UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| | |

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material under §240.14a-12

|

| | | | |

| DST Systems, Inc. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

Table of Contents

333 West 11th Street

Kansas City, MO 64105

DST SYSTEMS, INC.

NOTICE AND PROXY STATEMENT

Annual Meeting of Stockholders

Tuesday, May 13, 2014

YOUR VOTE IS IMPORTANT

You have received information on casting your vote. We began delivering Annual Meeting materials, or

Notice of Internet Availability of Proxy Materials, on or about March 31, 2014.

Table of Contents

DST Systems, Inc.

333 West 11th Street

Kansas City, Missouri 64105

Proxy Statement

and

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

We cordially invite you to attend our Annual Meeting of Stockholders.

| | |

| Place: | | 333 W. 11th Street, 3rd Floor

Kansas City, Missouri 64105 |

Time: |

|

8:00 a.m. Central Daylight Time |

Date: |

|

Tuesday, May 13, 2014 |

Stockholders will consider and vote upon the following matters:

- •

- Election of the Company's nominees for Director, each to serve a three-year term expiring upon the 2017 Annual Meeting of Stockholders or until a successor is duly elected and qualified

- •

- Ratification of the Audit Committee's Selection of Independent Registered Public Accounting Firm

- •

- Advisory Resolution to Approve Named Executive Officer Compensation

- •

- Certain stockholder proposals, if properly presented at the Annual Meeting.

The record date for determining which stockholders may vote at this meeting or any adjournment is March 20, 2014. We will provide the recordholder list during the Annual Meeting if any stockholder wishes to examine it for any purpose pertaining to the meeting. We will also make the list available during regular business hours at the above address for the ten-day period before the Annual Meeting.

WE URGE YOU TO USE THE ENCLOSED PROXY CARD TO VOTE AS OUR BOARD RECOMMENDS:

- •

- "FOR" THE ELECTION OF BOARD NOMINEES LYNN DORSEY BLEIL AND JOHN W. CLARK IN PROPOSAL 1 AND "FOR" THE COMPANY'S PROPOSALS 2 AND 3.

- •

- "AGAINST" STOCKHOLDER PROPOSALS 4 AND 5.

Please note that our Board of Directors makes no recommendation regarding Stockholder Proposal 6.

Whether or not you will be able to attend the Annual Meeting, it is very important that your shares be represented. We urge you to read the accompanying Proxy Statement carefully and to use the enclosed proxy card to vote for the Board's nominees, and in accordance with the Board's recommendations on the other proposals, as soon as possible. You may vote your shares by signing and dating the enclosed proxy card and returning it in the postage-paid envelope provided, whether or not you plan to attend the Annual Meeting. For

2

Table of Contents

your convenience, you may also vote your shares via the Internet or by a toll-free telephone number by following the instructions on the enclosed proxy card.

If you need assistance at the Annual Meeting because of a disability, please let us know by May 1, 2014, at (816) 435-8655.

Thank you for your continued support. If you have any questions or need assistance voting, please contact Innisfree M&A Incorporated, our proxy solicitor assisting us in connection with the Annual Meeting. Stockholders may call toll-free at (888) 750-5835. Banks and brokers may call collect at (212) 750-5833.

| | |

| | By Order of the Board of Directors, |

|

|

|

| | Randall D. Young

Senior Vice President, General Counsel and Secretary |

The date of this Notice is March 28, 2014.

3

Table of Contents

| | | | |

| | | OUR BOARD URGES YOU TO SIGN, DATE AND RETURN THE ENCLOSED PROXY CARD AND VOTE FOR ALL OF OUR BOARD'S NOMINEES FOR DIRECTORS, AND IN ACCORDANCE WITH OUR BOARD'S RECOMMENDATIONS ON THE OTHER PROPOSALS. | | |

| | | | | | | | |

| &zwsp; | | The Board of Directors recommends you vote "FOR" the following Proposals: | | &zwsp; |

| | | PROPOSAL 1 | | | | Elect our Board Nominees Lynn Dorsey Bleil and John W. Clark to our Board of Directors | | |

| | | PROPOSAL 2 | | | | Ratify the Audit Committee's Selection of PricewaterhouseCoopers LLP | | |

| | | PROPOSAL 3 | | | | Advisory Resolution to Approve NEO Compensation | | |

| | | | | | | | | |

| &zwsp; | | The Board of Directors recommends you vote "AGAINST" the following Proposals: | | &zwsp; |

| | | PROPOSAL 4 | | | | Stockholder Proposal Regarding the Separation of the Chairman of the Board and Chief Executive Officer Positions | | |

| | | PROPOSAL 5 | | | | Stockholder Proposal Regarding a Majority Vote Standard for Director Elections | | |

| | | | | | | | | |

| &zwsp; | | The Board of Directors makes NO RECOMMENDATION regarding the following Proposal: | | &zwsp; |

| | | PROPOSAL 6 | | | | Stockholder Proposal Regarding the Repeal of the Company's Classified Board of Directors | | |

4

DST Systems, Inc.

333 West 11th Street

Kansas City, Missouri 64105

PROXY STATEMENT

Contents

| | |

| | Page

|

|---|

| |

The Board of Directors | | 8 |

Board Committee Matters and Reports | |

16 |

Non-Employee Director Compensation | |

24 |

Proposal 1: Elect Directors | |

26 |

Independent Registered Public Accounting Firm | |

27 |

Beneficial Ownership | |

28 |

Insider Disclosures | |

31 |

Executive Officers | |

32 |

Compensation Discussion and Analysis | |

34 |

NEO Compensation | |

44 |

NEO Award/Account Values for Certain Events | |

51 |

Additional Proposals Requiring Your Vote | |

58 |

Proposal 2: Ratify the Audit Committee's Selection of PricewaterhouseCoopers LLP | |

58 |

Proposal 3: Advisory Resolution to Approve NEO Compensation | |

59 |

Proposal 4: Stockholder Proposal Regarding the Separation of the Chairman of the Board and Chief Executive Officer Positions | |

61 |

Proposal 5: Stockholder Proposal Regarding a Majority Vote Standard for Director Elections | |

63 |

Proposal 6: Stockholder Proposal Regarding the Repeal of the Company's Classified Board of Directors | |

65 |

Annual Meeting Matters | |

67 |

| |

|

|

5

Table of Contents

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE 2014 ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON MAY 13, 2014: THE PROXY STATEMENT FOR SUCH MEETING AND THE ANNUAL REPORT ON FORM 10-K FOR THE FISCAL YEAR ENDED DECEMBER 31, 2013 ARE AVAILABLE ATwww.eproxyaccess.com/dst2014.

PROXY STATEMENT

We are providing this Proxy Statement and the enclosed proxy card in connection with the solicitation by the Board of Directors of DST Systems, Inc. (which we refer to in these materials as "we," "us," the "Company" or "our company") of proxies to be voted at our 2014 Annual Meeting of Stockholders (including at any adjournment or postponement thereof), which will take place at 8:00 a.m. Central Daylight Time on Tuesday, May 13, 2014, at 333 W. 11th Street, 3rd Floor, Kansas City, Missouri 64105.

We began delivering Annual Meeting materials, or Notice of Internet Availability of Proxy Materials, on or about March 31, 2014.

Our Board asks that you vote "FOR" the Board nominees for director included in Proposal 1. Our Board also asks that, on a non-binding basis, you vote "FOR" ratification of the Audit Committee's selection of our independent registered public accounting firm set forth in Proposal 2, and vote "FOR" advising the Board that you approve the compensation of the officers named in the "Summary Compensation Table" ("Say-on-Pay") set forth in Proposal 3.

