Issuer Free Writing Prospectus

Filed pursuant to Rule 433(d)

Registration No. 333-163463

April 30, 2012

US Airways, Inc.

2012-1C EETC Investor Presentation

April 30, 2012

Forward Looking Statements

Certain of the statements contained or referred to herein should be considered “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements may be identified by words such as “may,” “will,” “expect,” “intend,” “anticipate,” “believe,” “estimate,” “plan,” “project,” “could,” “should,” and “continue” and similar terms used in connection with statements regarding, among others, the outlook, expected fuel costs, revenue and pricing environment, and expected financial performance and liquidity position of US Airways Group (the “Company”). Such statements include, but are not limited to, statements about future financial and operating results, the Company’s plans, objectives, expectations and intentions, and other statements that are not historical facts. These statements are based upon the current beliefs and expectations of the Company’s management and are subject to significant risks and uncertainties that could cause the Company’s actual results and financial position to differ materially from these statements. Such risks and uncertainties include, but are not limited to, the following: the impact of significant operating losses in the future; downturns in economic conditions and their impact on passenger demand, booking practices and related revenues; the impact of the price and availability of fuel and significant disruptions in the supply of aircraft fuel; increased costs of financing, a reduction in the availability of financing and fluctuations in interest rates; the Company’s high level of fixed obligations and its ability to fund general corporate requirements, obtain additional financing and respond to competitive developments; any failure to comply with the liquidity covenants contained in the Company’s financing arrangements; provisions in the Company’s credit card processing and other commercial agreements that may affect its liquidity; the impact of union disputes, employee strikes and other labor-related disruptions; the Company’s inability to maintain labor costs at competitive levels; interruptions or disruptions in service at one or more of hub airports or focus city; regulatory changes affecting the allocation of slots; the Company’s reliance on third party regional operators or third party service providers; the Company’s reliance on and costs, rights and functionality of third party distribution channels, including those provided by global distribution systems, conventional travel agents and online travel agents; changes in government regulation; the impact of changes to the Company’s business model; competitive practices in the industry, including the impact of industry consolidation; the loss of key personnel or the Company’s ability to attract and retain qualified personnel; the impact of conflicts overseas or terrorist attacks, and the impact of ongoing security concerns; the Company’s ability to operate and grow its route network; the impact of environmental regulations; the Company’s reliance on technology and automated systems and the impact of any failure or disruption of, or delay in, these technologies or systems; costs of ongoing data security compliance requirements and the impact of any data security breach; the impact of any accident involving the Company’s aircraft or the aircraft of its regional operators; delays in scheduled aircraft deliveries or other loss of anticipated fleet capacity the Company’s dependence on a limited number of suppliers for aircraft, aircraft engines and parts; the Company’s dependence on a limited number of suppliers for aircraft, aircraft engines and parts; the Company’s ability to operate profitably out of Philadelphia International Airport; the impact of weather conditions and seasonality of airline travel; the impact of possible future increases in insurance costs or reductions in available insurance coverage; the impact of global events that affect travel behavior, such as an outbreak of a contagious disease; the impact of foreign currency exchange rate fluctuations; the Company’s ability to use NOLs and certain other tax attributes; and other risks and uncertainties listed from time to time in the Company’s reports to and filings with the SEC. There may be other factors not identified above of which the Company is not currently aware that may affect matters discussed in the forward-looking statements, and may also cause actual results to differ materially from those discussed. The Company assumes no obligation to publicly update any forward-looking statement to reflect actual results, changes in assumptions or changes in other factors affecting such estimates other than as required by law. Additional factors that may affect the future results of the Company are set forth in the section entitled “Risk Factors” in the Company’s Report on Form 10-Q for the quarter ended March 31, 2012 and in the Company’s other filings with the SEC, including the preliminary prospectus supplement for this offering, which are available at www.sec.gov.

This investor presentation highlights basic information about us and this offering. Because it is a summary, it does not contain all of the information that you should consider before investing.

We have filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents we have filed with the SEC for more complete information about us and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, US Airways, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling Morgan Stanley at 1-866-718-1649, Citigroup at 1-212-732 -6171, Goldman, Sachs & Co. at 1-866-471-2526, BofA Merrill Lynch at 1-800-294-1322, Barclays at 1-888-603-5847 or Natixis at 1-212-698-3108 (institutional investors).

