be identical in all respects to shares of Class A Common Stock as to all matters. Whereas shares of Class A Common Stock shall have unlimited voting rights, with each share being entitled to one vote, shares of Class B Common Stock shall have no voting rights except that the affirmative vote of the holders of a majority of the outstanding shares of Class B Common Stock, voting separately as a class, shall be required to amend (including by merger or otherwise) the Articles of Incorporation, to significantly and adversely affect the designation, preferences, limitations or relative rights of all or part of the shares of Class B Common Stock, and as otherwise required by law.

Dilution.Upon the Conversion,we will issue approximately 9,601,273 shares of Class A Common Stock and approximately 3,186,750 shares of Class B Common Stock. As a result, we expect there to be a dilutive effect on both the earnings per share of our Common Stock and the book value per share of our Common Stock. In addition, our existing common shareholders will own a smaller percentage of our outstanding Common Stock. See “CAPITALIZATION,” on page 20.

Effect on Earnings Per Share.The following table presents the Company’s unaudited pro forma earnings (loss) per share adjusted for the pro forma impacts of the Conversion for the periods shown. The pro forma consolidated earnings per share calculations assume no material pro forma impacts to net income (loss) for the periods shown. Pro forma earnings per share assumes the Company had completed the Private Placement and the Conversion on the first day of the period presented. Based on 15,655,868 shares of Common Stock outstanding as of the Record Date, following the Conversion, the Investors will own, in the aggregate, 45.0% of our total common stock (Class A Common Stock and Class B Common Stock) and existing common shareholders (excluding the Investors) will own approximately 55.0% of our total Common Stock.

| | | Actual Nine

Months Ended

September 30,

2012 | | | Conversion

Adjustments | | | Pro Forma Nine

Months Ended

September 30,

2012 | |

| | | (Dollars in thousands, except per share data) | |

| Net loss available to common shareholders | | $ | (32,206 | ) | | $ | 0.00 | | | $ | (32,206 | ) |

| Basic earnings per share | | $ | (2.06 | ) | | $ | 0.93 | | | $ | (1.13 | ) |

| Diluted earnings per share | | $ | (2.06 | ) | | $ | 0.93 | | | $ | (1.13 | ) |

| Weighted average common shares | | | 15,655,868 | | | | 12,788,023 | | | | 28,443,891 | |

| Weighted average dilutive shares | | | 15,655,868 | | | | 12,788,023 | | | | 28,443,891 | |

| | | Actual Twelve

Months Ended

December 31,

2011 | | | Conversion

Adjustments | | | Pro Forma Twelve

Months Ended

December 31,

2011 | |

| | | (Dollars in thousands, except per share data) | |

| Net income available to common shareholders | | $ | 1,761 | | | $ | 0.00 | | | $ | 1,761 | |

| Basic earnings per share | | $ | 0.11 | | | $ | (0.05 | ) | | $ | 0.06 | |

| Diluted earnings per share | | $ | 0.11 | | | $ | (0.05 | ) | | $ | 0.06 | |

| Weighted average common shares | | | 15,655,868 | | | | 12,788,023 | | | | 28,443,891 | |

| Weighted average dilutive shares | | | 16,573,064 | | | | 12,788,023 | | | | 29,361,087 | |

Elimination of Dividend and Liquidation Rights of Holders of Series B and C Preferred Stock.Upon the Conversion, all shares of Series B and C Preferred Stock will be cancelled. As a result, the dividend rights and liquidation preferences existing in favor of the Series B and C Preferred Stock will be eliminated. See “Description of Series B and C Preferred Stock,” on page 17.

Improved Balance Sheet and Regulatory Capital.The net proceeds from the Private Placement have already strengthened our balance sheet and regulatory capital levels. The Conversion will further strengthen certain of our key capital ratios, including improved capital treatment of the net proceeds from the Private Placement, because of the more favorable treatment of common stock for regulatory capital purposes.

Market Effects.Despite the existence of certain restrictions on transfer, the issuance of shares of Class A Common Stock and Class B Common Stock upon the Conversion may impact trading patterns and adversely affect the market price of Class A Common Stock. If significant quantities of shares of Class A Common Stock or Class B Common Stock issued to Investors upon the Conversion are sold (or if it is perceived that they may be sold) into the public market, the trading price of Class A Common Stock could be adversely affected.