Our Board also asks that you vote "AGAINST" Stockholder Proposal 4 regarding the separation of the Chairman of the Board and Chief Executive Officer positions, and "AGAINST" Stockholder Proposal 5 regarding a majority vote standard for director elections.

The Board has determined to make no voting recommendation to stockholders with respect to Stockholder Proposal 6, which is a proposal seeking to repeal the classification of the Board of Directors.

| | | | |

| | | OUR BOARD URGES YOU TO SIGN, DATE AND RETURN THE ENCLOSED PROXY CARD AND VOTE FOR ALL OF OUR BOARD'S NOMINEES FOR DIRECTORS, AND IN ACCORDANCE WITH OUR BOARD'S RECOMMENDATIONS ON THE OTHER PROPOSALS. | | |

We do not know of any other matters on which you will vote at the Annual Meeting. Recordholders may appoint the Proxy Committee as their proxy. The Proxy Committee members are Stephen C. Hooley, Chief Executive Officer and President; Gregg Wm. Givens, Senior Vice President, Chief Financial Officer and Treasurer; and Randall D. Young, Senior Vice President, General Counsel and Corporate Secretary. The Proxy Committee will vote your shares as you direct. If you do not specify how your shares are to be voted, your shares will be voted consistently with the Board's recommendations in this Proxy Statement.

This Proxy Statement contains a separate report by each of the Audit Committee and Compensation Committee of our Board. The two Board committee reports are "furnished," not "filed," for Securities Exchange Act of 1934 ("Exchange Act") purposes. Within Board committee reports, "we," "ours," "us" or similar terms mean the committee giving the report. Otherwise, such words or "the Company" mean DST Systems, Inc. ("DST") and its subsidiaries.

This Proxy Statement references the Corporate Governance Guidelines, the Business Ethics and Legal Compliance Policy, and the charters of the Board's Audit Committee, Compensation Committee, Finance Committee, and Corporate Governance/Nominating Committee ("Governance Committee"). You can access

6

Table of Contents

each of these documents at our website,www.dstsystems.com. We will furnish you a copy of any of these documents without charge, if you request in writing to:

DST Corporate Secretary

333 W. 11th Street, 5th Floor

Kansas City, MO 64105

INFORMATION ABOUT THE MEETING

Who Can Vote

Only holders of record of our common stock, par value $.01 per share, at the close of business on March 20, 2014, the record date for voting at the Annual Meeting, are entitled to vote at the Annual Meeting. Our common stock, our only class of voting securities ("DST stock"), is listed on the New York Stock Exchange.

How to Vote

Please follow the easy instructions on your proxy card to vote by telephone, by Internet, or by signing, dating and returning the proxy card in the postage-paid envelope provided. For additional information about voting, please also see the information contained in the "Annual Meeting Matters" of this Proxy Statement.

If You Have Questions or Need Assistance Voting Your Shares

Thank you for your continued support. If you have any questions or need assistance voting, please contact Innisfree M&A Incorporated, our proxy solicitor assisting us in connection with the Annual Meeting. Stockholders may call toll-free at (888) 750-5835. Banks and brokers may call collect at (212) 750-5833.

7

Table of Contents

THE BOARD OF DIRECTORS

SERVICE AND QUALIFICATIONS

DST and Public Company Board Service. Stephen C. Hooley is a DST executive officer. We do not employ the other persons named in the below table.

| | | | | | | | | | | | |

DIRECTORS AND BOARD

NOMINEES

| | Age

| | Dates of Service

on DST Board

| | Annual

Meeting

at Which

Term

Expires

| | Current

Service on

Committees of

DST Board

| | Registered

Investment Company

Directorships and

Public Company

Directorships

Other Than the Company

|

|---|

| |

A. Edward Allinson | | | 79 | | September 1995–present | | | 2016 | | Audit | | — |

| | | | | April 1977–December 1990 | | | | | Governance | | |

| | | | | | | | | | | | |

George L. Argyros | | | 77 | | February 2006–present | | | 2014 | | Compensation | | First American |

Governance Committee Chairperson | | | | | December 1998–November 2001 | | | | | Finance

Governance |

| Financial Corp

Pacific Mercantile

Bancorp |

| | | | | | | | | | | | |

Lynn Dorsey Bleil(*) | | | 50 | | — | | | — | | — | | — |

Nominee for Election | | | | | | | | | | | | |

| | | | | | | | | | | | |

Lowell L. Bryan | | | 68 | | May 2012–present | | | 2015 | | Audit | | — |

Compensation Committee Chairperson | | | | | | | | | | Compensation

Finance

Governance |

| |

| | | | | | | | | | | | |

John W. Clark(*)

Nominee for Election | | | 69 | | — | | | — | | — | | Pacific Mercantile

Bancorp |

| | | | | | | | | | | | |

Lawrence M. Higby

Lead Independent Director |

| | 68 | | May 2011–present | | | 2014 | | Audit

Compensation

Governance |

| eHealth, Inc. |

| | | | | | | | | | | | |

Stephen C. Hooley | | | 51 | | July 2012–present | | | 2016 | | — | | — |

Chief Executive Officer and President | | | | | | | | | | | | |

| | | | | | | | | | | | |

Brent L. Law | | | 48 | | January 2013–present | | | 2016 | | Compensation

Finance

Governance |

| — |

| | | | | | | | | | | | |

Samuel G. Liss | | | 57 | | May 2012–present | | | 2015 | | Audit | | Verisk Analytics, Inc. |

Finance Committee Chairperson | | | | | | | | | | Compensation

Finance

Governance | | |

| | | | | | | | | | | | |

Travis E. Reed | | | 79 | | July 2002–present | | | 2015 | | Audit | | — |

Audit Committee Chairperson | | | | | | | | | | Compensation

Finance

Governance |

| |

| |

- *

- The Board Nominee's term will expire in 2017 if the Company's stockholders elect the Board Nominee at the 2014 Annual Meeting.

8

Table of Contents

Principal Occupations and Qualifications. The Board has concluded that the Board Nominees and incumbent directors are qualified to serve on the Board due to the value of the experiences, qualifications, attributes and skills of each Board Nominee and incumbent director set forth below.

| | | | |

| | | THE BOARD NOMINEES | | |

|

|

LYNN DORSEY BLEIL |

|

|

|

|

Ms. Bleil was the leader of McKinsey & Company's West Coast Healthcare Practice, and a leader of McKinsey's worldwide Healthcare Practice. She retired in November 2013 as a Senior Partner (Director) in the Southern California Office of McKinsey. During her 25-plus years with McKinsey, she worked exclusively within the healthcare sector, advising senior management and boards of leading companies on corporate and business unit strategy, mergers and acquisitions/integration, marketing & sales, public policy, and organization – across all segments of the healthcare value chain. Much of Ms. Bleil's recent work has been with companies in the biotechnology/specialty pharma and medical device industries – focused on developing corporate strategies, go-to-market/reimbursement strategies, and organizational capabilities to address the rapidly changing payor/provider landscape in the United States and globally.

|

|

|

|

|

Ms. Bleil's significant expertise in the healthcare industry, which the Company expects to be a key growth and value driver for the Company going forward, will be a valuable asset to our Board. Ms. Bleil's experience in the healthcare industry will foster the Company's continued development of the healthcare industry as a potential engine of growth for the Company and advance the Company's strategic business plan.

|

|

|

|

|

JOHN W. CLARK |

|

|

|

|

Mr. Clark is currently the Managing Member of Westar Capital Associates II, LLC, a private investment firm where he has worked since 1995. Before joining Westar, Mr. Clark served as the President and Chief Executive Officer of Valentec International Corp. Earlier in his career, he was the Founder and Managing Partner of a CPA practice, Coyne and Clark, which grew substantially under his leadership and merged into a predecessor of Ernst & Young. Mr. Clark has also served on multiple boards of directors. He is currently a director on the board of Pacific Mercantile Bancorp, a bank, where he serves on the Audit Committee. From 1996 to 2007, Mr. Clark served on the board of directors of Amerigon, Inc., now renamed Gentherm.

