UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | | Preliminary Proxy Statement |

| ¨ | | CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14A-6(E)(2)) |

| x | | Definitive Proxy Statement |

| ¨ | | Definitive Additional Materials |

| ¨ | | Soliciting Material Pursuant to §240.14a-11(c) or §240.14a-12 |

COMMUNITY BANKS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

Notes:

COMMUNITY BANKS, INC.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

| | |

| Date: | | May 4, 2004 |

| Time: | | 10:00 a.m. |

| Place: | | Four Points Sheraton 800 East Park Drive Harrisburg, Pennsylvania |

Matters to be voted on:

1.Election of Directors. Election of four (4) Class A Directors to serve until the 2008 annual meeting.

2.Other Business. Any other business properly brought before the shareholders at the meeting.

You can vote your shares of common stock if our records show that you owned the shares at the close of business on February 27, 2004 (the “Record Date”). Your vote at the annual meeting is very important to us. Please vote your shares of common stock by completing the enclosed proxy card and returning it to us in the enclosed prepaid envelope. This proxy will not be used if you are present at the meeting and desire to vote in person.

BY ORDER OF THE BOARD OF DIRECTORS

PATRICIA E. HOCH

Secretary

Harrisburg, Pennsylvania

March 30, 2004

TABLE OF CONTENTS

COMMUNITY BANKS, INC.

PROXY STATEMENT

MARCH 30, 2004

GENERAL INFORMATION

This proxy statement has information about the annual meeting of shareholders of Community Banks, Inc., which is referred to in this proxy statement as the “Company.” The management of the Company and Community Banks, the Company’s bank subsidiary (referred to in this proxy statement as the “Bank”), prepared this proxy statement for the Board of Directors. We first mailed this proxy statement and the enclosed proxy card to shareholders on March 30, 2004.

The Company will pay the costs of preparing, printing and mailing the proxy and all related materials. In addition to sending you these materials, some of the Company’s employees may contact you by telephone, by mail or in person.

The Company’s corporate offices are located at 750 East Park Drive, Harrisburg, Pennsylvania, and our telephone number is (717) 920-1698. Our mailing address is 750 East Park Drive, Harrisburg, Pennsylvania 17111.

VOTING

Who can vote?

You can vote your shares of common stock if our records show that you owned the shares at the close of business on February 27, 2004 (the “Record Date”). A total of 11,699,162 shares of common stock were outstanding on the Record Date and can vote at the annual meeting. You get one vote for each share of common stock that you own. The enclosed proxy card shows the number of shares you can vote. We will hold the annual meeting if the holders of a majority of the shares of the common stock entitled to vote either sign and return their proxy cards or attend the meeting in person.

The Trust Department of the Bank, as sole trustee, holds 37,733 shares of the Company common stock. The Trust Department may vote these shares at the annual meeting.

As of the Record Date, management of the Company beneficially owned a total of 1,545,030 shares of the Company common stock.

What vote is required?

A plurality of the votes cast at a meeting at which a quorum is present is required for the election of directors, which means that since four directors are being elected, the four nominees receiving the most votes will be elected. A majority of the votes cast at a meeting at which a quorum is present is required for any other matter that may come before the meeting, except in cases where the vote of a greater number of shares is required by law or under the Company’s Articles of Incorporation or Bylaws.

What if other matters come up at the annual meeting?

The matters described in this proxy statement are the only matters we know will be voted on at the meeting. If other matters are properly presented at the annual meeting, the proxy holder named in the enclosed proxy card will exercise his judgment to vote your shares in a manner that he deems to be in the best interests of the Company and its shareholders.

How are votes counted?

Our transfer agent counts all votes cast by proxy before the annual meeting. Our judge of election will manually count all votes which are cast in person or by proxy at the annual meeting.

Voting is an important right of shareholders. If you abstain or otherwise fail to cast a vote on any matter, your proxy will be counted for purposes of determining whether there is a quorum but will not be counted as a vote. Broker non-votes will also not be counted. Broker non-votes occur when a broker or bank which holds your shares for you does not vote, either because it does not have the authority to vote on your behalf or because you have not given it instructions on how to vote.

How do I vote?

Refer to the voting instructions on the proxy card. You may vote by completing and returning the enclosed proxy card, by telephone or by appearing in person at the annual meeting. We encourage you to return the proxy card or to vote by telephone, to ensure that your vote is counted. However, you may attend the meeting and vote in person whether or not you have previously returned a proxy card or voted by telephone.

Can I change my vote after I return my proxy card or vote by telephone?

Yes. At any time before the vote on a proposal, you can change your vote either by:

| | • | | giving the Company’s Secretary a written notice revoking your proxy card; |

| | • | | signing, dating and returning to us a new proxy card; or |

| | • | | placing a second telephone vote. |

We will honor the proxy card or the telephone vote with the latest date.

Can I vote in person at the annual meeting?

Yes. We encourage you to complete and return the proxy card to ensure that your vote is counted. However, you may attend the meeting and vote in person whether or not you have previously returned a proxy card.

MANAGEMENT AND CORPORATE GOVERNANCE

Election Of Four Class A Directors Of The Company

With respect to electing directors, the Company’s bylaws provide as follows:

| | • | | the board of directors will consist of not less than five nor more than 25 directors; |

| | • | | there will be four classes of directors, as nearly equal in number as possible; |

| | • | | each class will be elected for a term of four years; and |

| | • | | each class will be elected in a separate election, so that the term of office of one class of directors will expire in each year. |

At the annual meeting, we will nominate the following persons as Class A Directors to serve until 2008. Although we do not know of any reason why any of these nominees might not be able to serve, we will propose a substitute nominee if any nominee is not available for election. The proxy holder named in the proxy card intends to vote for the election of the four persons listed as Class A Directors to serve until the 2008 annual meeting. Unless you indicate otherwise, your proxy will be voted in favor of the election of those nominees. Each nominee

2

for the position of Class A Director is currently a director of the Company and was nominated by the Board of Directors of the Company. None of the following nominees, nor any of the directors continuing in office, is a director of another company with a class of securities registered pursuant to Section 12 of the Securities Exchange Act of 1934.

Ronald E. Boyer. Mr. Boyer, age 66, has been a director of the Bank since 1981 and of the Company since its formation in 1983. Since 1977, Mr. Boyer has been the president of Alvord-Polk, Inc., based in Millersburg, Pennsylvania, a company which manufactures cutting tools.

Peter DeSoto. Mr. DeSoto, age 64, has been a director of the Bank since 1981 and of the Company since its formation in 1983. Since 1997, Mr. DeSoto has been the CEO of J. T. Walker Industries, Inc., parent of M.I. Home Products based in Elizabethville, Pennsylvania, a company which manufactures vinyl, aluminum and cellular composite windows and doors.

Thomas L. Miller. Mr. Miller, age 71, has been a director of the Bank since 1966 and of the Company since its formation in 1983. From 1967 to 1998, Mr. Miller was the president and CEO of the Bank and, from 1983 to 1998, president and CEO of the Company. Mr. Miller retired from his positions as president and CEO in 1998.

James A. Ulsh. Mr. Ulsh, age 57, has been a director of the Bank since 1977 and of the Company since its formation in 1983. Since 1973, Mr. Ulsh has been employed as an attorney with the Harrisburg, Pennsylvania law firm of Mette, Evans & Woodside.

Directors Continuing In Office

Class B Directors to continue in office until 2005, except as noted below with respect to Messrs. Long and Miller.

Samuel E. Cooper. Mr. Cooper, age 69, has been a director of the Company since 1992. From 1972 to 1996, Mr. Cooper was the superintendent of the Warrior Run School District in Turbotville, Pennsylvania. He has been retired since 1996.

Eddie L. Dunklebarger. Mr. Dunklebarger, age 50, has been a member and the Chairman of the Company’s Board of Directors since 1998. Since that time, he has also served as president and CEO of the Bank and the Company.

Thomas W. Long. Mr. Long, age 74, has been a director of the Bank since 1981 and of the Company since its formation in 1983. From 1958 until his retirement in 1997, Mr. Long was a principal and owner of Millersburg Hardware Company, Inc., a retail hardware business based in Millersburg, Pennsylvania.

Donald L. Miller. Mr. Miller, age 74, has been a director of the Bank since 1981 and of the Company since its formation in 1983. From 1953 to 2003, Mr. Miller was engaged in the ownership and operation of Miller Brothers Dairy, Inc., based in Millersburg, Pennsylvania, a business engaged in milk production and sales. He has been retired since 2003.

Because Messrs. Long and Miller will turn 75 in the coming year, the Company’s Bylaws provide that their terms of office will expire the day before the 2005 annual meeting.

