Exhibit 99.1

NASDAQ: NBBC www.newbridgebank.com 2013 ANNUAL MEETING OF SHAREHOLDERS Wednesday, May 15, 2013

FORWARD - LOOKING STATEMENTS Information in this presentation may contain forward - looking statements. Such statements involve known and unknown risks, uncertainties and other factors that may cause actual results to differ materially. Forward - looking statements are often characterized by the use of qualifying words such as “expects,” “anticipates,” “believes,” “estimates,” “plans,” “projects,” or other statements concerning opinions or judgments of the Company and its management about future events. The accuracy of such forward - looking statements could be affected by factors including, but not limited to, the financial success or changing conditions or strategies of the Company’s customers or vendors, fluctuations in interest rates, actions of government regulators, the availability of capital and personnel, or general economic conditions. Additional factors are discussed in the Company’s filings with the SEC, including without limitation, Forms 10 - K, 10 - Q and 8 - K. NewBridge Bancorp undertakes no obligations to revise these statements following the date of this presentation.

2012 OVERVIEW • Significant Events in 2012 – Raised $56 million of capital – Asset Disposition Plan: reduced classified assets by $106 million (67%) year - over - year – Developed plans to address TARP (to be executed in early 2013) • Enhanced revenue and continued to manage costs • Increased our presence in Raleigh and Charlotte (the largest two markets in the state) • Positioned the Company for future growth and increased shareholder value

OUR OPERATING MODEL Guiding Principles Strategic Plan Operating Plan Profit Plan

OUR GUIDING PRINCIPLES • Always do your best • Do what is right • Treat others as you want to be treated • Financial success begins with integrity

OUR OPERATING MODEL Guiding Principles Strategic Plan Operating Plan Profit Plan

OUR VISION AND MISSION Vision: To be a high - performing community bank by: – understanding and exceeding client expectations – supporting our communities – providing above average shareholder returns – living our Guiding Principles in all that we do Mission: To be the preferred financial partner for small and midsize businesses and retail clients by: – using a client - centric, consultative approach – growing in markets providing above average results – offering credit consistently while balancing risks and returns – supporting our clients and employees – employing professionals that live our Guiding Principles and are committed to being the best

MACROECONOMIC ENVIRONMENT • Slow growth is still the norm across our footprint • Real estate prices are rebounding to some extent but remain weak • Federal Reserve actions are keeping interest rates artificially low • Abundance of liquidity in the market and loan demand remains weak

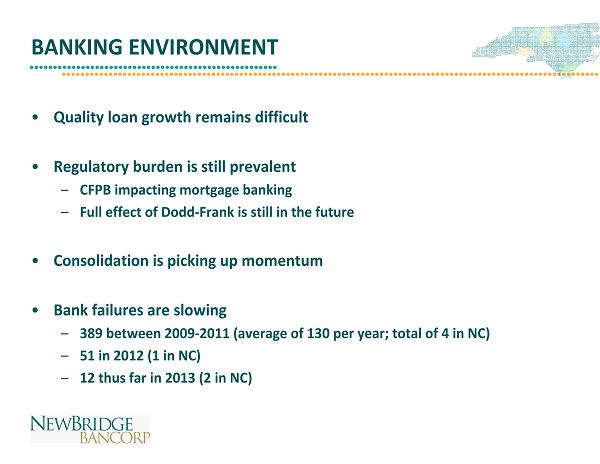

BANKING ENVIRONMENT • Quality loan growth remains difficult • Regulatory burden is still prevalent – CFPB impacting mortgage banking – Full effect of Dodd - Frank is still in the future • Consolidation is picking up momentum • Bank failures are slowing – 389 between 2009 - 2011 (average of 130 per year; total of 4 in NC) – 51 in 2012 (1 in NC) – 12 thus far in 2013 (2 in NC)

FINANCIAL UPDATE Ramsey K. Hamadi Chief Financial Officer

IMPROVING SHAREHOLDER VALUE THROUGH QUALITY, PROFITABILITY AND GROWTH 1Q 12 2Q 12 3Q 12 1 4Q 12 1Q 13 Net Interest Margin 4.15% 4.18% 4.02% 3.91% 3.92% Operating Results ($000) Net interest income 16,172$ 16,323$ 15,678$ 15,393$ 15,057$ Provision for loan losses 3,443 2,361 28,881 1,209 979 Net interest income before provision 12,729 13,962 (13,203) 14,184 14,078 Noninterest income 4,008 3,986 4,182 4,710 4,464 Noninterest expense (13,602) (13,738) (16,545) (14,008) (14,145) Net gain (loss) securities, OREO (1,008) (2,976) (10,584) 51 333 Income (loss) before taxes 2,127$ 1,234$ (36,150)$ 4,937$ 4,730$ Classified asset ratio 72% 63% 48% 31% 27% Weekly average stock price 4.14$ 4.37$ 4.43$ 4.56$ 5.79$ 1 3Q 12 - The Company implemented the asset disposition plan and announced the capital raise