|

|

|

|

|

Mr. Clark's decades of experience serving as both a manager and a director of many successful enterprises and his strong background in accounting makes him well qualified for membership in the Board. Mr. Clark's background allows him to keenly understand the dynamic between management and directors and make decisions to maximize shareholder welfare accordingly. Furthermore, Mr. Clark's prior service as a certified public accountant would make him a uniquely qualified and valuable member of the Board.

|

|

|

THE MEMBERS OF THE BOARD

A. EDWARD ALLINSON

Mr. Allinson was Executive Vice President of State Street Bank and Trust Company ("State Street Bank") and Executive Vice President of State Street Corporation ("State Street"), the parent company of State Street Bank, from March 1990 through December 1999. State Street is a financial services corporation that provides banking, trust, investment management, global custody, administration and securities processing services. From December 1999 through his retirement in October 2000, Mr. Allinson served as Chief Executive Officer and Chairman of the Board of EquiServe Limited Partnership, a stock transfer agent for publicly listed corporations which became, for a time, our wholly-owned subsidiary.

Mr. Allinson's extensive background as an executive in the financial services industry, the computer and data processing industry and transfer agency operations is uniquely suited to our businesses. He was one of the founders of Boston Financial Data Services, our full service transfer agency joint venture with State Street. He therefore has a deep understanding of our core transfer agency operations and related service and technology offerings, as well as our customer base. He also brings to our Board skills related to our international businesses, which he developed through his experiences at both State Street Bank and another major national bank. He contributes to our Board his past experience as a director with Kansas City Southern, which owned all of our shares prior to our initial public offering in 1995. His long service as our director and as a director of our previous

9

Table of Contents

parent gives him invaluable insights into our history and growth and a unique perspective of the strategic direction of our businesses.

LOWELL L. BRYAN

Mr. Bryan is a former Senior Adviser at McKinsey & Company, a global company in the business of management consulting to companies in numerous industries. He retired in mid-January 2012 from his 27 year role as a Director (i.e., Senior Partner) at McKinsey, where he was a co-founder of the company's financial institutions and strategy practices. Upon retirement from his 36 years of full-time service at McKinsey, he founded L L Bryan Advisory, LLC and Bayberry Lane Advisory, Inc. each of which advise management and boards on corporate strategy and organizational issues. He has advised the boards of directors and top management of dozens of financial institution, health care, and industrial clients primarily on issues of strategy and organization. Mr. Bryan brings an independent perspective to our Board as a result of his knowledge of the operation of the global capital markets and the global economy, as well as strategic, organizational, and operational issues faced by our financial and health care and other businesses. He is the author of several books on banking, capital markets, strategy and organizational topics, and his knowledge contributes to his effectiveness as Chairperson of our Compensation Committee.

STEPHEN C. HOOLEY

Mr. Hooley became our Chief Executive Officer and President in September 2012, after joining the Board in July 2012 and the Company in July 2009 as our President and Chief Operating Officer. He was the President and Chief Executive Officer of Boston Financial, our transfer agency joint venture with State Street, from mid-2004 until joining DST.

The Board elected Mr. Hooley as a director in recognition of his distinctive service in all his roles since joining DST. It unanimously determined that Mr. Hooley was the right person to succeed our former Chief Executive Officer, who retired from that position in September 2012. Mr. Hooley's deep experience in the financial services industry; knowledge of DST and the interrelationship of our diversified business ventures, domestic and international; and well-established relationships with our customers, employees and partners are valuable assets to the Board as it works to enhance value for stockholders. Mr. Hooley has developed a productive relationship with the Board and encourages a collaborative approach among directors in dealing with the Company's most important strategic issues.

BRENT L. LAW

The Board elected Mr. Law as a director in January 2013. Mr. Law has served since October 2003 as Chief Investment Officer and Corporate Secretary of Arnel & Affiliates, a prominent West Coast diversified investment company that is owned by Mr. Argyros and his affiliates. He has also served since 2001 as that company's Director of Tax. He oversees the investment of more than $1 billion in assets. Earlier in his career, Mr. Law served in a senior financial role at a start-up company and as a senior tax manager at a large public accounting firm. He has over 20 years of experience in investing, accounting and taxation and is a Certified Public Accountant. His experiences are helpful to Board evaluation of our diversification alternatives, and his accounting, tax and financial expertise is an asset to our Board in the evaluation of transactions and capital strategies.

SAMUEL G. LISS

Mr. Liss has been the managing principal since July 2010 of WhiteGate Partners LLC, an advisory firm focused on the financial services sector. He also serves as an Adjunct Professor at New York University Stern Graduate School of Business and Fordham University Graduate School of Business, focusing on global corporate governance. From April 2004 through June 2010, Mr. Liss was Executive Vice President, Travelers Companies, Inc., a provider of property and casualty insurance. He was responsible for corporate strategy, divestitures and acquisitions, and for a period had direct management responsibility for one of Travelers' three operating divisions – Financial, Professional and International Insurance. From February 2003 through March 2004, Mr. Liss was Executive Vice President of The St. Paul Companies. From 1994 through 2001, he served as

10

Table of Contents

Managing Director Investment Banking, Financial Institutions Group and Managing Director Equity Research at Credit Suisse First Boston, Inc., and began his career at Salomon Brothers. Since 2005, Mr. Liss has been a member of the Board of Directors of Verisk Analytics, Inc., a company which delivers risk-assessment services and decision analytics, serving on its audit committee and as chairman of its finance committee. In 2014, Mr. Liss joined the Board of Ironshore Inc., a commercial insurance company, and serves on its audit and investment committees. His strong background in financial services, management and capital markets contribute to his Board service and effectiveness as the Chairperson of our Finance Committee.

TRAVIS E. REED

Mr. Reed is founder of Reed Investment Corporation, which acquires equity interests in various businesses. He has served as its President since 1977.

Mr. Reed's experiences over almost five decades in the financial industry as an investor qualify him to serve on our Board. As an entrepreneur, he brings a unique perspective to the challenge of balancing risk and rewards faced by our businesses and in acquisition transactions. He has gained experiences valuable to our Board by serving as a founder, director and/or officer of two publicly-held corporations and one privately-held corporation. His knowledge of complex financial arrangements, regulatory compliance, mergers and acquisitions, and markets and trading activities is helpful to the Board in evaluating the merits of strategic initiatives and acquisitions and addressing strategic challenges. His service at the U.S. Department of Commerce in a senior leadership role involving both domestic and international businesses brings to the Board an understanding of the impact of national governmental initiatives, policies and regulation on our businesses.

Mr. Reed has chaired the board audit committee of a major university and has provided our Audit Committee with valuable perspective in managing its relationship with our independent auditors and performance of its financial reporting oversight function. His experiences contribute to his effectiveness as Chairperson of our Audit Committee.

COMMITTEES AND MEETINGS

The Board appoints the members of the four Board committees, and they had the following number of meetings during the year:

| | |

Committee

| | Number of Meetings

During 2013

|

|---|

| |

Audit | | 4 |

Compensation | | 5 |

Finance | | 2 |

Governance | | 6 |

| |

In 2013, the Board met eight times. Each director attended at least 75% of all regular and special Board meetings and all meetings of Board committees on which the director served. Seven directors who served during 2013 attended all such meetings.

Our directors shall, whenever reasonably practicable, attend annual meetings. All directors attended the 2013 Annual Meeting. Non-employee directors, all of whom are independent, meet regularly in private session without management. The Lead Independent Director presides over the private sessions of the independent directors.