Class C Directors to continue in office until 2006.

Kenneth L. Deibler. Mr. Deibler, age 80, has been a director of the Bank since 1966 and of the Company since its formation in 1983. Since 1943, Mr. Deibler has been a self-employed insurance broker, based in Elizabethville, Pennsylvania.

3

Earl L. Mummert. Mr. Mummert, age 58, has been a director of the Company since 1998. Since 1976, Mr. Mummert has been employed as a consulting actuary by Conrad Siegel, Inc., a company which provides a broad array of services to companies and employee benefit plans in Harrisburg, Pennsylvania.

Allen Shaffer. Mr. Shaffer, age 78, has been a director of the Bank since 1961 and of the Company since its formation in 1983. Since 1952, Mr. Shaffer has practiced law in Millersburg and Harrisburg, Pennsylvania.

Class D Directors to continue in office until 2007, except as noted below with respect to Mr. Taylor.

Wayne H. Mummert. Mr. Mummert, age 69, has been a director since 1998. Mr. Mummert has been a farmer since 1952 and from 1960 to 1991 was employed by the U. S. Postal Service.

Scott J. Newkam. Mr. Newkam, age 53, has been a director since 2003. Since September 1999, Mr. Newkam has been the president and CEO of Hershey Entertainment & Resort Company, a company which owns and operates resort and entertainment facilities in Hershey, Pennsylvania. From 1997 to September 1999, Mr. Newkam was executive vice president and chief operating officer of the company. In these positions, Mr. Newkam has supervised and been actively involved in the preparation of financial statements.

Robert W. Rissinger. Mr. Rissinger, age 77, has been a director of the Bank since 1961 and of the Company since its formation in 1983. Since 1977, Mr. Rissinger has been the Secretary/Treasurer of Alvord-Polk, Inc., based in Millersburg, Pennsylvania, a company which manufactures cutting tools. Since 1978, he has also been a principal in and owner of Engle-Rissinger Auto Group, Inc., a retail vehicle sales business also based in Millersburg, Pennsylvania.

John W. Taylor, Jr. Mr. Taylor, age 73, has been a director of the Company since 1998. Since 1980, Mr. Taylor has been president of Air Brake & Power Equipment Company, based in Pottsville, Pennsylvania, a company which distributes truck and industrial parts and equipment. Pursuant to the Company’s Bylaws, Mr. Taylor’s term of office will expire on the day before the 2006 annual meeting, because he will have turned 75 by that time.

When the Company amended its bylaws in 1973 to include age limits for Board members, Messrs. Deibler, Shaffer (Class C directors), Thomas Miller (a Class A director) and Rissinger (a Class D director) were excepted.

Independence Of Directors

The Board of Directors of the Company has determined that all directors with the exception of Mr. Dunklebarger and Mr. Ulsh are independent as defined in the NASDAQ Marketplace Rules. The Company’s independent directors intend to meet in executive session at least two times annually. Meetings have been scheduled for May 4, 2004 and November 2, 2004.

Transactions With Officers And Directors

During 2003, the Bank had, and expects to have in the future, banking transactions in the ordinary course of business with directors and officers of the Company and their associates on substantially the same terms, including interest rates and collateral on loans, as those prevailing at the time for comparable transactions with other persons. Management believes that these loans present no more than the normal risk of collectibility or other unfavorable features.

Allen Shaffer, a director of the Company, is an attorney with offices in Harrisburg and Millersburg, Pennsylvania, who has been retained in the last fiscal year by the Company and who the Company proposes to retain in the current fiscal year. James A. Ulsh, a director of the Company, is a shareholder/employee of the law

4

firm of Mette, Evans & Woodside, Harrisburg, Pennsylvania, which the Company has retained in the last fiscal year and proposes to retain in the current fiscal year. Earl L. Mummert, a director of the Company, is an actuarial consultant with Conrad M. Siegel, Inc., Harrisburg, Pennsylvania, which provides actuarial services to the Company.

Attendance At Annual Meeting

The Board of Directors has adopted a policy that all of its directors shall be present at the Company’s annual meeting, absent extenuating circumstances. All directors of the Company were in attendance at the Annual Meeting of Shareholders held May 1, 2003.

Meetings And Committees Of The Board

The Board of Directors met six (6) times during 2003. All directors attended no fewer than 75% of the total number of meetings of the Board and committees on which he served, except Peter DeSoto who attended 58% of the meetings.

In addition to committees related specifically to the Company’s banking business, the Board has Executive, Audit, Nominating and Corporate Governance and Compensation Committees. The Executive Committee reviews policies and other items to be presented to the Board and acts on behalf of the Board between scheduled Board meetings as permitted by law. A majority of the members of the Executive Committee is independent, as defined in applicable NASDAQ rules. The audit, nominating and compensation committees are described in more detail below.

Audit Committee

The members of the Audit Committee are Scott J. Newkam (Chairman), Ronald E. Boyer, Samuel E. Cooper, Kenneth L. Deibler, Earl L. Mummert and Wayne H. Mummert. The Committee met five times in 2003. The Board has adopted a charter for the Committee, which is attached to this proxy statement as Appendix A. Each member of the Committee is independent, as defined by the NASDAQ Marketplace Rules and applicable rules of the Securities and Exchange Commission. The Board has determined that Mr. Newkam is an audit committee financial expert, as defined by the Securities and Exchange Commission.

Report Of The Audit Committee

The general functions performed by the Audit Committee include supervising and recommending to the Board changes in audit procedures, recommending the hiring of independent certified public accountants, reviewing the complete audit of the books and financial statements of the Company and its subsidiaries, reviewing and making recommendations to the Board regarding the internal auditor’s report and the certified public accountants’ audit report, reviewing examination reports by state and federal banking regulators, and the monitoring of risks, which includes reviewing the adequacy of internal controls and assessing the extent to which audit recommendations have been implemented.

With respect to fiscal year 2003, the Audit Committee has reviewed and discussed the audited financial statements of the Company with management. Additionally, the Audit Committee has discussed with the independent accountants the matters required to be discussed by Statement on Auditing Standards No. 61, as may be modified or supplemented, has received the written disclosures and the letter from the independent accountants required by Independence Standards Board Standard No. 1,Independence Discussions with Audit Committees, as may be modified or supplemented, and has discussed with the independent accountant the independent accountant’s independence. Based on these discussions, the Audit Committee has recommended to

5

the Board of Directors of Community that the audited financial statements be included in the Company’s Annual Report on Form 10-K.

| | By: | | Scott J. Newkam (Chair), Ronald E. Boyer, Samuel E. Cooper, Kenneth L. Deibler, Earl L. Mummert, and Wayne H. Mummert. |

Nominating And Corporate Governance Committee

The Board has established a Nominating and Corporate Governance Committee, whose members are Robert W. Rissinger (Chair), Earl L. Mummert and Scott Newkam. Each member of the Committee is independent, as defined by the NASDAQ Marketplace Rules. The functions of the Committee are to provide assistance to the Board of Directors in fulfilling its responsibility to the shareholders, potential shareholders and investment community by identifying individuals qualified to become directors and recommending that the Board of Directors select the candidates for all directorships to be filled by the Board of Directors or by the shareholders; developing and recommending to the Board a set of corporate governance principles applicable to the Company and otherwise taking a leadership role in shaping the corporate governance of the Company. A copy of the charter that the Committee has adopted is attached to this proxy statement as Appendix B and can be found under the Investor Relations tab on the Company’s website, at www.communitybanks.com. Because the Nominating Committee was formed by the Board of Directors at its meeting in February 2004, it did not meet in 2003. Before recommending candidates for election to the Board, the Nominating Committee will consider the candidate’s character, judgment, business experience, expertise and acumen, as well as any other criteria contained in the Bylaws for membership on the Board.

Process For Identifying And Evaluating Nominees For Director

The Committee will utilize current board members, management and other appropriate sources to identify potential nominees. The Committee will conduct any appropriate and necessary inquiries into the backgrounds and qualifications of possible candidates after considering the function and needs of the Board of Directors, and recommend nominees for approval by the Board of Directors and stockholders. The Committee’s process for the consideration of potential nominees will be the same for nominees identified by shareholders, as well as the other sources identified above.