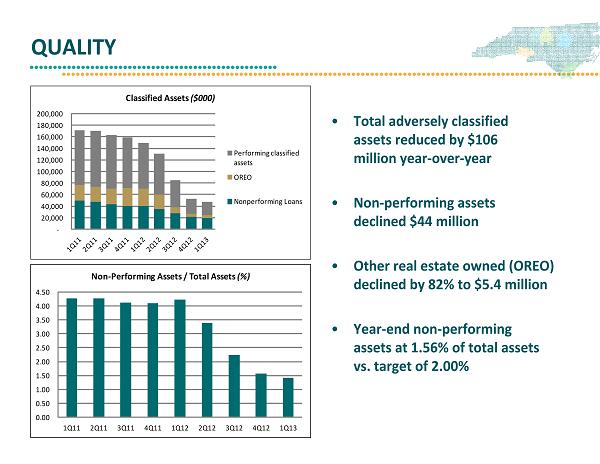

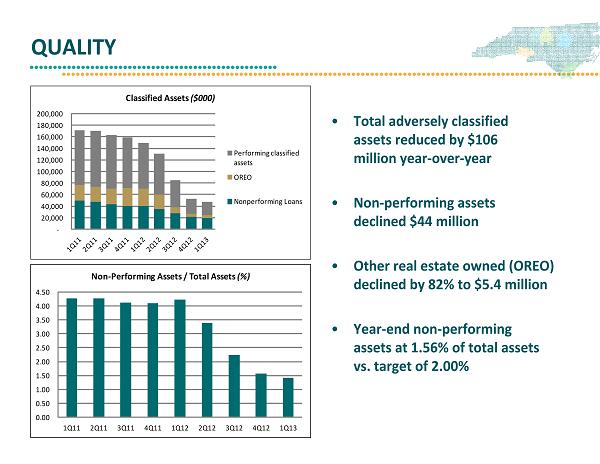

QUALITY • Total adversely classified assets reduced by $106 million year - over - year • Non - performing assets declined $44 million • Other real estate owned (OREO) declined by 82% to $5.4 million • Year - end non - performing assets at 1.56% of total assets vs. target of 2.00% - 20,000 40,000 60,000 80,000 100,000 120,000 140,000 160,000 180,000 200,000 Classified Assets ($000) Performing classified assets OREO Nonperforming Loans 0.00 0.50 1.00 1.50 2.00 2.50 3.00 3.50 4.00 4.50 1Q11 2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 4Q12 1Q13 Non - Performing Assets / Total Assets (%)

QUALITY • Classified asset percentage at year - end of 30.5% vs. target of less than 50% • Further reduction in 1Q 2013 to 27% • Reserves still adequate at 2.30% of total loans at year - end • Reserves - to - NPLs of 125% at year - end and 134% at 1Q 2013 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 1Q11 2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 4Q12 1Q13 Classified Asset Ratio (%) 0.00 0.50 1.00 1.50 2.00 2.50 3.00 3.50 1Q11 2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 4Q12 1Q13 Reserves / Total Loans (%)

PROFITABILITY • Managed net interest margin (NIM) in period of mounting rate compression • NIM averaged 4.06% • Competition for quality loans continue to affect loan yields • Core deposit costs declined to 0.16% at year - end 3.70 3.80 3.90 4.00 4.10 4.20 4.30 4.40 1Q11 2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 4Q12 1Q13 Net Interest Margin (% ) 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 1Q11 2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 4Q12 1Q13 Yield on Loans / Cost of Deposits (%) Yield on Loans Cost of Deposits

PROFITABILITY • Reduced costs through Franchise Validation Plan and continued cost management • Annual operating expenses declined by $16 million since 2007 • Cost savings allowed Bank to re - deploy resources in more vibrant markets (hiring experienced banking professionals) • Core ROAA remains strong despite continued margin pressures 48,000 50,000 52,000 54,000 56,000 58,000 60,000 62,000 64,000 66,000 FY 2009 FY 2010 FY 2011 FY 2012 1Q 2013 Annual Non - Interest Expense Less OREO Expense ($000) 3.70 3.80 3.90 4.00 4.10 4.20 4.30 4.40 0.00 0.20 0.40 0.60 0.80 1.00 1.20 1.40 1.60 1.80 2.00 1Q11 2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 4Q12 1Q13 N I M R O A A Core ROAA vs. Net Interest Margin (%) Core ROAA NIM