LEADERSHIP, EXPECTATIONS, OVERSIGHT

Board Leadership Structure. Our Bylaws provide that the Board has the discretion but may choose not to appoint a Chairman of the Board. In the absence of such an appointment, the Chief Executive Officer chairs

11

Table of Contents

meetings of the Board. Our Board has not elected a Chairman of the Board with the result that our Chief Executive Officer, Stephen C. Hooley, chairs the Board meetings and discharges the other duties of Chairman.

Lead Independent Director. The Board has determined that the Board and the Company are presently best led by having a Lead Independent Director as well as having the Chief Executive Officer discharge the duties of a Chairman. Having the Chief Executive Officer perform the functions of a Chairman provides both accountability to the Board and clear and effective leadership for the Board and the Company, while avoiding any potential for confusion or duplication of efforts between the Chief Executive Officer and a separately appointed Chairman.

Our Corporate Governance Guidelines, which are available on our website,www.dstsystems.com, provide for a strong lead independent director role and provide that the independent directors of the Board will designate a Lead Independent Director. In January 2013, Lawrence M. Higby was designated as Lead Independent Director. As Mr. Higby's current term is expiring at the end of the Annual Meeting and he is not standing for reelection, after the Annual Meeting, the independent directors will designate a new Lead Independent Director. The Lead Independent Director performs the following functions and such other functions as the Board may direct:

- •

- Presiding at all meetings of the Board at which the Chairman of the Board (if one is appointed) is not present, including executive sessions of the Board at which only non-management or independent directors are permitted to be present, along with other persons invited to attend such sessions by the Lead Independent Director or by consensus of a majority of the non-management or independent directors.

- •

- Serving as liaison between the non-management or independent directors and either the Chairman of the Board (if one is appointed) or the Chief Executive Officer.

- •

- Advising the Chairman of the Board (if one is appointed) or the Chief Executive Officer with respect to, and approving, Board agenda items (including items suggested by any non-management director), meeting schedules and information to be provided to the Board.

- •

- Serving as a point of contact for stockholders wishing to communicate with the Board other than through the Chairman of the Board (if one is appointed) or the Chief Executive Officer.

The independent directors of the Board regularly meet in executive session without management, and at such other times as the Lead Independent Director chooses. At the annual organizational meeting of the Board, and at such other times as the Lead Independent Director chooses, the independent directors may meet in executive session without management and without any non-independent directors.

Our governance processes, including the Board's involvement in developing and implementing strategy, active oversight of risk, regular review of business results and thorough evaluation of Chief Executive Officer performance and compensation, provide rigorous Board oversight of Mr. Hooley as he fulfills his various responsibilities, including discharging the duties of the Chairman.

Stock Ownership Expectations for Non-Employee Directors. The Board has adopted a guideline that its non-employee directors are expected to beneficially own an amount of DST stock with a fair market value equal to at least five times the annual minimum retainer for serving as a Board member. The guideline provides a grace period for achievement of such ownership level after joining the Board. The Board will consider personal circumstances, length of service on the Board, and the effect of market conditions in applying the guideline.

Board Risk Oversight. The Board, with the assistance of the Audit Committee, has oversight of the Company's risk assessment and risk management, with particular focus by the Board on material corporate governance and business strategy risks. The Audit Committee assists the Board with oversight of the Company's material financial risk exposures, including without limitation liquidity, credit, operational and investment risks, and the Company's material financial statement and financial reporting risks. The Compensation Committee assists the

12

Table of Contents

Board with oversight of whether the Company's compensation policies and practices for all employees, including non-executive officers, create risks that are reasonably likely to have a material adverse effect on the Company, and whether the effect of incentive compensation structures for executive officers may cause inappropriate risk-taking. In each case, the Board or the Audit Committee oversees the steps Company management has taken to monitor and control such exposures.

The Chief Executive Officer, by leading Board meetings, facilitates reporting by the Audit and Compensation Committees to the Board of their respective activities in risk oversight assistance. The Lead Independent Director, who serves on both committees, suggests risk management topics to be discussed at Board meetings as he and other non-management directors deem appropriate. He may lead risk management discussions in executive sessions of non-management or independent directors. The Chief Executive Officer's collaboration with the Board allows him to gauge whether management is providing adequate information for the Board to understand the interrelationships of our various business risks. He is available to the Board to address any questions from directors regarding executive management's ability to identify and mitigate risks and weigh them against potential rewards.

INDEPENDENCE, ACCESSIBILITY, AND ACCESS TO ADVISORS

Non-Employee Director Independence. New York Stock Exchange standards, certain securities and tax laws, and our Corporate Governance Guidelines govern the independence of non-employee directors. A majority of our Board must be independent, and directors must be independent for purposes of Board committee service. Our Board has determined the independence for Board service and for service on their respective Board committees of each of Messrs. Allinson, Argyros, Bryan, Higby, Law, Liss and Reed. In addition, our Board has determined that Board Nominees Bleil and Clark would qualify as independent directors. In determining the independence of Ms. Bleil, the Board considered that, until her retirement in November 2013, Ms. Bleil was a Senior Partner at McKinsey & Company ("McKinsey") and was part of the McKinsey team that provided professional consulting services to the Company. The amount of fees paid to McKinsey in 2013 was approximately $4.08 million. These fees were received directly by McKinsey as a firm, and Ms. Bleil's direct compensation as a Senior Partner of McKinsey was not a function of these fees.

As a group, the independent directors constitute a majority of the Board. Mr. Hooley, our Chief Executive Officer, is the only member of the Board who is also an employee, and is the only director who is not independent under applicable independence standards.

To determine independence for service on the Board and its committees, the Board has adopted categorical independence standards consistent with the New York Stock Exchange Standards and contained in our Corporate Governance Guidelines. The Board has applied these categorical independence standards in determining the independence of each non-employee director and the Board Nominees. It uses the standards to determine whether a non-employee director has a material relationship with us, either directly or as a partner, stockholder or officer of an organization that has a relationship with us.

Under the Corporate Governance Guidelines, the Board presumes a non-employee director is independent if the director:

- •

- during the preceding three years:

- •

- has not been our employee and has no immediate family member (as defined in the Corporate Governance Guidelines) whom we have employed as an executive officer, and

- •

- has not received, and has no immediate family member who has received, more than $120,000 in any 12-month period in direct compensation from us (other than in certain allowable circumstances including serving in his or her capacity as a member of the Board or of any Board committee);

13

Table of Contents

- •

- is not and has not been within the last three years, and has no immediate family member who is or has been within the last three years, employed as an executive officer by any company on whose compensation committee any one of our current executive officers concurrently serves or served;

- •

- is not a current employee, and has no immediate family member who is a current executive officer, of:

- •

- the Company,

- •

- a company that made payments to or received payments from us for property or services in any of the last three fiscal years in an amount which exceeds the greater of $1 million or 2% of such other company's consolidated gross revenues, as reported in the last completed fiscal year of such company, or

- •

- a charitable organization to which we contributed in any of the last three fiscal years more than 2% of such charitable organization's consolidated gross revenues or $1 million, whichever is greater;

- •

- has no immediate family member who is a current partner of a firm that is our internal or external auditor;

- •

- has no immediate family member who is a current employee of a firm that is our internal or external auditor and personally works on the Company's audit;

- •

- has no immediate family member who was, within the last three years, a partner or employee of such a firm and personally worked on our audit within that time; and

- •

- is not a current partner or employee of a firm that is our internal or external auditor, and who was not within the last three years a partner or employee of such a firm and personally worked on our audit within that time.

The Corporate Governance Guidelines are available on our website,www.dstsystems.com. They explain circumstances in which a director can be independent even though one or more of the above circumstances exist.