The Nominating Committee will receive and consider nominee recommendations that shareholders address to the Secretary of the Company at the address listed on the first page of this proxy statement. If shareholders wish to nominate candidates for election at the Company’s annual meeting of shareholders, however, they must comply with additional procedures contained in the Company’s bylaws. To nominate someone at the annual meeting, you must deliver or mail a notice to the Secretary of the Company not less than 45 days prior to the date of the annual meeting. Your notice must state your name and residence address and the number of shares of the Company which you own. Your notice must also contain the following information on each proposed nominee:

| | • | | the name, address and age of the nominee; |

| | • | | the principal occupation of the nominee; |

| | • | | the number of shares of the Company’s common stock owned by the nominee; and |

| | • | | the total number of shares that, to your knowledge, will be voted for the nominee. |

If you do not follow this procedure, the Chairman of the meeting will disregard a nomination made at the annual meeting, and the judges of election will disregard any votes cast for your nominees.

Compensation Committee

The members of the Committee are Earl L. Mummert (Chair), Peter DeSoto, Donald L. Miller, Robert W. Rissinger, and John W. Taylor, Jr. The Committee met five times in 2003. The functions of the Committee are to

6

evaluate the Company’s compensation policies and plans, review and evaluate the individual performance of executive officers, establish the compensation of the President/CEO and review recommendations on the compensation of the remaining executive officers. Each of the members of the Committee is independent, as defined in the NASDAQ Marketplace Rules. The report of the Compensation Committee appears in the section of this Proxy Statement titled “Compensation of Management.”

Compensation Committee Interlocks And Insider Participation

None of the Committee members has been an officer or employee of the Company or any of its subsidiaries at any time. Earl L. Mummert is a consulting actuary with Conrad M. Siegel, Inc. which provides actuarial services for the Company. As is the case with other Board members, any indebtedness of the members of the Compensation Committee to the Bank is on the same terms, including interest rate and collateral on loans, as those prevailing at the time of comparable transactions with others and does not involve more than the normal risk of collectibility or present other unfavorable features.

Shareholder Communications With The Board

Shareholders who wish to communicate directly with the Board may direct such communications in writing, via facsimile and/or letter to the Audit Committee Chair, c/o Community Banks, Inc., 750 East Park Drive, Harrisburg, PA 17111 (facsimile no. 717-920-1683). The Audit Committee Chair will convey any and all such communications to the full Board for consideration and review.

Executive Officers Of The Company

In addition to Mr. Dunklebarger, the following individuals serve as executive officers of the Company. The terms during which Messrs. Dunklebarger, Holt, Lawley, Leo and Seibert hold their positions are governed by the employment agreements that the Company has entered into with each of them, which are more fully discussed in the Employment Agreements section beginning on page 13.

Donald F. Holt. Mr. Holt, age 47, is the Company’s chief financial officer and executive vice president of finance, a position he has held since December 31, 2001. He was employed by Keystone Financial, Inc. as its senior vice president and controller from 1987-1998 and as executive vice president and chief financial officer from 1999-2000. During 2001, Mr. Holt served as vice president of finance and administration of the Pennsylvania Chamber of Business and Industry.

Robert J. Lawley. Mr. Lawley, age 49, is the Company’s executive vice president of operations. He has been an executive vice president of the Company since 1984.

Anthony N. Leo. Mr. Leo, age 43, is the Company’s executive vice president of financial services and administration. He has been an executive vice president of the Company since 1998.

Jeffrey M. Seibert. Mr. Seibert, age 44, is the Company’s executive vice president of banking services. He has been an executive vice president of the Company since 1998.

Code Of Ethics

The Company has adopted a Code of Ethics that is applicable to the Company’s chief executive officer, chief financial officer, principal accounting officer, and other designated senior officers. A copy of the Code of Ethics can be found under the Corporate Governance section of the Company’s website at www.communitybanks.com.

7

COMPENSATION OF MANAGEMENT

EXECUTIVE OFFICERS

The following tables and reports apply to the compensation the Company paid to the President/CEO and the Company’s four other most highly compensated officers. These five individuals are referred to in this proxy statement as the “Named Executive Officers.”

The following Summary Compensation Table shows the annual salary and other compensation for the Named Executive Officers for the last three years.

Summary Compensation Table

| | | | | | | | | | |

Name and Principal Position

| | Year

| | Annual

Compensation(1)

| | Long Term

Compensation | | All Other

Compensation ($)(5)

|

| | | | Awards(2)

| |

| | | Salary ($)

| | Bonus($)(3)

| | Securities

Underlying

Options/ SARs (#)(4)

| |

Eddie L. Dunklebarger President & CEO of the Company and Community Banks | | 2003

2002

2001 | | 325,000

300,000

265,000 | | 161,500

218,900

80,000 | | 24,000

25,200

26,460 | | 58,383

57,162

50,330 |

| | | | | |

Donald F. Holt Executive Vice-President/Finance | | 2003

2002 | | 150,000

135,000 | | 53,800

67,000 | | 7,200

7,560 | | 12,000

12,377 |

| | | | | |

Robert W. Lawley Executive Vice-President/Operations | | 2003

2002

2001 | | 150,000

137,080

119,500 | | 53,800

73,000

25,000 | | 7,200

7,560

7,938 | | 27,266

21,578

23,932 |

| | | | | |

Anthony N. Leo Executive Vice-President/Financial Services and Administration | | 2003

2002

2001 | | 150,000

135,000

113,500 | | 53,800

73,000

25,000 | | 7,200

7,560

7,938 | | 21,759

23,456

27,364 |

| | | | | |

Jeffrey M. Seibert Executive Vice-President/Banking Services | | 2003

2002

2001 | | 150,000

135,000

113,500 | | 53,800

84,000

25,000 | | 7,200

7,560

7,938 | | 22,655

24,288

20,935 |

| (1) | | The total personal benefits provided by the Company and its subsidiaries for any Named Executive Officer did not exceed the lesser of $50,000 or 10% of the salary and bonus of the officer for any of the years shown and are not shown on this table. This does not include benefits that are available to all salaried officers, directors and employees on a non-discriminatory basis. |

| (2) | | The Company has not issued any restricted stock awards to any executive officer. Additionally, the Company does not maintain any Long-Term Incentive Plan other than a stock option plan, and grants to Named Executive Officers pursuant to that plan are reported in the Stock Option Grant Table. |

| (3) | | The bonuses reported for 2002 and 2001 differ from the amounts reported in the Company’s proxy statements for the annual meetings in 2002 and 2003, respectively. Previously, the Company reported bonuses paid, instead of earned, in the respective years. In this table, the amounts reported are for bonuses earned in the respective years, regardless of when they were paid. The amounts reported for bonuses earned by Messrs. Dunklebarger, Holt and Leo in 2003 include amounts deferred by those officers pursuant to a new Senior Management Deferred Compensation Plan that is described on page 16. |

| (4) | | When appropriate, stock options shown above have been adjusted for subsequent stock dividends and stock splits. |

8

| (5) | | “All other compensation” includes the following: |

Mr. Dunklebarger—Director fees of $10,000 for 2003, $5,400 for 2002 and $5,400 for 2001; employer contributions to the Company 401(k) Plan of $12,000 in 2003, $18,000 in 2002 and $13,600 in 2001; and SERP accruals of $36,383 in 2003, $33,762 in 2002 and $31,330 in 2001.

Mr. Holt—Employer contributions to the Company 401(k) Plan of $12,000 in 2003 and 12,150 in 2002; and imputed income of $227.

Mr. Lawley—Employer contributions to the Company 401(k) Plan of $12,000 in 2003, $14,587.00 in 2002 and $12,240 in 2001; SERP accruals of $15,266 in 2003, $6,991 in 2002 and $11,692 in 2001.

Mr. Leo—Employer contributions to the Company 401(k) Plan of $12,000 in 2003, $14,400 in 2002 and $11,760 in 2001; SERP accruals of $9,759 in 2003, $9,056 in 2002 and $8,404 in 2001; car allowance of $7,200 in 2001.

Mr. Seibert—Employer contributions to the Company 401(k) Plan of $12,000 in 2003, $14,400 in 2002 and $11,760 in 2001; SERP accruals of $10,655 in 2003, $9,888 in 2002 and $9,175 in 2001.

Stock Options

In 1998, the shareholders of the Company adopted the Community Banks, Inc. Long-Term Incentive Plan. This plan allows the Company to issue awards to key officers of the Company. Awards may be made in the form of incentive stock options (ISOs), non-qualified stock options (NQSOs) and stock appreciation rights (SARs).

Incentive Stock Options

The Internal Revenue Code requires all ISOs to be granted at a price not less than 100% of the fair market value of the Company common stock on the date the ISO is granted. ISOs are not transferable, except upon death by will or descent and distribution, and may not have a term of exercise longer than ten years. In addition, no ISO may be exercised for a period of at least six months after the ISO is granted.

The plan requires adjustment of the options to reflect changes in the number of outstanding shares caused by events such as the declaration and payment of a stock dividend. Consequently, the option price of and number of shares subject to all ISOs granted has been adjusted each time a stock dividend has been declared and paid.