Consequences if the Proposals are Not Approved

The Series B and C Preferred Stock Will Remain Outstanding.Unless we receive the Shareholder Approvals or unless our shareholders approve similar proposals at a subsequent meeting, the Series B and C Preferred Stock will remain outstanding in accordance with their terms.

Continued Dividend Payment.For so long as the Series B and C Preferred Stock remains outstanding, we will be required to accrue and pay dividends as summarized below and as set forth in the articles of amendment attached hereto asAppendix B (the “Preferred Stock Articles of Amendment”.

Market Effects.As with any dividends, there is no assurance that we will be able to pay dividends on the Series B and C Preferred Stock and, if we are unable to pay such dividends as scheduled, the market perception could have a serious adverse impact on the price of our Common Stock.

Restriction on Payment of Dividends.For as long as the Series B and C Preferred Stock is outstanding, if full dividends payable on all outstanding shares of the Series B and C Preferred Stock have not been declared and paid, or declared and a sum sufficient for payment of those dividends been set aside, we will not be permitted to: (i) declare and pay or set aside for payment or declare and make or set aside for payment any distribution of assets, including dividends, on any of our junior securities (including our Common Stock) or parity securities, or (ii) repurchase, redeem, or acquire any of our junior securities, or (iii) repurchase, redeem, or acquire any junior security or parity security, subject to limited exceptions.

Additional Shareholder Meetings.We will be required to call additional shareholder meetings and recommend approval of proposals similar to these Proposals at each meeting every six months, if necessary, until such approvals are obtained pursuant to the provisions of the Securities Purchase Agreements. We will bear the costs of soliciting the approval of our shareholders in connection with these meetings.

Liquidation Preference.For as long as the Series B and C Preferred Stock remain outstanding, such shares will retain a senior liquidation preference over shares of our Common Stock in connection with any liquidation of us and, accordingly, no payments will be made to holders of our Common Stock upon any liquidation unless the full liquidation preference on the Series B and C Preferred Stock has first been paid in full.

Certain Interests of Certain Directors and Executive Officers in the Proposals

Upon the Conversion, we will issue approximately 304,750 shares of Class A Common Stock to those directors and executive officers who purchased shares of Series B Preferred Stock in the Private Placement. These directors and executive officers purchased their shares of Series B Preferred Stock at the same price and on the same terms and conditions as other independent unaffiliated third party Investors and did so to further align such directors’ and executive officers’ interests with generating long-term shareholder value. No director or officer purchased Series C Preferred Stock in the Private Placement. See “SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT” on page 21.

Description of Series B and C Preferred Stock.

The following is a summary description of the preferences, limitations and relative rights of our Series B and C Preferred Stock. This summary does not purport to be complete in all respects. This description is subject to and qualified in its entirety by reference to the North Carolina Business Corporation Act (the “NCBCA”), our Articles of Incorporation, as amended by the Preferred Stock Articles of Amendment attached hereto asAppendix B, and our Bylaws.

General.Our Articles of Incorporation currently authorize the issuance of 10,000,000 shares of preferred stock, of which 52,372shares are designated as TARP Preferred Stock, 1,000,000 shares are designated as Series B Preferred Stock, and 500,000 shares are designated as Series C Preferred Stock. The Series B and C Preferred Stock have a par value of $0.01 per share, and a liquidation preference of $100 per share. As of the Record Date, the Company had issued and outstanding approximately 422,456 shares of Series B Preferred Stock and approximately 140,217 shares of Series C Preferred Stock. All of the outstanding shares of Series B and C Preferred Stock were issued to the Investors in the Private Placement.

Mandatory Conversion.Each share of Series B Preferred Stock will automatically convert into shares of Class A Common Stock on the business day after the date on which the Common Stock Articles of Amendment are accepted for filing by the North Carolina Secretary of State. Each outstanding share of Series B Preferred Stock will automatically convert into such number of shares of Class A Common Stock as determined by dividing (i)��$100 (the purchase price per share of the Series B Preferred Stock) by (ii) $4.40 (the conversion price of the Series B Preferred Stock). Each share of Series C Preferred Stock will automatically convert into shares of Class B Common Stock on the business day after the date on which the Common Stock Articles of Amendment are accepted for filing by the North Carolina Secretary of State. Each outstanding share of Series C Preferred Stock will automatically convert into such number of shares of Class B Common Stock as determined by dividing (i) $100 (the purchase price per share of the Series C Preferred Stock) by (ii) $4.40 (the conversion price of the Series C Preferred Stock). No fractional shares of either Class A Common Stock or Class B Common Stock will be issued as a result of the Conversion. In lieu of any fractional share otherwise issuable as a result of the Conversion, the Investors will receive a cash payment equal to the corresponding fraction of a share based on the closing price of the Common Stock on the NASDAQ Global Stock Market on the second trading day immediately preceding the date of the Conversion.