The Corporate Governance Guidelines provide that a non-employee director is independent for purposes of serving on the Audit Committee only if he has not received any consulting, advisory or other compensatory fee other than for serving on the Board or a Board committee, and he is not considered an affiliated person of the Company under applicable securities regulations.

The Corporate Governance Guidelines provide that the Board must consider whether, for purposes of serving on the Compensation Committee, a non-employee director has received any consulting, advisory or other compensatory fee other than for serving on the Board or Board committees or is affiliated with the Company or one of its subsidiaries or affiliates.

14

Table of Contents

Interested Party and Stockholder Communication with Directors. Interested parties and stockholders may communicate in writing with the Board, the Lead Independent Director, any director, or any group of directors such as all non-employee directors or all members of a Board committee. A vendor unaffiliated with DST receives such communications and forwards them to directors. You may direct communications to the directors in care of our vendor:

Clarence M. Kelley and Associates, Inc.

Attention: Rod Smith/regarding DST

7945 Flint

Lenexa, Kansas 66214

15

Table of Contents

BOARD COMMITTEE MATTERS AND REPORTS

AUDIT COMMITTEE

We identify Audit Committee members in a table under "The Board of Directors." Committee members serve staggered three-year terms corresponding with their terms as directors. As described in the Committee's charter, the Committee is responsible for:

- •

- appointing, approving the services and overseeing the work of, and receiving reports directly from, the independent registered public accounting firm;

- •

- reviewing audited financial statements and various other public disclosures;

- •

- assisting the Board in overseeing material financial risk exposures; and

- •

- assisting the Board in overseeing our internal audit function and legal and regulatory compliance, as well as the integrity of our financial statements and certain internal controls.

Our Board has determined that Messrs. Liss and Reed, who are independent under the applicable standards, are each an "audit committee financial expert" as defined in securities regulations. Other members of the Committee may also qualify as audit committee financial experts under the regulations. No Committee member serves on more than two other public company audit committees.

Audit Committee Report

We reviewed and discussed the Company's consolidated financial statements with management and PricewaterhouseCoopers LLP, DST's independent registered public accounting firm. PricewaterhouseCoopers LLP gave us its opinion, and management represented, that the Company prepared its consolidated financial statements in accordance with generally accepted accounting principles in the United States of America. We discussed with the Company's independent registered public accountants the matters that Auditing Standard No. 16 (Communications with Audit Committees), as adopted by the Public Company Accounting Oversight Board ("PCAOB"), requires the Committee and the auditors to discuss.

PricewaterhouseCoopers LLP gave us and we reviewed the written disclosures and the letter required by applicable requirements of the PCAOB regarding the independent registered public accounting firm's communications with us concerning independence. We also discussed with PricewaterhouseCoopers LLP its independence from management.

Based on the above discussions, we recommended to the Board that the audited consolidated financial statements be included in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2013.

THE AUDIT COMMITTEE

Travis E. Reed, Chairperson

A. Edward Allinson

Lowell L. Bryan

Lawrence M. Higby

Samuel G. Liss

16

Table of Contents

COMPENSATION COMMITTEE

Committee Structure. We identify Compensation Committee members in a table under "The Board of Directors." Committee members serve one-year terms. As described in the Committee's charter, the Committee is responsible for:

- •

- establishing policies and procedures for compensating executive officers and non-employee directors

- •

- retaining independent compensation consultants

- •

- determining the structure and objectives of each element of executive officer compensation, and the base salaries, incentive award opportunity levels, and all other components of such compensation

- •

- setting incentive compensation goals

- •

- approving awards under equity and incentive compensation programs, and exercising administrative authority under benefit plans

- •

- evaluating Chief Executive Officer performance and reviewing evaluations of the performance of other executive officers

- •

- recommending to the Board the structure of non-employee director compensation

- •

- assisting the Board in overseeing compensation risk including determinations regarding the risk of employee compensation practices and policies

- •

- approving certain compensation disclosures.

Executive Officer Compensation Practices. The processes and procedures for determining executive officer compensation are written and were approved by the Committee. The Committee is responsible for and has the authority under its Charter to determine the components of executive officer compensation.

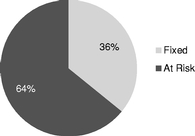

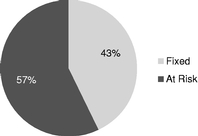

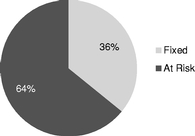

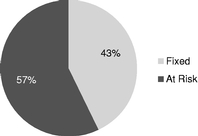

In support of its pay-for-performance philosophy, the Committee ties a significant portion of executive officer compensation to the creation of stockholder value over the long-term, structures executive officer compensation so that a significant portion of total compensation is at-risk rather than fixed, and uses balanced performance goals that incent short- and long-term objectives.

The Committee periodically reviews executive officer compensation. For each review, the Committee may consider, and decide the weight it will give to, any combination of the following:

- •

- market competitive data

- •

- individual responsibilities

- •

- Company or business unit performance and objectives and other Company financial and strategic information

- •

- tax and accounting impact of proposed compensation

- •

- retention

- •

- effects of a potential severance, change in control or Company transaction.

The Committee may request our Chief Executive Officer or Vice President of Global Human Resources to recommend compensation package components. Such officers communicate executive hiring and retention

17

Table of Contents

concerns to the Committee. The Committee may ask the Chief Executive Officer, Vice President of Global Human Resources, Chief Financial Officer or General Counsel to provide the Committee with:

- •

- market analysis data

- •

- proposed benefit plan terms and conditions

- •

- financial, accounting and tax information

- •

- legal requirements for benefit plan and award structures

- •

- valuation information regarding outstanding awards and undistributed account balances and other historical Company compensation data

- •

- Company performance data and individual performance evaluations.

The Committee develops the criteria for evaluating Chief Executive Officer performance and annually reviews his performance against such criteria. The Chief Executive Officer periodically discusses with the Committee his view of the performance of the other executive officers.

The 2005 Equity Incentive Plan permits the Committee to delegate certain administrative matters, and the Committee has made administrative delegations to the Chief Executive Officer, Vice President of Global Human Resources, and Chief Financial Officer.

The Committee and the Board rely on the Vice President of Global Human Resources to implement compensation decisions and adopt appropriate compensation procedure internal controls.

Non-Employee Director Compensation Practices. The processes and procedures for determining non-employee director compensation are written and were approved by the Committee. The Committee recommends components of non-employee director compensation to the Board. The Board is responsible for and has the authority to determine the components of non-employee director compensation.

Compensation Consultant Engagements. The Committee may retain, at Company expense, a compensation consultant to advise the Committee on executive compensation practices and trends and to assist the Committee with determinations it may make. Under its Charter, the Committee must take into consideration certain factors regarding the independence of the consultant. The consultant recommends to the Committee executive officer and non-employee director compensation alternatives based on market data, but does not determine such compensation. The Committee has engaged Deloitte Consulting LLP ("Deloitte") with respect to executive officer compensation and has determined Deloitte to be independent. The fees charged by Deloitte for compensation-related services during 2013 were $267,357.

During 2013, Deloitte affiliates provided services that were not related to compensation consulting. Recipients were DST, DST subsidiaries, including ALPS Holdings, Inc. and its businesses, and investment company clients advised by (and not under the control of) the ALPS businesses. ALPS-related engagements reflect arrangements that were in place prior to our acquisition of ALPS, and thus those arrangements were not initially recommended by members of our management. Our management has determined to continue procuring these services from Deloitte affiliates.

| | | | |

Other Deloitte Services During 2013

| | Fees ($)

| |

|---|

| | |

Internal Control Attest Work for ALPS businesses (including amounts paid by or reflected in fees to clients) | | | 221,500 | |

Audit and audit-related services for ALPS clients | | | 749,427 | |

Tax-related services for ALPS clients | | | 320,293 | |

Tax Services for DST executives reimbursed by DST | | | 7,450 | |

Tax Services | | | 19,186 | |

Accounting Advisory Services | | | 145,664 | |

| | |

18

Table of Contents

The Committee has reviewed the various services provided by Deloitte and its affiliates and has approved the provision of all such services. The Committee does not believe that any of the non-compensation services impair Deloitte's ability to provide independent advice to the Committee or otherwise pose a conflict of interest.