Non-Qualified Stock Options (NQSO)

NQSOs may or may not have a vesting schedule, depending on the terms of the grant as determined by the Committee administering the plan. Although tax treatment of ISOs and NQSOs may differ, the plan imposes the same general conditions and restrictions on NQSOs as it does on ISOs. These conditions are described above. To date, all NQSOs granted have an option price equal to the fair market value of the Company common stock on the date the NQSO was granted.

9

Stock Option Grants

The following table shows:

| | • | | the number of stock options granted to Named Executive Officers in 2003; |

| | • | | the percentage which the executive’s options bears in relation to the total options granted to all employees during the year; |

| | • | | the expiration of the option; and |

| | • | | the potential realizable value of the options assuming certain rates of stock appreciation: |

Stock Option Grants In Last Fiscal Year

| | | | | | | | | | | | | | | | |

| | | Individual Grants

| | | | |

| | | Number of

Securities

Underlying

Options/

SARs

Granted (#)

| | % of Total

Options/

SARs

Granted

to

Employees

in Fiscal

Year

| | | Exercise or

Base

Price ($/Sh)(1)

| | Expiration

Date

| | Potential Realizable Value

at Assumed Annual Rates

of Stock Price

Appreciation for Option

Term

|

Name

| | | | | | 5% ($)(2)

| | 10% ($)(2)

|

Eddie L. Dunklebarger | | 24,000 | | 16.00 | % | | $ | 31.92 | | 12/4/2013 | | $ | 481,783 | | $ | 1,220,934 |

Donald F. Holt | | 7,200 | | 4.8 | % | | $ | 31.92 | | 12/4/2013 | | $ | 144,535 | | $ | 366,280 |

Robert W. Lawley | | 7,200 | | 4.8 | % | | $ | 31.92 | | 12/4/2013 | | $ | 144,535 | | $ | 366,280 |

Anthony N. Leo | | 7,200 | | 4.8 | % | | $ | 31.92 | | 12/4/2013 | | $ | 144,535 | | $ | 366,280 |

Jeffrey M. Seibert | | 7,200 | | 4.8 | % | | $ | 31.92 | | 12/4/2013 | | $ | 144,535 | | $ | 366,280 |

| (1) | | Options were granted in December, 2003, each with an exercise price of $31.92 per share. The option prices in all events equal the fair market value of the Company common stock on the date of the grant. The options granted in December, 2003 were for the year 2003. |

| (2) | | Applicable SEC regulations require us to disclose the potential appreciation in options granted to executive officers, assuming annualized rates of stock price appreciation of 5% and 10% over the term of the option. Appreciation is determined as of the expiration date of the option. The figures shown above assume 5% and 10% rates of appreciation on an annual basis, with annual compounding of the appreciation rate, beginning with the original option price of $31.92. |

10

Stock Option Exercises

The following table shows:

| | • | | all options exercised by the Named Executive Officers during 2003; |

| | • | | the number of shares acquired on exercise; |

| | • | | the value realized by the Named Executive Officer upon exercise; and |

| | • | | the number of exercisable and un-exercisable options outstanding for each Named Executive Officer, and the value of those options, as of December 31, 2003: |

Aggregated Option Exercises In Last Fiscal Year And Fiscal Year-End Option Values

| | | | | | | | |

Name

| | Number

of Shares

Acquired

on

Exercise

| | Value

Realized

($)

| | Number of

Securities

Underlying

Unexercised

Options/SARs at

FY-End (#)

Exercisable/

Unexercisable(1)

| | Value of Unexercised

In-the-Money

Options/SARs at

FY-End ($) Exercisable/

Unexercisable(1),(2)

|

Eddie L. Dunklebarger | | 12,900 | | 218,702 | | 163,014/46,506 | | 2,934,937/356,648 |

Donald F. Holt | | 0 | | 0 | | 1,512/13,248 | | 16,088/70,327 |

Robert W. Lawley | | 7,433 | | 141,462 | | 29,729/21,933 | | 504,698/205,334 |

Anthony N. Leo | | 2,779 | | 30,812 | | 25,798/21,933 | | 414,116/205,334 |

Jeffrey M. Seibert | | 4,847 | | 102,994 | | 53,957/21,933 | | 1,082,028/205,334 |

| (1) | | All options granted through December 31, 2003 are reported. Exercisable options are fully vested. Options which will vest in the future are reported as unexercisable. |

| (2) | | The dollar values shown above were calculated by determining the difference between the closing trading price of the Company common stock at December 31, 2003, which was $32.75 per share, and the option price of each option as of December 31, 2003. |

Pension Plan

The Bank maintains a pension plan for certain individuals who were employed by Community Banks, N.A., a predecessor of the Bank. Employees hired by Community Banks, N.A. prior to December 31, 1998 became participants in the pension plan on January 1 or July 1 after completing one year of service (12 continuous months and 1,000 hours worked) and reaching age 21. The cost of the pension is actuarially determined and paid by the Bank. The amount of monthly pension is equal to 1.15% of average monthly pay, plus ..60% of average monthly pay in excess of $650, multiplied by the number of years of service completed by an employee. The years of service for the additional portion are limited to a maximum of 37. Average monthly pay is based upon the 5 consecutive plan years of highest pay in the last 10 years. The maximum amount of annual compensation used in determining retirement benefits is $200,000. A participant is eligible for early retirement after reaching age 60 and completing five years of service. The early retirement benefit is the actuarial equivalent of the pension accrued to the date of early retirement. As of December 31, 2003, the only Named Executive Officer who participates in the plan and who has been credited with years of service is Robert W. Lawley (28 years of service).

In 1999, the Board of Directors amended the plan so that pension benefits will be offset by employer contributions to the Company 401(k) Plan. Employees hired after December 31, 1998 are not eligible to participate in the pension plan. In 2003, the Board of Directors amended the plan so that all benefit accruals under the Plan shall cease as of December 31, 2003 and all participants will be 100% vested in their accrued benefit effective as of December 31, 2003. The amount shown on the following table assumes an annual retirement benefit for an employee who chose a straight life annuity and who will retire at age 65. These amounts are not yet offset for the employer contribution in the 401(k) Plan.

11

Pension Plan Table

| | | | | | | | | | | | | | | | | | |

| | | Years of Service

|

Remuneration

| | 15

| | 20

| | 25

| | 30

| | 35

| | 40

|

$35,000 | | $ | 8,486 | | $ | 11,314 | | $ | 14,143 | | $ | 16,971 | | $ | 19,800 | | $ | 22,138 |

55,000 | | $ | 13,736 | | $ | 18,314 | | $ | 22,893 | | $ | 27,471 | | $ | 32,050 | | $ | 35,778 |

75,000 | | $ | 18,986 | | $ | 25,314 | | $ | 31,643 | | $ | 37,971 | | $ | 44,300 | | $ | 49,418 |

95,000 | | $ | 24,236 | | $ | 32,314 | | $ | 40,393 | | $ | 48,471 | | $ | 56,550 | | $ | 63,058 |

115,000 | | $ | 29,486 | | $ | 39,314 | | $ | 49,143 | | $ | 58,971 | | $ | 68,800 | | $ | 76,698 |

135,000 | | $ | 34,736 | | $ | 46,314 | | $ | 57,893 | | $ | 69,471 | | $ | 81,050 | | $ | 90,338 |

150,000 | | $ | 38,673 | | $ | 51,564 | | $ | 64,455 | | $ | 77,346 | | $ | 90,237 | | $ | 100,568 |

175,000 | | $ | 45,236 | | $ | 60,314 | | $ | 75,393 | | $ | 90,471 | | $ | 105,550 | | $ | 117,618 |

200,000 | | $ | 51,798 | | $ | 69,064 | | $ | 86,330 | | $ | 103,596 | | $ | 120,862 | | $ | 134,668 |

225,000 | | $ | 51,798 | | $ | 69,064 | | $ | 86,330 | | $ | 103,596 | | $ | 120,862 | | $ | 134,668 |

250,000 | | $ | 51,798 | | $ | 69,064 | | $ | 86,330 | | $ | 103,596 | | $ | 120,862 | | $ | 134,668 |

275,000 | | $ | 51,798 | | $ | 69,064 | | $ | 86,330 | | $ | 103,596 | | $ | 120,862 | | $ | 134,668 |

| (a) | | The compensation covered by the pension plan includes salary and bonus compensation, as reported under the heading “Annual Compensation” in the Summary Compensation Table on page 8. |

| (b) | | Of the Named Executive Officers, only Mr. Lawley participates in the Pension Plan. As of December 31, 2003, Mr. Lawley had 28 years of credited service under the Plan. |

| (c) | | The estimated benefits shown in the table above were computed assuming that participants would elect to receive straight line annuity payments. The amounts shown on the above table do not take into account any deductions for Social Security or other offset amounts. |