GROWTH • Non - classified loans grew $36 million year - over - year and $72 million from 1Q 2012 to 1Q 2013 • 1Q 2013 linked quarter loan growth of 1.25% • Gross loan production in 2012 increased 30% over 2011 • Deposit mix remains favorable with core deposits comprising 75% of total deposits at year - end 750,000 850,000 950,000 1,050,000 1,150,000 1,250,000 1,350,000 Loans Oustanding ($000) Classified Loans Non - Classified Loans 0 200,000 400,000 600,000 800,000 1,000,000 1,200,000 1,400,000 1,600,000 Deposit Mix ($000) Cerfificates of Deposit Savings and MM Accounts Transaction Accounts

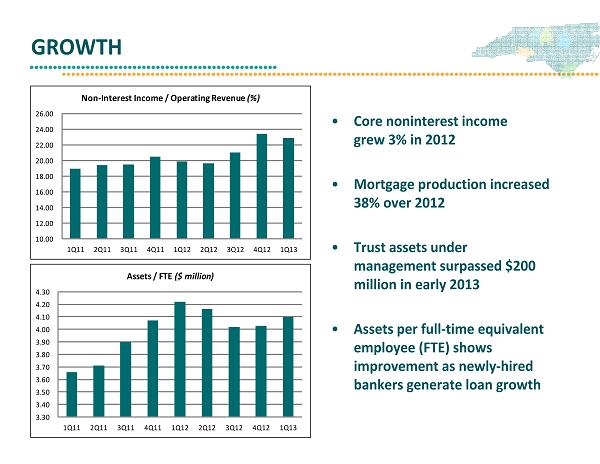

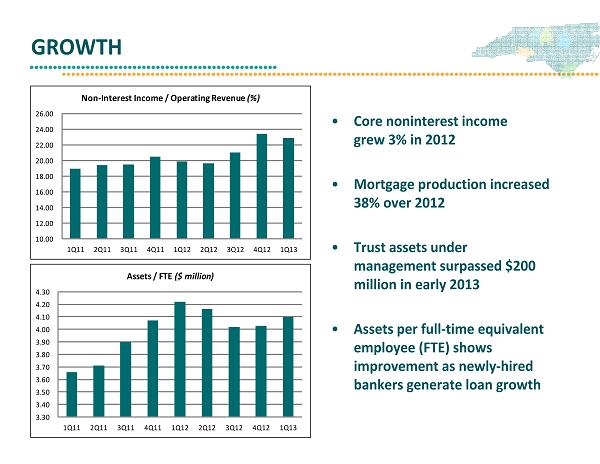

GROWTH • Core noninterest income grew 3% in 2012 • Mortgage production increased 38% over 2012 • Trust assets under management surpassed $200 million in early 2013 • Assets per full - time equivalent employee (FTE) shows improvement as newly - hired bankers generate loan growth 10.00 12.00 14.00 16.00 18.00 20.00 22.00 24.00 26.00 1Q11 2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 4Q12 1Q13 Non - Interest Income / Operating Revenue (%) 3.30 3.40 3.50 3.60 3.70 3.80 3.90 4.00 4.10 4.20 4.30 1Q11 2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 4Q12 1Q13 Assets / FTE ($ million)