Employee Compensation Risk. The Committee determines whether employee compensation policies and practices create risks that are reasonably likely to have a material adverse effect on the Company. The Committee obtains information from the Vice President of Global Human Resources regarding corporate, business unit, domestic, international, incentive, equity, sales commission and other programs and considers controls such as benchmarking, setting goals and award limits, and receiving assistance from independent compensation consultants. In February 2014, the Committee determined that our employee compensation practices and policies do not create risks that are reasonably likely to have a material adverse effect on the Company.

Compensation Committee Report

We reviewed and discussed with management the "Compensation Discussion and Analysis" section of this Proxy Statement. Based on such review and discussion, we recommended to the Board that this Proxy Statement include the "Compensation Discussion and Analysis."

THE COMPENSATION COMMITTEE

Lowell L. Bryan, Chairperson

George L. Argyros

Lawrence M. Higby

Brent L. Law

Samuel G. Liss

Travis E. Reed

FINANCE COMMITTEE

We identify Finance Committee members in a table under "The Board of Directors." Committee members serve one-year terms. As described in the Committee's charter, the Committee is responsible for:

- •

- assisting the Board in its oversight responsibilities with respect to financial policies, strategies and capital structure

- •

- advising the Board and our management on matters of asset and liability management, financial aspects of strategic and operational plans, and other such financial matters as may come before the Committee.

GOVERNANCE COMMITTEE

Committee Functions and Structure. We identify Governance Committee members in a table under "The Board of Directors." Committee members serve one-year terms. As described in the Committee's charter, the Committee is responsible for:

- •

- identifying and recommending to the Board persons to serve as directors and on Board committees

- •

- evaluating independence and other qualifications of Board and committee members

- •

- recommending corporate governance guidelines to and overseeing evaluations of the Board

19

Table of Contents

- •

- adopting and implementing written policies and procedures for reviewing, approving and ratifying transactions of $120,000 or more in which the persons listed in the Beneficial Ownership section or their immediate families have a direct or indirect material interest

- •

- adopting and performing certain administrative duties with respect to our Business Ethics and Legal Compliance Policy.

Related Person Transaction Procedures. Written policies and procedures adopted by the Committee address Committee review of transactions of $120,000 or more in which the Company participates and a "related person" has a direct or indirect material interest. A "related person" is a director, executive officer, 5% or more stockholder, or immediate family member of any such person. Our management informs the Committee Chairperson whenever it becomes aware that any related person has, or during the relevant period has had, a direct or indirect material interest in a related person transaction and reports any actual or proposed related person transaction to the Committee Chairperson. For each such reported transaction, the Committee considers whether the related person serves on a Board committee and, if so, whether such continued service is appropriate under securities regulations pertaining to such committee. The Committee determines whether to ratify the transaction considering:

- •

- the significance of the transaction to the Company

- •

- the best interests of our stockholders

- •

- our ethics policy requirements

- •

- the materiality of the transaction to the related person

- •

- whether the transaction is significantly likely to impair any judgments an executive officer or director would make on our behalf.

If the Committee does not approve or ratify a transaction, it discusses with management a strategy for terminating the transaction or modifying the structure of the transaction.

Director Nomination Matters. In recommending nominees to the Board, the Committee identifies candidates who meet the current challenges and needs of the Board. The Committee identifies and evaluates nominees through multiple sources including Board and management referrals. The Committee has not adopted a policy for considering whether to designate as a Board nominee a candidate proposed by a stockholder. It does not believe a policy is necessary because it could respond on an ad hoc basis. It will consider director nominees timely proposed by stockholders in a written notice and evaluate stockholder nominees for director in the same manner it evaluates other nominees, which includes considering and giving weight to input about a nominee from management or incumbent directors.

In recommending a director nominee (including an incumbent director), the Committee considers:

- •

- whether the nominee has the requisite or appropriate experience, qualifications and skills

- •

- the nominee's commitment to prepare for and regularly attend meetings of the Board and committees

- •

- whether, if applicable, the nominee meets the New York Stock Exchange standards for independence and has qualifications and attributes necessary under applicable listing standards and laws and regulations for service on Board committees.

20

Table of Contents

In considering these items, the Committee may contemplate the interplay of the nominee's attributes with those of the other Board members and appraise the extent to which a candidate would be a desirable addition to the Board and, as applicable, its committees. Although the Board does not have a specific policy for Board diversity, the Board may, as stated in the Corporate Governance Guidelines, consider whether the nominee's background would add to the diversity of experiences, qualifications, and skills the various directors may bring to their Board service. Additionally, the Committee considers in recommending an incumbent director for re-election the nominee's prior service on the Board, continued commitment to Board service, whether the nominee possesses the requisite financial and management experience and expertise appropriate for service on the Board and its respective committees, and any changes in employment or other status that are likely to affect such nominee's qualifications to serve.

Based on an amendment to the Corporate Governance Guidelines dated February 24, 2011 ("Restriction Commencement Date"), the Committee generally prohibits nominations of individuals who are age 75 or older at the date of nomination ("Age Restriction"). For purposes of assuring transition of productive relationships and necessary skills among directors and to facilitate an appropriate process of succession upon the adoption of the Age Restriction, the restricted age is 80 (rather than 75) for any incumbent director who was age 70 or older at the Restriction Commencement Date. The Board may approve an exception to the Age Restriction under extraordinary circumstances, on a case-by-case basis.

2014 Argyros Agreement. The Company entered into an agreement (the "2014 Argyros Agreement") with Julia A. Argyros, the Argyros Family Trust, GLA Financial Corporation and HBI Financial, Inc. (collectively, the "Argyros Group"), relating to the Company's 2014 Annual Meeting, certain governance matters of the Company and a process to help facilitate the disposition of a substantial portion of the Argyros Group's ownership of DST stock (the "Argyros Disposition").

Pursuant to the 2014 Argyros Agreement, the Company agreed to nominate John W. Clark (or his Replacement (as defined below)) and Lynn Dorsey Bleil (collectively, the "2014 Nominees") for election as directors at the 2014 Annual Meeting. In addition, each of the Company and the Argyros Group agreed to take all necessary actions to nominate the 2014 Nominees for election to the Board at the 2014 Annual Meeting, and the Argyros Group agreed to vote its shares of DST stock in favor of each of the 2014 Nominees. Information on the 2014 Nominees is included in this Proxy Statement under "The Board of Directors." In addition, the Argyros Group agreed to support the Company's recommendations with respect to voting for the stockholder proposals submitted to the Company for consideration at the 2014 Annual Meeting. As requested by the Company, the Argyros Group agreed to abstain from voting for Stockholder Proposal 6 regarding the repeal of the Company's classified Board of Directors. Information on the stockholder proposals is included in this Proxy Statement under "Additional Proposals Requiring Your Vote."

The 2014 Argyros Agreement also provides that, if Mr. Clark (or his Replacement) is unable to serve as a nominee for election as director at the 2014 Annual Meeting or if Mr. Clark (or his Replacement) is unable to serve as a director during the three-year term for which Mr. Clark is elected at the 2014 Annual Meeting (the "Term"), for any reason, the holder(s) of a majority of the shares held by the Argyros Group as of March 23, 2014 will have the right to submit the name of a replacement (the "Replacement") to the Company for its reasonable approval and who will serve as the nominee for election as director at the 2014 Annual Meeting or serve as director in such vacated seat during the remainder of the Term until the Company approves that such Replacement will serve as a nominee for election as director at the 2014 Annual Meeting or will serve as a director during the remainder of the Term.