Board Compensation Committee Report On Executive Compensation

Through our executive compensation policy, we seek to achieve the following goals in determining compensation of our executive officers:

| | • | | integrate compensation with the Company’s and the Bank’s annual and long-term performance goals; |

| | • | | reward exceptional performance; |

| | • | | recognize individual initiative and achievements; |

| | • | | attract and retain qualified executives; |

| | • | | provide compensation packages competitive with those offered by other similar bank holding companies and banks; and |

| | • | | encourage stock ownership by executive officers. |

The Compensation Committee believes that compensation for the Company’s executive officers can best be accomplished through a combination of techniques, including:

| | • | | the Company Bonus Plan; |

| | • | | the Long-Term Incentive Plan; and |

| | • | | appropriate fringe benefits. |

The Company’s Bonus Plan

The Company maintains a Bonus Plan for the executive officers of the Company and its subsidiaries. Pursuant to this plan, a certain percentage of net income is placed in a bonus pool. Bonuses paid to the executive

12

officers are determined by the Compensation Committee pursuant to guidelines established by the Committee. The guidelines are based upon the level of net income the Company achieves during the year. The remainder of the bonus pool is distributed to other officers of the Company or its subsidiaries. The Compensation Committee delegates to the Chief Executive Officer the distribution of the remainder of the bonus pool. In 2003, Eddie L. Dunklebarger, President and CEO, earned a bonus of $161,500. The total amount of bonuses earned by all Named Executive Officers, including the amount paid to Mr. Dunklebarger, was $376,700.

Long-Term Incentive Plan

In 1998, the Company adopted a Long-Term Incentive Plan. Under the plan, the Company can issue incentive stock options, stock appreciation rights, and non-qualified stock options. The Compensation Committee believes that stock ownership by management helps align management’s interests with the interests of the shareholders in enhancing and increasing the value of the Company common stock. The Compensation Committee considers the same criteria in awarding stock options that it considers in making other compensation decisions.

Employment Agreements

The Company has entered into employment agreements with our Named Executive Officers. Following is a summary of those agreements.

Mr. Dunklebarger

Mr. Dunklebarger’s employment agreement provides that he is employed for a period of five (5) years beginning March 31, 1998. Upon the expiration of the third year of the initial five-year term, and upon the expiration of each additional year of employment, Mr. Dunklebarger’s employment automatically extends for an additional year (resulting in successive three-year terms) unless, no later than ninety (90) days prior to the expiration date, either the Board of Directors of the Company or Mr. Dunklebarger gives written notification to the other of an intent not to renew the employment agreement. The agreement also provides that Mr. Dunklebarger will be paid 120% of his salary for the remainder of the term of the agreement, in the event that he terminates his employment for certain reasons, such as a reassignment of duties, a reduction in compensation, the Company’s breach of the agreement or the removal of Mr. Dunklebarger from his current positions. If Mr. Dunklebarger terminates his employment as the result of a change of control, he is entitled to a lump-sum payment of the total amount of salary which he would have received for the remainder of the term of the agreement.

Pursuant to his agreement, Mr. Dunklebarger receives an annual salary, which is subject to increase as the Compensation Committee and the Board of Directors deem appropriate. Under the terms and conditions of the contract, Mr. Dunklebarger now participates in the Company’s executive bonus plan. Additionally, Mr. Dunklebarger is entitled to participate in or receive benefits under all the Company employment benefit plans, including the right to receive options for at least 6,000 shares of the Company Common Stock (to be adjusted for stock splits and stock dividends) per year, under the Company’s existing stock option plan. Mr. Dunklebarger is also entitled to other benefits and perquisites as the Company’s Board of Directors deems appropriate.

Messrs. Lawley, Leo, Seibert and Holt

The agreements with Robert W. Lawley, Anthony N. Leo, Donald F. Holt and Jeffrey M. Seibert generally provide that they are employed for rolling terms of two (2) years. On each anniversary date of the agreements, the terms of the agreements automatically renew and are extended for an additional one-year period unless either party has provided the other party with notice of intent not to renew within sixty (60) days before the anniversary date. The agreements also provide that if the executive’s employment is terminated pursuant to a change in control, as defined in the agreements, the executive may receive an amount equal to salary to which the executive would be entitled to be paid between the date of termination and the end of the remaining term of the agreement.

13

Executive Compensation

The Compensation Committee seeks to attract and retain qualified executive officers by offering compensation competitive with that offered by similar bank holding companies. The Compensation Committee considers objective and subjective criteria. Among other things, the Committee considers data from the SNL Executive Compensation Review and data compiled by Human Resource Partners, which used a peer analysis of similarly sized Pennsylvania bank holding companies. The SNL Executive Compensation Review compares:

| | • | | the salaries of the chief executive officer and other executive officers; |

| | • | | return on average assets; and |

| | • | | return on average equity. |

The Compensation Committee also considers the performance of the Company’s common stock on the NASDAQ Stock Market, particularly compared with the performance of the stock of other comparable bank holding companies.

The Compensation Committee does not make its recommendations based solely on corporate performance. The Committee also considers subjective factors. However, the Committee considers peer group information and corporate performance to be significant factors in determining executive compensation.

Mr. Dunklebarger

For 2003, Mr. Dunklebarger received an annual salary of $325,000. He was also a participant in the Community Banks, Inc. Long Term Incentive Plan and the Company’s Bonus Plan. Mr. Dunklebarger earned a bonus of $161,500. Pursuant to the Company Long Term Incentive Plan, Mr. Dunklebarger received stock options to purchase 24,000 shares of the Company common stock at an exercise price of $31.92 per share. These options, granted in December of 2003, were based on 2003 performance.

Other Executive Officers

With respect to the compensation of the Company’s other executive officers, the Compensation Committee considers information provided by the Chief Executive Officer about each executive officer including:

| | • | | level of individual performance; |

| | • | | contribution to the consolidated organization; and |

The Compensation Committee also considers:

| | • | | the earnings of the Company on a consolidated basis; |

| | • | | the peer group compensation information discussed above; |

| | • | | individual performance factors; and |

| | • | | its subjective evaluation of the services provided by each executive officer. |

You can see the compensation paid to the Company’s other executive officers in the Summary Compensation Table on page 8 of this proxy statement.

This report is given by the Compensation Committee, consisting of Earl L. Mummert (Chair), Peter DeSoto, Donald L. Miller, Robert W. Rissinger, and John W. Taylor, Jr.

14

Other Compensation Arrangements For Named Executive Officers

Community Banks, Inc. 401(k) Profit Sharing Plan

Employees are eligible to participate in the Company’s 401(k) plan after they have completed six months of service and have reached their twenty-first birthday. The plan offers both immediate and future benefits to employees in the program. The plan was submitted to the Internal Revenue Service for favorable determination as a tax deferred retirement program.

The Company allocates for participating accounts an annual amount based on the Company’s earnings at the end of each calendar year. The amount allocated to an employee’s account is based on the relationship of the employee’s annual compensation to the total annual compensation paid by the Company to all employees participating in the plan. Subject to limitations of the plan and the trust under plan, an employee can receive a percentage (to be determined in the discretion of the Board of Directors) of his or her annual compensation as a contribution to the plan account each year. The monies allocated to each employee’s account are held and invested by the trustee for the plan. Employees become fully vested in the plan after five years of service. Upon retirement, employees will be eligible to withdraw their vested interest in the plan according to the plan provisions. Should the participant become disabled or upon his or her death, the plan allows for other payment options. As a participant in the plan, the employee has the right to direct the investment of all of his or her funds. An employee may split his or her investment between two or more types of investments or instruct the administrator to place the entire amount in one investment account.

In order to allow participants the opportunity to increase their retirement income, each participant may, at the discretion of the administrator, elect to voluntarily contribute no less than 1% and no more than 17% (subject to certain limitations) of his or her total compensation earned while a participant under the plan. The amounts in each participant’s voluntary contribution account are fully vested at all times and are not subject to forfeiture for any reason. The normal retirement age under the plan is age 65.

Survivor Income Agreements

On June 1, 1994, Community Banks, N.A. entered into a Survivor Income Agreement with Robert W. Lawley. On February 5, 1999, The Peoples State Bank and the Company entered into similar agreements with Eddie L. Dunklebarger, Anthony N. Leo and Jeffrey M. Seibert. On December 31, 2001, Community Banks, N.A. and The Peoples State Bank merged to form one bank named Community Banks. On August 29, 2002, Community Banks entered into a similar agreement with Donald F. Holt. For the purpose of describing the provisions of these agreements, Community Banks and its predecessors will each be referred to as the “Bank.”