US Airways 2012-1C EETC

US Airways, Inc. (“US Airways”) is offering $118,636,000 of Class C Pass Through Certificates, Series 2012-1

This transaction will finance newly delivered aircraft and refinance previously delivered aircraft, and the Certificates will represent interests in trusts which, when each aircraft is delivered or refinanced, will own equipment notes secured by such aircraft. The aircraft will be 14 Airbus A321-200 aircraft:

– 2 aircraft currently owned by US Airways and originally delivered in October and December 2009

– 12 new aircraft to be delivered between September 2012 and March 2013

Proceeds will be used to pre-fund financing of the 2012 and 2013 deliveries and refinance the 2009 aircraft

Joint Bookrunners: Morgan Stanley, Citigroup and Goldman, Sachs & Co.

Co-Managers: Barclays, BofA Merrill Lynch and Natixis

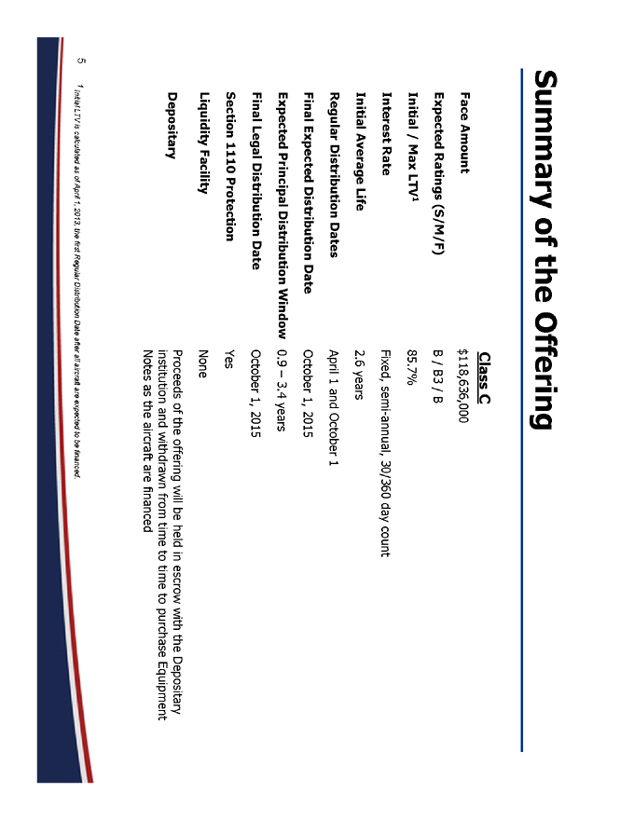

Summary of the Offering

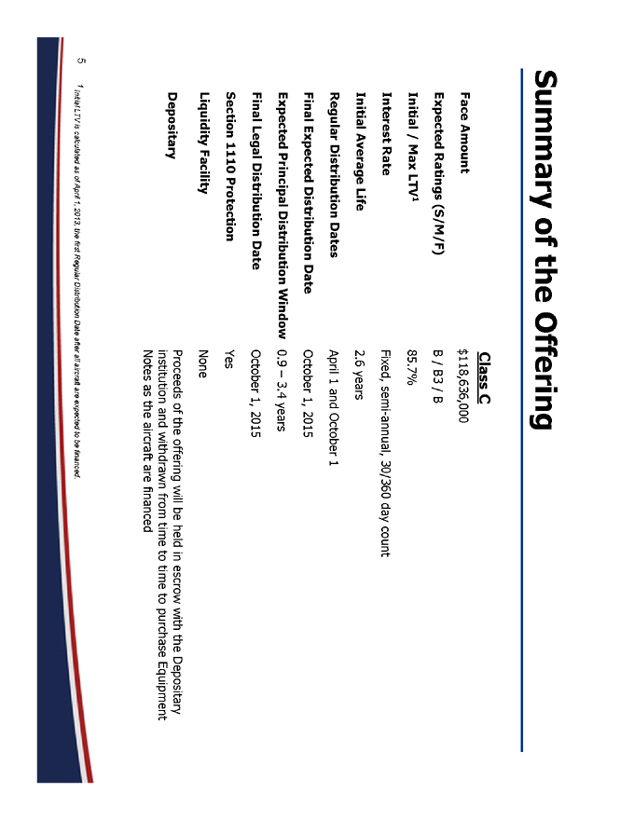

Face Amount

Expected Ratings (S/M/F)

Initial / Max LTV1

Interest Rate

Initial Average Life

Regular Distribution Dates

Final Expected Distribution Date

Expected Principal Distribution Window

Final Legal Distribution Date

Section 1110 Protection

Liquidity Facility

Depositary

Class C

$118,636,000

B / B3 / B

85.7%

Fixed, semi-annual, 30/360 day count

2.6 years

April 1 and October 1

October 1, 2015

0.9 – 3.4 years

October 1, 2015

Yes

None

Proceeds of the offering will be held in escrow with the Depositary institution and withdrawn from time to time to purchase Equipment Notes as the aircraft are financed

5 1 Initial LTV is calculated as of April 1, 2013, the first Regular Distribution Date after all aircraft are expected to be financed.