In the 2014 Argyros Agreement, the Company and the Argyros Group agreed to negotiate in good faith definitive agreements (the "Definitive Agreements") to facilitate, among other things, certain transactions relating to the Argyros Disposition (the "Transactions"), described in the term sheet attached to the 2014 Argyros Agreement as Exhibit A (the "Term Sheet"). Subject to the negotiation and finalization of the terms and conditions to be set forth in, and the execution of, the Definitive Agreements, the Transactions contemplated would include a

21

Table of Contents

registered, secondary common stock offering by the Argyros Group of $450 million (before any overallotment option) of DST stock beneficially owned by the Argyros Group (the "Offering"), and concurrent with the consummation of the Offering, the Company would repurchase $200 million of DST stock beneficially owned by the Argyros Group and not sold in the Offering (the "Repurchase").

Subject to the negotiation and finalization of the terms and conditions to be set forth in, and the execution of, the Definitive Agreements, in the event that the Argyros Group does not consummate the Offering within nine months following the earlier of (i) the execution by the Company and the Argyros Group of Definitive Agreements and (ii) April 24, 2014 (such earlier date, the "Signing Date," and such nine-month period, the "Transaction Period"), so long as the Company has complied with its obligations, to be contained in such Definitive Agreements, to the Argyros Group, the Company would no longer have any obligation to help facilitate the Argyros Disposition.

Subject to the negotiation and finalization of the terms and conditions to be set forth in, and the execution of, the Definitive Agreements, in the event the Transactions are consummated or in certain other circumstances described in the Term Sheet, the Argyros Group and the Company would enter into a customary registration rights agreement providing for, depending on the particular circumstances, two or three demand registrations and setting forth the terms pursuant to which the Company would participate in an offering pursuant to a demand registration of at least $50 million of DST stock beneficially owned by the Argyros Group per each registration (the 'Demand Registrations'), and the right of the Argyros Group to the Demand Registrations would expire on the fifth anniversary of the Signing Date.

In the 2014 Argyros Agreement, subject to the negotiation and finalization of the terms and conditions to be set forth in, and the execution of, the Definitive Agreements, the Argyros Group would enter into certain customary standstill provisions, including restrictions on acquisitions by the Argyros Group of shares of DST stock, in addition to certain ongoing restrictions on the rights of the Argyros Group to submit director nominees for election to the Board of Directors of the Company, in each case, to expire on the later of the 5th anniversary of consummation of the Transactions or the date on which the Argyros Group beneficially owns less than 5% of the shares outstanding of DST stock, and the Company and the Argyros Group would agree to the following relating to the terms of directors and arrangements for director nominees proposed by the Argyros Group and to be submitted to the Company's stockholders for election to the Board:

- •

- On the earlier of (x) consummation of the Transactions, (y) the date on which the Argyros Group owns less than 10% of shares of DST stock outstanding and (z) the expiration of Mr. Law's (or his Replacement's) current term as a director of the Board, Mr. Law (or his Replacement) will resign from the Board or agree not to stand for election at the 2016 Annual Meeting, as applicable.

- •

- So long as the Argyros Group owns 5% or more of shares of DST stock outstanding, the Argyros Group will have the right to nominate one director for election at the Company's annual meeting of stockholders unless the Argyros Group nominee already sits on the Board and is not up for election at such annual meeting, and the Argyros Group will have the right to select a Replacement for such nominee or director.

- •

- On the first date that the Argyros Group owns less than 5% of shares of DST stock outstanding, then each of Mr. Clark and Mr. Law (or their respective Replacements) will resign from the Board.

Subject to the negotiation and finalization of the terms and conditions to be set forth in, and the execution of, the Definitive Agreements, the Argyros Group would vote in favor of the Company's slate of director nominees and any other matters brought before the stockholders by the Company at any annual meeting of stockholders.

The Definitive Agreements, which are subject to the negotiation, finalization and execution by the Company and the Argyros Group, will be filed with the SEC. The terms and conditions described above with respect to the

22

Table of Contents

Transactions or other matters set forth in the Term Sheet will only come into effect upon execution of the Definitive Agreements by the Company and the Argyros Group.

In addition, pursuant to the 2014 Argyros Agreement, the Argyros Family Trust withdrew its notice of nomination of two director nominees for election to the Board of Directors and four proposals for consideration by stockholders at the 2014 Annual Meeting.

The foregoing is not a complete description of the 2014 Argyros Agreement and is qualified in its entirety by reference to the full text of the 2014 Argyros Agreement. For a copy of the 2014 Argyros Agreement, see Exhibit 99.2 to the Company's Current Report on Form 8-K that was filed with the SEC on March 24, 2014.

2013 Argyros Agreement. The Company entered into an agreement (the "2013 Argyros Agreement") on January 22, 2013 with George L. Argyros, the Argyros Family Foundation, the Argyros Family Trust, GLA Financial Corporation, HBI Financial, Inc., the Lenore Trigonis Trust Established under the Leon and Olga Argyros 1986 Trust and the Selia Poulos Trust Established under the Leon and Olga Argyros 1986 Trust (collectively, the "2013 Argyros Group"). The 2013 Argyros Agreement provides, among other things, that the Company will maintain the size of the Board at no more than nine directors at least until the conclusion of the 2014 Annual Meeting. In addition, if Mr. Law, who was elected at the 2013 Annual Meeting of Stockholders (the "2013 Annual Meeting") to serve as a director for a three-year term ending in 2016, or his replacement (the "Replacement"), is unable to serve as a director at any point during such three-year term, for any reason, the 2013 Argyros Agreement provides that the 2013 Argyros Group shall have the right to submit the name of a Replacement to the Company for its reasonable approval, and the Replacement shall serve as Director in the seat vacated by Mr. Law or his Replacement for the remaining portion of such three-year term. The 2013 Argyros Group shall have the right to continue submitting the name of a proposed Replacement to the Company for its reasonable approval until the Company approves such Replacement, whereupon such person shall be appointed as the Replacement.

Pursuant to the 2013 Argyros Agreement, the Company also agreed to take, and did, in fact, take, certain actions with respect to the 2013 Annual Meeting that are described in the Proxy Statement for the 2013 Annual Meeting that was filed on March 19, 2013.

The foregoing is not a complete description of the 2013 Argyros Agreement and is qualified in its entirety by reference to the full text of the 2013 Argyros Agreement. For a copy of the 2013 Argyros Agreement, see Exhibit 99.2 to the Company's Current Report on Form 8-K that was filed with the SEC on January 23, 2013.

23

Table of Contents

NON-EMPLOYEE DIRECTOR COMPENSATION

Only non-employee directors participate in the director compensation program. The Board considered Board and committee members' duties and the Compensation Committee's recommendations in approving the program. The following table shows the compensation program for 2013:

| | |

Compensable Event/Position

| | Fee ($)

|

|---|

| |

Annual Cash Retainer | | 40,000 |

Retainer for Lead Independent Director | | 30,000 |

| | |

Committee Chairperson Retainer | | 20,000 Audit |

| | 15,000 Compensation |

| | 15,000 Finance |

| | 12,500 Governance |

Board Meeting Fee | | 5,000 in-person |

| | 1,000 by teleconference |

| | |

Committee Meeting Fee | | 2,000 in-person |

| | 500 by teleconference |

Annual Equity Award* | | 130,000 (fair market value of DST stock) |

| |

- *

- Grants of DST stock are made pursuant to the 2005 Non-Employee Directors' Award Plan and are paid as soon as practicable following the date of the annual meeting if the non-employee director will continue to serve immediately following such meeting. The number of shares is based on the fair market value (as determined under rules of Compensation Committee) on the date of grant.