In these agreements, the Bank promised to pay to each executive employee’s designated beneficiary a survivor income benefit. The survivor’s income benefit is payable only if the executive employee dies before terminating employment with the Bank and only to the extent that the Bank owns life insurance policies on the executive employee’s life at the time of his or her death.

The base death benefit is equal to the lesser of:

| | • | | three times the executive employee’s base salary for the calendar year in which the executive’s death occurs; or |

| | • | | the amount of life insurance proceeds received by the Bank due to the executive’s death. |

The base death benefit, however, will be increased by an amount equal to the death benefit multiplied by the Company’s projected highest marginal federal income tax rate for the year in which the executive’s death occurs. The survivor’s income benefit will be paid in a lump sum within 60 days after the executive employee’s death. These agreements are funded by life insurance policies on each executive employee’s life.

15

The life insurance policies are owned by the Bank, and are in place of each executive employee’s participation in the Bank’s group life insurance plan. A split dollar insurance agreement goes into effect after the executive employee reaches the age of 65, as long he has completed ten (10) years of service. Pursuant to the terms of the split dollar agreement, the executive employee has the right to designate the beneficiary of the death proceeds of the policy to the extent the proceeds exceed the cash surrender value of the policy on the date before the executive employee’s death.

Supplemental Executive Retirement Plans

The Company maintains Supplemental Executive Retirement Plans providing key man life insurance on the lives of certain executive employees. Pursuant to the plans, the Company has purchased key man life insurance policies with death benefits payable to the Company if an executive dies in the course of his employment with the Company, in initial net amounts of:

| | • | | $1,270,000 covering the life of Eddie L. Dunklebarger; |

| | • | | $912,000 covering the life of Robert W. Lawley; |

| | • | | $575,000 covering the life of Anthony N. Leo; and |

| | • | | $570,000 covering the life of Jeffrey M. Seibert. |

The plans also provide salary continuation benefits for the executives pursuant to Salary Continuation Agreements entered into between the Company and the executives. If the executive remains employed by the Company until he reaches age 62, then the executive will be entitled to salary continuation for twenty years after retirement. Pursuant to their respective agreements, the following individuals are entitled to the following amounts:

| | • | | Eddie L. Dunklebarger—$80,000 per year; |

| | • | | Anthony N. Leo—$40,000 per year; |

| | • | | Jeffrey M. Seibert—$40,000 per year; and |

| | • | | Robert W. Lawley—$35,000 per year. |

If the executive’s employment with the Company is terminated before age 62, the executive will receive reduced benefits at age 62 in accordance with accrual of benefits schedules set forth in the respective agreements. Benefits will not be paid if an executive’s employment is terminated for cause (as defined in the respective agreements). In the event of termination due to disability, the Company may elect to pay the accrued benefit immediately in a lump sum, discounted to present value. In the event that an executive is terminated after a change in control but prior to age 62, the executive will receive at age 62 his accrued benefit, plus an additional benefit equal to three years additional accrual in the case of Mr. Dunklebarger, and two years additional accrual in the cases of Messrs. Leo, Seibert and Lawley. If the executive dies prior to or during the benefit payment period, normal retirement benefits will be payable to the executive’s beneficiaries beginning within one month after the executive’s death.

Directors And Senior Management Deferred Compensation Plan

The Company has adopted the Community Banks, Inc. Directors and Senior Management Deferred Compensation Plan, effective January 1, 2004, to assist the executives in establishing a program to provide supplemental retirement benefits. This plan is a voluntary variable deferred compensation plan. The amount deferred from salary or bonus by the Company’s chief executive officer and the four most highly compensated executives if applicable is included in the Summary Compensation Table under the salary or bonus column.

16

DIRECTORS

Attendance Fees

In 2003, each Company director received a quarterly fee of $1,250. Each outside director received a fee of $350 for each Board meeting attended. Each director who was not an executive officer also received $350 for each Committee meeting attended.

Directors’ Stock Option Plan

In 2000, the shareholders of the Company approved the Directors’ Stock Option Plan. The purpose of the Directors’ Stock Option Plan is to attract and retain non-employee directors who have outstanding abilities. The plan enables the directors to purchase shares on terms which will give the directors a direct and continuing interest in the success of the Company. The price of the options must equal at least the fair market value of the Company shares on the date the options are granted. Directors may not exercise the options before the first anniversary of the option grant or a change of control in the Company, whichever first occurs. The options will expire in ten years, unless they are exercised.

On December 4, 2003, the Company granted options to all non-employee directors, except emeritus directors, to purchase 500 shares at a price of $31.92 per share. Each non-employee member of the executive committee of the board was awarded options to purchase an additional 250 shares, and each chairman of a board committee received options to purchase an additional 250 shares.

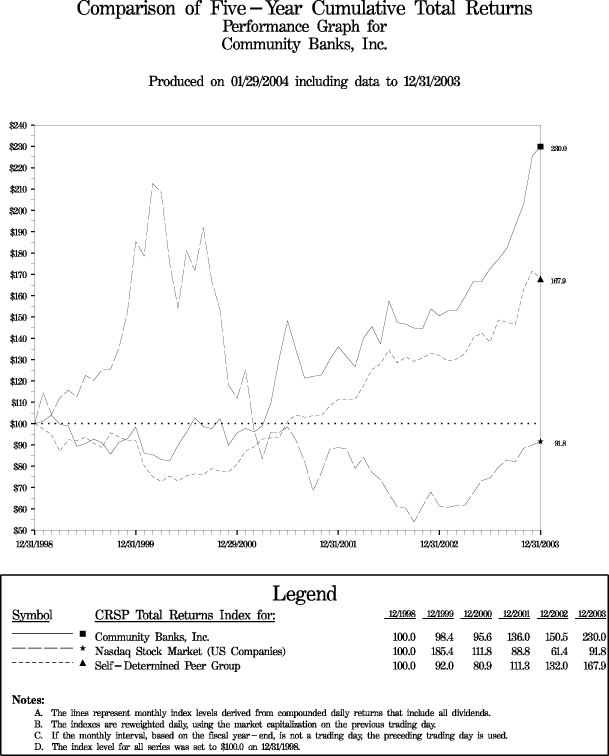

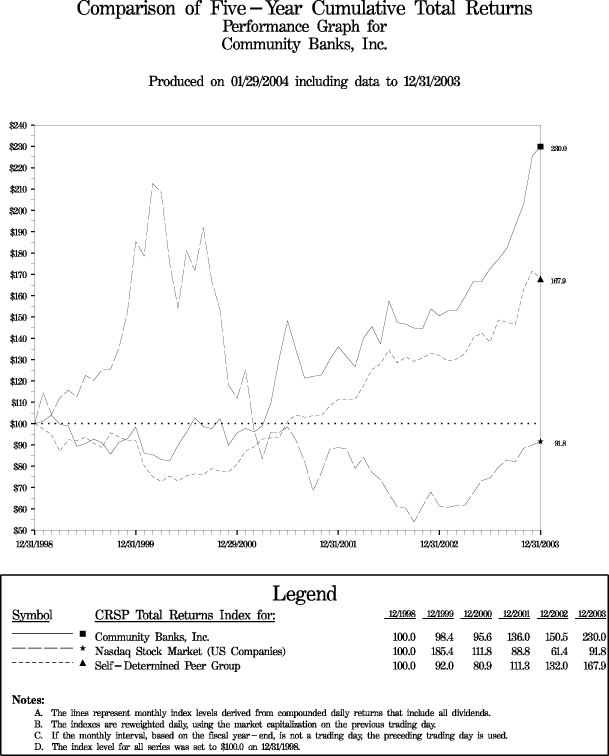

STOCK PERFORMANCE GRAPH

The following graph shows the yearly percentage change in the Company’s cumulative total shareholder return on its common stock from December 31, 1998 to December 31, 2003 compared with the cumulative total return of the NASDAQ Stock Market (US Companies), and a self-determined peer group consisting of 12 bank holding companies. The graph assumes that a $100 investment was made in the Company’s common stock and each of the indices at the earliest date shown and that dividends, if any, were reinvested. The bank holding companies in the peer group are Bryn Mawr Bank Corp., Columbia Bancorp, Comm Bancorp, Inc., Harleysville National Corp., Leesport Financial Corp., National Penn Bancshares, Inc., Omega Financial Corp., Pennrock Financial Services Corp., S & T Bancorp, Inc., Sandy Spring Bancorp, Inc., Sterling Financial Corp., and Sun Bancorp, Inc. The Company selected these companies because they conduct a community banking business in similar markets and they are similar to the Company in asset size and market capitalization. Four of the companies that were in the peer group used in the stock performance graph in the Company’s 2003 proxy statement (F&M Bancorp, MD, First Colonial Group, Inc., Patriot Bank Corp and Promistar Financial Group) have been deleted, because they have merged into other bank holding companies and the necessary stock price information is no longer available for them.