Anti-dilution Provisions.The conversion price of the Series B Preferred Stock and Series C Preferred Stock is subject to customary anti-dilution adjustments.

Dividends. Holders shall be entitled to receive, when, as and if authorized and declared by the Board, out of legally available funds, on a cumulative basis, cash dividends payable in semi-annual installments commencing on May 30, 2013 at the rate of (i) 5% per annum for the initial six month period ending May 30, 2013, (ii) 6% per annum for the next six month period, (iii) 7% per annum for the next six month period, and (iv) 8% per annum thereafter. If the Conversion occurs prior to May 30, 2013, no dividends will be paid on the Series B and C Preferred Stock.

Ranking.Shares of Series B and C Preferred Stock rank, with respect to the payment of dividends and distributions and upon liquidation, dissolution or winding-up, on parity with our TARP Preferred Stock and senior to our Common Stock, and each other class or series of our capital stock, the terms of which do not expressly provide that it ranks on parity with or senior to the Series B or C Preferred Stock, that the Company may issue in the future.

Voting Rights.Shares of the Series B Preferred Stock generally have no voting rights other than as required by law except that (i) the approval of at least a two-thirds majority of the holders of the Series B Preferred Stock, voting as a single class, will be required for the creation of any series of senior equity securities, and (ii) the approval of all of the holders of the Series B Preferred Stock will be required for amendments to our Articles of Incorporation (including by means of a merger or otherwise) significantly and adversely affecting the special rights, preferences, privileges or voting powers of the Series B Preferred Stock. Shares of the Series C Preferred Stock generally have no voting rights other than as required by law except that (i) the approval of at least a two-thirds majority of the holders of the Series C Preferred Stock, voting as a single class, will be required for the creation of any series of senior equity securities, and (ii) the approval of all of the holders of the Series C Preferred Stock will be required for amendments to our Articles of Incorporation (including by means of a merger or otherwise) significantly and adversely affecting the special rights, preferences, privileges or voting powers of the Series C Preferred Stock.

Liquidation.In the event of any liquidation, dissolution or winding-up, the holders of the Series B and C Preferred Stock will be entitled to receive liquidating distributions in an amount equal to the greater of (i) $100 per share, plus an amount equal to any accrued but unpaid dividends and any authorized and declared but unpaid dividends, and (ii) the payment or distribution to which such holders would be entitled if the Series B and C Preferred Stock were converted into Class A Common Stock and Class B Common Stock, respectively, immediately before such liquidation, dissolution or winding-up, in each case out of assets legally available for distribution to our shareholders, before any distribution of assets is made to the holders of our Common Stock or any other junior securities.

Reorganization Event.In the event of a merger of the Company or the sale, transfer, lease or conveyance of all or substantially all of our property and assets (in each case pursuant to which our Common Stock will be converted into cash, securities or other property) or for certain reclassifications or exchanges of our Common Stock, then in such event (each a “Reorganization Event”) each share of Series B and C Preferred Stock outstanding immediately prior to such event will, at the option of the holder, either (i) convert into the securities, cash and other property receivable in the transaction by the holder of the number of shares of Common Stock determined by assuming each of the outstanding shares of Series B and C Preferred Stock were converted immediately prior to the transaction at the conversion rate, plus any accrued and unpaid dividends on each share of Series B and C Preferred Stock, or (ii) liquidating distributions as if the transaction were a liquidation of the Company.

Perpetual; No Maturity. Except in the case of a Reorganization Event, the Series B and C Preferred Stock are perpetual and without maturity subject only to mandatory conversion to Class A Common Stock or Class B Common Stock, as applicable.