Structural Strengths

Class Offered: One tranche of amortizing debt is being offered, Class C

Waterfall: Standard post-2004 waterfall, interest on the Preferred Pool Balance on the Class B and Class C Certificates will be paid ahead of Class A principal

– Consistent with recent precedent EETCs, including LCC 2011-1 and LCC 2010-1

Buy-out Rights: Standard buy-out rights for the Class B and Class C certificateholders

– After a Certificate Buyout Event, Class B certificateholders have the right to purchase all (but not less than all) of the Class A Certificates at par plus accrued interest

– After a Certificate Buyout Event, Class C certificateholders will have the right to purchase all (but not less than all) of the Class A and Class B Certificates at par plus accrued interest

– No buyout right during the 60-day Section 1110 period

– No buyout right after 60-day Section 1110 period if US Airways has entered into agreements to perform its obligations with respect to the equipment notes and has cured all defaults under the related indentures

Cross-Default and Cross-Collateralization: Provisions are available from date of issuance of each equipment note

Collateral: Pool features all either new or “like-new” popular A321s that are core aircraft types to US Airways’ current fleet operations

Parent Guarantee: US Airways’ payment obligations under the Equipment Notes are fully

and unconditionally guaranteed by US Airways Group, Inc.

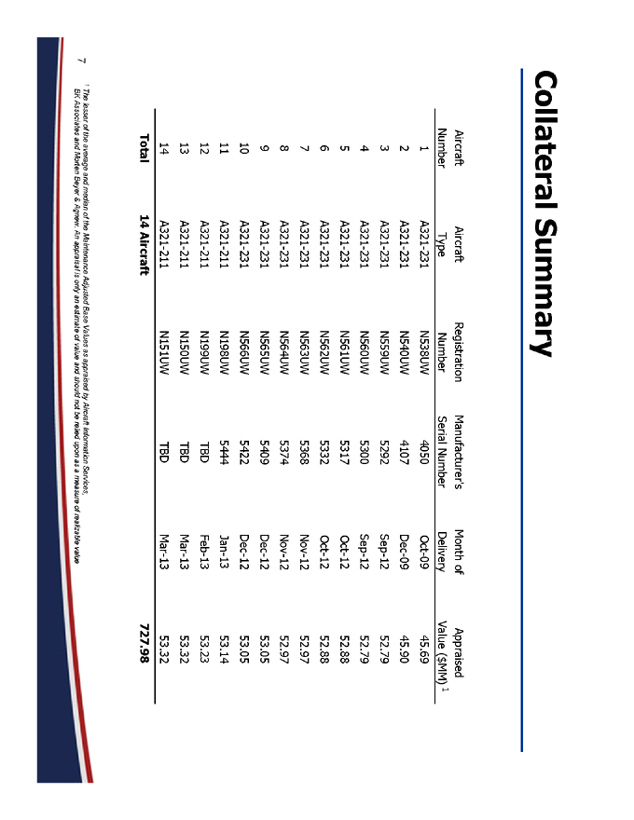

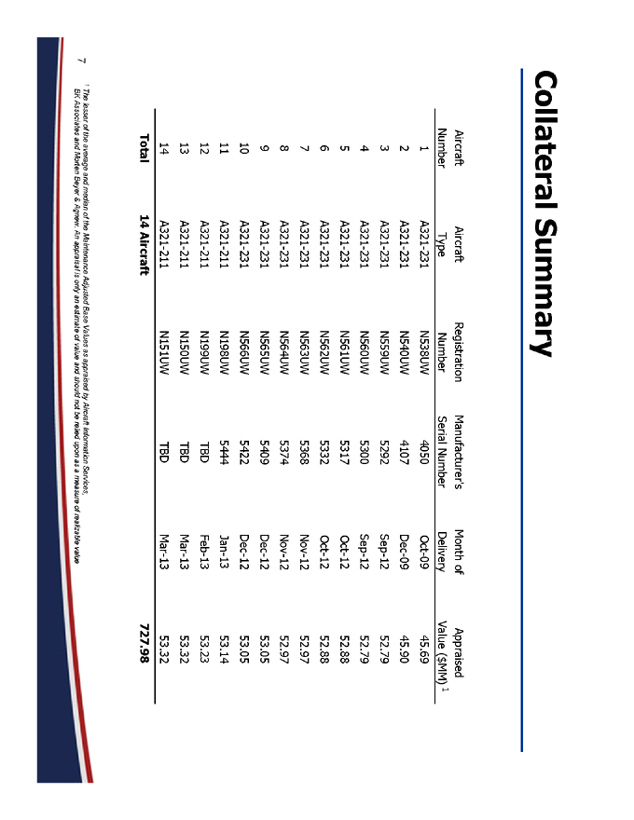

Collateral Summary

Aircraft Aircraft Registration Manufacturer’s Month of Appraised

Number Type Number Serial Number Delivery Value ($MM) 1

1 | | A321-231 N538UW 4050 Oct-09 45.69 |

2 | | A321-231 N540UW 4107 Dec-09 45.90 |

3 | | A321-231 N559UW 5292 Sep-12 52.79 |

4 | | A321-231 N560UW 5300 Sep-12 52.79 |

5 | | A321-231 N561UW 5317 Oct-12 52.88 |

6 | | A321-231 N562UW 5332 Oct-12 52.88 |

7 | | A321-231 N563UW 5368 Nov-12 52.97 |

8 | | A321-231 N564UW 5374 Nov-12 52.97 |

9 A321-231 N565UW 5409 Dec-12 53.05

10 | | A321-231 N566UW 5422 Dec-12 53.05 |

11 | | A321-211 N198UW 5444 Jan-13 53.14 |

12 | | A321-211 N199UW TBD Feb-13 53.23 |

13 | | A321-211 N150UW TBD Mar-13 53.32 |

14 | | A321-211 N151UW TBD Mar-13 53.32 |

Total 14 Aircraft 727.98

7 1 The lesser of the average and median of the Maintenance Adjusted Base Values as appraised by Aircraft Information Services,

BK Associates and Morten Beyer & Agnew. An appraisal is only an estimate of value and should not be relied upon as a measure of realizable value

Aircraft Appraisals