17

18

SECURITY OWNERSHIP BY MANAGEMENT AND CERTAIN BENEFICIAL OWNERS

The following table shows the number of shares of common stock owned by each of the Company’s directors and Named Executive Officers and by the directors and Named Executive Officers as a group, as of February 27, 2004. Common stock is the only class of equity securities that is outstanding. No one owns more than 5% of the Company’s common stock.

| | | | | | |

Name of Beneficial Owner and Position

| | Number of Shares

Beneficially Owned

| | | Percentage of

Outstanding

Common Stock

| |

Directors | | | | | | |

Ronald E. Boyer | | 43,256 | (2) | | * | |

Samuel E. Cooper | | 7,046 | (3) | | * | |

Kenneth L. Deibler | | 53,578 | (4) | | * | |

Peter DeSoto | | 75,261 | (5) | | * | |

Eddie L. Dunklebarger, Chairman, President and CEO | | 288,167 | (6) | | 2.43 | % |

Thomas W. Long | | 19,585 | | | * | |

Donald L. Miller | | 133,635 | (7) | | 1.14 | % |

Thomas L. Miller | | 59,203 | (7) | | * | |

Earl L. Mummert | | 37,328 | (8) | | * | |

Wayne H. Mummert | | 90,335 | (9) | | * | |

Scott J. Newkam | | 250 | | | * | |

Robert R. Rissinger | | 372,364 | (10) | | 3.18 | % |

Allen Shaffer | | 155,258 | (11) | | 1.33 | % |

John W. Taylor, Jr. | | 38,355 | (12) | | * | |

James A. Ulsh | | 29,021 | (13) | | * | |

| | |

Named Executive Officers (other than Mr. Dunklebarger) | | | | | | |

Donald F. Holt | | 1,513 | (14) | | * | |

Robert W. Lawley | | 29,809 | (15) | | * | |

Anthony N. Leo | | 35,529 | (16) | | * | |

Jeffrey M. Seibert | | 86,726 | (17) | | * | |

| | |

Directors and Named Executive Officers as a Group | | 1,545,030 | (18) | | 12.85 | % |

| * | | Indicates less than one percent (1%). |

Notes to Security Ownership Table

| (1) | | The securities “beneficially owned” by an individual are determined in accordance with the definition of “beneficial ownership” set forth in the regulations of the Securities and Exchange Commission. Accordingly, they may include securities owned by or for, among others, the wife and/or minor children of the individual and any other relative who has the same home as such individual, as well as other securities as to which the individual has or shares voting or investment power or has the right to acquire under outstanding stock options within 60 days after February 27, 2004. Beneficial ownership may be disclaimed as to certain of the securities. |

| (2) | | Includes 11,195 shares owned by Alvord-Polk, Inc., the stock of which is held 50% by Robert Rissinger and 50% by Ronald Boyer; 880 shares held by Mr. Boyer’s wife; and stock options to acquire 4,023 shares. |

| (3) | | Includes stock options to acquire 3,376 shares. |

| (4) | | Includes stock options to acquire 1,291 shares. |

| (5) | | Includes 3,600 shares held in Mr. DeSoto’s IRA and stock options to acquire 4,023 shares. |

| (6) | | Includes 492 shares owned by Mr. Dunklebarger’s wife, 16,714 shares owned by Mr. Dunklebarger’s children, 19,478 shares in his 401(k) Plan, 13,263 shares in his IRA, 3,689 shares held in an ESPP, and stock options (ISOs and Non-Qualified Stock Options) to acquire 163,014 shares. |

| (7) | | Includes stock options to acquire 4,023 shares. |

| (8) | | Includes 27,450 shares held by Earl Mummert’s IRA and stock options to acquire 7,741 shares. |

19

| (9) | | Includes 20,005 shares held by Wayne Mummert’s wife and stock options to acquire 7,095 shares. |

| (10) | | Includes 11,195 shares owned by Alvord-Polk, Inc., the stock of which is held 50% by Robert Rissinger and 50% by Ronald Boyer. Also includes 24,947 shares owned by Engle Ford, Inc., 66,357 shares owned by Mr. Rissinger’s wife, 115,945 shares held in Mr. Rissinger’s IRA and stock options to acquire 4,669 shares. |

| (11) | | Includes 84,223 shares owned by the Polk Foundation, of which Mr. Shaffer is chairman, and for which Mr. Shaffer holds voting and investment power; and stock options to acquire 4,023 shares. |

| (12) | | Includes 1,849 shares owned by Mr. Taylor’s wife, 1,322 shares held in Mr. Taylor’s IRA, and stock options to acquire 4,023 shares. |

| (13) | | Includes 2,640 shares held in Mr. Ulsh’s 401(k) Plan and stock options to acquire 4,023 shares. |

| (14) | | Consists entirely of exercisable stock options, except for one share held in Mr. Holt’s 401(k) Plan. |

| (15) | | Includes 47 shares held in the Employee Stock Purchase Plan, 29 shares held by Mr. Lawley’s children; 3 shares held in his 401(k) account and options to acquire 29,729 shares. |

| (16) | | Includes 8,887 shares held in his 401(k) account and options to acquire 25,796 shares. |

| (17) | | Includes 11,463 shares held in Mr. Seibert’s IRA; 8,610 shares held in his 401(k) account and options to acquire 53,957 shares. |

| (18) | | Includes 266,313 shares that are indirectly held. The 11,195 shares owned by Alvord-Polk, Inc. are counted only once in this total, as Alvord-Polk, Inc. is 50% owned by Robert W. Rissinger and 50% owned by Ronald E. Boyer. Thus, these shares are indicated above as being beneficially owned by both Mr. Rissinger and Mr. Boyer. |

Section 16(a) Beneficial Ownership Reporting Compliance

Our directors and executive officers must file reports with the Securities and Exchange Commission indicating the number of shares of the Company common stock they beneficially own and changes in their beneficial ownership. To the best of our knowledge, all such reports were filed on a timely basis, except for the following: Robert W. Lawley, Executive Vice President – one late filing of a small acquisition from the Company of 6.284 shares under the Dividend Reinvestment Plan by Mr. Lawley’s children; Robert W. Rissinger, Director – one late filing regarding 330 shares transferred in kind by Mr. Rissinger’s wife to a joint account held by Mr. and Mrs. Rissinger; and John W. Taylor, Jr., Director – four late filings regarding a small acquisition under the Dividend Reinvestment Plan of 37.689 shares purchased on the open market and three small acquisitions from the Company under the Dividend Reinvestment Plan of 38.789 shares, 36.080 shares, and 31.418 shares respectively.

OTHER MATTERS RELATING TO SHAREHOLDERS

Other Business

At the date of mailing of this proxy statement, we are not aware of any business to be presented at the annual meeting other than the proposals discussed above. If other proposals are properly brought before the meeting, any proxies returned to us will be voted pursuant to the judgment of the proxy holder.

Relationship With Independent Certified Public Accountants

On June 4, 2003, Community dismissed its independent accountants, PricewaterhouseCoopers LLP (PricewaterhouseCoopers) and appointed Beard Miller Company LLP (“Beard Miller”) as its new independent accountants, each effective immediately. The decisions to dismiss PricewaterhouseCoopers and to engage Beard Miller were approved by the Company’s Audit Committee. PricewaterhouseCoopers’ report on the Company’s consolidated financial statements for 2002 and 2001 contained no adverse opinion or disclaimer of opinion or qualification as to uncertainty, audit scope or accounting principles. During the fiscal years 2002 and 2001 and interim periods, there were no disagreements or reportable events relating to any matter of accounting principles

20

and practices, financial statements disclosure or auditing scope or procedure, which PricewaterhouseCoopers would have referred to in connection with its report if the disagreement had not been resolved to its satisfaction. The Company acknowledges that disagreements required to be reported in response to the preceding sentence include both those resolved to PricewaterhouseCoopers’ satisfaction and those not resolved to PricewaterhouseCoopers’ satisfaction. The Company further acknowledges that disagreements contemplated by this rule are those which occurred at the decision-making level, i.e., between Company personnel responsible for the presentation of its financial statements and PricewaterhouseCoopers personnel responsible for rendering its report. There have been no reportable events within the meaning of Item 304 of Regulation S-K.