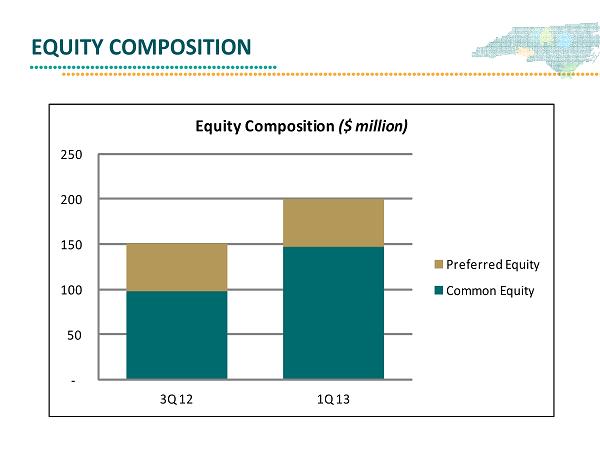

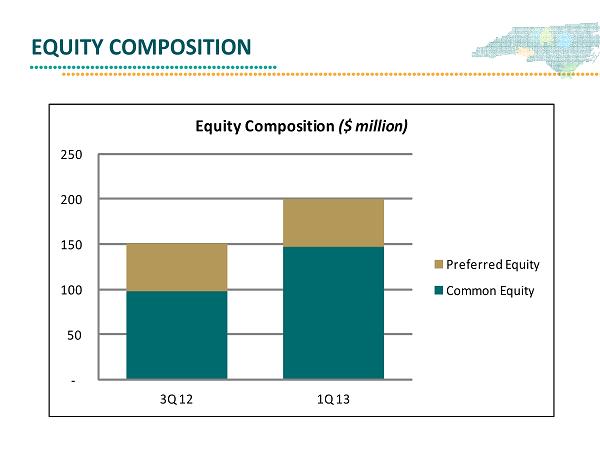

EQUITY COMPOSITION - 50 100 150 200 250 3Q 12 1Q 13 Equity Composition ($ million) Preferred Equity Common Equity

POSITIONING FOR GROWTH Pressley A. Ridgill Chief Executive Officer

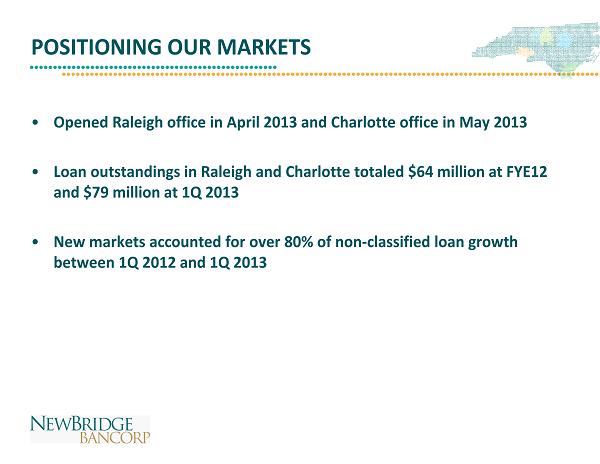

POSITIONING OUR MARKETS • Opened Raleigh office in April 2013 and Charlotte office in May 2013 • Loan outstandings in Raleigh and Charlotte totaled $64 million at FYE12 and $79 million at 1Q 2013 • New markets accounted for over 80% of non - classified loan growth between 1Q 2012 and 1Q 2013

POSITIONING OUR TALENT • Continue to add talented banking professionals to our team – Triad Commercial Banking Manager – Charlotte Commercial Real Estate banking professional – Builder Finance banking professionals in Raleigh and Charlotte • Leadership Academy for Professional Development (LAPD) enters its second two - year program • Employee Engagement and Wellness Initiatives • Road to Cooperstown sales and sales management initiatives continue • Management Team changes

POSITIONING OUR PRODUCTS • Product consolidation and Revenue Enhancement projects completed in 2012 • Launch of new mobile banking products positioned for 2013 • Continue to study enhanced delivery channels (mobile payments, tablet banking, etc.) to supplement traditional branch delivery • Use of social media increases with Facebook, Twitter and LinkedIn

POSITIONING OUR CAPITAL • Capital raise of $56 million completed in 2012; converted to common stock in February 2013 • TARP position auctioned in April 2013 • US Treasury received an annualized return on TARP investment of over 7% • TARP Action Plan – Paying 70% of TARP position, at par value, on June 3, 2013 – Remaining $15 million of TARP will likely be repaid over the next few quarters – Purchasing the warrant from US Treasury on May 15, 2013 for $7.8 million

STOCK PERFORMANCE

POSITIONING FOR THE FUTURE • Maintain our focus on quality, profitability and growth • Continue to seek opportunities to enhance revenue and improve client satisfaction – Mergers and acquisitions – New markets (through LPOs) – Enhanced product lines • Attract quality banking professionals and ensure they are engaged with the Bank’s Vision and Mission • Seek out quality community partners to enhance the NewBridge Bank brand • Work for our shareholders and on behalf of our clients to increase the value of NewBridge Bank

NASDAQ: NBBC www.newbridgebank.com 2013 ANNUAL MEETING OF SHAREHOLDERS Wednesday, May 15, 2013

QUESTIONS AND COMMENTS In accordance with the Rules of Conduct, each shareholder or proxyholder will have a maximum of three minutes to ask questions or make comments. After you are recognized, proceed to the microphone. Please identify yourself by stating your name and whether you are a shareholder or hold the proxy for a shareholder. Please direct all questions and comments to the Chairman of the meeting or the President and Chief Executive Officer of the Company.

NASDAQ: NBBC www.newbridgebank.com 2013 ANNUAL MEETING OF SHAREHOLDERS Wednesday, May 15, 2013