US Airways has obtained Desktop Appraisals from three appraisers: Aircraft Information Services, BK Associates and Morten Beyer & Agnew

Appraisals for recently acquired aircraft are calculated using maintenance adjusted base values while new aircraft values are half-life base values

Maintenance Adjusted Base Value includes adjustments from the mid-time, mid-life baseline to account for the actual maintenance status of the aircraft

Appraisers utilized March 2012 maintenance information provided by US Airways

The aggregate aircraft appraised value is $727,980,0001

Appraisals indicate an initial collateral cushion of 14.3% on the Class C Certificates, which increases over time as the debt amortizes based on assumed depreciation of collateral value

Appraisals are included in the Preliminary Prospectus Supplement

8 1 Appraised value is the lesser of the average and median of the Maintenance Adjusted Base Values of each aircraft as appraised by AISI, BK and MBA.

An appraisal is only an estimate of value and should not be relied upon as a measure of realizable value.

A321-200 Overview

Strengths:

Among the best selling narrowbodies in the world

– Over 609 aircraft in operation and over 320 on order backlog with 71 operators worldwide1

Offer more seats than the Boeing 737-900ER and lower seat-mile costs than other 150 seat options2

Aircraft availability is limited and storage levels are very low (less than 1%)2

Importance to US Airways:

Core to the US Airways fleet, used to replace older, less fuel efficient narrowbody aircraft and to support domestic mainline operations3

US Airways has modified its A321-200s to:

– Deliver from the manufacturer with an increased MTOW of 205,027lbs versus the basic 196,211lbs increasing payload capacity and range3

– Include dual auxiliary fuel tanks to further increase range3

1 | | Source: MBA Appraisal Report |

9 2 Source: Ascend Q1 2012 Airbus A321 Market Commentary

Company Information

As of March 31, 2012, US Airways has hubs in Charlotte, Philadelphia and Phoenix, and Washington, D.C. is a focus city. US Airways offers scheduled passenger service on more than 3,200 flights daily to more than 200 communities in the United States, Canada, Mexico, Europe, the Middle East, the Caribbean and Central and South America.

More information about US Airways, including its most recent financial information, can be found in its filings on the SEC website (www.sec.gov) including but not limited to its quarterly report on Form 10-Q for the quarter ended March 31, 2012 and its annual report on Form 10-K for the year ended December 31, 2011.

10