Limitations on Beneficial Ownership and Dividends.In the event that the Conversion would result in a holder and its affiliates owning or controlling in the aggregate more than a 9.9% voting ownership interest in the Company, then, in lieu of issuing the holder shares of Class A Common Stock in excess of such limit, the holder shall receive an equal number of shares of Class B Common Stock. In the event that the Conversion would result in the holder and its affiliates owning or controlling in the aggregate more than 33.3% of the Company’s total equity, then, in lieu of issuing the holder shares of Class A Common Stock and/or Class B Common Stock in excess of such limit, the holder shall continue to hold shares of Series B and C Preferred Stock equal to such excess. Each share of Series B or C Preferred Stock that is not converted due to such limitation shall remain outstanding and shall be automatically converted into Class A Common Stock upon a subsequent permitted transfer of such Series B Preferred Stock or Series C Preferred.

No Preemptive Rights; Redemption Rights; Sinking Fund and Redemption Provisions.Our Series B and C Preferred Stock have no preemptive rights, redemption rights, sinking fund or redemption provisions.

Transfer Agent and Registrar.Computershare is the transfer agent and registrar for our Series B and C Preferred Stock.

Description of our Class A Common Stock and Class B Common Stock

The following is a summary description of the preferences, limitations and relative rights of our Class A Common Stock and Class B Common Stock. This summary does not purport to be complete in all respects. This description is subject to and qualified in its entirety by reference to the NCBCA, our Articles of Incorporation, as amended by the Common Stock Articles of Amendment attached hereto asAppendix A, and our Bylaws.

General.Our Articles of Incorporation currently authorize the issuance of 50,000,000 shares of Common Stock. Upon shareholder approval of the Proposals at the Special Meeting and the filing of the Common Stock Articles of Amendment with the North Carolina Secretary of State, our Articles of Incorporation, as amended by the Common Stock Articles of Amendment, will authorize the issuance of 100,000,000 shares of common stock, of which 90,000,000 shares will be designated Class A Common Stock and 10,000,000 shares will be designated Class B Common Stock. Neither the Class A Common Stock nor the Class B Common Stock will have a par value. As of the Record Date, the Company had issued and outstanding 15,655,868 shares of Common Stock, which were held of record by approximately 2,938 persons. In addition, as of the Record Date, 4,296,605 shares of our Common Stock are reserved for issuance pursuant to our stock compensation plans and the TARP Warrant.

Our Common Stock is listed and traded on the NASDAQ Global Select Market under the symbol “NBBC.” Upon the Conversion, all outstanding shares of our Common Stock shall be re-designated Class A Common Stock, no par value, and shall be listed and traded on the NASDAQ Global Select Market under the symbol “NBBC.” We have no plans to list our Class B Common Stock on any national stock exchange. Outstanding shares of our Common Stock are validly issued, fully paid and non-assessable.

Identical Rights. Except as to voting rights, the Class B Common Stock shall have the same preferences, limitations and relative rights as, share ratably with and be identical in all respects to the Class A Common Stock as to all matters. Each share of Class A Common Stock shall have the same preferences, limitations and relative rights as, and shall be identical in all respects with, all the other shares of Class A Common Stock. Similarly, each share of Class B Common Stock shall have the same preferences, limitations and relative rights as, and shall be identical in all respects with, all the other shares of Class B Common Stock.

Voting Rights. Whereas shares of Class A Common Stock shall have unlimited voting rights, with each share being entitled to one vote, shares of Class B Common Stock shall have no voting rights except that the affirmative vote of the holders of a majority of the outstanding shares of Class B Common Stock, voting separately as a class, shall be required to amend (including by merger or otherwise) the Articles of Incorporation, to significantly and adversely affect the designation, preferences, limitations or relative rights of all or part of the shares of Class B Common Stock, and as otherwise required by law. Shareholders are not entitled to cumulate their votes for the election of directors. Directors are elected by a plurality of the votes cast.

Distributions.Subject to the preferential distribution rights, if any, of any preferred stock of the Company, the holders of Class B Common Stock will be entitled to receive, to the extent permitted by law, such distributions as may be declared from time to time by the Board on the Class A Common Stock. If a distribution is declared and paid with respect to the Class A Common Stock, then the Board will declare and pay an equivalent distribution, on a per share basis, on the Class B Common Stock. Likewise, if the Board declares and pays a distribution on the Class B Common Stock, it will declare and pay an equivalent distribution, on a per share basis, on the Class A Common Stock. Notwithstanding the foregoing, no distribution payable in Class A Common Stock or rights or warrants to subscribe for Class A Common Stock shall be declared on the Class B Common Stock and no dividend payable in Class B Common Stock or rights or warrants to subscribe for Class B Common Stock shall be declared on the Class A Common Stock, but instead, in the case of such a dividend, each class shall receive such dividend in like stock or rights or warrants to subscribe for like stock.