The Audit Committee has engaged Beard Miller Company LLP to act as the Company’s auditor for 2004. A representative of Beard Miller Company LLP is expected to be at the 2004 annual meeting and will have the opportunity to make a statement if he so desires and to respond to appropriate questions.

The Sarbanes Oxley Act of 2002 and the auditor independence rules of the United States Securities and Exchange Commission require all public accounting firms who audit public companies to obtain pre-approval from their respective Audit Committees in order to provide professional services without impairing independence. Before Beard Miller performs any services for the Company, the Audit Committee is informed that such services are necessary and is advised of the estimated costs of such services. The Audit Committee then decides whether to approve Beard Miller’s performance of the services. In 2003, all services performed by Beard Miller were approved in advance pursuant to these procedures, except to the extent that the Audit Committee relied on the de minimus exception to pre-approval of services discussed below. The Audit Committee has determined that the performance by Beard Miller of tax services is compatible with maintaining that firm’s independence.

Beard Miller Company LLP has previously issued engagement letters to or obtained formal approval from the Company’s Audit Committee for certain services. These services are summarized below.

Fees Billed By Independent Certified Public Accountants

Fees for professional services provided by our independent accountants were as follows for the last two fiscal years:

| | | | | | | | | | | | | | |

Year

| | Audit

| | | Audit-Related

| | | Tax

| | | All Other

Fees

|

| |

| | | PricewaterhouseCoopers LLP

|

2002 | | $ | 99,180 | | | $ | 4,000 | | | $ | 119,303 | | | -0- |

2003 | | $ | 9,452 | | | $ | 21,895 | | | $ | 28,199 | | | -0- |

| |

| | | Beard Miller Company LLP

|

2003 | | $ | 115,967 | (1) | | $ | 8,195 | (2) | | $ | 425 | (3) | | -0- |

| (1) | | Includes professional services rendered for the audit of the Company’s annual financial statements and review of financial statements included in Forms 10-Q, FDICIA attestation and out-of-pocket expenses. |

| (2) | | Includes assistance on matters of accounting and due diligence related to a proposed acquisition. |

| (3) | | Includes assistance with various tax matters. |

These fees paid to Beard Miller Company LLP in 2003 were approved in accordance with the Audit Committee’s policy. The de minimus exception (as defined in Rule 202 of the Sarbanes-Oxley Act) was applied to 1% of the 2003 total fees. These fees are located in the audit-related and tax fees categories in the table above.

21

Shareholder Proposals For The 2005 Annual Meeting Of Shareholders

Under the Company’s Bylaws, no shareholder proposals may be brought before an annual meeting of shareholders unless a proposal is specified in the notice of the meeting or is otherwise brought before the meeting by the Board of Directors or by a shareholder entitled to vote who has delivered notice to the Company (containing information specified in the Bylaws) not less than 120 days prior to the anniversary of the mailing of the previous year’s proxy statement. These requirements are separate from and in addition to the SEC’s requirements that a shareholder must meet in order to have a shareholder proposal included in the Company’s proxy statement. A shareholder wishing to submit a proposal for consideration at the 2005 Annual Meeting of Shareholders, either under SEC Rule 14a-8, or otherwise, should do so no later than November 30, 2004.

If the Secretary of the Company receives notice of a shareholder proposal that complies with the governing Bylaw provision on or prior to the required date and if such proposal is properly presented at the 2005 annual meeting of shareholders, the proxies appointed by the Company may exercise discretionary authority in voting on such proposal if, in the Company’s proxy statement for such meeting, the Company advises shareholders of the nature of such proposal and how the proxies appointed by the Company intend to vote on such proposal, unless the shareholder submitting the proposal satisfies certain SEC requirements, including the mailing of a separate proxy statement to the Company’s shareholders.

The presiding officer of the meeting may refuse to permit any proposal to be made at an annual meeting by a shareholder who has not complied with all of the governing Bylaw procedures, including receipt of the required notice by the Secretary of the Company by the date specified. If a shareholder proposal is received by the Company after the required notice date but the presiding officer of the meeting nevertheless permits such proposal to be made at the 2005 annual meeting of shareholders, the proxies appointed by the Company may exercise discretionary authority when voting on such proposal.

If the date of our next annual meeting is advanced or delayed by more than 30 days from May 4, 2005, we will promptly inform you of the change of the annual meeting and the date by which shareholder proposals must be received.

22

Form 10-K Annual Report

The Company’s Annual Report on Form 10-K for the year ended December 31, 2003 is included with this proxy statement.

Our annual report on Form 10-K for the year ended December 31, 2003, which we filed with the SEC, is incorporated in this proxy statement by reference. All information appearing in this proxy statement should be read together with, and is qualified in its entirety by, the information and financial statements (including notes) appearing in the Form 10-K.

Only one Annual Report on Form 10-K and proxy statement is being delivered to shareholders sharing an address unless we have received contrary instructions from one or more of the shareholders. We will deliver promptly, upon written or oral request, a separate copy of the Annual Report on Form 10-K and proxy statement to a shareholder at a shared address to which single copies were sent. A shareholder can make a request by calling Donald F. Holt, Executive Vice President and CFO at 717-920-1698, or by mailing a request to the above address. If shareholders sharing an address are currently receiving more than one annual report or proxy statement, they can request that the Company send only one copy by calling Mr. Holt or mailing a request to the above address.

Return Of Proxy

You should sign, date and return the enclosed proxy card as soon as possible whether or not you plan to attend the meeting in person. If you wish to vote in person at the meeting, you may then withdraw your proxy.

By order of the Board of Directors,

Patricia E. Hoch

Secretary

Harrisburg, Pennsylvania

March 30, 2004

23

APPENDIX A

COMMUNITY BANKS, INC.

COMMUNITY BANKS

AUDIT COMMITTEE CHARTER

The Boards of Directors of Community Banks, Inc. (CMTY) and Community Banks hereby constitute and establish an Audit Committee with its authority, structure, membership, responsibilities, processes, and specific duties as follows:

AUTHORITY

The authority for the Audit Committee is derived from the full Boards of Directors of Community Banks, Inc. and Community Banks. The Committee has the authority to engage independent counsel and other advisors, as deemed necessary, with appropriate funding to be provided by the Corporation. Committee membership is reviewed annually, and members and the chairperson are appointed accordingly.

FUNDING

In addition to providing funding for independent counsel and advisors employed by the Committee, as discussed above, the Corporation will provide appropriate funding, as determined by the Committee, in its capacity as a committee of the board of directors, for payment of:

Compensation to any registered public accounting firm engaged for the purpose of preparing or issuing an audit report or performing other audit, review or attest services for the Corporation;

Ordinary administrative expenses of the Committee that are necessary or appropriate in carrying out its duties.

STRUCTURE AND MEMBERSHIP

The Committee shall be comprised of at least three members and consist of independent CMTY directors only. A director is independent if he or she both: a.) is independent as that term is defined in the NASDAQ Marketplace rules and b.) meets the criteria for independence set forth in SEC Rule 10A-3(b)(1) (subject to the exemptions provided in Rule 10A-3(c)). Also, committee members must not have participated in the preparation of the financial statements of the Corporation or any current subsidiary of the Corporation at any time during the past three (3) years.All members must be able to read and understand fundamental financial statements, including the company’s balance sheet, income statement, and cash flow statement. At least one member must have past employment experience in finance/accounting, requisite professional certification in accounting, or other comparable experience or background, including a current or past position as a chief executive or financial officer or other senior officer with financial oversight responsibilities which results in the individual’s financial expertise.

Notwithstanding the requirement that the members of the Committee be independent, as discussed above, one director who:

| | (i) | | is not independent as defined in NASDAQ Marketplace Rule 4200; |

| | (ii) | | meets the criteria set forth in Section 10A(m)(3) under the Securities Exchange Act of 1934 and the rules there under, and |

| | (iii) | | is not a current officer or employee or a Family Member (as that term is defined in the NASDAQ Marketplace Rules) of such officer or employee, may be appointed to the Committee, if the board, under exceptional and limited circumstances, determines that membership on the Committee by the |

A-1

| | individual is required by the best interests of the Corporation and its shareholders, and the board discloses, in the next annual proxy statement subsequent to such determination, the nature of the relationship and the reasons for that determination. A member appointed under this exception may not serve longer than two years and may not chair the Committee. |

RESPONSIBILITIES, PROCESSES, AND SCOPE

The Committee’s purpose is to oversee the accounting and financial reporting processes of the Corporation and the audits of the financial statements of the Corporation. To this end, the responsibilities of the Committee include the monitoring of risks; oversight of the internal and external audit, accounting and financial reporting functions; and the analysis of regulatory examinations. Specific responsibilities include:

Meetings