To address retirement and tax planning, the Board allows non-employee directors to defer their cash compensation. The DST Systems, Inc. Directors' Deferred Fee Plan, a nonqualified deferred compensation plan, governs the deferrals and allows non-employee directors to annually elect deferral of all or a part of any cash compensation earned during the next calendar year. We credit each participating non-employee director's account with the amount of compensation deferred. We adjust the account monthly by a rate of return on a hypothetical investment the director selects among a limited number of choices including long-term investments, both equity-based and income-oriented. If the non-employee director does not select hypothetical investments for all or a portion of the account, we adjust the account by an interest factor equal to a rate of return the Board selects. Non-employee directors are fully vested in their accounts.

We will distribute a non-employee director's plan account balance after Board service terminates. We pay balances in a lump sum but will pay them in installments not to exceed ten years if the Board allows and the director has timely elected installments pursuant to plan provisions and applicable tax laws and regulations.

We have established a grantor trust in connection with the current Directors' Deferred Fee Plan. We may fund the trust equal to the sum of the payout obligations under such plans. If on or after a change in control we fail to honor obligations under such plans to a plan participant, the trust, if funded, is to distribute the required amounts to the plan participants. The trust requires us to be solvent to distribute trust accounts. Trust assets are subject to the claims of our creditors in the event of our bankruptcy. The Compensation Committee may revoke the trust until we have a change in control. The trust uses the same definition of change in control as used in executive compensation award agreements, summarized under "NEO Award/Account Values for Certain Events."

We continue to hold fully-vested fees related to Mr. Allinson's prior service on the Board from 1977 to 1990. The fees are held in a directors' deferred fee plan that terminated effective August 31, 1995. On February 26, 2014, the Board determined to liquidate this terminated plan. A payout will be made to Mr. Allinson which we anticipate will occur in the second quarter of 2014. As of December 31, 2013, the balance was $14.7 million.

24

Table of Contents

We purchase term life insurance for non-employee directors. The directors name the policy beneficiaries. We provide spousal travel to occasional off-site planning meetings and reimburse family entertainment at such meetings. If we do not incur an incremental cost for an additional passenger, the spouse or significant other of a director may accompany the director to the location at which meetings of the Board or its committees are occurring by traveling on aircraft in which we have an interest.

2013 NON-EMPLOYEE DIRECTOR COMPENSATION

| | | | | | | | | | | | | |

| | A

| | B

| | C

| | D

| |

|---|

| | Fees Earned

or Paid

in Cash

($)

| | Stock

Awards1

($)

| | All Other

Compensation2

($)

| | Total

($)

| |

|---|

| | |

A. Edward Allinson | | | 85,000 | | | 130,000 | | | 23 | | | 215,023 | |

George L. Argyros | | | 91,000 | | | 130,000 | | | 23 | | | 221,023 | |

Lowell L. Bryan | | | 114,000 | | | 130,000 | | | 71 | | | 244,071 | |

Lawrence M. Higby | | | 133,500 | | | 130,000 | | | 71 | | | 263,571 | |

Brent L. Law | | | 95,333 | | | 173,333 | | | 71 | | | 268,737 | |

Samuel G. Liss | | | 114,000 | | | 130,000 | | | 71 | | | 244,071 | |

Travis E. Reed | | | 119,000 | | | 130,000 | | | 23 | | | 249,023 | |

Robert T. Jackson, Former Director3 | | | 1,500 | | | — | | | 71 | | | 1,571 | |

| | |

- 1

- Each non-employee director continuing service after the annual meeting received 1,868 shares of DST stock as of the date of the 2013 annual meeting. We determined the number of shares by dividing $130,000 by $69.595, the average of the highest and lowest reported sale price of DST stock on May 14, 2013, the date of the 2013 annual meeting. Mr. Law, who joined the Board in February 2013, received an additional 642 shares, reflecting a pro-rated amount for his partial year of service. We determined the number by dividing $43,333 (one-third of the annual grant amount) by $67.50, the average of the highest and lowest reported sale price of DST stock on the date of Mr. Law's appointment.

- 2

- None of our non-employee directors had perquisites in an amount of at least $10,000, so Column C does not include any amounts attributable to perquisites. Amounts in Column C are for term life insurance premiums.

- 3

- Mr. Jackson completed his service on the Board in early 2013.

Directors may participate in our charitable match program. Under the program, the Company, through a donor-advised fund at a community charitable foundation, matches contributions by the director to qualified not-for-profit organizations in an annual amount equal to three times the contribution but not to exceed $30,000. Matching amounts to the foundation were $30,000 for each of the directors other than Mr. Higby, who did not participate. We have not included matching amounts in compensation. We do not believe the contribution directly or indirectly affects the director personally.

25

Table of Contents

PROPOSAL 1

ELECT DIRECTORS

Our Bylaws divide our Board into three classes with class terms expiring each year in rotation. At each annual meeting, stockholders elect a class of directors for a full three-year term. Our Board asks you to elect Lynn Dorsey Bleil and John W. Clark (collectively, the "Board Nominees") for a three-year term expiring in 2017 or until their successors are duly elected and qualified. The Board Nominees are willing to serve as directors.

The Board applied the nominating processes described under "Board Committee Matters and Reports." It considered the Board Nominees' backgrounds and experiences described under "The Board of Directors."

If a Board Nominee should become unavailable for election, the Proxy Committee will vote for another nominee whom the Governance Committee will propose in accordance with the 2014 Argyros Agreement described under "Board Committee Matters and Reports."

OUR BOARD RECOMMENDS THAT

YOU VOTE "FOR" THE ELECTION OF THE BOARD NOMINEES

26

Table of Contents

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Engagement. PricewaterhouseCoopers LLP served as our independent registered public accounting firm as of and for the year ended December 31, 2013. PricewaterhouseCoopers LLP performed professional services in connection with the audit of our consolidated financial statements and internal control over financial reporting and the review of reports we filed with the Securities and Exchange Commission. It also reviewed control procedures of our mutual fund processing services and provided us certain other accounting, auditing and tax services.

PricewaterhouseCoopers LLP's fees for services related to 2013 and 2012 were as follows:

| | | | | | | |

Type of Fees

| | 2013($)

| | 2012($)

| |

|---|

| | |

Audit Fees | | | 5,061,733 | | | 4,993,682 | |

Audit-Related Fees1,2 | | | 2,845,298 | | | 2,630,352 | |

Tax Fees1,3 | | | 3,085,689 | | | 3,815,902 | |

All Other Fees1,4 | | | 10,048 | | | 27,080 | |

| | |

- 1

- The Audit Committee has determined that the provision of these services is compatible with maintaining the independence of PricewaterhouseCoopers LLP.

- 2

- $2,668,200 of the 2013 amount and $2,475,900 of the 2012 amount was for attest services relating to SSAE 16 reports and other controls reviews; $69,500 of the 2013 amount and $68,400 of the 2012 amount was for financial statement audits of employee benefit plans; and $107,598 of the 2013 amount and $113,132 of the 2012 amount was for projects related to agreed upon procedures, due diligence and a reasonable assurance.

- 3

- $880,922 of the 2013 amount and $1,122,542 of the 2012 amount was for U.S. federal, state and local tax, and international compliance; and $2,204,767 of the 2013 amount and $2,693,360 of the 2012 amount was for other tax services.

- 4

- Of the 2013 amount $10,048 was for United Kingdom revenue recognition software training. Of the 2012 amount $25,280 was for United Kingdom tax reporting assistance.