Dissolution. In the event of a dissolution of the Company, after distribution in full of the preferential amounts, if any, to be distributed to the holders of shares of preferred stock of the Company, holders of the Class A Common Stock and the Class B Common Stock shall be entitled to receive all the net assets of the Company of whatever kind available for distribution to shareholders ratably in proportion to the number of shares of Class A Common Stock and Class B Common Stock held by them.

Adjustments.In the event of any stock split, combination or other reclassification of shares of either the Class A Common Stock or the Class B Common Stock, the outstanding shares of the other class shall be proportionately split, combined or reclassified in a similar manner; provided, however, that in any such transaction, holders of Class A Common Stock shall receive only shares of Class A Common Stock and holders of Class B Common Stock shall receive only shares of Class B Common Stock.

Conversion.Any holder of shares of Class B Common Stock may convert any number of shares of Class B Common Stock into an equal number of shares of Class A Common Stock at the option of the holder; provided, however, that each share of Class B Common Stock will not be convertible in the hands of or at the election of the initial holder or any affiliate of such initial holder and will only be convertible by a transferee and in connection with or after a transfer to a third party unaffiliated with such initial holder and that complies with the transfer restrictions described in this paragraph. Shares of Class B Common Stock may only be transferred through one or more of the following alternatives: (i) to an affiliate of the initial holder, (ii) in a widespread public distribution, (iii) in a transfer to a person that would control more than 50% of any class of the company’s outstanding voting securities without any transfer from the transferor, or (iv) in a transfer in which no one transferee (or group of associated transferees) would receive 2% or more of the voting securities of the Company then outstanding. In connection with a transfer pursuant to clauses (ii), (iii) or (iv) above, the transferor of the Class B Common Stock is entitled to surrender to the Company the shares of the Class B Common Stock to be so transferred, and, upon such surrender, the Company will issue to the transferee, in lieu of the shares of Class B Common Stock, an equal number of shares of Class A Common Stock.

Mergers, Etc. In the event of any merger, reclassification or other transaction in which shares of Class A Common Stock are exchanged for or changed into other stock or securities, cash and/or any other property, each share of Class B Common Stock will at the same time be similarly exchanged or changed in an amount per whole share equal to the aggregate amount of stock, securities, cash and/or any other property (payable in kind), as the case may be, that each share of Class A Common Stock would be entitled to receive as a result of such transaction, provided that at the election of such holder, any securities issued with respect to the Class B Common Stock shall be non-voting securities under the resulting corporation’s organizational documents and the Company shall make appropriate provisions (in form and substance reasonably satisfactory to the holders of a majority of the Class B Common Stock then outstanding) and take such actions necessary to ensure that holders of the Class B Common Stock shall retain securities with substantially the same privileges, limitations and relative rights as the Class B Common Stock. Subject to the foregoing, in the event the holders of Class A Common Stock are provided the right to convert or exchange Class A Common Stock for stock or securities, cash and/or any other property, then the holders of the Class B Common Stock shall be provided the same right based upon the number of shares of Class A Common Stock such holders would be entitled to receive if such shares of Class B Common Stock were converted into shares of Class A Common Stock immediately prior to such offering. In the event that the Company offers to repurchase shares of Class A Common Stock from its shareholders generally, the Company shall offer to repurchase Class B Common Stock pro rata based upon the number of shares of Class A Common Stock such holders would be entitled to receive if such shares were converted into shares of Class A Common Stock immediately prior to such repurchase. In the event of any pro rata subscription offer, rights offer or similar offer to holders of Class A Common Stock, the Company shall provide the holders of the Class B Common Stock the right to participate based upon the number of shares of Class A Common Stock such holders would be entitled to receive if such shares were converted into shares of Class A Common Stock immediately prior to such offering; provided that at the election of such holder, any shares issued with respect to the Class B Common Stock shall be issued in the form of Class B Common Stock rather than Class A Common Stock.

No Preemptive Rights; Redemption Rights; Sinking Fund and Redemption Provision.Our Class A Common Stock and Class B Common Stock will have no preemptive rights, redemption rights, sinking fund or redemption provisions.

Transfer Agent and Registrar.Computershare will be the transfer agent and registrar for our Class A Common Stock and Class B Common Stock.

CAPITALIZATION